#GlobalPayroll

Explore tagged Tumblr posts

Text

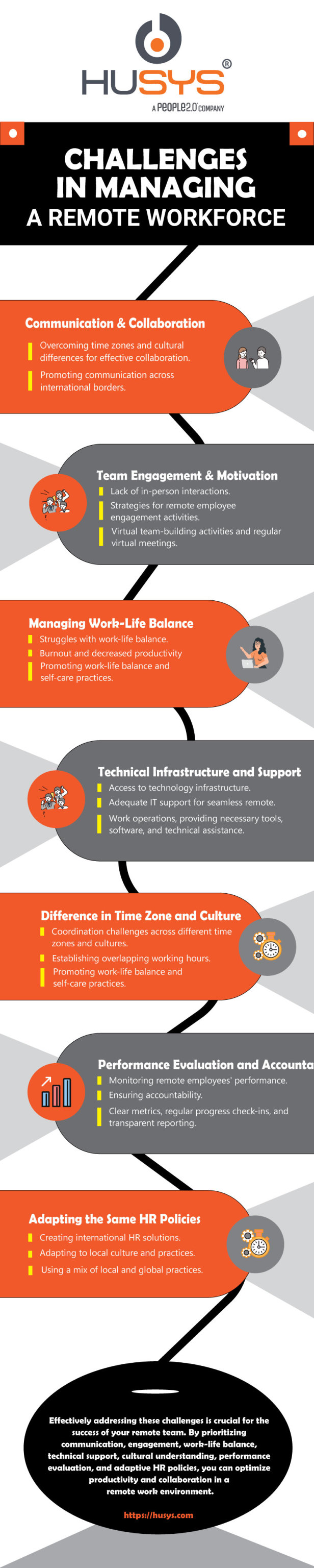

Managing a remote workforce brings unique challenges that can affect productivity and collaboration. To ensure your remote team's success, it's essential to tackle these challenges head-on. Check out my latest post to discover the common hurdles faced when managing a remote workforce and strategies for overcoming them. Let's thrive in the world of remote work! 💼🌍✨

#peo services in india#employer of record#peo services#payroll#payroll outsourcing#globalpayroll#business expansion#eor services india#remote work#remote workforce

2 notes

·

View notes

Text

The Future of Payroll Management 💡

Managing global payroll is a complex endeavor full of complexities and challenges. Multinational organizations have long struggled with the burdens of navigating diverse regulations, ensuring accurate and timely cross-border payments, and mitigating compliance risks across jurisdictions. The costs of manual errors, delays, and non-compliance can be immense.

That's why the Pay Anytime, Any Team idea from Alariss Global marks a transformative moment for global payroll management. With seamless integration capabilities and customizable features, this revolutionary solution offers unprecedented flexibility, efficiency, and compliance. HR and payroll teams gain enhanced visibility and transparency into global payroll operations while leveraging advanced analytics to uncover insights and optimize processes.

The automated compliance checks and real-time reporting empower organizations to proactively manage compliance in every jurisdiction. By integrating payroll, benefits, time tracking, and more into one central hub, Alariss eliminates fragmented systems and empowers HR teams with a holistic view of global workforce management. Pay Anytime, Any Team ushers in a new era of simplified payroll processes, administrative ease, risk mitigation, and data-driven decision-making. https://alariss.com/blog/introducing-pay-anytime-any-team/

For multinational corporations and high-growth startups alike, the complexities of global payroll management are now easy. Alariss' Pay Anytime, Any Team marks the future of payroll administration - one of enhanced flexibility, transparency, and compliance excellence worldwide. This innovative solution with Remote promises to revolutionize global payroll operations. https://remote.com/partners/alariss

Join us on this journey towards simplified payroll processes and compliance excellence. https://alariss.com/book-demo

#GlobalPayroll#PayrollManagement#Compliance#Innovation#AlarissGlobal#PayAnytimeAnyTeam#Partnership#Remote 🌐💰

0 notes

Text

#d365fo#msdyn365fo#dynamicsnav#dynamics365#microsoftpartner#payroll#globalpayroll#payrollsolutions#payrollprocessing#cloudpayroll#cloudHR#UAE#Dubai#HR#AbuDhabi#SaudiArabia#Egypt#Qatar#KSA

0 notes

Text

Innovative Payroll Solutions Worldwide: Exela HR's Expertise in Global Payroll Processing Outsourcing

Unleash the power of #PayrollOutsourcing with Exela HR Solutions. Our expert services encompass everything from basic #payroll calculations to tax processing and HRFM. Whether you are an employer seeking project-based solutions or large-scale outsourcing, our dedication and trust cement partnerships. Discover the benefits of ongoing #payrollProcess administration, legal compliance expertise, and risk mitigation.

#Payroll#PayrollProcessing#PayrollOutsourcing#HRO#PayrollProcessingOutsourcing#HR#GlobalPayroll#ExelaHRSolutions#HRServices#HRSolutions#HROutsourcing#PayrollSolutions#PayrollManagement#EHRS#humanresources

0 notes

Text

Boosting Accuracy and Efficiency in Payroll Management

Discover key strategies and expert tips for enhancing payroll accuracy and efficiency. Streamline payroll management process and ensure precision every payday.

#PayrollProcess#PayrollProcesses#PayrollManagement#Payroll#HRSolutions#ExelaHRSolutions#PayrollProcessing#PayrollOutsourcing#HRServices#PayrollProcessingOutsourcing#HumanResourcesServices#GlobalPayroll#hr#hroutsourcing#humanresources#hro#globalpayrollprocessing

0 notes

Text

The Payroll Quest: Finding the Ideal Partner

Unlock the Path to Perfect Payroll Partnerships! Discover how to find your ideal payroll service provider in our latest article. Navigate the complexities of payroll with confidence and ease.

Discover more! Explore our article for insights - https://www.linkedin.com/.../payroll-quest-finding-ideal.../

#payrollservices#globalpayroll#hrcompliance#employeepayments#taxcompliance#payrollmanagement#businesssolutions#efficientpayroll#payrollpartner#bizessence

1 note

·

View note

Text

Unlocking Talent: 7 Compelling Reasons to Hire from Canada

In the dynamic landscape of today's global business arena, companies are perpetually on the lookout for strategies to enhance the diversity and resilience of their workforce. Amidst the myriad options available, Canada stands out as a burgeoning hotspot for talent acquisition. Renowned for its highly educated and culturally diverse populace, integrating Canadian professionals into your team can yield a myriad of advantages for your organization. This blog will delve into 7 compelling reasons why harnessing talent from Canada can be a strategic move, ranging from the country's stellar educational system and cultural richness to the renowned work ethic of its citizens. As we explore each facet, you'll discover the unique strengths that Canadian talent brings to the table, making a compelling case for businesses to consider the vast potential within the Canadian talent pool.

Top 7 reasons to hire talent from Canada

1. Educational excellence

Canada boasts a world-class education system, consistently ranking high in global education indices. Canadian universities and colleges are renowned for their rigorous academic standards and commitment to innovation. When you hire from Canada, you're tapping into a talent pool that is likely to possess a strong educational background, ensuring that your team is equipped with the knowledge and skills needed to thrive in today's competitive business landscape.

2. Cultural diversity

Canada is celebrated for its cultural mosaic, with a population that embraces diversity. This cultural richness translates into workplaces where employees are accustomed to working alongside individuals from various backgrounds. Hiring from Canada can bring a unique perspective to your team, fostering creativity, and enhancing problem-solving capabilities. A culturally diverse workforce is also more adept at understanding and catering to a global customer base, a crucial advantage in the interconnected world of business.

3. High-quality workforce

Canadians are known for their strong work ethic and professionalism. With a reputation for reliability and dedication, employees from Canada can contribute significantly to the productivity and success of your organization. The Canadian work culture places a premium on teamwork and collaboration, making individuals from this country excellent team players who can seamlessly integrate into your existing work environment.

4. Language proficiency

English and French are the official languages of Canada, and a large majority of Canadians are fluent in English. This linguistic advantage can be a game-changer for businesses with a global clientele or partnerships. Effective communication is the cornerstone of successful collaboration, and by hiring from Canada, you ensure that language barriers are minimized, facilitating smooth and clear communication within your team and with external stakeholders.

5. Stable economic and political environment

Canada is known for its stable economic and political environment. The country consistently ranks high on global stability indexes, providing a secure backdrop for businesses to operate and grow. Hiring talent from a country with a stable economic and political climate can mitigate risks associated with uncertainties, ensuring that your workforce remains focused on achieving organizational goals without unnecessary distractions.

6. Innovative mindset

Canada has a thriving innovation ecosystem, fostering a culture of creativity and forward-thinking. The country consistently invests in research and development, and its workforce is often at the forefront of technological advancements. By hiring from Canada, you bring on board individuals with an innovative mindset, capable of generating fresh ideas and adapting to the rapidly changing technological landscape. This can be a valuable asset in industries where staying ahead of the curve is crucial for success.

7. Quality of life

Canada consistently ranks high in global quality of life indices. With a strong emphasis on work-life balance, employees from Canada often prioritize overall well-being. This focus on a healthy work-life equilibrium contributes to higher job satisfaction and employee retention. When you hire from Canada, you're not just gaining skilled professionals; you're also getting individuals who value a holistic approach to life, which can positively impact team morale and overall productivity.

Conclusion

Incorporating Canadian talent into your workforce can be a strategic move that pays dividends in the long run. With a well-educated, diverse, and skilled population, Canada offers a unique pool of professionals ready to contribute to the success of your organization. From cultural adaptability to linguistic proficiency, the benefits of hiring from Canada are diverse and impactful. So, if you're looking to elevate your team and position your business for success, Canada might just be the untapped resource you've been searching for.

0 notes

Text

Don't let job hunting hold you back. Let us take care of the search so you can focus on your future. . . . . Please mail us at: [email protected]

#business#work#experience#education#communication#hrdunia#PeoplesoftHCM#GlobalPayroll#ApplicationDeveloper#jobopening#hiringnow#job#future

0 notes

Text

A complete guide to global payroll systems for multinational corporations

#Microsoftpartners#d365bc#msdyn365bc#dynamicsnav#dynamics365businesscentral#dynamics365#businesstransformation#microsoftdynamics365#microsoftdynamics365businesscentral#digitaltransformation#payroll#globalpayroll#payrollsolutions#payrollprocessing#internationalpaymentsolutions#cloudpayroll#cloudHR#UAE#Dubai#HR

0 notes

Text

Global EOR Payrolling and PEO Services for World Talent Hiring

Global Squirrels- On-demand EOR and PEO Services Company, helps Organization's world talent hiring includes HR, payroll, compliances at less minimum cost.

#globalsquirrels#remotehiring#globalpayroll.#global hiring#jobs#saas software#payroll solutions#eor#Employer Of Records#Professional Employment Organization

2 notes

·

View notes

Text

Global payroll and HR software in UAE

Unlock efficiency with Global Payroll and HR Software in the UAE. Streamline your workforce management seamlessly with Decibel360Cloud, a cutting-edge solution that simplifies payroll processes and enhances HR operations. From payroll calculations to employee data management, Decibel360Cloud ensures accuracy and compliance. Elevate your business performance and empower your team with a unified platform. Experience the future of payroll and HR management. #Decibel360Cloud #GlobalPayroll #HRSoftware #UAEBusiness #Efficiency #Innovation

1 note

·

View note

Text

Is your business expanding internationally? Ensure smooth transitions and optimal performance with our expert workforce solutions. From hiring to payroll, we've got you covered. we specialize in streamlining your workforce operations across borders. Our comprehensive solutions ensure compliance, efficiency, and productivity, no matter where your team is located. 📈 Benefits of Global Workforce Optimization: 👉 Seamless onboarding 👉Compliance with local laws 👉Cost-effective payroll management 👉Enhanced employee experience 🌟 Why Choose Us? 👉Expertise in 100+ countries 👉Tailored HR solutions 👉Reduced administrative burden 👉Focus on strategic growth Ready to elevate your global operations?

Click Here to Contact Our Experts today!

#GlobalWorkforce#PEOServices#HROptimization#GlobalBusiness#WorkforceManagement#businessexpansion#HRservices#HR#HRserviceprovider#GlobalHRservices#Globalpayroll#Globalpayrollserviceprovider#internationalexpansion

0 notes

Text

Struggling with managing international payroll? Explore 4 unique expertise at https://www.payroll.com.bd/offshore-payroll-outsourcing-services/ and ensure flawless offshore payroll outsourcing now! 🌎💼🚀 #PayrollOutsourcing #GlobalPayroll #BusinessGrowth

Struggling with managing international payroll? Explore 4 unique expertise at https://www.payroll.com.bd/offshore-payroll-outsourcing-services/ and ensure flawless offshore payroll outsourcing now! 🌎💼🚀 #PayrollOutsourcing #GlobalPayroll #BusinessGrowth

0 notes

Text

#d365fo#msdyn365fo#dynamicsnav#dynamics365#microsoftpartner#payroll#globalpayroll#payrollsolutions#payrollprocessing#cloudpayroll#cloudHR#UAE#Dubai#HR#AbuDhabi#SaudiArabia#Egypt#Qatar

0 notes

Text

Precision in Payroll: 10 Tips for Foolproof Compliance

Ensure seamless payroll processes with our comprehensive guide! Discover 10 expert tips for foolproof compliance. Streamline your payroll and mitigate risks.

#PayrollProcessing#PayrollOutsourcing#HR#GlobalPayroll#PayrollProcesses#HRSolutions#GlobalPayrollProcessing#HRServices#Payroll#ExelaHRSolutions#PayrollOutsourcingService#PayrollServices#EHRS#hroutsourcing#humanresources#hro

0 notes

Text

From Complexity to Simplicity: Navigating the Payroll Function with an End-to-End Approach

Direct deposit, introduced more than four decades ago, is a significant innovation in the world of payroll processing that stood out as a true game-changer.

It revolutionized the way employees receive their hard-earned money.

However, fortunately, recent years have seen technology permeate the payroll realm, bringing forth exciting developments in time reporting and flexible payment options. The future of payroll is poised for further transformation, ensuring a seamless and rewarding experience for both employees and employers.

Handling payroll is a vital but intricate task for businesses. In today's unpredictable economy, ensuring timely and error-free delivery of employee paychecks has become a paramount concern.

Organizational leaders must offer their staff clear, concise, and comprehensive guidance on accessing payroll information to minimize payroll mishaps.

Additionally, HR departments must remain vigilant about staying abreast of evolving government policies or consider leveraging the services of a global payroll provider, particularly in a hybrid-remote work environment, to streamline payroll information for employees residing in different states or countries. By adopting these practices, businesses can navigate payroll management challenges with confidence and efficiency.

While payroll processing may appear daunting initially, rest assured that paying your employees doesn't have to be complex.

Simplifying Payroll: Definition, Standard Terms, and Processes

Payroll processing refers to the process of calculating and distributing employee compensation, including wages, bonuses, and deductions. It involves ensuring accurate payment calculations, tax withholding, compliance with labor regulations, and maintaining records of financial transactions related to employee compensation.

Here are some standard payroll terms you will encounter while dealing with your company's payroll function.

Standard Payroll Terms

Gross Pay

The gross salary is the complete sum of all the elements of an employee's compensation package. It represents the total salary amount before any compulsory or optional deductions, such as income tax, provident fund contributions, medical insurance premiums, and other similar deductions.

Net Pay

Once the gross pay has been determined, it is necessary to deduct government-mandated withholdings, such as income tax and provident fund, from the gross pay. The remaining amount that an employee receives after these deductions is referred to as net pay or net salary.

Overtime

Overtime is the additional hours worked by an employee in a company that exceeds the standard hours set by government regulations. The policies established by the company determine the compensation or additional remuneration an employee receives for working overtime.

Pay Period

Pay periods are specific timeframes during which employee wages are calculated and payslips are issued. These periods are scheduled and repeated either every two weeks or every month.

Compensation

Payroll management encompasses administering, analyzing, and calculating employee compensation, including salaries, benefits, and performance-related bonuses.

Contractual Employees

These individuals are typically engaged temporarily and do not hold permanent employee status. The specifics of their employment arrangement are outlined in the contractual agreement.

Payroll Processing: An End-to-End Approach to Elevated Payroll

Payroll management is an essential aspect of any organization.

It involves complex calculations, compliance with legal regulations, and timely processing of employee payments. As businesses grow and the workforce expands, managing payroll becomes increasingly challenging.

However, you can streamline your payroll function and ensure accurate and efficient processing with the right approach and measures. Here are steps to consider while building a robust payroll processing function, simplifying the entire process, and saving valuable time and resources.

Understanding State and Federal Payroll Laws

Irrespective of your industry, you must be aware of and comply with the payroll laws at the state, federal, and local levels.

It is advisable to conduct thorough research to understand the specific laws that apply to your situation.

Take the time to ascertain the minimum wage set by your state, the method for calculating overtime, the provisions for paid or unpaid leaves, the requirements for workers' compensation, and the frequency at which paydays should occur according to your state's regulations.

Additionally, it is crucial to determine whether you are obligated to withhold funds for disability insurance and local income tax. By familiarizing yourself with these legal requirements, you can ensure that your payroll processes adhere to the applicable laws and regulations.

Choose a Payroll Schedule

Typically, there are four primary pay schedules available: weekly, biweekly, bimonthly, and monthly.

It is crucial to carefully assess the advantages and disadvantages associated with each schedule before finalizing your decision. Several factors, including the nature of your workforce, industry, budgetary considerations, and payroll procedures, should be considered when determining the most suitable payroll schedule for your organization.

Considering these variables, you can choose the optimal pay schedule that aligns with your business requirements.

Collect Employee Paperwork

Payroll processing requires specific forms from both current and new employees.

These forms include the W-4, I-9 Employment Eligibility Verification, and State Tax Withholding (if applicable for state income tax withholding). Additionally, if you opt for direct deposit, you will need the banking information of each employee. Some payroll services allow employees to submit these forms electronically for additional convenience.

Calculate Pre-tax Pay

Now it's time to perform some calculations to determine the gross pay for your employees, which is the amount they will receive before taxes. The specific calculations will vary depending on the types of workers you employ.

For hourly employees: Multiply their hourly pay by the number of hours they worked during the pay period. Be sure to deduct any hours they didn't work if they took time off.

For salaried employees: Divide the annual salary by the number of pay periods in your yearly payroll schedule.

For commission employees: Determine their hourly or salaried base pay and add their commission earnings for that particular pay period. The commission earnings will be based on your unique commission structure.

Figure out tax withholding

The paperwork provided by your employees will indicate the amount of earnings to be withheld. Typically, this includes federal, state, and possibly local income taxes and FICA taxes encompassing Social Security and Medicare. It may also involve deductions for court-ordered child support and tax levies. Moreover, if your state mandates unemployment insurance, it is essential to calculate this amount, as you will be responsible for paying it on behalf of the employer.

Determine net pay

Net pay, or take-home pay, is the actual remuneration employees receive after deductions from their gross income. To determine the net pay, you can subtract the applicable deductions from the gross revenue. For instance, if an employee has a gross salary of $5,000 and $1,250 is withheld for taxes, their net pay will amount to $3,750, which is the amount they receive on payday.

Distribute paychecks

The next step is to distribute the net pay owed to your employees after processing your payroll. Various methods are available for this purpose, with direct deposit being the preferred choice for many. To proceed with direct deposit, ensure you have the bank details provided by your employees. However, it's important to note that some employees may still prefer traditional paper checks. If that's the case, you can simplify the paycheck distribution process by utilizing a payroll service. To explore the top payroll services suitable for small businesses, find out more about the subject here.

File taxes

As an employer, you must fulfill your tax obligations on behalf of your W-2 employees. These obligations include paying taxes to the IRS, state tax collection departments, and local government, depending on your operational location. Additionally, you are responsible for FICA (Federal Insurance Contributions Act) or Social Security and Medicare taxes, which are divided between you and your employees. Another tax you must pay is the FUTA (Federal Unemployment Tax Act) tax, which covers unemployment insurance at a rate of 6% for each employee. Fortunately, deducting the taxes paid for your employees is possible, providing some relief.

Pay into benefits

When it comes to employee compensation, a portion of the funds withheld from their paychecks is allocated towards employee benefits, provided that your organization offers them. These benefits encompass various offerings, such as health insurance, health savings accounts, retirement plans, and flexible spending accounts. It is your responsibility as an employer to ensure accurate and timely payments towards these benefits, depositing them into the appropriate accounts on a per-pay-period basis.

Maintain payroll records

According to the Fair Labor Standards Act (FLSA), it is mandatory to maintain specific payroll processing records for nonexempt employees for a period of three years. Nonexempt employees are eligible to receive minimum wage and overtime pay if they work beyond 40 hours in a week. These records should include information such as employee pay rates, hours worked, vacation pay, overtime payments, and holiday pay. To ensure convenient accessibility, storing all employee records securely in a centralized human resources system is recommended. This allows for easy retrieval whenever necessary.

Conclusion

Simplifying your payroll function is a strategic move that saves time and resources, minimizes errors, and ensures compliance.

We at Exela HR Solutions provide a wide range of services, including accurate payroll calculations, efficient tax processing, and seamless HRFM (Human Resources and Financial Management) integration. By leveraging our extensive expertise, strategic approaches, and state-of-the-art technology, we are dedicated to handling your administrative tasks with utmost precision and effectiveness.

Here are the benefits of choosing Exela HR Solutions as your HR services partner:

Ongoing management of payroll operations

Mass data corrections and uploads

Management of compensation, benefits, and annual talent cycles

Proficiency in legal and compliance matters

Efficient risk mitigation

Speak with our experts to learn more about our services.

DISCLAIMER: The information on this site is for general information purposes only and is not intended to serve as legal advice. Laws governing the subject matter may change quickly, and Exela cannot guarantee that all the information on this site is current or correct. Should you have specific legal questions about any of the information on this site, you should consult with a licensed attorney in your area.

Source of the original blog: https://ow.ly/Ml4F50PTQHZ

Contact us for more details: https://ow.ly/w26L50PKpGy

#PayrollProcessing#PayrollFunction#HRServices#PayrollServices#HRSolutions#GlobalPayrollProcessing#PayrollandHRServices#HumanResourcesServices#HROutsourcing#PayrollOutsourcing#ExelaHRSolutions#GlobalPayroll#hr#humanresources#hro#payroll

0 notes