#Insects as Animal Feed Market Share

Explore tagged Tumblr posts

Text

this is the place to post about your knowledge and i’m thinking about my little royal sunangel (from the coquette hummingbird family) google deep-dive and i wanted to show you guys these rare little bastards!

this is a male (left) and female (right) sunangel, they’re sexually dichromatic (different colors indicate different sexes) and so, so teensy! they’re roughly 4.3-4.7 inches/10-12 cm long from their beak to their tail!

they’re as little in number as they are little in size, too. they are exclusively found in the bordering andes area ecuador and peru share, where there are subtropical elven forests (because everything about them deserves a pretty name). there are only 8 known sunangel habitats within this area. when documentation started, around the start of the 2010s, there were 12. the estimated population of this endangered bird is anywhere from 3-7 thousand. the royal sunangel population has been steadily — and scarily — declining since their discovery in 2009, and this is largely attributed to the deforestation due to frequent forest fires and the conversion of their habitats into agricultural fields.

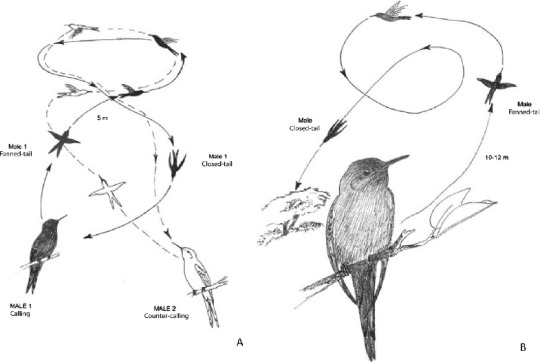

it feels like the royal sunangel JUST got discovered, and the scientific community has only JUST started noting down how unique they are among their hummingbird family and birds at large, and now their delicate little frames and stubborn commitment to their habitat range might lead them to death’s door before i reach middle age and have the credentials or cause to observe them myself. ornithologists love these little guys because they feed in these little circuits so no two (super territorial) males may meet, and when they feed, they either stalk and eventually eat insects or take nectar from shrubs and flowers using the punctured feeding holes of some other animals’ labor. also, you know how hummingbirds famously hover while they feed? these hummingbirds are the only ones who don’t. they perch and relax (as is only sensible)!

If you find them as charming as I do, or if you have a heart, you’re probably asking yourself how we go about conserving these birds in the first place.

well, on the agricultural front (which is more heavily an ecuadorian obstacle for these habitats), the situation feels more complicated. ecuador’s market relies on agricultural exports and i don’t see how tumblr users could make the government prioritize sustainability over profits. There are already conservation groups trying to fight that good fight and buy properties on these fragile biodiverse lands before agricultural companies can (you can punch in neoprimate.org for a good one, my link function isn’t working on here) and if you can donate a little to these initiatives you’d be contributing to the protection of tons of endangered species in the local areas.

another way to prevent habitat loss is by funding efforts to prevent the forest fires that frequently wipe out habitats around this area, especially those in peru (the area with the majority of sunangel habitats). there are legal and activist groups putting energy towards that that’s linked above, but another subtle improvement is to provide local farmers and residents with fire weather forecast devices. this way, everyone will be on the same page, and know that if it’s an arid/risky day to light a fire, they should act conscientiously. these devices are being circulated and groups are educating about and encouraging them to the local communities and could use some help in these links. below, i have a screenshot from an organization that doesn’t have a clear donation link for me, but i heavily encourage supporting, because ultimately i think local, sustainable, community-based and indigenous-prioritizing efforts are the way to go.

thanks so much for listening to my little spiel about these cuties, and i hope this information brightens your day and motivates you to care about the beautiful things we can protect. 💙💜

#conservación#conservation#ornithology#birdblr#birdlovers#birds#birdphotography#hummingbird#royal sunangel#peru#ecuador#conservatism#amazon#rainforest

454 notes

·

View notes

Text

thinking about kaveh feeding a lost scarab on a lonely winter day…

winters in sumeru don't contain snowy days, but it does get colder significantly.

it's enough for kaveh to replace his usual attire with thicker coats and sweaters.

he'd be cleaning the shared apartment of him and alhaitham on one of his days off and then he sees a weak little scarab crawling by the window sill, its wings twitching slightly.

i just know he'll contemplate whether he should throw it away but deep down his princess heart wants to nurse it back to health and release it back to the desert.

"my, how did you even get here?" he'll mumble to himself.

he watches his surroundings to check if alhaitham is home, and when he's sure that he's not yet there, he'll sneak into his library and find some books about bugs.

he'll look for a way to feed it and when he does find a way, he'll also make it a little home filled with sand he bought from the market, a small hollowed log and some pebbles for decoration.

when alhaitham comes home and finds out, he's most likely gonna tell him to give up since it's not gonna live long anyway.

"wow, what an insensitive thing to say." kaveh would complain, raising his voice a little. he turns to the scarab and coos (yes he will treat it like his child) at it, earning a disapproving look from alhaitham.

"it's just an insect-"

"insects are animals too!"

"fine. do what you want." he sighs, resigning back to his room.

remember what i said about releasing it back to the wild?

that never happened. kaveh grew attached and eventually kept it as a pet.

he'll feed it lettuce and some pruned dates, because the thought of catching smaller bugs for food unsettles him.

knowing him, he'll replace the log with a small tent similar to what eremites use, so that the bug would have shelter.

kaveh knew that alhaitham was right ーthe bug would not live long, but somehow he ignored that because he wanted it to enjoy its last days amidst the cold winter season.

yeah. he will bawl his eyes out when it dies

alhaitham would probably mumble an "i told you so." and kaveh would shut him up.

weeks after, when the days grew warmer, kaveh would come home to find a scarab figurine placed on his desk

it was totally not given by alhaitham 😂

ー Lolita

#kaveh#alhaitham#kavetham#haikaveh#genshin impact#genshin#genshin impact imagines#genshin impact headcanons#kaveh fluff#alhaitham fluff#kaveh crack#alhaitham crack#kaveh hcs#kaveh imagines#kaveh headcanons#lolita writes

35 notes

·

View notes

Text

Protein Ingredients Industry Share and Specification forecast To 2030

The global protein ingredients market was valued at USD 77.69 billion in 2022 and is expected to grow at a revenue-based compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This steady growth is driven by rising demand for a variety of food products such as margarine, cold cuts, bakery items, spreads, yogurt, and milk sausages that use protein ingredients. Increased consumption of these protein-rich foods among health-conscious and elderly consumers is further fueling the market. The growing interest in these products stems not only from their nutritional benefits but also from specific functional properties, such as satiety, muscle repair, weight loss, and energy balance. These functions are made possible by innovative protein formulations containing diverse amino acid profiles, which present vast growth opportunities for the market.

The market has also experienced a notable rise in demand for animal-based protein products. In the U.S., demand for animal-derived protein is especially strong and is expected to continue growing in the near future. Companies that produce and distribute these products have undertaken supply chain initiatives to ensure a steady and reliable distribution network, supporting sustained market growth.

Gather more insights about the market drivers, restrains and growth of the Protein Ingredients Market

Plant-based protein ingredients, derived from crops like soy, canola, wheat, and pea, are also seeing significant demand. Soy protein, in particular, leads the plant-based category and is anticipated to grow rapidly over the forecast period. The Food and Drug Administration (FDA) has even approved a health claim that suggests soy protein, when consumed daily in four servings, can lower LDL cholesterol levels by around 10%. This endorsement has further boosted soy protein’s popularity as a health-supportive ingredient.

In addition to soy protein’s growth, technological advancements and innovative production methods are further propelling market expansion. Protein ingredients are now applied across diverse products, such as isolates, which have high dispersibility and fine particle size, making them ideal for dairy applications. Growing consumer awareness of health benefits associated with protein ingredients has been a major growth driver for the market in recent years and is likely to continue this trajectory.

Application Segmentation Insights:

In terms of applications, the food and beverage segment led the market in 2022, capturing a 39.21% revenue share, and it is expected to retain this leading position over the forecast period. Whey protein ingredients, for instance, are an affordable source of protein and are widely used in the bakery and confectionery sectors. Recent advancements in process design and technology have refined whey products, resulting in higher quality variations like demineralized whey, Whey Protein Isolates (WPIs), and Whey Protein Concentrates (WPCs). These improvements have enabled greater use of protein ingredients in various functional food products, making them nutrient-dense options for consumers.

Animal feed is another key application area projected to grow rapidly, with an estimated CAGR of 6.3% by revenue over the forecast period. The animal feed industry is focusing on reducing environmental impact, which has increased interest in alternative proteins for feed products. The need to improve animal feed formulations with high-protein content, particularly with non-GMO sources, is becoming a priority.

Traditional protein sources for animal feed, such as soybean meal and fishmeal, have become more expensive due to rising demand, limited availability, and environmental concerns. This shift has led to an increased interest in alternative protein sources like insect meal, algae, and single-cell proteins, which are generally more sustainable and cost-effective. By using these alternative proteins, the animal feed industry aims to meet nutritional needs while reducing dependency on conventional, high-cost protein sources, thereby enhancing the sector’s overall sustainability and cost-efficiency.

Order a free sample PDF of the Protein Ingredients Market Intelligence Study, published by Grand View Research.

0 notes

Text

Protein Ingredients Market Product Overview, Research, Share by Types and Region till 2030

The global protein ingredients market was valued at USD 77.69 billion in 2022 and is expected to grow at a revenue-based compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This steady growth is driven by rising demand for a variety of food products such as margarine, cold cuts, bakery items, spreads, yogurt, and milk sausages that use protein ingredients. Increased consumption of these protein-rich foods among health-conscious and elderly consumers is further fueling the market. The growing interest in these products stems not only from their nutritional benefits but also from specific functional properties, such as satiety, muscle repair, weight loss, and energy balance. These functions are made possible by innovative protein formulations containing diverse amino acid profiles, which present vast growth opportunities for the market.

The market has also experienced a notable rise in demand for animal-based protein products. In the U.S., demand for animal-derived protein is especially strong and is expected to continue growing in the near future. Companies that produce and distribute these products have undertaken supply chain initiatives to ensure a steady and reliable distribution network, supporting sustained market growth.

Gather more insights about the market drivers, restrains and growth of the Protein Ingredients Market

Plant-based protein ingredients, derived from crops like soy, canola, wheat, and pea, are also seeing significant demand. Soy protein, in particular, leads the plant-based category and is anticipated to grow rapidly over the forecast period. The Food and Drug Administration (FDA) has even approved a health claim that suggests soy protein, when consumed daily in four servings, can lower LDL cholesterol levels by around 10%. This endorsement has further boosted soy protein’s popularity as a health-supportive ingredient.

In addition to soy protein’s growth, technological advancements and innovative production methods are further propelling market expansion. Protein ingredients are now applied across diverse products, such as isolates, which have high dispersibility and fine particle size, making them ideal for dairy applications. Growing consumer awareness of health benefits associated with protein ingredients has been a major growth driver for the market in recent years and is likely to continue this trajectory.

Application Segmentation Insights:

In terms of applications, the food and beverage segment led the market in 2022, capturing a 39.21% revenue share, and it is expected to retain this leading position over the forecast period. Whey protein ingredients, for instance, are an affordable source of protein and are widely used in the bakery and confectionery sectors. Recent advancements in process design and technology have refined whey products, resulting in higher quality variations like demineralized whey, Whey Protein Isolates (WPIs), and Whey Protein Concentrates (WPCs). These improvements have enabled greater use of protein ingredients in various functional food products, making them nutrient-dense options for consumers.

Animal feed is another key application area projected to grow rapidly, with an estimated CAGR of 6.3% by revenue over the forecast period. The animal feed industry is focusing on reducing environmental impact, which has increased interest in alternative proteins for feed products. The need to improve animal feed formulations with high-protein content, particularly with non-GMO sources, is becoming a priority.

Traditional protein sources for animal feed, such as soybean meal and fishmeal, have become more expensive due to rising demand, limited availability, and environmental concerns. This shift has led to an increased interest in alternative protein sources like insect meal, algae, and single-cell proteins, which are generally more sustainable and cost-effective. By using these alternative proteins, the animal feed industry aims to meet nutritional needs while reducing dependency on conventional, high-cost protein sources, thereby enhancing the sector’s overall sustainability and cost-efficiency.

Order a free sample PDF of the Protein Ingredients Market Intelligence Study, published by Grand View Research.

0 notes

Text

Mukka Proteins Limited Announces ₹98 Crore Preferential Issue for Acquisition and Expansion

Mukka Proteins Limited, India’s largest fish meal and insect meal producer and a leader in the animal protein industry, has announced the approval of a preferential issue worth ₹98 crore by its Board of Directors. This strategic move will help Mukka Proteins in its ongoing domestic and international acquisition and expansion efforts, reinforcing its position in the global market. A significant portion of the funding will come from the promoter and promoter group, underlining their commitment to the company’s robust growth strategy.

The preferential issue will comprise up to 1.96 crore equity shares at ₹50 per share, aggregating to ₹98 crore. This price includes a premium of ₹49 per share on the face value of ₹1. Mukka Proteins will use the raised capital to enhance production capabilities and meet the growing global demand for sustainable and high-quality protein solutions, particularly in the fishmeal and insect meal sectors.

Mukka Proteins has consistently embraced sustainability, having commercialized insect protein as a significant innovation for the aquaculture and animal feed industry. The company’s waste-to-food initiatives have contributed to environmental sustainability, particularly in collaboration with the Mangaluru municipality for waste management. These efforts not only align with global environmental best practices but also enhance circular economy processes, focusing on converting municipal waste into valuable protein and oil products.

Mukka Proteins is known for its strong commitment to ecological preservation, evident through the development of sustainable products such as fishmeal, fish oil, and insect protein. As a key player in the aquaculture and nutraceutical markets, Mukka contributes 25-30% of the market share in India’s fishmeal and fish oil industry.

The company plans to expand its operations further, capitalizing on this capital infusion to enter new markets and enhance its global footprint. Additionally, the company’s Board approved an increase in its authorized share capital from ₹30 crore to ₹40 crore to facilitate the preferential issue. This issuance is subject to necessary statutory and regulatory approvals, including shareholder approval at the upcoming Extra-Ordinary General Meeting (EGM) on November 16, 2024.

Managing Director and CEO Mr. Harris commented, "This preferential issue is a major milestone for Mukka Proteins as we continue to strengthen our market position. Our growth plans remain firmly rooted in sustainability, and this capital will enable us to scale up production, diversify our product offerings, and reinforce our commitment to responsible and eco-friendly business practices.”

Mukka Proteins Limited is poised to capture new opportunities in the animal protein sector, reinforcing its legacy of innovation, sustainability, and operational excellence.

Independent Business Review

For further details, please contact:

*Vikraam Sanass*

Mob: 9904491500

Mail: [email protected]

ICON MEDIA SOLUTION

0 notes

Text

Insect Protein Market Landscape, Regional Forecast to 2032

Insect Protein to Reach USD 1.77 Billion by 2032, Growing at a CAGR of 25.01%

Global Insect Protein Size, Share, and Forecast Report 2024-2032

Introduction

As the global population continues to rise and concerns over sustainable food production intensify, alternative protein sources are gaining significant traction. One such alternative is Insect Protein Market Size, which is emerging as a viable, eco-friendly, and nutritious option to meet the growing demand for protein-rich food. According to the latest research, the global insect protein was valued at USD 237.53 million in 2023 and is expected to grow at an impressive compound annual growth rate (CAGR) of 25.01%. By 2032, the is projected to reach a value of USD 1.77 billion.

This press release provides insights into the factors driving the growth of the insect protein , key trends, segmentation, and regional analysis.

Drivers and Growth Factors

Several factors are contributing to the rapid growth of the global insect protein :

Sustainability and Environmental Benefits: Insect protein production requires significantly fewer resources—land, water, and feed—compared to traditional livestock farming. Additionally, it produces lower greenhouse gas emissions, making it an environmentally friendly alternative. With rising concerns about climate change and the environmental impact of conventional meat production, insect protein is becoming an attractive solution for sustainable food systems.

Rising Demand for High-Quality Protein Sources: As global protein consumption increases, there is a growing demand for alternative sources that are nutritious and eco-friendly. Insects are rich in high-quality protein, essential amino acids, and micronutrients, making them a highly desirable protein source for both human and animal consumption.

Acceptance of Edible Insects: Consumer perception of edible insects is slowly shifting as more people recognize the health and environmental benefits. In many parts of the world, particularly in Asia, Africa, and Latin America, insects have been consumed as a regular part of the diet for centuries. This growing acceptance, combined with efforts by food companies to develop insect-based products that are both palatable and accessible, is driving the forward.

Expansion in Animal Nutrition: Insect protein is not only being adopted for human consumption but is also gaining popularity in animal nutrition. As regulations evolve and the benefits of insect protein for livestock, poultry, and aquaculture are recognized, the use of insect-based feed is expected to see significant growth.

Innovation in Food Products: The development of insect-based protein powders, energy bars, snacks, and other food products is driving increased consumer interest. Companies are innovating to create products that cater to the health-conscious and environmentally aware consumers, further fueling the 's growth.

Segmentation

The global insect protein can be segmented by insect type, application, form, and region.

By Insect Type:

Beetles: Beetles represent a significant portion of the insect protein due to their high protein content and the ease of breeding them on a large scale.

Caterpillars: Caterpillars are consumed in many cultures worldwide and are increasingly being incorporated into insect protein production due to their nutritional benefits.

Bees, Wasps, and Ants: These insects are rich in protein and other nutrients, making them a valuable source of alternative protein.

Grasshoppers, Locusts, and Crickets: These insects are among the most popular and widely used for insect protein production. Crickets, in particular, are favored for their high protein content and ease of farming.

By Application:

Animal Nutrition: The animal nutrition segment holds the largest share, driven by the growing demand for sustainable and protein-rich feed for livestock, poultry, and aquaculture. Insect protein is recognized for its ability to improve animal health and growth.

Food & Beverages: The food and beverage segment is expected to see significant growth as consumer acceptance of insect-based foods increases. Insect protein is being used in various products such as protein bars, snacks, and even pasta, catering to the growing health-conscious and eco-friendly consumer base.

By Form:

Powder: Insect protein powder is the most popular form, as it can be easily incorporated into a wide range of food products, including shakes, energy bars, and baked goods.

Whole: Whole insects are also sold as snacks or used in specialty culinary applications, though this is more niche.

Paste: Insect protein paste is used in certain processed foods and supplements, providing a more flexible ingredient option for food manufacturers.

Regional Outlook

North America: North America is one of the fastest-growing regions for insect protein, driven by increasing consumer awareness about the environmental and health benefits of alternative proteins. The U.S. and Canada are seeing significant investments in insect protein startups, along with growing retail and online availability of insect-based products.

Europe: Europe is at the forefront of insect protein regulation and innovation. The European Food Safety Authority (EFSA) has approved several insect species for human consumption, paving the way for wider adoption. Countries like France, the Netherlands, and the U.K. are seeing a rise in insect-based food and feed products.

Asia-Pacific: Asia-Pacific holds the largest share of the global insect protein , owing to the traditional consumption of insects in countries like China, Thailand, and Vietnam. The region is expected to continue dominating the as consumer demand for sustainable protein sources increases and production capabilities expand.

Latin America and Middle East & Africa: Insects have long been a part of the diet in many parts of these regions, and as global interest in insect protein grows, so too will local production and consumption. These regions are expected to see moderate growth, driven by both cultural acceptance and the development of new s for insect-based products.

Trends Shaping the Future of the Insect Protein

Integration into Mainstream Food Products: As insect protein gains mainstream acceptance, we are likely to see an increase in insect-based products on super shelves. This includes everything from protein bars and shakes to pasta and baked goods, providing more choices for consumers looking for sustainable protein sources.

Growth in Insect-Based Animal Feed: The use of insect protein in animal feed is expected to see explosive growth, particularly in the aquaculture sector, where it has shown great potential as a sustainable feed alternative to fishmeal.

Strategic Partnerships and Investments: Key players in the insect protein are forming strategic partnerships with food and feed companies to scale up production and increase penetration. Investments in insect farming technologies are also driving down production costs and improving supply chain efficiencies.

Key Players

Several key players are driving the growth of the insect protein , including:

Ynsect

Protix

AgriProtein

EnviroFlight LLC

Entomo Farms

These companies are focused on scaling production, improving product quality, and expanding their product offerings to cater to the growing global demand for insect protein.

Conclusion

The global insect protein is on the cusp of rapid expansion, driven by growing consumer demand for sustainable, eco-friendly, and nutrient-rich protein sources. With a projected CAGR of 25.01% from 2024 to 2032, the is expected to reach USD 1.77 billion by 2032, offering significant opportunities for innovation and growth in both the food and animal nutrition sectors.

Read More Details @ https://www.snsinsider.com/reports/insect-protein-market-1355

Contact Us:

Akash Anand – Head of Business Development & Strategy

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

0 notes

Text

0 notes

Text

Insect Protein Market Size: Competitive Landscape and Recent Industry Development Analysis 2023 to 2033

From 2023 to 2033, the insect protein market (Marché des protéines d’insectes) is projected to accelerate at a CAGR of 17.7% from its 2023 value of USD 602.3 million. By 2033, there is going to be USD 3.1 billion global market.

Over the projected period, the demand for insect protein is anticipated to increase due to rising consumer awareness of the consumption of nutrient-dense food products and rising customer preference for a healthy lifestyle.

Information Source: https://www.futuremarketinsights.com/reports/insect-protein-market

Thriving Applications and High Protein Content in Insects Insect Protein Need is Increasing

The demand for wholesome food products has grown as a result of rising health consciousness among customers throughout the world. As a result, manufacturers in a variety of industries now have the opportunity to sell such food items.

Consumers today place a premium on natural products and pay attention to the components in their food as well as how it is produced and where it comes from. Some of the main factors anticipated to boost insect protein market expansion throughout the projected period include rising expenditure on functional food products, an increase in the number of sports and gym enthusiasts, and consumers searching for healthy and sustainable food options.

High Costs Limit Market Expansion

Due to its functional, environmental, and nutritional advantages, insect protein is one of the distinctive and innovative animal feed proteins. High costs, regulations, and constrained production capacity continue to be the key barriers to progress of the insect protein market.

The equipment and processes needed to create insect-based proteins need to be optimised for large-scale manufacturing because they are currently expensive. Although many consumers are priced out of this market, few consumers are willing to pay higher rates for the health and environmental advantages of protein derived from insects.

Regional Outlook

Developing Product Demand for Human Consumption May Cause Europe to Exhibit a Strong Growth.

The lion’s share of the revenue came from the European continent. For uses in the food and beverage sector, animal nutrition, and personal care, insect protein is more widely accepted by consumers in the European insect protein market.

Demand is anticipated to increase in the European market as a result of the recent approval of insect protein for feed, especially that for pigs and poultry. The market is anticipated to grow significantly over the forecast period due to the high demand for insect protein from industrialised nations like France, Germany, and the United Kingdom.

The revenue was largely from North America. The market is projected to be a significant market because consumers are becoming more conscious of the use of insect-based products and have a greater need for food products that are nutrient-dense.

Due to Mexico and Canada’s substantial growth potential for new companies and product launches, the insect protein market is likely to grow throughout the projected period.

Key Takeaways

With a CAGR of 20.6% and an expected market size of US$ 1.1 billion in 2033, the insect protein market in the United States is expected to grow rapidly over the projected period.

With a strong CAGR of 11.9% and an expected market size of US$ 129 million in 2033, the Chinese market is expected to grow throughout the course of the estimated period.

In 2033, it is expected that the Japan market would generate US$ 61.7 million and grow at a 9.5% CAGR.

With a CAGR of 23.6% throughout the projection period, it is anticipated that the United Kingdom market would grow quickly, reaching US$ 300.8 million in 2033.

The insect protein market in South Korea is predicted to expand at a CAGR of 9.8% over the predicted time period and could reach US$ 35.5 million in 2033.

Powder is anticipated to expand at a CAGR of 15.4% over the anticipated time frame in the form category.

The insect type category’s Caterpillars sector could have a CAGR of 21.8% from 2023 to 2033.

Competitive Landscape

With numerous large- and small-scale manufacturers present, the market is competitive and concentrated. The leading market participants include Aspire Food Group Protifarm, EntomoFarms, Chapul Cricket Protein, Jimini’s, Swarm Nutrition GmbH, EnviroFlight LLC, AgriProtein Holdings Ltd. nsect, Hexafly, Innovafeed, and Protix. To meet the demand on a global scale, these major firms are concentrating on increasing their manufacturing capacity.

Recent Development

· Partnership – To Expand Its Insect Protein Industry

Archer Daniels Midland Company and Innova Feed announced a partnership in November 2020. The partnership was formed in order to grow its insect protein business by developing a new facility in Illinois, the U.S., with a target capacity of 60,000 tonnes of insect protein annually.

Key Segments

Insect Type:

Beetles

Caterpillars

Bees, Wasps, and Ants

Grasshoppers, Locusts, and Crickets

Others

Form:

Whole Insect

Powder

Application:

Food & Beverages

Animal Nutrition

Aquafeed

Pet Food

Poultry Feed

Pharmaceuticals & Cosmetics

Region:

North America

Latin America

Europe

East Asia

South Asia

Oceania

The Middle East & Africa (MEA)

0 notes

Text

Okay. So. Speaking here as a Jew who keeps kosher by... let’s call it “somewhat stringent American Conservative* standards.” (This is very long, but I’ve tl;dr’ed.)

*obligatory disclaimer that this is a religious, not a political, affiliation

tl;dr: You’d have to ask your friend, because we have nesting layers of stringencies around this, and what works for one won’t necessarily work for all. Our standards for “in public” may be very different than our standards for “in our own homes.” And that’s all before getting into the additional rules for Pesach.

That said, if you live somewhere where lots of food are labeled as kosher on the packaging in the grocery store (do not trust the sale signs and stickers from the store itself), it is probably a safe bet that many of those are reliable.

Tips and peeves and info on how the labeling works below the readmore. No brands, because that’s more of a local thing.

Broadly speaking, we have kosher certification agencies. These are nearly all Orthodox, and the large ones are generally acceptable to everyone (asterisk for triangle K), although the specifics of who accepts which ones for one can get fuzzy sometimes. Those symbols marking something as kosher are legally recognized trademarks -a brand cannot include them without rabbinic supervision that their ingredients, equipment, and processes are kosher without opening themselves up to some lawsuits that are just not worth it given how negligible a share of the market we are. If something’s got a kosher trademark, it can generally be reasonably be assumed to be kosher, barring something egregiously wrong in the ingredients. Every so often, there are errors, and we’ve got organizations that send out emails and alerts about this.

An issue comes up with cooking -many people who keep kosher won’t eat food that’s been made or processed in a kitchen that handles food that isn’t. Many will, but with caveats on what kind. If you wanted to keep some granola bars that had an OU (that’s a U inside a circle) certification on them for your hypothetical friend, they’d almost certainly have no religious objections to eating them. If you were to open the granola bar and put it on a plate, they might not. If you were to make your own granola bar, they would very likely avoid it, especially if it contained gelatin.

General tips:

The CRC (Chicago Rabbinical Council) has a list of other reliable agencies. They’re good, and so are their recommendations. That’s not a complete list, but it’ll work, especially if you’re in the US. I’m not adding the link because tumblr reblogs, but the phrase to google is crc hechscher list.

As a general rule, unadulterated raw produce is religiously safe for all of us outside of Pesach.

Don’t bother trying to feed a friend who keeps kosher during Pesach unless they tell you they’re cool with it. It’s just. It’s a lot. Especially if they’re Ashkenazi and hold to the traditional stringencies therein.

“Kosher-style” is always unkosher. Always. When it comes to hotdogs, it just means “all-beef.”

If a restaurant serves any unkosher food, it is not a kosher restaurant. If it serves meat and dairy together, it is not a kosher restaurant. Be especially wary of this in delis.

Manischewitz is a very well-known and very reliable producer of kosher food. Their wine is infamously terrible. It is marginally better chilled, but it’s still gross.

There are criteria for acceptable species of animals and fish. We’ve roughly got a set for birds. No insects (yes, there’s an asterisk; IME, most of us don’t care). The animal also needs to be slaughtered appropriately and deblooded. Also we don’t eat every part of the animal. It’s a lot more complicated than just “oh, don’t worry, it’s beef.”

The most likely areas to be problems are, in approximate order (based on my experience with how many of us care): meat, fish, gelatin, cheese, wine, general dairy, leafy vegetables, the actual kitchen and dishes.

It’s not unusual to be stricter about kashrut at home than in public.

When cooking for someone who’s strict about kashrut, 1) aluminum foil is your friend and 2) don’t be surprised or offended if they ask to be present. There’s a lot of rules and weird niche areas that can come up that you’d have no reason to know about without living immersed in this.

Common pet peeves:

Rabbis don’t make food kosher. It’s not about blessing the food. Their presence when it comes to certification is entirely about having an expert present to watch that everything’s done right, and a masgiach (kosher certifier) doesn’t need to be a rabbi. If someone says “oh, yeah, my restaurant’s kosher, we have a rabbi come in to bless the premises every week,” either they’re full of shit, or someone’s playing them. Either way, I’m not eating there.

Kosher has nothing to do with taste or quality. You want to pay the extra money for it, that’s your prerogative, but in a country with trustworthy federal regulatory agencies guaranteeing that your beef is beef and also that it didn’t die of disease, there’s really no point for someone who isn’t Jewish.

“Kosher-style” doesn’t mean kosher.

“Jewish” or “Jewish-style” delis that are flagrantly treif -doubly so if they were never Jewish. My university town had a small local chain that was along the line of “Grandma Finkelstein’s New York deli” (name changed for my privacy). No Jews were or had ever been involved in the restaurant or related to the people responsible for the name, nearly everything they served couldn’t be made kosher, and they routinely stopped selling their scant few vegetarian options on weekends. It was just slapping on a stereotypical Jewish name, taking the general concept of popularly Jewish food, making it completely inaccessible to Jews, and profiting off using us as a mascot.

Goyim who tell me I’m wrong about kashrut. (Extra infuriating if they cite “messianic” or “biblical Christian” they know.)

“Challah” is not “braided egg bread.” It’s commonly used that way, but it refers to a specific ritual action done in the making of the bread, and it can be done with any kind of bread.

No, I can’t just “pick off the unkosher bits.” That’s not how this works. Unkosher is a contaminant.

That said, I couldn’t possible care less if someone is eating unkosher with/around/in front of me. Goyim aren’t supposed to keep kosher in the first place, and it’s not my job to police other Jews.

That said, don’t bring treyfe into a kosher home. It’s just not cool. Not all dishes can be made kosher again, and even for those that can, it can be an annoying hassle.

I wish I'd made it clearer when I make this post but shit like that is super common.

Every Jew has had someone "joke"/threaten/say they were gonna sneak pork into our food. Every single Jewish person, who keeps Kosher or not has had someone say something about giving us bacon or whatever without us knowing

I've had people passive aggressively ask if I wanted any bacon or ham and literally wave it at me while speaking.

I can't count the number of times that the first question out of someone's mouth when they learn I am Jewish is "but do you eat bacon" "have you ever tried bacon?" "what about ham?" "do you want to try bacon?(as in right now this very minute 30 seconds into knowing me)"

Countless Jews have spoken to the person in charge of an event, weeks or even months in advance about their Kosher needs, been assured up down and sideways that those needs will be met to show up and find no Kosher option.

and finally SO! many Jews do indeed have a story of being tricked into eating something not Kosher, and most commonly something pork related.

like this is one of the most common antisemitic micro (and not so micro) aggressions Jews face and is one of the reasons lots of Jews don't keep Kosher, they can't trust even (so-called) friends to have even baseline respect or to learn anything about Kosher.

29K notes

·

View notes

Text

Why the worst of food inflation may be over Higher kharif plantings on the back of good monsoon so far, plus benign international prices, offers hope of an easing of inflationary pressures in the months ahead Retail food inflation ruled above 8% for eight straight months from November 2023 to June 2024. That year-on-year increase, in the official consumer food price index (CFPI), fell to 5.4% in July, from 9.4% the month before. The sharp decline, though, is a statistical illusion, stemming from a high "base" inflation of 11.5% in July 2023. The monthly CFPI rise (July 2024 over June 2024), at 2.8%, translates into an annualised inflation of 33.8%! Simply put, food inflation remains the economy's bugbear , eating into household incomes and suppressing spending on other things, besides preventing the Reserve Bank of India (RBI) from cutting its policy interest rates. Given the high share of food in the average Indian's consumption basket, "the public at large understands inflation more in terms of food inflation…[which also] adversely affects household inflation expectations," the RBI governor Shaktikanta Das said recently. Amidst all this, there are at least two reasons for cautious optimism. Monsoon optimism The first has to do with the monsoon. The southwest monsoon set in over Kerala on May 30, two days before schedule. Yet, June as a whole registered 10.9% below the historical long period average ("normal") rainfall for the month. Rain was subpar everywhere, save the South, Maharashtra (excluding Vidarbha), west Madhya Pradesh and east Rajasthan . It was, perhaps, the residual effect of El Niño that lasted from April-June 2023 to March-May 2024. But as El Niño – an abnormal warming of the central and eastern Pacific Ocean waters off Ecuador and Peru, generally known to suppress rainfall in India – transitioned into a "neutral" phase, the monsoon revived. July recorded 9% above normal rain. The current month, too, has seen 15.4% above-normal rainfall so far, taking the cumulative surplus for the season (June-September) to 4.8% as on August 15. The deficiency is now largely confined to the East, and parts of northwest India where farmers have access to irrigation. The overall good monsoon with well-distributed rainfall has led to higher acreages under most kharif crops this year. Area sown is up for rice, pulses such as arhar (pigeon pea) and moong (green gram), maize, oilseeds (soyabean and groundnut) and sugarcane – relative to both the corresponding period of 2023 and the normal coverage for this time ( see table ). Farmers plant more when there is adequate water. They also go for crops whose prices are better or assured. Arhar and maize are now wholesaling at Rs 10,500-11,000 and Rs 2,600-2,700 per quintal respectively, way above their corresponding official minimum support prices ( MSP ) of Rs 7,550 and Rs 2,225. Not surprising, then, that farmers have aggressively sown both crops – which should also help ease inflation in pulses ( arhar dal is retailing at an average of Rs 165/kg, against Rs 140 a year ago and Rs 110 two years ago) and animal proteins (maize is a key poultry and cattle feed ingredient) down the line. On the other hand, farmers have sown less area under cotton, trading at Rs 7,500-7,600 per quintal in Gujarat's Rajkot market. That's just around the MSP of Rs 7,521 for long-staple varieties, when the new crop's first picking is due only after mid-September. Flat prices, long cropping duration (6-7 months) and risks of insect pest attacks (especially the deadly pink bollworm) have dampened farmers' enthusiasm in planting cotton. They have switched area this time to groundnut, soyabean and maize (which mature in 3-4 months) or even paddy (where MSP is assured through government procurement). Low global food prices Farmer supply response to a good monsoon and high prices apart, there's a second factor that may reduce inflationary pressures in food. Global food inflation has been in negative territory since December 2022. The United Nations' Food and Agriculture Organization's food price index averaged 120.8 points in July 2024, 3.1% down from its year-ago level. The index – a weighted average of the world prices of a basket of food commodities over a base period value (taken at 100 for 2014-16) – is also 24.7% below its 160.3 points peak scaled in March 2022 following Russia's full-scale invasion of Ukraine . Even sharper is the cereal price index's fall, from 173.5 points in May 2022 to 110.8 points now. While global and domestic food inflation have been moving in opposite directions in recent times (see chart), low international prices, however, make imports more feasible. Russian wheat, for instance, is currently being exported at about $220 per tonne free-on-board (i.e. from the port of origin), compared to $250-plus a year back and $395-405 in March-May 2022. Adding ocean freight and other charges of $45-50 would take the landed cost of imported wheat in India to $265-270 per tonne or Rs 2,225-2,270/quintal. That's below the ruling market price of Rs 2,600 in Delhi and even the MSP of Rs 2,275. The point to note is that benign international prices – a contrast to the situation post the outbreak of the Russia-Ukraine war – not only lessen the risk of "imported inflation", as it happened particularly in vegetable oils from late-2020 to 2022. They can put a lid on domestic prices, like with wheat if imports are allowed through lowering of duty (from the present 40%). Going forward Wheat stocks in government warehouses, at 268.12 lakh tonnes (lt) on August 1, were the third lowest for this date after 2022 (266.45 lt) and 2008 (243.80 lt). However, the rice stocks (including the grain equivalent from un-milled paddy) of 454.83 lt were the highest ever for the same date. The prospects of a monsoon-aided bumper kharif crop should enable relaxation of the export ban/restrictions on non-basmati rice as well as sugar, along with the lifting of stockholding limits on pulses applicable to traders, retailers and dal millers. Above-average rains so far have filled up the country's major reservoirs to nearly 65% of their total storage capacity (as against last year's 61% and the 10-year normal of 54% for this time) and also recharged groundwater tables. That – plus the high probability of the emergence of La Niña (El Niño's "cool cousin", associated with robust rainfall activity in India) during September-November and persisting through the winter-spring months – is encouraging for the ensuing rabi cropping season too. But all this optimism has to be tempered by the fact that the kharif crop's harvesting is at least a month away, while not before March-end for wheat and other rabi crops. The uncertainty over food inflation will continue for some time till then.

0 notes

Text

Pet Food Market - Forecast(2024 - 2030)

Pet Food Market Overview:

The Pet Food Market size is estimated to reach $90 billion by 2030, growing at a CAGR of 8.4% during the forecast period 2023-2030. Pet food is a specialty food for domesticated animals and is formulated to meet their nutritional requirements such as meat, grains, cereals, meat by-products, vitamins and minerals. It is available in supermarkets/hypermarkets & pet stores and customized to the types of animals such as cats, dogs, fish and other pets.

Increasing demand for Premium Pet Food Products and rising pet ownership across developing economies are expanding the Pet Food Market opportunities. Rising health awareness among customers and attraction towards organic products are also driving the Pet Food Market growth. As per American Veterinary Medical Association, pet ownership for cats has increased to 29% in 2022. For dogs, it has increased to 45% in 2022. This represents the Pet Food Industry Outlook.

Pet Food Market Report Coverage:

AttributeSegment

By Food Type

Semi-moist Foods

Kibble Foods

Canned Foods

Veterinary

Nutritional Foods

Others

By Animal Type

Cat

Dog

Rabbit

Birds

Fish

Ferrets

Others

By Nature

Conventional

Organic

By Price

Premium

Mass

By Source Type

Animals

Plants

Cereals

Others

By Packaging

Stand-up pouches

Tin cans

Premade multi-layered pouches

Bags Roll stock

Corrugated boxes

Others

By Distribution Channel

Offline Platforms

Online Platforms

By Geography

North America (the US, Canada and Mexico)

Europe (Germany, France, UK, Italy, Spain, Russia and the Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand and the Rest of Asia-Pacific)

South America (Brazil, Argentina, Chile, Colombia and the Rest of South America)

The Rest of the World (the Middle East and Africa).

Request Sample

COVID-19 / Ukraine Crisis - Impact Analysis:

The COVID-19 pandemic has impacted the supply chain of the animal feed industry. The different animal nutrition food items, vitamins and medicines including pet pharmaceuticals were out of stock.

The Russia-Ukraine war has impacted the supply chain and resulted in high input prices. In the short term, rising product prices in the domestic market contributed to increased earnings for producers.

Key Takeaways:

Dominance of North America Region

Geographically, North America led the Pet Food Market with a 37.3% share of the overall market in 2022. This is due to the increasing innovation by pet food manufacturers and rising pet adoption in the region. In 2020, as per American Pet Products Association National Pet Owners Survey, 63 million households or 74.6% of all households have dogs as pets.

Canned Food Segment holds the largest market share

According to the Pet Food Market forecast, the Canned Food Segment held the largest Pet Food Market revenue of $18 billion in 2022. The segment is estimated to grow at the fastest CAGR of 9.5% during the period 2023-2030. This is due to increasing consumer desire for feeding their pets nutritional food rich in vitamins, minerals, protein, fiber and other elements that are crucial to a balanced diet.

Premade Multi-layered Pouches Segment is anticipated to grow faster

As per the Pet Food Market analysis, the Premade Multi-layered Pouches segment is estimated to grow at the fastest CAGR of 9.8% during the forecast period 2023-2030. It is due to the durable structure, puncture-resistance protection and proper closures for pet food products, driving the segment growth.

Inquiry Before Buying

Increasing innovation by pet food manufacturers

The major competitors in the market are focusing on the launch of a number of pet food products to meet the needs of different types of animals that belong to different age groups. This is anticipated to fuel the expansion of the pet food industry. For instance, In November 2020, Nestle Purina introduced pet animal food that builds on alternative proteins to make better use of global resources. The range includes insects and plant proteins from millet and fava beans.

Rising health awareness among customers toward the organic product for pets

Customers are now more aware of the ingredients in their pet food. The market for organic pet food is increasing rapidly as a result of pet owners' growing attention to the health and welfare of their pets. The increasing number of health problems affecting pets has influenced pet owners to choose organic pet food over conventional options. These factors are contributing to the key Pet Food Market trends during the forecast period. In 2020, organic pet food consumption was worth $22 billion.

Schedule a Call

Imposition of strict regulations hamper market growth

Pet food comes with some of the strictest regulations out there, especially in western markets. Pet animal products are strictly examined in developed markets at every stage from the ingredients used in food preparation to their sales and marketing. The high stringency involved with commercialization is one of the major factors hampering the growth of the pet food industry.

Key Market Players:

Product/Service launches, approvals, patents and events, acquisitions, partnerships and collaborations are key strategies adopted by players in the Pet Food Market. The 10 key companies in this industry are:

Mars Pet care, Inc. (PEDIGREE®, NUTRO)

General Mills (Chex, Lucky Charms)

Nestle Purina Pet Care (Purina ONE®, Purina® Pro Plan®)

The J.M. Smucker Company (Meow Mix®, Rachael Ray®)

Hill’s Pet Nutrition (Hill's® Science Diet®, Prescription Diet®)

Diamond Pet Foods (Diamond V®, DIAMOND PRO89)

Simmons Pet Food (Twin Pet, Strongheart)

Global Pet Care (DreamBone, Good 'n' Fun)

Agrolimen SA (Advance Junior Maxi, Ultima Leche)

Deuerer (Katze, Wau)

Buy Now

Scope of Report:

Report MetricDetails

Base year considered

2022

Forecast period

2023–2030

CAGR

Growing at the rate of 8.4%

Market Size

90 billion USD

Segments covered

Food Type, Animal Type, Nature, Price, Source Type, Packaging, Distribution Channel and Region

Geographies covered

North America (the US, Canada and Mexico), Europe (Germany, France, the UK, Italy, Spain, Russia and the Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand and the Rest of Asia-Pacific), South America (Brazil, Argentina, Chile, Colombia and the Rest of South America) and the Rest of the World (the Middle East and Africa).

Key Market Players

Mars Pet care, Inc.

General Mills

Nestle Purina Pet Care

The J.M. Smucker Company

Hill’s Pet Nutrition

Diamond Pet Foods

Simmons Pet Food

Global Pet Care

Agrolimen SA

Deuerer

#Pet Food Market Size#Pet Food Market Trends#Pet Food Market Growth#Pet Food Market Forecast#Pet Food Market Revenue#Pet Food Market Vendors#Pet Food Market Share#Pet Food Industry

0 notes

Text

Plant-Based Proteins Surge in Popularity Due to Veganism and Cultural Preferences

Protein Ingredients Market size is expected to be worth around USD 134.0 billion by 2033, from USD 74.1 billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2023 to 2033.

Get a Sample Copy with Graphs & List of Figures @ https://market.us/report/protein-ingredients-market/#requestSample

As consumer preferences shift towards healthier eating habits, there is a growing demand for protein ingredients in products like margarine and cold cuts. This trend is driven by increased awareness of health benefits associated with protein consumption, including improved muscle repair, weight management, and energy balance.

The market is experiencing robust growth due to innovation in protein formulations by manufacturers, who are developing new protein types tailored to specific health needs. These advancements cater to a diverse range of consumer requirements, from enhancing muscle recovery to promoting satiety and weight loss.

As clean eating and health-conscious lifestyles gain popularity, the demand for functional and high-quality protein ingredients continues to rise, presenting significant opportunities for expansion within the industry.

Кеу Маrkеt Ѕеgmеntѕ

By Source

Microbe-Based Proteins

Animal/Diary Proteins

Plant Proteins

Insect Proteins

By Application

Food & Beverages

Protein Bars

Protein Beverages

Meat Alternatives

Dairy Products

Dietary Supplements

Pharmaceuticals

Animal Feed

Personal Care Products

Others

By SourceIn 2023, animal-based proteins dominated the market with over 75.4% share, crucial for liquid biopsy tests and recognized for their health benefits. Whey proteins, in particular, support nutrition and immunity, especially for chemotherapy patients. Despite the high cost, animal proteins continue to drive market growth.

Application AnalysisFood and beverages led the protein ingredients market in 2023, capturing over 40.2% of the share. Advances in technology have improved whey protein quality, driving demand for protein-rich functional foods and beverages.

Кеу Маrkеt Рlауеrѕ

DuPont

Fonterra Co-operative Group Limited

Cargill, Incorporated

ADM

Kerry Group plc

Arla Foods amba

BRF Global

International Flavors & Fragrances Inc.

Royal FrieslandCampina NV

Glanbia plc

Solae LLC

Axiom Food Inc.

Davisco Foods International, Inc.

Roquette Freres S.A.

FrieslandCampina DMV B.V

DriversPost-COVID-19, there's been a notable shift towards healthier eating, with a focus on boosting immunity through diet. As people increasingly prioritize health and wellness, the demand for protein-rich foods has surged, reflecting a global trend toward stronger immune systems and healthier lifestyles.

RestraintsGelatin, commonly derived from animal parts like bones and hides, faces restrictions in markets where dietary or religious practices oppose animal products. For example, in Muslim communities and other regions with specific dietary rules, pork-derived gelatin is unacceptable, limiting the market's expansion.

OpportunitiesThe rising interest in dairy and plant-based proteins presents significant growth opportunities. With a shift towards veganism and concerns about sustainability and animal welfare, plant proteins are gaining traction, particularly in regions with dietary restrictions or cultural preferences, such as Islamic nations and parts of India and Nepal.

ChallengesThe use of genetically modified (GM) ingredients in plant-based foods poses health and safety concerns. As regulatory bodies demand clear labeling of GM products, and consumers express worries about potential health risks and residues from weed killers, the market faces challenges related to food quality and consumer trust.

0 notes

Text

Insect Protein Market to Showcase Continued Growth in the Coming Years

Insect protein, derived from insects, serves as a nutritious food source for both humans and animals. This protein is highly sustainable and environmentally friendly, requiring significantly less land, water, and feed compared to traditional livestock like cows or pigs. Insects are rich in protein, healthy fats, and essential vitamins and minerals. The use of insect protein is gaining popularity in various culinary applications, including protein bars, energy drinks, and burgers. Additionally, insects are being explored as a potential solution to the global food crisis due to their abundance and scalability in production.

At a CAGR of 33.4% from 2022 to 2027, the global insect protein market size is estimated to be worth $0.8 billion in 2022 and $3.3 billion by the end of 2027.

The insect protein industry boasts unique qualities that distinguish it from traditional protein sources. Insects offer a highly nutritious protein source, rich in essential amino acids, vitamins, and minerals. They are also a sustainable option, requiring minimal resources to farm and leaving a smaller ecological footprint compared to conventional livestock. Insects’ versatility as a protein source allows for a wide range of applications, from protein bars to pet food. However, the market faces challenges, such as limited consumer acceptance and regulatory hurdles.

Get PDF Copy: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=150067243

The Food & Beverage Segment is the Fastest Growing Application of Insect Protein During the Forecast Period

The major buyers in this market are food and beverage companies, dairy-alternative manufacturers, and feed industrials among others. The supply of insect protein affects the production of insect-based food and beverages production. Insect-based protein is considered a viable alternative source for protein, majorly in food and feed applications. Though whole insects are also available in the market as a rich source of protein, the scope of this report has been limited to only the processed products available as insect protein.

What role do start-ups play in the insect protein market in North America?

North America is anticipated to hold the largest insect protein market share in 2022, followed by Europe, Asia Pacific, and RoW. The presence of key insect protein manufacturing companies in developed regions such as North America and Europe contributes to these regions’ high market share. Many start-ups have been established in the region that provide both edible insects and insect protein-based products for food and feed applications. Enterra Feed Corporation (Canada), Entomo Farms (Canada), EnviroFlight LLC (US), and Aspire Food Group (US) are some of the leading companies providing insect protein-based products. The market for insect protein-based food products is projected to record the fastest growth during the forecast period due to the increasing awareness among people.

Insect Protein Market Growth Drivers

Sustainability and Environmental Benefits: Insects require significantly less land, water, and feed compared to traditional livestock, making them a highly sustainable protein source with a smaller ecological footprint.

Nutritional Value: Insects are rich in essential amino acids, healthy fats, vitamins, and minerals, offering a highly nutritious alternative to conventional protein sources.

Increasing Demand for Alternative Proteins: The rising global population and growing awareness of the environmental impact of meat production are driving demand for sustainable and alternative protein options.

Versatility in Applications: Insect protein can be used in a wide range of products, including protein bars, energy drinks, pet food, and animal feed, enhancing its market appeal.

Rising Consumer Awareness: As consumers become more aware of the environmental and health benefits of insect protein, acceptance and demand are increasing.

Investment and Innovation: Significant investments and innovations in insect farming and processing technologies are improving production efficiency and product quality, contributing to market growth.

Make an Inquiry to Address your Specific Business Needs: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=150067243

Government Support and Regulations: Favorable government policies and regulations promoting sustainable food production are encouraging the development and adoption of insect protein.

Growing Number of Start-ups: The establishment of numerous start-ups focused on edible insects and insect protein-based products is driving market expansion and increasing product availability.

Food Security Concerns: Insects are being explored as a potential solution to global food security issues due to their abundance and scalability in production.

Corporate Initiatives: Leading companies in the food and beverage industry are increasingly incorporating insect protein into their product lines, boosting market visibility and growth.

Top Insect Protein Companies

EnviroFlight (US)

InnovaFeed (France)

HEXAFLY (Ireland)

Protix (Netherlands)

Global Bugs (Thailand)

Entomo Farms (Canada)

Ynsect (France)

0 notes

Text

Exploring Innovations Revolutionizing the Animal Feed Industry

Introduction

The global animal feed market was valued at over USD 460 billion in 2021 and is projected to exceed USD 650 billion by 2028, registering a compound annual growth rate CAGR of 4% during the forecast period. The Animal Feed Market is experiencing dynamic changes driven by evolving consumer preferences, technological advancements, and sustainability initiatives. This in-depth analysis delves into the latest innovations shaping the animal feed industry, providing insights into key trends, opportunities, and challenges for stakeholders.

Innovations Driving the Animal Feed Market:

Alternative Protein Sources:

With the escalating demand for sustainable and plant-based diets, alternative protein sources for animal feed formulations are gaining momentum.

Innovations in insect protein production, algae cultivation, single-cell proteins, and microbial biomass offer sustainable alternatives to conventional protein sources like soybean meal and fishmeal.

These alternative protein sources not only promote environmental sustainability but also provide essential nutrients for animals while reducing reliance on scarce resources.

Precision Nutrition:

Advancements in precision nutrition technologies are reshaping feed formulation and delivery, enabling customized diets tailored to individual animals' specific nutritional requirements.

Technologies such as near-infrared spectroscopy (NIRS), metabolomics, and predictive modeling enable real-time monitoring of animal health, performance, and nutrient utilization, leading to more efficient feed management practices.

The precision nutrition segment is anticipated to witness substantial growth, driven by increasing investments in digital technologies and data analytics, with the market expected to surpass USD 3 billion by 2028.

Alternative protein sources are expected to capture a significant market share, with insect protein alone projected to reach USD 1.5 billion by 2028.

Functional Feed Additives:

Functional feed additives, including probiotics, prebiotics, enzymes, organic acids, and botanical extracts, are gaining prominence for their potential to enhance animal health, immunity, and performance.

These additives support gut health, improve nutrient absorption, and mitigate the adverse effects of stress, pathogens, and environmental challenges on animal welfare.

Innovations in encapsulation and delivery technologies are enhancing the stability and efficacy of functional additives, ensuring their effectiveness throughout the animal's digestive tract.

Blockchain and Traceability:

Blockchain technology is increasingly being harnessed to enhance transparency, traceability, and accountability in the animal feed supply chain.

Through blockchain-based platforms, stakeholders can track feed ingredient journeys from farm to fork, ensuring compliance with quality standards, safety regulations, and sustainability criteria.

Blockchain facilitates seamless data sharing and verification across the supply chain, mitigating the risks of fraud, contamination, and mislabeling, thereby safeguarding animal and human health while bolstering consumer trust.

Challenges and Opportunities

Regulatory Hurdles:

Despite the potential benefits of innovative feed technologies, regulatory hurdles and approval processes can impede their adoption and commercialization.

Stakeholders must navigate complex regulatory landscapes and demonstrate the safety, efficacy, and sustainability of novel feed ingredients and additives to gain regulatory approval and market acceptance.

Cost Considerations:

The adoption of innovative feed technologies may involve higher initial costs and necessitate investment in research and development.

Stakeholders must carefully evaluate the cost-benefit ratio of implementing new technologies, considering factors such as feed efficiency improvements, animal performance gains, and long-term sustainability benefits.

Conclusion

Innovation is driving profound changes in the Animal Feed Market, offering transformative solutions to meet the evolving needs of livestock producers, consumers, and the environment. By embracing cutting-edge technologies and addressing regulatory challenges, stakeholders can unlock new opportunities for sustainable and profitable animal nutrition solutions while ensuring the health, welfare, and productivity of animals.

#Animal Feed Suppliers#Animal Feed Companies#Animal Feed Additives Market#Animal Feed Market Share#Animal Feed Market#Animal Feed Industry#Animal Feed Market Size#Compound Feed Market#Global Animal Feed Market#Global Animal Feed Market Size#Animal Feed Composition Market#Animal Feed Industry Trends#Animal Feed Market Growth#Animal Feed Market Challenges#Animal Feed Market Type#Animal Feed Market Research Reports#Animal Feed Industry Research Reports#Animal Feed Supplements Market#Animal Feed Suppliers Market

0 notes

Text

Biopesticides: Nature's Answer to Pest Control and Management

Pest control is not just about eradicating pests; it's about striking a balance between control measures and environmental sustainability. It encompasses a diverse range of strategies aimed at preventing, monitoring, and controlling pests while minimizing risks to human health and the environment.

Effective pest management begins with understanding the biology and behavior of pests, as well as their interactions with the surrounding environment. This knowledge forms the foundation for implementing integrated pest management (IPM), a holistic approach that integrates multiple tactics to address pest problems.

In the age-old battle against pests, humanity has often turned to chemical solutions. However, with growing concerns about the environmental impact and health risks associated with traditional pesticides, there's a rising interest in more sustainable alternatives, Biopesticides – nature's own arsenal in pest control and management.

Embracing Nature's Wisdom with Biopesticides

Biopesticides are natural and biologically occurring compounds derived from animals, plants, bacteria, and certain minerals. Unlike synthetic pesticides, they offer a safer, environment-friendly, and targeted approach to pest control. As biopesticides offer a safer alternative for both humans and the ecosystem, they have a greater advantage over their chemical counterparts and are expected to occupy a large share of the market in the near future.

What are the types of Biopesticides?

There are three main categories of biopesticides.

1. Microbial Biopesticides: These biopesticides are derived from microorganisms such as bacteria, fungi, and viruses. They work by infecting or parasitizing pests, disrupting their biological functions, and ultimately leading to their destruction. Examples include Bacillus thuringiensis (Bt) and Beauveria bassiana.

2. Plant-Incorporated Protectants (PIPs): PIPs are produced by incorporating genetic material from one organism into the plant genome, allowing the plant itself to produce compounds toxic to pests. In simple terms plants are manipulated to create pesticides. This technology is commonly used in genetically modified (GM) crops, where the plant produces its own insecticides, such as the Bt toxin.

3. Biochemical Biopesticides: These are naturally occurring substances, commonly extracted from plants, animals, or minerals, that affect pest physiology or behavior. One such example includes neem oil, which disturbs insect feeding and reproduction, and insect pheromones, which in turn disrupt mating patterns.

Why should we Use Biopesticides?

The use of biopesticides for pest control and management offers several advantages over conventional pesticides. They are as follows:

· Environmental Safety: Biopesticides are inherently less toxic to non-target organisms, hence minimizing the risk of harm to beneficial insects, wildlife, and the environment.

· Targeted Action: Biopesticides usually have specific modes of action that target pests while sparing beneficial organisms, reducing off-target effects.

· Reduced Residue: They typically degrade faster than their synthetic counterparts, leaving fewer residues in the environment and food chain.

· Resistance Management: As they employ diverse mechanisms of action, biopesticides will be helpful in mitigating the development of pest resistance over time.

Challenges and Considerations

While biopesticides offer promising benefits to the environment and food chain, their widespread adoption faces certain challenges.

· Effectiveness: Some biopesticides are less potent or have a narrower spectrum of effectiveness compared to synthetic pesticides, thus require careful selection and integration into pest control and management programs.

· Regulatory Hurdles: Regulatory approval processes for biopesticides can be stringent and time-consuming, affecting their commercialization and market availability.

· Perception and Awareness: There is skepticism or lack of awareness among growers and consumers regarding the efficacy and safety of biopesticides, necessitating education and outreach efforts for proper utilization.

The Future of Pest Control and Management

As concerns over pesticide residues, environmental pollution, and human health continue to mount, biopesticides are poised to play a crucial role in sustainable pest control and management practices. Their compatibility with integrated pest management (IPM) strategies, along with ongoing research, awareness among people and technological advancements, holds the promise of a greener, healthier future for the environment, agriculture and beyond.

Biopesticides represent a natural and sustainable approach to pest control and management that aligns with our evolving understanding of ecosystem dynamics and the need to protect both human health, the environment, and the biosphere as a whole. By embracing nature's own solutions, we can build a sustainable and harmonious relationship with the natural world while safeguarding our crops, communities, and planet.

0 notes