#Employee Payroll Management System

Explore tagged Tumblr posts

Text

Top reasons to upgrade your Payroll Management System

Introduction

Payroll is more than just a monthly task—it's a foundation of trust between employers and employees. However, many businesses still use outdated tools or manual systems that slow down operations, increase the risk of errors, and make it hard to stay compliant with evolving tax laws. In today’s fast-paced business environment, relying on such methods can be a serious disadvantage.

An efficient Payroll Management System simplifies the entire process—right from calculating salaries and deductions to ensuring timely tax filings and generating reports. It reduces dependency on manual work, cuts down on errors, and helps organizations stay compliant with government regulations.

If you're still wondering whether it's time to upgrade your current payroll setup, this guide outlines the top reasons why businesses are making the switch to modern systems like Kredily’s Payroll Management System to better manage and scale their operations.

1. Stay Ahead with Compliance and Accuracy

Tax laws, labor regulations, and compliance requirements are constantly changing. Staying updated is not only challenging but also critical—non-compliance can lead to legal trouble and financial penalties. A modern Payroll Management System is designed to adapt to these changes automatically, taking the guesswork out of compliance.

Features that Support Compliance:

Auto-updates to government tax slabs and labor laws

TDS, PF, ESI, and other statutory calculations

Built-in audit trails for transparency and accountability

Benefits You’ll See:

Peace of mind with timely, error-free statutory filings

Reduced risk of penalties

Better preparedness during audits

An Employee Payroll Management System ensures that your payroll process is aligned with the latest regulations, removing the constant need for manual checks or third-party verification.

2. Eliminate Manual Errors and Boost Efficiency

One of the biggest challenges of traditional payroll systems is the high chance of manual errors. A missed entry or wrong calculation can delay salaries and affect employee morale. With an Online Payroll Management System, automation takes care of repetitive tasks such as calculating gross pay, deductions, taxes, and generating payslips.

Features that Improve Accuracy:

Automated payroll workflows

Real-time sync with attendance and leave data

Auto calculation of bonuses, deductions, and reimbursements

Operational Benefits:

Quicker payroll processing cycles

Reduced dependency on multiple spreadsheets

Less time spent on cross-verification

Automation not only saves time but also increases overall productivity. HR teams can focus more on strategy and less on fixing errors or responding to repeated payroll queries.

3. Deliver a Better Employee Experience

In any organization, payroll is directly tied to employee satisfaction. Delays or inaccuracies can lead to distrust and frustration. Today’s workforce expects digital convenience—and rightly so. A well-integrated Employee Payroll Management System gives employees the access they need, when they need it.

Features That Empower Employees:

Mobile and desktop access to payslips

Option to update personal tax declarations

Self-service for downloading Form 16, salary slips, and tax documents

Why It Matters:

Transparency builds trust

Fewer employee queries for HR to handle

Improved morale and retention

Offering a self-service portal not only makes your payroll process smoother but also shows that you value your employees’ time and convenience.

4. Get Actionable Insights and Smarter Reporting

Payroll data, when analyzed properly, can provide powerful insights into your organization’s financial and operational health. A modern Payroll Management System allows you to pull detailed reports that help you understand trends in compensation, identify anomalies, and plan better for the future.

Smart Tools You Can Use:

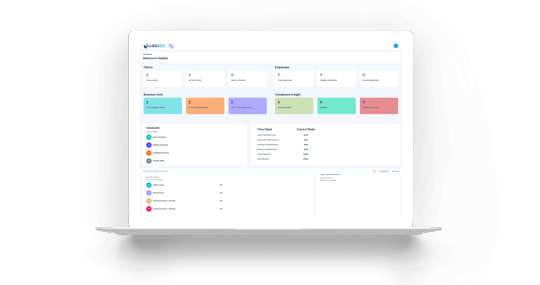

Customizable dashboards

Department-wise salary cost breakdowns

Integration with accounting and HR tools

Long-Term Advantages:

Budgeting becomes more accurate

Identifying high-cost areas is easier

Strategic decision-making based on real-time data

Instead of just being a transactional process, payroll becomes a source of valuable insights that can support leadership and planning efforts.

5. Scale Seamlessly with Business Growth

As your business grows, so does the complexity of managing payroll. Whether you're adding new employees, opening new branches, or working with remote teams, your payroll system should be equipped to grow with you. A flexible Online Payroll Management System supports multi-location teams, diverse salary structures, and scalable employee volumes without needing a complete overhaul.

Features that Support Scalability:

Cloud-based access

Role-based permissions

Multi-entity and multi-location support

What You’ll Gain:

A single payroll platform for your entire business

Cost-effective scalability

Smooth onboarding of new team members

Upgrading your system now ensures you're ready to handle expansion tomorrow—without major disruptions or added costs.

6. Ensure Data Security and Confidentiality

Payroll data includes sensitive information such as salaries, tax IDs, and bank details. Ensuring this data remains secure is a top priority. A reliable Payroll Management System includes features to secure sensitive data through encryption, access control, and secure backups.

Key Security Features:

Encrypted data storage and transfers

Role-based access to limit data exposure

Regular backups and disaster recovery

Security Benefits:

Reduced risk of data breaches

Trust from employees and stakeholders

Compliance with data privacy regulations

In a world where data privacy is non-negotiable, your payroll system should be built with security at its core.

7. Save Costs Over Time

While upgrading may seem like a big step initially, a modern payroll solution often ends up saving money in the long run. Fewer errors mean fewer penalties. More automation means less time and resources spent on payroll. And cloud solutions remove the need for expensive infrastructure.

Long-Term Savings Come From:

Reduced manual labor

No need for multiple software tools

Lower risk of compliance-related penalties

An efficient Payroll Management System offers high ROI by optimizing the payroll function across the board.

Conclusion

Whether it’s compliance, accuracy, employee experience, or scalability—upgrading to a modern Payroll Management System touches every aspect of your business in a positive way. It streamlines your processes, reduces errors, and helps you make informed decisions based on accurate payroll data.

If you're looking for a reliable and intuitive solution, Kredily’s Payroll Management System offers all the features needed to handle payroll efficiently, while supporting future growth and keeping employees happy.

Explore how an advanced Online Payroll Management System can make payroll seamless for your business. Get started with Kredily and experience the difference that modern payroll automation can bring.

#Payroll Management System#Employee Payroll Management System#Online Payroll Management System#Payroll Management System in India#Payroll Management Software

0 notes

Text

Simplify Payroll with an Efficient Employee Payroll Management System

An Employee Payroll Management System streamlines the payroll process, ensuring timely and accurate payments. Automate calculations, tax deductions, and compliance while reducing errors and administrative tasks, boosting efficiency and saving valuable time.

0 notes

Text

HRCraft top HR software solutions to streamline recruitment, onboarding, payroll, and employee management. Simplify processes, enhance productivity, and improve workforce engagement with innovative tools tailored for businesses of all sizes.

#HR software solutions#payroll management software#employee payroll system#human resource management#employee payroll management system#top hrms software in india#salary management system

1 note

·

View note

Text

With reliability, efficiency and attention to detail, we give our clients peace of mind knowing their soft services are in good hands.

Experience the difference with Alta Global, where excellence meets innovation in facility management.

With a team of experienced professionals and the latest technology, we offer bespoke solutions for the underlined services, designed to meet your specific needs.

#payroll management services#paycheck companies#employee payroll management system#payroll in india#hr and payroll services#payroll management system#payroll processing companies#payroll agency#payroll service#payroll provider

0 notes

Text

#payroll management#payroll management system#payroll management software#employee payroll management system#payroll software#'payroll services#payroll software in india#payroll software india#payroll in india#greytHR

0 notes

Text

0 notes

Text

Essential Things You Need to Know About Staff Management Software in 2023

In today's fast-paced digital era, the significance of effective staff management cannot be overstated. Staff management software has quickly become an integral part of efficient business operations in various industries. With the continuous evolution of technology, 2023 has brought forth new updates, features, and trends to watch out for. Here's what you need to know about staff management software this year.

Remote Work Adaptability:

With the increase in remote work due to the ongoing pandemic, staff management software now offers features that adapt to this new work model. Tools for virtual meetings, remote project management, and digital timesheets have become standard.

Employee Wellbeing and Engagement:

Employee mental health has gained more focus. In 2023, staff management software increasingly includes features promoting employee wellbeing, such as mood tracking, mental health resources, and wellness programs. Simultaneously, gamification strategies are being utilized to improve employee engagement and satisfaction.

Security and Data Privacy:

As we handle more sensitive data digitally, the importance of cybersecurity has skyrocketed. In 2023, staff management software has stepped up its game with enhanced data encryption, multi-factor authentication, and regular software updates to ward off potential cybersecurity threats.

Integration and Customization:

Integration with other systems such as CRM, payroll, and HRIS is more seamless than ever. Furthermore, staff management software now offers greater customization options to cater to the unique needs of each organization.

Eco-Friendly Practices:

More businesses are looking for ways to reduce their carbon footprint. Paperless management, energy-efficient operations, and other eco-friendly features are more common in staff management software in 2023.

Conclusion:

Staff management software in 2023 is about more than just efficiency and productivity; it's about creating a conducive and sustainable work environment that values employees' mental health and respects data privacy. As technology evolves, we can expect these systems to become even more intelligent, versatile, and user-friendly, becoming an indispensable tool in the modern workplace.

#staff management software#employee work management system#staff management system#employee management system#employee payroll management system#employee database management software#best staff management software#temporary staff management software#temporary staffing uk#medical staffing solutions timesheet#employee management software

1 note

·

View note

Text

Discover the magic of transforming your workplace with our latest YouTube content on the successful implementation of Human Resource Management Systems (HRMS)! Whether you're an HR pro or just curious about the benefits of HRMS, our engaging videos break down best practices, real-life success stories, and practical tips to help you unleash the full potential of your HR strategy. Don't miss out—let's revolutionize your HR game together! To listen to the full video click on the link given.

#best hrms software companies in india#podcast#salesforce implementation#hrms payroll software#learning management system in india#employee helpdesk

2 notes

·

View notes

Text

HR Onboarding Solutions for Bahraini Employers

Streamline your HR management in Bahrain with the best HR software systems. From HR onboarding to employee data management, our cloud HR software offers a seamless HR management system for enhanced efficiency.

#hr & payroll software#hr payroll software#hr software pricing#employee training software#travel management#software#Employee Offboarding Software#core hr software#HR Reporting Software#Employee management software#payroll#hr payroll software bahrain#employee appraisal system#performance management system#employee records#management#leave management system#leave tracking software#asset management system#asset management software#attendance management software#employee attendance software#time and attendance software#Onboarding software#Cloud HR#Software#hiring software#hr software in bahrain#talent acquisition software#HR Onboarding

0 notes

Text

CRMLeaf Features Built to Improve Sales and Customer Relationships

In this blog, we’ll explore the key features of CRMLeaf that are designed to elevate your sales process and enhance customer relationships at every stage.

Read the full blog

#CRMLeaf#Sales CRM#Business CRM#CRM software#Lead management#Customer engagement#Project management#HR software#Payroll system#Billing CRM#Task tracking#Team collaboration#Pipeline management#Ticketing system#Employee tracking#Recruitment tool#Data security#Reports & insights#Role-based access

0 notes

Text

Why Switch to a Payroll Management System? Let’s Break It Down!

Introduction

Managing payroll is a crucial yet challenging task for any business. Many companies still rely on manual payroll processes, which can lead to calculation errors, delayed salary disbursements, and compliance issues. Tracking employee salaries, deductions, and tax regulations manually consumes valuable time and increases the risk of costly mistakes.

A Payroll Management System provides an automated solution that ensures payroll accuracy, improves compliance, and saves time. Whether you’re a small business or a growing enterprise, shifting to a digital system can significantly enhance payroll operations.

1. Increased Accuracy and Compliance

One of the primary reasons to switch to a Payroll Management Software is the precision it brings to payroll calculations. Businesses that manage payroll manually often struggle with:

Salary miscalculations, leading to overpayments or underpayments.

Errors in tax deductions, which can result in non-compliance penalties.

Complex labor laws that require constant updates and monitoring.

A Payroll Management System in India ensures that payroll is processed with up-to-date tax laws and compliance regulations. It minimizes the risk of human errors and ensures employees are paid accurately and on time.

2. Improved Efficiency and Productivity

Processing payroll manually can be tedious and time-consuming. An Online Payroll Management System automates salary calculations, deductions, and tax filings, allowing HR and finance teams to focus on more strategic tasks.

Key benefits include:

Automated payroll processing, reducing the time spent on administrative tasks.

Faster salary disbursement, eliminating payment delays.

Integrated data management, reducing the need for manual record-keeping.

With an efficient Payroll Management System, businesses can significantly reduce payroll-related administrative burdens.

3. Enhanced Employee Experience

An Employee Payroll Management System improves transparency and accessibility for employees. With a self-service portal, employees can:

Access their salary slips, tax documents, and payment history.

Track their leave balances and submit time-off requests effortlessly.

Resolve payroll-related queries faster without HR intervention.

By providing employees with easy access to their payroll data, businesses can enhance trust and satisfaction in the workplace.

4. Cost Savings and Financial Control

A Payroll Management Software helps companies reduce costs by minimizing errors and improving compliance. Some key cost-saving advantages include:

Reduced penalties and fines due to payroll miscalculations.

Elimination of excessive administrative expenses, as payroll processing is automated.

Better payroll budget control, with real-time tracking of salary expenditures.

By implementing an Online Payroll Management System, businesses can gain better financial insights and optimize payroll expenses.

5. Scalability and Flexibility for Business Growth

As businesses expand, managing payroll for a growing workforce becomes complex. A Payroll Management System in India is designed to scale with your business needs. Key features include:

Seamless integration with HR and accounting systems, reducing duplicate data entry.

Customizable payroll settings, allowing businesses to tailor salary structures and benefits.

Automated compliance updates, ensuring businesses stay in line with changing regulations.

This flexibility makes a Payroll Management System an essential tool for businesses aiming for long-term growth and efficiency.

Conclusion

Switching to a Payroll Management System simplifies payroll processing, reduces errors, and ensures compliance with legal regulations. Businesses can improve efficiency, cut operational costs, and enhance employee satisfaction with an automated payroll solution. Whether you are a small business or a large enterprise, investing in a Payroll Management Software can lead to smoother operations and better financial control.

Looking for a reliable Online Payroll Management System to streamline your payroll processes? Kredily offers an advanced, cost-effective solution tailored to meet your business needs. Contact us today and take the first step towards effortless payroll management!

#payroll management software#Payroll management system#Payroll Management system in India#Employee payroll management system#Online Payroll Management system

0 notes

Text

Discover Affordable and Comprehensive Payroll Software Solutions with Accent Consulting at an affordable price.

Call us today to crack the best offers @ 9999143778!

Read more steps below for Complete Payroll Software in India -

#appraisal management#performance appraisal management system#employee performance management#training management software#payroll outsourcing services#travel management software#expense management software#grievance management software#complaint management software#employee resignation management tool#letters management software#human resource management system#employee recruitment software#hr recruitment software#hr mobile software#mobile payroll software#payroll software in Faridabad#payroll software in Gurugram#payroll software

0 notes

Text

Streamline Payroll with PerfettoHR: Effortless Employee Payroll Management System

PerfettoHR offers a powerful employee payroll management system designed to simplify payroll processing, ensure compliance, and reduce manual errors. Manage employee salaries, tax calculations, and more with ease using our efficient and user-friendly solution.

0 notes

Text

Streamline Payroll and Leave Management with Munc Software

Managing payroll and employee leave manually is a task no modern business should endure in today’s digital-first world. It’s time-consuming, error-prone, and often leads to compliance issues. That’s where Mun-C Software’s Payroll and Leave Management Software comes in — a powerful tool designed to simplify HR processes, boost productivity, and ensure your business runs smoothly.

In this blog, we’ll explore why payroll and leave management are critical to your business, how Mun-C Software solves common HR challenges, and what features set it apart from the competition.

Understanding Payroll and Leave Management Software

Payroll and Leave Management Software automates the process of tracking employee salaries, bonuses, tax deductions, and leave entitlements. It ensures employees are paid accurately and on time while maintaining compliance with labor laws and internal company policies.

With growing teams and changing workforce dynamics, having the right software in place is no longer optional. It’s a necessity for businesses that want to remain efficient, transparent, and compliant.

Why Mun-C Software?

Mun-C Software is designed with both HR professionals and business owners in mind. It combines simplicity with robust functionality, offering a user-friendly interface that makes payroll and leave tracking seamless — even for non-technical users.

Here’s why companies choose Mun-C Software:

✅ Accuracy and Compliance

Mun-C Software automatically calculates salaries, deductions, and taxes, reducing the risk of manual errors. It stays updated with the latest labor laws and tax regulations, so you don’t have to worry about compliance issues.

✅ Customizable Leave Policies

Every organization has its own leave policy structure. Mun-C Software allows businesses to set and manage different leave types such as casual leave, sick leave, earned leave, and more, based on employee roles and tenure.

✅ Self-Service for Employees

Employees can access their pay slips, apply for leave, view leave balances, and track approval statuses through a self-service portal. This reduces HR workload and improves employee satisfaction.

✅ Integrated Reporting

Generate detailed reports on payroll summaries, tax filings, attendance trends, and leave utilization. These insights help HR teams make informed decisions and identify cost-saving opportunities.

Key Features of Mun-C Payroll and Leave Management Software

Here are some of the standout features that make Mun-C Software a preferred choice:

1. Automated Payroll Processing

Calculate earnings, deductions, bonuses, and reimbursements with a single click. Mun-C ensures all payments are made accurately and timely, including auto-generation of payslips and tax documents.

2. Leave Tracking and Calendar Integration

Track employee attendance, leave balances, and public holidays all in one dashboard. Managers get real-time visibility into team availability and can approve or decline leave requests with ease.

3. Multi-Level Access Control

Different users can access the platform with role-based permissions. For instance, HR managers, finance teams, and employees each get relevant access to perform their tasks without compromising data security.

4. Cloud-Based Accessibility

Being a cloud-based solution, Mun-C Software allows anytime, anywhere access. Whether you're in the office or working remotely, you can manage HR operations without interruption.

5. Compliance-Ready Reports

From EPF, ESI, and TDS to Form 16 generation, the system ensures you’re audit-ready and in full legal compliance at all times.

Benefits of Using Mun-C Software

Implementing Mun-C Software comes with numerous advantages:

Time-Saving: Eliminate repetitive tasks and free up HR teams for more strategic work.

Error Reduction: Automation minimizes the risk of human errors.

Transparency: Employees gain real-time access to payroll and leave data.

Employee Satisfaction: Better visibility, faster processing, and ease of use result in happier teams.

Scalability: Whether you’re a startup or a large enterprise, Mun-C grows with your business.

Use Case: How a Growing Startup Streamlined HR with Mun-C

A rapidly growing tech startup with 50+ employees faced challenges with manual payroll processing and inconsistent leave tracking. Errors in salary calculation and delays in leave approvals led to employee dissatisfaction.

After implementing Mun-C Software, they automated their entire payroll cycle, streamlined leave approvals, and provided employees with transparent access to their records. Within 3 months, HR processing time reduced by 60%, and employee engagement significantly improved.

Future-Ready HR Management

As businesses continue to embrace digital transformation, adopting robust software like Mun-C is no longer a luxury—it’s a strategic necessity. Mun-C’s Payroll and Leave Management Software brings structure, transparency, and efficiency to your HR operations.

Whether you're a small business looking to automate for the first time or a growing enterprise seeking better control over HR processes, Mun-C is your ideal partner.

Read More

Frequently Asked Questions (FAQs)

1. Is Mun-C Software suitable for small businesses?

Yes, Mun-C is ideal for businesses of all sizes. It offers scalable features that grow with your organization and is budget-friendly for startups and SMEs.

2. Can I customize leave policies for different departments?

Absolutely. Mun-C allows complete customization of leave policies based on departments, employee roles, or locations.

3. Is my data secure on Mun-C’s cloud platform?

Yes, Mun-C employs top-tier security protocols, including data encryption, regular backups, and secure access controls to ensure your data is safe.

4. Does Mun-C Software support multi-country payroll compliance?

Currently, Mun-C is optimized for local and regional payroll compliance. For international payroll needs, our team offers customized solutions based on requirements.

#Payroll Management Software#Leave Management System#Employee Leave Tracking#Attendance and Leave Management#Time and Attendance Software

0 notes

Text

Soft Services

Focused on reliability, efficiency, and attention to detail, we bring peace of mind to our clients, knowing that their soft service needs are in capable hands. Experience the difference with Alta Global, where excellence meets innovation in facility management.

With a team of seasoned experts and state-of-the-art technology, we offer customized solutions covering underlined services, designed to precisely address your unique needs.

Integrated Facility Management

Housekeeping & Cleaning Services

Pantry / Cafeteria Services

Gardening / Horticulture Services

Specialized Services

Pest Control Services

Deep Cleaning Services

Upholstery Cleaning

Facade Cleaning

#payroll management services#employee payroll management system#paycheck companies#payroll agency#payroll in india#payroll processing companies#hr and payroll services#payroll provider#payroll management system#payroll service

0 notes

Text

Best HR software in UAE| Best HRMS in UAE

Our best HR software in UAE is designed to simplify employee management, payroll processing, attendance tracking, and more. As the best HRMS in UAE, it offers powerful automation, real-time analytics, and seamless integration to enhance workforce efficiency. Whether you’re a small business or a large enterprise, our HR solution ensures compliance, improves productivity, and optimizes HR workflows. Experience a smarter way to manage your human resources with our advanced HR software.

#best hr software in uae#best hrms in uae#best payroll software in uae#payroll processing software in uae#software for leave management system#employee leave management software#attendance software in uae#hr software for onboarding#best hr onboarding software#hr software uae#hrm features#HR software for small businesses#Best HRMS software#Cloud-based HR software#HR and payroll management system#Employee management software#Automated payroll software#hrms software#hr system software#best hr management software#hr solution

0 notes