#Euro 7 compliance

Explore tagged Tumblr posts

Text

Mazda Continuă Dezvoltarea Motoarelor Termice: Noul Skyactiv-Z și Confirmarea viitorului SUV CX-5

Mazda continuă să investească în dezvoltarea motoarelor termice și confirmă lansarea unei noi generații de propulsoare pe benzină, alături de viitoarea generație a SUV-ului său popular, CX-5. Aceasta decizie surprinde, având în vedere trendul actual al industriei auto spre electrificare totală. Totuși, Mazda reiterează angajamentul față de performanță și eficiență printr-o combinație de…

#automotive innovation#combustie eficientă#CX-5#efficient combustion#eficiență energetică#electrificare Mazda#energy efficiency in cars#Euro 7#Euro 7 compliance#hybrid and electric vehicles#hybrid și electric Mazda#industria auto#inovare auto#internal combustion#Mazda#Mazda engine#Mazda future models#Mazda SUV#motor termic#motorizare pe benzină#new engine generation#noua generație Mazda#Skyactiv technology#Skyactiv-Z#SUV#tehnologie motor#viitor Mazda

0 notes

Text

How to Register a Company in the EU: A Step-by-Step Guide by Euro Company Formations

The European Union (EU) is an attractive location for entrepreneurs looking to expand their businesses into a market of over 450 million consumers. The EU's seamless internal market, robust legal framework, and favorable business environment make it a hotspot for both startups and established businesses.

At Euro Company Formations, we help businesses navigate the complexities of EU company registration, offering expertise and guidance every step of the way. This article provides an overview of the EU registration process and the benefits of incorporating within the EU.

Why Register a Company in the EU?

Register a company in the EU offers numerous advantages:

Access to a Large Market: With 27 member countries, the EU is one of the world's largest markets, providing ample opportunity for business growth.

Favorable Business Regulations: The EU provides clear regulations on trade, intellectual property, and consumer protection, giving businesses a stable environment.

Free Movement of Goods, Services, and Capital: Once established in one EU country, your business can trade freely across the entire EU without additional tariffs or complex regulatory barriers.

Tax Benefits: Many EU countries offer tax incentives and advantages to new businesses, especially those in innovation and technology sectors.

Steps to Registering a Company in the EU

1. Choose Your Business Structure

The EU allows different types of business structures, including Limited Liability Companies (LLCs), Sole Proprietorships, and Public Limited Companies. Choosing the right structure impacts your tax liabilities, personal liability, and reporting requirements. Euro Company Formations can help you select the structure that best suits your business model.

2. Choose a Country for Registration

Each EU country has its own regulations, so it’s essential to choose a country that aligns with your business goals. For instance, Ireland and Estonia are popular for tech startups due to favorable tax regimes and online accessibility.

3. Register Your Business Name

You’ll need to check that your desired business name is available in the chosen country’s commercial register. The name must be unique and comply with any naming conventions.

4. Prepare Required Documents

Most countries require basic documents, including:

Articles of association (company bylaws)

Proof of identity for directors and shareholders

Proof of registered office address

In many cases, you’ll also need to provide proof of funds if starting a capital-intensive business. Euro Company Formations offers services to help organize these documents and ensure compliance with local regulations.

5. Register with Tax Authorities

Once your company is legally established, you must register with the relevant tax authorities for VAT, corporation tax, and, in some cases, employee payroll taxes.

6. Obtain Necessary Licenses and Permits

Depending on your industry, you may need specific licenses to operate legally within the EU. This includes permits for regulated sectors like finance, healthcare, and pharmaceuticals.

7. Open a Business Bank Account

Opening a business bank account in the EU simplifies transactions and helps establish credibility. Many banks require proof of company registration, identification of the company's directors, and sometimes even a business plan.

Why Choose Euro Company Formations?

At Euro Company Formations, we simplify the process by offering personalized guidance and support tailored to your business needs. Our experienced team has in-depth knowledge of each EU country’s specific requirements, ensuring your company registration is smooth and hassle-free.

Benefits of Partnering with Euro Company Formations:

Personalized Assistance: From choosing the best jurisdiction to completing paperwork, we offer end-to-end support.

Quick and Reliable Service: We handle all the paperwork and liaise with local authorities, reducing your waiting time.

Cost-Effective Solutions: Our services are designed to save you both time and money.

Long-Term Compliance Support: We offer ongoing support to help you stay compliant with EU regulations.

Conclusion

Registering a company in the EU is a strategic step towards expanding your business. By working with Euro Company Formations, you can navigate the complexities of the EU market with ease and focus on what matters most—growing your business. Let us help you unlock the opportunities of the European market today!

#euro company formations#register company in eu#company formations europe#europe company registration

2 notes

·

View notes

Text

https://www.reuters.com/world/europe/eu-countries-back-landmark-artificial-intelligence-rules-2024-05-21/

BRUSSELS, May 21 (Reuters) - Europe's landmark rules on artificial intelligence will enter into force next month after EU countries endorsed on Tuesday a political deal reached in December, setting a potential global benchmark for a technology used in business and everyday life.

The European Union's AI Act is more comprehensive than the United States' light-touch voluntary compliance approach while China's approach aims to maintain social stability and state control.

The vote by EU countries came two months after EU lawmakers backed the AI legislation drafted by the European Commission in 2021 after making a number of key changes.

Concerns about AI contributing to misinformation, fake news and copyrighted material have intensified globally in recent months amid the growing popularity of generative AI systems such as Microsoft-backed (MSFT.O), opens new tab OpenAI's ChatGPT, and Google's (GOOGL.O), opens new tab chatbot Gemini.

"This landmark law, the first of its kind in the world, addresses a global technological challenge that also creates opportunities for our societies and economies," Belgian digitisation minister Mathieu Michel said in a statement.

"With the AI Act, Europe emphasizes the importance of trust, transparency and accountability when dealing with new technologies while at the same time ensuring this fast-changing technology can flourish and boost European innovation," he said.

The AI Act imposes strict transparency obligations on high-risk AI systems while such requirements for general-purpose AI models will be lighter.

It restricts governments' use of real-time biometric surveillance in public spaces to cases of certain crimes, prevention of terrorist attacks and searches for people suspected of the most serious crimes.

The new legislation will have an impact beyond the 27-country bloc, said Patrick van Eecke at law firm Cooley.

"The Act will have global reach. Companies outside the EU who use EU customer data in their AI platforms will need to comply. Other countries and regions are likely to use the AI Act as a blueprint, just as they did with the GDPR," he said, referring to EU privacy rules.

While the new legislation will apply in 2026, bans on the use of artificial intelligence in social scoring, predictive policing and untargeted scraping of facial images from the internet or CCTV footage will kick in in six months once the new regulation enters into force.

Obligations for general purpose AI models will apply after 12 months and rules for AI systems embedded into regulated products in 36 months.

Fines for violations range from 7.5 million euros ($8.2 million) or 1.5% of turnover to 35 million euros or 7% of global turnover depending on the type of violations.

($1 = 0.9199 euros)

3 notes

·

View notes

Text

WOTP manson rig update!

looks like the euro rig has some different beauties in the lineup, heres a little breakdown for anyone interested :)

mansons kept in the rig: Matt Black FR(Matt Black Whammy), Chrome FR(Chrome Whammy), Chrome FR 2.0, Verona Sky, M1D1 Stealth*, Oryx*, Red Alert, Holoflake***, Manson Black 7-String 2.0**

*technically matt's using a different guitar but its exactly the same, just a duplicate of it **only used for special songs(MOTP/Citizen Erased)

matt's brought back Matt Black LED 2.0(aka TronCaster) which hasn't been used since 2019! looks like she's replaced the MB-1 Blue which makes sense since their hardware is basically identical, Sustainiac Humbuckers on the neck and Psychopafs on the bridge. she's taking over the Blue Steel songs, look out for her in TIRO, Madness, and Resistance!

sad news for Mirror stans, looks like its Chrome Fuzz's turn with PIB. it can be hard to see, but besides the obvious difference in finish, Chrome Fuzz also has slightly flatter knob covers, though the placement is similar to Mirror 2.0. she seems to be the same as Mirror 2.0 in every other way, but we will miss Mirror's shine.

photos from x

of course the most notable addition to the rig: Mask aka WOTPcaster!!! i'm ngl this one has been throwing me for a loop and a half. obviously she's a beaut and we're so happy to have her here, she's taking on a lot of the heavy lifting Chrome Whammy was doing on the U.S. leg. appropriately, matt's using her to start the show with WOTP and Interlude/Hysteria. makes perfect sense as she's built as somewhat of a simplified version of Chrome FR, just lacking the tremolo system, kill switch, and YES/NO toggle switches, and presumably is in standard tuning. she's got the standard single coil Sustainiac in the neck and a Psychopaf humbucker in the bridge, nothing new or fancy.

where it gets kinda funky is matt has also been using her for WAFF. matt used Matt Black 3.0 for WAFF in the U.S. leg, and that was the only song he used her for. Matt Black 3.0 has been tuned in Drop D in the past, so i assumed the drop tuning is why she was only used for one song, like Holoflake(Drop C for MOTP). if that's true, using WOTPcaster for WAFF would not make any sense, at least in my uneducated opinion, since they have entirely different tuning. it could be that MB3.0 was only used for WAFF because of special hardware, however replacing her with WOTPcaster wouldn't make much sense there either since they have different neck pickups, and the mods for WOTPcaster aren't that fancy where i could see him making it have the same sound without a humbucker. MB3.0 was damaged in the U.S. leg, but matt has another version of it in the euro rig anyway so basically i'm just very confused. but happy to be here anyway.

Final Euro rig lineup:

WOTPcaster: WOTP, (Interlude)Hysteria, WAFF

Chrome FR*: Compliance, Thought Contagion, KOC

Chrome FR 2.0: Halloween

Matt Black FR: Psycho

Oryx: WSD, KOBK

TronCaster: TIRO, Madness, Resistance

Verona Sky: Verona, TDS(AR)

M1D1 Stealth: SBH

Chrome Fuzz: PIB

Red Alert: Uprising

Holoflake: MOTP

Black 7-String 2.0: Citizen Erased

*also used for cycled songs excluding MOTP and CE

#its throwing me off a little when i try to guess what song they're playing by photo lol#autism things#ok when i said “little” that was clearly a lie sorry i underestimated my insanity once again#i have so many things i should be doing but the mental illness got me#tar.txt#muse band#manson guitars#matt bellamy

15 notes

·

View notes

Text

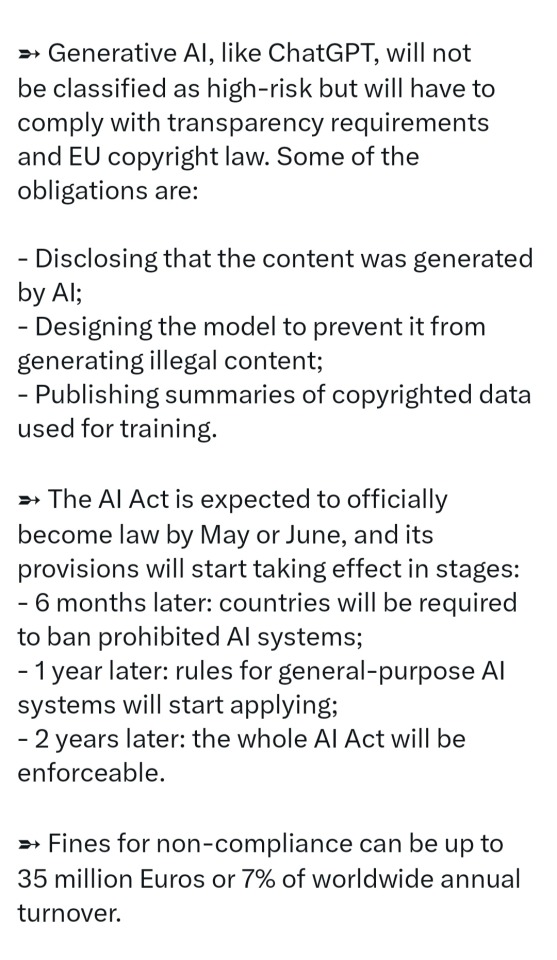

[ID: screenshot of text

→ Generative Al, like ChatGPT, will not be classified as high-risk but will have to comply with transparency requirements and EU copyright law. Some of the obligations are: - Disclosing that the content was generated by Al;Designing the model to prevent it from generating illegal content; - Publishing summaries of copyrighted data used for training. → The Al Act is expected to officially become law by May or June, and its provisions will start taking effect in stages: - 6 months later: countries will be required to ban prohibited Al systems; - 1 year later: rules for general-purpose Al systems will start applying; - 2 years later: the whole Al Act will be enforceable. → Fines for non-compliance can be up to 35 million Euros or 7% of worldwide annual turnover.

/End ID.]

We finally have a European law on artificial intelligence. Always have the law at hand, for whatever may happen 👇🏼

3K notes

·

View notes

Text

Crypto News: Key Insights Shaping the Future of Digital Assets in 2025

The cryptocurrency marketplace maintains to conform at an excellent pace, pushed with the aid of the usage of technological enhancements, regulatory shifts, and international adoption. As we step into 2025, staying up to date with the current crypto facts is critical for customers, clients, and blockchain fans. This article explores the most awesome tendencies shaping the virtual asset panorama and what they propose for the future of cryptocurrencies.

1. Bitcoin and Ethereum:The Market Leaders Maintain Their DominanceBitcoin (BTC) and Ethereum (ETH) continue to be the cornerstone of the cryptocurrency environment. Bitcoin's reputation as "virtual gold" is similarly solidified through developing institutional adoption and the brand new approval of Bitcoin ETFs in vital economic markets. Meanwhile, Ethereum's transition to Ethereum 2.Zero has notably advanced scalability and electricity performance, making it a favored blockchain for decentralized programs (DApps) and clever contracts.

2. The Rise of Central Bank Digital Currencies (CBDCs)Governments worldwide are accelerating their efforts to launch Central Bank Digital Currencies (CBDCs). China’s virtual yuan, the EU’s virtual euro, and the U.S. Federal Reserve’s exploration of a virtual dollar highlight a shift towards u . S . A .-controlled digital currencies. While CBDCs promise economic inclusion and standard typical overall performance, moreover they beautify issues approximately privateness and centralization.

3. The Impact of Regulatory Changes on the Crypto MarketCrypto policies stay a warm problem depend, with governments tightening compliance requirements to decrease illicit sports. The U.S. Securities and Exchange Commission (SEC) keeps its scrutiny of crypto exchanges, on the identical time because the European Union’s MiCA (Markets in Crypto-Assets) law devices a smooth framework for virtual assets. These rules reason to offer investor safety and market stability while fostering innovation.

4. The Emergence of Decentralized Finance (DeFi) 2.0DeFi has revolutionized conventional finance with the aid of way of permitting peer-to-peer lending, borrowing, and shopping for and selling without intermediaries. The next evolution, DeFi 2.Zero, focuses on sustainability, security, and fee enhancements. Protocols are integrating insurance mechanisms, higher governance models, and pass-chain compatibility to cope with the demanding conditions faced thru early DeFi obligations.

5. The Expanding Influence of Non-Fungible Tokens (NFTs)NFTs have transcended digital artwork and gaming, coming into industries like track, actual belongings, and ticketing. Major producers and celebrities are leveraging NFTs for fan engagement, at the identical time as metaverse systems are the use of them to installation virtual ownership. The developing software of NFTs past speculative trading is a testomony to their extended-time period capability.

6. The Role of Artificial Intelligence (AI) in Crypto TradingAI-driven looking for and promoting bots and predictive analytics are reshaping cryptocurrency shopping for and selling. Advanced device analyzing algorithms take a look at marketplace tendencies, execute trades, and reduce risks, imparting each retail and institutional traders a place. AI-powered protection structures are also improving fraud detection and hazard management in crypto transactions.

7. Institutional Adoption and the Future of Crypto InvestmentsLarge financial institutions, hedge price range, and tech giants keep to integrate cryptocurrencies into their portfolios. Companies like Tesla and MicroStrategy have progressed their Bitcoin holdings, at the equal time as most important charge processors which includes PayPal and Mastercard expand their crypto offerings. Institutional interest is a strong indicator of crypto's developing legitimacy and mainstream reputation.

8. The Sustainability Debate: Crypto and Environmental ImpactThe environmental impact of crypto mining stays a controversial trouble. However, current solutions together with renewable electricity-powered mining farms, carbon-independent blockchain networks, and Layer-2 scaling answers much like the Lightning Network are addressing concerns. Ethereum’s flow into to Proof-of-Stake (PoS) has already reduced its strength consumption thru over 99%, placing a precedent for sustainable blockchain practices.

9. The Role of Crypto News in Investor Decision-MakingStaying informed with dependable crypto data is vital for making knowledgeable funding alternatives. With speedy marketplace fluctuations and regulatory modifications, crypto facts structures offer real-time updates, professional analysis, and marketplace predictions. Following credible property permits customers navigate the unstable crypto panorama and seize worthwhile opportunities.

Conclusion

The cryptocurrency marketplace is at a essential juncture, with technological enhancements and regulatory tendencies shaping its future. From Bitcoin’s dominance to the rise of DeFi 2.Zero, CBDCs, NFTs, and AI-pushed buying and selling, crypto keeps to redefine the global monetary surroundings. As the enterprise matures, staying informed with the cutting-edge crypto information can be key to capitalizing on possibilities and mitigating risks in this dynamic area.

0 notes

Text

[ad_1] he test was designed in line with the text of the AI Act. (Photo: Shutterstock)4 min read Last Updated : Oct 16 2024 | 12:11 PM IST Some of the most prominent artificial intelligence models are falling short of European regulations in key areas such as cybersecurity resilience and discriminatory output, according to data seen by Reuters. The EU had long debated new AI regulations before OpenAI released ChatGPT to the public in late 2022. The record-breaking popularity and ensuing public debate over the supposed existential risks of such models spurred lawmakers to draw up specific rules around "general-purpose" AIs (GPAI). Click here to connect with us on WhatsApp Now a new tool designed by Swiss startup LatticeFlow and partners, and supported by European Union officials, has tested generative AI models developed by big tech companies like Meta and OpenAI across dozens of categories in line with the bloc's wide-sweeping AI Act, which is coming into effect in stages over the next two years. Awarding each model a score between 0 and 1, a leaderboard published by LatticeFlow on Wednesday showed models developed by Alibaba, Anthropic, OpenAI, Meta and Mistral all received average scores of 0.75 or above. However, the company's "Large Language Model (LLM) Checker" uncovered some models' shortcomings in key areas, spotlighting where companies may need to divert resources in order to ensure compliance. Companies failing to comply with the AI Act will face fines of 35 million euros ($38 million) or 7 per cent of global annual turnover. MIXED RESULTS At present, the EU is still trying to establish how the AI Act's rules around generative AI tools like ChatGPT will be enforced, convening experts to craft a code of practice governing the technology by spring 2025. But LatticeFlow's test, developed in collaboration with researchers at Swiss university ETH Zurich and Bulgarian research institute INSAIT, offers an early indicator of specific areas where tech companies risk falling short of the law. For example, discriminatory output has been a persistent issue in the development of generative AI models, reflecting human biases around gender, race and other areas when prompted. When testing for discriminatory output, LatticeFlow's LLM Checker gave OpenAI's "GPT-3.5 Turbo" a relatively low score of 0.46. For the same category, Alibaba Cloud's "Qwen1.5 72B Chat" model received only a 0.37. Testing for "prompt hijacking", a type of cyberattack in which hackers disguise a malicious prompt as legitimate to extract sensitive information, the LLM Checker awarded Meta's "Llama 2 13B Chat" model a score of 0.42. In the same category, French startup Mistral's "8x7B Instruct" model received 0.38. "Claude 3 Opus", a model developed by Google-backed Anthropic, received the highest average score, 0.89. The test was designed in line with the text of the AI Act, and will be extended to encompass further enforcement measures as they are introduced. LatticeFlow said the LLM Checker would be freely available for developers to test their models' compliance online. Petar Tsankov, the firm's CEO and cofounder, told Reuters the test results were positive overall and offered companies a roadmap for them to fine-tune their models in line with the AI Act. "The EU is still working out all the compliance benchmarks, but we can already see some gaps in the models," he said. "With a greater focus on optimising for compliance, we believe model providers can be well-prepared to meet regulatory requirements." Meta declined to comment. Alibaba, Anthropic, Mistral, and OpenAI did not immediately respond to requests for comment. While the European Commission cannot verify external tools, the body has been informed throughout the LLM Checker's development and described it as a "first step" in putting the new laws into action. A spokesperson for the European Commission said: "The Commission welcomes this study and AI model evaluation platform as a first step in translating the EU AI Act into technical requirements.

"(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)First Published: Oct 16 2024 | 12:11 PM IST [ad_2] Source link

0 notes

Text

[ad_1] he test was designed in line with the text of the AI Act. (Photo: Shutterstock)4 min read Last Updated : Oct 16 2024 | 12:11 PM IST Some of the most prominent artificial intelligence models are falling short of European regulations in key areas such as cybersecurity resilience and discriminatory output, according to data seen by Reuters. The EU had long debated new AI regulations before OpenAI released ChatGPT to the public in late 2022. The record-breaking popularity and ensuing public debate over the supposed existential risks of such models spurred lawmakers to draw up specific rules around "general-purpose" AIs (GPAI). Click here to connect with us on WhatsApp Now a new tool designed by Swiss startup LatticeFlow and partners, and supported by European Union officials, has tested generative AI models developed by big tech companies like Meta and OpenAI across dozens of categories in line with the bloc's wide-sweeping AI Act, which is coming into effect in stages over the next two years. Awarding each model a score between 0 and 1, a leaderboard published by LatticeFlow on Wednesday showed models developed by Alibaba, Anthropic, OpenAI, Meta and Mistral all received average scores of 0.75 or above. However, the company's "Large Language Model (LLM) Checker" uncovered some models' shortcomings in key areas, spotlighting where companies may need to divert resources in order to ensure compliance. Companies failing to comply with the AI Act will face fines of 35 million euros ($38 million) or 7 per cent of global annual turnover. MIXED RESULTS At present, the EU is still trying to establish how the AI Act's rules around generative AI tools like ChatGPT will be enforced, convening experts to craft a code of practice governing the technology by spring 2025. But LatticeFlow's test, developed in collaboration with researchers at Swiss university ETH Zurich and Bulgarian research institute INSAIT, offers an early indicator of specific areas where tech companies risk falling short of the law. For example, discriminatory output has been a persistent issue in the development of generative AI models, reflecting human biases around gender, race and other areas when prompted. When testing for discriminatory output, LatticeFlow's LLM Checker gave OpenAI's "GPT-3.5 Turbo" a relatively low score of 0.46. For the same category, Alibaba Cloud's "Qwen1.5 72B Chat" model received only a 0.37. Testing for "prompt hijacking", a type of cyberattack in which hackers disguise a malicious prompt as legitimate to extract sensitive information, the LLM Checker awarded Meta's "Llama 2 13B Chat" model a score of 0.42. In the same category, French startup Mistral's "8x7B Instruct" model received 0.38. "Claude 3 Opus", a model developed by Google-backed Anthropic, received the highest average score, 0.89. The test was designed in line with the text of the AI Act, and will be extended to encompass further enforcement measures as they are introduced. LatticeFlow said the LLM Checker would be freely available for developers to test their models' compliance online. Petar Tsankov, the firm's CEO and cofounder, told Reuters the test results were positive overall and offered companies a roadmap for them to fine-tune their models in line with the AI Act. "The EU is still working out all the compliance benchmarks, but we can already see some gaps in the models," he said. "With a greater focus on optimising for compliance, we believe model providers can be well-prepared to meet regulatory requirements." Meta declined to comment. Alibaba, Anthropic, Mistral, and OpenAI did not immediately respond to requests for comment. While the European Commission cannot verify external tools, the body has been informed throughout the LLM Checker's development and described it as a "first step" in putting the new laws into action. A spokesperson for the European Commission said: "The Commission welcomes this study and AI model evaluation platform as a first step in translating the EU AI Act into technical requirements.

"(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)First Published: Oct 16 2024 | 12:11 PM IST [ad_2] Source link

0 notes

Text

Understanding the New Emission Standards: What Truck Owners Need to Know

The trucking industry is undergoing significant changes with the introduction of new emission standards aimed at reducing the environmental impact of diesel engines. As a truck owner, it’s essential to understand these regulations and how they affect your operations. In this blog, we’ll delve into the key aspects of the new emission standards, provide answers to frequently asked questions, and offer guidance on maintaining compliance.

FAQs

1. What are the new emission standards? The new emission standards, often referred to as Euro 6 or Tier 4 standards, are regulations set by environmental agencies to limit the amount of harmful pollutants emitted by diesel engines. These standards require significant reductions in nitrogen oxides (NOx), particulate matter (PM), and other pollutants.

2. How do these standards impact truck owners? Truck owners must ensure their vehicles comply with the new emission standards, which may involve retrofitting older trucks with advanced emission control systems or purchasing newer, compliant models. Non-compliance can result in hefty fines and restricted access to certain areas.

3. What technologies are used to meet these standards? Several technologies help meet emission standards, including:

Selective Catalytic Reduction (SCR): Reduces NOx emissions using a urea-based solution.

Diesel Particulate Filters (DPF): Captures and stores particulate matter from exhaust gases.

Exhaust Gas Recirculation (EGR): Lowers NOx emissions by recirculating a portion of the exhaust gas back into the engine.

4. Are there any maintenance requirements for these technologies? Yes, maintaining emission control technologies is crucial for their effectiveness. Regular inspections, cleaning, and replacement of components like the DPF are necessary to ensure optimal performance and compliance.

5. What should I do if my truck doesn’t meet the new standards? If your truck doesn’t meet the new standards, consider the following options:

Retrofitting: Install emission control systems on your existing truck.

Upgrading: Purchase a new or used truck that meets the current emission standards.

Consulting Experts: Seek advice from professionals in the truck repair industry to explore the best solutions for your situation.

6. Where can I find reliable support for emission compliance? For truck owners in and around Elk City, JG Diesel Repairs and Towing is your go-to solution. We offer expert services, including 24/7 Roadside Assistance Near me, Mobile Truck Repair Elk City, and comprehensive repairs at our Truck repair shop .

Navigating the complexities of the new emission standards can be challenging, but staying informed and proactive is key to ensuring compliance and avoiding penalties. By leveraging advanced emission control technologies and maintaining regular service schedules, you can keep your trucks running efficiently and in line with regulations.

At JG Diesel Repairs and Towing, we are committed to supporting truck owners through these changes. Whether you need emergency roadside assistance, mobile repairs, or comprehensive services at our repair shop, we have you covered. Contact us today to learn more about how we can help you stay compliant and keep your fleet in top condition.

Contact Us:

Phone: +1 (580) 289-0265

Email: [email protected]

Service Area: Serving Elk City and surrounding areas

For the best Truck Repair, Mobile Truck Repair, and reliable services at our Truck repair shop Elk City, trust JG Diesel Repairs and Towing.

Stay ahead of the curve with JG Diesel Repairs and Towing, where your truck’s performance and compliance are our top priorities.

0 notes

Text

9 Tips to avoid scams

To best protect yourself from scams in the trading world, here are some measures to take:

1 – Lack of information is the investor’s first risk Before trusting any broker, trading platform or automated system, do thorough research. Check their online reputation, read our reviews and those of other users. Don't forget to research information about the company or individual behind the service offered.

2 – Check approvals and regulations Make sure the broker or trading platform is regulated by a recognized financial authority. Regulators provide some protection to investors by ensuring compliance with standards and investigating questionable practices.

💡 Take the reflex to consult the AMF website to check these approvals.

3 – Caution when faced with promises of high returns Be wary of promises of quick and unrealistic returns . Financial markets involve risks, and no so-called “risk-free” investment can guarantee consistent and high gains.

To give you an idea of the aberration that unrealistic returns can represent , here is an example:

A trainer promises you to earn 10% per month This means that an investment of €10,000 over 10 years would earn you… €927,000,000 Yes, almost a billion euros! However, this example allows me to remind you of the power of compound interest. You can use this compound interest calculator to assess the credibility of what you are promised.

4 – Focus on training and education Learn the basics of trading and investing. A solid understanding of financial markets and investment strategies can help you spot potential scams.

🚨 But be careful! Fake training is common and sometimes sold at high prices to appear more “credible”. You can already start with our free 7-day training to get the basics .

5 – Ask for references If you are considering hiring a portfolio manager or investment advisor, ask for references and inquire about their experience and qualifications.

🧐 And above all, cross-reference information because it is very easy to create fake profiles on social networks.

6 – Be particularly wary of unsolicited calls and emails Be cautious of any unsolicited calls or emails urging you to invest money. Scammers often use these methods to target potential investors.

Likewise, a common technique is to pose as an online bank or a well-known neobank (such as Revolut ) in order to offer you particularly attractive investments.

But it is generally enough to go to the website of the bank in question (or our reviews ) to verify that these investments simply do not exist.

7 – Use secure platforms If you trade online, be sure to use secure platforms with adequate encryption to protect your personal and financial information, such as double authentication. This will also make it easier for you to recover your account in the event of a hack.

➡️ We have checked the security of each platform in our comparison of the best brokers & stock brokers .

8 – Consult an independent financial advisor Before making any significant investment decision, consult an independent financial advisor . He will be able to provide you with personalized advice based on your objectives and help you avoid potential pitfalls.

9 – Listen to your instinct If something seems too good to be true, or simply raises doubts, don't rush headlong into it.

Take the time to think and find out more before sending any euro or your banking information.

1 note

·

View note

Text

Finally: Europe Has a Preliminary Agreement on New AI Regulations - Technology Org

New Post has been published on https://thedigitalinsider.com/finally-europe-has-a-preliminary-agreement-on-new-ai-regulations-technology-org/

Finally: Europe Has a Preliminary Agreement on New AI Regulations - Technology Org

On Friday, Europe achieved a preliminary agreement on groundbreaking European Union regulations addressing the use of artificial intelligence. This agreement also spans government applications of AI in biometric surveillance and the regulation of AI systems like ChatGPT.

EU flags – illustrative photo. Image credit: Guillaume Périgois via Unsplash, free license

This political consensus propels the EU towards becoming the first major global entity to establish laws governing AI.

The agreement was reached after nearly 15 hours of negotiations between EU member states and European Parliament representatives, following a nearly 24-hour debate the previous day.

Both sides will continue to work on refining the details in the coming days, potentially influencing the final shape of the legislation.

The agreement mandates that foundation models like ChatGPT and general-purpose AI systems (GPAI) must adhere to transparency requirements before entering the market. These requirements also require creating technical documentation, compliance with EU copyright laws, and providing detailed summaries about the content used for training.

High-impact foundation models posing systemic risks are obligated to undergo model evaluations, assess and mitigate systemic risks, conduct adversarial testing, report serious incidents to the European Commission, ensure cybersecurity, and disclose information on energy efficiency.

GPAIs with systemic risks may choose to adhere to codes of practice to meet the new regulatory standards.

Governments are limited to using real-time biometric surveillance in public spaces under specific conditions, such as cases involving victims of certain crimes, prevention of genuine and imminent threats like terrorist attacks, and searches for individuals suspected of the most serious crimes.

The agreement explicitly prohibits cognitive behavioral manipulation, untargeted scraping of facial images from the internet or CCTV footage, social scoring, and biometric categorization systems aimed at inferring political, religious, philosophical beliefs, sexual orientation, and race.

Consumers would be granted the right to file complaints and receive meaningful explanations, with fines for violations ranging from 7.5 million euros ($8.1 million) or 1.5% of turnover to 35 million euros or 7% of global turnover.

The legislation is anticipated to come into effect early next year, following formal ratification by both sides, and is slated to be applicable two years thereafter.

Written by Alius Noreika

You can offer your link to a page which is relevant to the topic of this post.

#A.I. & Neural Networks news#ai#applications#artificial#Artificial Intelligence#artificial intelligence (AI)#Authored post#biometric#chatGPT#compliance#consumers#copyright#cybersecurity#details#efficiency#energy#energy efficiency#eu#Europe#european union#European Union (EU)#Featured information processing#Featured technology news#Foundation#Global#Government#images#intelligence#Internet#Link

0 notes

Text

A Comprehensive Checklist for Choosing Technical Rubber Products Manufacturers

In the modern-day interconnected world, locating the right producer for technical rubber products is critical for industries counting on precision and sturdiness. The Netherlands, acknowledged for its cutting-edge technology and commercial prowess, is a hub for various production sectors, along with technical rubber merchandise. When navigating the online world for a reliable producer, it is important to have a comprehensive checklist to ensure you're making the right choice. Make the following considerations before purchasing technical rubber products online to get returns on every Euro you spend.

1. Define Your Requirements:

Begin by defining your technical rubber product requirements. Understand the specifications, dimensions and performance criteria you need. This consideration will assist you to filter producers based on their potential to fulfill your specific needs.

2. Certifications and Compliance:

Ensure that the technical rubber products manufacturer selling online in the Netherlands adheres to enterprise requirements and has the necessary certifications. Look for ISO certifications and compliance with relevant management systems. This guarantees that the producer follows quality practices and produces merchandise of high quality.

3. Material Expertise:

Check the manufacturer's information in managing exclusive rubber substances. Technical rubber products can vary substantially on the kind of rubber used. Ensure that the producer has experience in the particular rubber compound required for your needs.

4. Customization Capabilities:

A dependable producer will provide customization options to satisfy your unique necessities. Whether it's a specific length, shade or layout, the producer will be capable of tailoring their merchandise for your specifications.

5. Production Capacity:

Evaluate the manufacturing capacity of the technical rubber products manufacturer selling goods online in the Netherlands. Ensure they are able to handle your order size within your required timeline. This is important for industries with high demands and tight schedules.

6. Quality Control Processes:

Inquire approximately about the manufacturer's quality control tactics. A robust control system ensures that every product meets the desired requirements. This may additionally consist of inspections at numerous levels of manufacturing to rectify any defects.

7. Technology and Innovation:

Look for technical rubber products manufacturers selling online in the Netherlands that spend money on modern technology generation and innovation. A company that remains abreast of the new advancements in rubber manufacturing is much more likely to supply products with superior performance and durability.

8. Reviews and Testimonials:

Research the manufacturer's goodwill through studying reviews and testimonials from previous clients. This gives insights into who has associated with the producer, helping you make a knowledgeable choice.

9. Supply Chain Transparency:

A transparent delivery chain is critical for ensuring the reliability of your technical rubber products. Ask the manufacturer about their sourcing practices and the way they make certain the availability of raw materials.

10. Communication and Support:

Effective communique is key to a trusted partnership. Assess the producer's responsiveness timeline and willingness to provide assistance. A producer who values clear communication is more likely to cope with any hindrances right away.

The method of choosing a technical rubber products manufacturer online within the Netherlands calls for careful attention and a scientific technique. By defining your requirements, making sure certifications, comparing customization abilities and thinking about factors like production capability and quality control procedures, you could navigate the extensive array of options and make a knowledgeable choice. Remember, investing time within the selection process will pay off in the end, making sure a dependable delivery of incredible technical rubber merchandise for your enterprise.

#technical rubber products online#technical rubber#neoprene rubber#rubber products online#rubber products

0 notes

Text

In today’s interconnected world, globalization testing is a critical process that ensures your software or application functions seamlessly across diverse cultures and languages. It is essential for businesses that want to reach a global audience and provide an inclusive user experience. At SDET Tech, we understand the importance of globalization testing and the key factors to consider while performing it for your software. In this blog, we’ll delve into the significant aspects of globalization testing to help you ensure international success for your product.

The following are some key factors that need to be considered when performing globalization testing:

1. Linguistic Diversity and Localization One of the primary aspects of globalization testing is linguistic diversity. Your software should be able to display content in multiple languages, which means the user interface (UI) should adapt to the language and culture of the user. For this, make sure that:

Translations are accurate and culturally sensitive.

Date formats, time zones, and currency symbols are localized.

Text doesn’t get cut off due to character length differences in various languages.

2. User Interface and Layout Different languages might require more space on the screen than others. Pay attention to the UI layout to ensure it accommodates longer or shorter text strings. Also, consider the use of right-to-left (RTL) languages like Arabic or Hebrew, which requires a different UI design.

3. Date and Time Formats Ensure that date and time formats automatically adapt to the user’s region. Some countries use day/month/year while others use month/day/year. Also, consider time zone differences and daylight saving time adjustments.

4. Currency and Numeric Formats Financial data, such as currency symbols and number formats, should be tailored to the user’s location. For example, in the U.S., you use the dollar sign ($) and comma (,) as a thousands separator while in Europe, it’s often the euro symbol (€) and a period (.) as the thousands separator.

5. Character Encoding Make sure your software supports various character encodings. Unicode (UTF-8) is a common encoding standard that allows your application to display a wide range of characters from different languages.

6. User Input and Data Validation Consider language-specific input methods, keyboard layouts and data validation rules. For example, some languages have unique characters that should be supported for user input.

7. Accessibility that Ensures Inclusivity Ensure your software is accessible to a wide range of users irrespective of their abilities. Implementing accessibility features like screen reader support, keyboard navigation and text-to-speech capabilities is important.

8. Test Across Multiple Platforms Globalization testing should be conducted in various environments, including different operating systems, browsers and devices. Ensure that your software is compatible with the technology that is commonly used in the targeted regions.

9. Local Regulations and Compliance Be aware of local laws and regulations, such as data privacy laws (e.g. General Data Protection Regulation in Europe). Ensure your software complies with these regulations when it handles user data.

10. Comprehensive Testing Approach Globalization testing should not be a one-time effort. It should be integrated into the development cycle, from the early stages of design to continuous monitoring and improvement.

The Way Forward Globalization testing is the most crucial aspect of software development for businesses aiming to reach a global audience. At SDET Tech, we understand the complex nature of globalization testing and the importance of ensuring that your software works seamlessly across diverse cultures and languages. By considering the key factors mentioned above, one will not only expand their global reach but also provide an inclusive and culturally sensitive user experience for users across the globe.

0 notes

Text

Will the digital freedom restrictions have an impact on women’s mental health?

From loss of jobs to loss of loved ones to loss of freedom, the COVID disruption has brought about a climate of uncertainty among all generations, especially women. Falling incomes, job uncertainties, isolation, social restrictions have impacted women during the pandemic.

In South Korea, there was a 7% increase in suicide rates among women. 1,924 women in their late teens and 20s committed suicide in the first half of the year. Less than a thousand kilometers from South Korea, in Japan, the economic crisis has impacted women, which resulted in female suicides jumping up by 40% in August 2020.

As World Mental Health Day 2020 focused on investing resources towards improving mental health, the world needs to invest in a broader mindset towards improving the mental health of women. And that can only happen by giving them their due freedom on both fronts - digital and physical.

Restrictions on the digital freedom

In its last survey that was conducted in 2018, ‘Freedom on the Net’, a comprehensive study of internet freedom in 65 countries around the globe, covering 87 percent of the world’s internet users. It tracked improvements and declines in internet freedom conditions each year. Of the 65 countries assessed, 26 had been on an overall decline since June 2017, compared with 19 that registered net improvements. The biggest score declines took place in Egypt and Sri Lanka, followed by Cambodia, Kenya, Nigeria, the Philippines, and Venezuela.

Earlier this year, in June, the authorities in Egypt arrested five of its citizens — all of them were women — all of them in their early twenties — all of them were social media influencers — all of them were from working-class backgrounds. This was for posting videos of themselves on social platforms promoting products and services from brands they have been paid to endorse.

In Egypt, with influencers imprisoned for ‘violating public morals, and the values and principles of the Egyptian family’, the question being asked is if the alleged wrongdoings are being tried under the correct legal charges, or if broad cultural grey areas are replacing the legal black and white. Egypt, and especially her youth, has repeatedly shown the world the desire and willingness to be a valued member of a global, digital community. They are now at the cusp of another transition.

Digital media censorship?

In Germany, instead of censoring the content shared by its people, it introduced a law called 'Network Enforcement Act' or NetzDG in 2017. NetzDG obligates all social media platforms with over 2 million users to delete any content that promotes hate speech or offends religious sentiments posted on their platforms within 24 hours from the time of posting. NetzDG is effective, because when a social media platform fails to delete the content within the stipulated timeframe, NetzDG punishes the violating company with steep fines of up to 50 million euros for non-compliance.

Laws need to be applied to content that clearly incites danger – whether to do with individual harm, mass violence, or national security matters. Governments need to listen, to adapt, and to harness their energies, rather than impose unreasonable expectations. There needs to be a new social compact to meet the youths’ desire to express themselves freely, and, at the same time, respect societal values – one that is achieved by consultation, not coercion.

While social media platforms, whether, due to their own aggressive content guidelines, or the restrictive framework set by the countries they are being used in, are proactively deleting content that's even remotely sensitive, it must be remembered that over-implementation of such censorship is a violation of human rights law under Article 19 of the International Covenant on Civil and Political Rights.

Any censorship that misleads people at large must be censored. Only then, can we pave the way for a more transparent future. Many countries have shown that highlighting and recognising influencers with positive social messages can have an impact on the wider pool content being created. At the same time, authorities need to recognise that it is not feasible to impose ‘One Country, One Culture’, as the Internet already provides spaces and content for every imaginable interest group. This seriously impacts the mental health of today’s youth especially women.

Thankfully, the power of the internet and digital allows us to step beyond closed doors. Unfortunately, for women, their right for freedom is curbed and trampled upon even in virtual space.

Are we ready to support them?

9 notes

·

View notes

Text

The Longest Day

Monday and we had to be on the ferry to Milos island by 9.30. The guys at the apartments were dropping us off to the ferry terminal at the Port about 4kms away and they were pretty relaxed about timing. We left just after 9.00 for the short trip. They were right, ferry was nowhere to be seen and took another 20 mins or so to roll up. The port was small but quite busy with people waiting for the ferry. The local fishermen on one boat displaying their catch and selling it to any interested parties ie individual fish. Liz noticed a large eel which unfortunately for it must have got caught in the nets. We hadn't noticed eel on the menu so not sure what they do with that. Also there were the ubiquitous cats hovering around looking for a feed. They seem to like and look after the cats in Greece (seen far more than dogs) though they need to do some serious doctoring of the male ones as skinny mother cats fending for several offspring are everywhere. The island ferry boarding routine is much more structured than at Piraeus. There was a place to queue and a policeman in attendance to make sure you were standing in the right area. Also time is money so when the ferry did roll up they hurry you off and hurry you on. Total turnaround time less than 15 mins. Anyway an uneventful trip of an hour ensued fairly calm and some good views of islands along the way. We were met at the dock by the delightful and friendly Panos from our new digs the Hotel Rigas which is a 10 minute walk from the centre of Milos town. We jumped in his old Volvo cramming the bags in for the short drive. Our room spacious with a very large balcony. There are sea (more Port) views but only from one end of the balcony at the side of the building. We essentially face backwards onto a vacant block of land with a few houses behind it. No prob though, we are lucky to have this large room and balcony. Panos in particular but also brother Christos could not be more different to our hosts at the apartment in Folegandros. Let's charitably say they were a bit diffident in Folegandros. Here, nothing seems too much trouble. All tinged with some good humour and, from both, though Panos in particular, superb and subtle English. He has passed the ESL teacher's stringent evaluation with flying colours. Panos is a football fan (nut) and of all teams supports Newcastle United in the UK (how many Greeks do that?). We swopped a few soccer stories. Rooms were not ready so by 11.30 we were on our way to the local beach just a few hundred metres up the road on a very warm day. Planning to return mid to late afternoon. This beach is essentially the town beach so not one of those delightful coves but not particularly crowded. A few people in the cheap seats sheltering under the sporadic trees along the foreshore and the same number sitting under umbrellas on beach beds. We did the latter for the princely some of 8 euros for the two beds. The pretty cheap seats. Compared to Sicily this was a saving of 20 euros. We settled in, swam of course, read books, blogged and snoozed on and off from around mid-day to gone 6.00pm. We were pretty much the last to leave our little area of beach beds. Two tavernas nearby for refreshments though we just went for the toasted sarnie. Very relaxing intro. Panos got quite a shock when we rolled back to the hotel around 6.30 given he had last seen us at 11.30 heading off. It was a good and enjoyable stint. Showers and some more downtime (as if we needed it) and it was off to dinner. Panos had recommended two restaurants - one for fish and one for meat. We fancied the fish restaurant which he also said was his favourite. As we we heading off so was he from the hotel his shift presumably over. He pulled over to ask if we wanted a lift which was not necessary as the restaurant was just a couple of hundred metres away but he did offer to pull over there and ask them to find us a good place in the line and a good table. We arrived a few minutes later and dropped his name but either we asked the wrong person or it didn't work as 4/5 ahead of us. We decided to wait and repared to the bar for a drink. Didn't take long, about 25 mins later we were in, partly because couple before us were no shows. Seats weren't ideal so the Panos connection had definitely not worked. The restaurant is by the sea but the early arrivals nab the seafront seats and we were 3 back. That wasn't so much of a prob except that was close to the road and also a bit drafty. We were feeling a bit cool, though had brought something to slip on. Cool on a Greek island in July - not what we expected. Anyway, Liz did her fish inspection and came up with a couple of corkers - common Bream and Common Pandora. They were out of the box. Absolutely delightful. Cooked closed on the charcoal grill and we filleted them ourselves (keeps them warmer for a start). They did offer to do that at the table but Liz declined and the maitre de agreed that if he was us he would do it himself as well. The fish came with vegetables and of course bread and we soon knew why the place was Panos' favourite. Rose wine, as ever, deplorable though. We strolled around town for a bit after that and found a place selling craft beers. First one we've seen in Greece though weren't looking hard. A couple of acquisitions for consumption on the balcony in the next few days. It had been a good day. Tuesday a measured start. Not too early as usual. Breakfast at hotel was a casual and enjoyable one. Fruit, yoghourt, pastries, cheese, ham, tomatoes. Again putting the Folegandros place to shame where breakfast was not part of the tariff though similar priced rooms. We caught a bus just after midday to a beach around 7/8kms away. Paliochori. Liked the place straight away in a nice largeish cove with beach chairs for 15 euros a set and a taverna right behind. We settled in for what turned out to be a 4 hour stay lazing basically. Liz did have a swim and we hauled ourselves the 15 metres or so up to the taverna for lunch. Taramoslata and fries. Odd mix but both were good. Crusty bread of course. Sitting beside us on the beach was a lady of Greek origin from Sydney who ran her own business selling handbags and luggage wholesale. She was here catching up with family in various places and then heading to New York to buy more bags. She was fun and interesting to chat to. Every now and then you get a real reminder that we just don't all do the same things. I thought everyone was in risk and compliance. Well of course in one way we are. Bussed it home. The bus entry was not a particularly dignified affair. Finite number of seats. Smallish bus and fair bit of manoeuvring if not quite jostling. We got a couple of the last two seats though only one guy had to stand as it turned out. We had a couple of drinks on the balcony before heading out. We now have the travelling vodka and a fresh lime and of course my draft beers. Dinner was a simple affair of grilled sardines and Greek salad. Both excellent. Post dinner on the recommendation of the lady from Sydney we wandered up to the top of town via some steps and found a pretty church. Closed and quiet at around 10.00pm. We kept walking and found a pretty chic but relaxed cocktail bar at the top of a small hill/cliff overlooking the docks including the fancy motor boats. A caipiroska x2 later and we were feeling pretty mellow enjoying the view and just chilling. Post drinks we did go for a stroll around the dock area looking at the multi million dollar boats and a few beautiful (and not so beautiful) people adorning them. The next stage of our trip partly unbooked at this stage had needed resolving. We had to decide where we wanted to spend the next 2.5 weeks (Istria in Croatia has been the plan). Liz had also been sussing car hire costs and they seemed cheaper from Trieste in Italy than Croatia though all sorts of permutations were considered including flying to Split and a range of other places. Of course also had to be sure if there was a loading to get the car out of Italy and use in Croatia which might make it prohibitive. Liz rang thrifty in Trieste to confirm the policy. Extra 40 euros - not too bad. That morning we had therefore booked the ferry off the island and a flight to Trieste from Athens. We could have caught a flight off the island which would have been tempting given only 45 mins to Athens compared to 4 hours on ferry plus taxi ride but it didn't quite line up with the flight to Trieste. Aggravatingly we had to catch the 11.25 ferry rather than one an hour earlier which would have made the journey to the airport more flexible (train or cab) as only 1 seat available on the earlier ferry. It's pretty busy over here. Again last minute booking caught us out slightly but that's the trade off for flexibility. Our leeway to the connecting flight now reduced and let's hope ferry on time unlike when arriving. After drinkies at the cocktail bar we arrived back at the hotel around 12.30-1.00am and got back into planning in earnest. We need to book a couple of nights in Trieste, a car for the 2.5 weeks pre-Riga and also book a flight from somewhere to Riga on 5/8 where we are meeting friends the Boxes. Various considerations eg needed a 24 hour front desk location ideally close to the centre in Trieste given late flight arrival and didn't want to have to trek into Trieste from suburbs on our 1 day there. Cost is also a consideration with a variety of options possible. The biggest conundrum really was the flight to Riga which was proving expensive and Liz investigated all ports of disembarkation in Europe it seemed trying to find a good deal eg. fly to Istanbul and then fly to Riga, fly back to London then to Riga. Catching various trains across the old Eastern Europe. Swings and roundabouts with all options and she was getting frustrated. Also car hire costs seemed to swing dramatically and the great deal of 1 day ago in Trieste seemed to have evaporated. Also car availability was diminishing the with some options no longer available (thrifty). ahhhhhhhh!!! We did book the hotel for 2 nights in Trieste but gave up on flight and car hire just before 4.00am, knackered. The next morning we vowed to complete this. Well not much choice really. Post breakfast the car was booked through Budget (via car rental.com) not as good a deal as the Thrifty one but not too bad and we drop it off at Rome airport where we also found a reasonable flight to Riga. It gets in late at night but seemed to be the only option from that destination timewise. Yeh! pretty sorted. The only decision left which we will make over the next few days is where we head to next. We are now thinking of heading down into Italy - Puglia which was always a possibility or perhaps a bit of Croatia and Italy. We will see but we both like the idea of drifting down the Italian coast and seeing what we can find. Weight off the mind to sort this out. It's no doubt easier travelling between more major cities where the flight options are more extensive. Pretty sorted for the next 3 weeks or so other than seeing where the road leads from Trieste which will be exciting.

1 note

·

View note

Text

Missing waste: why Spanish construction companies break the law

The new regulations[1] oblige Spanish companies to separate the waste generated in the works

The European Union generates more than 2,500 million tons of waste per year and those derived from construction and demolition (RCD) [2] occupy the first position in the ranking, according to Eurostat data.[3] Spain is no stranger to this reality; The building sector is also in first place with 29.8% of the total waste generated in the country. In order to reduce these figures, the new Waste Law approved last April requires the separation of rubble on site and establishes the objective of reaching 70% recovery of the waste generated by construction. According to the results of a survey carried out by the Building Cluster[4], 75% of construction companies fail to comply with this law.

Beatriz de Diego, an expert from the Technical Area of the Green Building Council Spain (GBCe)[5], believes that there is a compelling reason for this non-compliance: the increase in cost. [6] “The process is complicated and more space is needed on site to carry out the separation, which includes the fractions of wood, minerals, metals, glass, plastic and plaster. In addition, those products that can be reused and therefore retain more value should be separated, for example, roof tiles, sanitary ware or structural elements”, she argues. Alfons Ventura, an expert at GBCe, also points out that the separation of the plaster represents a real challenge, especially in renovation works in which it is attached to the wall and it should be pealed off in order to separate it before the demolition of any partition, "Which is probably not being fulfilled either."

The Building Cluster survey[7] gives percentages to the reasons why the new regulations are not complied with: lack of economic incentives (61%); absence of space for the separation of construction and demolition waste (57%); difficulty with materials due to their recyclability (44%); lack of awareness and motivation (24%). Miguel García, co-leader of the Building Cluster's waste management and circular economy working group and head of the Rockwool Prescription Department[8], stresses that compliance with the objectives set by law not only depends on the construction company, "but on all the agents within the value chain”. Opinion shared by Juan Diego Berjón, head of the waste treatment service at Surge Ambiental[9], of the Sacyr group[10]: "Although the intention of this regulation is positive, the reality is that the agents involved (companies, administrations...) are not prepared for so much volume of documentary generation. There is a lack of digitisation to achieve adequate traceability and comply with the extended responsibility of the producer of the waste”.

Digitised process

It is important to have the material traceability process digitized. “In the displacement and treatment of waste, documentation must be generated that certifies said process. If this documentation continues to be issued manually, it is very likely that errors will be made and that there will be fields that are not properly filled in", says David Ganuza, also co-leader of the Cluster's waste management and circular economy working group and director of Institutional Relations of Cocircular[11].

Experts believe that the legislator has missed the opportunity to improve the current waste situation. “Many of our regulations do not contemplate or, in the best of cases, limit the use of materials with the adjective 'recycled' to a lower percentage. We must develop a regulatory context where the benefit prevails, that is, the final contribution of the whole, without discriminating whether the source material is recycled or not”, explains Ramiro García, head of Innovation and Development at Sika[12].

The truth is that for a construction company, the cost of recycling construction waste is high. In a building of 80 or 90 homes, which could be the most representative, it would mean around 600 euros per property, according to data from the Building Cluster. And this figure is without considering the cost of managing the earth residues produced in the excavation. It is recommended that the cost of recycling not exceed 0.2% of the material execution budget (PEM)[13], "which indicates the low importance of this chapter in the planning of the work," says Berjón.

“This is mainly due to the fact that the taxation of construction waste does not reflect the environmental cost of its disposal. The new Waste Law establishes the taxation of inert waste at three euros per ton, compared to non-hazardous waste, which will be 15 euros per ton. But the situation is further aggravated when there is no control over the waste that is deposited in inert waste landfill vessels, these being a very attractive place to deposit non-hazardous waste at a very low tax rate”, adds the expert from the Sacyr group. .

Berjón recalls that the Waste Law implies that everything that cannot be recovered or valued is not controlled and can be deposited in a landfill at no cost, externalizing the environmental costs that this has in the medium term and clearly discouraging separation of waste at source. This context makes the management of the construction residues a minimum item in the budget of a work.

The renovation of houses is not gaining strength by improving recycling either. And this despite the fact that the actions derived from the Next Generation funds[14] must guarantee that at least 70% (by weight) of the construction and demolition waste generated is prepared for reuse, recycling and the revaluation of other materials. Although it is not implying a brake to grant these aids, this is a widespread concern in the sector and among professionals, as confirmed by Juan López-Asiain, director of the Technical Cabinet of the General Council of Technical Architecture of Spain[15].

Source

Juanjo Bueno del Amo, Residuos en paradero desconocido: por qué las constructoras incumplen la ley, in: El País, 9-01-2023, https://elpais.com/economia/negocios/2023-01-09/residuos-en-paradero-desconocido-por-que-las-constructoras-incumplen-la-ley.html

[1] Read also: https://www.tumblr.com/earaercircular/690913091543842816/digitisation-of-construction-and-demolition-waste

[2] Reducing the use of plastic bags or containers and trying to generate less waste by using reusable containers is an easy New Year's resolution to fulfil. It is a gesture that can help to improve the high levels of pollution that exist worldwide and that also has a direct impact on spending, since in this way economic savings are also favoured. https://elpais.com/escaparate/2023-01-10/11-productos-sostenibles-de-uso-cotidiano-para-reducir-el-consumo-de-plastico-y-generar-menos-residuos.html

[3] Read also: https://at.tumblr.com/earaercircular/circular-economy-building-waste-management-turns/sxq1c6tjqmus

[4] The building sector is one of the strategic sectors in Spain due to its size and its economic, environmental and social significance. In this area, the Building Cluster operates as a non-profit association and is made up of companies, universities and research centres. The objective shared by all is to innovate in the construction of the existing park and new construction of any use or possession. The leadership of el Clúster de la Edificación (the Building Cluster) is based on the critical mass that its cooperation processes generate and that strengthen the competitiveness of its associates, enhance the generation of knowledge and the visibility of the sector. https://clusteredificacion.com/quienes-somos/

[5] GBCe (Green Building Council Spain, or Consejo para la Edificación Sostenible en España) is the main sustainable building organization in Spain. Established in 2008, they are the benchmark in the transformation towards a sustainable model of the building sector. It belongs to a broad, growing and diverse global network, with a presence in more than 70 countries and 36,000 members representing the entire value chain: World Green Building Council, WorldGBC. Together with its associates, it trains, certifies and facilitates connections to accelerate the transformation towards the sustainability of the Spanish habitat. https://gbce.es/

[6] How to control cost overruns when building. The drop in the price of materials makes the works cheaper, but there are other formulas to guarantee that the budgets do not deviate and trigger the final invoice https://elpais.com/economia/2021-04-10/como-controlar-los-sobrecostes-al-construir.html

[7] Industry releases a new manager in a hurry: execute more than 4,000 million of European funds in a year. Francisco Blanco assumes the general secretary in a year in which Minister Maroto will also leave to be mayor of Madrid. https://elpais.com/economia/2021-04-10/como-controlar-los-sobrecostes-al-construir.html

[8] https://www.rockwool.com/pt/contato/representante-de-vendas/

[9] Surge Ambiental S.L. was born as a construction and demolition waste management company, although currently, thanks to growing demand, trends and experience, we are committed to comprehensive management of all waste. For this reason, our scope of application is the management of any privately generated waste. In addition, we are a company 100% owned by Valoriza Medioambiente that is part of the Sacyr S.A. business group. All this provides us with a position with complete national coverage, as well as a great experience in the entire sector. https://www.surgeambiental.com/quienes-somos

[10] SACYR S.A. is a Spanish infrastructure operator and developer company based in Madrid. Sacyr was the largest shareholder in the Spanish oil company Repsol YPF, holding an approximate 20% stake. On December 20, 2011, Repsol YPF bought half of Sacyr's stake back in order to save the shares from being seized in a foreclosure. As of June 2021, SACYR owned 7.8% of Repsol YPF. https://www.sacyr.com/en/

[11] CoCircular is one of the initiatives that arises from Zubi Labs, whose objective is to create companies that provide solutions to social and environmental challenges, generating a positive impact in our immediate environment. We are more than 80 people dedicated to projects in different fields and stages of maturity. with a common goal: Create a better future. https://www.cocircular.es/

[12] Sika AG is an international specialty chemical company with a leading position in the development and production of systems and products for bonding, sealing, waterproofing, damping, reinforcement and protection in the construction and automotive industries. Sika is headquartered in Baar, Switzerland and has subsidiaries in 100 countries around the world and manufactures in more than 300 factories. Sika employs more than 25,000 people and has an annual sales turnover of CHF 9.3 billion. At the end of 2019, Sika won the Swiss Technology Award for a groundbreaking new adhesive technology. https://www.sika.com/

[13] The Presupuesto de Ejecución Material (PEM) (Material Execution Budget) is the amount of the cost of materials and labour, necessary for the execution of a work. This is calculated by multiplying the measurement by the unit price of each unit of work.

[14] Given the COVID-19 crisis and the challenges it is posing for Europe, the European Union and the Member States have had to adopt emergency measures to protect both the health of their citizens and the economy. For this reason, on July 21, 2020, the European Council agreed on an exceptional temporary recovery instrument, the NextGenerationEU, with a budget of 750,000 million euros. This European NextGeneration fund authorizes the European Commission to borrow up to 750,000 million euros on behalf of the European Union for the first time, and can be used to grant repayable loans for a volume of up to 360,000 million euros and non-refundable transfers for 390,000 million of euros. The disbursement of these amounts will be made until 2026 and the loans will have to be repaid before the end of 2058. https://es.fi-group.com/plan-recuperacion-y-resiliencia-nextgenerationeu/?campaignid=17932172134&adgroupid=148992114447&adid=645267025410&gclid=Cj0KCQiAw8OeBhCeARIsAGxWtUzv0CEOpWfbz8NMhrgcGP7Cr_4xu_qfNxUZDw5xgnjSJHLo5qoBGAoaAh6UEALw_wcB

[15] The Consejo General de Colegios Oficiales de Aparejadores y Arquitectos Técnicos (General Council of Official Colleges of Quantity Surveyors and Technical Architects) is a public law corporation that has its own legal personality and full capacity to fulfil its purposes, configuring itself as the representative body of the profession and coordinator of its collegiate organization, at the state level. and international. https://www.cgate.es/pagina.asp?Pagina=15

0 notes