#GrowthOpportunities

Explore tagged Tumblr posts

Text

Get ready to welcome the holy month of Ramadan with open hearts and gratitude! 🌙 Let the divine spirit of this blessed month fill your life with love, harmony, and prosperity. May you and your loved ones find countless blessings and opportunities for growth. Wishing everyone a joyful and enriching Ramadan Mubarak!

#marumaru#marumaruhotel#marumaruzanzibar#zanzibar#succession#Hotel#marumaruhotelzanzibar#ramadan#iftar#meal#stonetown#HolyMonth#Blessings#Spirituality#LoveAndHarmony#ProsperityAhead#GratitudeInOurHearts#FamilyBonding#CommunitySpirit#GrowthOpportunities

2 notes

·

View notes

Text

#BusinessFinance#FinancialServicesUAE#DigitalTransformationAI#Innovation#DubaiTranscendAccounting#PersonalizedServices#FutureofFinance#GrowthOpportunities#EmbraceChange

2 notes

·

View notes

Text

The challenges life throws at you suck, but they are the best growth opportunities.

#LifeChallenges#GrowthOpportunities#OvercomingObstacles#Strength#Resilience#PersonalDevelopment#Adversity#LearningExperience#EmbraceChange#PositiveOutlook#InnerStrength#RisingAbove#FacingDifficulties#SelfImprovement#TurningPoint#CharacterBuilding#Progress#MindsetShift#Transformation#HardTimes#Perseverance

1 note

·

View note

Text

Product Prototyping Market size by value at USD 3.95 billion in 2024. During the forecast period between 2025 and 2031, BlueWeave expects Global Product Prototyping Market size to boom at a robust CAGR of 11.45% reaching a value of USD 8.45 billion by 2031. The Product Prototyping Market across the world is driven by technological advancements like additive manufacturing and AI integration, enabling rapid and precise prototype development. A rising demand for innovative products in major sectors including aerospace, automotive, healthcare, and consumer electronics, fuels the growth of Global Prototyping Market. Additionally, an increasing focus on sustainability leads manufacturers to adopt eco-friendly materials and processes in prototyping. It, in turn, is projected to boost the expansion of Global Product Prototyping Market.

Sample Request: https://www.blueweaveconsulting.com/report/product-prototyping-market/report-sample

#BlueWeave#Consulting#Marketforecast#Marketresearch#ProductPrototyping#MarketGrowth#Innovation#MarketResearchReport#GrowthOpportunities

0 notes

Photo

💰 Boost your business potential! Explore 6 compelling benefits of business lending you shouldn't miss. 🌟📊 https://cstu.io/cab423

0 notes

Text

Need a Feasibility Study Company in India?

India’s diverse market offers immense potential, but success depends on thorough feasibility studies. From startups to large enterprises, expert research ensures business sustainability and competitive advantage.

Explore more at DigiRoadsResearch.com

1 note

·

View note

Text

📈 UK Economic Growth: A Bright Future Ahead! 🇬🇧

💡 The UK is on track for strong economic growth in 2025! With rising GDP, easing inflation, and investment opportunities, the outlook is promising. What’s driving this success? Read our in-depth analysis now! 👇

📖 Read more: https://thinquer.com/financial/uk-economic-growth-outlook-for-a-succesfull-2025/

💬 What are your thoughts on the UK’s economic future? Drop your opinions in the comments! Stay tuned for daily updates and expert insights.

#UKEconomy#EconomicGrowth#FinanceNews#GDP#UKFinance#Investment#BusinessNews#UK2025#GrowthOpportunities#FinancialTrends#MarketUpdate#MonetaryPolicy#Thinquer

0 notes

Text

Case Studies of Successful Commercial Loan Brokering!

Introduction:

Case studies offer valuable insights into the strategies, challenges, and outcomes of real-life commercial loan brokerage deals. By analyzing successful case studies, brokers can uncover best practices, identify key success factors, and gain inspiration for their own brokerage business. Here are real-life examples of successful commercial loan brokerage deals and the lessons that can be learned from them.

Case Study 1: Securing Financing for a Multifamily Development

In this case, a commercial loan broker successfully secured financing for a multifamily development project in a high-demand urban market. The broker conducted thorough market research to identify lenders specializing in multifamily loans and negotiated favorable terms that met the developer's needs. By highlighting the project's strong location, market demand, and developer experience, the broker convinced lenders of the project's viability, resulting in successful financing.

Key Lesson: Understanding the unique characteristics and demands of the property type and market is essential for securing financing for commercial real estate projects.

Case Study 2: Refinancing a Small Business with Cash Flow Challenges

In this case, a commercial loan broker helped a small business struggling with cash flow challenges refinance its existing debt to improve financial stability. The broker worked closely with the borrower to assess the business's financial health, identify areas for improvement, and develop a comprehensive loan package. By presenting the borrower's turnaround plan and future growth prospects to lenders, the broker secured refinancing with favorable terms, enabling the business to overcome its cash flow difficulties.

Key Lesson: Tailoring loan proposals to address specific borrower needs and presenting a clear plan for financial improvement can help secure financing for businesses facing challenges.

Case Study 3: Financing a Commercial Real Estate Acquisition

In this case, a commercial loan broker facilitated financing for a client looking to acquire a prime commercial property for investment purposes. The broker conducted extensive due diligence on the property, analyzed market trends, and identified lenders willing to finance the acquisition. By structuring the deal with favorable terms and highlighting the property's income-generating potential, the broker secured financing that met the client's investment objectives.

Key Lesson: Conducting thorough due diligence, understanding market trends, and presenting a compelling investment thesis are crucial for securing financing for commercial real estate acquisitions.

Conclusion:

Case studies of successful commercial loan brokerage deals offer valuable insights and lessons for brokers seeking to enhance their skills and drive success in the industry. By analyzing real-life examples of successful deals, brokers can learn from best practices, identify key success factors, and apply these lessons to their own brokerage business. By leveraging the strategies and insights gained from successful case studies, brokers can increase their effectiveness, build credibility, and achieve positive outcomes for their clients and their brokerage business.

#CommercialLoanBrokerage#RealEstateFinance#LoanSuccessStories#BusinessDevelopment#CommercialRealEstate#InvestmentOpportunities#RealEstateInvesting#CashFlowSolutions#FinancingStrategies#BusinessGrowth#LoanBroker#CommercialLoans#RealEstateInvestments#FinancialSuccess#MarketTrends#BrokerageBusiness#LenderConnections#PropertyFinancing#BusinessFinancing#GrowthOpportunities

1 note

·

View note

Text

Ready to hit the road to success? Let Sambhav carve out the opportunities you need to thrive. 🚀

#DriveToSuccess#SambhavConsultants#SuccessJourney#OpportunitiesAwait#SuccessPath#BusinessGrowth#Entrepreneurship#SuccessMindset#FutureOfBusiness#GrowthOpportunities#BusinessSuccess#StrategicGrowth

0 notes

Text

#MarketTrends#GrowthOpportunities#BusinessGrowth#CustomerSuccess#coffeez for closers#CustomerExperience

0 notes

Text

Childhood Bicycle Became a Symbol of Lost Opportunities

#Life doesn’t wait, and neither should you. Start by reconnecting with your #passions. #dreams #indecisiveness #childhood #opportunities #inspirational #BMX #Casio #cycling #awakening #mentalhealth #wellness #wellbeing #career #goals #decision-making #luv

Do you remember the one thing you cherished in your childhood? Perhaps it was a toy, a book, or a treasured gadget. For me, it was my silver-grey BSA SLR Roadster bicycle with handle locks similar to those on a motorbike. In the early ’90s, it cost my parents a princely sum of Rs. 800 (about 40 USD then), making it a luxury by our standards. That cycle was more than a two tyres and a frame—it was…

#BMX#childhood#dailyprompt#dailyprompt-1813#Dreams#goals#GrowthOpportunities#LIfe Transformation#LifeBeyond50#motivational#moving forward#PassionPursuits

0 notes

Text

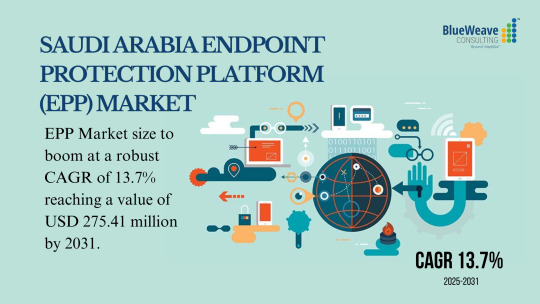

Saudi Arabia Endpoint Protection Platform (EPP) Market size by value at USD 112.11 million in 2024. During the forecast period between 2025 and 2031, BlueWeave expects Saudi Arabia Endpoint Protection Platform (EPP) Market size to boom at a robust CAGR of 13.7% reaching a value of USD 275.41 million by 2031. The Endpoint Protection Platform (EPP) Market in Saudi Arabia is propelled by the escalating frequency and complexity of cyber threats. Organizations are prioritizing the protection of diverse endpoints, including computers, laptops, and smartphones, through the implementation of advanced EPP solutions. Key features such as device control, data loss prevention, and patch management are critical components of these deployments. The adoption of cloud-based EPP solutions is further accelerating market expansion, offering scalability, flexibility, and cost-efficiency compared to traditional on-premises models. The documented surge in cyberattack incidents, exemplified by the Cybersecurity and Infrastructure Security Agency's (CISA) report of over 800 million attacks in 2021, reinforces the necessity for robust endpoint security measures and underscores the pivotal role of EPP in mitigating organizational risk.

Sample Request: https://www.blueweaveconsulting.com/report/saudi-arabia-endpoint-protection-platform-market/report-sample

#BlueWeave#Consulting#Marketforecast#Marketresearch#Cybersecurity#EndpointProtection#EndpointSecurity#ThreatIntelligence#MarketResearchReport#GrowthOpportunities#CybersecuritySolutions#EPPMarket

0 notes

Photo

💰 Boost your business potential! Explore 6 compelling benefits of business lending you shouldn't miss. 🌟📊 https://cstu.io/cab423

0 notes

Text

How NBFCs Contribute to Economic Development

NBFCs are instrumental in driving economic growth by providing vital funding for infrastructure development, consumer loans, and business investments. Their diverse financial products cater to individuals and businesses alike, stimulating demand across various sectors. By offering credit to industries and financing large-scale infrastructure projects, NBFCs license help fuel both short-term consumer spending and long-term economic development. Their contribution is essential to sustaining and accelerating economic progress in growing economies.

#nbfc#nbfc license#EconomicDevelopment#ConsumerLoans#GrowthOpportunities#BusinessInvestment#FinancialMarkets#InvestmentOpportunities#Corpbiz

0 notes

Text

Fuel your growth with Om Logistics With a customer-centric approach and tailored logistics solutions, we cover every mile—from the first to the last—delivering efficient and cost-effective services without ever compromising on quality. Backed by a strong nationwide network and state-of-the-art infrastructure, our reliable, multi-modal services are designed to drive excellence at every turn. Trust Om Logistics to deliver success, unlock new markets and support your journey toward sustainable growth.

#ReliableLogistics#GrowthOpportunities#seamlesssupplychain#streamlinedlogistics#PanIndiaOperations#PanIndiaDelivery#sme#msme#logisticsprofessionals#LogisticsExcellence#supplychainexcellence#Omlogistics#retailexpress#inventory#wareshouing#3PLCompany

0 notes

Text

youtube

ASE at Utech Sleep Expo Mumbai 2024

Our Director, Mr. Arnav Puri, expresses his heartfelt gratitude for the phenomenal response on the opening day of UTECH India Expo Mumbai 2024.

He shares his thoughts, celebrating a successful start and looking forward to equally vibrant and promising days ahead!

#UTechexpo#UTechmumbai#Sleepexpo2024#PUfoamindustry#Businesscollaboration#Expohighlights#entrepreneurship#Growthopportunities#Youtube

0 notes