#Fraud Prevention Service Providers

Explore tagged Tumblr posts

Text

#kyc api#kyc uk#kyc solution#kyc companies#fake identity#identity fraud#identity fraud prevention#id fraud prevention#KYC Provider#kyc services#KYC Company#KYC software#business#uk

2 notes

·

View notes

Text

#fraud related to fraudulent portrayal of prior contact or communications or the existence of such things#counsel#criminals providing supposedly useful but deliberately ineffective life support or services#recusal#the accused's policies or orders preventing actions against them#those associated with the accused#public knowledge of suspicion or accusation#public trial#vested interests in outcomes#please read and analyze all related information#bradley carl geiger#google scholar

0 notes

Text

I am going to burn my pharmacy to the ground I stg.

I’ve been trying to get my Zoloft refilled for a month now, and I ran out of it almost a week ago so I’ve been an absolute disaster all week without it. I haven’t been able to get it refilled because my pharmacy insisted I didn’t have any refills left despite my doctor having placed at least 2 refills on it.

Well I finally had enough and called my pharmacy to ask them what the fuck they were doing, and that sparked me spending the rest of the morning having to talk to a different pharmacy AND my insurance.

Turns out, my stupid ass pharmacy managed to fuck up spectacularly and never dispensed my medication to me, yet they STILL filed a claim to my insurance saying they did, leaving me unable to get it filled anywhere else as my insurance had believed it had already been filled. I of course explained to my insurance that NO, I did NOT receive any medication from my pharmacy nor did they have any record of giving me that prescription since sometime last year.

And despite my insurance contacting the pharmacy and not only verifying this, but also telling them they needed to reverse the claim, my pharmacy STILL hasn’t reversed it despite them assuring my insurance that they would have it reversed in the next hour. I contacted a different pharmacy from the first pharmacy to have it filled there, and it STILL wouldn’t go through because my first pharmacy still hasn’t reversed their false claim almost 4 hours later.

Y’all I am seething, I’m having to pay for a medication that SHOULD’VE gone through insurance because I can’t wait any longer for my original pharmacy to fix their fuck up! As soon as I pick up this prescription, I’m calling my original pharmacy and tearing them a new one for committing insurance fraud whether it was intentional or not!

#i am beyond pissed right now#their fuckery has caused me to spiral into a completely preventable depressive episode with full on suicidal thoughts#and before anyone asks yes billing insurance for a service you didn’t actually provide IS indeed fraud#and you can get in HUGE trouble for it if you get caught#insurance companies do not take kindly to fraudulent claims#once i get back on this medication it’ll still probably be several days before I stabilize again#due to stopping so abruptly and then being off it for so long afterwards#this has been hell#i forgot how fucking miserable i am without my Zoloft#so i pray i never run out of it again because jfc

0 notes

Text

A lawsuit filed Wednesday against Meta argues that US law requires the company to let people use unofficial add-ons to gain more control over their social feeds.

It’s the latest in a series of disputes in which the company has tussled with researchers and developers over tools that give users extra privacy options or that collect research data. It could clear the way for researchers to release add-ons that aid research into how the algorithms on social platforms affect their users, and it could give people more control over the algorithms that shape their lives.

The suit was filed by the Knight First Amendment Institute at Columbia University on behalf of researcher Ethan Zuckerman, an associate professor at the University of Massachusetts—Amherst. It attempts to take a federal law that has generally shielded social networks and use it as a tool forcing transparency.

Section 230 of the Communications Decency Act is best known for allowing social media companies to evade legal liability for content on their platforms. Zuckerman’s suit argues that one of its subsections gives users the right to control how they access the internet, and the tools they use to do so.

“Section 230 (c) (2) (b) is quite explicit about libraries, parents, and others having the ability to control obscene or other unwanted content on the internet,” says Zuckerman. “I actually think that anticipates having control over a social network like Facebook, having this ability to sort of say, ‘We want to be able to opt out of the algorithm.’”

Zuckerman’s suit is aimed at preventing Facebook from blocking a new browser extension for Facebook that he is working on called Unfollow Everything 2.0. It would allow users to easily “unfollow” friends, groups, and pages on the service, meaning that updates from them no longer appear in the user’s newsfeed.

Zuckerman says that this would provide users the power to tune or effectively disable Facebook’s engagement-driven feed. Users can technically do this without the tool, but only by unfollowing each friend, group, and page individually.

There’s good reason to think Meta might make changes to Facebook to block Zuckerman’s tool after it is released. He says he won’t launch it without a ruling on his suit. In 2020, the company argued that the browser Friendly, which had let users search and reorder their Facebook news feeds as well as block ads and trackers, violated its terms of service and the Computer Fraud and Abuse Act. In 2021, Meta permanently banned Louis Barclay, a British developer who had created a tool called Unfollow Everything, which Zuckerman’s add-on is named after.

“I still remember the feeling of unfollowing everything for the first time. It was near-miraculous. I had lost nothing, since I could still see my favorite friends and groups by going to them directly,” Barclay wrote for Slate at the time. “But I had gained a staggering amount of control. I was no longer tempted to scroll down an infinite feed of content. The time I spent on Facebook decreased dramatically.”

The same year, Meta kicked off from its platform some New York University researchers who had created a tool that monitored the political ads people saw on Facebook. Zuckerman is adding a feature to Unfollow Everything 2.0 that allows people to donate data from their use of the tool to his research project. He hopes to use the data to investigate whether users of his add-on who cleanse their feeds end up, like Barclay, using Facebook less.

Sophia Cope, staff attorney at the Electronic Frontier Foundation, a digital rights group, says that the core parts of Section 230 related to platforms’ liability for content posted by users have been clarified through potentially thousands of cases. But few have specifically dealt with the part of the law Zuckerman’s suit seeks to leverage.

“There isn’t that much case law on that section of the law, so it will be interesting to see how a judge breaks it down,” says Cope. Zuckerman is a member of the EFF’s board of advisers.

John Morris, a principal at the Internet Society, a nonprofit that promotes open development of the internet, says that, to his knowledge, Zuckerman’s strategy “hasn’t been used before, in terms of using Section 230 to grant affirmative rights to users,” noting that a judge would likely take that claim seriously.

Meta has previously suggested that allowing add-ons that modify how people use its services raises security and privacy concerns. But Daphne Keller, director of the Program on Platform Regulation at Stanford's Cyber Policy Center, says that Zuckerman’s tool may be able to fairly push back on such an accusation.“The main problem with tools that give users more control over content moderation on existing platforms often has to do with privacy,” she says. “But if all this does is unfollow specified accounts, I would not expect that problem to arise here."

Even if a tool like Unfollow Everything 2.0 didn’t compromise users’ privacy, Meta might still be able to argue that it violates the company’s terms of service, as it did in Barclay’s case.

“Given Meta’s history, I could see why he would want a preemptive judgment,” says Cope. “He’d be immunized against any civil claim brought against him by Meta.”

And though Zuckerman says he would not be surprised if it takes years for his case to wind its way through the courts, he believes it’s important. “This feels like a particularly compelling case to do at a moment where people are really concerned about the power of algorithms,” he says.

370 notes

·

View notes

Text

S.V. Dáte at HuffPost:

WASHINGTON ― When Donald Trump was told by a White House aide that his own vice president, Mike Pence, had to be evacuated from the Senate on Jan. 6, 2021, for his own safety following an inflammatory tweet from Trump, the former president had but a two-word response: “So what?” The anecdote was among hundreds of pieces of evidence gathered by federal prosecutors into a 165-page court filing, unsealed Wednesday, in their four-count felony prosecution against Trump for his actions leading up to and during his coup attempt.

“This motion provides a comprehensive account of the defendant’s private criminal conduct; sets forth the legal framework created by Trump for resolving immunity claims; applies that framework to establish that none of the defendant’s charged conduct is immunized because it either was unofficial or any presumptive immunity is rebutted; and requests the relief the government seeks, which is, at bottom, this: that the court determine that the defendant must stand trial for his private crimes as would any other citizen,” special counsel Jack Smith wrote. The question of immunity became critical thanks to a July Supreme Court ruling stating that all official acts done by a president are immune from prosecution, but left it to the trial court to determine whether Trump’s attempt to remain in power were “official.” “The answer to that question is no,” Smith argued. The filing was unsealed by U.S. District Judge Tanya Chutkan, the judge in the case. It can be read here. Trump’s lawyers had argued that everything their client did leading up to Jan. 6 was covered by the Supreme Court ruling, and requested that Chutkan not allow the public to see any of the evidence Smith has collected against Trump.

Chutkan rejected that and, in a order also filed Wednesday, ruled that Smith would be permitted to file a version of his brief with some names and details redacted. Wednesday’s brief by Smith is riddled with blacked-out words and phrases in the section providing the narrative of the indictment. Much of the information in the filing was known previously, thanks largely to the work of the House Jan. 6 Committee, albeit in broader strokes. But key players in Trump’s attempt to overturn his 2020 election loss and remain in office did not cooperate with that committee. They did, however, honor prosecutors subpoenas. Pence — a crucial witness, as Smith’s brief makes clear almost from the start — had repeatedly told Trump he had lost and to look ahead to 2024 instead. On Nov. 12, during a private lunch with Trump, Pence “reiterated a face-saving option for the defendant: ‘don’t concede but recognize the process is over.’” In another private lunch on Dec. 21, Pence ”‘encouraged’ the defendant ‘not to look at the election “as a loss ― just as an intermission.”’”

[...] “If Pence would not do as he asked, the defendant needed to find another way to prevent the certification of Biden as president. So on January 6, the defendant sent to the Capitol a crowd of angry supporters, whom the defendant had called to the city, and inundated with false claims of outcome determinative election fraud, to induce Pence not to certify the legitimate electoral votes and to obstruct the certification.”

Trump sent out a tweet telling his followers that Pence had lacked “the courage” to do as he was told at 2:24 p.m., which was followed by a surge of his supporters into the Capitol. A minute later, Pence had to be moved by his Secret Service detail to a secure location. As Pence came within yards of Trump’s angry mob, the president demonstrated his unconcern for his running mate’s life. As Smith’s brief details, Trump was just as unbothered by safety concerns in the run-up to Jan. 6. When a campaign aide warned a Trump operative ― both of whose names have been blacked out ― that attempts to block vote counting in Detroit could lead to unrest, the operative responded “Make them riot” and “Do it!!!”

A 165-page brief in United States v. Trump was unsealed yesterday, and it revealed that Donald Trump dismissed the danger to Mike Pence’s livelihood for refusing to go along with Trump’s plan to overturn the election with a “so what?” response.

The filing revealed that a Trump operative yelled “make them riot” and “do it” when reminded of the fact that blocking the certification would lead to unrest.

These filings are yet more proof that domestic terrorist insurrection-inciter Trump is NOT fit to hold the Presidency.

See Also:

The Guardian: Special counsel reveals new details of Trump bid to overturn 2020 election

#Donald Trump#Mike Pence#Capitol Insurrection#Jack Smith#Jack Smith Special Counsel Investigation#Tanya Chutkan#United States v. Trump

19 notes

·

View notes

Text

Two retired New York City Fire Department fire chiefs were arrested by the feds early Monday for allegedly accepting more than $190,000 in bribes to allegedly help fast-track safety inspections and reviews, officials said.

Anthony Saccavino and Brian Cordasco, who worked in the FDNY’s Bureau of Fire Prevention, were nabbed on bribery, corruption and false statements offenses as part of the long-running corruption probe, according to an indictment unsealed in Manhattan federal court.

They are accused of “soliciting and accepting tens of thousands of dollars in bribe payments in exchange for providing preferential treatment to certain individuals and companies with matters pending before the FDNY” from 2021 through 2023.

“For nearly two years, Saccavino and Cordasco misused this authority for their own financial gain,” the indictment alleged.

The arrests come after the two former chiefs had their homes raided by the FBI and city investigators back in February.

The FDNY’s Brooklyn headquarters was also searched at the same time.

At the time of the raids, both Saccavino and Cordasco allegedly lied to federal investigators to “conceal their involvement in the bribery scheme,” according to the indictment.

The nearly two-year scheme involved roughly 30 different projects across the Big Apple — including fire alarm checks at apartment buildings, restaurants, bars and hotels, court filings state.

They have both been charged with conspiracy to solicit and receive a bribe, solicitation and receipt of a bribe, honest services wire fraud, conspiracy to commit honest services wire fraud, and making false statements.

Federal officials with the Southern District of New York will be holding a news conference on the arrests later Monday morning.

8 notes

·

View notes

Text

By: Adam B. Coleman

Published: May 17, 2024

The law of attraction dictates that you attract what you are, so it is by no coincidence that the Diversity Industrial Complex often attracts con artists.

It’s an industry predicated on siphoning phoning money from gullible corporations who are desperate to project themselves as societal changemakers.

This is how immoral people like ex-Facebook and Nike diversity program manager, Barbara Furlow-Smiles, were able to extract millions of dollars from resource abundant corporations.

Smiles, who led the diversity, equity, and inclusion (DEI) programs for Facebook from January 2017 to September 2021, pleaded guilty in December to a wire fraud scheme that helped her steal more than $4.9 million from Facebook and a six-figure sum from Nike.

Atlanta US Attorney Ryan Buchanan lamented how Smiles was “utilizing a scheme involving fraudulent vendors, fake invoices, and cash kickbacks.”

“After being terminated from Facebook, she brazenly continued the fraud as a DEI leader at Nike, where she stole another six-figure sum from their diversity program,” Buchanan stated.

Smiles used her authority to approve invoices to pay for services and events that never occurred, funneling the money to several personal associates and pay Smiles in kickbacks.

She would later submit fake expense reports claiming her associates completed work for Facebook, such as providing marketing help and merchandise fulfillment.

Smiles’ lavish lifestyle will be replaced with a stiff punishment of five years imprisonment, three years of supervised release and an order to pay back the money she stole from both Facebook and Nike.

There is something apropos about a sham employee like Smiles being able to climb the ranks of a sham sector of corporate America.

Post-George Floyd’s death, business enterprises fell in love with — or were backmailed into — the idea of a marriage between capitalism and social philanthropy.

DEI job positions increased 123% between May and September of 2020, according to Indeed.

It was no longer enough to have financial success in the business environment, they now wanted to become adored by the public — or at least not be accused of white supremacy.

But when you’re desperate for an outcome, there will always be fraudsters waiting to exploit you.

DEI is a sham because you can’t quantify if it’s succeeding. There are never enough programs or seminars or representation — it just keeps expanding.

Smiles likely was able to get away with what she was doing for years at Facebook because DEI is treated like a new romance; constantly given the benefit of the doubt despite their red flags.

Falling for a scam has nothing to do with intelligence or experience; literally anyone can get scammed.

We fall for scams when we become so desperate for an outcome that we’re willing to suspend belief and overlook common sense.

The problem is that ego prevents industry leaders from hearing our warnings about the falsehoods they’re being fed.

People who believe they’re always the smartest ones in the room won’t conceive how they’re being played by ideological nitwit college graduates who are motivated by ending capitalism.

They’re scared of being accused of being racist, and thus surround themselves with con artists who enjoy manipulating their empathy to drain their wealth.

Corporate America loves chasing love; DEI loves their money.

Adam B. Coleman is the author of “Black Victim to Black Victor” and founder of Wrong Speak Publishing. Follow him on Substack: adambcoleman.substack.com.

--

See:

==

DEI is inherently fraudulent. It's premised upon fraudulent grievance "scholarship," it's unquantifiable, untestable and unfalsifiable, and will accuse you of istaphobism for expecting that its objectives should be quantifiable, testable and falsifiable. Much like traditional religion.

In practice, it's like doing phrenology or dowsing for hidden "bigotry," and "curing" it with more identity homeopathy.

So, it's unsurprising that a fraudulent industry is rife with frauds. We've seen non-stop academic fraud and plagiarism from DEI academics, so we should expect comparable fraud from DEI practitioners.

Interesting how these DEI types are usually raging anti-capitalists, though.

#Adam B. Coleman#Barbara Furlow Smiles#DEI#diversity equity and inclusion#diversity#equity#inclusion#DEI must die#DEI bureaucracy#fraud#diversity chief#diversity officer#corruption#grifters#grifters gonna grift#con artist#scam artists#religion is a mental illness

8 notes

·

View notes

Text

High-Risk E-Commerce: Maximizing Sales with Credit Card Payments

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In today's digital age, e-commerce reigns supreme in the business world. Yet, for enterprises operating within high-risk industries, the e-commerce payment landscape can be challenging to navigate. This is where High-Risk Credit Card Payments come into play as a crucial asset. This article explores how accepting credit card payments can revolutionize high-risk e-commerce. We will delve into strategies that span payment processing solutions to merchant accounts, with a focus on maximizing sales and achieving success within the high-risk e-commerce domain.

DOWNLOAD THE HIGH-RISK E-COMMERCE INFOGRAPHIC HERE

Broaden Customer Reach in High-Risk Sectors Industries characterized as high-risk, such as credit repair and CBD, necessitate the adoption of credit card payments. Offering this payment option not only extends your customer base but also fosters trust. It streamlines payment processing, making it accessible and efficient, which, in turn, instills confidence in customers, encouraging them to make purchases.

The Vital Role of High-Risk Merchant Accounts High-risk e-commerce demands a specialized approach. High-Risk Merchant Accounts are tailored to the unique needs of industries prone to elevated risks. These accounts incorporate features like chargeback protection and fraud prevention, serving as essential tools for high-risk business operations.

Efficient High-Risk Payment Processing Solutions High-Risk Payment Processing solutions cater to the distinctive requirements of high-risk businesses. They simplify payment acceptance, thus reducing the likelihood of transaction issues. The incorporation of a High-Risk payment gateway ensures that sensitive customer information is handled securely, instilling further confidence in your business.

The Significance of E-Commerce Payment Processing Efficient payment processing lies at the core of e-commerce businesses, whether they operate within the high-risk domain or not. Credit card payments play a pivotal role in this payment processing. By providing a seamless e-commerce payment experience, you enhance the overall shopping process, which, in turn, leads to increased sales and heightened customer satisfaction.

Leveraging SEO for Success in High-Risk E-Commerce In the highly competitive e-commerce arena, search engine optimization (SEO) should not be underestimated. The inclusion of pertinent keywords, such as High-risk credit card processing and accept credit cards for e-commerce, boosts your website's visibility. SEO optimization attracts potential customers actively seeking your products or services.

youtube

High-Risk Credit Card Payment Services for Businesses Payment processing is a constantly evolving field, with high-risk industries requiring adaptable solutions. High-Risk Credit Card Payment Services continuously adapt to cater to these distinctive demands. Keeping yourself informed and partnering with the right service providers, whether for CBD merchant processing or credit repair payment processing, is pivotal for sustained success.

In conclusion, high-risk e-commerce enterprises can thrive by embracing High-Risk Credit Card Payments. By offering credit card payments, you broaden your customer base and establish trust, streamline payment processing, and position your business for lasting success in the high-risk e-commerce realm.

#high risk merchant account#payment processing#merchant processing#credit card processing#high risk payment gateway#high risk payment processing#accept credit cards#credit card payment#payment#youtube#Youtube

21 notes

·

View notes

Text

✨Reminder: Your Acheron Prime subscription comes with a free familiar of your choice (subject to availability; note that there are currently shortages of toads, ravens, and miniature chimeras). As a continued valued Acheron Prime member, you can swap out your familiar each year, or get a new familiar if something happened to your old one (provided our fraud department does not conclude that you were responsible for your previous familiar's demise).✨ ✨Please note that it is against the terms of service to take any measures that would prevent your familiar from communicating with Acheron.wiz headquarters. If you are concerned with what information your Acheron Prime familiar may be passing on to Acheron.wiz headquarters... Don't worry about it. Don't worry about it.✨

#wizard alexa#just ask alexa#wizardposting#wizard posting#wizardblogging#wizard blogging#wizard#acheron.wiz#acheron prime

5 notes

·

View notes

Text

#background checks#fraud prevention#identity verification company#KYC service providers#kyc uk#kyc solution

2 notes

·

View notes

Text

Tax Auditors in Delhi: Expert Services by SC Bhagat & Co.

Navigating the complexities of tax regulations is crucial for businesses and individuals alike, especially in a dynamic financial landscape like Delhi. Choosing a reliable tax auditor ensures your financial compliance, reduces audit risks, and enhances your financial credibility. SC Bhagat & Co., a leading tax auditing firm in Delhi, provides expert services designed to meet the unique needs of businesses and individuals, from tax compliance to advanced auditing solutions.

Why Tax Auditing Matters Tax auditing is essential for ensuring that financial records are accurate and compliant with current tax laws. Regular audits help businesses identify financial discrepancies, optimize their tax liabilities, and avoid costly penalties. For individuals, tax audits can validate their tax filings and enhance financial transparency. Whether you're a business owner or an individual taxpayer, tax audits play a vital role in:

Ensuring Compliance: By following regulatory requirements, tax audits help organizations and individuals avoid penalties. Detecting Errors and Fraud: An audit reveals inconsistencies in financial records, helping to prevent fraud or accidental errors. Improving Financial Accuracy: A professional audit provides a detailed review of financial data, ensuring accurate tax calculations. Building Credibility with Stakeholders: Regular audits reflect a commitment to transparency, boosting stakeholder confidence. SC Bhagat & Co.: Trusted Tax Auditors in Delhi SC Bhagat & Co. has earned its reputation as a trusted provider of tax auditing services in Delhi, thanks to its dedicated team of qualified professionals, extensive industry knowledge, and commitment to client success. Their expert tax auditors help clients stay compliant, reduce tax risks, and optimize their financial health through strategic auditing and consulting.

Key Services Offered by SC Bhagat & Co. SC Bhagat & Co. offers a range of tax auditing and related services designed to meet the unique needs of both individuals and businesses in Delhi:

Statutory Tax Audits SC Bhagat & Co. conducts thorough statutory tax audits to ensure clients meet legal requirements and minimize tax liabilities. Their expertise in Indian tax laws ensures every client is fully compliant with government regulations.

Internal Audits For businesses seeking to improve internal processes, SC Bhagat & Co. offers internal auditing services that identify areas of risk, improve financial accuracy, and enhance operational efficiency.

GST Audits GST compliance is critical for businesses in India, and SC Bhagat & Co. specializes in GST audits to ensure accurate filing and adherence to GST regulations. This minimizes the risk of penalties and provides peace of mind.

Income Tax Audits SC Bhagat & Co. offers comprehensive income tax audits for individuals and businesses, ensuring accurate filings and preventing potential issues with tax authorities.

Forensic Audits For clients requiring deeper analysis, SC Bhagat & Co. provides forensic audits to detect and address financial discrepancies, fraud, or irregularities within an organization.

Benefits of Working with SC Bhagat & Co. When you choose SC Bhagat & Co. as your tax auditor in Delhi, you gain access to a team that brings professionalism, in-depth knowledge, and dedication to every audit. Here are some reasons clients prefer SC Bhagat & Co.:

Industry Expertise: With years of experience in tax auditing and consulting, SC Bhagat & Co. provides services across various industries. Client-Centric Approach: The team at SC Bhagat & Co. takes time to understand each client's specific requirements, offering tailored solutions that best meet their needs. Timely and Efficient Services: Understanding the importance of meeting deadlines, SC Bhagat & Co. ensures timely audits and reporting. Confidentiality and Trust: They prioritize client confidentiality, ensuring all information is handled securely and professionally. Why Delhi Businesses and Individuals Choose SC Bhagat & Co. Delhi’s competitive business environment demands precision and reliability in tax matters. SC Bhagat & Co.’s commitment to excellence, coupled with their local expertise, makes them a preferred choice for tax audits in Delhi. Their clients range from small businesses to large corporations, as well as individuals seeking precise and trustworthy tax audit solutions.

Testimonials from Satisfied Clients Many of SC Bhagat & Co.'s clients have shared positive experiences, appreciating their professionalism and thorough approach. Here are a few testimonials:

“SC Bhagat & Co. has transformed our financial process. Their tax auditors identified several areas where we could reduce tax liabilities, helping us save significantly.”

“We’ve been working with SC Bhagat & Co. for years, and their expertise in GST audits has been invaluable. Highly recommended for any business in Delhi!”

Contact SC Bhagat & Co. for Expert Tax Auditing in Delhi If you're in need of reliable and professional tax auditing services in Delhi, SC Bhagat & Co. is here to help. Their team is ready to assist you with all your tax auditing needs, ensuring you meet compliance requirements and optimize your financial standing.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices#remittances

3 notes

·

View notes

Text

What Happened: Why Cash App is shutting Down Accounts?

Cash App, one of the most popular mobile payment platforms, has been making headlines recently for cash app shutting down accounts. Many users are left frustrated and confused as their accounts are suddenly closed, often without warning. These closures have sparked a flurry of questions, with users asking why this is happening and how they can recover their money.

In this article, we will explore why Cash App is closing accounts, what you can do if your account is shut down, and how to avoid these closures in the future.

Cash App Shutting down Accounts Today: What’s Happening?

Recently, there has been an increase in reports of Cash App shutting down accounts. While this may seem alarming, the company typically closes accounts for specific reasons. These reasons usually include violations of Cash App’s terms of service, suspicious activity, or security concerns. With stricter policies being enforced in 2024, more users are being impacted by these measures.

Why is Cash App Closing Everyone’s Accounts?

Cash App is not arbitrarily closing accounts. The platform is required to comply with federal laws and financial regulations. If Cash App detects suspicious activity, potential fraud, or violations of its terms, cash app shut down accounts to protect users and prevent illegal activity. In some cases, the algorithm might incorrectly flag an account, resulting in closure even if no wrongdoing occurred.

Cash App Account Closed Due to Violation of Terms of Service

One of the most common reasons for cash app account closed violation of terms of service. These terms include several rules that users must follow to maintain access to their accounts. Violations can include, but are not limited to:

Fraudulent transactions

Unauthorized use of the app for gambling

Suspicious or high-risk activity

Sending or receiving large amounts of money without proper verification

If Cash App determines that an account has violated its terms, it may close the account immediately. Users often find out their account has been closed when they attempt to log in and receive a notification that the account has been restricted or terminated.

Cash App Closed My Account with Money in It

A particularly distressing scenario occurs when Cash App closes an account that still has money in it. If this happens, it doesn’t necessarily mean your money is lost. Cash App typically holds the funds until the issue is resolved or refunds the balance to your linked bank account.

If your cash app account was closed with money in it, you should:

Contact Cash App customer support as soon as possible.

Provide all necessary verification documents to prove ownership of the account.

Request a refund or assistance in withdrawing the remaining funds.

Be aware that if your account was closed for serious violations, such as fraudulent activity or money laundering, retrieving the funds may take longer as Cash App investigates the matter further.

Cash App Closing Accounts in 2024: Stricter Policies

In 2024, Cash App has implemented stricter policies to comply with new financial regulations. This has led to a noticeable uptick in account closures. The company is required to adhere to laws that govern money transfers and payment platforms, which means they must take extra precautions against illegal activity. As a result, even minor violations or unusual patterns in transactions could result in an account being flagged and eventually shut down.

Gambling and Cash App Account Closures

A notable area where users are seeing their cash app accounts shut down is related to online gambling. Cash App’s terms of service strictly prohibit using the platform for illegal gambling transactions. If the system detects that an account is engaging in this type of activity, it may lead to an immediate closure. Even if gambling is legal in some regions, Cash App does not allow its services to be used for this purpose, which leads to account closures when violated.

What to Do If Cash App Closed Your Account

If Cash App closed your account, there are steps you can take to try and recover it or, at the very least, retrieve your funds. Here’s what you should do:

1. Contact Cash App Support

The first step is to contact Cash App’s customer service. Explain the situation and provide any information that may help resolve the issue. Cash App will typically ask for identification and other documents to verify your account ownership.

2. Appeal the Closure

In some cases, if you believe the closure was a mistake, you can appeal the decision. Contact Cash App support and explain why you think your account should not have been closed. While not all appeals are successful, Cash App may reinstate your account if the closure was due to an error.

3. Retrieve Your Money

Even if your account remains closed, Cash App usually allows users to recover their funds. If you had money in the account, you should be able to transfer it to a linked bank account once verification is complete. If this is not possible, Cash App may issue a check or transfer the balance to a new payment platform.

Can You Open a New Cash App Account After One Has Been Closed?

If Cash App closed your account, you might wonder whether you can simply create a new account. The answer is yes, but it comes with certain conditions.

1. Use Different Information

To open a new Cash App account, you will need to use different information than your previous account. This means a new email address, phone number, and potentially even a different bank account. Cash App tracks user activity and may block new accounts that share details with closed accounts.

2. Adhere to Terms of Service

If your previous cash app account was closed due to a violation of the terms of service, make sure you comply with all rules and regulations when using the new account. Violating the terms again could lead to another closure, and at that point, it may be much harder to open a new account.

Why Cash App Closed Accounts Due to Gambling

As mentioned earlier, Cash App has a strict policy against using the platform for gambling. Even if gambling is legal in your region, using Cash App to fund betting activities can result in an account closure. This is because Cash App must follow federal laws, which prohibit the use of payment services for unauthorized gambling activities.

If your account was closed for this reason, the chances of reopening it are slim. Cash App is unlikely to reinstate accounts that were involved in illegal or high-risk activities like gambling. You’ll need to follow up with customer support to recover any remaining funds, but the account itself may stay permanently closed.

Conclusion

The recent wave of Cash App account closures is largely due to stricter policies and regulatory requirements. Whether your account was closed for violating terms of service, suspicious activity, or other reasons, it’s important to take action quickly. Contacting Cash App support, verifying your identity, and complying with all requests can help you recover your funds or reopen your account.

If your account was closed for a serious violation, such as gambling, it may be difficult to restore access, and you may need to open a new account. Always ensure you follow Cash App’s rules to avoid future closures.

2 notes

·

View notes

Text

Physical Verification of Fixed Assets: Why Your Business Needs It

Introduction In the world of business, fixed assets—like machinery, buildings, and equipment—are fundamental to operations and profitability. However, without proper management and regular verification, businesses can lose track of these valuable resources. Physical verification of fixed assets is a critical process to ensure that a company’s assets are accurately recorded and maintained. In this article, we’ll delve into why physical verification of fixed assets is essential and how MAS LLP offers a streamlined approach to safeguarding these vital resources.

What is Physical Verification of Fixed Assets? Physical verification of fixed assets is a systematic process of counting and verifying a company's tangible assets to confirm their presence, condition, and alignment with accounting records. This process helps ensure assets are accounted for, thereby minimizing risks of asset misappropriation, losses, or unexpected depreciation.

Key Components of Physical Verification Inventory Count: Ensuring that all assets, big or small, are physically located and accounted for. Condition Assessment: Reviewing the status and usability of assets to determine if they need maintenance, repair, or replacement. Compliance Check: Ensuring that the asset register aligns with financial statements and legal regulations. Tagging & Labeling: Using asset tags or barcodes for easy tracking and future verification. Why Physical Verification is Essential for Businesses

Improved Financial Accuracy An accurate inventory of fixed assets ensures that the company's financial statements reflect true value. By confirming asset existence and condition, physical verification helps in producing precise data for depreciation, amortization, and insurance claims.

Asset Utilization Optimization Physical verification helps identify underutilized or idle assets, providing opportunities to redeploy them where needed. This leads to optimized resource allocation, potentially saving costs by maximizing the productivity of existing assets.

Enhanced Security and Fraud Prevention Unauthorized use, theft, or misappropriation of assets can have significant financial consequences. Regular verification protects businesses by preventing fraudulent practices and ensuring that each asset is appropriately safeguarded.

Accurate Tax Reporting Fixed assets have tax implications, especially in terms of depreciation. Accurate records enable businesses to file correct depreciation values, avoid tax penalties, and ensure compliance with local tax laws.

Supporting Business Valuation For businesses seeking investments or mergers, a well-documented and verified list of fixed assets enhances business valuation. A clean asset register is a positive indicator for potential investors, showing operational control and value transparency.

Physical Verification with MAS LLP At MAS LLP, we provide comprehensive physical verification of fixed assets services, tailored to meet your company’s unique requirements. Our process is designed to deliver accuracy, transparency, and peace of mind. Here’s how we can help:

Detailed Asset Inventory Creation Our team conducts an in-depth assessment to create an exhaustive inventory list that aligns with your company’s financial records. We account for every asset to ensure you have a clear picture of your holdings.

Customized Verification Plans MAS LLP works with clients to develop verification schedules suited to the size and nature of the business. Whether it’s annual, semi-annual, or periodic checks, we customize our approach to your operational needs.

State-of-the-Art Tracking Technology We leverage advanced tracking solutions, such as barcode tagging and RFID, to simplify the asset verification process and minimize errors. This enhances the traceability and management of assets, especially for larger organizations.

Condition and Compliance Reporting Our experts assess the physical state of assets and generate detailed reports on their condition. We also ensure compliance with relevant regulations, maintaining an accurate record of all assets in your register.

Seamless Integration with Financial Statements Once verification is complete, we update the asset register and integrate findings with your financial statements. This ensures consistency across your asset records, accounting books, and tax documents, giving you a precise and compliant asset overview.

Why Choose MAS LLP? When it comes to managing your fixed assets, MAS LLP’s expertise in physical verification of fixed assets helps you minimize risk and maximize control. With a team of seasoned professionals, we have the resources, technology, and industry knowledge to provide you with a comprehensive asset verification solution.

Benefits of Working with MAS LLP Unmatched Accuracy: Our rigorous processes ensure asset records are accurate and up-to-date. Cost-Efficiency: We help you avoid over-investment by identifying and redistributing idle assets. Compliance Assurance: Stay compliant with regulatory requirements through verified asset data. Transparent Reporting: Receive detailed, actionable reports for informed decision-making. Conclusion The physical verification of fixed assets is an indispensable aspect of asset management that safeguards your company’s resources, supports financial accuracy, and boosts compliance. With MAS LLP, businesses can gain confidence in the integrity of their asset records and optimize asset utilization for long-term success. Reach out to MAS LLP today to learn more about how we can assist you in managing your fixed assets effectively.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

6 notes

·

View notes

Text

Congress may be closer than ever to passing a comprehensive data privacy framework after key House and Senate committee leaders released a new proposal on Sunday.

The bipartisan proposal, titled the American Privacy Rights Act, or APRA, would limit the types of consumer data that companies can collect, retain, and use, allowing solely what they’d need to operate their services. Users would also be allowed to opt out of targeted advertising, and have the ability to view, correct, delete, and download their data from online services. The proposal would also create a national registry of data brokers, and force those companies to allow users to opt out of having their data sold.

“This landmark legislation gives Americans the right to control where their information goes and who can sell it,” Cathy McMorris Rodgers, House Energy and Commerce Committee chair, said in a statement on Sunday. “It reins in Big Tech by prohibiting them from tracking, predicting, and manipulating people’s behaviors for profit without their knowledge and consent. Americans overwhelmingly want these rights, and they are looking to us, their elected representatives, to act.”

Congress has tried to put together a comprehensive federal law protecting user data for decades. Lawmakers have remained divided, though, on whether that legislation should prevent states from issuing tougher rules, and whether to allow a “private right of action” that would enable people to sue companies in response to privacy violations.

In an interview with The Spokesman Review on Sunday, McMorris Rodgers claimed that the draft’s language is stronger than any active laws, seemingly as an attempt to assuage the concerns of Democrats who have long fought attempts to preempt preexisting state-level protections. APRA does allow states to pass their own privacy laws related to civil rights and consumer protections, among other exceptions.

In the previous session of Congress, the leaders of the House Energy and Commerce Committees brokered a deal with Roger Wicker, the top Republican on the Senate Commerce Committee, on a bill that would preempt state laws with the exception of the California Consumer Privacy Act and the Biometric Information Privacy Act of Illinois. That measure, titled the American Data Privacy and Protection Act, also created a weaker private right of action than most Democrats were willing to support. Maria Cantwell, Senate Commerce Committee chair, refused to support the measure, instead circulating her own draft legislation. The ADPPA hasn’t been reintroduced, but APRA was designed as a compromise.

“I think we have threaded a very important needle here,” Cantwell told The Spokesman Review. “We are preserving those standards that California and Illinois and Washington have.”

APRA includes language from California’s landmark privacy law allowing people to sue companies when they are harmed by a data breach. It also provides the Federal Trade Commission, state attorneys general, and private citizens the authority to sue companies when they violate the law.

The categories of data that would be impacted by APRA include certain categories of “information that identifies or is linked or reasonably linkable to an individual or device,” according to a Senate Commerce Committee summary of the legislation. Small businesses—those with $40 million or less in annual revenue and limited data collection��would be exempt under APRA, with enforcement focused on businesses with $250 million or more in yearly revenue. Governments and “entities working on behalf of governments” are excluded under the bill, as are the National Center for Missing and Exploited Children and, apart from certain cybersecurity provisions, “fraud-fighting” nonprofits.

Frank Pallone, the top Democrat on the House Energy and Commerce Committee, called the draft “very strong” in a Sunday statement, but said he wanted to “strengthen” it with tighter child safety provisions.

Still, it remains unclear whether APRA will receive the necessary support for approval. On Sunday, committee aids said that conversations on other lawmakers signing onto the legislation are ongoing. The current proposal is a “discussion draft”; while there’s no official date for introducing a bill, Cantwell and McMorris Rodgers will likely shop around the text to colleagues for feedback over the coming weeks, and plan to send it to committees this month.

22 notes

·

View notes

Text

Explore the Reason Why your Cash App Account may be closed

Cash App has become a popular tool for sending and receiving money instantly. However, despite its widespread use, some users have found themselves facing a frustrating situation: Cash App has closed their account due to violations of the platform's Terms of Service. Understanding why this happens and what steps to take afterward is crucial to resolving the issue and potentially regaining access.

In this article, we will explore why your Cash App account might be closed, what to do if Cash App has sent money to a closed account, and whether or not you can reopen a closed account. We will also provide solutions to help you navigate through the frustrating situation if Cash App shut down your account. Let's dive in.

Why Did Cash App Close My Account?

There are several reasons why Cash App may close an account. The platform follows strict guidelines to ensure a safe and secure environment for its users. Violations of the Terms of Service can result in immediate suspension or permanent closure of accounts. Below are some common reasons that could explain why Cash App shut down your account:

Suspicious Activity or Fraud: If Cash App detects any suspicious or fraudulent transactions on your account, such as multiple failed attempts to send or receive money or illegal activities, it may close your account to protect both the user and the platform.

Violation of the Terms of Service: Cash App has a detailed Terms of Service that users must follow. Violating these terms, such as sending or receiving money for illegal goods or services, engaging in scam activities, or utilizing the app for other unpermitted uses, may lead to account closure.

Incorrect or False Information: If your Cash App account is linked to incorrect or fraudulent personal information, such as fake names or addresses, Cash App may shut down your account to prevent identity theft or fraud.

Unverified Account: Failure to verify your account by providing the necessary identification documents when requested by Cash App can also result in account closure. Verifying your identity is an important step to ensure compliance with anti-money laundering and financial security regulations.

Excessive Chargebacks or Disputes: If your account has a history of excessive chargebacks or disputes with payments, Cash App may consider this a violation of its policies, leading to account closure.

What to Do If Cash App Sent Money to a Closed Account

One of the most common concerns users face is what happens if Cash App sent money to a closed account. If your account has been closed but you had pending transactions, you may be worried about what will happen to the money.

Funds Returned to the Sender: If someone attempts to send money to your closed Cash App account, the money will typically be returned to the sender. Cash App does not hold onto funds if an account is no longer active.

Contact Cash App Support: If you are unsure about the status of the funds or need assistance with transactions involving a closed account, it's important to contact Cash App support directly. They can provide clarity on the situation and may be able to assist with recovering the funds.

Check Linked Bank Accounts: In some cases, funds may be automatically transferred to a linked bank account even if your Cash App account is closed. Ensure that the bank details linked to your Cash App account are accurate and up-to-date.

Can I Reopen a Closed Cash App Account?

If you find yourself asking, "Can I reopen a closed Cash App account?", the answer depends on why your account was closed in the first place. In some cases, it may be possible to recover your account, while in other situations, the closure may be permanent.

Account Review: If your account was closed due to a temporary issue, such as a security concern or suspicious activity, Cash App may allow you to submit a request for a review. During the review process, you may need to provide additional documentation or identification to verify your account.

Permanent Closure: Unfortunately, not all closed accounts are eligible for reopening. If your account was closed due to severe violations of the Terms of Service, such as fraudulent activity, the closure may be permanent, and you may not be able to regain access to the account.

Create a New Account: If your account was permanently closed, your only option may be to create a new account. However, this may require using a different email address and phone number than what was associated with your original account.

Steps to Take If Your Cash App Account Is Closed

If Cash App shut down your account, follow these steps to resolve the issue or seek alternative options:

Contact Cash App Support: The first and most important step is to contact Cash App's customer support. You can do this through the app or via email. Provide as much information as possible about your account and the situation that led to its closure.

Review the Terms of Service: Take time to carefully review Cash App's Terms of Service to identify any possible reasons for the closure. Understanding what may have gone wrong can help you avoid similar issues in the future.

Provide Identification Documents: If Cash App requests verification documents to reopen your account, be prompt in providing the necessary information. This can include a government-issued ID, proof of address, or other forms of identification.

Stay Patient: The review process can take time, especially if Cash App is investigating suspicious activity. Stay patient and wait for a response from the support team.

Consider Alternatives: If you are unable to reopen your Cash App account, consider using alternative payment platforms such as PayPal, Venmo, or Zelle. These services offer similar features and may be a good substitute for Cash App.

Conclusion

Having your Cash App account closed can be a frustrating experience, especially if you rely on the platform for your daily transactions. Understanding why Cash App may have closed your account and following the proper steps to resolve the issue can help you navigate this challenging situation. While some account closures are permanent, others may be resolved through proper communication with Cash App's support team.

If your Cash App shut down your account, it’s important to stay calm and follow the necessary steps to resolve the situation. Whether it's recovering lost funds, understanding the reason for closure, or considering alternative payment options, you can find a solution that works for you.

4 notes

·

View notes

Text

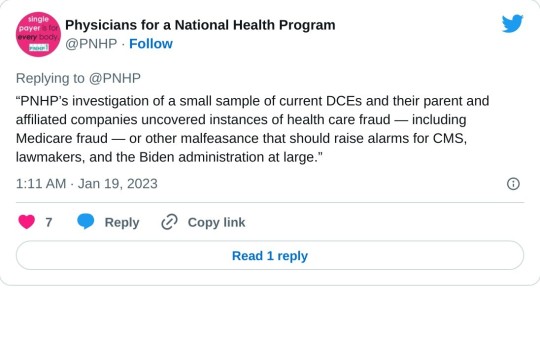

A national physician group this week called for the complete termination of a Medicare privatization scheme that the Biden White House inherited from the Trump administration and later rebranded—while keeping intact its most dangerous components.

Now known as the Accountable Care Organization Realizing Equity, Access, and Community Health (ACO REACH) Model, the experiment inserts a for-profit entity between traditional Medicare beneficiaries and healthcare providers. The federal government pays the ACO REACH middlemen to cover patients' care while allowing them to pocket a significant chunk of the fee as profit.

The rebranded pilot program, which was launched without congressional approval and is set to run through at least 2026, officially began this month, and progressive healthcare advocates fear the experiment could be allowed to engulf traditional Medicare.

In a Tuesday letter to Health and Human Services Secretary Xavier Becerra and Centers for Medicare and Medicaid Services Administrator Chiquita Brooks-LaSure, Physicians for a National Health Program (PNHP) argued that ACO REACH "presents a threat to the integrity of traditional Medicare, and an opportunity for corporations to take money from taxpayers while denying care to beneficiaries."

The group, which advocates for a single-payer healthcare system, voiced alarm over the Biden administration's decision to let companies with records of fraud and other abuses take part in the ACO REACH pilot, which automatically assigns traditional Medicare patients to private entities without their consent.

CMS said in a press release Tuesday that "the ACO REACH Model has 132 ACOs with 131,772 healthcare providers and organizations providing care to an estimated 2.1 million beneficiaries" for 2023.

"As we have stated, PNHP believes that the REACH program threatens the integrity of traditional Medicare and should be permanently ended," Dr. Philip Verhoef, the physician group's president, wrote in the new letter. "Whether or not one agrees with this statement, we should all be able to agree that companies found to have violated the rules have no place managing the care of our Medicare beneficiaries."

Among the concerning examples PNHP cited was Clover Health, which has operated so-called Direct Contracting Entities (DCEs)—the name of private middlemen under the Trump-era version of the Medicare pilot—in more than a dozen states, including Arizona, Florida, Georgia, and New York.

PNHP noted that in 2016, CMS fined Clover—a large Medicare Advantage provider—for "using 'marketing and advertising materials that contained inaccurate statements' about coverage for out-of-network providers, after a high volume of complaints from patients who were denied coverage by its MA plan. Clover had failed to correct the materials after repeated requests by CMS."

Humana, another large insurer with its teeth in the Medicare privatization pilot, "improperly collected almost $200 million from Medicare by overstating the sickness of patients," PNHP observed, citing a recent federal audit.

"It appears that in its selection process [for ACO REACH], CMS did not prevent the inclusion of companies with histories of such behavior," Verhoef wrote. "Given these findings, we are concerned that CMS is inappropriately allowing these DCEs to continue unimpeded into ACO REACH in 2023."

While the Medicare pilot garnered little attention from lawmakers when the Trump administration first launched it during its final months in power, progressive members of Congress have recently ramped up scrutiny of the program.

Last month, Sen. Elizabeth Warren (D-Mass.) and Rep. Pramila Jayapal (D-Wash.) led a group of lawmakers in warning that ACO REACH "provides an opportunity for healthcare insurers with a history of defrauding and abusing Medicare and ripping off taxpayers to further encroach on the Medicare system."

"We have long been concerned about ensuring this model does not give corporate profiteers yet another opportunity to take a chunk out of traditional Medicare," the lawmakers wrote, echoing PNHP's concerns. "The continued participation of corporate actors with a history of fraud and abuse threatens the integrity of the program."

#us politics#news#2023#common dreams#medicare#trump administration#biden administration#Accountable Care Organization Realizing Equity Access and Community Health model#department of health and human services#Xavier Becerra#Chiquita Brooks-LaSure#Physicians for a National Health Program#Centers for Medicare and Medicaid Services#Dr. Philip Verhoef#Direct Contracting Entities#Medicare Advantage#sen. elizabeth warren#Rep. Pramila Jayapal#medicare for all#us healthcare#us health insurance

95 notes

·

View notes