#InsuranceAnalytics

Explore tagged Tumblr posts

Text

What are the key reporting features for monitoring policy utilization and claims in Health Group Insurance software?

The key reporting features in Health Group Insurance software include real-time policy utilization tracking, claims status monitoring, detailed claims history, and customizable reports that allow businesses to analyze claim trends, payment cycles, and utilization rates. These insights enable HR departments to make informed decisions about employee benefits and optimize health insurance plans. Learn more about the features of Health Insurance Management Software here.

#EmployeeHealthInsurance#HealthInsuranceSoftware#PolicyUtilization#ClaimsTracking#InsuranceManagement#GroupHealthInsurance#EmployeeBenefits#HealthInsuranceManagement#ClaimsReporting#HealthInsuranceTech#HRTech#InsuranceReporting#EmployeeWellness#ClaimsStatus#HealthBenefits#InsuranceAnalytics#BenefitOptimization#ClaimsHistory#PolicyManagement#InsuranceClaims#HealthCoverage#InsuranceSolutions#DataDrivenInsurance#EmployeeCare#DigitalInsurance#InsuranceForEmployees#EmployeeHealthCoverage#HRSoftware#InsuranceTechnology#ClaimsAnalytics

0 notes

Text

Insurance Analytics Makes It Easier to Create Security Policies 2022

Insurance Analytics. And including risk management, the analytic solution assists insurance companies in providing better insurance contracts in areas such as life insurance, health insurance, and property insurance. Insurance Analytics is hastening data investment and transforming the insurance industry. There is no doubt that data analysis is an important pillar of insurance. Actuaries have been using mathematical models to predict property loss and damage for many years. However, in recent years, insurers have recognized the strategic value of their customers' data investments. As a result, they are implementing insurance analytics solutions and services in order to improve the customer experience.

What is insurance analytics?

Insurance analytics is a sophisticated method of gathering, extracting, and analyzing relevant insights from various data sources. It aids in effective risk management. In addition, the analytics solutions provide the best insurance contracts in the fields of life, health, property, and casualty. Various companies, managers, agents, and professionals offer coverage analytics services. Because it aids in cost reduction and the optimization of customer relationship processes.

The significance of insurance data analysis

Using insurance insights to design insurance models aids in the creation of trustworthy reports. These services and solutions are extremely beneficial to brokers and businesses. It keeps track of expenses efficiently and allows for more stable financial operations. Insurance analytics can also track sales, marketing, operations, and a variety of other operational costs. Creating insurance policies was once thought to be a time-consuming task. It is now a simpler process thanks to the use of analytics. Individuals can make more informed decisions as it aids in the optimization of operations. So, in essence, it serves as a link between humans and numbers.

Why is insurance business intelligence thriving? The data of insurance companies is the heartbeat of their operations. They are looking for advanced solutions and services that can handle their data effectively. Insurance companies have access to a vast amount of information all over the world. As a result, advanced analytics assists these companies in optimizing performance through insurance analytics. As a result, insurance analytics is progressing and becoming one of the flourishing solutions in the insurance industry. What are the uses of Insurance Analytics? Insurance analytics services and solutions improve security for both businesses and individuals. It can be updated based on the increasing activities of threats and vulnerabilities. As a result, it generates more business applications.

Insurance data analysis can be found in claims management, risk management, customer management, and sales and marketing. Data Analytics solutions in insurance companies help them improve the customer experience, lower claim costs, improve risk assessment in underwriting, and identify new sources of sustainable growth. What exactly is End User Insurance Analytics? Companies that provide insurance The insurance industry is entirely data-driven. The players are fiercely competitive. For them, the most important step is to mine precise data. Those who can convert mined data into useful insights can gain a competitive advantage. As a result, they are implementing insurance analytics to improve the predictions of big data reports.

Governmental Organizations Government agencies benefit from insurance analytics as well. Data from both internal and external sources is required for predictive underwriting. It includes information from insurers as well as information from social media, credit agencies, and government agencies. Insurance analytics can help you plan precise investments to avoid future losses. Administrators, brokers, and consultancies who work on a third-party basis Third-party Administrators and Consultancies can benefit from insurance analytics to increase customer loyalty. Because analytics services and solutions aid in the prediction of customized plans that are tailored to each individual customer. Brokers and agents can gain confidence in making smart recommendations to customers when purchasing a new policy or making changes to an existing one thanks to insurance analytics. The Benefits of Insurance Analytics Give the insurer a competitive advantage It is the age of competition in the insurance industry. Currently, almost every insurer is competing with the internet. Insurance analytics facilitates the extraction of more precise information from unstructured data. Thus, using such services and solutions, customer behavior and market opportunities can be easily understood.

Assists in increasing customer satisfaction People have a higher level of trust in an insurance company that can accurately predict the customer's needs. As a result, insurance analytics assist them in better analyzing existing customer data. As a result, such services and solutions can provide prescriptive insights into insurer data while also improving customer satisfaction. Aids in the reduction of fraudulent cases The insurance industry's biggest challenge is dealing with fraudulent claims in the claims processing process. Insurance analytics reduces it. As in the past, fraudulent cases are recorded in the company's data trends. Insurers can carefully monitor such activities while processing claims, reducing the likelihood of fraud.

To summarize Because of the increasing demand for advanced technologies in various industries, the insurance analytics Market has been rapidly expanding. Insurance analytics must be implemented in the insurance industry in order to provide integrated and value-added services to customers. Insurance techniques are used in claims management, risk management, customer management, sales and marketing, and other areas. There are numerous benefits to insurance analytics, and it can assist insurance companies in gaining a competitive advantage in the insurance industry. Read the full article

0 notes

Text

What level of customization can be offered for different insurance agencies using CRM software?

Insurance CRM software offers extensive customization options to meet the unique needs of different insurance agencies:

Custom Dashboards: Tailor dashboards to display metrics most relevant to your agency’s focus.

Workflow Automation: Configure workflows for claims, renewals, or customer interactions based on agency requirements.

Custom Fields: Add unique data fields to capture specific policyholder information.

Personalized Communication: Enable targeted campaigns with customizable email and SMS templates.

Integration Flexibility: Seamlessly connect with third-party tools, accounting software, or APIs specific to agency operations.

Scalable Features: Adjust functionality as your agency grows or diversifies its offerings.

Learn more about how our Insurance CRM software can revolutionize your agency’s operations: https://mindzen.com/what-is-a-crm-in-insurance/

#InsuranceCRM#CRMSoftware#CustomInsuranceCRM#AgencyTools#InsuranceSolutions#DigitalInsurance#InsuranceInnovation#InsuranceAutomation#CRMCustomization#InsuranceGrowth#PolicyManagement#CustomerEngagement#DataDrivenInsurance#InsuranceTechnology#CRMIntegration#InsuranceEfficiency#SmartInsuranceTools#InsuranceCRMIndia#InsuranceSuccess#CustomWorkflows#InsuranceAnalytics#PolicyholderManagement#CustomerRetention#ScalableCRM#InsuranceAgencyTools#DigitalInsuranceCRM#PolicySolutions#InsuranceBenefits#InsuranceMarketing#SmartAgencyTools

0 notes

Text

What are the benefits of integrating Insurance CRM software with accounting tools?

Integrating Insurance CRM software with accounting tools provides numerous benefits:

Streamlined Operations: Automates financial processes such as billing, invoicing, and commission tracking.

Centralized Data: Combines customer and financial data for better decision-making.

Improved Accuracy: Reduces manual errors in financial calculations and reporting.

Real-Time Insights: Provides real-time updates on financial health and revenue performance.

Enhanced Reporting: Enables detailed financial and sales reports for performance tracking.

Faster Payment Processing: Simplifies premium and claims payment workflows.

Compliance Management: Ensures adherence to financial regulations with automated tracking.

Cost Efficiency: Reduces administrative costs by eliminating redundant tasks.

Seamless Collaboration: Facilitates coordination between sales, finance, and operational teams.

Better Customer Experience: Ensures accurate billing and reduces payment delays.

Learn more about Insurance CRM software: https://mindzen.com/what-is-a-crm-in-insurance/

#InsuranceCRM#AccountingIntegration#CRMSoftware#InsuranceTech#FinanceAutomation#StreamlinedProcesses#InsuranceSolutions#CRMIntegration#FinancialTools#CustomerExperience#AccountingSoftware#DigitalTransformation#CRMFeatures#EfficiencyInInsurance#InsuranceCRMBenefits#DataDrivenDecisions#CRMInnovation#SmartInsurance#AutomationInInsurance#BetterCustomerService#FinanceTools#InsuranceAnalytics#CRMOptimization#BillingAutomation#InsuranceEfficiency#InsuranceAccounting#CRMAndFinance#PolicyManagement#RevenueTracking#SeamlessIntegration

0 notes

Text

How does Health Group Insurance software leverage AI to predict claims trends?

Health Group Insurance software uses AI to predict claims trends through:

Data Analysis: AI analyzes historical claims data to identify patterns and trends.

Risk Prediction: Machine learning models assess risk factors and predict potential claims frequencies.

Fraud Detection: AI identifies anomalies in claims submissions, reducing fraudulent activities.

Cost Estimation: Predictive analytics help insurers estimate future claim costs and manage budgets effectively.

Personalized Insights: AI provides insights into employee health trends, enabling targeted wellness programs.

Proactive Management: Early identification of high-risk cases allows for proactive interventions, reducing claim volumes.

Real-Time Updates: AI systems provide real-time dashboards for monitoring claims activities and trends.

Integration with Wearables: Data from fitness devices and health apps enhance predictive accuracy.

Dynamic Adjustments: Algorithms adjust predictions based on real-time updates and new data inputs.

Learn more about Employee Benefits Management Software: https://mindzen.com/employee-health-insurance-benefits-management-software/

#EmployeeBenefits#HealthInsuranceSoftware#AIInInsurance#EmployeeBenefitsSoftware#ClaimsManagement#PredictiveAnalytics#InsuranceTech#AIForBenefits#ClaimsTrends#DataDrivenInsurance#EmployeeHealth#InsuranceSoftware#BenefitsManagement#EmployeeWellness#RiskPrediction#DigitalInsurance#InsuranceAI#HealthTech#InsuranceSolutions#FraudDetection#ClaimsAutomation#PredictiveModeling#InsuranceEfficiency#InsuranceAnalytics#WellnessPrograms#InsuranceTools#EmployeeCare#CostManagement#AIInsuranceSolutions#InsuranceInnovation

0 notes

Text

What reporting and analytics capabilities does POSP software provide?

POSP software offers robust reporting and analytics capabilities to empower insurers and agents with actionable insights. Here’s what it provides:

Performance Dashboards:

Comprehensive dashboards that track agent performance, sales trends, and policy issuance.

Provides real-time visualizations for quick decision-making.

Sales Analytics:

Tracks premium collections, renewals, and policy lapses.

Identifies high-performing products and market opportunities.

Agent Productivity Reports:

Monitors agent activity, including policies sold, commissions earned, and client interactions.

Helps in setting and achieving sales targets.

Customer Insights:

Analyzes customer demographics, preferences, and policy purchasing behavior.

Enables personalized recommendations for upselling and cross-selling.

Compliance and Regulatory Reports:

Generates IRDAI-compliant reports for seamless audits.

Ensures data transparency and adherence to regulations.

Customizable Reports:

Allows insurers to create custom reports tailored to specific business needs.

Exports data in multiple formats for integration with other systems.

Mindzen’s POSP Insurance Software provides a cutting-edge analytics platform to optimize sales and operations. Discover more here: https://mindzen.com/mzapp-retail-posp/.

#POSPInsurance#InsuranceAnalytics#ReportingSoftware#InsuranceSoftware#POSPTools#InsuranceTech#SalesPerformance#AgentProductivity#PolicyManagement#CustomerInsights#InsuranceSolutions#POSPManagement#AnalyticsTools#MindzenPOSP#DigitalInsurance#SalesAnalytics#AgentMonitoring#InsuranceDashboards#InsuranceData#CustomerAnalytics#POSPInsights#InsuranceCompliance#InsuranceReporting#PolicyInsights#POSPSolutions#AgentPerformance#POSPFeatures#InsuranceTrends#POSPBenefits#DigitalPOSP

0 notes

Text

Can POSP software integrate with existing insurance CRM and policy management systems?

Yes, POSP software can seamlessly integrate with existing insurance CRM and policy management systems, enhancing overall operational efficiency. Here's how:

Data Synchronization:

Syncs customer data, policy details, and claims information across platforms.

Reduces duplicate data entry and ensures consistency.

API Integration:

Uses APIs to enable smooth communication between POSP software and CRM systems.

Allows real-time updates for better decision-making.

Policy Tracking:

Monitors policies from creation to renewal in coordination with CRM tools.

Streamlines the workflow for agents and brokers.

Customizable Workflows:

Integrates workflows to suit specific operational needs.

Ensures uninterrupted processes between systems.

Enhanced Reporting:

Combines CRM data with POSP software analytics for comprehensive insights.

Offers a unified view of performance metrics.

Improved Scalability:

Supports the growth of insurance businesses by connecting multiple tools.

With Mindzen’s POSP Insurance Software, integration becomes effortless, allowing you to maximize the potential of your existing systems. Learn more here: https://mindzen.com/.

#POSPSoftware#InsuranceSoftware#InsuranceTech#PolicyManagement#CRMIntegration#InsuranceCRM#PolicyTracking#POSPIntegration#InsuranceInnovation#DigitalInsurance#POSPSolutions#InsuranceAutomation#PolicyTools#InsuranceEfficiency#CRMTools#POSPForInsurance#InsuranceScalability#PolicyManagementTools#POSPIntegrationSolutions#InsuranceDigitalization#InsuranceAnalytics#InsuranceGrowth#MindzenPOSP#InsuranceEfficiencyTools#AgentManagement#POSPTech#InsuranceSoftwareTools#PolicyManagementSystem#CRMIntegrationTools#POSPSuccess

0 notes

Text

What solutions does Health Group Insurance software provide for managing multiple policy providers?

Health Group Insurance software streamlines the complex task of managing multiple policy providers by offering robust solutions:

Centralized Dashboard:

Provides a unified platform to view and manage policies from various providers.

Simplifies comparison and decision-making across multiple offerings.

Policy Integration:

Ensures seamless integration with different insurance provider systems.

Reduces manual data entry and increases efficiency.

Automated Updates:

Syncs policy terms, coverage changes, and premium updates automatically.

Keeps records accurate and up-to-date.

Customizable Reports:

Generates detailed reports for each provider’s policies.

Helps in analyzing coverage trends and claims performance.

Claim Coordination:

Facilitates claim tracking and resolution across different insurers.

Ensures transparency and timely communication with providers.

Regulation Compliance:

Maintains compliance with regulatory standards for all integrated policies.

With Mindzen’s Health Group Insurance software, managing multiple policy providers becomes hassle-free, saving time and reducing administrative burdens. Explore its features: https://mindzen.com/health-insurance-management-software/.

#EmployeeHealthInsurance#HealthInsuranceSoftware#PolicyManagement#InsuranceTech#HealthBenefits#GroupInsuranceSoftware#PolicyProviderIntegration#InsuranceManagement#HealthGroupInsurance#InsuranceSolutions#ClaimTracking#InsuranceInnovation#DigitalInsurance#InsuranceEfficiency#HealthPolicyManagement#MindzenSoftware#InsuranceDashboard#EmployeeBenefits#InsuranceCompliance#HealthInsuranceManagement#InsuranceAutomation#InsuranceTools#HealthInsuranceTech#InsuranceAnalytics#PolicyProviderTools#InsuranceData#InsuranceReporting#HRSoftware#InsuranceAdmin#InsuranceSuccess

0 notes

Text

What metrics can be tracked using Insurance CRM software to measure performance?

Insurance CRM software provides robust tools to track and analyze critical performance metrics, ensuring optimized operations and growth. Key metrics include:

Policy Sales Metrics:

Total policies sold by agents or teams.

Sales conversion rates for different insurance products.

Customer Retention Rates:

Percentage of renewals and long-term customer loyalty.

Feedback and satisfaction scores from clients.

Lead Management Metrics:

Number of leads generated, qualified, and converted.

Time taken to convert leads into policies.

Claim Resolution Metrics:

Average time taken to process claims.

Number of claims approved or rejected.

Agent Performance Metrics:

Individual and team performance in policy sales.

Commission earnings and training progress.

Customer Engagement Metrics:

Interaction frequency via multi-channel communication (calls, emails, chat).

Response time to customer queries and concerns.

Revenue and Profitability Metrics:

Revenue generated per product or agent.

Profit margins across various insurance plans.

Compliance Tracking:

Adherence to industry regulations and documentation accuracy.

Mindzen’s Insurance CRM software simplifies tracking and analysis with customizable dashboards and real-time insights. Learn more: https://mindzen.com/what-is-a-crm-in-insurance/.

#InsuranceCRM#CRMSoftware#InsuranceSoftware#PerformanceMetrics#PolicyManagement#CustomerRetention#InsuranceTech#LeadManagement#InsuranceInnovation#AgentPerformance#InsuranceCRMTools#InsuranceAnalytics#ClaimsManagement#CustomerEngagement#CRMForInsurance#InsuranceGrowth#MindzenCRM#InsuranceDashboards#SalesTracking#PolicySalesMetrics#InsuranceOperations#CRMInsights#InsurancePerformance#RenewalTracking#InsuranceOptimization#CustomerSatisfaction#LeadConversion#AgentSuccess#InsuranceCompliance#InsuranceSuccess

0 notes

Text

How does the software address the challenge of managing a large agent network?

Managing a large agent network is streamlined with advanced POSP Insurance software through:

Centralized Agent Management:

Provides a unified platform for onboarding, training, and monitoring agents.

Tracks agent performance and productivity metrics in real-time.

Automated Workflows:

Automates repetitive tasks like policy issuance, document verification, and claims tracking.

Reduces administrative workload and enhances operational efficiency.

Training and Certification Modules:

Offers built-in training programs and compliance certifications for agents.

Ensures agents stay updated on regulatory requirements and product offerings.

Communication Tools:

Facilitates seamless communication with agents via integrated messaging and notifications.

Supports instant updates on new policies, commission structures, or regulatory changes.

Scalable Infrastructure:

Handles increasing agent numbers without compromising software performance.

Ensures reliability with cloud-based solutions for high data traffic.

Analytics and Insights:

Provides data-driven insights into agent performance and policy sales trends.

Helps insurance companies optimize their agent network strategies.

Learn more about how Mindzen’s POSP Insurance software supports large agent networks: https://mindzen.com/.

#POSPInsurance#InsuranceSoftware#AgentManagement#InsuranceTech#POSPSoftware#DigitalInsurance#InsuranceSolutions#AgentNetwork#POSPIndia#InsuranceManagement#InsuranceTechnology#AgentTracking#InsuranceAgents#InsuranceCRM#PolicyManagement#InsuranceCompliance#AgentTraining#CloudInsurance#InsuranceAnalytics#MindzenSolutions#POSPTools#InsuranceEfficiency#SmartInsurance#AgentOnboarding#CommissionManagement#POSPPlatform#DigitalTransformation#InsuranceForAgents#InsuranceBrokerTech#AgentProductivity

0 notes

Text

What features should insurers look for when choosing POSP software?

When choosing POSP software, insurers should consider the following features:

Ease of Agent Onboarding: A simple onboarding process for POSP agents.

Policy Management Tools: Efficient tools for managing multiple insurance products.

CRM Integration: Seamless integration with existing customer management systems.

Analytics and Reporting: Real-time data insights for better decision-making.

Document Management: Quick and secure handling of policy-related documents.

Mobile Accessibility: A mobile-friendly interface for agents on the go.

Training Modules: Built-in resources for agent training and development.

Secure Payment Processing: Robust mechanisms for handling premium payments securely.

Discover how Mindzen’s POSP Insurance software simplifies insurance management. Learn more: https://mindzen.com/.

#POSPInsurance#InsuranceSoftware#POSPTools#DigitalInsurance#InsuranceManagement#POSPAgents#AgentOnboarding#PolicyManagement#InsuranceTech#CRMIntegration#InsuranceAutomation#MobileInsurance#PolicyIssuance#AgentTraining#SecurePayments#POSPSolutions#RetailInsurance#InsuranceInnovation#InsuranceSoftwareIndia#POSPFeatures#TechForInsurance#SmartInsurance#AgentSupport#InsuranceAnalytics#PolicyTracking#InsurancePOSP#InsuranceAutomationTools#InsuranceEfficiency#POSPSoftwareFeatures#PolicyManagementTools

0 notes

Text

Is Insurance CRM software beneficial for small insurance agencies?

Yes, Insurance CRM software is highly beneficial for small insurance agencies. Here’s how:

1. Streamlined Client Management

Insurance CRM helps small agencies organize and manage client information in one place. It centralizes customer data, including contact details, policy information, claims history, and communication logs. This makes it easier for agents to access and update client records, improving overall efficiency.

2. Enhanced Customer Relationships

With CRM software, small agencies can track customer interactions and provide personalized service. Agents can follow up on policy renewals, cross-sell products, and offer customized solutions based on clients’ needs, leading to stronger relationships and improved customer retention.

3. Improved Sales and Lead Management

Insurance CRM tools help small agencies manage leads and track sales opportunities effectively. With features like lead scoring, automated reminders, and follow-up tasks, CRM software ensures no potential client is missed, enhancing conversion rates.

4. Increased Productivity

By automating routine tasks such as appointment scheduling, reminders, and follow-up emails, CRM software frees up valuable time for agents to focus on more strategic activities. This leads to higher productivity and more sales.

5. Efficient Policy and Claims Management

Insurance CRM simplifies policy management by tracking the lifecycle of policies, from issuance to renewals. It also allows agencies to manage claims efficiently, reducing processing time and improving customer satisfaction.

6. Reporting and Analytics

CRM software offers valuable insights into sales performance, customer behaviors, and market trends. Small agencies can generate reports that help them make data-driven decisions, optimize sales strategies, and improve overall agency performance.

7. Cost-Effective

Insurance CRM software provides small agencies with the tools to compete with larger agencies without the need for significant investment in infrastructure. Most CRMs are available on a SaaS (Software as a Service) model, which means small agencies only pay for what they use, keeping costs manageable.

8. Scalability

As a small agency grows, the CRM software can scale to accommodate more clients, policies, and agents. This ensures that the CRM remains a valuable asset even as the business expands.

9. Mobile Accessibility

Many CRM solutions come with mobile applications that allow agents to access client data and manage sales activities on the go. This flexibility is crucial for small agencies with agents working in the field.

10. Better Collaboration

CRM software facilitates collaboration between team members, allowing agents to share information and collaborate on sales strategies and customer service. This improves communication and ensures everyone is on the same page.

Why Choose Mzapp Insurance CRM for Your Agency?

Mzapp Insurance CRM offers small agencies a user-friendly and scalable solution to streamline operations, enhance client relationships, and boost sales productivity. It’s designed to support small businesses in the competitive insurance market.

Learn More

👉 Explore Insurance CRM Features 👉 Book a Demo Meeting

#InsuranceCRM#SmallInsuranceAgencies#CRMSoftware#InsuranceAgencyTools#CustomerManagement#SalesAutomation#LeadManagement#ClientRelationships#PolicyManagement#InsuranceSales#InsuranceTech#AgencyGrowth#SalesEfficiency#DataDrivenSales#ClientRetention#InsuranceSolutions#AgencyProductivity#InsuranceLeadManagement#InsuranceAnalytics#CustomerInsights#CustomerSupport#InsuranceSalesGrowth#CRMForAgents#InsuranceAutomation#InsuranceClaimsManagement#SmallBusinessCRM#InsurTech#SalesSupport#InsuranceAgencySoftware#InsuranceCustomerCare

0 notes

Text

Can Insurance CRM software integrate with existing insurance broker tools?

Yes, Insurance CRM software can seamlessly integrate with existing insurance broker tools, enhancing workflow efficiency and productivity. Here's how integration benefits insurance brokers:

1. Centralized Data Management

Combines client data, policy details, and sales information from various tools into a single dashboard.

Eliminates the need for manual data entry and reduces errors.

2. Enhanced Communication

Syncs with email platforms and telephony tools for streamlined communication.

Enables automated notifications and reminders for policy renewals and follow-ups.

3. Policy Management Integration

Works with policy management systems to provide real-time updates on claims, renewals, and underwriting.

Simplifies policy tracking and processing for brokers.

4. Accounting and Billing Synchronization

Integrates with accounting software to streamline billing, commissions, and financial reporting.

Automates invoice generation and payment tracking.

5. Analytics and Reporting

Merges with analytics tools for advanced insights into customer behavior, sales trends, and agent performance.

Customizable dashboards display actionable data in real-time.

6. Marketing Automation

Connects with marketing platforms for targeted campaigns, lead generation, and nurturing.

Tracks campaign performance to optimize marketing strategies.

7. Cloud-Based Access

Integrates with cloud storage tools for secure and easy access to documents and records.

Ensures scalability and mobility for brokers.

Why Choose Mzapp Insurance CRM?

Offers out-of-the-box integrations with popular insurance tools.

Provides API support for custom integrations tailored to your business needs.

Ensures a smooth transition and reduces downtime during implementation.

Learn More

👉 Explore the Software 👉 Book a Demo Meeting

#InsuranceCRM#CRMIntegration#InsuranceTools#BrokerTools#PolicyManagement#InsuranceTech#InsuranceWorkflow#CRMFeatures#InsuranceSolutions#DigitalInsurance#CRMForBrokers#InsuranceIndustryTech#InsuranceAutomation#InsuranceCRMIndia#BrokerEfficiency#CRMIntegrationTools#ClientManagement#PolicyTracking#InsuranceData#CRMFeaturesIndia#InsuranceCRMSoftware#CustomerManagement#TechForBrokers#InsuranceSoftware#InsuranceAnalytics#CRMPlatform#InsuranceIntegration#InsuranceTechnology#InsuranceInnovation#CRMIndia

0 notes

Text

How to Start an Insurance Broker Business, and What CRM Software is Flexible for It?

Starting an insurance broker business can be a rewarding venture if approached with the right tools and strategies. Here's a step-by-step guide:

Steps to Start an Insurance Broker Business

Obtain Necessary Licenses:

Register as an insurance broker with your country's regulatory authority, such as IRDAI in India.

Understand Your Market:

Research your target audience and the types of insurance products in demand, such as health, motor, or life insurance.

Build a Network of Insurers:

Establish partnerships with insurance providers to offer a range of products to your customers.

Set Up an Office or Go Digital:

Choose a physical or virtual office setup depending on your budget and business model.

Use Technology for Operations:

Invest in flexible CRM software like Mzapp Insurance Broking Software to streamline customer management, policy tracking, and renewals.

Why Choose Mzapp Insurance Broking Software?

Customizable Features:

Tailor the CRM to meet the unique needs of your business.

Integrated Policy Management:

Manage all policies, claims, and renewals on a single platform.

Client Engagement Tools:

Stay connected with clients via automated communication and reminders.

Scalable Solutions:

Grow your operations without worrying about outgrowing the software.

Real-Time Analytics:

Monitor sales performance and improve strategies with data-driven insights.

Starting an insurance broker business with the right CRM ensures operational efficiency, customer satisfaction, and business growth.

👉 Book a Demo Meeting For more details, visit: https://mindzen.com/

#InsuranceBrokingSoftware#InsuranceBrokerBusiness#InsuranceTech#InsuranceCRM#CRMForBrokers#InsuranceSolutions#InsuranceBrokingCRM#InsuranceSalesTools#DigitalInsurance#InsuranceBrokersIndia#BrokingCRM#StartInsuranceBusiness#FlexibleInsuranceCRM#InsuranceCRMSoftware#PolicyManagement#InsuranceBusinessStartup#InsuranceTechnology#CustomerEngagementTools#InsuranceSoftwareSolutions#InsuranceForBrokers#DigitalInsuranceTools#InsuranceBusinessGrowth#CRMForInsurance#InsuranceBrokerTools#PolicyTrackingSoftware#CRMCustomization#InsuranceAnalytics#InsuranceRenewals#InsuranceBrokerCRM#PolicyManagementSoftware

0 notes

Text

Is it Possible to Create Your Own Insurance CRM?

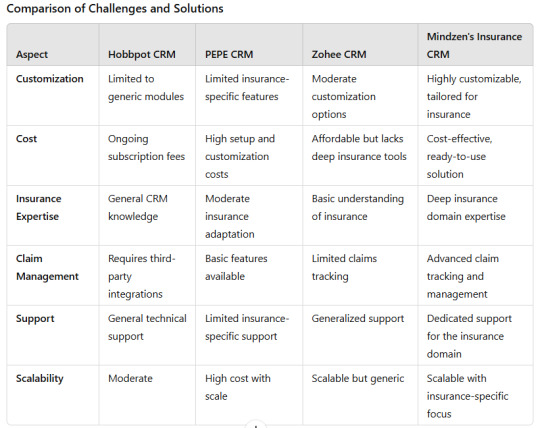

Yes, creating your own Insurance CRM is feasible, but it comes with challenges that demand expertise, resources, and time. When compared to platforms like Hobbpot CRM, PEPE CRM, and Zohee CRM, building a custom CRM allows for addressing specific insurance-related needs. However, it is often more practical to choose a tailored solution like Mindzen’s Insurance CRM that already integrates industry-specific features.

Why Choose Mindzen's Insurance CRM?

Mindzen’s Insurance CRM stands out as an industry-specific solution, designed for insurance brokers and businesses. It addresses gaps that general CRMs like Zohee CRM leave unfulfilled by offering:

Robust claim and policy management tools.

Integration with network hospitals and HR systems.

Comprehensive dashboards for renewals, claims, and analytics.

Enhanced customer engagement features tailored to insurance.

Choosing Mindzen’s Insurance CRM ensures long-term efficiency, seamless scalability, and a complete insurance-focused toolkit without the need for extensive custom development.

For more details, visit: https://mindzen.com/what-is-a-crm-in-insurance/

#InsuranceCRM#InsuranceSoftware#CRMforInsurance#InsuranceManagement#PolicyManagement#ClaimManagement#InsuranceSolutions#InsuranceTechnology#CRMComparison#CustomCRM#InsuranceBrokerSoftware#MindzenCRM#InsuranceBrokersIndia#ClientManagement#InsuranceApps#TailoredCRM#CRMFeatures#InsuranceEfficiency#InsuranceAutomation#InsuranceDigitalTransformation#CRMIntegration#InsuranceInnovation#CRMCustomization#InsuranceTools#AdvancedInsuranceCRM#PolicyTracking#ClaimTracking#InsuranceAnalytics#ClientRetention#InsuranceCustomerEngagement

0 notes

Text

How does retail POSP insurance software help insurance brokers increase their profitability?

Retail Point of Sale (POSP) insurance software offers a powerful tool for insurance brokers to expand their reach, streamline operations, and boost profitability. Here’s how:

Broader Market Access: POSP software enables brokers to tap into retail channels, making insurance policies available at various retail points, increasing sales opportunities.

Quick Policy Issuance: With instant policy generation and issuance, brokers can save time and improve customer satisfaction, driving repeat business.

Improved Agent Productivity: Equip POSP agents with easy-to-use tools for selling policies, tracking leads, and managing clients, enhancing overall productivity.

Cost Efficiency: Automating sales processes reduces overheads, enabling brokers to focus on scaling their business without increasing operational costs.

Real-Time Reporting and Analytics: Access detailed insights on sales trends, agent performance, and customer preferences to refine strategies and maximize returns.

Customer-Centric Approach: Offer personalized policies and seamless services through retail outlets, strengthening relationships and retaining customers.

By leveraging retail POSP insurance software, brokers can create new revenue streams, enhance operational efficiency, and achieve sustainable growth.

👉 Learn more about how POSP insurance is transforming the industry: Mindzen - Point of Sale Insurance

#POSPInsurance#PointOfSaleInsurance#RetailInsurance#InsuranceBrokers#InsuranceSoftware#POSPSoftware#InsuranceTechnology#BrokerProfitability#InsuranceSales#PolicyAutomation#POSPAgents#InstantPolicyIssuance#RetailPOSP#InsuranceGrowth#CustomerRetention#InsuranceAnalytics#InsuranceCRM#RetailInsuranceSoftware#InsuranceBusinessGrowth#AutomationInInsurance#InsuranceEfficiency#POSPSales#InsuranceRevenue#InsuranceOperations#PointOfSaleTools#InsuranceInnovation#InsuranceIndustryTech#RetailPolicyManagement#CustomerSatisfactionInsurance#POSPFeatures

0 notes