#Futures and Options

Explore tagged Tumblr posts

Text

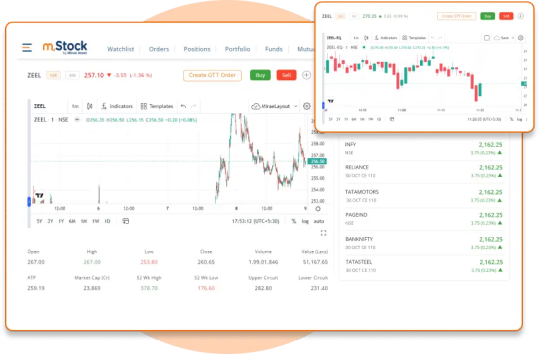

Start Futures and Options (F&O) Trading Online in India | m.Stock

Invest in Futures and options (F&O) trading to maximize your returns. Get tools with real time tracking & industry charts for in-depth analysis with m.Stock

0 notes

Text

Make Money Investing On Upstox

Upstox is a popular online trading platform that allows users to invest in stocks, mutual funds, and other financial instruments. Here are some ways you can potentially earn money using Upstox:

1. Stock Trading: Buy and sell stocks based on market research and analysis. Look for short-term gains through day trading or hold stocks for the long term.

2. Investing in Mutual Funds: Upstox offers access to various mutual funds. You can invest in equity or debt funds depending on your risk appetite and investment goals.

3. Futures and Options (F&O): Trade in derivatives to potentially earn higher returns. This involves more risk and requires a good understanding of market trends.

4. IPOs: Invest in Initial Public Offerings (IPOs) when new companies go public. If the stock performs well post-listing, you can earn substantial profits.

5. Portfolio Management: Utilize Upstox’s tools for portfolio management to track and optimize your investments.

6. Referral Program: Upstox has a referral program where you can earn money by referring new users to the platform.

7. Education and Research: Leverage the educational resources provided by Upstox to enhance your trading skills and strategies.

Before investing, it's essential to do thorough research and consider your financial goals and risk tolerance. If you’re new to investing, consider starting small and gradually increasing your investments as you gain more experience. Interested in making money using Upstox, then click here now!!!

#indian jobs#stocks#mutual funds#futures and options#ipo alert#portfolio management#referral program#education#online jobs#jobs#online earning#earn money online#how to earn money#online income

0 notes

Text

Where Can I Trade Gold and Silver?

Looking to invest in gold and silver? Discover the best ways to trade these precious metals! From online brokers and ETFs to mining stocks and precious metal dealers, explore diverse investment options. Stay informed and secure your financial future!

Gold and silver are popular investment forms, and there are various ways to trade these precious metals. Here are some of the most common options: 1. Precious Metal Exchanges Precious metal exchanges are specialized trading venues for buying and selling gold and silver bars and coins. Well-known exchanges include: London Bullion Market Association (LBMA): Regulates international trading in…

#Buying precious metals#Commodity trading#Economic uncertainty#Financial markets#Futures and options#Gold and silver market#Gold coins#Gold ETFs#Gold prices#Gold trading#Inflation hedge#Investing in gold#Investing in silver#market analysis#Market developments#Mining stocks#Online brokers#Physical gold#Physical silver#Portfolio diversification#Precious metal dealers#Precious metal exchanges#Precious metal investments#Precious metals#risk management#Silver bars#Silver ETFs#Silver prices#Silver trading#Store of value

0 notes

Text

"FM Nirmala Sitharaman Flags Concerns Over Retail F&O Trading Surge"

Finance Minister Nirmala Sitharaman sounded a note of caution regarding the unchecked surge in retail futures and options (F&O) trading during an event at the Bombay Stock Exchange (BSE) on Tuesday. Stressing the importance of a stable majority government for vibrant financial markets, she expressed confidence in Prime Minister Narendra Modi’s leadership for India’s continued economic growth.

Sitharaman highlighted the potential challenges posed by the unchecked expansion of retail F&O trading, emphasizing its impact on market stability and household finances. With a significant portion of retail investors experiencing losses in F&O trading, she underscored the need to safeguard household finances from potential risks.

The Finance Minister’s remarks come in the wake of concerns raised by market regulators regarding the high rate of losses among individual traders in the equity F&O segment. With the majority of traders incurring losses, Sitharaman stressed the importance of long-term investments for wealth creation and real rate of returns.

She called upon stock exchanges to enhance market stability and mitigate systemic risks through technological advancements, promoting efficiency, transparency, and security. Sitharaman noted the growing trend of household savings entering the stock market, reflected in the substantial increase in retail demat accounts over the past years.

Highlighting the confidence of retail investors in the stock market, she attributed it to the improved compliance levels of listed companies, which have enhanced transparency and corporate governance. Sitharaman emphasized the role of domestic savings in providing stability to the market, acting as a counterbalance to foreign portfolio investments.

Looking ahead, she stressed the importance of a stable government, predictable policies, and a conducive regulatory framework for fostering efficient and stable financial markets. With the vision of investment-led growth and inclusive development, Sitharaman expressed confidence in Prime Minister Modi’s leadership for India’s ascent to becoming the third-largest economy.

In summary, Sitharaman’s address underscores the need for caution in retail F&O trading, emphasizing the significance of a stable government and visionary leadership for India’s financial market stability and growth.

0 notes

Text

#investing#stock market#stock trading#equity trading#financial literacy#finance#learn stock market trading#paper trading#derivatives trading#virtual trading#option trading#futures and options#options#options writing

0 notes

Text

#equity trading#finance#financial literacy#long term trading#investor#day trading#equity reseach#investors#equity#futures and options#futures trading#learn stock market trading#stock market india#stock market investing

0 notes

Text

all you really need to make a good first impression on the ceo's grandson is for him to have suffered a year of solitary confinement

#auri de riva#lace harding#lucanis dellamorte#datv#dragon age#my art#harding and auri are besties bc#the options were 'become besties' or 'kill each other'#does this need spoiler tags? ehh#dav spoilers#datv spoilers#veilguard spoilers#trying out all caps. thinking all caps might be the way of the future. in that it’s slightly less of a pain in the ass to make legible

5K notes

·

View notes

Text

Which is Better?-Futures or Options

Many investors are interested in investing in futures and options, but they need assistance comprehending them. Options and futures are two types of financial derivatives used by investors to hedge against market price fluctuations. Both enable investors to purchase investments at a predetermined price prior to a given date. But options and futures contracts have distinct regulations, resulting in vastly different risks for investors. Consequently, what are their characteristics and distinctions, and how should investors choose? To learn more about these two investments, read our writing.

What exactly are Futures?

Futures are also known as forward contracts or futures contracts. Purchasing future commodities or other financial assets at current prices is the definition of futures. Futures contracts originated in the agricultural product trading market as a hedge against future price uncertainty. Futures are positioned opposite the location. Futures trading entails the sale of future goods, whereas spot trading involves the exchange of current goods. Futures contracts are between a buyer and a vendor who agree on a price, delivery date, and a deposit. At this precise date in the future, the transaction will be completed at the agreed-upon price.

Various Futures

According to the agreed commodity classification, futures contracts can be classified as commodity futures or financial futures.

Agricultural Futures

Through futures contracts, commodity futures merchants can trade commodities such as oil, gold, natural gas, and even sugar.

Futures Financial

Futures traders invest in financial assets such as indices, equities, and bonds.

Instances of Futures

A farmer is concerned that the price of produce will decline in the future due to an abundance of agricultural products. Similarly, a merchant is concerned that weather-related disasters will impact yields, resulting in decreased production and rising prices. So they agree to purchase and sell a quantity of crops at the current spot crop prices with a three-month delivery date. After the deposit is paid to initiate the contract, the buyer and vendor must reach an agreement at the agreed price three months later, regardless of whether the crop price has increased or decreased.

Futures' Pros and Cons

Positives of Futures

Futures trading has extensive trading hours and high liquidity. The trading hours of each futures contract span nearly the entire day, allowing futures merchants to act at any moment. Compared to the stock market, the futures market is less prone to gaps, making it significantly more liquid than the spot market.

Low transaction costs exist. The only costs associated with trading futures are transaction tax and handling fees, with the handling fee for futures being preset. Typically, the performance cost of a futures contract is a negligible portion of the equivalent OTC transaction.

Utilize modest expenditures to accomplish a substantial objective. Futures holders can control a more prominent position at a lower cost with leverage, while hedgers can reduce their risk exposure at a lower cost. Futures trading does not entail the literal purchase or sale of underlying assets; instead, margins are used to manipulate more substantial assets. Investors can profit from price fluctuations in the market without committing substantial capital.

Negatives of Futures

Futures must be resolved on a monthly basis and cannot be employed as a long-term investment vehicle. If you choose the far-month contract, the contract's liquidity may be greater.

Due to the leverage effect, the danger is substantial. In addition to magnifying profits, leverage also magnifies losses. If you make an error while using leverage, it may result in significant losses to the principal.

What are the Alternatives?

Options are a form of derivative financial product. Contracts for options grant option holders the right to purchase commodities, which may include products, securities, or other financial assets, at an agreed price within a specified time frame. The buyer pays the option premium to the vendor, agrees on the type, price, quantity, and expiration date of the purchased product, and enters into an option contract. Unlike a futures contract, the proprietor of an option is not required to complete the transaction when the option expires.

Types of Choices

Options can be divided into two categories. Options rights are subdivided into call options and put options. The remaining portion is subdivided based on the delivery date of the option, which is separated into American and European options.

Call Option Contracts

Call options refer to the buyer's right, but not obligation, to purchase a certain quantity of specified commodities from the seller at the agreed price within the validity period of the options contract, after paying a fee to the seller. The vendor of an option is obligated to sell a particular commodity at a contract-specified price at the buyer's request during the option contract's duration of validity.

Put Choices

A put option signifies that after the buyer pays the premium to the seller, he has the right, but not the obligation, to sell a predetermined quantity of specific commodities to the seller at an agreed-upon price within the option contract's validity period. Obligation. The option vendor is obligated to purchase a specific commodity at the price specified in the option contract at the request of the buyer during the option's validity period.

American Choices

American options refer to options that can be exercised at any time during the option contract's validity period.

European Choices

European options are options that can only be exercised on the specified expiration date. The purchaser of the option cannot exercise the right prior to the expiration of the contract. After the contract's expiration date, it automatically becomes null and void.

Examples of Alternative

The buyer pays the option fee, and the buyer and vendor agree to purchase 10 ounces of gold at a price of $1,800 per ounce three months later. After three months, if the price of gold exceeds $1,800 per ounce, the buyer may still purchase gold at $1,800 below the spot price; however, if the price of gold declines below $1,800 per ounce, the buyer may opt not to Buy.

Pros and Cons of Alternatives

Pros of Choices

The investment risk associated with options is moderate. Most individual investors should avoid using leverage when trading options. Without leverage, individual traders are extremely unlikely to incur unmanageable losses. As long as you control the transaction size rationally prior to investing, you will not incur significant losses.

Low investment minimum. On the market, investors have access to numerous options, some of which are very inexpensive. This provides numerous opportunities for investors in options to place low-cost wagers.

Trading hours are unrestricted. In contrast to futures, options contracts are exercised prior to a specific date. Unlike futures contracts, which must be executed on a specific date, options investors have more flexibility and can choose the time they deem appropriate to execute the contract.

The option holder has no obligation to execute. The futures buyer must purchase the products on a specified date, regardless of whether there is a profit. However, if there is no profit, the vendor of the option may choose not to accept the specific commodity specified in the option.

Cons of Choices

Options are no different from any other investment in that regard. The most frequent error made by option investors is investing large sums of money without conducting sufficient investigation and without seeking clarification on complex investment strategies, resulting in a loss of capital.

Before the expiration date, options may be exercised at any time. Options differ from futures in that the option customer is not required to perform the contract on a specific date. The time stipulated in the option contract is the buyer's deadline for exercising his rights. And many investors believe they must wait until a certain date to begin trading, which could cause them to lose out on price fluctuations or even expire.

Even if the commodity's price on the expiration date is not favorable to you as the option vendor, you must allow the buyer to exercise the option according to its terms.

Many investors will attempt to purchase extremely inexpensive options on the cheap. However, there is a high chance that these inexpensive options are worthless.

Comparability of Futures and Options

Before investing in options and futures, investors must establish a third-party custodian for their margin account. Options and futures both require a margin account. Thus, options and futures trading can be distinguished from other retirement investments.

Futures and options have similar insurance functions. Due to the fact that both options and futures agree on a price to purchase commodities at a specific time in the future, both can effectively avoid abrupt fluctuations in commodity prices and maintain expenses within an acceptable range.

Comparisons of Futures and Options

Options and futures have distinct obligation structures. When the date specified in the futures contract arrives, regardless of whether the actual price of the commodity is profitable for the buyer at this time, the buyer is obligated to purchase the commodities specified in the contract in accordance with the terms of the futures contract. However, the holder of the option is under no obligation and can choose whether to exercise power based on the accurate price.

The trading dates for options futures vary. Futures contracts may only be traded on a specific date, whereas options have no specific trading day and may be modified at any time until expiration.

Futures contracts necessitate the payment of a margin. When entering into a futures contract, traders are not required to make a down payment, but the contract will charge a margin. Simultaneously, leverage will also magnify the margin, allowing futures investors to make substantial gains or losses.

How Should Futures and Options be Invested?

Opening a financial account is required for trading options and futures, and you can establish an account with TOP1 Markets. Select the futures or options contract you intend to trade after opening an economic report. Futures contracts and options contracts are primarily divided into two categories: derivatives of stocks and derivatives of commodities.

When trading stock market derivatives on a stock exchange, investors are only required to pay a margin and the difference between the contract price and the actual price. The trend of the futures contract is more rapid than that of the option contract, and the contract can be extended for a maximum of three months.

You must visit a commodity exchange in order to invest in commodity derivatives. The prices of commodities fluctuate significantly. Investors can select commodity derivatives futures or options to avoid significant losses. Nevertheless, investors still have the opportunity to profit from the rising commodity prices due to the severe fluctuations in commodity prices.

Who Should Make Futures and Options Investments?

Whether trading options or futures, investors must have a certain level of knowledge of the securities market, and they must constantly monitor market fluctuations to avoid incurring losses. In addition, both types of investments are extremely speculative, so options and futures are better suited for speculators and hedgers who wish to avoid wild price fluctuations in commodities.

Typically, speculative traders predict future price fluctuations based on market sentiment and potential events. Typically, they engage in short selling, purchase contracts at low prices, and invest long-term while waiting for opportunities to generate high returns.

The hedger is another form of investor who is well-suited to options and futures investing. In comparison to contracts with high returns, hedgers place greater emphasis on the hedging function of futures and options. Because futures and options contracts can guarantee specific price stability, hedgers typically choose to invest in commodities with rapid price fluctuations and broad ranges. The greater risk can be avoided regardless of the market price, despite the fact that the contract's fixed price may deprive investors of the chance to make substantial profits in the event of price fluctuations.

Special Considerations Prior to Futures and Options Investment

Reduce transaction expenses.

While the trading threshold for options and futures is low, numerous service fees and taxes may be incurred. Furthermore, options and futures transactions are highly liquid, and multiple transactions can take place in a brief period of time. At this time, investors will face a sharp increase in investment costs. Therefore, we must thoroughly consider it before proceeding.

Set stop loss and profit taking positions.

Investors can establish loss and profit caps. The former is intended to prevent investors from incurring more losses than they can sustain. The latter is intended to ensure that investors can earn consistent profits and avoid potential price declines following the price's apogee.

Use leverage with caution.

Many investors are only aware of leverage's enormous benefits and increase it indiscriminately, forgetting that leverage can also magnify losses. Don't increase leverage recklessly, and ensure that the amount after the leverage effect is within your affordability range.

Consider the hazards.

The greater the benefits, the greater the hazards. Consequently, investors must pursue profits. Before investing, investors must consider the range of possible hazards.

Final Reflections

Now that you are well-versed in the distinction between options and futures, you must base your investment decision on your risk tolerance and investment strategy. Futures are riskier than options, but they offer greater profit potential. Consequently, you must contemplate your objective prior to selecting an investment.

1 note

·

View note

Text

Trade in F&O with 1 Click

You can place trades with just 1 click for F&O Contracts and enjoy greater leverage, market efficiency, and the advantages of hedging, through F&O. Futures & Options can be a great tool for diversification as well.

0 notes

Text

Difference between the forward contracts and future contracts:

0 notes

Text

youtube

1 note

·

View note

Text

oops!!!!!!!! accidentally caught the script up to msq!!!!

i honestly did not think this was going to be possible with the amount of time left after i finished 6.0, but here we are!!!!!!!

the entire msq, at your fingertips!!!!!!!!!

please know that i will NOT be doing dawntrail's MSQ immediately after it drops though. i want to enjoy playing through for the first time without making it into a job. i hope to get to it before TOO too long, though 💖

#i'm not sure if i missed any characters hiding around the world with specific post-6.55 dialogue; i only checked around old sharlayan#but i haven't done any of the other post-patch hiding npcs so completionism there is for a future run#(unless you know of any specific ones i missed; if so please lmk)#and of course i'm still missing all of the usual things#like conditional dialogue for optional content like the extra gaia scene in 6.5#i'll get there eventually!!!!!!!!!!!!!!!! i hope#ff#ffxiv#ew#xiv script

1K notes

·

View notes

Photo

A Comprehensive Guide to Futures and Options Trading

Futures and options trading, especially for beginners, is far more intricate than other types of investing, such as equities investing. This is why you should not rush into anything without first learning the ins and outs of the situation.

0 notes

Text

What are Options?

Options are financial derivatives that provide the holder with the right, but not the obligation, to buy or sell an underlying asset (such as stocks, commodities, currencies, or indices) at a predetermined price, known as the strike price, within a specified period. The buyer of an option pays a premium to the seller for this right.

There are two types of options:

1. Call Option: A call option gives the holder the right to buy the underlying asset at the strike price within the specified period. Call options are typically used when investors anticipate the price of the underlying asset to rise.

2. Put Option: A put option gives the holder the right to sell the underlying asset at the strike price within the specified period. Put options are generally used when the holder expects the price of the underlying asset to fall.

Features of Options Trading

1. Flexibility: Options provide traders with a high degree of flexibility in structuring trades and managing risk. Traders can choose from a variety of options strategies, including buying calls or puts, selling covered calls or puts, constructing spreads, straddles, and strangles, among others. This flexibility allows traders to tailor their positions to specific market conditions, outlooks, and risk tolerance.

2. Leaverage: Options offer leverage, allowing traders to control a larger position with a smaller amount of capital compared to trading the underlying asset directly. This leverage amplifies potential returns but also increases the risk of losses. Options provide traders with the opportunity to achieve significant profits relative to the amount invested, but it's important to manage leverage carefully to avoid excessive risk-taking.

3. Defined Risk: Unlike futures or Forex trading, where losses can exceed the initial investment, options trading offers defined risk. The maximum potential loss for an options trade is limited to the premium paid or received, depending on whether the trader is buying or selling options. This defined risk makes options trading appealing for risk-averse traders who want to know their maximum potential loss upfront.

4. Hedging: Options can be used as effective hedging tools to protect against adverse price movements in the underlying asset. By buying or selling options contracts, traders can hedge existing positions in stocks, commodities, or other assets, reducing the impact of market volatility and downside risk. Options provide traders with the flexibility to tailor hedging strategies to their specific risk exposure and investment objectives.

5. Profit Potential in Any Market Condition: Options offer opportunities for profit in various market conditions, including bullish, bearish, or sideways markets. Depending on their outlook, traders can implement different options strategies to capitalize on anticipated price movements or volatility changes. For example, buying call options allows traders to profit from upward price movements, while buying put options enables them to profit from downward price movements.

6. Liquidity: Options markets are generally highly liquid, with active trading in a wide range of options contracts on various underlying assets. High liquidity ensures tight bid-ask spreads and efficient order execution, allowing traders to enter and exit positions with minimal slippage. Liquidity is particularly important for options traders, as it ensures that they can easily enter and exit positions at fair market prices.

7. Diverse Range of Underlying Assets: Options are available on a diverse range of underlying assets, including stocks, stock indices, commodities, currencies, and interest rates. This wide selection of underlying assets provides options traders with ample opportunities to diversify their portfolios and trade different markets according to their preferences and expertise.

8. Limited Capital Requirement: Options trading typically requires lower capital compared to trading the underlying asset directly. Instead of purchasing or short-selling the underlying asset, options traders only need to pay the premium to initiate a position. This lower capital requirement enables traders with limited funds to access the options market and participate in trading opportunities that would otherwise be inaccessible.

9. Versatile Strategies Options trading offers a wide range of trading strategies that cater to different market outlooks, risk profiles, and trading objectives. Traders can deploy directional strategies, such as buying calls or puts, to speculate on price movements, or implement non-directional strategies, such as iron condors or butterflies, to profit from range-bound markets or low volatility environments. The versatility of options strategies allows traders to adapt to changing market conditions and deploy strategies that align with their trading goals.

Advantages of Options Trading

1. Limited Risk: One of the key advantages of option trading is the ability to define and limit risk. Unlike trading stocks or futures, where losses can be unlimited if the market moves against you, options allow traders to know their maximum potential loss upfront. The premium paid to purchase an option contract is the most you can lose, providing a level of downside protection.

2. High Potential Returns: While the risk is limited, options also offer the potential for significant returns. Options provide leverage, allowing traders to control a larger position with a smaller amount of capital compared to trading the underlying asset directly. As a result, successful options trades can generate substantial profits relative to the initial investment.

3. Versatility: Options provide traders with a wide range of strategies to profit from various market conditions. Whether the market is trending up, down, or sideways, there are options strategies available to capitalize on different scenarios. Options can be used for speculation, hedging, income generation, or risk management, making them versatile instruments for portfolio management.

4. Flexibility: Options offer flexibility in terms of investment horizon and risk tolerance. Unlike stocks, which require a significant upfront investment and may tie up capital for extended periods, options contracts have expiration dates, allowing traders to choose short-term or long-term positions based on their investment objectives. Additionally, options can be traded on a variety of underlying assets, including stocks, indices, commodities, and currencies, providing ample opportunities for diversification.

5. Opportunities in Volatile Markets: Options thrive in volatile markets, where price fluctuations create trading opportunities. Volatility is a key determinant of options prices, and higher volatility generally leads to higher option premiums. Traders can benefit from increased volatility by employing strategies such as straddles, strangles, or iron condors to profit from anticipated price movements or capitalize on volatility expansion.

6. Risk Management: Options can be used as effective risk management tools to protect against adverse price movements in the underlying asset. Strategies like buying protective puts or selling covered calls can help hedge against downside risk or generate income to offset losses. Options also allow traders to implement stop-loss orders or adjust positions dynamically to manage risk effectively.

7. Liquidity: Options markets are highly liquid, with active trading in a wide range of contracts across different strike prices and expiration dates. High liquidity ensures tight bid-ask spreads and efficient order execution, enabling traders to enter and exit positions with minimal slippage and transaction costs.

8. Income Generation: Options trading can provide a steady stream of income through strategies like selling covered calls or cash-secured puts. These strategies allow traders to collect premiums upfront in exchange for assuming certain obligations, such as selling the underlying asset at a predetermined price. Income-generating strategies can supplement investment returns and enhance portfolio yields.

Disadvantages of Options Trading

1. Limited Time Horizon: Options contracts have expiration dates, limiting the time available for the underlying asset to move in a favorable direction. Unlike stocks, which can be held indefinitely, options positions must be managed within a specified timeframe. Failure to exit or adjust positions before expiration can result in the loss of the entire premium paid for the option.

2. Time Decay: Options contracts lose value over time due to a phenomenon known as time decay or theta decay. As expiration approaches, the value of an option diminishes, especially for out-of-the-money options, regardless of the direction of the underlying asset's price movement. Time decay accelerates as expiration nears, eroding the option's value and reducing profitability, particularly for buyers of options.

3. Complexity: Options trading involves complex strategies and concepts that can be challenging for novice traders to grasp. Understanding options terminology, pricing models, and various trading strategies requires a significant amount of education and experience. Novice traders may struggle to navigate the complexities of options trading, leading to costly mistakes and losses.

4. Leverage and Magnified Losses: While options provide leverage, amplifying potential returns, they also magnify losses. Options traders can control a large position with a relatively small amount of capital, but this leverage can work against them if the trade moves unfavorably. A small adverse price movement in the underlying asset can result in significant losses for option buyers, especially when trading highly leveraged strategies.

5. Unlimited Risk for Sellers: Option sellers, also known as writers, face unlimited downside risk. While option buyers' losses are limited to the premium paid, sellers' losses can be substantial if the market moves significantly against their positions. Selling naked options, without proper risk management or hedging strategies, exposes sellers to potentially catastrophic losses beyond their initial investment.

6. Market Volatility: Options are sensitive to changes in market volatility, which can affect their prices and behavior. Increased volatility can inflate option premiums, making options more expensive to buy. Conversely, declining volatility can reduce option premiums, impacting profitability for option buyers and sellers. Managing volatility risk is essential for options traders, as unexpected volatility spikes can lead to unpredictable outcomes.

7. Execution Risks: Options trading involves execution risks, including slippage and liquidity issues. Illiquid options contracts may have wider bid-ask spreads and limited trading volume, making it difficult to enter and exit positions at desired prices. Slippage, the difference between expected and actual execution prices, can erode profits and increase trading costs, particularly during fast-moving markets or low-volume periods.

8. Commissions and Fees: Options trading often incurs commissions and fees, including brokerage commissions, exchange fees, and regulatory fees. These costs can eat into profits, especially for frequent traders or those trading large volumes. It's essential to consider transaction costs when evaluating the profitability of options trades and incorporate them into overall trading strategies.

9. Emotional Challenges: Options trading can be emotionally taxing, especially during periods of market uncertainty or volatility. Fear, greed, and overconfidence can cloud judgment and lead to impulsive decision-making. Managing emotions and adhering to disciplined trading plans are critical for success in options trading, but it requires discipline, patience, and psychological resilience.

Precautions for Options Trading

1. Education: Gain a comprehensive understanding of options trading before venturing into the market. Familiarize yourself with basic concepts, strategies, and risk management techniques.

2. Risk Management: Implement robust risk management strategies, such as setting stop-loss orders and position sizing, to protect your capital and minimize potential losses.

3. Practice: Before trading options with real money, consider practicing on a virtual trading platform like SmartBulls. Virtual trading allows you to test strategies and hone your skills without risking actual capital.

4. Diversification: Avoid overexposure to a single asset or strategy. Diversifying your options portfolio can help mitigate risks and enhance overall returns.

In conclusion, options trading offers a plethora of opportunities for investors to profit from market movements and hedge against risks. However, it requires careful planning, diligent research, and prudent risk management to succeed in this complex and dynamic market. By understanding the nuances of options trading and taking appropriate precautions, investors can navigate the market with confidence and potentially achieve their financial goals. Practice on virtual trading app SmartBulls can help traders hone their skills and gain confidence before entering the market with real money.

#investing#stock market#stock trading#equity trading#financial literacy#finance#learn stock market trading#paper trading#virtual trading#derivatives trading#futures and options#options trading#options

0 notes

Text

Uncle Vlad

So! Vlad Masters, Maddie Walker, and Jack Fenton were a group of friends that studied together at Gotham University. They all studied the Effects of Ectoplasm of the world around them, from how it affected Space-time to how it affected the Flora of the world.

But they had another friend, one who was interested on how Ectoplasm affected Human Beings before they died, rather than after. He was a Med Student, and he wanted to see if there were any Medicinal applications to Ectoplasm.

His name was Thomas Wayne.

Thomas was actually great friends with the Trio, and eventually they became a Quartet. He was just as crazy as them, although he hid it better, and he loved to get into stupid shenanigans with them.

Unfortunately that all came to an end when Vlad got was put in the Hospital by a Lab Accident. He refused to see any of them, but Thomas managed to convince him to let him study how the Ectoplasm was affecting his Body to hopefully find a Cure. He was the most skilled Ecto-Biologist they had after all.

Thomas never managed to find a Cure, but he did manage to maintain his friendship with Vlad, even after Jack and Maddie got married and moved away to Illinois. He felt bad that their friend group fell apart like that, but with all their lives changing it was inevitable. Thomas himself was planning on proposing to his girlfriend Martha soon.

When Vlad moved away to Wisconsin after recovering from his Accident, he stayed in contact with Thomas as thanks for all the help he gave in trying to find a Cure. Unlike Jack and Maddie who moved away without even trying to say goodbye, Thomas stuck around and stayed his friend.

He even became the Godfather to his son, Bruce. He later got a Letter from Jack and Maddie naming him the Godfather of their own son, Daniel, but he didn't really care as much. Bruce was an adorable little boy, and incredibly intelligent, he got that from his Father obviously.

Or course, then That Day happened. Thomas and his wife were Shot by a mugger and poor Bruce was left without his parents. Vlad tried to take him in, but was rejected on the grounds that he was still "Too frail to get out of his House".

He stayed in Contact with Bruce, but it became harder as time went on. From both the revelation that Daniel Fenton was a Halfa like him, and the fact that Bruce was traveling so much, he didn't have much of a chance to contact him. He needed to split his attention, and Daniel took a lot more than expected.

He hoped Bruce would stay a good kid, Daniel gave him too many headaches already.

...

A few years later, Bruce Wayne became the Batman.

#Dpxdc#Dp x dc#Dcxdp#Dc x dp#Danny Phantom#Dc#Dcu#Vlad Masters is Bruce Wayne's Godfather#Thomas Wayne was friends with Vlad Masters#The reason Vlad couldn't take on Bruce was because of the Wayne Enterprises Board#They thought he would manipulate Bruce into selling his Stocks in WE giving Vlad a majority share#So they payed off the courts#Vlad knows this and will wait for his chance to get revenge at a later date#One that will not inconvenience Bruce#Like after those guys retire#Or after they die#Both are viable options#Danny and Bruce know about eachother#But only as the Other Godson of Vlad#Bruce only knows that Danny is the son of his Dad's old friends#And Danny only knows that Bruce is the son of his Parents old friend#They will meet one day in the future#Vlad fully lost contact with Bruce when he was 16 because he adopted Dan#Years later he regains Contact and figures out that Bruce became a Vigilante while he wasn't looking#What was it with his Godson's tendency to become Vigilantes?!#Was it a curse?!

519 notes

·

View notes