#European Aircraft MRO Market

Explore tagged Tumblr posts

Text

Soaring High: The Europe Aircraft MRO Market Takes Flight

Europe's bustling aviation industry relies on a robust network of maintenance, repair, and overhaul (MRO) services to keep its aircraft airworthy. Mordor Intelligence's latest report delves into the dynamic European aircraft MRO market, analyzing its growth trajectory, key players, and future outlook.

A Market Poised for Takeoff

The European aircraft MRO market is estimated to reach a value of USD 23.68 billion by 2029, propelled by a CAGR of 5% during the forecast period (2024-2029). This growth is fueled by several key factors:

Fleet Revival and Aging Aircraft: With the aviation industry recovering from the pandemic, airlines are reviving grounded aircraft. These aircraft require MRO services to ensure they meet airworthiness standards before returning to service. Additionally, Europe boasts a large fleet of aging aircraft, necessitating frequent maintenance checks and overhauls.

Growth in Air Traffic: As air travel demand continues to rise, airlines will require increased MRO services to maintain their operational fleets. This growing demand for air travel translates to more flying hours, leading to a higher need for aircraft maintenance.

Focus on Efficiency and Cost Optimization: Airlines are constantly seeking ways to optimize costs and improve operational efficiency. MRO service providers are responding by offering innovative solutions like predictive maintenance and component pooling, ensuring aircraft are operational for longer periods.

Beyond Routine Maintenance: A Multifaceted Market

The European aircraft MRO market caters to a diverse range of services:

Airframe MRO: Ensuring the structural integrity of the aircraft fuselage remains a critical aspect of MRO services.

Engine MRO: Regular maintenance and overhauls of aircraft engines are crucial for optimal performance and fuel efficiency.

Avionics MRO: Maintaining and upgrading complex avionics systems ensures safe and efficient navigation.

Component Repair and Overhaul: Repairing and replacing individual aircraft components like landing gear or cabin interiors is a vital aspect of the MRO market.

A Competitive Landscape: A Hub of Expertise

The European aircraft MRO market is a diverse landscape with established players and emerging companies vying for market share:

Major MRO Providers: Large, globally recognized MRO providers like Lufthansa Technik, AFI KLM E&M, and ST Engineering offer comprehensive MRO services for a variety of aircraft types.

Airline-Owned MROs: Several airlines operate their own MRO facilities, catering to their internal fleet requirements and potentially offering services to other airlines.

Independent MRO Providers: Independent MRO providers cater to specific aircraft types or specialize in particular maintenance services, offering competitive pricing and niche expertise.

Looking Ahead: A Sky Full of Opportunities

The future of the European aircraft MRO market promises a clear view of growth:

Focus on Innovation and Technology: Embracing technological advancements like digitalization and automation within MRO processes will enhance efficiency and optimize costs.

Sustainability in MRO Practices: As environmental concerns grow, MRO providers are focusing on sustainable practices like using eco-friendly materials and adopting waste reduction strategies.

Expansion into Emerging Markets: Established European MRO providers are expected to expand their operations into emerging markets with growing aviation industries.

#European Aircraft MRO Market#European Aircraft MRO Industry#European Aircraft MRO Market Size#European Aircraft MRO Market Share#European Aircraft MRO Market Analysis#European Aircraft MRO Market Trends

0 notes

Text

Europe Aircraft Aftermarket: Growth, Competitors, Statistics, Forecast 2024-2032

The European aircraft aftermarket sector is set to experience robust growth and intensifying competition from 2024 to 2032, propelled by economic recovery, technological advancements, and evolving regulatory landscapes.

Growth Drivers and Market Dynamics

Europe remains a pivotal hub for aerospace innovation and manufacturing, with a comprehensive network of OEMs, MRO facilities, and parts suppliers. The aftermarket sector in Europe is bolstered by a diverse fleet of commercial, regional, and business aircraft, supported by stringent safety regulations and a growing emphasis on sustainability.

Competitive Landscape

Key competitors in the European aircraft aftermarket include Rolls-Royce plc, Safran Aircraft Engines, and MTU Aero Engines, leading the charge in engine maintenance and overhaul services. Additionally, companies like SR Technics, ST Engineering Aerospace, and Thales Avionics are prominent players offering comprehensive MRO solutions and avionics upgrades.

The market is witnessing increased competition from emerging players specializing in digitalization, AI-driven analytics, and sustainable aviation solutions. These innovations are reshaping customer expectations and driving demand for more efficient, cost-effective aftermarket services.

Request Free Sample Report - Receive a free sample report to preview the valuable insights and data we offer.

Statistics and Forecast

The European aircraft aftermarket is expected to grow steadily, supported by a recovering aviation sector post-pandemic and increasing air travel demand. As airlines and operators focus on operational efficiency and cost management, the demand for aftermarket services, including component repairs, modifications, and upgrades, is projected to rise.

Forecasted trends indicate a shift towards predictive maintenance technologies, eco-friendly solutions, and the integration of digital platforms for real-time monitoring and optimization. This evolution presents opportunities for collaboration across the value chain and strategic investments in technology to enhance service capabilities.

In conclusion, the European aircraft aftermarket is poised for dynamic growth over the forecast period, driven by technological innovation, regulatory imperatives, and competitive dynamics. Stakeholders who can navigate these challenges while capitalizing on emerging trends will be well-positioned to capitalize on growth opportunities and deliver value to customers across the aviation ecosystem.

About US

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services. MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions. To stay updated with technology and work process of the industry, MRFR often plans & conducts meet with the industry experts and industrial visits for its research analyst members.

Contact us:

Market Research Future (part of Wants tats Research and Media Private Limited),

99 Hudson Street,5Th Floor, New York, New York 10013, United States of America

Sales: +1 628 258 0071 (US) +44 2035 002 764 (UK)

Email: [email protected]

0 notes

Text

Navigating the Skies: Unveiling the Trajectory of Aircraft Filters Market Growth

The Aircraft Filters Market is set for substantial growth, projecting an increase from an estimated USD 823 million in 2021 to an impressive USD 1002 million by 2026, representing a steady CAGR of 4.0% during the forecast period. This comprehensive report explores the market dynamics, challenges, opportunities, and key trends shaping the trajectory of the Aircraft Filters Industry.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=263556495

Market Overview:

Elevating Efficiency: Fueled by the surge in aircraft renewals and deliveries, the Aircraft Filters Market emerges as a vital component in ensuring the longevity and efficiency of aircraft systems. With a robust CAGR, the market is poised for a transformative journey, overcoming challenges and capitalizing on emerging opportunities.

Market Statistics and Trends:

Short Replacement Cycle Driving MRO Demand:

Catalyst for Market Growth: The short replacement cycle of aircraft filters serves as a driving force, particularly in the MRO segment. With replacement cycles ranging from 6 to 18 months, and 300 to 3,500 flight hours, high passenger traffic contributes to increased cycles. The significant growth in global air travel, exemplified by a surge from 2.628 billion passengers in 2010 to 4.397 billion in 2019, underlines the sustained demand for aircraft filters.

Decline in Large Aircraft Orders:

Commercial Challenges: A decline in orders for large and very large aircraft poses a restraint for the Aircraft Filters Market. The decrease in demand for large aircraft, attributed to factors such as the rise in domestic airline traffic and the impact of the COVID-19 pandemic, necessitates strategic adjustments in the industry to maintain market equilibrium.

Opportunities in Emerging Markets:

Asia Pacific and Latin America Dynamics: The emergence of aircraft manufacturers in Asia Pacific and Latin America, including COMAC, Embraer SA, and Mitsubishi Aircraft Corporation, presents a significant opportunity for market growth. Initiatives by regional players, like Cebu Pacific in the Philippines, to expand passenger capacity contribute to the upward trajectory of the Aircraft Filters Market.

Challenges with Alternate Fuel Aircraft:

Navigating the Shift: The rise of electric and alternate fuel aircraft, aimed at reducing carbon footprints, presents a challenge for aircraft filter manufacturers. With electric aircraft requiring fewer parts, including filters, the industry faces the task of adapting to changing technologies. Startups like Urban Aeronautics Ltd. spearheading hydrogen-powered urban air mobility further intensify this challenge.

Inquiry Before Buying: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=263556495

Market Segmentation:

Platform Dynamics:

UAVs Taking Flight: The Unmanned Aerial Vehicles (UAVs) segment is poised for the highest CAGR in the Aircraft Filters Market. Fueled by rising demand in the military sector, UAVs, though currently representing a small portion of the market, hold potential for substantial growth. Future advancements might even position UAVs for human transportation, amplifying the demand for aerospace filters.

Regional Dynamics:

Europe Soaring Ahead: Europe takes the lead as the fastest-growing region in the Aerospace Filters Market. Maturation of the market, coupled with the presence of key manufacturers and end-users, propels growth. Aircraft modernization programs in various European countries further contribute to the regional demand. North America and Asia Pacific, driven by air travel growth and aircraft demand, follow closely, shaping a dynamic global landscape.

The Aircraft Filters Market embarks on a journey of growth, propelled by dynamic market forces and industry trends. With key players like Parker Hannifin Corporation, Donaldson Inc., and Safran leading the way, the market is well-positioned to navigate challenges, seize opportunities, and ensure clear skies ahead for the aviation industry. As air travel continues to evolve, the Aircraft Filters Market stands as an indispensable guardian of aircraft efficiency, reliability, and sustainability.Top of FormTop of Form

Get 10% Free Customization on this Report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=263556495

About MarketsandMarkets™

MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report.

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook.

Contact: Mr. Aashish Mehra MarketsandMarkets™ INC. 630 Dundee Road Suite 430 Northbrook, IL 60062 USA: +1-888-600-6441 Email: [email protected]

0 notes

Text

Passenger to Freighter Market Size by Global Major Companies Profile and Key Regions by 2029

The global passenger to freighter market size was valued at USD 2.14 billion in 2021. The market is projected to grow from USD 2.52 billion in 2022 to USD 5.19 billion by 2029, exhibiting a CAGR of 10.84% during the forecast period. This information is presented by Fortune Business Insights, in its report titled, “Passenger to Freighter Market, 2022-2029.” The report offers valuable insights obtained by thorough study done by our researchers. An extensive research was conducted to provide the estimated size of the market. The data used to project the shares for multiple segments at the country, regional, and global levels is obtained from in-depth interviews with numerous stakeholders.

Information Source :

Drivers and Restraints:

Rise in Aircraft Conversion Facilities Infrastructure by Key Players due to Increased Demand for Conversion Slots to Boost Market Growth

Due to the growing market for P2F conversion, major industry participants are concentrating on converting standard and smaller narrow body aircraft. These aircraft will be brand-new to the conversion industry, necessitating the construction of a brand-new conversion facility.

Embraer secured its first official deal in June 2022 with an unknown customer to convert 10 E-jets into freighters. The freighter's deliveries are anticipated to start in 2024. The main deck front door will be modified, the cabin door will be strengthened, the smoke detection system will be adjusted, and the interior air management system will undergo changes. This conversion is anticipated to take place at the manufacturer's facility in Brazil. This is expected to boost the passenger to freighter market growth.

Segments:

Refurbished Segment Dominated the Market in 2021 Owing to High Investment to Expand Conversion Capabilities by Key Players

By build type, the market is bifurcated into new build and refurbished. The refurbished segment dominated the market in 2021.

Narrow Body to Grow at Highest CAGR Due to the Wide Usage in E-Commerce During the Forecast Period

Based on aircraft model, the market is segmented into narrow body, wide body, and regional jets. The narrow body segment is expected to become dominant in the market due to its wide range of applications in the e-commerce sector.

Slot/Retro Fitment Segment to Grow at Highest CAGR Due to Rise in Demand from MRO Service Providers During the Forecast Period

Based on fitment, the market is segmented into slot/retro fitment and line fitment. The slot/retro fitment segment is expected to become dominant in the market due to increase in focus by MRO providers to enter into the freighter market.

By region, the market is segmented into North America, Europe, Asia Pacific, the Middle East, and the rest of the world.

List of Key Players Mentioned in the Report:

AerCap (Ireland)

Aeronautical Engineers, Inc. (U.S.)

Airbus SE (Netherlands)

Boeing Company (U.S.)

Bombardier, Inc. (Canada)

Elbe Flugzeugwerke GmbH (Germany)

Embraer SA (Brazil)

HAECO Group (Hong Kong)

Other key players.

Regional Insights:

North America to Lead Backed by Extraordinary Rise in E-Commerce

During the projected period, the freighter conversion market is expected to grow significantly in North America. Demand for domestic flights surged significantly in 2020 and 2021 as a result of the extraordinary rise in e-commerce brought on by lack of consumer mobility and a significant infusion of government stimulus.

It is anticipated that the European market would expand significantly during the projection period. Europe, which includes nations, such as the U.K., Germany, and France, has the second-largest passenger to freighter market share.

Throughout the forecast period, Asia Pacific is anticipated to display the most dominance in the market. Due to the growth of international trade, increase in air cargo activities, and other factors, the Asia Pacific region should be the market for passenger to freighters.

Competitive Landscape:

Important Business-related Announcements by Key Players to Influence Market Dynamics

Fundamental passenger to freighter companies often make crucial announcements regarding some business moves, which, in turn, affect the market either positively or negatively. Players acquire companies, launch products, engage in partnership deals, sign contracts with government organizations, and so on.

Key Industry Development:

February 2022: Boeing and ST Engineering declared that they are planning to produce a novel 767-300 Boeing Converted Freighter (BCF) line at the facility in Guangzhou.

0 notes

Text

Sanctions on Russians should lead from bad to worse the maintenance of Indian Air Force jets

More than 50% of all Indian material is of Soviet or Russian origin, requiring sustained assistance from Moscow for its maintenance, repair and overhaul.

Fernando Valduga By Fernando Valduga 03/05/2022 - 10:20 am in Military, War Zones

The optimism of the Indian Air Force (IAFs) about the ability to obtain spare parts to ensure the operability of its fleet of military aircraft, despite the punitive sanctions imposed on Moscow for its invasion of Ukraine, is denied by the recurrent shortage of components that the force has always faced, even when there were no embargoes.

The deputy chief of staff of the IAF, Air Marshal Sandeep Singh, told reporters on Wednesday, March 2, that the sanctions would not greatly affect the Indiana Air Force's ability to obtain Russian spare parts and auxiliary equipment, especially for its Sukhoi Su-30MKI and MiG-29 fighters.

Su-30MKI.

“We are evaluating (the situation) and there will be difficulties, but (sanctions) should not affect us much,” said Air Marshal Singh. He, an unbelieving, added that the IAF would in no way be "significantly affected" in this regard, as its good relations with the US and Russia persevered.

The three-star officer seemed to assume, without a basis, that New Delhi's lasting strategic, defense, diplomatic and political ties with Moscow and Washington before the invasion of Ukraine would make it immune to sanctions forever, despite the US's determination to penalize Russia for its militarism.

And, like most officers in the country, Air Marshal Singh also seems to assume that jugaad (creative innovation) or, better yet, the namesake 'Indian rope trick' of 'hypnotizing' the US, the European Union and other sanctioning countries in ceding Delhi in their efforts to maintain their military trade with Russia, without hindrance.

Resorting to financial jugaad, much like what the IAF achieves on its many platforms, however, does not seem to be an option for India to circumvent sanctions. According to the New York finance website 'Investopedia', sanctions by countries or organizations "provide a political tool without military force to punish or prevent objectionable actions". He goes on to state that sanctions can cost his targets dearly, or simply that trying any sanctions breach ploy can be harmful, not only to Russia as a seller of embargoed goods, but also to India as a buyer.

MiG-29UPG.

It also seems that Air Marshal Singh was denying the very reiteration of the IAF and the Ministry of Defense of the shortage of Russian equipment spare parts, which negatively impacted not only the IAF, but the entire army of India, for decades. More than 50% of all Indian material is of Soviet or Russian origin, requiring sustained assistance from Moscow for its maintenance, repair and overhaul (MRO) and, in some cases, even its updating.

However, these continuously delayed shortcomings and MROs persisted even during what many officers called the "good years" of India-Russia ties and were routinely highlighted by numerous parliamentary defense committees and Comptrollership and General Audit (CAG) audits. But under the recent sanctions imposed on all Russian military and related entities, India's endless problem of obtaining Russian spare parts, despite the confidence of Air Marshal Singh, promises only to get much worse if the acquisition does not cease completely.

“It is a critical issue for the IAF and it is getting harder every day, in an unlikely situation to correct for several years,” said military analyst Air Marshal V. K. ‘Jimmy’ Bhatia (retired). Sanctions on Russia, warned the former fighter pilot, will be a detrimental disadvantage in keeping Russian IAF platforms operational and may even force it to resort to inadequate purchases of "gray market" components to compensate for asset deficiencies.

Former Chief of Staff of the Indian Navy, Admiral Arun Prakash, takes an apocalyptic step further.

"Severe sanctions on Russia may eventually result in the disarmament of the Indian military due to the shortage of equipment and spare parts," he warned, blaming Indian authorities for the imminent quagmire of material hanging over the country's armed forces. “Indian politicians,” said the former navy chief, “were apparently indifferent to this crisis; the incomprehensible bureaucracy and scientists from the Defense Research and Development Organization (DRDO) were never held responsible for their inability to deliver competent weapons systems on time.”

MiG-21.

The IAF currently operates more than 410 Soviet and Russian fighters comprising a mixture of imported and licensed platforms. These included about 14 Su-30MKI 'Flanker' squadrons of about 260 fighter jets that make up the IAF front line; five MiG-21 'Fishbed' ground attack squadrons representing about 90 aircraft; and five MiG-29 'Fulcrum' (UPG) air superiority squadrons, comprising 60 platforms, including eight All of them rely unanimously on Russian parts and components, whose availability has always been uncertain, although many of them were built locally by Hindustan Aeronautics Limited (HAL) under Russian technology transfer.

In turn, this shortage resulted in low operational availability of IAF Russian fighter jets and several rotary and transport platforms. In a revealing statement in Parliament in December 2015, the Ministry of Defense had declared that the operational availability of the IAF combat fleet was only 55%, mainly due to the unavailability of spare parts even at that time. Little has changed in the following seven years.

Su-30MKI.

This parliamentary disclosure meant that only about 350 of the 700 predominantly Russian combat aircraft in service at the time - many of which have already been retired - were available at any time to carry out operations. In addition, the ministry clearly stated that between 15-20% of fighter jets of Russian origin were "grounded aircraft (AOG) due to the lack of spare parts" and that even the operational availability of the IAF frontline Su-30MKIs was 50%.

After that, the availability of the Su-30MKI rose to about 60%, but the perennial problem of spare parts even for this advanced and multifunctional aircraft and the twin-engine MiG-29s, highlighted in Defense Minister Rajnath Singh's discussions with Russian authorities in Moscow in mid-2020. Ironically, this was three years after HAL signed two agreements with Russia for long-term maintenance and spare parts support for the IAF Su-30MKI fleet.

Beriev A-50EI Mainstay.

The two five-year agreements, worth an estimated $300 million, aimed to provide the fast delivery of about 57,000 spare parts of the Su-30MKI, licensed local manufacture of some components and a logistics center for advanced fighters in Bangalore, where HAL builds them. But IAF sources said little was achieved after that.

"The usual promises were made (by Rajnath Singh in Moscow) and protocols signed as before, but the situation on the ground simply did not change," said a retired three-star IAF officer at the time, refusing to be identified. The operational capacity of fighters, he lamented, remains a chronic problem for the IAF and seemed difficult to overcome, mainly due to the shortage of spare parts.

Under the current sanctions regime, the same officer declared, this would only get worse, as Russia would seek to manufacture equipment for itself, instead of holding the Indian armed forces by sending spare parts.

Problems with spare parts are not limited to IAF fighters

By August 2017, CAG had severely indicted the IAF for 'low' maintenance capacity and 'poor' availability of its fleet of Ilyushin Il-76 'Candid' transport aircraft and Il-78 'Midas' tankers that were negatively affecting the operational efficiency force, due to its inability to obtain spare parts from Russia. CAG reported that the average availability of the 14 Il-76 of the IAF of 2010-16 was only 38%, while that of its six Il-78 for the same period was 49%; significantly lower than the 70% of "wanted" maintenance levels. In addition, the avionics of both platforms dated from 1985, so “it was not allowed to operate in international flight corridors,” CAG said.

Il-78 Midas and Su-30MKI.

These endless complications ?? about military parts for India were exacerbated after the disintegration of the Soviet Union in the early 1990s, after which many defense manufacturing units and factories fell under the limits of separatist republics such as Ukraine, which were enemies of Moscow. This generated not only a shortage of spare parts, making them difficult, if not impossible, to obtain, but also prohibitively expensive, as some of the production lines had closed due to little or no demand.

This also resulted in the entire Indian army, including the IAF, obtaining spare parts of dubious quality from the parallel market that, in some cases, even led to equipment failures, for which responsibility was rarely attributed.

One thousand Mi-17 of the Indian Army.

Despite Air Marshal Singh's braggart about the imminent resumption of the IAF's uninterrupted military trade with Russia, he also does not seem to take into account the dual sanctions of the Swords of Damocles that hang over force, which also include the Act to Combat the Opponents of America through US Sanctions (CAATSA

This 2017 law, which followed Russia's annexation of Crimea in 2014 and Moscow's alleged interference in the U.S. elections two years later, directly threatens the recent implementation of the IAF of the first of five Almaz-Antey S-400 Triunf S-400 air defense missile systems that India had acquired at the end of 2018 for $5.5 billion

Antonov AN-26.

So far, CAATSA has been invoked against China and Turkey for installing S-400 systems, but not against Delhi, which seems to have received (for now) a silent resignation by Washington. Perhaps in this case, too, the military of India, especially the IAF, and its political and bureaucratic establishment are discreetly betting on administering these calamities collectively, via jugaad or the rope trick, or possibly even both.

Source: The Wire

Tags: Military AviationIAF - Indian Air ForceMiG-29UPGRussiaSukhoi Su-30MKI FlankerWar Zones - Russia/Ukraine

Embraer promotes its Defense & Security portfolio at the World Defense Show in Saudi Arabia

Fernando Valduga

Aviation photographer and pilot since 1992, he has participated in several air events and operations, such as Cruzex, AirVenture, Dayton Airshow and FIDAE. He has works published in specialized aviation magazines in Brazil and abroad. Uses Canon equipment during his photographic work in the world of aviation.

Cavok Brazil - Digital Tchê Web Creation

16 notes

·

View notes

Text

Aircraft MRO Market Size, Share, And Forecast 2027

Market Overview

Aircraft MRO Market will grow at a CAGR of 6.60%. According to VPR-analysis, the market value will reach up to USD 95.50 billion during the forecast 2027

The Aircraft MRO Market of airplane comprises of different administrations connected with aircrafts like update, fix, and upkeep, combined with different oversight and regulatory exercises. It helps in the smooth and proficient working of airplane by reestablishing it to its unique condition of capacity and execution. It comprises of different exact and severe necessities demanded via airworthiness specialists. It guarantees the wellbeing of aircrew, travelers, and freight. Further, it helps in improving dependability, item quality, and accessibility.

The worldwide pandemic of COVID 19 has impacted a significant lump of the populace. Many individuals have lost their occupation due to this worldwide pandemic. It has impacted the elements and development of a few businesses. Everybody is stressed over their resistance and follows social removing. Limitation on movement brought about the constriction of interest. During the lockdown circumstance, functional exercises were stopped, bringing about an interest recoil for the aircraft MRO market, which further prompts diminished deals income. Indeed, even after the advancement of limitations after the lockdown circumstance, airplane was not working at their full limit which additionally declines the market income and market development.

In any case, the aircraft MRO market is relied upon to recuperate from this worldwide pandemic before the finish of the second from last quarter of the approaching year by appropriately planning as per the requirements of the market.

Key Players

Major Key Players for Aircraft MRO Market are Airbus Group, Air France KLM Engineering & Maintenance, Air Works, Delta TechOps, HAECO, Honeywell International, GMF Aero Asia, Jet Maintenance Solutions, ST Aerospace, GE Aviation, Rolls-Royce, Pratt & Whitney, Lufthansa Technik, Safran Aircraft Engines.

Get More Professional and Technical Industry Insights @ https://valuepropresearch.com/report/aircraft-mro-market-1157/

Market Segmentation

The aircraft MRO market has been isolated all over the globe in view of the airplane type, part, application, and area.

In light of the Aircraft Type

The market has been partitioned the whole way across the globe in light of the airplane type into local vehicle airplane, tight body airplane, and wide-body airplane.

In light of the Component

The market has been separated the whole way across the globe in light of the part into motor, wings, landing gear, empennage, fuselage, and numerous others.

In view of the Application

The market has been isolated all over the globe in view of the application into business and general flight, business air transport, and military avionics. The biggest piece of the pie in the worldwide market is held by business air transport as in 201aircraft MRO market, it has the biggest portion of the overall industry of aircraft MRO market3.11%. In 201aircraft MRO market, the second biggest piece of the pie is held by Military flying and it is additionally expected to develop at a higher CAGR of 3.30% during the audit time frame.

In light of the Region

The market has been partitioned in the worldwide market in light of the district into the North American area, Asia-Pacific locale, European area, Latin American locale, and the Middle East and African area.

0 notes

Text

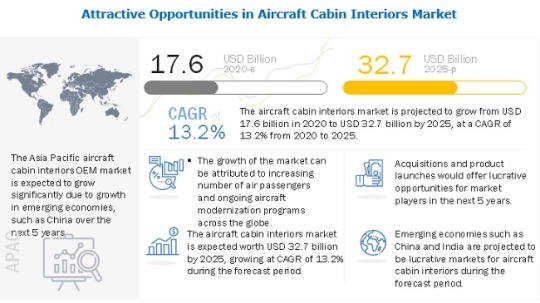

Aircraft Cabin Interiors Market Prominent Company Overview & Product Benchmarking, 2025

The global aircraft cabin interiors market size is projected to grow from USD 17.6 billion in 2020 to USD 32.7 billion by 2025, at a CAGR of 13.2% during the forecast period from 2020 to 2025. The growth of this market can be attributed to increasing number of aircraft orders due to rise in air passenger traffic across the globe. Moreover, airlines are concerned about enhancing the customer experience and as such, are investing in carrying out upgradation of their existing aircraft fleets.

Based on type, the In-flight Entertainment & Connectivity (IFEC) segment of the aircraft cabin interiors market is projected to grow at the highest CAGR during the forecast period.

The in-flight entertainment & connectivity segment of the aircraft cabin interiors market is projected to grow at the highest CAGR from 2018 to 2025. The growth of this segment can be attributed to an increased demand for in-flight entertainment & connectivity systems as they have become an alternate source of income for most of the airlines. The ancillary revenue obtained from these systems is helping airlines in maintaining and enhancing the quality of their onboard services. Different airlines are using different sources such as onboard shopping, Wi-Fi connectivity, and advertising for revenue generation.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=74760139

Based on aircraft type, the wide body aircraft segment of the aircraft cabin interiors market is projected to grow at the highest CAGR from 2018 to 2025.

Based on aircraft type, the wide body aircraft segment is projected to grow at the highest CAGR during the forecast period. The increasing number of new aircraft orders and rising demand for enhanced passenger experience, especially the long-haul aircraft are leading to the growth of the wide body aircraft segment of the aircraft cabin interiors market.

Based on end user, the Aftermarket segment of the aircraft cabin interiors market is projected to grow at the highest CAGR during the forecast period. The growth of this segment is due to rising demand for retrofitting components within the aircraft cabin.

The Middle Eastaircraft cabin interiors market is projected to grow at the highest CAGR from 2018 to 2025. The growth of the market in this region is largely due to increase in fleet size, this market consists of aftermarket and MRO.

Major players operating in the aircraft cabin interiors market include Zodiac Aerospace (France), United Technologies Corporation (US), Astronics Corporation (US), Cobham plc (UK), Diehl Stiftung & Co. KG (Germany), Global Eagle Entertainment (US), Gogo (US), Honeywell International (US), Panasonic Avionics (US), and RECARO Aircraft Seating GmbH & Co. KG (Germany), among others. These players offer different products used in aircraft cabin interiors such as aircraft seating, in-flight entertainment & connectivity, aircraft galley, and aircraft lavatory. These companies have well-equipped manufacturing facilities and strong distribution networks across North America, Europe, and Asia Pacific regions.

United Technologies Corporation accounted for a major share of the aircraft cabin interiors market in 2019. The company has a strong presence in the European and North American regions. It has a good breadth of offerings, well-established delivery and support networks, and excellent product distribution networks. It offers aircraft lavatory, aircraft galley, in-flight entertainment & connectivity, and aircraft cabin lighting. In 2017, Rockwell Collins, Inc. was selected by TCS World to provide onboard broadband connectivity for its private jets. In November 2018, UTC was acquired by Rockwell Collins, which is another leading company in the market, thereby resulting in the formation of Collins Aerospace. In February 2020, Collins Aerospace Systems signed a five-year tailored FlightSense agreement valued at approximately USD 200 million with Japan Airlines to service air management and electric power components of its growing fleet of Boeing 787 aircraft.

Get Sample Here: https://www.marketsandmarkets.com/requestsampleNew.asp?id=74760139

About MarketsandMarkets™

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies’ revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model – GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets’s flagship competitive intelligence and market research platform, "Knowledgestore" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

Contact: Mr. Aashish Mehra MarketsandMarkets™ INC. 630 Dundee Road Suite 430 Northbrook, IL 60062 USA : 1-888-600-6441

0 notes

Text

Industrial Fasteners Market Product, Component and Distribution Channel Analysis, 2025

The global Industrial Fasteners Market research report provides complete insights on industry scope, trends, regional estimates, key application, competitive landscape and financial performance of prominent players. It also offers ready data-driven answers to several industry-level questions. This study enables numerous opportunities for the market players to invest in research and development.

Market Overview:

Global Industrial Fasteners Market is expected to grow at a significant CAGR during the forecast period. Industrial fasteners include a set of bolts and nuts and are used in all production activities. Bolts and nuts comprise a major link in industrial fasteners and are used in all industrial domains. Mainly, steel is used in the production of physical products made from wood and metal. Industrial uses of bolts and nuts entail fastening wherein placement of pieces and parts is essential.

Key Players:

Alcoa, Inc.

Precision Castparts Corporation

Illinois Tool Works Incorporated (ITW)

Acument Global Technologies

ATF

Dokka Fasteners

LISI Group - Link Solutions for Industry

Nippon Industrial Fasteners Company (Nifco)

Stanley Black & Decker

Penn Engineering

Hilti AG

Standard Fasteners Ltd.

Request free sample to get a complete analysis of top-performing companies @ https://www.millioninsights.com/industry-reports/industrial-fasteners-market/request-sample

Growth Drivers:

The commercial demand for nuts and bolts is gaining much traction as the industrial need is on the rise. With the constant rise in annual imports, there arises a need for establishing a manufacturing base. Rise in transportation, railways, aircrafts, wagon, bicycles and automotive makers are several components operating in industrial fasteners.

The drivers for industrial fasteners market include rise in use of automotive, machinery, and electronics. Apart, industrial fasteners are used in the production of medical equipment, consumer appliances, suspension system and wheels. Increase in urbanization and rise in construction sector is likely to propel the industrial fastener market growth during the forecast period.

Application Outlook:

Automotive OEM

Machinery OEM

Other OEM

MRO

Construction

Product Outlook:

Externally threaded

Aerospace grade

Regional Outlook:

North AmericaUS

EuropeGermany

Asia PacificIndia China Thailand Japan South Korea

Central & South AmericaBrazil

MEA

Asia-Pacific regions are likely to gain much higher traction in the global period. Rise in OEM is another factor stimulating the market growth. Presence of a vast industrial corridor and end-user market is likely to trigger the market growth during the forecast period.North American and European markets are expected to gain a significant CAGR during the forecast period due to increase in construction activities and mounting demand for industrial fasteners. The key players in the industrial fasteners market include Precision Castparts Corp, Nifco, ITW, Alcoa, Kova Fasteners Pvt Ltd, LISI Group, Standard Fasteners, and Dokka Fasteners.

Browse Related Category Research Reports @ https://industryanalysisandnews.wordpress.com/

0 notes

Text

Narrowbody Aircraft MRO Market to Demonstrate a Strong Growth Over 2027 – MRFR

Narrowbody Aircraft MRO Market – Overview

The global narrowbody aircraft MRO market is growing with the rapid pace. According to a recent study report published by the Market Research Future, The global narrowbody aircraft MRO market will grow at a rapid pace over the forecast period. The market is forecasted to witness slow but steady growth by 2021, which will be a surplus growth at a moderate CAGR during the projected period (2017 -2021).

Many new narrowbody aircraft MRO centres have been set up in numerous countries in recent years. This increases the participation of manufacturers in the field of narrowbody aircraft MRO service. Moreover, the growing demand for narrowbody aircraft MRO equipment’s that satisfy the demand for aircraft fleet expansion. The expansion of aircraft fleet is estimated to rise in aircraft MRO expenses and as well as it is expected to add to the growth of the market. However, the high cost of repair and replacement, retrofit of older aircraft with upgraded systems, and environmental hazards acts as a barrier to the growth of narrowbody aircraft MRO market.

The growing demand for the low-cost aircraft directly has an impact on the market. Moreover, the factor responsible for the growth of narrowbody aircraft MRO market increased procurement of narrowbody aircraft, outsourcing of MRO activities, and usage of 3D manufacturing in aircraft components. This is the primary factor that drives the growth of the narrowbody aircraft MRO market and has gained prevalence in the recent times, with the usage of best in class technologies in aircraft. Narrowbody aircraft has a lesser capacity than the wide-body aircraft, they are larger in number. These planes generally fly over short routes, and are, thus suited to cater to budget travellers. Thus, the growth of the narrowbody aircraft MRO market is expected to go hand in hand with the growth of low-cost carriers in the aircraft industry.

The expansion of the military aircraft fleets, which has resulted in the development of a set of narrowbody aircraft MRO market. The increased focus of manufacturers on narrowbody aircraft MRO will lead to an increase in the use of military aircraft, due to which there will be growth in narrowbody aircraft MRO market. The expansion of the existing military aircraft fleets along with the launch of new airlines would result in increased narrowbody aircraft MRO the forthcoming years. Hence, it is expected that the rapid fleet expansion would eventually drive the narrowbody aircraft MRO market. Moreover, the popularity of radio-frequency identification (RFID) and integration of portable devices for an effective turnaround, will drive the growth of narrowbody aircraft MRO market during the forecast period.

Access Report Details @

https://www.marketresearchfuture.com/reports/narrowbody-aircraft-mro-market-1664

Industry/ Innovation/ Related News:

November, 2014 – Air works India has formed a joint-venture with Nepal-based Yasaka Investment that will provide aviation maintenance services to international airlines.

March, 2018 - Lufthansa Technik AG have signed a Total Component Maintenance contract for Jet Airways' narrowbody fleet of 80 Boeing 737NG, with single components repaired in a closed-loop and flat rate-based process.

Narrowbody Aircraft MRO Market – Segmentation

The global narrowbody aircraft MRO market is segmented in to 3 key dynamics for the convenience of the report and enhanced understanding;

Segmentation by MRO Type : Comprises Airframes and Modification, Components, Engine and Line Maintenance

Segmentation by Platform : Comprises Military and Commercial

Segmentation by Regions : Comprises Geographical regions - North America, Europe, Asia-Pacific, Middle East & Africa and South America.

Key Players:

GE Aviation, Honeywell Aerospace, Lufthansa Technik, Pratt & Whitney, Rolls-Royce, Air Works, Jet Maintenance Solutions, GMF AeroAsia and Singapore Technologies Aerospace and others are some of the prominent players profiled in MRFR Analysis and are at the forefront of competition in the global narrowbody aircraft MRO market.

Narrowbody Aircraft MRO Market: Regional Analysis

North America region market is dominating the market of narrowbody aircraft MRO market due to growth in air traffic in the international long-haul routes. The market in the developed countries is largely driven by fleet size expansion which helps in growth of narrowbody aircraft MRO market.

European region is referred to as the second-largest narrowbody aircraft MRO’s market due to factors such as presence of major MRO service providers have fuelled the demand for narrowbody aircraft MRO market.

Request a Sample Report @

https://www.marketresearchfuture.com/sample_request/1664

NOTE: Our Team of Researchers are Studying Covid19 and its Impact on Various Industry Verticals and wherever required we will be considering Covid19 Footprints for Better Analysis of Market and Industries. Cordially get in Touch for More Details.

0 notes

Text

Industrial Fasteners Market Growth by Global Key Players: Nifco, ITW & Alcoa

Global Industrial Fasteners Market is expected to grow at a significant CAGR during the forecast period. Industrial fasteners include a set of bolts and nuts and are used in all production activities. Bolts and nuts comprise a major link in industrial fasteners and are used in all industrial domains. Mainly, steel is used in the production of physical products made from wood and metal. Industrial uses of bolts and nuts entail fastening wherein placement of pieces and parts is essential.

The commercial demand for nuts and bolts is gaining much traction as the industrial need is on the rise. With the constant rise in annual imports, there arises a need for establishing a manufacturing base. Rise in transportation, railways, aircrafts, wagon, bicycles and automotive makers are several components operating in industrial fasteners.

The drivers for industrial fasteners market include rise in use of automotive, machinery, and electronics. Apart, industrial fasteners are used in the production of medical equipment, consumer appliances, suspension system and wheels. Increase in urbanization and rise in construction sector is likely to propel the industrial fastener market growth during the forecast period.

Access Sample Report of this report @ https://www.millioninsights.com/industry-reports/industrial-fasteners-market/request-sample

Geographical segmentation includes North America, South America, Europe, Asia-Pacific, Middle East and Africa. Asia-Pacific regions are likely to gain much higher traction in the global period. Rise in OEM is another factor stimulating the market growth. Presence of a vast industrial corridor and end-user market is likely to trigger the market growth during the forecast period.

North American and European markets are expected to gain a significant CAGR during the forecast period due to increase in construction activities and mounting demand for industrial fasteners. The key players in the industrial fasteners market include Precision Castparts Corp, Nifco, ITW, Alcoa, Kova Fasteners Pvt Ltd, LISI Group, Standard Fasteners, and Dokka Fasteners.

Market Segment:

Product Outlook (Revenue, USD Million; 2014 - 2025) • Externally threaded • Aerospace grade • Other standard fasteners

Application Outlook (Revenue, USD Million; 2014 - 2025) • Automotive OEM • Machinery OEM • Other OEM • MRO • Construction

Regional Outlook (Revenue, USD Million; 2014 - 2025) • North America • U.S. • Europe • Germany • Asia Pacific • China • India • Thailand • Japan • South Korea • Central & South America • Brazil • MEA

Browse Full Report With TOC @ https://www.millioninsights.com/industry-reports/industrial-fasteners-market

Get in touch

At Million Insights, we work with the aim to reach the highest levels of customer satisfaction. Our representatives strive to understand diverse client requirements and cater to the same with the most innovative and functional solutions.

Contact Person:

Ryan Manuel

Research Support Specialist, USA

Email: [email protected]

0 notes

Text

Germany Aerospace Bearing Market Research : Global Economy, By Penetration, Forecast, 2024-2032.

The German aerospace bearing market is a vital component of the country's aerospace industry, supporting aircraft manufacturing, maintenance, and repair operations. Aerospace bearings are critical components that ensure smooth and efficient operation of various aircraft systems, including engines, landing gear, and control surfaces. Let's delve into the key dynamics shaping this market.

Market Overview: Germany boasts a strong aerospace industry, with companies like Airbus Defence and Space, MTU Aero Engines, and Liebherr-Aerospace Lindenberg GmbH leading the sector. The German aerospace bearing market benefits from this robust industry, with a focus on innovation, precision engineering, and quality manufacturing. Bearings are indispensable components in aircraft systems, providing support, reducing friction, and enabling precise movement in critical applications.

Technological Advancements: Technological advancements in materials science, design optimization, and manufacturing processes drive innovation in the German aerospace bearing market. High-performance materials like titanium alloys, ceramic composites, and advanced polymers are utilized to develop bearings with superior strength, durability, and reliability. Innovative design concepts and precision machining techniques enable the production of bearings with tight tolerances and exceptional performance characteristics.

Maintenance, Repair, and Overhaul (MRO) Operations: Germany's aerospace bearing market benefits from a robust MRO industry, offering comprehensive services for the maintenance, repair, and overhaul of aircraft components, including bearings. MRO facilities specialize in bearing inspection, refurbishment, and replacement, ensuring the continued airworthiness of aircraft fleets and optimizing the performance of critical systems.

Regulatory Compliance and Safety Standards: The aerospace industry in Germany adheres to stringent regulatory requirements and safety standards established by authorities such as the European Union Aviation Safety Agency (EASA) and the German Federal Aviation Office (LBA). Aerospace bearings undergo rigorous testing and certification processes to ensure compliance with airworthiness regulations and maintain the highest levels of safety and reliability in aviation operations.

Market Trends and Opportunities: The German aerospace bearing market is witnessing several trends and opportunities. The increasing demand for lightweight and durable bearings to support the development of fuel-efficient aircraft, the adoption of advanced technologies such as self-lubricating and corrosion-resistant bearings, and the growing emphasis on digitalization and predictive maintenance solutions to optimize bearing performance and reduce downtime are some of the trends shaping the market landscape.

Request Free Sample Report - Receive a free sample report to preview the valuable insights and data we offer.

Challenges: Despite the opportunities, the German aerospace bearing market faces challenges such as intense competition, cost pressures, and supply chain disruptions. Additionally, the COVID-19 pandemic has impacted air travel demand and led to temporary disruptions in aircraft production and aftermarket activities, affecting the demand for aerospace bearings and related services.

Future Outlook: Looking ahead, the German aerospace bearing market is poised for continued growth driven by factors such as increasing aircraft production rates, technological innovation, and the demand for fuel-efficient and environmentally sustainable aircraft solutions. Collaboration between aerospace manufacturers, bearing suppliers, and regulatory agencies will be essential in driving innovation, ensuring regulatory compliance, and maintaining Germany's position as a global leader in the aerospace industry.

About US

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services. MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions. To stay updated with technology and work process of the industry, MRFR often plans & conducts meet with the industry experts and industrial visits for its research analyst members.

Contact us:

Market Research Future (part of Wants tats Research and Media Private Limited),

99 Hudson Street,5Th Floor, New York, New York 10013, United States of America

Sales: +1 628 258 0071 (US) +44 2035 002 764 (UK)

Email: [email protected]

0 notes

Text

Passenger to Freighter Market Worth USD 5.19 Million by 2029| At a CAGR of 10.84%Size, Growth and Demand

The global passenger to freighter market size was valued at USD 2.14 billion in 2021. The market is projected to grow from USD 2.52 billion in 2022 to USD 5.19 billion by 2029, exhibiting a CAGR of 10.84% during the forecast period. This information is presented by Fortune Business Insights, in its report titled, “Passenger to Freighter Market, 2022-2029.”

Informational Source: https://www.fortunebusinessinsights.com/passenger-to-freighter-market-107354

Report Coverage:

The report offers valuable insights obtained by thorough study done by our researchers. An extensive research was conducted to provide the estimated size of the market. The data used to project the shares for multiple segments at the country, regional, and global levels is obtained from in-depth interviews with numerous stakeholders.

List of Key Players Mentioned in the Report:

AerCap (Ireland)

Aeronautical Engineers, Inc. (U.S.)

Airbus SE (Netherlands)

Boeing Company (U.S.)

Bombardier, Inc. (Canada)

Elbe Flugzeugwerke GmbH (Germany)

Embraer SA (Brazil)

HAECO Group (Hong Kong)

Other key players.

Segments:

Refurbished Segment Dominated the Market in 2021 Owing to High Investment to Expand Conversion Capabilities by Key Players

By build type, the market is bifurcated into new build and refurbished. The refurbished segment dominated the market in 2021.

Narrow Body to Grow at Highest CAGR Due to the Wide Usage in E-Commerce During the Forecast Period

Based on aircraft model, the market is segmented into narrow body, wide body, and regional jets. The narrow body segment is expected to become dominant in the market due to its wide range of applications in the e-commerce sector.

Slot/Retro Fitment Segment to Grow at Highest CAGR Due to Rise in Demand from MRO Service Providers During the Forecast Period

Based on fitment, the market is segmented into slot/retro fitment and line fitment. The slot/retro fitment segment is expected to become dominant in the market due to increase in focus by MRO providers to enter into the freighter market.

By region, the market is segmented into North America, Europe, Asia Pacific, the Middle East, and the rest of the world.

Drivers and Restraints:

Rise in Aircraft Conversion Facilities Infrastructure by Key Players due to Increased Demand for Conversion Slots to Boost Market Growth

Due to the growing market for P2F conversion, major industry participants are concentrating on converting standard and smaller narrow body aircraft. These aircraft will be brand-new to the conversion industry, necessitating the construction of a brand-new conversion facility.

Embraer secured its first official deal in June 2022 with an unknown customer to convert 10 E-jets into freighters. The freighter's deliveries are anticipated to start in 2024. The main deck front door will be modified, the cabin door will be strengthened, the smoke detection system will be adjusted, and the interior air management system will undergo changes. This conversion is anticipated to take place at the manufacturer's facility in Brazil. This is expected to boost the passenger to freighter market growth.

Regional Insights:

North America to Lead Backed by Extraordinary Rise in E-Commerce

During the projected period, the freighter conversion market is expected to grow significantly in North America. Demand for domestic flights surged significantly in 2020 and 2021 as a result of the extraordinary rise in e-commerce brought on by lack of consumer mobility and a significant infusion of government stimulus.

It is anticipated that the European market would expand significantly during the projection period. Europe, which includes nations, such as the U.K., Germany, and France, has the second-largest passenger to freighter market share.

Throughout the forecast period, Asia Pacific is anticipated to display the most dominance in the market. Due to the growth of international trade, increase in air cargo activities, and other factors, the Asia Pacific region should be the market for passenger to freighters.

Competitive Landscape:

Important Business-related Announcements by Key Players to Influence Market Dynamics

Fundamental passenger to freighter companies often make crucial announcements regarding some business moves, which, in turn, affect the market either positively or negatively. Players acquire companies, launch products, engage in partnership deals, sign contracts with government organizations, and so on.

Key Industry Development:

February 2022: Boeing and ST Engineering declared that they are planning to produce a novel 767-300 Boeing Converted Freighter (BCF) line at the facility in Guangzhou.

0 notes

Text

Airbus A330-800 Receives Type Certification from EASA and FAA

The Airbus A330-800 has received joint Type Certification from the European Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA). The aircraft’s certification flight-test campaign was performed by aircraft MSN1888, which completed the programme in 370 flight test hours and 132 flights since its first flight in November 2018.

The A330-800 is powered by Rolls-Royce Trent 7000 engines and features a new 3D-optimised wing and new Sharklets made up of lighter composite materials. Airbus says that together, these advances result in a "significant reduction in fuel consumption". Certified initially with a maximum take-off weight (MTOW) of 242 tonnes for a range capability of up to 7,500 nautical miles, the A330-800 will typically seat 220 to 260 passengers in three classes, or up to 406 travellers in a single-class high-density configuration. To date the A330neo Family has won 337 firm orders from 22 operators. See latest Travel News, Interviews, Podcasts and other news regarding: A330, A330-800, FAA, EASA, Certification. Headlines: AirAsia to Launch Flights from Clark and Cebu to General Santos, Philippines MICE in North Wales - Interview with Richard Jones of venue cymru, Llandudno Air New Zealand Extends Reduction in Flights to Hong Kong and Shanghai Patrick de Castelbajac to Join Nordic Aviation Capital as CEO Thai Airways Opens New Lounge at Phuket Airport Bulgaria Air and Qatar Airways to Codeshare Tarom Takes Delivery of First of Nine ATR 72-600s Whitbread Signs Sixth Premier Inn Hotel in Ireland Mandarin Oriental Jumeira Dubai Opens Royal Penthouse COVID19: Zero Risk and Travel Advisories - Where Do We Stop? Campbell Wilson to Rejoin Scoot as CEO MIAT to Implement Sabre's Global Demand Data Solution Cathay Pacific Carried 3M Pax in Jan; Reduces Flight Capacity by 40% Roger Brantsma Joins 825-Room Hilton Tokyo as General Manger Thai Airways Increases Passenger Screening on Flights from Cambodia Mandarin Oriental Boston to Complete US$ 15 Million Renovation in April Erica Antony Joins CWT as Chief Product Officer Bjoern van den Oever Joins Alila Villas Koh Russey as Executive Chef Unicorn Hospitality Opens 47-Room Hotel in Bangkok, Thailand Hong Kong Airport Handled 5.7 Million Passengers in January Vietnam Airlines Adds Wide-Body Aircraft to Hanoi - Saigon Route Pratt & Whitney GTF Engines to Power Korean Air's New A321neos AsBAA Appoints Jeff Chiang as Chief Operating Officer Psychometrics at Naruna Retreats in Cambodia, Laos, Myanmar and Thailand Airbus A330-800 Receives Type Certification from EASA and FAA Hamza Sehili Joins Four Seasons Tunis as Hotel Manager British Airways and Royal Air Maroc to Codeshare Green Africa Airways Signs MOU for 50 Airbus A220-300s Hong Kong Visitor Arrivals Plummet to Below 3,000 Per Day What Does Tourism Mean to Conwy, North Wales? Interview with Mayor Thai Airways Launches Promotion for Royal Orchid Plus Members Dusit Thani Abu Dhabi Upgrades Rooms and MICE Facilities FlyArystan to Launch New Routes, Expand Capacity from Almaty, Kazakhstan Finnair Extends Suspension of Flights to China; Reduces HK Service SAS Extends Suspension of Flights to China Air Astana to Launch Flights to Mumbai, India HK7s and Singapore Sevens Rescheduled Quay Hotel & Spa in Deganwy, North Wales - Interview with Brid Collins Royal Thai Air Force Orders Six Airbus H135 Helicopters CWT Appoints Laura Watterson as SVP - Global Talent & Rewards Yee Pin Tan Joins Six Senses as Head of Design Boeing Forecasts Southeast Asia to Need 4,500 New Airplanes Over Next 20 Years Bombardier Completes Strategic Exit from Commercial Aviation British Airways to Launch Flights Between London Heathrow and Newquay Six Senses Appoints Bryan Gabriel as CCO Piotr Madej Joins The Andaman Langkawi as GM Sustainable Inspiration from Farmer Gareth Wyn Jones in North Wales PNG Air Orders Three ATR 42-600S Aircraft Japan Airlines Joins Amadeus NDC Program BBAM to Convert Three Boeing 737-800s into Freighters John Woolley Joins The Ritz-Carlton Bali as GM French Navy to Operate Four Airbus H160 Helicopters British Airways Extends Suspension of Flights to Beijing and Shanghai Air France Extends Suspension of Flights to Beijing and Shanghai Welsh Wine from the Gwinllan Conwy Vineyard - Interview with Colin Bennett Vietjet to Launch Three New Routes to India WTTC's 20th Global Summit to Take Place 22-23 April in Cancun, Mexico Keio Plaza Hotel Tokyo to Open Renovated Rooms on 29 March 2019-nCoV - Arbitrary Restrictions and Blanket Travel Bans Cause Confusion China and Mandarin Airlines Make Further Changes to Cross-Strait Services Premier Inn to Add 735 Beds to Scotland Portfolio in 2020 Valentino Longo Wins North America's Most Imaginative Bartender Competition Aviation: Slower But Steady Growth in 2019 Three Countries to Participate in Singapore Airshow 2020 Flying Displays 2019 Worst Year for Air Cargo Since End of Global Financial Crisis in 2009 Korean Air to Sell Land and Assets ibis Styles Hotel Opens in Bekasi, Indonesia Air France Takes Delivery of Airbus' 350th A350 United Airlines to Buy a Flight Training Academy Bombardier to Double Size of Service Centre at London Biggin Hill LA7s to Take Place at Dignity Health Sports Park in Los Angeles 29 Feb - 1 Mar Singapore Airshow 2020 Still On; SAALS Cancelled IHG Signs 61-Key InterContinental Resort in Khao Yai, Thailand Fusion Suites Opens in Vung Tau, Vietnam Aeroviation Expands Flight Training in Singapore with DA-20 Simulator CWT Appoints Nick Vournakis as MD - Global Customer Group SEHT Aviation Donates Six SH40-10 Headsets to Aerobility China Airlines Adds 2019-nCoV Service Information Centre to Website Four Seasons Resort Lanai Appoints Bradley Russell as Resort Manager Leading Yachts of the World Appoints Anthony Brisacq as CEO Second Four Seasons Hotel in Tokyo Starts Accepting Reservations Korean Air to Launch Passenger and Cargo Flights to Budapest, Hungary Aviation: Alliance Established to Investigate Use of Blockchain in MRO Chain SAS Closes Sale of Beijing and Shanghai Flights Until 15 March North Face 100 Thailand Attracts Over 4,000 Runners from 20+ Countries Hong Kong Air Cargo Renews IOSA Registration Swiss-Belhotel to Open Over 2,000 Rooms in 12 Hotels in Indonesia Elena Nazarovici Joins The Sanchaya Bintan as Director of Sales Amadeus Joins Mastercard's City Possible Network Asia Pacific Airlines Carried 375.5m Int. Pax in 2019 Thai Airways Reduces Flights to Mainland China Cebu Pacific Cancels All Flights to Hong Kong and Macau Batik Air Takes Delivery of First Airbus A320neo Fiji Beat South Africa to Win First HSBC Sydney Sevens Maldives Rejoins Commonwealth Korean Air Making a Difference to Orphans in Tondano, Sulawesi Qatar Airways Becomes Official Airline of Paris Saint-Germain Polish Air Ambulance Service Orders Two Learjet 75 Liberty Aircraft Vietnam Airlines Makes Changes to Hong Kong, Macau and Taiwan Flights Football: Pictures from Ascot United FC vs Egham Town FC Aerobility - The British Flying Charity, Interview with Mike Miller-Smith MBE ANA and SIA Sign Joint Venture Framework Agreement Dusit Signs First Hotel in Hanoi, Vietnam SkyWest Orders 20 Embraer E175 Jets SAS Suspends All Shanghai and Beijing Flights Kuala Lumpur Int. Airport Trials Single Token Journey Technology Air Canada Suspends All Flights to Beijing and Shanghai Korean Air Sets Up Emergency Response Team; Suspends Select China Flights Mark Radford Joins Trenchard Aviation as VP Business Development CWT Appoints R. Thompson as VP Global Internal Communications & Culture Vietjet Launches Daily Flights Between Hanoi and Bali, Indonesia WTTC Moves April's Global Summit from Puerto Rico to Mexico Andy Flaig Joins Wyndham as Head of Development South East Asia / Pacific Rim Air Astana Reports 2019 Net Profit Increase of 461% NASA Orders Three Airbus H135 Helicopters Hahn Air Simplifies Distribution of Corporate Shuttle Flights Sydney 7s to Take Place at Bankwest Stadium on 1-2 February Russia's Sirena Travel Signs Multi-Year Retailing Deal with ATPCO Shell to Use Airbus H160 for Offshore Transportation ANA to Operate International Flights Out of Haneda T2 and T3 from 29 March CAL Group Makes Changes to Inflight Services on Taiwan-HK / Macau Routes Philippines Suspends Visa Upon Arrival Service for Chinese Nationals UK Visitor Arrivals Spending Up 19% in October 2019 Todd Probert Joins CAE as Group President, Defence & Security Six Senses Appoints Mark Sands as Vice President of Wellness Air France and Sata Azores Airlines Start Codesharing Norwegian Implements New Hand Baggage Policy AirAsia X Launches KL - Taipei - Okinawa Flights First Boeing 777-9 Begins Flight Tests Accor Commits to Global Elimination of Single-Use Plastics by 2022 Etihad Receives EASA Approval to Train Boeing 777, 787 Pilots Jeane Lim Appointed GM of Grand Park City Hall Hotel in Singapore Whitbread Opens First hub by Premier Inn Hotel Outside of London's Zone 1 Delta Enhances Travel Experience for Pets All Blacks Sevens Make History in Hamilton Air Canada Becomes Official Airline of Cirque du Soleil Pictures from Ascot United vs Hanworth Villa SHOW DC Hall to Give Bangkok's MICE Industry a Significant Boost IHG Signs First voco Hotel in New Zealand OYO Signs Global Distribution Agreement with Sabre Hong Kong Cancels Chinese New Year Carnival NAC Orders 20 Airbus A220 Aircraft IHG to Launch Customer Insights Portal for Large Enterprises Cathay Pacific Reports December 2019 Traffic Duetto Appoints David Woolenberg as CEO Phuket to Host Thailand Travel Mart (TTM+) 2020 in June Sabre and Accor to Create Unified Technology Platform for Hospitality Industry Groupe Couleur to Manage RWC 2023 Official Travel Agent Selection Process Two Senior Global Marketing Appointments at IHG ANA Begins Autonomous Electric Bus Trial at Haneda Airport China Airlines and Mandarin Airlines Cancel Flights to Wuhan, China Rosa Wong Joins Hotel Alexandra HK as Director of Event Management Four Seasons Madrid Now Accepting Reservations UK Military Flight Training System Orders 4 More H145 Helicopters Sabre Forges 10-Year Partnership with Google Accor Expands Pullman Brand to Rotorua, New Zealand Korean Air Reveals More Details of New SkyPass FFP Airbus to Produce A321 Aircraft in Toulouse, France Cornelia Mitlmeier Joins Four Seasons Dubai as Resort Manager Hotel Alexandra Appoints Daniel Chan as Executive Chef SITAOnAir Acquires GTD Air Services Boeing Hoping for 737 MAX Ungrounding in Mid-2020 1.5 Billion Int. Tourist Arrivals in 2019; UNWTO Forecasts 4% Increase in 2020 Hong Kong Airport Handled 71.5 Million Passengers in 2019 Ascott Opens First Citadines in Osaka, Japan Thai Airways Appoints New Chairman Singapore Airshow Aviation Leadership Summit to Take Place 9-10 Feb PATA Forecasts Over 971 Million Int. Visitor Arrivals into Asia Pacific by 2024 Green Light for Garmin G5000 Avionics Upgrade on Learjet Aircraft Four Seasons Silicon Valley Installs High-Tech AI Gym in Select Rooms Assistance Requests for Airline Pax with Intellectual Disabilities up 762% Accor Opens Mercure Resort in Vung Tau, Vietnam Vietjet Launches Flights Between Dalat and Seoul FlyArystan Reports First Year Load Factor of 94% Amadeus Looks at How Technology Will Shape Airports of the Future CALC Signs Purchase Agreement for 40 A321neo Aircraft Daniele Polito Joins Four Seasons Seoul as Boccalino's Chef de Cuisine Charlotte Svensson to Join SAS as EVP and CIO Airbus Helicopters Appoints Head of External Communications Thailand: Did Strength of Thai Baht Affect Number of Arrivals from UK in 2019? What Does TAT Have Planned for Thailand Travel Mart (TTM+) 2020? Exclusive Interview Seaplanes in Thailand? Interview with Dennis Keller, CBO of Siam Seaplane Future of Airline Distribution and NDC - Interview with Yanik Hoyles, IATA Cambodia Airways Interview with Lucian Hsing, Commercial Director HD Videos and Interviews Podcasts from HD Video Interviews Travel Trade Shows in 2019, 2020 and 2021 High-Res Picture Galleries Travel News Asia - Latest Travel Industry News Read the full article

#0aprtravelcreditcards#0interesttravelcreditcards#0travelcards#0travelcreditcards#0travelmoney#0traveltrain#1travel2000#1travelinsurance#2travel2egypt#2traveldads#2traveldialindicator#2travelindicator#2travelinsurancepolicies#2traveltogether#2travelersgarrettsville#2travelingangelsstory#2travelingdogs#2travelinglovers#3countiestravelnews#3newstravel#3travelbloggers#3travelcreditcard#3travelsim#3travelsimcard#3travelsimeurope#3travelswagger#3travelerscardtrick#3travelersregisteratahotel#3travelingsalesmanriddle#3travellingabroad

0 notes

Text

Aircraft MRO Market Trends, Key Players, And Report 2027

Market Overview

The Aircraft MRO part market of airplane comprises of different administrations connected with aircrafts like update, fix, and upkeep, combined with different oversight and regulatory exercises. It helps in the smooth and proficient working of airplane by reestablishing it to its unique condition of capacity and execution. It comprises of different exact and severe necessities demanded via airworthiness specialists. It guarantees the well being of aircrew, travelers, and freight. Further, it helps in improving dependability, item quality, and accessibility.

The worldwide pandemic of COVID 19 has impacted a significant lump of the populace. Many individuals have lost their occupation due to this worldwide pandemic. It has impacted the elements and development of a few businesses. Everybody is stressed over their resistance and follows social removing. Limitation on movement brought about the constriction of interest. During the lockdown circumstance, functional exercises were stopped, bringing about an interest recoil for the aircraft MRO market, which further prompts diminished deals income. Indeed, even after the advancement of limitations after the lockdown circumstance, airplane were not working at their full limit which additionally declines the market income and market development.

In any case, the aircraft MRO market is relied upon to recuperate from this worldwide pandemic before the finish of the second from last quarter of the approaching year by appropriately planning as per the requirements of the market.

Key Players

Major Key Players for Aircraft MRO Market are Airbus Group, Air France KLM Engineering & Maintenance, Air Works, Delta TechOps, HAECO, Honeywell International, GMF AeroAsia, Jet Maintenance Solutions, ST Aerospace, GE Aviation, Rolls-Royce, Pratt & Whitney, Lufthansa Technik, Safran Aircraft Engines

Get More Professional and Technical Industry Insights @ https://valuepropresearch.com/report/aircraft-mro-market-1157/

Market Dynamics

Drivers

Various variables drive the market in the worldwide market. Expanding enhancement among carriers drives the market request the whole way across the globe. Likewise, the rising number of travelers the whole way across the globe brings about provoking higher interest during the audit time frame. An abrupt ascent in salaries of working class people groups in different areas like the European district, the North American locale, and the Asia-Pacific district brought about improved and effective avionics industry drives the market interest during the survey time frame.

Open doors

The ascent in the interest for airplane part market in the worldwide market. A rising number of airplane avionics particularly in the North American area. It is assessed that by 2035, roughly 10,000 airplanes will be in assistance which gives different learning experiences in the worldwide market during the determined period. Development of different carriers to improve their support of a few far off geographic areas gives different learning experiences in the worldwide market.

Limitations

However the airplane part market is expanding colossally in the worldwide market, a few variables limit the market development. The significant expense related with top caliber and productive upkeep for plane parts impedes the market interest during the estimated period as it isn't managed by all. Additionally, an absence of mindfulness in regards to the accessibility of parts in different areas likewise limits the market development during the survey time frame.

Esteem Chain Analysis

The airplane part MRO is developing at an inconceivable rate all around the world because of different advantages related with it. A rising number of requests from different nations for organization of the F-35 Lightning II Joint Strike Fighter (JSF) plane drives the market interest for the MRO market in the worldwide market. Additionally, the presence of all parts of F-35 JSF combined with fix abilities in the different areas like the Asia-Pacific district, European locale, and the US makes more market fragments during the determined period.

0 notes

Text

Aircraft Health Monitoring Market Ecosystem, Value Chain Analysis, Industry Trends, Futuristic Platforms, Region & Future Scope

The report Aircraft Health Monitoring Market size is projected to grow from an estimated USD 3.3 billion in 2020 to USD 5.5 billion by 2025, at a CAGR of 10.8% during the forecast period. This growth can be attributed to the increasing aircraft operational and flight safety activities.

The MRO segment accounts for the largest market size during the forecast period

Based on end user, the aircraft health monitoring market has been segmented into MRO, OEMs and Airlines are considered in the aircraft health monitoring market. The MRO is estimated to be account for the largest share in the aircraft health monitoring market. Increase in aircraft modernization programs is one of the most significant factors driving the MRO segment in the aircraft health monitoring market.

The commercial aviation segment is projected to grow at the highest CAGR during the forecast period