#GST REGISTRATION

Explore tagged Tumblr posts

Text

Simplifying GST Registration: A Comprehensive Guide by GTS Consultant

Introduction

With the economy adopting a dogfight-like pace, organisations face the need to become agile enough to grow unhindered. As goods and services tax (GST) is one of the most important reforms in the Indian tax system, it means the inclusion of indirect tax in a single tax. Understanding and filling the GST Registration is the dire straits that every company will have to face because it is to operate within the law and take the advantage. Holding a reputable GTS Consultant AB, with a past period of more than 12 years of combine experience. We are combining our expertise to offer businesses a hassle- free expedition.

In this blog, we will provide an in-depth look at GST registration, its importance, process, benefits, and the expertise GTS Consultant brings to the table.

What is GST Registration?

The identification of goods and services that require a business to be in line with local legislation by obtaining registration under the GST Act is called the process of GST registration. It authorizes the entities to not only collect tax from their clients but also to claim Input Tax Credit (ITC) for the taxes that were paid on their purchases. Depending upon the limit of the prescribed turnover or the activities engaged in, the businesses are obliged to get registered for GST

Who Needs GST Registration?

GST registration is mandatory for:

Businesses with Aggregate Turnover:

₹20 lakhs (₹10 lakhs for special category states): For service providers.

₹40 lakhs (₹20 lakhs for special category states): For goods suppliers.

Interstate Suppliers: Businesses involved in the interstate supply of goods and services.

E-commerce Operators: Platforms facilitating sales of goods and services.

Casual Taxable Persons: Individuals undertaking occasional transactions involving the supply of goods or services.

Input Service Distributors: Businesses distributing input tax credits to their branches.

Documents Required for GST Registration

For the smooth registration process, be sure to gather the following documents:

PAN Card: It's essential for the business and for the owner and owner(s) of the business to have a PAN card.

Proof of Business: This along with partnership deeds, incorporation certificates, as well as, registration certificates.

Identity and Address Proof of Promoters: The Aadhaar card, the passport, or the voter ID should be provided.

Business Address Proof: Lease agreements, contract transit costs, or utility bills.

Bank Account Details: One may use the copy of a canceled cheque, a bank statement, or a passbook copy.

Digital Signature: It is required to be electronically signed prior to online submission.

Authorization Letter: For the account signatories that are authorized to, if applicable.

Benefits of GST Registration

Legal Compliance: Penalty prevention and adherence to Indian tax laws.

Input Tax Credit (ITC): The ITC claim should be able to reduce the total tax burden by this method.

Market Expansion: GST registration will help in the inter-State sales and e-commerce trade.

Credibility: A registered GST number enhances the credibility of a business and makes it more trustworthy in the eyes of their clients.

Ease of Doing Business: One consolidated tax system offers several advantages such as easier filing of tax returns and tax payments.

Why Choose GTS Consultant for GST Registration?

GTS Consultant, located in Bhiwadi, Alwar, Rajasthan is a determined and particular accounting and tax services company dedicated to offering the best services Imagine why the companies would trust us:

Expert Guidance: Our group of skilled public accountants and chartered accountants guarantees a mistake-free and effective GST registration.

Comprehensive Support: From preparation to submission and post-registration help, we include each and every part of it.

Time-Saving: You focus on your operations, we refine your registration business process.

Cost-Effective Solutions: Services of high rank at budget prices.

Client-Centric Approach:We will customize our services so that they match your requirements and bring you the best possible benefits.

Frequently Asked Questions (FAQs)

1. What is the penalty for not registering under GST?

A penalty of the greater of ten percent of the tax due or ten thousand rupees is paid for non-registration. If a taxpayer evades tax on his own volition, DRI is supposed to impose a penalty equal to the tax that was evaded, i.e. 100%

2. Can I voluntarily register for GST?

Yes, turnover not reaching the requirement limit, businesses can choose to register at their own discretion and thus gain great benefits such as ITC and market credibility.

Contact GTS Consultant Today

Certainly, getting through the GST registration process be a hard time, however, if your partner is GTS Consultant, you can rest assured you will be guided thoroughly through the process. Be it a new business venture or an already existing set up, we, the team at GTS Consultant, will get you the best service by ensuring that we register you without pain points.

Reach us at:

Address: TC-321-325, R-Tech Capital Highstreet, Phool Bagh, Bhiwadi, Alwar (RJ) - 301019

Email: [email protected]

Website: Explore our services and resources on our official website GTS Constultant india

2 notes

·

View notes

Text

Digital Signature Certificate for Import-Export Code (IEC) Registration

The Import-Export Code (IEC) is a unique identification number required by businesses involved in the import or export of goods and services in India. One of the mandatory requirements for IEC registration is the submission of documents using a Digital Signature Certificate (DSC). This blog explains the importance of DSCs in the IEC registration process, how they are used, and why securing your DSC is crucial for your business’s growth in international trade.

What is the Import-Export Code (IEC)?

The Import-Export Code (IEC) is a key business identification number provided by the Directorate General of Foreign Trade (DGFT). It is mandatory for businesses wishing to engage in international trade activities. Whether you’re a manufacturer, wholesaler, or trader, an IEC is essential for clearing goods through customs, making payments for exports/imports, and availing other export benefits.

Why is a Digital Signature Certificate (DSC) Needed for IEC Registration?

E-Filing Requirement: The DGFT requires businesses to submit their IEC registration forms electronically via the DGFT portal. To sign and submit these online forms, you need a Digital Signature Certificate (DSC). This DSC ensures that the forms are validated and processed by the authorities without the risk of fraud.

Ensures Legal Validity: A DSC is recognized under the Information Technology Act, 2000, and serves as a legally valid electronic signature. This makes it possible for the IEC application to be processed legally, just like a traditional paper submission.

Prevents Tampering: The use of encryption technology in DSCs ensures that the information submitted for IEC registration cannot be altered once it’s been signed, thus preventing tampering or fraudulent modifications to the documents.

Faster Processing: Using a DSC speeds up the entire IEC registration process. Since the registration is done electronically, you can avoid delays associated with manual document submission and processing.

How to Apply for IEC Registration with a DSC

Obtain a Digital Signature Certificate (DSC): To apply for an IEC, you first need to obtain a DSC from a Certifying Authority (CA). You can choose between Class 2 and Class 3 DSCs, with Class 3 being the more secure option for business-related applications like IEC registration.

Prepare the Required Documents: The DGFT requires various documents for IEC registration, such as the PAN card, proof of address, bank certificate, and the identity of the applicant. Along with these documents, you will need your DSC to authenticate and sign the application.

Register on the DGFT Portal: Visit the DGFT’s official website and create an account. After registering, log in to complete the IEC application form online. During this process, you’ll be asked to upload your documents.

Attach the DSC: Once you’ve completed the form and uploaded all the necessary documents, you’ll need to sign the form using your DSC. This step ensures the authenticity of the registration application and validates your submission.

Submit the Application: After attaching your DSC, submit the application. The DGFT will process your application, and once it is approved, your IEC will be issued electronically.

Benefits of Using DSC for IEC Registration

Security: The encryption technology in DSCs secures your business’s data and ensures that sensitive information remains protected during the registration process.

Legitimacy: With a DSC, you can ensure that your IEC registration is legally valid, reducing the chances of rejection or delays due to discrepancies.

Efficiency: The use of DSC reduces the manual effort involved in IEC registration and ensures that your application is processed more quickly.

Reduced Fraud Risks: Since the DSC links your identity to the submitted documents, it prevents any fraudulent or unauthorized transactions, protecting your business from potential legal and financial issues.

Conclusion

A Digital Signature Certificate (DSC) plays an integral role in securing and facilitating the Import-Export Code (IEC) registration process. By ensuring the authenticity of your online submission and protecting your business’s sensitive data, a DSC is essential for those seeking to engage in international trade. For a smooth IEC registration experience, consult with the Best CA Firm in Delhi, which can help you obtain a DSC and guide you through the entire registration process, ensuring your business is ready for global expansion.

2 notes

·

View notes

Text

GST Registration In Jaipur

The concept of virtual offices comes as a great advantage in today’s competitive business world. It provides ample opportunity for companies to tend towards a professional image, sans the costs and commitments associated with leasing and maintaining a real office. Virtual offices seem particularly best suited to the needs of startups, small businesses, and freelancers who desire a legitimate business address for official use without bearing the overheads. Best Desk Cove Premium Virtual Office provides a perfect solution located in one of the premium locations, having robust services at cost-effective plans for businesses in Jaipur who want to get registered under GST or incorporate their companies. In this article, we are going to review why Best Desk Cove is the best virtual office provider for GST and Company registration in Jaipur.

The Advantages of a Virtual Office for GST and Company Registration in Jaipur

Virtual offices provide businesses with a professional address for all their official purposes without them having to physically rent space. The Indian regulations consider a business address to be one of the primary requirements for GST registration, and a good and credible address adds to the Company Incorporation process. Hence, this can dramatically serve in improving a business’s credibility with all sorts of clients, investors, and regulatory authorities. Best Desk Cove offers companies in Jaipur a chance to reduce overhead costs. They provide essential services such as handling mail, answering calls, and offering meeting rooms when needed. This support helps businesses operate efficiently and effectively. This is because it can offer a company a professional view and at the same time keep such a setup simple so that no hassles are faced at the time of GST registration and incorporation.

Why Jaipur is a Strategic Location for Virtual Offices

The capital of Rajasthan, Jaipur is also emerging as a key business hub by blending its age-old cultural heritage with modern infrastructure. Besides being one of the most ardent tourism and trade centers, Jaipur is also proving economical for new ventures owing to relatively lower real estate prices compared to metropolitan cities. The strategic position of the city in North India provides excellent connectivity and growing digital infrastructure, thus making it the most appealing entrepreneurship hub starting on a small scale, too, up to established companies. Setting up a virtual office in Jaipur, therefore, enables tapping into this vibrant market. Best Desk Cove Premium Virtual Office amplifies this with a prestigious address in a prime Gst Filing Through Virtual Office business district. More so, the combination with Best Desk Cove will let the company draw power from the vibrant ecosystem at Jaipur, build a professional presence, and find support in GST Registration In Jaipur and company incorporation.

#gst virtual office#gstreturns#gstfiling#gst billing software#gst registration#best gst registrations in jaipur#gst registration near me

2 notes

·

View notes

Text

A Tax of 5% on The World’s Multi-Millionaires and Billionaires Could Raise $1.7 trillion, Enough to Lift 2 Billion People out of Poverty

#A Tax of 5% on The World’s Multi-Millionaires and Billionaires Could Raise $1.7 trillion#Enough to Lift 2 Billion People out of Poverty#property taxes#us taxes#death and taxes#filing taxes#taxes#tax#gst registration#gstfiling#gstreturns#gst services#gst#eat the rich#eat the fucking rich#class war#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#fuck capitalism#fuck work#fuckslavery#antiwork

4 notes

·

View notes

Text

#hatsune miku#gravity falls#logan howlett#mabel pines#bill cipher#beautiful hair#dead boy detectives#trending#the boys#basketball#america#htf#v for vendetta#ai generated#fashion#the book of bill#interview with the vampire#fsmp#vfkinktober2024#viralpost#animation vs minecraft#hfw photomode#germany#formula 1#animator vs animation#bnha bkdk#gst registration#x afab reader#fall out boy#gshade

6 notes

·

View notes

Text

Demystifying the Process of GST Registration

Navigating the world of taxation can often feel like traversing a labyrinth, especially for business owners. However, understanding and complying with the Goods and Services Tax (GST) registration process is crucial for businesses operating in India. In this guide, we'll unravel the complexities surrounding GST registration, making it easy to grasp and implement for your business needs.

1. Introduction to GST Registration

Before we delve into the intricacies of the registration process, let's grasp the fundamentals of GST registration. GST, introduced in India in 2017, aims to streamline the taxation system by amalgamating various indirect taxes. GST registration is the process by which businesses register themselves under this unified tax regime.

2. Importance of GST Registration

2.1 Compliance with Tax Laws

First and foremost, GST registration is a legal requirement for businesses whose turnover exceeds the prescribed threshold. By registering for GST, businesses ensure compliance with tax laws, avoiding penalties and legal consequences.

2.2 Access to Input Tax Credit

One of the significant benefits of GST registration is the ability to claim Input Tax Credit (ITC). Registered businesses can offset the taxes paid on inputs against the taxes collected on outputs, reducing their overall tax liability.

2.3 Legitimacy in Business Operations

GST registration lends credibility and legitimacy to business operations. It provides a unique identification number, known as the GSTIN, which is essential for conducting business transactions seamlessly.

3. Understanding the GST Registration Process

3.1 Eligibility Criteria

Before initiating the registration process, businesses must determine their eligibility for GST registration. Generally, businesses with an annual turnover exceeding the prescribed threshold are required to register for GST.

3.2 Documentation Required

To complete the GST registration process, businesses need to provide certain documents and information, including PAN card, Aadhaar card, proof of business ownership, bank account details, and address proof.

3.3 Step-by-Step Registration Procedure

The registration process involves several steps, including online application submission, verification of documents, and issuance of the GSTIN. Businesses can register for GST through the GST portal by following a simple and user-friendly registration interface.

4. Conclusion

In conclusion, GST registration is a critical aspect of tax compliance for businesses operating in India. By understanding the importance and intricacies of the registration process, businesses can ensure legal compliance, access input tax credit, and foster legitimacy in their business operations.

Follow Our FB Page: https://www.facebook.com/bizadviseconsultancy/

2 notes

·

View notes

Text

How to start your E-commerce business.

Being an E-commerce seller requires numerous steps, ranging starting with planning and sourcing items to creating the online shop and coordinating the logistics. This step-by-step guide will assist you in becoming an e-commerce seller:

Market Research

Business Plan

Legal Considerations

Source Products

Create an Online Presence

Payment and Shipping Setup

Product Listings and Descriptions

Make Marketing Strategy

Implement Customer Service

Optimization of Business performance

Scaling Your Business

Click below to read more.

#virtual office#gst registration#Virtual office in Delhi#Virtual office for Online seller#Virtual office for business registration#E-commerce seller

2 notes

·

View notes

Text

2 notes

·

View notes

Text

Consultancy services refer to professional advice and expertise offered by specialized individuals or firms to assist businesses, organizations, or individuals in addressing specific challenges, improving processes, and achieving their goals. Consultants are typically experts in their respective fields and provide unbiased, objective insights and recommendations.

#gst registration#itrfiling#msme registration#food license registration#esic#gem registration#labour license#passport

2 notes

·

View notes

Text

Help me reach my goal and save my family 🙏🏻🍉📍🇵🇸

514£/100،000£(1%)

@wayneradiotv @90-ghost @pangur-and-grim @nabulsi @bilal-salah0 @dlxxv-vetted-donations @comrademango @prisonhannibal @mistress--kanzaki @wellwaterhysteria @riding-with-the-wild-hunt @thatdiabolicalfeminist @sar-soor @cantyouseeimsmarmy @irhabiya @spongebobssquarepants @sattelite-of-love @sayruq @feluka @heritageposts @killyourhistory @valtsv @beserkerjewel @northgazaupdates2 @mitsukai974 @bixlers @magnus-rhymes-with-swagness-blog @wolfertinger666 @tamamita @punkitt-is-here @weirdmarioenemies @wis-art @rickybabyboy @thatdiabolicalfeminist @apas-95 @itwashotwestayedinthewater @ot3 @omegaversereloaded @pcktknife @postanagramgenerator @anneemay-blog @a-shade-of-blue @amygdalae @annabelle--cane @sporesgalaxy @hotvampireadjacent @zzoupz

🚨URGENT DISTRESS CALL

I am a mother of 5 children from Gaza. I lost my husband, my home, and everything I own in the war. I am writing to you with full pain and hope that you will heed my call and save my family.📍🍉🍉💔😭😭

This is my family of 6 people and we now live in a tent💔💔🍉

This is our house that was destroyed by the occupation😭😭😭💔💔🍉

This is our source of livelihood, but the occupation burned and destroyed it and we became without income😭😭💔🍉📍

This tent we live in is not fit for human habitation.🍉🍉📍💔💔😭

“Help me survive and go home 🏠💔”

My campaign is protected on gofundme for a year 🍉🍉📍📍🚨

The situation is very difficult, and with my family who needs support to survive in these harsh conditions. Every donation, no matter how small, may be the difference that helps us provide food and shelter💔💔😭😭🍉📍

@fly-sky-high-09 @awetistic-things @imjustheretotrytohelp @riding-with-the-wild-hunt @wellsbering @blomstermjuk @innovatorbunny @operationladybug @acehimbo @butch-king-frankenstein @butchjeremyfragrance @ohjinyoungblr @rememberthelaughter2016 @parfaithaven @huznilal-blog @saintverse @bagofbonesmp3 @anneemay-blog @ankle-beez @thatsonehellofabird @sunidentifiables @neechees

@maester-cressen @lampsbian @sundung @shinydreamtacoprune-blog @rob-os-17 @brokenbackmountain @unwinni3 @whateveroursoulsaremadeoff @cultreslut @halfbloodfanboy @pontaoski @fei-huli @elbiotipo @selkiebrides @bloodandgutsyippee @wherethatoldtraingoes2 @ibtisams-blog @ap-kinda-lit @frigidwife @vetted-gaza-funds @gazagfmboost @nabulsi27

#free gaza#free gaza 🇵🇸#free palestine#free palestine 🇵🇸#free palestine 🇵🇸🍉#free plaestine#free use slvt#free 🍉#from the river to the sea 🇵🇸#gaza genocide#gaza strip#gaza 🍉#gazaunderattack#gaza#i stand with palestine 🇵🇸#palestine fundraiser#palestine 🍉#save palestine 🇵🇸#save palestine#all eyes on palestine#i stand with palestine#🇵🇸🇵🇸🇵🇸#palestinian genocide#gaming#chude uda#gst registration#hsr fanart#please help#send help#save 🍉

13K notes

·

View notes

Text

Expert GST Registration Consultants in Agra

Looking for hassle-free GST registration in Agra? Our experienced GST Registration Consultants in Agra provide end-to-end solutions for businesses, startups, and entrepreneurs. We ensure seamless documentation, error-free filing, and quick processing to help you stay tax-compliant.

#GST Registration Consultants in Agra#GST Registration in Agra#GST Registration#GST Registration Consultants

0 notes

Text

Why GST Registration is Important for Your Business?

✅ Legal Recognition – Get your business officially recognized by the government.

✅ Input Tax Credit – Claim tax benefits and reduce your tax liability.

✅ Expand Business Online – Required for selling on e-commerce platforms like Amazon & Flipkart.

✅ Avoid Penalties – Stay compliant and avoid hefty fines.

✅ Enhance Credibility – Gain customers' trust with a GST-registered business.

Need help with GST registration in Noida ? Contact us @+91 9312888823 today!

#gst services#gst registration#taxcompliance#income tax#GST registration#gst compliance#bahuguna#bahuguna and company#ca bahuguna#hemant bahuguna

0 notes

Text

Income Tax Return Filing in Bangalore: Common Mistakes to Avoid

Submission of income tax returns (ITR) is a significant duty of individuals and enterprises in Bangalore. Yet most taxpayers commit general errors that invite penalties, slippage, or tax notifications. To obtain an easy return, it is imperative to realize such pitfalls and undertake the respective measures. Here are a few of the most common mistakes and how you can avoid them with the help of the Best CA firm In Bangalore, Mind Your Tax.

Incorrect Personal Information

Another most frequent error while filing ITR is furnishing incorrect personal details like PAN, Aadhaar number, or bank account number. Mismatches in these particulars can cause processing delays or rejection of the return. Double-check your personal information before filing the return.

Selecting the Wrong ITR Form

Various taxpayers have to file different ITR forms depending on their sources of income. The wrong choice of form may result in filing errors and hassles. Seeking professional advice from a CA firm like Mind Your Tax guarantees that you select the right form and meet tax requirements.

Not Reporting All Sources of Income

Most taxpayers do not report other sources of income, including fixed deposit interest, rental income, or freelance income. The Income Tax Department cross-verifies the income details, and discrepancies can lead to penalties. Reporting all income sources is important to avoid problems with the law.

Ignoring Deductions and Exemptions

Taxpayers tend to lose out on deductions available under Sections 80C, 80D, and 10(14), which have a considerable effect on lowering tax liability. This can be optimized by availing all possible deductions and exemptions through a professional CA.

Discrepancy in TDS Details

Tax Deducted at Source (TDS) must be reconciled with the details reflected in Form 26AS. Mismatch can lead to undue scrutiny or delay in refunds. Always reconcile TDS details prior to filing your ITR.

Late Filing or Non-Filing of Returns

Most of the taxpayers procrastinate in filing their returns, which results in penalties and forfeiture of some tax benefits. Filing ITR is typically due on July 31st for individuals, and missing this date can incur late charges and interest on taxes due. Using the Best CA firm In Bangalore, Mind Your Tax, helps avoid late filing and errors.

Not Verifying the ITR

Filing the return is not sufficient; verification must be done to finalize the process. Not verifying within the time limit can invalidate the ITR. Verification can be done through Aadhaar OTP, net banking, or by mailing a hard copy of ITR-V to the CPC.

Conclusion

Avoiding these pitfalls can make your income tax return filing smooth and hassle-free. If you are in doubt about anything related to ITR filing, it is always advisable to seek professional help. Mind Your Tax, the Best CA firm In Bangalore, offers professional guidance to make your income tax returns error-free and timely.

For easy ITR filing, get in touch with Mind Your Tax today and remain compliant with all tax laws.

#gst registration#mind your tax#gst#income tax consultants#income tax return#gst update#tax consultant#income tax return consultants#company registration#gst consultant

0 notes

Text

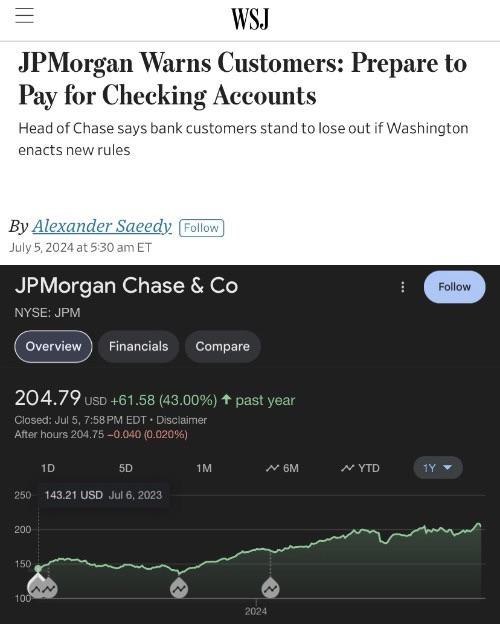

THINK OF THE SHAREHOLDERS.

#THINK OF THE SHAREHOLDERS.#shareholders#eat the rich#eat the fucking rich#jpmorgan#class war#chase bank#exploitation#exploitative#gst registration#gstfiling#gst accounting software for retail#gstreturns#gst#property taxes#us taxes#death and taxes#filing taxes#taxes#tax#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government

3 notes

·

View notes

Text

#bill cipher#hatsune miku#gravity falls#logan howlett#trending#mabel pines#dead boy detectives#beautiful hair#basketball#the boys#fields of mistria#girlblogging#long hair#dungeon meshi#gaming#gk ogata#cute boys#black and white#tw 3d vent#human rights#animation vs minecraft#fdom stuff#fall out boy#gst registration#so hot 🔥🔥🔥#gay boys#bj blazkowicz#fanfic#novak djokovic#vent post

2 notes

·

View notes

Text

How to Maximize ITC Refunds and Reduce Tax Liability?

The Goods and Services Tax (GST) system in India rolled out a refined tax model, providing the benefit of Input Tax Credit (ITC) to decrease their overall tax liabilities. The GST ITC refund procedure enables businesses to demand credit for taxes paid on purchases, assisting in improving cash flow and decreasing tax obligations. On the other hand, increasing ITC refunds necessitates thoughtful organization, compliance with rules and regulations and harnessing tech solutions to prevent retractions.

This blog provides efficient approaches to improve GST credit utilization, preventing ITC claim rejection reasons, and securing efficient processing of refunds.

Input Tax Credit (ITC) Under GST

Input Tax Credit (ITC) enables businesses to offset the GST paid on goods and services against their output tax liability. However, availing ITC is subject to compliance with input tax credit rules, including timely vendor payments, proper documentation, and ensuring suppliers file their returns correctly.

The ITC refund process has evolved with regulatory changes, emphasizing greater scrutiny and automated checks via GSTR 2B. Therefore, businesses must proactively reconcile their purchases and avoid discrepancies that can trigger ITC claim rejection reasons.

Key Strategies to Maximize ITC Refunds

1. Ensure Timely and Accurate Filing of GST Returns

One of the most common reasons for ITC denial is the mismatch between the details filed in GSTR-1, GSTR-3B, and GSTR-2B. To ensure seamless claiming ITC GST, businesses should:

Regularly reconcile GSTR-2B with purchase registers to identify missing invoices.

Verify supplier compliance to ensure they file returns on time and pay GST liabilities.

Maintain accurate invoice records to avoid errors in GST ITC calculator entries.

2. Track GST Compliance of Vendors

A major challenge in ITC claim GST India is vendor non-compliance. If your supplier fails to file GSTR-1, your ITC claim could be denied. Best practices include:

Engaging with GST-compliant vendors and verifying their GST refund status.

Monitoring vendor filings via the GST portal to prevent ITC reversals.

Using digital tools to automate vendor compliance tracking.

3. Minimize ITC Reversal GST Scenarios

ITC reversals occur when businesses fail to comply with input tax credit rules. Common triggers include:

Non-payment to vendors within 180 days from invoice date.

Utilizing ITC for non-business or exempt supplies.

Vendor’s GST registration cancellation, leading to a mandatory reversal of previously claimed ITC.

To mitigate these risks:

Conduct regular compliance checks on vendor registrations.

Maintain robust accounting systems to track invoice payments.

Ensure ITC claims align with eligible business activities.

4. Optimize GST Credit Utilization for Tax Savings

To maximize the GST ITC refund, businesses should strategically apply available credits before cash payments. Best practices include:

Prioritizing IGST credit utilization before CGST/SGST to minimize tax outflows.

Ensuring proper documentation for capital goods ITC to maximize long-term benefits.

Automating ITC tracking with GST ITC calculator tools for precise calculations.

5. Claim Refunds for Unutilized ITC

In cases where ITC exceeds output tax liability, businesses can claim GST ITC refund under two scenarios:

Export of Goods and Services: Businesses exporting without paying IGST can claim a refund on unutilized ITC.

Inverted Duty Structure: When the tax rate on inputs exceeds that on output supplies, ITC can be refunded.

To ensure a hassle-free ITC refund process, businesses must:

File RFD-01 for refund applications.

Maintain valid documentation, including shipping bills and tax invoices.

Regularly check GST refund status to track refund processing.

Leveraging Technology for ITC Optimization

With growing tax scrutiny, businesses must embrace automation and AI-driven compliance solutions to manage ITC claims effectively. Digital solutions help:

Automate ITC reconciliation between GSTR-2B and purchase records.

Identify discrepancies that could trigger ITC claim rejection reasons.

Provide real-time vendor compliance alerts, reducing the risk of ITC reversals.

Conclusion

Maximizing GST ITC refund and minimizing ITC reversal GST scenarios requires a proactive approach, including stringent vendor compliance checks, timely filing, and leveraging technology for GST credit utilization. By following best practices in claiming ITC GST, businesses can reduce tax liability, optimize working capital, and ensure smooth tax compliance.

In the ever-evolving GST landscape, businesses that stay ahead in compliance and leverage automation will gain a competitive advantage while mitigating financial risks associated with ITC claim GST India.

Stay GST-compliant and unlock the full potential of Input Tax Credit!

0 notes