#Ignoring Broker-Specific Requirements

Explore tagged Tumblr posts

Text

Maximize Your Forex Profits: A Guide to Margin Calculators for Funded Traders Global

Discover how margin calculations are essential for successful forex trading, especially for Funded Traders Global members. This article explores the significance of margin, the risks associated with margin trading, and the role of margin calculators in optimizing trading strategies. Learn how to use margin calculators effectively, choose the right type for your needs, and avoid common mistakes. Join Funded Traders Global and elevate your forex trading with precision and profitability.

#Accessing a Margin Calculator#Accurate Position Sizing#Automating Calculations#Avoiding Margin Calls#Benefits of Using a Margin Calculator#Broker-Provided Calculators#Common Mistakes to Avoid#Comparing and Contrasting Margin Calculator Types#Definition of Margin#Effective Risk Management#Enhanced Decision-Making#Forex Trading#Forex Trading for Beginners#FTG Prop Firm#FTG Trading#How Margin Works and Its Significance#Ignoring Broker-Specific Requirements#Leverage-Induced Losses#Margin Calculator#Margin Calls#Market Volatility#Maximize Your Profits with a Margin Calculator for Forex Trading#Neglecting to Update Data#Online Margin Calculators#Overleveraging#Prop Trading Firm#Receiving Calculation Results#Recommendations Based on Trader Needs and Preferences#Risks Associated with Margin Trading#Simplifying the Margin Calculation Process

0 notes

Text

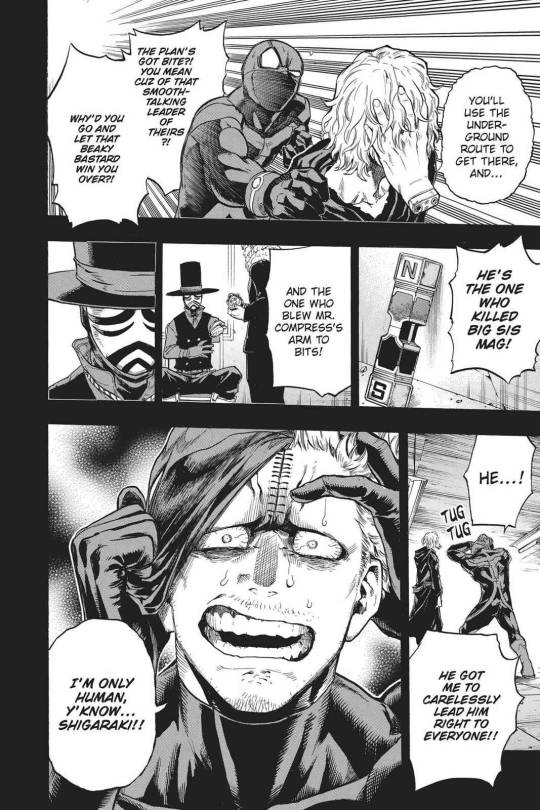

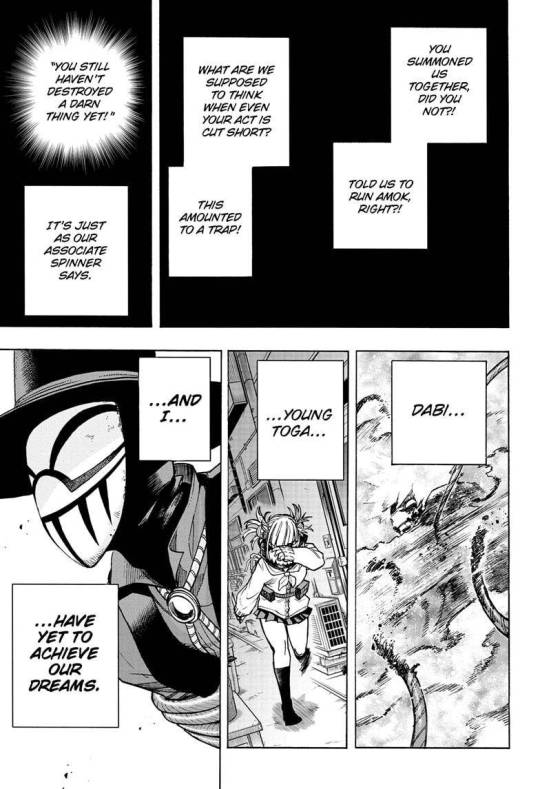

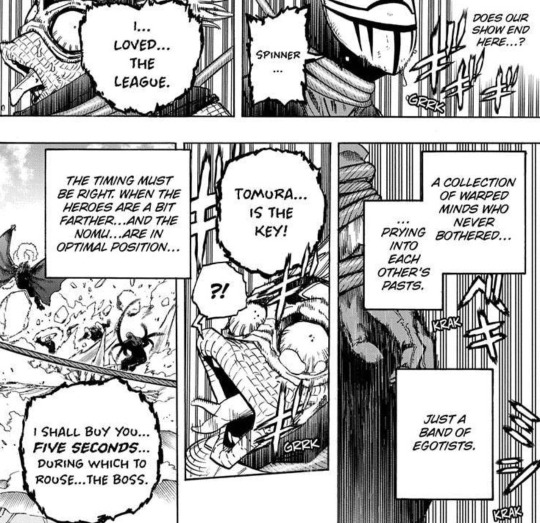

after sitting with my thoughts about the epilogue for some time, I think the thing that broke the story had started right after Dabi's dance. said thing is LOV' utterly out of character treatment of each other and Shigaraki specifically.

them just standing there and passively observing the scene makes absolutely zero sense, if you use anything from their previously established relationships within the organisation for reference. especially with All for One's creepy comments. Spinner even points out shortly before this chapter that AFO!Shigaraki seems nothing like his normal self and this person is not the one he had chosen to follow.

and yes, Spinner does approach screaming Shigaraki and tries to help him, and his concern later leads him to seeing Shigaraki's mutated form in the cave, and on its own this development for Spinner is in line with his character and all around fine. pretty reminiscent of Toga and Twice, too.

(except Spinner is not allowed to really help Shigaraki in any way, unlike Toga was allowed to help Twice, and this entire thing between Shigaraki and Spinner only ends with Spinner's regrets and survivor's guilt instead of anything good or meaningful that isn't meaningless angst porn)

it isn't Spinner approaching Shigaraki that is the issue, it's the other's complete lack of action or even reaction besides appearing mildly disturbed. this is simply out of character for all of them, just judging by Twice's example who had similar breakdowns and wasn't plainly ignored by the others until his fit stops. this reaction makes even less sense, when you take into account the current state of the League. Twice had just been murdered by Hawks, the double agent who had infiltrated the League via Dabi, and Mister Compress had just sacrificed himself to give the League a chance for escape, and was sent to Tartarus immediately after his condition was no longer life threatening. Kurogiri is also being held captive by the heroes. there are only four of them left, with two dead and two captured. and none of them even mention the dead or the captured outside of the context of Kurogiri and his quirk.

this straight out makes no sense if you look back to the Overhaul arc and remember how far Shigaraki and the rest of them were willing to go to avenge Magne's death and Mr Compress' destroyed arm. this was important.

the event had motivated Shigaraki to be a better leader, because he had realized these people depend on him, and he won't let them be hurt under his protection. it had started the seed of self-doubt in Jin which would eventually grow to the desperation that allowed him to overcome the mental block against his quirk in the MVA arc, because he wanted to do everything he possibly could to help the League. it allowed him to make his clones despite the crippling trauma, because he saw Toga's hurt, bleeding body, and he didn't want her to die.

even fucking Giran, a broker whose very profession requires him to care about himself and his own well-being first and foremost, had sacrificed all of his fingers to prevent Redestro from getting his hands on the League. because he wants to protect them, to save them. and then we never actually see his mutilated hands or hear anything from him ever again.

and when Twice actually dies? all we get in response to that are two upset faces from Dabi and Toga's fury. that's it.

i really want to stress how out of character this barely-present reaction is, because Magne's example is right there and when Overhaul had killed her, the League knew each other for no longer than a month. this League has been together for at least half a year, had been through thick and thin together, had spent months on the run, homeless, having no one but each other to rely on, has defeated the Meta Liberation Army, quite literally, with the power of their friendship. they all cared enough about each other and Shigaraki specifically to stay with him during those months they had to fight Gigantomachia with barely any breaks for rest, still homeless, barely scraping by. it was imperative that they all survive through this together, especially for Shigaraki, who had went on this quest of getting stronger at least partly so that he would become a more reliable protector for the League. and when Twice falls victim to the hero who had murdered him in cold blood, because no one except for Dabi was there to save him, Shigaraki doesn't even get to react to Twice's death, and possibly never even learns about the fact.

on topic of Dabi, his reaction being exactly two frames of sad expressions and including the footage of Twice's murder into his broadcast, and ending immediately after that, also makes no sense. Dabi is someone who holds himself accountable and despite his declarations, cares about the League, it's the very reason he was keeping Hawks from the League and sprinted to Twice as soon as he realized Hawks' intentions with him, to protect him. Dabi's unsuccessful attempt to save Twice is another iteration of Overhaul, a combination of Shigaraki and Twice's roles in the tragedy. but unlike Shigaraki, who had steeled himself into taking care of his subordinates and becoming a responsible and strong leader, or Twice who had never forgotten about his role in the incident, Dabi just somehow forgets about the entire thing as soon as the first war is over. Toga is the one whom the narrative allows to actively react to Twice's death and express her grief. it makes sense that her reaction would be the strongest, as she was the closest with Twice, but why are two LOV members no longer allowed to care about the same incident at the same time? why aren't they allowed to protect each other anymore, when Giran, who is not even in the League, had made that sacrifice for them?

These are pretty small things, but it's these instances of Toga and Dabi preventing Machia from being injected with the sedative, protecting the League that are sorely missing in the second war.

and the biggest act of devotion and protection to the League, which was the last time we saw anything like this for them, Mister Compress' last moments with the League.

Mutilating his own body just to buy them five seconds to possibly escape. Because he loved the League, because he wanted all of them to be happy and achieve their dreams, to be free, and to live.

and in return for the favour, not only do they not come back for him like they did for Kurogiri (because his quirk is important for the plot, while Compress' isn't), but none of them mention Compress ever again. same with Twice (with the exception of Toga), same with Magne. from this point onwards, none of them are allowed by the plot to even care about the League of Villains. the interpersonal relationships between two individuals still shine through, occasionally, like Spinner's devotion to Shigaraki (and him alone), Dabi and Toga's pyromaniac trauma lane visit to her house and him giving her Twice's blood, Kurogiri reaching out to Shigaraki in the very end. but what about the League? ahd what about the dead members of the League, or Mister Compress?

somehow, at the point of the final war it boils down to the generalized conflict of heroes vs villains and the morality gymnastics involved in the concept. on its own, this would have been an okay development, if the examples the story was using to prove its point weren't people who had become very close friends and who had lost four people to this war against the heroes.

if the individual conflicts, like Toga's desperation to be acknowledged as human being deserving of affection, Dabi's familial abuse trauma and Shigaraki's lifelong manipulation by All for One not giving him any chance to be saved at all, were the finishing line of the villains' story development, why join them within the League at all? LOV is a separate concept functioning as a collective uniting all these villains, giving them a place to belong and people who give a fuck whether they live or die. except not anymore, because for some reason after the first war this concept is scratched completely.

so why not make them mere acquaintances who sometimes collaborate to bother the heroes together, if the bond between them got in the way of the story and wasn't the point of the story? why prove the depth of their bond with the Overhaul and My Villain Academia arcs? why make Shigaraki develop relationships and a sense of responsibility for these people at all, if in the very end his desire to save these people is denied by the author himself?

the previous arcs have spent a great deal of effort establishing that the villains are human too. they have human feelings, human desires and human relationships. so why is it that in the final arc their ability to experience human emotions towards each other is turned on and off manually by the author? at the very end even the author stops pretending like anything happening to the villains is evaluated on the scale of human experiences (unlike the heroes, whose injuries and deaths are talked about and mourned in great detail) and Kurogiri and Shigaraki are wiped out like plot inconveniences rather than important and well written characters.

honestly? it's ironically meta that the story ended up proving the very point it has spent 400 chapters arguing against.

#join me on my bnha ending hate campaign episode 2736#bnha#boku no hero academia#bnha critical#bnha spoilers#league of villains#shigaraki tomura#shimura tenko#spinner#shuichi iguchi#mister compress#atsuhiro sako#kurogiri#toga himiko#dabi#todoroki touya#long post

369 notes

·

View notes

Text

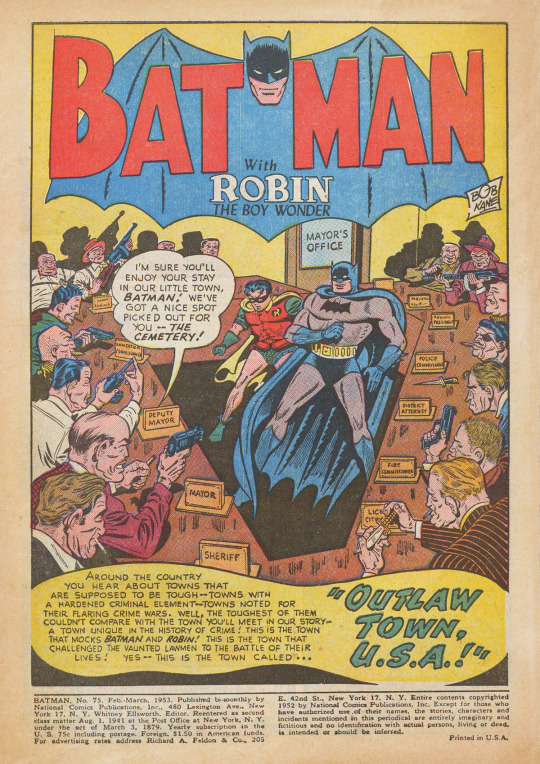

February-March 1953. A recurring motif in Golden Age Batman stories is a specific type of demimonde, where the institutions of respectable society are mirrored in the world of criminals and outlaws. For example, in David Vern Reed's "Outlaw Town, U.S.A.!" (BATMAN #75, above), the old mining town of Silver Vein, "in the mountains near Death Valley," has become a haven for 2,000 gangsters and wanted men, taking advantage of an old law allowing self-governance without state interference. This libertarian environment is not only a hideout, but has developed a booming local economy, full of hotels, casinos, and shops of all kinds. As a narrative caption notes, "Yes, Silver Vein has everything--newspapers, hotels, restaurants, theatres--everything but law!"

In the 1943 story "License for Larceny" (DETECTIVE COMICS #72), by Joe Samachson, J. Spencer Larson, a respectable and seemingly legitimate investment broker, has created a complete miniature ecosystem of law, capital, civil government, taxation, and criminal justice: As "Larry the Judge," he requires other criminals to purchase licenses to commit crimes, taxes them a percentage of their loot, and hires an army of uniformed men to enforce these rules. Those accused of violating the "law" must stand trial, with Larson presiding as judge, and pay a fine — or worse.

The story explains that Larson has established this setup by using funds from his investment clients (which include Bruce Wayne and Dick Grayson) to pay his men, and then using his cut of the crimes committed under his licenses to pay impressive dividends to investors — whom he promptly arranges to have robbed! It's a potent piece of satire: capital as extortion and outright theft, where the only real difference between a gangland enforcer and a cop is the uniform, and the idea of economic mobility is largely a fiction to line the pockets of those in power. Just like the real world, in other words!

While Larson demonstrates no particular remorse, it was fairly common for Golden Age Batman stories, especially in the 1940s, to present characters caught in these demimondes as conflicted or tragic figures. The most familiar (and most extreme) example is Two-Face, first seen in DETECTIVE COMICS #66, who teeters between respectable society and the underworld on the flip of a coin, but there were others as well, like Matthew Thorne, the Crime Doctor (or Crime Surgeon, as he's called in his second appearance), "doctor of medicine...and doctor of crime!!" First seen in DETECTIVE COMICS #77 and probably inspired by the 1938 Warner Bros. film adaptation of Barré Lyndon's THE AMAZING DR. CLITTERHOUSE, starring Edward G. Robinson, Thorne is a respectable surgeon who can't resist the thrill of crime. He establishes a "Crime Clinic" where he offers "prescriptions" to help other crooks with their rackets, occasionally making "house calls" to assist directly in exchange for half the loot — essentially a variation on Larry the Judge's racket.

In his second appearance in BATMAN #18 (above), Thorne has lost his medical license, but he can't entirely ignore his Hippocratic Oath, actually performing surgery to save Robin's life after the Boy Wonder is shot by one of Thorne's men. He's eventually killed by another of his men, whose sick wife Thorne had promised but failed to save. In these stories, the overlap between worlds is not sustainable (except for Batman and Robin), and generally must be resolved by either regeneration or death.

While fighting crime was of course the central preoccupation of the Batman strip, one can also see variations of the demimonde motif in other types of Golden Age Batman stories, in particular the various excursions into the fantastical. Neither the Mars of "Batman, Interplanetary Policeman!" nor the 31st Century of Brane Taylor is an underworld, although they do of course have crime for Batman and Robin to fight, but settings like those have certain similarities with the strip's various criminal demimondes: They are worlds complete unto themselves; they are in some way cloistered; and Batman and Robin's access to them is relatively unique within the narrative. In some cases, even the characters who facilitate that access don't share it; for example, Professor Carter Nichols is not aware of Bruce Wayne and Dick Grayson's secret identities, and, with a few exceptions, isn't privy to the details of the time-travel adventures he sends them on.

In this respect, the principal failing of the weird aliens and bizarre transformations of the early Silver Age Batman stories was not so much that the fantastical aspects were necessarily out of place, but that they were no longer presented as secret, miniature worlds Batman and Robin were privileged to access. Aliens and visitors from the future would just land in downtown Gotham City in broad daylight — visible to everyone, and thus no longer special, or even particularly interesting, just as an ordinary small town is far less interesting than "Outlaw Town, U.S.A.!"

#comics#batman#detective comics#david vern#joe samachson#dick sprang#charles paris#bob kane#jerry robinson#robin#robin the boy wonder#larry the judge#the crime doctor#carter nichols#brane taylor#this theme is not realistic#and no longer made sense when realism became a priority#david vern did some stories along these lines in the '70s#which felt very dated#but it was an important aspect of the appeal of batman#in the golden age#and something to keep in mind when trying to decipher#those stories' ideas about crime and justice

13 notes

·

View notes

Text

Sydney Property Conveyancing: Why Employing a Conveyancer in Sydney is Crucially Important

Purchasing or selling Sydney real estate may be an exciting but daunting process. Whether your experience with real estate is new or seasoned, negotiating the legal and administrative complexity of property transactions calls for knowledge and accuracy. This is where a Sydney professional conveyancer can help. This article will discuss the value of Sydney property conveyancing, the function of conveyancers, and the reasons behind Campbelltown conveyancers' reputation among many property buyers and sellers.

Conveyance is what?

Conveyancing is the legal process by which one party transfers its ownership of property to another. Contract review, title searches, government official correspondence, and verifying all legal requirements are met in a sequence of actions. Although the procedure seems simple, it is usually laden with legal jargon, deadlines, and possible hazards that could postpone or destroy a deal.

Having a qualified conveyancer in Sydney, where the property market is fiercely competitive and rules are strict, is not only a need—it's also a luxury.

Why Hire a Conveyancer in Sydney ?

Local Laws and Regulations: Expert Knowledge New South Wales (NSW) has complicated and always changing property laws. Well-versed in these rules, a skilled Sydney property conveyancer can make sure your transaction follows all legal criteria. They handle the specifics from zoning rules to stamp duty computations so you're free from having to.

Time and Stress Reduction Saving Strategies

One of the most important financial decisions you will make is probably either buying or selling real estate. Managing the paperwork, timelines, and correspondence with all the parties engaged helps a conveyancer relieve some of your responsibilities. This lets you concentrate on other facets of your move or investment.

Steer clear of expensive mistakes.

One mistake in the conveyancing procedure may cause delays, fines, or perhaps legal conflict. Ignorance of an easement or encroachment on the land title, for instance, could cause unanticipated expenses later on. The meticulous nature of a conveyancer reduces these dangers.

Cooperation and Problem-Solving in Negotiation

Skilled conveyancers can negotiate conditions on your behalf and handle problems that can develop during a transaction. Whether it's a disagreement about property borders or a delayed settlement, they have the knowledge to resolve problems fast.

The function of a conveyancer in Sydney real estate transactions Usually, the conveying process consists in the following actions:

Review Contractualism

To guarantee a fair and accurate contract of sale, your conveyancer will go over it. They will look for any unusual circumstances that might affect your rights or responsibilities.

Title Inquiries

To verify the legal ownership of the property and find any encumbrances including covenants, liens, or mortgages, a comprehensive title search is done.

Working with Stakeholders

To coordinate the purchase, your conveyancer will interact with government officials, lenders, and real estate brokers.

Making Legal Documents Ready

Your conveyancer guarantees all paperwork is done accurately and turned in on time, from transfer documentation to settlement statements.

Settlement

Your conveyancer will complete the deal, transfer ownership, and guarantee proper distribution of all money on settlement day.

Why choose Campbelltown Conveyancers?

Working with local Campbelltown Conveyancers has many benefits whether you are buying or selling real estate in the Campbelltown area:

Local Market Understanding

Deep knowledge of the local property market including trends, price, and community-specific rules is possessed by Campbelltown conveyancers. Making wise judgments can benefit much from this awareness.

Individualized Service

Many Campbelltown conveyancers provide a more individualised approach than big, impersonal companies. They give customized assistance after spending time to grasp your particular requirements.

Accessibility

Being local means your conveyancer is readily available for in-person meetings, which could be very beneficial if you would want direct contact.

Trust and Reputation

Many times, Campbelltown conveyancers develop long-standing bonds with clients and the community. Many property buyers and sellers choose them based on their dependability and professionalism.

Advice on Selecting a Conveyancer in Sydney

Verify credentials and experience.

Make sure your conveyancer has Sydney property conveyancing experience and is licenced. Seek former customer reviews or testimonials.

Analyze Charges

Although cost shouldn't be the sole consideration, one should be aware of the connected fees. While some charge hourly rates, other conveyancers have set prices. Make sure there are no unstated expenses.

Ask About Transmission.

Timeliness and clarity of communication are really vital. Select a conveyancer that responds quickly and keeps you informed all through the procedure.

Think About Local Knowledge.

Working with a local conveyancer will help you whether you are buying or selling in a particular region, say Campbelltown.

Conclusion

Negotiating complexity Conveyancer in Sydney doesn't have to be a scary chore. Engaging a Sydney professional conveyancer will help to guarantee a seamless and stress-free transaction. Local conveyancers provide the knowledge, individualized care, and piece of mind you need to ensure your property journey is successful whether you live in the vibrant center of Sydney or the growing community of Campbelltown.

Get in touch with a reputable local company if you are seeking dependable Campbelltown conveyancers. Their assistance will help you to be on your path to closing a profitable transaction or safeguarding your ideal house. Recall, in property transactions, the difference between having the correct specialist at your side is everything. original reference - https://handyclassified.com/guide-to-sydney-property-conveyancing-why-employing-a-conveyancer-in-sydney-is-crucially-important

0 notes

Text

Stock Trading: How to Start and Learn from Scratch

Stock trading is an exciting financial activity that allows individuals to buy and sell shares of publicly traded companies. It offers opportunities for profit but also carries risks. Whether you are a beginner looking to understand the basics or someone seeking to improve your trading skills, this guide will help you learn how stock trading works and how to start from scratch. source:دورات تداول الأسهم للمبتدئين

What is Stock Trading?

Stock trading refers to the buying and selling of company shares through stock exchanges. When you buy a stock, you are purchasing a small ownership stake in a company. The goal of traders is to make profits by selling stocks at a higher price than they were purchased.

There are two main types of stock trading:

Day Trading – Buying and selling stocks within the same day to take advantage of short-term price movements.

Long-Term Investing – Holding stocks for months or years, focusing on the company��s growth over time.

How Stock Trading Works

Stock trading is conducted through stock exchanges such as the New York Stock Exchange (NYSE) and the Nasdaq. Investors use brokerage accounts to trade stocks, and prices are determined by supply and demand.

The key elements of stock trading include: Stock Exchanges: Platforms where stocks are traded (e.g., NYSE, Nasdaq). Brokers: Companies or online platforms that allow you to buy and sell stocks. Market Orders vs. Limit Orders: A market order buys or sells at the current price, while a limit order sets a specific price for the trade. Stock Prices: Prices fluctuate based on company performance, economic conditions, and investor sentiment.

How to Start Stock Trading from Scratch

If you are new to stock trading, follow these steps to get started:

1. Learn the Basics

Before investing money, it is crucial to understand basic trading concepts, including:

Stock market terminology (e.g., shares, dividends, bull vs. bear markets).

Types of stocks (e.g., blue-chip stocks, growth stocks, dividend stocks).

Fundamental analysis (evaluating a company’s financial health).

Technical analysis (using charts and patterns to predict price movements). more:دورات التحليل الفني للاسهم

2. Choose a Reliable Brokerage Account

To trade stocks, you need a brokerage account. Choose a platform that offers: Low fees and commissions User-friendly interface Educational resources for beginners Real-time stock market data

Some popular brokers include E*TRADE, TD Ameritrade, Robinhood, and Fidelity.

3. Practice with a Demo Account

Many brokers offer paper trading (simulated trading) that allows beginners to practice buying and selling stocks without risking real money.

4. Start with Small Investments

As a beginner, start with small amounts of money and focus on low-risk stocks before exploring high-risk trades.

5. Develop a Trading Strategy

Successful traders follow strategies such as: Buy and Hold – Investing in strong companies for long-term growth. Swing Trading – Holding stocks for a few days or weeks to capitalize on price movements. Scalping – Making multiple small trades within a day to gain quick profits.

6. Keep Learning and Stay Updated

Stock markets are constantly changing. Follow financial news, study successful traders, and continue learning through books, online courses, and market analysis.

Common Mistakes to Avoid

Investing without research – Always analyze companies before buying their stocks. Letting emotions drive decisions – Fear and greed can lead to poor trading choices. Overtrading – Making too many trades can increase risks and transaction fees. Ignoring risk management – Set stop-loss orders to minimize losses.

Conclusion

Stock trading can be a rewarding way to build wealth, but it requires patience, knowledge, and discipline. By understanding the basics, choosing a good broker, practicing with a demo account, and following a trading strategy, beginners can start their journey in stock trading confidently. also:تعليم التداول من الصفر

Would you like recommendations for books or online courses to help you learn more?

0 notes

Text

5 Common Mistakes When Applying for a Real Estate License

Getting a real estate license is an exciting step toward a new career. However, many people make mistakes during the process. These errors can delay your license or even cause you to fail. Here are five common mistakes to avoid.

1. Not Meeting the Education Requirements

Every state has different education requirements. Some need 60 hours of training, while others require more. If you don’t complete the right courses, your application may be rejected.

2. Skipping Exam Preparation

The real estate exam can be tough. Many people fail because they don’t study enough. Practice tests and study guides can help you pass on the first try.

3. Providing Incorrect Information

Your application must be 100% accurate. Mistakes in your personal details or education records can cause delays. Double-check everything before submitting.

4. Ignoring the Background Check

A background check is required for a real estate license. If you have past legal issues, you may need to provide extra documents. Failing to disclose any issues can lead to rejection.

5. Not Understanding State-Specific Rules

Each state has different licensing rules. Some require fingerprints, while others need sponsorship from a broker. Not knowing these details can slow down the process.

If you're wondering how to get a real estate license, start by understanding your state’s requirements. Then, avoid these common mistakes to make the process smooth.

Study well, provide accurate information, and follow all the steps carefully. With the right preparation, you can get your real estate license.

0 notes

Text

Top 5 Mistakes to Avoid When Choosing a Luxury Real Estate Broker

Choosing the right luxury real estate broker is crucial for a successful high-end property transaction, but common mistakes can derail the process. First, avoid overlooking the broker's experience in luxury markets—specialized knowledge is essential. Second, don’t prioritize cost over quality; experienced brokers may charge more but deliver better results. Third, failing to check client reviews and testimonials can lead to working with someone lacking credibility. Fourth, neglecting to evaluate their network and connections could limit access to exclusive properties or buyers. Finally, avoid choosing a broker who lacks transparency or doesn’t align with your vision. By steering clear of these pitfalls, you can find a broker who will expertly guide you through the luxury real estate market with confidence.

Prioritizing Price Over Experience

One of the biggest mistakes is choosing a broker solely based on their commission rate. While saving money is tempting, inexperienced brokers may lack the skills and knowledge required to manage high-stakes luxury transactions. Instead, prioritize luxury real estate broker with a proven track record of success in the luxury market, even if their fees are slightly higher.

Overlooking Specialized Expertise in Luxury Markets

Not all real estate brokers are equipped to handle luxury properties. Avoid brokers who lack experience in high-end markets, as they may struggle with pricing, negotiation, and understanding unique buyer preferences. Always choose a broker specializing in luxury real estate broker properties who can provide tailored strategies and access to exclusive listings.

Failing to Verify Credentials and Reviews

Many buyers and sellers fail to check a broker’s credentials, licenses, and client testimonials. This oversight can result in working with someone who doesn’t have the credibility or expertise needed. Research reviews, ask for references, and ensure they have a history of successful luxury property transactions.

Neglecting to Evaluate Their Network and Connections

A luxury broker’s network is one of their greatest assets. A broker with strong connections to high-net-worth individuals, exclusive property listings, and other industry professionals can open doors to opportunities you wouldn’t find elsewhere. Avoid brokers who lack a robust network, as this limits your access to premium options.

Choosing a Broker Without Local Market Knowledge

Luxury real estate is highly location-specific, with factors like market trends, neighborhood appeal, and local amenities playing a vital role. Avoid brokers unfamiliar with the local luxury market, as they may miss critical details that could affect your investment or sale. A broker with in-depth local knowledge ensures informed decisions.

Ignoring Compatibility and Communication Styles

A successful relationship with your broker relies on clear communication and aligned expectations. Choosing a broker who doesn’t understand your preferences or communicate effectively can lead to frustration and missed opportunities. Prioritize compatibility and ensure they are responsive, transparent, and proactive in their approach.

Underestimating the Importance of Marketing Strategies

Luxury properties require targeted and sophisticated marketing to attract the right buyers. Avoid brokers who lack a comprehensive marketing plan, including professional photography, virtual tours, and exposure to international markets. A broker skilled in high-end marketing ensures your property stands out in a competitive market.

Conclusion

Choosing the right luxury real estate broker is a pivotal step in buying or selling high-end properties. By avoiding these common mistakes—such as prioritizing price over experience, ignoring specialized expertise, and neglecting their network—you can ensure a seamless and successful transaction. Partnering with a knowledgeable, connected, and communicative broker guarantees access to premium opportunities and the best possible outcomes in the luxury real estate market.

0 notes

Text

An Introduction to International Shipping: Crucial Advice on Customs and Compliance

KGRN Shipping Services Dubai. Let me know if you need further edits or enhancements!

Introduction: Using International Shipping to Grow Enterprises Worldwide

International shipping is a powerful tool for businesses looking to expand their reach beyond local borders. It opens up a world of potential customers and markets. However, while the opportunities are exciting, navigating the waters of customs regulations and compliance can feel overwhelming. Understanding these critical elements is essential to ensure smooth transactions and prevent potential delays that could hinder the growth of your enterprise

Comprehending Customs Regulations

When venturing into international shipping, one of the most complex aspects is customs regulations, which vary greatly from country to country. Each destination has its own set of rules designed to control what enters its borders and how goods are taxed. Here’s a brief overview of what you should be mindful of:

Certificates of Origin: This document certifies that the product was made in a specific country. It can influence tariffs, so be sure to check if it's required by the destination country.

Packing Lists: A detailed packing list helps customs officials understand what is in the shipment, making the clearance process smoother. This list should include item descriptions, quantities, and values.

Invoices: Accurate and detailed invoices are critical not just for customs clearance but also for accounting purposes. Make sure they reflect the true value of the goods being shipped.

Duties and Tariffs

One of the most unexpected costs that can arise during international shipping is duties and tariffs. These taxes can vary based on the type of goods being shipped and their declared value. Researching these costs in advance can save you from nasty surprises down the road.

Tip: Utilize online duty calculators to estimate costs and prepare your budget accordingly.

Example: If you're shipping electronic goods to the EU, check the specific tariffs that apply. Depending on trade agreements, your costs may differ significantly.

Prohibited Items

Every country has its list of prohibited or restricted items that cannot be imported. Before sending your products overseas, it’s crucial to verify these limitations.Highlight: Take time to review each destination’s customs regulations to avoid shipping items that could create headaches later on. For example, some countries prohibit certain food items or materials that are deemed hazardous.

International Shipping Compliance Standards

Compliance with international shipping standards is vital. This not only ensures you stay on the right side of the law but also fosters trust with your customers. Here are key areas to focus on:

Using Trade Agreements (FTAs): Familiarize yourself with available free trade agreements, as they can significantly lower tariffs on your goods.

Labelling Requirements: Each country has its own labelling requirements concerning language, symbols, and safety information. Make sure to adhere to these to avoid delays.

Sanctions and Embargoes: Stay updated on any trade restrictions or sanctions against specific countries. Ignoring them can lead to legal complications for your business.

How to Make Sure Transactions Go Well

To ensure your international shipping transactions go smoothly, consider these strategies:

Investigate Destination Laws: Before you ship, take the time to understand the laws of your destination country. This can prevent many misunderstandings.

Working with Freight Forwarders or Customs Brokers: Collaborating with professionals who specialize in customs clearance can simplify the process significantly. They have the expertise to navigate complex regulations.

Educating Teams on Compliance Protocols: Regular training for your team can enhance compliance awareness and preparedness, reducing the risk of errors.

“Taking these steps not only protects your business but also contributes to building a reliable and trustworthy international reputation.”

Conclusion

International shipping may seem daunting at first, with customs and compliance at the forefront of your worries, but understanding these processes can lead to successful global trade. By being aware of regulations, managing duties, and knowing what to avoid, you’ll position your business for overseas success. Make it a point to educate yourself and your team, and don’t hesitate to seek the help of professionals when needed. Happy shipping!

0 notes

Text

Common Pitfalls in the Dubai Car Import Process and How to Avoid Them

Importing a car into Dubai can be a complex process, especially if you're unfamiliar with the local regulations and procedures. While the allure of driving a high-end vehicle in one of the world’s most glamorous cities is enticing, several pitfalls can complicate the import process. This guide outlines common mistakes and offers practical advice on how to avoid them, ensuring a smoother and more efficient experience.

1. Ignoring Local Regulations

One of the most significant pitfalls is failing to understand and comply with Dubai's car import regulations. Dubai has specific rules regarding vehicle age, emissions standards, and safety requirements. Importing a car that doesn’t meet these regulations can lead to delays or even rejection. How to Avoid It: Research Dubai’s vehicle import regulations thoroughly before purchasing your car. Consult with local experts or customs brokers to ensure that your vehicle complies with all necessary standards.

2. Underestimating the Total Costs

Many first-time importers underestimate the total costs involved in importing a car, including not only the purchase price but also import duties, shipping fees, insurance, and registration costs. This oversight can lead to unexpected financial strain. How to Avoid It: Create a comprehensive budget that includes all potential expenses. Factor in import duties (typically 5% of the vehicle’s value), shipping costs, insurance, registration fees, and any necessary modifications.

3. Incomplete or Incorrect Documentation

Incomplete or incorrect documentation is a frequent issue that can cause delays or complications in the import process. Essential documents such as the original purchase invoice, Bill of Lading, Certificate of Origin, and insurance documents must be accurate and complete. How to Avoid It: Double-check all documents before submission. Ensure that they are accurate, complete, and meet Dubai Customs’ requirements. Consider working with a customs broker to handle the paperwork.

4. Choosing the Wrong Shipping Method

Selecting an inappropriate shipping method can affect the safety of your vehicle and the overall cost. Common options include container shipping and Roll-on/Roll-off (RoRo) shipping, each with its own pros and cons. How to Avoid It: Evaluate the value of your car and your budget when choosing a shipping method. Container shipping offers better protection for high-value vehicles, while RoRo is more cost-effective but exposes the car to weather conditions.

5. Not Accounting for Vehicle Modifications

Dubai’s regulations may require specific modifications to ensure that the vehicle meets local standards. Failure to account for these modifications can result in additional costs and delays. How to Avoid It: Research required modifications based on your car’s make and model. Consult with local experts or service providers to understand what changes might be necessary and include these costs in your budget.

6. Delaying Customs Clearance

Delays in customs clearance can result in additional storage fees and extended waiting periods. Efficiently managing the customs process is crucial to avoid these issues. How to Avoid It: Submit all required documentation promptly and accurately. Work with a customs broker to expedite the clearance process and ensure that all paperwork is handled correctly.

7. Overlooking Insurance Needs

Insurance is a critical aspect of the import process. Many importers overlook the need for insurance during shipping, which can leave the vehicle unprotected against potential damage or loss. How to Avoid It: Arrange for comprehensive insurance coverage that includes the shipping phase. Ensure that the policy covers potential risks and damages during transit.

8. Failing to Understand the Registration Process

The final step in the import process involves registering your vehicle with the Roads and Transport Authority (RTA). Failing to understand this process can lead to delays in getting your vehicle on the road. How to Avoid It: Familiarize yourself with the RTA’s registration requirements and procedures. Ensure that you have all necessary documents and pay any required fees promptly.

9. Neglecting Post-Import Maintenance

Once your car arrives in Dubai, it may require additional maintenance or inspections to ensure it meets local standards. Neglecting this step can result in issues down the line. How to Avoid It: Schedule a post-import inspection with a reputable service center to address any maintenance needs. Ensure that the vehicle is in optimal condition and complies with local regulations.

10. Not Using a Reputable Customs Broker

Handling the complexities of car importation can be challenging without professional assistance. Choosing an inexperienced or unreliable customs broker can result in significant issues. How to Avoid It: Select a reputable customs broker with experience in vehicle imports. Verify their credentials and read reviews from previous clients to ensure they have a track record of successful imports.

Conclusion

Avoiding common pitfalls in the Dubai car import process requires careful planning, thorough research, and attention to detail. By understanding local regulations, accurately budgeting for all costs, ensuring proper documentation, and working with experienced professionals, you can navigate the import process smoothly. Preparing for potential challenges and addressing them proactively will help ensure a successful and hassle-free experience. With the right approach, you can enjoy the thrill of driving your imported car on Dubai’s vibrant streets. Raed more

0 notes

Text

Common Pitfalls in the Dubai Car Import Process and How to Avoid Them

Importing a car into Dubai can be a complex process, especially if you're unfamiliar with the local regulations and procedures. While the allure of driving a high-end vehicle in one of the world’s most glamorous cities is enticing, several pitfalls can complicate the import process. This guide outlines common mistakes and offers practical advice on how to avoid them, ensuring a smoother and more efficient experience.

1. Ignoring Local Regulations

One of the most significant pitfalls is failing to understand and comply with Dubai's car import regulations. Dubai has specific rules regarding vehicle age, emissions standards, and safety requirements. Importing a car that doesn’t meet these regulations can lead to delays or even rejection. How to Avoid It: Research Dubai’s vehicle import regulations thoroughly before purchasing your car. Consult with local experts or customs brokers to ensure that your vehicle complies with all necessary standards.

2. Underestimating the Total Costs

Many first-time importers underestimate the total costs involved in importing a car, including not only the purchase price but also import duties, shipping fees, insurance, and registration costs. This oversight can lead to unexpected financial strain. How to Avoid It: Create a comprehensive budget that includes all potential expenses. Factor in import duties (typically 5% of the vehicle’s value), shipping costs, insurance, registration fees, and any necessary modifications.

3. Incomplete or Incorrect Documentation

Incomplete or incorrect documentation is a frequent issue that can cause delays or complications in the import process. Essential documents such as the original purchase invoice, Bill of Lading, Certificate of Origin, and insurance documents must be accurate and complete. How to Avoid It: Double-check all documents before submission. Ensure that they are accurate, complete, and meet Dubai Customs’ requirements. Consider working with a customs broker to handle the paperwork.

4. Choosing the Wrong Shipping Method

Selecting an inappropriate shipping method can affect the safety of your vehicle and the overall cost. Common options include container shipping and Roll-on/Roll-off (RoRo) shipping, each with its own pros and cons. How to Avoid It: Evaluate the value of your car and your budget when choosing a shipping method. Container shipping offers better protection for high-value vehicles, while RoRo is more cost-effective but exposes the car to weather conditions.

5. Not Accounting for Vehicle Modifications

Dubai’s regulations may require specific modifications to ensure that the vehicle meets local standards. Failure to account for these modifications can result in additional costs and delays. How to Avoid It: Research required modifications based on your car’s make and model. Consult with local experts or service providers to understand what changes might be necessary and include these costs in your budget.

6. Delaying Customs Clearance

Delays in customs clearance can result in additional storage fees and extended waiting periods. Efficiently managing the customs process is crucial to avoid these issues. How to Avoid It: Submit all required documentation promptly and accurately. Work with a customs broker to expedite the clearance process and ensure that all paperwork is handled correctly.

7. Overlooking Insurance Needs

Insurance is a critical aspect of the import process. Many importers overlook the need for insurance during shipping, which can leave the vehicle unprotected against potential damage or loss. How to Avoid It: Arrange for comprehensive insurance coverage that includes the shipping phase. Ensure that the policy covers potential risks and damages during transit.

8. Failing to Understand the Registration Process

The final step in the import process involves registering your vehicle with the Roads and Transport Authority (RTA). Failing to understand this process can lead to delays in getting your vehicle on the road. How to Avoid It: Familiarize yourself with the RTA’s registration requirements and procedures. Ensure that you have all necessary documents and pay any required fees promptly.

9. Neglecting Post-Import Maintenance

Once your car arrives in Dubai, it may require additional maintenance or inspections to ensure it meets local standards. Neglecting this step can result in issues down the line. How to Avoid It: Schedule a post-import inspection with a reputable service center to address any maintenance needs. Ensure that the vehicle is in optimal condition and complies with local regulations.

10. Not Using a Reputable Customs Broker

Handling the complexities of car importation can be challenging without professional assistance. Choosing an inexperienced or unreliable customs broker can result in significant issues. How to Avoid It: Select a reputable customs broker with experience in vehicle imports. Verify their credentials and read reviews from previous clients to ensure they have a track record of successful imports.

Conclusion

Avoiding common pitfalls in the Dubai car import process requires careful planning, thorough research, and attention to detail. By understanding local regulations, accurately budgeting for all costs, ensuring proper documentation, and working with experienced professionals, you can navigate the import process smoothly. Preparing for potential challenges and addressing them proactively will help ensure a successful and hassle-free experience. With the right approach, you can enjoy the thrill of driving your imported car on Dubai’s vibrant streets. Raed more

0 notes

Text

Facts About Intermodal Trucking Insurance in Harrisburg and Concord, NC

Owning and operating a truck or a fleet of vehicles to haul freight and cargo is a wonderful way to earn a living. The risks on the road are too great to ignore as well. Being covered by the requisite trucking and /or commercial insurance plan can reduce the risks considerably. Companies that need to use multiple modes of transport to deliver cargo to the final destination may find it advantageous to choose intermodal trucking insurance in Harrisburg and Concord, NC. The idea of using multiple types of coverage in unison is indeed heartening. The trucker or company owner must know the associated facts before purchasing the required coverage. It suffices to know that trucks that haul containers carrying all sorts of cargo need to be covered specifically by the intermodal insurance policy. Intermodal trucking refers to the trucks hauling containers, usually from one port to another. This type of insurance coverage is also deemed appropriate for companies that use multiple types of transport to reach the final destination. The vehicles may include cargo ships and/or rail and trucks.

The risks of intermodal trucking are diverse and highly challenging. The truck's lock pins and chassis must be inspected carefully to ensure the capability of hauling loaded containers across great distances. The truck's road-worthiness is also a must to qualify for insurance coverage.

It is essential to know that the UIIA (Uniform Intermodal Interchange and Facilities Access Agreement) requires the purchase of insurance by truckers or carriers who haul loaded containers carrying cargo. The carrier cannot access the port or the railway yard with no insurance coverage. Such truckers often lease the chassis, making hired and non-owned insurance essential, too. Furthermore, the risks of physical damage to the containers are reduced with the help of Trailer interchange coverage.

The UIIA has specific requirements for intermodal truckers who are advised to buy the following coverage when using multiple modes of transportation for their business:

· Liability coverage · General liability coverage · Cargo insurance based on the type of equipment provider used · Trailer Interchange Insurance · Comprehensive, Collision, Fire, and Theft coverage that is similar to auto insurance · Truckers Uniform Intermodal Interchange Endorsement

Many types of trucks, trucking companies, drivers, and cargo are used for this type of transportation. The insurance buyer must make sure to invest in the right type of insurance plan by choosing between the following: -

Trucking Insurance The trucking company can choose specific or multiple coverages to minimize financial risks:

· High-Risk · New-Venture · Owner-Operator Insurance · Bulk Transporters · Box Trucks · Container Haulers · Dump Operations · Hazardous Carriers · Couriers · Tow-Truck Operations · LTL Trucking Businesses · Warehousing Operations Freight Broker Insurance The brokerages are free to pick and choose from multiple-car liability coverage.

Commercial Insurance It is essential to consider investing in comprehensive commercial insurance coverage to keep the financial risks low.

While a tenant is not responsible for protecting the dwelling or the premises, they should safeguard their possessions and ensure paying liability claims with the help of renters insurance in Huntersville and Mooresville, NC.

#intermodal trucking insurance in Harrisburg and Concord#NC#renters insurance in Huntersville and Mooresville

0 notes

Text

Orbán has plan to unblock North Macedonia’s path to EU

During his visit to North Macedonia, Hungarian Prime Minister Viktor Orbán announced a plan to unblock Skopje’s accession to the EU by the end of the year, bne IntelliNews informed.

Orbán did not disclose specific details of the plan, but announced his willingness to act as a mediator to facilitate dialogue between the two countries. The initiative was announced during a press conference with North Macedonian Prime Minister Hristijan Mickoski in Ohrid on 27 September.

The Hungarian leader arrived in the Balkan country on 26 September on a two-day visit aimed at strengthening economic and cultural relations. He established strong ties with North Macedonia’s ruling VMRO-DPMNE (The Internal Macedonian Revolutionary Organisation – Democratic Party for Macedonian National Unity) party.

One of the reasons why I am here in Ohrid is to seek a solution to the dispute with Bulgaria.

Bulgaria’s demands were a major obstacle to North Macedonia’s EU accession, as Sofia blocked the progress in 2020 due to historical and cultural disputes. However, the blockade was lifted in 2022 after an EU-brokered compromise. The bloc demanded that the country amend its constitution to recognise Bulgarians as a minority.

However, tensions between the two countries remain. North Macedonia faces difficulties in implementing the constitutional changes, mainly due to opposition from the VMRO-DPMNE party.

Despite Orbán’s optimism, Bulgarian officials flatly refused his offer to mediate the ongoing tensions between Skopje and Sofia. Foreign Minister Ivan Kondov stated that his country did not need mediators as the EU framework agreement with North Macedonia required constitutional amendments.

EU priorities

Orbán also expressed his concern about the EU’s handling of the situation. He said the recent separation of Albania’s EU accession process from that of North Macedonia was the bloc’s “huge mistake.”

Given Hungary’s role as the EU chair, it is only natural that this topic is at the forefront of our discussions today [September 27]. Hungary’s stance is clear: the stability of the Western Balkans and the region’s integration into the EU are of paramount importance.

The prime minister criticised the bloc for accelerating the EU accession processes of Ukraine and Moldova while ignoring countries such as North Macedonia, which have been working on accession for years. Formerly known as Macedonia, it has been an EU candidate since 2005. During his visit, he expressed gratitude for the support in Hungary’s fight against illegal migration. He also reaffirmed his commitment to strengthening bilateral political and economic ties.

We will never forget North Macedonia’s support in our fight against illegal migration.

In response, Mickoski said that Hungary was a strategic ally of North Macedonia. He also noted the importance of strategic projects such as the North-South transport and energy corridors linking the Balkans with Budapest.

Read more HERE

#world news#news#world politics#europe#european news#eu politics#european union#eu news#hungary#hungary 2024#viktor orban#orban#north macedonia

0 notes

Text

Common Pitfalls in the Dubai Car Import Process and How to Avoid Them

Importing a car into Dubai can be a complex process, especially if you're unfamiliar with the local regulations and procedures. While the allure of driving a high-end vehicle in one of the world’s most glamorous cities is enticing, several pitfalls can complicate the import process. This guide outlines common mistakes and offers practical advice on how to avoid them, ensuring a smoother and more efficient experience.

1. Ignoring Local Regulations

One of the most significant pitfalls is failing to understand and comply with Dubai's car import regulations. Dubai has specific rules regarding vehicle age, emissions standards, and safety requirements. Importing a car that doesn’t meet these regulations can lead to delays or even rejection. How to Avoid It: Research Dubai’s vehicle import regulations thoroughly before purchasing your car. Consult with local experts or customs brokers to ensure that your vehicle complies with all necessary standards.

2. Underestimating the Total Costs

Many first-time importers underestimate the total costs involved in importing a car, including not only the purchase price but also import duties, shipping fees, insurance, and registration costs. This oversight can lead to unexpected financial strain. How to Avoid It: Create a comprehensive budget that includes all potential expenses. Factor in import duties (typically 5% of the vehicle’s value), shipping costs, insurance, registration fees, and any necessary modifications.

3. Incomplete or Incorrect Documentation

Incomplete or incorrect documentation is a frequent issue that can cause delays or complications in the import process. Essential documents such as the original purchase invoice, Bill of Lading, Certificate of Origin, and insurance documents must be accurate and complete. How to Avoid It: Double-check all documents before submission. Ensure that they are accurate, complete, and meet Dubai Customs’ requirements. Consider working with a customs broker to handle the paperwork.

4. Choosing the Wrong Shipping Method

Selecting an inappropriate shipping method can affect the safety of your vehicle and the overall cost. Common options include container shipping and Roll-on/Roll-off (RoRo) shipping, each with its own pros and cons. How to Avoid It: Evaluate the value of your car and your budget when choosing a shipping method. Container shipping offers better protection for high-value vehicles, while RoRo is more cost-effective but exposes the car to weather conditions.

5. Not Accounting for Vehicle Modifications

Dubai’s regulations may require specific modifications to ensure that the vehicle meets local standards. Failure to account for these modifications can result in additional costs and delays. How to Avoid It: Research required modifications based on your car’s make and model. Consult with local experts or service providers to understand what changes might be necessary and include these costs in your budget.

6. Delaying Customs Clearance

Delays in customs clearance can result in additional storage fees and extended waiting periods. Efficiently managing the customs process is crucial to avoid these issues. How to Avoid It: Submit all required documentation promptly and accurately. Work with a customs broker to expedite the clearance process and ensure that all paperwork is handled correctly.

7. Overlooking Insurance Needs

Insurance is a critical aspect of the import process. Many importers overlook the need for insurance during shipping, which can leave the vehicle unprotected against potential damage or loss. How to Avoid It: Arrange for comprehensive insurance coverage that includes the shipping phase. Ensure that the policy covers potential risks and damages during transit.

8. Failing to Understand the Registration Process

The final step in the import process involves registering your vehicle with the Roads and Transport Authority (RTA). Failing to understand this process can lead to delays in getting your vehicle on the road. How to Avoid It: Familiarize yourself with the RTA’s registration requirements and procedures. Ensure that you have all necessary documents and pay any required fees promptly.

9. Neglecting Post-Import Maintenance

Once your car arrives in Dubai, it may require additional maintenance or inspections to ensure it meets local standards. Neglecting this step can result in issues down the line. How to Avoid It: Schedule a post-import inspection with a reputable service center to address any maintenance needs. Ensure that the vehicle is in optimal condition and complies with local regulations.

10. Not Using a Reputable Customs Broker

Handling the complexities of car importation can be challenging without professional assistance. Choosing an inexperienced or unreliable customs broker can result in significant issues. How to Avoid It: Select a reputable customs broker with experience in vehicle imports. Verify their credentials and read reviews from previous clients to ensure they have a track record of successful imports.

Conclusion

Avoiding common pitfalls in the Dubai car import process requires careful planning, thorough research, and attention to detail. By understanding local regulations, accurately budgeting for all costs, ensuring proper documentation, and working with experienced professionals, you can navigate the import process smoothly. Preparing for potential challenges and addressing them proactively will help ensure a successful and hassle-free experience. With the right approach, you can enjoy the thrill of driving your imported car on Dubai’s vibrant streets. Raed more

0 notes

Text

Mistakes to Avoid When Investing in Real Estate

The Cayman Islands are a series of beautiful islands in the Caribbean Sea. Their inviting turquoise waters, pristine beaches, and lavish lifestyles are tempting. Therefore, it is no surprise that many people dream of buying real estate in the Cayman Islands as an excellent investment, one that can be rented out or used as a personal getaway.

Just like any other business investment, real estate investing requires proper planning and an understanding of possible pitfalls. This blog explores ten mistakes to avoid to ensure your journey through the Cayman Islands real estate market is smooth sailing.

1. Diving In Without a Plan

When it comes to real estate sales, impulsive buying does not work, especially in places such as the Cayman Islands, where we live now. Do not plunge headlong into Cayman Islands real estate market listings without a clear investment strategy. Consider these questions before planning:

- Are you looking for vacation rentals or long-term properties?

- Do you have specific budgetary constraints, and what incomes do you expect?

Depending on what you aim at achieving, search for properties accordingly. Beachfront condominiums are ideal for rent, while big houses give ultimate privacy.

2. Skimping on Research

Having beachfront villas to cute condos, you can find different property variants in the Cayman Islands real estate market. Beware of pretty pictures –– you need to study the location with its amenities, rental potential, and restrictions, by visiting the location!

Research other similar homes within the range to learn market prices. Never forget that location matters most in the Cayman Islands, like the value of beachside luxury estates’ strongly depends on proximity to Seven Mile Beach.

3. Going Solo and Don’t Consider Local Realtor

The Cayman Islands property market operates differently from anywhere else, so getting help from reliable local brokers will be priceless! They will know everything about the market peculiarities, help with legal issues, and recommend trustworthy property managers if you rent your investment property. Thus, a good realtor can find hidden gems for you and work on favorable terms, reducing time, money, and stress.

4. Sticking to Numbers

Still, it’s worth remembering that love at first sight may not be practical because buying land in the Cayman Islands should be guided by rational thinking. Always stick to a pre-determined budget and return on investment (ROI) expectations.

Do not forget that no matter how beautiful an estate looks, the most important thing is whether this property can generate income as expected or bring valuable capital gains.

5. Forgetting the Hidden Costs

Compared to some other areas, they have a high standard of living, resulting in higher property taxes, maintenance costs, and insurance charges, among other things.

All these additional costs must be included in future profit calculations for possible returns from such investments. Furthermore, international investors must recognize their exposure to a single currency.

6. Underestimating Due Diligence

Before making any purchase decision, make sure there is a comprehensive house inspection done by experts who will check things like structural errors or termites, among others, which might not meet the required standards.

In case of any non-compliance of anything else, like design flaws within specifications, then it should go back home with deeds showing titles evidencing no residual liabilities or other encumbrances over land.

7. Ignoring Market Trends

Like any other market, the Cayman Islands real estate market also experiences fluctuations. Keep up with what’s currently happening –tourism data and upcoming property development projects that could affect prices within your area!

This assists you when buying and selling by making informed choices regarding this process based on knowledge rather than speculation of one person only. Besides, it could also prove wrong at times, leading you astray while making such decisions.

8. Misjudging rental potentials

If you are looking forward to earning some rental income, check the rental potential of your selected property. Consider things such as seasonality, tourist demographics, and competition in the area. Research how much similar properties are being rented for so that you can have realistic expectations.

9. Failing to Recognize Legal and Tax Implications

Owning foreign property in the Cayman Islands involves several legal and tax issues. Consult with a qualified attorney or tax advisor to learn about residency requirements, possible taxes that can be paid or not, and restrictions on foreign ownership.

10. Failure to Think about Exit Strategies

Although the Cayman Islands have a solid real estate market, clear-cut exit strategies are essential. Consider how you will sell your property later and any possible taxes on capital gains incurred.

You can turn your luxury real estate Cayman Islands dream into an investment by avoiding these common pitfalls and doing thorough research. Consider the diverse opportunities available in the Cayman Islands property market, ranging from luxury real estate Cayman Islands down to more humble options. If you plan well and are guided accordingly, you may find the perfect slice of paradise, which comes with financial gain and idyllic Caribbean living.

Look out for Cayman Islands Real Estate for Sale

The Cayman Islands offer stunning beachfront properties, lavish condos, and quaint residences. There are various vacation rentals or personal sanctuaries for those who prefer them all in-between for sale in the Cayman Islands real estate section, whether holiday letting heaven or truly mine alone.

This includes exclusive estates by water bodies and small apartments within Seven Mile Beach, among other places, located at strategic points around this place yet hidden from many people’s knowledge.

Walk along with a local agent who knows everything about it so that when you get there, you can buy the perfect piece of land for your own Cayman Islands paradise. Turn your Caribbean fantasy into a reality and invest in Cayman Islands real estate for sale today.

0 notes

Text

Accuracy Keys for Oilfield Services Business Valuation

Obtaining accurate valuations for niche service companies such as oilfield services business valuation, screen printing shops or landscaping services business valuation obliges considering quantitative finances through qualitative lenses, aligning valuation multiples to industry growth trends and barrier analysis. Business brokers derive realistic asking prices to attract qualified buyers during ownership transfer listings by factoring niche market traits into appraisal models.

This overview examines key valuation methodologies and custom adjustments when representing specialized service sector sellers. You’ll discover how fine-tuning financial projection assumptions and risk metrics to align with subsector maturity timelines and consolidation patterns allows dialing in selling figures, garnering great Exit outcomes for all stakeholders.

Common Approaches – Cost, Market or Income Valuations

Brokers appraising service businesses like oilfield services, screen printing stores and landscaping crews combine quantitative and qualitative assessments when recommending fair market value (FMV) pricing to sellers planning exits. Typical methodologies examine:

Cost Approach – Tallying cumulative investments in tangible assets like fleet vehicles, printing presses and mowers represents one baseline indicator of replacement startup costs if hypothetically rebuilding enterprises from scratch.

Income Approach – Discounted cash flow analysis projects future earnings potential based on historical income statements, capacity utilization metrics and realistic growth assumptions given industry outlooks.

Market Approach: Comparing past valuation multiples from recent transactions of similar-caliber companies explains pricing factors that worked for earlier deals and suggests competitively aligned listing levels.

Custom Tailoring Valuations to Specific Service Niches

However, generically applying formulas uniformly across service sectors ignores idiosyncrasies distinctly affecting individual niche upside potentials and risk exposures. For example, an oilfield services business valuation company’s value alignment depends greatly on customer drilling budget outlooks and regional hydrocarbon basin production forecasts. A screen printing business valuation shop’s digitization vulnerability significantly impacts earning assumption credibility. And local landscaping services remain beholden to property owner whims and seasonal rainfall patterns.

Therefore, accurately valuing such entities requires the following niche customizations:

Oilfield Services – Heavy Equipment Valuations

Secondary sales market for rigs and durability affecting fleet value retention over

Employee training levels constraining competitor duplication of expertise

Drilling activity hot/cold cycles impacting multi-year income smoothing

Screen Printing business valuation – Custom Artwork Valuations

Strength of creative portfolio securing client loyalty against overseas digital competition

Artist staff skills limiting replica work quality dilution by new shops

Online workflow integration capabilities keeping processes updated

Landscaping Services business valuation – Outdoor Property Maintenance

Customer revenue retention stickiness year-over-year

Rain patterns and climate change disruption assumptions

Barriers against competitor saturation from low startup costs

These niche variables significantly sway earnings and discounted cash flow models when calculating FMV by subsector. Realistically aligning growth assumptions and risk factors makes or breaks deal pricing attractiveness for qualified buyers.

Partner With a Valuation Pro Guiding Your Business Sale

For service enterprise owners seeking accurately priced listings to secure satisfying ownership transfers, enlist a professional broker early on to hone valuations specifically customized to your niche. Receive guidance identifying measurable milestones demonstrating enterprise maturity needed to maximize exits. Discuss industry subsector projections to strategically time listings, balancing growth indicators and consolidation timing. And compare recent deals, explaining what woos investors seeking secure service sector acquisitions.

Connect today with a certified valuation expert specializing in service categories like oilfield services, screen printing stores or landscaping crews to map exit plans perfectly supporting your legacy vision. Ideal business transitions depend greatly on accurately valued sellers aligning with qualified buyers committed to stewarding service legacies to the next level. Take time now to understand key valuation methodologies applied across your niche so that when ideal timing arrives, deals unfold smoothly, securing satisfying outcomes for all stakeholders.

0 notes

Text

Complete Guide to Stop-Loss: Protect Your Trades Like a Pro

Stop-loss orders are a crucial risk management tool for traders and investors. Whether you're trading stocks, forex, or crypto, understanding how to use stop-loss effectively can save you from significant losses. This guide will walk you through everything you need to know about stop-loss orders, their types, strategies, and common mistakes, with real-world examples from the Indian stock market (NSE & BSE).

What is a Stop-Loss Order? – A Simple Explanation for Beginners

A stop-loss order is a preset order placed with a broker to sell a stock once it reaches a specific price. It helps traders limit losses and protect profits.

🔹 Example: Suppose you buy Reliance Industries (NSE: RELIANCE) at ₹2,500 per share. To manage risk, you set a stop-loss at ₹2,400. If the stock drops to this level, the order will automatically trigger a sell.

💡 Key Benefit: Prevents emotional trading and minimizes sudden losses during high volatility.

Types of Stop-Loss Orders – Which One Should You Use?

Different types of stop-loss orders cater to different trading styles. Here’s a breakdown:

1. Regular Stop-Loss Order

✅ Triggers a market order when the stock hits the stop price. ❌ Can suffer from slippage if the price moves rapidly.

💡 Example: If you place a stop-loss at ₹1,000 for TCS (NSE: TCS), and the stock opens at ₹990, the order will execute at ₹990 (not ₹1,000).

2. Trailing Stop-Loss Order

✅ Moves dynamically with stock price movements. ❌ Requires monitoring and adjustment.

💡 Example: If you set a 5% trailing stop-loss on Infosys (NSE: INFY) at ₹1,500, and it moves up to ₹1,600, your stop-loss will automatically adjust to ₹1,520.

3. Stop-Limit Order

✅ Converts into a limit order instead of a market order. ❌ May not get executed if the price gaps down.

💡 Example: You set a stop-limit on HDFC Bank (NSE: HDFCBANK) at ₹1,500 with a limit price of ₹1,490. If the stock falls to ₹1,480, your order won’t execute.

How to Set the Perfect Stop-Loss Level? – Best Strategies for Traders

Setting an effective stop-loss level is more than just picking a random percentage. Here are the best strategies used by top traders:

1. ATR-Based Stop-Loss (Volatility-Based)

The Average True Range (ATR) helps measure market volatility. Traders use it to set stop-loss levels dynamically.

📌 Formula: 👉 Stop-Loss = Entry Price – (ATR × Multiplier)

💡 Example: If Nifty 50 has an ATR of 50 points, and you set a 2x ATR stop-loss, your stop-loss would be 100 points below your entry.

🔹 Tools to Use: Strike.Money provides ATR-based stop-loss indicators for better trade management.

2. Support & Resistance Stop-Loss

Using support levels as stop-loss zones ensures protection from unwanted fluctuations.

💡 Example: If Tata Motors (NSE: TATAMOTORS) has strong support at ₹600, setting a stop-loss slightly below at ₹595 ensures you avoid fake breakdowns.

3. Moving Average Stop-Loss

Popular moving averages (50-day, 100-day, 200-day) help in deciding stop-loss levels.

💡 Example: If ICICI Bank (NSE: ICICIBANK) is trading above its 50-day EMA, a stop-loss just below this EMA helps reduce false triggers.

The Role of Stop-Loss in Risk Management – Don’t Let Your Portfolio Bleed

📊 Statistics Matter: 🔹 Research from NSE India shows that over 80% of retail traders face losses due to improper risk management.

📌 Best Practices: ✅ Use a risk-reward ratio of at least 1:2 (Risk ₹1 to make ₹2). ✅ Never risk more than 2% of your capital on a single trade.

💡 Example: If your total trading capital is ₹1,00,000, risk only ₹2,000 per trade by setting a stop-loss at an appropriate level.

Stop-Loss Mistakes That Cost Traders Thousands – Avoid These Blunders!

❌ 1. Placing Stop-Loss Too Close to Entry

🔹 Tight stop-losses often get hit due to normal market fluctuations.

💡 Example: A stop-loss of just 0.5% on volatile stocks like Adani Enterprises (NSE: ADANIENT) is too tight and likely to get triggered unnecessarily.

❌ 2. Ignoring Market Volatility

🔹 Stocks with high volatility need wider stop-losses.

💡 Example: Setting a 1% stop-loss on Bank Nifty options is useless since they move 2-3% in minutes.

❌ 3. Stop-Loss Hunting – Beware of Market Manipulation

🔹 Institutions often trigger retail traders' stop-losses before moving prices in their favor.

💡 Example: Many traders experience stop-loss hunting in highly traded stocks like HDFC Bank and Reliance Industries before the price moves back up.

How Algo Trading Uses Stop-Loss – The Role of Automation

Algorithmic trading has transformed how stop-loss orders are executed. Many institutional traders use:

✅ Dynamic stop-loss adjustments based on volatility. ✅ Automated stop-loss execution via brokerage platforms.

📌 Tools to Use: Strike.Money provides algo trading features with dynamic stop-loss settings for better risk management.

Stop-Loss in Crypto, Forex, and Stock Markets – What’s Different?

🔹 Stop-Loss in Crypto Trading

✅ Requires wider stop-losses due to extreme volatility. ✅ Trailing stop-loss is recommended for tokens like Bitcoin (BTC) & Ethereum (ETH).

🔹 Stop-Loss in Forex Trading

✅ Pips-based stop-loss helps control risk in currency pairs like USD/INR. ✅ Forex traders often use ATR-based stop-loss calculations.

🔹 Stop-Loss in the Indian Stock Market

✅ Stop-limit orders are useful due to liquidity concerns in mid-cap and small-cap stocks. ✅ Traders follow SEBI & NSE stop-loss regulations for compliance.

Expert Opinions on Stop-Loss – What Professional Traders Say