#IoT Chip Market Size

Explore tagged Tumblr posts

Text

Rising Internet Penetration Propels IoT Chip Industry

The IoT chip industry generated $427.0 billion in revenue in 2021, and it is expected to reach $693.8 billion by 2030, growing at a CAGR of 5.5% during the forecast period.

The increasing internet penetration in emerging markets is driving the adoption of connected devices and the development of networking protocols. Moreover, the rising number of AI-driven devices is fueling industry growth. Currently, there are over 10 billion active IoT devices, creating a significant demand for IoT chips.

North America holds a major share of the IoT chip market and is projected to dominate by 2030, with revenues surpassing $300 billion. This growth is attributed to the expansion of the research and development sector and the increasing demand for consumer electronics.

The development of advanced infrastructure is leading to a growing need for improved wireless connectivity solutions, particularly in smart cities. This drives demand for logic devices and integrated circuits (ICs) in connected vehicles, smart transportation systems, and residential applications.

Logic devices represent the largest segment of the market, driven by their superior prototyping and reprogramming capabilities for debugging. Field-programmable gate arrays (FPGAs), which offer customizable logic blocks, are widely adopted due to their cost-effectiveness, programmability, and high performance.

The increasing demand for smartwatches and higher shipments of logic devices are key factors propelling the market. FPGAs are faster than other devices and can be modified, reconfigured, and updated to handle a wide range of tasks.

For instance, more than 14 million wearable devices were shipped in 2021, with over 12 million being smartwatches. The rising demand for wearables to monitor health metrics such as blood oxygen levels, respiration, and heart rate is contributing to the market’s expansion.

The sensor segment is expected to experience the fastest growth in the coming years, driven by the growing use of temperature and pressure sensors in manufacturing. The increasing application of motion and position sensors in smart electronics, such as alarms, security cameras, and live video monitoring systems, is also fueling growth in this category.

The surge in consumer electronics sales, particularly smart appliances like thermostats, door locks, and home monitors, is further driving industry growth.

In the healthcare and fitness sectors, the rising popularity of smartwatches is capturing a significant market share. IoT chips enable real-time tracking of medical equipment such as oxygen pumps, wheelchairs, and defibrillators.

Connected wearable devices, including smartphones, smartwatches, smart jewelry, and smart shoes, account for a notable share of the market. These devices, which utilize IoT chips to track various functions, are driving industry growth by facilitating sensor integration and internet connectivity.

As a result, the increasing popularity of smartwatches is significantly boosting the IoT chip industry.

Source: P&S Intelligence

#IoT Chip Market Share#IoT Chip Market Size#IoT Chip Market Growth#IoT Chip Market Applications#IoT Chip Market Trends

1 note

·

View note

Text

Agilex 3 FPGAs: Next-Gen Edge-To-Cloud Technology At Altera

Agilex 3 FPGA

Today, Altera, an Intel company, launched a line of FPGA hardware, software, and development tools to expand the market and use cases for its programmable solutions. Altera unveiled new development kits and software support for its Agilex 5 FPGAs at its annual developer’s conference, along with fresh information on its next-generation, cost-and power-optimized Agilex 3 FPGA.

Altera

Why It Matters

Altera is the sole independent provider of FPGAs, offering complete stack solutions designed for next-generation communications infrastructure, intelligent edge applications, and high-performance accelerated computing systems. Customers can get adaptable hardware from the company that quickly adjusts to shifting market demands brought about by the era of intelligent computing thanks to its extensive FPGA range. With Agilex FPGAs loaded with AI Tensor Blocks and the Altera FPGA AI Suite, which speeds up FPGA development for AI inference using well-liked frameworks like TensorFlow, PyTorch, and OpenVINO toolkit and tested FPGA development flows, Altera is leading the industry in the use of FPGAs in AI inference workload

Intel Agilex 3

What Agilex 3 FPGAs Offer

Designed to satisfy the power, performance, and size needs of embedded and intelligent edge applications, Altera today revealed additional product details for its Agilex 3 FPGA. Agilex 3 FPGAs, with densities ranging from 25K-135K logic elements, offer faster performance, improved security, and higher degrees of integration in a smaller box than its predecessors.

An on-chip twin Cortex A55 ARM hard processor subsystem with a programmable fabric enhanced with artificial intelligence capabilities is a feature of the FPGA family. Real-time computation for time-sensitive applications such as industrial Internet of Things (IoT) and driverless cars is made possible by the FPGA for intelligent edge applications. Agilex 3 FPGAs give sensors, drivers, actuators, and machine learning algorithms a smooth integration for smart factory automation technologies including robotics and machine vision.

Agilex 3 FPGAs provide numerous major security advancements over the previous generation, such as bitstream encryption, authentication, and physical anti-tamper detection, to fulfill the needs of both defense and commercial projects. Critical applications in industrial automation and other fields benefit from these capabilities, which guarantee dependable and secure performance.

Agilex 3 FPGAs offer a 1.9×1 boost in performance over the previous generation by utilizing Altera’s HyperFlex architecture. By extending the HyperFlex design to Agilex 3 FPGAs, high clock frequencies can be achieved in an FPGA that is optimized for both cost and power. Added support for LPDDR4X Memory and integrated high-speed transceivers capable of up to 12.5 Gbps allow for increased system performance.

Agilex 3 FPGA software support is scheduled to begin in Q1 2025, with development kits and production shipments following in the middle of the year.

How FPGA Software Tools Speed Market Entry

Quartus Prime Pro

The Latest Features of Altera’s Quartus Prime Pro software, which gives developers industry-leading compilation times, enhanced designer productivity, and expedited time-to-market, are another way that FPGA software tools accelerate time-to-market. With the impending Quartus Prime Pro 24.3 release, enhanced support for embedded applications and access to additional Agilex devices are made possible.

Agilex 5 FPGA D-series, which targets an even wider range of use cases than Agilex 5 FPGA E-series, which are optimized to enable efficient computing in edge applications, can be designed by customers using this forthcoming release. In order to help lower entry barriers for its mid-range FPGA family, Altera provides software support for its Agilex 5 FPGA E-series through a free license in the Quartus Prime Software.

Support for embedded applications that use Altera’s RISC-V solution, the Nios V soft-core processor that may be instantiated in the FPGA fabric, or an integrated hard-processor subsystem is also included in this software release. Agilex 5 FPGA design examples that highlight Nios V features like lockstep, complete ECC, and branch prediction are now available to customers. The most recent versions of Linux, VxWorks, and Zephyr provide new OS and RTOS support for the Agilex 5 SoC FPGA-based hard processor subsystem.

How to Begin for Developers

In addition to the extensive range of Agilex 5 and Agilex 7 FPGAs-based solutions available to assist developers in getting started, Altera and its ecosystem partners announced the release of 11 additional Agilex 5 FPGA-based development kits and system-on-modules (SoMs).

Developers may quickly transition to full-volume production, gain firsthand knowledge of the features and advantages Agilex FPGAs can offer, and easily and affordably access Altera hardware with FPGA development kits.

Kits are available for a wide range of application cases and all geographical locations. To find out how to buy, go to Altera’s Partner Showcase website.

Read more on govindhtech.com

#Agilex3FPGA#NextGen#CloudTechnology#TensorFlow#Agilex5FPGA#OpenVINO#IntelAgilex3#artificialintelligence#InternetThings#IoT#FPGA#LPDDR4XMemory#Agilex5FPGAEseries#technology#Agilex7FPGAs#QuartusPrimePro#technews#news#govindhtech

2 notes

·

View notes

Text

North America Semiconductor Manufacturing Equipment Market Size, Growth Status, Analysis and Forecast 2027

North America Semiconductor Manufacturing Equipment Market Semiconductor manufacturing equipment market in North America is expected to grow from US$ 8.45 Bn in 2018 to US$ 13.17 Bn by the year 2027 with a CAGR of 4.7% from the year 2019 to 2027.

North America Semiconductor Manufacturing Equipment Market Significant demand for consumer electronic devices boost the manufacturing prospects, which is further fueling the growth of the semiconductor manufacturing equipment market. North America Semiconductor Manufacturing Equipment Market Moreover, North America Semiconductor Manufacturing Equipment Market the increase in adoption of IoT, artificial intelligence, and connected devices across industry verticals is anticipated to boost semiconductor manufacturing equipment market growth in the forecast period. Today’s smart products contain complex electronic systems that require flawless operation in the real world. North America Semiconductor Manufacturing Equipment Market Device miniaturization, support for multiple wireless technologies, faster data rates, and longer battery life, demand highly sophisticated Integrated Circuits (ICs) incorporated into the devices.

Additionally, North America Semiconductor Manufacturing Equipment Market demand for numerous feature integrations onto a single device has led to complex circuit board designs of these electronics. As an example, a smartphone today includes features such as camera, calling function, torch, storage drives, and connectivity with other devices, compatible ports for connections, a multimedia player, and many other functions, etc. Similarly, other consumer electronic devices have been improving on similar lines propelling the semiconductor manufacturers for more miniaturization of the chips and integration of more functionalities. Smartphones lead the incorporations of semiconductor equipment into the devices.

📚 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐂𝐨𝐩𝐲@ https://www.businessmarketinsights.com/sample/TIPRE00005043

North America Semiconductor Manufacturing Equipment Market The Wafer Manufacturing Equipment segment is the leading equipment type with the highest market share in North America semiconductor manufacturing equipment market. North America Semiconductor Manufacturing Equipment Market It includes single crystal manufacturing equipment, wafer processing equipment, inspection & metrology equipment, and others. The wafer manufacturing equipment is available in different forms and most of which are specific to growing, removing, depositing materials from the wafer. The increase in demand for semiconductor in various applications is expected to have a significant impact on the growth of wafer manufacturing equipment market.

The US dominated the semiconductor manufacturing equipment market in 2018 and is anticipated to lead the semiconductor manufacturing equipment market across the North American region through the forecast period, followed by Mexico and Canada. North America Semiconductor Manufacturing Equipment Market The figure given below highlights the revenue share of the Mexico in the North American semiconductor manufacturing equipment market in the forecast period:

𝐓𝐡𝐞 𝐋𝐢𝐬𝐭 𝐨𝐟 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬

Advantest Corporation

Applied Materials, Inc.

ASML Holding N.V.

Hitachi High-Technologies Corporation

KLA Corporation

Lam Research Corporation

Rudolph Technologies, Inc.

Screen Holdings Co., Ltd.

Teradyne Inc.

Tokyo Electron Ltd.

📚𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐋𝐢𝐧𝐤 @ https://www.businessmarketinsights.com/reports/north-america-semiconductor-manufacturing-equipment-market

NORTH AMERICA SEMICONDUCTOR MANUFACTURING EQUIPMENT MARKET SEGMENTATION

By Equipment Type

Wafer Manufacturing Equipment

Assembly & Packaging Equipment

Test Equipment

Others

By End-Use

Semiconductor Fabrication Plant/Foundry

Semiconductor Electronics Manufacturing

Test Home

By Dimension

2D

2.5D

3D

By Country

U.S.

Canada

Mexico

North America Semiconductor Manufacturing Equipment Market: Overview and Insights

The semiconductor industry forms the backbone of modern technology, providing critical components used in everything from smartphones to electric vehicles. As a result, the semiconductor manufacturing equipment (SME) market plays an essential role in the development and production of semiconductor chips. North America, home to major semiconductor companies and manufacturers, is a key player in the global SME market. The region’s demand for cutting-edge technologies, increasing investments in advanced semiconductor manufacturing processes, and growing reliance on semiconductors across various industries make it a focal point of market activity.

Market Overview

The North American semiconductor manufacturing equipment market encompasses various tools and machinery used to produce semiconductors. These include photolithography equipment, wafer fabrication equipment, assembly and packaging tools, and other supporting technologies. The market is driven by the increasing demand for semiconductors, advancements in process technologies, and the rise of applications such as Artificial Intelligence (AI), 5G networks, automotive electronics, and Internet of Things (IoT).

In recent years, North America has seen significant growth in the semiconductor industry, with both established companies and new entrants investing heavily in manufacturing capabilities. Semiconductor production is capital-intensive, and companies must continuously invest in advanced machinery to stay competitive. Furthermore, geopolitical factors, such as the ongoing U.S.-China trade tensions and the push for reshoring manufacturing, have amplified the region’s focus on building robust semiconductor production capabilities.

Key Players in the Market

The North American semiconductor manufacturing equipment market is characterized by the presence of several established players who supply both equipment and advanced technologies. Some of the major companies in the market include:

Applied Materials: A leading supplier of semiconductor fabrication equipment, Applied Materials offers solutions for wafer fabrication, deposition, etching, and inspection. The company is at the forefront of developing cutting-edge technologies, such as atomic layer deposition (ALD) and EUV lithography.

Lam Research: Lam Research provides equipment used in the wafer fabrication process, specializing in etching, deposition, and clean technology. The company plays a crucial role in enabling advanced semiconductor manufacturing for the most cutting-edge chips.

KLA Corporation: Specializing in process control and yield management solutions, KLA provides tools for inspection, metrology, and patterning. Their technologies are critical in ensuring the reliability and quality of semiconductors produced in fabs.

Tokyo Electron: A global leader in semiconductor manufacturing equipment, Tokyo Electron provides equipment used in both front-end and back-end semiconductor processes. Their tools cover a wide range of activities from lithography to packaging.

ASML: While primarily based in the Netherlands, ASML is a significant player in the North American market, providing the highly specialized EUV lithography equipment needed for the most advanced semiconductor production processes.

Market Trends

Adoption of EUV Lithography: One of the most important technological advancements in semiconductor manufacturing is the adoption of extreme ultraviolet (EUV) lithography. EUV enables the production of smaller and more powerful chips. North American companies are among the first to invest in EUV equipment, and its increasing use is driving growth in the market.

Increased Focus on Sustainability: As environmental concerns continue to grow, semiconductor manufacturers are investing in energy-efficient equipment and adopting more sustainable practices. This trend is expected to continue as companies aim to reduce their carbon footprint and meet regulatory requirements.

Integration of AI and Automation in Manufacturing: Artificial intelligence (AI) and automation are playing a larger role in semiconductor manufacturing. AI is being used to improve yield rates, optimize production processes, and reduce defects. Automation is helping improve efficiency and reduce labor costs.

Diversification of Supply Chain: With the ongoing semiconductor shortages and supply chain disruptions, manufacturers are increasingly diversifying their supply chains to reduce dependence on specific regions or suppliers. This has implications for the distribution of semiconductor manufacturing equipment, which may result in changes in supplier relationships and manufacturing strategies.

𝐀𝐛𝐨��𝐭 𝐔𝐬:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications

You can see this

North America Sleep Apnea Devices Market- https://www.openpr.com/news/3924087/north-america-sleep-apnea-devices-market-size-share

Europe EV Charging Infrastructure Market- https://www.openpr.com/news/3911041/europe-ev-charging-infrastructure-market-analysis-segments

0 notes

Text

Top B.Tech Branches to Secure Your Future By 2027

Hey, which B.Tech branch has the highest salary?”, “Which engineering field is future proof?”

If you’re asking these questions, you’re not alone! Choosing a B.Tech branch is a BIG decision, and let’s be real, you don’t want to be stuck in a field that’s outdated in 5 years.

So let’s break this down — what are the top B.Tech branches that’ll not just get you a job, but set you up for a killer career in the future?

1. Computer Science & Engineering (CSE)

If tech is the future, CSE is the throne. From AI/ML to Cybersecurity, Data Science to Software Development, this field has limitless opportunities.

India’s IT sector alone is expected to grow to $500 billion by 2030 (Source: Nasscom).

Global spending on AI is projected to reach $407 billion by 2027 (Source: IDC) — and guess who’s making AI systems? Yep, CSE grads.

Cybersecurity market projected to hit $538.3 billion by 2030 (Source: Fortune Business Insights).

Top Job Roles & Paychecks:

• AI/ML Engineer – ₹12–40 LPA in top MNCs.

• Data Scientist – ₹10–35 LPA.

• Software Developer – ₹8–30 LPA.

• Cloud Architect & DevOps – ₹15–45 LPA (AWS, Azure, Google Cloud).

Industries Hiring: Tech, Fintech, E-commerce, Cybersecurity, Healthcare, even Gaming.

Top Recruiters: Google, Microsoft, Amazon, Infosys, TCS, Wipro

Verdict: If you’re even a little into coding or tech, CSE is a jackpot.

2. Electronics & Communication Engineering (ECE)

Want a mix of hardware + software? ECE is where it’s at. From embedded systems to IoT, robotics, and telecom, this branch gives you wide career options.

• India to become a $1 trillion digital economy by 2027 (Source: MeitY) — need ECE engineers for IoT, embedded systems, robotics.

• Global IoT market size will hit $2,465 billion by 2029 (Source: Fortune Business Insights).

• 5G deployment is creating millions of new jobs for telecom and ECE experts.

• Semiconductor and chip design is booming — India is set to become a global hub (big money!)

Top Job Roles & Paychecks:

• VLSI Design Engineer – ₹10–30 LPA.

• IoT Engineer – ₹8–25 LPA.

• Telecom/5G Engineer – ₹6–18 LPA.

• Embedded Systems Engineer (Robotics, Automotive) – ₹7–20 LPA.

Industries Hiring: Telecom, Defense (DRDO, ISRO), Electronics, Robotics, Semiconductors, AI hardware.

Verdict: If you like electronics AND software and want to be part of the 5G & IoT revolution, ECE is the move.

Top Recruiters: Qualcomm, Intel, Samsung, DRDO, ISRO, Ericsson

3. Mechanical Engineering

“Old but gold” — Mech isn’t going anywhere. With Automation, Robotics, Aerospace, and Electric Vehicles (EVs) on the rise, mechanical engineers are in huge demand — if you’re ready to adapt.

India’s EV market is set to reach $206 billion by 2030 (Source: IESA) — engineers needed for design, batteries, manufacturing.

• Robotics market globally is expected to hit $74.1 billion by 2026 (Source: Markets and Markets).

• 3D printing, automation, and drones are reshaping Mech engineering jobs.

• Focus on Industry 4.0, Smart Manufacturing, and Mechatronics creating modern Mech jobs.

Top Job Roles & Paychecks:

• EV Design Engineer – ₹8–25 LPA.

• Robotics & Automation Engineer – ₹10–28 LPA.

• Aerospace Engineer (ISRO, HAL) – ₹9–30 LPA.

• Product Design & Development (3D, CAD) – ₹7–18 LPA.

Industries Hiring: EV Companies (Tata, Mahindra, Ola Electric), Defense, Robotics firms, Aerospace.

Verdict: Traditional Mech + New Tech = High Demand. Great for those who like machines, robotics, and cars.

Top Recruiters: Tesla, Mahindra, Tata Motors, GE, ISRO, HAL

4. Information Technology (IT)

Don’t sleep on IT! Very close to CSE, but more application focused. Perfect if you’re into software, systems, and networks but not hard-core algorithms.

India’s tech services exports hit $194 billion in 2023 and growing (Source: Economic Times).

Digital transformation of every sector — banks, healthcare, education, startups need IT pros

Cybersecurity, Cloud Computing, and Big Data = top fields hiring IT graduates.

Top Job Roles & Paychecks:

• Web/App Developer – ₹7–20 LPA.

• Cloud Engineer – ₹10–30 LPA.

• Cybersecurity Analyst – ₹9–28 LPA.

• Database Administrator (DBA) – ₹8–18 LPA.

Industries Hiring: Finance, E-commerce, Edtech, Healthtech, IT giants, Startups.

Verdict: Less intense than CSE but high demand, stable careers — perfect for practical tech lovers.

Top Recruiters: IBM, Accenture, Capgemini, Cisco, Oracle

5. Electrical Engineering

From Renewable Energy to Smart Grids, Electric Vehicles, and Automation, Electrical engineers are shaping the future.

India aims for 500 GW renewable energy capacity by 2030 (Source: MNRE) — huge demand for Electrical Engineers.

EV boom — battery systems, smart grids.

Global smart grid market to grow to $92.97 billion by 2026 (Source: Fortune Business Insights).

Top Job Roles & Paychecks:

• Renewable Energy Engineer – ₹8–22 LPA.

• EV Charging Systems Engineer – ₹7–18 LPA.

• Power Electronics Engineer – ₹9–25 LPA.

• Automation Control Systems – ₹10–30 LPA.

Industries Hiring: Renewable energy firms, EV sector, Power, Smart Home, Automation.

Verdict: Go for this if you care about energy, sustainability, and automation — it’s growing FAST.

Top Recruiters: Siemens, Schneider Electric, ABB, NTPC, Adani Green

Bonus: AI & Data Science (Emerging B.Tech Specializations)

New-age fields like Artificial Intelligence, Data Science, and Robotics Engineering are game-changers. If you can find a college offering B.Tech in these areas — you’re already ahead of the game.

AI/Data Science = Premium salaries + Global demand.

Conclusion: So, Which B.Tech Branch Should You Choose?

CSE & IT if you want high demand, great salaries, global opportunities.

ECE for flexibility — a mix of electronics + coding.

Mechanical & Electrical if you love core engineering and emerging tech like EVs and Robotics.

AI/Data Science for the risk-takers ready to lead the future.

Lost on what to pick? Check out Aimshala.

At Aimshala, we don’t do cookie-cutter advice. We give you personalized career guidance so you pick the right B.Tech branch for YOUR future, not just what your cousin picked.

Confused between CSE and AI?

Not sure if Mech is future-proof?

Want to know where jobs will actually be in 5-10 years?

We got you. Book a session with expert career consultants on Aimshala and get clarity like never before.

Your future deserves real answers. Let’s get it right together.

FAQs:

1. Which B.Tech branch has the highest salary?

• CSE, IT, and AI/Data Science currently offer the highest packages, especially in tech giants and startups.

2. Is Mechanical Engineering still a good choice?

Yes, if you focus on EVs, Robotics, Mechatronics, and stay updated with modern tools. Traditional Mech is evolving fast.

3. Can I switch careers after B.Tech?

Absolutely! Many engineers move into MBA, Data Science, Finance, Product Management later — a B.Tech gives you that flexibility.

4. Which B.Tech branch is best for government jobs?

Civil, Electrical, Mechanical are top choices for PSUs, Railways, and Defense sectors.

5. Should I choose AI/DS even if it’s new?

• If you’re passionate about it and ready to learn — yes! These are future-facing fields with huge demand, but you’ll need to keep learning as tech evolves.

#tech branch#b tech branches#btech job#btech career#future best technology#best tech companies for the future#top b.tech branches to secure your future by 2027 there will be more etfs

0 notes

Text

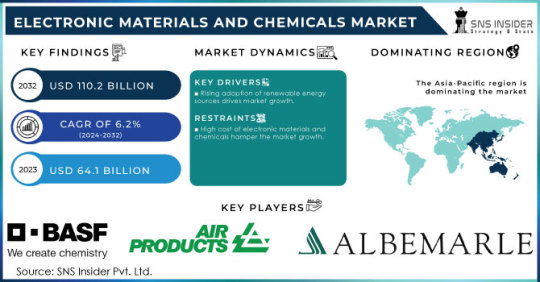

Electronic Materials and Chemicals Market Size, Share, and Industry Analysis

Growing Semiconductor and Electronics Manufacturing Drives Expansion of the Electronic Materials and Chemicals Market.

Electronic Materials and Chemicals Market Size was valued at USD 64.1 billion in 2023 and is expected to reach USD 110.2 billion by 2032 and grow at a CAGR of 6.2% over the forecast period 2024-2032.

The Electronic Materials and Chemicals Market is driven by advancements in semiconductors, printed circuit boards (PCBs), displays, and consumer electronics. These materials and chemicals are essential for the manufacturing of microchips, OLED and LED displays, batteries, and advanced computing devices. With the rising adoption of 5G, IoT, AI, and electric vehicles (EVs), the demand for high-performance materials and chemicals is increasing, pushing manufacturers to innovate and enhance product efficiency.

Key Players in the Electronic Materials and Chemicals Market

The major key players are BASF, Air Products & Chemicals Inc., Albemarle Corporation, Air Liquide Holdings Inc., Ashland Inc., Bayer Ag, Linde Group, Honeywell International Inc., Cabot Microelectronics Corporation, Dow Chemical Company, Monsanto Electronic Materials Co., Hitachi Chemical Company, Brewer Science, Sumitomo Chemical, Shin-Etsu, Covestro, AZ Electronic Materials Plc, HD Microsystems, Drex-Chem Technologies, and other key players are mentioned in the final report.

Future Scope of the Market

The future of the Electronic Materials and Chemicals Market looks promising due to:

Rapid growth of the semiconductor industry with rising chip demand.

Increased production of OLED and micro-LED displays for smartphones and TVs.

Expansion of 5G networks, boosting the need for advanced materials.

Rising investment in AI, IoT, and smart device technologies.

Surging demand for electronic chemicals in electric vehicle (EV) batteries and components.

Emerging Trends in the Electronic Materials and Chemicals Market

The industry is witnessing a shift toward miniaturization and high-performance materials as electronics become more compact and powerful. The rise of 5G technology has accelerated demand for specialized chemicals used in high-frequency circuits and antennas. Additionally, eco-friendly and low-VOC electronic chemicals are gaining traction due to stringent environmental regulations. The growth of quantum computing, AI-driven processors, and flexible electronics is also shaping the market, leading to increased investment in next-generation semiconductor materials, advanced display coatings, and nanoelectronics.

Key Points:

Semiconductor and PCB industries fueling market expansion.

5G, IoT, and AI boosting demand for high-performance materials.

OLED and micro-LED displays driving growth in display chemicals.

Sustainable, low-VOC, and environmentally friendly chemicals gaining traction.

Strong demand for advanced materials in electric vehicle (EV) components.

Conclusion

The Electronic Materials and Chemicals Market is set for robust growth, driven by technological advancements in semiconductors, displays, and smart devices. As demand for high-performance and sustainable materials rises, manufacturers are investing in cutting-edge solutions for the future of electronics. Companies focusing on eco-friendly, high-purity, and next-generation electronic materials are expected to gain a competitive edge in this rapidly evolving market.

Read Full Report: https://www.snsinsider.com/reports/electronic-materials-and-chemicals-market-4156

Contact Us:

Jagney Dave — Vice President of Client Engagement

Phone: +1–315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Electronic Materials and Chemicals Market#Electronic Materials and Chemicals Market Size#Electronic Materials and Chemicals Market Share#Electronic Materials and Chemicals Market Report#Electronic Materials and Chemicals Market Forecast

0 notes

Text

Organic Substrate Packaging Material Market, Global Outlook and Forecast 2025-2032

Organic Substrate Packaging Material Market Size, Share 2024

Organic substrate packaging material is a highly reliable and fine design rule used in semiconductor packaging. These materials serve as a foundational layer in semiconductor devices, providing structural support, electrical connections, and thermal management. They are crucial in the miniaturization and performance enhancement of semiconductor components used in various industries such as consumer electronics, automotive, and healthcare. Organic substrates are primarily made from epoxy resin, polyimide, or other advanced polymer-based materials, which offer high thermal stability and electrical insulation.

Market Size

Download a free Sample Copy https://www.statsmarketresearch.com/global-organic-substrate-packaging-material-forecast-2025-2032-810-8026044

The global Organic Substrate Packaging Material market was valued at approximately USD 13,630 million in 2023 and is projected to reach USD 21,326.54 million by 2032, registering a CAGR of 5.10% during the forecast period.

The North American market, valued at USD 3,868.89 million in 2023, is anticipated to grow at a CAGR of 4.37% over the same period.

The market's growth is driven by rising demand in consumer electronics, advancements in semiconductor packaging technologies, and increasing applications in the automotive and healthcare sectors.

Market Dynamics (Drivers, Restraints, Opportunities, and Challenges)

Drivers:

Growing Demand for Miniaturized Electronics: The increasing demand for compact, high-performance electronic devices fuels the need for advanced semiconductor packaging solutions.

Advancements in Semiconductor Technology: Continuous innovations in chip design and packaging drive the market for organic substrates.

Expansion of 5G and IoT Applications: The widespread adoption of 5G technology and Internet of Things (IoT) devices is increasing the demand for advanced packaging solutions.

Restraints:

High Initial Investment and R&D Costs: The development of organic substrate packaging materials involves significant research and production costs.

Availability of Alternative Packaging Technologies: The presence of alternative packaging materials, such as ceramic-based substrates, may hinder market growth.

Opportunities:

Growing Semiconductor Manufacturing in Asia-Pacific: Countries like China, Taiwan, and South Korea are heavily investing in semiconductor production, creating new opportunities for organic substrate packaging materials.

Emerging Applications in Automotive and Healthcare Sectors: The increasing use of semiconductor-based solutions in autonomous vehicles and medical devices presents growth potential.

Challenges:

Supply Chain Disruptions: Geopolitical tensions and trade restrictions can impact raw material supply and manufacturing operations.

Stringent Environmental Regulations: Increasing concerns regarding the environmental impact of semiconductor manufacturing processes pose regulatory challenges.

Regional Analysis

North America:

Strong presence of leading semiconductor manufacturers in the U.S.

Growing demand for AI-driven and IoT-enabled devices.

Europe:

Increasing R&D investment in semiconductor packaging solutions.

Expansion of the automotive semiconductor industry.

Asia-Pacific:

Dominates the global market due to high semiconductor manufacturing in China, Japan, and South Korea.

Significant government initiatives to boost local semiconductor production.

South America:

Emerging demand for consumer electronics and automotive applications.

Growing investments in the electronics manufacturing sector.

Middle East and Africa:

Increasing focus on digital transformation and smart city projects.

Limited presence of semiconductor manufacturing facilities.

Competitor Analysis

Key Companies:

Amkor Technology Inc.

ASE Kaohsiung

Compass Technology Co. Ltd.

Hitachi Chemical Company Ltd.

Mitsubishi Corporation

STATS ChipPAC Pte. Ltd.

NGK Spark Plug Co. Ltd.

Shinko Electric Industries Co. Ltd.

Showa Denko

Kyocera Corporation

WUS Printed Circuit Co. Ltd.

Market Segmentation (by Application)

Consumer Electronics

Automotive

Manufacturing

Healthcare

Other

Market Segmentation (by Type)

Small Outline (SO) Packages

Grid Array (GA) Packages

Flat No-Leads Packages

Quad Flat Package (QFP)

Dual In-Line Package (DIP)

Other

Geographic Segmentation

North America: USA, Canada, Mexico

Europe: Germany, UK, France, Russia, Italy, Rest of Europe

Asia-Pacific: China, Japan, South Korea, India, Southeast Asia, Rest of Asia-Pacific

South America: Brazil, Argentina, Columbia, Rest of South America

Middle East and Africa: Saudi Arabia, UAE, Egypt, Nigeria, South Africa, Rest of MEA

FAQ Section

What is the current market size of the Organic Substrate Packaging Material market?

As of 2023, the global market size was estimated at USD 13,630 million, with projections reaching USD 21,326.54 million by 2032.

Which are the key companies operating in the Organic Substrate Packaging Material market?

Leading companies include Amkor Technology Inc., ASE Kaohsiung, Compass Technology Co. Ltd., and Hitachi Chemical Company Ltd.

What are the key growth drivers in the Organic Substrate Packaging Material market?

Key growth drivers include rising demand for miniaturized electronics, advancements in semiconductor technology, and expanding applications in 5G and IoT.

Which regions dominate the Organic Substrate Packaging Material market?

Asia-Pacific leads the market due to its strong semiconductor manufacturing industry, followed by North America and Europe.

What are the emerging trends in the Organic Substrate Packaging Material market?

Emerging trends include increased investment in semiconductor packaging innovations, growth in automotive and healthcare applications, and advancements in high-density interconnect (HDI) substrates.

Key Benefits of This Market Research:

Industry drivers, restraints, and opportunities covered in the study

Neutral perspective on the market performance

Recent industry trends and developments

Competitive landscape & strategies of key players

Potential & niche segments and regions exhibiting promising growth covered

Historical, current, and projected market size, in terms of value

In-depth analysis of the Organic Substrate Packaging Material Market

Overview of the regional outlook of the Organic Substrate Packaging Material Market:

Key Reasons to Buy this Report:

Access to date statistics compiled by our researchers. These provide you with historical and forecast data, which is analyzed to tell you why your market is set to change

This enables you to anticipate market changes to remain ahead of your competitors

You will be able to copy data from the Excel spreadsheet straight into your marketing plans, business presentations, or other strategic documents

The concise analysis, clear graph, and table format will enable you to pinpoint the information you require quickly

Provision of market value data for each segment and sub-segment

Indicates the region and segment that is expected to witness the fastest growth as well as to dominate the market

Analysis by geography highlighting the consumption of the product/service in the region as well as indicating the factors that are affecting the market within each region

Competitive landscape which incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled

Extensive company profiles comprising of company overview, company insights, product benchmarking, and SWOT analysis for the major market players

The current as well as the future market outlook of the industry concerning recent developments which involve growth opportunities and drivers as well as challenges and restraints of both emerging as well as developed regions

Includes in-depth analysis of the market from various perspectives through Porter.

Report AttributesReport DetailsReport TitleOrganic Substrate Packaging Material Market, Global Outlook and Forecast 2025-2032Historical Year2018 to 2022 (Data from 2010 can be provided as per availability)Base Year2023Forecast Year2031Number of Pages136 PagesCustomization AvailableYes, the report can be customized as per your need.

#Organic Substrate Packaging Material Market#Organic Substrate Packaging Material Market size#Organic Substrate Packaging Material Market share

0 notes

Text

Conductive Polymer Hybrid Aluminium Electrolytic Capacitor Market 2025-2032

The global Conductive Polymer Hybrid Aluminum Electrolytic Capacitor market was valued at US$ 518.6 million in 2022 and is projected to reach US$ 626.1 million by 2029, at a CAGR of 2.7% during the forecast period.

Download Sample Report PDF

Conductive Polymer Hybrid Aluminum Electrolytic Capacitor Market Overview

The Conductive Polymer Hybrid Aluminum Electrolytic Capacitor is an innovative component in the electrolytic capacitor market, combining the high conductivity of polymers with the robust performance of aluminum electrolytic capacitors. This hybrid technology offers improved stability, longer life, and better performance under high temperatures, making it ideal for applications in the semiconductor industry. As the semiconductor market continues to expand, driven by advances in electronic devices and automotive electronics, the demand for high-performance capacitors like these is set to rise. The electrolytic capacitor market size is expected to grow significantly, with various electrolytic capacitor manufacturers market share evolving in response to technological advancements. Comprehensive electrolytic capacitor market analysis highlights trends such as increased adoption in power supply and automotive sectors, further fueling electrolytic capacitor market growth.

Conductive Polymer Hybrid Aluminum Electrolytic Capacitor Market Segmentation

by Type

Chip Surface Mount Type

Radial Lead Type

SMD (Surface Mount Device) Type

by Application

Automotive Electronics

Industrial Equipment

Consumer Electronics

Power Supplies

Telecommunications Equipment

Medical Devices

key players

Panasonic

Nichicon

Su’scon

Toshin Kogyo

Nippon Chemi-Con

Rubycon

Conductive Polymer Hybrid Aluminum Electrolytic Capacitor Key Market Trends :

Growing Demand for High-Performance Capacitors

Rising Adoption in Automotive Electronics

Expansion in 5G and IoT Applications

Focus on Miniaturization and Higher Capacitance

Advancements in Material and Manufacturing Technologies

FAQs –

Q: What is the current market size of the Conductive Polymer Hybrid Aluminum Electrolytic Capacitor market? A: The market was valued at USD 626.1 million in 2023 and is projected to grow at a steady CAGR 2.7% during the forecast period.

Q: Which are the key companies operating in the Conductive Polymer Hybrid Aluminum Electrolytic Capacitor market? A: Major players include Panasonic, Nichicon, Rubycon, Vishay, KEMET, and Nippon Chemi-Con, among others.

Q: What are the key growth drivers in the Conductive Polymer Hybrid Aluminum Electrolytic Capacitor market? A: Growth is driven by increasing demand for high-performance capacitors in automotive, industrial, and telecom applications, along with advancements in power electronics.

Q: Which regions dominate the Conductive Polymer Hybrid Aluminum Electrolytic Capacitor market? A: Asia-Pacific leads the market, with China, Japan, and South Korea being major hubs due to strong semiconductor and electronics manufacturing industries.

0 notes

Text

Tech Stocks in the US

The tech industry is on fire, and it's no surprise to anyone monitoring the stock market. With rapid advancements in artificial intelligence, cloud computing, semiconductors, 5G, and cybersecurity, investors are keen to know more about which tech stocks have the potential to soar. In this blog post, we’ll dive into these key trends shaping the tech sector and spotlight some promising stocks.

Understanding Tech Stocks

Before we jump into specific sectors, let’s unpack what we mean by tech stocks. Tech stocks refer to shares in companies involved in technology—ranging from software and hardware to telecommunications. Investors often turn to tech stocks for high growth potential. Despite their volatility, the scales of innovation and adoption can lead to significant returns.

Artificial Intelligence

Artificial Intelligence (AI) is more than just buzzword; it's a genuine revolution. Companies like NVIDIA and Microsoft are leading the charge in powerful AI applications. - Estimates show that the global AI market will grow from $27 billion in 2020 to $266 billion by 2027 (Mordor Intelligence). - This staggering growth indicates a treasure chest of potential tech stocks linked to AI. Both NVIDIA (known for making graphics chips) and Microsoft (with Azure's AI integration) could become household names as the industry explodes. Companies investing in AI solutions are increasing efficiency and creating smarter systems which positions them favorably in the stock market.

Cloud Computing

Cloud computing is another vital part of the tech landscape. It’s all about storing and managing data online rather than on local computers. Leading the cloud computing race are companies like Amazon and **Google). - In fact, the global cloud computing market size was valued at $371.4 billion in 2020, and it is expected to expand at a CAGR of 16.3% from 2021 to 2028 (Grand View Research). Increased demand for flexible data storage options gives these companies significant growth potential. Amazon Web Services (AWS) is notably a giant in this field, and their expansive cloud services contribute heavily to the company's overall revenue.

Semiconductors

Let's not forget the world of semiconductors. These tiny chips are essential in powering everything from smartphones to supercomputers. With companies like Intel and AMD at the forefront, there's immense opportunity for growth here. - The semiconductor industry is projected to reach $1 trillion after 2030, driven by advancements in AI, IoT, and more (Bloomberg). Given high demand and increasing reliance on technology, designers and manufacturers in this sector could see their stocks rise sharply over the coming years.

5G Technology

Next up is 5G technology, which promises to enhance connectivity like never before. This technology supports faster data speeds, lower latency, and more reliable wireless communication. Leading companies Energy telecommunications giants include Verizon and T-Mobile. - With an estimated $13.2 trillion in global economic output possible by 2035, companies investing in 5G technology stand to benefit enormously (IHS Markit). Expect developments in smart cities and autonomous vehicles fueled by 5G - both of which signal considerable investment opportunities.

Cybersecurity

As technology advances, so do the threats in the cybersecurity space. Companies like CrowdStrike and Palo Alto Networks focus on guarding against cyber threats. This market is booming faster than most realize, with many businesses increasingly prioritizing data protection. - The global cybersecurity market was valued at $126.0 billion in 2019 and is projected to grow to $345.4 billion by 2026 (Fortune Business Insights). With an ever-increasing number of breaches and ransomware attacks reported, investing in cybersecurity stocks seems wise.

Notable Stocks to Watch

With all these sectors moving fast, let’s look at some specific stocks worthy of your attention. - NVIDIA: Dominant in AI and graphics processing, NVIDIA's chips are everywhere. - Amazon (AWS): They lead in cloud services, revolutionizing operating models. - AMD: Their semiconductor growth is set to keep climbing. - Verizon: As a leading telecom player, their investment into 5G promises future benefits. - CrowdStrike: A rising leader in the cybersecurity field focusing on modern attack vectors. Tips for Investing Wisely - Research Thoroughly: Always examine earnings reports, as well as technological advancements. - Diversify Your Portfolio: Don't put all your eggs in one basket—spread your investments across different sectors. - Stay Updated on Trends: Tech is always changing, so keeping up to date is essential for making informed decisions.

Conclusion

By focusing on artificial intelligence, cloud computing, semiconductors, 5G, and cybersecurity, tech stocks present lucrative investment opportunities. Though it's vital to stay informed, the growing demand in these sectors indicates that tech stocks may continue to shine in the U.S. market. Take a deep dive into these areas of technology, and you may uncover a powerful advantage in your investment strategies. Happy investing! For more detailed analyses about specific tech stocks, make sure to check reliable news sources and investment websites. They often provide valuable insights and updates—a must for any savvy investor! Read the full article

0 notes

Text

Semiconductor Wafer Polishing and Grinding Equipment Market: Trends and Insights

Market Overview

The Semiconductor Wafer Polishing and Grinding Equipment Market is expected to register a CAGR of 4.1% during the forecast period. The global semiconductor wafer polishing and grinding equipment market has been witnessing steady growth, driven by the rising demand for miniaturized electronic devices and advanced semiconductor fabrication technologies. The increasing adoption of System-on-Chip (SoC), microelectromechanical systems (MEMS), and advanced packaging techniques has further propelled market expansion.

Key Market Drivers

Surging Demand for Consumer Electronics – The proliferation of smartphones, laptops, smart devices, and IoT-connected appliances fuels the need for high-performance semiconductors.

Growth in AI and 5G Technologies – AI-driven applications and the widespread deployment of 5G networks demand sophisticated semiconductor chips, boosting the need for precision wafer processing.

Advancements in Semiconductor Manufacturing – The shift towards 3D ICs, FinFET technology, and smaller node sizes (7nm, 5nm, and beyond) has necessitated advanced wafer grinding and polishing techniques.

Rising Demand for Automotive Electronics – The increasing use of semiconductor-based sensors, processors, and controllers in electric vehicles (EVs) and autonomous vehicles contributes to market growth.

Increase in Foundry Investments – Leading semiconductor manufacturers such as TSMC, Samsung, and Intel are heavily investing in new fabrication plants, further driving the demand for wafer processing equipment.

Market Segmentation

The market is segmented based on equipment type, wafer size, application, and geography.

1. By Equipment Type

Wafer Grinding Equipment – Used for thinning wafers to the desired thickness for different applications.

Wafer Polishing Equipment – Ensures smooth surfaces and removes defects to improve wafer quality.

CMP (Chemical Mechanical Polishing) Equipment – Provides a hybrid polishing approach for high-precision semiconductor processing.

2. By Wafer Size

150mm Wafers

200mm Wafers

300mm Wafers (Dominant segment) – Most advanced semiconductor production relies on larger wafer sizes to improve yield and efficiency.

3. By Application

Memory & Logic ICs – Used in computing and data storage applications.

Power Devices – Essential for energy-efficient systems in electric vehicles and renewable energy applications.

MEMS & Sensors – Integral to industrial automation, healthcare, and smart consumer electronics.

Optoelectronics – Widely used in LED, laser, and photonic applications.

4. By Geography

North America – Leading due to strong semiconductor industry players like Intel, AMD, and Qualcomm.

Asia-Pacific (Largest Market) – Driven by semiconductor giants in Taiwan, South Korea, and China.

Europe – Growing demand for automotive and industrial semiconductor applications.

Rest of the World – Emerging semiconductor manufacturing hubs in the Middle East and Latin America.

Industry Challenges

Despite strong growth, the industry faces several challenges:

High Capital Investment – The cost of wafer polishing and grinding equipment is significant, impacting smaller semiconductor manufacturers.

Technological Complexity – Achieving ultra-thin wafers without defects requires advanced and precise equipment.

Supply Chain Disruptions – Semiconductor shortages and geopolitical factors affect the availability of raw materials and machinery components.

Stringent Regulatory Standards – Environmental regulations around chemical usage in polishing and grinding processes require manufacturers to adopt sustainable practices.

Market Trends and Innovations

Automation & AI Integration – Adoption of AI-driven predictive maintenance and automation in wafer processing to enhance efficiency.

Sustainable Manufacturing – Development of eco-friendly CMP slurries and water-recycling systems to reduce environmental impact.

Hybrid Processing Techniques – Combination of CMP and mechanical polishing to improve wafer uniformity and precision.

Emergence of 450mm Wafers – Although still in development, larger wafer sizes could revolutionize semiconductor production.

Future Outlook

The semiconductor wafer polishing and grinding equipment market is poised for sustained growth, driven by ongoing technological advancements and the increasing need for high-performance semiconductors. With strong investments in semiconductor fabrication plants and growing demand for AI, 5G, and automotive electronics, manufacturers are expected to prioritize innovation in wafer processing solutions.

Companies investing in automation, sustainable practices, and precision technologies will likely gain a competitive edge in this evolving industry. The future of semiconductor manufacturing will depend on how efficiently companies can scale up production while maintaining wafer quality and sustainability.

Conclusion

The semiconductor wafer polishing and grinding equipment market is an integral part of the rapidly expanding semiconductor industry. As demand for smaller, more efficient, and powerful semiconductor chips continues to grow, advancements in wafer processing technology will play a crucial role in shaping the future of electronics. By addressing industry challenges and leveraging cutting-edge innovations, market players can capitalize on the tremendous growth opportunities in this sector. For a detailed overview and more insights, you can refer to the full market research report by Mordor Intelligence. https://www.mordorintelligence.com/industry-reports/semiconductor-wafer-polishing-and-grinding-equipment-market

#Semiconductor Wafer Polishing and Grinding Equipment Market#Semiconductor Wafer Polishing and Grinding Equipment Market size#Semiconductor Wafer Polishing and Grinding Equipment Market share#Semiconductor Wafer Polishing and Grinding Equipment Market trends

0 notes

Text

3D Semiconductor Packaging Market - Forecast, 2024-2030

3D Semiconductor Packaging market size is forecast to reach US$37.8 billion by 2030, after growing at a CAGR of 16.9% during 2024-2030. 3D semiconductor packaging involves stacking and interconnecting multiple layers of chips to create more compact, powerful, and efficient electronic devices. The growing demand for miniaturized electronics such as smartphones and wearables are a key driver of this market. Additionally, the rising number of IoT devices has increased the need for high-performance, high-density chips. Automotive electronics and the expansion of data centers also contribute to market growth as they require advanced packaging solutions for better power efficiency and thermal management.

0 notes

Text

🤖 Future Unlocked: How Robots Are Revolutionizing Semiconductor Sorting!

Robotic Semiconductor Sorting Systems Market : In the fast-paced semiconductor industry, robotic semiconductor sorting systems are transforming the efficiency, precision, and scalability of wafer and chip processing. These cutting-edge systems leverage AI-driven automation, machine vision, and high-speed robotic arms to ensure defect-free semiconductor manufacturing.

To Request Sample Report : https://www.globalinsightservices.com/request-sample/?id=GIS32684 &utm_source=SnehaPatil&utm_medium=Linkedin

How Robotic Sorting Works

Robotic semiconductor sorters integrate machine vision cameras, deep learning algorithms, and precision robotic actuators to categorize wafers, dies, and chips based on quality, size, and electrical characteristics. The system consists of: ✔ Automated Pick-and-Place Robots — High-speed robotic arms with micro-level accuracy move chips efficiently. ✔ AI-Powered Inspection — Deep learning-based vision systems detect defects and classify components in real time. ✔ High-Throughput Handling — Advanced sorting algorithms optimize wafer handling, minimizing downtime. ✔ Real-Time Data Analytics — IoT-enabled robots provide live performance insights, improving yield and quality control.

Key Benefits of Robotic Sorting Systems

📌 Precision & Accuracy — Sub-micron level accuracy ensures reliable sorting of chips for high-performance applications. 📌 Speed & Throughput — AI algorithms combined with robotic systems enhance processing speeds beyond human capabilities. 📌 Cost Reduction — Automation lowers labor costs and reduces waste by improving defect detection. 📌 Scalability — Easily adapts to different chip sizes and packaging types for future semiconductor demands.

Future Trends in Semiconductor Sorting Robotics

🔹 AI-Driven Predictive Maintenance — Machine learning models predict failures before they happen. 🔹 5G & Edge Computing Integration — Faster data processing for real-time sorting optimization. 🔹 Collaborative Robotics (Cobots) — Safer human-robot interaction for hybrid automation. 🔹 Quantum Chip Sorting — Next-gen robotic sorters designed for ultra-precise quantum computing components.

With semiconductor manufacturing pushing toward sub-5nm nodes and AI-driven fabs, robotic sorting systems are crucial for achieving the next level of automation. The future is autonomous, data-driven, and highly efficient!

#robotics #semiconductors #automation #ai #machinelearning #visioninspection #pickandplace #chipmanufacturing #waferhandling #industry40 #smartmanufacturing #autonomousrobots #deeplearning #roboticautomation #microelectronics #highprecision #iot #predictivemaintenance #cobots #5g #nanotechnology #edgecomputing #intelligentautomation #yieldoptimization #defectdetection #chipquality #electronicsmanufacturing #waferfabrication #cleanroomtechnology #advancedmanufacturing #integratedcircuits #artificialintelligence #siliconchips #manufacturingautomation #quantumcomputing

0 notes

Text

Boost Manufacturing Efficiency with the Latest in Artificial Intelligence

The global artificial intelligence in manufacturing market size is anticipated to reach USD 47.88 billion by 2030 and is anticipated to expand at a CAGR of 44.2% during the forecast period, according to a new report by Grand View Research, Inc. The substantial driver propelling the growth of the market is the escalating demand to manage progressively larger and intricate datasets, coupled with the emergence of industrial IoT and automation technology. The market's expansion is primarily attributed to the widespread utilization of big data, machine learning models, industrial robots, and the progression of the Internet of Things (IoT). Additionally, key macro drivers such as prioritizing value creation and delivering enhanced customer experiences contribute significantly to the notable growth observed in the artificial intelligence in manufacturing market.

Innovations in computer vision technology empowered manufacturers to apply AI-based quality control methods. With machine learning algorithms trained on vast datasets, it became possible to perform real-time inspections and identify flaws during production. AI-powered systems were proficient in accurately spotting variations or faults in products, ensuring elevated quality standards, and decreasing the chances of faulty goods reaching consumers. This shift in quality control not only boosted product dependability but also aided in minimizing waste and enhancing customer satisfaction.

The European market anticipates a consistent and rapid surge in revenue growth throughout the projected period, primarily propelled by increased governmental endeavors to implement smart factory initiatives across Europe. The European Union (EU) has formulated an AI strategy with the objective of positioning the EU as a frontrunner in AI innovation while ensuring the development and utilization of machine learning aligns with human-centric values and is deemed reliable. To bolster proficiency in AI, there's a concerted effort between the commission and member states to collaborate on policies and investments. The Commission's ambitious plan involves an annual allocation of 20 billion euros for the next decade towards AI, aiming to draw additional investments from both private sectors and EU member states. These measures are poised to bolster and sustain market revenue growth within the region.

Artificial Intelligence in Manufacturing Market Report Highlights

The hardware segment dominated the component segment with 42.13% share in 2023 owing to the increasing demand for specialized chips.

The production planning segment held the largest market share in 2023. AI-powered production planning systems were transforming demand prediction by incorporating sophisticated predictive analytics.

The medical device segment held the largest market in 2023 in end use segment. Owing to its technology, encompassing quality control, yield optimization, and predictive maintenance, among other functionalities.

North America’s market's revenue growth is propelled by the presence of large companies producing high-performance hardware components essential for running advanced machine learning models.

In January 2023, Intel Corporation launched the 4th Generation Xeon Scalable Processors along with the Max Series CPUs and GPUs, representing Intel's highly sustainable data center processors. These processors offer a variety of capabilities to enhance power efficiency and performance while maximizing CPU resources, aligning with customers' sustainability objectives.

Artificial Intelligence in Manufacturing Market Segmentation

Grand View Research has segmented the artificial intelligence in manufacturing market on the basis of component, technology, application, and end-use region:

Artificial Intelligence in Manufacturing Component Outlook (Revenue, USD Million, 2017 - 2030)

Hardware

Software

Services

Artificial Intelligence in Manufacturing Technology Outlook (Revenue, USD Million, 2017 - 2030)

Machine Learning (ML)

Computer Vision

Context Awareness

Natural Language Processing

Artificial Intelligence in Manufacturing Application Outlook (Revenue, USD Million, 2017 - 2030)

Material Movement

Predictive Maintenance & Machinery Inspection

Production Planning

Field Services

Quality Control & Reclamation

Others

Artificial Intelligence in Manufacturing End-Use Outlook (Revenue, USD Million, 2017 - 2030)

Semiconductor & Electronics

Energy & Power

Medical devices

Automobile

Heavy Metal & Machine Manufacturing

Others

Artificial Intelligence in Manufacturing Region Outlook (Revenue, USD Million, 2017 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Asia Pacific

Japan

China

India

South Korea

Australia

Latin America

Brazil

Mexico

Middle East & Africa

South Africa

Saudi Arabia

UAE

Key Players in the Artificial Intelligence in Manufacturing Market

AIBrain Inc.

Amazon Web Services

Aquant Inc.

Cisco Systems Inc

General Electric Company

General Vision Inc.

Google LLC (Alphabet Inc.)

IBM Corporation

Intel Corporation

Micron Technology Inc.

Microsoft Corporation

Mitsubishi Electric Corporation

NVIDIA Corporation

Oracle Corporation

Rethink Robotics

Rockwell Automation Inc

SAP SE

Siemens AG

Sight Machine

Spark Cognition Inc.

Order a free sample PDF of the Artificial Intelligence in Manufacturing Market Intelligence Study, published by Grand View Research.

0 notes

Text

Weekly Tech News & Product Announcements (Feb 24-Feb 28, 2025)

1. Apple’s iPhone 16 to Feature Revolutionary Foldable Display Date: February 24, 2025 What’s Happening: Apple has revealed plans to introduce a foldable display in its upcoming iPhone 16, marking the company’s entry into the foldable smartphone market. Why It Matters: The foldable display will allow Apple to offer a larger screen size in a compact form, catering to the growing demand for foldable devices. With Apple’s massive user base, this could push the foldable phone market into mainstream adoption. Source: TechCrunch

2. Microsoft Announces AI-Powered Windows 12 Features for Enhanced Productivity Date: February 25, 2025 What’s Happening: Microsoft has previewed new AI features coming to Windows 12, including predictive text, automated task management, and enhanced security. Why It Matters: These features are designed to improve user productivity by automating routine tasks and enhancing system security. As the first AI-integrated version of Windows, it promises a smarter, more efficient operating system for users across different sectors. Source: The Verge

3. Tesla’s New Full-Self Driving Beta Update Released in Europe Date: February 26, 2025 What’s Happening: Tesla has rolled out its Full-Self Driving (FSD) beta update across Europe, expanding its autonomous driving features to more regions. Why It Matters: The update includes advanced navigation and autopilot features, pushing Tesla closer to full autonomy. This release is a key step in Tesla’s global expansion of its self-driving technology, bringing it one step closer to mainstream use in Europe. Source: Reuters

4. Google’s Bard AI Becomes Available to Developers for Custom Applications Date: February 27, 2025 What’s Happening: Google has made its Bard AI platform available to developers for building custom AI applications, further enhancing its capabilities in language understanding and generation. Why It Matters: By opening up Bard AI to developers, Google is enabling the creation of more diverse and specialized AI solutions, which could drive innovation in industries like healthcare, education, and customer service. Source: Wired

5. Sony Expands PlayStation VR2 with New Exclusive Game Titles Date: February 27, 2025 What’s Happening: Sony has announced the release of several exclusive titles for its PlayStation VR2 headset, enhancing its VR gaming experience. Why It Matters: With these new titles, Sony is solidifying its position in the VR gaming market and driving further adoption of PlayStation VR2. The exclusive games offer immersive experiences, catering to a growing demand for high-quality VR content. Source: CNET

6. AMD Releases New Ryzen 8000 Series Processors for Gaming and Workstations Date: February 28, 2025 What’s Happening: AMD has launched its Ryzen 8000 series processors, designed to deliver cutting-edge performance for gaming PCs and professional workstations. Why It Matters: The new Ryzen chips offer faster clock speeds, better multi-threading, and improved energy efficiency, providing gamers and professionals with the power needed to run the most demanding applications. This release strengthens AMD’s position as a leader in the high-performance processor market. Source: Tom’s Hardware

About Kinghelm

Kinghelm is a leading provider of high-quality electronic components, including RoHS-compliant antennas, wires, plug-ins, switches, and connectors. With over 17 years of experience, the company serves industries including automotive, telecommunications, industrial automation, medical devices, and consumer electronics. Kinghelm is known for its durable, reliable components that meet international standards and are used in applications ranging from renewable energy to IoT devices.

#TechNews #Electronics #AI #QuantumComputing #VR #EVTech #Sustainability #Innovation

0 notes

Text

Quantum Networking Market: Revolutionizing Secure Data Transmission

The Next Frontier in Ultra-Secure and High-Speed Communication

Introduction

The quantum networking market is rapidly gaining momentum as advancements in quantum computing, cryptography, and secure data transmission redefine the future of communications. With growing concerns over cybersecurity threats and data breaches, industries are shifting towards quantum-secure networks to ensure unbreakable encryption and ultra-fast communication.

The Quantum Networking Market Size is expected to witness significant growth, projected to reach $11,060 Million by 2030, expanding at a CAGR of 41.7%. The increasing investments in quantum technologies, government funding, and the rise of quantum-enabled cybersecurity solutions are fueling this expansion.

Key Market Drivers

Rising Cybersecurity Threats – The need for hacker-proof encryption is driving demand for quantum-safe communication.

Advancements in Quantum Computing – Breakthroughs in quantum entanglement and QKD (Quantum Key Distribution) enhance network security.

Growing Government & Enterprise Investments – Countries like the U.S., China, and European nations are funding quantum research extensively.

Expansion of 5G and Edge Computing – Integration of quantum networks with 5G and IoT will revolutionize secure data transmission.

How Is Quantum Networking Transforming Data Security?

The Global Quantum Networking Market is bringing a paradigm shift in cybersecurity. Quantum networks use quantum key distribution (QKD) to create unbreakable encryption that cannot be hacked using traditional computing methods. With entanglement-based communication, quantum networks ensure absolute data integrity, making them crucial for sectors like finance, defense, and healthcare.

Market Challenges & Emerging Innovations

While the quantum networking market holds immense potential, it faces key challenges:

High Implementation Costs – Quantum networks require specialized infrastructure and high investment.

Scalability Issues – Large-scale quantum communication networks are still in early development stages.

Technological Limitations – Quantum repeaters and error correction remain major hurdles for long-distance communication.

Despite these challenges, innovations such as satellite-based quantum communication, hybrid classical-quantum networks, and advanced photonic chips are driving industry advancements.

Regional Insights: Where Is the Market Growing the Fastest?

North America leads due to strong R&D investments and enterprise adoption of quantum technologies.

Europe is making strides with government-backed quantum initiatives and secure communication projects.

Asia-Pacific is witnessing rapid growth, particularly in China and Japan, where major investments are accelerating quantum networking applications.

Future Outlook: What Lies Ahead for the Quantum Networking Market?

The Quantum Networking Market Size is set to expand as governments, tech giants, and startups collaborate to build the next generation of secure communication networks. As quantum computing continues to evolve, quantum networks will become a mainstream solution for ultra-secure data transmission.

For expert insights into the evolving market landscape, Mark & Spark Solutions provides in-depth research and strategic analysis.

0 notes

Text

Future of 5G Chipset Market: Insights from Industry Experts

The global 5G chipset market size is anticipated to reach USD 143.69 billion by 2030, expanding at a CAGR of 20.7% from 2024 to 2030, according to a new report by Grand View Research, Inc. With the increasing demand for 5G-enabled devices, there is a growing need for more powerful and efficient 5G chipsets that can support these devices. To improve performance and efficiency, many chipsets are being designed with built-in Artificial Intelligence (AI) capabilities, which allow devices to process data more quickly and accurately and make more intelligent decisions.

Additionally, there is an increasing focus on the development of specialized 5G chipsets for specific use cases, such as IoT devices, automotive applications, and virtual and augmented reality applications, which bodes well for the market growth. The rising demand for high-speed internet is a major driving force behind the growth of the market. With the increasing popularity of bandwidth-intensive applications such as high-quality video streaming, virtual and augmented reality, and cloud gaming, there is a need for faster and more reliable internet connectivity.

The 5G network is designed to provide significantly faster download and upload speeds, lower latency, and greater capacity than previous generations of wireless networks. As a result, there is a growing need for 5G chipsets that can enable high-speed internet connectivity for a wide range of devices, including smartphones, laptops, and IoT devices.

With the rollout of 5G networks in many parts of the world, consumers are increasingly looking for devices that can take advantage of the new technology. 5G smartphones offer faster download and upload speeds, lower latency, and greater capacity than previous generations of smartphones, allowing users to enjoy faster and more reliable internet connectivity. As a result, there is a growing need for 5G chipsets that can power these devices, enabling them to provide the high-speed connectivity that users demand.

Gather more insights about the market drivers, restrains and growth of the 5G Chipset Market

5G Chipset Market Report Highlights

• Based on type, the RFICs segment dominated the market in 2023. The rising complexity of smartphones, which necessitates the use of additional RF transceiver ICs to support numerous antennas for features such as 4G/5G connection, Wi-Fi, Bluetooth, GPS, and NFC, is a major factor driving the segment growth.

• Based on operating frequency, the Sub-6 GHz segment dominated the market in 2023. Increasing use of Sub-6 GHz technologies to provide comprehensive coverage in urban and rural regions, since these frequency bands offer more range and penetration than higher mmWave bands, is a primary factor driving the segment growth.

• Based on processing node type, the 7 nm segment dominated the market in 2023. The increasing use of the 7 nm technology node in chip design, which offers lower power consumption, greater switching performance, and higher density, is a primary factor driving the segment growth.

• Based on deployment type, the smartphones segment dominated the market in 2023. The segment's growth is mostly attributed to the rising customer demand for mobile connection that is both quicker and more dependable.

• Based on vertical, the IT & telecommunication segment dominated the market in 2023. Significant factors influencing the segment growth include major manufacturers' extensive efforts in developing 5G chipset modules for telecom base stations, and other communication equipment’s.

• The Asia Pacific region dominated the market in 2023 owing to the rising demand for high-speed connection by consumers and the growing usage of modern technologies such as IoT, AI, and cloud computing.

• In September 2023, Qualcomm Technologies, Inc. announced an agreement with Apple Inc. to provide Snapdragon 5G Modem-RF Systems for upcoming smartphone releases spanning 2024 through 2026. This partnership reinforces Qualcomm Technologies, Inc.’s continued dominance in 5G technologies and product innovation.

5G Chipset Market Segmentation

Grand View Research has segmented the global 5G chipset market based on type, operating frequency, processing node type, deployment, vertical, and region:

5G Chipset Type Outlook (Revenue, USD Million, 2019 - 2030)

• Modems

• RFICs

o RF Transceivers

o RF FE

• Others

5G Chipset Operating Frequency Outlook (Revenue, USD Million, 2019 - 2030)

• Sub-6 GHz

• 24-39 GHz

• Above 39 GHz

5G Chipset Processing Node Type Outlook (Revenue, USD Million, 2019 - 2030)

• 7 nm

• 10 nm

• Others

5G Chipset Deployment Type Outlook (Revenue, USD Million, 2019 - 2030)

• Telecom Base Station Equipment

• Smartphones/Tablets

o Single-Mode

o Multi-Mode

• Connected Vehicles

o Single-Mode

o Multi-Mode

• Connected Devices

o Single-Mode

o Multi-Mode

• Broadband Access Gateway Devices

o Single-Mode

o Multi-Mode

• Others

o Single-Mode

o Multi-Mode

5G Chipset Vertical Outlook (Revenue, USD Million, 2019 - 2030)

• Manufacturing

• Energy & Utilities

• Media & Entertainment

• IT & Telecom

• Transportation & Logistics

• Healthcare

• Others

5G Chipset Regional Outlook (Revenue, USD Million, 2019 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o UK

o Germany

o Sweden

• Asia Pacific

o China

o India

o Japan

o South Korea

o Australia

• Latin America

o Brazil

• Middle East & Africa

o Kingdom of Saudi Arabia

o UAE

o South Africa

List of Key Players in the 5G Chipset Market

• Huawei Technologies, Inc.

• MediaTek Inc.

• Intel Corporation

• Samsung Electronics Co., Ltd.

• Infineon Technologies AG

• Qualcomm Technologies, Inc.

• Unisoc Communications Inc.

• Qorvo, Inc.

• Murata Manufacturing Co., Ltd.

• MACOM

Order a free sample PDF of the 5G Chipset Market Intelligence Study, published by Grand View Research.

#5G Chipset Market#5G Chipset Market Size#5G Chipset Market Share#5G Chipset Market Analysis#5G Chipset Market Growth

0 notes

Text

Ultra-high Purity Metal Sputtering Targets for Semiconductors Market, Global Outlook and Forecast 2025-2032

Ultra-high purity metal sputtering targets are critical materials used in semiconductor manufacturing. These targets are composed of highly refined metals, such as aluminum, copper, tantalum, and titanium, and are utilized in physical vapor deposition (PVD) processes to create thin films in semiconductor devices. Their superior purity ensures minimal contamination, making them essential for advanced microelectronics and nanotechnology applications.

Market Size

Download FREE Sample of this Report @ https://www.24chemicalresearch.com/download-sample/288635/global-ultrahigh-purity-metal-sputtering-targets-for-semiconductors-forecast-market-2025-2032-46

The global Ultra-high Purity Metal Sputtering Targets for Semiconductors market was valued at USD 721.50 million in 2023 and is projected to reach USD 1138.62 million by 2032, growing at a CAGR of 5.20% during the forecast period.