#Gold Price 7 July 2023

Text

সপ্তাহের শুরুতে বাড়ল না কমল ? জেনে নিন আজ কত যাচ্ছে সোনা-রুপোর বাজারদর!

রুপোর দাম গ্রামের নিরিখে-গতকাল, রবিবার ৬ অগাস্ট, ২০২৩ তারিখে ১ কেজি রুপোর দাম ছিল ৭৫১০০ টাকা, আজ, সোমবার, ৭ অগাস্ট, ২০২৩ তারিখে সমপরিমাণের রুপোর দাম যাচ্ছে ৭৫১০০ টাকা।

Source link

View On WordPress

#Gold#gold price#Gold Price 7 July 2023#Gold Price Today#Gold Price Today Kolkata#Silver#silver price#Silver Price 7 July 2023#Silver Price Today#Silver Price Today Kolkata

0 notes

Text

It came to my attention a little while ago that AAs have criticized my stance on Jensen's house purchase under the guise of "making fun of fan fiction". Included in the points these AAs were making pertaining my blog specifically was pertaining to how "buying a beautiful historic home was a poor choice". Yes, it was a poor choice not only from a spiritual standpoint but also for more logical, physical reasons.

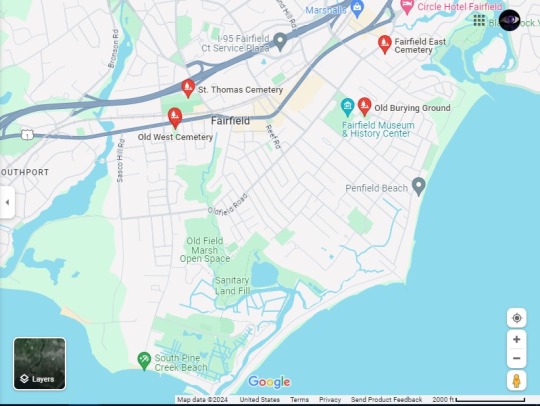

There are multiple cemeteries within a 2 mile radius from this house. Maybe not close enough to be a big deal but given there are quite a few in this general area, depending on your set of beliefs this may or may not be a deal breaker.

A potentially big public health issue is there's a landfill not even 3 miles from the house. Some of the concerns with sanitary landfills include methane gas and leachate leakage, general habitat destruction at the landfill site, potential scent issues during summer months especially, more rodents, etc. While this might not be an "open air" type of landfill where garbage is not buried or otherwise separated from land outside of the said landfill, there are still potential health hazards associated with living within a 3 mile radius from a landfill.

According to one cohort study spanning from 1996 to 2008 of about 250,000 people states that people who live within 3 miles from a landfill in central Italy were more likely to be admitted to a hospital or die with lung disease compared to those who lived further away from landfills. One of the biggest culprits with the reported health ailments higher in prevalence and incidence in these areas is hydrogen sulfide. While it's said that trash regulations are different from US regulations where this house is located and therefore some like that expert try to say this doesn't apply to the US, is it really that safe to live near a landfill (looking at you Love Canal)? Other studies conducted in the past which are mentioned in this paper listed on the EPA's website suggest there too are health hazards of living near landfills in the USA as well, not just Italy or even England.

Point is, it may be debatable as to how "safe" it is living near any landfills let alone this one but it is nonetheless a factor one should consider when buying any home. Location, location, location as any real estate agent can tell you...

According to the Home Details per Zillow, this house has depreciated greatly over the years. Back in 2001 this house sold for $48.9 million dollars. This house was listed in September 2013 for $62 million dollars and removed April 2016. In August 2021 it was sold for $17.5 million, which is a good bit less from the $48.9 million it was previously bought for. Part of this property sold (separated into 7 separate lots, as it was once a 20 acre property) for $5 million back in May 2023 with another part of this property being listed for sale for $44.5 million. The portion of the property Jensen bought in July 2023 was purchased for $9.375 million and appears to be the main house on this property. Overall, the value of this house greatly depreciated over the years. It appears that in order to make this house actually sell the property had to be reduced in size to make it more affordable to buy.

Chris Mark's property that's also for sale in Woodstock, CT property also shrunk in size. This particular house which is about an hour and 45 min Northeast from Jensen's CT property also greatly decreased in value. It seems that the decrease in number of acres included in the current price was a move done to make the house more affordable or in other words, so someone buys it. It was listed for sale in Oct 2022 for $50 million, down to $35 million in March 2023, $29.995 million in April 2023 and taken off the market in May 2023. However, the house returned to the market in July 2023 for $26 million, increased to $39 million in September 2023 and again removed early Oct 2023. The Chris Mark mansion was listed yet again 2 days before Halloween for $29 million and is still on the market as of today, February 18, 2024.

4. I mentioned this before but some people in the past speculated the Ackles may intend on opening another brewery or even a B&B at this house. According to the zoning type for this property (AAA), they would not be allowed to open any manufacturing facility on this property (or really most any kind of business), nor would they be able to have a B&B on this property per current Fairfield city ordinances. Someone else about 4 miles from the Ackles' property over 10 years ago tried to get a law passed to allow for B&Bs in residential areas, which ultimately did not pass. This same house a woman wanted to turn into a bed and breakfast was sold a few years later.

Overall, the general rule seems to be that buying houses may not be the greatest investment when crunching the bottom line numbers but this is especially true with the larger houses. Given the Ackles' history of buying homes to renovate and then eventually sell, they most likely intend to sell this house at some point down the not too distant future. Given they also probably won't make this their forever home, the cost of the upkeep of this house compared to what they purchased this house for and ultimately sell it for probably will not churn out the profits they are hoping to gain by selling down the road. If the Ackles' had any intentions of using this house for anything other than as a personal residence (which was not listed on the real estate paperwork at the time of purchase back in July 2023), their plans would/will be foiled rather quickly.

I brought up the Chris Mark house as another case where McMansions just aren't a good investment. Not only is this house not a good choice for an investment as is the case for a family like the Ackles, the location of it is in my humble opinion not the greatest overall despite it being an affluent neighborhood due to some of the landmarks in this area.

9 notes

·

View notes

Text

iDeal Deals: Refurbished iPhone at 5K or Less

Are you a true iPhone enthusiast and looking to buy that in India, you`ve come to right place. vlebazaar.in is your one stop destination for all electronic product with budget friendly price.

Check out best iPhone under 5000 with there specification and features

Tuesday, July 25, 2023

5 BEST IPHONE UNDER 5000

1- APPLE IPHONE 4 WHITE REFURBISHED

Specification

Model:A1332-1

Weight:0.20kg

Dimensions:6.00cm x 15.00cm x 12.00cm

SKU:B07FRF43PC

Battery:142mAh

Condition:Used

DESCRIPTION

5MP primary camera with LED flash, geotagging, video recording and VGA front facing camera

3.5-inch scratch resistant multi-touch screen

iOS operating system and in-built memory upto 8GB

Battery providing talk-time of 14 hours and standby time of 300 hours on 2G network and talk-time of 7 hours on 3G network

VleBazaar Price: 3,999/-

BUY NOW:

2-APPLE IPHONE 4S BLACK REFURBISHED

Specification

Model:A1387-1

Weight:0.20kg

Dimensions:6.00cm x 15.00cm x 12.00cm

SKU:B00CL8XCE0

Colour:Black

Condition:Used

Description

8MP primary camera with autofocus, tap to focus, LED flash, face detection, hybrid IR filter, panorama, video stabilisation, geotagging, video recording and VGA front facing camera

3.5-inch multi-touchscreen with 960 x 340 pixels resolution

iOS operating system and in-built memory up to 16GB

Battery providing talk-time of 14 hours and standby time of 200 hours on 2G network and talk-time of 8 hours on 3G network

VleBazaar Price: 3,099/-

Buy now:

3-APPLE IPHONE 5 (16 GB, WHITE) REFURBISHED

Specification

Model:A1429-1

Weight:0.20kg

Dimensions:6.00cm x 15.00cm x 12.00cm

SKU:B0097CZJEO

Colour:White

Condition:Refurbished

DESCRIPTION

Apple iPhone 5s mobile was launched in September 2013. The phone comes with a 4.00-inch touchscreen display offering a resolution of 640x1136 pixels at a pixel density of 326 pixels per inch (ppi) and an aspect ratio of 16:9. Apple iPhone 5s is powered by a 1.3GHz dual-core Apple A7 processor. It comes with 1GB of RAM. The Apple iPhone 5s runs iOS 7 and is powered by a 1570mAh non-removable battery.

As far as the cameras are concerned, the Apple iPhone 5s on the rear packs an 8-megapixel camera with an f/2.2 aperture and a pixel size of 1.5-micron. The rear camera setup has autofocus. It sports a 1.2-megapixel camera on the front for selfies with an f/2.4 aperture.

Apple iPhone 5s is based on iOS 7 and packs 16GB of inbuilt storage. The Apple iPhone 5s is a single SIM (GSM) mobile that accepts a Nano-SIM card. The Apple iPhone 5s measures 123.80 x 58.60 x 7.60mm (height x width x thickness) and weighs 112.00 grams. It was launched in 0, Gold, Silver, and Space Grey colours. It bears a metal body.

Vlebazar Price: 4,999/-

BUY NOW:

4-APPLE IPHONE 5C (BLUE, 16 GB) REFURBISHED

Specification

Model:A1529-1

Weight:0.20kg

Dimensions:6.00cm x 15.00cm x 12.00cm

SKU:NDXQ5W396M

Colour:Blue

Condition:Used

DESCRIPTION

8MP iSight primary camera with LED flash, auto focus, geo tagging, face detection, 1.2MP front facing camera with HD video recording, Facetime and backside illumination sensor

4-inch multi-touch retina display with 1136 x 640 pixels resolution at 326ppi

iOS 7 operating system with 16GB internal memory

Rechargable lithium-ion battery providing talk-time up to 10 hours on 3G network, standby time up to 250 hours and upto 40 hours of music playback

VleBazaar Price: 3,299/-

BUY NOW:

5-APPLE IPHONE 5s GOLD REFURBISHED

Specificaton

Model:A1530-1

Weight:0.20kg

Dimensions:12.00cm x 15.00cm x 6.00cm

SKU:LJTFO64ANP

Colour:Gold

Condition:Used

DESCRIPTION

8MP primary camera with true tone flash, auto focus, geo tagging, face detection burst mode, 1.2MP front facing camera with HD video recording and backside illumination sensor

4-inch multi-touch retina display with 1136 x 640 pixels resolution

iOS 7 operating system with 16GB internal memory

Rechargable battery providing talk-time up to 10 hours on 3G network and standby time up to 250 hours

VleBazaar Price: 4,299/-

BUY NOW:

CONCLUSION:

In conclusion, all five product are great option for those who are looking for a good quality iPhone . They all are suitable for use

2 notes

·

View notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the 2nd Quarter in the books, equity markets showed strength reversing the pull backs from the prior week. Elsewhere looked for Gold ($GLD) to continue its pullback while Crude Oil ($USO) consolidated in the lower end of a broad range. The US Dollar Index ($DXY) continued to drift to the upside in consolidation while US Treasuries ($TLT) churned in their own consolidation range. The Shanghai Composite ($ASHR) looked to continue the slow drift lower while Emerging Markets ($EEM) consolidated.

The Volatility Index ($VXX) looked to remain very low and stable making the path easier for equity markets to the upside. Their charts looked strong, especially on the longer timeframe with the SPY and QQQ printing new cycle weekly highs. On the shorter timeframe the $QQQ, $SPY and $IWM all erased last week’s losses with the SPY making a new 14 month high.

The week played out with Gold finding support and bouncing while Crude Oil rose up off the lower end of its consolidation zone. The US Dollar met resistance and pulled back while Treasuries fell back to the March low. The Shanghai Composite met resistance at a lower high and fell back while Emerging Markets also made a lower high and then dropped.

Volatility rose to a 3 week high before it fell back Friday. This put pressure on equities and they responded with a 2 day move lower following the holiday. All found support by midday Thursday and reversed. They continued higher Friday only to sell off in the afternoon and finish the week lower. This resulted in the SPY and QQQ ending just off their recent highs with the IWM below the 3 month high. What does this mean for the coming week? Let’s look at some charts.

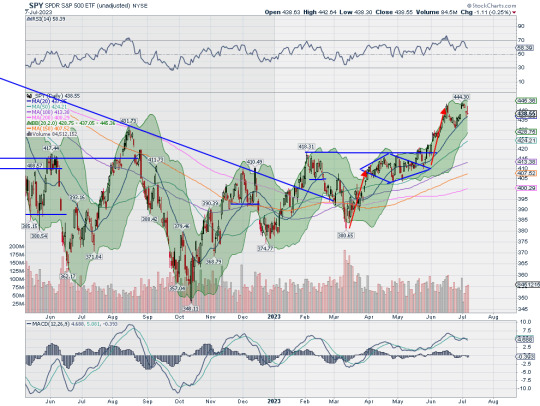

SPY Daily, $SPY

The SPY came into the week following a gap up to end June, leaving an island below on the daily chart. It held there on Monday, printing a new 14 month high, and then gapped down Thursday. Friday it opened lower and drove to fill the gaps before fading in the afternoon and closing slightly lower on the day. This left price above the 20 day SMA on the daily chart with a RSI falling in the bullish zone and the MACD dropping but positive.

The weekly chart printed an inside week near the top of the prior week’s move. Price continues to hold along the rising Bollinger Bands® with the RSI in the bullish zone and the MACD positive and rising. There is resistance at 441 and 444 then 447 and 451 before 454 and 457. Support lower comes at 437.50 and 435.50 then 431.50 and 430 before 428.50 and 425.50. Uptrend.

SPY Weekly, $SPY

With the first week of July in the books, equity markets showed some weariness, stalling in their moves higher and giving back minor amounts. Elsewhere look for Gold to continue its downtrend while Crude Oil consolidates in a broad range. The US Dollar Index looks to move lower in consolidation while US Treasuries drop and may be resuming their downtrend. The Shanghai Composite looks to continue the intermediate trend lower while Emerging Markets consolidate.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. Their charts look strong on the longer timeframe with the SPY and QQQ leading over the IWM. On the shorter timeframe both the QQQ and SPY are now in a short term consolidation with the IWM in a wider consolidation holding over the prior range. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview July 7, 2023

2 notes

·

View notes

Text

Saturday, March 16, 2024

Upwardly mobile

(NYT) Two economists—Ran Abramitzky of Stanford and Leah Boustan of Princeton—embarked on an ambitious project more than a decade ago. They wanted to know how the trajectory of immigrants to the United States had changed since the 1800s. To do so, Abramitzky and Boustan collected millions of tax filings, census records and other data and analyzed upward mobility over time. Their findings, published in a 2022 book titled “Streets of Gold,” showed that recent immigrant families had climbed the country’s ladder at a strikingly similar pace to immigrant families from long ago. “The American dream is just as real for immigrants from Asia and Latin America now as it was for immigrants from Italy and Russia 100 years ago,” Abramitzky and Boustan wrote. As in the past, immigrants themselves tend to remain poor if they arrive poor, as many do. But as in the past, their children usually make up ground rapidly, regardless of where they come from. This encouraging pattern obviously challenges the dark view of recent immigrants that conservatives sometimes offer.

Drone Swarms Are About to Change the Balance of Military Power

(WSJ) The most formidable element of American power-projection has long been the warship. After the Oct. 7 attacks against Israel, the Biden administration sent two carrier battle groups to the region to deter Iranian aggression. One of those carriers, the USS Gerald R. Ford, was on its maiden voyage, having recently been completed at a price tag of $13 billion. This makes it the most expensive warship in history. For that same sum, a nation could purchase 650,000 Shahed drones. It would only take a few of those drones finding their target to cripple and perhaps sink the Ford. Fortunately, the Ford and other U.S. warships possess ample missile defense systems that make it highly improbable that a few, or even a few dozen, Shahed drones could land direct hits. But rapid developments in AI are changing that. The drone will change the face of warfare when employed in swarms directed by AI. This moment hasn’t yet arrived, but it is rushing to meet us. If we’re not prepared, these new technologies deployed at scale could shift the global balance of military power.

New York City’s Population Shrinks by 78,000, According to Census Data

(NYT) New York City’s population declined again last year, according to new census estimates. But city officials said that those figures did not fully account for the growing number of migrants, which would have resulted in a minimal drop being reported. The city lost nearly 78,000 residents in 2023, shrinking its population to 8.26 million people, according to the estimates, which were released on Thursday. In 2022, it lost more than 126,000 residents. From April 2020 to July 2023, the city lost almost 550,000 residents, or more than 6 percent of its population.

Haiti’s top gang leader threatens politicians as fires break out in capital

(Reuters) A powerful gang leader in Haiti has issued a threatening message aimed at political leaders who would participate in a planned transition council, as fires broke out amid a fresh surge of violence in the Caribbean nation’s capital. Nearby countries bolstered their border security and withdrew staff from embassies while plans to send a long-awaited international security force remain uncertain. After unpopular Prime Minister Ariel Henry announced on Monday he would step down once the council was in place, the capital, Port-au-Prince, was initially quieter, but violence appeared to be flaring up again as of late Wednesday, with a shootout in one neighborhood and an attack on the police academy early on Thursday.

Cuba’s food shortage

(The Week) Cuba has experienced hardships for months in what some are calling the country’s “worst economic crisis in 30 years.” Cubans are facing skyrocketing prices for gas, commodities and basic services, along with an economy that continues to shrink overall. The most pressing issue, though, remains a national food shortage that has led to widespread humanitarian issues. Amid this continuing shortage, the Cuban government has made a request to the United Nations’ World Food Program (WFP) seeking nutritional aid for its people. Previously, Cuba had only requested WFP support following natural disasters—never due to economic hardships. But food scarcity remains an ongoing problem throughout the country, and overall food production is reportedly down 50% since 2018, officials said. Cuban officials blame the crisis on the aftermath of Covid-19, as well as “stiffened sanctions against the island implemented under former President Donald Trump,” Reuters said. But many say the problem lies with mismanagement.

Denmark plans to expand military draft to women for the first time

(AP) Denmark wants to increase the number of young people doing military service by extending conscription to women and increasing the time of service from 4 months to 11 months for both genders, Danish Prime Minister Mette Frederiksen said Wednesday. Denmark currently has up to 9,000 professional troops on top of the 4,700 conscripts undergoing basic training, according to official figures. The government wants to increase the number of conscripts by 300 to reach a total of 5,000. All physically fit men over the age of 18 are called up for military service, which lasts roughly four months. However, because there are enough volunteers, there is a lottery system, meaning not all young men serve. In 2023, there were 4,717 conscripts in Denmark. Women who volunteered for military service accounted for 25.1% of the cohort, according to official figures.

The Tories’ Take On Extremism

(NYT) On Thursday, the British Tory government announced a new definition of extremism, which has raised criticism from rights groups who say that the new definition may be used to attack campaigners’ rights and curb free speech in an election year. A government spokesman says the new definition will “protect democratic values” by being “clear and precise in identifying the dangers posed by extremism,” and the government says it will be used to cut ties or funding to groups that exhibit extremism under its new definition. “The definition remains extremely broad,” said one British lawyer who reviews legislation for the government. “For example, it catches people who advance an ideology which negates the fundamental rights of others. One can imagine both sides of the trans debate leaping on that one.” Rishi Sunak’s government is expected to publish a list of groups it’s deemed to have run afoul of its new extremism threshold in the next few weeks.

US-Hungary relationship reaches new low

(NYT) Prime Minister Viktor Orban is jeopardizing Hungary’s position as a trusted NATO ally, the U.S. ambassador to Budapest warned on Thursday, with “its close and expanding relationship with Russia,” and with “dangerously unhinged anti-American messaging” in state-controlled media. The ambassador, David Pressman, has for months criticized Mr. Orban for effectively siding with President Vladimir V. Putin of Russia over the war in Ukraine, but his latest remarks sharply ratcheted up tensions and indicated that trust in Hungary among NATO allies had collapsed. The speech followed a visit last week by Mr. Orban, a darling of MAGA Republicans in the United States, to Donald J. Trump at the former president’s home and members-only club in Florida. After their meeting, Mr. Orban claimed in an interview with Hungarian state television that Mr. Trump had outlined to him a “pretty detailed plan” for ending the war in Ukraine that would involve an abrupt halt to United States aid to Russia’s embattled neighbor. Such a plan closely parallels what Mr. Orban has been advocating for the European Union—a suspension of all financial and military support for Ukraine, and a policy of pushing the government in Kyiv into immediate peace negotiations with Moscow.

Russian Election Begins

(1440) President Vladimir Putin is expected to claim a fifth presidential term as Russia begins its three-day election today. The vote will include inhabitants of regions of Ukraine occupied by Russia since 2022. Putin has led Russia as either prime minister or president since 1999. While Russia’s 1993 constitution implemented term limits, referendums and amendments since have allowed Putin to keep power. The 71-year-old retains high approval ratings, and Russia’s economy has withstood broad international sanctions initiated after the invasion. Observers claim the government’s control of candidates and its ban on independent media have effectively neutralized opponents’ ability to compete with Putin. While the three opposition candidates have levied criticisms against the regime, all support the Ukraine war. An antiwar candidate, Boris Nadezhdin, was barred from the ballot last month.

On Gaza aid, U.S. seeks complex workarounds to straightforward problem

(Washington Post) President Biden’s plan to build a temporary port to supply aid to Gaza recalls the effort at Normandy: a near-insurmountable engineering and logistics problem. But in undertaking this resource-heavy endeavor—set to require 1,000 troops and two months, at a cost that remains to be tallied, alongside expensive and inefficient aid airdrops—the United States is not circumventing forbidding geography. It is pursuing a logistically complicated workaround to what analysts say is a fundamentally simple problem: Getting aid into Gaza by land. The Gaza Strip is surrounded by existing routes, in the care of staunch U.S. allies, by which a massive increase in aid could feasibly arrive by truck. For months, aid groups have urged Israel to allow more trucks into Gaza. Drawing in part on field research conducted within the region, Refugees International, a U.S.-based humanitarian organization, issued a report this month finding that Israeli restrictions had “obstructed humanitarian action at every step of the aid delivery process” by seemingly arbitrary denials of legitimate humanitarian goods entering Gaza; a highly complicated and inconsistent inspection process; frequent denials of internal humanitarian movements; and attacks on humanitarian and critical infrastructure, among other policies “causing a man-made humanitarian crisis.”

West, Central Africa see major internet outage with undersea cables down

(Reuters) A major internet outage affected West and Central Africa on Thursday, the internet observatory Netblocks said, as operators of multiple subsea cables reported failures. The cause of the cable failures was not immediately clear. Ivory Coast was experiencing a severe outage, while Liberia, Benin, Ghana and Burkina Faso were seeing a high impact, Netblocks’s data showed. Internet firm Cloudflare said in a post on the X social media platform that major internet disruptions were ongoing in Gambia, Guinea, Liberia, Ivory Coast, Ghana, Benin and Niger.

Google meals

(Bloomberg) Google is best known as a tech company, but it’s got a formidable food business too, as it seeks to feed its armies of workers in a crucial tech perk that helps it maintain talent. The company’s food waste, however, threatens its ambitious climate goals, so it’s trying to make the whole operation more efficient without ticking off workers. The company prepares over 240,000 meals per day across 386 cafes, as well as 1,500 microkitchens and 49 food trucks in a fairly expansive operation. For perspective, there are only 360 Cheesecake Factory restaurant locations in North America, so the company is really operating at an impressive logistical scale, and a tweak as simple as adjusting when eggs are prepared cut food waste for the dish by 44 percent.

0 notes

Text

[ad_1]

The Israel-Hamas struggle makes traders nervous, however hasn’t sparked a headlong rush into lots of the property that historically see large inflows during times of geopolitical disaster. Whereas dwarfed by the tragic human penalties of the battle, the market response has left some analysts and traders struggling to elucidate why thus far only some conventional havens have benefited from a so-called flight to high quality.

Inventory-market volatility, in the meantime, has risen, however at 20.37, the Cboe Volatility Index

VIX,

an options-based measure of anticipated volatility within the S&P 500 over the approaching 30 days is simply barely above its long-term common slightly below 20. Maybe, argued Marc Ostwald, chief economist and world strategist at ADM Investor Companies Worldwide, a scarcity of extra pronounced market volatility and subdued inflows into safe-haven property go hand in hand, reflecting a way of paralysis within the face of an amazing array of worries.

“The complexity of the big quantity of occasion dangers, be that geopolitical, macro- or microeconomic which markets are confronted with on the present juncture borders on the thoughts boggling,” he stated in a Monday be aware. “The truth that volatility has not picked up much more than it has in all probability attests to a component of ‘being rabbits in entrance of the headlights’, in addition to the truth that a superb many conventional ‘secure haven’ or defensive property’ are something however,” together with the Japanese yen

USDJPY,

+0.02%,

authorities bonds, utilities, client staples or well being care. In flip, he stated, that has created “bubblelike” flows into gold

GC00,

-0.15%

and the Swiss franc

USDCHF,

-0.02%

— the 2 havens which have rallied because the Oct. 7 Hamas assault on southern Israel. Gold was up greater than 7.5% from its Oct. 6 shut via Monday, whereas the Swiss franc strengthened greater than 2% versus the U.S. greenback over the identical stretch. However U.S. Treasurys, seen because the world’s risk-free asset, have suffered. Yields, which transfer reverse to cost, continued a pointy rise, with the 10-year price

BX:TMUBMUSD10Y

briefly topping the 5% threshold early Monday for the primary time since 2007. Rising Treasury yields and geopolitical angst are blamed for a tough October for shares. Equities have prolonged a pullback that’s seen the S&P 500

SPX

retreat 8.5% from its 2023 excessive set on July 31, leaving it up 9.8% for the 12 months up to now. Since Oct. 6, the large-cap benchmark is down round 2.1%. The Dow Jones Industrial Common

DJIA

turned decrease on the 12 months final week. The Japanese yen, sometimes the most important haven beneficiary alongside the Swiss franc during times of uncertainty, has been left on the sidelines. The greenback briefly fetched greater than 150 yen final week, a degree that dangers yen-buying intervention by the Financial institution of Japan. The central financial institution’s ultraloose financial coverage explains the yen’s lack of haven attraction, analysts stated. In the meantime, “even a struggle within the Center East will not be persuading traders to purchase US Treasuries, or authorities bonds, an asset class that's often seen as the last word haven as a result of they're priced on the planet’s reserve foreign money and include the backing of America, the world’s main financial and navy energy,” stated Russ Mould, funding director at AJ Bell, in a be aware. He supplied three causes which will clarify the continued Treasury selloff:

It isn’t sure that inflation is cooling. If the battle forces crude costs to leap and stay elevated, it is going to make it harder to rein in inflation.

Markets are pricing in multiple extra Federal Reserve price hike, however the first lower isn’t seen till summer season 2024 on the earliest.

A 12 months in the past, the rate-cutting cycle had been anticipated to have begun by now.

U.S. federal debt continues to mushroom, with borrowing up $1.6 trillion since he April debt deal. On prime of that, the U.S. must refinance $15 trillion to $17 trillion of current debt within the subsequent two years. And the Federal Reserve is unwinding its stability sheet, which implies it’s not a “price-blind purchaser of final resort” with regards to Treasury provide.

All of it provides as much as a laundry record of worries which will make for extra unsettled buying and selling within the close to future. Alongside the Mideast battle, the persevering with struggle in Ukraine, the “debacle” across the choice of the subsequent speaker of the U.S. Home, China’s property woes, and U.S.-China tensions tied to considerations in regards to the degree of public sector debt within the U.S. and developed and emerging-market international locations will possible present extra “key prompts for markets to react to, in what's going to stay uneven buying and selling situations,” stated ADM’s Ostwald.

[ad_2]

0 notes

Text

Non-fungible tokens (NFTs) emerged as the poster children of a digital renaissance. With the hype reaching its peak during the 2021 bull run, the NFT market saw nearly $2.8 billion monthly trading volume in August 2021. But by July 2023, the tune has changed drastically.

Indeed, weekly traded values plummeted to around $80 million, marking a significant contraction. Amid this backdrop, recent research brought to light a startling reality. Most NFTs are trading at a market cap of zero Ethereum (ETH), rendering them “worthless.”

NFTs Become “Worthless”

The meteoric rise of NFTs was hailed as a novel frontier for the cryptocurrency industry. However, as the dust settles, the market is now in a bear run. Many NFT projects scramble to find buyers amid a somber outlook on future values.

The data, derived from an extensive analysis of over 73,000 NFT collections, unveils a sobering narrative contrasting sharply with the stories of million-dollar deals and overnight success. Indeed, of the analyzed NFT collections, a meager 21% were fully claimed or had over 100% ownership, leaving 79% unsold.

“Almost 4 out of every 5–have [NFTs] remained unsold. This situation is telling of a significant imbalance between the creation of new Non Fungible Tokens (NFTs) and the actual demand for these digital assets,” the report reads.

Read more: Where To Sell NFTs: Top 15 NFT Marketplaces

This imbalance between the flurry of new NFTs and the actual demand represents a pivotal issue of oversupply, creating a buyer’s market. In such an environment, discerning investors are increasingly scrutinizing the uniqueness, potential value, and narrative behind NFT projects before taking the plunge.

“95% of people holding NFT collections are currently holding onto worthless investments. Having looked into those figures, we would estimate that 95% to include over 23 million people whose investments are now worthless,” the report reads.

NFTs Ownership. Source: DappGambl

Drilling down into the cream of the NFT crop, a closer examination of the top 8,850 NFT collections, as listed on CoinMarketCap, unearthed a continuation of this disquieting trend.

Even among these successful projects, 18% have a floor price of zero, while only 1% command a price above $6,000. This reality is far from the ballyhooed million-dollar deals that once dominated headlines. Subsequently spotlighting the nature of value in a market driven by speculation and fleeting trends.

Read more: 7 Most Common NFT Scams

MacContract on Ethereum, a project boasting a floor price of $13,234,204.2 but with a paltry all-time sales of $18, exemplifies a glaring disconnect between listed prices and real-world transactions. Such chasms expose the speculative vein running through parts of the NFT market. Essentially, listed prices often lack tangible demand or trading history.

This trend, indicative of speculative and hopeful pricing estranged from actual trading dynamics, could potentially mislead new or uninformed investors.

Are NFTs Also Dead?

The investigation also threw a spotlight on the environmental footprint of NFTs. The energy consumed in minting the assets of 195,699 NFT collections with no apparent owners or market share equated to a carbon footprint comparable to the yearly emissions of 2,048 homes.

As the narrative around sustainable digital technologies grows louder, the NFT space is under the scanner. Particularly, NFTs that lack apparent utility or genuine artistic value.

The emergence and subsequent downturn of NFTs embody a cautionary tale of hype cycles in the crypto market. As speculators set out on a quest for the next gold rush, the question remains whether these NFTs lacked a genuine use case, rendering them dead.

Read more: How To Start NFT Trading: A Step-by-Step Guide

NFTs Listed. Source: DappGambl

Amid the allure and the glitter, the tale of NFTs is a stark reminder to creators and investors. It is an example of meaningful value and the perils of speculative frenzy.

0 notes

Text

Seventeenth Sunday in Ordinary Time

Readings of Sunday, July 30, 2023

Reading 1

1 KGS 3:5, 7-12

The LORD appeared to Solomon in a dream at night.

God said, “Ask something of me and I will give it to you.”

Solomon answered:

“O LORD, my God, you have made me, your servant, king

to succeed my father David;

but I am a mere youth, not knowing at all how to act.

I serve you in the midst of the people whom you have chosen,

a people so vast that it cannot be numbered or counted.

Give your servant, therefore, an understanding heart

to judge your people and to distinguish right from wrong.

For who is able to govern this vast people of yours?”

The LORD was pleased that Solomon made this request.

So God said to him:

“Because you have asked for this—

not for a long life for yourself,

nor for riches,

nor for the life of your enemies,

but for understanding so that you may know what is right—

I do as you requested.

I give you a heart so wise and understanding

that there has never been anyone like you up to now,

and after you there will come no one to equal you.”

Responsorial Psalm

PS 119:57, 72, 76-77, 127-128, 129-130

R./ Lord, I love your commands.

I have said, O LORD, that my part

is to keep your words.

The law of your mouth is to me more precious

than thousands of gold and silver pieces.

R./ Lord, I love your commands.

Let your kindness comfort me

according to your promise to your servants.

Let your compassion come to me that I may live,

for your law is my delight.

R./ Lord, I love your commands.

For I love your command

more than gold, however fine.

For in all your precepts I go forward;

every false way I hate.

R./ Lord, I love your commands.

Wonderful are your decrees;

therefore I observe them.

The revelation of your words sheds light,

giving understanding to the simple.

R./ Lord, I love your commands.

Reading 2

ROM 8:28-30

Brothers and sisters:

We know that all things work for good for those who love God,

who are called according to his purpose.

For those he foreknew he also predestined

to be conformed to the image of his Son,

so that he might be the firstborn

among many brothers and sisters.

And those he predestined he also called;

and those he called he also justified;

and those he justified he also glorified.

Gospel

MT 13:44-52

Jesus said to his disciples:

“The kingdom of heaven is like a treasure buried in a field,

which a person finds and hides again,

and out of joy goes and sells all that he has and buys that field.

Again, the kingdom of heaven is like a merchant

searching for fine pearls.

When he finds a pearl of great price,

he goes and sells all that he has and buys it.

Again, the kingdom of heaven is like a net thrown into the sea,

which collects fish of every kind.

When it is full they haul it ashore

and sit down to put what is good into buckets.

What is bad they throw away.

Thus it will be at the end of the age.

The angels will go out and separate the wicked from the righteous

and throw them into the fiery furnace,

where there will be wailing and grinding of teeth.

“Do you understand all these things?”

They answered, “Yes.”

And he replied,

“Then every scribe who has been instructed in the kingdom of heaven

is like the head of a household

who brings from his storeroom both the new and the old.”

0 notes

Text

The Timeless Elegance of the Rolex Daytona 116518

The Timeless Elegance of the Rolex Daytona 116518

July 09, 2023

Welcome to our blog, where we delve into the world of luxury timepieces. Today, we're going to take a closer look at the Rolex Daytona 116518, a legendary watch that has captivated watch enthusiasts and collectors alike. Renowned for its impeccable craftsmanship and timeless design, the Daytona 116518 represents the epitome of luxury and sophistication. Join us as we explore the remarkable features and history of this iconic timepiece.

A Brief History: The Rolex Daytona has a rich heritage that dates back to the 1960s when it was initially introduced to meet the demands of professional racing drivers. Over the years, it has become synonymous with elegance and precision. The Daytona 116518, introduced in 2000, brought a fresh interpretation to the iconic line, combining the allure of 18-karat yellow gold with the functionality of a chronograph.

Exquisite Design: The Daytona 116518 showcases Rolex's unwavering commitment to exceptional design and attention to detail. The 40mm case, crafted from solid 18-karat yellow gold, exudes a sense of opulence and sophistication. The bezel, with its engraved tachymeter scale, allows the wearer to measure average speeds over a given distance—a vital feature for motorsport enthusiasts.

Striking Dial Options: This Daytona model offers a variety of dial options to suit individual tastes. The classic champagne dial, with its elegant sunburst finish, embodies timeless elegance. Another popular choice is the black dial, which exudes a sporty and bold aesthetic. The contrasting sub-dials provide excellent readability and add a touch of dynamic flair to the overall design.

The Caliber 4130 Movement: The Daytona 116518 is powered by Rolex's in-house Caliber 4130, a self-winding mechanical chronograph movement. Renowned for its reliability and precision, this movement incorporates innovative features, such as the vertical clutch mechanism, ensuring smooth chronograph operation. The movement also boasts a remarkable 72-hour power reserve, allowing for extended periods of use without the need for winding.

Comfort and Versatility: While the Daytona 116518 is undoubtedly a sports chronograph, it effortlessly transitions from the racetrack to more formal occasions. The luxurious Oysterflex bracelet, a patented Rolex innovation, combines the comfort of an elastomer strap with the durability of a metal bracelet. It provides an excellent fit on the wrist while maintaining a refined appearance. The Rolex Daytona 116518 is a luxurious timepiece that combines exquisite design with exceptional performance. Here are the specifications and price details for the Rolex Daytona 116518:

Specifications:

1. Case: 18-karat yellow gold

2. Case Diameter: 40mm

3. Bezel: Fixed, engraved with a tachymeter scale

4. Dial Options: Champagne or black dial with contrasting sub-dials

5. Crystal: Scratch-resistant sapphire

6. Movement: Rolex Caliber 4130, self-winding mechanical chronograph movement

7. Power Reserve: Approximately 72 hours

8. Water Resistance: 100 meters (330 feet)

9. Bracelet: Oysterflex bracelet (elastic strap with metal blades) in 18-karat yellow gold

10. Clasp: Folding Oysterlock safety clasp

Price:

The price of the Rolex Daytona 116518 can vary based on factors such as location, retailer, availability, and market conditions. As of my knowledge cutoff in September 2021, the retail price for the Rolex Daytona 116518 was approximately $33,150 USD. However, please note that prices may have changed since then, and it's always recommended to check with authorized Rolex retailers or official sources for the most up-to-date pricing information.

Please keep in mind that luxury timepieces like the Rolex Daytona 116518 can be subject to market fluctuations, and additional costs may apply for customization options or limited editions. The Rolex Daytona 116518 continues to captivate watch enthusiasts with its remarkable blend of style, functionality, and precision. Whether you appreciate its heritage, admire its impeccable design, or seek the reliability of its movement, the Daytona 116518 is an exceptional timepiece that embodies the spirit of luxury and elegance. It's a symbol of achievement and an investment that will endure for generations to come.

#luxury lifestyle#luxury living#luxuryshopping#rolex#luxurywatch#fashluxee#india#rolexexplorer#luxurious

0 notes

Photo

A LEAP THROUGH TIME ~ When do we begin to hope?

5 October 2021

Idris,

I’ve arrived back in Kadeu safely. I have firmly planted the Vega Gem’s doors shut for the last six months and it is taking everything in me not to swing them wide open this very instant. I’m sure you’re chuckling now, insisting it would have been like this anyway given that that ridiculous winged oaf threatened me into keeping it closed for at least four of those months. Nonetheless, you silly creature…it’s good to be home.

Home. I’d never thought I’d say that about Kadeu without all the vitriol I’ve always—and still do—feel for this gods forsaken continent. Especially after the tensions of that civil war that was brewing in Club earlier this past summer and the other factions’ subsequent reactions to such chaos. But it is. Home. I’ve come to terms with this truth. In part thanks to you. I still laugh thinking of your shocked expression when we met face-to-face after decades apart. It seems that all it took to surprise my favorite, silly Fae was to sail across the sea in search of your whimsical heart. And look at all the trouble it’s caused me. I have dreams now, Idris, you bastard. I have hope.

How close was I to staying by your side, across the sea so far from these lands? Remembering the ever-so-slightly faded tattoos marring my skin—far closer than anyone can imagine. So much hope born in me partly in thanks to you and the realization that even these marks were not permanent.

Perhaps, it is also partly due to my mother no longer having a hold of me. After all, how can the dead grip us with rotted fingers? No longer, Idris. No longer. I want to forget that part of my life, and with her gone I hope that I can. But this ache…what is this ache? I have discovered so much in that time I was by your side, but it seems I have still more to learn.

’Til next time Old Friend,

Hyeonju

25 September 2022

Idris,

I can’t help but think of our time together during those six months. Those apprenticeships I took on simply because I could. Not for survival. Not in your name or honor, nor anyone else’s. Doing what I wanted for the first time in my 153 years simply because I could. It was…freeing. I’ve never used that word for myself. Gods, I sound so whimsical. I sound like you.

That time has changed me. It makes me want to open another shop, maybe two. For clothing. Creating fashion suited for any rank. Clothes that compliment the jewelry I craft with such care and adoration they might as well be my blood-born children.

Idris, what have you done to me? I tell you this in every exchange and in every exchange you mock me in that knowing way of yours, but I’ll say it again. You have ruined me to the life I had grown accustomed to in Kadeu. I thought this feeling would die naturally on its own after a few weeks. But here I am still dreaming hopeless dreams.

Hopeless because that bastard of gold has set his sights on me. Or rather, he refuses look my way. He hasn’t said in so many words, nor does he need to. He no longer uses my shop. He walks around in gaudy jewels fashioned from jewelers of far lower caliber than you or myself—all for his pride. All because he knows I despise him. So be it. I rose to this rank without him. And while he may set the precedent for much of Heart, I take pride in knowing I set the precedent for its continued refined appearance.

Ah. I’ll end the letter here. Another letter from Luke has reached my doorstep. I should answer before he thinks I’ve all but cast him away again. And before you put quill to paper, Idris, no I have yet to forgive him for Lita.

…but I’m not adverse to having him in my life again.

’Til next time Old Friend,

Hyeonju

7 July 2023

Idris,

It is so quiet and calm this year. Boring, even. Yes, I dare say that despite only being halfway through. The Resistance is silent. Clubs are far more reasonable and less prone to violent tantrums in the street. Spade is as dull as it’s always been, stiff and musty like waterlogged wooden planks. I daresay the Diamonds have become almost bearable in attitude (the low and midrankers, at least) thanks to Ms. Moon’s much needed hand to guide their wayward, gaudy souls.

They still dress like they fashioned clothes from their grandmother’s lint balls and bags of misshapen enchanted confetti, though. In other words—there’s room for significant improvement. But it’s better than it was just a few years prior.

I wish I could say the same of Heart. Idris, my friend, that beast in gold has been starting up Fae-run businesses and education. That in itself is not a bad thing. In fact., I’d welcome it from any other person if it didn’t originate from the mind of someone as calculating and cruel as the one I shall not name. But because these wonderful ideas were founded by him I do not trust them. I do not trust his motives, nor do I trust the gradual influx of Fae migrating under his rule.

From what you’ve told me of Fae and their realm, I’m suspicious of why they’d come here despite preferring their own realm. I doubt they’re all like you--actually enjoying and preferring the company of this world. What his he up to? I don’t like these murmurs of his guards growing in size and strength. I worry for Heart—and the rest of Kadeu with it.

I’ll spare you more morbid talk. I know how much you dislike it. Let me tell you instead of the of all the plans I’ve made for those shops I’ve spoken of so many times. Wonder at the names I’ve created for each…!

**The rest of the letter’s writing is faded with time and illegible.**

9 August 2024

Idris,

This heat is no good for my fur. Even my ears are frizzing in this humidity. The customers and Alexei have told me I look “cuddly”. Disgusting. A child with her mother waltzed right up to me and began to give my tails too-hard thumps with her little Strongarm fists. You will be proud to know I did not growl at the sudden and violent touch. I am better at reminding myself not every hand coming at me will bring me harm. Still hurt like hell, though.

I am finishing up a commission today. It’s beautiful and will fetch a high price. The money is being set aside, as always, for my new shops. I hope to open the first one by the end of this year if all goes well. I’d ask for you to wish me luck, but we both know it’s my blood, sweat, and tears that have gotten me this far and will continue to do so.

Idris, you silly creature. My old and dearest friend. I hope this letter finds you well. That you are taking in the world. That you find what you have been looking for all these years. Just as I know you wish the same for me. And as always I hope even if we should meet again many, many, many centuries from now we are still comfortable companions in whatever way it takes shape.

Now excuse me while I go and chastise this overly energetic Shapeshifter trying to tell tall tales about ghosts haunting my jewelry. For a Spade, I’m amazed I see her wandering this faction so often. Shamelessly even. I like her. As much as I can like any Spade, I suppose. But she needs to stop alarming my customers.

’Til next time Old Friend,

Hyeonju

#kadeu: task#kadeuxhyeonju#Headcanon#: a leap through time#a look into the idris' box of letters from juju he keeps in a special chest#yes i said chest#this took me way longer than it shouldve#juju has gotten just a tad soft#A TAD i said#it's called getting away from your toxic environment and gaining perspective#he still dislikes most diamonds tho sorry#and spades#and clubs#and joui#what#i really like this letter style#maybe i'll this for eva and idris too#oh god im seeing double im so sleep deprived#off to bed i go gnight#hashtag 14 to 16 hour workshifts are not recommended#self para

17 notes

·

View notes

Text

Market Talk - August 24, 2022

ASIA:

Foreigners are returning to Indian stocks after dismissing them in the first half as they seek higher yields amid expectations that major central banks will slow their growth cycles as price pressures ease. Foreigners have invested $6.4 billion in Indian stocks since the start of July, after spending more than $27 billion in the previous six months, according to stock exchange data. Domestic investors bought over $30 billion worth of stocks in the first half, helping to prop up the market. But overseas investors took up the baton this month, pouring in more than $5 billion on the hope that Indian companies will deliver higher profits and that falling oil prices will help reduce the country’s current account deficit.

Russian oil and gas production in July was 10.76 million barrels per day (bpd), up from 10.70 million barrels per day in June, according to data released Wednesday by the Rosstat statistics office. Rosstat also said crude oil production excluding gas condensate was 42.2 million tonnes last month, up from 40.7 million tonnes in June, down a day. It also said liquefied natural gas (LNG) production reached 2.3 million tonnes in July, up 25% year-on-year but down 7% from June. Natural gas production was 36.5 billion cubic meters last month, down 24.5% from July 2021 and down 6.9% from June 2022.

The major Asian stock markets had a mixed day today:

- NIKKEI 225 decreased 139.28 points or -0.49% to 28,313.47

- Shanghai decreased 61.02 points or -1.86% to 3,215.20

- Hang Seng decreased 234.51 points or -1.20% to 19,268.74

- ASX 200 increased 36.30 points or 0.52% to 6,998.10

- Kospi increased 12.11 points or 0.50% to 2,447.45

- SENSEX increased 54.13 points or 0.09% to 59,085.43

- Nifty50 increased 27.45 points or 0.16% to 17,604.95

The major Asian currency markets had a mixed day today:

- AUDUSD decreased 0.00091 or -0.13% to 0.69054

- NZDUSD decreased 0.00291 or -0.47% to 0.61829

- USDJPY increased 0.248 or 0.18% to 137.043

- USDCNY increased 0.02392 or 0.35% to 6.87712

Precious Metals:

l Gold increased 1.43 USD/t oz. or 0.08% to 1,749.10

l Silver decreased 0.121 USD/t. oz or -0.63% to 19.039

Some economic news from last night:

South Korea:

Manufacturing BSI Index (Sep) increased from 80 to 82

Some economic news from today:

EUROPE/EMEA:

The major Europe stock markets had a mixed day:

l CAC 40 increased 24.74 points or 0.39% to 6,386.76

l FTSE 100 decreased 16.60 points or -0.22% to 7,471.51

l DAX 30 increased 25.83 points or 0.20% to 13,220.06

The major Europe currency markets had a mixed day today:

- EURUSD decreased 0.00005 or -0.01% to 0.99646

- GBPUSD decreased 0.00375 or -0.32% to 1.17887

- USDCHF increased 0.00229 or 0.24% to 0.96609

Some economic news from Europe today:

Norway:

Credit Indicator (YoY) (Jul) increased from 5.1% to 5.2%

US/AMERICAS:

The National Association of Business Economics (NABE) found that 72% of polled economists are expecting the US to enter a recession. Around 20% stated that America is already in a recession, considering two quarters of GDP contraction and record-high inflation. An additional 20% expect the US economy to turn down further before the second half of 2023. Although Federal Reserve Chair Jerome Powell stated that he does not believe the “slow down” is a recession, the majority is less optimistic.

President Joe Biden announced this Wednesday that he will begin to cancel student debt for borrowers earning under $125,000 annually. Those eligible will receive a $10,000 debt cancelation, while Pell Grant recipients will see a $20,000 reduction.

US Market Closings:

- Dow advanced 59.64 points or 0.18% to 32,969.23

- S&P 500 advanced 12.04 points or 0.29% to 4,140.77

- Nasdaq advanced 50.23 points or 0.41% to 12,431.53

- Russell 2000 advanced 16.14 points or 0.84% to 1,935.29

Canada Market Closings:

- TSX Composite advanced 36.03 points or 0.18% to 20,021.38

- TSX 60 declined 0.43 of a point or -0.04% to 1,207.99

Brazil Market Closing:

- Bovespa advanced 40.74 points or 0.04% to 112,897.84

ENERGY:

The oil markets had a mixed day today:

l Crude Oil increased 0.688 USD/BBL or 0.73% to 94.428

l Brent increased 0.538 USD/BBL or 0.54% to 100.758

l Natural gas increased 0.1647 USD/MMBtu or 1.79% to 9.3577

l Gasoline decreased 0.146 USD/GAL or -4.98% to 2.7870

l Heating oil increased 0.1617 USD/GAL or 4.21% to 4.0036

The above data was collected around 13:57 EST on Wednesday

- Top commodity gainers: Heating Oil (4.21%), Coffee (5.07%), Cocoa (4.43%) and Oat (2.50%)

- Top commodity losers: Lean Hogs (-2.35%), Lumber (-4.40%), Copper (-1.52%) and Gasoline (-4.98%)

The above data was collected around 14:07 EST on Wednesday.

BONDS:

Japan 0.224%(+0bp), US 2’s 3.38% (+0.076%), US 10’s 3.1095% (+5.55bps); US 30’s 3.32% (+0.064%), Bunds 1.370% (+4.9bp), France 1.9850% (+7.1bp), Italy 3.6740% (+0bp), Turkey 12.81% (-48bp), Greece 3.973% (+3.4bp), Portugal 2.493% (+8.1bp); Spain 2.590% (+8.2bp) and UK Gilts 2.6970% (+0bp).

Original Article

Original Article Here:

Read the full article

0 notes

Text

Pet Corner Launches UAE’s First Real Diamond And Gemstone Studded Dog Collars.

Pet Corner Launches UAE’s First Real Diamond And Gemstone Studded Dog Collars.

(MENAFN-S Factor ) ● Pet Corner introduces “The Elite Club”, offering luxury products and services for pets

● The global pet accessories market poised to reach USD 300 Billion in 2023

UAE — July 06, 2022: Pet Corner, a one-stop shop for all pet supplies, veterinary care, fresh and marine aquariums, in store / mobile pet grooming, announce their launch of “The Pet Corner Elite Club”, which will feature a premium line of pet products and accessories for the first time in the region.

Under Pet Corner Elite, the store introduces UAE’s first diamond and gemstone studded exquisite collars for dogs of small to medium breeds. The Haute hound collection features a bow-shaped centerpiece brooch dazzling with about 2.6 carats of certified natural diamonds and about 6–7 carats of natural rubies encrusted on 18 carat gold. The brooch can be easily fitted or changed to any collar of the client’s choice.

Pet Corner in dubai would also be able to custom make the jewel with any natural gemstone in any color of gold as chosen by the client. Priced from AED 37,000/- onwards, every high-end collar comes with a certificate to ensure authenticity, diamond grading and gemstone identification.

Sidarth Mahindra, Chief Pet Officer, Pet Corner said, “Dogs are man’s best friends and Diamonds/Gems are truly one of nature’s most precious and beautiful creations — making it a perfect accessory for any pooch. We see our customers wanting only the best for their precious pets. This collection offers comfort and style to make any pup stand out from the crowd. We will be introducing many more elite products and supplies in the coming months.”

According to reports*, rise in pet ownership is expected to fuel the growth of the pet accessories market, which is anticipated to reach USD 300 Billion by the end of 2023 globally.

MENAFN06072022005357011948ID1104484779

Tags- pet corner, pet shop,pet shop near me,pet shop dubai,pet store,pet food dubai,pet store near me

0 notes

Text

AUGUST 2022

The Rib Page

Please let Richard Thomas win an Emmy for his work on Ozark when 2023 rolls around!!!!!!

*****

Cindy and Kate and Fred are hitting the road one more time! The B-52's are on tour!

*****

There are so many crimes that the media revisits every year. They never seem to reinvestigate the Jimmy Hoffa case.

*****

Marcia Gay Harden and Neil Patrick Harris are in uncoupled. Keep an eye on Model, Painter Jordyn Owens.

*****

Kirsten Dunst and Jesse Plemons got married!** Kris Keach married Miso.** Lopez became an Affleck.** Anya Taylor-Joy wed Malcolm McRae

*****

Check out The Lost Weekend: A Love Story

*****

The house passed a record-high $840 billion military budget, the same amount as all the stimulus checks combined. ** Huh, guess when they print money for people, it’s socialist, but when they do it for military contractors it’s bipartisan. - Dan Price

*****

The 2022 medal of freedom recipients are Simone Biles, Siter Simone Campbell, Julieta Garcia, Gabrielle Giffords, Fred Gray, Steve Jobs, Khizr Khan, Father Alexander Karloutsos, Sandra Lindsay, John McCain, Diane Nash, Megan Rapinoe, Alan Simpson, Richard Trumka, Wilma Vaught, Denzel Washington and Rauly Zaguirre.

*****

Watch for Downtown Owl with Lily Rabe, Ed Harris and Finn Wittrock.

*****

Jim Thorpe had his Olympic Gold reinstated and it’s about time!

*****

Christopher Bell won a race this year! Woo Hoo!!!

*****

Did Ivanka Trump have an abortion? Is it our business?

*****

Check out the Newman/ Woodward doc from Ethan Hawke!!

*****

The Talisman is coming to Netflix.

*****

Brittney Griner has pled guilty to drug possession in Russia.

*****

J.B. Pritzker was on the South Lawn at the WH for the signing of a Bill that will toughen requirements for young people, deny firearms to more domestic abusers and help get guns out of the hands of dangerous people.

*****

I think Michael Flynn could very well be on the VP short list. And if the President doesn’t run, I strongly believe Mike is running. - Steve Bannon** Milwaukee will be the host for the 2024 Republican National Convention.

*****

There has been intense ‘random’ tax audits of James Comey and Andrew McCabe that started with the Trump administration.

*****

Liza O’Brien has her own podcast. ** Conan and Bowen Yang have joined the cast of a movie brought to us by Ben Marshall, John Higgens and Martin Herlihy AKA Please don’t destroy.

*****

Shawn Mendes has cancelled his tour for mental health reasons.

*****

Can’t wait for Starbright, a film starring Ted Levine, Elizabeth Rohm and Gary Grubbs.

*****

Days alert: Beyond Salen: Chapter 2 came out this month. Wow!! They pulled out the old Prism story. Ok, it is kind of silly but OMG: Larry Welch, Megan Hathaway Dimera, Andrew Donovan, Thomas Banks and a new Shin named Wendy!!!!!!! I am sure that huge Bo and Hope fans are just in heaven just as their heroes are. Please bring Andrew and Paul to Salem!!!!! This could give Theresa a reason to come back to break up Chloe and Brady! For years, I have been wondering if we would ever hear from Andrew. Finally!!** By the way, More JJ!!!!! And speaking of JJ, portrayer Casey Moss is engaged to True O’Brien who used to play his love Paige!!!AWWWWW!!** Wally Kurth, Eric Martsolf, Carson Boatman and Brandon Barash have put a band together called Day Players!!** Richard Wharton will take over the role of Dr. Rolf that was previously played by William Utay ,who was unavailable.

*****

American Horror Stories is back on July 21 with Denis O’Hare, Gabourey Sidibe, Cody Fern, Alicia Silverstone and Judith Light.

*****

Let’s give attention to the first US woman aviator: Bessica Reicht. How do some things get swallowed up by history??

*****

Robert Downey Jr. Has apparently paid for Armie Hammer’s rehab stint. Hammer has been accused of rape.** Ricky Martin’s nephew, Dennis Sanchez has an order of protection against the singer. He claims that he and Martin had a sexual relationship and they were together for 7 months and now Martin is harassing him. Martin denies all allegations and blames the mental health issues of his nephew. ** Martin is also being sued by his former manager, Rebecca Drucker for unpaid commissions. ** By the end of July, Martin’s nephew withdrew the charges.

*****

Sona Movsesian has a book out, The World’s worst assistant. Conan did the forward.

*****

Say what you will about Showtime’s The First Lady but Michelle Pfeiffer was really great as Betty Ford!

*****

The big ego of Joe Manchin has left him unable to keep supporting the climate change bill.

*****

Beanie Feldstein has quit the Funny Girl production on Broadway. She will be leaving even sooner than first announced. She also now has tonsilitis. Lea Michelle will take over.

*****

There is a siracha shortage!!

*****

There has been a rise in vasectomies.

*****

Don Henley’s handwritten stolen Hotel California lyrics have been found after decades.

*****

Jeremy Mayfield was on Dale Jr’s Download podcast talking about the mafia type tactics that Nascar uses. He claims that a raid on his house and other punishments were heaped upon him. He has corroborating evidence from others.

*****

Check out Sandyhookpromise.org.

*****

You know, the flack about Trump and his daughter, Ivanka is strange. To me, it isn’t strange because there may be something wacky going on, because that is probably not true. The thing that always hit me is that back in the day I think he was giving her his endorsement or something. A man with an ego like that probably thought that the best thing he could give his daughter was his seal of approval on her looks et al. JS** The last of the summer Jan. 6 hearings was repetitive but was proof positive that Trump is a traitor. The committee was able to prove that although seemingly inactive thru the entire Jan. 6 ordeal, the President was active in the failed coup attempt by trying to influence senators and the targeting of Pence. There were no photos allowed of him in the 187 minutes. ** Bannon was convicted for failing to show up for a congressional hearing.

*****

Kid Rock kicked off his current tour with a video from Trump. In July’s North Dakota’s state fair, Rock had to cancel due to weather concerns and fans trashed the place.

*****

I loved Bob Costa’s interview with Kamala Harris but she does not seem as self -assured as she did thru the campaign.

*****

Mo. GOP Rep. Tricia Derges was found guilty of wire fraud, illegal distribution of controlled substances and lying to Feds. ** Why do these candidates keep talking about faith? This is America, it should not matter! ** Kendall Co. Republicans in Illinois are raffling off a Smith and Wesson semi-automatic very similar to the one used in the Highland Park shooting. They are not the first county to think of this either!

*****

Will Julia Garner play Madonna in the biopic?? Word is that the Madonna directed film wants her.

*****

Let’s get real!! Why do women deserve less rights than men? Have we started charging men for child support while baby is in the womb?? Let’s get on it if that is the way the country is going.

*****

Bradley Cooper is dating Huma Abedin, Hillary’s chief of staff. They were reportedly introduced by Anna Wintour.

*****

Ginni Thomas paid for buses to bring insurrectionists to Washington.

*****

The Emmy noms have been announced. The hardest category has to be Drama series: I mean, honestly, how do you pick between Better Call Saul, Ozark or Succession (the leader with 25 nods)? Ok, there are other good shows too but c’mon!! The comedy category is great too with Hacks, Barry, Curb your enthusiasm, Abbott Elementary, Only Murders in the Building and the Marvelous Mrs. Maisel. The actors face stiff competition with leads like Donald Glover, Bill Hader, Steve Martin, Martin Short, Rachel Brosnahan, Qinta Brunson, Jean Smart, Issa Rae, Jason Bateman, Brian Cox, Jeremy Strong, Bob Odenkirk, Laura Linney, Jodie Comer and Sandra Oh. Supporting role nominees include Anthony Carrigan, Tony Shalhoub, Bowen Yang, Henry Winkler, Tyler James Williams, Alex Borstein, Sheryl Lee Ralph, Kieran Culkin, Nicholas Braun, Chris Walken, Matt Macfadyen, Patricia Arquette, Rhea Seehorn, J. Smith Cameron and Julia Garner. Ok, that supporting dramatic actress thing is a tough one too. Guest actors include James Cromwell and Tom Pelphrey. Tom’s other half, Kaley Cuoko is also nominated this year. Rhea Seehorn is also nominated for Cooper’s Bar and Julia Garner gets a second nod for Inventing Anna. Voice over work that has been honored comes from Julie Andrews, Chadwick Boseman, Maya Rudolph and Jessica Walter. The narrator category is full with Barack Obama, Lupita Nyongo, W. Kamau Bell, Kareem Abdul Jabar and David Attenborough. There is also some love for Michael Keaton, Sebastian Stan, Lily James, Sarah Paulson, Mare Winningham, Jennifer Coolidge, The Randy Rainbow Show, Late Night with Seth Meyers, McCartney 3,2,1, Andy Warhol Diaries, My next guest needs no introduction with Letterman and Norm Macdonald: Nothing Special.

Clint Eastwood won a 2nd lawsuit against online marketers. There are more lawsuits to come!

*****

D. Bailey, the Gubernatorial candidate for Il. Governor had a quote after the Oakland Parade shooting: “Let’s move on and celebrate the independence of this nation.”

*****

Boris Johnson resigned as Prime Minister in the UK. Best headline: CLOWNFALL!

*****

The DEA has made the biggest bust of its kind in California. Found were 1 million pills with Fentanyl that are linked to the Cartel.

*****

Joanne Lumley is a dame!!

*****

A woman was ticketed for driving alone in the HOV Lane. She is pregnant and told the police that her unborn child counts as a passenger since Roe was overturned. The State can’t have it both ways.

*****

Brendan Fraser will stun us in the Whale with Sadie Sink. ** Look for him in Killers of the Flower Moon as well. In an interview, he seemed nervous and excited to be working with Leo and Marty. Does he realize he is on equal footing with them? His talent has blown me away (Gods and Monsters, anyone) so I am sure that he will not disappoint! ** Scorsese will direct DiCaprio in The Wager.

*****

Mehmet Oz and his wife’s family paid a $95 mil fine for hiring thousands of illegal immigrants in Pa. The other guy running, John Fetterman’s wife created a free store serving 20,000 families a year. They also have a food rescue serving over 25 million pounds of food for those in need in Pa.

*****

The new Kennedy Center honorees have been announced: George Clooney, Gladys Knight, U2, Amy Grant and Tania Leon. The program will air on Dec. 4.

*****

There will be a Stranger Things spinoff from Upside down pictures.

*****

Full Frontal with Samantha Bee was canceled.

*****

Yamiche Alcindor is the latest recipient of the Zenger award for journalists who fights for freedom of the press and the people’s right to know.

*****

Did we all see the self- congratulatory fist bumps between Republicans after they blocked a bill to help toxin-exposed vets survive. ** Republicans haven’t met a veteran they won’t screw over. - Jon Stewart

*****

Pa. Gov. Hopeful Doug Mastriano has aligned himself with GAB and founder Andrew Torba. Torba, a spouter of the big lie said, “My policy is not to conduct interviews with reporters who aren’t Christian and Doug, he does not talk to these people. They are dishonest. They’re liars. They’re a den of vipers, they want to destroy you.”

*****

I have railed here about this before and now have seen Colbert joke about his money and fame. Why do they think this is funny with all the poverty around them. We get it, you are rich and powerful, why do you want to keep reminding us of this?

*****

The black and white episode of Better Call Saul was awesome! Carol Burnett will win the Emmy next year for guest star, I am sure of it!

*****

What a sad day to hear about the death of Bob Rafelson. Check out the obit in the Hollywood Reporter because it tells all. The Monkees and Easy Rider shaped so much of my life. I will miss our tremendous talent.

*****

R.I.P. James Caan, Shin Zo Abe, Clifford Alexander Jr., the latest shooting victims, Peter Brook, Larry Storch, Adam Wade, L.Q. Jones, Vernon Winfrey, Tony Sirico, Jak Knight, Ivana Trump, Monty Norman, William Hart, Rebecca Balding, Tanya Kersey, David Warner, Shonka Dukureh, Tony Dow, Mable Haddock, Paul Sorvino, Bill Russell, Nichelle Nichols, Ophie Brook and Bob Rafelson.

0 notes

Text

bitcoin (BTC) experienced a 5% increase after testing the $25,000 support level on Sept. 11. However, this breakout rally doesn't necessarily indicate a victory for Bulls. To put today’s Price action in perspective, BTC has witnessed a 15% decline since July. In contrast, the S&P 500 index and gold have maintained relatively stable positions during this period. This underperformance demonstrates that bitcoin has struggled to gain momentum, despite significant catalysts such as Microstrategy's plan to acquire an additional $750 million worth of BTC and the multiple requests for bitcoin spot ETFs from trillion-dollar asset management firms. Still, according to bitcoin derivatives, Bulls are confident that $25,000 marked a bottom and opened room for further Price gains.bitcoin/USD vs. gold and S&P 500 futures, 12-hour. Source: TradingViewSome argue that bitcoin's primary drivers for 2024 are still in play, specifically the prospects of a spot ETF and the reduction in supply following the April 2024 halving. Additionally, some of the Cryptocurrency markets’ immediate Risks have diminished following the U.S. Securities and Exchange Commission (SEC) experiencing partial losses in three separate cases involving Grayscale, Ripple and the decentralized exchange Uniswap.On the other hand, bears have their own set of advantages, including the ongoing legal cases against leading exchanges like Binance and Coinbase. Moreover, there is the troubled financial situation of the Digital Currency Group (DCG) after one of its subsidiaries declared bankruptcy in January 2023. The group is burdened with debts exceeding $3.5 billion, potentially leading to the sale of funds managed by Grayscale, including the Grayscale bitcoin Trust (GBTC).Let's look at derivatives metrics to understand better how professional traders are positioned in the current Market conditions.bitcoin futures and options metrics held steady despite the correctionbitcoin monthly futures typically trade at a slight premium to spot markets, indicating that sellers are asking for more money to delay settlement. As a result, BTC futures contracts should typically trade at a 5 to 10% annualized premium — a situation known as contango, which is not unique to crypto markets.bitcoin 1-month futures annualized premium. Source: Laevitas.chIt's worth noting that the demand for leveraged BTC long and short positions through futures contracts did not have a significant impact on the drop below the $25,000 mark on Sept. 11. However, the BTC futures premium continues to hover below the 5% neutral threshold. This metric remains in the neutral-to-bearish range, indicating a lack of demand for leverage long positions.To gauge Market sentiment further, it’s also helpful to look at the options markets, as the 25% delta skew can assess whether the retest of the $25,000 has made investors more optimistic. In short, if traders expect a drop in bitcoin’s Price, the skew metric will rise above 7%, while periods of excitement typically have a negative 7% skew.bitcoin 30-day options 25% delta skew. Source: Laevitas.chThe situation underwent a notable shift on Sept. 11, as the 25% delta skew metric, which previously indicated a 9% premium on protective put options, suggesting investors were expecting a correction, has now leveled off at 0. This indicates a balanced Pricing between call and put options, implying equal odds for both Bullish and bearish Price movements.Macroeconomic uncertainty favors bears, but BTC Bulls remain confidentGiven the uncertainty on the macroeconomic front, particularly with the upcoming release of the inflation CPI report on Sept. 13 and retail sales data on Sept. 14, it's likely that crypto traders will be cautious and prefer a "return to the mean." In this context, the mean represents the predominant Trading range of $25,500 to $26,200 observed over the past couple of weeks.However, from a Bullish perspective, the fact that derivatives markets held up during the dip below $25,000 is a promising sign.

In other words, if bears had significant conviction, one would expect a stronger appetite for put options and a negative BTC futures premium, known as "backwardation."Ultimately, both Bulls and bears have significant triggers that could influence the Price of bitcoin, but predicting the timing of events such as court decisions and ETF rulings is challenging. This dual uncertainty likely explains why derivatives metrics have remained resilient, as both sides exercise caution to avoid excessive exposure.This article is for general Information purposes and is not intended to be and should not be taken as legal or Investment advice. The views, thoughts, and Opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and Opinions of Cointelegraph.

0 notes

Text

Market Talk - August 9, 2022

ASIA:

China’s export sector posted strong growth in July, providing a much-needed boost to the world’s second-largest economy, which is almost certain to miss its GDP target this year. Exports measured in US dollars jumped 18% in July from a year earlier, marking the fastest pace of growth this year, according to Chinese customs statistics released on Sunday. Analysts polled by Reuters had predicted a 15% increase. In June, exports increased by 17.9%. Imports, meanwhile, rose 2.3% from a year earlier, slightly missing expectations and suggesting domestic demand remains weak. July’s strong exports sent China’s trade surplus to a record $101 billion for the month, the first time it has surpassed the $100 billion mark. By comparison, the trade surplus in July 2021 was just $56.6 billion.

India’s central bank kept rates at record lows on Friday but raised its inflation forecast and said it would normalize liquidity conditions in a signal that policymakers may be moving closer to tapering pandemic-induced stimulus. As widely predicted, the RBI kept the repo rate, its key lending rate, at 4% and the reverse repo rate, the borrowing rate, unchanged at 3.35%. The RBI has cut the repo rate by a total of 115 basis points (bps) since March 2020 to cushion the blow from the health crisis and tough austerity measures. This comes after cutting rates by 135 basis points since the start of 2019. The consensus in the latest Reuters poll expects the RBI to raise rates twice by 25 basis points in the next fiscal year, with the repo rate reaching 4.50% by the end. March 2023.

The major Asian stock markets had a mixed day today:

- NIKKEI 225 decreased 249.28 points or -0.88% to 27,999.96

- Shanghai increased 10.50 points or 0.32% to 3,247.43