#Income tax reforms India

Explore tagged Tumblr posts

Text

Telangana urges removal of borrowing conditionalities at pre-Budget meet

Telangana has pitched for a growth-driven approach to reducing the debt-to-GDP ratio rather than an austerity-driven strategy. In the pre-budget meeting called by Union Finance Minister Nirmala Sitharaman and her team on Friday at Jaisalmer, the State Deputy Chief Minister who holds the Finance portfolio, Bhatti Vikramarka Mallu, said that “Telangana supports a realistic fiscal deficit target of…

#Climate resilience funding India#Gig worker social security framework India#Growth-driven debt reduction strategy#GST exemptions on machinery#Income tax reforms India#Jaisalmer pre-budget meeting highlights#MGNREGA flexible fund usage#MSME Technology Upgradation Fund#PLI schemes for emerging sectors#pre-budget meeting 2024#Smart Cities Mission expansion#Special Assistance for States capital expenditure#telangana#Telangana CSS fair share#Telangana Deputy CM Bhatti Vikramarka Mallu

0 notes

Text

Navigating the Indian Investment Landscape: A Comprehensive Guide for International Investors

India, with its vibrant economy, diverse market opportunities, and favorable regulatory environment, has emerged as an attractive destination for international investors seeking high returns and long-term growth prospects. From burgeoning sectors like technology and e-commerce to traditional industries such as manufacturing and agriculture, India offers a wealth of investment opportunities for savvy investors. In this comprehensive guide, we'll explore the Indian investment landscape, highlighting key sectors, regulatory considerations, investment strategies, and tips for international investors looking to capitalize on India's growth story.

Understanding the Indian Investment Landscape:

1. Economic Overview: India is the world's sixth-largest economy by nominal GDP and one of the fastest-growing major economies globally. With a young and dynamic population, a burgeoning middle class, and increasing urbanization, India offers a vast consumer market and a favorable demographic dividend for investors.

2. Key Investment Sector: India's economy is diverse and offers investment opportunities across various sectors. Some of the key sectors attracting international investors include:

- Information Technology (IT) and Software Services

- E-commerce and Digital Payments

- Healthcare and Pharmaceuticals

- Renewable Energy and Clean Technology

- Infrastructure and Real Estate

- Manufacturing and Automotive

- Agriculture and Agribusiness

3. Regulatory Environment: India has implemented several reforms to streamline its regulatory environment and improve the ease of doing business for investors. The government has introduced initiatives such as Make in India, Startup India, and Digital India to encourage investment, innovation, and entrepreneurship. Additionally, foreign direct investment (FDI) policies have been liberalized across various sectors, allowing greater foreign participation in the Indian economy.

4. Taxation and Legal Considerations: International investors should familiarize themselves with India's tax laws, regulations, and legal frameworks before making investment decisions. India has a progressive tax regime with corporate tax rates varying based on business structure, industry, and income levels. It's advisable to consult with tax advisors and legal experts to navigate the complexities of India's taxation and legal landscape.

Investment Strategies for International Investors:

1. Market Research and Due Diligence: Conduct thorough market research and due diligence to identify investment opportunities aligned with your investment objectives, risk tolerance, and sector preferences. Evaluate market trends, competitive dynamics, regulatory changes, and macroeconomic indicators to make informed investment decisions.

2. Diversification: Diversify your investment portfolio across different asset classes, sectors, and geographic regions to mitigate risks and maximize returns. Consider allocating capital to both high-growth sectors such as technology and healthcare, as well as stable sectors like infrastructure and consumer goods.

3. Long-Term Perspective: Adopt a long-term investment perspective when investing in India. While short-term market volatility and regulatory changes may occur, India's economic fundamentals remain strong, offering attractive growth prospects over the medium to long term. Patient investors can capitalize on India's demographic dividend and structural reforms to generate significant returns.

4. Partnering with Local Experts: Partnering with local investment advisors, financial institutions, and legal experts can provide valuable insights and guidance on navigating the Indian investment landscape. Local expertise can help international investors navigate regulatory hurdles, identify investment opportunities, and mitigate operational risks effectively.

5. Investment Vehicles: Evaluate different investment vehicles available for investing in India, including direct investments, private equity funds, venture capital funds, and mutual funds. Each investment vehicle offers unique benefits and risks, so it's essential to assess their suitability based on your investment goals and risk appetite.

Tips for International Investors:

1. Stay Informed: Stay updated on market developments, regulatory changes, and economic trends affecting the Indian investment landscape. Follow reputable financial news sources, attend industry conferences, and engage with local experts to stay informed and make timely investment decisions.

2. Network and Build Relationships: Networking with industry professionals, government officials, and fellow investors can provide valuable insights and access to investment opportunities in India. Join industry associations, attend networking events, and leverage social media platforms to expand your network and build relationships in the Indian business community.

3. Be Patient and Persistent: Investing in India requires patience, persistence, and a long-term commitment. Building relationships, navigating regulatory hurdles, and achieving investment success take time and effort. Stay focused on your investment goals, adapt to changing market conditions, and remain resilient in the face of challenges.

4. Seek Professional Advice: Consult with financial advisors, tax consultants, and legal experts specializing in India to seek professional advice tailored to your specific investment needs. Expert guidance can help you navigate regulatory complexities, optimize tax efficiency, and maximize returns on your investments in India.

5. Cultural Sensitivity: Recognize and respect cultural differences when conducting business in India. Building strong relationships and trust with local partners and stakeholders requires understanding and appreciating Indian customs, traditions, and business etiquette.

6. Risk Management: Assess and manage risks effectively by diversifying your investment portfolio, conducting thorough due diligence, and implementing risk mitigation strategies. Consider geopolitical risks, currency fluctuations, regulatory changes, and market volatility when making investment decisions.

7. Sustainability and ESG Factors: Consider environmental, social, and governance (ESG) factors when evaluating investment opportunities in India. Increasingly, investors are prioritizing sustainability and responsible investing practices to mitigate risks, enhance long-term value, and align investments with their values and principles.

8. Stay Flexible and Agile: Remain flexible and agile in adapting to changing market conditions, regulatory requirements, and investor preferences. India's business environment is dynamic and evolving, requiring investors to stay nimble and responsive to emerging opportunities and challenges.

India offers a wealth of investment opportunities for international investors seeking high growth potential and diversification benefits. With its robust economy, favorable demographic trends, and supportive regulatory environment, India continues to attract capital inflows across various sectors. By understanding the Indian investment landscape, adopting sound investment strategies, and leveraging local expertise, international investors can capitalize on India's growth story and unlock significant value for their investment portfolios. As India continues on its path of economic development and reform, it remains a compelling destination for investors looking to participate in one of the world's most dynamic and promising markets.

In conclusion, navigating the “Invest in India” landscape requires careful planning, strategic decision-making, and a long-term perspective. By understanding the key sectors, regulatory considerations, investment strategies, and tips outlined in this guide, international investors can position themselves to capitalize on the vast opportunities offered by India's vibrant economy and emerging market dynamics. With the right approach and guidance, investing in India can yield attractive returns and contribute to portfolio diversification and long-term wealth creation for investors around the globe.

This post was originally published on: Foxnangel

#regulatory environment#international investors#investment opportunities#investment ideas#india's economy#startup india#investing in India#investment opportunities in india#investments in india#foxnangel

3 notes

·

View notes

Text

Extremist or mainstream: how do Tim Walz’s policies match up globally?

Ed PilkingtonFri 16 Aug 2024 12.00 CEST

Within hours of Minnesota’s governor, Tim Walz, being chosen by Kamala Harris to be her Democratic presidential running mate, Donald Trump and team began attacking him as a “dangerously liberal extremist”.

Trump surrogates seized on Walz’s record of expanding voting rights for former felons, combatting the climate crisis, and other measures as proof that Harris-Walz would be the “most radical ticket in American history”.

If you step back from the melee, and look at his gubernatorial acts through a global lens, they appear anything but extreme. From the perspective of other industrialised nations, what Trump denounces as leftwing radicalism looks little more than basic public welfare provisions.

Far from being militant and revolutionary, initiatives such as paid family leave, free college tuition and rudimentary gun controls – all championed by Walz in Minnesota – have long been regarded as middle-of-the-road and unremarkable in large swathes of the world. Through this frame, it is not Walz who is the outlier, but his Republican critics.

Here are how some of Walz’s most impactful reforms compare with the rest of the world.

Free school lunches

View image in fullscreenTim Walz gets a huge hug from students at Webster Elementary in Minneapolis after he signed into law a bill that guarantees free school meals on 17 March 2023. Photograph: Star Tribune/Getty Images

‘On fire with excitement’: Tim Walz’s former students react to nominationRead more

Walz’s record: “What a monster! Kids are eating and having full bellies so they can go learn.” That was Walz’s sardonic reply to CNN when he was asked about having introduced free breakfast and lunch for all Minnesota schoolkids. The 2023 measure puts Minnesota among just eight US states that offer school meals at no cost to all children, no matter their family’s income.

Around the world: Several countries provide free lunches for their children nationwide. Sweden, Finland and the three Baltic nations all provide meals at no cost for all schoolchildren irrespective of income, and many more European countries provide targeted or subsidised meals. Even a developing country such as India ensures access to lunch for more than 100 million kids daily.

“The idea of offering free meals to all students during the school day is hardly new – many countries already do so,” said Alexis Bylander at the Food Research and Action Center, a US anti-hunger organisation. “Numerous studies show the benefits, including improving student attendance, behaviour and academic success.”

Combatting the climate crisis

View image in fullscreenPublic works employees run a water pump to prevent flood waters from coming up through the storm drains in Stillwater, Minnesota, in 2023. Photograph: Nicole Neri for The Washington Post via Getty Images

Walz’s record: In February 2023 Walz signed legislation committing Minnesota to having all its electricity produced by wind, solar and other clean energy sources by 2040 – an even more ambitious timeframe than adopted by California, America’s sustainable energy leader. The legislature also passed more than 40 climate initiatives, including expanding charging infrastructure for electric vehicles and introducing a new code for commercial buildings to cut energy use by 80% by 2036.

Around the world: By global standards, Minnesota’s ambitions do not stand out. Some 27 countries have written into law target dates by which they will become net zero – that is, stop loading additional greenhouse gases into the atmosphere. In the developed world, Finland is leading the way, pledging to be net zero by 2035, and to begin absorbing more carbon dioxide than it produces by 2040. In December, almost 200 countries at the Cop28 climate summit in Dubai agreed to call on all countries to transition away from fossil fuels and for global renewable energy to be tripled by 2030.

Child tax credit

View image in fullscreenTim Walz reads a story to a group of kindergarteners in St Paul on 17 January 2023. Photograph: Glen Stubbe/Star Tribune via Getty Images

Walz’s record: Last year the governor signed into law a child tax credit program for low-income Minnesota families. The measure sought to fill the hole left by a federal scheme that expired in 2021 after Congress failed to extend it. The Minnesota plan is the most generous of its type in the US, offering $1,750 per child and reaching more than 400,000 children.

Around the world: The Organisation for Economic Co-operation and Development (OECD), the forum of high-income democracies, reported in 2018 that 34 of the 35 countries with available information provided their people with some form of family benefit including tax credits. The OECD compared the value of family benefits for two-child families, measured as a percentage of average earnings, across 41 countries and found that the US came in at No 40, with only Turkey being less generous in its support.

Basic gun controls

View image in fullscreenTim Walz hands out pumpkin bars to a gun safety advocate before the first day of the legislative session in St Paul in 2023. Photograph: Abbie Parr/AP

Walz’s record: The governor identifies as a proud gun-owner and hunter, and he accepted Harris’s invitation to be her running mate wearing a camo hat. That didn’t stop him in May 2023 enacting a slew of gun safety measures, including requiring all private sales of handguns and semi-automatic rifles to go through an FBI background check that looks for evidence of criminal or mental health risks. The changes also introduced a “red flag law” that allows relatives and other interested parties to intervene when someone is in danger of injuring themselves or others with guns.

Around the world: International comparisons show that Americans own vastly more guns than civilians in other rich countries – 121 guns per 100 Americans, compared with five guns per 100 people in the United Kingdom. The number of gun killings per 100,000 people is also vastly higher: 4.12 in the US, 0.04 in the UK.

Other countries also have much tougher gun controls that make those introduced by Walz look weak by comparison. Canada requires gun buyers to wait 28 days before acquiring a firearm, and imposes mandatory safety training and a ban on military-style rifles that does not exist in the US. The UK also bans some semi-automatic rifles and most handguns. Japan tightly restricts gun ownership, banning most guns other than air guns and a few other special categories and even then requiring owners to submit to annual inspections.

Paid family and medical leave

Walz’s record: House File 2, enacted by the governor last year, gave Minnesotans access to up to 20 weeks in every year of partial wages to cover medical leave after a life-changing diagnosis, mental health leave, or time off to care for a new baby. “Paid family and medical leave is about investing in the people that made our state and economy strong in the first place,” Walz said as he signed the bill.

Around the world: The US is the only OECD member country without a national law giving all workers access to paid leave for new mothers. Thirty-seven out 38 OECD countries offer national paid maternity leave – the only exception being the US. France, which holds the top spot, allows mothers and fathers to take paid leave until their child is three years old.

The US is also one of only six countries with no form of national paid leave covering either family or medical leave in the case of a health concern.

Voting rights for former felons

Walz’s record: The governor signed a bill that restores the vote to more than 50,000 Minnesotans who have been convicted of a felony. The Trump campaign denounced the measure as evidence of Walz’s “dangerously liberal agenda”, which is ironic, given that Trump himself, as a convicted felon, will only be able to vote for himself in November thanks to a similar reform in New York.

Around the world: A report released by Human Rights Watch (HRW) in June concluded that the US was an “outlier nation in that it strips voting rights from millions of citizens solely on the basis of a criminal conviction”. In 2022, more than 4 million people in the US were disenfranchised on those grounds. By contrast, when HRW surveyed 136 countries around the world, it found that the majority never or rarely deny the vote because of a criminal record, while those with restrictions tend to be much less draconian in their approach than US states.

2 notes

·

View notes

Text

Union Budget 2024 (India) Summary

The Union Budget 2024 of India focuses on simplifying tax processes, promoting economic growth, and supporting various sectors. Here are the key highlights:

Simplification of Tax Processes

Income Tax Returns (ITR): The process of filing ITR has been simplified.

Revised Tax Deductions and Rates

Standard Deduction: Increased from ₹50,000 to ₹75,000 in the new tax regime.

Family Pension Deduction: Enhanced from ₹15,000 to ₹25,000.

New Tax Structure:

No tax on income up to ₹3 lakhs.

5% tax on income from ₹3 lakhs to ₹7 lakhs.

10% tax on income from ₹7 lakhs to ₹10 lakhs.

15% tax on income from ₹10 lakhs to ₹12 lakhs.

20% tax on income from ₹12 lakhs to ₹15 lakhs.

30% tax on income above ₹15 lakhs.

Changes in Import Taxes

Gold and Silver: Import tax reduced from 6.5% to 6%.

Support for Start-ups and Entrepreneurs

Angel Tax Exemption: Investors in start-ups are exempt from the angel tax.

Late Payment of TDS: No longer considered a crime.

Changes in Capital Gains Tax

Long-Term Capital Gains Tax: Set at 12.5%.

Short-Term Capital Gains Tax: Increased to 20%.

Industrial and Economic Growth Initiatives

Capital Gains: Increase in capital gain limit.

Industrial Parks: Plug and Play Industrial Park Scheme in 100 cities.

Export Concessions: For mineral products.

Support for Women: ₹3 lakh crores provision.

Cheaper Goods: Electric vehicles, gold and silver jewelry, mobile phones, and related parts.

Agriculture: Priority on increasing production.

FDI Simplification: Simplified process for foreign direct investment.

Interest-Free Loans: To states for 15 years.

Rural Development: ₹2.66 lakh crores provision.

Support for Farmers: ₹1.52 lakh crores provision.

Education Loans: Financial support for loans up to ₹10 lakhs for higher education.

Nine Priorities for Upcoming Years

Manufacturing and Services

Urban Development

Energy Security

Infrastructure

Innovation and R&D

Next-Generation Reforms

Productivity and Resilience in Agriculture

Employment and Skilling

Inclusive Human Resource Development and Social Justice

Employment-Linked Incentives

First-Time Employees: One-month wage incentive.

Manufacturing Sector: Incentives for employers and employees for four years.

Youth Employment: Incentives for 30 lakh youths entering the job market.

EPFO Contribution Reimbursement

Government will reimburse ₹3,000 per month towards EPFO contribution for two years for each additional employee.

E-Commerce and Youth Internship Initiatives

E-Commerce Export Hub: To be created in collaboration with the private sector.

Youth Internship Scheme: Internships for 1 crore youth with a one-time assistance of ₹6,000 and a monthly allowance of ₹5,000 during the internship.

The Union Budget 2024 aims to drive economic growth, support various sectors, simplify tax procedures, and provide robust support for employment and youth development. By focusing on these areas, the budget seeks to create a more inclusive and prosperous economy for all citizens. Click here read more

2 notes

·

View notes

Text

TORY PARTY MANIFESTO 2024 SUMMARY

tldr: little rishi is liz truss now. words 8, 9 and 10 of the manifesto are 'covid and ukraine', so they're swinging hard on excusemaking, and it's very negativist and defensive - attacking labour and justifying their terrible government. they know they’re losing so it’s a mess in an attempt to stop their base voting reform. this is the only major manifesto whose headings are written in serif, tryna act all official and luxe

💷ECONOMY

flat-rate employee national insurance cuts from 12% to 6% over the next two financial years, allegedly cutting income taxation for a £35k/a worker by £1,350 (their numbers) BUT also giving the highest 'employee' earners this same tax-cut

trickle-down economics: keep corporation tax at extreme lows

exempt the self-employed from national insurance contributions, essentially cutting overall income taxation by a couple percent

specific, direct threat to cut benefits for 'people of working age with a disability or health condition', restrict PIP entitlements with harsher assessments, massively expand 'fit to work' status over people with mental health and mobility conditions to remove benefits from 400k people (despite the current regime leading to misery and deaths), transfer fit note responsibility from GPs to the dwp to restrict more benefits, reduce the 'claimant review' date from 18 months to 12 months without work

transition child benefit entitlements to be based on 'household' earnings rather than individual earnings

"we will not increase the number of council tax bands, undertake an expensive council tax revaluation or cut council tax discounts, as labour is currently doing in wales", preventing councils from getting more property tax revenue whilst not increasing their funding from anywhere, enabling more and more and more and more councils to shit themselves and die, letting them blame labour for "bankrupting" the councils that the central government themselves squeezed to death

ban councils doing four-day week schemes

reduce net borrowing – curious considering the unfunded nature of the manifesto proposals

increase taxes on online distribution warehouses "to help the high street" [citation needed]

"use brexit freedoms" to recategorise many 'large' businesses as 'medium', exempting them from reporting requirements and allowing them to exploit their workers more

more fucking 'freeport' special economic zones

'strengthen the commonwealth' because that's the favourite excuse of europhobic excusemakers acting like severing trade with the mainland wasn't a horrifically bad idea. india and malaysia do not give a shit about us mate and it's ridiculous to think australia and guyana could ever offer as much economic integration as the mainland can

do nothing to supervise or control the City with a specific eye to doing nothing about "fintech" and "ai"

economic commitment to continue union-busting and restricting union rights, 'continue implementing' the so-called 'minimum service levels legislation' to enable strikebreaking and mandatory scabbing

🏥PUBLIC SERVICES

continue the privatisation of the NHS but with a focus on small/medium enterprises

expand, that's right, expand the indefensible multi-academy trusts, build more indefensible 'free schools' (ie with private charters, no oversight, and public cash), expand faith schools, strengthen ofsted to be even more bureaufascistic against attacks after that headteacher's suicide

continue and enforce the ongoing propaganda push into primary schools, "we will always support teachers to uphold and promote fundamental British values"

'close university courses with the worst outcomes' [clarification needed], again, threatening the higher education sector into compliance with their whims

stick all children not in school on a register

make the NHS app a single frontend for all NHS stuff

slash the size of the civil service and 'bring quango spending under control', incorporate so-called 'ai' into the civil service [clarification needed]

🏠HOUSING

lax planning laws including environmental protections and opportunities for legal challenge, and force councils to set aside land for builders, to allow more private-finance soulless newbuild sprawl, with no new infrastructure, no new community, only house-for-sale after house-for-sale

target the building of mcmansions on inner-city brownfields

expand help-to-buy for these horrible newbuilds

restrict social housing along xenophobic and classist lines: "we will legislate for new ‘local connection’ and ‘uk connection’ tests for social housing in england, to ensure this valuable but limited resource is allocated fairly"

'reform' leaseholds and cap ground rents, not abolishing this indefensible stain

give 105 towns a pathetic £20m

🚄TRANSPORT ?

build northern powerhouse rail including Bradford Station "using money saved from HS2" and £12b more, and upgrade the east midlands mainline

lax planning restrictions on new strategic (big and polluting) roads

deliver money centrally for transport projects: £1.75b for the midlands rail hub, a pathetic £1b for buses in the north AND in the midlands, and £13b for 'local priorities' to 'cut congestion' (read: roads)

introduce a specific 'death by dangerous cycling' offence

"automated vehicles will be on British roads in the next parliament"🤮

ban low-traffic neighbourhoods except on a 'road by road basis' 'with the support of the people who live there' and create a statutory right to challenge existing LTNs

"labour’s incoherent and ideological nationalisation plan would put the trade unions in charge", ie the incoming british railways (being set up) will continue the indefensible franchise-concession system that emerged after the final collapse of the franchise system in 2020

"include measures to reform outdated working practises in the rail industry" – ie forcing through driver-only trains and other things the drivers are striking against, possibly requiring strikebreaking them

👮FORCE

"in recent months we have seen shocking increases in protests being used as a cover for extremist disruption and criminality. we cannot allow a small and vocal minority to destroy our democratic values. that is why we unveiled a new extremism definition under which certain groups that promote an ideology based on violence, hatred or intolerance will be blocked from government funding and meeting officials. we have passed tough new laws to curb disruptive protests. our public order act 2023 [ie the Bill that the kill the bill protests were trying to kill] gave the police new powers to intervene where protests cause serious disruption to communities, leading to the arrests of over 600 just stop oil and extinction rebellion protestors in London alone. we will introduce further powers to ban face coverings, pyrotechnics and climbing on war memorials. we will strengthen police powers to prevent protests or marches that pose a risk of serious disorder, by allowing police to take into account the cumulative impact of protests"

"building on our new powers for the police, we will further speed up the use and enforcement of powers to remove illegal traveller sites, while giving councils greater planning powers to prevent unauthorised development by travellers", furthering the ongoing clampdown on the civil rights of our country's GRT people

surge funding for the armed forces

deliberate target to be europe's largest arms exporter by 2030 no i am not fucking joking

sabrerattle at the 'Axis of Hostile Actors' (russia, china, iran), giving a catchy name to the other side of this little cold war of theirs

abuse the permanent un council seat as much as possible

"we will push for a two-state solution in the middle east - our long-standing position has been that we will recognise a palestinian state that is most conductive to the peace process" [oxymoronic – SEE ME]

roll out broken windows policing

mandatory minimum of life for 'most heinous murderers', prohibit parole for rapists

not enact Leveson 2 and allow the press hate speech and corruption to continue, proceed with centralised renegotiation of BBC funding with all statecapture (or the effects of the threats thereof) that may entail

half-baked national service proposal. look, they know they're gonna lose so they've come up with this faff to win over their base. all 18-year-olds (no specific enumeration given so i'm guessing it means from yer 18th birthday to 19th birthday, interfering with exams and start of uni) forced to do one weekend a month 'community volunteering', or get one of 30k places in the military (out of a typical annual cohort of 400k) for a year, so the troops get distracted from their warcrimes by being forced to do childcare lmao. the compulsion to do this is not enumerated, with one rogue minister suggesting fines could fall at the feet of the parents of these adult people. takeaway: this is total nonsense and they don't have to make it make sense so who cares

legal cap on work and family visas, screen migrants for health conditions and force them to pay if they need treatment, do the rwanda concentration camp scheme, ban asylum seekers from countries 'that don't work with us', mass deportations of illegals [clarification needed]

LEAVE THE EUROPEAN COURT OF HUMAN RIGHTS if it finds against the rwanda concentration camp scheme

expand the NCA with a focus on being the hostile environment

promote the imperialistic ambitions of the anglosphere and english as the cosmocratic imperial lingua franca

only 30k of the so-called 'national service' would in the military, so basically forcing the military to do daycare

commitment to continued strikebreaking and union-busting

force landlords to evict "antisocial" tenants in a 'three strikes and you're out' policy

ban mobile phones in schools

pledge for a Bad Internet Bill to restrict online content, 'carefully consider' the bertin review to implement hostile measures against pornography

🌱CLIMATE ?

build new gas power stations and accelerate oil and gas extraction in the north sea

treble offshore wind, in line with labour's proposals

invest £1b into green energy – a pathetically small amount

approve more nuclear reactors

carbon credit scheme for imports of materials

restrict the mandate of the climate change committee

force solar power stations to be a minimum distance from another solar power station 'to protect rural landscapes'

allow nimby organisations to prevent onshore wind

reverse the ultra-low emissions zone expansion

slowly work towards a deposit-return system

a new national park. a new one. a. one

🗳️DEMOCRACY ?

"we remain committed to the first past the post system for elections, maintaining the direct link with the local voter. we will not change the voting age rom 18. we will maintain rules to tackle voting fraud, including the requirement to show id"

"we believe the governments in Scotland, Wales and Northern Ireland now have the right balance of powers"

"we will bring forward legislation to reapply the entirety of the trade union act 2016 (ie restricting the rights of unions) to wales. and a welsh conservative government would reverse labour's plans to expand the senedd" [relevance - this isn't a manifesto for the senedd election]

expand the useless sticking-plaster combined authorities, give powers first to Tees Valley in bare-faced partisan corruption

🏳️⚧️REACTIONARY AGENDA

"biological sex is a reality. the overwhelming majority of people in this country recognise that. it has been more than a decade since the equality act was passed by a labour government. it has not kept pace with evolving interpretations and is not sufficiently clear on when it means sex and when it means gender. the next conservative government will introduce primary legislation to clarify that the protected characteristic of sex in the equality act means biological sex. this will guarantee that single sex services and single sex spaces can be provided, for example in healthcare and sports settings, to ensure women and girls are protected"

"in recent years, an increasing number of children have started questioning their gender, the consequences of which are still unknown. parents will have a right to know if their child wants to be treated as the opposite sex and schools will have to involve parents when it comes to decisions about their children"

"attempts at so-called 'conversion therapy' are abhorrent. but legislation around conversion practices is a very complex issue, with existing criminal law already offering robust protections. in light of the cass review final report, it is right that we take more time before reaching a final judgement"

"we will work to strengthen the relationship between schools and parents, including by delivering new legislation which will make clear, beyond all doubt, that parents have a right to see what their child is being taught in school [they made it bold not me] and schools must share all materials, especially on sensitive matters like relationships and sex education. this builds on the progress [citation needed] we have already made, having updated relationships, sex and health education guidance to introduce clear age-limits on what children can be taught [the rightist outrage at 'sex education for five year olds' is literally stuff like gay people exist so don't bully billy two-dads for having two dads, which is of course fucking unacceptable to the daily mosley] and guarantee the contested concept of gender identity is not taught to children [clarification needed -- or not, because the vagueness is the point, it's Section 28 two, terrorising the entire public sector into silence about anything the daily mosley might clench their pearls about]."

commitment to implement the cass review, ban the private prescription of puberty blockers, accelerate the increasing prohibition of their NHS prescription, fight 'ideologically-driven care' and follow 'evidence' (in the context of the case review meaning absolute prohibition and literal torture)

stop public sector DEI [clarification needed]

'not allow the word woman to be erased'

🤔STRAIGHT UP NON-POLICIES

a load of stuff in the manifesto, especially in the economic section, is just 'maintain funding for...', including 'maintaining' the living wage (ie without even making it legally mandatory), and do ongoing plans instituted by public sector organs that wouldn't be theirs to organise

the so-called 'triple lock plus' or 'quadruple lock': the triple lock legally mandates three possible minima for the state pension, depending on which is highest. it's currently below the tax-free personal allowance, but it is forecast to go above the current personal allowance at some point, which would mean pensioners would start paying tax on the income above the allowance. the tories have made a huge song and dance about raising the personal allowance for pensioners in line with the triple lock. George W Bush 'Mission Accomplished' energy. they're trying to present 'removing' this weird and unhelpful discrepancy as a 'tax cut', even though it is currently not a 'tax' and would be easily rectified by any incumbent government facing this situation by just raising the allowance, because all pensioners would cause a hell of a storm were the government to forget to solve the discrepancy. and it totally ignores any possibility of the personal allowance being raised anyway

prevent first-time buyers from having to pay stamp duty! except there's been a 'temporary' lien for years so this is nothing

'maintain the ban on prisoners voting' is listed as an actual policy

6 notes

·

View notes

Text

This week, the Supreme Court will hear oral arguments in Moore v. United States, a case that centers on the mandatory repatriation tax (MRT). The MRT was enacted as part of the 2017 Tax Cuts and Jobs Act (TCJA) and required corporations to a pay a one-time tax on deferred foreign profits. These are profits that were earned by foreign subsidiaries of American businesses, but not returned home and therefore not yet subjected to U.S. taxation.

The plaintiffs, Charles and Kathleen Moore, argue that a ruling in their favor would ensure Congress could never impose a wealth tax. Many on the right oppose such a tax, most famously proposed by Sen. Elizabeth Warren (D-Mass.) and thus organizations like Americans for Tax Reform, the Cato Institute, FreedomWorks, and the Manhattan Institute have filed amicus briefs in support of the plaintiffs. In reality, the case has little to do with such a tax.

Rather, a ruling in favor of the Moores risks upending key elements of the current federal income tax and wreaking havoc on parts of the U.S. economy. As we detail with additional colleagues in an amicus brief in support of the respondent, the federal government, the Court should rule against the Moores and affirm the lower court ruling.

The Moores, shareholders in a manufacturing business based in India, were subject to the MRT on the business’s profits that had not yet been distributed to shareholders. The MRT rate is 15.5 percent if such profits were held in liquid assets such as cash or 8 percent if such profits were illiquid (invested in a factory abroad, for example). The TCJA allows taxpayers to pay the MRT in installments over eight years. The Moores’ MRT liability was approximately $15,000.

At enactment, the MTR was estimated to raise $338.8 billion and was used, in part, to finance the transition to a new system of taxing foreign profits of U.S. multinational corporations. To give a sense of the magnitude involved here: the entire TCJA was estimated to reduce revenue by $1.456 trillion, or just about four times the amount involved here.

Prior to the TCJA, the United States had a “worldwide” corporate income tax with deferred taxation of foreign profits. This meant that profits earned in a foreign country by U.S.-based multinational corporations first faced that jurisdiction’s corporate income tax. If and when those profits were repatriated to the United States, they were subject to additional taxation: the U.S. corporate tax minus a tax credit for any foreign income taxes paid. Because the U.S. corporate tax rate was among the highest in the world (35 percent), any foreign tax credit was almost never sufficient to fully offset additional U.S. tax.

This system created several perverse incentives. Corporations could avoid the additional U.S. tax by holding foreign profits overseas, which led to a significant accumulation of overseas profits. Prior to the TCJA, the Joint Committee on Taxation estimated that there were more than $3 trillion in retained foreign profits. The system also encouraged corporations to shift profits, mobile assets, and their headquarters overseas as strategies to minimize their tax liability.

The TCJA addressed these issues by moving to a “quasi-territorial” system. Under this system, U.S. corporations no longer face an additional U.S. tax when they repatriate earnings. At the same time, the TCJA enacted a minimum tax, without deferral, on foreign profits as a backstop. U.S. corporations now either pay a low-rate U.S. tax immediately on their foreign profits or not at all.

For foreign profits that were earned under the previous system but had yet to face U.S. tax, lawmakers decided that it would be an unfair windfall to completely excuse them from U.S. taxation. These profits had, after all, been earned with the expectation that they would eventually be subject to U.S. tax. And it would have been too complex to require corporations to track two stocks of profits for years or decades: pre-TCJA profits that would face tax when repatriated and post-TCJA profits that face no tax. It was far simpler and fairer to immediately wipe the slate clean with a one-time low tax on all existing unrepatriated profits.

The Moores disagree. They argue that the MRT is “an unapportioned direct tax in violation of the Constitution’s apportionment requirements.” There is an exception to this requirement: the 16th Amendment, which authorizes income taxation without apportionment among the states. But that amendment, they argue, only applies to taxes on realized income, while the MRT taxes unrealized income.

There is, however, no reason to think the MRT is unconstitutional. In fact, the Court need not even consider whether the 16th Amendment applies only to realized income for the simple reason that the MRT is not a direct tax. As an indirect tax, the MRT does not need to be apportioned among the states.

Court precedent clearly does not support the argument that a tax on foreign commerce is a direct tax. Historical sources are clear that all direct taxes are internal. In addition, the MRT is not a direct tax because it is a tax on the use of a certain business entity. Indeed, the Court cited similar grounds when, prior to the adoption of the 16th Amendment, it upheld the corporate income tax as an indirect tax.

Leaving aside any question of constitutionality, a ruling in favor of the Moores risks upending key elements of the income tax. A constitutional requirement that income be realized in order to be subject to tax would increase economic distortions, create policy uncertainty, and reduce federal revenue.

A realization requirement is undesirable because a realization-based tax system is economically incoherent. Economists generally favor one of two coherent tax bases: income or consumption. A realization-based income tax is neither. As a result, it creates economic distortions, such as an incentive to hold on to assets that have gone up in value, as well as unfairness, as equally well-off individuals are taxed differently based on when they buy and sell, and opportunities to avoid paying tax altogether.

A realization requirement would also introduce significant economic uncertainty by calling into question numerous provisions of the income tax that currently deviate from the realization principle. For example, partners in Subchapter K partnerships are taxed on their share of business profits whether or not those profits are distributed. This provision and many more could be subject to years of litigation. During this time, businesses could delay or forgo important investments.

A ruling in favor of the Moores could also put important pro-growth tax policy at risk. The current income tax system deviates from the realization principle by providing depreciation deductions. These provisions allow businesses to deduct the value of an asset prior to its disposal. Under a strict realization requirement, a taxpayer would need to wait until they sold or otherwise disposed of a fixed asset to deduct its cost, similar to how a corporate stock is treated under current law. Many proponents of pro-growth tax reform advocate for the immediate write-off (expensing) of some or all of the cost of these assets as an effective means of lowering the marginal effective tax rate on new investment. In fact, a key provision of the TCJA significantly strengthened this policy. A strict realization rule would risk upending this policy and would raise the effective tax burden on new investment.

A Moore victory could also reintroduce many of the problems with the taxation of multinational corporations that the TCJA sought to address. A realization requirement could undo elements known as Subpart F and GILTI, or global intangible low-taxed income, which tax foreign profits of U.S. multinational corporations without realization. Without these backstops, corporations would have a much greater incentive to shift profits and intellectual property into low-tax jurisdictions.

Besides introducing new economic distortions, a realization requirement could threaten a significant amount of federal revenue. The direct effect of a ruling would be a loss of hundreds of billions of dollars in revenue due to invalidation of the MRT. On top of that, the federal government also risks losing much more depending on the breadth of the ruling. Economist Eric Toder at the Tax Policy Center estimates that the federal government could lose more than $87 billion in 2024 and more than $124 billion by 2028 and every year thereafter. Congress may respond to this lost revenue by enacting taxes that are even more distortionary or by incurring even larger, and less sustainable, budget deficits.

Economists have long understood that whether or not income is realized, it is still income. Nevertheless, it is reasonable and prudent for administrative and other reasons for Congress to distinguish between realized and unrealized income in some situations. For example, measuring income from the appreciation of certain closely held businesses or other illiquid assets is difficult and Congress has reasonably decided not to subject those gains to tax until they are realized. On the other hand, the current tax treatment of partnerships is appropriate to avoid obvious tax avoidance: Such taxpayers could otherwise park their income in their business to avoid tax. It could also be reasonable for Congress to design a system to tax unrealized gains that are easy to measure, such as those that arise from the appreciation of publicly traded assets.

Finally, there is an additional, and somewhat peculiar, aspect to this case. The Moores and several amici argue that the realization requirement they believe is inherent to the 16th Amendment means that a wealth tax, unless apportioned, would also be unconstitutional. It appears as if this logic has served to motivate much of the support behind them.

While we agree that any plausible wealth tax would likely be unconstitutional, there are obvious problems with the Moores’ claim that the MRT is nothing like a wealth tax. A wealth tax applies to the full value of an asset each year. As such, it would not matter whether an asset appreciates or not: A taxpayer would be subject to tax as long as the asset had positive value. In contrast, the MRT applies to earnings and profits of a foreign enterprise, not the value of the foreign enterprise. If the Moores’ foreign business earned no profit or if prior profits had already been repatriated, they would have owed no additional tax.

Given the risks and economic shortcomings of a realization requirement, the Supreme Court should not enshrine it in the Constitution. Instead, Congress should be free to decide whether and how to tax unrealized income.

6 notes

·

View notes

Text

About the Achievements of Uzbekistan's Economy: Anvar Mullabekov's Perspective

Anvar Mullabekov is a businessman from Tashkent whose professional activities are closely related to the aviation industry. He is well-known in his professional field both in his homeland and beyond.

Recently, the second Tashkent International Investment Forum (TIIF-2023) concluded, confirming the growing interest of the global business community in Uzbekistan's investment development.

Anvar Mullabekov closely follows such significant economic and financial events in Uzbekistan. His education and experience in Innovation Management and Financial Management, as well as his training at Stanford University and in London, enable him to deeply understand the importance and impact of such events on the country's economy and the region. Anvar Mullabekov's specialization in aviation leasing, financing, insurance, and aviation risk management makes him interested in events that can stimulate growth and innovation in these industries. Anvar Mullabekov actively participates in projects not only in Central Asia but also in European countries, the Middle East, Africa, and the Asia-Pacific region. This means that he is directly involved in international investments and business projects. The successful conduct of major economic forums like TIIF-2023 can contribute to attracting investments and expanding business connections, which, in turn, will have a positive impact on his own projects and interests.

TIIF-2023 gathered around 2,500 representatives from the business and financial sectors from 70 countries, including the USA, EU, UK, Turkey, China, India, Egypt, CIS countries, Southeast Asia, and the Middle East. This is a significant growth compared to the first similar forum in 2022, which was attended by more than two thousand guests from 56 countries.

While last year saw the signing of 105 documents totaling $7.8 billion, TIIF-2023 resulted in 164 agreements and contracts worth $11 billion. These figures clearly demonstrate the expanding interest of foreign investors in cooperation with Uzbekistan.

Anvar Mullabekov believes that the success of TIIF-2023 is due to Uzbekistan confidently gaining momentum in its economic growth during the post-pandemic period amid the turbulence of the global economy. The country's gross domestic product increased by 5.5 percent in the first quarter of 2023. The favorable investment climate of Uzbekistan has also undergone significant improvements.

During TIIF-2023, it was noted that after the 2022 forum, systemic reforms aimed at further liberalizing the economy were accelerated.

In the field of taxation, the value-added tax rate was reduced from 20 percent to 12 percent. Dividend income received by foreign investors from shares is exempt from income tax for a period of three years, and the corporate income tax rate for them is also reduced from 20 percent to 12 percent.

Anvar Mullabekov is confident that such measures stimulate the inflow of foreign investments and contribute to the development of local entrepreneurship. Uzbekistan is actively developing its infrastructure, establishing industrial parks and technopolises, which creates new opportunities for investors and enables job creation for the population.

Additionally, Uzbekistan collaborates with international financial institutions and implements large-scale infrastructure projects, which also serves as an additional incentive for foreign investors.

Diversification of industrial production and innovative activities is an important direction for the country's economic development. Uzbekistan seeks to create conditions for the growth of high-tech industries, making the country attractive to technology companies and research centers.

Anvar Mullabekov is convinced that overall, the increasing interest in Uzbekistan from foreign investors and the successes in implementing economic reforms are important indicators of the country's stable and sustainable development. However, it is crucial to continue working in this direction

3 notes

·

View notes

Text

Helsingin Sanomat carries an editorial on the ongoing government formation talks at the House of the Estates, and their likely impact on trade unions.

HS says that the four right-wing parties engaged in coalition talks have some big disagreements, primarily on immigration and climate change, but there is a consensus on labour market reforms.

Finland's generous income-linked unemployment benefits face a shakeup, according to HS, with payments set to be tapered. That means they will be higher at the start of a stretch of unemployment, but reduce over time as the two-year-eligibility period expires.

The National Coalition Party also wants to eliminate the tax deduction for trade union membership fees, effectively making membership of trade unions more expensive.

HS suggests that the intention is to push union members to join YTK, a fund that offers eligibility for unemployment benefits but does not negotiate pay rises for members or offer many of the other services that come with union membership.

That would weaken the trade unions' voice in society, says HS, likely prompting protests and a vote for the left in the next parliamentary elections — thereby increasing polarisation and features of a two-party system in Finland.

That said, HS warns that a new government is still some way off, and even if it is formed it might not last the distance due to dissent among the ranks of government parties.

Foreign students seeking work

Kauppalehti reports on a hot topic: foreign graduates looking for work. The paper focuses on those from India, interviewing two students hoping to stay in Finland after they finish their degrees.

India has a surplus of workers, says KL, meaning the government there is very happy for young people — even highly educated people — to seek higher incomes and a better life abroad.

The Indians interviewed for the story say they love Finland. India's pollution, corruption and "difficult atmosphere" weigh heavily on their minds, and they love the Finns' peaceful nature and the quality of life obtainable in Finland.

Back in India, one is a university teacher and the other manages a factory. But they are not so optimistic that they expect to find work in their fields in Finland.

One studying business administration says she'll do any work anywhere in the Nordic country, while the factory manager says he is considering driving a truck because he has the licence and it does not require Finnish language skills.

The stats are against them. Finland ranks fourth in the European Union for graduate employment, among graduates from outside the European Economic Area. But that still means only 13 percent of graduates from outside Europe get a job.

KL says that the job search is different in Finland.

"In India jobs are found through networks, but in Finland jobs are generally filled via application processes and according to [candidates'] merits," said KL.

That may come as a surprise to researchers who found recruiters discriminated extensively against those with foreign names.

Speeding fine

Ilta-Sanomat has a classic Finnish story: the quirky news report picked up internationally and then reported through the prism of the foreign news desk interpretations.

Anders Wiklöf, a shipping magnate from Åland, has received a humongous fine for speeding. He was clocked at 82 km/h in a 50 km/h zone, and was fined 121,000 euros.

That's because Finland has a system of income-linked fines for some offences, and Wiklöf's income is pretty high.

The penalty sounds pretty tough to foreign ears, however, and IS notes that the story was covered by The Guardian, the Daily Mail, ABC News and even AS, in Spanish.

The tabloid neglects to credit the original source, however. That appears to be the Aland outlet Nya Åland, which reported the fine two days ago.

Wiklöf had told the paper that he regretted the fine, and had just not slowed down enough when the speed limit changed. He did have a request for those handling his contribution to public coffers, though, suggesting that he has followed government formation talks closer than some.

"I have heard that they are planning to cut 1.5 billion euros from healthcare spending in Finland, so I hope my contribution can fill a gap there," Wiklöf told Nya Åland. "Ideally I'd like it to be earmarked for that purpose."

2 notes

·

View notes

Text

BNP Paribas AM: Investment Outlook for 2025

The Investment Outlook for 2025 highlights a year of significant economic and market transitions. With inflation under control, central banks are poised for easing cycles, offering new opportunities for investors. At the same time, geopolitical and environmental challenges underscore the importance of resilience, diversification, and thematic investing. Key Themes and Strategic Insights 1. Navigating Macroeconomic Shifts - Soft Landing or Recession Risks: - Markets anticipate a soft landing, but scenarios such as renewed inflationary pressures or a hard landing remain possible. - Global central banks, including the Federal Reserve and European Central Bank, are expected to cut rates to support growth. - Regional disparities persist, with the U.S. outperforming Europe, while China focuses on stabilizing its property market and stimulating emerging industries.

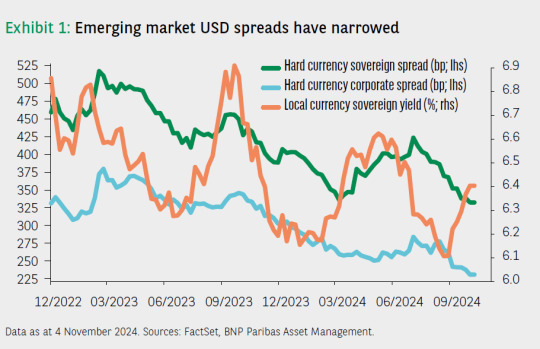

- Geopolitical Dynamics: - The re-election of Donald Trump introduces uncertainty, with potential shifts in U.S. tax policies, trade agreements, and global economic ties. - Geopolitical hotspots (e.g., Ukraine, Taiwan, Israel) create additional risks for markets. 2. Sustainability and Thematic Investments - Transition Finance: - Investments targeting decarbonization and sustainable operations in high-emission sectors (e.g., energy, heavy industry) are gaining momentum. - EU regulations like ESMA’s fund naming guidelines in 2025 will enhance transparency and accountability in transition investments. - Climate Adaptation: - Climate resilience strategies, including infrastructure upgrades and disaster response, are becoming central to investment portfolios. - Water scarcity solutions (e.g., smart irrigation, water treatment) present a diverse and resilient investment opportunity. - Natural Capital: - Regenerative agriculture, forestry, and water resource preservation are key areas for achieving both economic stability and sustainability goals. - Governments and institutions increasingly prioritize biodiversity and ecosystem restoration. 3. Equity Markets: Favoring Resilience - U.S. Market Leadership: - U.S. equities remain attractive due to fiscal stimulus and advancements in technology, particularly artificial intelligence (AI). - Small caps and value stocks are positioned for recovery as interest rates decline. - European Equities: - Europe lags due to structural challenges in Germany and geopolitical headwinds, but exporters benefit from robust U.S. growth. - Consumer-driven sectors depend on stronger demand recovery. - Emerging Markets: - Markets like India and Southeast Asia offer growth potential, driven by demographics and policy reforms. - China’s success in revitalizing its economy remains a critical swing factor. 4. Fixed Income: Life Beyond Cash - Opportunities in Bonds: - Investment-grade credit offers stable returns amid easing monetary policies. - U.S. mortgages and emerging market local currency bonds provide attractive yields. - Active Management: - A steep yield curve and higher real yields favor active strategies to capitalize on dispersion and timing. - Quantitative Tightening: - Central banks unwinding quantitative easing introduce volatility, creating arbitrage opportunities in fixed income markets.

5. Private Credit and Alternatives - Private Credit Expansion: - Private credit markets are democratizing, with innovations like ELTIF 2.0 making them accessible to retail investors in Europe. - Partnerships between asset managers, banks, and insurers streamline the credit chain. - Sustainability in Private Credit: - Investors increasingly demand ESG-compliant frameworks, pushing managers to develop robust methodologies for evaluating borrowers’ sustainability practices. - Infrastructure and Real Assets: - Renewable energy projects, energy-efficient buildings, and digital infrastructure investments align with long-term structural trends. Strategic Asset Allocation - Equities: - Overweight U.S. equities, particularly AI and technology sectors. - Focus on value opportunities in Europe and growth-oriented emerging markets. - Fixed Income: - Emphasize high-yield credit, local currency emerging market bonds, and inflation-linked securities. - Active duration management to navigate rate volatility. - Private Markets: - Leverage private credit for stable yields and diversification. - Real assets, including infrastructure and water solutions, provide inflation hedging and long-term growth. - Sustainability: - Prioritize transition finance, climate adaptation strategies, and natural capital investments. 2025 presents a landscape of opportunities driven by sustainability, technological innovation, and economic recovery. Investors should adopt a balanced and flexible approach, leveraging thematic investments, private markets, and active management to navigate risks and capture growth. Resilience, diversification, and long-term sustainability remain key to optimizing portfolios in an evolving global environment. Read the full article

0 notes

Text

Best Income Tax Services in India, Best GST Services in India, and Best Corporate Services in India by Tax Bucket

Managing taxes, complying with regulations, and handling corporate services efficiently is critical for the smooth functioning of a business in India. Whether you are an individual or a business owner, dealing with complex tax systems, GST filing, and corporate compliance can be challenging. However, with the right guidance and services, these processes become much easier and more manageable. Tax Bucket is one of the leading service providers in India, offering the best income tax services in India, best GST services in India, and best corporate services in India.

In this blog, we will explore why Tax Bucket stands out as a trusted partner for businesses and individuals in India and how their expert services can help you navigate the complexities of income tax, GST, and corporate compliance.

Best Income Tax Services in India by Tax Bucket

Income tax is an essential aspect of any financial planning. As the Indian tax landscape becomes more complex with frequent changes, it is crucial to seek professional advice to ensure compliance and minimize tax liabilities. Tax Bucket offers the Best Income Tax Services in India, tailored to meet the needs of individuals, startups, and large enterprises.

1. Tax Filing and Return Preparation

Filing income tax returns (ITR) accurately and on time is crucial to avoid penalties and legal complications. Tax Bucket provides expert tax filing services, helping individuals and businesses file their tax returns in accordance with the latest tax laws. Whether it’s ITR-1 for salaried individuals or ITR-3 for professionals and businesses, Tax Bucket ensures all necessary forms are filed correctly. Their team ensures that you benefit from all eligible tax deductions and exemptions, which can reduce your overall tax burden.

2. Tax Planning and Advisory

Effective tax planning is vital for individuals and businesses to minimize tax liabilities while remaining compliant with the law. Tax Bucket offers tax advisory services, helping you plan your finances in a tax-efficient way. Their expert advisors review your financial situation and suggest strategies that can help you reduce your taxable income, maximize deductions, and take advantage of various exemptions available under the Income Tax Act.

3. Tax Consultation for Businesses

For businesses, tax compliance can be especially complicated due to the variety of taxes, including income tax, capital gains tax, and more. Tax Bucket offers specialized business tax consulting services that focus on corporate tax issues, transfer pricing, tax audits, and more. Their professionals help businesses comply with tax regulations while optimizing their tax liabilities.

4. Handling Tax Notices and Audits

If you receive any tax notices from the Income Tax Department or are selected for an audit, it can be a stressful experience. Tax Bucket’s team assists in handling tax notices and audits. They provide comprehensive support, representing your interests before the tax authorities and ensuring that your business or personal finances remain in good standing.

Best GST Services in India by Tax Bucket

The Goods and Services Tax (GST) has reformed the Indian taxation system by consolidating various indirect taxes into a single system. However, navigating GST regulations can still be challenging for many businesses. Tax Bucket offers the Best GST Services in India, making GST compliance easy and hassle-free for businesses of all sizes. Here's how Tax Bucket can help you with GST-related tasks:

1. GST Registration Services

If your business crosses the GST threshold or if you are involved in interstate sales, GST registration is mandatory. Tax Bucket offers GST registration services for businesses across India. Their team ensures that your business is registered under GST, obtains the GSTIN (GST Identification Number), and complies with all the requirements of the GST Act. They help you choose the appropriate GST scheme based on your business type and turnover, including the Composition Scheme, Regular Scheme, and more.

2. GST Filing and Returns

Filing GST returns accurately and on time is essential to avoid penalties and interest. Tax Bucket helps businesses with GST return filing services, including GST returns like GSTR-1, GSTR-3B, GSTR-9, and others. Their team ensures that all transactions, input tax credits, and GST liabilities are reported correctly, reducing the risk of errors. Tax Bucket also helps businesses reconcile their sales and purchase invoices with GST returns, ensuring that everything is in order.

3. GST Consultation and Advisory

GST laws can be intricate and complicated for business owners to navigate without expert help. Tax Bucket offers GST advisory services to businesses, guiding them on the best practices for GST compliance. Their team offers tailored advice on GST exemptions, refunds, input tax credit, reverse charge mechanisms, and more. They ensure your business is compliant with the latest GST amendments and that you are utilizing the full benefits of the GST regime.

4. GST Audit and Support

Tax Bucket provides GST audit services, ensuring that your GST filings are accurate and meet the requirements of the GST Act. They assist businesses in preparing for GST audits by reviewing records and transactions, identifying potential discrepancies, and helping rectify errors before an audit takes place. Their expert team ensures that you avoid any unnecessary penalties and that your business stays fully compliant with the GST framework.

Best Corporate Services in India by Tax Bucket

Running a business in India involves managing various corporate responsibilities such as legal compliance, registration, filings, and much more. Tax Bucket provides the Best Corporate Services in India, offering a full range of services that help businesses thrive while remaining compliant with local laws and regulations.

1. Company Registration Services

Starting a business in India requires proper legal registration. Tax Bucket provides company registration services to help businesses establish themselves as legal entities. They assist with the registration of Private Limited Companies, Limited Liability Partnerships (LLPs), and Sole Proprietorships. Tax Bucket handles the paperwork and all necessary filings with the Ministry of Corporate Affairs (MCA), making the process smooth and hassle-free.

2. Corporate Compliance Services

Every company in India must comply with numerous regulatory requirements, such as filing annual returns, conducting board meetings, and maintaining statutory records. Tax Bucket offers comprehensive corporate compliance services to ensure that your company stays up to date with its obligations. Their team handles compliance with the Companies Act, corporate governance, filings with the MCA, and more, helping your business avoid legal issues.

3. Business Licenses and Permits

Depending on the nature of your business, you may need various licenses and permits to operate legally. Tax Bucket provides services to obtain business licenses and permits such as FSSAI, MSME registration, Import-Export Code (IEC), and more. Their team ensures that your business is compliant with industry-specific regulations, helping you avoid fines and penalties.

4. Secretarial Services

A company must maintain its corporate records and governance structures according to the law. Tax Bucket provides secretarial services that include maintaining company records, drafting resolutions, preparing minutes of meetings, and filing necessary forms with regulatory authorities. Their corporate secretarial services ensure that your company operates smoothly and in line with legal standards.

5. Director and Shareholder Services

Tax Bucket helps businesses with director and shareholder-related services, including managing appointments, ensuring compliance with the Companies Act, and filing necessary documents with the MCA. Their team also assists with share transfers, issuing share certificates, and other shareholder-related activities.

Why Choose Tax Bucket for Income Tax, GST, and Corporate Services?

There are several reasons why Tax Bucket is considered a top choice for income tax services, GST services, and corporate services in India:

Expertise and Experience: Tax Bucket has a team of highly qualified professionals, including tax consultants, accountants, and legal experts, with extensive experience in handling a wide range of tax and corporate matters. They stay updated with the latest laws and regulations, ensuring that their clients always benefit from expert advice and support.

Comprehensive Solutions: Tax Bucket provides end-to-end solutions, covering everything from tax filing to corporate registration and compliance. Whether you are an individual or a business, Tax Bucket offers services that meet your specific needs.

Timely and Efficient: Tax Bucket understands the importance of time in business operations. They offer timely services, ensuring that all filings, registrations, and compliance requirements are completed promptly and accurately.

Customer-Centric Approach: Tax Bucket focuses on building long-term relationships with clients. Their team takes the time to understand your unique requirements and offers personalized services that align with your business goals.

Conclusion

Choosing the best income tax services in India, best GST services in India, and best corporate services in India is essential for ensuring the smooth operation and compliance of your business. Tax Bucket offers a comprehensive range of expert services that cater to all your needs, whether you are an individual taxpayer or a business owner.

With their professional guidance and support, you can rest assured that your taxes are filed correctly, your GST returns are compliant, and your business is running smoothly in accordance with Indian corporate laws. Partner with Tax Bucket today and experience hassle-free tax management, GST compliance, and corporate services that allow you to focus on growing your business.

0 notes

Text

Old vs. New Tax Regime: Budget 2025 to Bring Key Updates

The Indian tax system could be on the verge of a significant overhaul as Finance Minister Nirmala Sitharaman prepares to present Budget 2025. The big question on everyone’s mind: Will the old income tax regime be discontinued permanently?

The government introduced the new tax regime in 2020, aiming to simplify taxation with lower rates and fewer exemptions. Since then, over 72% of taxpayers have shifted to the new system for the Assessment Year 2024-25. However, a complete phase-out of the old regime has sparked intense debate among taxpayers and experts alike.

Old vs. New Tax Regime: The Debate

The new tax regime has been lauded for its simplicity. Taxpayers no longer need to maintain detailed records or file deductions, making compliance easier. “The increased adoption of the new regime indicates a move toward a simpler tax system,” says Rahul Charkha, Partner at Economic Laws Practice. Employers also find the new system easier for payroll processing, as it reduces the need to verify extensive documentation.

However, critics argue that the new regime doesn’t suit everyone. Many middle-class taxpayers, who rely heavily on exemptions like house rent allowance (HRA) or Section 80C investments, may face higher taxable incomes and tax liabilities under the new system. Gaurav Makhijani, a Chartered Accountant, explains, “For those dependent on deductions and exemptions, the shift could mean rethinking their financial strategies.”

What to Expect in Budget 2025?

While the complete discontinuation of the old tax regime seems unlikely in this budget, the government may take further steps to promote the new system. Experts anticipate changes like revised tax slabs, selective deductions, and enhanced pre-filled forms to encourage adoption.

Amit Gupta, Tax Partner at Saraf and Partners, points out that the new regime offers clearer tax savings for a smaller group of taxpayers. He suggests that better incentives could help bridge this gap and make the new system more attractive.

A Lesson from Global Reforms

India can look to countries like Italy, which successfully transitioned to a simplified tax system through gradual reforms. By reducing tax brackets over time, Italy ensured taxpayers could adapt without disruption. A similar phased approach could help ease the transition in India while maintaining compliance.

Awaiting the Verdict

With less than two months to go, Budget 2025 has taxpayers on edge. Whether the old tax regime will finally sunset remains uncertain, but the push toward a unified and simplified tax structure is undeniable. For now, the focus remains on creating a system that balances simplicity with fairness.

For latest news India updates in Hindi, subscribe to our newsletter.

#werindia#leading india news source#top news stories#top news headlines#national news#top news of the day#latest national news#business news India#business

0 notes

Text

India Courier, Express, and Parcel (CEP) Industry: Market Overview and Growth Prospects

The Courier, Express, and Parcel (CEP) industry in India has witnessed robust growth over the past decade, driven by rapid advancements in e-commerce, increasing demand for logistics solutions, and the country's growing middle class. As one of the largest and fastest-growing economies in the world, India offers significant opportunities for companies within the CEP sector. This blog explores the market dynamics, key drivers, challenges, and future outlook for the CEP industry in India.

Market Overview

The India Courier, Express, and Parcel (CEP) market is projected to be valued at USD 8.58 billion in 2024 and is anticipated to grow to USD 15.93 billion by 2030, registering a compound annual growth rate (CAGR) of 10.87% during the forecast period from 2024 to 2030.

India's CEP industry has evolved into a vital component of the country’s logistics infrastructure, playing a critical role in connecting consumers, businesses, and markets across the nation. The sector is responsible for the swift and efficient movement of parcels, documents, and goods, both domestically and internationally.

The Indian CEP market is valued at approximately USD 22 billion in 2024, with expectations for continued expansion. This growth is fueled by the increasing demand for fast, reliable delivery services, particularly in the wake of digital transformation and the rise of e-commerce platforms like Flipkart, Amazon, and Myntra.

Key Drivers of Growth

E-commerce Boom The exponential growth of e-commerce has been a game-changer for India’s CEP industry. Online shopping has gained immense popularity among urban and rural consumers alike, driving the demand for faster delivery services. Companies like Amazon and Flipkart have played a pivotal role in boosting the market, as their business models rely heavily on a robust, efficient CEP network for last-mile delivery. Furthermore, the rising number of small and medium-sized enterprises (SMEs) that rely on CEP services to reach customers nationwide is adding momentum to the sector.

Technological Advancements The integration of technology has been instrumental in streamlining the operations of CEP companies. The use of AI, machine learning, and data analytics has enhanced route optimization, inventory management, and customer tracking, leading to faster and more accurate deliveries. In addition, the rise of mobile applications has made it easier for consumers to track their parcels in real-time, improving customer satisfaction and convenience.

Government Initiatives The Indian government’s push to improve the country's infrastructure through the ‘Make in India’ and ‘Atmanirbhar Bharat’ initiatives has provided a conducive environment for the growth of the CEP industry. The development of express highways, better connectivity, and increased foreign direct investment (FDI) in the logistics sector have significantly boosted the sector's ability to handle the increasing volume of shipments. Additionally, reforms in taxation, such as the implementation of the Goods and Services Tax (GST), have streamlined the movement of goods across state borders, improving overall efficiency.