#InsuranceBrokerSoftware

Explore tagged Tumblr posts

Text

What Are the Key Features of POSP Insurance Software?

A POSP (Point of Sale Person) Insurance Software is designed to streamline the policy issuance process for agents, making it easier to sell and manage insurance policies efficiently. The right POSP software ensures compliance, automates sales, and enhances the customer experience.

Key Features of a POSP Insurance Software:

1️⃣ Easy POSP Registration & Onboarding

A seamless registration process helps agents get onboarded quickly with minimal paperwork. Automated KYC verification and IRDAI-compliant training modules ensure a smooth start.

2️⃣ Automated Policy Issuance

POSP agents can issue insurance policies instantly without manual intervention. The system integrates with insurance providers, allowing quick premium calculations and policy generation.

3️⃣ Lead & Customer Management

A built-in CRM enables POSP agents to track and manage leads effectively. It provides real-time insights into customer interactions, follow-ups, and conversions.

4️⃣ Commission Tracking & Payout Management

Agents can monitor their earnings with an advanced commission tracking system. Automated payout calculations ensure transparency and timely disbursement.

5️⃣ Digital Document Management

Store, manage, and retrieve policy documents, customer details, and compliance records securely within the software. E-signatures and digital approvals eliminate paperwork hassles.

6️⃣ Multi-Insurance Product Support

POSP software supports various insurance categories, including motor, health, life, and travel insurance. Agents can offer multiple policy options to customers from a single dashboard.

7️⃣ Real-time Sales Dashboard

A user-friendly dashboard provides real-time data on sales, revenue, and performance analytics. Agents can track their progress and optimize their selling strategies.

8️⃣ Mobile Accessibility & Cloud Integration

Modern POSP solutions come with mobile apps, allowing agents to sell policies on the go. Cloud-based systems ensure data security, seamless updates, and remote access.

9️⃣ Regulatory Compliance & IRDAI Guidelines

A robust POSP software ensures compliance with IRDAI regulations, providing automated checks and built-in compliance management.

🔟 Customer Engagement & Support

Integrated chat, WhatsApp, and email support help agents engage with customers effectively. Automated reminders for renewals and follow-ups enhance customer retention.

🚀 Looking for the Best POSP Insurance Software? Explore Mindzen’s mZapp Retail - POSP Insurance Software and empower your insurance sales with automation and efficiency.

#POSPInsurance#POSPSoftware#Mindzen#mZapp#InsuranceTechnology#InsuranceSales#POSPIndia#RetailInsurance#POSPManagement#DigitalInsurance#PolicyIssuance#AgentDashboard#SalesAutomation#LeadManagement#CommissionTracking#POSPRegistration#InsuranceBrokerSoftware#CustomerEngagement#RegulatoryCompliance#InsuranceAgents#POSPPlatform#InsuranceSolutions#CloudBasedCRM#AgentEmpowerment#POSPTraining#PolicyManagement#ClientManagement#POSPOpportunities#POSPOnboarding#InsuranceGrowth

0 notes

Text

MOST RECOMMENDED TIPS TO GENERATE INSURANCE LEADS

Insurance lead generation is one of the promising and challenging market segments. Like any other marketing activity, the hitches and lenience of policy selling co-exist. It’s all about how you perceive the behavioral patterns of your potential customers.

This article will walk you through the most recommended lead generation tips that can be used by insurance brokers and agents in order to generate high-quality leads on a consistent basis. Check out the details now.

↗️ Be a genuine “helper” to your existing client base ↗️ Practice compensation based referral programs ↗️ Listen more to talk levelheaded

CHECK OUT THIS BLOG TO EXPLORE FULL TIPS‼️

✅ LINK HERE: https://sibro.xyz/7-best-lead-generation-tips-for-your-insurance-broking-business/

2 notes

·

View notes

Text

Why do top-performing insurance brokers rely on CRM software?

Top-performing insurance brokers rely on CRM software because it helps them streamline operations, boost client relationships, and drive business growth. A specialized Insurance CRM offers features like policy management, automated follow-ups, claims tracking, and real-time analytics, ensuring brokers can focus on sales and customer service rather than administrative tasks.

With Mindzen's Insurance Broker Software (https://mindzen.com/insurance-broker-software/), brokers can efficiently manage leads, automate reminders for renewals, integrate with insurers, and provide a seamless experience to clients—all from a single platform.

💡 Why brokers trust CRM software? ✅ Efficient Lead Management – Organize and track leads effortlessly ✅ Automated Follow-Ups – Never miss a renewal or follow-up ✅ Claims & Policy Tracking – Manage policies and claims with ease ✅ Data-Driven Decisions – Access real-time reports and analytics ✅ Enhanced Customer Engagement – Deliver personalized service and faster responses

🚀 Stay ahead in the competitive insurance market with Mindzen's Insurance Broker Software!

#InsuranceCRM#InsuranceBrokerSoftware#Mindzen#CRMForBrokers#InsuranceTechnology#InsuranceLeads#CRMTools#CustomerEngagement#DigitalInsurance#PolicyManagement#ClaimsTracking#AutomatedFollowUps#LeadManagement#InsuranceSolutions#CRMIntegration#ClientRetention#BusinessGrowth#SalesAutomation#BrokerEfficiency#InsuranceTrends#InsuranceSales#TechForInsurance#InsurTech#RenewalManagement#BrokerTools#CRMStrategy#AIInInsurance#InsuranceCRMIndia#SmartInsurance#InsuranceBusiness

0 notes

Text

Ready to Boost Your Retail Insurance Business with Mzapp Retail POSP?

Are you managing your retail insurance processes with outdated tools? Is your POSP system holding back your potential? 🚨

Ask yourself: ✅ Do you have a POSP team? ✅ Are you spending precious time and resources reconciling the POSP payouts? ✅ Are you planning for a cost effective B2C retail portal?

If you said YES, then it’s time to revolutionize your insurance process with Mzapp Retail - POSP Insurance Broker Software!

🔑 Simplify Retail Insurance Sales 📲 Empower POSP Agents with Smart Tools 📊 Optimize Policy Tracking, Claims & Renewals

🔗 Book a Free Demo and see how Mzapp Retail can enhance your retail insurance process!

Don’t miss out on the future of retail insurance! 🚀

#MzappRetail#POSPInsurance#InsuranceBrokerSoftware#RetailInsurance#POSPIndia#InsurancePOSP#POSPManagement#InsuranceTechnology#InsuranceCRM#POSPSolutions#RetailInsuranceBrokers#SmartInsurance#InsuranceSoftware#PolicyManagement#InsuranceRenewals#POSPSupport#ClaimsTracking#POSPIndiaSoftware#DigitalInsurance#InsuranceTools#RetailSales#InsuranceAgents#PolicyTracking#RetailBusinessGrowth#InsuranceAutomation#InsuranceTech#InsuranceSales#DigitalPOSP#RetailInsuranceIndia#POSPSoftware

0 notes

Text

🚀 Attention Insurance Brokers! Struggling to Grow Your Business?

If you want to attract more clients, increase policy sales, and automate follow-ups, I’d love to share how our digital marketing strategies can help you:

📈 Generate high-quality insurance leads 🌍 Increase visibility with SEO & targeted ads 🤖 Automate follow-ups to boost conversions 📢 Strengthen your brand presence across digital platforms

💡 Our Digital Marketing Services Include: ✅ SEO, SEM, Social Media Marketing (SMM), SMO, Email & WhatsApp Marketing ✅ Website Creation & Optimization for Insurance Brokers ✅ Lead Nurturing & CRM for Client Management ✅ Marketing Automation for Emails & WhatsApp

🎯 Free Insurance Marketing Audit! We’re currently offering a free insurance marketing audit to help optimize your website & campaigns for better lead generation.

📅 Claim your free marketing audit here: 🔗 https://mindzen.com/claim-your-free-website-audit-or-book-a-consultation/?utm_source=quora&utm_medium=organic-social&utm_campaign=insurance-marketing-audit

📂 Download a Sample Audit Report: 🔗 https://share.hsforms.com/1ept0w6SzQrKpboH7INCPWQ3el5k

📌 More details: 🔗 https://mindzen.com/digital-marketing/?utm_source=quora&utm_medium=organic-social&utm_campaign=insurance-marketing

I’d love to discuss how we can help! Let’s connect.

📞 Type "Call back" – Let’s discuss how we can help!

Lakshmi - Customer Support 📩 Email: [email protected] 📞 Call/WhatsApp: +91 91763 26404 / +91 70109 37311

#InsuranceBroker#InsuranceCRM#InsuranceSoftware#InsuranceLeads#DigitalMarketingForInsurance#InsuranceAgencyGrowth#InsuranceTechnology#InsuranceBusiness#LeadGeneration#InsuranceMarketing#SEOForInsurance#InsuranceSales#PolicySales#MarketingAutomation#SocialMediaMarketing#EmailMarketing#WhatsAppMarketing#InsuranceWebsite#InsuranceSEO#InsuranceAds#GoogleAdsForInsurance#InsuranceBranding#InsuranceGrowth#LeadNurturing#ClientManagement#InsuranceBrokerSoftware#InsuranceCRMSoftware#PolicyManagement#ClaimsManagement#HealthInsurance

0 notes

Text

What are the essential features to look for in an Insurance CRM solution?

An Insurance CRM solution should streamline processes, enhance customer relationships, and drive operational efficiency. Here are the essential features to look for:

1. Policy Management

Centralized repository for managing policies, renewals, and expirations.

Automated reminders for policy updates to ensure seamless renewals.

2. Claims Tracking

Real-time updates on claims status.

Simplified claims submission workflows for brokers and customers.

3. Lead Management

Tools to capture, track, and nurture leads efficiently.

Integration with marketing campaigns to drive conversions.

4. Multi-Channel Communication

In-app messaging, email, and SMS notifications for customer engagement.

Centralized communication logs for easy access.

5. Customizable Dashboards

Personalized views for brokers to track performance metrics and client portfolios.

Detailed analytics for decision-making.

6. Integration Capabilities

Seamless integration with third-party tools like payment gateways, accounting software, and marketing platforms.

Support for API connections to enhance functionality.

7. Security and Compliance

Advanced encryption and role-based access controls.

Adherence to IRDAI and other regulatory standards.

8. Mobility and Accessibility

Cloud-based access for real-time updates from anywhere.

Mobile app support for brokers on the go.

Why Choose Mzapp Insurance Broker Software?

Tailored to the unique needs of insurance brokers.

Scalable solutions for businesses of all sizes.

Proven track record in improving operational efficiency.

Want to Learn More?

👉 Explore the Software 👉 Book a Demo Meeting

#InsuranceBrokerSoftware#InsuranceCRM#CRMForInsurance#PolicyManagementTools#InsuranceClaimsTracking#LeadManagementCRM#InsuranceTechSolutions#BrokerCRM#InsurancePolicyCRM#InsuranceRenewals#InsuranceSoftwareIndia#DigitalInsuranceTools#InsuranceManagementSoftware#CRMForInsuranceBrokers#BrokerSolutions#InsuranceAgentCRM#PolicyRenewalManagement#InsuranceOperationsTech#InsuranceCRMFeatures#InsuranceBrokerageTech#InsuranceCustomerManagement#InsuranceBrokerSolutions#InsuranceCRMIndia#DigitalInsuranceCRM#CustomerRelationshipManagement#ClaimsManagementSoftware#InsuranceProcessAutomation#BrokersCRMTools#InsuranceCRMBenefits#PolicyManagementSoftware

0 notes

Text

Is it Possible to Create Your Own Insurance CRM?

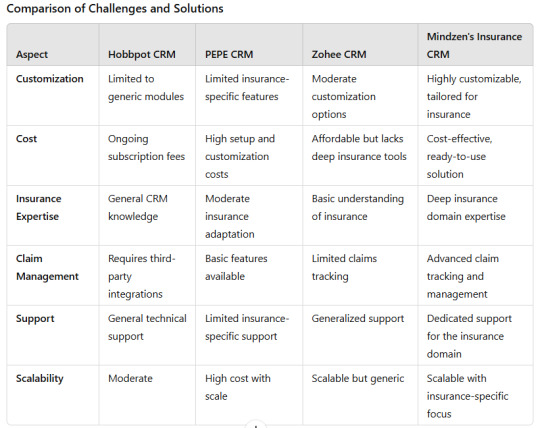

Yes, creating your own Insurance CRM is feasible, but it comes with challenges that demand expertise, resources, and time. When compared to platforms like Hobbpot CRM, PEPE CRM, and Zohee CRM, building a custom CRM allows for addressing specific insurance-related needs. However, it is often more practical to choose a tailored solution like Mindzen’s Insurance CRM that already integrates industry-specific features.

Why Choose Mindzen's Insurance CRM?

Mindzen’s Insurance CRM stands out as an industry-specific solution, designed for insurance brokers and businesses. It addresses gaps that general CRMs like Zohee CRM leave unfulfilled by offering:

Robust claim and policy management tools.

Integration with network hospitals and HR systems.

Comprehensive dashboards for renewals, claims, and analytics.

Enhanced customer engagement features tailored to insurance.

Choosing Mindzen’s Insurance CRM ensures long-term efficiency, seamless scalability, and a complete insurance-focused toolkit without the need for extensive custom development.

For more details, visit: https://mindzen.com/what-is-a-crm-in-insurance/

#InsuranceCRM#InsuranceSoftware#CRMforInsurance#InsuranceManagement#PolicyManagement#ClaimManagement#InsuranceSolutions#InsuranceTechnology#CRMComparison#CustomCRM#InsuranceBrokerSoftware#MindzenCRM#InsuranceBrokersIndia#ClientManagement#InsuranceApps#TailoredCRM#CRMFeatures#InsuranceEfficiency#InsuranceAutomation#InsuranceDigitalTransformation#CRMIntegration#InsuranceInnovation#CRMCustomization#InsuranceTools#AdvancedInsuranceCRM#PolicyTracking#ClaimTracking#InsuranceAnalytics#ClientRetention#InsuranceCustomerEngagement

0 notes

Text

Transform Client Follow-Ups with Mzapp Insurance CRM

Tired of manual tracking and missed follow-ups? Mzapp Insurance CRM is the ultimate tool for insurance brokers to stay organized and build trust with clients.

🔑 Top Features:

Automated reminders for policy renewals

Detailed dashboards for claims and exposures

Easy access to client data anytime, anywhere

Empower your insurance business with cutting-edge CRM technology. Discover more about Mzapp here.

#InsuranceCRM#ClientFollowUp#InsuranceBrokers#InsuranceSoftware#PolicyRenewals#InsuranceAgents#MzappCRM#InsuranceManagement#CustomerEngagement#CRMFeatures#InsuranceOperations#PolicyManagement#InsuranceSolutions#InsuranceClaims#CRMForInsurance#RenewalReminders#InsuranceDashboard#InsuranceTracking#AutomatedFollowUp#InsuranceProfessionals#ClaimsManagement#InsuranceBrokerSoftware#InsuranceTech#CRMForBrokers#PolicyTracking#InsuranceApp#CustomizableCRM#CustomerRetention#InsuranceIndustry#CRMTechnology

0 notes

Text

🌟 Why Do Insurance Brokers Need CRM Software? 🌟

In the competitive world of insurance, staying ahead means more than just offering great policies—it’s about building and maintaining relationships. That’s where Insurance CRM software steps in, helping brokers streamline operations, improve customer interactions, and boost sales.

✅ Centralized Data Management: Easily access client data, policies, claims, and renewals from a single platform.

✅ Improved Customer Engagement: Automate follow-ups, send timely reminders, and personalize communication for a better customer experience.

✅ Enhanced Productivity: Save time on administrative tasks, allowing more focus on nurturing relationships and closing deals.

✅ Data-Driven Insights: Make informed decisions with real-time analytics and reporting to identify growth opportunities.

Don't miss out on the edge that Insurance CRM software can give your brokerage. Learn more about how our solution can transform your operations: https://mindzen.com/

#InsuranceCRM#InsuranceBroker#InsuranceAgent#InsuranceSoftware#CRMForInsurance#InsuranceTech#CustomerRelationshipManagement#InsuranceSolutions#InsuranceSales#ClientManagement#InsuranceIndustry#InsuranceBusiness#InsuranceMarketing#PolicyManagement#CRMSoftware#InsuranceLeads#InsurTech#InsuranceAutomation#CustomerEngagement#InsuranceProductivity#InsuranceAgency#InsuranceGrowth#InsuranceAdvisor#LeadManagement#InsuranceTools#CustomerSatisfaction#PolicyRenewal#InsuranceManagement#InsuranceBrokerSoftware#InsuranceCRMSoftware

0 notes

Text

India’s Best Insurance Management Software for 2024

Looking for a way to simplify your insurance operations in 2024? Discover the power of Mindzen's Insurance Management Software—India's leading solution for streamlining policy management, claims tracking, and client engagement. Designed to cater to the evolving needs of insurance brokers, agencies, and companies, this software ensures a seamless experience for managing policies and claims efficiently.

Key Features:

Automated Policy Management: Reduce manual efforts with automated workflows.

Comprehensive Claims Tracking: Monitor claims status and improve resolution times.

Client Dashboard: Access insights to better serve your clients and manage renewals.

Why settle for less when you can have the best? Transform your insurance operations with India’s top-rated Insurance Management Software of 2024.

🔗 Learn More and book a demo today!

#InsuranceManagementSoftware#Mindzen#InsuranceSoftware#InsuranceTech#InsurTech#PolicyManagement#ClaimsManagement#InsuranceSolutions#InsuranceBrokerSoftware#InsuranceCRM#ClientManagement#InsuranceAutomation#InsuranceIndustry#DigitalInsurance#Insurance2024#IndiaInsurance#InsuranceTools#InsuranceInnovation#PolicyTracking#InsuranceOperations#InsuranceTechnology#InsuranceBusiness#CRMSoftware#EmployeeBenefitsSoftware#InsuranceForBrokers#InsuranceCompanies#PolicySoftware#InsuranceMarket#InsuranceIndia#ClaimsSoftware

0 notes

Text

Top 10 Insurance Broker Software You Should Consider in 2024

Choosing the right insurance broker software can transform your brokerage operations. Here’s a quick look at the top 10 insurance broker software solutions that are leading the industry in 2024:

Mzapp Insurance Broker Software - A top choice for its comprehensive features like policy management, claims tracking, and customer engagement. Learn more here: https://mindzen.com/

Applied Epic

NowCerts

QQCatalyst

AgencyBloc

HawkSoft

Jenesis

Insly

Nexsure

AMS360

Each of these software platforms offers unique benefits tailored to different needs. For a deeper dive into why Mzapp Insurance Broker Software is highly recommended, visit https://mindzen.com/.

#InsuranceBrokerSoftware#Top10InsuranceSoftware#InsuranceCRM#InsuranceTech#InsurTech#InsuranceAutomation#InsuranceManagement#DigitalInsurance#InsuranceSolutions#InsuranceSoftware2024#InsuranceBrokerage#InsuranceTools#BrokerSoftware#ClientManagement#PolicyManagement#ClaimsManagement#CustomerEngagement#InsuranceInnovation#InsuranceWorkflow#CRMForInsurance#InsurTechSolutions#InsuranceBusiness#InsuranceIndustry#InsuranceAgency#CloudInsuranceSoftware#InsuranceDigitalization#InsurancePlatform#InsuranceServices#InsuranceSolutionsProvider#InsuranceTech2024

0 notes

Text

How do I discover the best corporate insurance portal with Mzapp's Employee Health insurance software?

Looking for an efficient way to manage your corporate insurance needs? Let’s find you the best Corporate Insurance Portal with Mzapp Insurance Broker Software. Our Employee Health Insurance Software comes with exclusive benefits designed for both HR teams and employees:

💼 For HR:

HR Policy Management Dashboard - Streamline your insurance policies, track employee benefits, and access real-time analytics in one place.

Dedicated Relationship Manager - Get personalized support for your organization’s insurance needs, ensuring a smooth experience.

🧑💼 For Employees:

In-app Claim Submission - Easy and hassle-free claim submissions directly through the app, making the process faster and more convenient.

Unlock the potential of seamless policy management and employee satisfaction with Mzapp's innovative solution. Visit the link to learn more: https://mindzen.com/employee-health-insurance-benefits-management-software/

#EmployeeHealthInsuranceSoftware#CorporateInsurancePortal#MzappInsurance#HRPolicyManagement#EmployeeBenefits#InAppClaimSubmission#HealthInsuranceManagement#CorporateWellness#HRTech#InsuranceSolutions#InsuranceBrokerSoftware#EmployeeWellbeing#HRSoftware#HealthBenefits#DigitalInsurance#InsuranceTechnology#CorporateInsurance#EmployeeCare#InsurancePortal#HRDashboard#EmployeeSatisfaction#InsuranceManagement#InsuranceClaims#RelationshipManager#HRSupport#SeamlessClaims#EmployeeEngagement#DigitalTransformation#CorporateBenefits#InsuranceAutomation

0 notes

Text

Which software is best for insurance brokers?

AgencyBloc: Ideal for health and life insurance brokers, offering CRM, commissions tracking, and automated workflow features.

Applied Epic: A comprehensive platform for large agencies, offering policy management, customer relationship management (CRM), and accounting.

Mindzen Mzapp Insurance Broker Software: Offers features tailored to Indian insurance brokers, such as CRM management, client login, claims, policy renewals, and employee benefits integration.

Zoho Insurance CRM: A customizable CRM that integrates with various insurance management tools for tracking clients, leads, and policy renewals.

HawkSoft: Popular for small to medium-sized agencies, it provides a robust system for managing policies, claims, and commissions.

NowCerts: Offers cloud-based agency management, focusing on efficient claims handling, customer data management, and carrier integrations.Insurance Broker Management Software - Insurance Broker Software in India | Top Insurance Broking SoftwareSay goodbye to managing multiple software solutions. Mzapp provides seamless, all-in-one insurance broker management software.https://mindzen.com/

You can explore the features of Mzapp Insurance Broker Software along with their offerings like Employee Benefits Management and Retail POSP Insurance Management on this site.

#InsuranceBrokerSoftware |#InsuranceCRM |#InsuranceTech |#InsurTech |#InsuranceSolutions |#PolicyManagement |#InsuranceSoftware |#ClaimsManagement |#InsuranceAutomation#InsuranceIndia |#InsuranceBrokersIndia |#POSPIndia |#HealthInsuranceIndia |#InsurTechIndia#EmployeeBenefitsSoftware |#HealthInsuranceSoftware |#InsuranceCRMIndia |#ClientManagement |#EmployeeHealthInsurance |#CRMSoftware#DigitalInsurance |#CustomerEngagement |#InsuranceMarketing |#InsuranceForBusiness |#BrokerageSolutions

0 notes

Text

Transform Your Business with Cutting-Edge Insurance Broker Software

🚀 Are you an insurance broker looking to streamline operations and enhance client management?

Discover Mindzen's Insurance Broker Software, a complete solution designed to manage policies, claims, renewals, and customer relationships all in one place.

✅ Automate workflows ✅ Boost customer engagement ✅ Track policy renewals and claims ✅ Increase efficiency with easy-to-use dashboards

Stay ahead of the competition by transforming the way you handle your insurance processes. Learn more about how this software can revolutionize your business today!

👉 Check it out here: Mindzen Insurance Broker Software

#InsuranceBrokerSoftware #InsuranceCRM #InsurTech #PolicyManagement #ClaimsManagement #MindzenSoftware

#insurance#insurance agency#insurance broker#insurancecrm#employee benefits#employee engagement#insurance brokers#employee health benefits#employee management software#insurance software

0 notes

Text

Revolutionize Your Insurance Business with Mzapp Insurance Broker Software!

Optimize Efficiency, Enhance Client Engagement, and Boost Sales

Unlock the full potential of your insurance brokerage with Mzapp, the leading insurance broker software designed to streamline operations and drive growth. Our cutting-edge platform offers:

✅ Comprehensive Policy Management: Simplify policy administration with seamless tracking, renewal alerts, and detailed reports.

✅ Customer-Centric Solutions: Deliver personalized experiences with tailored quotes and recommendations for your clients.

✅ Integrated CRM Capabilities: Enhance relationship management with a unified platform for client interactions and communications.

✅ Advanced Analytics and Insights: Make data-driven decisions with real-time analytics, policy performance metrics, and market insights.

✅ Efficient Claims Processing: Speed up claims with automated workflows and transparent tracking.

Join the ranks of successful brokers who trust Mzapp to elevate their business. Experience the power of technology to transform your insurance brokerage today!

Visit Mindzen to learn more and schedule your demo!

#InsuranceBrokerSoftware #ClientEngagement #InsuranceTech #Mzapp #Mindzen

#insurance#insurance agency#insurance broker#insurancecrm#employee benefits#employee engagement#insurance brokers#employee health benefits

0 notes