#Hydrogen Aircraft Market Market

Explore tagged Tumblr posts

Text

The hydrogen aircraft market size is estimated to be USD 143 million in 2020 and is projected to grow from USD 7,427 million by 2030, at a CAGR of 28.9% from 2025 to 2030.

#Hydrogen Aircraft Market#Hydrogen Aircraft Market Market#Hydrogen Aircraft Market Industry#Global Hydrogen Aircraft Market Market#Hydrogen Aircraft Market Market Companies#Hydrogen Aircraft Market Market Size#Hydrogen Aircraft Market Market Share#Hydrogen Aircraft Market Market Growth#Hydrogen Aircraft Market Market Statistics

0 notes

Photo

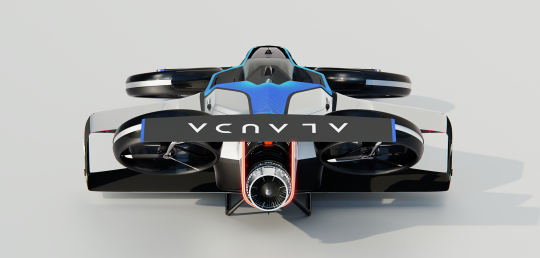

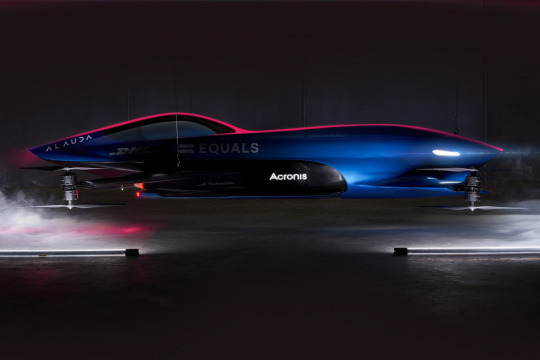

Alauda's Airspeeder MK-4

The company said in a statement that the one-person electric racing machine will have a top speed of 225 mph, and potential range of 180 miles.

It will be powered by a Thunderstrike Hydrogen Turbogenerator connected to electric motors on the eVTOL wings.

#art#design#evtol#vtol#racing#sports#alauda#airspeed#MK-4#hydrogen#trurbogenerator#vtol aircraft#evtol aircraft market#FLYING PRIVATE#AI

80 notes

·

View notes

Text

#Hydrogen Aircraft Market#Hydrogen Aircraft Size#Hydrogen Aircraft Growth#Hydrogen Aircraft Trend#Hydrogen Aircraft segment#Hydrogen Aircraft Opportunity#Hydrogen Aircraft Analysis 2024#Hydrogen Aircraft Forecast

0 notes

Text

Navigating the Hydrogen Aircraft Market: Global Industry Outlook

Increasing regulatory pressure to reduce carbon emissions, coupled with advancements in hydrogen propulsion technology are the factors driving market in the forecast period 2025-2029.

According to TechSci Research report, “Hydrogen Aircraft Market – Global Industry Size, Share, Trends, Competition Forecast & Opportunities, 2029”, The Global Hydrogen Aircraft Market stood at USD 84.62 Billion in 2023 and is anticipated to grow with a CAGR of 6.84%in the forecast period, 2025-2029. The Global Hydrogen Aircraft Market is experiencing a transformative phase marked by a paradigm shift towards sustainable aviation solutions. The market is driven by a growing awareness of environmental issues and the imperative to reduce carbon emissions in the aviation sector. Hydrogen aircraft, with their potential to offer a cleaner alternative to traditional aviation fuels, are gaining significant traction.

In terms of technology, advancements in hydrogen fuel cell technology are at the forefront, enabling the development of aircraft with reduced environmental impact. Major aerospace players are actively investing in research and development to enhance the efficiency and safety of hydrogen-powered aircraft, fostering innovation in the industry.

Government support and favorable regulations are crucial factors influencing the market. Various countries and regions, such as Europe and North America, are implementing policies to promote the adoption of hydrogen aircraft, including financial incentives and stringent emissions targets. The European Union's commitment to achieving carbon neutrality by 2050 has propelled the continent to the forefront of hydrogen aviation development.

While passenger aircraft lead the market, there is also a growing focus on hydrogen-powered cargo aircraft, aligning with the broader push for sustainable freight transportation. The market's evolution is a result of collaborative efforts between governments, industry stakeholders, and research institutions to create a more sustainable and eco-friendly future for the aviation sector. As the demand for cleaner transportation solutions intensifies, the Global Hydrogen Aircraft Market is poised for continued growth, representing a pivotal step towards a greener aviation landscape.

One prominent trend in the Global Hydrogen Aircraft Market is the increasing collaboration between major aerospace manufacturers, governments, and research institutions to drive advancements in hydrogen propulsion technology. This collaborative effort is fostering innovation and accelerating the development of commercially viable hydrogen-powered aircraft. The trend is marked by joint ventures, research partnerships, and funding initiatives, reflecting a collective commitment to address environmental concerns and transition towards sustainable aviation. This collaborative ecosystem is pivotal in overcoming technological challenges, ensuring regulatory alignment, and establishing a robust foundation for the widespread adoption of hydrogen aircraft, shaping the future of eco-friendly air travel.

Browse over market data Figures spread through XX Pages and an in-depth TOC on "Global Hydrogen Aircraft Market.” https://www.techsciresearch.com/report/hydrogen-aircraft-market/22410.html

In North America, particularly the United States, the market is dynamically evolving due to a strong commitment to sustainable aviation practices. Key industry players are investing significantly in research and development, aiming to position the region as a leader in hydrogen-powered aircraft technology. The regulatory landscape and government support for eco-friendly initiatives further contribute to the region's prominence in the market.

Europe emerges as a frontrunner in hydrogen aircraft adoption, driven by a combination of stringent environmental regulations and proactive government policies. The European Union's ambitious goals for carbon neutrality by 2050 have accelerated the development of hydrogen aircraft technologies. The collaborative efforts between governments, aerospace companies, and research institutions contribute to Europe's dominance in shaping the future of sustainable aviation.

In the Asia-Pacific region, countries like Japan and South Korea are making substantial strides in embracing hydrogen-powered aviation. The market is fueled by a growing focus on environmental sustainability and investments in hydrogen infrastructure. As awareness increases and partnerships between governments and industry players strengthen, Asia-Pacific is poised to play a significant role in the global hydrogen aircraft market.

While these regions lead in adoption, South America and Africa are in the early stages of embracing hydrogen aircraft technologies. The market in these regions is characterized by a gradual shift towards cleaner aviation solutions as awareness grows and infrastructure develops. Overall, regional dynamics in the Global Hydrogen Aircraft Market reflect a complex interplay of policies, technological advancements, and industry collaboration.

Major companies operating in Global Hydrogen Aircraft Market are:

SAFRAN S. A.

Shanghai Pearl Hydrogen Energy Technology Co., Ltd.

DigiSky s.r.l.

Thales Group

Volta Volare Inc.

Bell Textron Inc

Israel Aerospace Industries Ltd.

Honeywell International Inc

Download Free Sample Report https://www.techsciresearch.com/sample-report.aspx?cid=22410

Customers can also request 10% free customization in this report.

“The hydrogen-powered aircraft on the aviation sector, emphasizing its potential to revolutionize air travel by significantly reducing carbon emissions. The consensus among experts is that the current momentum in research and development, coupled with growing government support and increasing environmental awareness, will drive rapid advancements in hydrogen propulsion technology.

This collective optimism underscores hydrogen aircraft as a key player in the global shift towards sustainable aviation, promising a greener and more efficient future for the industry,” said Mr. Karan Chechi, Research Director with TechSci Research, a research-based management consulting firm.

“Hydrogen Aircraft Market – Global Industry Size, Share, Trends Opportunity, and Forecast, Segmented By Passenger Capacity (Less than 100, 101 to 200 and More Than 200), By Range (Short Haul, Medium Haul and Long Haul), By Application (Passenger Aircraft and Cargo Aircraft), By Region, Competition, 2019-2029”, has evaluated the future growth potential of Global Hydrogen Aircraft Market and provides statistics & information on market size, structure, and future market growth. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment decisions. Besides, the report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in Global Hydrogen Aircraft Market.

Browse Related Reports

Space Situational Awareness Market https://www.techsciresearch.com/report/space-situational-awareness-market/13125.html Aircraft Seating Market https://www.techsciresearch.com/report/aircraft-seating-market/7971.html Commercial Aircraft Door Market https://www.techsciresearch.com/report/commercial-aircraft-door-market/14577.html

Contact

Techsci Research LLC

420 Lexington Avenue, Suite 300,

New York, United States- 10170

M: +13322586602

Email: [email protected]

Website: www.techsciresearch.com

#Hydrogen Aircraft Market#Hydrogen Aircraft Market Size#Hydrogen Aircraft Market Share#Hydrogen Aircraft Market Trends#Hydrogen Aircraft Market Growth

0 notes

Text

Challenges and Opportunities for Hydrogen Aircraft Market

The hydrogen aircraft market holds significant potential for reducing the environmental impact of aviation. However, like any emerging industry, it faces a set of challenges and opportunities that will shape its growth and development.

Buy Full Report to Know More About the Sector Scorecards

Download A Free Report Sample

Here are some key challenges and opportunities for the hydrogen aircraft market:

Challenges:

Infrastructure Development:

The creation of a hydrogen supply infrastructure, including production, storage, transportation, and refueling facilities, is a major challenge. It requires substantial investment and coordination.

Hydrogen Storage:

Hydrogen has a low energy density, which makes storage and distribution more challenging. Developing lightweight, safe, and efficient hydrogen storage solutions is crucial.

Production Costs:

Hydrogen production, particularly through green hydrogen methods, can be costly. Reducing production costs to make hydrogen fuel competitive with traditional aviation fuels is a significant challenge.

Regulatory and Safety Compliance:

Developing and adhering to regulatory standards for hydrogen aircraft safety and operations is a complex and evolving process. Ensuring compliance is paramount.

Range and Payload Constraints:

Hydrogen-powered aircraft may face limitations in terms of range and payload capacity, which could restrict their use on long-haul routes and for certain types of cargo.

Consumer Acceptance:

Convincing passengers to trust and use hydrogen-powered aircraft is a challenge. Public perception, safety concerns, and familiarity with hydrogen as a fuel source need to be addressed.

Competing Technologies:

Hydrogen aircraft face competition from other sustainable aviation technologies like electric aircraft and sustainable aviation fuels. Balancing these options is a challenge for the industry.

Opportunities:

Emissions Reduction:

Hydrogen aircraft have the potential to significantly reduce carbon emissions in the aviation sector, offering a sustainable solution to combat climate change.

Innovation and R&D:

The development of hydrogen aircraft is driving innovation in aviation technology, including fuel cells, electric propulsion, and lightweight materials, benefiting the entire industry.

Collaboration and Partnerships:

Collaborations between aviation companies, hydrogen producers, and governments can help overcome infrastructure and financial challenges. Public-private partnerships are crucial.

Regional and Short-Haul Flights:

Hydrogen aircraft are well-suited for short-haul and regional flights where range limitations are less of a concern. This market segment offers growth opportunities.

Government Support:

Many governments are offering incentives, subsidies, and grants to promote hydrogen technology, providing a financial boost for the industry.

Market Expansion:

Hydrogen aircraft can access new markets and routes, including remote regions with limited access to traditional aviation fuels, expanding the reach of air travel.

Economic Benefits:

The hydrogen economy has the potential to create jobs and stimulate economic growth in regions involved in hydrogen production and distribution.

In summary, the hydrogen aircraft market holds great promise in terms of reducing aviation's environmental impact. Overcoming challenges related to infrastructure, cost, and public perception is essential. The industry's continued growth relies on a combination of technological advancements, regulatory support, and collaborative efforts to make hydrogen aviation a viable and sustainable solution for the future.

0 notes

Text

Excerpt from this story from RMI:

1. Batteries Become Everybody’s Best Friend

Battery prices continue to drop and their capacity continues to rise. The cost of electric vehicle (EV) batteries are now about 60 percent what they were just five years ago. And around the world, batteries have become key components in solar-plus-storage microgrids, giving people access to reliable power and saving the day for communities this past hurricane season.

2. Americans Get Cheaper (and Cleaner) Energy

State public utility commissions and rural electric co-operatives around the country are taking steps to deliver better service for their customers that also lowers their rates. At the same time, real momentum is building to prevent vertically integrated utilities from preferencing their coal assets when there are cleaner and cheaper alternatives available.

3. A Sustainable Shipping Future Gets Closer

More than 50 leaders across the marine shipping value chain — from e-fuel producers to vessel and cargo owners, to ports and equipment manufacturers — signed a Call to Action at the UN climate change conference (COP29) to accelerate the adoption of zero-emission fuels. The joint statement calls for faster and bolder action to increase the use of zero and near-zero emissions fuel, investment in zero-emissions vessels, and global development of green hydrogen infrastructure, leaving no country behind.

4. Corporations Fly Cleaner

In April, 20 corporations, including Netflix, JPMorgan Chase, Autodesk, and more, committed to purchase about 50 million gallons of sustainable aviation fuel (SAF), avoiding 500,000 tons of CO2 emissions — equivalent to the emissions of 3,000 fully loaded passenger flights from New York City to London. SAF is made with renewable or waste feedstocks and can be used in today’s aircraft without investments to upgrade existing fleets and infrastructure.

5. More and More Places Go From Coal to Clean

Around the world, coal-fired power plants are closing down as communities switch to clean energy. From Chile to the Philippines to Minnesota coal-to-clean projects are creating new jobs, improving local economic development, and generating clean electricity. In September, Britain became the first G7 nation to stop generating electricity from coal — it’s turning its last coal-fired power plant into a low-carbon energy hub. And in Indonesia, the president vowed to retire all coal plants within 15 years and install 75 gigawatts of renewable energy.

6. Methane Becomes More Visible, and Easier to Mitigate

Methane — a super-potent greenhouse gas — got much easier to track thanks to the launch of new methane tracking satellites over the past year. In March, the Environmental Defense Fund launched MethaneSAT, the first for a non-governmental organization, and the Carbon Mapper Coalition soon followed with the launch of Tanager-1. By scanning the planet many times each day and identifying major methane leaks from orbit, these new satellites will put pressure on big emitters to clean up.

7. EVs Speed By Historic Milestones

This past year was the first time any country had more fully electric cars than gas-powered cars on the roads. It’s no surprise that this happened in Norway where electric cars now make up more than 90 percent of new vehicle sales. And in October, the United States hit a milestone, with over 200,000 electric vehicle charging ports installed nationwide.

8. Consumers Continue to Shift to Energy-Efficient Heat Pumps for Heating and Cooling

Heat pumps have outsold gas furnaces consistently since 2021. And while shipments of heating and cooling equipment fell worldwide in 2023, likely due to broad economic headwinds, heat pumps held on to their market share through. And over the past 12 months, heat pumps outsold conventional furnaces by 27 percent. Shipments are expected to continue increasing as states roll out home efficiency and appliance rebate programs already funded by the Inflation Reduction Act – worth up to $10,000 per household in new incentives for heat pump installations. Link: Tracking the Heat Pump & Water Heater Market in the United States – RMI

9. China Reaches Its Renewable Energy Goal, Six Years Early

China added so much renewable energy capacity this year, that by July it had surpassed its goal of having 1,200 gigawatts (GW) of clean energy installed by 2030. Through September 2024, China installed some 161 GW of new solar capacity and 39 GW of new wind power, according to China’s National Energy Administration (NEA). China is deploying more solar, wind, and EVs than any other country, including the United States, which is — by comparison — projected to deploy a record 50 GW of solar modules by the end of 2024.

10. De-carbonizing Heavy Industry

For steel, cement, chemicals and other heavy industries, low-carbon technologies and climate-friendly solutions are not only increasingly available but growing more affordable. To speed this process, Third Derivative, RMI’s climate tech accelerator, launched the Industrial Innovation Cohorts to accelerate the decarbonization of steel, cement, and chemicals. Also on the rise: clean hydrogen hubs — powered by renewable energy — designed to supply green hydrogen to chemical, steel, and other heavy industries to help them shift to low-carbon production processes.

27 notes

·

View notes

Text

Exploring the Dynamics of the Synthetic Fuels Market: A Sustainable Energy Solution

The Synthetic Fuels Market is rapidly gaining traction as a viable alternative in the quest for sustainable energy sources. With the growing concerns over climate change and the need to reduce carbon emissions, synthetic fuels offer a promising solution. These fuels, also known as e-fuels or renewable fuels, are produced through advanced processes that utilize renewable energy sources such as wind, solar, or hydroelectric power.

One of the primary drivers behind the surge in demand for synthetic fuels is the global shift towards greener energy solutions. Governments, industries, and consumers alike are increasingly recognizing the importance of reducing dependency on fossil fuels and embracing renewable alternatives. Synthetic fuels present a compelling option as they not only offer a cleaner energy source but also provide a pathway to decarbonizing sectors such as transportation, industrial manufacturing, and power generation.

The versatility of synthetic fuels is another factor contributing to their growing popularity. Unlike traditional fossil fuels, synthetic fuels can be easily integrated into existing infrastructure without the need for significant modifications. This means that vehicles, aircraft, and machinery powered by gasoline or diesel can seamlessly transition to synthetic fuels without compromising performance or efficiency. Additionally, synthetic fuels can be tailored to meet specific energy needs, offering a customizable solution for various applications.

Moreover, advancements in technology have significantly improved the efficiency and cost-effectiveness of synthetic fuel production. Innovative processes such as Power-to-Liquid (PtL) and Gas-to-Liquid (GtL) have made it possible to produce synthetic fuels on a commercial scale, driving down production costs and increasing accessibility. As a result, synthetic fuels are becoming increasingly competitive with conventional fossil fuels, further fueling their adoption across different sectors.

The transportation industry stands to benefit significantly from the widespread adoption of synthetic fuels. With concerns over air quality and emissions regulations becoming more stringent, many vehicle manufacturers are exploring alternative fuel options to meet regulatory requirements and consumer demand for greener transportation solutions. Synthetic fuels offer an attractive alternative, providing a bridge between conventional combustion engines and future zero-emission technologies such as electric vehicles and hydrogen fuel cells.

In addition to transportation, synthetic fuels find applications in other sectors such as power generation and industrial manufacturing. The ability to produce clean, reliable energy from renewable sources makes synthetic fuels an appealing choice for companies seeking to reduce their carbon footprint and meet sustainability targets. Furthermore, synthetic fuels offer energy security benefits by reducing reliance on imported oil and mitigating the geopolitical risks associated with fossil fuel dependence.

Looking ahead, the Synthetic Fuels Market is poised for significant growth as the world transitions towards a low-carbon economy. With ongoing advancements in technology, coupled with increasing environmental awareness and regulatory pressures, the demand for synthetic fuels is expected to soar in the coming years. As governments and industries continue to invest in renewable energy solutions, synthetic fuels are well-positioned to play a crucial role in shaping the future of energy production and consumption.

#energy#sustainability#renewable fuels#e-fuels#carbon emissions#alternative energy#transportation#industrial applications

2 notes

·

View notes

Text

Hydrogen Is the Future—or a Complete Mirage!

The green-hydrogen industry is a case study in the potential—for better and worse—of our new economic era.

— July 14, 2023 | Foreign Policy | By Adam Tooze

An employee of Air Liquide in front of an electrolyzer at the company's future hydrogen production facility of renewable hydrogen in Oberhausen, Germany, on May 2, 2023. Ina Fassbender/ AFP Via Getty Images

With the vast majority of the world’s governments committed to decarbonizing their economies in the next two generations, we are embarked on a voyage into the unknown. What was once an argument over carbon pricing and emissions trading has turned into an industrial policy race. Along the way there will be resistance and denial. There will also be breakthroughs and unexpected wins. The cost of solar and wind power has fallen spectacularly in the last 20 years. Battery-powered electric vehicles (EVs) have moved from fantasy to ubiquitous reality.

But alongside outright opposition and clear wins, we will also have to contend with situations that are murkier, with wishful thinking and motivated reasoning. As we search for technical solutions to the puzzle of decarbonization, we must beware the mirages of the energy transition.

On a desert trek a mirage can be fatal. Walk too far in the wrong direction, and there may be no way back. You succumb to exhaustion before you can find real water. On the other hand, if you don’t head toward what looks like an oasis, you cannot be sure that you will find another one in time.

Right now, we face a similar dilemma, a dilemma of huge proportions not with regard to H2O but one of its components, H2—hydrogen. Is hydrogen a key part of the world’s energy future or a dangerous fata morgana? It is a question on which tens of trillions of dollars in investment may end up hinging. And scale matters.

For decades, economists warned of the dangers of trying through industrial policy to pick winners. The risk is not just that you might fail, but that in doing so you incur costs. You commit real resources that foreclose other options. The lesson was once that we should leave it to the market. But that was a recipe for a less urgent time. The climate crisis gives us no time. We cannot avoid the challenge of choosing our energy future. As Chuck Sabel and David Victor argue in their important new book Fixing the Climate: Strategies for an Uncertain World, it is through local partnership and experimentation that we are most likely to find answers to these technical dilemmas. But, as the case of hydrogen demonstrates, we must beware the efforts of powerful vested interests to use radical technological visions to channel us toward what are in fact conservative and ruinously expensive options.

A green hydrogen plant built by Spanish company Iberdrola in Puertollano, Spain, on April 18, 2023. Valentine Bontemps/AFP Via Getty Images

In the energy future there are certain elements that seem clear. Electricity is going to play a much bigger role than ever before in our energy mix. But some very knotty problems remain. Can electricity suffice? How do you unleash the chemical reactions necessary to produce essential building blocks of modern life like fertilizer and cement without employing hydrocarbons and applying great heat? To smelt the 1.8 billion tons of steel we use every year, you need temperatures of almost 2,000 degrees Celsius. Can we get there without combustion? How do you power aircraft flying thousands of miles, tens of thousands of feet in the air? How do you propel giant container ships around the world? Electric motors and batteries can hardly suffice.

Hydrogen recommends itself as a solution because it burns very hot. And when it does, it releases only water. We know how to make hydrogen by running electric current through water. And we know how to generate electricity cleanly. Green hydrogen thus seems easily within reach. Alternatively, if hydrogen is manufactured using natural gas rather than electrolysis, the industrial facilities can be adapted to allow immediate, at-source CO2 capture. This kind of hydrogen is known as blue hydrogen.

Following this engineering logic, H2 is presented by its advocates as a Swiss army knife of the energy transition, a versatile adjunct to the basic strategy of electrifying everything. The question is whether H2 solutions, though they may be technically viable, make any sense from the point of view of the broader strategy of energy transition, or whether they might in fact be an expensive wrong turn.

Using hydrogen as an energy store is hugely inefficient. With current technology producing hydrogen from water by way of electrolysis consumes vastly more energy than will be stored and ultimately released by burning the hydrogen. Why not use the same electricity to generate the heat or drive a motor directly? The necessary electrolysis equipment is expensive. And though hydrogen may burn cleanly, as a fuel it is inconvenient because of its corrosive properties, its low energy per unit of volume, and its tendency to explode. Storing and moving hydrogen around will require huge investment in shipping facilities, pipelines, filling stations, or facilities to convert hydrogen into the more stable form of ammonia.

The kind of schemes pushed by hydrogen’s lobbyists foresee annual consumption rising by 2050 to more than 600 million tons per annum, compared to 100 million tons today. This would consume a huge share of green electricity production. In a scenario favored by the Hydrogen Council, of the United States’ 2,900 gigawatts of renewable energy production, 650 gigawatts would be consumed by hydrogen electrolysis. That is almost three times the total capacity of renewable power installed today.

The costs will be gigantic. The cost for a hydrogen build-out over coming decades could run into the tens of trillions of dollars. Added to which, to work as a system, the investment in hydrogen production, transport, and consumption will have to be undertaken simultaneously.

Little wonder, perhaps, that though the vision of the “hydrogen economy” as an integrated economic and technical system has been around for half a century, we have precious little actual experience with hydrogen fuel. Indeed, there is an entire cottage industry of hydrogen skeptics. The most vocal of these is Michael Liebreich, whose consultancy has popularized the so-called hydrogen ladder, designed to highlight how unrealistic many of them are. If one follows the Liebreich analysis, the vast majority of proposed hydrogen uses in transport and industrial heating are, in fact, unrealistic due to their sheer inefficiency. In each case there is an obvious alternative, most of them including the direct application of electricity.

Technicians work on the construction of a hydrogen bus at a plant in Albi, France, on March 4, 2021. Georges Gobet/AFP Via Getty Images

Nevertheless, in the last six years a huge coalition of national governments and industrial interests has assembled around the promise of a hydrogen-based economy.

The Hydrogen Council boasts corporate sponsors ranging from Airbus and Aramco to BMW, Daimler Truck, Honda, Toyota and Hyundai, Siemens, Shell, and Microsoft. The national governments of Japan, South Korea, the EU, the U.K., the U.S., and China all have hydrogen strategies. There are new project announcements regularly. Experimental shipments of ammonia have docked in Japan. The EU is planning an elaborate network of pipelines, known as the hydrogen backbone. All told, the Hydrogen Council counts $320 billion in hydrogen projects announced around the world.

Given the fact that many new uses of hydrogen are untested, and given the skepticism among many influential energy economists and engineers, it is reasonable to ask what motivates this wave of commitments to the hydrogen vision.

In technological terms, hydrogen may represent a shimmering image of possibility on a distant horizon, but in political economy terms, it has a more immediate role. It is a route through which existing fossil fuel interests can imagine a place for themselves in the new energy future. The presence of oil majors and energy companies in the ranks of the Hydrogen Council is not coincidental. Hydrogen enables natural gas suppliers to imagine that they can transition their facilities to green fuels. Makers of combustion engines and gas turbines can conceive of burning hydrogen instead. Storing hydrogen or ammonia like gas or oil promises a solution to the issues of intermittency in renewable power generation and may extend the life of gas turbine power stations. For governments around the world, a more familiar technology than one largely based on solar panels, windmills, and batteries is a way of calming nerves about the transformation they have notionally signed up for.

Looking at several key geographies in which hydrogen projects are currently being discussed offers a compound psychological portrait of the common moment of global uncertainty.

A worker at the Fukushima Hydrogen Energy Research Field, a test facility that produces hydrogen from renewable energy, in Fukushima, Japan, on Feb. 15, 2023. Richard A. Brooks/AFP Via Getty Images

The first country to formulate a national hydrogen strategy was Japan. Japan has long pioneered exotic energy solutions. Since undersea pipelines to Japan are impractical, it was Japanese demand that gave life to the seaborne market for liquefied natural gas (LNG). What motivated the hydrogen turn in 2017 was a combination of post-Fukushima shock, perennial anxiety about energy security, and a long-standing commitment to hydrogen by key Japanese car manufacturers. Though Toyota, the world’s no. 1 car producer, pioneered the hybrid in the form of the ubiquitous Prius, it has been slow to commit to full electric. The same is true for the other East Asian car producers—Honda, Nissan, and South Korea’s Hyundai. In the face of fierce competition from cheap Chinese electric vehicles, they embrace a government commitment to hydrogen, which in the view of many experts concentrates on precisely the wrong areas i.e. transport and electricity generation, rather than industrial applications.

The prospect of a substantial East Asian import demand for hydrogen encourages the economists at the Hydrogen Council to imagine a global trade in hydrogen that essentially mirrors the existing oil and gas markets. These have historically centered on flows of hydrocarbons from key producing regions such as North Africa, the Middle East, and North America to importers in Europe and Asia. Fracked natural gas converted into LNG is following this same route. And it seems possible that hydrogen and ammonia derived from hydrogen may do the same.

CF Industries, the United States’ largest producer of ammonia, has finalized a deal to ship blue ammonia to Japan’s largest power utility for use alongside oil and gas in power generation. The CO2 storage that makes the ammonia blue rather than gray has been contracted between CF Industries and U.S. oil giant Exxon. A highly defensive strategy in Japan thus serves to provide a market for a conservative vision of the energy transition in the United Sates as well. Meanwhile, Saudi Aramco, by far the world’s largest oil company, is touting shipments of blue ammonia, which it hopes to deliver to Japan or East Asia. Though the cost in terms of energy content is the equivalent of around $250 per barrel of oil, Aramco hopes to ship 11 million tons of blue ammonia to world markets by 2030.

To get through the current gas crisis, EU nations have concluded LNG deals with both the Gulf states and the United States. Beyond LNG, it is also fully committed to the hydrogen bandwagon. And again, this follows a defensive logic. The aim is to use green or blue hydrogen or ammonia to find a new niche for European heavy industry, which is otherwise at risk of being entirely knocked out of world markets by high energy prices and Europe’s carbon levy.

The European steel industry today accounts for less than ten percent of global production. It is a leader in green innovation. And the world will need technological first-movers to shake up the fossil-fuel dependent incumbents, notably in China. But whether this justifies Europe’s enormous commitment to hydrogen is another question. It seems motivated more by the desire to hold up the process of deindustrialization and worries about working-class voters drifting into the arms of populists, than by a forward looking strategic calculus.

In the Netherlands, regions that have hitherto served as hubs for global natural gas trading are now competing for designation as Europe’s “hydrogen valley.” In June, German Chancellor Olaf Scholz and Italian Prime Minister Giorgia Meloni inked the contract on the SoutH2 Corridor, a pipeline that will carry H2 up the Italian peninsula to Austria and southern Germany. Meanwhile, France has pushed Spain into agreeing to a subsea hydrogen connection rather than a natural gas pipeline over the Pyrenees. Spain and Portugal have ample LNG terminal capacity. But Spain’s solar and wind potential also make it Europe’s natural site for green hydrogen production and a “green hydrogen” pipe, regardless of its eventual uses, in the words of one commentator looks “less pharaonic and fossil-filled” than the original natural gas proposal.

A hydrogen-powered train is refilled by a mobile hydrogen filling station at the Siemens test site in Wegberg, Germany, on Sept. 9, 2022. Bernd/AFP Via Getty Images

How much hydrogen will actually be produced in Europe remains an open question. Proximity to the point of consumption and the low capital costs of investment in Europe speak in favor of local production. But one of the reasons that hydrogen projects appeal to European strategists is that they offer a new vision of European-African cooperation. Given demographic trends and migration pressure, Europe desperately needs to believe that it has a promising African strategy. Africa’s potential for renewable electricity generation is spectacular. Germany has recently entered into a hydrogen partnership with Namibia. But this raises new questions.

First and foremost, where will a largely desert country source the water for electrolysis? Secondly, will Namibia export only hydrogen, ammonia, or some of the industrial products made with the green inputs? It would be advantageous for Namibia to develop a heavy-chemicals and iron-smelting industry. But from Germany’s point of view, that might well defeat the object, which is precisely to provide affordable green energy with which to keep industrial jobs in Europe.

A variety of conservative motives thus converge in the hydrogen coalition. Most explicit of all is the case of post-Brexit Britain. Once a leader in the exit from coal, enabled by a “dash for gas” and offshore wind, the U.K. has recently hit an impasse. Hard-to-abate sectors like household heating, which in the U.K. is heavily dependent on natural gas, require massive investments in electrification, notably in heat pumps. These are expensive. In the United Kingdom, the beleaguered Tory government, which has presided over a decade of stagnating real incomes, is considering as an alternative the widespread introduction of hydrogen for domestic heating. Among energy experts this idea is widely regarded as an impractical boondoggle for the gas industry that defers the eventual and inevitable electrification at the expense of prolonged household emissions. But from the point of view of politics, it has the attraction that it costs relatively less per household to replace natural gas with hydrogen.

Employees work on the assembly line of fuel cell electric vehicles powered by hydrogen at a factory in Qingdao, Shandong province, China, on March 29, 2022. VCG Via Getty Images

As this brief tour suggests, there is every reason to fear that tens of billions of dollars in subsidies, vast amounts of political capital, and precious time are being invested in “green” energy investments, the main attraction of which is that they minimize change and perpetuate as far as possible the existing patterns of the hydrocarbon energy system. This is not greenwashing in the simple sense of rebadging or mislabeling. If carried through, it is far more substantial than that. It will build ships and put pipes in the ground. It will consume huge amounts of desperately scarce green electricity. And this faces us with a dilemma.

In confronting the challenge of the energy transition, we need a bias for action. We need to experiment. There is every reason to trust in learning-curve effects. Electrolyzers, for instance, will get more affordable, reducing the costs of hydrogen production. At certain times and in certain places, green power may well become so abundant that pouring it into electrolysis makes sense. And even if many hydrogen projects do not succeed, that may be a risk worth taking. We will likely learn new techniques in the process. In facing the uncertainties of the energy transition, we need to cultivate a tolerance for failure. Furthermore, even if hydrogen is a prime example of corporate log-rolling, we should presumably welcome the broadening of the green coalition to include powerful fossil fuel interests.

The real and inescapable tradeoff arises when we commit scarce resources—both real and political—to the hydrogen dream. The limits of public tolerance for the costs of the energy transition are already abundantly apparent, in Asia and Europe as well as in the United States. Pumping money into subsidies that generate huge economies of scale and cost reductions is one thing. Wasting money on lame-duck projects with little prospect of success is quite another. What is at stake is ultimately the legitimacy of the energy transition as such.

In the end, there is no patented method distinguishing self-serving hype from real opportunity. There is no alternative but to subject competing claims to intense public, scientific, and technical scrutiny. And if the ship has already sailed and subsidies are already on the table, then retrospective cost-benefit assessment is called for.

Ideally, the approach should be piecemeal and stepwise, and in this regard the crucial thing to note about hydrogen is that to regard it as a futuristic fantasy is itself misguided. We already live in a hydrogen-based world. Two key sectors of modern industry could not operate without it. Oil refining relies on hydrogen, as does the production of fertilizer by the Haber-Bosch process on which we depend for roughly half of our food production. These two sectors generate the bulk of the demand for the masses of hydrogen we currently consume.

We may not need 600 million, 500 million, or even 300 million tons of green and blue hydrogen by 2050. But we currently use about 100 million, and of that total, barely 1 million is clean. It is around that core that hydrogen experimentation should be concentrated, in places where an infrastructure already exists. This is challenging because transporting hydrogen is expensive, and many of the current points of use of hydrogen, notably in Europe, are not awash in cheap green power. But there are two places where the conditions for experimentation within the existing hydrogen economy seem most propitious.

One is China, and specifically northern China and Inner Mongolia, where China currently concentrates a large part of its immense production of fertilizer, cement, and much of its steel industry. China is leading the world in the installation of solar and wind power and is pioneering ultra-high-voltage transmission. Unlike Japan and South Korea, China has shown no particular enthusiasm for hydrogen. It is placing the biggest bet in the world on the more direct route to electrification by way of renewable generation and batteries. But China is already the largest and lowest-cost producer of electrolysis equipment. In 2022, China launched a modestly proportioned hydrogen strategy. In cooperation with the United Nations it has initiated an experiment with green fertilizer production, and who would bet against its chances of establishing a large-scale hydrogen energy system?

The other key player is the United States. After years of delay, the U.S. lags far behind in photovoltaics batteries, and offshore wind. But in hydrogen, and specifically in the adjoining states of Texas and Louisiana on the Gulf of Mexico, it has obvious advantages over any other location in the West. The United States is home to a giant petrochemicals complex. It is the only Western economy that can compete with India and China in fertilizer production. In Texas, there are actually more than 2500 kilometers of hardened hydrogen pipelines. And insofar as players like Exxon have a green energy strategy, it is carbon sequestration, which will be the technology needed for blue hydrogen production.

It is not by accident that America’s signature climate legislation, the Inflation Reduction Act, targeted its most generous subsidies—the most generous ever offered for green energy in the United States—on hydrogen production. The hydrogen lobby is hard at work, and it has turned Texas into the lowest-cost site for H2 production in the Western world. It is not a model one would want to see emulated anywhere else, but it may serve as a technology incubator that charts what is viable and what is not.

There is very good reason to suspect the motives of every player in the energy transition. Distinguishing true innovation from self-serving conservatism is going to be a key challenge in the new era in which we have to pick winners. We need to develop a culture of vigilance. But there are also good reasons to expect certain key features of the new to grow out of the old. Innovation is miraculous but it rarely falls like mana from heaven. As Sabel and Victor argue in their book, it grows from within expert technical communities with powerful vested interests in change. The petrochemical complex of the Gulf of Mexico may seem an unlikely venue for the birth of a green new future, but it is only logical that the test of whether the hydrogen economy is a real possibility will be run at the heart of the existing hydrocarbon economy.

— Adam Tooze is a Columnist at Foreign Policy and a History Professor and the Director of the European Institute at Columbia University. He is the Author of Chartbook, a newsletter on Rconomics, Geopolitics, and History.

#Hydrogen#Battery-Powered Electric Vehicles (EVs)#Chuck Sabel | David Victor#Iberdrola Puertollano Spain 🇪🇸#Green Hydrogen#Hydrogen Council of the United States 🇺🇸#Hydrogen Economy#Airbus | Aramco | BMW | Daimler Truck | Honda | Toyota | Hyundai | Siemens | Shell | Microsoft#Japan 🇯🇵 | South Korea 🇰🇷 | EU 🇪🇺 | UK 🇬🇧 | US 🇺🇸 | China 🇨🇳#Portugal 🇵🇹 | Germany 🇩🇪 | Namibia 🇳🇦#European-African Cooperation

2 notes

·

View notes

Text

With the vast majority of the world’s governments committed to decarbonizing their economies in the next two generations, we are embarked on a voyage into the unknown. What was once an argument over carbon pricing and emissions trading has turned into an industrial policy race. Along the way there will be resistance and denial. There will also be breakthroughs and unexpected wins. The cost of solar and wind power has fallen spectacularly in the last 20 years. Battery-powered electric vehicles (EVs) have moved from fantasy to ubiquitous reality.

But alongside outright opposition and clear wins, we will also have to contend with situations that are murkier, with wishful thinking and motivated reasoning. As we search for technical solutions to the puzzle of decarbonization, we must beware the mirages of the energy transition.

On a desert trek a mirage can be fatal. Walk too far in the wrong direction, and there may be no way back. You succumb to exhaustion before you can find real water. On the other hand, if you don’t head toward what looks like an oasis, you cannot be sure that you will find another one in time.

Right now, we face a similar dilemma, a dilemma of huge proportions not with regard to H2O but one of its components, H2—hydrogen. Is hydrogen a key part of the world’s energy future or a dangerous fata morgana? It is a question on which tens of trillions of dollars in investment may end up hinging. And scale matters.

For decades, economists warned of the dangers of trying through industrial policy to pick winners. The risk is not just that you might fail, but that in doing so you incur costs. You commit real resources that foreclose other options. The lesson was once that we should leave it to the market. But that was a recipe for a less urgent time. The climate crisis gives us no time. We cannot avoid the challenge of choosing our energy future. As Chuck Sabel and David Victor argue in their important new book Fixing the Climate: Strategies for an Uncertain World, it is through local partnership and experimentation that we are most likely to find answers to these technical dilemmas. But, as the case of hydrogen demonstrates, we must beware the efforts of powerful vested interests to use radical technological visions to channel us towards what are in fact conservative and ruinously expensive options.

In the energy future there are certain elements that seem clear. Electricity is going to play a much bigger role than ever before in our energy mix. But some very knotty problems remain. Can electricity suffice? How do you unleash the chemical reactions necessary to produce essential building blocks of modern life like fertilizer and cement without employing hydrocarbons and applying great heat? To smelt the 1.8 billion tons of steel we use every year, you need temperatures of almost 2,000 degrees Celsius. Can we get there without combustion? How do you power aircraft flying thousands of miles, tens of thousands of feet in the air? How do you propel giant container ships around the world? Electric motors and batteries can hardly suffice.

Hydrogen recommends itself as a solution because it burns very hot. And when it does, it releases only water. We know how to make hydrogen by running electric current through water. And we know how to generate electricity cleanly. Green hydrogen thus seems easily within reach. Alternatively, if hydrogen is manufactured using natural gas rather than electrolysis, the industrial facilities can be adapted to allow immediate, at-source CO2 capture. This kind of hydrogen is known as blue hydrogen.

Following this engineering logic, H2 is presented by its advocates as a Swiss army knife of the energy transition, a versatile adjunct to the basic strategy of electrifying everything. The question is whether H2 solutions, though they may be technically viable, make any sense from the point of view of the broader strategy of energy transition, or whether they might in fact be an expensive wrong turn.

Using hydrogen as an energy store is hugely inefficient. With current technology producing hydrogen from water by way of electrolysis consumes vastly more energy than will be stored and ultimately released by burning the hydrogen. Why not use the same electricity to generate the heat or drive a motor directly? The necessary electrolysis equipment is expensive. And though hydrogen may burn cleanly, as a fuel it is inconvenient because of its corrosive properties, its low energy per unit of volume, and its tendency to explode. Storing and moving hydrogen around will require huge investment in shipping facilities, pipelines, filling stations, or facilities to convert hydrogen into the more stable form of ammonia.

The kind of schemes pushed by hydrogen’s lobbyists foresee annual consumption rising by 2050 to more than 600 million tons per annum, compared to 100 million tons today. This would consume a huge share of green electricity production. In a scenario favored by the Hydrogen Council, of the United States’ 2,900 gigawatts of renewable energy production, 650 gigawatts would be consumed by hydrogen electrolysis. That is almost three times the total capacity of renewable power installed today.

The costs will be gigantic. The cost for a hydrogen build-out over coming decades could run into the tens of trillions of dollars. Added to which, to work as a system, the investment in hydrogen production, transport, and consumption will have to be undertaken simultaneously.

Little wonder, perhaps, that though the vision of the “hydrogen economy” as an integrated economic and technical system has been around for half a century, we have precious little actual experience with hydrogen fuel. Indeed, there is an entire cottage industry of hydrogen skeptics. The most vocal of these is Michael Liebreich, whose consultancy has popularized the so-called hydrogen ladder, designed to highlight how unrealistic many of them are. If one follows the Liebreich analysis, the vast majority of proposed hydrogen uses in transport and industrial heating are, in fact, unrealistic due to their sheer inefficiency. In each case there is an obvious alternative, most of them including the direct application of electricity.

Nevertheless, in the last six years a huge coalition of national governments and industrial interests has assembled around the promise of a hydrogen-based economy.

The Hydrogen Council boasts corporate sponsors ranging from Airbus and Aramco to BMW, Daimler Truck, Honda, Toyota and Hyundai, Siemens, Shell, and Microsoft. The national governments of Japan, South Korea, the EU, the U.K., the U.S., and China all have hydrogen strategies. There are new project announcements regularly. Experimental shipments of ammonia have docked in Japan. The EU is planning an elaborate network of pipelines, known as the hydrogen backbone. All told, the Hydrogen Council counts $320 billion in hydrogen projects announced around the world.

Given the fact that many new uses of hydrogen are untested, and given the skepticism among many influential energy economists and engineers, it is reasonable to ask what motivates this wave of commitments to the hydrogen vision.

In technological terms, hydrogen may represent a shimmering image of possibility on a distant horizon, but in political economy terms, it has a more immediate role. It is a route through which existing fossil fuel interests can imagine a place for themselves in the new energy future. The presence of oil majors and energy companies in the ranks of the Hydrogen Council is not coincidental. Hydrogen enables natural gas suppliers to imagine that they can transition their facilities to green fuels. Makers of combustion engines and gas turbines can conceive of burning hydrogen instead. Storing hydrogen or ammonia like gas or oil promises a solution to the issues of intermittency in renewable power generation and may extend the life of gas turbine power stations. For governments around the world, a more familiar technology than one largely based on solar panels, windmills, and batteries is a way of calming nerves about the transformation they have notionally signed up for.

Looking at several key geographies in which hydrogen projects are currently being discussed offers a compound psychological portrait of the common moment of global uncertainty.

The first country to formulate a national hydrogen strategy was Japan. Japan has long pioneered exotic energy solutions. Since undersea pipelines to Japan are impractical, it was Japanese demand that gave life to the seaborne market for liquefied natural gas (LNG). What motivated the hydrogen turn in 2017 was a combination of post-Fukushima shock, perennial anxiety about energy security, and a long-standing commitment to hydrogen by key Japanese car manufacturers. Though Toyota, the world’s no. 1 car producer, pioneered the hybrid in the form of the ubiquitous Prius, it has been slow to commit to full electric. The same is true for the other East Asian car producers—Honda, Nissan, and South Korea’s Hyundai. In the face of fierce competition from cheap Chinese electric vehicles, they embrace a government commitment to hydrogen, which in the view of many experts concentrates on precisely the wrong areas i.e. transport and electricity generation, rather than industrial applications.

The prospect of a substantial East Asian import demand for hydrogen encourages the economists at the Hydrogen Council to imagine a global trade in hydrogen that essentially mirrors the existing oil and gas markets. These have historically centered on flows of hydrocarbons from key producing regions such as North Africa, the Middle East, and North America to importers in Europe and Asia. Fracked natural gas converted into LNG is following this same route. And it seems possible that hydrogen and ammonia derived from hydrogen may do the same.

CF Industries, the United States’ largest producer ammonia, has finalized a deal to ship blue ammonia to Japan’s largest power utility for use alongside oil and gas in power generation. The CO2 storage that makes the ammonia blue rather than gray has been contracted between CF Industries and U.S. oil giant Exxon. A highly defensive strategy in Japan thus serves to provide a market for a conservative vision of the energy transition in the United Sates as well. Meanwhile, Saudi Aramco, by far the world’s largest oil company, is touting shipments of blue ammonia, which it hopes to deliver to Japan or East Asia. Though the cost in terms of energy content is the equivalent of around $250 per barrel of oil, Aramco hopes to ship 11 million tons of blue ammonia to world markets by 2030.

To get through the current gas crisis, EU nations have concluded LNG deals with both the Gulf states and the United States. Beyond LNG, it is also fully committed to the hydrogen bandwagon. And again, this follows a defensive logic. The aim is to use green or blue hydrogen or ammonia to find a new niche for European heavy industry, which is otherwise at risk of being entirely knocked out of world markets by high energy prices and Europe’s carbon levy.

The European steel industry today accounts for less than ten percent of global production. It is a leader in green innovation. And the world will need technological first-movers to shake up the fossil-fuel dependent incumbents, notably in China. But whether this justifies Europe’s enormous commitment to hydrogen is another question. It seems motivated more by the desire to hold up the process of deindustrialization and worries about working-class voters drifting into the arms of populists, than by a forward looking strategic calculus.

In the Netherlands, regions that have hitherto served as hubs for global natural gas trading are now competing for designation as Europe’s “hydrogen valley.” In June, German Chancellor Olaf Scholz and Italian Prime Minister Giorgia Meloni inked the contract on the SoutH2 Corridor, a pipeline that will carry H2 up the Italian peninsula to Austria and southern Germany. Meanwhile, France has pushed Spain into agreeing to a subsea hydrogen connection rather than a natural gas pipeline over the Pyrenees. Spain and Portugal have ample LNG terminal capacity. But Spain’s solar and wind potential also make it Europe’s natural site for green hydrogen production and a “green hydrogen” pipe, regardless of its eventual uses, looks in the words of one commentator looks “less pharaonic and fossil-filled” than the original natural gas proposal.

How much hydrogen will actually be produced in Europe remains an open question. Proximity to the point of consumption and the low capital costs of investment in Europe speak in favor of local production. But one of the reasons that hydrogen projects appeal to European strategists is that they offer a new vision of European-African cooperation. Given demographic trends and migration pressure, Europe desperately needs to believe that it has a promising African strategy. Africa’s potential for renewable electricity generation is spectacular. Germany has recently entered into a hydrogen partnership with Namibia. But this raises new questions.

First and foremost, where will a largely desert country source the water for electrolysis? Secondly, will Namibia export only hydrogen, ammonia, or some of the industrial products made with the green inputs? It would be advantageous for Namibia to develop a heavy-chemicals and iron-smelting industry. But from Germany’s point of view, that might well defeat the object, which is precisely to provide affordable green energy with which to keep industrial jobs in Europe.

A variety of conservative motives thus converge in the hydrogen coalition. Most explicit of all is the case of post-Brexit Britain. Once a leader in the exit from coal, enabled by a “dash for gas” and offshore wind, the U.K. has recently hit an impasse. Hard-to-abate sectors like household heating, which in the U.K. is heavily dependent on natural gas, require massive investments in electrification, notably in heat pumps. These are expensive. In the United Kingdom, the beleaguered Tory government, which has presided over a decade of stagnating real incomes, is considering as an alternative the widespread introduction of hydrogen for domestic heating. Among energy experts this idea is widely regarded as an impractical boondoggle for the gas industry that defers the eventual and inevitable electrification at the expense of prolonged household emissions. But from the point of view of politics, it has the attraction that it costs relatively less per household to replace natural gas with hydrogen.

As this brief tour suggests, there is every reason to fear that tens of billions of dollars in subsidies, vast amounts of political capital, and precious time are being invested in “green” energy investments, the main attraction of which is that they minimize change and perpetuate as far as possible the existing patterns of the hydrocarbon energy system. This is not greenwashing in the simple sense of rebadging or mislabeling. If carried through, it is far more substantial than that. It will build ships and put pipes in the ground. It will consume huge amounts of desperately scarce green electricity. And this faces us with a dilemma.

In confronting the challenge of the energy transition, we need a bias for action. We need to experiment. There is every reason to trust in learning-curve effects. Electrolyzers, for instance, will get more affordable, reducing the costs of hydrogen production. At certain times and in certain places, green power may well become so abundant that pouring it into electrolysis makes sense. And even if many hydrogen projects do not succeed, that may be a risk worth taking. We will likely learn new techniques in the process. In facing the uncertainties of the energy transition, we need to cultivate a tolerance for failure. Furthermore, even if hydrogen is a prime example of corporate log-rolling, we should presumably welcome the broadening of the green coalition to include powerful fossil fuel interests.

The real and inescapable tradeoff arises when we commit scarce resources—both real and political—to the hydrogen dream. The limits of public tolerance for the costs of the energy transition are already abundantly apparent, in Asia and Europe as well as in the United States. Pumping money into subsidies that generate huge economies of scale and cost reductions is one thing. Wasting money on lame-duck projects with little prospect of success is quite another. What is at stake is ultimately the legitimacy of the energy transition as such.

In the end, there is no patented method distinguishing self-serving hype from real opportunity. There is no alternative but to subject competing claims to intense public, scientific, and technical scrutiny. And if the ship has already sailed and subsidies are already on the table, then retrospective cost-benefit assessment is called for.

Ideally, the approach should be piecemeal and stepwise, and in this regard the crucial thing to note about hydrogen is that to regard it as a futuristic fantasy is itself misguided. We already live in a hydrogen-based world. Two key sectors of modern industry could not operate without it. Oil refining relies on hydrogen, as does the production of fertilizer by the Haber-Bosch process on which we depend for roughly half of our food production. These two sectors generate the bulk of the demand for the masses of hydrogen we currently consume.

We may not need 600 million, 500 million, or even 300 million tons of green and blue hydrogen by 2050. But we currently use about 100 million, and of that total, barely 1 million is clean. It is around that core that hydrogen experimentation should be concentrated, in places where an infrastructure already exists. This is challenging because transporting hydrogen is expensive, and many of the current points of use of hydrogen, notably in Europe, are not awash in cheap green power. But there are two places where the conditions for experimentation within the existing hydrogen economy seem most propitious.

One is China, and specifically northern China and Inner Mongolia, where China currently concentrates a large part of its immense production of fertilizer, cement, and much of its steel industry. China is leading the world in the installation of solar and wind power and is pioneering ultra-high-voltage transmission. Unlike Japan and South Korea, China has shown no particular enthusiasm for hydrogen. It is placing the biggest bet in the world on the more direct route to electrification by way of renewable generation and batteries. But China is already the largest and lowest-cost producer of electrolysis equipment. In 2022, China launched a modestly proportioned hydrogen strategy. In cooperation with the United Nations it has iniated an experiment with green fertilizer production, and who would bet against its chances of establishing a large-scale hydrogen energy system?

The other key player is the United States. After years of delay, the U.S. lags far behind in photovoltaics batteries, and offshore wind. But in hydrogen, and specifically in the adjoining states of Texas and Louisiana on the Gulf of Mexico, it has obvious advantages over any other location in the West. The United States is home to a giant petrochemicals complex. It is the only Western economy that can compete with India and China in fertilizer production. In Texas, there are actually more than 2500 kilometers of hardened hydrogen pipelines. And insofar as players like Exxon have a green energy strategy, it is carbon sequestration, which will be the technology needed for blue hydrogen production.

It is not by accident that America’s signature climate legislation, the Inflation Reduction Act, targeted its most generous subsidies—the most generous ever offered for green energy in the United States—on hydrogen production. The hydrogen lobby is hard at work, and it has turned Texas into the lowest-cost site for H2 production in the Western world. It is not a model one would want to see emulated anywhere else, but it may serve as a technology incubator that charts what is viable and what is not.

There is very good reason to suspect the motives of every player in the energy transition. Distinguishing true innovation from self-serving conservatism is going to be a key challenge in the new era in which we have to pick winners. We need to develop a culture of vigilance. But there are also good reasons to expect certain key features of the new to grow out of the old. Innovation is miraculous but it rarely falls like mana from heaven. As Sabel and Victor argue in their book, it grows from within expert technical communities with powerful vested interests in change. The petrochemical complex of the Gulf of Mexico may seem an unlikely venue for the birth of a green new future, but it is only logical that the test of whether the hydrogen economy is a real possibility will be run at the heart of the existing hydrocarbon economy.

4 notes

·

View notes

Text

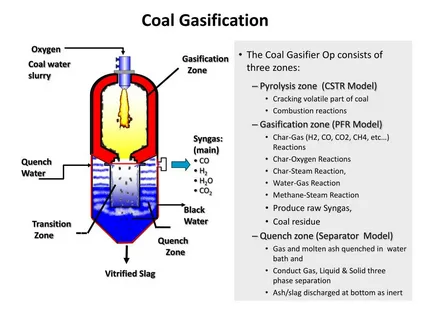

Global Coal Gasification Market 2024-2034: Technology, Feedstock & Growth

The Coal Gasification market report is predicted to develop at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2034, when global Coal Gasification market forecast size is projected to reach USD 38.63 Billion in 2034, based on an average growth pattern. The global Coal Gasification market revenue is estimated to reach a value of USD 23.36 Billion in 2024

𝐂𝐥𝐚𝐢𝐦 𝐲𝐨𝐮𝐫 𝐬𝐚𝐦𝐩𝐥𝐞 𝐜𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭 𝐢𝐧𝐬𝐭𝐚𝐧𝐭𝐥𝐲:

https://wemarketresearch.com/reports/request-free-sample-pdf/coal-gasification-market/1624

Globally, and particularly in Asia Pacific, the coal gasification industry is producing excellent quantities of chemicals, fertilizers, and hydrogen. Future market expansion is also anticipated to be accelerated by the increasing number of methanol-infused fuels utilized in hybrid cars and aircraft. Traditional coal-fired power plants burn the majority of coal, but it can also be transformed into other energy products like gas, electricity, and hydrogen.

Market Drivers for Coal Gasification

Rising Energy Demand: As the global population grows and industrial activities expand, the demand for energy continues to increase. While renewable energy sources like wind and solar are gaining traction, they cannot yet meet the global energy demand on their own. Coal gasification offers a way to utilize the world’s vast coal reserves more efficiently and with lower emissions compared to traditional coal combustion.

Environmental Concerns: With increasing pressure to reduce greenhouse gas emissions and combat climate change, coal gasification presents a promising solution. By capturing carbon emissions and enabling the production of cleaner fuels, coal gasification can help achieve environmental goals while still utilizing existing coal resources. Governments and corporations are also investing in technologies like carbon capture and storage (CCS) to make coal gasification even more environmentally friendly.

Coal Gasification Market Growth Factors

The increase of coal reserves in developing nations encourages the market to expand throughout the ensuing years.

Growing emphasis on clean and efficient energy sources and decreasing dependency on natural gas and fossil fuels are the main factors propelling the coal gasification market's growth throughout the forecast period.

The demand for coal gasification is expected to increase during the forecast period due to the rising urbanization and industrialization.

Underground coal gasification (UCG), which turns coal into valuable gases without the need for mining, is being adopted quickly, which is expected to drive market growth.

Opportunity: Supportive government investment and initiatives

The market for coal gasification is expected to rise throughout the forecast period thanks to increased government initiatives and investment. The government is aggressively working to develop sustainable and environmentally friendly methods of producing electricity.

Coal Gasification Market Segmentation

By Technology

Fixed-Bed Gasifiers

Moving Bed

Dry Ash

Fluidized-Bed Gasifiers

Bubbling Fluidized Bed

Circulating Fluidized Bed

Entrained-Flow Gasifiers

Single-Stage

Multi-Stage

Plasma Gasification

High-Temperature Gasification

Plasma Arc Technology

Integrated Gasification Combined Cycle (IGCC)

By Feedstock

Sub-Bituminous Coal

Bituminous Coal

Anthracite

Petroleum Coke

Biomass/Coal Blends

Municipal Solid Waste (MSW)

Others

By Gas Output

Synthetic Gas (Syngas)

Methane-Rich Gas

Hydrogen-Rich Gas

By End-use Industry

Energy and Utilities

Chemicals and Petrochemicals

Oil and Gas

Metals and Mining

Transportation

Others

Key Market Players

General Electric (GE)

Royal Dutch Shell

Siemens Energy

ThyssenKrupp AG

Air Products and Chemicals, Inc.

KBR Inc.

Mitsubishi Heavy Industries

Synthesis Energy Systems

Huaneng Clean Energy Research Institute

China Coal Energy Group

Sasol Limited

Air Liquide

BHEL (Bharat Heavy Electricals Limited)

Key Benefits For Stakeholders

The report provides exclusive and comprehensive analysis of the global coal gasification market scope, trends along with the coal gasification market forecast.

The report elucidates the coal gasification market trends along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts.

Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

The report entailing the coal gasification market analysis maps the qualitative sway of various industry factors on market segments as well as geographies.

The data in this report aims on market dynamics, trends, and developments affecting the coal gasification market demand.

Conclusion

The coal gasification market is poised for growth as it offers a potential solution to the global energy crisis while addressing environmental concerns. With its ability to produce cleaner energy and enable carbon capture, this Technology Presents a way to utilize the world’s vast coal reserves in a more sustainable manner. While challenges remain, ongoing technological advancements and investments in research and development are likely to drive the evolution of coal gasification, making it a key player in the energy landscape for years to come.

0 notes

Text

Super Heavy-lift Commercial Aircraft Market will grow at Highest Pace owing to Increasing Global Freight Transportation

The commercial aircraft market comprises aircraft used for transportation of passengers as well as freight across domestic and international routes. These aircraft range from narrow-body aircraft capable of carrying up to 210 passengers to wide-body aircraft capable of carrying over 300 passengers in a typical three-class seating configuration. Commercial aircraft help airlines and governments facilitate air transportation in a cost-effective manner to boost tourism and trade. Growing global transportation needs coupled with faster mobility are fueling the demand for commercial aircraft across the globe. The Global commercial aircraft market is estimated to be valued at US$ 158.83 Bn in 2024 and is expected to exhibit a CAGR of 6.4% over the forecast period 2024 To 2031. Key Takeaways Key players operating in the commercial aircraft market are Boeing Company, Airbus SE, Embraer S.A., Bombardier Inc., Lockheed Martin Corporation, General Dynamics Corporation, United Technologies Corporation, Rolls-Royce Holdings plc, Honeywell International Inc., Safran SA, Thales Group, and Raytheon Technology. The demand for commercial aircraft is growing exponentially owing to increasing global passenger traffic. Technological advancements such as new engine designs, advanced lightweight materials, and enhanced aerodynamics are helping aircraft manufacturers improve fuel-efficiency and reduce operating costs. Market Trends Commercial Aircraft Market Demand is witnessing a rising demand for freighter aircraft to support the booming e-commerce industry. Major aircraft OEMs are developing new-generation heavy-lift cargo aircraft with payloads over 100 tons to facilitate cross-continental freight transportation. Another key trend is the development of hybrid-electric and fully electric propulsion systems. Companies are intensifying R&D efforts to develop electric aircraft powertrains integrating batteries, electric motors, and hydrogen fuel cells to reduce aviation’s carbon footprint. Market Opportunities The market presents significant opportunities in the developing regions of Asia Pacific and Latin America attributed to rising incomes, expanding low-cost carrier operations, and growth in international trade. Another major opportunity lies in the development of super heavy-lift commercial freighters (payload over 150 tons) to support the transportation of over-dimensional cargos such as large wind turbines and manufacturing machinery globally. Successful demonstration of such aircraft could lead to new revenue streams for OEMs. Impact of COVID-19 on Commercial Aircraft Market The COVID-19 pandemic has severely impacted the commercial aircraft market globally. The imposition of lockdowns and international travel restrictions led to a steep decline in passenger air travel. Airlines around the world cancelled flights and delayed aircraft deliveries and orders due to low demand. This disrupted supply chains and production schedules of aircraft manufacturers. Boeing and Airbus witnessed significant reductions in revenue as customers deferred or cancelled aircraft orders. The commercial aerospace industry faced enormous challenges in 2020 to cover high fixed costs from low operations.

Get more insights on, Commercial Aircraft Market

For Deeper Insights, Find the Report in the Language that You want.

Japanese

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)

#Coherent Market Insights#Environmental regulations#Geopolitical tensions#Rising air passenger traffic#Economic uncertainties

0 notes

Text

0 notes