#Graphite Price

Explore tagged Tumblr posts

Text

Graphite Price Trend and Forecast

In the fourth quarter of 2022, Graphite price in the US market fluctuated due to increased product availability, moderate inflationary pressure, and a positive outlook for downstream demand. According to market participants, the global slowdown accelerated in October, with manufacturing and service performance deteriorating and output contracting more rapidly. According to manufacturers, production activity increased at a marginal rate, assisted by reduced bottlenecks. Despite lower inflationary pressures in mid-Q4, buyers claimed that the graphite demand outlook had worsened. According to market participants, the EV industry was gaining traction in the United States as a result of incentives provided by the Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law (BIL), but a major impediment to electrification was a lack of domestic EV battery material supply to meet production targets. As a ripple effect, the Graphite Flakes prices for CFR Houston settled at USD 1038/MT.

0 notes

Text

cod pencil doodles :] (ft. bad cam quality)

#lowkey paranoid the graphite might ruin these doodles in a few months so i'm keeping them here just in case#call of duty#cod mwii#call of duty ghosts#david hesh walker#riley the dog#john soap mactavish#simon ghost riley#kyle gaz garrick#john price

201 notes

·

View notes

Text

Basil Gogos - Vincent Price as Roderick Usher in House of Usher Illustration Original Art (2006) Source

Basil Gogos “Hunchback of Notre Dame” Signed Limited Edition Print (1994) Source

Basil Gogos “London After Midnight” Signed Limited Edition Print (1994) Source

Basil Gogos - Bela Lugosi as Dracula Illustration Art (c. 2003) Source

#basil gogos#vincent price#roderick usher#house of usher#graphite charcoal and white and beige color touches#Hunchback of Notre Dame#London After Midnight#bela lugosi

8 notes

·

View notes

Text

#“Do You Want Revenge?#” 2020-22. Acrylic paint#reverse-transfer print into acrylic polymer graphite and UV-print on aluminum composite#Seth price

9 notes

·

View notes

Text

#horror art#art#artists on tumblr#put the moon/ clouds on the same layer as background and now I can’t move them#So the price is forever imbalanced#Graphite pencil adobe fresco is my soulmate

3 notes

·

View notes

Text

Collab with xkaworu: My Captain Tsubasa main OC, Lily Del Valle, on a motorcycle 💙 The original drawing is very old, from the year 2010 or so, and at some point I printed it to finish it with colored pencils, but I don't remember why I didn't. I recently found the print in one of my folders and wanted to color it, although now with my new graphite pencils instead of using the colored ones. I loved the drawing at the time, but now that I see it again, I feel that the girl doesn't have Lily's essence, especially because of the expression, this girl looks very malevolent and Lily is not like that 😅

#traditional drawing#traditional art#pencil drawing#pencil#graphite#pencil art#graphite pencil drawing#sketching#graphite pencil#captain tsubasa#genzo wakabayashi#captain tsubasa oc#supercampeones#capitaintsubasa supercampeones#lilydelvalle#genzoandlily#oliver y benji#benji price#holly e benji#oc artist#artists on tumblr#female artists#lily de wakabayashi

8 notes

·

View notes

Text

I fucked up his face, and his hairline. Im so sorry Price, godbless.

#mw2 2022#cod modern warfare#call of duty mw2#john price mw2#captain john price#captain price#graphite is my passion#and I hate it#but ohohoho this powder sure is funky!#its charcoal#im such a fucking idiot its charcoal I did this with charcoal pencils#as punishment for my fuck up im forced to eat those crunchy#ashy#sticks of sin#godbless I want to apologize to Barry for fucking up his hairline... and his face.... im just so sorry.

4 notes

·

View notes

Text

Today’s Pencil Sketch: Vincent Price in “The Raven”! Literally, actually, in the Raven. Or projected onto the thing I suppose lol

I left in a few of the lines so I could return later and clean it up, see if I wanted to change it any. Went to the art museum today, saw the graphite pencil sets and fancy erasers and colored pencil set (and a new, large sized sketch book) and said “it’s time to upgrade from mechanical pencils, I think”. So! I made this. I’m quite proud of it.

#Vincent price#fanart#horror fanart#The Raven#art#my art#pencil sketch#pencil art#graphite sketch#Been on and off sick the last few days#spiking into low grade fevers after eating and fingers swelling and turning red#was gonna work on my fic when I got home but I am very much needing sleep#and drawing took less Brain power for me#Hope this eases up for work tomorrow

5 notes

·

View notes

Text

Just wanna keep my creative flow going but damn does tryna do art when you’re working 50 hour weeks suck

Pinned (Commissions) | Writing Masterlist | Kofi | Etsy

#roan does art#artist#art#all pieces for sale for the right price ;)#drawing#commisions open#artist on tumblr#illustration#artist on etsy#traditional art#traditional artist#queer artist#art for sale#skull#emo#edgy#anatomy#sketch#graphite#sketchbook#skull art#emo art#edgy art#dark aesthetic

2 notes

·

View notes

Text

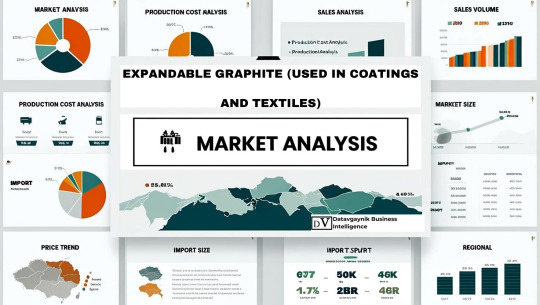

Top 15 Market Players in Global Expandable Graphite (Used in coatings and textiles) Market

Top 15 Market Players in Global Expandable Graphite (Used in coatings and textiles) Market

The global expandable graphite market, particularly in coatings and textiles, is driven by innovation, sustainability, and increasing demand for fire-resistant and conductive materials. Below is a list of the leading market players making significant contributions to the market landscape:

SGL Carbon SE Known for its advanced graphite materials, SGL Carbon SE provides high-quality expandable graphite used in flame-retardant coatings and technical textiles.

GrafTech International Ltd. A global leader in graphite technology, GrafTech specializes in supplying expandable graphite for coatings requiring high thermal stability.

Nippon Graphite Industries Co., Ltd. Based in Japan, the company offers innovative solutions in expandable graphite for applications in textiles and specialty coatings.

Qingdao Guangxing Electronic Materials Co., Ltd. A Chinese manufacturer excelling in high-purity expandable graphite, primarily for fire-resistant coatings and textile applications.

Asbury Carbons With decades of experience, Asbury provides high-quality expandable graphite for advanced coating systems and technical textile manufacturing.

Qingdao Kropfmuehl Graphite Co., Ltd. Known for high-performance graphite products, the company is a significant supplier to the coatings and textiles sectors.

LKAB Minerals A European leader in industrial minerals, LKAB specializes in expandable graphite for sustainable and fire-retardant coating systems.

Xincheng Graphite Co., Ltd. A prominent player in China, offering tailor-made expandable graphite solutions for various industrial applications.

NeoGraf Solutions, LLC This U.S.-based company focuses on engineered graphite materials, including expandable graphite for coatings with enhanced fire resistance.

Imerys Graphite & Carbon A global leader in specialty materials, Imerys supplies expandable graphite for advanced fire-retardant textiles and coatings.

Shandong Jinhui Graphite Co., Ltd. One of China's largest expandable graphite producers, catering to the needs of the coatings and textiles industries.

Qingdao Braide Graphite Co., Ltd. This company specializes in supplying high-grade expandable graphite, focusing on fire-resistant applications in textiles.

Graphite Central A leading supplier of graphite products in North America, offering customizable expandable graphite solutions for niche applications.

AMG Advanced Metallurgical Group This group integrates expandable graphite into high-tech applications, including fire-retardant coatings and conductive textiles.

Yichang Xincheng Graphite Co., Ltd. A global supplier of expandable graphite, focusing on environmentally friendly and sustainable industrial solutions.

Request report sample at https://datavagyanik.com/reports/global-expandable-graphite-used-in-coatings-and-textiles-market-size-production-sales-average-product-price-market-share/

Top Winning Strategies in Expandable Graphite (Used in coatings and textiles) Market

To succeed in the highly competitive global expandable graphite market, market players are employing strategic initiatives to drive growth, innovation, and sustainability. Here are some of the most effective strategies adopted by key players:

1. Focus on Sustainability

Companies are increasingly developing eco-friendly and non-toxic expandable graphite to meet stringent environmental regulations.

Promoting sustainable solutions to cater to industries prioritizing green technologies in coatings and textiles.

2. Investment in R&D

Heavy investments in research and development to enhance the properties of expandable graphite, such as improved thermal conductivity and fire resistance.

Innovation in production technologies to create high-purity and application-specific products.

3. Expansion of Production Capacity

Key players are expanding their production facilities to meet the growing demand for expandable graphite in emerging markets.

Establishing manufacturing plants closer to major industrial hubs in Asia-Pacific and Europe.

4. Strategic Partnerships and Collaborations

Collaborating with coating and textile manufacturers to co-develop customized solutions for niche applications.

Partnering with research institutions to explore new applications of expandable graphite.

5. Market Diversification

Exploring new applications of expandable graphite in conductive textiles and fire-resistant building materials.

Diversifying the product portfolio to include expandable graphite grades for different industrial requirements.

6. Regional Market Penetration

Targeting fast-growing markets in Asia-Pacific, particularly China and India, which are significant consumers of coatings and textiles.

Strengthening distribution networks in North America and Europe to expand market reach.

7. Emphasis on Product Quality

Offering high-purity expandable graphite that meets industry-specific standards, ensuring performance in fire-retardant and conductive coatings.

Quality certifications to build customer trust and gain a competitive edge.

8. Pricing Strategies

Competitive pricing strategies to attract cost-sensitive industries without compromising on quality.

Flexible pricing models for bulk buyers, particularly in textiles and construction sectors.

9. Adoption of Advanced Manufacturing Technologies

Implementing advanced production processes to improve efficiency and reduce waste during the manufacturing of expandable graphite.

Leveraging automation and digitalization to optimize production.

10. Mergers and Acquisitions (M&A)

Acquiring smaller companies specializing in expandable graphite to strengthen market position and broaden product offerings.

Consolidation strategies to achieve economies of scale and enhance global competitiveness.

By leveraging these strategies, companies in the expandable graphite market are not only meeting current demands but are also positioning themselves for long-term growth and sustainability in the coatings and textiles industries.

Request a free sample copy at https://datavagyanik.com/reports/global-tin-di-2-Expandable Graphite (Used in coatings and textiles)-market-size-production-sales-average-product-price-market-share-import-vs-export-united-states-europe-apac-latin-america-middle-east-africa/

#Expandable Graphite (Used in coatings and textiles) Market#Expandable Graphite (Used in coatings and textiles) Production#market players#average price#revenue#top trends#market size#market share

0 notes

Text

Graphite Price | Prices | Pricing | News | Database | Chart

In Q2 2024, North America saw a notable drop in graphite prices due to a convergence of critical factors. Key drivers included ongoing supply chain disruptions and weakened demand, both of which were intensified by geopolitical tensions and economic uncertainties. Oversupply in the market has been a persistent issue, keeping prices down. Additionally, logistics challenges, such as rising freight costs and shipping delays, further pressured the supply side and contributed to lower prices.

The U.S. experienced the most significant price decreases, following a steady downward trend. Seasonal patterns, like reduced industrial activity during the summer, played a role in this decline. Broader economic indicators, including slowdowns in manufacturing and lower automotive sales, also reinforced the negative sentiment around graphite prices. Compared to the first quarter of 2024, graphite prices fell by 2%. At the end of Q2, graphite flakes (94%, -100 mesh) were priced at USD 1109/MT CFR Houston, signaling a stable but negative pricing trajectory. No major plant shutdowns occurred during this period, further cementing the outlook for continued price drops.

The APAC region also saw a notable decline in graphite prices during Q2 2024, driven by elevated supply levels that overshadowed demand from sectors like electric vehicles and electronics. This supply glut, combined with stable mining output, led to a consistent decrease in prices. International trade policies, including tariffs and export controls, added further complexity, exacerbating the bearish sentiment.

China experienced the most significant price changes within APAC, with an oversupply situation and stagnant demand contributing to a persistent downtrend. Seasonal factors, like a lack of peak demand periods, resulted in subdued trading activities. Compared to the previous quarter, prices dropped by 4%, reflecting the continued negative market sentiment. By the end of Q2 2024, graphite flakes (94%, -100 mesh) FOB Shanghai were priced at USD 804/MT, underscoring the ongoing supply-demand imbalance. Despite the price drops, no major plant shutdowns were reported, indicating that the price decline was driven primarily by market forces rather than supply chain disruptions.

In Europe, graphite prices fell steadily throughout Q2 2024, driven by a combination of economic factors and regional dynamics. The EU’s Critical Raw Materials Act (CRMA) aimed to boost domestic production, leading to short-term oversupply. Rising energy costs and inflation, coupled with increased alloy surcharges for stainless steel, pushed production costs higher while demand remained weak. Global disruptions, such as rerouted shipping routes due to geopolitical tensions, added to supply chain inefficiencies.

Germany saw the most significant price fluctuations in Europe, with the automotive sector's recovery unable to offset the broader manufacturing slowdown. A decline in new car registrations and stagnant construction activity further suppressed demand for graphite, pushing prices down. Compared to the previous quarter, prices decreased by 2%, with graphite flakes (94%, -100 mesh) ending the quarter at USD 858/MT. Although no specific plant shutdowns were reported, operational challenges and broader industry disruptions continued to weigh on the market.

Get Real Time Prices for Graphite: https://www.chemanalyst.com/Pricing-data/graphite-1433

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Graphite#Graphite Price#Graphite Prices#Graphite Pricing#Graphite News#Graphite Price Monitor#Graphite Database#Graphite Price Chart

0 notes

Text

Discover competitive options with our Graphite CNC Lathe Price, designed to deliver exceptional value without compromising on quality and performance.

0 notes

Text

Graphite Block Digester NGBD-200

Labnics graphite block digester is a compact unit for Kjeldahl digestion of samples with nitrogen content. It offers a 20-sample capacity, 300ml tube volume, and 42mm tube diameter. Features include PID temperature control, 20 programs, and multiple safety protections.

0 notes

Text

Artificial Graphite Market - Forecast(2024 - 2030)

Overview

The artificial graphite market size is forecast to reach USD 9 billion by 2030, after growing at a CAGR of 12.83% during the forecast period 2023-2028. The demand for artificial graphite has been increasing rapidly as it is primarily used in the production of electrodes and electrolytic processes, carbon brushes, and batteries. due to the increased production of electric vehicles, batteries are one of the most popular applications for artificial graphite today. batteries for electric vehicles employ artificial graphite to boost energy density and faster charging. this has been increasing the demand for artificial graphite. the market expansion of artificial graphite is primarily driven by the automotive sector's robust growth. due to its lightweight, high mechanical strength, and lubricating properties, artificial graphite is widely utilized in the production of automotive parts such as brake lining, clutch materials, and gaskets. it is also a perfect asbestos replacement because it is a great conductor of electricity. as a result, market growth is being driven by the rising demand for artificial graphite from the automotive industry.

Report Coverage

The report “Artificial Graphite Market – Forecast (2024-2030)”, by IndustryARC, covers an in-depth analysis of the following segments of the artificial graphite market.

By Product Type: Graphite Electrodes, Graphite Anodes, Graphite Block, and Others.

By Type: Electrographite, Synthetic Graphite.

By Form: Primary Synthetic, Secondary Synthetic.

By Application: Anticorrosion Products, Batteries, Carbon Brushes, Coatings, Conductive Fillers, Electrodes and Electrolytic Processes, Fuel Cell Bipolar Plates, and Nuclear Moderator Rods.

By End Use Industry: Automotive, Metallurgy, Solar, Electronics, Nuclear, Aerospace, and Others.

By Geography: North America, South America, Europe, APAC, and RoW.

Request Sample

Key Takeaways

APAC held the largest market share with 52.50% in 2023. with more than 50% of the market's total volume coming from the Asia-pacific region, China was the area's largest consumer. China is the primary focus of the entire lithium-ion battery production process. China is by far the biggest and fastest-growing market for lithium-ion batteries, which is boosting demand for artificial graphite.

The high demand for batteries and other electrical gadgets coming from European countries will fuel the graphite market. the developed automotive industries in Germany, the UK, and other nations are currently concentrating on developing electric vehicles (EVs) that are powered by lithium-ion batteries. Europe wants to lead the way in next-generation batteries as a way to demonstrate technological independence. SGL Carbon from Germany and Carbon Savoie from France have been gathered into a significant battery partnership that Brussels will launch in 2020.

North America, Africa, and South America are anticipated to see significant market expansion due to their developing industrial economies and improved economic conditions for end-user industries like automotive, metallurgy, solar, electronics, and others.

By Product Type - Segment Analysis

Graphite anodes dominated the artificial graphite market in 2023. since the invention of lithium-ion batteries, graphite has dominated anode materials due to its unmatched combination of low cost, abundance, high energy density, high power density, and extremely long cycle life. graphite is an ideal anode. recent studies show that graphite's lithium storage capacity can be further enhanced, highlighting the material's significant potential for use in advanced libs for electric vehicles and grid-scale energy storage facilities. according to the most recent data from the China association of automobile manufacturers, China’s Nev output climbed by 167.40% from January to November 2021 to 3.02 million units, while total sales increased by 166.80% compared to the first 11 months of 2020 to 2.99 million units (CAAM).

By Type - Segment Analysis

Synthetic graphite dominated the artificial graphite market in 2023. high-purity carbon makes up synthetic graphite, which is prized for its resistance to corrosion and extreme temperatures. a few extremely niche sectors heavily rely on synthetic graphite. due to its use in lucrative industries with increasing demand, synthetic graphite is attractive to investors. but before exploring the area, it's critical to comprehend the subtleties of synthetic graphite and some common misconceptions about it. because synthetic graphite has a purer carbon composition and exhibits more predictable behavior, it has found applications in solar energy storage and arc furnaces. given that the process requires a large amount of energy, synthetic graphite can be significantly more expensive to make than natural graphite. the price can be double or triple what raw graphite is typically sold for.

Inquiry Before Buying

By Form - Segment Analysis

Secondary synthetic graphite dominated the artificial graphite market in 2023. electrodes used in heavy industry and manufacturing result in the production of secondary synthetic graphite as a by-product. secondary synthetic graphite, which is frequently produced as a powder, is another byproduct of the production of synthetic graphite. it is regarded as a low-cost version of graphite, and in some applications, such as brake linings and lubricants, it can compete with natural graphite.

By Application - Segment Analysis

Electrodes and electrolytic processes dominated the artificial graphite market in 2023. because graphite is such a good conductor, graphite electrodes are typically used in electrolysis. because of the way that its atoms are organized, graphite has a lot of free-floating electrons between its various layers (graphite bonds are formed of only three out of the four electron shells of the carbon atom, leaving the fourth electron to move freely). the electrolysis process can go without interruption because of these electrons' strong conductivity. graphite is also inexpensive, stable at high temperatures, and durable. graphite electrodes are widely used in electrolysis due to all of these factors. since many electrons are not linked in graphite due to their atomic structure, they can move freely between its layers. the abundance of free electrons (also known as electron delocalization) in graphite is what gives it exceptional conductivity. in addition to being a strong conductor, graphite is also inexpensive, durable, and widely available, which are all further reasons why it is frequently employed as an electrode.

By End User- Segment Analysis

Automotive dominated the artificial graphite market in 2023. one kilogram of graphite is required to produce one kilowatt-hour (kwh) of battery energy, making it the most significant component of the battery cell by weight. graphite makes up the great majority of the anode (95%) of a typical Li-ion battery installed in a battery electric vehicle (BEV). A memorandum of understanding [MoU] for the provision of synthetic graphite and silicon oxide to be utilized in specific stages of Britishvolt's battery production processes was signed in 2022 by Britishvolt, a battery manufacturer, and BTR, a company based in China.

By Geography - Segment Analysis

APAC artificial graphite market generated a revenue of $2 Billion in 2023 and is projected to reach a revenue of $5 Billion by 2030 growing at a CAGR of 13.88% during 2024-2030. China produces the majority of the artificial graphite that is produced in the Asia Pacific. For the development of their infrastructure and industrial expansion, countries like China are receiving significant investments. additionally, it is anticipated that during the forecast period, the growth of the industrial sector, particularly in this area, will fuel the market for artificial graphite. Chinese battery anode manufacturers revealed intentions to invest more than $3.9 billion in artificial graphite projects in 2022 in May as they seek to streamline their supply chains and cut prices. among the announcements is a new facility in Sichuan Province, Southwest China, whose operations can be fueled by renewable energy, assisting in lowering the carbon intensity of artificial graphite, which makes up a significant component of a battery's carbon footprint.

Schedule a Call

Drivers – Artificial Graphite Market

Growing application in the automotive industry is a significant aspect

As the anode content usage of lithium-ion batteries rises in tandem with the adoption of electric vehicles and lithium-ion battery applications, demand has been expanding in recent years. In the auto industry, artificial graphite is a solution for producing lithium-ion batteries, which are used to power newer electric cars and boost energy density while shortening charging times. Additionally, it is utilized to create thermally conductive polymers, which are increasingly employed to build automotive parts instead of metal. China is also the world's largest producer of batteries, with the energy storage system and automotive industries experiencing the highest growth rates for lithium-ion battery production in the future years. Chinese anode suppliers have the biggest installed capacities internationally, and China is the main hub of the lithium-ion battery value chain.

Market growth is driven by the metallurgy industry

In metallurgical applications, graphite is utilized in a variety of forms, including electrodes, refractories, bricks, monolithic crucibles, etc. artificial graphite is used as an anode in the electric arc furnace (eaf) process to produce steel, ferroalloys, and aluminum. in metallurgical processes, such as melting scrap iron in an electric furnace, polishing ceramics, producing compounds like calcium carbide, and others that call for high-temperature and clean energy sources, artificial graphite electrodes are used as a source of energy. the use of artificial graphite in metallurgical applications is anticipated to be driven by the increasing global production of crude steel and aluminum. however, it is anticipated that the market demand would be unpredictable due to erratic trends in the production of these metals. accordingly, based on the aforementioned factors, it is anticipated that as the production of important metals and alloys like steel and aluminum rises, artificial graphite will as well, drive the market.

Challenges – Artificial Graphite Market

The manufacture of artificial graphite comes with health risks that could restrict the market growth.

Calcined petroleum coke and coal tar pitch are the main ingredients used to make artificial graphite. these raw ingredients, though, are harmful to people's health. petroleum coke and coal tar pitch can irritate the eyes as well as cause a rash, inflammation, and burning on the skin in the event of contact. it can irritate the lungs, nose, and throat when inhaled. long-term exposure to these basic materials can also result in moderate symptoms like weariness, headache, and dizziness as well as severe ones like fainting and coma. additionally, occupational exposure to coal tar pitches raises the risk of developing skin cancer in addition to other cancers, such as lung, kidney, bladder, and, in some cases, digestive system cancer. therefore, the health risks related to using these raw materials to make artificial graphite may restrain market expansion.

Buy Now

Market Landscape

Technology launches, acquisitions, and R&D activities are key strategies adopted by players in the artificial graphite market. in 2023, the artificial graphite market share has been consolidated by the top seven players accounting for 65% of the share. major players in the artificial graphite market are SGL Carbon, Tokai Carbon, Elkem (Vianode), Imerys, Showa Denko, Toyo Tanso, Nippon Carbon Co Ltd, and Others.

Developments:

Ø In January 2021, Showa Denko announced the merger of between its consolidated branches, Showa Denko Carbon Holding GmbH (SDCH), and Showa Denko Europe GmbH (SDE). By combining the business management and business support functions of the two subsidiaries into one, this merger is expected to further expand the company’s business operation in Europe.

Ø In January 2021, Imerys Graphite & Carbon Ltd. launched its two new primary synthetic graphite namely KS6L and SFG6L. The main objective of the product development was to increase the company’s product portfolio.

We also publish more than 100 reports every month in "Chemicals and Materials", Go through the Domain if there are any other areas for which you would like to get a market research study.

#Artificial Graphite Market Price#Artificial Graphite Market Size#Artificial Graphite Market Share#Artificial Graphite Market Trends#Artificial Graphite Market Vendors#Artificial Graphite Market Industry

0 notes

Text

Graphite Prices Trend, Monitor, News & Forecast | ChemAnalyst

Graphite prices have witnessed notable fluctuations in recent years, influenced by a myriad of factors ranging from global market dynamics to technological advancements and environmental regulations. Understanding the dynamics of graphite prices requires a comprehensive analysis of supply and demand fundamentals, industrial applications, and macroeconomic trends.

The primary driver impacting graphite prices is the balance between supply and demand. Graphite, a versatile carbon-based mineral, finds extensive use in various industries such as steelmaking, automotive, electronics, and energy storage. Fluctuations in demand from these sectors can significantly impact graphite prices. For instance, the increasing adoption of electric vehicles and renewable energy technologies has led to a surge in demand for graphite used in lithium-ion batteries, driving prices upwards.

Supply-side factors also play a crucial role in determining graphite prices. Graphite production is concentrated in a few key regions, including China, India, and Brazil. Any disruptions in graphite mining activities, such as labor strikes, regulatory changes, or environmental concerns, can affect the global supply of graphite and subsequently impact prices. Moreover, the quality and purity of graphite extracted from different mines can influence its market value, with high-quality graphite commanding premium prices.

Get Real Time Prices of Graphite: https://www.chemanalyst.com/Pricing-data/graphite-1433

Macroeconomic indicators, such as GDP growth, inflation rates, and currency exchange rates, can indirectly affect graphite prices by influencing overall industrial activity and consumer demand. Economic downturns or currency fluctuations in major graphite-consuming countries may dampen demand and exert downward pressure on prices. Conversely, robust economic growth and stable currencies can support higher graphite prices by stimulating industrial production and consumer spending.

Geopolitical factors also contribute to graphite price volatility. Trade tensions, sanctions, and political instability in key graphite-producing regions can disrupt supply chains and lead to price fluctuations. For example, export restrictions imposed by graphite-producing countries or trade disputes between major economic powers can disrupt the flow of graphite to global markets, creating supply shortages and driving up prices.

Environmental regulations and sustainability concerns are increasingly influencing graphite prices. As governments worldwide prioritize environmental protection and carbon emission reduction, the graphite industry is facing pressure to adopt cleaner and more sustainable mining and processing practices. Compliance with stringent environmental standards may entail higher production costs, which could be passed on to consumers in the form of higher graphite prices.

Technological advancements and innovation also impact graphite prices by creating new demand sources and applications. For instance, the development of graphene, a two-dimensional form of graphite with exceptional properties, has opened up new opportunities in electronics, aerospace, and energy storage. As demand for graphene and other advanced graphite materials grows, it can contribute to overall demand growth and support higher graphite prices.

Looking ahead, several factors are likely to continue shaping graphite price dynamics. The transition towards cleaner energy sources and the electrification of transportation are expected to drive sustained demand for graphite used in lithium-ion batteries and fuel cells. Moreover, ongoing advancements in technology and materials science could unlock new applications for graphite, further bolstering demand and supporting price levels.

In conclusion, graphite prices are influenced by a complex interplay of factors, including supply and demand dynamics, macroeconomic trends, geopolitical developments, environmental regulations, and technological advancements. Stakeholders in the graphite market must closely monitor these factors to anticipate price movements and make informed decisions. As the global economy evolves and technological innovation accelerates, navigating the dynamic landscape of graphite pricing will remain a key challenge for industry participants.

Get Real Time Prices of Graphite: https://www.chemanalyst.com/Pricing-data/graphite-1433

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

0 notes