#GST Calculator India

Explore tagged Tumblr posts

Text

An Introduction about gst calculator India

GST - the Goods and Services Tax, is an indirect tax in India. With its origin, gst calculator india has replaced many other indirect taxes in India such as VAT, CST, central excise duty, service tax and so on. GST is levied on the sale of goods and services in the country. GST is collected at the point of consumption and not at the point of origin unlike other taxes.

GST is a comprehensive, multi-stage, destination-based tax. This is levied on every value addition. The law governing GST was passed in the parliament on the 29th of March 2017 and it was implemented across the country on the 1st of July 2017.

What is GST calculator? GST calculator is an online ready-to-use calculator to compute the payable GST payable for a month or quarter depending on the amount. This calculator is apt for use by users all types of trade - buyers, sellers etc.

Advantages of GST Calculator The simplified GST calculator helps you determine the price for gross or net product depending on the amount and gives you a split of percentage-based GST rates. It helps give the division of the rate between CGST and SGST or calculate IGST accurately.

0 notes

Text

GST Accountants in Delhi by SC Bhagat & Co. – Your Trusted Tax Experts

In the ever-evolving taxation landscape of India, businesses require expert assistance to manage Goods and Services Tax (GST) compliances effectively. If you are searching for professional GST accountants in Delhi, look no further than SC Bhagat & Co. – a trusted name in taxation and financial services.

Why Choose SC Bhagat & Co. for GST Accounting Services?

SC Bhagat & Co. brings decades of expertise in accounting and taxation, ensuring businesses comply with GST regulations seamlessly. Here’s why we stand out:

Expert GST Compliance & Filing

GST compliance requires timely and accurate filing of returns. Our skilled accountants help businesses register under GST, file returns (GSTR-1, GSTR-3B, GSTR-9), and maintain proper records to avoid penalties.

Input Tax Credit (ITC) Management

Maximizing Input Tax Credit is crucial for reducing tax liabilities. We help businesses ensure proper documentation and reconciliation to claim ITC efficiently.

GST Audit & Advisory

Our team provides GST audit services, ensuring compliance with regulatory standards. We also offer advisory services on tax planning, helping businesses optimize their tax liabilities.

Handling GST Notices & Litigation

Received a GST notice? Our experts assist in responding to tax authorities, resolving disputes, and representing clients in GST litigation cases.

Customized GST Solutions for Businesses

Every business has unique tax requirements. Whether you are a startup, SME, or large enterprise, we offer tailored GST solutions to meet your needs.

Benefits of Hiring a Professional GST Accountant

Avoid Penalties & Legal Issues: Ensuring timely GST filings prevents hefty penalties.

Time-Saving & Accuracy: Professional accountants handle complex tax calculations, saving businesses valuable time.

Better Financial Planning: Expert guidance helps in cash flow management and tax savings.

Seamless GST Compliance: Stay updated with the latest GST amendments and regulatory changes.

Get in Touch with SC Bhagat & Co. Today!

Managing GST can be complex, but with SC Bhagat & Co., you can ensure hassle-free tax compliance and expert financial guidance. Contact us today for professional GST accountants in Delhi and let us handle your taxation needs with precision and reliability.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices#remittances

4 notes

·

View notes

Text

Bookkeeping in India by MASLLP: Simplify Your Financial Management

In today’s fast-paced business environment, maintaining accurate financial records is essential for businesses to succeed and grow. Efficient bookkeeping helps track income, expenses, and overall financial performance, ensuring compliance with legal requirements. MASLLP, a trusted name in financial solutions, offers top-notch bookkeeping services in India tailored to meet the diverse needs of businesses.

Why Choose MASLLP for Bookkeeping in India?

Expertise in Financial Management With a team of experienced professionals, MASLLP specializes in delivering bookkeeping solutions that cater to businesses of all sizes. Whether you are a startup or an established enterprise, their team ensures precision and timeliness in managing your financial records.

Tailored Solutions for Every Business MASLLP understands that every business is unique. Their bookkeeping services are customized to match your specific needs, whether you require basic record-keeping or comprehensive financial management.

Compliance with Indian Accounting Standards Navigating the complexities of Indian accounting laws and regulations can be challenging. MASLLP ensures full compliance with Indian Accounting Standards (Ind AS), GST norms, and other legal requirements, saving you from potential financial and legal troubles.

Cost-Effective and Scalable Services By outsourcing bookkeeping to MASLLP, businesses can save on hiring in-house staff and investing in expensive accounting software. Their services are scalable, allowing your bookkeeping requirements to grow with your business.

Bookkeeping Services Offered by MASLLP

Recording Transactions MASLLP ensures all financial transactions, including sales, purchases, receipts, and payments, are accurately recorded.

Bank Reconciliation Their experts reconcile your bank statements with your financial records to detect and resolve discrepancies.

Accounts Payable and Receivable Management MASLLP manages invoices, vendor payments, and customer collections to keep your cash flow healthy.

Financial Reporting Generate accurate financial statements, including profit and loss statements, balance sheets, and cash flow reports, for better decision-making.

GST Compliance and Filing Stay ahead with GST-compliant bookkeeping and timely filing of GST returns to avoid penalties.

Payroll Processing Simplify your payroll management with error-free calculation of salaries, taxes, and benefits.

Benefits of Bookkeeping in India to MASLLP Focus on Core Business Activities: Leave the complexities of bookkeeping to the experts while you concentrate on growing your business. Accurate Financial Insights: Make informed decisions with real-time, error-free financial data. Timely Compliance: Avoid penalties with on-time tax filings and compliance updates. Reduced Overheads: Save money on hiring and training in-house accounting staff. Why Bookkeeping is Crucial for Businesses in India Bookkeeping is not just about maintaining records; it’s the foundation of sound financial management. It helps businesses:

Monitor cash flow effectively. Plan budgets and allocate resources. Ensure tax compliance. Detect fraud and prevent financial mishaps. By partnering with MASLLP for bookkeeping in India, you ensure your business operates smoothly, remains compliant, and is prepared for growth.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

6 notes

·

View notes

Text

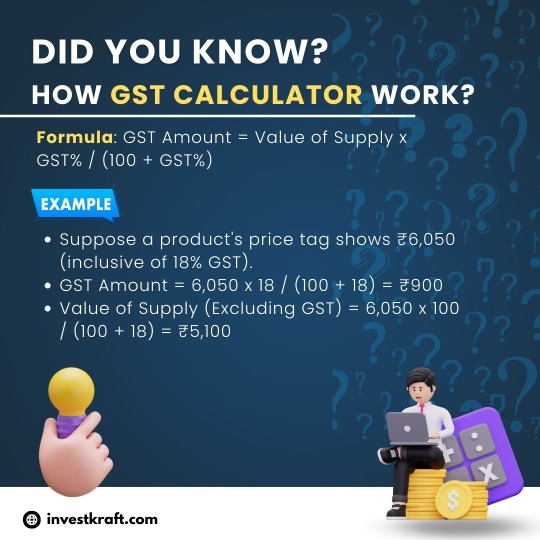

GST Confusion? Try Our Calculator for Easy Tax Calculation!

A GST Calculator simplifies the complex task of computing Goods and Services Tax (GST) in India. It efficiently determines the GST amount payable or included in a transaction, enabling accurate financial planning for businesses and individuals. Investkraft, a trusted financial platform, offers a user-friendly GST Calculator on its website. This tool allows users to swiftly calculate GST on various goods and services, ensuring compliance with tax regulations. With Investkraft's GST Calculator, users can input transaction details effortlessly and obtain precise GST figures, minimizing errors and saving time. Whether for business invoicing, tax filing, or personal budgeting, this calculator proves invaluable in navigating the intricacies of GST, empowering users to make informed financial decisions with ease.

2 notes

·

View notes

Text

Why UDYOG Stands Out as the Best ERP Software for Indian Enterprises

In today’s fast-paced business environment, Indian enterprises need an Enterprise Resource Planning (ERP) system that not only streamlines operations but also aligns with local compliance requirements. UDYOG best erp software in india has emerged as a top choice for businesses across industries due to its robust features, tax automation capabilities, and deep integration with Indian business processes. Let’s explore why UDYOG ERP stands out as the best ERP software for Indian enterprises.

Streamlined Operations

UDYOG ERP is the best erp software in india businesses, offering streamlined operations, tax automation, and industry-specific customization. Designed to handle complex GST, TDS, and e-invoicing compliance, it ensures seamless financial and regulatory management. With powerful inventory control, asset management, and user role security, businesses can optimize workflows and improve efficiency. Its scalable architecture supports cloud and on-premise deployments, making it ideal for SMEs and large enterprises alike. UDYOG ERP empowers businesses with real-time insights, automation, and cost-effective solutions, ensuring smooth operations and growth in the dynamic Indian market.

Customizable Solutions

UDYOG ERP stands out as the best erp software in india businesses due to its highly customizable solutions tailored to diverse industries like manufacturing, retail, pharmaceuticals, and logistics. Designed to meet India-specific compliance needs, including GST, e-Invoicing, and TDS management, UDYOG ERP ensures seamless operations while adapting to unique business workflows. With flexible modules, scalable architecture, and role-based access controls, it empowers enterprises to streamline processes, enhance productivity, and drive growth. Whether it’s inventory management, asset tracking, or tax automation, UDYOG ERP delivers a future-ready, cost-effective, and business-friendly solution for Indian enterprises.

Enhanced Productivity

UDYOG ERP is the perfect solution for Indian businesses looking to improve efficiency and simplify operations. It automates tasks, provides real-time insights, and adapts to different industries, making processes like purchasing, asset management, and inventory control much easier. With built-in GST compliance and e-invoicing, it eliminates manual tax calculations, saving time and reducing errors. Features like smart inventory tracking, secure user access, and mobile-friendly tools help businesses run smoothly with minimal disruptions. Whether you’re a small business or a large company, UDYOG best erp software in india gives you everything you need to work smarter, cut costs, and grow faster in the Indian market.

Robust Security

Security is crucial for Indian businesses, and UDYOG ERP provides strong protection for important data. It uses role-based access control to ensure only authorized users can access specific information. With multi-layer authentication, encrypted data storage, and detailed audit logs, it keeps business data safe from unauthorized access. UDYOG best erp software in india also includes regular security updates, automated backups, and compliance with Indian data protection laws, making it a reliable and secure choice for businesses.

Expert Support and Training

UDYOG ERP stands out as the best ERP software for Indian businesses, not just for its powerful features but also for its expert support and training. With a dedicated team of professionals, UDYOG ensures smooth implementation, user-friendly onboarding, and continuous assistance to help businesses maximize their ERP investment. From personalized training sessions to 24/7 customer support, businesses get the guidance they need to resolve queries, optimize workflows, and stay updated with the latest features. This commitment to expert support makes UDYOG best erp software in india the ideal choice for enterprises looking for a reliable and scalable ERP solution in India.

Why settle for generic ERP solutions when you can have an India-focused, compliance-ready, and scalable ERP system? Take your business to the next level with UDYOG ERP.

Contact Us Today for a Free Demo & Consultation!

0 notes

Text

Tririd Biz: Best Billing Software in India for 2025

Introduction

Efficacious financial constraints and billing for 2025 is an essential part of any business. New tax law developments, digital payment system, and evolving competition demand business software sophisticated enough for accounting and billing simplifications. The software which conceives Tririd Biz is the best 2025 billing solution in India and will manage financial order for any business, no matter how small it is.

So now, begin finding out why Tririd Biz is the total answer for intelligent billing on the part of business owners.

The Core Functions of Tririd Biz-Accounting & Billing Software

Here are some of the outstanding functions offered by Tririd Biz:

Simple Invoicing & Billing

Offering personalized templates, Tririd Biz makes it easy to create invoices-on-the-spot businesses can email promptly professional invoices and accept payments from many other platforms, such as UPI, a credit card, or bank transfers.

Advanced Accounting Instruments

The software doesn't only involve billing but also has an immense scope when dealing with everything needed for accounting, such as profit and loss account analysis, balance sheet, and compliance with the GST provision as guidance. Detailed and specific financial reports may come for businesses in seconds.

Inventory Management

With real-time stock tracking, never lack of one business essential. Procurement orders, as well as count alerts, will be automaticized by the system. Sale tracking will also be automated for inventory management.

Multiple User Access and Permission Model

If there are multiple users, Tririd Biz would provide access to overlaid permissions for different roles for each of the employees. Be they in the accounts team, sales team, or shops, virtually everyone, whether in or out, truly gets secure and well-regulated access using this app.

Accessible via the Cloud

Business owners have their companies' financial information at their fingertips on Tririd Biz cloud-based portal in just a matter of minutes. Data safety comes from automatic back-ups and real-time synchronization of financial statements.

Integration with Other Business Tools

Tririd Biz smoothly integrates with payment gateways, banking systems, as well as other 3rd party applications aiding in productivity, and financial management.

Our prediction on why Tririd Biz is the Best Billing Software in India for the Year 2025

GST and Compliance Features

E-filing is made simple with tririd biz. The respective GST rates and other taxes, even taxes on products and services shall be calculated by the software itself. Report, tax reports of the person as well as tax done with respect to India’s tax rules are done on time as the e-invoicing supports this and chooses Tririd Biz, as the e-commerce invoicing helps along with the tax on compliance invoice generation.

Fast and Intuitive User Interface

In order to serve mine of the masses and the very simple reasons of accounting, tririd biz has a user friendly very clean and simple design of user interface in that everyone, regardless of the financial management skill proficiency, can engage in it.

Fair Pricing For All Current Accountancy Plans

Tririd Biz offers a choice of subscription plans that include features which are designed to meet the needs of businesses of different sizes, yet reflect great value for a simple billing service.

In-House Customer Service

The clients of Tririd Biz are assured of help at any time of the day or night. Bye, users availing the service of Tririd Biz will sleep a lot better.

Using Tririd Biz for Various Sectors

Small and Medium Businesses or Even Startups

Additionally, tririd Biz reaches small businesses providing inconvenient financial solutions that involve management such as billing and expenditure control.

Shops and Small Markets

It is also a very common effect that retail and shopping applications including stock erp can easily integrate with any kind of erp and erp within erp.

Businesses That Provide Services

Invoices can be created automatically and rent can be distributed in an automated way using CB at according Jasper

Invoices can be created automatically and rent can be spread in a status quo way using contract billing to the attached Jasper accounts.

Conclusion

Tririd Biz Accounting & Billing Software is the perfect solution for businesses looking for a reliable, feature-rich, and easy-to-use billing system in 2025. With its GST compliance, user-friendly interface, cloud accessibility, and affordable pricing, it’s the ideal choice for businesses of all sizes in India.

If you’re searching for the best billing software in India, Tririd Biz is your go-to solution for effortless accounting and financial management.

Call us @ +91 8980010210

Visit Our Website: https://tririd.com/tririd-biz-gst-billing-accounting-software

0 notes

Text

Top Custom brokerage service in India

Customs brokerage is a critical service that ensures the smooth clearance of goods through customs, helping businesses comply with international trade regulations. Whether importing raw materials or exporting finished products, businesses must navigate complex customs laws, documentation requirements, and tariff classifications. This is where Top custom brokerage service in India plays a vital role, streamlining the process and minimizing delays.

What is Customs Brokerage?

Customs brokerage involves handling all regulatory requirements for importing and exporting goods, including documentation, tariff calculations, tax payments, and compliance with local and international trade laws. Customs brokers act as intermediaries between businesses and government agencies to ensure shipments are cleared efficiently.

Key Responsibilities of a Customs Broker

Customs Clearance — Ensuring goods meet import/export regulations and submitting necessary documents.

Tariff Classification & Duty Calculation — Determining the correct HS codes and calculating duties, taxes, and tariffs.

Compliance with Trade Laws — Ensuring shipments adhere to international trade policies and government regulations.

Documentation Management — Handling Bill of Lading, commercial invoices, packing lists, and certificates of origin.

Risk Management — Avoiding penalties, delays, and additional costs by ensuring regulatory compliance.

Duty Drawback & Refund Claims — Assisting businesses in claiming duty refunds where applicable.

Benefits of Using a Customs Brokerage Service

Faster Clearance & Reduced Delays — Ensures smooth customs processing, preventing shipment holds.

Cost Savings — Helps businesses minimize customs duties and avoid unnecessary penalties.

Regulatory Compliance — Reduces the risk of non-compliance with ever-changing trade laws.

Expert Guidance — Provides insights on duty exemptions, trade agreements, and documentation requirements.

Seamless International Trade — Facilitates hassle-free global shipping by managing cross-border regulations.

Challenges in Customs Brokerage

Changing Trade Regulations — Frequent updates in customs laws require constant monitoring.

Complex Documentation — Errors in paperwork can result in shipment delays and fines.

Tariff & Tax Fluctuations — Varying duty rates can impact overall import/export costs.

Security & Compliance Checks — Additional inspections may slow down clearance processes.

Customs Duty Fraud & Scams — Businesses must work with trusted brokers to avoid fraudulent practices.

Custom Brokerage Service in India: A Growing Need

India’s expanding trade network and global supply chain integration have increased the demand for custom brokerage service in India. With multiple trade agreements, GST implications, and varying import/export policies, businesses require expert customs brokers to ensure hassle-free logistics. Major ports like Mumbai, Chennai, and Kolkata, along with key airports, rely on efficient brokerage services to keep trade flowing smoothly.

Conclusion

A reliable custom brokerage service in India is essential for businesses looking to navigate complex customs regulations, minimize costs, and ensure timely shipments. By partnering with an experienced customs broker, companies can focus on their core operations while ensuring compliance and efficiency in global trade.

0 notes

Text

Best Income Tax Practitioner Course – Online & Offline Training

Income Tax Practitioner Course: सीखें और कमाएं

आज के समय में income tax practitioner course का महत्व तेजी से बढ़ रहा है। Taxation field में करियर बनाने के लिए यह कोर्स बहुत फायदेमंद है। Income tax return filing, GST registration, और financial auditing जैसे कार्य सीखने का अवसर मिलता है।

Income Tax Practitioner Course क्या है?

यह एक professional course है जिसमें व्यक्ति को tax laws और financial regulations की जानकारी दी जाती है। इसमें income tax rules, GST compliance, और audit process जैसे विषयों को शामिल किया जाता है।

Income Tax Practitioner बनने के लिए योग्यता और पात्रता

शैक्षणिक योग्यता (Educational Qualification)

Graduation या Diploma किसी भी stream से अनिवार्य होता है।

Commerce, Law, या Finance background वाले छात्रों को प्राथमिकता दी जाती है।

आयु सीमा (Age Limit)

न्यूनतम 18 years की उम्र होनी चाहिए।

कोई अधिकतम उम्र सीमा नहीं होती।

Income Tax Practitioner Course की अवधि और फीस

Course Duration (अवधि)

6 months से 1 year तक की अवधि होती है।

कुछ certification courses केवल 3 months में भी पूरे किए जा सकते हैं।

Course Fee (फीस)

कोर्स की फीस ₹10,000 से ₹50,000 के बीच होती है।

Government institutions और private academies में फीस अलग-अलग हो सकती है।

Income Tax Practitioner Course में क्या सिखाया जाता है?

मुख्य विषय (Main Subjects)

Income Tax Laws और Tax Planning

GST filing और Return Processing

Audit & Compliance Management

TDS Calculation और Tax Refunds

Accounting Software जैसे Tally, Zoho, QuickBooks

Income Tax Practitioner बनने के फायदे

करियर ग्रोथ (Career Growth)

Freelance tax consultant बनकर अपनी income source बढ़ा सकते हैं।

Government tax departments और private firms में नौकरी के अच्छे अवसर मिलते हैं।

Self-Employment के अवसर

खुद का tax consultancy business शुरू कर सकते हैं।

CA firms और financial institutions के साथ काम करने का मौका मिलता है।

Job Opportunities और Salary Expectations

कहाँ नौकरी के अवसर हैं?

Banks, Insurance Companies, और Financial Institutions

Corporate Sector और MNCs

Tax Consultancy Firms और Audit Companies

Salary Expectations (वेतन संभावनाएं)

शुरुआती वेतन ₹25,000 – ₹50,000 per month हो सकता है।

अनुभव बढ़ने पर ₹1,00,000+ per month कमाने का अवसर मिलता है।

Income Tax Practitioner Course के बाद क्या करें?

Government के साथ registration कराएं और certification प्राप्त करें।

Practical experience के लिए किसी tax consultancy firm के साथ इंटर्नशिप करें।

Online tax filing services और financial consultation शुरू करें।

Best Institutes for Income Tax Practitioner Course

The Institute of Chartered Accountants of India (ICAI)

National Institute of Financial Management (NIFM)

Indian Institute of Taxation (IITAX)

Local Universities and Private Institutes

निष्कर्ष (Conclusion)

Income Tax Practitioner Course उन लोगों के लिए बेहतरीन अवसर है जो finance और taxation field में करियर बनाना चाहते हैं। यह न केवल job security देता है बल्कि high-income potential भी प्रदान करता है। यदि आप self-employment या corporate tax consultant बनना चाहते हैं, तो यह कोर्स आपके लिए सबसे उपयुक्त विकल्प हो सकता है।

Accounting interview Question Answers

How to become an accountant

Tax Income Tax Practitioner Course

How to become an income tax officer

How to become GST Practitioner

Learn Tally free online

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs i India

ICWA Course

Short Cut keys in tally

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

0 notes

Text

Unlock Business Growth: Understanding MSME Loan Eligibility with RupeeBoss

Introduction

For small and medium-sized businesses, securing funding is often a crucial step toward growth and sustainability. MSME loans provide financial assistance to businesses, enabling them to expand operations, purchase equipment, and manage working capital effectively. But how do you determine whether your business qualifies for an MSME loan? In this guide, we will walk you through the essential eligibility criteria and the steps to successfully apply for an MSME loan with RupeeBoss.

What is an MSME Loan?

MSME loans are specially designed financial products aimed at Micro, Small, and Medium Enterprises (MSMEs). These loans cater to businesses in need of capital for expansion, modernization, or day-to-day operational needs. Various banks, NBFCs, and government-backed schemes provide MSME loans with flexible repayment options and competitive interest rates.

Key Benefits of MSME Loans

Quick Approval: Faster processing time compared to traditional loans.

Flexible Tenure: Repayment periods ranging from a few months to several years.

Minimal Collateral Requirement: Many MSME loans are unsecured, requiring no asset pledging.

Government Support: Several schemes, such as Mudra and CGTMSE, provide additional support.

Boosts Business Growth: Enables businesses to scale operations and increase profitability.

Who is Eligible for an MSME Loan?

Eligibility for an MSME loan depends on several factors. Financial institutions assess businesses based on their operational stability, creditworthiness, and financial health. Below are the core eligibility requirements:

1. Business Classification

Your business must fall within the Micro, Small, or Medium Enterprise category as per the MSME Act. This is based on:

Micro Enterprise: Investment up to ₹1 crore & turnover up to ₹5 crore.

Small Enterprise: Investment up to ₹10 crore & turnover up to ₹50 crore.

Medium Enterprise: Investment up to ₹50 crore & turnover up to ₹250 crore.

2. Business Registration & Documentation

The business must be registered under Udyam Registration.

Valid GST registration and PAN card.

Address proof of business premises.

Business bank account statements for the last 6-12 months.

3. Operational History & Turnover

The enterprise should have been operational for at least 1-3 years.

Must have a minimum annual turnover as per lender requirements (usually ₹10-₹50 lakh).

4. Credit Score Requirements

A CIBIL score of 650+ is generally preferred by most lenders.

Strong credit history improves the chances of approval and better loan terms.

5. Loan Purpose & Utilization

Lenders assess the intended use of the loan, whether for:

Business expansion.

Purchase of equipment or raw materials.

Working capital needs.

Upgrading technology.

Steps to Apply for an MSME Loan

Step 1: Determine Loan Requirements

Before applying, analyze your business needs and determine how much funding you require.

Step 2: Check Your Eligibility with RupeeBoss

Use RupeeBoss’s eligibility calculator to check whether your business qualifies for an MSME loan.

Step 3: Gather Necessary Documents

Prepare all required documents, including:

KYC documents (Aadhaar, PAN, business registration proof).

Financial statements (ITR, profit & loss statements, bank statements).

GST returns and trade licenses, if applicable.

Step 4: Choose the Right Loan Scheme

RupeeBoss offers multiple MSME loan options, including government-backed loans such as:

Mudra Loans (for micro-businesses, up to ₹10 lakh).

CGTMSE Scheme (collateral-free loans for MSMEs).

Stand-Up India (focused on SC/ST and women entrepreneurs).

Step 5: Submit Your Application

Apply online through RupeeBoss’s website or visit a branch. The application will be processed within a few days, and you’ll receive an update on your approval status.

Step 6: Loan Disbursement

Once approved, the loan amount is disbursed to your business account, allowing you to use it for your intended purpose.

Pro Tips to Improve MSME Loan Approval Chances

Maintain a Healthy Credit Score: Pay off existing debts on time.

Keep Financial Documents Updated: Ensure regular filing of ITR and GST returns.

Avoid Multiple Loan Applications: Too many applications can lower credit scores.

Choose a Loan Amount You Can Repay Comfortably: Don’t over-borrow beyond your repayment capacity.

Highlight Strong Business Growth: Showcase steady revenues and profit margins to lenders.

Conclusion

Understanding the eligibility criteria for MSME loans is the first step toward securing the right funding for your business. With RupeeBoss, you get access to expert guidance, multiple loan options, and a streamlined application process. Whether you’re looking to expand, invest in equipment, or strengthen your working capital, RupeeBoss is your trusted financial partner.

Ready to secure funding? Check your MSME loan eligibility with RupeeBoss today and take your business to the next level!

0 notes

Text

Payroll Services: A Comprehensive Guide for Businesses

Managing payroll is a critical and time-consuming task that every business, regardless of size, must handle efficiently. Whether you're a startup or a large corporation, payroll processing is essential to ensure that employees are compensated on time and in compliance with local labor laws and tax regulations. Payroll services help streamline this complex process, providing businesses with the expertise needed to manage employee compensation accurately.

At CompaniesNext, we understand that payroll management involves more than just calculating wages and distributing paychecks. It’s about ensuring compliance, reducing errors, and providing a smooth payroll experience for both the company and employees. This article will dive into what payroll services are, their benefits, how they work, and why businesses should consider outsourcing payroll to experts like CompaniesNext.

What Are Payroll Services?

Payroll services refer to outsourcing the responsibility of managing employee compensation to a professional third-party service provider. These services include the calculation of wages, bonuses, deductions, taxes, and benefits, as well as timely disbursement of payments. A professional payroll provider ensures that all payroll tasks are executed accurately and in compliance with local regulations.

By outsourcing payroll to a specialized company, businesses can avoid the administrative burden of managing payroll internally, reduce errors, and ensure timely and accurate payments for their employees.

Why Are Payroll Services Important?

Managing payroll effectively is vital for any business. The complexity of tax deductions, compliance regulations, and other factors makes it challenging for companies to handle payroll without specialized expertise. Below are some key reasons why payroll services are essential for businesses:

1. Time-Saving

Payroll processing can take up significant time, especially for small and medium-sized businesses. By outsourcing payroll, businesses can save valuable time and resources, allowing them to focus on core functions like product development, customer service, and growth strategies.

2. Compliance with Tax and Labor Laws

Payroll services ensure compliance with various tax laws and labor regulations. In India, businesses must adhere to tax filing requirements such as GST, TDS, Provident Fund (PF), and Employee State Insurance (ESI). Ensuring compliance with ever-changing tax rules is complicated, but payroll service providers like CompaniesNext stay up-to-date with the latest laws to prevent costly mistakes.

3. Error Reduction

Manual payroll management is prone to errors, whether it’s incorrect tax deductions, missed bonuses, or calculation mistakes. Payroll service providers use advanced software to automate the entire process, minimizing human errors and ensuring accurate calculations every time.

4. Employee Satisfaction

Timely and accurate payroll is essential for maintaining employee satisfaction and trust. When employees are paid on time and correctly, it boosts their morale and fosters a positive work environment. Outsourcing payroll ensures that employees receive their salaries without any delays or issues.

5. Data Security

Payroll involves sensitive employee information, including bank details, salary information, and tax data. Ensuring the security of this data is paramount. Payroll service providers use secure platforms and encryption technologies to protect this information from cyber threats and unauthorized access.

Key Features of Payroll Services

Outsourcing payroll to a professional service provider like CompaniesNext comes with a wide range of features that help businesses streamline their payroll process. Here are the key features of payroll services:

1. Automated Payroll Processing

Payroll service providers use automated systems to process payroll, making calculations for salaries, tax deductions, bonuses, and other benefits seamless. Automation ensures that the process is faster and error-free, allowing businesses to focus on other operations.

2. Tax Compliance and Filing

Payroll services ensure that businesses comply with all tax regulations, including tax deductions at source (TDS), GST compliance, and Provident Fund (PF) contributions. These services calculate the correct tax liabilities and file tax returns on time, reducing the risk of penalties for non-compliance.

3. Payslips and Reports

Payroll services generate detailed payslips for employees that break down their earnings, deductions, and taxes. These payslips help employees understand their compensation better. Additionally, businesses receive reports such as payroll summaries, tax reports, and financial statements, helping them maintain transparency and track payroll expenses.

4. Employee Benefits Management

Payroll service providers also assist in managing employee benefits such as health insurance, paid leave, bonuses, and retirement plans. Ensuring accurate management of these benefits ensures that employees are well-compensated and receive their full entitlements.

5. Statutory Compliance

Payroll services keep businesses compliant with statutory requirements such as ESI, PF, and Labour Welfare Fund. The service provider takes care of all regulatory filings and contributions, ensuring the business is always compliant with the latest labor laws.

6. Multi-Currency and Multi-Language Support

For businesses with global operations, some payroll services offer multi-currency and multi-language support. This allows businesses to handle payroll for international employees, ensuring local tax compliance and simplifying payroll processing across borders.

How Payroll Services Work

The process of outsourcing payroll to a service provider typically follows these key steps:

1. Employee Information Collection

The payroll provider collects necessary information such as employee personal details, compensation structure, tax deductions, bonuses, and benefits. This information is crucial for accurately calculating salaries and deductions.

2. Payroll Calculation

The provider calculates the salary of each employee, considering factors such as work hours, overtime, bonuses, and tax deductions. This calculation also includes statutory contributions like Provident Fund (PF), Employee State Insurance (ESI), and others.

3. Tax Deductions and Filings

Tax deductions, including TDS (Tax Deducted at Source) and other statutory contributions, are calculated. The payroll service provider also handles the timely filing of taxes and remittance of contributions, ensuring compliance with tax laws.

4. Payroll Disbursement

Once salaries are calculated and taxes are deducted, payroll providers initiate the salary payments via bank transfers or other agreed-upon methods. Employees receive their payslips detailing the breakdown of their compensation.

5. Compliance Reporting

The payroll service provider ensures that all statutory filings, such as TDS returns, PF deposits, and ESI contributions, are completed on time. Regular reports are generated to help businesses keep track of their payroll-related compliance.

Benefits of Outsourcing Payroll Services to CompaniesNext

Choosing CompaniesNext for your payroll services comes with numerous advantages:

1. Expertise and Professional Support

At CompaniesNext, our team of experts ensures that all payroll processing is done accurately and in compliance with the latest laws. We have the knowledge and experience to handle complex payroll needs and keep your business compliant with tax regulations.

2. Customized Payroll Solutions

We understand that every business is unique. Our payroll solutions are tailored to meet the specific needs of your company, whether you have a few employees or a large workforce. We work with you to design a payroll system that aligns with your business goals and objectives.

3. Cost Efficiency

Outsourcing payroll to CompaniesNext eliminates the need for hiring and training an in-house payroll team. It also reduces the risk of costly errors and compliance fines. Our services are affordable, offering excellent value for businesses looking to streamline payroll operations.

4. Scalable Solutions

As your business grows, your payroll needs will evolve. Our payroll services are scalable, ensuring that we can accommodate the changing requirements of your business and employees as you expand.

5. Timely and Accurate Payroll Processing

We ensure that your employees are paid accurately and on time, every time. This eliminates delays and payroll discrepancies, contributing to better employee morale and trust.

Conclusion

Payroll services are essential for businesses of all sizes to ensure timely and accurate compensation while adhering to regulatory requirements. By outsourcing payroll to experts like CompaniesNext, businesses can save time, reduce errors, and stay compliant with tax and labor laws. With the right payroll solutions in place, companies can focus on their core operations, improve employee satisfaction, and avoid costly mistakes.

At CompaniesNext, we provide comprehensive payroll services tailored to your business's unique needs. Whether you are a small business or a large enterprise, we have the expertise and resources to handle your payroll efficiently. Contact us today to learn how our payroll services can streamline your operations and support your business growth.

0 notes

Text

Why Professional Tax Filing for Businesses in Delhi is Crucial for Compliance?

Tax filing is an essential aspect of running a business in Delhi. Ensuring compliance with tax regulations not only helps businesses avoid penalties but also enhances their financial credibility. Whether it’s Business Tax Filing Services in Delhi, Business Income Tax Return Filing in Delhi, or GST and Business Tax Filing Delhi, proper tax filing ensures smooth business operations. In this blog, we will discuss the importance of professional tax filing for businesses and why seeking expert assistance is crucial for compliance.

The Importance of Professional Tax Filing for Businesses in Delhi

Tax compliance is a legal requirement for every business. It involves various aspects such as Company Tax Return Filing in Delhi, Online Business Tax Filing Delhi, and Business ITR Filing with CA Assistance in Delhi. Many businesses struggle with tax complexities due to frequent policy changes, multiple tax categories, and stringent filing deadlines. Hiring Best Business Tax Consultants in Delhi can help businesses navigate these challenges efficiently.

1. Ensuring Compliance with Tax Laws

Delhi, being a commercial hub, has stringent tax regulations. Businesses must comply with Business Tax Compliance Services in Delhi to avoid legal consequences. Professional tax consultants stay updated with the latest tax laws and ensure that all tax filings meet the necessary requirements.

2. Minimizing Tax Liabilities

A professional tax consultant can help businesses optimize their tax liabilities through strategic planning. By leveraging Business Income Tax Return Filing in Delhi, businesses can identify deductions, exemptions, and tax credits that reduce their overall tax burden.

3. Handling GST and Business Tax Filing in Delhi

GST is a critical component of business taxation in India. Non-compliance with GST regulations can lead to heavy penalties. GST and Business Tax Filing Delhi services ensure accurate and timely filing, proper input tax credit claims, and GST reconciliation to avoid discrepancies.

4. Accuracy in Filing Business ITR

Filing incorrect or incomplete business tax returns can result in audits and legal issues. Business ITR Filing with CA Assistance in Delhi ensures that tax returns are prepared accurately, reflecting the correct financial statements and income details.

5. Saving Time and Resources

Tax filing requires extensive documentation, calculations, and legal knowledge. Businesses can save significant time and resources by opting for Online Business Tax Filing Delhi services, allowing them to focus on core business activities while professionals handle their tax obligations.

Types of Business Tax Filing Services in Delhi

Businesses in Delhi must comply with various tax filing requirements, including:

1. Company Tax Return Filing in Delhi

Applicable to private limited companies, LLPs, and other registered businesses.

Includes filing income tax returns, balance sheets, and profit & loss statements.

Requires accurate financial records and professional assistance.

2. Business Income Tax Return Filing in Delhi

Mandatory for sole proprietors, partnerships, and corporations.

Helps businesses report their annual earnings and claim deductions.

Filing before deadlines ensures penalty avoidance and smooth operations.

3. GST and Business Tax Filing Delhi

Includes GST registration, monthly/quarterly GST returns, and tax payments.

Ensures proper input tax credit claims and compliance with GST laws.

Professionals help avoid errors that can lead to penalties or audits.

4. Professional Tax Filing for Businesses in Delhi

Ensures compliance with professional tax laws applicable to business owners and employees.

Professionals assist in calculating and filing the correct amount of tax.

5. Business Tax Compliance Services in Delhi

Covers all tax obligations, including direct and indirect taxes.

Ensures timely filing, accurate documentation, and adherence to regulatory norms.

Helps businesses avoid legal disputes and maintain financial credibility.

6. Online Business Tax Filing Delhi

Digital tax filing services simplify the process and enhance convenience.

Secure platforms ensure data accuracy and timely submission.

Reduces paperwork and allows businesses to file taxes from anywhere.

Why Hire the Best Business Tax Consultants in Delhi?

With evolving tax regulations, businesses need expert guidance to ensure proper tax compliance. Here’s why hiring Best Business Tax Consultants in Delhi is beneficial:

1. Expert Knowledge and Experience

Tax consultants understand the complexities of business taxation.

They provide accurate tax planning and filing services tailored to business needs.

2. Error-Free and Timely Filing

Professionals ensure tax returns are filed correctly and within deadlines.

Reduces the risk of penalties and legal complications.

3. Legal Compliance and Audit Support

Experts help businesses comply with tax laws and maintain proper records.

In case of audits, they provide necessary support and documentation.

4. Cost-Effective Tax Planning

Strategic tax planning helps businesses save money by minimizing tax liabilities.

Proper planning prevents unnecessary tax payments and legal costs.

How to Choose the Right Business Tax Filing Service Provider?

When selecting a tax consultant or service provider for Business Tax Filing Services in Delhi, consider the following factors:

1. Experience and Expertise

Look for tax professionals with a proven track record in business tax filing.

Verify their expertise in income tax, GST, and corporate taxation.

2. Certifications and Credentials

Ensure the tax consultant is certified and has necessary legal accreditations.

Chartered Accountants (CAs) and tax consultants with government recognition are preferable.

3. Range of Services Offered

A good service provider should offer comprehensive tax solutions, including Business ITR Filing Services Near Me, GST compliance, and corporate tax filing.

4. Client Reviews and Testimonials

Check online reviews and client feedback to assess service quality.

Reliable consultants have positive testimonials and high client satisfaction rates.

5. Use of Technology

Opt for firms that offer Online Business Tax Filing Delhi services for convenience.

Digital platforms ensure accuracy, security, and timely submission of tax documents.

Conclusion

Professional tax filing is essential for business compliance and financial stability in Delhi. Whether it's Company Tax Return Filing in Delhi, GST and Business Tax Filing Delhi, or Business ITR Filing with CA Assistance in Delhi, seeking expert assistance ensures accuracy and legal adherence. Hiring the Best Business Tax Consultants in Delhi saves time, reduces tax liabilities, and keeps businesses compliant with tax regulations.

By leveraging Business Tax Compliance Services in Delhi, companies can focus on growth while tax professionals handle their financial obligations. For businesses seeking reliable and efficient tax solutions, choosing Business ITR Filing Services Near Me ensures hassle-free tax filing and peace of mind.

Investing in professional tax filing services is not just a legal necessity but a strategic move for long-term business success!

#Business Tax Filing Services in Delhi#Business Income Tax Return Filing in Delhi#Professional Tax Filing for Businesses in Delhi#GST and Business Tax Filing Delhi#Online Business Tax Filing Delhi#Best Business Tax Consultants in Delhi#Business ITR Filing with CA Assistance in Delhi#Business ITR Filing Services Near Me#Business Tax Compliance Services in Delhi#Company Tax Return Filing in Delhi

0 notes

Text

Professional Tax Consultants in Delhi, India by SC Bhagat & Co.

Managing taxes efficiently is critical for individuals and businesses alike. Whether it's navigating complex tax laws, ensuring timely compliance, or optimizing tax savings, having an expert guide is invaluable. SC Bhagat & Co., a renowned name in the financial and accounting domain, offers top-notch services as professional tax consultants in Delhi India.

With years of expertise and a commitment to excellence, SC Bhagat & Co. provides comprehensive tax solutions tailored to your needs.

Why Choose SC Bhagat & Co. as Your Tax Consultant?

Expertise in Indian Tax Laws Navigating India's intricate tax system can be overwhelming. SC Bhagat & Co. brings years of experience in handling all aspects of taxation, including income tax, GST, TDS, and corporate tax, ensuring full compliance and minimizing liabilities.

Comprehensive Tax Solutions The firm caters to both individuals and businesses, offering services such as:

Income tax planning and filing GST registration and compliance Tax audits and assessments Representation before tax authorities Advisory on international taxation

Personalized Tax Strategies At SC Bhagat & Co., every client’s financial situation is carefully analyzed. Their team develops tailored strategies to optimize tax savings while ensuring strict adherence to legal requirements.

Trusted by Businesses Across Sectors SC Bhagat & Co. has built a reputation as a reliable partner for businesses across various industries. From startups to large corporations, their services are trusted by clients seeking seamless tax management.

Key Tax Consulting Services Offered

Income Tax Filing and Advisory Avoid penalties and maximize savings with SC Bhagat & Co.'s expert income tax filing services. Their team ensures accurate filing, helps identify deductions, and provides actionable advice for better financial management.

GST Services With the introduction of GST in India, compliance has become more critical than ever. SC Bhagat & Co. offers:

GST registration Filing of GST returns Input tax credit optimization GST audits

Corporate Taxation SC Bhagat & Co. provides end-to-end corporate tax solutions, including tax planning, audits, and representation during scrutiny. They help businesses align with tax regulations while achieving financial efficiency.

Tax Audit Services Their tax audit services ensure that financial records comply with tax regulations, minimizing the risk of disputes and penalties.

TDS Compliance Stay compliant with TDS (Tax Deducted at Source) regulations. SC Bhagat & Co. assists with TDS calculation, filing, and rectification of any discrepancies.

Benefits of Hiring Professional Tax Consultants in Delhi India Save Time and Resources: Tax consultants streamline processes, allowing you to focus on your core business operations. Reduce Errors: Accurate calculations and filings prevent unnecessary penalties or legal issues. Optimize Tax Savings: Professionals identify deductions, exemptions, and credits to minimize tax liabilities. Stay Compliant: Experts ensure timely filing and adherence to the latest tax laws. Why SC Bhagat & Co. Stands Out Experienced Professionals: Their team of Chartered Accountants and tax experts is well-versed in Indian and international tax laws. Client-Centric Approach: They offer personalized services that align with your financial goals. Proven Track Record: A long list of satisfied clients speaks to their reliability and excellence. Affordable Services: SC Bhagat & Co. delivers high-quality tax consulting services at competitive rates. Conclusion Tax management doesn’t have to be a daunting task when you have experts by your side. SC Bhagat & Co., with their unparalleled expertise and commitment to excellence, is your trusted partner for all tax-related needs. Whether you’re an individual, a startup, or a large corporation, their professional tax consultants in Delhi India, are equipped to handle it all.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices#remittances

4 notes

·

View notes

Text

Accounting Outsourcing India by MAS LLP: Streamline Your Business Operations

In today’s competitive business landscape, companies are constantly seeking ways to optimize costs and enhance efficiency. Accounting outsourcing in India has emerged as a highly effective solution for businesses worldwide. MAS LLP, a trusted name in financial services, offers expert accounting outsourcing solutions tailored to meet the unique needs of businesses across industries.

Why Choose Accounting Outsourcing India? Outsourcing accounting services to India has gained immense popularity due to several key advantages:

Cost Efficiency India offers high-quality accounting services at a fraction of the cost compared to Western countries. Businesses can save significantly on overheads like salaries, training, and infrastructure by outsourcing to skilled professionals in India.

Access to Skilled Professionals India is home to a vast pool of certified accountants and financial experts. By partnering with an experienced firm like MAS LLP, you gain access to knowledgeable professionals who ensure accuracy and compliance.

Focus on Core Business Activities Outsourcing accounting tasks allows businesses to focus on their core operations, such as sales, marketing, and product development, while leaving the financial complexities to experts.

Scalability Whether you're a startup or a large enterprise, accounting outsourcing India offers flexibility to scale services as your business grows.

Services Offered by MAS LLP As a leading provider of accounting outsourcing India, MAS LLP offers a comprehensive range of services, including:

Bookkeeping and Accounting Accurate bookkeeping is the foundation of effective financial management. MAS LLP ensures your records are maintained meticulously, allowing you to make informed decisions.

Payroll Management Outsource your payroll processing to MAS LLP for timely and error-free salary disbursements, tax calculations, and compliance with labor laws.

Taxation Services From GST filings to corporate tax returns, MAS LLP provides end-to-end taxation support to ensure compliance with Indian tax laws.

Financial Reporting Receive detailed financial statements and reports that provide a clear picture of your business's financial health, helping you strategize effectively.

Compliance and Regulatory Support MAS LLP ensures your business adheres to all regulatory requirements, minimizing the risk of penalties and legal complications.

Why MAS LLP Stands Out MAS LLP is not just another outsourcing firm—it’s a partner committed to your success. Here’s why they’re the preferred choice for accounting outsourcing India:

Client-Centric Approach: MAS LLP focuses on understanding your business needs and providing personalized solutions. Timely Delivery: They prioritize deadlines, ensuring your financial tasks are completed on time. Proven Track Record: MAS LLP has a long list of satisfied clients who have experienced significant growth through their services.

Conclusion Accounting outsourcing India is a smart choice for businesses looking to reduce costs, improve efficiency, and achieve financial accuracy. With MAS LLP as your trusted partner, you can rest assured that your accounting needs are in expert hands.

Take the next step toward streamlining your business operations—partner with MAS LLP today for reliable and professional accounting outsourcing India!

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

6 notes

·

View notes

Text

Free GST Software in India: Features, Limitations, and Best Options

Looking for Free GST Software in India? Here’s What You Need to Know💼

Struggling with GST compliance? Filing returns, generating invoices, and reconciling GST data can be a headache 😫—but free GST software can help!

🔍 What to Expect from Free GST Software?

✅ GST return filing 📄

✅ E-invoicing support 🧾

✅ ITC claim calculations 💰

✅ Basic reconciliation 🔄

💡 But Beware! Free software often comes with limitations—restricted features, data upload limits, or hidden costs. So, choosing the right software is crucial! 🔥

🌟 Why Suvit?

Unlike other free tools, Suvit automates GST reconciliation and simplifies compliance. Get a 7-day free trial and experience seamless GST management! ⚡

📌 Make a Smart Choice!

Find out which free GST software is worth your time and which one might slow you down. Read the full blog here: 👇

👉 https://www.suvit.io/post/free-gst-software-india

0 notes

Text

E-Invoicing in Logistics: The Shift to Paperless Transactions

In today’s digital era, logistics management software is transforming how businesses handle operations, and one of the biggest game-changers is e-invoicing software for logistics businesses. Traditional invoicing, with its reliance on paper, manual entries, and delayed approvals, is rapidly becoming obsolete. With cloud-based e-invoicing solutions, freight forwarders, transporters, and warehouse managers can streamline invoicing, enhance compliance, and accelerate cash flow—all while reducing costs and errors.

Why Logistics Companies Need E-Invoicing

Logistics companies handle a high volume of invoices daily, often involving multiple stakeholders, currencies, and regulations. Freight forwarding software with e-invoicing integration helps businesses eliminate delays and errors associated with manual invoicing.

With automated invoicing software, logistics businesses can:

Reduce Paperwork – Eliminate physical invoices and digitize the entire process.

Ensure Compliance – Stay aligned with tax laws like ZATCA (Saudi Arabia), GST (India), VAT (EU), and Peppol e-invoicing formats.

Accelerate Payments – Speed up invoice approvals and reduce payment cycles.

Enhance Accuracy – Reduce invoice disputes with AI-driven data validation.

Improve Cash Flow – Real-time tracking ensures better financial planning.

Integrate with ERP & Logistics CRM – Sync invoices seamlessly with existing TMS, WMS, and freight software.

Key Benefits of E-Invoicing Software for Logistics Businesses: -

1. Faster Payment Processing & Cash Flow Management

Delayed payments are a major challenge in logistics. AI-powered e-invoicing software automatically generates invoices, verifies data, and sends them instantly for approval. Automated payment reminders further reduce outstanding dues, improving overall cash flow.

2. Compliance with Tax & Regulatory Standards

Many countries now mandate e-invoicing for businesses. Whether it’s VAT, GST, or ZATCA-compliant e-invoicing, logistics companies need to ensure their software supports legal requirements. Cloud-based logistics ERP software integrates tax calculations and e-invoice generation, minimizing compliance risks.

3. Seamless Integration with Logistics Software

The best freight forwarding software and transport management systems (TMS) come with e-invoicing features, allowing logistics companies to generate digital invoices directly from shipments, freight charges, and delivery data. ERP-integrated e-invoicing solutions sync with financial systems like SAP, QuickBooks, and Oracle NetSuite, ensuring smooth operations.

4. AI & Blockchain-Enabled Security

AI-powered invoice verification prevents fraud and incorrect billing, while blockchain technology in logistics ensures tamper-proof invoice records, reducing invoice disputes and unauthorized modifications.

Final Thoughts

E-Invoicing is not just a digital upgrade—it’s a game-changer for logistics businesses. By leveraging cloud-based freight forwarding software and automated e-invoicing solutions, companies can:

Reduce operational costs

Improve compliance & tax reporting

Enhance cash flow & payment processing

Streamline global freight invoicing

Looking for the best e-invoicing solution for your logistics business?

Book Demo Now

#logistics software#freight software#freight forwarding software#software for freight forwarding software

1 note

·

View note

Text

How an Online GST Course in Mumbai Can Boost Your Accounting Career

In today’s competitive job market, upskilling is crucial to staying ahead, especially in the field of accounting and taxation. The introduction of the Goods and Services Tax (GST) in India has significantly transformed the financial sector, making it essential for accountants and finance professionals to have in-depth knowledge of GST compliance and regulations. Enrolling in an online GST course in Mumbai can be a game-changer for aspiring accountants, tax consultants, and business professionals.

Why Learn GST?

GST is the backbone of India’s indirect tax system, impacting businesses across all industries. Understanding GST laws, filing returns, and ensuring compliance are key responsibilities for accountants today. By completing a GST certificate course online, professionals can gain expertise in:

GST registration and filing

Tax invoice preparation

Input tax credit calculations

E-way bill compliance

GST audits and assessments

With GST compliance becoming mandatory for businesses, skilled professionals in this domain are in high demand.

Benefits of an Online GST Course in Mumbai

1. Career Advancement

Completing an online GST course in Mumbai enhances your resume and boosts your employability. Many companies prefer candidates who have specialized knowledge in GST, making it easier to secure roles in accounting, taxation, and financial consultancy.

2. Practical Knowledge & Hands-on Training

A well-structured GST certificate course online provides hands-on training in GST return filing, tax computation, and software applications like Tally and GSTN portals. This practical knowledge is invaluable for professionals handling real-world taxation matters.

3. Increased Earning Potential

Certified GST professionals are often offered better salary packages compared to those without GST expertise. Companies are willing to pay a premium for individuals who can handle GST compliance efficiently, reducing legal risks and penalties.

4. Flexibility & Convenience

Enrolling in an online GST course in Mumbai allows learners to study at their own pace, balancing their professional and personal commitments. The flexibility of online learning ensures that working professionals can upgrade their skills without compromising their job responsibilities.

5. Ideal for Entrepreneurs & Business Owners

A GST certificate course online is not only beneficial for accountants but also for business owners who want to manage their tax filings independently. Understanding GST helps entrepreneurs make informed financial decisions, ensuring compliance and avoiding unnecessary tax penalties.

Who Should Enroll in a GST Course?

Accounting & finance professionals

Chartered accountants (CAs) and tax consultants

Business owners & entrepreneurs

MBA & commerce students

Anyone interested in taxation and compliance

Conclusion

A specialized online GST course in Mumbai is an excellent investment for anyone looking to advance their accounting career. With flexible learning options, practical training, and industry-recognized certifications, a GST certificate course online equips professionals with the necessary skills to excel in taxation and compliance. Whether you are an aspiring accountant or a business owner, mastering GST can significantly enhance your financial expertise and career prospects.

Enroll now to boost your career with our comprehensive online GST course! Limited seats available – sign up today and take the first step toward financial expertise!

0 notes