#Global finance

Explore tagged Tumblr posts

Text

#SETAGAYA#GAIKO#WAYLAND ANDERSON#MEN OF BALLET#GLOBAL NEWS#POLITICAL NEWS#GLOBAL TRENDS#GLOBAL MEN#GLOBAL ECONOMY#GLOBAL FINANCE#GLOBAL POLITICS#GLOBAL

13 notes

·

View notes

Text

#saudi arabia#petrodollar#us dollar#global economy#oil trade#currency exchange#digital currency#project mbridge#international trade#economic shift#bitcoin transactions#cross-border payments#distributed ledger technology#central banks#global finance

4 notes

·

View notes

Text

0 notes

Text

Global Business Updates: Insolvencies, Credit Ratings, and Financial Restructuring News

A U S T R A L I A

AM LABOUR: First Creditors' Meeting Set for August 3 BROOKFIELD RIVERSIDE: ASIC Winds Up 5 Land Banking Companies HOTR AUSTRALIA: First Creditors' Meeting Set for August 6 MIGME LIMITED: Second Creditors' Meeting Set for August 3 ROSSAIR CHARTER: Second Creditors' Meeting Set for August 3

SHARMA HOLDINGS: First Creditors' Meeting Set for August 3 SIRENS BY THE BAY: First Creditors' Meeting Set for Aug. 6

H O N G K O N G

NOBLE GROUP: Expected to Post Q2 Net Loss of Up to US$140MM NOBLE GROUP: PT Alhasanie Files $20MM Lawsuit Against Subsidiary YIHUA ENTERPRISE: S&P Alters Outlook to Negative & Affirms B ICR

I N D I A

AAKASH DEVELOPERS: Ind-Ra Places BB LT Issuer Rating on RWN ADILABAD EXPRESSWAY: CARE Lowers Rating on INR268.88cr Loan to D BALAJI OIL: CRISIL Migrates B Rating in Not Cooperating Category BINANI CEMENT: CARE Migrates D Rating to Not Cooperating Category BNK ENERGY: CARE Assigns B+ Rating to INR2cr Long-Term Loan

CHEEKA RICE: CARE Downgrades Rating on INR8cr LT Loan to B COMMERCIAL CARRIERS: CARE Migrates D Rating to Not Cooperating DHROOV RESORTS: CARE Migrates D Rating to Not Cooperating ECO RICH: Insolvency Resolution Process Case Summary GRANNY'S SPICES: CARE Lowers Rating on INR6cr LT Loan to D

INCOM CABLES: Ind-Ra Maintains 'D' LT Rating in Non-Cooperating INDIAN ACRYLICS: Ind-Ra Withdraws 'D' Long Term Issuer Rating INNOTECH EDUCATIONAL: CARE Migrates D Rating to Not Cooperating KOHINOOR HATCHERIES: Ind-Ra Affirms BB+ LT Rating, Outlook Stable LAVANYA PUREFOOD: CARE Lowers Rating on INR13.32cr Loan to C

MAHALAXMI ROLLER: CARE Cuts Rating on INR5.84cr LT Loan to B MANGALDEEP RICE: CRISIL Maintains 'D' Rating in Not Cooperating METRO AGRI: CARE Lowers Rating on INR13.84cr LT Loan to D MEVADA OIL: CARE Lowers Rating on INR14.60cr LT Loan to D N.S.R. MILLS: CRISIL Maintains 'B' Rating in Not Cooperating

NATURAL AGRITECH: Ind-Ra Hikes Long Term Issuer Rating to 'B+' NAVEEN POULTRY: CRISIL Maintains D Rating in Not Cooperating NEW HORIZON: CARE Lowers Rating on INR6.40cr LT Loan to B NICE POULTRY: CRISIL Maintains B- Rating in Not Cooperating NIKKI STEELS: CARE Lowers Rating on INR12cr LT Loan to B-

ODYSSEY ADVANCED: Ind-Ra Moves BB- Rating to Non-Cooperating PERTH CERAMIC: CRISIL Maintains B+ Rating in Not Cooperating RAJ ARCADE: Ind-Ra Affirms 'BB' LT Issuer Rating, Outlook Stable RELISHAH EXPORT: Ind-Ra Affirms B+ Issuer Rating; Outlook Stable RICHU MAL: CARE Lowers Rating on INR5cr Long-term Loan to B

ROLTA INDIA: Bondholders Oppose Debt Restructuring Plan SARASWATI TRADING: CARE Reaffirms B+ Rating on INR4.5cr LT Loan SHREE DATT: Ind-Ra Lowers Long Term Issuer Rating to 'BB+' SHYAM CORPORATION: CRISIL Maintains B Rating in Not Cooperating STONE INDIA: Insolvency Resolution Process Case Summary

SUMERU DEVELOPERS: CRISIL Migrates B Rating in Not Cooperating SUNSTAR OVERSEAS: Insolvency Resolution Process Case Summary TATA MOTORS: S&P Cuts Issuer Credit Rating to BB; Outlook Stable U. K. PAPER: CRISIL Maintains 'B-' Rating in Not Cooperating VISHNU CARS: Ind-Ra Maintains B Issuer Rating in Non-Cooperating

#Business Updates#Insolvency News#Credit Ratings#Financial Restructuring#Global Companies#India Business News#Australia Financial Updates#Hong Kong Business Developments#Corporate Insolvency#Creditors' Meetings#Rating Downgrades#Debt Restructuring#Economic Insights#Industry News#Global Finance

0 notes

Text

The Global Monetary Landscape: BRICS Nations Set to Challenge the Dominance of the Dollar

The global monetary landscape is undergoing a significant transformation. The American dollar, which has been the world’s dominant reserve currency for decades, is facing challenges from emerging economies. As geopolitical tensions rise and the U.S. implements aggressive economic policies, the BRICS nations (Brazil, Russia, India, China, and South Africa) are working to reshape global finance. A…

#blockchain#BRICS Bridge#BRICS currency#BRICSCurrencyChallenge#BRICSEconomicRise#BRICSEconomies#BRICSvsDollar#DollarDominance#economic policies#economic power#EconomicPowerShift#financial sovereignty#FutureOfGlobalFinance#geopolitical tensions#global finance#global markets#GlobalCurrencyWar#GlobalMonetaryShift#MonetaryPolicy#U.S. dollar

0 notes

Text

Mixed markets today! Learn More: https://markets.tradermade.com/forex/morning-digest-mixed-bag-with-crude-oil-gold-gaining. $CHF & $GBP up vs $USD. Asia mixed, Europe flat. US stocks dip slightly. #oil gained, #NATGAS dipped, #gold & #silver shine.

0 notes

Text

GTCO Rated Nigeria’s Strongest Brand and Best Banking Brand in Nigeria

Africa’s leading financial services institution, Guaranty Trust Holding Company Plc (“GTCO” or “the Group”), has added to its impressive haul of accolades as it was recently named Nigeria’s strongest brand and Best Banking Brand in Nigeria by Brand Finance and Global Brands Magazine, respectively. These awards not only reaffirm GTCO’s position as a leading financial services group but also…

View On WordPress

#2023 Euromoney#Best Bank in CSR#Best Banking Brand in Nigeria#Global Finance#GTCO#Guaranty Trust Holding Company Plc#Segun Agbaje

0 notes

Text

Emerging Trends in the Global Financial Markets for 2024

The global financial markets are in a state of constant flux, driven by technological advancements, regulatory changes, and evolving investor preferences. As we step into 2024, several key trends are poised to shape the landscape of finance, influencing investment strategies, market dynamics, and the broader economic environment. This article explores some of the most significant emerging trends expected to dominate the global financial markets in the coming year.

1. Sustainable and Responsible Investing

Sustainable and responsible investing (SRI) continues to gain momentum as investors increasingly prioritize environmental, social, and governance (ESG) criteria. In 2024, this trend is expected to accelerate, driven by growing awareness of climate change, social inequalities, and corporate governance issues. Institutional investors, in particular, are integrating ESG factors into their investment processes, leading to a surge in demand for green bonds, renewable energy projects, and companies with strong ESG credentials. Regulatory bodies worldwide are also stepping up their efforts to standardize ESG reporting, enhancing transparency and accountability.

2. Digital Transformation and Fintech Innovation

The digital transformation of financial services is another trend that will shape the global markets in 2024. The rise of fintech companies has revolutionized how financial services are delivered, making them more accessible, efficient, and user-friendly. Key areas of innovation include blockchain technology, artificial intelligence (AI), and machine learning. Blockchain is expected to further disrupt traditional financial systems by enabling secure, transparent, and decentralized transactions. AI and machine learning, on the other hand, are enhancing decision-making processes, risk management, and customer service through advanced data analytics and predictive modeling.

3. Central Bank Digital Currencies (CBDCs)

Central bank digital currencies (CBDCs) are gaining traction as countries explore the potential benefits of digital currencies issued by central banks. In 2024, several nations are expected to launch or expand their CBDC projects. CBDCs promise to enhance financial inclusion, reduce transaction costs, and provide a more efficient payment system. However, their implementation also raises concerns about privacy, cybersecurity, and the potential disruption of the traditional banking system. The ongoing experiments and pilots will provide valuable insights into how CBDCs can coexist with existing financial infrastructures.

4. Geopolitical Tensions and Market Volatility

Geopolitical tensions remain a significant driver of market volatility. In 2024, conflicts such as the Russia-Ukraine war, US-China trade relations, and political instability in various regions will continue to impact investor sentiment and market dynamics. Investors are becoming more adept at navigating these uncertainties by diversifying their portfolios and adopting hedging strategies. Additionally, the increasing interconnectedness of global markets means that local geopolitical events can have far-reaching consequences, underscoring the importance of a well-rounded understanding of global political developments.

5. Inflation and Monetary Policy Adjustments

Inflationary pressures and monetary policy responses will be critical factors influencing the global financial markets in 2024. Central banks around the world are grappling with balancing economic growth and controlling inflation. The US Federal Reserve, European Central Bank, and other major central banks are likely to continue their monetary tightening cycles, albeit at different paces. Interest rate hikes and changes in quantitative easing programs will have profound effects on asset prices, borrowing costs, and investment flows. Investors will need to remain vigilant and adaptable to navigate this complex monetary landscape.

6. Technological Integration in Financial Services

Technological integration in financial services is advancing at an unprecedented pace. In 2024, the adoption of technologies such as the Internet of Things (IoT), 5G, and quantum computing will further transform the financial sector. IoT will enable real-time data collection and analysis, enhancing risk assessment and fraud detection capabilities. The rollout of 5G networks will improve connectivity and enable faster, more reliable financial transactions. Quantum computing, although still in its early stages, holds the potential to revolutionize complex financial modeling and cryptographic security.

7. Decentralized Finance (DeFi) and Cryptocurrencies

Decentralized finance (DeFi) and cryptocurrencies continue to be areas of significant interest and innovation. In 2024, DeFi platforms are expected to evolve, offering more sophisticated financial products and services without the need for traditional intermediaries. Cryptocurrencies, while still volatile, are gaining acceptance as alternative assets and payment methods. Regulatory frameworks are gradually being established to address the risks and challenges associated with these digital assets, providing a more secure environment for investors.

Conclusion

The global financial markets in 2024 will be shaped by a confluence of trends driven by technological advancements, regulatory changes, and evolving investor preferences. Sustainable investing, digital transformation, CBDCs, geopolitical tensions, inflationary pressures, technological integration, and the rise of DeFi and cryptocurrencies will all play pivotal roles in defining the financial landscape. Investors and market participants must stay informed and adaptable to navigate these dynamic and interconnected trends successfully.

Navigate the waves of financial decisions with the guidance of seasoned experts. Get started with a FREE consultation!💯

🔗 To know more, visit - www.fintlivest.com

📞 Contact us – 8951741819 / 9637778041

👉 Follow for daily financial tips and strategies: Fintlivest

https://www.fintlivest.com

https://www.instagram.com/fintlivest

https://www.youtube.com/@Fintlivest

https://in.pinterest.com/fintlivestservices/

#GlobalFinance2024 #EmergingTrends #FinancialMarkets #SustainableFinance #InvestmentTrends #MarketOutlook #EconomicForecast #FutureOfFinance #InvestSmart #FinancialInnovation

#investment#budgeting#insurance#personalfinance#wealthmanagement#investmentstrategy#financialplanning#smartinvesting#financialfreedom#emerging trends#global finance#market trends

0 notes

Text

0 notes

Text

#SAUVE#PINK TOWEL#LOCKERS#BROWN SKIN#MEN#BROWN MEN#PICTURE#global trends#global men#global art#global series#global economy#global finance#global health#global wealth#global markets#global approach#global collaboration#global communication#global community#global model#global#him#love#male#man#gay men#gay guys#guys#global d cds

17 notes

·

View notes

Text

UAE Central Bank Introduces Easy Cross-Border Payments

The Central Bank of the UAE has achieved a major milestone with the launch of the Minimum Viable Product (MVP) platform for the m-Bridge project. This platform, a first of its kind, promises to transform cross-border payments and settlements. Ready for early adopters, it's a game-changer in the world of wholesale transactions.

Teaming up with key institutions like the Bank for International Settlements Innovation Hub Hong Kong Centre, the Hong Kong Monetary Authority, the Bank of Thailand, and the Digital Currency Institute of the People’s Bank of China, the UAE Central Bank is leading the charge in digital currency innovation.

In January 2024, Sheikh Mansour Bin Zayed Al Nahyan initiated a historic cross-border payment of 'Digital Dirham' worth Dh50 million to China via the m-Bridge platform. This marked not only the platform's real-world readiness but also the first significant CBDC payment between a Mena country and a nation beyond the region.

The launch of the m-Bridge MVP platform signifies a monumental shift in global financial operations, promising enhanced efficiency, security, and transparency. With the UAE Central Bank at the forefront, the future of cross-border payments is brighter than ever.

#Cross-border payments#Digital currency#UAE Central Bank#m-Bridge project#Minimum Viable Product (MVP)#Wholesale transactions#Financial innovation#International collaborations#Digital Dirham#Central Bank Digital Currency (CBDC)#Global finance#Financial technology (FinTech)#Payment systems#Economic development#Financial transparency

0 notes

Link

Even skeptics can't ignore it anymore! 🚀 Discover how the Bitcoin popularity wave has even caught Donald Trump's attention. Dive into an intriguing mix of politics, digital currency regulation, and the undeniable rise of cryptocurrencies. Don't miss out on the details of how financial landscapes are evolving! #Bitcoin #DigitalCurrency #FinanceNews

0 notes

Text

Make easy Complex Web of Global Finance and grab the Trends, Challenges, and Opportunities

In our interconnected world, the global finance landscape plays a pivotal role in shaping economies, businesses, and individual lives. As we step into the heart of the 21st century, it’s essential to understand the dynamic forces driving global finance and the implications they have on the world stage. This blog explores the latest trends, challenges, and opportunities in the ever-evolving realm of global finance.

Digital Transformation and Fintech Revolution: The digital revolution has permeated every aspect of our lives, and the financial sector is no exception. Fintech, short for financial technology, has emerged as a disruptive force, transforming traditional banking and financial services. From blockchain and cryptocurrencies to robo-advisors and mobile payment solutions, the fintech revolution is reshaping how we transact, invest, and manage our finances.

Sustainable Finance and ESG Investing: Environmental, Social, and Governance (ESG) considerations have gained prominence in global finance. Investors are increasingly seeking opportunities that align with sustainability goals, leading to a surge in ESG investing. Governments and financial institutions are responding by integrating sustainable practices into their policies and operations. This shift towards responsible finance is not only ethical but also economically prudent in the long run.

Global Economic Challenges: The world faces a myriad of economic challenges, from geopolitical tensions to the aftermath of global health crises. Trade tensions between major economies, such as the United States and China, can have far-reaching implications. Additionally, the ongoing impact of the COVID-19 pandemic has highlighted the fragility of global supply chains and the need for resilient financial systems.

Central Bank Digital Currencies (CBDCs): Central banks worldwide are exploring the possibilities of issuing digital currencies. CBDCs have the potential to revolutionize the way we handle money, providing a secure and efficient alternative to traditional currencies. As governments experiment with digital fiat currencies, questions about privacy, security, and the broader economic impact continue to shape the discourse in global finance.

Rise of Emerging Markets: The economic prowess of emerging markets is steadily growing, challenging the traditional dominance of developed economies. Countries in Asia, Africa, and South America are becoming significant players in the global financial arena. Investors are increasingly diversifying their portfolios to include assets from these emerging markets, recognizing the potential for high returns and economic growth.

Remote Work and the Financial Industry: The COVID-19 pandemic accelerated the adoption of remote work across industries, including finance. The shift to remote work has implications for the financial sector, impacting everything from risk management to customer engagement. Adapting to this new normal requires financial institutions to invest in technology, cybersecurity, and employee training to ensure a seamless transition to remote operations.

0 notes

Text

Emerging Markets in the Global Financial Tapestry: Challenges and Opportunities

In the intricate world of global finance, emerging markets play an increasingly pivotal role. This blog post aims to dissect the complex dynamics of these markets, spotlighting both the challenges and opportunities they bring to the global financial system.

Understanding Emerging Markets: The New Frontiers of Global Finance

A. Defining Emerging Markets

Emerging markets refer to economies not yet fully developed but in the process of rapid growth and industrialization. Countries like China, India, Brazil, and South Africa are prime examples, each with unique characteristics and growth trajectories.

B. Growth Engines of the Global Economy

These markets are often seen as the growth engines of the global economy, offering higher growth potential compared to developed markets. This potential stems from factors like a young and growing workforce, increasing consumer spending, and ongoing industrialization.

The Role of Emerging Markets in Global Finance

A. Investment Opportunities

For investors, emerging markets offer a plethora of opportunities. Their high growth potential can translate into higher returns, albeit with higher risks. Diversifying into these markets can improve portfolio performance over the long term.

B. Increasing Global Influence

The growing economic clout of emerging markets is reshaping global economic power dynamics. Their increasing consumption and production capacities have significant implications for global trade and finance.

Navigating Challenges in Emerging Markets

A. Political and Economic Instability

One of the main challenges in these markets is political and economic instability. Issues like policy unpredictability, currency fluctuations, and governance problems can pose risks to investors and businesses alike.

B. Infrastructure and Regulatory Hurdles

Many emerging markets face infrastructure deficits and regulatory hurdles, which can impede business operations and growth. Addressing these challenges is crucial for realizing their full potential.

Harnessing Opportunities Amidst Risks

A. Tapping into Consumer Markets

The burgeoning middle class in many emerging economies presents vast opportunities for businesses. Companies that understand local consumer behavior and can navigate logistical challenges stand to benefit immensely.

B. Innovation and Technological Leapfrogging

Emerging markets are often hotbeds of innovation, with businesses and consumers leapfrogging to the latest technologies. This trend offers exciting prospects for technology-driven companies and investors.

Conclusion: A Balanced Approach to Emerging Markets

Emerging markets are integral to the global financial ecosystem, offering a mix of challenges and opportunities. A balanced approach—weighing risks against potential rewards—is essential for investors and businesses looking to tap into these dynamic markets.

Key Takeaways

Do Your Homework: Understanding the unique aspects of each emerging market is key to successful investment and business strategies.

Risk Management: While offering high potential returns, these markets also come with higher risks. Effective risk management is crucial.

Stay Agile: Flexibility and adaptability are important when dealing with the dynamic nature of emerging markets.

The role of emerging markets in global finance is both complex and significant. As these economies continue to evolve, they present a tapestry of opportunities for growth, innovation, and investment. Navigating this landscape requires a keen understanding of their unique characteristics and an agile approach to overcome challenges and capitalize on opportunities.

1 note

·

View note

Text

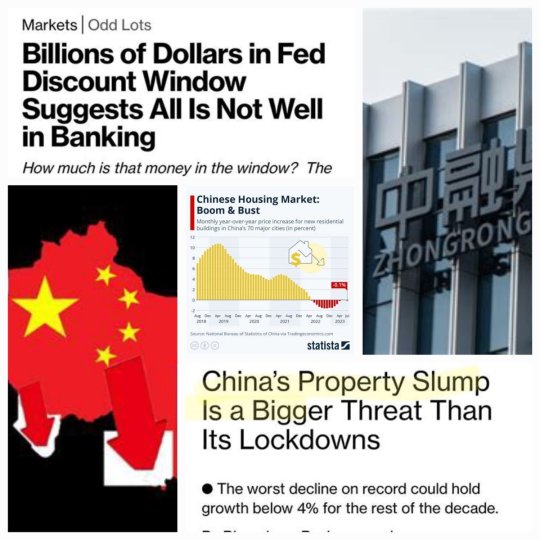

Shadows in the Global Economy: Unraveling China's Financial Crisis and the Looming Threats in the US

Shadows in the Global Economy: Unraveling China's Financial Crisis and the Looming Threats in the US #China #ChinaCrisis #GlobalEconomy #ChinaBankingCrisis #ChinaFinancialCrisis #USCrisis

China’s financial woes are escalating as its banks, anticipating significant loan losses, take drastic measures to bolster loan loss reserves by tapping into the bond markets for 30% more funds than the previous year. This predicament stems from the unfolding crisis that began over a year ago when Evergrande, a major property developer, declared its inability to support around $300 billion in…

View On WordPress

#Banking Woes#China#Economic Consequences#Evergrande#Financial Crisis#Financial Stability#Global Finance#regulatory oversight#Shadow Banking#US Hidden Debt

0 notes