#HyderabadTrainings

Explore tagged Tumblr posts

Text

High-Paying Career Opportunities for Oracle Fusion Financials Professionals.

Oracle Fusion Financials is a leading cloud-based financial management solution that integrates comprehensive financial applications with cutting-edge technology. As businesses increasingly migrate to cloud-based ERP solutions, professionals skilled in Oracle Fusion Financials are in high demand. This demand translates into lucrative career opportunities across industries. Let’s explore some of the top high-paying career paths for Oracle Fusion Financials professionals.

1. Oracle Fusion Financials Consultant

Average Salary: $90,000 – $150,000 per year

Oracle Fusion Financials Consultants help organizations implement and optimize Oracle Fusion Financials modules. They analyze business requirements, configure the system, and provide training to end-users. This role requires deep knowledge of financial processes and Oracle Cloud applications.

Key Responsibilities:

Implementing Oracle Fusion Financials solutions

Customizing financial modules to align with business needs

Training and supporting end-users

Troubleshooting system issues and optimizing performance

2. Oracle Fusion Financials Functional Lead

Average Salary: $100,000 – $160,000 per year

A Functional Lead is responsible for leading the implementation of Oracle Fusion Financials solutions for enterprises. They work closely with stakeholders to ensure smooth adoption and integration.

Key Responsibilities:

Leading Oracle Fusion Financials implementation projects

Coordinating between business and technical teams

Ensuring compliance with financial regulations

Managing project timelines and deliverables

3. Oracle Fusion Financials Technical Consultant

Average Salary: $95,000 – $145,000 per year

Technical Consultants focus on the technical aspects of Oracle Fusion Financials, including integrations, customizations, and troubleshooting. They need strong programming skills and an understanding of Oracle tools like SQL, PLSQL, and BI Publisher.

Key Responsibilities:

Developing custom reports and dashboards

Integrating Oracle Fusion Financials with other enterprise systems

Resolving technical issues and optimizing system performance

Automating financial processes through scripting and configuration

4. Oracle Cloud ERP Finance Solution Architect

Average Salary: $120,000 – $180,000 per year

Solution Architects design and oversee the deployment of Oracle Fusion Financials solutions, ensuring they align with an organization's strategic goals. This senior role requires deep expertise in ERP systems and financial processes.

Key Responsibilities:

Designing end-to-end Oracle Fusion Financials solutions

Providing strategic guidance on financial transformations

Ensuring system scalability and security

Collaborating with executives and IT teams

5. Oracle Fusion Financials Business Analyst

Average Salary: $85,000 – $140,000 per year

Business Analysts bridge the gap between business needs and Oracle Fusion Financials capabilities. They analyze financial processes, gather requirements, and help optimize system usage.

Key Responsibilities:

Conducting business process analysis and recommending improvements

Gathering and documenting system requirements

Coordinating with technical teams for system enhancements

Supporting financial reporting and data analysis

6. Oracle Fusion Financials Project Manager

Average Salary: $110,000 – $170,000 per year

Project Managers oversee the implementation and integration of Oracle Fusion Financials in an organization. They ensure projects are delivered on time, within budget, and meet business objectives.

Key Responsibilities:

Managing end-to-end Oracle Fusion Financials projects

Coordinating with functional and technical teams

Monitoring project risks and implementing mitigation strategies

Ensuring stakeholder alignment and satisfaction

7. Oracle Fusion Financials Trainer

Average Salary: $80,000 – $130,000 per year

With the rising demand for Oracle Fusion Financials professionals, training and coaching have become a lucrative career path. Trainers help individuals and organizations upskill in Oracle Cloud Financials.

Key Responsibilities:

Conducting training sessions on Oracle Fusion Financials modules

Developing course materials and hands-on exercises

Assisting learners with real-world financial scenarios

Keeping up-to-date with the latest Oracle Cloud updates

Conclusion

Oracle Fusion Financials professionals have numerous high-paying career opportunities across various industries. With businesses increasingly adopting Oracle Cloud solutions, expertise in this domain can lead to rewarding job roles with excellent salary potential. Investing in training and certification in Oracle Fusion Financials can significantly enhance career prospects and open doors to leadership positions in the financial and ERP sectors.Are you looking to kickstart your career in Oracle Fusion Financials? Enroll in a structured training program to gain in-depth knowledge and hands-on experience, ensuring you are well-prepared for these lucrative roles. To Your bright future join Oracle Fusion Financials.

#erptree#jobguarantee#oraclefusion#oraclefusionfinancials#100jobguarantee#hyderabadtraining#financecareers#erptraining#financejobs#careergrowth

0 notes

Text

sohanuu azure data bricks, azure data engineer ki ela use avuthadi?

dani gurinchi teliyali anthe post chudandi

.

.

.

.

For more information about azure data engineer course please contact

Phone: +91 9882498844

Email: [email protected]

Website: https://azuretrainings.in/

#Azure#azurecloud#SkillUp2025#TechSkills#TechTraining#CareerGrowth#HyderabadTraining#dataengineeringtrainee#DataEngineering#AzureTraining#azureengineer#azuredataengineer#azuredatabricks

0 notes

Text

Curious about Data Analytics? 🤔 "Ee Data Analytics ante enti?" Discover the world of Data Analytics with Data Analytics Masters and unlock your career potential! 🚀

👉 For expert training and comprehensive courses, visit our website: [www.dataanalyticsmasters.in](http://www.dataanalyticsmasters.in) 📞 Call us now: +91 9948801222

💡 Don't miss the chance to learn from the best!

#DataAnalytics#DataAnalyticsMasters#HyderabadCourses#CareerInDataAnalytics#LearnDataAnalytics#UpskillYourCareer#BrollyAcademy#HyderabadTraining#CareerGoals

0 notes

Text

Which type of machine learning involves labeled data? 🤔 Drop your answers in the comments! 👇

🚀 Ready to dive into the world of Data Science and Machine Learning? Join our Data Science Course in Hyderabad and unlock: ✔️ Hands-on learning with real-world projects ✔️ Mentorship from industry experts ✔️ In-depth modules covering Python, R, Machine Learning, and AI ✔️ 100% placement assistance to kickstart your career

📞 Call us: +91 99488 61888 🌐 Visit us: https://datascienceschool.in

📍 Location: Metro Pillar No. A689, JNTU Metro Station, 3rd Floor, Dr. Atmaram Estates, beside Sri Bhramaramba Theatre, Hyder Nagar, Hyderabad, Telangana 500072

📌 Begin your journey in Data Science today!

#datascience#machinelearning#datasciencecourse#hyderabadtraining#ai#python#artificialintelligence#bigdata#programming#datascientist#deeplearning#dataanalytics#tech#coding#careergoals

0 notes

Text

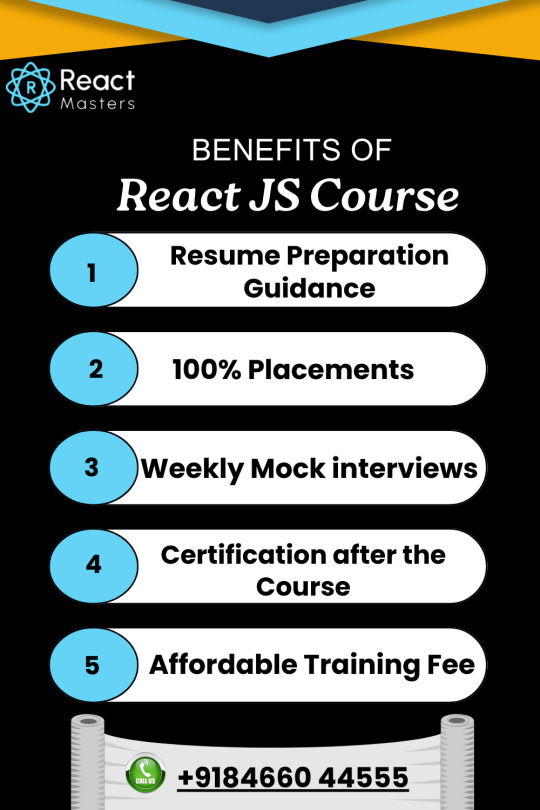

Benefits of Learning React?

Learning React can open doors to exciting career opportunities, and enrolling in a specialized course at React Masters can give you the edge you need to succeed. Here, we explore the benefits of learning React and why React Masters is the ideal place to start your journey.

What is React?

React is a powerful JavaScript library for building dynamic and interactive user interfaces. It is component-based, making code reusable and efficient.

React’s virtual DOM ensures high performance, even in complex applications. From simple websites to sophisticated web apps, React powers countless projects around the globe.

Benefits of Learning React

High Demand in the Job Market React developers are among the most sought-after professionals in the tech industry. Mastering React can significantly boost your employability and earning potential.

Easy to Learn and Use React’s simple syntax and comprehensive documentation make it beginner-friendly. Developers with basic JavaScript knowledge can quickly grasp its concepts.

Reusable Components React allows you to build reusable components, reducing development time and ensuring consistent design and functionality.

Rich Ecosystem React has a thriving ecosystem with tools like React Router, Redux, and Hooks that enhance its capabilities, enabling developers to build feature-rich applications.

SEO-Friendly React’s server-side rendering improves page load times and makes web applications more SEO-friendly, a crucial aspect for businesses.

Community Support React boasts a large and active community. From forums to GitHub repositories, help is always just a click away.

Scalability and Flexibility Whether you’re building a small website or a large enterprise application, React can scale efficiently to meet your needs.

Why Choose React Masters?

Expert Trainers React Masters offers training from industry professionals with years of real-world experience.

Comprehensive Curriculum Our course covers all essential topics, including React fundamentals, advanced concepts, and hands-on projects.

Practical Learning Learn through live projects, case studies, and real-world scenarios that prepare you for the job market.

Flexible Learning Options We offer online and offline classes to suit your schedule.

Career Assistance From resume building to interview preparation, React Masters provides end-to-end career support.

Who Should Learn React?

Aspiring Web Developers: Kickstart your career with in-demand skills.

Front-End Developers: Enhance your expertise with modern tools.

Students: Build a strong foundation for a tech career.

Professionals: Upskill to stay relevant in a competitive job market.

Types of Development Projects You Can Build with React

Let’s explore the different types of development projects that React is perfect for, and how these projects can add value to your portfolio.

1. Single Page Applications (SPAs)

Single Page Applications are one of the most common use cases for React. SPAs load a single HTML page and dynamically update the content as users interact with the app. React’s component-based architecture and virtual DOM make it easy to build fast, responsive, and user-friendly SPAs.

Examples:

Social media platforms

Project management tools

Online marketplaces

2. E-Commerce Websites

React is ideal for building modern e-commerce platforms with dynamic features. Its reusable components, combined with libraries like Redux for state management, allow developers to create scalable and interactive online stores.

Key Features:

Dynamic product listings

Shopping cart functionality

Secure payment integrations

3. Dashboards and Analytics Tools

React is widely used to build dashboards and analytics tools. Its ability to handle large amounts of data and update the user interface in real time makes it a great choice for such projects.

Use Cases:

Business intelligence dashboards

Data visualization tools

Performance tracking systems

4. Content Management Systems (CMS)

Developing custom CMS platforms becomes more streamlined with React. Its modularity allows developers to create flexible systems that cater to various business needs.

Features:

Easy-to-use content editing interfaces

Role-based access control

API integrations for external services

5. Mobile Applications

With React Native, a framework based on React, developers can build cross-platform mobile applications. React Native enables the creation of apps for both iOS and Android from a single codebase, saving time and resources.

Popular Examples:

Messaging apps

Fitness trackers

On-demand delivery apps

6. Progressive Web Apps (PWAs)

PWAs combine the best of web and mobile applications, offering offline access, push notifications, and fast load times. React’s lightweight and efficient features make it an excellent choice for building PWAs.

Examples:

News websites

Travel booking platforms

Event management systems

7. Real-Time Applications

React excels in developing real-time applications that require instant updates without refreshing the page. Combined with WebSocket or Firebase, React powers seamless user experiences.

Common Uses:

Chat applications

Live streaming platforms

Online collaboration tools

8. Gaming Applications

While not traditionally associated with gaming, React can be used to create browser-based games. Its component reusability and state management capabilities allow developers to craft interactive and engaging games.

Examples:

Puzzle games

Multiplayer card games

Educational games

9. Portfolio Websites

For developers and designers, creating a portfolio website with React is a great way to showcase skills. React’s flexibility allows you to craft visually appealing and interactive portfolios that stand out.

Features:

Dynamic content sections

Smooth animations

Easy scalability

10. Educational Platforms

React is perfect for building online learning platforms that require dynamic content delivery and interactive user interfaces. From quizzes to video lectures, React simplifies the development of robust educational tools.

Examples:

E-learning websites

Code learning platforms

Virtual classrooms

Frequently Asked Questions

1. Do I need prior programming experience to learn React?

Basic knowledge of JavaScript is recommended but not mandatory. Our beginner-friendly curriculum ensures that everyone can learn.

2. How long does it take to learn React?

With dedication, you can grasp the basics in 4-6 weeks. Advanced topics and mastery may take a few months.

3. Can React be used for mobile app development?

Yes! React Native, based on React, is widely used for building mobile applications.

4. Is it worth learning React JS?

Yes, learning React JS is highly worth it! React is one of the most popular JavaScript libraries for building dynamic user interfaces.

It is widely used by top companies, offers excellent career opportunities, and has a vast community for support.

Its flexibility, reusable components, and SEO-friendly nature make it a valuable skill for any web developer.

Start Your Journey Today!

Learning React at React Masters is an investment in your future. With expert guidance, practical exposure, and a supportive community, you’ll be well-equipped to excel in the tech industry.

Enroll Now and Take the First Step Toward a Successful Career in Web Development!

#LearnReact#ReactTraining#ReactMasters#WebDevelopment#ReactJS#ReactNative#FrontendDevelopment#JavaScriptLibrary#CareerInTech#HyderabadTraining

0 notes

Text

#Visualpath provides industry-leading #gcpdevops Training to professionals across the globe, including the USA, UK, Canada, Dubai, Australia, and Hyderabad. Our GCP DevOps Certification Training covers key skills like CI/CD, Kubernetes, Terraform, Docker, Jenkins, and Google Cloud services. Kickstart your career in cloud computing with expert guidance. Call +91-9989971070 for a free demo today!

WhatsApp: https://www.whatsapp.com/catalog/919989971070

Visit: https://www.visualpath.in/online-gcp-devops-certification-training.html

Visit our Blog: https://visualpathblogs.com/

#GCPTraining#DevOpsTraining#CloudComputing#KubernetesTraining#TerraformTraining#OnlineLearning#TechTraining#CareerInCloud#GCPDevOps#GoogleCloudTraining#Visualpath#HyderabadTraining#GlobalTechTraining#LearnDevOps#CI_CD#TechCareerBoost#CloudCareer#DevOpsCertification#HandsOnTraining#OnlineTechCourses

0 notes

Text

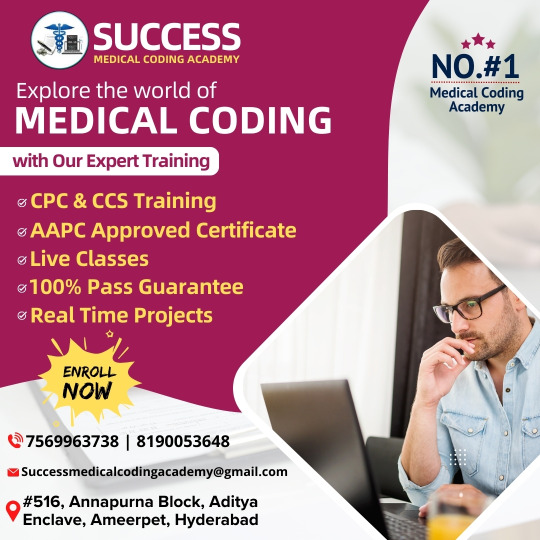

Success Medical Coding Academy in Ameerpet is the perfect place to launch a rewarding career in medical coding and billing. As Hyderabad’s leading training institute, we offer 100% job placement assistance with top-tier companies. Our affordable and expertly guided programs are tailored to meet the industry’s needs, ensuring you are well-equipped for success.

With both classroom and online certification options, our structured training and experienced instructors provide everything you need to excel. Join the best medical coding institute in Ameerpet and start your journey toward a bright and successful career in healthcare!

#MedicalCoding#MedicalBilling#JobPlacement#HealthcareCareers#SuccessInCoding#AmeerpetAcademy#CodingInstitute#MedicalCodingTraining#HyderabadTraining#JobReadySkills#CodingCareer#HealthcareEducation#CodingSuccess#ExpertTrainers#AmeerpetInstitute

0 notes

Text

Join us for the Expert Photo and Video Editing Course in Sanjeeva Reddy Nagar, Hyderabad, starting from September 10, 2024. Whether you're a beginner or an aspiring professional, this hands-on course will take your editing skills to the next level. Dive deep into advanced techniques, learn industry-standard software, and bring your creative visions to life with expert guidance.

At Pixel Ridz, our experienced instructors ensure you gain mastery over every aspect of photo and video editing, from color correction and retouching to cinematic effects and storytelling. Don’t miss this opportunity to turn your passion into a profession!

📅 Course Start Date: September 10, 2024

📍 Location: Pixel Ridz, Sanjeeva Reddy Nagar, Hyderabad

Limited seats available! Secure your spot now and become the editor you’ve always dreamed of being. 🎥📸

#PhotoEditingCourse#VideoEditingCourse#PixelRidz#EditingMastery#HyderabadWorkshops#CreativeLearning#SanjeevaReddyNagar#HyderabadCourses#EditingSkills#DigitalArt#PhotographyLovers#VideographyLovers#CreativeProfessionals#LearnAndCreate#HyderabadTraining#EditingExperts

0 notes

Text

Understanding Financial Modules in Oracle Fusion Cloud: A Deep Dive.

Introduction

Oracle Fusion Cloud Financials is a comprehensive suite of financial management applications that enables businesses to streamline their financial operations, improve decision-making, and ensure regulatory compliance. It integrates essential financial functions such as accounting, asset management, procurement, and revenue management, providing a unified and intelligent approach to managing an organization’s financial health.

In this article, we will take a deep dive into the core financial modules of Oracle Fusion Cloud, exploring their functionalities and benefits.

1. General Ledger (GL)

Overview

The General Ledger (GL) module is the backbone of Oracle Fusion Financials. It provides a real-time, centralized view of financial data, ensuring accurate financial reporting and control.

Key Features

Multi-dimensional reporting for in-depth financial analysis

Automated journal processing and reconciliations

Multi-currency and multi-GAAP compliance

Role-based dashboards and analytics

Benefits

Provides real-time insights into financial performance

Enhances compliance with automated controls

Reduces manual effort in financial consolidation

2. Accounts Payable (AP)

Overview

The Accounts Payable module manages supplier invoices, payments, and approvals to optimize cash flow and maintain good supplier relationships.

Key Features

Automated invoice matching and approval workflows

Integration with procurement for seamless processing

AI-driven anomaly detection for fraud prevention

Self-service supplier portal for invoice tracking

Benefits

Improves payment accuracy and reduces processing time

Enhances supplier collaboration with self-service capabilities

Strengthens financial controls through audit trails

3. Accounts Receivable (AR)

Overview

The Accounts Receivable module facilitates the management of customer invoicing, collections, and revenue tracking.

Key Features

Automated invoicing and billing processes

Customer credit and risk management

Integration with revenue recognition standards

AI-powered collection strategies

Benefits

Accelerates cash flow with optimized receivables management

Reduces revenue leakage with automated billing and tracking

Enhances customer relationships through accurate and timely invoicing

4. Asset Management (FA)

Overview

The Fixed Assets module helps organizations manage the complete lifecycle of assets from acquisition to disposal.

Key Features

Automated asset tracking and depreciation calculations

Support for multiple depreciation methods

Integration with General Ledger for financial accuracy

Role-based access control for asset management

Benefits

Ensures compliance with financial reporting standards

Improves asset utilization and reduces operational risks

Provides real-time visibility into asset valuation

5. Cash Management

Overview

The Cash Management module helps businesses monitor cash positions, bank reconciliations, and liquidity planning.

Key Features

Real-time cash position tracking and forecasting

Automated bank statement reconciliation

Support for multiple banks and accounts

AI-driven fraud detection and anomaly analysis

Benefits

Enhances cash flow visibility and liquidity management

Reduces manual reconciliation efforts

Improves financial decision-making with real-time insights

6. Expense Management

Overview

The Expense Management module streamlines the tracking and approval of business expenses to improve cost control and compliance.

Key Features

AI-driven expense policy enforcement

Mobile and web-based expense submission

Automated approvals and reimbursement processing

Integration with corporate credit cards and ERP

Benefits

Reduces fraudulent or non-compliant expense claims

Enhances employee satisfaction with faster reimbursements

Provides actionable insights into expense trends

7. Tax Management

Overview

The Tax Management module helps organizations handle indirect taxes such as VAT, GST, and sales tax while ensuring compliance with tax regulations.

Key Features

Automated tax calculation and reporting

Country-specific tax compliance support

Integration with AR, AP, and GL for seamless tax processing

AI-driven tax anomaly detection

Benefits

Minimizes tax compliance risks

Reduces manual tax reporting efforts

Ensures accuracy in tax calculations and filings

Conclusion

Oracle Fusion Cloud Financials provides a robust and integrated platform for managing financial operations efficiently. With its AI-driven automation, real-time insights, and compliance capabilities, businesses can optimize financial processes, improve decision-making, and achieve greater financial transparency.By leveraging these financial modules, organizations can streamline their operations, reduce costs, and stay ahead in the competitive market. If you are looking to enhance your expertise in Oracle Fusion Financials, consider enrolling in a structured training program to gain hands-on experience with these modules. To Your bright future join Oracle Fusion Financials.

#jobguarantee#oraclefusion#oraclefusionfinancials#financecareers#financejobs#erptree#hyderabadtraining#erptraining#careergrowth#100jobguarantee

0 notes

Text

✨ Today's Quiz from Generative AI Masters! What is the primary focus of discriminative models compared to generative models? 🤔

A quick challenge for all AI enthusiasts! Drop your answers in the comments below and test your AI knowledge. 🧠

💡 Stay tuned for more such exciting quizzes and insights on Artificial Intelligence and Generative AI.

📍 For Generative AI training in Hyderabad, visit us at www.generativeaimasters.in. 📞 Contact us: +91 98850 44555 📧 Email: [email protected]

#GenerativeAI#ArtificialIntelligence#QuizTime#AITraining#GenerativeAIMasters#DataScience#MachineLearning#AIEnthusiasts#HyderabadTraining#PromptEngineering#AIQuiz

0 notes

Text

Don't miss this opportunity to become a AZURE DATA ENGINEER . DM us for the job link and apply now!

We also provide AZURE ENGINEER course with case studies and also provide resume preparation, soft skill classes, and more

For more details

contact Phone: +91 9882498844

Email: [email protected]

Website: https://azuretrainings.in/ .

#DataEngineering#CareerGrowth#HyderabadTraining#TechTraining#jobvacancy#jobopportunity#jobopportunities#job#jobs

0 notes

Text

https://akshatait.com/selenium-with-java-course/

🌟 Master Selenium with Java in Hyderabad! 🌟

Are you ready to kickstart your career in automation testing? 🚀

Join our Selenium with Java Training Program in Hyderabad and unlock opportunities in the fast-growing field of software testing! 💻

✅ What You’ll Learn:

Basics of Java for Selenium

Advanced Selenium Automation Frameworks

Real-world Project Experience

Integration with Tools like TestNG, Maven, Jenkins & more

✅ Why Choose Us?

Expert Trainers 🧑🏫

Hands-on Practice 🛠️

Industry-Relevant Curriculum 🏆

100% Placement Assistance 🤝

📍 Location: Hyderabad (Online/Offline options available) 📅 Start Date: [Insert Date]

💡 Don’t miss the chance to enhance your skills and grow your career in automation testing!

📞 Call Now: [Insert Contact Number] 🌐 Learn More/Enroll Now: [Insert Website Link]

#SeleniumTraining #AutomationTesting #Java #CareerGrowth #HyderabadTraining #SoftwareTesting

0 notes

Text

🚀 Dive into the World of Big Data with Data Analytics Masters! 💡 Gain mastery in:

The Big Data Ecosystem Programming & Querying Distributed Systems Real-Time Processing Real-World Data Scenarios ✨ Upskill yourself and stay ahead in the data game!

📞 Call us at +91 99488 01222 🌐 Visit us: www.dataanalyticsmasters.in

0 notes

Photo

Medical Coding Training - Hyderabad

Struggling to begin a lucrative #career or just unable to pace up your career?Sona Yukti’s #MedicalCodingTraining in #Hyderabad can be the solution you are looking for! Click here to apply through WhatsApp : https://bit.ly/2D0QOIM Contact: Venu Gopal Email : [email protected] Call/WhatsApp : 6300691969 Visit : https://www.sonayukti.com/trainings/medical-coding-training/medical-coding-training-in-hyderabad.php

#HyderabadMedicalCoding#MedicalCodingTrainingHyderabad#HyderabadTrainings#MedicalCodingCourseHyderabad#CodingTraining#CodingTrainingHyderabad#HyderabadCodingCourse#Ameerpet#Telangana#Placement#Jobs

1 note

·

View note

Text

How Oracle Fusion Financials Transforms Accounting & Finance.

In today’s fast-paced business world, organizations are constantly seeking ways to streamline financial processes, improve reporting accuracy, and enhance decision-making. Oracle Fusion Financials is a comprehensive cloud-based financial management solution that has revolutionized the way businesses handle accounting and finance. From automation to real-time analytics, Oracle Fusion Financials is a game-changer for enterprises looking to optimize their financial operations.

The Power of Oracle Fusion Financials

Oracle Fusion Financials is a next-generation financial management solution built on Oracle Cloud. It integrates advanced technologies such as artificial intelligence (AI), machine learning, and automation to simplify complex financial processes. With its intuitive user interface and robust functionalities, Oracle Fusion Financials helps businesses enhance productivity, reduce errors, and ensure compliance.

Key Features of Oracle Fusion Financials

Comprehensive Financial Management

Oracle Fusion Financials covers all aspects of financial management, including general ledger, accounts payable, accounts receivable, asset management, and cash management.

Automation of Financial Processes

With built-in automation, organizations can eliminate manual data entry, reducing the risk of errors and improving efficiency.

Real-Time Analytics and Reporting

Oracle Fusion Financials provides real-time insights into financial data, allowing businesses to make informed decisions based on accurate financial reports and dashboards.

AI-Powered Risk Management

The system leverages AI and machine learning to detect anomalies and potential risks, ensuring compliance with financial regulations.

Seamless Integration with Other Modules

Oracle Fusion Financials seamlessly integrates with other Oracle Cloud applications, such as Procurement, Human Capital Management (HCM), and Supply Chain Management (SCM), creating a unified business ecosystem.

Scalability and Flexibility

Designed for businesses of all sizes, Oracle Fusion Financials can be customized and scaled to meet the evolving needs of an organization.

How Oracle Fusion Financials Transforms Accounting & Finance

1. Enhancing Financial Accuracy

Traditional accounting systems often involve manual data entry, which increases the likelihood of human errors. Oracle Fusion Financials automates key financial processes, ensuring greater accuracy in financial reporting and reconciliation.

2. Improving Decision-Making with Real-Time Insights

With real-time analytics and interactive dashboards, financial leaders can access up-to-date financial data, identify trends, and make strategic decisions with confidence.

3. Streamlining Compliance and Risk Management

Oracle Fusion Financials helps businesses comply with regulatory requirements by providing automated audit trails, advanced risk detection, and built-in controls for financial transactions.

4. Boosting Operational Efficiency

By automating repetitive tasks such as invoice processing, payment approvals, and expense management, Oracle Fusion Financials reduces the administrative burden on finance teams, allowing them to focus on value-added activities.

5. Facilitating Global Financial Management

For multinational companies, Oracle Fusion Financials offers multi-currency, multi-language, and multi-ledger capabilities, enabling seamless financial operations across different regions.

Conclusion

Oracle Fusion Financials is transforming the landscape of accounting and finance by providing organizations with a powerful, automated, and intelligent financial management solution. Businesses that leverage this cutting-edge technology can experience increased efficiency, improved financial accuracy, and enhanced decision-making capabilities. Whether you are a small enterprise or a large corporation, implementing Oracle Fusion Financials can propel your financial operations to the next level, ensuring long-term growth and success.If you're looking to upskill in Oracle Fusion Financials and secure a promising career in finance and accounting, consider enrolling in our comprehensive training program with a 100% job guarantee. To Your bright future join Oracle Fusion Financials.

#jobguarantee#oraclefusion#oraclefusionfinancials#financejobs#hyderabadtraining#erptree#erptraining#financecareers#100jobguarantee#careergrowth

0 notes

Text

Vinay Jay had an amazing journey with Generative AI Masters in Hyderabad. 💻🎓 With expert guidance and practical learning, mastering Generative AI has never been this easy! 🌟

Ready to kickstart your career in AI? Join us today! 📲 Call: +91 98850 44555 📧 Email: [email protected] 🌐 Website: www.generativeaimasters.in

#GenerativeAITraining#StudentFeedback#HyderabadTraining#GenerativeAIMasters#LearnGenerativeAI#AITrainingInstitute#StudentSuccessStory#AIJourney

0 notes