#Have also used company exchange/outlook

Explore tagged Tumblr posts

Note

Free Protonmail has a lot of limits though, really only good for minor things, you can't do many rules to sort into folders etc. Plus the UX isn't super great (though much better than in the past). For me free Protonmail would never be usable for my main email.

If you can afford to pay I highly recommend Fastmail or other paid email. Paid protonmail could work, but even then other ones have better UX.

Are there any email services you recommend? I'd love to ditch my gmail and maybe my outlook too.

Protonmail! I recommend protonmail!

There is some prior history where you'll see people complaining that protonmail shared customer data but the data they shared is data that is 100% necessary to be unencrypted as a result of email protocol and cannot be hidden even in extremely secure email (that protocol is why email is inherently insecure and if you want a secure messaging tool just use signal). As a result of the subpoena that forced them to share that data, they changed their retention policy in favor of keeping less data to better protect users.

WEIRD side issue: I've created a few online shopping accounts that did not allow me to create an account with a protonmail address; it's worthwhile to keep a throwaway gmail for exactly those kinds of things and those kinds of things only.

#Fastmail is what I use#Previously used gmail and before that yahoo and Netscape and Hotmail and ISP email#I have use free and paid protonmail at times#I haven't use the other big paid providers#Though a number of them seem like they would be quite good#Have also used company exchange/outlook#And company gmail#Never used non-company outlook.com

300 notes

·

View notes

Text

ever wonder why spotify/discord/teams desktop apps kind of suck?

i don't do a lot of long form posts but. I realized that so many people aren't aware that a lot of the enshittification of using computers in the past decade or so has a lot to do with embedded webapps becoming so frequently used instead of creating native programs. and boy do i have some thoughts about this.

for those who are not blessed/cursed with computers knowledge Basically most (graphical) programs used to be native programs (ever since we started widely using a graphical interface instead of just a text-based terminal). these are apps that feel like when you open up the settings on your computer, and one of the factors that make windows and mac programs look different (bc they use a different design language!) this was the standard for a long long time - your emails were served to you in a special email application like thunderbird or outlook, your documents were processed in something like microsoft word (again. On your own computer!). same goes for calendars, calculators, spreadsheets, and a whole bunch more - crucially, your computer didn't depend on the internet to do basic things, but being connected to the web was very much an appreciated luxury!

that leads us to the eventual rise of webapps that we are all so painfully familiar with today - gmail dot com/outlook, google docs, google/microsoft calendar, and so on. as html/css/js technology grew beyond just displaying text images and such, it became clear that it could be a lot more convenient to just run programs on some server somewhere, and serve the front end on a web interface for anyone to use. this is really very convenient!!!! it Also means a huge concentration of power (notice how suddenly google is one company providing you the SERVICE) - you're renting instead of owning. which means google is your landlord - the services you use every day are first and foremost means of hitting the year over year profit quota. its a pretty sweet deal to have a free email account in exchange for ads! email accounts used to be paid (simply because the provider had to store your emails somewhere. which takes up storage space which is physical hard drives), but now the standard as of hotmail/yahoo/gmail is to just provide a free service and shove ads in as much as you need to.

webapps can do a lot of things, but they didn't immediately replace software like skype or code editors or music players - software that requires more heavy system interaction or snappy audio/visual responses. in 2013, the electron framework came out - a way of packaging up a bundle of html/css/js into a neat little crossplatform application that could be downloaded and run like any other native application. there were significant upsides to this - web developers could suddenly use their webapp skills to build desktop applications that ran on any computer as long as it could support chrome*! the first applications to be built on electron were the late code editor atom (rest in peace), but soon a whole lot of companies took note! some notable contemporary applications that use electron, or a similar webapp-embedded-in-a-little-chrome as a base are:

microsoft teams

notion

vscode

discord

spotify

anyone! who has paid even a little bit of attention to their computer - especially when using older/budget computers - know just how much having chrome open can slow down your computer (firefox as well to a lesser extent. because its just built better <3)

whenever you have one of these programs open on your computer, it's running in a one-tab chrome browser. there is a whole extra chrome open just to run your discord. if you have discord, spotify, and notion open all at once, along with chrome itself, that's four chromes. needless to say, this uses a LOT of resources to deliver applications that are often much less polished and less integrated with the rest of the operating system. it also means that if you have no internet connection, sometimes the apps straight up do not work, since much of them rely heavily on being connected to their servers, where the heavy lifting is done.

taking this idea to the very furthest is the concept of chromebooks - dinky little laptops that were created to only run a web browser and webapps - simply a vessel to access the google dot com mothership. they have gotten better at running offline android/linux applications, but often the $200 chromebooks that are bought in bulk have almost no processing power of their own - why would you even need it? you have everything you could possibly need in the warm embrace of google!

all in all the average person in the modern age, using computers in the mainstream way, owns very little of their means of computing.

i started this post as a rant about the electron/webapp framework because i think that it sucks and it displaces proper programs. and now ive swiveled into getting pissed off at software services which is in honestly the core issue. and i think things can be better!!!!!!!!!!! but to think about better computing culture one has to imagine living outside of capitalism.

i'm not the one to try to explain permacomputing specifically because there's already wonderful literature ^ but if anything here interested you, read this!!!!!!!!!! there is a beautiful world where computers live for decades and do less but do it well. and you just own it. come frolic with me Okay ? :]

*when i say chrome i technically mean chromium. but functionally it's same thing

347 notes

·

View notes

Text

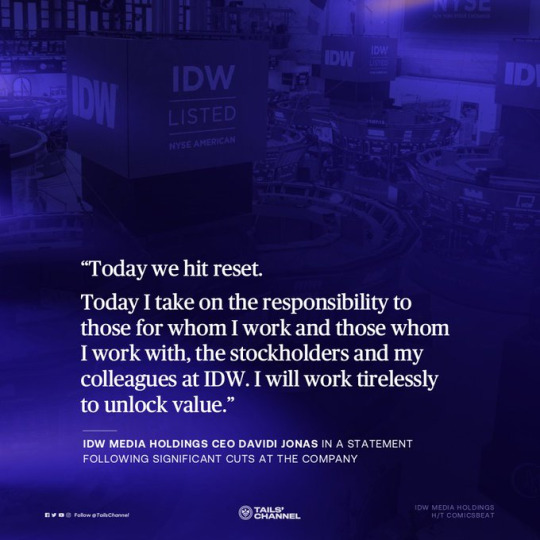

Significant cuts hits IDW's parent company in a self-described "reset"

IDW Media Holdings, the parent of IDW Publishing (the company behind the Sonic the Hedgehog comics), announced major cuts in an effort to unlock financial stability.

The company terminated their New York Stock Exchange listing, shook up senior management, and slashed entire promotional and editorial departments - around 39% of its workforce.

The newly-appointed CEO characterized the axe drop a "reset."

Background

There's no other way to describe it, the cuts at IDW are significant.

The axe drop was in direct response to a poor balance sheet in a tough economic environment. IDW suffered greatly during the COVID-19 pandemic, and non-publishing segments (like direct-to-consumer games) continued to illustrate repeated quarterly losses.

It's no secret that IDW experienced cash flow issues and various others financial challenges, even though the comic books in particular (like IDW Sonic and TMNT) are significant revenue generators.

The company hopes that these cost-cutting measures will provide $4.4 million USD in estimated annual savings.

The impacted

Marketing, public relations, and editorial at IDW were impacted by today's announced cuts.

Comicsbeat reported that the entire marketing and PR departments, and half of the editorial team, got the axe, with more specific details yet to come. That's 39% of the total workforce.

At press time, @idwsonicnews told us that Shawn Lee, a "designer and letterer on many IDW titles", were among the laid off. He tweeted, "whelp, I'm officially a freelancer now."

---

Meanwhile, senior management got a shakeup. Former chairman Davidi Jonas replaced Allan Grafman as Chief Economic Officer. Chief Financial Officer Brooke Feinstein was ousted, and Amber Huerta was promoted to Chief Operating Officer.

IDW also voluntarily delisted their Class B common stock from the New York Stock Exchange, the largest trading venue in the world; and suspended their reporting status to the U.S. Securities and Exchange Commission. The company hoped that this will "reduce pressure on limited resources and the Company’s current inability to realize many of the benefits."

Okay, what about IDW Sonic?

Deep breaths.

At press time, there's nothing we know that flags an immediate concern for the IDW Sonic comics. However, as this is a developing situation, and the long-term outlook is uncertain, the forecast can change.

Even though it, and other comic book franchises (TMNT, etc.) continues to generate significant revenue to the publishing unit, IDW will have to enact more critical decisions to remain financially sound.

IDW Sonic editors David Mariotte and Riley Farmer have yet to officially acknowledge the parent company's announcement, but both "retweeted posts related to the layoffs," @idwsonicnews told us.

We have reached out to IDW Publishing for further comment.

(Updated Friday 11:00 pm ET)

#not great!#idw sonic the hedgehog#idw sonic#idw publishing#sonic the hedgehog#sonic#sonic idw#sonic news

187 notes

·

View notes

Text

Silvercorp Metals: A Standout in Silver Mining Amid Rising Demand

Source: mining.com

Category: News

A Silver Surge Driven by Renewables and Geopolitics

Silvercorp Metals has capitalized on the remarkable growth in silver prices in 2024, with its price surging over 25% year-to-date (YTD). Industry analysts attribute this rise to a combination of factors, including increasing industrial demand, especially from electric vehicle (EV) manufacturers, and geopolitical uncertainties. The dollar index’s volatility and conflicts in regions like Ukraine and the Middle East further heightened the appeal of precious metals as a stable investment.

Beyond its traditional investment value, silver’s applications in emerging technologies have expanded. Its use in solar panels, electronics, and advanced healthcare technologies has supported demand growth. According to the Silver Institute, silver consumption for solar energy has more than tripled in five years, rising from 74.9 million ounces in 2019 to a projected 232 million ounces by the end of 2024. This aligns with the broader push for renewable energy and sustainability, positioning silver as a critical resource in the global transition to green energy.

Silvercorp Metals: Poised for Growth

Among leading silver mining stocks, Silvercorp Metals Inc. (NYSE:SVM) stands out for its potential in this thriving market. Industry experts foresee sustained demand for silver in renewable energy and electronics, offsetting uncertainties tied to global economic and monetary policies. Unlike gold, which sees only 10% of its output used industrially, over half of all silver production serves industrial applications. This diverse demand profile enhances silver’s long-term investment appeal.

In 2024, industrial demand for silver is projected to reach a record 700 million ounces, marking a 7% year-over-year increase. This milestone reflects strong growth in industrial applications, jewelry, and silverware. Meanwhile, mine production is expected to rise marginally by 1%, creating a favorable supply-demand dynamic for silver prices. Exchange-traded products (ETPs) tied to silver are also set for their first annual inflows in three years, fueled by anticipated interest rate cuts, periods of dollar weakness, and declining bond yields.

Production Outlook: A Global Perspective

Global silver production is expected to grow modestly by 1% in 2024, reaching 837 million ounces. Key contributors to this growth include Mexico, Chile, and the United States, offsetting reduced outputs from countries like Peru, Argentina, and China. Mexico, in particular, is projected to increase its production by 10 million ounces (a 5% year-over-year rise) to reach 209 million ounces. This uptick is driven by improved mill throughput and upgraded ventilation systems at Pan American Silver’s La Colorada mine, alongside a recovery at Newmont’s Peñasquito mine.

As silver continues to gain traction in industrial and renewable sectors, companies like Silvercorp Metals are well-positioned to capitalize on these trends. With industrial applications and investment demand soaring, the outlook for silver and leading miners in the industry appears promising, making stocks like Silvercorp an attractive consideration for investors.

#silver#gold#jewelry#jewellery#handmade#earrings#silverjewelry#ring#handmadejewelry#rings#style#bracelet#sterlingsilver#coins#jewels#silverjewellery#art#jewelrydesigner#diamond#bullion#design#k#bracelets#m#diamonds#silvercoins

3 notes

·

View notes

Text

How to Improve Effective Team Communication in the Workplace

What is Team Communication?

Team communication is the exchange of information inside or across teams. The idea that "teamwork makes the dream work" is best illustrated by effective team communication in the workplace. Effective team communication at work makes it possible for everyone to be aware of any problems, which enhances operations. In the workplace, it also promotes camaraderie, trust, morale, and employee engagement.

Working alone and in a silo-like setting will disrupt the relationships among employees and reduce their output. In order to accomplish goals in a coordinated and focused manner, team communication is essential. As they say, Two people are needed to tango. Without creating a communal work culture among its personnel, no organisation can afford to advance.

The demands of relating across several platforms to accomplish the shared goal of work might occasionally cause communication to become strained. This is where effective team communication is crucial. As a team's size increases, it is essential that the communication channel become more intelligent, seamless, and, of course, secure. For the entity's overall advantage, this promotes solid and enduring teamwork. Planning strategies to enhance workplace communication makes a lot of sense because this is essential. Effective team communication is difficult to get, but a concentrated effort will guarantee that all employees, regardless of location, are on the same page.

1. Gel Well

Using inclusive tactics helps team members develop a good outlook and effective communication skills. Information sharing within the company will be more honest, transparent, and based on greater trust. To promote a fair and honest exchange of thoughts and viewpoints regarding work, the team leader should make sure to build a personal rapport with each member of the team. Working in silos is far worse than using participatory management and working methods.

2. Instill Trust

When do you believe you'll be accepted by your community? Is it your wealth, your attractiveness, your power? These traits could actually "force" coworkers and subordinates to comply rather than guarantee a sincere and dedicated reaction to work. Allow your actions to speak for themselves. Set a good example and encourage greater levels of trust and teamwork among your staff. To create more equitable relationships and promote a positive work culture, demonstrate real interest in and empathy for others. Nearly one-third of workers have a favourable dislike for their bosses, according to multiple surveys.

When do you believe you'll be accepted by your community? Is it your wealth, your attractiveness, your power? These traits could actually "force" coworkers and subordinates to comply rather than guarantee a sincere and dedicated reaction to work. Allow your actions to speak for themselves. Set a good example and encourage greater levels of trust and teamwork among your staff. To create more equitable relationships and promote a positive work culture, demonstrate real interest in and empathy for others. Nearly one-third of workers have a favourable dislike for their bosses, according to multiple surveys.

3. Get to know individuals better

A blanket opinion about the staff is a big no when it comes to managing them. Take time, understand each individual, and know their strengths.

By understanding each other’s strengths and weaknesses, it’s easier to have effective team communication in the workplace.

No two personalities resemble fully. Comprehend the subtle variations in moods, responses, and reactions of one and all to varying situations at work.

4. Provide a level playing field

The ability to respect diversity begets positive vibes in the work environment.

Respect differing styles of working as long as the ultimate goal is not vitiated by divergent work styles.

While some may prefer team chat, some may depend on face-to-face interaction. However, both come under team communication skills.

Factor such preferences wherever possible and feasible to promote seamless communication among and with peers and staff.

5. Team Collaboration

Excellent team communication develops a workplace where everyone develops skills and ideas to help them become more educated about duties to various degrees by collaborating as a team instead of as individuals.

What are the different types of team communication?

Some of the different types of team communication are as follows:

Verbal: As was already established, one-on-one interaction is the ideal way to nurture effective team communication. Paying attention to one another and the dialogue promotes a sense of value and credibility. Face-to-face talks allow you to examine your team member successfully.

Body Language: Body language is a method of communication in which information is expressed or conveyed via bodily behaviors rather than words. This behavior includes facial expressions, body posture, gestures, eye movement, touch, and the use of space.

Written Communication: Any interaction that uses the written word is considered Written communication which involves expressing yourself clearly, using precise language, constructing a logical argument; note-taking, editing, summarising; and writing reports.

Visual Communication: Visual communication conveys information and ideas using symbols and visuals. It is based on actions that convey concepts, viewpoints, and values using visual materials like text, images, or video. Given that the message or information is communicated using a visual medium, visual communication is considered one of the best team communication styles most likely to impact and foster improved comprehension significantly.

Conclusion

Business chat apps that offer a wide range of functions and satisfy users' various needs abound in the unified chat app market. A small number of these team communication tools offer free services with enhanced security measures, but the majority charge users on a monthly basis. Make informed decisions since the secret to success is enhancing team communication.

#team communication#Effective Team Communication in the Workplace#Team Communication in the Workplace#Communication in the Workplace#team communication tools#communication#troop messenger#Effective Team Communication#workplace communication

2 notes

·

View notes

Note

"Celebrities don't owe you shit" Well then, they won't have their bills paid if they have no fans...Does that dumbass think these people became a millionaires by themselves? Fan—celeb relationships are an exchange: they work to give content, the content generates public who generates fans who are willing to invest on them monetarily in some way. Fans of actors go to the cinema to watch their movies, fans of musicians buy or stream their songs...It's an exchange, because, believe or not, being a celebrity IS A JOB where you have to give back to receive back.

Does that mean I'm mad that the scandal happened because he made a mistake? No, could never be mad at him for that, I'm more mad that Korea picked him apart and broke him when they let people who do way awful stuff be celebrities over there freely. But if baby boy Choi Seunghyun wants me to keep supporting him he has to keep his part of the bargain and give me something to support. It's why many VIPs watched Squid Game 2 even though we didn't give a shit about it or even liked it in the first place.

They aren't understanding the entire structure and heirachy of celebrity. You ARE the job, you are the measuring stick for the payroll beyond studios, companies, endorsements and other miscellaneous entitles paying you. As a public figure, you instantly relquinish the autonomy, privacy, solitude and ability to keep your life compact away from the public eye because you have something the general public does not have - being known without people directly meeting you in person, face to face, or by direct sit down / time together. Thousands upon millions of people will know who you are, your personality you present, what your profession is, birthday, your family and what they're about (unless you hide it) and they will know numerous things about you because we are systemically groomed to worship, praise, idolize, admire and have positive outlook towards celebrities. They are bult to be on a higher pedigree than us.

Besides kpop is structured on parasocial relationships and its a youth based cycle hence why most people who frequent this blog dont know or care about 1st and 2nd gen groups or remember the little groups back then. A new batch comes in and leaves minus the big stars. There is a reason blackpink is the rage and 2ne1 is not same with twice and not snsd anymore.

Also celebs have privilege and luxury of going to jail, prison, facing legal issues and criminal records and still be employed while us, the average people, do not get that luxury. They are a walking resume for their career. We need resumes and we don't have people aka agents, managers, PR overseeing us getting gigs and work for us - we apply ourselves even if we have friends to get us into work.

You are the job and the product as a celebrity so you do owe the public something. I personally believe in my opinion once you get to legend status or a pennacle of your career, retire or have a terrible illness / disorder (michael j fox, back to the future and his parksions disease) you then owe nobody nothing. I wouldn't say britney owes us anything cause she's done her time and shes clearly mentally unwell. She isnt promoting a product or performing. I used her as an example cause she isnt doing anything but living and being in a bubble due to abuse. Top decided to work on a major project after self exile (industry exile too) and the least he owes us is gratitude (which he expresses) for us standing by him and not allowing his notoriety and rep to totally tank and to keep us updated and show us respect as long as we respect him.

If we all colelctively dropped squid game the second episode and didnt watch, then he would've been screwed. Fans are the measuring stick and supplier of how far you go. I mention Michael Jackson constantly cause thats one person with a horrible background with scandals and oddities but his fans saved his ass and enabled this it it to become viable but sadly he didnt live to actually perform. If MJ was an asswipe to his fans and felt he didnt owe them shit, Music would be a lot different today.

I mean shit, taylor swift is who she is cause the fans pour into her unlike any other artist aside from BTS and rihanna right now. These are just examples.

But YES you understand. Thank you anon. Dude made mistakes but everyone does. We get disappointed, we get upset but we always stand by him and the other idols we like and keep beliving in them. Celebrity, it's a round the clock job where your behavior and opinions determines whether you have a check or not. We, the little people, don't have to deal with that unless something racist or problematic is said.

It's common sense at this point.

2 notes

·

View notes

Text

Blockchain Investment: A New Frontier for Investors

The rise of blockchain technology over the last decade has sparked interest across various industries, from finance and supply chain management to healthcare and entertainment. As blockchain matures, investors are starting to recognize its potential not only for transforming traditional sectors but also for offering new investment opportunities. In this article, we explore the significance of blockchain investment, the types of investments available, the associated risks, and the future outlook for this promising technology.

What is Blockchain?

Blockchain is a decentralized digital ledger technology that securely records transactions across multiple computers. It allows information to be stored transparently, immutably, and without the need for intermediaries such as banks or government bodies. The most famous application of blockchain technology is Bitcoin, the first cryptocurrency, but its potential extends far beyond digital currencies.

Blockchain’s unique features—decentralization, transparency, and security—make it an appealing foundation for various applications, ranging from finance to supply chain management to voting systems. With an increasing number of industries exploring blockchain’s use cases, it has garnered significant attention from investors.

youtube

Why Invest in Blockchain?

Disruption of Traditional Systems: Blockchain has the potential to disrupt a wide range of industries by providing more efficient, transparent, and secure alternatives to legacy systems. For example, blockchain-based financial services can lower transaction costs, reduce fraud, and offer access to previously unbanked populations. The transformation of industries such as healthcare, logistics, and government services is just beginning.

The Growth of Cryptocurrencies: Blockchain is the backbone of cryptocurrencies, which have seen exponential growth in recent years. Bitcoin, Ethereum, and other altcoins have become established assets, and decentralized finance (DeFi) platforms built on blockchain promise further innovation in financial markets. Investors can benefit from both the appreciation of these digital assets and the broader adoption of cryptocurrency ecosystems.

Tokenization of Assets: Blockchain enables the tokenization of real-world assets, including real estate, art, and commodities. This allows investors to gain fractional ownership in previously illiquid assets, opening up new avenues for diversification and investment. Tokenization can also improve liquidity and streamline processes such as cross-border payments and property transfers.

Venture Capital and Startups: Many blockchain-based startups are developing innovative applications, from decentralized applications (dApps) to non-fungible tokens (NFTs) to blockchain-based identity verification systems. Venture capitalists and angel investors can tap into the high growth potential of these companies, as blockchain adoption continues to rise globally.

Types of Blockchain Investments

Blockchain investments can be approached in several ways. Some of the most common types include:

Cryptocurrencies: Direct investment in digital currencies like Bitcoin, Ethereum, and other altcoins is the most straightforward form of blockchain investment. These cryptocurrencies can be purchased through exchanges and stored in digital wallets. While Bitcoin and Ethereum are the most well-known, there are thousands of altcoins that investors can explore.

Blockchain-related Stocks and ETFs: Rather than investing directly in cryptocurrencies, investors can gain exposure to blockchain technology by purchasing stocks in companies that are integrating blockchain into their operations. Public companies such as Nvidia (which provides hardware for mining), Coinbase (a cryptocurrency exchange), and Block (formerly Square) are examples of firms investing heavily in blockchain. Additionally, blockchain-focused exchange-traded funds (ETFs) allow investors to diversify their exposure to the sector.

Initial Coin Offerings (ICOs) and Token Sales: ICOs and token sales are fundraising mechanisms where startups issue their own cryptocurrency tokens in exchange for investments. While ICOs were initially seen as high-risk, high-reward ventures, they have become more regulated over time. This form of investment allows early-stage investors to gain a stake in blockchain projects before they are widely adopted.

Blockchain Real Estate: The tokenization of real estate allows fractional ownership of property via blockchain-based tokens. Platforms like RealT and Propy have been pioneers in this space, enabling investors to buy shares in real estate and receive dividends from rental income. Blockchain’s transparency and immutability make it ideal for managing property transactions.

Decentralized Finance (DeFi): DeFi is a rapidly growing sector that leverages blockchain to provide financial services such as lending, borrowing, and trading without intermediaries. By investing in DeFi projects or liquidity pools, investors can earn returns in the form of interest or tokens.

Risks of Blockchain Investment

While blockchain presents exciting investment opportunities, there are several risks to consider:

Volatility: Cryptocurrencies, in particular, are known for their extreme price volatility. Dramatic price swings can occur in a short time, making blockchain investments high-risk, especially for short-term traders. Long-term investors should be prepared for fluctuations in value.

Regulatory Uncertainty: Blockchain and cryptocurrencies are still in the early stages of regulatory development. Governments around the world are working on creating frameworks to govern blockchain and digital currencies, but until clear regulations are established, there could be sudden changes in legal and tax requirements that impact investment returns.

Security and Fraud Risks: While blockchain technology itself is secure, the platforms and exchanges built on top of it may not always be. Hacks, scams, and fraud have occurred in the blockchain space, with investors losing substantial amounts of money. Conducting thorough research and choosing reputable platforms is crucial.

Technological Risks: Blockchain is still an emerging technology, and its long-term scalability, interoperability, and environmental impact remain open questions. For instance, Ethereum, one of the leading blockchains, is transitioning from a proof-of-work to a more energy-efficient proof-of-stake consensus mechanism, highlighting the potential for technical challenges.

The Future of Blockchain Investment

As blockchain technology evolves, it’s expected that adoption across industries will only increase. Many experts believe that blockchain will play a central role in reshaping the global economy, particularly in areas like supply chain transparency, decentralized finance, and digital identity verification.

The rise of central bank digital currencies (CBDCs), which are government-backed digital currencies that leverage blockchain technology, will likely spur further mainstream adoption. Additionally, innovations in smart contracts, which automate transactions based on predefined conditions, will expand the use of blockchain beyond simple transactions into complex business processes.

For investors, this presents an exciting opportunity to position themselves at the forefront of a technological revolution. However, as with any emerging technology, it is important to approach blockchain investment with caution, conducting thorough due diligence and maintaining a diversified portfolio to manage risk effectively.

Conclusion

Blockchain investment offers promising opportunities for those willing to navigate its complexities. From cryptocurrencies to tokenized assets to decentralized finance, the potential for growth in this sector is vast. However, investors should carefully consider the risks associated with volatility, regulation, and security before diving in. As blockchain technology matures and becomes more widely adopted, it will likely be a key driver of innovation, providing unique opportunities for savvy investors to capitalize on the next generation of digital transformation.

2 notes

·

View notes

Text

The Benefits of Cloud Hosting for Small Business

In the past, hosting websites and apps just required paying a digital platform provider to rent out a single server or computing cluster. Services for web hosting have existed for as long as the internet. Over the past ten years, cloud hosting where the website or application resides on virtual servers dispersed across the cloud has emerged as a popular way to make digital assets accessible online.

A worldwide content delivery network can be connected to by Google Cloud to provide customers with optimal speed and minimal latency when serving material, or a domain can be registered and managed. Google Cloud also provides a range of hosting options for websites and applications.

What is cloud hosting?

Your data is stored on several servers rather than on a single server, which is what is meant by the term "cloud hosting." The term "cloud" refers to this network of several servers that collaborate to form the network. Cloud hosting services are currently being utilized by a multitude of businesses, both large and small. An investment of this kind is definitely worth the rewards, and it has the potential to achieve great things for your company.

You will have a single platform from which you can manage all of your applications and databases, which will allow you to streamline your operations. The productivity of your firm can also be improved by making an investment in cloud infrastructure resources. The various advantages of cloud hosting will be discussed in further depth in the following paragraphs.

Cloud hosting’s Significance for Small Businesses-

Adopting cloud computing has becoming increasingly important for small organizations. It helps small businesses to avoid the high initial investment and ongoing maintenance costs of having internal IT infrastructure. Small businesses can now access advanced technologies and capabilities that were previously exclusive to large organizations by utilizing the cloud.

What are the applications of cloud computing?

Although you might not be aware of it, there is a good chance that you are currently utilizing cloud computing. Whether you use an online service such as Gmail or Outlook 365 to send an email, collaborate on a document, save data, or stream a video, cloud computing makes it feasible behind the scenes to do all of these things.

Cloud Hosting:

Cloud hosting services make it possible to share a variety of information, such as using email services, hosting applications, using web-based phone systems, and storing data. Hosting your company's website, managing databases, and storing domain names are all things that may be done with a cloud hosting service. The fact that cloud hosting services are located offsite makes it simple to scale up in order to handle peak loads.

Backup services:

Backup services in the cloud are failsafe solutions that can be utilized in the event that your company suffers a server disaster, cyberattack, or other type of data loss. Storage, data synchronization and restoration, real-time backups, archiving, and a high level of security are all features that are included in the top cloud backup services. A great number of cloud storage firms now offer cloud backup and storage capabilities.

Storage in the cloud:

Cloud services guarantee that your data is stored in a cloud storage system that is located offsite, making it more convenient to access from any device or place that is linked to the internet. In cloud storage, you are able to securely exchange information with others and synchronize files across several devices. Companies such as Dropbox, Microsoft OneDrive, and Google Drive are examples of well-known cloud storage services.

Software as a service

Software as a service, also known as SaaS, is a solution for the distribution of applications that is hosted in the computer's cloud. SaaS solutions can be utilized by businesses in a variety of operational domains. For instance, you may adopt software for customer relationship management (CRM) that is hosted on the cloud, such as Salesforce, for the purpose of managing sales, accounting software, such as QuickBooks Online, for managing finances, and email marketing software for improving marketing communications.

Cloud Solutions' Advantages for Small Businesses-

Affordable

Small firms can minimize their expenditures on hardware, software licenses, and information technology by switching to cloud-based services, which results in cost savings. Companies that provide cloud computing services often provide a pay-as-you-go approach, which enables organizations to only pay for the resources and services that they actually employ.

Protection of Sensitive Information and Disaster Recovery

Cloud service companies adopt stringent security procedures to protect vulnerable information. In addition to this, they provide solutions for disaster recovery and automatic backups, which serves to ensure that vital corporate information is safeguarded, quickly recoverable, and less likely to be lost.

Scalability:

Cloud hosting solutions enable small businesses to swiftly scale their operations up or down as needed without the inconvenience and expense of physically upgrading their gear and software. Scalability includes the ability to scale up or down activities. This flexibility enables adaptability and growth prospects, both of which are essential in a market that is very competitive.

Advantage in the Market

Cloud hosting solutions give small firms the ability to compete on an equal playing field with larger organizations, which gives them a competitive advantage. It is possible for them to obtain insights, streamline operations, and make decisions based on data without breaking the bank by utilizing sophisticated software, analytics tools, and advanced information technology.

Flexibility

As a result of the fact that all that is required to access the cloud is an internet connection, one of the advantages of cloud hosting is that it provides direct remote access to the data that is pertinent to all of your employees, including yourself. If you run a small business, it's possible that you don't have the financial resources to purchase a dedicated office space. People are able to work from any location they choose thanks to this cloud-based technology. Having the ability to operate from a remote location is more important than ever before for the success of a company, especially in light of the recent epidemic.

Increased Capacity for Collaboration and Adaptability

Cloud solutions enable small businesses to communicate with remote team members, clients, and partners in a seamless manner, which helps improve the flexibility and collaboration capabilities of these firms. It makes it possible to share files in real time, modify them simultaneously, and gain access to the most recent versions of documents, all of which contribute to increased productivity and efficiency.

The Most Recent Technology

Cloud hosting eliminates the need for you to worry about the possibility of automatically upgrading and customizing your servers, in contrast to traditional hosting, which does not permit such activities. Scalability is something that may be easily achieved as your company expands and your requirements and preferences shift.

Because cloud hosting businesses are experts in this kind of technology, this is something that can be easily accomplished. Since they have access to more resources, they are able to undertake research and construct systems that are more robust and powerful. You will have access to the most cutting-edge technologies available if you make an investment in cloud infrastructure.

Very little to no upkeep is required

Recall what I mentioned earlier regarding the safety concerns associated with cloud computing. That being said, a portion of that security necessitates the routine maintenance of servers, the updating of software, and the administration of networks. The good news is that cloud computing relieves you of the responsibility of doing all of that upkeep and instead places it in the hands of skilled specialists.

Because none of the equipment is hosted by you, you do not need to be concerned about purchasing newer versions of it every three to four years. You are not required to deal with any of that maintenance, which frees up more time for your firm to concentrate on the product or service that it offers.

Remote access

When it comes to cloud computing, your email account is the ideal illustration. Providing that you have your login credentials and an internet connection, you are able to access your consolidated email account from any computer. Cloud computing is appealing to a majority of businesses because of the convenience it provides. Your colleagues and you will be able to access your work from any location in the globe thanks to the cloud, which eliminates the need to store your work on a desktop computer or on a local area network (LAN) server that is not linked to the internet. Your productivity and freedom in your workspace will both increase as a result of this remote access.

Conclusion-

Through the simplification of procedures and the facilitation of real-time collaboration among members of a team, cloud computing has the potential to boost both efficiency and productivity. It is possible for teams to collaborate effectively regardless of their geographical location or the time zone differences between them if they have shared access to documents and files. In addition, many cloud-based services provide automation technologies that reduce the amount of manual work that employees have to perform, such as data entry or report production. This allows employees to concentrate on high-value tasks that contribute to the success of the company.

Dollar2host Dollar2host.com We provide expert Webhosting services for your desired needs Facebook Twitter Instagram YouTube

3 notes

·

View notes

Text

The FIT21 Act: Paving the Way for a New Era in Digital Finance

Introduction: Today marks a pivotal moment for the digital finance sector as the U.S. House of Representatives considers the Financial Innovation and Technology for the 21st Century Act, commonly known as the FIT21 Act. This legislation is set to bring much-needed regulatory clarity to the digital asset ecosystem, promising to enhance consumer protections while fostering innovation.

Background: Non-compete agreements have traditionally been used by companies to prevent employees from joining competitors or starting similar businesses for a specified period. However, these agreements have often been criticized for limiting worker mobility and stifling innovation. On the other hand, the FIT21 Act aims to address the digital finance sector, which has been plagued by regulatory uncertainty. This act seeks to establish a comprehensive framework for digital asset regulation, delineating clear roles for the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC).

Key Provisions of the FIT21 Act:

Consumer Protections: The FIT21 Act mandates comprehensive disclosures from digital asset developers and customer-serving institutions, such as exchanges and brokers. These requirements are designed to ensure that consumers have access to accurate and relevant information, enhancing transparency and accountability.

Regulatory Jurisdiction: The Act provides a clear division of regulatory authority between the CFTC and the SEC. The CFTC will oversee digital assets classified as commodities, particularly those with decentralized blockchains. The SEC will regulate digital assets deemed securities, focusing on those with less decentralized structures.

Operational Requirements: Entities required to register with either the CFTC or the SEC will need to adhere to strict operational requirements. These include safeguarding customer assets, providing detailed disclosures, and reducing conflicts of interest.

Implications for Employees and Employers:

For Employees: The FIT21 Act, by reducing the ambiguity in digital asset regulation, could create new job opportunities in the fintech sector. Enhanced consumer protections and regulatory clarity may lead to increased trust and investment in digital assets, driving job growth and innovation.

For Employers: Companies in the digital asset space will need to adapt to the new regulatory landscape. This includes complying with detailed disclosure requirements and operational standards set forth by the CFTC and SEC. While this might increase compliance costs, it also provides a more stable and predictable regulatory environment, which can be beneficial in the long run.

Future Outlook: The passage of the FIT21 Act represents a significant step forward for the U.S. digital asset market. However, potential legal challenges could arise, focusing on the extent of regulatory authority and compliance requirements. Despite these challenges, the Act aims to position the United States as a leader in the global digital finance landscape by fostering innovation and providing robust consumer protections.

Conclusion: The FIT21 Act is a landmark piece of legislation that promises to bring much-needed regulatory clarity to the digital asset ecosystem. By enhancing consumer protections and delineating clear regulatory responsibilities, the Act aims to foster innovation and secure the United States' position as a global leader in digital finance. As we await the outcome of today's vote, it's clear that the FIT21 Act could reshape the future of digital assets and employment within this burgeoning sector.

We Want to Hear from You! Share your thoughts and experiences related to today's topic in the comments below. Make sure to subscribe to our blog for the latest updates and in-depth analyses on this and other crucial financial subjects.

#FIT21Act#FinancialInnovation#DigitalAssets#BlockchainTechnology#CFTC#SEC#ConsumerProtection#DigitalFinance#RegulatoryClarity#Fintech#FinancialLegislation#InnovationInFinance#FinancialEcosystem#DigitalAssetRegulation#FintechRegulation#USFinancialMarket#FinancialServices#FintechInnovation#FinancialTechnology#CryptocurrencyRegulation#bitcoin#financial education#financial empowerment#financial experts#cryptocurrency#digitalcurrency#finance#blockchain#unplugged financial#globaleconomy

3 notes

·

View notes

Text

Visit The Best Digital Marketing Institute in Bhubaneswar | Digital Gaurabh

Digital Gaurabh provides digital marketing learning pathways in Bhubaneswar to grow any business. The courses offered by the organisation can be customised to meet your needs, regardless of your background or level of experience in digital marketing. This freedom guarantees that you are learning at a pace that works for you and that you are also learning what is pertinent. Education is not a solitary process. With the help of Digital Gaurabh, students can engage in conversation, work together, and exchange ideas in a welcoming environment. Building relationships through networking with instructors, former students, and other students can lead to external partnerships, new opportunities, and insightful conversations. Success stories from alumni are frequently used to gauge the quality of an education. Digital Gaurabh is proud of its programme that helps students get jobs at reputable companies. Following their courses, graduates have a better chance of finding desirable positions thanks to their industry connections and established reputation in the field. In a world where digital transformation is rife, one must always be learning and adapting to stay ahead. With its forward-thinking outlook, industry knowledge, and dedication to quality, Digital Gaurabh has justifiably established itself as the best digital marketing institute in Bhubaneswar. By selecting Digital Gaurabh, you’re not just signing up for a course — rather, you’re taking the first steps towards a world of digital marketing that is full of development opportunities.

4 notes

·

View notes

Text

Bitcoin crosses $100,000 for 1st time: Will the rally sustain? 3 things to know Bitcoin has more than doubled in value since the start of 2024 and has risen by about 45% in the last four weeks following Donald Trump's US election victory.

Bitcoin has crossed the $100,000 mark for the first time, setting a historic milestone in its journey as a global financial asset. This landmark was fuelled by growing institutional interest and favourable regulatory developments, and has sparked discussions about whether the rally can sustain or if a pullback might follow.

Bitcoin has more than doubled in value since the start of 2024 and has risen by about 45% in the last four weeks following Donald Trump’s US election victory.

WHY DID BITCOIN REACH $100,000?

Bitcoin’s rise to six figures has been driven by several factors, including institutional investments, market momentum, and policy developments. Pro-crypto policies: The recent election of Donald Trump as the 47th President of the US has ushered in a wave of optimism for the cryptocurrency market. With Elon Musk appointed to the Department of Government Efficiency and Paul Atkins as the new SEC Chair, the market is anticipating pro-crypto policies and reforms.

Institutional confidence: Bitcoin exchange-traded funds (ETFs) have seen significant inflows, with $676 million added in a single day. BlackRock’s spot Bitcoin ETF now manages over 500,000 BTC, worth $48 billion, signalling strong institutional confidence in the asset.

Market momentum: Over the past month, Bitcoin has surged 50%, delivering a 144% return year-to-date (YTD). This rally has reignited interest from retail investors and strengthened its position as a mainstream asset.

“Crossing the $100,000 mark is a historic moment for Bitcoin and the global crypto industry. It’s incredible to see how far we’ve come—from Satoshi Nakamoto’s vision in the Bitcoin whitepaper to today. This milestone is not just about the price; it’s a testament to Bitcoin’s resilience and adoption,” said Sumit Gupta, Co-founder of CoinDCX.

He added, “As Bitcoin surpasses $100,000, it’s more than a number—it’s a psychological breakthrough that will prompt institutions, companies, and countries to take Bitcoin and crypto more seriously.”

Edul Patel, CEO and Co-founder of Mudrex, said, “Institutional confidence is continuing to grow, with Bitcoin ETFs adding $676 million in a single day. This milestone is also expected to attract more retail investors, pushing crypto further into becoming a mainstream asset. With Trump’s pro-crypto agenda and Atkins’ leadership, the market is bound for friendlier reforms and wider adoption.”

CAN BITCOIN MAINTAIN ITS MOMENTUM?

Experts have mixed opinions about whether Bitcoin can sustain this rally or face increased volatility.

"Retail investors may now view it as a validated, stable asset class, and we could see deeper integration of Bitcoin into mainstream investment products. While short-term volatility is inevitable, my focus remains long-term. I believe Bitcoin will continue to shape the future," said Gupta.

Himanshu Maradiya, Chairman of CIFDAQ, said, “While this breakthrough fuels optimism, it’s important to tread carefully—volatility remains part of the game. Seasoned investors see this as a chance to reassess risk strategies, while newcomers are urged to prioritise learning the ropes before diving in.”

BITCOIN FUTURE OUTLOOK

"The next phase will be crucial for two reasons — sustaining its growth amidst increased whale and institutionalised investor activities and supplementary policy from world governments. The Bitcoin and the larger crypto market is anticipating the creation of a strategic Bitcoin reserve in the USA, along with policy reforms that support the growth of Bitcoin in the coming months. These aspects will be crucial for Bitcoin in the upcoming time to create value, set new benchmarks and establish itself in a favourable position to avert conflict-driven investor sell-offs," said Mohammed Roshan Aslam co-founder and CEO of GoSats.

"With the US embracing pro-crypto policies other countries are also moving favourably, China has now lifted restrictions on personal crypto ownership. Brazil, and Russia are considering Bitcoin for reserves, signaling its growing global economic role. Based on historical post-halving performance- analysts project that Bitcoin could reach a peak of around $150,000 in 2025. If the past is any indicator, the April 2024 halving could spark a rally of 300–400%, aligning perfectly with this forecasted target. However, in this dynamic environment, investors must stay informed about market developments to make confident and well-informed decisions," said Balaji Srihari, Business Head, CoinSwitch.

www.cifdaq.com

0 notes

Text

Exploring Singapore’s Market Through Strategic Trading

Singapore’s financial market has always been a fascinating space to observe. From its well-regulated exchange to its global partnerships, it offers insights that extend beyond borders. Having spent time analyzing different markets, I’ve grown to appreciate how Singapore balances innovation and resilience in the face of global uncertainty.

My journey in understanding markets like Singapore’s has been shaped by learning strategies from ORION Wealth Academy. The live-streamed lessons have been particularly helpful in breaking down complex financial concepts, showing how to spot opportunities, and teaching practical skills that I can use across different markets.

SGX’s Role in Driving Growth

The Singapore Exchange (SGX) has been proactive in positioning itself as a hub for regional and international investment. Recently, its CEO, Loh Boon Chye, highlighted plans to expand collaborations with other bourses. This strategy not only strengthens Singapore’s global standing but also creates new opportunities for investors navigating an increasingly interconnected world.

At a time when trade and policy changes, particularly under the new U.S. administration, are likely to shape global markets, Singapore’s approach feels both steady and forward-looking. ORION’s lessons often stress the importance of tracking these macroeconomic shifts to better understand how they ripple through global markets, including those as dynamic as Singapore’s.

Evaluating BRC Asia’s Potential

One stock that recently caught my attention is BRC Asia Limited (SGX:BEC), which has raised its dividend payout to a new high. It’s always encouraging to see a company reward its shareholders while maintaining solid financials. BRC Asia’s steady earnings growth over the past few years reflects its ability to balance reinvestment with returns.

That said, it’s not without risks. The company’s history of dividend cuts is a reminder that even strong performers can face challenges. Yet, the current outlook suggests that BRC Asia has positioned itself well for future growth, and its dividend yield remains one of the more attractive ones in the market.

Macro Policies and Sector Insights

Singapore’s approach to monetary policy is another aspect worth noting. The recent adjustment by the Monetary Authority of Singapore (MAS) shows a calculated response to global economic pressures. It’s a good reminder that markets aren’t just about individual stocks but also about the larger framework of policies that support stability.

Certain sectors in Singapore stand out as particularly promising. Data centers, for instance, continue to grow as demand for digital infrastructure rises. Companies like Keppel DC REIT are benefiting from this trend. Similarly, the aviation sector is slowly recovering, presenting opportunities for long-term investors despite current challenges.

Thanks to the strategies I’ve learned from ORION, I’ve been able to analyze these sectors with a more structured approach. From understanding dividend sustainability to evaluating long-term growth prospects, these skills have made it easier to navigate a market like Singapore’s.

Lessons from Singapore’s Market

There’s something uniquely inspiring about observing how Singapore navigates its role in the global economy. For someone coming from a market where external factors heavily influence domestic conditions, Singapore offers a glimpse into how proactive strategies can create stability even during uncertain times.

ORION has reinforced the importance of blending local knowledge with global insights. Markets like Singapore’s are a reminder that opportunities exist everywhere, as long as we’re willing to learn and adapt.

Singapore’s market continues to evolve, presenting opportunities for those willing to learn and adapt. Whether it’s exploring the role of SGX in fostering global collaborations or understanding the impact of macroeconomic policies, there’s a lot to take away from this vibrant financial hub.

For anyone interested in deepening their understanding of trading and market strategies, platforms like ORION provide the tools and guidance to make confident decisions. Singapore’s market is an excellent example of how innovation and resilience can create a stable foundation for growth, even in uncertain times.

0 notes

Text

US Stocks Push Higher, Netflix Surge 9.7%

US stocks ended higher on Wednesday as investors continued to assess President Donald Trump’s new policies, with tech issues helped by strong results from Netflix.

Markets have been buoyed by President Trump's move to avoid imposing harsh import tariffs immediately, as he had threatened, although he told reporters he was considering placing levies on Mexico and Canada as soon as February 1. Tariffs on the European Union and a punitive duty on China were also being discussed, the new US President added.

DXY H1

On foreign exchanges, Trump’s slow pace on tariff impositions had seen the dollar reverse to two-week lows. But with sterling weakened by higher-than-expected UK government borrowing figures, the greenback recovered 0.2% versus the pound to 0.81. The dollar also rallied 0.12% against the euro to 0.96 with the European Central Bank widely expected to cut interest rates more consistently this year than the Federal Reserve and the Bank of England.

The first Fed policy-setting meeting of 2025 will conclude on January 29 next week, but markets are expecting little from the gathering, with more focus on messaging from the White House than the central bank.

At the stock market finish in New York, the broad S&P 500 index gained 0.6% at 6,086, just shy of a new closing high, having hit an intra-day peak at 6,100.81. Meanwhile, the blue-chip Dow Jones Industrials Average was up 0.3% at 44,156, and the tech-laden Nasdaq Composite jumped 1.3% to 20,009.

Tech issues got a lift after President Trump unveiled a $500 billion joint venture, named Stargate, which aims to construct extensive AI data centers and electricity generation facilities in Texas over the next four years. Among the Stargate US partners, Oracle gained 6.8%, while Nvidia rose 4.4%, and Microsoft added 4.1%.

NAS100Roll H4

Netflix surged 9.7% after the streaming giant reported a record-breaking 19 million new subscriber additions in the fourth quarter of 2024, far surpassing Wall Street’s expectations.

Away from tech, Procter & Gamble rose 1.9% after the consumer goods giant saw its second quarter net sales beat analysts' estimates helped by strong demand in the key US market.

Travelers Companies gained 3.2% after the insurer beat estimates for fourth-quarter profit, as strength in its underwriting business cushioned a blow from elevated catastrophe losses.

And United Airlines added 2.3% after the carrier issued better than expected fourth-quarter results and gave an upbeat outlook.

But Johnson & Johnson fell 1.9%, weighed by drop in sales of its blockbuster psoriasis treatment Stelara, even as the pharma firm posted better-than-expected fourth-quarter adjusted earnings and sales.

Among commodities, oil prices stayed weak, extending hefty losses made earlier this week on the back of President Trump’s declaration of a national emergency to ramp up energy production.

US WTI crude was down 0.6% to $75.40 a barrel, while UK Brent crude fell 0.3% to $76.61 a barrel.

Disclaimer:

The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions.

Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us.

The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

Bitcoin crosses $100,000 for 1st time: Will the rally sustain? 3 things to know

Bitcoin has more than doubled in value since the start of 2024 and has risen by about 45% in the last four weeks following Donald Trump's US election victory.

Bitcoin has crossed the $100,000 mark for the first time, setting a historic milestone in its journey as a global financial asset. This landmark was fuelled by growing institutional interest and favourable regulatory developments, and has sparked discussions about whether the rally can sustain or if a pullback might follow.

Bitcoin has more than doubled in value since the start of 2024 and has risen by about 45% in the last four weeks following Donald Trump’s US election victory.

WHY DID BITCOIN REACH $100,000?

Bitcoin’s rise to six figures has been driven by several factors, including institutional investments, market momentum, and policy developments.

Pro-crypto policies: The recent election of Donald Trump as the 47th President of the US has ushered in a wave of optimism for the cryptocurrency market. With Elon Musk appointed to the Department of Government Efficiency and Paul Atkins as the new SEC Chair, the market is anticipating pro-crypto policies and reforms.

Institutional confidence: Bitcoin exchange-traded funds (ETFs) have seen significant inflows, with $676 million added in a single day. BlackRock’s spot Bitcoin ETF now manages over 500,000 BTC, worth $48 billion, signalling strong institutional confidence in the asset.

Market momentum: Over the past month, Bitcoin has surged 50%, delivering a 144% return year-to-date (YTD). This rally has reignited interest from retail investors and strengthened its position as a mainstream asset.

“Crossing the $100,000 mark is a historic moment for Bitcoin and the global crypto industry. It’s incredible to see how far we’ve come—from Satoshi Nakamoto’s vision in the Bitcoin whitepaper to today. This milestone is not just about the price; it’s a testament to Bitcoin’s resilience and adoption,” said Sumit Gupta, Co-founder of CoinDCX.

He added, “As Bitcoin surpasses $100,000, it’s more than a number—it’s a psychological breakthrough that will prompt institutions, companies, and countries to take Bitcoin and crypto more seriously.”

Edul Patel, CEO and Co-founder of Mudrex, said, “Institutional confidence is continuing to grow, with Bitcoin ETFs adding $676 million in a single day. This milestone is also expected to attract more retail investors, pushing crypto further into becoming a mainstream asset. With Trump’s pro-crypto agenda and Atkins’ leadership, the market is bound for friendlier reforms and wider adoption.”

CAN BITCOIN MAINTAIN ITS MOMENTUM?

Experts have mixed opinions about whether Bitcoin can sustain this rally or face increased volatility.

"Retail investors may now view it as a validated, stable asset class, and we could see deeper integration of Bitcoin into mainstream investment products. While short-term volatility is inevitable, my focus remains long-term. I believe Bitcoin will continue to shape the future," said Gupta.

Himanshu Maradiya, Chairman of CIFDAQ, said, “While this breakthrough fuels optimism, it’s important to tread carefully—volatility remains part of the game. Seasoned investors see this as a chance to reassess risk strategies, while newcomers are urged to prioritise learning the ropes before diving in.”

BITCOIN FUTURE OUTLOOK

"The next phase will be crucial for two reasons — sustaining its growth amidst increased whale and institutionalised investor activities and supplementary policy from world governments. The Bitcoin and the larger crypto market is anticipating the creation of a strategic Bitcoin reserve in the USA, along with policy reforms that support the growth of Bitcoin in the coming months. These aspects will be crucial for Bitcoin in the upcoming time to create value, set new benchmarks and establish itself in a favourable position to avert conflict-driven investor sell-offs," said Mohammed Roshan Aslam co-founder and CEO of GoSats.

"With the US embracing pro-crypto policies other countries are also moving favourably, China has now lifted restrictions on personal crypto ownership. Brazil, and Russia are considering Bitcoin for reserves, signaling its growing global economic role.Based on historical post-halving performance- analysts project that Bitcoin could reach a peak of around $150,000 in 2025. If the past is any indicator, the April 2024 halving could spark a rally of 300–400%, aligning perfectly with this forecasted target. However, in this dynamic environment, investors must stay informed about market developments to make confident and well-informed decisions," said Balaji Srihari, Business Head, CoinSwitch.

0 notes

Text

Continuous Monitoring, Better Outcomes: The Surge in ECG Patch and Holter Monitor Demand

The global ECG patch and holter monitor market size is expected to reach USD 4.8 billion by 2030, according to a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 19.58% from 2023 to 2030. The Growing prevalence of cardiac arrhythmia, increasing demand for ambulatory monitoring devices, and technological advancements are likely to drive the market during the forecast period.

Recent technologies in ECG patch and Holter monitor market include ECG chip, which can be inserted in the body to record heart rhythms for a long duration; ECG data management solutions; and telemetry. ECG patch and Holter monitor are also used in noncardiology departments, such as electrophysiology labs and nursing & emergency departments, as well as management of respiratory disorders. Initiatives such as the Door-to-Balloon (D2B) time by the American College of Cardiology (ACC) and “Mission: Lifeline” by AHA are expected to drive demand for wireless solutions and 12-lead ECG devices.

COVID-19 pandemic has resulted in high burden on public health and health care delivery globally. The disease has major effects on cardiovascular system. A wide range of arrhythmias have been reported in patients, which complicate the course of COVID-19 due to the associated treatments. Due to the redistribution of health care resources, access to emergency services, such as reperfusion therapy, may be affected, based on severity of the diseases at a local level. Apart from obtaining EUA for innovative products, the market also witnessed strategies such as mergers & acquisitions focused on strengthening solutions offerings, including connected care and remote patient monitoring due to their increased demand during the COVID-19 pandemic. Acquisitions made by Philips of BioTelemetry in December 2020 and Capsule Technologies, Inc. in January 2021 are a few such events.

ECG Patch And Holter Monitor Market Report Highlights

In terms of product, the ECG patch segment held the largest share in 2022 and is expected to register the fastest growth over the forecast period. Acquisitions and partnerships & collaborations between device manufacturers & management service providers to facilitate better exchange of information are anticipated to boost market growth by simplifying ECG workflow and reducing complexity associated with custom integration.

On the basis of application, the diagnostics segment dominated the market in 2022. However, the monitoring segment is expected to register the fastest growth over the forecast period.

The manufacturers are engaging in activities such as mergers & acquisitions to strengthen their monitoring solutions portfolio in the market. In November 2021, Philips acquired Cardiologs, a French medical technology company. The acquisition will help the company make use of Cardiologs’ artificial intelligence model that can interpret data from various monitoring devices

ECG Patch And Holter Monitor Market Segmentation

Grand View Research has segmented the global ECG patch and holter monitor market based on product, application, end use, and region:

ECG Patch And Holter Monitor Product Outlook (Revenue, USD Million, 2017 - 2030)

ECG Patch

Holter Monitors

ECG Patch And Holter Monitor Application Outlook (Revenue, USD Million, 2017 - 2030)

Diagnostics

Monitoring

ECG Patch And Holter Monitor End Use Outlook (Revenue, USD Million, 2017 - 2030)

Hospitals & Clinics

Ambulatory Facilities

Others

ECG Patch And Holter Monitor Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Italy

Spain

Denmark

Norway

Sweden

Asia Pacific

China

Japan

India

South Korea

Australia

Thailand

Latin America

Brazil

Mexico

Argentina

Middle East & Africa (MEA)

Saudi Arabia

South Africa

UAE

Kuwait

List of Key Players

Nissha Medical Technologies (NMT)

Medtronic plc

Hill-Rom

iRhythm Technologies, Inc.

Nihon Kohden Corporation

Koninklijke Philips N.V.

GE Healthcare

Fukuda Denshi Co., Ltd.

Spacelabs Healthcare

AliveCor, Inc.

Cardiac Insight Inc.

VitalConnect

LifeSignals, Inc.

Bardy Diagnostics, Inc.

Nasiff Associates, Inc.

Midmark Corporation

Lief Therapeutics, Inc.

Schiller AG

Order a free sample PDF of the ECG Patch And Holter Monitor Market Intelligence Study, published by Grand View Research.

0 notes