#Free wealth consultations Abu Dhabi

Explore tagged Tumblr posts

Text

Boost Your Wealth with Expert Consultations – Free in Abu Dhabi

Introduction:

Wealth consultations offer valuable insights and personalized advice to help you manage and grow your assets. In Abu Dhabi, many financial advisors and Free wealth consultations Abu Dhabi to attract new clients and offer a glimpse of their expertise. These consultations can be a great opportunity to receive professional advice without any initial commitment. This blog will guide you through what to expect from a free wealth consultation in Abu Dhabi and how to make the most of this opportunity.

What is a Free Wealth Consultation?

A Free wealth consultations Abu Dhabi is an initial meeting offered by financial advisors or wealth management firms at no charge. The purpose is to discuss your financial goals, assess your current financial situation, and provide preliminary advice on how to achieve your objectives. These consultations are designed to help you understand how professional wealth management can benefit you and whether the advisor’s services align with your needs.

Benefits of Free Wealth Consultations

Free wealth consultations offer several advantages, especially if you’re considering professional financial advice for the first time.

1. Evaluate Financial Advisor Expertise

During a free consultation, you have the opportunity to assess the advisor’s expertise and approach. This meeting allows you to gauge their knowledge, experience, and whether their advice aligns with your financial goals. It’s a chance to understand their strategies and how they can help you achieve your financial objectives.

2. Understand Wealth Management Services

The consultation provides insight into the range of services offered by the financial advisor. This can include investment management, retirement planning, tax optimization, estate planning, and more. Understanding the services available helps you determine if they meet your specific needs.

3. No Financial Commitment Required

One of the key benefits of a free consultation is that it does not require any financial commitment. You can receive professional advice and explore options without any upfront costs. This is particularly useful for those who are new to wealth management or exploring different advisors.

What to Expect During a Free Wealth Consultation

To make the most of your free wealth consultation, it’s helpful to know what to expect during the meeting.

1. Financial Goals Discussion

The consultation typically begins with a discussion of your financial goals and aspirations. You’ll be asked about your short-term and long-term objectives, such as retirement plans, investment goals, and savings targets. This helps the advisor tailor their advice to your specific needs.

2. Review of Current Financial Situation

The advisor will review your current financial situation, including your income, expenses, assets, and liabilities. This assessment helps identify areas for improvement and potential strategies for achieving your goals.

3. Preliminary Recommendations

Based on the information provided, the advisor will offer preliminary recommendations and strategies. These suggestions might include investment options, savings plans, or financial adjustments to help you move towards your goals.

4. Explanation of Services and Fees

The advisor will explain the range of services they offer and any associated fees. This is an opportunity to understand how they charge for their services, whether it’s a flat fee, a percentage of assets under management, or another structure.

5. Opportunity to Ask Questions

You should take advantage of the consultation to ask any questions you have about Wealth management Abu Dhabi the advisor’s approach, or financial strategies. This helps ensure you have a clear understanding of how the advisor can help you.

How to Prepare for a Free Wealth Consultation

Preparing for your consultation can help you make the most of the meeting and ensure you receive relevant advice.

1. Gather Financial Documents

Bring relevant financial documents, such as bank statements, investment portfolios, and debt records. Having these documents on hand allows the advisor to provide a more accurate assessment of your financial situation.

2. Define Your Financial Goals

Clearly define your financial goals and priorities before the meeting. Whether it’s retirement planning, buying a home, or saving for education, knowing your objectives helps the advisor provide tailored recommendations.

3. Prepare Questions

Prepare a list of questions to ask during the consultation. This could include inquiries about the advisor’s experience, their investment philosophy, or how they can help with specific financial challenges.

Name: Redcliffe Partners

Address: #256 Al Wafra Square Building, Reem Island, Abu Dhabi, UAE

Phone No: +971 2886-4415

Website: https://redcliffepartners.ae/

FAQs

What is included in a free wealth consultation?

A Wealth management Abu Dhabi typically includes a discussion of your financial goals, a review of your current financial situation, and preliminary recommendations from the advisor. It’s also an opportunity to understand the advisor’s services and fee structure without any financial commitment.

Are there any costs associated with a free wealth consultation?

No, a Wealth management Abu Dhabi is offered at no charge. It’s designed to provide initial advice and assess whether the advisor’s services are a good fit for your needs. There is no financial obligation to proceed after the consultation.

How do I prepare for a free wealth consultation?

To prepare, gather relevant financial documents such as bank statements, investment portfolios, and debt records. Clearly define your financial goals and prepare any questions you have about the advisor’s services, strategies, and fees.

How long does a free wealth consultation typically last?

The duration of a Wealth management Abu Dhabi can vary, but it generally lasts between 30 minutes to an hour. The length depends on the complexity of your financial situation and the depth of the discussion.

#expat investment consultations abu dhabi#fixed income abu dhabi#free wealth consultations abu dhabi#investment consultants abu dhabi#equity raising abu dhabi#expat investment consultations bucharest#middle east wealth management advisors#uk property advice#wealth advisors bucharest#wealth management abu dhabi

0 notes

Text

President Donald Trump will apply pressure on Gulf states to bankroll the US’s takeover of the Gaza Strip amid frustration among advisors that the oil-rich allies haven’t coalesced behind the deal or made a counter-offer, a senior US official told Middle East Eye.

“The message is, ‘you don’t get what you want any longer from the US just for free',” the official said on Wednesday.

The Trump administration's plans for Saudi Arabia, Qatar and the UAE to obtain waterfront property rights in a reconstructed Gaza Strip and for their construction firms to be awarded contracts to build apartment towers there would be in return for funding the “relocation” of Palestinians and Gaza’s reconstruction, the official, who was briefed by one of a handful of Trump advisors consulted on the plan, told MEE.

However, it is no small matter that international law dictates those territorial rights, and the US does not control the property rights for Gaza's waterfront or its maritime boundaries.

Trump’s press conference on Tuesday, alongside Israeli Prime Minister Benjamin Netanyahu, stunned allies and foes alike, including ordinary Americans.

The world was left guessing whether or not a president who campaigned on ending foreign American entanglements was serious about taking over Gaza or merely setting himself up for negotiation with Gulf states for the enclave’s postwar future and, in the case of Saudi Arabia, normalisation of ties with Israel.

Trump has been calling for weeks for neighbouring Arab states, Jordan and Egypt, to accept forcibly displaced Palestinians from the Gaza Strip. His own State Department has warned him that Egypt will not be swayed.

Likewise, Saudi Arabia has struck a hard public line on what it would take to get them to provide funds for Gaza’s reconstruction.

Asked in an interview in January if Saudi Arabia would fund Gaza’s reconstruction, Prince Khalid bin Bandar bin Sultan Al Saud, Saudi Arabia’s ambassador to the UK, said: “To reconstruct a Palestinian state, yes. To reconstruct a territory that the Israelis might just destroy again in a matter of years, I don’t think that would be a sensible thing to do.”

Trump said on Tuesday that after emptying Gaza of Palestinians and taking a “long-term ownership position” of the territory, the US would turn it into the "Riviera of the Middle East”. “This might lead to a negotiation, but I take Trump seriously.

He and his people really believe this is the best path forward. I’m not surprised they are upset the Gulf is not on board,” Jonathan Panikoff, a former senior US intelligence official now at the Atlantic Council, told MEE.

But it may be the cold shoulder it received from the US’s Arab Gulf partners that is grating the White House the most.

Trump insisted on Tuesday that his vision would be “paid for by neighbouring countries of great wealth”. Emirati analyst Abdulkhaleq Abdullah, who has close ties to the UAE’s ruling Nahyan family, wrote on X: “We have just heard the most stupid idea come out of Washington DC regarding Gaza,” after Trump’s speech.

The plan was shot down by Saudi Arabia, which rushed out a statement early on Wednesday morning that rejected any efforts to displace Palestinians from their land.

It also upped Saudi Arabia’s demand that an independent Palestinian state be created before it normalises diplomatic relations with Israel.

The language, which said the Saudi position was nonnegotiable, marked a step up from previous statements that called for a pathway to a Palestinian state as a prerequisite to a deal.

“The Gulf isn’t pumping any cash into the Gaza Strip in the absence of a serious conversation on a two-state solution and, secondly, the fate of the current ceasefire,” Bilal Saab, a former Pentagon official in the first Trump administration, told MEE.

“Shooting off statements alongside Bibi Netanyahu is not the best way to conduct diplomacy towards Riyadh and Abu Dhabi,” he added. Anna Jacobs, a Middle East expert at the Arab Gulf States Institute in Washington DC, said that Gulf states had made it “crystal clear” to Trump that his statements on Gaza were a non-starter.

“They are not going to pay for the forced displacement of Palestinians,” she said.

The outpouring of criticism included the Arab League, which called Trump's proposal a "recipe for instability”.

The US president’s advisors spent Wednesday walking back some of his more stunning statements. US Secretary of State Marco Rubio said Trump’s speech "was not meant as hostile", describing it as a "generous move - the offer to rebuild and to be in charge of the rebuilding”.

White House Press Secretary Karoline Leavitt said Palestinians would only be "temporarily relocated” from the enclave and that Trump did not commit to deploying American troops.

Kristian Coates Ulrichsen, a fellow for the Middle East at Rice University's Baker Institute, said that, far from moving the needle in negotiations with the Gulf states about funding Gaza’s reconstruction, Trump may have caused them to harden their positions.

“If the idea was to shock the Gulf into action, I think it backfired,” he told MEE.

“Trump may think he created space to make concessions, but he made it harder for regional leaders to make a deal.”

✍️: MEE/Sean Mathews

#free Palestine#free gaza#free west bank#occupied west bank#illegal occupation of Palestine#occupied territories#west bank#I stand with Palestine#Gaza#Palestine#Gazaunderattack#Palestinian Genocide#Gaza Genocide#end the occupation#Israel is an illegal occupier#Israel is committing genocide#Israel is committing war crimes#Israel is a terrorist state#Israel is a war criminal#Israel is an apartheid state#Israel is evil#Israeli war crimes#Israeli terrorism#IOF Terrorism#Israel kills babies#Israel kills children#Israel kills innocents#Israel is a murder state#Israeli Terrorists#Israeli war criminals

22 notes

·

View notes

Text

Exploring the Best Ceramic Tiles in Dubai, Abu Dhabi, and Sharjah for Your Home Décor

When it comes to home décor, one of the most important elements to consider is the flooring. Ceramic tiles are a popular choice in the UAE, particularly in cities like Dubai, Abu Dhabi, and Sharjah. They offer durability, elegance, and a range of design options that can complement any interior style. Whether you’re renovating your home or building from scratch, understanding the best tiles in these cities is essential for creating the perfect living space.

Ceramic Tiles in Dubai: A Modern Touch to Your Home

Dubai is known for its luxurious and modern architecture, and ceramic tiles play a major role in enhancing the aesthetic appeal of homes and commercial spaces. The variety of ceramic tiles in Dubai is impressive, ranging from sleek, polished finishes to intricate patterns that make a bold statement. Whether you’re looking for a minimalist design or vibrant tiles that add personality to your rooms, Dubai offers a wealth of options.

One of the most notable trends in the city is photo tiles for home décor in Dubai. These tiles allow you to create a personalized touch in your home, featuring images that range from nature landscapes to custom family photos. Photo tiles are perfect for creating focal points in kitchens, living rooms, or bathrooms, making your space truly unique.

Tiles in Abu Dhabi: Combining Style and Function

Abu Dhabi offers a wide selection of ceramic tiles that combine style with practicality. The tiles in this city are known for their durability, making them an excellent choice for high-traffic areas like kitchens and bathrooms. From classic neutral shades to more adventurous colors and designs, the tiles in Abu Dhabi cater to all tastes.

Many suppliers in Abu Dhabi also offer ceramic tiles with advanced technology, such as anti-slip and stain-resistant properties, ensuring that your investment lasts longer and remains beautiful.

Best Tiles in Sharjah: Affordable Quality and Variety

Sharjah, while quieter compared to Dubai and Abu Dhabi, is home to some of the best tiles suppliers in Sharjah. The city is known for offering affordable yet high-quality ceramic tiles, making it an ideal destination for homeowners on a budget. Whether you’re renovating a small bathroom or looking to revamp your entire home, Sharjah provides tiles in various sizes, textures, and colors to suit your needs.

The best tiles in Sharjah come with excellent customer service from local suppliers, helping you choose the right tiles that fit both your style and budget. Plus, Sharjah’s suppliers often have more competitive prices compared to other emirates, making it an attractive option for savvy homeowners.

Why Choose Ceramic Tiles for Your Home?

Ceramic tiles offer numerous benefits that make them a preferred choice for many homeowners in Dubai, Abu Dhabi, and Sharjah. Some of the key advantages include:

Durability: Ceramic tiles are known for their strength and longevity. They can withstand heavy foot traffic and wear, making them perfect for both residential and commercial spaces.

Low Maintenance: These tiles are easy to clean and require minimal upkeep. Whether you spill something in the kitchen or need to wipe down the bathroom walls, ceramic tiles are hassle-free.

Variety: From traditional designs to modern photo tiles, the range of ceramic tiles is diverse, allowing you to choose exactly what fits your home décor.

Heat Resistance: Ceramic tiles are naturally resistant to heat, making them a great choice for homes in hot climates like the UAE.

Conclusion

Whether you are looking for ceramic tiles in Dubai, tiles in Abu Dhabi, or the best tiles in Sharjah, the UAE offers a wide range of options to enhance your home décor. From photo tiles for home décor in Dubai to affordable yet high-quality choices in Sharjah, there is no shortage of variety. Ensure you select the best tiles that suit your style, budget, and functional needs by consulting reliable tiles suppliers in Sharjah or other cities. Transform your living space with the timeless elegance of ceramic tiles!

#ceramic tiles dubai#tiles in abu dhabi#best tiles in sharjah#photo tiles home decor dubai#tiles supplier in sharjah

0 notes

Text

Starting a business in Abu Dhabi - A step-by-step guide

Abu Dhabi, the capital of the United Arab Emirates (UAE), has become a thriving hub for entrepreneurs and business professionals worldwide. With its favorable business environment, strategic location, and strong economy, the city offers a wealth of opportunities for both local and international entrepreneurs. However, understanding the legalities and processes involved in setting up a business is crucial for success.

In this step-by-step guide, we’ll walk you through the process of starting a business in Abu Dhabi, highlighting key requirements and services that can help smooth your entrepreneurial journey.

Step 1: Decide on the Type of Business

Before diving into the legalities, it's essential to decide what type of business you want to start. Abu Dhabi offers a variety of business structures, including:

Limited Liability Company (LLC): Ideal for foreign investors, as it allows up to 49% foreign ownership in most cases.

Free Zone Company: Perfect for businesses that require 100% foreign ownership, offering tax exemptions and other benefits.

Branch Office: A branch of an existing foreign company can be established to carry out the same business operations in Abu Dhabi.

Each structure has its own set of regulations, so it’s essential to choose one that suits your business needs.

Step 2: Choose a Business Name

Naming your business is a crucial step in the setup process. Ensure that the name is unique and complies with the UAE’s naming conventions. The name should not be offensive, and it must not already be in use by another entity. Additionally, certain words such as “bank,” “insurance,” or “international” may require special approval from relevant authorities.

Step 3: Apply for a Business License

Once you've decided on your business structure and name, the next step is to apply for a business license. Abu Dhabi offers various licenses depending on your business activities:

Commercial License: For trading and commercial activities.

Professional License: For consultancy or service-based businesses.

Industrial License: For manufacturing businesses.

You will need to submit relevant documents, including your business plan, passport copies, and any specific permits depending on your industry.

Step 4: Register with the Authorities

After obtaining the appropriate business license, you must register your business with the Abu Dhabi Department of Economic Development (DED). This registration process ensures that your business complies with all local laws and regulations. For foreign investors, registration with the DED also includes obtaining an approval from the UAE Ministry of Economy and other government bodies.

Step 5: Secure a Business Location

Choosing the right location for your business is essential. In Abu Dhabi, you can set up in the mainland, which allows you to operate freely within the UAE market, or in one of the many free zones that cater to specific industries, such as technology or logistics. Free zone companies benefit from 100% foreign ownership, tax exemptions, and simplified processes for establishing a business.

Step 6: Open a Corporate Bank Account

Every business in Abu Dhabi must have a corporate bank account. The process of opening a bank account typically requires submitting your company’s legal documents, proof of business address, and personal identification. Abu Dhabi has several international and local banks that offer business banking services.

Step 7: Hire Employees and Obtain Visas

If your business will require staff, you will need to follow the UAE’s labor laws and secure work visas for your employees. The UAE offers a straightforward process for obtaining employment visas, with the number of visas dependent on the size of your business. This includes residency visas for foreign nationals, allowing them to live and work in the UAE.

Step 8: Get Professional Assistance

Starting a business in Abu Dhabi can be a complex process, particularly for foreign entrepreneurs. Working with a business consultancy firm can help streamline the setup process, ensuring you comply with all legal requirements and avoid costly mistakes.

One such firm that specializes in helping entrepreneurs start their businesses in Abu Dhabi is Arabian Business Center. With their in-depth knowledge of local laws and regulations, they can provide invaluable assistance in navigating the various stages of business setup, from obtaining licenses to visa processing.

Step 9: Comply with Ongoing Regulations

After setting up your business, it’s essential to stay compliant with local regulations. This includes renewing your business license, keeping proper financial records, paying taxes, and following any other industry-specific regulations. Abu Dhabi has a business-friendly regulatory environment, but it's crucial to stay informed about changes in laws and practices.

Conclusion

Starting a business in Abu Dhabi offers tremendous potential for growth and success, but it requires careful planning and adherence to local laws. By following these steps and seeking professional guidance from trusted consultants like Arabian Business Center, you can set up a business in one of the most dynamic and lucrative markets in the Middle East. With the right approach and support, your entrepreneurial dreams in Abu Dhabi can become a reality.

#Business Setup in Abu Dhabi#Company Formation in Abu Dhabi#Business Setup#Abu Dhabi Company formation

0 notes

Text

Beyond Dubai: Emerging Business Hubs in the UAE You Should Consider

When it comes to business setup in the UAE, Dubai often grabs the spotlight. However, other emirates are rapidly gaining traction as attractive destinations for entrepreneurs. These emerging business hubs offer unique opportunities, cost-effective solutions, and favorable conditions that make them just as appealing as Dubai. As a business setup consultancy, we explore key locations beyond Dubai that you should consider for establishing your business.

Abu Dhabi: The Capital’s Business Potential

While Abu Dhabi is known for its oil wealth, the emirate has diversified its economy with growing sectors like real estate, tourism, technology, and renewable energy. Business-friendly policies and a strategic location make Abu Dhabi an attractive choice. The Abu Dhabi Global Market (ADGM) offers world-class financial services, while Khalifa Industrial Zone (KIZAD) provides cost-effective industrial and manufacturing solutions. Entrepreneurs benefit from robust infrastructure, access to capital, and a supportive business environment.

2. Sharjah: A Cultural and Industrial Hub

Sharjah is a vibrant mix of industry, culture, and commerce. It is emerging as a business hub, particularly for SMEs and startups. Sharjah Media City (Shams) and Sharjah Research Technology and Innovation Park (SRTIP) cater to tech, media, and innovation-driven businesses. The cost of setting up a business in Sharjah is generally lower than in Dubai, making it an attractive option for entrepreneurs on a budget. Sharjah’s proximity to Dubai is another key advantage, offering access to the region’s largest market without the associated high costs.

3. Ras Al Khaimah: The Budget-Friendly Free Zone

For those looking for an affordable business setup in UAE, Ras Al Khaimah Economic Zone (RAKEZ) offers excellent solutions. RAKEZ provides one of the most cost-effective business setups, with flexible licensing options, low operational costs, and a business-friendly environment. Entrepreneurs benefit from quick setup processes and a wide range of business activities. It’s a great choice for SMEs, freelancers, and startups who want to minimize costs while accessing the UAE market.

4. Ajman: The Rising Star for SMEs

Ajman is one of the UAE’s hidden gems for business setup. With Ajman Free Zone (AFZ) offering competitive packages and quick setup processes, it’s becoming a popular hub for small businesses and startups. Ajman’s strategic location between Dubai and Sharjah gives businesses easy access to major markets, while its cost-effective licensing and operational fees make it ideal for budget-conscious entrepreneurs.

5. Fujairah: A Gateway for Trade and Industry

Fujairah’s strategic position along the Indian Ocean makes it an ideal location for trade and shipping businesses. Fujairah Free Zone (FFZ) and Fujairah Creative City offer specialized zones for media, logistics, and industrial ventures. The emirate’s lower operational costs and proximity to key shipping routes make it a practical option for businesses involved in trade, logistics, and manufacturing.

Conclusion

While Dubai remains a top destination for business setup in UAE, these emerging business hubs offer unique advantages for entrepreneurs seeking cost-effective solutions, strategic locations, and specialized zones. Whether you are looking to set up in Abu Dhabi’s thriving economy, Ras Al Khaimah’s budget-friendly zone, or the cultural heart of Sharjah, the UAE has a diverse range of options to suit any business need. Let Setup Dubai Business guide you through the process and help you choose the best location for your entrepreneurial journey.

0 notes

Text

Top Real Estate Companies in Dubai for Investing in Abu Dhabi Apartments

Investing in real estate has always been a popular choice for investors looking to diversify their portfolios and achieve stable returns. In the UAE, both Dubai and Abu Dhabi stand out as prime locations for property investments. While Dubai is renowned for its dynamic real estate market, many investors are increasingly eyeing Abu Dhabi for its lucrative opportunities. This article explores why investors should consider working with top real estate companies in Dubai when investing in Abu Dhabi apartments.

Why Invest in Abu Dhabi Apartments?

Strategic Location and Economic Growth

Abu Dhabi, the capital of the UAE, boasts a strategic location that serves as a gateway between the East and the West. Its robust infrastructure, world-class amenities, and ongoing economic diversification efforts make it an attractive destination for real estate investment. The government’s Vision 2030 plan aims to transform Abu Dhabi into a global hub, further enhancing its appeal.

High Rental Yields and Capital Appreciation

Apartments in Abu Dhabi offer high rental yields compared to many other global cities. The rental market is bolstered by a steady influx of expatriates and professionals attracted by the city’s burgeoning economy. Additionally, the potential for capital appreciation is significant, driven by ongoing developments and the city’s expanding economic landscape.

Quality of Life and Sustainable Living

Abu Dhabi is synonymous with a high quality of life, featuring state-of-the-art healthcare, top-tier education, and a plethora of recreational facilities. The city is also focused on sustainable living, with numerous green spaces and eco-friendly developments. These factors make it an ideal place for families and professionals, thereby sustaining demand for residential properties.

The Role of Real Estate Companies in Dubai

Expertise and Market Knowledge

Top real estate companies in Dubai bring a wealth of expertise and market knowledge to the table. Their extensive experience in handling high-value transactions and understanding market trends enables them to provide valuable insights into the Abu Dhabi real estate market. They can guide investors on the best locations, property types, and investment strategies to maximise returns.

Comprehensive Services

These companies offer comprehensive services that go beyond just buying and selling properties. They provide end-to-end solutions, including property management, legal advice, financial consulting, and after-sales support. This holistic approach ensures that investors have a seamless and hassle-free experience throughout their investment journey.

Strong Network and Connections

Dubai-based real estate companies have strong networks and connections with developers, financial institutions, and government bodies. These relationships can be advantageous for investors, offering them access to exclusive deals, financing options, and streamlined processes. The credibility and reputation of these companies also provide an added layer of assurance for investors.

Key Considerations When Investing in Abu Dhabi Apartments

Location and Accessibility

When investing in Abu Dhabi apartments, location is paramount. Areas such as Al Reem Island, Saadiyat Island, and Al Raha Beach are highly sought after due to their prime locations, excellent amenities, and connectivity. Investors should consider proximity to key landmarks, business districts, schools, and transportation hubs to ensure high demand and rental yields.

Property Type and Amenities

The type of apartment and the amenities it offers are crucial factors that influence rental and resale value. Modern, well-designed apartments with facilities such as swimming pools, gyms, and concierge services are more attractive to tenants and buyers. Additionally, properties with sustainable features and energy-efficient systems are becoming increasingly popular.

Legal and Regulatory Framework

Understanding the legal and regulatory framework governing property investments in Abu Dhabi is essential. This includes knowledge of property ownership laws, visa regulations, and tax implications. Top real estate companies in Dubai can provide expert guidance on these aspects, ensuring compliance and safeguarding the investor’s interests.

Market Trends and Economic Indicators

Keeping abreast of market trends and economic indicators is vital for making informed investment decisions. Factors such as population growth, employment rates, and economic policies can significantly impact the real estate market. Real estate companies in Dubai leverage their analytical capabilities to offer insights into these trends, helping investors make strategic choices.

Benefits of Working with Top Real Estate Companies in Dubai

Professionalism and Reliability

Top real estate companies in Dubai are known for their professionalism and reliability. They adhere to high standards of service and ethics, ensuring transparency and integrity in all transactions. This reliability is crucial for investors, providing peace of mind and confidence in their investments.

Customised Investment Strategies

These companies offer customised investment strategies tailored to the investor’s goals and risk appetite. Whether the objective is long-term capital growth, rental income, or portfolio diversification, they can devise a strategy that aligns with the investor’s needs. This personalised approach maximises the potential for achieving desired outcomes.

Access to Exclusive Opportunities

Working with renowned real estate companies in Dubai grants investors access to exclusive opportunities that may not be available to the general market. This includes pre-launch offers, off-plan properties, and discounted deals. Such opportunities can provide a competitive edge, allowing investors to capitalise on high-potential investments.

Conclusion

Investing in Abu Dhabi apartments presents a wealth of opportunities for investors seeking stable returns and capital growth. The city’s strategic location, economic resilience, and high quality of life make it an attractive destination for real estate investment. By partnering with top real estate companies in Dubai, investors can leverage their expertise, comprehensive services, and strong networks to navigate the Abu Dhabi market effectively. These companies provide invaluable support, from identifying lucrative properties to managing investments, ensuring a successful and rewarding investment journey.

In conclusion, while the choice of the specific real estate company is important, focusing on firms with a proven track record, extensive market knowledge, and a commitment to client satisfaction will significantly enhance the chances of making sound and profitable investments in Abu Dhabi apartments.

0 notes

Text

How to Start a Business in Dubai

Introduction:

The United Arab Emirates (UAE) has emerged as a global hub for business and commerce, attracting entrepreneurs and investors from around the world. With its strategic location, favorable regulatory environment, and robust infrastructure, the UAE offers unparalleled opportunities for growth and prosperity.

In this article, we delve into the dynamics of business in the UAE, exploring its diverse sectors, regulatory framework, and the essential steps to start a business in Dubai, the commercial heart of the country. Additionally, we highlight the expertise of Southbridge Legal, a leading legal consultancy firm dedicated to empowering businesses in the UAE.

Understanding Business in the UAE:

Business in the UAE is characterized by its dynamic economy, diversified sectors, and investor-friendly policies. From oil and gas to tourism, finance, and technology, the UAE boasts a thriving business ecosystem that caters to a wide range of industries and sectors. With its strategic location at the crossroads of Europe, Asia, and Africa, the UAE serves as a gateway to lucrative markets, offering unparalleled access to global trade and investment opportunities.

Key Sectors Driving Business in the UAE:

Real Estate and Construction: The UAE is renowned for its iconic skyline, boasting world-class infrastructure, luxurious residential developments, and state-of-the-art commercial complexes. The real estate and construction sector continues to thrive, driven by ongoing urbanization, infrastructure projects, and mega-events such as Expo 2020 Dubai.

Tourism and Hospitality: With its stunning beaches, luxury resorts, and cultural attractions, tourism is a major driver of economic growth in the UAE. Dubai and Abu Dhabi, in particular, attract millions of tourists each year, fueling demand for hospitality services, entertainment, and leisure activities.

Finance and Banking: As a global financial center, the UAE offers a wide range of banking, investment, and wealth management services. Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM) serve as key hubs for finance and fintech, attracting multinational corporations, banks, and financial institutions from around the world.

Technology and Innovation: The UAE is committed to fostering innovation and embracing emerging technologies such as artificial intelligence, blockchain, and renewable energy. Dubai's Smart City initiatives and Abu Dhabi's investment in technology parks and innovation ecosystems underscore the country's commitment to becoming a leader in the digital economy.

How to Start a Business in Dubai: Essential Steps and Considerations

Choose the Right Business Structure: The first step in how to start a business in Dubai is choosing the appropriate legal structure, which can vary depending on the nature of your business, ownership preferences, and regulatory requirements. Common business structures in Dubai include Limited Liability Company (LLC), Free Zone Company, and Branch Office.

Obtain the Necessary Licenses and Permits: Depending on your business activities and location, you may need to obtain various licenses and permits from relevant authorities such as the Department of Economic Development (DED), Dubai Municipality, and Dubai Health Authority. These licenses ensure compliance with regulatory requirements and enable you to operate legally in Dubai.

Secure Local Sponsorship or Partnership: In many cases, foreign entrepreneurs looking how to start a business in Dubai are required to have a local sponsor or partner who holds at least 51% ownership of the business. Choosing the right local sponsor is crucial, as they will play a significant role in facilitating the setup process and navigating local regulations.

Open a Corporate Bank Account: Once your business is registered and licensed, you'll need to open a corporate bank account in Dubai to manage your finances, conduct transactions, and facilitate business operations. Choose a reputable bank that offers comprehensive banking services tailored to the needs of businesses in Dubai.

Southbridge Legal: Your Trusted Partner in Navigating Business in the UAE

When venturing into the dynamic world of business in the UAE, having the right legal guidance and support is essential for success. Southbridge Legal is a leading legal consultancy firm specializing in corporate law, commercial transactions, and business advisory services in the UAE. Here's why Southbridge Legal is your trusted partner:

Expertise and Experience: With years of experience and a team of seasoned legal professionals, Southbridge Legal offers unparalleled expertise in navigating the complex legal landscape of business in the UAE. Whether you're starting a new venture, expanding your operations, or seeking legal advice, Southbridge Legal provides comprehensive solutions tailored to your specific needs and objectives.

Regulatory Compliance: The UAE's regulatory environment can be intricate and multifaceted, with laws and regulations governing various aspects of business operations. Southbridge Legal helps clients navigate regulatory compliance requirements, ensuring adherence to local laws, regulations, and best practices to avoid legal pitfalls and mitigate risks.

Strategic Guidance: Beyond legal compliance, Southbridge Legal offers strategic guidance and business advisory services to help clients achieve their long-term goals and objectives. Whether it's structuring investments, negotiating contracts, or resolving disputes, Southbridge Legal provides strategic insights and practical solutions to drive business success in the UAE.

Conclusion:

How to start a Business in the UAE Southbridge Legal, offers unparalleled opportunities for growth, innovation, and prosperity, driven by a dynamic economy, diversified sectors, and investor-friendly policies. Whether you're a seasoned entrepreneur or a budding startup, navigating the intricacies of business setup and operations in Dubai requires careful planning, strategic decision-making, and expert legal guidance.

With the support of Southbridge Legal, you can embark on your business journey in the UAE with confidence, knowing that you have a trusted partner by your side to navigate the complexities and unlock the full potential of the vibrant business landscape in Dubai and beyond.

0 notes

Text

How to Start a Business in Dubai

Introduction:

The United Arab Emirates (UAE) has emerged as a global hub for business and commerce, attracting entrepreneurs and investors from around the world. With its strategic location, favorable regulatory environment, and robust infrastructure, the UAE offers unparalleled opportunities for growth and prosperity.

In this article, we delve into the dynamics of business in the UAE, exploring its diverse sectors, regulatory framework, and the essential steps to start a business in Dubai, the commercial heart of the country. Additionally, we highlight the expertise of Southbridge Legal, a leading legal consultancy firm dedicated to empowering businesses in the UAE.

Understanding Business in the UAE:

Business in the UAE is characterized by its dynamic economy, diversified sectors, and investor-friendly policies. From oil and gas to tourism, finance, and technology, the UAE boasts a thriving business ecosystem that caters to a wide range of industries and sectors. With its strategic location at the crossroads of Europe, Asia, and Africa, the UAE serves as a gateway to lucrative markets, offering unparalleled access to global trade and investment opportunities.

Key Sectors Driving Business in the UAE:

Real Estate and Construction: The UAE is renowned for its iconic skyline, boasting world-class infrastructure, luxurious residential developments, and state-of-the-art commercial complexes. The real estate and construction sector continues to thrive, driven by ongoing urbanization, infrastructure projects, and mega-events such as Expo 2020 Dubai.

Tourism and Hospitality: With its stunning beaches, luxury resorts, and cultural attractions, tourism is a major driver of economic growth in the UAE. Dubai and Abu Dhabi, in particular, attract millions of tourists each year, fueling demand for hospitality services, entertainment, and leisure activities.

Finance and Banking: As a global financial center, the UAE offers a wide range of banking, investment, and wealth management services. Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM) serve as key hubs for finance and fintech, attracting multinational corporations, banks, and financial institutions from around the world.

Technology and Innovation: The UAE is committed to fostering innovation and embracing emerging technologies such as artificial intelligence, blockchain, and renewable energy. Dubai's Smart City initiatives and Abu Dhabi's investment in technology parks and innovation ecosystems underscore the country's commitment to becoming a leader in the digital economy.

How to Start a Business in Dubai: Essential Steps and Considerations

Choose the Right Business Structure: The first step in how to start a business in Dubai is choosing the appropriate legal structure, which can vary depending on the nature of your business, ownership preferences, and regulatory requirements. Common business structures in Dubai include Limited Liability Company (LLC), Free Zone Company, and Branch Office.

Obtain the Necessary Licenses and Permits: Depending on your business activities and location, you may need to obtain various licenses and permits from relevant authorities such as the Department of Economic Development (DED), Dubai Municipality, and Dubai Health Authority. These licenses ensure compliance with regulatory requirements and enable you to operate legally in Dubai.

Secure Local Sponsorship or Partnership: In many cases, foreign entrepreneurs looking how to start a business in Dubai are required to have a local sponsor or partner who holds at least 51% ownership of the business. Choosing the right local sponsor is crucial, as they will play a significant role in facilitating the setup process and navigating local regulations.

Open a Corporate Bank Account: Once your business is registered and licensed, you'll need to open a corporate bank account in Dubai to manage your finances, conduct transactions, and facilitate business operations. Choose a reputable bank that offers comprehensive banking services tailored to the needs of businesses in Dubai.

Southbridge Legal: Your Trusted Partner in Navigating Business in the UAE

When venturing into the dynamic world of business in the UAE, having the right legal guidance and support is essential for success. Southbridge Legal is a leading legal consultancy firm specializing in corporate law, commercial transactions, and business advisory services in the UAE. Here's why Southbridge Legal is your trusted partner:

Expertise and Experience: With years of experience and a team of seasoned legal professionals, Southbridge Legal offers unparalleled expertise in navigating the complex legal landscape of business in the UAE. Whether you're starting a new venture, expanding your operations, or seeking legal advice, Southbridge Legal provides comprehensive solutions tailored to your specific needs and objectives.

Regulatory Compliance: The UAE's regulatory environment can be intricate and multifaceted, with laws and regulations governing various aspects of business operations. Southbridge Legal helps clients navigate regulatory compliance requirements, ensuring adherence to local laws, regulations, and best practices to avoid legal pitfalls and mitigate risks.

Strategic Guidance: Beyond legal compliance, Southbridge Legal offers strategic guidance and business advisory services to help clients achieve their long-term goals and objectives. Whether it's structuring investments, negotiating contracts, or resolving disputes, Southbridge Legal provides strategic insights and practical solutions to drive business success in the UAE.

Conclusion:

How to start a Business in the UAE Southbridge Legal, offers unparalleled opportunities for growth, innovation, and prosperity, driven by a dynamic economy, diversified sectors, and investor-friendly policies. Whether you're a seasoned entrepreneur or a budding startup, navigating the intricacies of business setup and operations in Dubai requires careful planning, strategic decision-making, and expert legal guidance.

With the support of Southbridge Legal, you can embark on your business journey in the UAE with confidence, knowing that you have a trusted partner by your side to navigate the complexities and unlock the full potential of the vibrant business landscape in Dubai and beyond.

0 notes

Text

Navigating Success: The Strategic Advantages of Sharjah Airport for Business Expansion

As an Arab business consultant, I am continuously exploring avenues that offer strategic advantages to my clients. One such gem in the Gulf region is Sharjah Airport. Often overshadowed by its neighboring counterparts, Sharjah Airport presents an array of opportunities for businesses seeking expansion and growth. In this blog, we'll delve into why Sharjah Airport stands out as a prime choice for businesses looking to establish themselves or expand their operations in the region.

1. Strategic Location:

Situated in the heart of the UAE, Sharjah Airport enjoys proximity to key business hubs such as Dubai and Abu Dhabi. Its strategic location serves as a gateway to both local and international markets, facilitating seamless connectivity and accessibility for businesses across the globe.

2. Efficient Infrastructure:

Sharjah Airport boasts state-of-the-art facilities and infrastructure, ensuring smooth operations and efficient logistics. With modern cargo handling capabilities and passenger terminals equipped with advanced amenities, businesses can leverage these resources to streamline their operations and enhance customer satisfaction.

3. Business-Friendly Environment:

The Emirate of Sharjah is renowned for its business-friendly policies and supportive regulatory framework. As a business consultant, I've witnessed firsthand the conducive environment that Sharjah offers for businesses of all sizes. From simplified company formation procedures to favorable tax incentives, Sharjah fosters an environment where businesses can thrive and flourish.

4. Diverse Economic Opportunities:

Sharjah is not only a hub for trade and commerce but also a center for diverse economic activities. From manufacturing and logistics to tourism and education, Sharjah offers a myriad of opportunities across various sectors. This diversity presents businesses with ample prospects for collaboration, expansion, and diversification.

5. Strategic Partnerships:

Sharjah Airport serves as a catalyst for fostering strategic partnerships and collaborations. With its extensive network of airlines and cargo operators, businesses can leverage Sharjah Airport as a gateway to connect with potential partners, suppliers, and customers across the globe. Moreover, the airport's proximity to key free zones and industrial clusters further enhances opportunities for collaboration and synergy.

6. Focus on Innovation and Sustainability:

In today's rapidly evolving business landscape, innovation and sustainability are paramount. Sharjah Airport is committed to embracing innovation and adopting sustainable practices across its operations. From implementing green initiatives to fostering innovation hubs, Sharjah Airport aligns with the evolving needs and values of modern businesses.

7. Access to Skilled Talent:

The Emirate of Sharjah is home to a diverse pool of talent from across the globe. With its focus on education and skill development, Sharjah cultivates a skilled workforce equipped with the expertise needed to drive businesses forward. Whether it's recruiting local talent or tapping into the global workforce, businesses can access a wealth of skilled professionals to fuel their growth and innovation.

Conclusion

sharjah airport free zone emerges as a strategic asset for businesses seeking expansion and growth in the Gulf region. With its strategic location, efficient infrastructure, business-friendly environment, and diverse economic opportunities, Sharjah Airport offers a compelling proposition for businesses across various sectors. As an Arab business consultant, I highly recommend exploring the myriad opportunities that Sharjah Airport has to offer and leveraging its strategic advantages to propel your business to new heights of success.

0 notes

Text

Abu Dhabi Business: Consulting Excellence for Success

The capital of the United Arab Emirates, Abu Dhabi Business stands as a beacon of opportunity in the Middle East. With its dynamic economy, strategic location, and supportive business environment, it has become a magnet for entrepreneurs and investors seeking to capitalize on its vast potential. As an Arab business consultant, I've witnessed firsthand the remarkable growth and transformation of Abu Dhabi's business landscape. In this blog, we'll explore the key factors driving business success in Abu Dhabi and how entrepreneurs can leverage these opportunities for growth and prosperity.

Strategic Location and Connectivity:

Situated at the crossroads of Europe, Asia, and Africa, Abu Dhabi enjoys unparalleled connectivity, making it an ideal hub for international trade and investment. Its state-of-the-art infrastructure, including world-class airports, seaports, and road networks, facilitates seamless connectivity with global markets, enabling businesses to reach customers and partners with ease.

Diversified Economy:

Abu Dhabi's economy is characterized by its diversification efforts, with significant investments in sectors such as energy, tourism, finance, and technology. This diversification strategy has helped mitigate risks associated with dependency on oil revenue and has created a fertile ground for innovation and entrepreneurship across various industries.

Business-Friendly Policies:

The government of Abu Dhabi has implemented a range of business-friendly policies and initiatives to attract foreign investment and foster economic growth. These include tax incentives, streamlined regulatory processes, and robust legal frameworks that provide a conducive environment for businesses to thrive. Additionally, free zones such as the Abu Dhabi Global Market (ADGM) offer attractive incentives for companies looking to establish a presence in the region.

Investment in Innovation and Technology:

Abu Dhabi is committed to fostering innovation and technological advancement as key drivers of economic growth. The establishment of research institutions, technology parks, and innovation hubs underscores the government's dedication to building a knowledge-based economy. Entrepreneurs and startups in Abu Dhabi benefit from access to funding, mentorship, and collaborative opportunities to transform their ideas into successful ventures.

Focus on Sustainability and ESG:

Sustainability and environmental stewardship are central themes in Abu Dhabi's economic development agenda. The adoption of sustainable practices, renewable energy initiatives, and green technologies align with global trends towards environmental responsibility and corporate social responsibility. Businesses that prioritize sustainability and ESG (Environmental, Social, and Governance) factors not only contribute to the well-being of society but also enhance their long-term competitiveness and resilience.

Cultural and Social Dynamics:

Abu Dhabi's rich cultural heritage and cosmopolitan lifestyle contribute to its vibrant social fabric and multicultural workforce. Embracing diversity and fostering inclusivity are integral to the fabric of Abu Dhabi's society, creating a conducive environment for collaboration and innovation. Businesses that embrace cultural sensitivity and social responsibility can build strong relationships with local communities and enhance their brand reputation in the region.

In conclusion, Abu Dhabi Business offers a wealth of opportunities for businesses seeking to expand their footprint in the Middle East and beyond. With its strategic location, diversified economy, business-friendly policies, and commitment to innovation and sustainability, it has emerged as a dynamic hub for entrepreneurship and investment. As an Arab business consultant, I encourage entrepreneurs to seize the opportunities that Abu Dhabi presents and leverage its strengths to achieve success in the global marketplace. By understanding the unique dynamics of the Abu Dhabi business landscape and adapting to its evolving trends, businesses can unlock their full potential and thrive in this dynamic and exciting environment.

0 notes

Text

Fixed Income Abu Dhabi: Maximize Your Earnings Safely

Introduction

Fixed income investments are a popular choice for those seeking stable and predictable returns. In Abu Dhabi, a key financial hub in the Middle East, the fixed income market offers a range of opportunities for investors. This article provides an in-depth look at fixed income Abu Dhabi, covering the types of fixed income instruments available, the benefits of investing in fixed income, and the factors to consider when building a fixed income portfolio.

Understanding Fixed Income Investments

Abu Dhabi fixed income investments are financial instruments that provide regular, fixed payments over a specified period. They are typically issued by governments, corporations, and other entities to raise capital. The most common types of fixed income instruments include bonds, certificates of deposit (CDs), and treasury bills.

Types of Fixed Income Instruments

Government Bonds: Government bonds are debt securities issued by the government to finance public spending. In Abu Dhabi, these bonds are considered low-risk investments as they are backed by the government. They provide regular interest payments and return the principal amount at maturity.

Corporate Bonds: Corporate bonds are issued by companies to raise capital for business operations and expansion. These bonds typically offer higher interest rates than government bonds to compensate for the increased risk. Investors can choose from various corporate bonds based on their risk tolerance and investment goals.

Certificates of Deposit (CDs): CDs are time deposits offered by banks and financial institutions. They provide a fixed interest rate over a specified term. CDs are considered low-risk investments, making them an attractive option for conservative investors.

Treasury Bills: Treasury bills are short-term government securities with maturities of one year or less. They are sold at a discount to their face value, and investors receive the full-face value at maturity. Treasury bills are ideal for investors seeking short-term, low-risk investments.

Benefits of Fixed Income Investments

Fixed income investments offer several advantages, making them an essential component of a diversified investment portfolio.

Stability and Predictability

Abu Dhabi securities provide regular interest payments, offering a stable and predictable income stream. This makes them an excellent choice for investors seeking consistent returns and capital preservation.

Capital Preservation

Abu Dhabi fixed-income market, especially government bonds and CDs, are considered low-risk and help preserve capital. They are less volatile than equities, making them suitable for risk-averse investors.

Diversification

Including fixed income investments in a portfolio helps diversify risk. They often perform differently from equities, providing a hedge against market volatility. This diversification can enhance the overall stability of a portfolio.

Interest Rate Risk Management

Fixed income investments can be used to manage interest rate risk. For example, long-term bonds can provide higher yields when interest rates are low, while short-term bonds are less sensitive to interest rate fluctuations.

Fixed Income Market in Abu Dhabi

Abu Dhabi's fixed income market is growing, offering a range of opportunities for both local and international investors. The market includes government and corporate bonds, as well as various fixed income funds.

Government Bonds

The government of Abu Dhabi issues bonds to finance infrastructure projects and other public expenditures. These bonds are considered low-risk due to the emirate's strong economic position and credit rating. Government bonds are available in various maturities, catering to different investment horizons.

Corporate Bonds

Abu Dhabi is home to several large corporations that issue bonds to raise capital. These bonds offer higher yields compared to government bonds but come with increased risk. Investors can choose from bonds issued by companies in diverse sectors, such as energy, real estate, and finance.

Fixed Income Funds

Fixed income funds pool money from multiple investors to invest in a diversified portfolio of fixed income securities. These funds are managed by professional portfolio managers who aim to achieve specific investment objectives. Fixed income funds provide a convenient way for investors to gain exposure to a broad range of fixed income assets.

Factors to Consider When Investing in Fixed Income

Investing in fixed income requires careful consideration of various factors to ensure alignment with your financial goals and risk tolerance.

Credit Risk

Credit risk refers to the possibility that the issuer may default on interest or principal payments. Government bonds typically have low credit risk, while corporate bonds vary depending on the issuer's financial health. Assessing the credit rating of bonds can help investors gauge the level of risk involved.

Interest Rate Risk

Interest rate risk is the risk that changes in interest rates will affect the value of fixed income investments. When interest rates rise, the value of existing bonds typically falls, and vice versa. Investors should consider the maturity of bonds and their sensitivity to interest rate changes.

Inflation Risk

Inflation risk is the risk that inflation will erode the purchasing power of the returns from fixed-income strategies. Investing in bonds with inflation protection, such as inflation-linked bonds, can help mitigate this risk.

Liquidity Risk

Liquidity risk refers to the ease with which an investment can be bought or sold in the market without affecting its price. Government bonds and high-quality corporate bonds generally have high liquidity, while lower-rated corporate bonds may be less liquid.

Yield

The yield is the return an investor can expect from a fixed income investment. It is essential to consider the yield relative to the risk involved. Higher yields often come with higher risk, so investors should strike a balance that aligns with their risk tolerance and investment goals.

Building a Fixed Income Portfolio

Constructing a well-balanced fixed income portfolio involves diversification across different types of bonds and maturities. Here are some strategies to consider:

Diversification

Diversify your fixed income portfolio by including a mix of government bonds, corporate bonds, and fixed-income returns. This helps spread risk and reduces the impact of any single investment's poor performance.

Laddering

Laddering involves investing in bonds with varying maturities. This strategy helps manage interest rate risk and provides regular income as bonds mature at different intervals.

Quality Assessment

Focus on the quality of bonds by considering their credit ratings. Higher-rated bonds generally offer lower yields but come with reduced credit risk. A mix of high-quality and higher-yielding bonds can provide a balanced approach.

Active Management

Consider working with a financial advisor or investment manager who can actively manage your fixed income portfolio. Professional management can help navigate market changes and optimize returns.

Conclusion

Fixed income investments in Abu Dhabi offer a range of opportunities for investors seeking stable and predictable returns. By understanding the types of fixed income instruments, benefits, and risks, investors can build a diversified and balanced portfolio that aligns with their financial goals. Whether you are a conservative investor looking to preserve capital or seeking to diversify your investment portfolio, fixed income investments can play a crucial role in achieving your financial objectives.

Name: Redcliffe Partners

Address: #256 Al Wafra Square Building, Reem Island, Abu Dhabi, UAE

Phone No: +971 2886-4415

Website: https://redcliffepartners.ae/

FAQs

What are fixed income investments?

Fixed income investments are financial instruments that provide regular, fixed payments over a specified period. Common types include government bonds, corporate bonds, certificates of deposit (CDs), and treasury bills.

Why invest in fixed income in Abu Dhabi?

Fixed income investments in Abu Dhabi offer stability, predictable returns, capital preservation, and diversification. The market includes government and corporate bonds, as well as fixed income funds.

What factors should I consider when investing in fixed income?

Key factors to consider include credit risk, interest rate risk, inflation risk, liquidity risk, and yield. Assessing these factors helps align investments with your financial goals and risk tolerance.

How can I diversify my fixed income portfolio?

Diversify by including a mix of government bonds, corporate bonds, and fixed income funds. Strategies like laddering and focusing on bond quality can also enhance diversification.

What is laddering in fixed income investing?

Laddering involves investing in bonds with varying maturities to manage interest rate risk and provide regular income as bonds mature at different intervals.

#expat investment consultations abu dhabi#free wealth consultations abu dhabi#fixed income abu dhabi#investment consultants abu dhabi#wealth advisors bucharest#middle east wealth management advisors#equity raising abu dhabi#expat investment consultations bucharest#uk property advice#wealth management abu dhabi

0 notes

Text

best Sofa Upholstery Abu Dhabi

Looking to give your old sofa a fresh lease on life? Look no further than our top-notch sofa upholstery services in Abu Dhabi! Whether your sofa has lost its charm due to wear and tear, or you simply want to update its appearance to match your evolving style, our skilled upholstery specialists are here to transform your furniture into a stunning centerpiece that will stand the test of time. Read on to discover why our sofa upholstery services in Abu Dhabi are the best choice for your home.

Expert Sofa Upholstery Services in Abu Dhabi When it comes to sofa upholstery, experience matters. Our team of highly trained professionals has a wealth of expertise in rejuvenating sofas of all types, from classic designs to contemporary styles. No matter the size or shape of your sofa, we take pride in delivering exceptional craftsmanship and attention to detail, ensuring that your sofa looks as good as new.

Quality Materials for Lasting Beauty We understand that the key to a long-lasting upholstery job lies in using high-quality materials. That's why we source our fabrics, foams, and other upholstery components from trusted suppliers. From luxurious fabrics to durable foams, we guarantee that our materials will not only enhance the comfort of your sofa but also maintain their beauty for years to come.

Personalized Design Options Your sofa is an extension of your personality and home decor. Our sofa upholstery services in Abu Dhabi offer a wide range of design options to suit your taste and preferences. Choose from an extensive selection of fabrics, patterns, and colors to create a custom look that complements your existing interior design or brings an exciting new twist to your space.

Budget-Friendly Solutions We believe that sofa upholstery shouldn't break the bank. Our services are competitively priced, ensuring that you receive the best value for your investment. Whether it's a minor repair or a complete sofa makeover, we offer flexible solutions that accommodate your budget without compromising on quality.

Timely and Reliable Service At Sofa Upholstery Abu Dhabi, we understand the importance of delivering our services promptly. From the moment you contact us, our team works efficiently to schedule an appointment that suits your convenience. Once the project begins, our experts will work diligently to complete the upholstery work within the agreed timeframe, ensuring minimal disruption to your daily routine.

Satisfaction Guaranteed Customer satisfaction is our top priority. We take pride in our work and are confident in the quality of our upholstery services. That's why we offer a satisfaction guarantee to give you peace of mind. If for any reason, you're not fully satisfied with the results, we'll work closely with you to make it right.

Conclusion: Transform your sofa into a show-stopping centerpiece with our expert sofa upholstery services in Abu Dhabi. With our skilled team, top-quality materials, personalized designs, and budget-friendly options, we promise to revamp your furniture to perfection. Don't wait any longer; contact us today for a free consultation and let us breathe new life into your cherished sofa.

0 notes

Text

Welcome to a New Era of Petrodollar Power! What are the Hundreds of Billions of Oil Riches Being Spent On?

— Finance & Economics | Sovereign-Stealth Funds | April 9th, 2023

DOHA, QATAR - November 16: Doha Bay with the skyline of the city in the background taken from the Museum of Islamic art ahead of the FIFA World Cup Qatar 2022 at on November 16, 2022 in Doha, Qatar. (Photo by Buda Mendes/Getty Images)

Apack of hungry headhunters has descended on Europe’s financial quarters. Over coffee in the mid-morning lull, they tempt staffers at blue-chip investment funds with tax-free jobs, golden visas and gorgeous vistas at the firms’ clients: sovereign-wealth funds in the Gulf.

A decade in Doha was once a hard sell, but the roles are juicy enough that many would-be recruits volunteer for desert-bound “business trips” to see headquarters. In October recruiters nabbed the second-in-command at Amundi, Europe’s biggest money manager, to deploy artificial intelligence at the Abu Dhabi Investment Authority (adia), which oversees assets worth $1trn. Now they are chasing others to invest in infrastructure for the Qatar Investment Authority (qia) and oversee finance for Saudi Arabia’s Public Investment Fund (pif). Together these two funds manage another $1trn.

War and sanctions have buoyed hydrocarbon prices, meaning fuel exporters are swimming in money. During previous booms they would recycle the proceeds in Western capital markets, snapping up pedestrian, uber-liquid assets via banks based offshore. Underpinning this was an unspoken agreement: America would offer military aid and buy oil from Saudi Arabia and friends, in exchange for which they would plug Uncle Sam’s gaping current-account deficit with petrodollars. The talent-hunting party suggests the deal is crumbling. Uncle Sam, now a major oil exporter, is a less watchful partner. Gulf states, lured by Asia and eager to mend ties with Israel and, lately, Iran, no longer feel compelled to woo the White House. On April 2nd Saudi Arabia and its allies angered America by deepening crude-output cuts to nearly 4m barrels a day, equivalent to 4% of global production, which helped lift prices. They also feel freer to use their mountains of cash however they wish.

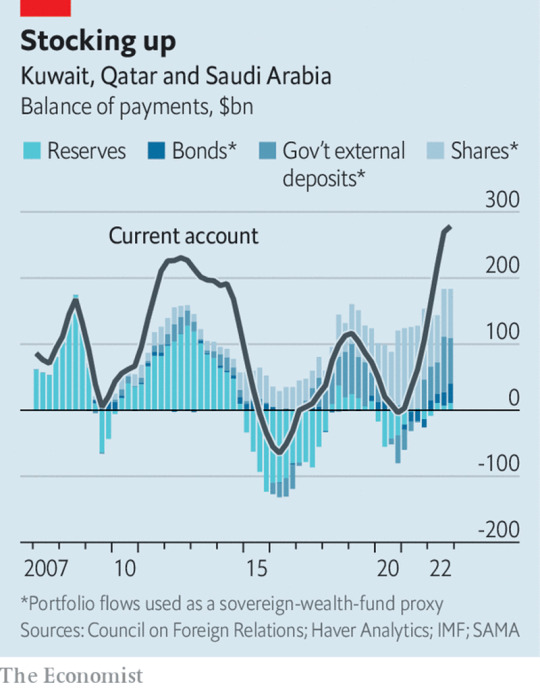

We estimate that in 2022-23 the current-account surplus of the Gulf’s petrostates may hit two-thirds of a trillion dollars. Yet outside central banks, which no longer collect much of the bounty, the region’s treasure troves are notoriously opaque. To map where the money is going, The Economist has scrutinised government accounts, global asset markets and the deal rooms of companies tasked with investing the windfall. Our investigation suggests that less of the money is returning to the West. Instead, a growing share is being used to advance political aims at home and gain influence abroad, making global finance a murkier system.

The Gulf is not alone in enjoying a windfall. Last year Norway, which cranked up gas exports to Europe as Russia cut supplies, earned a record $161bn in tax from hydrocarbon sales, a 150% jump from 2021. Even Russia, under sanctions, saw such revenue rise by 19%, to $210bn. But it is the Gulf states, which benefit from low production costs, spare capacity and convenient geography, that are hitting the jackpot. Rystad Energy, a consultancy, reckons they pocketed $600bn in tax from hydrocarbon exports in 2022.

Not all of them are in a position to truly benefit. Governments in Bahrain and Iraq are so bloated that even as higher revenues flow in, they barely break even. Most of the bounty is instead being accrued by the four biggest members of the Gulf Co-operation Council (gcc): Kuwait, Qatar, the uae and Saudi Arabia. Alex Etra of Exante, a data firm, estimates their combined current-account surplus in 2022 was $350bn. Oil prices have fallen since last year, when Brent crude, the global benchmark, averaged $100 a barrel. Yet assuming it stays near $85—a conservative bet—Mr Etra reckons the four giants could still pocket a $300bn surplus in 2023. That makes a cumulative $650bn over the two years.

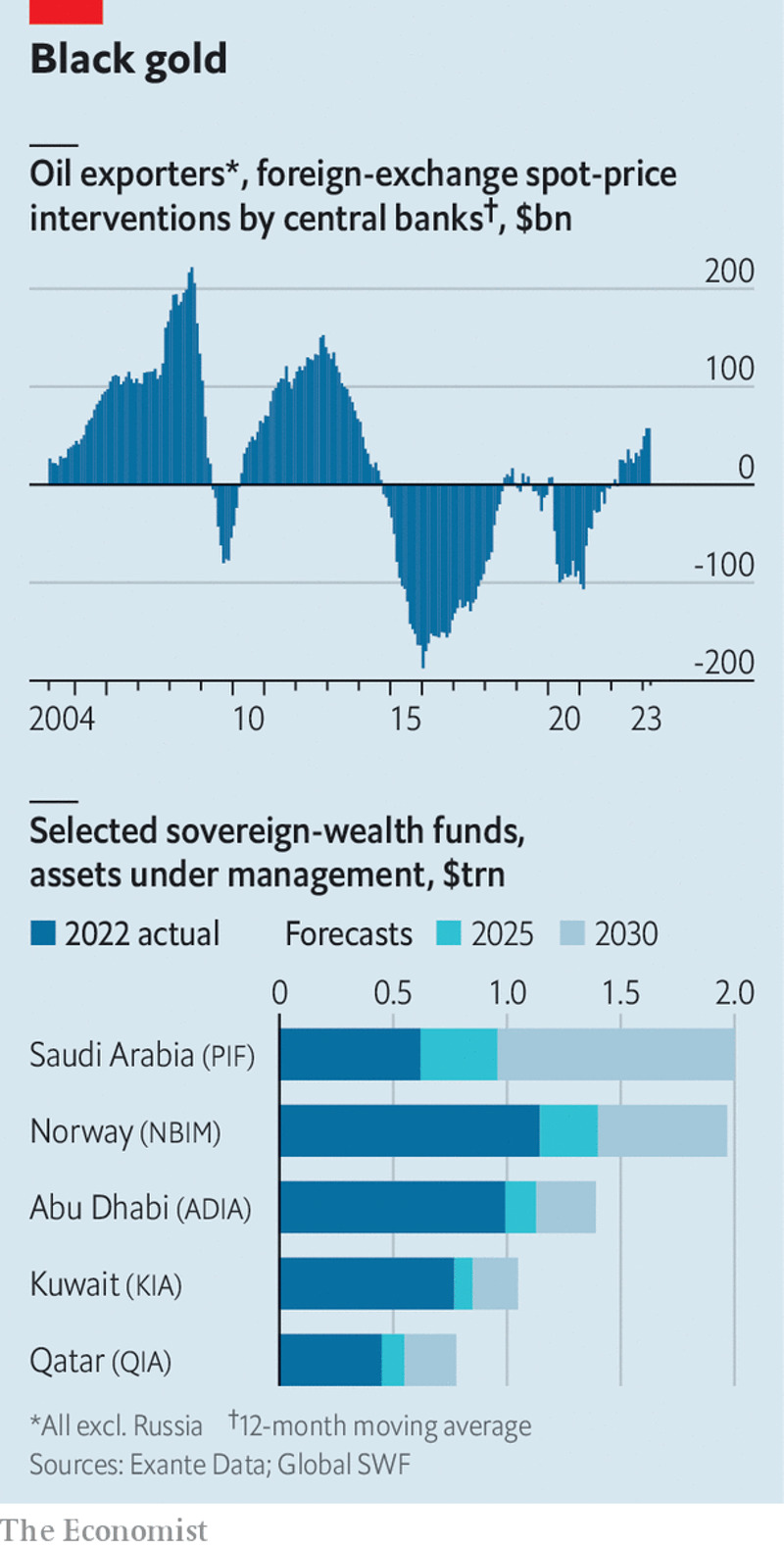

In the past the majority of this would have gone straight into central banks’ foreign-exchange reserves. Most members of the gcc peg their currencies to the dollar, so they must set aside or invest hard currency during booms. This time, however, central-bank reserves seem to be hardly growing. Interventions on foreign-currency markets have also been rare, confirming that the usual guardians of state riches are not getting the surplus.

So where have the elusive billions gone? Our research finds they have been used in three novel ways by a variety of actors that include national governments, central banks and sovereign-wealth funds. These are to pay back external debt, lend to friends and acquire foreign assets.

Start with debt. Between 2014 and 2016 a petroleum glut fuelled by America’s shale boom caused the oil price to fall from $120 a barrel to $30, the steepest decline in modern history. In 2020, as covid-19 lockdowns depressed demand, prices cratered again, to $18 in April. To withstand the earnings shock, Gulf states liquidated some foreign assets and their central banks sold part of their foreign-currency stash. But this was not enough, so they also borrowed a lot of hard currency on Western capital markets.

Now some petrostates are taking advantage of higher prices to shore up their balance-sheets. Abu Dhabi, the uae’s richest emirate, has repaid $3bn since the end of 2021—about 7% of the total outstanding, according to Alexander Perjessy of Moody’s, a ratings agency. Qatar’s load has shrunk by $4bn, or about 4%. Kuwait’s has halved since 2020. This broad deleveraging is a new phenomenon: gcc countries had little debt in the late 2000s, when the previous oil boom got going.

Gulf states are also lending a hand to friends in need—the second use of the new oil money. In early 2022 the central bank of Egypt, a big food importer squeezed by high grain prices, received $13bn in deposits from Qatar, Saudi Arabia and the uae. In recent years, Saudi Arabia has also allowed Pakistan to defer payment for billions of dollars in oil purchases. This money is more conditional than in the past. Eager to see at least some of its cash return, Saudi Arabia recently demanded Egypt and Pakistan implement economic reforms before giving them more help. Some of the Gulf support also comes in exchange for stakes in state-owned assets these embattled countries are putting up for sale.

So Pumped

The real novelty in this regard is Turkey. When squeezed, Ankara used to turn to the imf, or European banks, for emergency-cash injections. Recently, as surging inflation and earthquakes have pushed the country to the brink, it is Gulf states that have been holding the syringe. The support takes various forms. On March 6th Saudi Arabia said it would deposit $5bn at the country’s central bank. Qatar and the uae have also set up $19bn in currency swaps with the institution, according to an estimate by Brad Setser of the Council on Foreign Relations, a think-tank. All three have pledged to participate in Turkey’s forthcoming auctions of government bonds.

Qatar is a long-standing ally of Turkey. Saudi Arabia and the uae, which until recently had a frosty relationship with the republic, are now competing for influence. All sense an opportunity to gain sway over Recep Tayyip Erdogan, the country’s president, who faces a tough election in May. The Turkish case sets a precedent. As more neighbours face crunches, bilateral credit will become core to gcc statecraft, predicts Douglas Rediker, a former imf official.

Yet for all their geopolitical significance, such loans account for only a fraction of the oil jackpot. That leaves the main escape channel: foreign investments.

In past booms the central banks of the world’s two largest petrostates—Russia and Saudi Arabia—did much of the recycling, meaning that the assets they purchased were labelled as reserves. All these countries wanted was stable yields and few surprises. Most often they parked the cash at Western banks or bought super-safe government bonds—so many that Gulf appetite, along with China’s, is credited for helping to create the loose monetary conditions that fed the 2000s sub-prime bubble. Only Qatar, known then as the “cowboy of the Middle East”, did anything more daring: buying a football club here, a glitzy skyscraper there.

Today the Russian central bank’s reserves are frozen. And since 2015, when Muhammad Bin Salman (mbs) became de facto ruler, the Saudi central bank has received far less money than pif, which mbs chairs. In just a few years pif and its peers across the region have swelled in size. If hydrocarbons stay expensive, and more of the bounty flows to them, they could grow much bigger still. Everything indicates that their way of recycling riches is very different. It is more adventurous and political, and less Western-centric.

Figuring out what Gulf sovereign-wealth funds have been up to is much more difficult than it would be for, say, Norway’s fund. The Gulf institutions do not update their strategy, size and holdings live on their websites, as the one in Oslo does. But there are clues. Data from the Bank for International Settlements, a club of central banks, suggests that, initially, most of the cash was parked in foreign bank accounts. In the Saudi case, such deposits were worth $81bn in the year to September, equivalent to 54% of the current-account surplus over the period, calculates Capital Economics, a consultancy.

Perhaps sovereign-wealth funds have been waiting for interest rates to peak before piling into bonds. More likely they are after less conventional assets, which take time to select. Data from the Treasury International Capital system, which tracks flows into American securities, suggest oil exporters have been buying fewer Treasury bonds than would previously have been expected. But they have been hungrier for stocks—and such numbers understate their appetite, because Gulf sovereign-wealth funds often buy American shares through European asset managers. An executive at one such firm says his Gulf clients have topped up their American-stock accounts copiously in recent months.

Sovereign-wealth funds largely invest in stocks via index funds, which are low cost and offer diversification. But they also like riskier bets. Today “alternative assets”—private equity, property, infrastructure and hedge funds—represent 23-37% of total assets for the three largest funds in the Gulf, according to Global swf, a data firm. These shares have jumped at the same time as war chests have grown.

Although such investments are often done through funds, “direct” investments—private-market deals, or acquisitions of stakes in listed companies—are growing very fast, says Max Castelli of ubs, a bank. pif’s alone reached $18bn in the year to September, against $48bn for more classic “portfolio” investments. Sovereign-wealth funds have also begun to provide debt to finance large takeovers, including by buy-out groups. On April 4th pif disclosed that it had acquired dozens of stakes in private-equity firms themselves.

Sovereign-wealth funds can do all this because they now have the ability to manage investments. “Unless we have something extraordinary, we are forbidden from pitching anything to them,” says a European asset manager. adia has cut its workforce from 1,700 to 1,300 since 2021, but new recruits include a group of maths whizzes co-led by an Ivy League professor. The current hiring offensive suggests funds will grow more independent, retaining investment firms only for specific services and market intelligence.