#IncomeTaxEFiling

Explore tagged Tumblr posts

Text

E Filing Income Tax

Income Tax Refund Income & Address Proof Credit Card Processing Quick VISA Processing Avoid Penalties

ITR filing Online in Noida at CharteredHelp

0 notes

Video

youtube

#lallulal #lallulalnews @lallulalnews क्रेडिट कार्ड से ऐसे करें टैक्स का पेमेंट, रिफंड के साथ ऐसे मिलेगा कैशबैक #incometax #creditcardloan 7 जून, 2021 को लॉन्च किया गया इनकम टैक्स पोर्टल टैक्सपेयर्स को कई तरह के लाभ प्रदान करता है, जिससे उनकी टैक्स देनदारियां आसान हो जाती हैं. आज की स्टोरी में हम जानने वाले हैं कि अगर आप आईटीआर फाइल करने के बाद अपने टैक्स का पेमेंट क्रेडिट कार्ड की मदद से करते हैं तो आप उससे कैशबैक का लाभ उठा सकते हैं. #creditcardbillpayment #creditcard #hindi #creditcardrewards #creditcardbillpayment #creditcard #hindi #creditcardprocessing #creditcardemi #creditcardpayments #creditcards #creditcardloan #creditcardapplication #incometax #incometaxnotices #incometaxact #incometaxefiling #incometaxreturn #incometaxreturnfiling2020 #incometaxrevisioninenglish #incometaxrevisionplaylist #incometaxnotices #incometaxrevisionbcom #incometaxindiaefiling #viralvideo #incometax,how to submit reply notice from incometax sec 133(6),income tax credit card,credit card income tax,income tax on credit card,income tax credit card limit,credit card use income tax,credit card and income tax,#incometaxoncreditcard,credit card income tax rules,credit card income tax limit,credit card limit income tax,credit card usage income tax,credit card income tax notice,income tax notice credit card,credit card income tax telugu Lallu Lal (लल्लू लाल)- हे भैया सच्ची खबर तो लल्लू लाल ही देंगे..भारत के हर कोने से चुनी गई खबरों का संग्रह। भारत के राजनैतिक, सामाजिक और आर्थिक मुद्दों पर गहराई से जानकारी देना हमारा लक्ष्य है। हम यहाँ पर हर विषय को गहराई से देखते हैं, ताकि भारत के करोड़ों Online User के पास सही खबर मिले। www.lallulal.com

0 notes

Text

Budget 2021: करदाताओं के लिए दो स्लैब की चुनौती बरकरार

Budget 2021: करदाताओं के लिए दो स्लैब की च���नौती बरकरार

वित्त मंत्री ने बजट 2021-22 में आयकर दाताओं को बचत के मोर्चे पर कोई राहत नहीं दी, जिससे उनके सामने दो कर स्लैब में बेहतर चुनने की चुनौती बरकरार है। बजट 2020 में सरकार ने कर जिले में कटौती तो की थी लेकिन को भी बनाए रखा था। दोनों दरों को चुनने में असमंजस इसलिए होता है क्योंकि कम दरों वाला स्लैब चुनने वाले करदाताओं के लिए सभी तरह की टैक्स छूट खत्म कर दी गई है। वहीं रियायतों का लाभ लेने वाले करदाताओं…

View On WordPress

#Budget 2021#Business#Business Diary Hindi News#Business Diary News in Hindi#Business News in Hindi#ELSS#EPF#FD#home loan (principal) tuition fee#Income Tax#income tax slab#incometaxefiling#Life insurance#NPS#nsc#PPF#senior citizen savings scheme#tax saving#taxpayers#two slabs challenge for taxpayers#Union Budget 2021#बजट 2021#बजट 2021-22

0 notes

Photo

Proud to be part of the #Government of #India's Honest #Tax Payer Community and to have received the PROUD FILER badge for #Localturnon (#Localturnon is owned by #Happitive Enterprise Private Limited) (Jan 2021) #localturnon #GovernmentofIndia #ITDepartment #HEP #LTO #Incometaxefiling #india #proudfiler #HonestTaxPayer #noida #happitive #happitiveenterpriseprivatelimited https://www.instagram.com/p/CJvQUiwBMyt/?igshid=1mipzj9kymt7w

#government#india#tax#localturnon#happitive#governmentofindia#itdepartment#hep#lto#incometaxefiling#proudfiler#honesttaxpayer#noida#happitiveenterpriseprivatelimited

0 notes

Photo

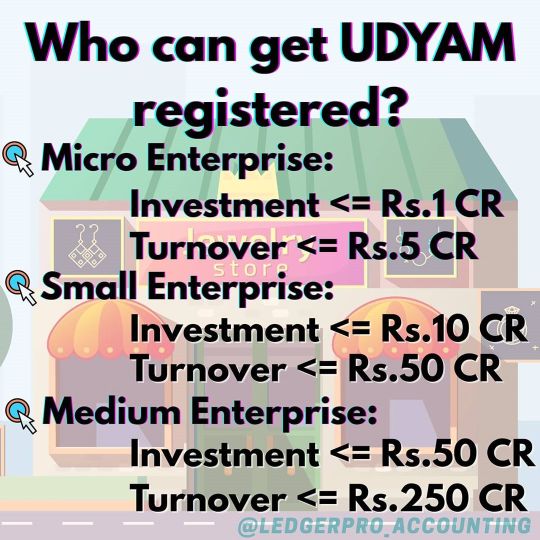

In exercise of the powers conferred by the Micro, Small and Medium Enterprises Development Act, 2006, the Central Government, after obtaining the recommendations of the Advisory Committee in this behalf, hereby notifies certain criteria for classifying the enterprises as micro, small and medium enterprises and specifies the form and procedure for filing the memorandum (hereafter in this notification to be known as “Udyam Registration”), with effect from the 1st day of July, 2020 namely: Micro Enterprise: Investment upto ₹ 1 Cr AND Turnover upto ₹ 5 Cr Small Enterprise: Investment upto ₹ 10 Cr AND Turnover upto ₹ 50 Cr Medium Enterprise: Investment upto ₹ 50 Cr AND Turnover upto ₹ 250 Cr . . . #IncomeTaxUpdate #IncomeTaxReturn #ITR1 #CBDT #IncomeTaxEfiling #TaxReturn #IncomeTaxIndia#ledgerprofinance#incometaxindia#stockanalysis#nationalstockexchange#incometaxes#stockmarketquotes#taxpreparer#dailymarketupdate#sharemarketindia#futuresandoptions#gstr #udyamregistration #msme https://www.instagram.com/p/CCY9TZTjc0N/?igshid=1k947ja3zs1x

#incometaxupdate#incometaxreturn#itr1#cbdt#incometaxefiling#taxreturn#incometaxindia#ledgerprofinance#stockanalysis#nationalstockexchange#incometaxes#stockmarketquotes#taxpreparer#dailymarketupdate#sharemarketindia#futuresandoptions#gstr#udyamregistration#msme

0 notes

Text

Why is Income Tax necessary?

Income Tax is a kind of tax that is levied by government on the income generated from different sources. It is a direct tax, that is paid directly by the taxpayer to the Government of India. Income Tax is one of the major sources of income for the Government, which is thereafter used to fund public services, payment of government obligations and provide goods and services to citizens. Income Tax is imposed on individuals and entities that varies with the income or profits of the taxpayers. Hence, every individual must e-file income tax return during the financial year.

Income Tax is calculated as the product of tax rate times the taxable income of the taxpayer wherein the tax rate may increase as the taxable income increases. The tax rate can vary as per the type of taxpayer as well depending on their age and income. However, the government has different provisions wherein credits are provided to taxpayers in the form of refund when they file their Income Tax Return in order to reduce the burden of tax.

What is the reason for tax imposition?

Following are the reasons for tax imposition: -

· To raise money for govt. expenditures

· To redistribute income among the people

· Social development

· Demand management

· To correct market failures

Why we, as taxpayers, need to pay Income Tax?

· Income Tax return e-filing is one of the major taxes in our country that every earning individual and company needs to pay.

· The constitution of India gives its government to collect taxes in order to provide services and goods to its citizens, to borrow money in times of need or to prepare for war in case the need arises.

· Furthermore, since Income Tax is one of the major taxes in our country, it helps to fund most of the big projects such as meeting the defense needs of a nation and development of the country.

What is Income Tax calculator?

Income Tax calculator provides assessee to calculate their tax liability. It will provide you with an accurate insight to your income tax obligations.

How income tax is calculated?

In present, the income tax slabs and exemption limits has been divided on the basis of age and residential status. There are three major components of income tax calculator they are gross taxable income, HRA exemption, and transport allowance.

#Income tax india efiling login#incometaxindiaefiling login#incometaxefiling#inocmetaxindiaefiling#income tax login#income tax efiling login#income tax efiling login portal#it return login#income tax efiling login page#itr filing#online income tax return#efiling income tax income tax return filing#efiling of income tax return#\#itr filing online#income tax online#itr return#income tax e-filing#income tax india e-filing#e-filing of income tax online#e-file income tax#income tax return#income tax calculator#hra exemption#ITR efiling

0 notes

Link

Taxes are the foundation of a country’s economy. Filing Income Tax is mandatory for all individuals and companies if their income is more than the basic exemption limit specified by the Income Tax Department of India.

#IncomeTaxinDubai#FileIncomeTaxReturn#IncomeTaxEFiling#IncomeTaxReturn#IncomeTaxFiling#IncomeTaxReturnUAE#ITRFiling2021#ITRUAEOnline#AlankitUAE

0 notes

Link

#taxreturnfiling#fileincometax#onlineincometaxreturnfiling#onlineincometaxfiling#incometaxfilingonline#itreturnfilingonline#filingofincometaxreturn#howtofileincometax#onlinetaxreturn#taxreturnonline#incometaxfiling#incometaxefiling#incometaxreturnfiling#accountingservices#accountingfirms#payrollservices#payrollprocess#employeepayroll

0 notes

Text

बढ़ सकती है आईटी रिटर्न भरने की तारीख

बढ़ सकती है आईटी रिटर्न भरने की तारीख #LASTDATE#RETURN#INCOMETAX#ITR

नई दिल्लीः वित्त मंत्रालय इनकम टैक्स रिर्टन फाइल करने की डेडलाइन को आगे बढ़ा सकता है. इसके लिए विचार विमर्श चल रहा है. पंजाब केसरी की खबर के मुताबिक इस पर गंभीरता से विचार चल रहा है कि लोगों को थोड़ा और वक्त दे दिया जाए.

अखबार ने वित्त मंत्रालय के एक अनाम वरिष्ठ अधिकारी के हवाले से लिखा है कि नयी तारीखों का एलान सोमवार तक हो सकता है और इस बात पर फैसला होते ही आई.टी.आ. भरने की तारीख की सरकार जल्द…

View On WordPress

0 notes

Video

youtube

#lallulal #lallulalnews @lallulalnews Budget 2024: सेविंग अकाउंट पर मिलेगा बजट में तोहफा! 25 हजार तक के ब्याज पर मिल सकती है छूट #savingaccounts #budget2024news #budget2024summary #budget202425 #budget2024srilanka #budget2024_25 #budget2024withcnbcawaaz #budget2024live #budget2024highlights #savingaccount #incometax #incometaxreturn #incometaxreturnfiling2020 #incometaxrevisioninenglish #incometaxrevisionplaylist #incometaxnotices #incometaxact #incometaxrevisionbcom #incometaxefiling #incometaxindiaefiling #viralvideo #pmmodi #bjp #congressparty #priyankagandhi #rahulgandhi #aap #aapneta #delhiaap Union Budget 2024: इस साल चुनाव के चलते फरवरी में अंतरिम बजट पेश हुआ था. वित्त मंत्री निर्मला सीतारमण इस महीने वित्त वर्ष 2024-25 का पूर्ण बजट पेश करने वाली हैं budget 2024,high yield savings account,high yield savings accounts,health savings account,budget,how to budget,best savings account 2022,savings account,saving money,budget 2024 income tax,high yield savings account 2022,best savings accounts 2023,hysa savings account,best savings account,money saving tips,ynab savings accounts,best savings accounts,taxes on savings account,budget 2024 stocks,budget 2024 update,tax-free savings account Lallu Lal (लल्लू लाल)- हे भैया सच्ची खबर तो लल्लू लाल ही देंगे..भारत के हर कोने से चुनी गई खबरों का संग्रह। भारत के राजनैतिक, सामाजिक और आर्थिक मुद्दों पर गहराई से जानकारी देना हमारा लक्ष्य है। हम यहाँ पर हर विषय को गहराई से देखते हैं, ताकि भारत के करोड़ों Online User के पास सही खबर मिले।

0 notes

Text

Instructions for Filing ITR 7 For AY 2017-18, Download ITR 7 Form in PDF

Instructions for Filing ITR 7 For AY 2017-18, Download ITR 7 Form in PDF

Instructions for Filing ITR 7 For AY 2017-18. These instructions are guidelines for filling the particulars in this Return Form. In case of any doubt, please refer to relevant provisions of the Income-tax Act, 1961 and the Income tax Rules, 1962. This Form is relevant for “This Return Form is applicable for assessment year 2017-18 only i.e., it relates to income earned in Financial Year…

View On WordPress

#2017-18#E-File Income Tax Return Online#E-Filing 2017-18#Efiling#File ITR Online#filing itr 7#incometaxefiling#incometaxindiaefiling.gov.in#ITR#ITR 2017-18#itr 7 for ay 2017-18#ITR Forms#ITR Forms in Excel#ITR Forms in Java#ITR Forms in PDF#Online ITR Filing

0 notes

Text

Income Tax Return File

निश्चित काम के अनुसार अर्जित होने वाली आय का विवरण जमा करने के लिए इनकम टैक्स रिटर्न के अनेक प्रकार के फॉर्म जारी किए गए है। जिनके क्रम के साथ नाम भी दियें गए है।

For more details click on ...

0 notes

Text

What is Pan Card and Why Should I Use One

Of all the unique identification documents improvised, a PAN card is assigned to determine and get a hold of the financial attributes of an individual in India. PAN stands for Primary Account Number which includes a 10-digit alphanumeric number and is unique for all. Unlike the other unique identification documents, a PAN card is issued by the Income-Tax Department of India. The primary significance of a PAN card is to put a thorough check on the tax deposits of an individual as it links all the financial transactions made by an entity or an individual. A PAN is not only assigned to an individual but also a sole proprietorship firm or a partnership firm or an enterprise and thereby records all the transactions linked herewith. It is proof of identification for everyone who is a part of any monetary transaction that is happening across the nation.

HOW TO SEARCH FOR PAN CARD DETAILS

A PAN card search is possible through a number of ways, and all of them are equally effective. It can be done through a search with PAN number, name of an individual, date of birth of an individual and also by the address of an individual. There are ways through which it can be done online via the e-filing website of the Income Tax Department and by registering ourselves with the same.

PAN card details can also be updated through the website link mentioned above.

STEPS THAT NEEDS TO BE FOLLOWED FOR PAN CARD ADDRESS CHECKING

STEP 1: We need to visit the website www incometaxefiling gov in and click on the option “Register Yourself”.

STEP2: We need to fill in the information and register ourselves accordingly.

STEP3: We need to select the User Type and click on “Continue”.

STEP4: We need to fill in our basic details, respectively.

STEP5: We need to fill up the Registration form and click on “Submit”.

STEP6: Consequently, a link will be sent to the email address that we provided and we need to click on that link to activate our account with the Income Tax e-filing department.

STEP7: We need to visit “incometaxindiaefiling gov in/e-Filing/UserLogin/LoginHome html”

STEP8: We need to select “My Account.”

STEP9: We need to go to “Profile Settings” and click on “PAN Details” wherein the address and other details will be displayed.

TO AVAIL THE ADDRESS UPDATE FACILITY

In order to update the address of the PAN card which is extremely important in case one chooses to change one’s address, one has to have ADHAAR card and must have the phone number and email id which is registered with the ADHAAR card. A new address can also be updated by filling in the PAN Change Request Form available at the Nation Securities Depository Limited (NSDL) website.

SIGNIFICANCE OF HAVING A PAN CARD

PAN card has its own significance in ensuring all financial facilities offered by financial organizations as well as by our Govt.

It becomes easier to avail facilities like personal, educational, home and business loans. Life becomes a lot easier if one has this document issued and updated accordingly.

iCrederity offers highly reliable Employee Background Verification, Educational Verification, Pre Employment Screening solutions, employment background check, Pan Card Details verification, Criminal Background Check, Employee Screening, Employment Verification, credential verification, KYC Verification that helps in verifying and recruiting the right person for a job in Delhi Mumbai Bangalore Chennai Hyderabad.

#kyc verification#education verification#background education verification#pan card address verification#pan card number verification#pan card address checking#pan card verification#pan card details verification

0 notes

Photo

Only those enterprises are considered eligible for Udyam Registration which are either in manufacturing or production or processing or preservation of Goods OR in the providing or rendering of services. In other words, the enterprises which are engaging only in trading i.e. buying, selling importing, exporting of Goods are not even eligible for applying for Udyam Registration. #IncomeTaxUpdate #IncomeTaxReturn #ITR1 #CBDT #IncomeTaxEfiling #TaxReturn #IncomeTaxIndia#ledgerprofinance#incometaxindia#stockanalysis#nationalstockexchange#incometaxes#stockmarketquotes#taxpreparer#dailymarketupdate#sharemarketindia#futuresandoptions#gstr #udyamregistration #msme https://www.instagram.com/p/CCY9G-UDA1X/?igshid=g8p3tzvb9pgb

#incometaxupdate#incometaxreturn#itr1#cbdt#incometaxefiling#taxreturn#incometaxindia#ledgerprofinance#stockanalysis#nationalstockexchange#incometaxes#stockmarketquotes#taxpreparer#dailymarketupdate#sharemarketindia#futuresandoptions#gstr#udyamregistration#msme

0 notes

Text

Here's How to claim HRA exemption at the time of Fiing ITR

Any salaried individuals who reside in rented accommodation and pays rent to the landlord can claim the House Rent Allowance in respect of rental payments under section 10(13A) of the Income-tax Act, 1961. In case you don’t live in rented accommodation, this allowance will be fully taxable. Basically, the amount of HRA exemption is deductible from the total income of the individuals. HRA exemption helps employees to save the taxes. Keep in mind that the HRA received from your employer will be fully taxable if an employee is living in his own house or if he doesn’t pay any rent.

Who can avail HRA?

It is important to know that there are many people who are living with their parents or in their own houses, hence this tax benefit can be receive by salaried employees who have the HRA component as part of his salary structure, stating it as rented accommodation. On the other hand, an individual who does not receive HRA as part of her salary and is staying in a rented apartment can still claim the deduction in respect of rental payments under section 80GG of the Act.

How much deduction is exempted?

The deduction available is the least of the following amounts:

· Actual HRA received;

· 50% of [basic salary + DA] for those living in metro cities (40% for non-metros); or

· Actual rent paid less 10% of basic salary + DA

What documents do you need?

For claiming HRA exemption, you will be required to submit the relevant documents of rent receipts of the rent agreement issued by the landlord. Additionally, if your rent exceeds Rs. 1lakh, then it is mandatory for the employee to report the PAN card of the landlord.

Can HRA be claimed during the time of filing returns?

While seeking tax benefits on HRA, if one fails to justify the deduction of the amount from the total income it can attract penal consequences under the provisions of the Income-tax Act, 1961. The amount of HRA, in any case, will get reflected in Form 16 issued by the employer

Also, individual taxpayers not receiving a house rent allowance (could be non-salaried individuals as well) could claim a deduction for their rental expenses based on Section 80GG subject to specified limits.

How to claim?

Exemption under 80GG can be claimed by an individual while filing her income tax return. There is a specific form for this, Form 10BA. The form is available on the e-filing website of the income tax department—incometaxindiaefiling login website. In this form, the assessee claiming the exemption has to declare that he stays on rent in the particular property, and neither her nor her spouse and children own any property.

How to report exempt incomes in ITR

In the latest amendments of ITR Forms, it has been notified that the taxpayers will be required to provide break up of their salary details. Therefore, any portion of HRA which is taxable will require to be reported while itr filing.

Calculate HRA Deduction

All India provides you with HRA calculator to find that part of your income that is exempt from tax on account of payment towards House rent.

For more details about income tax india efiling login, You can visit our website : https://www.allindiaitr.com

#Income tax india efiling login#incometaxindiaefiling login#incometaxefiling#inocmetaxindiaefiling#income tax login#income tax efiling login#income tax efiling login portal#it return login#income tax efiling login page#it returns login#it return efiling login#it return e filing login#income tax efilingindia login#itr login page#online income tax efiling login#income tax department e filing login#income tax login registration#income tax indiaefiling login#income tax india online login

0 notes

Photo

Happy World Environment Day to all! Today let us strive together to keep our environment clean & green and Pledge to be the solution to Stop the pollution.

#worldenvironmentday #environment #sustainable #tax2win #efiling #Incometaxefiling #incometaxindia #Pollution #green #paperlessbusiness #paperlessfiling #doyourbit

0 notes