#Payroll system

Explore tagged Tumblr posts

Text

Payroll services in India

Get Payroll Outsourcing India, We are one of the top payroll outsourcing companies and payroll service providers in India and offer online payroll services.

payroll services in India, Top payroll outsourcing companies in India, payroll outsourcing services, Online payroll services, payroll outsourcing in India, Payroll providers in India, payroll companies in Delhi, payroll companies, payroll service providers

#payroll#payrollservices#payroll software#payrollmanagement#payroll system#payrollsolutions#payroll specialist

2 notes

·

View notes

Text

CRMLeaf Features Built to Improve Sales and Customer Relationships

In this blog, we’ll explore the key features of CRMLeaf that are designed to elevate your sales process and enhance customer relationships at every stage.

Read the full blog

#CRMLeaf#Sales CRM#Business CRM#CRM software#Lead management#Customer engagement#Project management#HR software#Payroll system#Billing CRM#Task tracking#Team collaboration#Pipeline management#Ticketing system#Employee tracking#Recruitment tool#Data security#Reports & insights#Role-based access

0 notes

Text

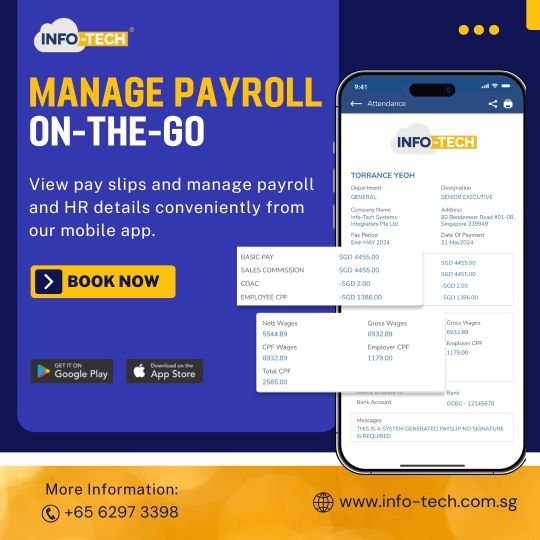

Cloud Payroll Singapore: All You Need to Know

Managing payroll in Singapore can be a complex and time-consuming task, especially with strict regulations around CPF, IRAS, and MOM compliance. That’s why many businesses are turning to Cloud Payroll solutions to simplify and automate the process.

At Info-Tech, our cloud-based payroll software is designed to help Singapore businesses process salaries, manage employee data, and stay compliant — all from one secure, online platform.

What is Cloud Payroll?

Cloud payroll is a modern payroll solution hosted online, allowing businesses to access payroll features from anywhere with internet access. Unlike traditional software that requires installation and manual updates, cloud payroll offers real-time processing, data backups, and secure access from both desktop and mobile.

It enables HR software teams and business owners to handle payroll operations more efficiently while reducing errors and improving compliance.

Why Cloud Payroll Makes Sense for Singapore Businesses

In Singapore’s fast-paced and compliance-driven environment, switching to cloud payroll is more than a convenience — it's a necessity. With frequent updates to CPF rates, tax requirements, and IRAS filing deadlines, a reliable payroll system ensures your company stays aligned with all statutory obligations.

Here’s how cloud payroll helps businesses in Singapore:

✅ Automated CPF and Tax Compliance

Cloud payroll software like Info-Tech’s automatically calculates CPF contributions, prepares IR8A forms, and aligns with IRAS requirements — ensuring your submissions are timely and accurate.

✅ Accessible from Anywhere

With cloud-based access, HR teams can manage payroll and generate reports whether they’re working from the office, home, or on the move. This is especially valuable for companies with remote or hybrid teams.

✅ Secure Cloud Storage

All payroll data is stored in a secure cloud environment, protected with enterprise-grade encryption and regular backups — removing the risk of data loss from local system failures.

✅ Reduces Manual Workload

Say goodbye to spreadsheets. Cloud payroll reduces admin work by automating recurring tasks like salary calculations, bank GIRO file generation, and payslip distribution.

✅ Better Employee Experience

With Info-Tech’s integrated Employee Self-Service (ESS) app, staff can easily access payslips, IR8A documents, and leave balances — saving time for both employees and HR.

Key Features of Info-Tech’s Cloud Payroll Software

Info-Tech’s solution is built for Singapore’s business needs and regulatory framework. Features include:

Auto Payroll Calculations

Integrated CPF and IRAS Filing

Multi-country, Multi-currency Support

Mobile Payslip and ESS Access

Bank GIRO Integration

Linkage with Attendance, Leave & Claims Modules

This integrated system ensures smooth, end-to-end payroll management.

Who Should Use Cloud Payroll?

Whether you're a startup, SME, or large organisation, cloud payroll can help you:

Save time and cut costs

Avoid costly penalties from missed submissions

Improve accuracy and accountability

Scale easily as your company grows

Get Started with Info-Tech Cloud Payroll

Thousands of businesses in Singapore trust Info-Tech to manage their payroll with speed, accuracy, and compliance. Our team provides full onboarding, training, and support to help you get started with minimal disruption.

Plus, our cloud payroll software is eligible for the PSG Grant, giving you up to 50% funding support to go digital at a lower cost.

Start simplifying your payroll today with Info-Tech — a smarter, faster, and compliant solution built for Singapore businesses.

0 notes

Text

Let’s Explore the Future of Payroll Systems in 2025

As businesses continue to evolve, so does the need for an efficient and error-free Payroll System. Many organizations still face challenges such as compliance risks, manual errors, and time-consuming payroll calculations. With technological advancements, 2025 promises a more automated, data-driven, and strategic payroll landscape. From AI-powered automation to sustainability-focused payroll solutions, the future of the Payroll System in India and across the globe is set to transform how businesses manage employee compensation.

Let’s explore the key innovations shaping the Payroll System in 2025.

1. The Rise of AI and Automation in Payroll Processing

Online Payroll Systems powered by Artificial Intelligence (AI) and Robotic Process Automation (RPA) will take center stage.

AI-driven automation will eliminate repetitive tasks such as salary calculations, tax deductions, and compliance checks.

Businesses will experience fewer payroll errors, ensuring accurate and timely payments.

Payroll professionals will shift from administrative tasks to strategic planning, improving workforce efficiency.

2. Data-Driven Payroll for Better Decision Making

Payroll data is evolving into a critical business intelligence tool for financial and HR planning.

Advanced analytics in HR Payroll Systems will help companies track salary trends, optimize workforce costs, and forecast payroll budgets.

Predictive insights will allow businesses to proactively manage overtime costs, benefits administration, and compensation strategies.

3. Personalized Payroll Experiences for Employees

The future of payroll is employee-centric, with self-service portals and mobile applications enhancing accessibility.

Employees will have instant access to payslips, tax details, and leave balances, reducing dependency on HR teams.

Seamless integration between HR Payroll Systems and benefits management will enhance employee satisfaction.

4. Strengthened Compliance and Risk Management

Evolving labor laws and tax regulations make payroll compliance a constant challenge.

AI-powered Payroll Systems in India will ensure accurate payroll tax filings and statutory deductions.

Businesses will benefit from real-time compliance monitoring, reducing risks of penalties and legal complications.

Automated audit trails will provide transparent payroll processing and better record-keeping.

5. Global Payroll Integration for Multinational Businesses

As companies expand internationally, a unified Online Payroll System will be essential for seamless global payroll management.

AI-driven payroll platforms will handle currency conversions, tax variations, and country-specific labor laws.

Businesses will achieve centralized control over payroll, ensuring compliance across multiple regions.

6. Sustainability and the Digital Payroll Revolution

Paperless payroll will become the standard, with digital payslips replacing traditional printed salary statements.

Eco-friendly payroll solutions will contribute to reducing carbon footprints.

Businesses leveraging Free Payroll Systems will minimize operational costs while promoting sustainability.

Conclusion: Embracing the Future of Payroll

By 2025, Payroll Systems in India and around the world will be more efficient, AI-powered, and employee-friendly. Businesses that adapt to these advancements will experience increased compliance, reduced administrative burdens, and improved workforce satisfaction.

Is Your Payroll System Ready for the Future?

Explore how Kredily’s Online Payroll System can help automate payroll processing, enhance compliance, and optimize workforce management. Get started today and take your payroll to the next level!

0 notes

Text

Reliable Payroll Software Hong Kong

Our Payroll Software is designed to simplify payroll management for businesses in Hong Kong. Automate salary calculations, MPF contributions, and tax deductions while ensuring compliance with local regulations. With seamless integration into your HR systems, you can streamline your payroll process, reduce errors, and save time.

#payroll software Hong Kong#hr payroll software#payroll software#payroll system#payroll software for sme#payroll software for small business#best payroll software Hong Kong

0 notes

Text

Switching to New Payroll Software: Automation or Complication?

Is upgrading to new payroll software a step toward smoother automation or a potential headache? Discover how modern payroll solutions can streamline your HR processes, reduce errors, and enhance compliance. We’ll guide you through the challenges of transitioning to a new system while highlighting the benefits of automation for accuracy and efficiency. Learn how to make the switch seamlessly and maximize the value of your payroll software upgrade!

0 notes

Text

0 notes

Text

Online Payroll Management Software - Get 15 Days Free Trail

Payroll Management Software is wanted to modernize your cash strategy and make it quieter than any time in memory to deal with your resources. Through modernizing in every practical sense, all piece-related undertakings, this payroll system guarantees consistency with charge rules and other monetary guidelines of India. It is easy to utilize and has every one of the highlights you would anticipate from a cash objective, making it a staggering propensity for affiliations, all things considered.

With the assistance of this thing, you can at first get a free demo starter for 15 days.

#payroll system#payroll management software#best payroll management system#payroll solution#online payroll management software for india

0 notes

Text

Streamline Your Payroll Processes with Ascent Payroll System: A Comprehensive Guide

Introduction:

In today's fast-paced business landscape, managing payroll efficiently is crucial for the success of any organisation. Ascent Hcm Payroll System emerges as a game-changer, offering a robust and user-friendly solution to simplify payroll processes. In this blog, we'll explore the key features and benefits of Ascent Payroll System, helping you make an informed decision for your payroll management needs.

Why Choose Ascent Payroll System?

Ascent Hcm Payroll System is designed to meet the diverse needs of businesses, from small enterprises to large corporations. Its advanced features ensure accuracy, compliance, and efficiency in payroll processing.

Benefits of Ascent Payroll System

Time and Cost Efficiency

Discover how Payroll System reduces manual workload, minimizes errors, and saves time, allowing your HR team to focus on strategic initiatives.

Compliance and Accuracy

Learn how the system ensures compliance with local tax laws and regulations, providing accurate calculations and reducing the risk of costly errors.

Employee Self-Service

Explore the convenience of Ascent's Employee Self-Service portal, allowing employees to access their pay stubs, tax documents, and other relevant information online.

Implementation and Integration

Easy Implementation

Learn about the hassle-free implementation process, ensuring a smooth transition to Ascent Payroll System without disrupting your day-to-day operations.

Integration Capabilities

Discover how Ascent seamlessly integrates with other business systems, such as accounting software and time-tracking tools, creating a unified and efficient workflow.

Real-World Success Stories

Explore case studies and success stories from businesses that have benefited from the Ascent Hcm Payroll System. Gain insights into how organisations have improved efficiency, reduced costs, and enhanced overall payroll management.

Transparent Pricing

Get an overview of Ascent Payroll System's pricing model, ensuring transparency and helping you choose a plan that aligns with your budget and requirements.

Dedicated Support

Learn about the robust customer support provided by Ascent, ensuring that you have assistance whenever you need it.

Conclusion:

Ascent Payroll System stands out as a comprehensive solution for businesses seeking to streamline their payroll processes. With its advanced features, benefits, and seamless integration capabilities, it proves to be a valuable asset for organisations of all sizes. Make the smart choice for your payroll management – choose Ascent Payroll System and experience a new level of efficiency and accuracy.

Ascent Hcm not only provide payroll management system but also provides softwares such as leave management, attendance management,

0 notes

Text

Maximizing Efficiency: How ERPNext Transforms Payroll Processing

In today’s fast-paced business landscape, optimizing operations is paramount for sustained success. One area where this is particularly crucial is payroll processing. Traditional methods often lead to inefficiencies, delays, and errors. This is where ERPNext steps in as a game-changer, revolutionizing how businesses handle their payroll processes. Streamlining Payroll with ERPNext 1. Automated…

View On WordPress

#Business Efficiency#Employee Management#ERPNext Features#ERPNext HR & Payroll#HR Revolution#HR Solutions#HRTransformation#Human Resources Software#Payroll Automation#Payroll Management#Payroll Simplified#Payroll Solutions#Payroll System#Streamlined HR

0 notes

Text

Simplify Payroll Management with Info-Tech Payroll Software

Effortlessly manage your payroll processes with Info-Tech Payroll Software. Designed for businesses of all sizes, it features automated calculations, tax compliance, and seamless integration with HR and accounting systems. Enhance accuracy, save time, and stay compliant with our user-friendly payroll solution.

#payroll software singapore#hr payroll software#payroll software#payroll system#payroll software for sme#payroll software for small business#best payroll software singapore#payroll and leave management

0 notes

Text

Sage Payroll System: Simplifies the payroll management system

Do you want to Optimise the payroll processes of the company? If so, then rely on the Sage Payroll System. We assure you that we offer an all-inclusive solution for various tasks like automating tax deductions and calculations and ensuring easy compliance. It is Tailored to meet the requirements of businesses of all sizes. It is customisable and user-friendly.

0 notes

Text

Redefining Payroll Software Management Excellence in India

In the realm of Payroll Software Management in India, Qandle has emerged as an undisputed leader, revolutionizing the way organizations handle payroll processing and HR functions. Let's explore why Qandle stands out as the best choice for payroll software management in India.

Robust Payroll Processing

Qandle offers an all-encompassing payroll processing solution that caters to the intricate and ever-changing tax regulations in India. With a deep understanding of the Indian tax system, Qandle ensures accurate and timely payroll generation, covering components such as basic salary, allowances, deductions, and statutory compliance.

Legislative Compliance Expertise

India's labor laws and tax regulations can be labyrinthine, often causing compliance-related headaches for organizations. Qandle alleviates these concerns by continuously updating its software to align with the latest legal requirements. This ensures that businesses using Qandle remain compliant with minimal effort and avoid penalties and legal hassles.

Customization for Indian Businesses

Every Indian organization has its unique payroll and HR policies. Qandle stands out by offering a high degree of customization, allowing businesses to tailor the software to their specific requirements. Whether it's configuring leave policies, tax structures, or reporting formats, Qandle adapts seamlessly.

User-Friendly Interface

Qandle's user-centric design ensures that both HR professionals and employees can navigate the platform effortlessly. Its intuitive interface minimizes the learning curve, saving time and ensuring productive use of the software from day one.

Employee Self-Service

One of Qandle's distinguishing features is its Employee Self-Service portal. This empowers employees to access their payroll and HR-related information, request leaves, and update personal details, reducing the HR department's administrative workload while enhancing employee satisfaction.

Data Security and Privacy

Data security is a paramount concern in the digital age. Qandle prioritizes the security and privacy of sensitive payroll and HR data, employing robust encryption measures and security protocols to safeguard information.

Scalability

As businesses grow and evolve, their payroll and HR needs change. Qandle's software is highly scalable, accommodating organizations of various sizes and industries. It adapts to changing workforce dynamics and growing demands seamlessly.

Comprehensive HR Integration

Beyond payroll, Qandle's software integrates seamlessly with a suite of HR functions, providing a holistic HR management solution. This comprehensive approach streamlines HR operations, eliminating the need for multiple software solutions.

Analytics and Reporting

Qandle's payroll software includes advanced analytics and reporting tools that transform raw payroll data into actionable insights. This enables HR professionals to make informed decisions and strategic planning based on data-driven insights.

Customer-Centric Support

Qandle's commitment to excellence extends to its customer support. The company provides robust support and training resources to assist organizations in getting the most out of their payroll software. Their responsive support team is always ready to address queries and concerns promptly.

In conclusion, Qandle has distinguished itself as the best Payroll Software Management provider in India by combining legislative compliance expertise, customization, user-friendliness, data security, scalability, and comprehensive HR integration. As organizations strive for efficiency, accuracy, and compliance in their payroll and HR functions, Qandle remains a trusted partner, offering the tools and support needed to navigate the complexities of Indian payroll management effectively.

0 notes

Text

#payroll software Hong Kong#hr payroll software#payroll software#payroll system#payroll software for sme#payroll software for small business#best payroll software Hong Kong#payroll and leave management

0 notes

Text

Streamline Your Payroll with DigiSME

Optimize your payroll process with our Payroll Software, the perfect solution for businesses of all sizes. Our software simplifies payroll tasks, ensuring accurate salary calculations, easy tax filing, and compliance with regulations. With DigiSME, you can automate your payroll and save time, reducing the risk of costly errors. Discover how DigiSME can transform your payroll management today. Contact us for more details!

0 notes

Text

Unleashing the Power of Payroll Outsourcing: Streamline Your Core Business with Ease

Running a business is no walk in the park. From managing operations and dealing with clients to keeping up with the latest trends, entrepreneurs often find themselves juggling multiple tasks simultaneously. Amidst the chaos, one crucial aspect that can become overwhelming is managing payroll.

Luckily, there’s a solution that can help ease the burden and allow you to focus on what you do best: outsourcing payroll services. In this blog post, we’ll explore the benefits of partnering with an outsourcing payroll company and how it can streamline your core business. Let’s begin, shall we?

Boost Efficiency and Productivity

When it comes to managing payroll, there’s no denying that it can be a time-consuming and tedious task. From calculating employee wages to handling tax deductions, the entire process can leave you feeling like you’re lost in a never-ending maze of numbers.

Well, that’s where outsourcing payroll services come to the rescue. By entrusting this responsibility to a specialized company, you’re essentially handing over the reins to a team of experts who thrive in the realm of payroll outsourcing management. They possess the knowledge, experience, and tools to efficiently handle all your payroll needs, ensuring accurate calculations, on-time payments, and seamless record-keeping.

With this weight lifted off your shoulders, you and your team can devote your energy to what truly matters: growing your core business and fostering innovation.

Reduce Costs and Overhead

As a business owner, you’re always on the lookout for ways to cut costs and optimize your operations. Maintaining an in-house payroll department can be an expensive endeavor. From hiring and training staff to investing in software and staying up-to-date with ever-changing regulations, the financial burden can quickly add up.

By outsourcing your payroll, you can bid farewell to these overhead costs and channel your resources towards more impactful endeavors. An outsourcing payroll company takes care of all the intricacies of payroll management, including handling payroll taxes, managing benefits, and staying compliant with employment laws.

Doing this will not only save you money but also will ensure that your payroll processes are accurate and in line with legal requirements. It’s like finding a pot of gold at the end of the payroll rainbow, all while keeping your finances in check.

Ensure Compliance and Accuracy

Navigating the complex landscape of payroll regulations and compliance requirements can feel like walking through a maze blindfolded. From federal and state tax obligations to wage garnishments and employee benefits, there are numerous rules and regulations to abide by. The consequences of non-compliance can be severe, ranging from financial penalties to damaged reputations.

Fortunately, outsourcing payroll services can be your guiding light through this labyrinth of legalities. An outsourcing payroll company is well-versed in the latest laws and regulations, constantly staying abreast of changes to ensure your payroll system remain compliant.

These companies handle all tax filings, maintain accurate records, and ensure that your employees are paid correctly and on time. With their expertise, you can bid adieu to sleepless nights filled with visions of audits and fines, knowing that your payroll is in capable hands.

Enhance Data Security and Confidentiality

In the digital age, data security has become a paramount concern for businesses of all sizes. The thought of sensitive employee information falling into the wrong hands can send shivers down your spine. When you partner with a reputable outsourcing payroll company, you gain the assurance that your data is in safe hands.

These companies employ state-of-the-art security measures, including encryption protocols, secure servers, and stringent access controls, to safeguard your payroll information. Additionally, they conduct regular data backups to prevent data loss in case of unforeseen events.

With their robust security infrastructure, you can rest easy, knowing that your employees’ personal and financial data remains secure and confidential. It’s like having a digital fortress protecting your most valuable assets, allowing you to focus on growing your business without worrying about data breaches.

Access Expertise and Stay Updated

The world of payroll is a dynamic one, with ever-evolving regulations, tax laws, and industry best practices. Staying updated with these changes can be a daunting task, especially when you’re already occupied with running your business.

However, by outsourcing your payroll, you gain access to a team of experts who specialize in payroll management. These professionals are dedicated to staying on top of the latest trends, updates, and compliance requirements, ensuring that your payroll processes are always up-to-date. They can provide valuable insights and recommendations to optimize your payroll operations, helping you streamline processes and mitigate risks.

With their expertise, you can navigate the complexities of payroll tax, wage garnishments, and other payroll-related matters with finesse. It’s like having a payroll guru whispering golden nuggets of knowledge into your ear, guiding you toward greater efficiency and peace of mind.

Scale Your Business with Ease

Every entrepreneur dreams of growing their business and expanding their horizons. However, scaling up your operations can bring its fair share of challenges, particularly when it comes to managing payroll. As your workforce grows, so do the complexities of calculating wages, tracking employee benefits, and complying with employment laws. Well, this is where outsourcing payroll services truly shines.

An outsourcing payroll company has the scalability to accommodate your business’s growth effortlessly. Whether you’re hiring ten new employees or expanding internationally, they have the resources and expertise to adapt to your changing needs. Their streamlined processes and advanced payroll software enable seamless scalability, ensuring that your payroll keeps pace with your expanding business.

Conclusion

Payroll management, with its intricate calculations and ever-changing regulations, can easily become a burden on business owners. However, by embracing the power of payroll outsourcing services, you can unlock a world of possibilities for your core business.

By partnering with a trusted outsourcing payroll company, you can enhance efficiency, reduce costs, ensure compliance, and focus on what truly matters: growing your business and nurturing your team. With experts handling the complexities of payroll, you can reclaim valuable time and resources, allowing you to invest them in strategic initiatives and innovation.

So, embrace the payroll superheroes who will effortlessly manage your payroll needs, ensuring accurate calculations, on-time payments, and compliance with legal obligations. With the weight of payroll off your shoulders, you can focus on propelling your core business to new heights of success.

0 notes