#Infant Nutrition Market

Explore tagged Tumblr posts

Text

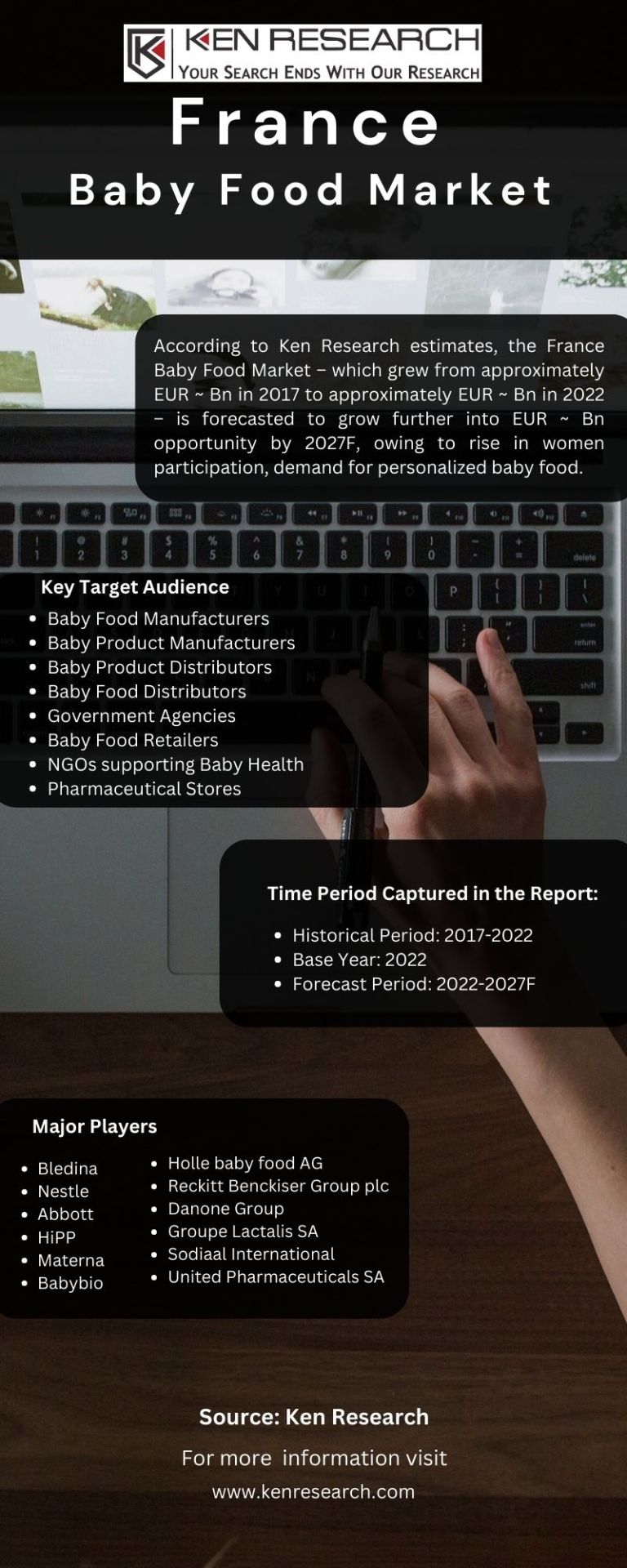

What Drives the Growth of the Baby Food Market in France?

The growth of the baby food market in France is driven by various factors, including global trends in the rice cereal for infant market, evolving baby food market trends, and the expanding Infant Nutrition Market. These dynamics are influenced by changing consumer preferences, increased awareness of infant nutrition, and the demand for convenient, nutritious options. Understanding these drivers is essential for businesses looking to thrive in the competitive French baby food market.

#France Baby Food Market#Baby Food Market Size#Baby Food Market Analysis#global rice cereal for infant market#baby food market trends#Infant Nutrition Market#global Infant Nutrition Market

0 notes

Text

Infant Nutrition Ingredients Market: Global Industry Analysis and Forecast 2023 – 2030

The Global Market for Infant Nutrition Ingredients Estimated at USD 63100 Million In the Year 2022, Is Projected To Reach A Revised Size Of USD 133870 Million By 2030, Growing At A CAGR Of 10.20% Over The Forecast Period 2022-2030.

The infant nutrition ingredients market is a vital segment within the broader nutritional supplements industry, catering to the unique dietary needs of infants and toddlers. This market encompasses a wide array of ingredients essential for the formulation of infant formulas, baby foods, and other nutritional products targeted at this demographic. With increasing awareness about the importance of early childhood nutrition and the rising number of working parents seeking convenient yet healthy options for their infants, the demand for high-quality infant nutrition ingredients is on the rise globally. Factors such as urbanization, growing disposable incomes, and changing lifestyles further contribute to the expansion of this market.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

https://introspectivemarketresearch.com/request/16602

Leading players involved in the Infant Nutrition Ingredients Market include:

Danone S.A. (France), Cargill Inc. (United States), Arla Foods (Denmark), Fonterra Co-operative Group Limited (New Zealand), Proliant Inc. (United States), APS Biogroup (United States), Nestle S.A. (Switzerland), Groupe Lactalis (France), Koninklijke DSM (Netherlands), Saputo Inc. (Canada) and Other Major Players

The latest research on the Infant Nutrition Ingredients market provides a comprehensive overview of the market for the years 2023 to 2030. It gives a comprehensive picture of the global Infant Nutrition Ingredients industry, considering all significant industry trends, market dynamics, competitive landscape, and market analysis tools such as Porter's five forces analysis, Industry Value chain analysis, and PESTEL analysis of the Infant Nutrition Ingredients market. Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years. The report is designed to help readers find information and make decisions that will help them grow their businesses. The study is written with a specific goal in mind: to give business insights and consultancy to help customers make smart business decisions and achieve long-term success in their particular market areas.

Market Driver:

One significant driver propelling the growth of the infant nutrition ingredients market is the escalating emphasis on health and wellness among parents. With a growing understanding of the critical role nutrition plays in early childhood development, parents are increasingly seeking products that offer optimal nutrition for their infants. This trend is particularly evident in developed regions where consumers are willing to invest in premium products with added health benefits. Consequently, manufacturers are under pressure to innovate and incorporate ingredients that promote brain development, immune support, and overall growth, thus driving the demand for specialized infant nutrition ingredients.

Market Opportunity:

An emerging opportunity within the infant nutrition ingredients market lies in the development of organic and clean label ingredients. As consumer awareness regarding the potential harmful effects of synthetic additives and genetically modified organisms (GMOs) continues to rise, there is a growing preference for natural and organic alternatives. This presents an opportunity for ingredient suppliers to expand their product portfolios to include certified organic ingredients, non-GMO options, and clean label formulations. By tapping into this demand for transparent and sustainable ingredients, companies can gain a competitive edge and capitalize on the shifting preferences of health-conscious parents.

If You Have Any Query Infant Nutrition Ingredients Market Report, Visit:

https://introspectivemarketresearch.com/inquiry/16602

Segmentation of Infant Nutrition Ingredients Market:

By Type

Alpha-Lactalbumin

Casein Glycomacropeptide

Milk Minerals

Lactose

Hydrolysates

Others

By Age Group

0-6 Months

6-12 Months

By Regions: -

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

What to Expect in Our Report?

(1) A complete section of the Infant Nutrition Ingredients market report is dedicated for market dynamics, which include influence factors, market drivers, challenges, opportunities, and trends.

(2) Another broad section of the research study is reserved for regional analysis of the Infant Nutrition Ingredients market where important regions and countries are assessed for their growth potential, consumption, market share, and other vital factors indicating their market growth.

(3) Players can use the competitive analysis provided in the report to build new strategies or fine-tune their existing ones to rise above market challenges and increase their share of the Infant Nutrition Ingredients market.

(4) The report also discusses competitive situation and trends and sheds light on company expansions and merger and acquisition taking place in the Infant Nutrition Ingredients market. Moreover, it brings to light the market concentration rate and market shares of top three and five players.

(5) Readers are provided with findings and conclusion of the research study provided in the Infant Nutrition Ingredients Market report.

Our study encompasses major growth determinants and drivers, along with extensive segmentation areas. Through in-depth analysis of supply and sales channels, including upstream and downstream fundamentals, we present a complete market ecosystem.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Acquire This Reports: -

https://introspectivemarketresearch.com/checkout/?user=1&_sid=16602

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyse extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1047

Email: sales@introspectivemarketresearch.com

#Infant Nutrition Ingredients#Infant Nutrition Ingredients Market#Infant Nutrition Ingredients Market Size#Infant Nutrition Ingredients Market Share#Infant Nutrition Ingredients Market Growth#Infant Nutrition Ingredients Market Trend#Infant Nutrition Ingredients Market segment#Infant Nutrition Ingredients Market Opportunity#Infant Nutrition Ingredients Market Analysis 2023

0 notes

Text

#Saudi Arabia Infant Nutrition Market#Market Size#Market Share#Market Trends#Market Analysis#Industry Survey#Market Demand#Top Major Key Player#Market Estimate#Market Segments#Industry Data

0 notes

Text

Infant Nutritional Premix Market Analysis, Leading Players, Future Growth, Business Prospects Research Report Foresight To 2032

The infant nutritional premix market refers to the industry involved in the production and distribution of powdered blends of essential nutrients specifically formulated for infants and young children. These premixes are designed to be added to infant formula, baby food, and other nutritional products to ensure that infants receive the necessary vitamins, minerals, and other essential nutrients for their growth and development.

Future Market Insights (FMI) anticipated that the global infant nutritional premix market would be worth USD 235 million in 2032 and USD 370 million in 2032, growing at a 4% CAGR.

The infant nutritional premix demand is predicted to rise significantly over the forecast period. The rapid migration of working women into metropolitan areas has resulted in an increased need for quick and nutritious baby nourishment. Consumer understanding of infant food’s potential health benefits has prompted them to regard it as a viable alternative to nursing.

Request our comprehensive sample report today and gain valuable insights into this thriving industry. Download Now! https://www.futuremarketinsights.com/reports/sample/rep-gb-6473

To support good postnatal growth and to reduce newborn morbidity and death, infants require an appropriate vitamin and mineral intake. As a result, babies are provided a high-nutrient food premix to suit their nutritional requirements. Infant nutrition is a broad term that refers to a variety of infant nutrition products for babies and infants.

Newborn nutritional premixes made with organic foods, probiotics, vitamins, and amino acids are becoming increasingly commonly utilised around the world as awareness of their benefits grows.

Increased demand for purified protein-based newborn nutritional premixes, increased investment by key players to create high-quality infant nutritional premixes, and increased innovation in infant nutritional premixes are likely to propel the Infant Nutritional Premix Market over the projection period.

Key Takeaways from Market Study

Because of the existence of key market players and a high consumption rate, the United States will control over 36% of the global market throughout the projection period.

Vitamin-based infant nutrition premix contributed for roughly a third of the entire market share in 2021, and it is predicted to expand at a rate of more than 5% over the following ten years.

The growing desire for homemade, fresh, organic baby food, are driving the market for infant nutritional premixes in China.

Market players are experimenting with new ways to handle, package, and technical development.

“ Leading organizations around the world are focusing on customising vitamin and mineral premixes, which is propelling the market of Infant Nutritional Premix even further”.-says a lead analyst at Future Market Insights.

Competitive Landscape

Infant Nutritional Premix have a strongly competitive global market. Leading companies are experimenting with new marketing approaches, opening new retail locations, technological advancements, and mergers and acquisitions.

Some of the leading companies offering Infant Nutritional Premix are Koninklijke DSM N.V, Hexagon Nutrition Pvt. Ltd., Vaneeghan International B.V, SternVitamin GmbH & Co. AG, BASF SE , Lycored Limited, Watson Inc., Fenchem Biotek Limited, Farbest Brands, Glanbia Plc., Jubilant Life Sciences, Prinova Group LLC, Barentz International B.V, Vitablend Nederland B.V, ADM.

Ready to tap into the potential of the Infant Nutritional Premix Market? Get an edge over your competitors with comprehensive insights. Buy now and gain access to detailed segment information: https://www.futuremarketinsights.com/checkout/6473

Get More Valuable Insights

Future Market Insights, in its new offering, provides an unbiased analysis of the Infant Nutritional Premix presenting historical demand data (2017-2021) and forecast statistics for the period from 2022-2032.

By Form :

Powder

Liquid

By Ingredient :

Vitamins

Minerals

Nucleotides

Amino Acids

Others

By Function :

Bone Health

Immunity

Digestion

Vision Health

Brain Health & Memory

Others

By Distribution Channel :

Pharmacy Stores

Specialty Outlets

Supermarkets

Online channel

Others

By Region :

North America

Latin America

Europe

East Asia

South Asia

Oceania

Middle East & Africa

Information Source: https://www.futuremarketinsights.com/reports/infant-nutritional-premix-market

0 notes

Link

The market drivers and restraints have been assessed to fathom their impact over the forecast period. This report further identifies the key opportunities for growth while also detailing the key challenges and possible threats. The infant nutrition market research report also analyses the application of infant nutrition by mother nutrient product type that includes dietary supplements, milk, and others and infant nutrient product type that includes dried & prepared baby food and milk.

#Infant & Mother Nutrition Market Growth#Infant & Mother Nutrition Market Keyplayers#Infant & Mother Nutrition Market

0 notes

Text

10 things Matty does as a dad

A/n: the brain rot will not stop so….

Warnings: none

————

Freak out at the hospital when the nurse hands him his newborn baby for the first time. “Oh gosh what if I drop her.” “Oh she’s so small. How can a person be so small.” “hi little one. I’m your daddy it’s so good to meet you.” “I love you already.”

Gets up every single time the baby does. Even though he and the wife have a schedule and it hinges upon one of them being awake and alert when the other isn’t. So it defeats the purpose for him to wake up every time but he insists he’d just feel guilty if he kept sleeping while his wife and child are awake at night.

Takes a year off from work. No producing. No writing for other artists. No 1975 stuff. He might scribble stuff down or try ideas if something comes to him. But he’s not like actively trying to make a record at all. So, he stays with the baby at home all day when the missus gets back to work and gets really into baby nutrition. Reading books on obscure health benefits of rare oils and extracts. Tries to buy a bunch of them online.

Oh the online shopping. When it’s late at night and he’s rocking the baby back to sleep and he’s kinda sleep deprived, he makes questionable decisions. Buys every toy that markets itself as “educational.” Or important to kids cognitive development or whatever. His missus has to institute a rule where they need to donate 2 old toys for each new toy they purchase.

The pediatrician tells him that talking and reading to the baby is important in order to make sure they acquire the strongest vocabulary by age 3. So he starts to read to her regularly. First, it’s children’s books. But then it progresses to whatever he can find around the house. Grocery lists, the blender manual, song lyrics, emails. He even does different voices and sound effects to keep things interesting.

He asks his baby girl for her input on music even before she’s old enough to understand what she’s really saying. “Come here, daddy wants to show you something. What do you think? You like it?”

Let’s her design tour posters/ album cover/ merch graphics

Establishes a regular dad-daughter date. Even when she’s an infant. A whole day of just the two of them. It starts out as just him needing to prove to himself that he could take care of her all day without asking for help from anyone. But he just keeps doing it as time goes by. It becomes a bonding experience. As she grows up, they start to use this time to talk about school, what she’s into, her friends, etc.

Cries when she’s sick. The missus will be like “matty, children get the sniffles sometimes. She’ll be okay. This is fine. Necessary even! For her immune system.” But he’s just like “she’s so miserable and can hardly breathe poor girl.” He’s practically a mess when she gets the chickenpox. All his memories of getting it or watching his brother get it mean nothing to him. He acts as if his kid is the first and last one to ever get sick on parent earth.

He watches YouTube tutorials to learn to do various hair styles just to impress her by offering her options when she asks him to help her do her hair for school in the morning.

63 notes

·

View notes

Text

The Story of Marabel’s Past

**This is my OC for Hazbin Hotel, Marabel. Character reference sheet/design coming soon!**

TW: mention sexual abuse, imprisonment, and generally bad times for this poor character

Part I

In her childhood, Marabel was a sweet and curious child. She was born in the southern United States to a mother who came from a long line of witches, and a father who worked on the railroads. Marabel’s mother made her young life whimsical within the walls of their quaint cottage. She taught Marabel how to properly plant seeds, care for them, and eventually she taught her daughter how to harness her magic- enhancing the growth of whatever she may plant. Marabel enjoyed having a small garden of her own, growing various flowers of several different colors, and perhaps a vegetable if she was lucky. Marabel’s mother showed her many small wonders, magical party tricks, and how to befriend the creatures of the earth.

Tragedy struck the family when their mother died during childbirth; Marabel was only eight years old when her father, herself and her five other siblings stood at the funeral for their mother and infant sister. To say their family struggled to make ends meet would be an ignorant understatement. It became increasingly more difficult to put food on the table for six hungry, growing children.

Marabel’s older brothers eventually joined their father on the railroads to help make what meager money they could. Their father resorted to something truly unthinkable after a couple particularly rough weeks when the foreman caught a glimpse of a picture of Marabel, the eldest daughter. Watching her childhood home slowly shrink in the distance, with tears silently rolling down her cheeks, would be a memory she would not soon forget.

The carriage took her away to a train station, where Marabel marveled at the large mechanical beasts before being hurriedly ushered onto a train bound eastward. The railroad foreman secretly dealt in the trade of children on the black market, making a profit off her by selling her to a couple who claimed to be burdened with infertility. The couple brought her to their home where they housed two other boys who Marabel discovered were the couple’s biological children.

She was given a couple sets of ragged dresses as it was made clear she was here to work for the owners of the house. Her days ran unbelievably long as they exploited her for manual labor, household chores, and anything else they could think of. The meals they allowed her were bland, lacking any fresh ingredients or proper nutrition. As difficult as life became after her mother died… This house was truly one of horrors. Many nights she stared into the unwavering darkness in the witching hour, wondering why her father had sold her. Had he not loved her enough to keep her and make something work? Did he know where she was now? She spent many sleepless nights fruitlessly attempting to accept the reality that she would never know why.

The woman was harsh and unforgiving. She scolded Marabel often with lashes and isolation if she was especially furious- those days Marabel was given only one bland meal a day. She knew not what the man did for work, but whatever it was it took him out of the house. When he did return his cruelty matched that of his wretched wife. Abusive, irrational, unrelenting. There were days he returned particularly cross, and if Marabel was within his sights he dragged her out to the barn where no one could hear her protests, and he forced himself upon her, defiling her. The years of abuse taught Marabel that it was in her best interest to detach herself from her nightmarish reality. During the unspeakable acts she endured she would imagine herself anywhere else to bring her a modicum of comfort.

In the good moments she found solace in the forest nearby the house she dwelled in. Recalling the memories of her outdoor adventures with her mother, growing flowers and living in harmony with the woodland creatures. Over time, Marabel befriended new small creatures- one white rabbit in particular that would appear whenever she would escape the house in search of refuge in nature.

Marabel learned to be obedient in the eyes of her abusers, perceptively noting certain particulars that would incite their wrath, consciously avoiding them for her own well being. There were plenty of times her efforts were fruitless, as nothing seemed to truly protect her from their cruelty. In her young naivety Marabel found herself craving their praise, almost as a last-ditch effort to make her life easier- what little control she could muster. She miserably tried to present herself as docile and obedient, showing them the ‘good behavior’ she thought they wanted, which became wholly confusing when the man of the house would steal her away to ravish her young body. Conflicting emotions raged within when her thoughts raced and sleep evaded her- she came to question her very existence in this hell.

After a particularly stressful day of verbal abuse from the woman and an ill-fated encounter with the man of the house, Marabel escaped to her sanctuary in the forest, but as soon as she was just beyond the tree line she fell to her knees, clutching her chest. The uncontrollable feeling of panic grew as she heaved each breath- despair, self-loathing- Mara felt disgusted when she saw her reflection. All she could see was a shell of a person- a person whose body was nothing more than a commodity to the people who owned her. In the weeks and months following, these feelings would return to haunt Marabel, forcing her to adapt when she could not manage an escape to her woodland haven. She hid behind corners, finding nooks and crannies in the house to hide away, even if just for a moment, never truly getting accustomed to the near-constant anxiety.

As Marabel grew into an older teenager, she began a ritual of sneaking away some nights. The nights she was able to sneak out, she would prepare by slipping valerian root into the nighttime hooch of the man and woman of the house. At first it was to guarantee time to visit her modest sanctuary, spending time with her woodland companions to bask in the moonlight, miles away from the property she lived on. Many months passed until Marabel thought of something truly daring. She had stolen a map from the house, locating a city a few more miles away from the house, away from her sanctuary. Distance be damned, Marabel had made up her mind to prepare for her next adventure- the biggest one yet, for it was too good to pass up. Each time she made her escape thereafter she would add more valerian root, masked by the alcohol in their cups, and traveled farther and farther, becoming more familiar with the land as she ventured.

One night Mara found herself on the outskirts of the largest city she had ever seen, wandering until a smallish building caught her attention, bustling with loud music and echoing crowds of people. She had never seen such a place before, and her curiosity got the better of her as she located a small window on the far side of the building. Trying her best to appear discreet, Marabel peeked over the edge of the window, her eyes immediately drawn to a stunning blonde woman singing on a stage in front of a small band, who was just outside her spotlight.

The music was loud and lively; the voice of the blonde woman complimenting the instruments perfectly as Mara stared, enthralled with her beautiful singing. Her face flushed as she continued watching, butterflies fluttering within her as she noticed the woman was quite attractive in her sparkly dress. With all her attention on the alluring performer, Mara failed to notice she had caught the attention of a patron of the bar.

He eyed her curiously as she watched the show, oblivious to his prying gaze. A moment of distraction pulled his attention away long enough for her to disappear by the time he turned back to look for her, for she had vanished as mysteriously as she had appeared. The patron man discreetly excused himself from the bar, rounding the corner of the building in an attempt to follow the strange girl. Alas, he was met with an empty clearing, and she was nowhere to be found as he was left lingering, wondering who she was.

Marabel returned to the farm after her long journey back only to be blindsided by an outcome she had failed to account for all the nights she made her escape. The man and woman of the house were awake and furious when Mara walked through the entrance door in the hours of the early morning. The punishment was severe- two weeks in isolation. Under the farmhouse, separate from the house they lived in, was an unfinished basement area with a rusty cot in the corner to serve as a bed, cuffs welded onto the headboard and footboard.

There was no light in the basement where Marabel was trapped all day and night, subject to the perverted whims of the man and eventually his sons later on, for the first time ever. There was no escape from their indulgences; even when they left her alone all she would do is ruminate in her thoughts, feeling suffocated by the darkness. Eventually she began to feel anger- anger toward the cruel people who bought her, anger toward her father for selling her, toward the world for allowing all of these horrible things to happen to her, toward her mother... for dying and leaving her all alone.

She paced the room back and forth, back and forth, balling her fists in a rage-induced fit of despair– she lashed out into the nothingness– a momentary relief from the strife she held within her. It wasn’t enough. The hatred she harbored spilled over her threshold for restraint as she screamed into the abyss, clenching her fists until she felt the familiar slick of blood running down her skin. Her mind swirled; she sank to her knees, holding her head in her bloody hands as she contemplated her sanity. However there was too much adrenaline coursing through her to sit still as she opted to stand once again. Blind with the desire to lash out, she swung into the darkness once more– only this time she was astonished by the flame that left her fingers, scorching the stone wall that she had narrowly missed. Marabel froze, shock written on her face as she stared in disbelief, the last flicker of flame dying at her bare feet, swallowing the room in shadow.

She had never produced anything like fire before.

A pang of fear shot through her core as the discovery of this power sunk in. For once in her young life, Marabel felt she had a chance to have some power of her own. It also wasn’t too bad to be her own self-sufficient heater during the cold nights. From that moment on, Marabel leaned into her anger, giving herself permission to harness the energy that came with it, for it made her feel truly powerful. Her anger and resentment fueled her flames when she practiced in secret– even after her eventual release from the basement.

One day she saw her chance. It had been months since her last escape that landed her in a fortnight-long punishment. The man and woman of the house had returned from a rare night out together, drunk off their asses. They, as well as their sons, slept like the dead that night as Mara tiptoed around the house, igniting small, flammable items as she made her way to the front door. She ran as fast as she could towards the forest, only occasionally looking back to see the light of the fire grow brighter as it engulfed the first floor of the house.

As soon as she felt she was safely away from the growing fire, she turned to admire her work. If she focused she could hear the frantic screams filled with fear as the family woke to the fire creeping outside their bedrooms. Marabel rested against a large cypress tree for a while, watching the structure collapse and the screams die out. The happiness she felt as she realized she was finally free of their torment was all too fleeting as she sighed, turning her back to the destruction she caused.

This was hardly the end for her as she started on her journey of newfound freedom, not once looking back. She had vowed to live life for herself; that she would rely on no one beside herself.

Her conviction was strong, and she spent several weeks out in the wilderness alone, fending for herself somewhat easily. Until one day, she heard strange noises coming from the direction of a clearing in the woods– finding a group of women dressed all in black, candles burning in their palms, standing in a circle around a severed goat’s head, pooled in blood. Marabel watched from the shadows as they performed what seemed to be some sort of ritual– right up until the moment she was blinded by a bag thrown over her head, her captor dragging her towards the clearing she had been spying on.

“Who is this? An outsider?”

#hazbin hotel#original character#vivziepop#vivzieverse#hellaverse#hazbin#my writing#sephwrites#criticism welcome#but please be nice#alastor#alastor hazbin hotel#alastor x oc#x OC

6 notes

·

View notes

Text

Decisions by CVS and Optum Panicked Thousands of Their Sickest Patients

Arthur Allen

NEW YORK — The fear started when a few patients saw their nurses and dietitians posting job searches on LinkedIn.

Word spread to Facebook groups, and patients started calling Coram CVS, a major U.S. supplier of the compounded IV nutrients on which they rely for survival. To their dismay, CVS Health confirmed the rumors on June 1: It was closing 36 of the 71 branches of its Coram home infusion business and laying off about 2,000 nurses, dietitians, pharmacists, and other employees.

Many of the patients left in the lurch have life-threatening digestive disorders that render them unable to eat or drink. They depend on parenteral nutrition, or PN — in which amino acids, sugars, fats, vitamins, and electrolytes are pumped, in most cases, through a specialized catheter directly into a large vein near the heart.

The day after CVS’ move, another big supplier, Optum Rx, announced its own consolidation. Suddenly, thousands would be without their highly complex, shortage-plagued, essential drugs and nutrients.

“With this kind of disruption, patients can’t get through on the phones. They panic,” said Cynthia Reddick, a senior nutritionist who was let go in the CVS restructuring.

“It was very difficult. Many emails, many phone calls, acting as a liaison between my doctor and the company,” said Elizabeth Fisher Smith, a 32-year-old public health instructor in New York City, whose Coram branch closed. A rare medical disorder has forced her to rely on PN for survival since 2017. “In the end, I got my supplies, but it added to my mental burden. And I’m someone who has worked in health care nearly my entire adult life.”

CVS had abandoned most of its less lucrative market in home parenteral nutrition, or HPN, and “acute care” drugs like IV antibiotics. Instead, it would focus on high-dollar, specialty intravenous medications like Remicade, which is used for arthritis and other autoimmune conditions.

Home and outpatient infusions are a growing business in the United States, as new drugs for chronic illness enable patients, health care providers, and insurers to bypass in-person treatment. Even the wellness industry is cashing in, with spa storefronts and home hydration services.

But while reimbursement for expensive new drugs has drawn the interest of big corporations and private equity, the industry is strained by a lack of nurses and pharmacists. And the less profitable parts of the business — as well as the vulnerable patients they serve — are at serious risk.

This includes the 30,000-plus Americans who rely for survival on parenteral nutrition, which has 72 ingredients. Among those patients are premature infants and post-surgery patients with digestive problems, and people with short or damaged bowels, often the result of genetic defects.

While some specialty infusion drugs are billed through pharmacy benefit managers that typically pay suppliers in a few weeks, medical plans that cover HPN, IV antibiotics, and some other infusion drugs can take 90 days to pay, said Dan Manchise, president of Mann Medical Consultants, a home care consulting company.

In the 2010s, CVS bought Coram, and Optum bought up smaller home infusion companies, both with the hope that consolidation and scale would offer more negotiating power with insurers and manufacturers, leading to a more stable market. But the level of patient care required was too high for them to make money, industry officials said.

“With the margins seen in the industry,” Manchise said, “if you’ve taken on expensive patients and you don’t get paid, you’re dead.”

In September, CVS announced its purchase of Signify Health, a high-tech company that sends out home health workers to evaluate billing rates for “high-priority” Medicare Advantage patients, according to an analyst’s report. In other words, as CVS shed one group of patients whose care yields low margins, it was spending $8 billion to seek more profitable ones.

CVS “pivots when necessary,” spokesperson Mike DeAngelis told KHN. “We decided to focus more resources on patients who receive infusion services for specialty medications” that “continue to see sustained growth.” Optum declined to discuss its move, but a spokesperson said the company was “steadfastly committed to serving the needs” of more than 2,000 HPN patients.

DeAngelis said CVS worked with its HPN patients to “seamlessly transition their care” to new companies.

However, several Coram patients interviewed about the transition indicated it was hardly smooth. Other HPN businesses were strained by the new demand for services, and frightening disruptions occurred.

Smith had to convince her new supplier that she still needed two IV pumps — one for HPN, the other for hydration. Without two, she’d rely partly on “gravity” infusion, in which the IV bag hangs from a pole that must move with the patient, making it impossible for her to keep her job.

“They just blatantly told her they weren’t giving her a pump because it was more expensive, she didn’t need it, and that’s why Coram went out of business,” Smith said.

Many patients who were hospitalized at the time of the switch — several inpatient stays a year are not unusual for HPN patients — had to remain in the hospital until they could find new suppliers. Such hospitalizations typically cost at least $3,000 a day.

“The biggest problem was getting people out of the hospital until other companies had ramped up,” said Dr. David Seres, a professor of medicine at the Institute of Human Nutrition at Columbia University Medical Center. Even over a few days, he said, “there was a lot of emotional hardship and fear over losing long-term relationships.”

To address HPN patients’ nutritional needs, a team of physicians, nurses, and dietitians must work with their supplier, Seres said. The companies conduct weekly bloodwork and adjust the contents of the HPN bags, all under sterile conditions because these patients are at risk of blood infections, which can be grave.

As for Coram, “it’s pretty obvious they had to trim down business that was not making money,” Reddick said, adding that it was noteworthy both Coram and Optum Rx “pivoted the same way to focus on higher-dollar, higher-reimbursement, high-margin populations.”

“I get it, from the business perspective,” Smith said. “At the same time, they left a lot of patients in a not great situation.”

***

Smith shares a postage-stamp Queens apartment with her husband, Matt; his enormous flight simulator (he’s an amateur pilot); cabinets and fridges full of medical supplies; and two large, friendly dogs, Caspian and Gretl. On a recent morning, she went about her routine: detaching the bag of milky IV fluid that had pumped all night through a central line implanted in her chest, flushing the line with saline, injecting medications into another saline bag, and then hooking it through a paperback-sized pump into her central line.

Smith has a connective tissue disorder called Ehlers-Danlos syndrome, which can cause many health problems. As a child, Smith had frequent issues such as a torn Achilles tendon and shoulder dislocations. In her 20s, while working as an EMT, she developed severe gut blockages and became progressively less able to digest food. In 2017, she went on HPN and takes nothing by mouth except for an occasional sip of liquid or bite of soft food, in hopes of preventing the total atrophy of her intestines. HPN enabled her to commute to George Washington University in Washington, D.C., where in 2020 she completed a master’s in public health.

On days when she teaches at LaGuardia Community College — she had 35 students this semester — Smith is up at 6 a.m. to tend to her medical care, leaves the house at 9:15 for class, comes home in the afternoon for a bag of IV hydration, then returns for a late afternoon or evening class. In the evening she gets more hydration, then hooks up the HPN bag for the night. On rare occasions she skips the HPN, “but then I regret it,” she said. The next day she’ll have headaches and feel dizzy, sometimes losing her train of thought in class.

Smith describes a “love-hate relationship” with HPN. She hates being dependent on it, the sour smell of the stuff when it spills, and the mountains of unrecyclable garbage from the 120 pounds of supplies couriered to her apartment weekly. She worries about blood clots and infections. She finds the smell of food disconcerting; Matt tries not to cook when she’s home. Other HPN patients speak of sudden cravings for pasta or Frosted Mini-Wheats.

Yet HPN “has given me my life back,” Smith said.

She is a zealous self-caretaker, but some dangers are beyond her control. IV feeding over time is associated with liver damage. The assemblage of HPN bags by compounding pharmacists is risky. If the ingredients aren’t mixed in the right order, they can crystallize and kill a patient, said Seres, Smith’s doctor.

He and other doctors would like to transition patients to food, but this isn’t always possible. Some eventually seek drastic treatments such as bowel lengthening or even transplants of the entire digestive tract.

“When they run out of options, they could die,” said Dr. Ryan Hurt, a Mayo Clinic physician and president of the American Society for Parenteral and Enteral Nutrition.

***

And then there are the shortages.

In 2017, Hurricane Maria crippled dozens of labs and factories making IV components in Puerto Rico; next came the covid-19 emergency, which shifted vital supplies to gravely ill hospital patients.

Prices for vital HPN ingredients can fluctuate unpredictably as companies making them come and go. For example, in recent years the cost of the sodium acetate used as an electrolyte in a bag of HPN ballooned from $2 to $25, then briefly to $300, said Michael Rigas, a co-founder of the home infusion pharmacy KabaFusion.

“There may be 50 different companies involved in producing everything in an HPN bag,” Rigas said. “They’re all doing their own thing — expanding, contracting, looking for ways to make money.” This leaves patients struggling to deal with various shortages from saline and IV bags to special tubing and vitamins.

“In the last five years I’ve seen more things out of stock or on shortage than the previous 35 years combined,” said Rigas.

The sudden retrenchment of CVS and Optum Rx made things worse. Another, infuriating source of worry: the steady rise of IV spas and concierge services, staffed by moonlighting or burned-out hospital nurses, offering IV vitamins and hydration to well-off people who enjoy the rush of infusions to relieve symptoms of a cold, morning sickness, a hangover, or just a case of the blahs.

In January, infusion professionals urged FDA Commissioner Robert Califf to examine spa and concierge services’ use of IV products as an “emerging contributing factor” to shortages.

The FDA, however, has little authority over IV spas. The Federal Trade Commission has cracked down on some spa operations — for unsubstantiated health claims rather than resource misuse.

Bracha Banayan’s concierge service, called IVDRIPS, started in 2017 in New York City and now employs 90 people, including 60 registered nurses, in four states, she said. They visit about 5,000 patrons each year, providing IV hydration and vitamins in sessions of an hour or two for up to $600 a visit. The goal is “to hydrate and be healthy” with a “boost that makes us feel better,” Banayan said.

Although experts don’t recommend IV hydration outside of medical settings, the market has exploded, Banayan said: “Every med spa is like, ‘We want to bring in IV services.’ Every single paramedic I know is opening an IV center.”

Matt Smith, Elizabeth’s husband, isn’t surprised. Educated as a lawyer, he is a paramedic who trains others at Columbia University Irving Medical Center. “You give someone a choice of go up to some rich person’s apartment and start an IV on them, or carry a 500-pound person living in squalor down from their apartment,” he said. “There’s one that’s going to be very hard on your body and one very easy on your body.”

The very existence of IV spa companies can feel like an insult.

“These people are using resources that are literally a matter of life or death to us,” Elizabeth Smith said.

Shortages in HPN supplies have caused serious health problems including organ failure, severe blisters, rashes, and brain damage.

For five months last year, Rylee Cornwell, 18 and living in Spokane, Washington, could rarely procure lipids for her HPN treatment. She grew dizzy or fainted when she tried to stand, so she mostly slept. Eventually she moved to Phoenix, where the Mayo Clinic has many Ehlers-Danlos patients and supplies are easier to access.

Mike Sherels was a University of Minnesota Gophers football coach when an allergic reaction caused him to lose most of his intestines. At times he’s had to rely on an ethanol solution that damages the ports on his central line, a potentially deadly problem “since you can only have so many central access sites put into your body during your life,” he said.

When Faith Johnson, a 22-year-old Las Vegas student, was unable to get IV multivitamins, she tried crushing vitamin pills and swallowing the powder, but couldn’t keep the substance down and became malnourished. She has been hospitalized five times this past year.

Dread stalks Matt Smith, who daily fears that Elizabeth will call to say she has a headache, which could mean a minor allergic or viral issue — or a bloodstream infection that will land her in the hospital.

Even more worrying, he said: “What happens if all these companies stop doing it? What is the alternative? I don’t know what the economics of HPN are. All I know is the stuff either comes or it doesn’t.”

KHN (Kaiser Health News) is a national newsroom that produces in-depth journalism about health issues. Together with Policy Analysis and Polling, KHN is one of the three major operating programs at KFF (Kaiser Family Foundation). KFF is an endowed nonprofit organization providing information on health issues to the nation.

USE OUR CONTENT

This story can be republished for free (details).

Read more here https://angelino.news

3 notes

·

View notes

Text

Decisions by CVS and Optum Panicked Thousands of Their Sickest Patients

Arthur Allen

NEW YORK — The fear started when a few patients saw their nurses and dietitians posting job searches on LinkedIn.

Word spread to Facebook groups, and patients started calling Coram CVS, a major U.S. supplier of the compounded IV nutrients on which they rely for survival. To their dismay, CVS Health confirmed the rumors on June 1: It was closing 36 of the 71 branches of its Coram home infusion business and laying off about 2,000 nurses, dietitians, pharmacists, and other employees.

Many of the patients left in the lurch have life-threatening digestive disorders that render them unable to eat or drink. They depend on parenteral nutrition, or PN — in which amino acids, sugars, fats, vitamins, and electrolytes are pumped, in most cases, through a specialized catheter directly into a large vein near the heart.

The day after CVS’ move, another big supplier, Optum Rx, announced its own consolidation. Suddenly, thousands would be without their highly complex, shortage-plagued, essential drugs and nutrients.

“With this kind of disruption, patients can’t get through on the phones. They panic,” said Cynthia Reddick, a senior nutritionist who was let go in the CVS restructuring.

“It was very difficult. Many emails, many phone calls, acting as a liaison between my doctor and the company,” said Elizabeth Fisher Smith, a 32-year-old public health instructor in New York City, whose Coram branch closed. A rare medical disorder has forced her to rely on PN for survival since 2017. “In the end, I got my supplies, but it added to my mental burden. And I’m someone who has worked in health care nearly my entire adult life.”

CVS had abandoned most of its less lucrative market in home parenteral nutrition, or HPN, and “acute care” drugs like IV antibiotics. Instead, it would focus on high-dollar, specialty intravenous medications like Remicade, which is used for arthritis and other autoimmune conditions.

Home and outpatient infusions are a growing business in the United States, as new drugs for chronic illness enable patients, health care providers, and insurers to bypass in-person treatment. Even the wellness industry is cashing in, with spa storefronts and home hydration services.

But while reimbursement for expensive new drugs has drawn the interest of big corporations and private equity, the industry is strained by a lack of nurses and pharmacists. And the less profitable parts of the business — as well as the vulnerable patients they serve — are at serious risk.

This includes the 30,000-plus Americans who rely for survival on parenteral nutrition, which has 72 ingredients. Among those patients are premature infants and post-surgery patients with digestive problems, and people with short or damaged bowels, often the result of genetic defects.

While some specialty infusion drugs are billed through pharmacy benefit managers that typically pay suppliers in a few weeks, medical plans that cover HPN, IV antibiotics, and some other infusion drugs can take 90 days to pay, said Dan Manchise, president of Mann Medical Consultants, a home care consulting company.

In the 2010s, CVS bought Coram, and Optum bought up smaller home infusion companies, both with the hope that consolidation and scale would offer more negotiating power with insurers and manufacturers, leading to a more stable market. But the level of patient care required was too high for them to make money, industry officials said.

“With the margins seen in the industry,” Manchise said, “if you’ve taken on expensive patients and you don’t get paid, you’re dead.”

In September, CVS announced its purchase of Signify Health, a high-tech company that sends out home health workers to evaluate billing rates for “high-priority” Medicare Advantage patients, according to an analyst’s report. In other words, as CVS shed one group of patients whose care yields low margins, it was spending $8 billion to seek more profitable ones.

CVS “pivots when necessary,” spokesperson Mike DeAngelis told KHN. “We decided to focus more resources on patients who receive infusion services for specialty medications” that “continue to see sustained growth.” Optum declined to discuss its move, but a spokesperson said the company was “steadfastly committed to serving the needs” of more than 2,000 HPN patients.

DeAngelis said CVS worked with its HPN patients to “seamlessly transition their care” to new companies.

However, several Coram patients interviewed about the transition indicated it was hardly smooth. Other HPN businesses were strained by the new demand for services, and frightening disruptions occurred.

Smith had to convince her new supplier that she still needed two IV pumps — one for HPN, the other for hydration. Without two, she’d rely partly on “gravity” infusion, in which the IV bag hangs from a pole that must move with the patient, making it impossible for her to keep her job.

“They just blatantly told her they weren’t giving her a pump because it was more expensive, she didn’t need it, and that’s why Coram went out of business,” Smith said.

Many patients who were hospitalized at the time of the switch — several inpatient stays a year are not unusual for HPN patients — had to remain in the hospital until they could find new suppliers. Such hospitalizations typically cost at least $3,000 a day.

“The biggest problem was getting people out of the hospital until other companies had ramped up,” said Dr. David Seres, a professor of medicine at the Institute of Human Nutrition at Columbia University Medical Center. Even over a few days, he said, “there was a lot of emotional hardship and fear over losing long-term relationships.”

To address HPN patients’ nutritional needs, a team of physicians, nurses, and dietitians must work with their supplier, Seres said. The companies conduct weekly bloodwork and adjust the contents of the HPN bags, all under sterile conditions because these patients are at risk of blood infections, which can be grave.

As for Coram, “it’s pretty obvious they had to trim down business that was not making money,” Reddick said, adding that it was noteworthy both Coram and Optum Rx “pivoted the same way to focus on higher-dollar, higher-reimbursement, high-margin populations.”

“I get it, from the business perspective,” Smith said. “At the same time, they left a lot of patients in a not great situation.”

***

Smith shares a postage-stamp Queens apartment with her husband, Matt; his enormous flight simulator (he’s an amateur pilot); cabinets and fridges full of medical supplies; and two large, friendly dogs, Caspian and Gretl. On a recent morning, she went about her routine: detaching the bag of milky IV fluid that had pumped all night through a central line implanted in her chest, flushing the line with saline, injecting medications into another saline bag, and then hooking it through a paperback-sized pump into her central line.

Smith has a connective tissue disorder called Ehlers-Danlos syndrome, which can cause many health problems. As a child, Smith had frequent issues such as a torn Achilles tendon and shoulder dislocations. In her 20s, while working as an EMT, she developed severe gut blockages and became progressively less able to digest food. In 2017, she went on HPN and takes nothing by mouth except for an occasional sip of liquid or bite of soft food, in hopes of preventing the total atrophy of her intestines. HPN enabled her to commute to George Washington University in Washington, D.C., where in 2020 she completed a master’s in public health.

On days when she teaches at LaGuardia Community College — she had 35 students this semester — Smith is up at 6 a.m. to tend to her medical care, leaves the house at 9:15 for class, comes home in the afternoon for a bag of IV hydration, then returns for a late afternoon or evening class. In the evening she gets more hydration, then hooks up the HPN bag for the night. On rare occasions she skips the HPN, “but then I regret it,” she said. The next day she’ll have headaches and feel dizzy, sometimes losing her train of thought in class.

Smith describes a “love-hate relationship” with HPN. She hates being dependent on it, the sour smell of the stuff when it spills, and the mountains of unrecyclable garbage from the 120 pounds of supplies couriered to her apartment weekly. She worries about blood clots and infections. She finds the smell of food disconcerting; Matt tries not to cook when she’s home. Other HPN patients speak of sudden cravings for pasta or Frosted Mini-Wheats.

Yet HPN “has given me my life back,” Smith said.

She is a zealous self-caretaker, but some dangers are beyond her control. IV feeding over time is associated with liver damage. The assemblage of HPN bags by compounding pharmacists is risky. If the ingredients aren’t mixed in the right order, they can crystallize and kill a patient, said Seres, Smith’s doctor.

He and other doctors would like to transition patients to food, but this isn’t always possible. Some eventually seek drastic treatments such as bowel lengthening or even transplants of the entire digestive tract.

“When they run out of options, they could die,” said Dr. Ryan Hurt, a Mayo Clinic physician and president of the American Society for Parenteral and Enteral Nutrition.

***

And then there are the shortages.

In 2017, Hurricane Maria crippled dozens of labs and factories making IV components in Puerto Rico; next came the covid-19 emergency, which shifted vital supplies to gravely ill hospital patients.

Prices for vital HPN ingredients can fluctuate unpredictably as companies making them come and go. For example, in recent years the cost of the sodium acetate used as an electrolyte in a bag of HPN ballooned from $2 to $25, then briefly to $300, said Michael Rigas, a co-founder of the home infusion pharmacy KabaFusion.

“There may be 50 different companies involved in producing everything in an HPN bag,” Rigas said. “They’re all doing their own thing — expanding, contracting, looking for ways to make money.” This leaves patients struggling to deal with various shortages from saline and IV bags to special tubing and vitamins.

“In the last five years I’ve seen more things out of stock or on shortage than the previous 35 years combined,” said Rigas.

The sudden retrenchment of CVS and Optum Rx made things worse. Another, infuriating source of worry: the steady rise of IV spas and concierge services, staffed by moonlighting or burned-out hospital nurses, offering IV vitamins and hydration to well-off people who enjoy the rush of infusions to relieve symptoms of a cold, morning sickness, a hangover, or just a case of the blahs.

In January, infusion professionals urged FDA Commissioner Robert Califf to examine spa and concierge services’ use of IV products as an “emerging contributing factor” to shortages.

The FDA, however, has little authority over IV spas. The Federal Trade Commission has cracked down on some spa operations — for unsubstantiated health claims rather than resource misuse.

Bracha Banayan’s concierge service, called IVDRIPS, started in 2017 in New York City and now employs 90 people, including 60 registered nurses, in four states, she said. They visit about 5,000 patrons each year, providing IV hydration and vitamins in sessions of an hour or two for up to $600 a visit. The goal is “to hydrate and be healthy” with a “boost that makes us feel better,” Banayan said.

Although experts don’t recommend IV hydration outside of medical settings, the market has exploded, Banayan said: “Every med spa is like, ‘We want to bring in IV services.’ Every single paramedic I know is opening an IV center.”

Matt Smith, Elizabeth’s husband, isn’t surprised. Educated as a lawyer, he is a paramedic who trains others at Columbia University Irving Medical Center. “You give someone a choice of go up to some rich person’s apartment and start an IV on them, or carry a 500-pound person living in squalor down from their apartment,” he said. “There’s one that’s going to be very hard on your body and one very easy on your body.”

The very existence of IV spa companies can feel like an insult.

“These people are using resources that are literally a matter of life or death to us,” Elizabeth Smith said.

Shortages in HPN supplies have caused serious health problems including organ failure, severe blisters, rashes, and brain damage.

For five months last year, Rylee Cornwell, 18 and living in Spokane, Washington, could rarely procure lipids for her HPN treatment. She grew dizzy or fainted when she tried to stand, so she mostly slept. Eventually she moved to Phoenix, where the Mayo Clinic has many Ehlers-Danlos patients and supplies are easier to access.

Mike Sherels was a University of Minnesota Gophers football coach when an allergic reaction caused him to lose most of his intestines. At times he’s had to rely on an ethanol solution that damages the ports on his central line, a potentially deadly problem “since you can only have so many central access sites put into your body during your life,” he said.

When Faith Johnson, a 22-year-old Las Vegas student, was unable to get IV multivitamins, she tried crushing vitamin pills and swallowing the powder, but couldn’t keep the substance down and became malnourished. She has been hospitalized five times this past year.

Dread stalks Matt Smith, who daily fears that Elizabeth will call to say she has a headache, which could mean a minor allergic or viral issue — or a bloodstream infection that will land her in the hospital.

Even more worrying, he said: “What happens if all these companies stop doing it? What is the alternative? I don’t know what the economics of HPN are. All I know is the stuff either comes or it doesn’t.”

KHN (Kaiser Health News) is a national newsroom that produces in-depth journalism about health issues. Together with Policy Analysis and Polling, KHN is one of the three major operating programs at KFF (Kaiser Family Foundation). KFF is an endowed nonprofit organization providing information on health issues to the nation.

USE OUR CONTENT

This story can be republished for free (details).

Read more here https://angelino.news

3 notes

·

View notes

Text

¶ … Vitamin D Supplementation: Health & Safety Issues Audience: General primarily female audience interested in health and nutrition Description The magazine selected for this project is Health, a national magazine available by subscription as well as through direct sale; the magazine also maintains a free public website, www.Health.com, where readers can obtain additional information on featured topics and advertised products and services. Health magazine covers general health and nutrition topics for a lay public and is geared primarily for an adult female audience of all ages. Regular features cover issues of nutritional health, diet and weight loss, cuisine, exercise and fitness, beauty, and general advice on topical issues that comprise the full range of everyday life. The magazine was selected because vitamin D deficiency is more common among women than men, particularly pregnant women in whom insufficient vitamin D can inhibit healthy weight gain during pregnancy and also prolong labor. Various studies also indicate that nursing infants whose mothers with too little vitamin D in their breast milk build less healthy bone and are more susceptible to developing diabetes in childhood. Additionally, Health magazine was selected because the market of nutritional products and vitamin supplementation for males is saturated with fitness and muscle-building products advertised in numerous fitness magazines, most of which are also published by interested entities that also sell nutritional and exercise products for males. Health magazine is typically read in the home where it is also available to the entire household I addition to its primary audience of professional adult women and fulltime homemakers. Vitamins and Health Vitamins are essential for good health and a well-rounded diet should provide the full recommended daily allowance (RDA) established by the Food and Drug Administration (FDA). However, many of us are sometimes too busy to make sure that we get enough fresh fruits and vegetables in our diet because we eat on the run, sometimes eating too much fast food and other selections that may be lacking in the necessary ingredients for optimal nutrition and health. For those of us unable to make sure that our daily diet provides adequate amounts of every vitamin and mineral recommended for our health, vitamin supplements are an economical way of avoiding the consequences of long-term vitamin deficiency. The Health Benefits of Vitamin D Many of us are already familiar with the importance of some vitamins, like vitamin C, which prevents scurvy, but we are often less aware of how important other vitamins are for our health. On the other hand, too much of a good thing can sometimes be even more harmful than too little. In that regard, it is very important to understand the role of vitamin D, both because of its role in maintaining our health, as well as because of the potential for harm associated with excessive supplementation. Unlike other vitamins and minerals, vitamin D is not readily available through diet because its primary source is natural sunlight. The U.S. FDA recommends a daily dose of 200 IU, which according to medical authorities, is sufficient to protect against osteomalacia, a medical condition characterized by softening of the bones. However, because vitamin D requirements fluctuate depending on how much sunlight a person receives and are difficult to satisfy through diet alone, 200 IU is considered the RDA in the absence of regular exposure to natural sunlight. Vitamin D is necessary for the proper absorption of calcium in the process of new bone formation, which is why many supplements combine the two together. Research strongly suggests that up to twice that amount of vitamin D may actually be necessary to protect against the risk of other conditions and diseases, including osteoporosis, secondary hyperparathyroidism, multiple sclerosis, hypertension, and several types of cancers. The recent increase the disease rickets has been linked to the decreasing amount of sunlight exposure since the realization that sunlight is the main cause of skin cancers. Previously, doctors typically recommended The Potential Dangers of Too Much Vitamin D Unlike most other vitamins, vitamin D is fat soluble instead of being water soluble. That means that if you consume too much vitamin a or Vitamin D, toxic levels can build up in the body tissues instead of simply being excreted the way that too much vitamin B or vitamin C are disposed of by the body naturally. In nature, we might safely receive as much as 10,000 IU of vitamin D through natural exposure to sunlight, but in the concentrated forms in which supplemental vitamins are available commercially, it is fairly easy to receive far more than even that amount of vitamin D Medical authorities have not determined the ultimate consequences of excessive vitamin D consumption, but note that increased kidney stone formation is among the results observed. Therefore, it is equally important to avoid over supplementation with any vitamin, but especially fat-soluble vitamins like vitamin a and vitamin D https://www.paperdue.com/customer/paper/vitamin-d-supplementation-health-amp-23564#:~:text=Logout-,VitaminDSupplementationHealth,-Length3pages Read the full article

0 notes

Link

0 notes

Text

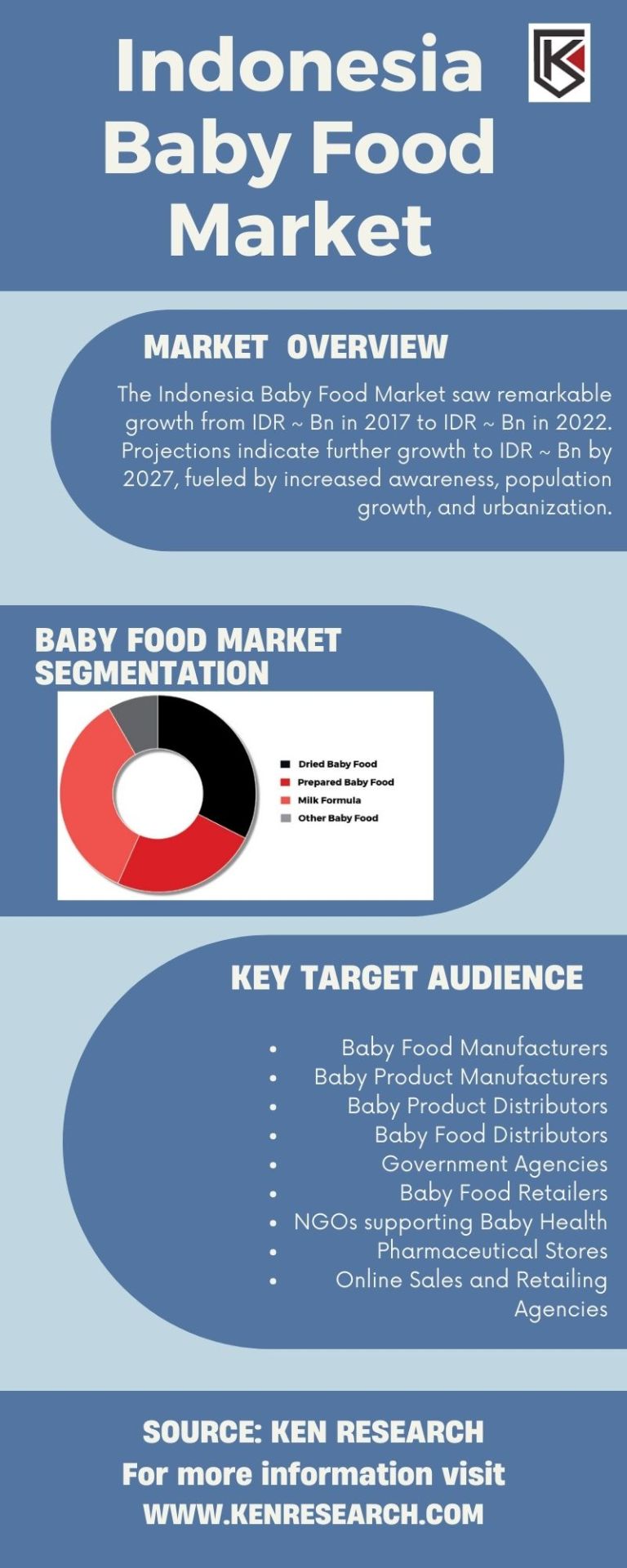

Balancing Nutrition and Taste: Indonesia's Baby Food Market Analysis

Explore Indonesia's Baby Food Market Analysis, delving into the intersection of nutrition and taste. Uncover insights into global rice cereal for the infant market and the latest baby food market trends.

#Indonesia Baby Food Market#Baby Food Market Size#Baby Food Market Analysis#global rice cereal for infant market#baby food market trends#Infant Nutrition Market#global Infant Nutrition Market

0 notes

Text

Infant Nutrition Ingredients Market: Global Industry Analysis and Forecast 2023 – 2030

The Global Market for Infant Nutrition Ingredients Estimated at USD 63100 Million In the Year 2022, Is Projected To Reach A Revised Size Of USD 133870 Million By 2030, Growing At A CAGR Of 10.20% Over The Forecast Period 2022-2030.

The infant nutrition ingredients market is a vital segment within the broader nutritional supplements industry, catering to the unique dietary needs of infants and toddlers. This market encompasses a wide array of ingredients essential for the formulation of infant formulas, baby foods, and other nutritional products targeted at this demographic. With increasing awareness about the importance of early childhood nutrition and the rising number of working parents seeking convenient yet healthy options for their infants, the demand for high-quality infant nutrition ingredients is on the rise globally. Factors such as urbanization, growing disposable incomes, and changing lifestyles further contribute to the expansion of this market.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

https://introspectivemarketresearch.com/request/16602

Leading players involved in the Infant Nutrition Ingredients Market include:

Danone S.A. (France), Cargill Inc. (United States), Arla Foods (Denmark), Fonterra Co-operative Group Limited (New Zealand), Proliant Inc. (United States), APS Biogroup (United States), Nestle S.A. (Switzerland), Groupe Lactalis (France), Koninklijke DSM (Netherlands), Saputo Inc. (Canada) and Other Major Players

The latest research on the Infant Nutrition Ingredients market provides a comprehensive overview of the market for the years 2023 to 2030. It gives a comprehensive picture of the global Infant Nutrition Ingredients industry, considering all significant industry trends, market dynamics, competitive landscape, and market analysis tools such as Porter's five forces analysis, Industry Value chain analysis, and PESTEL analysis of the Infant Nutrition Ingredients market. Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years. The report is designed to help readers find information and make decisions that will help them grow their businesses. The study is written with a specific goal in mind: to give business insights and consultancy to help customers make smart business decisions and achieve long-term success in their particular market areas.

Market Driver:

One significant driver propelling the growth of the infant nutrition ingredients market is the escalating emphasis on health and wellness among parents. With a growing understanding of the critical role nutrition plays in early childhood development, parents are increasingly seeking products that offer optimal nutrition for their infants. This trend is particularly evident in developed regions where consumers are willing to invest in premium products with added health benefits. Consequently, manufacturers are under pressure to innovate and incorporate ingredients that promote brain development, immune support, and overall growth, thus driving the demand for specialized infant nutrition ingredients.

Market Opportunity:

An emerging opportunity within the infant nutrition ingredients market lies in the development of organic and clean label ingredients. As consumer awareness regarding the potential harmful effects of synthetic additives and genetically modified organisms (GMOs) continues to rise, there is a growing preference for natural and organic alternatives. This presents an opportunity for ingredient suppliers to expand their product portfolios to include certified organic ingredients, non-GMO options, and clean label formulations. By tapping into this demand for transparent and sustainable ingredients, companies can gain a competitive edge and capitalize on the shifting preferences of health-conscious parents.

If You Have Any Query Infant Nutrition Ingredients Market Report, Visit:

https://introspectivemarketresearch.com/inquiry/16602

Segmentation of Infant Nutrition Ingredients Market:

By Type

Alpha-Lactalbumin

Casein Glycomacropeptide

Milk Minerals

Lactose

Hydrolysates

Others

By Age Group

0-6 Months

6-12 Months

By Regions: -

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

What to Expect in Our Report?

(1) A complete section of the Infant Nutrition Ingredients market report is dedicated for market dynamics, which include influence factors, market drivers, challenges, opportunities, and trends.

(2) Another broad section of the research study is reserved for regional analysis of the Infant Nutrition Ingredients market where important regions and countries are assessed for their growth potential, consumption, market share, and other vital factors indicating their market growth.

(3) Players can use the competitive analysis provided in the report to build new strategies or fine-tune their existing ones to rise above market challenges and increase their share of the Infant Nutrition Ingredients market.

(4) The report also discusses competitive situation and trends and sheds light on company expansions and merger and acquisition taking place in the Infant Nutrition Ingredients market. Moreover, it brings to light the market concentration rate and market shares of top three and five players.

(5) Readers are provided with findings and conclusion of the research study provided in the Infant Nutrition Ingredients Market report.

Our study encompasses major growth determinants and drivers, along with extensive segmentation areas. Through in-depth analysis of supply and sales channels, including upstream and downstream fundamentals, we present a complete market ecosystem.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Acquire This Reports: -

https://introspectivemarketresearch.com/checkout/?user=1&_sid=16602

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyse extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1047

Email: sales@introspectivemarketresearch.com

#Infant Nutrition Ingredients#Infant Nutrition Ingredients Market#Infant Nutrition Ingredients Market Size#Infant Nutrition Ingredients Market Share#Infant Nutrition Ingredients Market Growth#Infant Nutrition Ingredients Market Trend#Infant Nutrition Ingredients Market segment#Infant Nutrition Ingredients Market Opportunity#Infant Nutrition Ingredients Market Analysis 2023

0 notes

Text

#United Arab Emirates Infant Nutrition Market#Market Size#Market Share#Market Trends#Market Analysis#Industry Survey#Market Demand#Top Major Key Player#Market Estimate#Market Segments#Industry Data

0 notes

Text

The Rise of Nutritional Food Ingredients in UAE: Key Trends and Suppliers

The food industry in the UAE has experienced significant growth in recent years, driven by a rising consumer demand for healthier and more nutritious food options. As the country continues to establish itself as a global hub for trade and commerce, nutritional food ingredients have become increasingly important. These ingredients are essential for improving the nutritional value of a wide range of products, including snacks, beverages, ready-to-eat meals, and dietary supplements. In response to this growing demand, nutritional food ingredients suppliers in UAE have become more crucial in providing high-quality solutions that cater to both health-conscious consumers and the food industry’s evolving needs.

Key Trends Shaping the Nutritional Food Ingredients Market in the UAE

Health and Wellness FocusAs awareness of health and fitness continues to rise, consumers in the UAE are placing greater emphasis on nutrition when making food choices. This shift in consumer behavior has prompted food manufacturers to explore ways to improve the nutritional content of their products. Ingredients like plant-based proteins, probiotics, vitamins, and minerals are in high demand, as they align with this growing trend. Food producers are actively seeking ingredients that offer health benefits, such as improved digestion, enhanced immune function, and overall better wellness.

Rise of Plant-Based ProductsThe UAE has seen a rise in plant-based food popularity, with more consumers adopting vegetarian and vegan diets. This shift has increased demand for plant-based proteins like pea, soy, and rice, which are rich in essential amino acids. Nutritional food ingredient suppliers play a key role in meeting this demand, helping manufacturers create plant-based alternatives to animal products. Additionally, ingredients like plant-based oils, fibers, and natural sweeteners are gaining popularity, catering to health-conscious and eco-aware consumers seeking clean-label, sustainable options.

Demand for Functional FoodsFunctional foods are becoming more popular as consumers seek products that offer health benefits beyond basic nutrition. Ingredients like antioxidants, omega-3 fatty acids, fiber, and vitamins are increasingly being added to food products to enhance their functional value. These ingredients are commonly found in items such as energy bars, smoothies, and fortified beverages, which appeal to consumers looking for more than just flavor in their food. Consumers in the UAE are increasingly prioritizing foods that support mental health, gut health, and immune function. Ingredients like probiotics and prebiotics are particularly in demand due to their beneficial effects on digestive health and overall well-being. Nutritional food ingredients suppliers are responding to this trend by supplying the necessary raw materials to create these functional food products.

Clean Label and TransparencyConsumers in the UAE are increasingly seeking clean-label products, driving demand for natural, sustainable ingredients free from additives and preservatives. This trend has boosted the popularity of organic and non-GMO ingredients, as consumers prioritize health and environmental impact. Nutritional food ingredient suppliers in the UAE are meeting this demand by offering premium, natural ingredients to support the clean-label movement.

Enriched FoodsThe demand for fortified foods in the UAE is rising as fortification helps address common nutrient deficiencies like vitamin D, calcium, and iron. Food manufacturers are adding these nutrients to products such as breakfast cereals, dairy, and infant foods. Nutritional food ingredient suppliers play a crucial role in providing the necessary ingredients, ensuring essential nutrients are accessible in convenient and affordable forms.

The Role of Nutritional Food Ingredients Suppliers in the UAENutritional food ingredient suppliers are key to the UAE's food industry, providing essential ingredients like proteins, fibers, vitamins, minerals, and natural sweeteners for health-focused products. They face challenges in meeting local and international food safety standards, such as compliance with the UAE's Food Safety Department and certifications like ISO and GMP. Sustainability and ethical sourcing are also vital. Mimoza Gulf is a trusted supplier known for quality, innovation, and sustainability, playing a crucial role in the UAE's growing food industry.