#GST Recovery Efforts

Explore tagged Tumblr posts

Text

GST Collections In Jamshedpur Set To Break Records

CGST Commissioner Reports 7.3% Increase In Kolhan Region Revenue Officials aim for 15% growth in the coming year through improved compliance and streamlined procedures. JAMSHEDPUR – The Goods and Services Tax (GST) collection in Jamshedpur is on track to surpass previous records, with the Kolhan region reporting Rs 7690.38 crore for the 2023-2024 financial year. CGST Commissioner Binod Kumar…

View On WordPress

#बिजनेस#business#Business Tax Cooperation#CGST Commissioner Binod Kumar Gupta#GST Growth Projections#GST Recovery Efforts#Jamshedpur Economic Indicators#Jamshedpur GST Collections#Jharkhand Financial News#Kolhan Region Tax Revenue#Streamlined Tax Procedures#Tax Compliance Jamshedpur

0 notes

Text

Financial Document Organization Software

In today’s fast-paced business environment, the ability to access, manage, and store financial records efficiently is essential for smooth operations, compliance, and informed decision-making. Traditional methods of managing paper documents or scattered digital files are no longer sustainable, especially for companies handling large volumes of data. That’s where Financial Document Organization Software steps in – an innovative solution that simplifies document handling, ensures data security, and enhances productivity. PDMPL, a leading provider of document management solutions, offers advanced financial document organization tools tailored for businesses of all sizes.

What is Financial Document Organization Software?

Financial Document Organization Software is a specialized tool designed to store, organize, retrieve, and secure all types of financial documents – including invoices, purchase orders, expense reports, tax documents, balance sheets, audit reports, and bank statements – in a centralized digital repository. It allows businesses to eliminate paperwork, automate workflows, and maintain a clear audit trail, ensuring compliance with financial regulations and standards.

Key Features of Financial Document Organization Software by PDMPL

PDMPL’s software solution is engineered to deliver robust features that address the unique needs of financial departments:

1. Centralized Digital Repository

All financial documents are stored in a structured, searchable database. Whether it’s accounts payable, receivables, or annual reports, everything is easily accessible with a few clicks.

2. Advanced Search and Indexing

The intelligent search feature uses metadata, keywords, and filters to locate files instantly. Indexing ensures that no document is ever misplaced or lost.

3. Automated Workflows

The software supports workflow automation for document approvals, invoice processing, and audit preparation. This reduces manual effort, minimizes errors, and accelerates routine financial operations.

4. Role-Based Access Control

PDMPL’s solution ensures document security with customizable user permissions. Sensitive documents are only accessible to authorized personnel, reducing the risk of data breaches.

5. Compliance and Audit Trail

Every document transaction is tracked and logged. This feature ensures regulatory compliance with standards such as GST, TDS, SOX, and internal audit policies.

6. Cloud Integration

Access your financial documents anytime, anywhere with PDMPL’s cloud-enabled solution. It ensures business continuity and secure remote access for distributed teams.

Benefits of Using Financial Document Organization Software

Implementing PDMPL’s Financial Document Organization Software delivers tangible benefits across your financial operations:

- Enhanced Productivity

By eliminating time-consuming manual searches and redundant filing tasks, your finance team can focus on analysis and strategic planning rather than administrative overhead.

- Improved Accuracy

Automated data entry, file version control, and validation rules reduce errors in financial documentation, leading to more accurate reporting.

- Faster Decision-Making

With instant access to updated and accurate financial records, business leaders can make quick and informed decisions.

- Cost Efficiency

Going paperless reduces printing, storage, and labor costs. It also frees up physical space, allowing businesses to optimize their office setup.

- Disaster Recovery

Digital documents backed up in the cloud are safe from physical damage such as fire, theft, or flooding, ensuring operational resilience.

Use Cases in Financial Departments

PDMPL’s software is highly effective for businesses across various industries. Common use cases include:

Accounts Payable & Receivable: Automate invoice capture, approvals, and payment processing.

Audit Preparation: Maintain a clean, searchable archive of all financial records, simplifying external or internal audits.

Tax Filing: Organize tax returns, TDS certificates, and related paperwork efficiently to avoid last-minute hassles.

Budgeting & Forecasting: Access historical financial data quickly to support planning and forecasting activities.

Why Choose PDMPL?

PDMPL is a trusted name in the field of document management with years of experience in helping organizations across India digitize and streamline their operations. Our Financial Document Organization Software is designed keeping in mind the practical challenges faced by accounting professionals and finance teams.

We offer:

Tailored implementation for small businesses, SMEs, and large enterprises

User-friendly interface with minimal training required

Secure data storage compliant with Indian financial regulations

Dedicated customer support and software updates

Future-Ready Financial Management

As digital transformation continues to reshape the way businesses operate, staying ahead of the curve is crucial. By adopting Financial Document Organization Software from PDMPL, you’re not only improving your current workflows but also preparing your business for future growth and innovation.

Our solution integrates seamlessly with existing ERP and accounting systems like Tally, Zoho Books, and QuickBooks, ensuring smooth data exchange and better process control.

Conclusion

Efficient financial document management is no longer a luxury – it’s a necessity for any business aiming for scalability, transparency, and compliance. PDMPL’s Financial Document Organization Software empowers your finance department to work smarter, reduce risk, and gain deeper insights into your business performance.

Embrace digital finance with PDMPL – your trusted partner in intelligent document management.

0 notes

Text

The Benefits of Using EASY BILL for Free GST Billing

As businesses grow, managing finances becomes a critical task. For small and medium enterprises (SMEs), the pressure to stay compliant with tax regulations can be overwhelming. One essential requirement in India is GST billing, which businesses must manage with utmost precision. This is where EASY BILL comes in. Offering free GST billing services, EASY BILL is a game-changer for entrepreneurs and businesses. Here, we explore the key benefits of using EASY BILL and how it can simplify your billing process.

1. User-Friendly Interface

One of the standout features of EASY BILL is its intuitive design. Whether you're a seasoned business owner or just starting, navigating the software is simple and hassle-free. The easy billing software provides an easy-to-use interface that doesn't require any technical expertise, making it ideal for everyone, including non-tech-savvy users.

Simple navigation with a clean dashboard

Easy data entry for products and services

Fast invoice generation with just a few clicks

2. GST-Compliant Invoicing

GST compliance is a crucial aspect of business operations in India. With EASY BILL, generating GST-compliant invoices becomes incredibly straightforward. The software automatically calculates GST for your products and services, reducing human errors and ensuring that your invoices meet all legal requirements.

Automated GST calculation for accurate billing

Ready-to-use GST invoices with detailed tax breakdowns

Direct integration with GST returns to save time and effort

3. Free Billing Software

One of the most attractive features of EASY BILL is that it is completely free. This is especially beneficial for small businesses and startups that need to keep their expenses in check. With EASY BILL, you don’t need to spend on expensive billing software or additional plugins.

No hidden charges or subscription fees

Free for businesses of all sizes

Perfect for businesses looking to reduce operational costs

4. Cloud-Based Access

Gone are the days when billing software was confined to desktop installations. EASY BILL is a cloud-based solution, allowing you to access your billing data from anywhere, at any time. Whether you’re in the office or on the go, your information is always within reach.

Access your billing information from multiple devices

Secure cloud storage for your invoices and billing history

No need for manual backups or data recovery

5. Customization Options

Different businesses have different needs when it comes to billing. With EASY BILL, you can fully customize your invoices to match your branding and business requirements. Add your company logo, choose your preferred invoice format, and personalize payment terms, all with a few simple steps.

Customizable invoice templates with logos

Option to add payment terms and conditions

Ability to modify invoice layout as per your preferences

6. Seamless Integration with Other Tools

For businesses using multiple tools for finance management, EASY BILL integrates easily with other accounting software. This ensures smooth data transfer and eliminates the need for manual entry, which reduces errors and saves time.

Integration with popular accounting software

Easy export of invoice data to Excel or PDF

Simplified GST returns filing

7. Time-Saving Features

Time is money, and EASY BILL understands this. By automating many aspects of billing, such as tax calculations and invoice generation, EASY BILL saves you valuable time. You can focus on growing your business instead of spending hours managing billing.

Automatic invoice generation based on entries

Automatic GST tax calculation with minimal effort

Quick invoice delivery via email to clients

8. Secure and Safe

With the rise in data breaches, security is a concern for every business. EASY BILL ensures your billing data is protected with advanced encryption, ensuring that all sensitive information, such as client details and financial records, remains secure.

High-level encryption for data protection

Secure user login with multi-factor authentication

Regular software updates for improved security

9. Comprehensive Reports

Tracking your business's financial health is vital, and EASY BILL offers comprehensive reports that help you analyze sales, taxes, and payments. These reports are available at your fingertips, helping you make informed decisions.

Real-time reports on sales and GST calculations

Easy access to payment and tax reports

Generate monthly or yearly summaries for better insights

10. Customer Support

Despite being free, EASY BILL offers excellent customer support. Whether you need help setting up the software or troubleshooting issues, the support team is responsive and ready to assist.

24/7 customer support via email and phone

Helpful FAQs and knowledge base

Dedicated support for any billing-related queries

Conclusion

EASY BILL is a powerful and user-friendly tool that simplifies the process of GST billing for businesses of all sizes. Its free access, cloud-based convenience, GST compliance, and time-saving features make it an excellent choice for businesses looking to streamline their billing process. By using EASY BILL, you can reduce manual errors, ensure tax compliance, and save valuable time, all while keeping your costs low. If you’re looking for an easy, secure, and effective way to handle your GST invoicing, EASY BILL is the solution you need!

#billing software#free invoicing software#invoicing software#free invoice software#software for billing#invoice software#best billing software#cgst#online invoicing software#gst billing software#easy-bill#free-gst-billing#gst-billing-software#benefits-of-easy-bill#gst-billing-tools#free-billing-software#gst-compliance#gst-invoicing#gst-solutions#gst-billing-benefits#gst-software-for-businesses#gst-billing-for-small-business

0 notes

Text

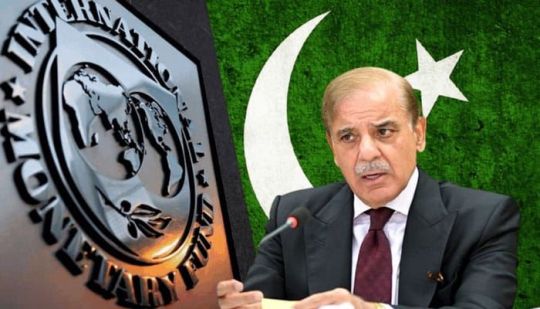

🔴BREAKING NEWS: There is hope for Pakistan! It might get a new loan from the IMF soon!! 🤔 What happened?

▪ Pakistan had recently completed a short-term $3 billion loan program with the International Monetary Fund (IMF), which was crucial in helping the country avoid a sovereign debt default. This program provided Pakistan with much-needed financial stability and averted a potential economic crisis by ensuring that the country could meet its debt obligations.

▪ After the successful completion of the initial loan program, Pakistan immediately opened discussions with the IMF to secure a new, larger loan facility. This move was aimed at further strengthening the country’s financial position and addressing ongoing economic challenges. The larger loan facility would provide Pakistan with additional resources to support economic reforms and stabilize its economy.

▪ Now, the IMF has announced that significant progress has been made towards reaching a staff-level agreement between the lender and Pakistan. This agreement is an important step in the process of securing the new loan facility, indicating that both parties are aligned on the key terms and conditions. The staff-level agreement will pave the way for formal approval and disbursement of funds, which will further aid Pakistan in its economic recovery efforts.

🧐 Why?

▪ Pakistan is reportedly seeking a fresh loan of $6-8 billion to stimulate economic growth and support its financial stability. The additional funds are intended to boost the country's economic development, address fiscal imbalances, and provide a cushion against external economic shocks.

�� However, obtaining this loan may prove challenging as the IMF has mandated stringent policy reforms as a condition for the funding. These reforms are aimed at ensuring long-term economic stability and sustainability, but they come with significant demands on the Pakistani government and economy.

▪ Pakistan has been asked to implement measures to raise revenues, which likely means higher taxes. The IMF has emphasized the need for Pakistan to increase its tax base and enhance tax collection efforts. Additionally, the country has been instructed to trim expenditures, which involves cutting down on government spending and reducing fiscal deficits. The IMF is also pushing for structural reforms to improve the efficiency and effectiveness of Pakistan's economic policies and institutions.

▪ Some of the controversial demands from the IMF include increasing the General Sales Tax (GST) rate to 18%, which would raise the cost of goods and services for consumers. Another contentious requirement is the imposition of taxes on monthly pensions above PKR 100,000, which could affect retirees and those on fixed incomes.

▪ Furthermore, the IMF insists that all these reform and policy actions receive parliamentary approval. This means that the Pakistani government must secure the backing of its legislative body for the proposed changes, ensuring that there is broad political support and legitimacy for the reforms. This step is crucial for the successful implementation and sustainability of the agreed measures.

😲Interestingly: ▪ 40% of Pakistani citizens are now in poverty. ▪ Yet, Pak PM Shehbaz Sharif and his team have assured the IMF mission that they would implement all its conditions! ❓Pakistan has already received 23 bailout programs from the IMF and several loans from other countries! Can it survive without begging for money?? Follow Jobaaj Stories (the media arm of Jobaaj.com Group for more)

0 notes

Text

Recovering your debt could cost you nothing!

The sole expense you'll encounter is the $39 set-up fee, plus GST. Nonetheless, we exert every effort to incorporate this fee into the debtor's repayment, ensuring that you can recoup your debts without any additional charges. Our approach aims to make debt collection a seamless process for you, enabling you to pursue outstanding debts without financial burden. By leveraging our strategies, you can alleviate the costs typically associated with debt recovery, allowing you to focus on your core business priorities. With our transparent and efficient practices, we strive to maximize your returns while minimizing your expenses. Trust our team to handle the complexities of debt collection, providing you with a cost-effective solution to reclaim what you are owed.

Know More

0 notes

Text

Streamlining Invoicing Processes: How GST E-Invoicing Enhances Transparency

In the era of digital transformation, the adoption of e-invoicing under the Goods and Services Tax (GST) regime in India has emerged as a transformative initiative aimed at streamlining invoicing processes, enhancing transparency, and curbing tax evasion. E-invoicing, which involves the electronic generation, transmission, and authentication of invoices in a standardized digital format, offers a myriad of benefits for businesses and tax authorities alike, revolutionizing the way invoices are generated, managed, and reported.

Let's explore how GST e-invoicing enhances transparency and accountability in tax administration:

1. Real-Time Reporting:

E-invoicing enables real-time reporting of invoices to the GSTN platform, providing tax authorities with instant access to transaction data, invoice details, and compliance status. The seamless integration between the e-invoicing system and GSTN ensures timely submission of invoice data, facilitating prompt verification, validation, and reconciliation of invoices by tax authorities.

2. Auditable Trail:

E-invoicing creates a digital trail of transactions that can be easily audited, monitored, and analyzed by tax authorities for compliance verification and enforcement purposes. The digital trail includes a timestamped record of invoice generation, transmission, receipt, and authentication, providing irrefutable evidence of transactional activity and compliance with GST regulations.

3. Authentication Mechanisms:

The GST e-invoice system incorporates robust authentication mechanisms, such as digital signatures and QR codes, to enhance the authenticity and traceability of e-invoices. Digital signatures provide cryptographic assurance of the origin, integrity, and non-repudiation of e-invoices, while QR codes contain vital information for easy verification and validation by stakeholders.

4. Automated Validation:

E-invoicing enables automated validation and verification of invoices against predefined rules, formats, and data fields prescribed by the GST authorities. Any discrepancies, errors, or non-compliance with e-invoicing standards are promptly detected and flagged for rectification, ensuring accuracy, consistency, and compliance in invoice reporting and submission.

5. Transparency and Accountability:

E-invoicing fosters transparency and accountability in tax administration by providing stakeholders, including businesses, tax authorities, and consumers, with real-time visibility into transaction data, invoice details, and compliance status. The standardized digital format of e-invoices ensures uniformity, consistency, and accuracy in reporting, enhancing trust and confidence in the integrity of electronic transactions.

6. Reduced Tax Evasion:

E-invoicing acts as a powerful deterrent against tax evasion and fraud by creating a digital trail of transactions that can be easily audited, monitored, and analyzed by tax authorities. The real-time reporting of invoices facilitates timely detection of discrepancies, unauthorized transactions, and non-compliance with GST regulations, enabling prompt enforcement action and deterrence of fraudulent practices.

7. Enhanced Data Analytics:

E-invoicing enables tax authorities to leverage advanced data analytics tools and techniques for trend analysis, anomaly detection, and risk profiling of taxpayers. By analyzing transaction data, invoice patterns, and compliance behavior, tax authorities can identify potential tax evasion, fraud, or non-compliance, enabling targeted enforcement measures and revenue recovery efforts.

In summary, the adoption of e-invoicing under GST enhances transparency, accountability, and compliance in tax administration, creating a level playing field for businesses, promoting fair competition, and bolstering trust and confidence in the tax ecosystem. By leveraging the capabilities of e-invoicing, businesses and tax authorities can collaborate effectively to combat tax evasion, foster compliance, and uphold the integrity of the GST regime.

#gst#gst services#business#taxes#gst filing#GST e-invoice#gst registration#business ideas#finance#business growth#entrepreneur

0 notes

Text

NPA Mitigation in Business Practices

Non-Performing Assets (NPAs) stand as a persistent challenge in India's financial sector. These are loans that haven't yielded expected returns due to borrowers' failure to meet repayment obligations. NPAs weaken banks' balance sheets, curtail credit flow, and hinder economic growth. Therefore, mitigating NPAs is crucial for fostering a robust financial ecosystem.

Understanding NPAs

NPAs are primarily categorized into two types: Substandard Assets and Doubtful Assets. Substandard Assets indicate the possibility of not being repaid fully, while Doubtful Assets signify a higher level of uncertainty regarding repayment.

Several factors contribute to the surge in NPAs, such as economic downturns, inadequate risk assessment, borrower insolvency, and policy or regulatory changes. Moreover, sectors like infrastructure, steel, textiles, and aviation have notably high NPA ratios, demanding specific attention for resolution.

Mitigation Strategies

Strengthening Credit Evaluation

Enhancing credit appraisal mechanisms is pivotal. Rigorous assessment of borrowers' creditworthiness, industry trends, and repayment capacity can mitigate the risk of NPAs. Employing robust risk management tools and embracing technological advancements in credit scoring aids in making informed lending decisions.

Prudent Loan Structuring

Adopting prudent loan structuring practices involves aligning repayment schedules with borrowers' cash flow projections. It ensures that repayment obligations are realistic and manageable, reducing the probability of defaults and consequent NPAs.

Uday Kotak, the founder and MD of Kotak Mahindra Bank, has often discussed the need for prudent management of NPAs and the role of banks in reducing these non-performing assets.

Also Read: NBFCs Vs Banks: Which One Is Better For Business Loans?

Early Detection and Resolution

Prompt identification of potential NPAs is vital. Implementing effective monitoring systems enables early detection, allowing timely intervention to prevent assets from deteriorating further. Initiating resolution mechanisms promptly, such as restructuring or recovery measures, helps salvage the assets before turning non-performing.

Poonawalla Fincorp’s MD, Abhay Bhutada emphasized that they do not cater to the new-to-credit segment so as to maintain their Net NPA below 1 for year 2025.

Asset Reconstruction Companies (ARCs)

ARCs play a pivotal role in acquiring distressed assets from banks, aiding in their resolution. They specialize in turning around non-performing assets by infusing capital, restructuring, or selling them to investors, facilitating recovery and cleaning banks' balance sheets.

Strengthening Legal Framework

A robust legal framework expedites the recovery process. Streamlining legal procedures and establishing specialized tribunals or mechanisms for swift resolution of NPA cases expedites the recovery process, instilling confidence in lenders and investors.

Also Read: Impact of GST Payments on Loan Approvals

The Way Forward

Efforts undertaken by regulatory bodies and financial institutions have shown promising results in mitigating NPAs. However, consistent vigilance and adaptability to changing economic scenarios remain imperative.

Enhanced transparency, accountability, and risk management practices are fundamental pillars for sustainable NPA mitigation. Collaboration among stakeholders—government, regulators, financial institutions, and borrowers—is critical for developing a resilient financial ecosystem.

Conclusion

Mitigating NPAs is a multifaceted endeavor requiring proactive measures, technological advancements, and robust risk management frameworks. A concerted effort aimed at enhancing credit evaluation, timely resolution, and a supportive legal ecosystem is paramount for mitigating NPAs, paving the way for a healthier financial landscape in India.

0 notes

Text

Genesis Hospital: Your Best Choice for Gallbladder Stone Surgery in Kolkata

If you are seeking the best hospital for gallbladder stone surgery, you have come to the right place. With Expertise of Renowned Surgeons and a team of highly skilled medical professionals, Genesis Hospital is committed to providing superior care and successful outcomes for patients requiring gallbladder stone surgery. In this blog, we will delve into the reasons why Genesis Hospital stands out as the top choice for this critical surgical procedure in Kolkata.

Expertise of Renowned Surgeons:

Our team of surgeons includes some of the most renowned and experienced specialists in the field of gallbladder stone surgery. Their expertise, combined with a compassionate approach, ensures that patients receive the highest quality of care throughout their surgical journey.

Comprehensive Pre-surgery Evaluation:

At Genesis Hospital, we believe in personalized care. Before recommending gallbladder stone surgery, our team conducts a thorough pre-surgery evaluation to assess the patient's overall health and determine the best course of action. This approach ensures that each patient receives a tailored treatment plan, optimizing the chances of successful surgery and a smooth recovery.

Post-surgery Care and Rehabilitation:

At Genesis Hospital, our responsibility towards patients does not end with the surgical procedure. We provide comprehensive post-surgery care and rehabilitation, ensuring a swift and steady recovery. Our team of dedicated healthcare professionals guides patients through the healing process, allowing them to resume their regular activities at the earliest.

Patient-Centric Approach:

At the heart of Genesis Hospital's philosophy is a patient-centric approach. We understand that undergoing surgery can be a daunting experience, which is why we prioritize patient comfort, safety, and satisfaction at every step. Our compassionate staff is always available to address any concerns and provide support to patients and their families.

When it comes to gallbladder stone surgery, Genesis Hospital is the unparalleled choice in Kolkata. With our experienced surgeons, and patient-centric approach, we ensure that our patients receive the best possible care and outcomes. We would also like to express our gratitude to our dedicated team of doctors, nurses, and staff members, whose tireless efforts and commitment to patient care have earned us the reputation of being the best hospital for gallbladder stone surgery in Kolkata.

Thank you for considering Genesis Hospital for your healthcare needs. We remain dedicated to upholding the highest standards of medical excellence and compassionate care. Should you require gallbladder stone surgery or any other medical assistance, we are here to serve you with unwavering dedication and expertise.

For more information:-

Hospital Address

1470 Rajdanga Main Road,

Kolkata 700107 (Beside GST Bhawan)

Mobile 8584883878 | 8584883884

E-mail [email protected]

Website- www.genesishospital.co

#hospital for laparoscopic surgery in kolkata#best hospital for laparoscopic surgery in kolkata#hospital for gallbladder stone surgery in kolkata#best hospital for gall stone surgery in kolkata#general hospital#health benefits#health care#health & fitness#hospital#health

0 notes

Text

What Is Gender Specific Therapy?

Gender Specific Therapy (GST) is a unique form of therapy that can help individuals who experience gender identity issues. The practice is based on the theory that gender differences in a person's behavior, thought patterns, or emotions are shaped by a combination of genetic and environmental factors.

Process group therapy

Process group therapy is a surprisingly powerful tool for growth. It can help people learn new behaviors and increase their awareness of psychological defenses. It's also a useful way to develop assertive communication skills.

Typically, process groups have five to ten members. The group is led by a trained therapist. They meet to discuss current problems and establish a high level of trust. In process groups, the therapist can also make suggestions on how to improve the quality of the group experience.

A good therapist will create a safe and neutral environment free of sexual misconduct or other forms of discrimination. This will allow people to share their experiences in a positive, encouraging, and nonjudgmental setting.

Group therapy can also be used to address emotional issues, such as anxiety and depression. These types of groups are usually less expensive than individual treatment. As with any type of therapy, participation is key.

Gender-specific recovery groups are becoming more common in treatment facilities. These types of groups allow men and women to share their experiences and provide support to each other. While many of the participants may be at a similar stage of recovery, each person will face different challenges. Both genders have a lot to teach each other.

Reducing distractions

When it comes to treating clients who struggle with substance abuse, distractions are one of the most prevalent challenges. Men and women need to heal from addiction and avoid the risks of relapse. To reduce distractions, gender-specific therapy programs are designed to address both men and women's unique needs.

In addition to the obvious benefits of eliminating distracting situations in a mixed-gender environment, gender-specific treatment programs can help men and women work through their differences and find common ground. This approach can lead to healing and lasting relationships with peers.

Despite the benefits of avoiding distraction, there are few evidence-based strategies to mitigate the risks of patient safety problems. As such, clinicians must learn how to safely manage their work in the face of interruptions.

Until more effective strategies are identified, the risk of error increases. For example, physicians in the emergency department are interrupted 10 times a day. Similarly, nurses are interrupted even more frequently.

Several studies have investigated the effect of distraction on labor pain. While some have suggested that the practice may reduce pain, others have found no such relationship.

Improve stroke care in both genders

In order to improve stroke care, clinicians must better understand how the sex of the patient interacts with the disease. The gender of the patient influences the type of treatment, as well as outcomes. For example, women have a higher risk of disability and death, and the sex of the patient may influence how a particular treatment is used.

Several studies have shown that the sex of the patient affects the outcome of stroke. This is largely a function of the type of condition presented and the severity of it. Compared with males, females are older, more frail, and more likely to have a second condition during hospitalization.

Despite these differences, there has been little effort to evaluate sex-related differences in the acute therapy for ischemic stroke. However, the American Heart Association (AHA) recently issued a scientific statement, which provides guidelines for improving the care of people who have undergone endovascular therapy for a ischemic stroke.

In order to understand how the sex of the patient affects treatment, researchers looked at specific-cause mortality after a stroke. Using competing risk models, they estimated standardized mortality ratios for cause-specific mortality by sex. They found that age was the biggest contributor to the sex differences in cause-specific mortality.

Physical and emotional effects of addiction

Addiction is an illness that affects mental, physical and interpersonal functioning. It occurs when a person uses a substance or activity in an excessive amount. The person engages in behavior that causes a disruption of obligations, such as work, home, and social activities.

In addition to psychological factors, sociological, social and environmental factors also contribute to a person's vulnerability to addiction. For example, individuals have been found to be more vulnerable to addiction if they have negative life experiences, such as emotional abuse, sexual abuse, parental divorce, loss of a parent, loss of a child, separation from a significant other, and financial instability.

Addiction is the result of changes in the brain's structures and functions. When a person takes a substance or engages in an activity, the reward pathway in the brain is affected. Similarly, the learning system is affected. These changes can last long after the effects of the substance or activity have worn off.

Addictions can cause feelings of guilt and hopelessness. They can also induce feelings of shame. People with substance use disorders may experience persistent desire for the drug, distorted thinking, and poor social relationships.

0 notes

Text

Bhushan Power and Steel Insolvency Professionals Mahender Khandelwal

I am Mahender Khandelwal is a registered insolvency and Chartered Accountant professional. Senior management and financial professional with wide experience spanning over 30 years in entire continuum of structuring, financing through debt and equity instruments. Management and turnaround of Special situations and Insolvency across wide spectrum of industries. Led Restructuring and Resolution of a large corporates (100+) across various sectors viz. Iron and Steel, Stainless Steel and utensils, System Packaging, Forging Industry, Pharma, Hotels, NBFC, Rice and Food Processing, Fertilizers, Biodiesel, Edible Oils, Biomass, Solar Panels, Power and Infrastructure, Textile, Education, Auto Component, Polymers, Electric Appliances, Plywood, Construction and Real Estate. Started BRS practice in BDO & PWC as Leader & Partner successfully resolved 20 plus cases in Insolvency under my leadership ranging fromm 200 crores to 50,000 crores.

Prior to that I was running my Boutique Consultancy firm in the name of Varrenyam Consultants Pvt Ltd.

MONITORING PROFESSIONAL

Bhushan Power and Steel Limited.

Jul 2017 – Mar 2021

3 years

BPSL is the among first dirty dozen cases referred by lenders to insolvency. The company have a borrowing of more than 47000 crores from over 35 lenders. There has been an all-round growth and complete turnaround in the operations of the company since the commencement of CIRP. When RP took control over BPSL, capacity utilization was meagre 47% with production level of 82,000 MT per month and EBITDA loss. Due to combination of proactive CoC and decisions taken by the RP for enhancement of capacity utilization. During CIRP period production had increased to 200,000 MT and the company generated EBITDA of more than 4000 crores. Moreover, the company under the leadership of the RP/MP was able to reduce the statutory and worker liabilities besides improving working capital levels. The RP/MP further ensured smooth operations while managing 15,000 employees across 9 locations and provided increments to the employees. Some of the incomplete projects were completed by incurring additional CAPEX with COC approval. On the date of implementation there was working capital of more than 7500 crores in cash balance of around 2500 crores. During CIRP Period RP have handled enquiries/investigations from Regulatory Authorities i.e. SFIO, CBI, ED and GST for pre CIRP period including closing of draft forensic audit conducted during pre CIRP period including closing of draft forensic audit report conducted during pre CIRP period. Due to turnaround and enhanced operations, Resolution applicants improved their bid amount from initial12,000 crores to 19,800 crores and JSW successfully implemented the resolution plan and taken over control of BPSL. The Financial creditors have recovered around 42 percent of their dues in BPSL resolution.

Corporate Insolvency Resolution Process

KSK MAHANADI POWER COMPANY LIMITED Oct 2019 – June 2020

Hyderabad Area, India, Power Plant at Bilaspur 3600MW

KSK Mahanadi operates a coal-based power project with a nameplate capacity of 3600 MW. The company has 3 operational units and rest are under various stages of construction. After commencement of CIRP process, we are able to operate all 3 units generating highest load with 80% capacity utilization and PLF of about 76%. With existing operational and technical team, we have introduced various cost cutting programs to bring in efficiency in operations. In the ongoing COVID-19 lockdown, we were running the plant at full capacity and supplying power to distribution companies despite cash flow constraints. CIRP of KSK is substantially delayed as rail and water infrastructure of power plant are housed in separate subsidiary companies and lenders have filed a consolidated application in NCLT. Getting investors interest in standalone Power plant is a challenge due to unenviability of rail and water infrastructure.

Resolution Professional

Prius Group of Entities

Apr 2019 – Present

New Delhi

RP for 5 Commercial real estate companies of Ex Ranbaxy promoters namely Pawan Impex Pvt Ltd, SVIIT Software Pvt. Ltd, Payne Realtors Pvt Ltd, Prius Commercial Projects Pvt Ltd. and Sharan Hospitality Ltd.

Financial Creditors

S. No.

Entity

Amount Admitted

Resolution Amount

Percentage Recovery

Resolution Applicant

Stage of Implementation

1

Prius Commercial Projects Private Limited

407.83

407.83

100.00%

Consortium of Kotak Investment Advisors Limited, Minicon Insulated Wires LLP and Elita Capital Advisors LLP

implementation has been completed

successfully

2

Sharan Hospitality Private Limited

76.75

76.75

100.00%

Majestic Auto Limited

Resolution Plan

approved,

implementation of plan

is still going on

3

Payne Realtors Private Limited

27.36

27.36

100.00%

City Gold Entertainment Ltd.

implementation has

been

completed

successfully

4

Pawan Impex Private Limited

194.85

130.00

67.00%

Consortium of DMI Alternative Investment Fund - Special Opportunities Scheme, Fact Software Private Limited and Yash Gupta

Resolution Plan

approved,

implementation of plan

is still going on

5

SVIIT Software Private Limited

59.23

35.15

60.00%

Mr. Parmjit Gandhi

Resolution Plan approved, implementation of plan

is

still going on

Educomp Solutions Ltd.

May 2017 till date:

Till date running the company as going concern and up to date in payment to employees, Statutory dues and operational expenses in spite of adverse situation due to covid 19. Resolution Plan of EBIX Singapore Pte. Ltd. was approved by the lenders and subsequently approved by NCLT. However, due to covid resolution applicant have filed application in NCLT/NCLAT for withdrawal which NCLAT not allowed. Resolution applicant filed in Supreme court, which is pending for final judgement.

Partner and Leader Business Restructuring Services

PwC Professional Services LLP Full-time

Apr 2018 – Aug 2019

1 year

Gurgaon

Joined as Partner & Leader of Business Recovery Services (BRS) practice at PwC India. PwC is among the top consultancy firm in India and a world leader in BRS & stressed asset resolution practices. As a BRS Leader, I was leading a team of 70 dedicated professionals for the overall development and growth of the vertical. I have overseen and guided various CIRP assignments under various RP’s including Uttam Value Steels, Uttam Galva Metallics, Era Infra & Engineering, Parabolic Drugs, Diamond Power Infrastructure Ltd, Videocon group companies, KSK Mahanadi, Sukam Power Systemsand PRIUS group of companies. During this stint, I have developed strong and credible relationships with, stressed assets funds, international fund houses, ARCs and NBFC.

Partner & Leader- Business Restructuring

BDO India LLP Full-time

May 2017 – Apr 2018

1 year

New Delhi Area, India

BDO India LLP is the India member firm of BDO International. BDO India offers strategic, operational, accounting, tax & regulatory advisory and assistance for both domestic and international organizations across a range of industries. As the leader and partner of BRS division, I was instrumental in establishing insolvency practice for BDO. Through persistent market development efforts, BDO was successfully awarded 3 out of first dirty dozen insolvency cases. These cases were Jyoti Structures, ABG Shipyards and Bhushan Power and Steel Ltd. BDO also won 3 cases in mid-market segment. I also developed a team of insolvency professionals, execution team for claim verification, process advisory, operation and maintenance, sectorial compliances, Balance sheet and cash flow monitoring. My team was the first one to develop system, procedures and SOP’s for insolvency practice. In the very first year of operations, we won more than Rs. 100 crore business.

Managing Director

Varrenyam Consultants Private LimitedSelf-employed

May 2004 – May 2017

13 years and From April 2021 to till date

New Delhi Area, India

A boutique financial advisory services firm specializes in the field of financial restructuring of distressed companies, settlement of debts, and resources mobilization. During this period, I have advised more than 100 corporates on financial restructuring and settlements ranging from 200 crores to 25000 crores. My firm was leading advisor in the Corporate Debt Restructuring process (CDR) and was instrumental in strategy formulation, scheme preparation, financial modelling, valuation and techno economic studies. We were also involved in finding strategic investor/buyers for some of the companies where post restructuring plan required change of management.

We also organised funding for distressed assets through ARC, special situation funds, NBFC’s.

Post implementation of CIRP assignments I have restarted my above Boutique firm.

General Manager Finance

ROLLATAINERS LTD

Apr 2000 – Apr 2004

4 years

Faridabad, Haryana and Delhi

As finance head, my job profile included Treasury Management, funds control including collections and disbursements and supervision of banking transactions. I was directly reporting to the President, Executive Director and Board of Directors comprising top Professionals. I was instrumental in implementing Financial and Operational Restructuring. Financial restructuring involved Rephasement of repayments and lowering of interest rates in first phase, creating vehicle for Venture fund investment and saving the company from BIFR. As a member of Board presentation to board on various restructuring options, Strategy formation and approvals of board on various cost cutting and restructuring options including shutting down. I also involved in strategy formation and approvals of board on various cost cutting and restructuring options including shutting down of loss-making businesses. Redesigning of MIS Systems and assisting top management on various financial strategies. Consolidation and Centralization of Finance, Accounts and Purchase function. Business valuation, financial modeling, Audit Finalization – Statutory, Internal, Tax, Stock, Concurrent and due diligences.

Senior Manager-Finance &Accouts

Modi Rubbers Ltd

May 1997 – Mar 2000

2 yrs 11 months

Delhi Area, India

Part of Modicorp (ultimate holding company of B. K. Modi group companies), I was responsible for managing funds, control, overall supervision of accounts department of 13 companies in layers of holding and subsidiary structure. I was also involved in Tax Planning, finalization of Accounts and interaction with Statutory, Internal, Tax Auditors and Auditors for valuation and Due Diligence. I also supported group financial controller for credit rating in respect of US$ 50 Million ECB. Liaison with banks, financial institutions and taxation authorities.

Sr. Manager-Finance

SARDA PLYWOOD INDUSTRIES LTD

Mar 1992 – Mar 1997

5 yrs 1 mo

Delhi, India

As a part new project division, worked on project evaluation and viability study of various projects and participated in launching of new project from grass root level to concept paper for management, Joint Venture partners, and term lending institutions, venture capital funds, banks and state level institutions. I was also responsible for arrangement of export credit limits from banks and export documentation. Overall supervision of Accounts department, balance sheet finalization and other related activities.

1 note

·

View note

Text

Shiv Kumar Sehgal:Renowed Analyst Predicts July 2016 Stock Market

Renowed Analyst Predicts July 2016 Stock Market

On June 28, 2016,The first half of 2016 was a turbulent period for the global and Indian stock markets, with various events affecting the market sentiment and

performance. Shiv Sehgal , a leading market Renowed Analyst, has released a comprehensive report on the stock market trends and outlook for July 2016, authored by its chief analyst Shiv Sehgal. The report provides a summary of the key factors that influenced the market in the first half of the year, and a forecast of the market direction and opportunities in the following month.

Key Factors in the First Half of 2016

The report identifies four major factors that had a significant impact on the Indian stock market in the first half of 2016:

· Brexit: The unexpected outcome of the British referendum to leave the European Union on June 23, 2016, caused a shockwave in the global markets, triggering volatility and uncertainty. The Indian rupee depreciated to 67.96 against the US dollar on June 24, 2016, its lowest level in nearly three months. The Indian stock market also witnessed a sharp sell-off, with the Sensex and Nifty50 plunging by 604.51 points and 181.85 points, respectively, on the same day.

· Interest Rate Cut: The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.5% on June 7, 2016, the lowest level since 2011. The rate cut was aimed at supporting the growth of the Indian economy and controlling inflation, which eased to 5.76% in May 2016 from 6.07% in April 2016. The rate cut was welcomed by the market, as it signaled the RBI’s confidence in the economic recovery and the fiscal consolidation efforts of the government.

· GST Bill: The Goods and Services Tax (GST) bill, which seeks to simplify and unify India’s tax system and promote its economic integration and development, was passed by the Lok Sabha on June 20, 2016. The bill is expected to boost the GDP growth by 1-2% and increase the tax revenue by 15-20%. The bill is awaiting the approval of the Rajya Sabha and the state legislatures, which is likely to happen in the monsoon session of the parliament. The market reacted positively to the progress of the GST bill, as it reflected the government’s commitment to the reform agenda and the consensus among the political parties.

· Pay Hike: The Indian government announced on July 1, 2016, that it would implement the recommendations of the 7th Pay Commission of Central Government Employees and increase the salaries and allowances of central government employees by approximately 23.5%. The pay hike is expected to benefit about 10 million employees and pensioners, and improve their spending power and confidence. The pay hike is also expected to have a positive spillover effect on the private sector and the consumption-driven sectors of the economy.

Market Outlook for July 2016

Based on the above relevant data, LRO chief analyst Shiv Sehgal predicts the trend of the Indian stock market in July 2016 as follows:

· Sensex and Nifty50: The benchmark indexes of the Indian stock market will show a volatile upward trend in July 2016, benefiting from the interest rate cut by the RBI, the government’s tax reform and pay hike policies, as well as the growth of the Indian economy and the improvement of corporate profits. The Sensex and Nifty50 are expected to trade in the range of 26,000-28,000 and 8,000-8,600, respectively, with a positive bias. The market may face some resistance at the higher levels, due to the global uncertainties and the earnings season.

· Sectoral Performance: The main sectors of the Indian stock market, including finance, information technology, consumption, energy, materials, etc., will show different opportunities and challenges. Among them, the finance and consumption sectors are relatively strong, benefiting from policies such as interest rate cuts and pay hikes, and the demand for credit and consumer goods. The information technology sector is relatively weak, affected by factors such as Brexit and the depreciation of the rupee, which may hurt the export-oriented IT services. The energy and materials sector is influenced by oil prices and exchange rates, which may fluctuate depending on the global supply and demand situation.

· Stock Selection: Individual stocks in the Indian stock market will show different ranges of rise and fall based on their respective performance, valuation, growth, competitiveness, and other factors. Among them, some high-quality large-cap stocks and small- and medium-cap stocks are expected to resist market fluctuations and even offer opportunities for rising. The report provides a list of some of the recommended stocks for July 2016, along with their target prices and rationales.

Investment Strategy and Recommendations

For investors, chief analyst Shiv Sehgal recommends the following strategy:

· Focus on industries and companies closely related to India’s economic growth, such as finance, consumption, etc., and pay attention to their profitability, growth potential, valuation level, and other indicators. You can add positions in these sectors, as they are likely to outperform the market in the long term.

· Diversify your investment portfolio and avoid over-concentration in one industry or company to reduce risk and increase the stability of returns. You can also use hedging strategies, such as options and futures, to protect your portfolio from market volatility.

· Monitor the market trends and news, and adjust your investment plan accordingly. You can also use technical analysis tools, such as moving averages, trend lines, support and resistance levels, etc., to identify the entry and exit points for your trades.

0 notes

Text

BJP MPs in Rajya Sabha: Opposition should not make farm stir another Shaheen Bagh

NEW DELHI: Asserting that the new farm laws were passed after extensive deliberations in Parliament, the BJP Wednesday said in the Rajya Sabha that doors are always open for farmers to resolve the issue amicably, and urged opposition parties not to make the farmers’ agitation another Shaheen Bagh. Moving the Motion of Thanks to the President’s address in the upper house, BJP member Bhubaneswar Kalita said the government respects farmers. He said the government has given new rights to farmers through these new farm laws and none of their rights or facilities have been taken away. Attacking the opposition members, who were trying to disrupt the proceedings of the House, he said, “Let me remind them that the three farm laws have been passed by both the houses of Parliament after much deliberations.” “The benefits of these three important farm laws have started reaching more than 10 crore people and small farmers. There has been no reduction in the rights and facilities of farmers. Through these agriculture reforms, the government has given new rights to farmers,” he said initiating the debate. The motion was seconded by another BJP member Vijay Pal Singh Tomar. Prime Minister Narendra Modi was in the House when the debate started. The opposition members moved as many as 118 amendments to the Motion of Thanks to the President’s address. Kalita said even after opposition members are raising the issue to disrupt the House, “we have utmost respect for our farmers”. He said agriculture minister and railways minister have been holding discussion with farmers and many rounds of discussions have already taken place. “The door is always open for farmers for discussion so that this issue of farm laws can be resolved amicably.The government is ready to discuss all issues concerning it, but my appeal to our friends, please do not make it another Shaheen Bagh,” he said. Shaheen Bagh in the national capital was the the epicentre of the protests against the Citizenship (Amendment) Act (CAA). The BJP member from Assam cited the example of the Citizenship amendment bill which was passed by Parliament after the BJP returned to power with a decisive majority. “Now they have objections and they want to organise another Shaheen Bagh. The anti-CAA parties in Assam are forming new parties and let me remind you what Congress got in 2019 Lok Sabha elections by supporting CAA, the anti-CAA parties will lose in 2021 elections in Assam,” Kalita said. “The BJP alliance will win and return to power in Assam,” he asserted. He lauded the Prime Minister for his numerous visits to Assam, noting that Modi and central government officials have visited Assam and northeastern states 40 times during his two terms. This is probably the first time that any Prime Minister has paid so much attention to the northeast region, he said. He also noted that the government is committed to strengthen the underprivileged sections of society. This government believes in 100 percent implementation of its promises, he said. Kalita said the GST collection was picking up as the economy was on the path of recovery due to efforts taken by the government. Vijay Pal Singh Tomar said the farm laws were passed after extensive deliberations, noting that there have been 12 expert committees in the past two decades on farm reforms. He hit out at those criticising the farm laws, saying they are spreading misinformation. The new laws will help small farmers and the agricultural sector, he said. He also drew a comparison between the agriculture budgets during the UPA tenure and now. He aid one year budget provision for agriculture has been more than five years of that in UPA. He said the agriculture budget was Rs 1.21 lakh crore during 2009-2014 whereas the agriculture budget in 2019-20 was 1.51 lakh crore. “The way the Prime Minister has taken steps in the agriculture sector, we are sure the sector will grow and help make India a $5 trillion economy,” he said. He stressed on value addition in farming, saying diversification is required in the sector and that is possible only with the new farm laws. Small and marginal farmers which comprise 86 per cent will benefit from new laws, he said. He said post harvesting losses to farmers is said to be 15-22 per cent and a survey attributes losses at Rs 92,000 crore per annum. Proper storage can save it, he said. Tomar said middlemen were eating into the profits of farmers and new laws were intended to benefit farmers. He pitched for diversification of agriculture and lauded Modi and the BJP government for recognising industrious farmers and conferring awards like Padmashri on them. Tomar also stressed on ethanol production by farmers and said the demand was bound to increase following government’s decision to increase blending limit to 20 per cent by 2030. On farm laws, he said some people were creating confusion that farmers will not get MSP whereas during the BJP regime it has risen sharply. The children of farmers will become job providers after these laws and would not be required to work for petty sums, he said. Those who moved amendments included Tiruchi Siva, Digvijay Singh and Deependra Singh Hooda.

source https://bbcbreakingnews.com/2021/02/03/bjp-mps-in-rajya-sabha-opposition-should-not-make-farm-stir-another-shaheen-bagh/

0 notes

Text

2Cs can trigger the animal spirits in the economy

Covid-19 lockdown has locked down the Indian economy, which is set to face one of the worst ever growth slumps in the recent decades. Of course, this economic slump induced by Covid-19 is a global phenomenon and we may still end up being the best among the worst performing economies around the World. After series of macro economic reforms like GST and various other measures, Indian economy was looking to consolidate on the back of those reforms; and this virus came as a bolt from the blue. The Covid-19 strike only reaffirms the need for more, long lasting reforms for the economy to get back to 8% growth levels and look beyond that too.

That said, there are two critical components for the economy to lift from the current slump and only those factors can kick start the economy. I would call them as 2Cs impact on the economy to measure the amount of recovery in the key macro indicators.

Consumption: The primary growth driver in the coming months would be the return of consumption story, which is hampered by the loss of jobs, cut in salaries and lesser discretionary spending by the consumers. But the real kick start for the economy would be the return of the consumers to the pre-Covid levels. In the current scenario this looks the goal is a far fetched one, but eventually consumers will come back to spending mode. The government needs to ensure the consumption returns with some demand and supply side measures to boost the consumption oriented economy.

It is also highly imaginative to think consumers will never go back to consumption mode, given the fact that we have the youngest population count in the World compared to even countries like China. They would eventually come back to the older ways provided strong measures are taken to mitigate the Covid-19 disruptions. Businesses do understand the current circumstances to be highly challenging to get back the consumers, but measures from their side would also boost the return of consumption growth in the economy.

Credit: Government, as a post Covid-19 measure has unleashed the credit tool in the economy to kick start the credit cycle; and this could be the most effective weapon for the trade and industry to kick start the economic cycle. India, though hamstrung by Covid-19 disruption, still has the best bet on the economic recovery. Remember, post Covid-19 China may end up a big loser in attracting foreign capital and industries would like to shift gears and head towards India. Added to that, the global anger against China is a huge detrimental factor for its further prospects on the foreign capital flows. Even the existing industries run by foreign companies in China would press the exit button in the coming months, given the poor handling of Covid-19 by China and its belligerent posturing in the recent times.

India would be a natural destination provided if we have the right platform to attract the fleeing foreign capital into Indian trade and industry. With many desi companies outsourcing industrial materials from China, the credit boost could help the companies build domestic capacities to manufacture the components locally rather than relying on Chinese imports. Moreover, the credit boost should reach the last mile in this country's economy with the return of the vibrant street stall economy.

Overall, the recovery of Indian economy remains a huge challenge even as the lockdown is still in place in many parts of the country, that too in some important industrial states like Maharashtra and Tamilnadu. It's also a fact that a vaccination could be the only solution to end this mess, but nevertheless the governmental efforts would go on in getting the economy back on track. For the recovery to get fast tracked, the emergence of 2C factor will be crucial for the pace of the economic recovery. The “Indian” story remains intact despite the disruptions caused by Covid-19, we could emerge as the fastest growing economy in the coming years if the 2C factor emerges stronger than never before!

0 notes

Text

About Mahender Kumar Khandelwal Insolvency Professional

I am Mahender Kumar Khandelwal is a professional registered insolvency and Chartered Accountant professional. Senior management and financial professional with wide experience spanning over 30 years in the entire continuum of structuring, financing through debt and equity instruments. Management and turnaround of Special situations and Insolvency across a wide spectrum of industries.

Led Restructuring and Resolution of large corporates (100+) across various sectors viz. Iron and Steel, Stainless Steel and utensils, System Packaging, Forging Industry, Pharma, Hotels, NBFC, Rice and Food Processing, Fertilizers, Biodiesel, Edible Oils, Biomass, Solar Panels, Power and Infrastructure, Textile, Education, Auto Component, Polymers, Electric Appliances, Plywood, Construction and Real Estate.

Started BRS practice in BDO & PWC as Leader & Partner successfully resolved 20 plus cases in Insolvency under my leadership ranging from 200 crores to 50,000 crores. Before that, I was running my Boutique Consultancy firm in the name of Varrenyam Consultants Pvt Ltd.

MONITORING PROFESSIONAL

Bhushan Power and Steel Limited. Jul 2017 – Mar 2021 3 years

BPSL is the among first dirty dozen cases referred by lenders to insolvency. The company have a borrowing of more than 47000 crores from over 35 lenders. There has been an all-around growth and complete turnaround in the operations of the company since the commencement of CIRP.

When RP took control over BPSL, capacity utilization was meagre 47% with a production level of 82,000 MT per month and EBITDA loss. Due to a combination of proactive CoC and decisions taken by the RP for enhancement of capacity utilization.

During CIRP period production had increased to 200,000 MT and the company generated EBITDA of more than 4000 crores. Moreover, the company under the leadership of the RP/MP was able to reduce the statutory and worker liabilities besides improving working capital levels. The RP/MP further ensured smooth operations while managing 15,000 employees across 9 locations and provided increments to the employees. Some of the incomplete projects were completed by incurring additional CAPEX with COC approval. On the date of implementation, there was a working capital of more than 7500 crores in a cash balance of around 2500 crores.

During CIRP Period RP have handled enquiries/investigations from Regulatory Authorities i.e. SFIO, CBI, ED and GST for pre CIRP period including the closing of a draft forensic audit conducted during pre CIRP period including the closing of draft forensic audit report conducted during pre CIRP period.

Due to turnaround and enhanced operations, Resolution applicants improved their bid amount from initial12,000 crores to 19,800 crores and JSW successfully implemented the resolution plan and taken over control of BPSL. The Financial creditors have recovered around 42 percent of their dues in BPSL resolution.

Corporate Insolvency Resolution Process KSK MAHANADI POWER COMPANY LIMITED Oct 2019 – June 2020 Hyderabad Area, India, Power Plant at Bilaspur 3600MW

KSK Mahanadi operates a coal-based power project with a nameplate capacity of 3600 MW. The company has 3 operational units and the rest are under various stages of construction. After commencement of CIRP process, we can operate all 3 units generating the highest load with 80% capacity utilization and PLF of about 76%.

With the existing operational and technical team, we have introduced various cost-cutting programs to bring in efficiency in operations. In the ongoing COVID-19 lockdown, we were running the plant at full capacity and supplying power to distribution companies despite cash flow constraints.

CIRP of KSK is substantially delayed as rail and water infrastructure of the power plant are housed in separate subsidiary companies and lenders have filed a consolidated application in NCLT. Getting investors interest in standalone Power plants is a challenge due to the unenviability of rail and water infrastructure.

Educomp Solutions Ltd. September 2017 till date:

Till date running the company as going concerned and up to date in payment to employees, Statutory dues and operational expenses despite adverse situation due to covid 19. The Resolution Plan of EBIX Singapore was approved by the lenders and subsequently approved by NCLT. However, due to covid resolution applicants have filed an application in NCLT/NCLAT for withdrawal which NCLAT is not allowed. Resolution applicant filed in Supreme court, which is pending for final judgement.

Partner and Leader Business Restructuring Services PwC Professional Services LLP Full-time Apr 2018 – Aug 2019 1 year Gurgaon

Joined as Partner & Leader of Business Recovery Services (BRS) practise at PwC India. PwC is among the top consultancy firm in India and a world leader in BRS & stressed asset resolution practices.

As a BRS Leader, I was leading a team of 70 dedicated professionals for the overall development and growth of the vertical. I have overseen and guided various CIRP assignments under various RP’s including Uttam Value Steels, Uttam Galva Metallics, Era Infra & Engineering, Parabolic Drugs, Diamond Power Infrastructure Ltd, Videocon group companies, KSK Mahanadi, Sukam Power Systems and PRIUS group of companies.

During this stint, I have developed strong and credible relationships with, stressed assets funds, international fund houses, ARCs and NBFC.

Partner & Leader- Business Restructuring BDO India LLP Full-time May 2017 – Apr 2018 1 year New Delhi Area, India

BDO India LLP is the India member firm of BDO International. BDO India offers strategic, operational, accounting, tax & regulatory advisory and assistance for both domestic and international organizations across a range of industries.

As the leader and partner of BRS division, I was instrumental in establishing insolvency practice for BDO. Through persistent market development efforts, BDO was successfully awarded 3 out of the first dirty dozen insolvency cases. These cases were Jyoti Structures, ABG Shipyards and Bhushan Power and Steel Ltd. BDO also won 3 cases in the mid-market segment. I also developed a team of insolvency professionals, an execution team for claim verification, process advisory, operation and maintenance, sectorial compliances, Balance sheet and cash flow monitoring. My team was the first one to develop systems, procedures and SOP’s for insolvency practice. In the very first year of operations, we won more than Rs. 100 crore businesses.

Managing Director Varrenyam Consultants Private LimitedSelf-employed May 2004 – May 2017 13 years and From April 2021 to till date New Delhi Area, India

A boutique financial advisory services firm specializes in the field of financial restructuring of distressed companies, settlement of debts, and resources mobilization. During this period, I have advised more than 100 corporates on financial restructuring and settlements ranging from 200 crores to 25000 crores.

My firm was a leading advisor in the Corporate Debt Restructuring process (CDR) and was instrumental in strategy formulation, scheme preparation, financial modelling, valuation and techno-economic studies. We were also involved in finding strategic investors/buyers for some of the companies where the post-restructuring plan required a change of management. We also organised funding for distressed assets through ARC, special situation funds, NBFC’s. Post-implementation of CIRP assignments I have restarted my above Boutique firm.

General Manager Finance ROLLATAINERS LTD Apr 2000 – Apr 2004 4 years Faridabad, Haryana and Delhi

As finance head, my job profile included Treasury Management, funds control including collections and disbursements and supervision of banking transactions. I was directly reporting to the President, Executive Director and Board of Directors comprising top Professionals.

I was instrumental in implementing Financial and Operational Restructuring. The financial restructuring involved Rephasement of repayments and lowering of interest rates in the first phase, creating a vehicle for Venture fund investment and saving the company from BIFR. As a member of Board presentation to board on various restructuring options, Strategy formation and approvals of the board on various cost-cutting and restructuring options including shutting down.

I was also involved in strategy formation and approvals of the board on various cost-cutting and restructuring options including shutting down loss-making businesses. Redesigning of MIS Systems and assisting top management on various financial strategies. Consolidation and Centralization of Finance, Accounts and Purchase function. Business valuation, financial modelling, Audit Finalization – Statutory, Internal, Tax, Stock, Concurrent and due diligence.

Senior Manager-Finance & Accounts Modi Rubbers Ltd May 1997 – Mar 2000 2 yrs 11 months Delhi Area, India

Part of Modicorp (ultimate holding company of B. K. Modi group companies), I was responsible for managing funds, control, overall supervision of accounts department of 13 companies in layers of holding and subsidiary structure.

I was also involved in Tax Planning, finalization of Accounts and interaction with Statutory, Internal, Tax Auditors and Auditors for valuation and Due Diligence. I also supported the group financial controller for credit rating in respect of US$ 50 Million ECB. Liaison with banks, financial institutions and taxation authorities.

Sr. Manager-Finance SARDA PLYWOOD INDUSTRIES LTD Mar 1992 – Mar 1997 5 yrs 1 mo Delhi, India

As a part of new project division, worked on project evaluation and viability study of various projects and participated in the launching of a new project from grass root level to a concept paper for management, Joint Venture Partners, and term lending institutions, venture capital funds, banks and state-level institutions.

I was also responsible for the arrangement of export credit limits from banks and export documentation. Overall supervision of Accounts department, balance sheet finalization and other related activities.

#MahenderKumarKhandelwal#MahenderKhandelwal#MahenderKumar#MrMKhandelwal#MKkhandelwal#KhandelwalMahenderKumar#MrMahenderKumarKhandelwal#MKhandelwal

0 notes

Link

KUALA LUMPUR: The Finance Ministry through the Royal Malaysian Customs Department is committed to ensuring that the Goods and Services Tax (GST) refund to taxpayers will be expedited, and payment to be made beginning June 22. Minister Tengku Datuk Seri Zafrul Abdul Aziz said the payment process would be completed by December this year. “The Finance Ministry has agreed for the Customs Department to employ the ‘pay first and audit later’ approach for selected companies based on the Goods and Services Tax (Repeal) Act 2018 and also certain criteria. “In this regard, I have instructed the department to expedite the refund process that had been deferred due to the Movement Control Order (MCO) and Conditional MCO during which the field audits could not be done,” he said in a statement today. Tengku Zafrul said the decision would hopefully ease the cash flow of the various business sectors during the challenging economic recovery period. “This effort is in line with the economic recovery steps introduced under the National Economic Recovery Plan (PENJANA) unveiled by Prime Minister Tan Sri Muhyiddin Yassin on June 5, 2020,” he said. — BERNAMA (function(d, s, id) { var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) return; js = d.createElement(s); js.id = id; js.src="https://connect.facebook.net/en_US/sdk.js#xfbml=1&version=v3.1&appId=517691711979098&autoLogAppEvents=1"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk')); (function(d, s, id) { var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) return; js = d.createElement(s); js.id = id; js.src = "http://connect.facebook.net/en_US/all.js#xfbml=1"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk')); HEROKITA.com | Digital Talents On Demand Source link

0 notes

Text

'Covid-19 hangs over future like spectre': RBI in Monetary Policy Report

The macroeconomic risks held forth by the Covid-19 outbreak would be severe for India, the Reserve Bank of India (RBI) said in its monetary policy report, released on Thursday morning.

The impact of the pandemic came at a time when the economy was just at the turn of a recovery, “but Covid-19 now “hangs over the future, like a spectre,” it said. “While efforts are being mounted on a war footing to arrest its spread, Covid-19 would impact economic activity in India directly through domestic lockdown.”

The second-round effects would operate through a severe slowdown in global trade and growth. “More immediately, spillovers are being transmitted through finance and confidence channels to domestic financial markets.”

These would inevitably accentuate the growth slowdown, which started in the first quarter of the 2018-19 financial year and continued through the second half of 2019-20.

The outlook for 2020-21 growth was looking up before the Covid-19 scare. There was a bumper rabi harvest, and higher food prices during 2019-20 provided conducive conditions for the strengthening of rural demand. The transmission of policy rate cuts was also improving, with favourable implications for both consumption and investment demand. Reductions in the goods and services tax (GST) rates, corporation tax rate cuts in September 2019, and measures to boost rural and infrastructure spending were to have a positive impact at boosting domestic demand. But “the Covid-19 pandemic has drastically altered this outlook”, the monetary policy report said.

The central bank now expects the global economy “to slump into recession in 2020, as post-Covid-19 projections indicate”. However, the sharp reduction in international crude oil prices, if sustained, could improve the country’s terms of trade. “But the gain from this channel is not expected to offset the drag from the shutdown and loss of external demand,” the RBI said.

0 notes