#Financial technology (FinTech)

Explore tagged Tumblr posts

Link

Some of Europe's top fintech firms are starting to crumble as investors question their true valuation. Asset manager Schroders has cut the value of its stake in financial "superapp" Revolut by 46%, according to a filing on April 17 that threatens Revolut's title as the UK's most valuable fintech. The writedown suggests the London-headquartered firm is now valued at about $17.7bn (£14.2bn), which is substantially less than the $33bn it was valued at in a funding round last July. Revolut has been criticised for the late filing of accounts, EU regulatory breaches and corporate culture. It has also been waiting two years for regulators to approve its UK banking license. Schroders has also marked down its stake in Atom Bank by 31%. Meanwhile, Allianz is selling its stake in struggling fintech N26 at a heavily-reduced price, according to the Financial Times, while buy-now-pay-later firm Klarna has seen its valuation tumble from $45.6bn to $6.7bn.

39 notes

·

View notes

Text

How Financial Education Platforms Can Empower You ?

In an increasingly complicated financial market, knowledge is power. financial education platforms, powered by innovative fintech software like Xettle Technologies, offer a pathway to empowerment by providing individuals with the knowledge, skills, and resources they need to take control of their financial futures. From basic budgeting to advanced investing strategies, these platforms empower users to make informed decisions, achieve their financial goals, and build a solid foundation for long-term financial success.

Access to Comprehensive Learning Resources: Financial education platforms offer access to a wealth of comprehensive learning resources, including articles, videos, webinars, and interactive tools, covering a wide range of topics relevant to personal finance, investing, and entrepreneurship. Whether you're a beginner looking to build a basic understanding of financial concepts or an experienced investor seeking to expand your knowledge, these platforms provide resources tailored to your needs and skill level.

Xettle Technologies, a leader in fintech software, has developed a robust financial education platform designed to empower users with the knowledge and skills they need to succeed financially. Through its intuitive interface and user-friendly design, Xettle's platform provides access to a curated library of educational resources, curated by industry experts and thought leaders, covering everything from budgeting and saving to investing and retirement planning.

Personalized Learning Experiences: One of the key benefits of financial education platforms is their ability to deliver personalized learning experiences tailored to each user's unique needs, preferences, and learning style. Through advanced algorithms and machine learning, these platforms analyze user data and behavior to deliver customized content recommendations, learning paths, and interactive experiences that engage and motivate users to learn.

Xettle Technologies leverages its expertise in fintech software to create personalized learning experiences for users of its financial education platform. By analyzing user interactions and preferences, Xettle's platform delivers tailored content recommendations and learning paths that align with each user's financial goals and objectives. Whether it's through interactive quizzes, simulations, or live webinars, Xettle's platform provides users with the tools they need to master their finances and achieve their financial goals.

Promoting Financial Inclusion: Financial education platforms play a crucial role in promoting financial inclusion by democratizing access to financial knowledge and resources. By providing accessible and affordable education, these platforms empower individuals from all walks of life, regardless of their background or financial situation, to participate in the financial system and make informed decisions about their money.

Xettle Technologies is committed to promoting financial inclusion through its financial education platform. By leveraging its expertise in fintech software, Xettle has developed a platform that is accessible to users across the globe, regardless of their socioeconomic status or geographic location. Through partnerships with organizations and institutions, Xettle is working to ensure that its platform reaches those who need it most, helping to bridge the financial literacy gap and promote economic empowerment.

Empowering Financial Advisors: Financial education platforms are not only empowering individuals but also financial advisors. These platforms provide advisors with a wealth of educational resources and tools that they can use to educate and empower their clients. By arming clients with the knowledge they need to make informed decisions, advisors can build stronger relationships, provide more value-added services, and help clients achieve their financial goals.

Xettle Technologies recognizes the important role that financial advisors play in promoting financial literacy and empowering clients. That's why Xettle's financial education platform includes features specifically designed for financial advisors, such as customizable content libraries, client engagement tools, and analytics dashboards. Through its platform, Xettle is helping advisors educate and empower their clients, driving better outcomes for all.

Conclusion: Financial education platforms are powerful tools for empowering individuals to take control of their financial futures. By providing access to comprehensive learning resources, delivering personalized learning experiences, promoting financial inclusion, and empowering financial advisors, these platforms are transforming the way people think about and interact with money. As these platforms continue to evolve and expand, they have the potential to revolutionize financial education and empower millions of individuals around the world to achieve financial freedom and security.

#Financial Education#Planning#Software Development#Fintech#artists on tumblr#ecommerce#xettle technologies

5 notes

·

View notes

Text

Introduction

Financial technologies environment has improved very quickly over the last 20 years. This development causes enormous challenges to national and international policy and law makers. This paper will give a brief outline of recent preparations for new Turkish Crypto Law 2024. At the beginning, it is useful to remember what the meaning of FinTech is.

For a comprehensive discussion on the FinTech Environment in Turkey, take a look at our article on FinTech Guide in Turkey

What is the meaning of FinTech?

The term “FinTech” describes emerging electronic payment methodologies based on the automation and facilitation of payment systems. Indeed FinTech contains a broad range of payment models such as electronic money institutions, payment institutions, digital banks, online insurance agencies, and crowdfunding platforms and blockchain such as crypto currencies. What is really important is that the FinTech environment is mostly dedicated to the development of faster and better delivery of financial services.

For our work and all legal services on the matter of financial technologies, please click our “Practice Areas”, titled, FinTech

For more discussion for banking and finance, take a look at our article on Banking and Finance Law in Turkey

What is the main role of FinTech ecosystem?

The main intention of financial technologies market is to facilitate shopping and trade. There are several advantages of alternative virtual payment instruments. Financial technologies provide numerous tools for individuals.

What is the news on new Turkish Crypto Law 2024?

The draft bill on Turkish Crypto Law 2024 came to the Grand National Assembly of Turkey. Draft on New Turkish Crypto Law 2024 was introduced by Mehmet Şimşek, the Ministry of Treasury and Finance to the Parliament agenda. That step is of utmost importance in the development of the digital era in Turkey. It should be remembered that the previous step for digital technologies was to recognize digital wallets by means of new regulation of the Central Bank of the Republic of Türkiye.

For more observation about digital wallet regulation, take a look at our article on Digital Wallet Era in Turkey

What is the importance of the draft bill on new Turkish Crypto Law 2024?

Main intention of the draft on New Turkish Crypto Law is to provide a compliance of the capital markets system in line with the Financial Task Force standards and principles aiming at the prevention of money laundering and terrorist financing. It is firstly intended to formulate core standards for the definition of crypto asset, crypto asset exchange platform, crypto assets service providers. Secondly, legal obligations will be placed for the certification and licensing of crypto currency service providers. In this context, Central Bank of Republic of Türkiye will be authorized for granting licensing for the establishment and operation. Thirdly, the relevant crypto asset is subject to an approval process by the Scientific and Technological Research Council of Türkiye (TÜBİTAK).

Conclusion

It would be a little earlier now to make comments on the potential results of the Law. Because it is beyond easy to imagine to what extent all articles in draft will be finalized and adopted by the Parliament. Because Parliament has a direct power to make comprehensive changes and|or rejection of the draft bill completely. Nevertheless, considering that the fundamental objective of policy makers from the draft is to introduce certification and|or licensing and the approval of blockchain instruments in Turkey. In this way, crypto assets will be regarded and recognized as capital markets instruments as well.

3 notes

·

View notes

Text

Equi Corp Legal has the best lawyers in Delhi NCR

#Corporate Disputes Litigation Lawyers in Delhi#Insolvency Bankruptcy NCLT Lawyers in Delhi#Private Equity Funds Investment Transaction Advisory M&A Lawyers in Delhi#Technology E-Commerce Fintech Blockchain Lawyers in Delhi#Regulatory Compliance Legal Audits in Delhi Noida#Director Investor Shareholder Dispute Litigation Lawyers in Delhi#Sports Gaming lawyers in Delhi#Startup Investor Lawyers in Delhi#Banking NBFC Financial Services DRT Debt Restructuring Lawyers in Delhi#Corporate lawyers in Delhi#Arbitration Lawyers in Delhi#Consumer Protection Lawyers in Delhi#Commercial Civil Disputes Litigation Lawyers in Delhi

10 notes

·

View notes

Photo

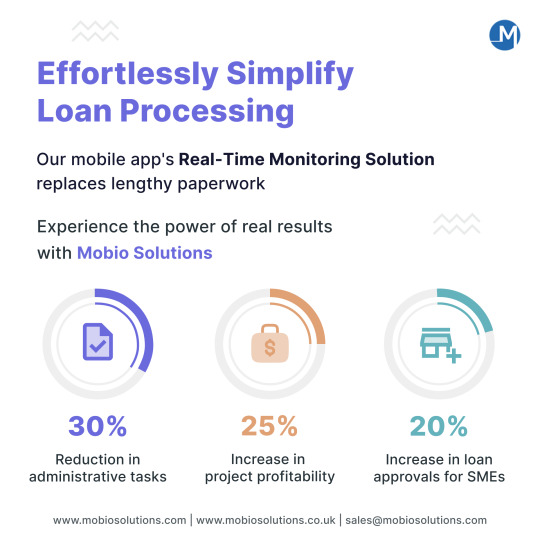

Don't miss out on this opportunity to transform your fintech business. See how our real-time monitoring mobile app solution for a leading fintech firm saved their time and money and gave them a competitive edge in the market. Don't settle for less than exceptional with Mobio Solutions!

#loanprocessing#fintech#technology#automation#startups#Business#banking#finance#financial management#payments#applicationsoftware#mobileapp#MobileAppDevelopmentCompany#mobiosolutions

8 notes

·

View notes

Text

FinThink - Financial Technology

FinThink Research will Launch by covering 20 Crypto Projects, 20 NFT Reports, and 30 Equity Reports. Covering a total of 70 profiles and updating them every quarter.

Surveillance reports will be released throughout the quarter covering news releases to keep members up to date on relevant macro events.

FinThink AI is a suite of Machine Learning Applications that will:

Forecast Stock Prices.

Provide market sentiment per individual stock or the overall stock market.

Provide Search Trends Corellated with price movements.

Risk Management forecasting Maximum Loss at a 95% and 99% probability level.

Trading Entry and Exit Points using our Trading Algorithm.

FinThink is a Financial Technology Company Headquartered in New York City.

Finthink AI is a Financial Technology Product

FinThink Finance Tools will consist of a Mortgage Calculator, a Car Buying Calculator, and a Real Estate Portfolio Building Calculator. Close every Mortgage confidently and never leave the car dealership feeling that you were taken advantage of. Learn how to build a Real Estate portfolio and build financial freedom.

FinThink Members can achieve Financial Freedom for $50 a month.

FinThink is Financial Technology.

Financial Technology is the Future of Finance.

Check out the Future of Finance at:

www.finthink.com

2 notes

·

View notes

Text

Why CIOs need embedded finance technology to moderniz

As technology becomes increasingly important to the success of any business, CIOs face a new challenge to leverage tech and deliver winning business capabilities. Previously, digital transformation decisions often took a backseat to other business initiatives. However, the move from archaic systems to emerging technologies has become a requirement to survive the constantly changing environment. Navigating our new normal and maintaining a competitive edge now falls on CIOs’ shoulders.

CIO priorities have been redefined due to recent market expansion, skyrocketing consumer expectations and behaviors, and disruptions to traditional business models. Currently, CIOs carry the burden of producing a significant impact within their organizations through digital transformation. The 2023 Gartner CIO and Technology Executive survey of over 2,000 CIOs in 81 countries and all major industries revealed that CIOs expect IT budgets to increase 5% on average this year. In an increasingly tech-driven business landscape, CIOs are expected to move beyond simply managing IT to leveraging technology to create value for the business.

Unfortunately, many tech decisions don’t get sufficient business scrutiny beyond cost and high-level strategy discussions. Corporate leaders can struggle to see the measurable value of digital transformation as they don’t understand or believe that it positively impacts the bottom line. Without a strategic approach, unsuccessful transformations are expensive, time-consuming, and not worth the effort—only 31% succeed because most are not planned or executed without a realistic year-over-year transformation game plan. This is where CIOs can articulate to other C-suite executives how the business can best use technology to develop digital-enabled capabilities that generate revenue, improve profit margins, or advance the company’s mission.

More Info: https://fintecbuzz.com/why-cios-need-embedded-finance-technology-to-modernize/

For more such Updates Log on to https://fintecbuzz.com/ Follow us on Google News Fintech News

#DIGITAL TRANSFORMATION#FINANCE INDUSTRY#FINANCIAL SERVICES#FINTECH#INVESTING#LENDING#PAYMENTS#TECHNOLOGY

3 notes

·

View notes

Text

Exploring the RegTech in Finance Market: Forecasts, Trends, and Major Industry Players

RegTech in Finance Market: A Deep Dive into Growth, Trends, and Future Prospects

The global regulatory technology (RegTech) in finance market is experiencing a transformative phase, with a rapidly growing demand for solutions that enhance regulatory compliance, risk management, and fraud prevention. Valued at USD 13,117.3 million in 2023, the market is projected to grow significantly, reaching USD 82,084.3 million by 2032, growing at an impressive compound annual growth rate (CAGR) of 22.6% during the forecast period (2024–2032). This growth is being driven by increasing regulatory pressures, the complexity of compliance requirements, and the need for more efficient and cost-effective solutions within the financial services industry.

Industry Dimensions

The RegTech market in finance refers to the use of technology, particularly software and platforms, to help financial institutions manage regulatory compliance, risk management, and other compliance-related tasks more efficiently and cost-effectively. This rapidly evolving market encompasses technologies like artificial intelligence (AI), machine learning (ML), big data analytics, blockchain, and automation tools designed to streamline regulatory processes and ensure compliance with global financial regulations.

The market's size was valued at USD 13,117.3 million in 2023, and it is projected to grow from USD 16,081.9 million in 2024 to USD 82,084.3 million by 2032, with a CAGR of 22.6% over the forecast period.

Request a Free Sample (Full Report Starting from USD 1850): https://straitsresearch.com/report/regtech-in-finance-market/request-sample

Key Industry Trends Driving Growth

Several key trends are driving the growth of the RegTech market in finance, and these include:

Increasing Regulatory Complexity: As global regulatory environments become more complex, financial institutions are under immense pressure to comply with evolving laws, such as GDPR, MiFID II, and Basel III. This has increased the demand for RegTech solutions that automate compliance processes and reduce human errors.

Adoption of AI and Machine Learning: Financial institutions are increasingly adopting AI and ML for tasks such as risk assessment, fraud detection, and regulatory reporting. These technologies can process large volumes of data quickly and accurately, helping organizations identify potential compliance issues before they become major problems.

Blockchain for Compliance: Blockchain technology is being explored as a solution to increase transparency and trust in financial transactions. It offers the potential to streamline reporting and improve the integrity of compliance data.

Cloud Adoption: Financial institutions are shifting to cloud-based solutions for scalability, flexibility, and cost-efficiency. Cloud deployment models are growing in popularity for RegTech solutions due to the increased need for faster updates and seamless integration with legacy systems.

Demand for Real-Time Monitoring: Financial institutions are increasingly focusing on real-time monitoring to detect potential fraud, money laundering activities, and other compliance violations. This trend is pushing the adoption of real-time RegTech solutions capable of providing instantaneous alerts and actions.

RegTech in Finance Market Size and Share

The market for RegTech in finance is expanding rapidly, driven by the growing need for efficient compliance and risk management solutions in the financial services sector. As regulatory requirements continue to evolve and increase in complexity, the demand for RegTech solutions is expected to rise sharply. With North America, Europe, and Asia-Pacific leading the charge, the RegTech market is set to become a cornerstone of the global financial infrastructure.

RegTech in Finance Market Statistics

Market Size (2023): USD 13,117.3 Million

Projected Market Size (2032): USD 82,084.3 Million

CAGR (2024-2032): 22.6%

The growth is driven by a wide range of applications, including anti-money laundering (AML), fraud management, regulatory reporting, and identity management, which all contribute significantly to the total market size.

Regional Trends and Impact

North America

North America holds the largest market share for RegTech in finance, driven by stringent regulatory standards and the presence of major financial hubs in the U.S. and Canada. The region's dominance is fueled by the increasing adoption of RegTech solutions across banks, insurance companies, and fintech firms to ensure compliance with regulations like Dodd-Frank, AML, and FATCA. Moreover, the region is seeing increased investments in AI and cloud technologies that are enhancing the performance of RegTech solutions.

Key Countries: United States, Canada

Europe

Europe is another significant player in the global RegTech market, with growing demand for compliance solutions in light of regulations like the General Data Protection Regulation (GDPR) and the European Market Infrastructure Regulation (EMIR). The region’s regulatory environment, particularly the EU’s focus on financial transparency, has accelerated the adoption of RegTech. Furthermore, Brexit has created a need for new compliance frameworks, propelling the demand for innovative RegTech solutions.

Key Countries: United Kingdom, Germany, France, Italy, Spain

Asia-Pacific (APAC)

The APAC region is expected to witness the highest growth in the RegTech market. As financial services become increasingly digitized in countries like China, India, and Japan, the need for robust compliance and risk management solutions is growing. The adoption of blockchain, AI, and cloud technologies is gaining momentum, and local governments are gradually introducing regulatory frameworks that demand improved compliance measures.

Key Countries: China, India, Japan, Australia, South Korea

Latin America, Middle East, and Africa (LAMEA)

The LAMEA region is experiencing a slow but steady growth in the RegTech market. Rising awareness about the importance of financial regulations and the increasing number of fintech startups in the region are driving the demand for RegTech solutions. While regulatory pressures may not be as stringent as in other regions, the need for better governance, transparency, and anti-money laundering (AML) measures is gaining traction.

Key Countries: Brazil, South Africa, UAE, Mexico

For more details: https://straitsresearch.com/report/regtech-in-finance-market/segmentation

RegTech in Finance Market Segmentations

The RegTech market in finance can be broken down into various segments, including component, deployment model, enterprise size, application, and end-user. Here’s an overview of the key segments:

By Component

Solution – Refers to the technology platforms and software used to address compliance, risk management, fraud prevention, and reporting.

Services – Includes advisory services, implementation, integration, and managed services related to RegTech solutions.

By Deployment Model

On-premises – RegTech solutions deployed within the financial institution's premises, offering enhanced security but higher upfront costs.

Cloud – Cloud-based solutions that offer flexibility, scalability, and cost-efficiency, which are growing in popularity among financial institutions.

By Enterprise Size

Large Enterprises – Large financial institutions with extensive compliance and risk management needs.

Small & Medium Enterprises (SMEs) – Smaller financial institutions that are increasingly adopting RegTech solutions to streamline operations and maintain compliance with regulatory standards.

By Application

Anti-money laundering (AML) & Fraud Management – Tools designed to detect and prevent money laundering and fraud in financial transactions.

Regulatory Intelligence – Systems that help financial institutions monitor and analyze regulatory changes.

Risk & Compliance Management – Solutions for managing risks and ensuring ongoing regulatory compliance.

Regulatory Reporting – Software that automates the creation and submission of regulatory reports.

Identity Management – Solutions that ensure secure customer authentication and prevent identity theft.

By End-User

Banks – One of the largest consumers of RegTech solutions, due to the high regulatory requirements they face.

Insurance Companies – Increasingly adopting RegTech for fraud detection and regulatory reporting.

FinTech Firms – Leveraging RegTech to maintain compliance while innovating financial products.

IT & Telecom – Supporting financial services with technology infrastructure for regulatory compliance.

Public Sector – Government entities that require RegTech to enhance transparency and financial integrity.

Energy & Utilities – These sectors are adopting RegTech to manage complex financial regulations and improve operational efficiency.

Others – Includes sectors like healthcare, retail, and real estate that also require regulatory compliance.

Top Players in the RegTech in Finance Market

Key players in the RegTech in finance market include:

Abside Smart Financial Technologies

Accuity

Actico

Broadridge

Deloitte

IBM

Fenergo

Eastnets

Nasdaq Bwise

PwC

Wolters Kluwer

Startups: Datarama, AUTHUDA, RegDelta, Seal, CHAINALYSISDetailed Table of Content of the RegTech in Finance Market Report: https://straitsresearch.com/report/regtech-in-finance-market/toc

These companies are leading innovation in the RegTech space, offering solutions that address regulatory compliance, fraud prevention, reporting, and data privacy issues in the financial industry.

Conclusion

The RegTech market in finance is poised for significant growth, driven by the increasing complexity of financial regulations and the need for efficient, cost-effective compliance solutions. The adoption of AI, blockchain, and cloud technologies is reshaping the regulatory landscape, allowing financial institutions to automate and streamline compliance processes. As the market continues to expand, financial institutions worldwide will increasingly turn to RegTech solutions to navigate regulatory challenges, manage risks, and remain competitive in a rapidly changing environment.

Purchase the Report: https://straitsresearch.com/buy-now/regtech-in-finance-market

About Straits Research

Straits Research is a top provider of business intelligence, specializing in research, analytics, and advisory services, with a focus on delivering in-depth insights through comprehensive reports.

Contact Us:

Email: [email protected]

Address: 825 3rd Avenue, New York, NY, USA, 10022

Phone: +1 646 905 0080 (US), +91 8087085354 (India), +44 203 695 0070 (UK)

#RegTech in Finance#Financial Technology#Compliance Solutions#Regulatory Technology#Anti-money Laundering#Fraud Prevention#Risk Management#Cloud-based RegTech#AI in Finance#Regulatory Reporting#Blockchain in Finance#RegTech Market Growth#Global Financial Regulations#Financial Institutions#FinTech Compliance#Risk & Compliance Management#AML Solutions#Financial Market Trends#Regulatory Intelligence#Financial Services Automation#FinTech Regulatory Solutions#Future of RegTech

0 notes

Text

Navigating recruitment in the fintech sector involves addressing challenges such as talent shortages, skill gaps, and intense competition.

#fintech recruitment#top fintech recruiting firms#best fintech recruiters#fintech recruitment agency#fintech recruiting firms#fintech executive search consultants#fintech executive recruiters#fintech executive search#fintech recruitment solutions#top fintech recruiters#financial technology recruiters#fintech industry recruiters#fintech recruitment company

0 notes

Text

Top 5 Plaid Features That Improve User Experience in Finance Apps

Plaid offers several standout features that significantly enhance user experience in finance apps by providing secure and seamless access to financial data. Among its top features are its robust bank account linking capabilities, which allow users to connect their accounts quickly and effortlessly. Its transaction categorization tools deliver valuable insights by organizing spending data into meaningful categories. Plaid also ensures a high level of security with advanced encryption and tokenization methods, safeguarding user information. Its real-time balance checks enable better financial management, while its streamlined authentication process ensures a smooth and hassle-free experience. These features collectively make Plaid an essential tool for modern finance apps.

#Financial IT Services#financial technology services#financial services it solutions#IT solutions for financial services#financial software development#financial software engineering#financial software development company#financial software development services#financial software development agency#custom financial software development#financial development company#finance software development companies#finance software development company#finance software development services#software development finance#finance software development#financial software development companies#financial mobile app development company#financial mobile app development#financial application development#fintech developments#fintech development company

0 notes

Text

How Financial Education Platforms Can Help in 2024 ?

n the rapidly evolving landscape of finance, staying financially literate is more critical than ever. As we navigate complex economic challenges and embrace technological advancements, financial education platforms play a pivotal role in empowering individuals and businesses to make informed decisions and achieve financial well-being. This article explores the transformative potential of financial education platforms in 2024, with a focus on the integration of Fintech Software and the innovative solutions offered by Xettle Technologies.

The Importance of Financial Education Platforms:

Financial education platforms serve as invaluable resources for individuals and businesses seeking to enhance their financial literacy and capabilities. In an era marked by economic uncertainty, technological disruption, and shifting regulatory landscapes, these platforms offer a wealth of educational content, tools, and resources designed to equip users with the knowledge and skills they need to navigate the complexities of finance with confidence.

Leveraging Fintech Software:

One of the key drivers of innovation in financial education platforms is the integration of Fintech Software. Fintech solutions leverage cutting-edge technologies such as artificial intelligence, machine learning, blockchain, and data analytics to revolutionize traditional financial services and empower users with new capabilities and opportunities.

In 2024, financial education platforms are leveraging Fintech Software to enhance their functionality, effectiveness, and user experience. By integrating features such as secure payment processing, real-time analytics, personalized recommendations, and interactive simulations, these platforms are able to deliver more immersive, engaging, and impactful learning experiences to users.

Xettle Technologies: Leading the Way in Fintech Innovation:

At the forefront of this technological revolution is Xettle Technologies, a leading provider of Fintech Software solutions. With a focus on innovation, reliability, and customer satisfaction, Xettle Technologies offers a range of cutting-edge solutions designed to empower individuals and businesses to thrive in the digital economy.

In 2024, Xettle Technologies continues to push the boundaries of Fintech innovation, partnering with financial education platforms to integrate its solutions and enhance their offerings. Whether it's secure payment processing, advanced analytics, blockchain integration, or compliance solutions, Xettle Technologies provides the tools and expertise needed to drive growth, efficiency, and success.

How Financial Education Platforms Can Help in 2024:

Enhanced Accessibility and Convenience: Financial education platforms leverage Fintech Software to offer more accessible and convenient learning experiences. With mobile-friendly interfaces, on-demand access to content, and personalized learning paths, users can learn anytime, anywhere, and at their own pace.

Personalized Learning Experiences: Through the integration of advanced analytics and machine learning algorithms, financial education platforms can deliver personalized learning experiences tailored to individual preferences, goals, and learning styles. By analyzing user behavior, preferences, and performance, these platforms can provide customized recommendations, targeted content, and adaptive learning pathways that maximize engagement and effectiveness.

Real-time Insights and Feedback: Fintech Software enables financial education platforms to provide real-time insights and feedback to users. Whether it's tracking progress, monitoring spending habits, or analyzing investment performance, these platforms offer users valuable insights into their financial behaviors and decisions, empowering them to make informed choices and take control of their financial futures.

Gamification and Interactivity: Financial education platforms leverage gamification techniques and interactive simulations to make learning fun, engaging, and effective. By incorporating elements such as quizzes, challenges, simulations, and virtual scenarios, these platforms enhance user engagement, motivation, and retention, transforming the learning experience into a more immersive and enjoyable journey.

Comprehensive Content and Resources: With access to a vast array of educational content, tools, and resources, financial education platforms empower users with the knowledge and skills they need to succeed in today's complex financial landscape. From basic financial concepts to advanced investment strategies, these platforms offer comprehensive resources covering a wide range of topics relevant to users' needs and interests.

Conclusion:

In 2024, financial education platforms are poised to play an even more significant role in empowering individuals and businesses to achieve financial literacy and success. By leveraging Fintech Software and partnering with innovative providers like Xettle Technologies, these platforms are delivering more accessible, personalized, and impactful learning experiences than ever before. As we embrace the opportunities of the digital age, financial education platforms stand ready to empower us all to navigate the complexities of finance with confidence and competence.

#Financial Education#Platform#Fintech#Fintech Software#Fintech Service#artists on tumblr#xettle technologies#technology#viral trends#fi̇ntech

3 notes

·

View notes

Text

How FinTech is being empowered with AI and analytics

New Post has been published on https://thedigitalinsider.com/how-fintech-is-being-empowered-with-ai-and-analytics/

How FinTech is being empowered with AI and analytics

This article was adapted from one of our previous virtual FP&A Summits, featuring Amit Kurhekar, Head of Data at MoneyLion.

Unless you’ve been consistently offline over the last few years, you’ll know that the financial industry is undergoing a significant transformation driven by AI and machine learning technologies.

This revolution isn’t just about adopting new technologies but about changing how financial services and processes are delivered and experienced by consumers.

In this article, we’ll explore some of the most compelling AI and ML strategies in finance with use cases to show how they work in real-life scenarios.

Whether you’re a financial professional or simply interested in the evolving landscape of FinTech, this article offers valuable insights into the intersection of finance, AI, and digital transformation.

Case study: Day in the life of ‘financially savvy’ John

Let me introduce you to John. He considers himself to be very financially savvy, he’s in his 30s, intelligent and he uses a smartphone like so many of us.

One day, he receives a notification on his phone that reads:

“John, your utility bill of $50 is due tomorrow. Do you want to pay now?”

A few seconds later, another notification comes through,

“John, your net-worth increased by 1% last week with Apple stock making the maximum gains.”

John gets on with his day. He goes to work, enjoys chatting to his co-workers, and then in the afternoon, he notices yet another notification on his phone. This one says,

“John, you have excess balance in your savings account. Invest 20% of the amount to earn an extra 8% vs keeping in your savings account. Invest now?”

These are smart notifications and nudges and in today’s financial world, it’s a reality. If you’re not using technology to help improve your finances, you’re missing out.

By embracing AI and ML, you can make a huge impact not just in your role but also in your daily life.

Pillars of digital transformation

Within digital transformation, there are emerging technologies. Most companies are utilizing these emerging technologies to drive and improve consumer experiences. These include things like internet of things (IoT), robotics, AR/VR and Cloud.

Before 2020, not many people were working online or working from home, and then almost the majority of the IT workforce moved into remote working. The transformation from almost everyone working in-office to everyone working remotely because of Covid meant that many people had to embrace technology in new ways. There was a huge mobilization of IT and IT infrastructure.

I think that both AI and ML are critical pieces that are enabling today’s world. So, a part of that could be coming as simple as receiving smart nudges throughout the day on your smartphone or you could even have nudges to help you forecast numbers for your financial forecast.

This post is for paying subscribers only

Subscribe now

Already have an account? Sign in

Become a member to see the rest

Certain pieces of content are only to AIAI members and you’ve landed on one of them. To access tonnes of articles like this and more, get yourself signed up.

Subscribe now

Already a member? Awesome Sign in

#ai#amp#Analytics#apple#ar#Article#Articles#Artificial Intelligence#Case Study#Cloud#Companies#consumers#content#covid#data#Digital Transformation#emerging technologies#Experienced#expert insights#finance#finances#financial#Financial industry#financial services#fintech#forecast#how#impact#Industry#Infrastructure

0 notes

Text

Exploring the Future of Finance with Open Banking

Exploring the Future oOpen banking has emerged as a revolutionary force, transforming the financial services industry. Open banking technology enables individuals and organizations to securely share financial data with third-party suppliers. This innovation opens up new opportunities for improved client experiences, increased competition, and the democratization of financial services. We will examine at the key components of open banking, including its merits, drawbacks, and the future of this disruptive trend.f Finance with Open Banking. Read more

0 notes

Text

Lawsuit Challenges CFPB’s ‘Buy Now, Pay Later’ Rule

On Oct. 18, 2024, fintech trade group Financial Technology Association (FTA) filed a lawsuit challenging the Consumer Financial Protection Bureau’s (CFPB) final interpretative rule on “Buy Now, Pay Later” (BNPL) products. Released in May 2024, the CFPB’s interpretative rule classifies BNPL products as “credit cards” and their providers as “card issuers” and “creditors” for purposes of the Truth…

#administrative procedure act#APA#BNPL#buy now pay later#card issuers#CFPB#Consumer Financial Protection Bureau#credit cards#creditors#District Court for the District of Columbia#Financial Technology Association#fintech#FTA#interpretive rule#lawsuit#Regulation Z#TILA#Truth in Lending Act

0 notes

Text

How Tech is Transforming the Financial Industry

Are you curious about how the world of finance is changing as a result of digital finance? The most recent developments in technology are transforming every aspect of corporate operations and consumer experiences, ranging from big data and AI to blockchain and mobile banking. Financial institutions are competing for leadership positions as customized, on-demand services become more and more important in boosting consumer satisfaction, particularly among millennials and Gen Z. Digital transformation is essential for maintaining competitiveness, whether it be through quicker transactions, wiser choices, or game-changing goods. Interested in learning how these trends might help your company? Explore the potential of digital finance and its implications for the future of banking by reading our most recent blog!

1 note

·

View note