#Global Green Hydrogen Market industry

Explore tagged Tumblr posts

Text

The Global Green Hydrogen Market is projected to grow at a CAGR of around 15.7% during the forecast period, i.e., 2023-28. The market is driven by the escalating emissions, including carbon & methane, in the environment and their ill effects on environment sustainability & health. It, in turn, is instigating the governments of different countries to bring favorable policies and encourage the development, production, and utilization of green hydrogen as an alternative to widely used hydrogen across industries for energy. The role of the governments of different countries is highly prevalent in this industry & contributes substantially to exploring the potential of green hydrogen in the coming years.

#Global Green Hydrogen Market#Global Green Hydrogen Market growth#Global Green Hydrogen Market size#Global Green Hydrogen Market industry

0 notes

Text

Global Green Hydrogen Size, Trends, Report 2022–2028

Green hydrogen is produced exclusively from sustainable resources. Grey hydrogen, which makes up 95% of the market and is produced by steam reforming natural gas, produces substantially less CO2 than green hydrogen.

Utilizing green hydrogen as a bridge between them, the green electricity or power can be transformed into a fuel for transportation or used as a feedstock in industrial processes.

Read More: https://introspectivemarketresearch.com/reports/green-hydrogen-market/

#Global Green Hydrogen Market size#Global Green Hydrogen Market growth#Global Green Hydrogen Market share#Global Green Hydrogen Market industry

0 notes

Text

Green Ammonia Market Statistics, Segment, Trends and Forecast to 2033

The Green Ammonia Market: A Sustainable Future for Agriculture and Energy

As the world pivots toward sustainable practices, the green ammonia market is gaining momentum as a crucial player in the transition to a low-carbon economy. But what exactly is green ammonia, and why is it so important? In this blog, we'll explore the green ammonia market, its applications, benefits, and the factors driving its growth.

Request Sample PDF Copy:https://wemarketresearch.com/reports/request-free-sample-pdf/green-ammonia-market/1359

What is Green Ammonia?

Green ammonia is ammonia produced using renewable energy sources, primarily through the electrolysis of water to generate hydrogen, which is then combined with nitrogen from the air. This process eliminates carbon emissions, setting green ammonia apart from traditional ammonia production, which relies heavily on fossil fuels.

Applications of Green Ammonia

Agriculture

One of the most significant applications of green ammonia is in agriculture. Ammonia is a key ingredient in fertilizers, and its sustainable production can help reduce the carbon footprint of farming. By using green ammonia, farmers can produce food more sustainably, supporting global food security while minimizing environmental impact.

Energy Storage

Green ammonia can also serve as an effective energy carrier. It can be synthesized when there is surplus renewable energy and later converted back into hydrogen or directly used in fuel cells. This capability makes it an attractive option for balancing supply and demand in renewable energy systems.

Shipping Fuel

The maritime industry is under increasing pressure to reduce emissions. Green ammonia has emerged as a potential zero-emission fuel for ships, helping to decarbonize one of the most challenging sectors in terms of greenhouse gas emissions.

Benefits of Green Ammonia

Environmental Impact

By eliminating carbon emissions during production, green ammonia significantly reduces the environmental impact associated with traditional ammonia. This aligns with global efforts to combat climate change and achieve sustainability goals.

Energy Security

Investing in green ammonia can enhance energy security. As countries strive to reduce their dependence on fossil fuels, green ammonia offers a renewable alternative that can be produced locally, minimizing reliance on imported fuels.

Economic Opportunities

The growth of the green ammonia market presents numerous economic opportunities, including job creation in renewable energy sectors, research and development, and new supply chain dynamics. As demand increases, investments in infrastructure and technology will drive innovation.

Factors Driving the Growth of the Green Ammonia Market

Regulatory Support

Governments worldwide are implementing policies and incentives to promote the adoption of green technologies. These regulations often include subsidies for renewable energy production and carbon pricing mechanisms, making green ammonia more competitive.

Rising Demand for Sustainable Solutions

With consumers and businesses becoming increasingly aware of their environmental impact, the demand for sustainable solutions is on the rise. Green ammonia aligns with this trend, providing an eco-friendly alternative to traditional ammonia.

Advancements in Technology

Ongoing advancements in electrolysis and ammonia synthesis technologies are making the production of green ammonia more efficient and cost-effective. As these technologies mature, they will further enhance the viability of green ammonia in various applications.

Conclusion

The green ammonia market represents a promising avenue for sustainable development across agriculture, energy, and transportation sectors. As technology advances and regulatory support strengthens, green ammonia is poised to become a cornerstone of the global transition to a greener economy. Investing in this market not only contributes to environmental preservation but also opens up new economic opportunities for innovation and growth.

#The Green Ammonia Market: A Sustainable Future for Agriculture and Energy#As the world pivots toward sustainable practices#the green ammonia market is gaining momentum as a crucial player in the transition to a low-carbon economy. But what exactly is green ammon#and why is it so important? In this blog#we'll explore the green ammonia market#its applications#benefits#and the factors driving its growth.#Request Sample PDF Copy:https://wemarketresearch.com/reports/request-free-sample-pdf/green-ammonia-market/1359#What is Green Ammonia?#Green ammonia is ammonia produced using renewable energy sources#primarily through the electrolysis of water to generate hydrogen#which is then combined with nitrogen from the air. This process eliminates carbon emissions#setting green ammonia apart from traditional ammonia production#which relies heavily on fossil fuels.#Applications of Green Ammonia#Agriculture#One of the most significant applications of green ammonia is in agriculture. Ammonia is a key ingredient in fertilizers#and its sustainable production can help reduce the carbon footprint of farming. By using green ammonia#farmers can produce food more sustainably#supporting global food security while minimizing environmental impact.#Energy Storage#Green ammonia can also serve as an effective energy carrier. It can be synthesized when there is surplus renewable energy and later convert#Shipping Fuel#The maritime industry is under increasing pressure to reduce emissions. Green ammonia has emerged as a potential zero-emission fuel for shi#helping to decarbonize one of the most challenging sectors in terms of greenhouse gas emissions.#Benefits of Green Ammonia#Environmental Impact#By eliminating carbon emissions during production#green ammonia significantly reduces the environmental impact associated with traditional ammonia. This aligns with global efforts to combat

0 notes

Text

ESSEN, Germany (AP) — For most of this century, Germany racked up one economic success after another, dominating global markets for high-end products like luxury cars and industrial machinery, selling so much to the rest of the world that half the economy ran on exports.

Jobs were plentiful, the government's financial coffers grew as other European countries drowned in debt, and books were written about what other countries could learn from Germany.

No longer. Now, Germany is the world’s worst-performing major developed economy, with both the International Monetary Fund and European Union expecting it to shrink this year.

It follows Russia's invasion of Ukraine and the loss of Moscow's cheap natural gas — an unprecedented shock to Germany’s energy-intensive industries, long the manufacturing powerhouse of Europe.

The sudden underperformance by Europe's largest economy has set off a wave of criticism, handwringing and debate about the way forward.

Germany risks “deindustrialization” as high energy costs and government inaction on other chronic problems threaten to send new factories and high-paying jobs elsewhere, said Christian Kullmann, CEO of major German chemical company Evonik Industries AG.

From his 21st-floor office in the west German town of Essen, Kullmann points out the symbols of earlier success across the historic Ruhr Valley industrial region: smokestacks from metal plants, giant heaps of waste from now-shuttered coal mines, a massive BP oil refinery and Evonik's sprawling chemical production facility.

These days, the former mining region, where coal dust once blackened hanging laundry, is a symbol of the energy transition, dotted with wind turbines and green space.

The loss of cheap Russian natural gas needed to power factories “painfully damaged the business model of the German economy,” Kullmann told The Associated Press. “We���re in a situation where we’re being strongly affected — damaged — by external factors.”

After Russia cut off most of its gas to the European Union, spurring an energy crisis in the 27-nation bloc that had sourced 40% of the fuel from Moscow, the German government asked Evonik to keep its 1960s coal-fired power plant running a few months longer.

The company is shifting away from the plant — whose 40-story smokestack fuels production of plastics and other goods — to two gas-fired generators that can later run on hydrogen amid plans to become carbon neutral by 2030.

One hotly debated solution: a government-funded cap on industrial electricity prices to get the economy through the renewable energy transition.

The proposal from Vice Chancellor Robert Habeck of the Greens Party has faced resistance from Chancellor Olaf Scholz, a Social Democrat, and pro-business coalition partner the Free Democrats. Environmentalists say it would only prolong reliance on fossil fuels.

Kullmann is for it: “It was mistaken political decisions that primarily developed and influenced these high energy costs. And it can’t now be that German industry, German workers should be stuck with the bill.”

The price of gas is roughly double what it was in 2021, hurting companies that need it to keep glass or metal red-hot and molten 24 hours a day to make glass, paper and metal coatings used in buildings and cars.

A second blow came as key trade partner China experiences a slowdown after several decades of strong economic growth.

These outside shocks have exposed cracks in Germany's foundation that were ignored during years of success, including lagging use of digital technology in government and business and a lengthy process to get badly needed renewable energy projects approved.

Other dawning realizations: The money that the government readily had on hand came in part because of delays in investing in roads, the rail network and high-speed internet in rural areas. A 2011 decision to shut down Germany's remaining nuclear power plants has been questioned amid worries about electricity prices and shortages. Companies face a severe shortage of skilled labor, with job openings hitting a record of just under 2 million.

And relying on Russia to reliably supply gas through the Nord Stream pipelines under the Baltic Sea — built under former Chancellor Angela Merkel and since shut off and damaged amid the war — was belatedly conceded by the government to have been a mistake.

Now, clean energy projects are slowed by extensive bureaucracy and not-in-my-backyard resistance. Spacing limits from homes keep annual construction of wind turbines in single digits in the southern Bavarian region.

A 10 billion-euro ($10.68 billion) electrical line bringing wind power from the breezier north to industry in the south has faced costly delays from political resistance to unsightly above-ground towers. Burying the line means completion in 2028 instead of 2022.

Massive clean energy subsidies that the Biden administration is offering to companies investing in the U.S. have evoked envy and alarm that Germany is being left behind.

“We’re seeing a worldwide competition by national governments for the most attractive future technologies — attractive meaning the most profitable, the ones that strengthen growth,” Kullmann said.

He cited Evonik’s decision to build a $220 million production facility for lipids — key ingredients in COVID-19 vaccines — in Lafayette, Indiana. Rapid approvals and up to $150 million in U.S. subsidies made a difference after German officials evinced little interest, he said.

“I'd like to see a little more of that pragmatism ... in Brussels and Berlin,” Kullmann said.

In the meantime, energy-intensive companies are looking to cope with the price shock.

Drewsen Spezialpapiere, which makes passport and stamp paper as well as paper straws that don't de-fizz soft drinks, bought three wind turbines near its mill in northern Germany to cover about a quarter of its external electricity demand as it moves away from natural gas.

Specialty glass company Schott AG, which makes products ranging from stovetops to vaccine bottles to the 39-meter (128-foot) mirror for the Extremely Large Telescope astronomical observatory in Chile, has experimented with substituting emissions-free hydrogen for gas at the plant where it produces glass in tanks as hot as 1,700 degrees Celsius.

It worked — but only on a small scale, with hydrogen supplied by truck. Mass quantities of hydrogen produced with renewable electricity and delivered by pipeline would be needed and don't exist yet.

Scholz has called for the energy transition to take on the “Germany tempo,” the same urgency used to set up four floating natural gas terminals in months to replace lost Russian gas. The liquefied natural gas that comes to the terminals by ship from the U.S., Qatar and elsewhere is much more expensive than Russian pipeline supplies, but the effort showed what Germany can do when it has to.

However, squabbling among the coalition government over the energy price cap and a law barring new gas furnaces has exasperated business leaders.

Evonik's Kullmann dismissed a recent package of government proposals, including tax breaks for investment and a law aimed at reducing bureaucracy, as “a Band-Aid.”

Germany grew complacent during a “golden decade” of economic growth in 2010-2020 based on reforms under Chancellor Gerhard Schroeder in 2003-2005 that lowered labor costs and increased competitiveness, says Holger Schmieding, chief economist at Berenberg bank.

“The perception of Germany's underlying strength may also have contributed to the misguided decisions to exit nuclear energy, ban fracking for natural gas and bet on ample natural gas supplies from Russia,” he said. “Germany is paying the price for its energy policies.”

Schmieding, who once dubbed Germany “the sick man of Europe” in an influential 1998 analysis, thinks that label would be overdone today, considering its low unemployment and strong government finances. That gives Germany room to act — but also lowers the pressure to make changes.

The most important immediate step, Schmieding said, would be to end uncertainty over energy prices, through a price cap to help not just large companies, but smaller ones as well.

Whatever policies are chosen, “it would already be a great help if the government could agree on them fast so that companies know what they are up to and can plan accordingly instead of delaying investment decisions," he said.

7 notes

·

View notes

Text

Exploring the Global Aldehydes Market: Key Players and Market Dynamics

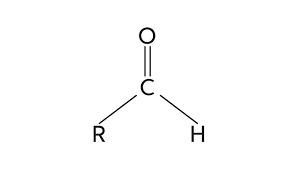

The aldehydes market is a segment of the chemical industry that deals with the production and distribution of a class of organic compounds known as aldehydes. These compounds are characterized by the presence of a carbonyl group (C=O) bonded to a hydrogen atom and a carbon atom in their chemical structure. Aldehydes find widespread applications in various industries, thanks to their unique properties and versatile reactivity.

In terms of market overview, the aldehydes market has been experiencing steady growth in recent years. This growth can be attributed to the increasing demand for aldehydes in industries such as pharmaceuticals, agriculture, food and beverages, and cosmetics. Aldehydes serve as crucial intermediates in the synthesis of various chemicals and are essential in the production of fragrances, flavor enhancers, and pharmaceuticals.

The growth in the aldehydes market industry can be primarily attributed to the expansion of these end-user industries. For instance, the pharmaceutical industry relies heavily on aldehydes for the synthesis of a wide range of drugs and active pharmaceutical ingredients (APIs). Additionally, the food and beverage industry utilizes aldehydes for flavor enhancement and preservation purposes, further driving market growth.

The aldehydes market is also influenced by evolving industry trends. One significant trend is the increasing emphasis on green chemistry and sustainable practices. Many companies in the aldehydes sector are adopting environmentally friendly production processes, such as catalytic hydrogenation, to reduce the environmental impact of their operations. This trend aligns with the growing awareness of environmental issues and the need for more eco-friendly chemical manufacturing.

Another noteworthy trend is the constant innovation and development of novel aldehyde derivatives with enhanced properties. This innovation is driven by the demand for higher-quality products in various industries. Researchers and manufacturers are continuously exploring new applications and synthesizing aldehydes tailored to meet specific industry requirements, which contributes to market expansion.

In conclusion, the aldehydes market is a dynamic segment within the chemical industry, driven by the increasing demand from various end-user industries. As industries continue to grow and evolve, the market is expected to witness further advancements, particularly in sustainable production methods and novel aldehyde derivatives, to meet the changing needs of consumers and businesses alike.

2 notes

·

View notes

Text

Hydrogen Market & Opportunity in India

Positive market momentum for hydrogen with 200+ projects announced globally – GW scale projects fast catching the pace as well

There has been a great buzz around entire H2 value chain projects across the globe with around 17 giga-scale production projects (i.e., >1 GW for renewable and over 200 thousand tons per annum of low-carbon hydrogen) already announced. Europe, Asia and Oceania are the leading regions comprising bulk of hydrogen value chain projects. With focus upon greener source of energy generation and reducing carbon emissions in transport projects it is quintessential to look H2 as a tenable alternative.

Currently, of the total projects close to 55% are housed in Europe. However, the demand centers are spread well across not only in Europe but also in countries like that of Japan and South Korea. The focus for Asian countries lie upon the road transportation applications, green ammonia, LH2 & LOHC projects, while Europe seems to have championed multiple integrated hydrogen economy projects. The major driver has been the development in cross industry and policy co-operation from which India can draw a leaf in order to build an even environment for H2 development in the country.

Why green H2 is pegged as a game-changer in India?

India has been no different when it comes to investments for H2 from the world in terms of sentiments to say the least. With companies like Reliance, Adani, IOCL and NTPC all geared up with ambitious green H2 plans, India certainly looks poised for a carbon free transition. Also, with National Hydrogen Mission the country aims to become the largest exporter and producer of green H2. Strategic collaborations, massive technological investments and ideal policy & regulatory interface for Indian firms is shaping the green H2 market in the country to acquire a fast pace by 2025. This shall be inline with projections that by 2050, 3/4th of all the hydrogen produced shall be green produced by renewable energy and electrolysis.

For India, the scene shall be dominated by low-cost renewable projects like solar PV electrolysis or wind-based electrolysis could see the green hydrogen cost as low as $1.5/kg to $2.3/kg which shall increase the competitiveness by 2030, respectively. Thus, India shall be the destination next for global investments for green hydrogen projects.

https://store.eninrac.com/reports/hydrogen-market-and-opportunity-in-india

2 notes

·

View notes

Text

In January, after New York-based short seller Hindenburg Research released a report accusing Adani Group of accounting fraud and stock manipulation, the Indian conglomerate defended itself by appealing to nationalism. “This is … a calculated attack on India, the independence, integrity and quality of Indian institutions, and the growth story and ambition of India,” the group said in a 413-page response refuting the allegations.

It is no surprise that Adani Group tied itself to India’s “growth story.” The industrial empire of Gautam Adani, the group’s founder, has been key to Prime Minister Narendra Modi’s vision for India, which centers on big infrastructure projects as drivers of growth. In turn, Adani’s support for Modi’s nation-building plans, from airports to green hydrogen plants, has propelled his conglomerate’s meteoric rise. From 2014 to December 2022, Adani Group’s market capitalization soared from $6.5 billion to more than $223 billion.

Hindenburg’s report triggered a sudden reversal, however. The value of Adani Group’s publicly traded stocks soon fell by more than half—a rout that has continued a month after the report’s release. Modi has chosen to remain quiet about the affair, even as it has raised serious questions about India’s economy.

If Adani Group seeks refuge from criticism by tying its success to that of India’s, then the converse must also be reckoned with: The collapse of its shares represents a stress test for India’s growth project. It has cast doubt on whether Modi’s strategy of propping up a few favored corporate titans can translate into lasting results on the ground. And, beyond that, whether Modi’s India can deliver on hopes that it could become a driver of global economic growth, as China was for the past three decades.

Modi’s rise has long been intertwined with that of Adani’s. As chief minister of Gujarat from 2001 to 2014, Modi made his name through his so-called Gujarat model of development, with its large infrastructure projects, such as dams, extensive highways, and solar power plants. Adani was critical not just to constructing many of these projects but also to bringing big business around to the idea of Modi as a potential prime minister. After Modi was elected in 2014, he flew from Gujarat to his new home of New Delhi in Adani’s private jet.

As Modi became India’s most popular leader since the republic’s first prime minister, Jawaharlal Nehru, Adani’s business interests expanded. His conglomerate partnered with the government on critical infrastructure projects within India and, increasingly, abroad. Since Modi entered office, Adani’s net worth increased by more than 5,000 percent to $150 billion in September 2022, making him Asia’s richest man before the scandal. His wealth came largely on the back of winning government contracts; expanding into strategic sectors, such as clean energy and defense; and building critical infrastructure projects. For instance, Adani Group secured seven out of the eight airports that the Indian government leased out to private companies. These kinds of contracts, in turn, led to more interest in Adani Group stock from investors.

The government has undoubtedly placed its trust in Adani, but the Hindenburg report could be a stumbling block in Modi’s plans to ensure that India remains the world’s fastest-growing major economy. After the brutal stock rout, the group called off a $2.5 billion share sale and had to delay its expansion plans. A margin call followed, leading Adani to prepay a $1.1 billion loan. Meanwhile, French energy giant TotalEnergies has put on hold a $4 billion investment in an Adani Group green hydrogen project.

Over his tenure, Modi has been unwilling or unable to push through structural reform that would allow more companies to enter new sectors without significant risk-taking. He therefore has no option but to depend on national champions, such as Adani. But even among Indian billionaires, Adani is unique. Very few businesspeople enjoy the government’s confidence, can navigate dizzying state regulation, and, most of all, are willing to risk enormous amounts of capital.

In 2015, Credit Suisse published its House of Debt report, which examined the precarious debt levels of 10 prominent Indian business groups with a significant presence in various infrastructure sectors. Out of the 10 groups, many have ended up in bankruptcy courts in recent years, while others have pursued debt consolidation plans. Only one group—the Adani conglomerate—has continued to borrow and invest at a breathtaking pace.

The Economist has estimated that the combined revenues of companies controlled by Adani and fellow tycoon Mukesh Ambani, chair of India’s Reliance Industries, are equivalent to 4 percent of India’s GDP. Firms controlled by the pair also account for nearly a quarter of the capital spending of all publicly traded non-financial firms.

While many analysts fret over whether Adani Group is too big to fail, the more pertinent question is whether Adani has been too integral to the Indian economic project to fail.

Modi now faces a difficult dilemma. On the one hand, he relies heavily on large infrastructure development delivered by India’s billionaires. For example, Adani plans to develop massive renewable energy projects—and without them, India would find it challenging to fulfill its commitment to meet 50 percent of its energy requirements with renewables by 2030.

On the other hand, if Modi continues to protect Adani—as India’s opposition has alleged—by not addressing Hindenburg’s allegations, he runs the risk of undermining the credibility of India’s corporate governance and, by extension, its growth narrative.

Although India’s financial regulatory institutions are far from perfect, India has an established history of investigating and punishing financial fraud. The Adani Group scandal, however, has cast doubt on the ability of these institutions—such as the Securities and Exchange Board of India (SEBI), the country’s capital markets regulator—to operate independently.

It’s worth asking whether the Adani saga could have been anticipated, investigated, and defused long before Hindenburg came along if watchdogs had done their job.

Consider, for instance, a puzzling question that Hindenburg has sought to address: What explains the mind-boggling rise in the price of many Adani Group stocks? The price-to-earnings ratio of Adani Enterprises, the conglomerate’s flagship entity, went from 37.6 to 343.9 in just two years. But as experts have pointed out, growth of that nature is typically seen in companies in the technology sector, not brick-and-mortar industries.

There could be innocuous explanations, but the fact that the company’s board of directors didn’t examine the issue publicly opened the door for worrying allegations put forth by Hindenburg. In particular, the short seller has alleged that Adani Group’s stocks are being inflated by the conglomerate itself through secretive offshore entities.

This brings us to the question of what India’s stock market and banking regulators were doing. Long before Hindenburg came along, news outlets had pointed to the existence of three Mauritius-based funds that appeared to only invest in Adani Group companies and whose ultimate ownership was opaque. Why weren’t these funds forced to furnish details of their ownership structure at any point in the last few years and nip allegations of “round-tripping” in the bud?

In addition, SEBI continued to sign off on the conglomerate’s fundraising proposals even though the Indian government disclosed in Parliament in 2021 that SEBI had begun a probe to investigate some Adani Group companies over “non-compliance of rules.” It’s unclear what the scope of the SEBI investigation was and whether it has concluded.

For years, India’s beleaguered political opposition has accused regulatory authorities of corruption and raised allegations of crony capitalism, specifically pointing to Adani. But given the opposition’s lack of specific allegations made against SEBI, it seems more likely that the economy and stock market’s overseers are simply indifferent and plagued by inertia. Regardless, these accusations, and the Adani Group controversy, have not hurt Modi’s popularity, thanks in part to his administration’s tight control over the mainstream media.

Yet there may be consequences that stem from outside of India’s borders. It’s possible that global investors will become less bullish on India if they think that Indian business empires won’t be able to build necessary infrastructure or be reined in by domestic regulatory systems. Overseas partnerships and joint ventures could face headwinds as well, just as the Adani-TotalEnergies partnership has.

A fair, independent, and transparent probe into the allegations against Adani Group could ease these fears. Modi has so far ignored demands for one made by opposition political parties. But continuing to do so could very well be damaging to the long-term economic interests of India, and the world, even if it does not hurt Modi politically in the short term.

3 notes

·

View notes

Text

SmartGen | SmartGen Attended the AMIM-CCEC Diesel Electric Summit 2024

A touch of blue stirs in the heart, as everyone harbors a dream of the sea: it is freedom, a faraway self-exile, the spirit of adventure and exploration of medieval seafarers, a fusion of passion and dreams. In that fleeting moment before setting sail: be it aboard a cruise ship where sea and sky meet, or on a fishing boat with flickering lights. There is both liberation and guardianship at sea: from the sailors on cargo ships sending messages of homesickness, to the engineers maintaining equipment on drilling platforms or in ship cabins.

ince the start of the 21st century, advancements in shipbuilding and navigation technologies have driven cultural exchanges, technological innovations, and diversity. Each step forward in ship technology opens the door to a new era. As a leader in domestic intelligent control systems, SmartGen has made efforts to bring its top-quality marine control products to the overseas market. Recently, we proudly attended the AMIM-CCEC Diesel Electric Summit 2024. The event brought together top experts in global shipping and prominent figures from local marine associations, including representatives from Chongqing Cummins Engine Company (CCEC) and Bureau Veritas (BV). The discussions and exchanges on market prospects, major trends, and carbon reduction were proactive, in-depth and influential.

The summit emphasized that technological innovation continues to lead the shipping industry forward, with ship propulsion shifting from diesel to hybrid and fully electric systems, signaling the technological revolution on the horizon. How do we make a green and clean energy transition? Our marine product line ranges from the well-developed HMC9000A control system, HPM6 parallel controller to the hybrid system solutions. SmartGen has always been focused on delivering cleaner, more efficient energy control solutions.

SmartGen Hybrid Energy Control System HMU8N-EMS

HMU8N-EMS Hybrid Energy Control System is used for hybrid energy system consists of solar energy, wind energy, energy storage battery, hydrogen fuel cell, mains supply and diesel genset. It can read and display the data and status of various energies, control the power distribution, customize the control policy and support multiple control modes. The communication protocol is customized and the touch screen display LCD is configurable by PC, the operation policy or control logic can be written by using the built-in PLC. It is suitable for hybrid energy systems with flexible configuration and easy operation.

SmartGen Micro-Grid Controller HEMS200

HEMS200 Micro-Grid Controller is developed based on Linux operation system that can make the power system work in intelligent and high efficiency way and expand intelligent modules to realize more functions. The product can provide more powerful, user-friendly and convenient interface, support the management and real-time communication of PCS, rectifier, solar module, wind power module, inverter module, DC/DC module, diesel genset, lead-acid/lithium-ion battery, liquid cooling/air cooling, intelligent breaker, ATS, AC energy meter, DC energy meter, collect important data of all communication substations, then control the whole system to operate orderly and reliably through the data acquisition, processing, analysis and logical operation of internal program.

This summit gave us a wealth of insights and connections with experts in the field. We extend special thanks to our partners Cummins and AMIM Chairman Mr. Adren Siow for their high praise. SmartGen will keep pushing forward in marine power control, joining hands with partners to drive innovation in marine power and control technology, and building a clean, efficient, and sustainable energy system.

www.smartgen.cn

0 notes

Text

Global Green Hydrogen in Synthetic Fuel Production Market: A Deep Dive

The global push for decarbonization has spotlighted green hydrogen as a sustainable solution for numerous industries, including synthetic fuel production. This sector is positioned to grow significantly, with an impressive compound annual growth rate (CAGR) of 41.3% from 2024 to 2032. Let’s explore how green hydrogen is transforming synthetic fuel production, the market drivers and challenges, and its potential impact on the global energy landscape.

For more details: https://www.xinrenresearch.com/reports/global-green-hydrogen-in-synthetic-fuel-production-market/

For more similar reports: https://www.xinrenresearch.com/

1. Introduction to Green Hydrogen and Synthetic Fuels

Green hydrogen, produced via renewable energy-driven electrolysis, emits no carbon emissions, making it an environmentally friendly alternative to fossil fuels. Synthetic fuels, on the other hand, are hydrocarbons manufactured through chemical processes, allowing for a drop-in replacement to conventional fossil fuels. When green hydrogen is used as a feedstock in synthetic fuel production, it creates a cleaner energy source that can be employed in sectors where direct electrification may not be feasible, such as aviation, maritime, and heavy transportation.

Importance of Green Hydrogen in Synthetic Fuels

Green hydrogen offers a viable solution to decarbonize synthetic fuels, which have typically relied on fossil-derived feedstocks. By integrating green hydrogen, synthetic fuels become carbon-neutral, helping nations achieve net-zero targets.

2. Market Drivers

The significant growth in the global green hydrogen for synthetic fuel production market is fueled by several key factors:

Climate Commitments and Decarbonization Goals: Nations worldwide are committing to climate targets aligned with the Paris Agreement, necessitating a shift to low or zero-carbon technologies. The use of green hydrogen in synthetic fuels plays a central role in meeting these ambitious goals.

Government Policies and Incentives: Governments are increasingly incentivizing green hydrogen production through subsidies, tax benefits, and grants to accelerate adoption. Policies in the European Union, United States, and Asia are particularly supportive, encouraging investments in green hydrogen infrastructure.

Energy Security and Diversification: Green hydrogen offers a way for nations to reduce dependence on fossil fuel imports, increasing energy resilience. As synthetic fuels can be produced domestically with green hydrogen, they provide a more stable and sustainable energy source.

Technological Advancements in Electrolysis: The development of more efficient electrolyzers has made green hydrogen production economically feasible. Innovations continue to lower production costs, making green hydrogen a competitive option in synthetic fuel production.

3. Market Challenges

Despite its potential, several barriers need to be overcome to ensure the widespread adoption of green hydrogen in synthetic fuel production:

High Production Costs: Green hydrogen is currently more expensive to produce than grey or blue hydrogen. The high capital cost of electrolysis and renewable energy integration remains a challenge for profitability.

Infrastructure Limitations: Hydrogen infrastructure, including transport and storage, is still underdeveloped in many regions. A lack of established supply chains can hinder scaling synthetic fuel production using green hydrogen.

Energy Requirements for Electrolysis: Green hydrogen production is energy-intensive, necessitating large amounts of renewable energy. Limited access to or high costs of renewable energy can constrain production scalability.

Market Competitiveness: Competing against low-cost fossil fuels remains a significant hurdle. Until green hydrogen production costs can rival fossil fuels, synthetic fuels produced from green hydrogen may remain less attractive from a cost perspective.

4. Technological Advancements Driving Market Growth

Technological progress in hydrogen production and synthetic fuel conversion methods is accelerating growth in this sector:

Electrolysis Innovations

Advances in electrolyzer efficiency, such as proton exchange membrane (PEM) and solid oxide electrolyzers, are making green hydrogen production more efficient and cost-effective. These innovations enable higher hydrogen yields at lower energy inputs, reducing the overall cost of synthetic fuel production.

Carbon Capture and Utilization (CCU)

When green hydrogen is combined with carbon dioxide captured from industrial sources, it produces synthetic fuels with a lower carbon footprint. Carbon capture technologies continue to evolve, providing a more sustainable feedstock source for synthetic fuel production.

Direct Air Capture (DAC)

Direct air capture technologies pull carbon dioxide from the atmosphere to combine with green hydrogen in synthetic fuel production. Though still expensive, DAC has the potential to make synthetic fuels carbon-neutral or even carbon-negative, enhancing their environmental appeal.

5. Regional Market Insights

Europe

Europe is at the forefront of green hydrogen integration in synthetic fuels, driven by ambitious climate targets and supportive policies. The European Green Deal and the “Fit for 55” package emphasize the importance of green hydrogen in decarbonizing the continent, with a focus on hard-to-electrify sectors.

North America

In the United States, the Inflation Reduction Act (IRA) and other policy measures are accelerating green hydrogen adoption. North America’s vast renewable energy resources and funding programs support the development of hydrogen infrastructure and synthetic fuel production facilities.

Asia-Pacific

Asia-Pacific, particularly countries like Japan, South Korea, and Australia, is investing heavily in green hydrogen as part of energy transition strategies. Japan has committed to green hydrogen as a key component of its future energy matrix, while Australia is leveraging its renewable resources to become a leading exporter of green hydrogen and synthetic fuels.

6. Applications of Green Hydrogen in Synthetic Fuel Production

The use of green hydrogen in synthetic fuel production has transformative applications across various sectors:

Aviation

The aviation industry is exploring synthetic fuels derived from green hydrogen as a means to reduce emissions without altering current aircraft infrastructure. Sustainable aviation fuel (SAF) produced from green hydrogen and captured carbon offers a near-term solution to decarbonize air travel.

Maritime

In the maritime industry, where electrification is challenging, synthetic fuels offer a viable alternative to conventional bunker fuels. Green hydrogen-based synthetic fuels can reduce emissions and pollution in international shipping, a sector that significantly impacts global greenhouse gas emissions.

Heavy Transport and Industry

For heavy-duty transport and industrial sectors, synthetic fuels from green hydrogen provide a lower-emission alternative to diesel and other fossil fuels. Industries like steel, cement, and chemicals, which face difficulty electrifying processes, stand to benefit substantially from this transition.

7. Key Market Players

Numerous companies and consortiums are leading the way in the green hydrogen and synthetic fuels market. Here are some prominent names:

Siemens Energy

Air Products and Chemicals

Linde plc

Plug Power Inc.

ENGIE

Iberdrola

Shell

These players are investing in R&D, expanding infrastructure, and entering strategic partnerships to promote green hydrogen in synthetic fuel production.

8. Future Outlook

The future of the global green hydrogen in synthetic fuel production market looks promising, driven by continuous technological advancements, policy support, and increasing private sector investments. The projected 41.3% CAGR indicates rapid growth as governments, businesses, and consumers push toward sustainable energy solutions.

The industry is likely to benefit from several key trends:

Increased Renewable Energy Capacity: As renewable energy capacity grows, green hydrogen production costs will decrease, enhancing the competitiveness of synthetic fuels.

Policy and Regulatory Support: Global climate commitments will continue to spur policy measures favoring green hydrogen, creating a conducive environment for market growth.

Public-Private Partnerships: Collaboration between governments and private companies will be crucial to develop the necessary infrastructure and supply chains for synthetic fuel production.

9. Conclusion

The global green hydrogen in synthetic fuel production market is on the brink of a revolutionary phase, with a remarkable CAGR projected through 2032. Green hydrogen has the potential to transform the energy landscape, offering a sustainable, zero-emission solution for sectors that have traditionally relied on fossil fuels. While challenges persist, continuous innovation, policy support, and investment are paving the way for green hydrogen to play a pivotal role in synthetic fuel production, contributing to a cleaner, more sustainable future.

The path forward will require collaboration across industries, investments in technology, and a strong commitment to sustainability. As the market grows, green hydrogen will become a cornerstone of synthetic fuel production, supporting global efforts to combat climate change and achieve net-zero targets.

0 notes

Text

Pem Water Electrolyzer Market Dynamics and Future Growth Review 2024 - 2032

The PEM (Proton Exchange Membrane) water electrolyzer market is emerging as a pivotal segment in the renewable energy landscape, facilitating the production of green hydrogen through electrolysis. This technology is gaining traction due to its efficiency and potential to contribute to a sustainable energy future. This article provides an in-depth analysis of the PEM water electrolyzer market, exploring its significance, growth drivers, challenges, market segmentation, regional insights, and future trends.

Understanding PEM Water Electrolyzers

PEM water electrolyzers utilize a proton exchange membrane to conduct protons from the anode to the cathode while separating oxygen and hydrogen. This process involves applying an electrical current to water, splitting it into its basic components: hydrogen and oxygen. The hydrogen produced can be used as a clean fuel source or as a feedstock for various industrial applications, making PEM electrolyzers a key technology in the transition to a hydrogen economy.

Importance of PEM Water Electrolyzers

Green Hydrogen Production

PEM electrolyzers are crucial for generating green hydrogen, produced from renewable energy sources like wind, solar, and hydropower. This hydrogen is considered environmentally friendly, as it does not emit carbon dioxide during production.

Energy Storage Solution

Hydrogen produced via PEM electrolysis can be used as an energy carrier, offering a viable solution for energy storage. It can help balance supply and demand, particularly when renewable energy generation fluctuates.

Industrial Applications

The hydrogen generated can be used in various industrial applications, including refining, ammonia production, and fuel cell technologies. This versatility enhances the commercial appeal of PEM water electrolyzers.

Market Dynamics

Growth Drivers

Rising Demand for Clean Energy

The global shift towards cleaner energy sources is driving the demand for PEM water electrolyzers. Governments and industries are increasingly focused on reducing carbon footprints, making hydrogen a desirable energy alternative.

Technological Advancements

Continuous advancements in electrolyzer technology are enhancing efficiency, reducing costs, and improving performance. Innovations in membrane materials and stack design are contributing to the market's growth.

Supportive Government Policies

Government incentives and regulatory frameworks promoting hydrogen adoption and renewable energy sources are fostering investments in PEM water electrolyzer technology. Many countries have set ambitious hydrogen targets to meet climate goals.

Challenges

High Initial Costs

The high capital expenditure associated with PEM electrolyzers can be a barrier to widespread adoption, especially in developing regions. While operating costs are lower, the initial investment remains a significant hurdle.

Limited Infrastructure

The current hydrogen infrastructure is underdeveloped, which can hinder the deployment of PEM water electrolyzers. Investments in infrastructure are necessary to facilitate the integration of hydrogen into existing energy systems.

Competition from Other Technologies

PEM water electrolyzers face competition from other electrolysis technologies, such as alkaline electrolyzers and solid oxide electrolyzers. Each technology has its advantages and limitations, creating a competitive landscape.

Market Segmentation

By Product Type

Standalone PEM Electrolyzers

These systems operate independently and are primarily used in dedicated hydrogen production facilities. They are ideal for applications requiring significant hydrogen output.

Integrated PEM Electrolyzers

Integrated systems combine PEM electrolyzers with renewable energy sources, such as solar or wind. These systems optimize the utilization of generated energy and provide on-site hydrogen production.

By Application

Industrial Hydrogen Production

The industrial sector is the largest consumer of hydrogen, utilizing it for refining, chemical production, and other applications. PEM electrolyzers are increasingly being adopted to meet this demand sustainably.

Transportation

Hydrogen fuel cells are gaining popularity in transportation, particularly in heavy-duty vehicles and public transport. PEM electrolyzers play a crucial role in producing the hydrogen needed for these applications.

Energy Storage

The energy storage sector is leveraging PEM water electrolyzers to produce hydrogen, which can be stored and converted back into electricity when needed, enhancing grid stability and resilience.

By Region

North America

North America is witnessing significant growth in the PEM water electrolyzer market, driven by government incentives, investments in clean energy, and a focus on hydrogen as a fuel source. The U.S. and Canada are leading in research and development efforts.

Europe

Europe is at the forefront of hydrogen technology adoption, with ambitious hydrogen strategies and strong regulatory support. The region's focus on decarbonization and renewable energy integration is propelling the PEM electrolyzer market.

Asia-Pacific

The Asia-Pacific region is experiencing rapid growth in the PEM water electrolyzer market, fueled by increasing energy demands and a focus on sustainable development. Countries like Japan and South Korea are investing heavily in hydrogen technologies.

Future Trends

Advancements in Materials and Technology

Research into new materials and manufacturing processes is expected to enhance the performance and reduce the costs of PEM water electrolyzers. Innovations in membrane technology and catalyst development will play a significant role in market evolution.

Expansion of Hydrogen Infrastructure

The development of hydrogen infrastructure, including production, storage, and distribution networks, will facilitate the widespread adoption of PEM water electrolyzers. Collaborative efforts between governments, industries, and research institutions will be crucial.

Integration with Renewable Energy Systems

The integration of PEM water electrolyzers with renewable energy sources is expected to increase, enhancing the viability of green hydrogen production. This synergy will enable more efficient use of renewable energy and support grid stability.

Conclusion

The PEM water electrolyzer market is poised for significant growth as the world transitions towards sustainable energy solutions. Driven by the demand for green hydrogen, technological advancements, and supportive government policies, PEM electrolyzers are becoming essential components of the energy landscape. While challenges such as high initial costs and limited infrastructure remain, ongoing innovations and the expansion of hydrogen networks will shape the future of this market. As industries and governments prioritize decarbonization, PEM water electrolyzers will play a crucial role in facilitating the hydrogen economy and achieving global sustainability goals.

More Trending Reports

MENA Solar Energy Market Growth

Europe Power Transmission Infrastructure Market Growth

Permanent Magnet Market Growth

Europe Biochar from Woody Biomass Market Growth

0 notes

Text

Understanding the Technology Behind the Hydrogen Energy Storage Market

The global hydrogen energy storage market was estimated to be valued at approximately USD 15.97 billion in 2023, with expectations to expand at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030. This growth is primarily driven by the rapid industrialization occurring in developing nations, coupled with a rising acceptance of alternative energy sources. Notably, the U.S. market is anticipated to experience significant growth during the forecast period, fueled by ongoing research and development initiatives and the construction of full-scale hydrogen storage projects. One such initiative is the Hydrogen Fueling Infrastructure Research and Station Technology (H2FIRST), spearheaded by the Fuel Cell Technologies Office, which focuses on existing and emerging technologies at national laboratories.

A key objective of the U.S. government is the development and establishment of cost-effective and energy-efficient hydrogen stations. These efforts are expected to further enhance market growth in the U.S. Additionally, the increasing applications of hydrogen across various industries are predicted to contribute to market expansion. Hydrogen is versatile and can be utilized in several ways: for industrial processes in oil refineries, as a power source in stationary fuel cells, as fuel in fuel cell vehicles, and stored in different forms such as cryogenic liquids, compressed gases, or loosely bonded hydride chemical compounds.

According to the International Renewable Energy Agency (IRENA), to ensure that renewable hydrogen is competitive with hydrogen produced from fossil fuels, it needs to be generated at a cost of less than USD 2.5 per kilogram. Several factors influence this cost, including the production location, market segment, renewable energy tariff rates, and potential future investments in electrolyzers. The increasing affordability of hydrogen production is expected to lead to a wider deployment of energy storage systems. Many participants in the hydrogen industry are also becoming more vertically integrated. The growing demand for stored hydrogen across various applications—including fuel cell vehicles, grid services, and telecommunications—is compelling market players to align their facilities with the needs of end-user industries.

Gather more insights about the market drivers, restrains and growth of the Hydrogen Energy Storage Market

Market Dynamics

Various government initiatives are underway to support the adoption of hydrogen as a fuel source. The European Commission has introduced a strategy aimed at advancing green hydrogen. This strategy includes the approval of green hydrogen production, which involves reforming hydrogen from natural gas while capturing carbon dioxide emissions through carbon capture and storage technologies. In 2020, Engie successfully completed a pilot test of its first renewable hydrogen passenger train in the Netherlands. The introduction of hydrogen-fueled trains is anticipated by 2024, with Engie collaborating with Alstom to expand this technology throughout the Netherlands. Following this success, there is potential for Engie to extend its hydrogen solutions to other countries, which would likely result in increased demand for hydrogen energy and its storage.

Despite these advancements, the slow development of distribution channels for transporting hydrogen in developing countries poses a significant challenge to market growth. Merchant distribution channels have yet to establish a strong presence in regions such as Africa and parts of the Middle East. The limited availability of hydrogen distributors in these areas has negatively impacted industrial expansion, thereby restricting the packaging and supply of industrial gases. Furthermore, an irregular and unpredictable supply of hydrogen can severely disrupt industries that rely on it, ultimately hindering the growth of numerous end-use sectors.

Order a free sample PDF of the Hydrogen Energy Storage Market Intelligence Study, published by Grand View Research.

#Hydrogen Energy Storage Market#Hydrogen Energy Storage Market Analysis#Hydrogen Energy Storage Market Report#Hydrogen Energy Storage Industry

0 notes

Text

Australia, the land of iron ore exports, faces a green reckoning. (Washington Post)

Excerpt from this story from the Washington Post:

For more than a century, Australia has fed the world’s hunger for iron ore. Vast swaths of the rusty red Outback have been dug up and delivered overseas to make the steel that helped transform other nations: first the United States, then Japan and most recently China,which buys more than 80 percent of Australia’s iron ore.

Now that trade is at risk as China’s slumping economy dries up its demand for construction materials.

But there is a bigger threat. Governments around the globe are beginning to crack down on the steel industry, which is responsible for roughly 10 percent of global CO2 emissions.

Australia — the world’s biggest iron ore exporter, accounting for almost 60 percent of the global market — has the most to lose. That’s because its ore happens to be poorly suited for making the “green” steel the globe increasingly demands.

Australian iron miners are trying to adapt and maintain their place in the global market. For decades, they have been pulling raw iron ore out of the ground and exporting it to be made into steel. That was the dirty, basic commodity way.

But as Beijing begins to look elsewhere for better ore, Australian miners are looking to move up the value — and the environmental — chain by using renewable energy to turn their ore into “green” iron for export.

Companies and state governments are pressing ahead with efforts to use green hydrogen — which is made using solar or wind power and produces almost no carbon emissions, unlike coal — to enable them to churn out more valuable and environmentally friendly “green iron” for export. Steelmaking nations such as Japan, South Korea, Germany and China will turn that iron into green steel for electric vehicles, appliances, bridges and skyscrapers.

Companies in other parts of the world — from Sweden and Canada to Brazil and parts of Africa — are attempting to make the same shift.

The state has all the ingredients for green iron, according to analysts and officials. Though it mines far less than Western Australia, South Australia is rich in magnetite, a type of iron ore that, when processed, is pure enough for making green iron and steel. It also has abundant wind and sun, one of the country’s two remaining steelworks and, importantly, political resolve.

Steelmaking is normally a dirty business. Iron oxide ore is fed into coal-fired blast furnaces, which remove the oxygen and produce iron that can be strengthened into steel. For each ton of steel, the process creates about two tons of CO2.

More than 70 percent of the world’s steel is still made using the centuries-old technique. But efforts are underway to clean up the industry, driven in part by tougher regulation. The European Union will impose levies on steel and other carbon-intense imports starting in 2026, and the United States is considering similar steps.

“We don’t get to net zero by 2050 globally without decarbonizing steel,” Malinauskas said. “Markets are realizing this. Regulators are realizing this.”

One way to clean up the industry is by replacing blast furnaces with a process called direct reduction, which uses natural gas or hydrogen to lower emissions.

Only a handful of countries have both the iron ore and green hydrogen ability required, Nicholas said.

1 note

·

View note

Text

Green Hydrogen Market Poised for Strong Growth by 2031, Fueled by Global Transition to Renewable Energy

The Green Hydrogen Market size was valued at USD 1.0 billion in 2023 and is expected to reach over USD 49.8 billion by 2031 with a growing CAGR of 63% over the forecast period of 2024–2031.

Green hydrogen has the potential to significantly decarbonize various sectors where direct electrification is challenging, such as heavy industry and long-haul transportation. Unlike conventional hydrogen production methods, green hydrogen is produced using renewable electricity, making it a zero-emission energy carrier. As the global demand for clean energy grows, green hydrogen is expected to play a pivotal role in achieving climate goals and energy security, making it an attractive option for industries and governments alike.

With advancements in electrolysis technology and declining costs of renewable energy, the green hydrogen market is seeing accelerated growth. Several regions are investing in large-scale production projects and infrastructure to support the adoption of green hydrogen as part of their long-term energy strategies.

Global Decarbonization Initiatives: Countries around the world are setting ambitious targets to reduce carbon emissions. Green hydrogen is viewed as a critical tool in achieving net-zero goals, driving substantial investments in production capacity.

Declining Costs of Renewable Energy: As the costs of solar and wind energy continue to decline, the production of green hydrogen through renewable-powered electrolysis is becoming more economically viable, making it an increasingly competitive alternative to fossil-based energy sources.

Government Incentives and Policies: Numerous governments are offering financial support, subsidies, and incentives to accelerate green hydrogen production and usage. National hydrogen strategies in regions like Europe and Asia-Pacific are fostering market growth.

Demand from Hard-to-Decarbonize Sectors: Industries such as steel, cement, chemicals, and long-haul transportation face challenges in adopting conventional clean energy solutions. Green hydrogen offers a viable alternative for these sectors to reduce their carbon footprint.

Technological Advancements in Electrolysis: Innovation in electrolyzer technology, such as improvements in efficiency and scalability, is making green hydrogen production more efficient, contributing to market growth.

Request Sample Report@ https://www.snsinsider.com/sample-request/2790

Market Segmentation

The Green Hydrogen Market can be segmented by technology, application, end-use industry, and region.

By Technology

Proton Exchange Membrane (PEM) Electrolysis: Known for its efficiency and high-purity output, PEM electrolysis is commonly used for green hydrogen production and is expected to witness strong demand.

Alkaline Electrolysis: Alkaline electrolysis is cost-effective and well-suited for large-scale production, making it a preferred choice for industrial applications.

Solid Oxide Electrolysis: Although still in early stages, solid oxide electrolysis is gaining attention for its high efficiency at elevated temperatures and its potential for integration with waste heat recovery systems.

By Application

Transportation: Green hydrogen is increasingly used as a clean fuel for fuel cell vehicles, particularly in sectors such as heavy-duty trucking, buses, and rail, where battery electrification faces challenges.

Power Generation: Green hydrogen can be used in fuel cells or as a direct fuel source for power generation, offering an alternative for grid stabilization and backup power.

Industrial Processes: Hard-to-decarbonize industries, including steel production and chemical manufacturing, are adopting green hydrogen as a sustainable feedstock to replace fossil fuels.

By End-Use Industry

Transportation: The transportation sector, especially heavy-duty vehicles, is seeing growing adoption of green hydrogen as a clean fuel alternative, driven by emissions regulations and the need for sustainable logistics.

Utilities: Utility companies are incorporating green hydrogen into power generation and energy storage applications, particularly for grid balancing and renewable energy storage.

Industrial Manufacturing: Industries such as steel, cement, and chemicals are transitioning to green hydrogen to replace carbon-intensive processes, reducing their overall emissions.

Buy a Complete Report of Green hydrogen Market 2024–2031@ https://www.snsinsider.com/checkout/2790

Regional Analysis

Europe: Europe is leading the global green hydrogen market, with countries like Germany, France, and the Netherlands launching ambitious hydrogen strategies. The EU’s Green Deal and commitment to net-zero emissions by 2050 are driving significant investments in green hydrogen infrastructure and production.

Asia-Pacific: Asia-Pacific is an emerging hub for green hydrogen, with countries such as Japan, South Korea, and Australia investing heavily in hydrogen technology and infrastructure. Japan and South Korea are particularly focused on hydrogen-powered transportation and fuel cell technology.

North America: In North America, the United States and Canada are promoting green hydrogen as part of their energy transition efforts. Government incentives and partnerships between public and private sectors are fostering market growth, especially in industries like transportation and heavy industry.

Middle East & Africa: The Middle East, with its abundant solar resources, is positioning itself as a major player in green hydrogen production. Countries like Saudi Arabia and the UAE are investing in large-scale projects to export green hydrogen and diversify their energy portfolios.

Latin America: Latin American countries, especially Chile, are investing in green hydrogen to leverage their renewable energy potential and reduce dependence on fossil fuels. Chile aims to become a leading exporter of green hydrogen due to its favorable wind and solar resources.

Current Market Trends

Large-Scale Hydrogen Production Projects: Globally, large-scale green hydrogen projects are being developed to meet the increasing demand for sustainable energy. Notable projects in Europe, the Middle East, and Australia are expected to enhance production capacity.

Expansion of Hydrogen Fueling Infrastructure: As green hydrogen adoption grows, investments in hydrogen fueling stations are increasing, particularly in regions like Japan, Europe, and North America, to support hydrogen fuel cell vehicles.

Emergence of Green Ammonia: Green ammonia, produced using green hydrogen, is gaining traction as an energy-dense fuel and a transport medium, especially for export. It can be used directly or as a carrier for green hydrogen.

Collaborations Across Industries: Partnerships between energy companies, technology providers, and government entities are becoming more common, aimed at accelerating technology development and market adoption of green hydrogen.

Focus on Energy Storage Applications: Green hydrogen is being integrated into energy storage solutions to address the intermittency of renewable energy sources, offering a clean alternative for long-duration storage.

About Us:

SNS Insider is a global leader in market research and consulting, shaping the future of the industry. Our mission is to empower clients with the insights they need to thrive in dynamic environments. Utilizing advanced methodologies such as surveys, video interviews, and focus groups, we provide up-to-date, accurate market intelligence and consumer insights, ensuring you make confident, informed decisions. Contact Us: Akash Anand — Head of Business Development & Strategy [email protected] Phone: +1–415–230–0044 (US) | +91–7798602273 (IND)

1 note

·

View note

Text

The GCC Industrial Gases Market is expected to grow from USD 1,271.3 million in 2024 to USD 2,267.33 million by 2032, registering a compound annual growth rate (CAGR) of 7.50%.The GCC (Gulf Cooperation Council) region, comprising Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE, is witnessing robust economic growth and rapid industrialization. This expansion fuels demand across a range of sectors, one of the most critical being the industrial gases market. Industrial gases, such as oxygen, nitrogen, hydrogen, and carbon dioxide, play essential roles in numerous industries, including healthcare, petrochemicals, energy, and manufacturing. With significant investments in infrastructure and industry, the GCC industrial gases market is positioned for sustained growth in the coming years.

Browse the full report https://www.credenceresearch.com/report/gcc-industrial-gases-market

Market Overview

As of recent estimates, the GCC industrial gases market is valued in billions of dollars, driven by increasing demand from core industries like oil and gas, metallurgy, chemicals, and healthcare. Due to the rapid pace of industrialization, the market has been growing at a notable CAGR (compound annual growth rate), with expectations to continue its upward trend. The region’s strategic position as a global oil and gas powerhouse gives it unique advantages, but also creates demand for advanced industrial gas solutions to support downstream activities, refining, and environmental management.

Industrial gases in the GCC are typically divided into two main categories: atmospheric gases and process gases. Atmospheric gases such as oxygen, nitrogen, and argon are produced through air separation and are fundamental in steel production, food processing, and welding. Process gases like hydrogen and carbon dioxide are used in refining processes, petrochemicals, and fertilizers. The oil and gas sector’s dominance in the region also makes hydrogen a key component of the industrial gases market, given its utility in refining operations and as a clean energy source.

Key Growth Drivers

1. Expanding Petrochemical and Refining Industries The GCC region’s economy is heavily reliant on oil and gas, with an increasing emphasis on developing downstream petrochemical projects to diversify economic activities. Saudi Arabia’s Vision 2030 and the UAE’s industrial strategy are examples of government initiatives to develop high-value-added sectors. Industrial gases like nitrogen and hydrogen are crucial in these sectors, particularly for refining and petrochemical processes, ensuring a steady demand pipeline for industrial gas suppliers.

2. Infrastructure and Construction Boom Major infrastructure and construction projects in the region, such as NEOM in Saudi Arabia, the Qatar National Vision 2030, and Dubai’s Expo 2020 legacy projects, drive demand for industrial gases in welding, metal fabrication, and construction materials. Oxygen and nitrogen, in particular, play essential roles in these industries, supporting steel production and other manufacturing processes integral to large-scale infrastructure developments.

3. Rising Demand in Healthcare The healthcare sector in the GCC is growing rapidly, partly driven by a high prevalence of lifestyle-related diseases and an aging population. Oxygen is essential in hospitals for patient care, respiratory therapy, and surgical procedures. The COVID-19 pandemic underscored the importance of reliable oxygen supplies and has increased demand for medical gases, boosting the healthcare sector's share of the industrial gases market.

4. Focus on Sustainability and Green Initiatives Environmental sustainability is becoming a significant focus within the GCC region. Countries like Saudi Arabia and the UAE have announced net-zero targets, aiming for more sustainable practices in line with global climate goals. Hydrogen, seen as a green fuel, has attracted significant interest, with the potential to decarbonize the region's heavy industries and lower overall emissions. This has led to partnerships and investments in green hydrogen projects, creating a promising new avenue for growth in the industrial gases sector.

Market Challenges

Despite its growth potential, the GCC industrial gases market faces challenges. High operational costs due to energy-intensive gas production methods, fluctuating oil prices, and competition from global players can impact profitability. Additionally, regulatory requirements related to emissions and environmental standards pose compliance challenges for industrial gas companies, pushing them to adopt cleaner, more energy-efficient production techniques.

Another significant challenge is the need for skilled labor and advanced technologies to meet the industry’s technical demands. With industrial gas production and distribution requiring specific safety and operational standards, companies must invest in training and advanced technology to maintain reliability and safety standards.

Key Players and Competitive Landscape

The GCC industrial gases market comprises several international and regional players. Leading global companies such as Linde Group, Air Products and Chemicals, and Air Liquide operate in the region, benefiting from their technological expertise and established distribution networks. Meanwhile, local companies like Gulf Cryo and National Industrial Gas Plants (NIGP) provide region-specific solutions, catering to the unique demands of GCC industries.

Future Prospects

The future of the GCC industrial gases market looks promising, supported by diversification efforts, green energy initiatives, and strategic industrial projects. Investments in green hydrogen production, carbon capture, and other sustainable practices could transform the industrial gases landscape, positioning the GCC as a key player in the global energy transition.

As industries evolve and technology advances, the need for industrial gases will only increase, particularly in sectors like healthcare, energy, and manufacturing. With continued government support, infrastructure development, and an increasing emphasis on sustainability, the GCC industrial gases market is set for robust growth, playing a pivotal role in the region's industrial and economic future.

Key Player Analysis:

Air Liquide

Linde plc

Air Products and Chemicals, Inc.

Gulf Cryo

National Industrial Gas Plants (NIGP)

Messer Group

Buzwair Industrial Gases

Taiyo Nippon Sanso Corporation

Yateem Oxygen

Abdullah Hashim Industrial Gases & Equipment Co. Ltd

Segmentations:

By Gas Type:

Oxygen

Nitrogen

Helium

Acetylene

Argon

Hydrogen

Carbon Dioxide

By Application:

Metals and Metallurgy

Medical & Healthcare

Welding & Metal Fabrication

Automotive & Aerospace

Electronics

Refining

Energy, Oil & Gas

Food & Beverage

Chemicals & Petrochemicals

Pulp & Paper

Pharmaceutical & Biotechnology

Other

By Region

North America

US

Canada

Mexico

Europe

Germany

France

UK

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

South-east Asia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

GCC Countries

South Africa

Browse the full report https://www.credenceresearch.com/report/gcc-industrial-gases-market

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

Website: www.credenceresearch.com

0 notes

Text

Global Power Supply Equipment Market, Key Players, Market Size, Future Outlook | BIS Research

Power supply equipment refers to devices and systems that convert electrical energy from a source into usable power for various applications. This includes components such as transformers, rectifiers, inverters, and voltage regulators, which manage voltage levels, convert alternating current (AC) to direct current (DC), and ensure stable and reliable power delivery. Power supply equipment is essential in a wide range of settings, from industrial machinery and data centers to consumer electronics, ensuring that devices operate efficiently and safely.

The power supply equipment market was valued at $331.5 million in 2022, and it is expected to grow at a CAGR of 33.27% and reach $5,714.8 million by 2032

Global Power Supply Equipment Overview

Power supply equipment encompasses a variety of devices and systems designed to provide and manage electrical power for various applications. At its core, it transforms electrical energy from a source, such as the electrical grid or renewable sources, into the specific voltage and current needed by different devices.

Key Components

Transformers

Rectifiers

Inventors

Voltage Regulators

Market Segmentation

1 By Application

• Alkaline Electrolyzer

• Proton Exchange Membrane (PEM) Electrolyzer

• Solid Oxide Electrolytic Cell (SOEC) Electrolyzer

• Anion Exchange Membrane (AEM) Electrolyzer

By Equipment Type

Rectifier

Transformer

Others

By Region

Grab a look at our sample for the report click here!

Recent Developments in the Power Supply Equipment Market for Water Electrolysis

• In March 2023, Ingeteam introduced a new rectifier solution specifically designed for electrolyzers, known commercially as the INGECON H2 FSK E12000. This innovative product is tailored for large-scale green hydrogen production facilities. The initial units are scheduled to be delivered in September 2023, with projects in Germany and Spain being the first recipients of this technology. • In March 2023, Nidec Industrial Solutions unveiled two significant projects focused on green hydrogen production and storage in the southwestern region of the U.S. In the first project, the power supply unit, capable of generating 5.6 MW of energy, is expected to be housed within a 40-foot container. In the second project, Nidec Industrial Solutions assumes a crucial role in the storage of liquid hydrogen. The company is responsible for supplying the electrical component of the order, which includes 14 electric motors. These motors would be coupled with 14 compressors forming the mechanical part of the system

Visit our Advanced Materials and Chemical Vertical Page !

Key Players

ABB, General Electric

Nidec Industrial Solutions

Danfoss Drives

SMA Solar Technology AG

American Superconductor.

Conclusion

In conclusion, power supply equipment plays a crucial role in ensuring the reliability and efficiency of electrical systems across various applications. Its ability to convert, regulate, and distribute power effectively is essential for both industrial and commercial operations.

As technology continues to evolve, the demand for advanced power supply solutions that enhance performance, reduce energy consumption, and promote sustainability will only increase. Investing in high-quality power supply equipment not only improves operational efficiency but also contributes to the overall resilience and longevity of electrical systems.

0 notes

Text

Hydrogen Plants: Driving the Transition to Green Energy More Info:https://www.transparencymarketresearch.com/hydrogen-plants-market.html