#Emerging Markets Index

Explore tagged Tumblr posts

Text

Diversification: Spreading Your Investment Risk for Long-Term Growth

Introduction: Welcome to another insightful blog post on personal finance and investing. Today, we’ll be delving into the concept of diversification and its vital role in spreading investment risk for long-term growth. Whether you’re a seasoned investor or just starting out, understanding and implementing diversification strategies can significantly enhance your investment portfolio’s stability…

View On WordPress

#Asset Allocation#asset classes#Bonds#Diversification#diversification strategies#emerging markets#ETFs#Financial Goals#financial journey#geographic diversification#growth opportunities#improved returns#Index funds#industry-specific risks#international diversification#Investing#investment portfolio diversification#investment risk#Investment Strategy#Investment Vehicles#long term growth#Market Volatility#Mutual Funds#Personal Finance#portfolio rebalancing#risk reduction#risk tolerance#sector diversification#stability#Stocks

1 note

·

View note

Text

Turkey votes in runoff election after candidates double down on nationalism and fear

People walk past an election campaign poster for Turkey’s President Recep Tayyip Erdogan on May 25, 2023 in Istanbul, Turkey. The country is holding its first presidential runoff election after neither candidate earned more than 50% of the vote in the May 14 election. Chris Mcgrath | Getty Images News | Getty Images Millions of Turks are casting their ballots Sunday for the second time in two…

View On WordPress

#Breaking News: Politics#business news#DXY US Dollar Currency Index#Elections#Emerging markets#Government and politics#Kemal Kılıçdaroğlu#politics#Recep Tayyip Erdoğan#Turkey#Voting

0 notes

Text

ETFs in practice

Consider ETFs as the building blocks of your wealth without forgetting to take into account the price level and your overall portfolio before investing.

After having covered the key theoretical aspects to better understand ETFs in a previous article, let us now consider the more practical aspects of ETF investing. A simple portfolio of ETFs In his “Little Book of Common Sense Investing”, John Bogle suggests using a single fund such as a Total Stock Market Index Fund to hedge equity exposure. Investor-author Taylor Larimore also recommends…

View On WordPress

0 notes

Text

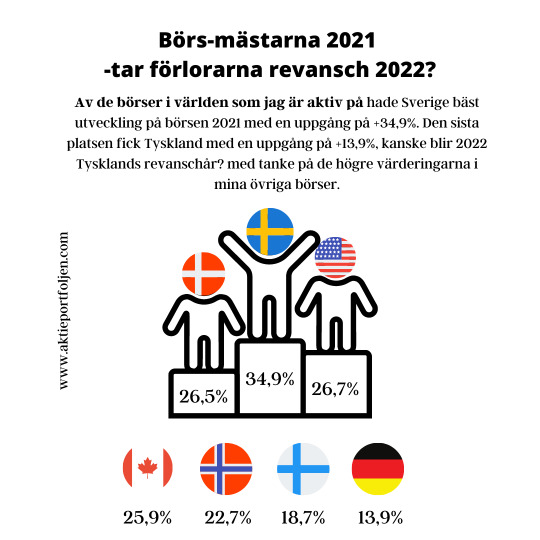

Börsmästarna 2021 - tar förlorarna revansch 2022?

Av de #börser i #världen som jag är aktiv på hade Sverige bäst utveckling på #börsen 2021 med en uppgång på +34,9%. Den sista platsen fick Tyskland med en uppgång på +13,9%,

Av de börser i världen som jag är aktiv på hade Sverige bäst utveckling på börsen 2021 med en uppgång på +34,9%. Den sista platsen fick Tyskland med en uppgång på +13,9%, kanske blir 2022 Tysklands revanschår? med tanke på de högre värderingarna i mina övriga börser. Inom kategorin Developed Markets är Österrike vinnare med en uppgång på 44,4%. Det är inte så förvånande egentligen då den…

View On WordPress

0 notes

Text

'Santa rally' won't rekindle due to omicron risks and profit-taking, PNC Financial's CIO predicts

‘Santa rally’ won’t rekindle due to omicron risks and profit-taking, PNC Financial’s CIO predicts

PNC Financial is throwing cold water on the fourth-quarter rally. Covid omicron fears will take a heavy toll on risk appetites over the next two weeks, according to Chief Investment Officer Amanda Agati. “We’ve already gotten the Santa rally,” she told CNBC’s “Trading Nation” on Monday. “We’re seeing a little bit of investor fatigue here.” The major indexes kicked off the week in the red. The S&P…

View On WordPress

#Business news#coronavirus#covid-19#economy#Federal Reserve Bank#fiscal policy#Interest rates#Investment strategy#iShares MSCI Emerging Markets ETF#Jerome Powell#markets#Monetary Policy#NASDAQ Composite#S&P 500 INDEX -#vaccinations#wall street

0 notes

Text

This mutual fund scheme will let you invest solely in Taiwan; check out details

This mutual fund scheme will let you invest solely in Taiwan; check out details

The Nippon India Joint Fund launched the Nippon India Taiwanese Equity Fund, the country’s first open-ended equity program focused on Taiwan. The fund will be advised by Cathay SITE, which is Taiwan’s largest asset manager with $42.8 billion in assets under management (AUM). Furthermore, the two Finance Boards also collaborated for an exclusive strategic collaboration for joint or individual…

View On WordPress

#Kathy&039;s website#MSCI Emerging Markets Index#mutual fund#nippon india#Nippon India Mutual Fund#Nippon India Taiwan Stock Fund#Taiwan Mutual Fund

0 notes

Text

Emerging Markets Bond Index (EMBI)

What Is the Emerging Markets Bond Index (EMBI)?

The Emerging Markets Bond Index (EMBI) is a benchmark list for estimating the all-out return execution of worldwide government and corporate securities gave by developing business sector nations that meet explicit liquidity and primary necessities.

Notwithstanding their expanded danger comparative with created markets, developing business sector securities offer a few potential advantages, for example, portfolio variety as their profits are not firmly related to customary resource classes.

Understanding the Emerging Markets Bond Index

A developing business sector depicts a non-industrial nation or economy that is advancing toward turning out to be further developed by quickly industrializing and embracing unrestricted economy economies. The biggest developing business sectors incorporate Nigeria, China, India, Brazil, South Africa, Poland, Mexico, Turkey, Argentina, Russia, and so forth To exploit the fast development happening in these nations, financial backers hope to bonds given by the public authority of these countries.

Developing business sector obligations or bonds are viewed as sovereign obligations. These administration bonds are ordinarily given in unfamiliar monetary standards, either in US dollars, euros, or Japanese yen. On account of the expanded monetary and political danger present in these nations, the FICO score on developing business sector securities will in general be lower than that on created market securities. Because of the apparent higher danger of putting resources into these resources, the sovereign securities have more significant returns for financial backers than that of more steady bonds in created nations. For instance, the PIMCO Emerging Local Bond Fund conveyed a complete return of over 14% in the initial nine months of 2017, while the iShares Core US Aggregate Bond ETF acquired 3.1% during a similar time frame. Financial backers who need openness to arise economies and who will face extra danger challenges do as such through shared assets or trade exchanged assets (ETFs) that track the exhibition of a benchmark record, for example, the developing business sectors bond file.

How the EMBI Is Used

Developing business sectors' security files are utilized as benchmarks for security execution in developing business sectors. The most famous developing business sectors' bond records are the JP Morgan EMBI+ Index, JP Morgan EMBI Global Index, and JP Morgan EMBI Global Diversified Index. The EMBI+ Index estimates Brady bonds, which are dollar-designated gave principally by Latin American nations. The EMBI+ additionally incorporates dollar-designated credits and Eurobonds and develops J.P. Morgan's unique Emerging Markets Bond Index (EMBI), which was presented in 1992 when it covered just Brady securities. Nations in the EMBI+ record are chosen by a sovereign FICO assessment level. The record is weighted based available capitalization of government securities, yet it is the sub-file with the best liquidity necessities, so a few business sectors are barred. To fit the bill for record enrolments, the obligation should be over one year to develop, have something like a $500 million extraordinary presumptive worth, and meet tough exchanging rules to guarantee that evaluating failures don't influence the file.

KEY TAKEAWAYS

· The Emerging Markets Bond Index (EMBI) tracks the presence of developing business sector bonds and was first distributed by speculation bank JP Morgan.

· Developing business sector securities are obligation instruments gave by non-industrial nations, which will in general convey more significant returns than government or corporate obligations of created nations.

· The vast majority of the benchmark EMBI record tracks arising sovereign obligation, with the rest in territorial corporate securities.

iShares JPMorgan USD Emerging Markets Bond ETF

Dispatched with the assistance of iShares in December 2007, the iShares JPMorgan USD Emerging Markets Bond ETF (EMB) tracks the JPMorgan EMBI Global Core Index. EMBI Global Core is an exceptionally expansive, U.S.- dollar named, developing business sectors obligation benchmark. It is additionally exceptionally different – no single obligation instrument contains over 2% of all our possessions, and most miss the mark concerning 1%. Almost 3/4 of the EMBI Global Core is arising government obligation, with the greater part of the lay zeroed in on high-yielding corporate securities. The cost proportion is following what you'd anticipate from an iShares ETF at 0.40%.

The iShares JPMorgan USD Emerging Markets Bond ETF is most appropriate for financial backers who are searching for an expanded way to high-yielding fixed pay. The asset has property in 50 nations, remembering for portion in Russia, Mexico, Poland, Hungary, South Africa, and the Philippines.

youtube

For more information visit to our websites:

https://astrodunia.com/

https://rajeevprakash.com/

#emerging markets bond index (embi)#emerging markets bond index etf#emerging markets bond index fund#emerging markets bond index global#portfolio stocks india#portfolio stocks for 2021#portfolio stocks bonds#bond etf india#bond etf price#bond etf vs mutual fund#bond etf asx#stock market#stock market astrology#astro prediction nifty#astro market#astro stock market prediction#indian market today#stock market live today#astro nifty twitter#Youtube

0 notes

Text

Shake-up in Chinese stocks raises questions over the future of international investing

Shake-up in Chinese stocks raises questions over the future of international investing

Traders on the floor of the New York Stock Exchange. Source: NYSE The latest volatility in China — with regulators in Beijing attempting to rein in several sectors of the Chinese economy — is only the latest blow for international investors. “The invest-in-China mantra has always been based on the idea that China was going to be the next big global power, so that’s where I need to be,” said…

View On WordPress

#ARK Innovation ETF#business news#China#Emerging markets#Investment strategy#iShares MSCI China ETF#iShares MSCI Emerging Markets ETF#markets#United States#Vanguard FTSE Emerging Markets Index Fund ETF Shares

0 notes

Note

advice for people just wanting to be educated in the finance field?

I would start dipping your toe in the finance sections of reputable sources (i.e. Financial Times, Wall Street Journal, Harvard business review, MarketWatch, etc.) and start researching terms and companies you don’t know. I treat myself with a Bloomberg Businessweek subscription sent to my home because I love their design team and it’s actually very informative. You can also sign up for the Morning Brew finance newsletter, it’s free and I read it every morning to get a brief overview of what’s going on. Even just being informed of current events is helpful in learning about finance because all major events effect the market and businesses. Look at stock performance charts. Learn about different types of investment accounts and different kinds of investments. There are a lot of really great courses on platforms like Coursera as well, I just took one called Private Equity & Venture Capital from Università Bocconi. Flirt with equity crowdfunding platforms (I accidentally made a lot of money on one of these as an early investor with less than $1k). If you live in the US start looking into personal and business tax deductions. Even credit card rewards can actually get you a lot, I’ve gotten free hotel rooms and free flights from money I would have spent anyway. Investments also mean more than just individual stocks: could be index funds, mutual funds, bonds, CDs, REITs, forex, precious gems & metals, real estate, even some designer goods retain and increase in value if bought strategically and handled correctly. Even just having the fundamentals of a maxed out retirement account (a Roth IRA or a backdoor Roth IRA is my personal preference) full of index funds and mutual funds that are balanced well, a fully funded emergency fund of 3-12 months personal expenses, any debt above 7% interest paid off, and sinking funds for various expenses automatically set up in a high yield savings account will have you very well off. When you have a foundation like that you have the breathing room to change careers, take time off, buy investment properties, invest in volatile but potentially profitable ventures, start businesses, and set up additional streams of income.

#i am not a financial advisor but this is what I’ve learned from school and self education and personal trial and error#i think I’m gonna do a detailed finance books list if y’all would like that I think it could be very useful

154 notes

·

View notes

Text

Private equity health-care monopolies are on a profitable killing spree

It’s not just you. US healthcare, already a bureaucratic nightmare of buck-passing and price-gouging, has gotten far worse. Private equity firms have created regional health-care monopolies that don’t just rip patients off — they’re killing us.

Private equity is a scam. Fund managers raise gigantic sums by claiming to be able to “beat the market.” In reality, they do worse for their investors than a boring old index fund:

https://pluralistic.net/2020/02/25/pluralistic-your-daily-link-dose-25-feb-2020/#extraordinaryclaims

The fund managers don’t have to beat the market in order to make bank. They can take advantage of the “carried interest” loophole, which has nothing to do with interest rates — it’s a tax system that was invented for 16th century sea-captains (no, really):

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

PE dresses up its playbook in all kinds of bullshit, but it’s a smokescreen. At core, PE funds buy companies, merge them to monopoly, slash wages, fire staff, load up their businesses with debt, and then skedaddle before the businesses collapse. They call this “creating value”:

https://pluralistic.net/2020/07/24/software-is-cake-too/#looters

This playbook guarantees that everything PE touches will turn to shit. PE is a parasite that preys on weak industries and makes them even more dysfunctional. Think of how PE has cornered regional rental housing markets and then turned every rental in town into a slum:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

Most of us didn’t really think about rail-freight until last winter, when the whole system nearly collapsed. Again, the bloody handprints of PE are all over that crisis:

https://pluralistic.net/2022/02/04/up-your-nose/#rail-barons

The pandemic put a lot of businesses into a precarious state, and PE swooped in, buying up distressed businesses at scale and putting them into a death-spiral:

https://pluralistic.net/2020/03/30/medtronic-stole-your-ventilator/#blackstone-kkr

This acquisition was fueled by Trump’s corporate covid bailout and the trillions in public money that the GOP made available to corporate borrowers (remember, PE thrives on debt):

https://pluralistic.net/2020/09/17/divi-recaps/#graebers-ghost

Of all the sick industries in America, healthcare is the sickest, and it’s the domain where PE has done the most damage. PE stripped healthcare systems to the bone, removing all excess capacity and exhausting and demoralizing healthcare workers:

https://pluralistic.net/2020/05/21/profitable-butchers/#looted

They bought up emergency rooms, turned them into scam factories that hit every unfortunate person who stepped foot in them with thousands in “surprise billing” fees. Then they cut doctors’ pay and spent millions on ads to block anti-surprise billing legislation:

https://pluralistic.net/2020/04/21/all-in-it-together/#doctor-patient-unity

The ER scam was and is wild. Some hospitals lock all their doors except for the ER doors, and then they’d hit you for “emergency care” when you went through the ER on your way to receiving normal, non-emergency procedures:

https://pluralistic.net/2022/03/14/unhealthy-finances/#steins-law

The damage wasn’t limited to emergency rooms. Whole hospitals — whole hospital systems — were crashed by PE looters, and many of these got emergency government bailouts, because…free market?

https://pluralistic.net/2020/10/01/the-years-of-repair/#mass-murder

PE has bought its way into every corner of the health-care system, and made every bad thing, much, much worse. You know how “bad nursing home” are three of the scariest words in the English language? Try on “bad private equity owned nursing home” for size. The death toll is massive:

https://pluralistic.net/2021/02/23/acceptable-losses/#disposable-olds

Biden’s SEC chair Gary Gensler has made the most decisive anti-PE moves in decades, requiring disclosures that will help investors (especially union pension funds) pierce the veil of bullshit that brings in the billions that PE fashions into weapons of financial mass destruction:

https://pluralistic.net/2022/02/10/monopoly-begets-monopoly/#gary-gensler

But the wheels of justice grind slow, and PE has trillions to fuel its race to suck every bit of value out of the health-care system before the party comes to an end.

In “Sick Profit: Investigating Private Equity’s Stealthy Takeover of Health Care Across Cities and Specialties,” Kaiser Health News’s Fred Schulte reveals the plan of attack:

https://khn.org/news/article/private-equity-takeover-health-care-cities-specialties/

In 2021, PE firms bought 1,400 health care companies, spending $206b (the total since 2012 is more than $1t). They’ve cornered regional markets for eye care, dental care, family practices, hospices, and pet care. We’ve had a year to see how that played out, and it’s not pretty.

Since 2014, PE companies have paid out $500m in fines for falsifying health care billings to the US government, but a fine is a price, and the fines have been absorbed into PE’s business plans as part of the cost of operations.

Once a PE firm buys up all the specialists in a region, things get very bad. Take San Antonio, where nearly all the gastroenterology clinics have been bought up by PE firms, and where routine colonoscopies now cost patients thousands more than they paid before:

https://khn.org/news/article/private-equity-gastroenterologist-colonoscopy/

While there are plenty of illegal ways that PE companies extract value from their acquisitions, the legal tactics are pretty ugly all on their own, like cutting staff and replacing them with less skilled, less trained, cheaper workers, putting patients at risk.

This is particularly worrying when you consider how heavily PE companies invest in practices that treat people who are vulnerable and struggle to advocate for themselves, such as behavioral health specialists who treat autism, addiction and mental illness.

Whether or not you can escape PE depends a lot on where you live. PE only owns 12% of the nation’s anesthesiology practices, but those practices are concentrated in five states, where more than two thirds of anesthesiologists are PE owned.

When PE takes over your health care, billings go way up. The average PE-treated patient generates $71 more per claim, and is 9% more likely to experience “lengthy, more costly” care:

https://jamanetwork.com/journals/jama-health-forum/fullarticle/2795946

Doctors who sell their practices to PE companies are lured in with promises of administrative relief from experts who’ll handle billing, scheduling and compliance. But PE firms exercise fine-grained control over these doctors, violating rules that say medical practices must be run by MDs.

Take National Spine, a PE-backed chain owned by Sentinel Capital Partners that bought up 40+ pain-management clinics across the country. Doctors saw their caseload explode from 16 patients/day to 25. Medicare billings also exploded, with “unnecessary and often worthless” back braces being charged at up to $1,100 each. Patients were given $1,800 “medically unnecessary and often worthless” urine tests. National settled these claims for $3.3m in April 2019, without admitting guilt.

RLH Equity Partners’s pharmacies bilked the military health insurer Tricare out of $68m through a system of kickbacks and telemarketer sales. RLH settled the case for $21m and blamed it on a few corrupt “individuals.”

Most of the time, fraud claims are settled by the companies that the PE funds owe, while the PE funds themselves get off scot-free. That leaves the funds free to re-offend, and to further push the limits on patient endangerment.

One of the grisliest parts of this tale is in the realm of children’s dentistry. PE firms have bought up these practices and turned them into high-volume Medicare-fraud assembly lines that perform rushed, unnecessary major procedures on poor kids and bill the government a fortune for them.

These include baby root canals and crowns, and the PE-backed dental chains set quotas for their staff, requiring them to perform a certain number of major procedures on each patient. One particularly horrifying case recounted by the KHN article is that of two-year old Zion Gastelum, who died following major dental surgery.

Gastelum received six root canals and crowns on his baby teeth at a PE-owned Kool Smiles clinic in Yuma, AZ. The oxygen bottle used during his surgery “was empty or not operating properly” and the staff who oversaw the procedure were undertrained and didn’t notice. He never regained consciousness, and died of brain injuries days later.

Kool Smiles’s owners paid $24m to settle a DoJ overbilling claim less than a month later. The settlement alleged that Kool Smiles performed unnecessary procedures, including baby root canals. Kool Smiles denied that they were responsible for Gastelum’s death.

More than 90% of PE acquisitions fall below the $101m threshold for antitrust review, so they fly under the radar. Once the mergers are complete, they are very hard to unwind. The FTC is working its way through hundreds of comments from doctors or other health care workers asking for tighter scrutiny of health-care mergers.

The Healthcare Private Equity Association boasts that its members are poised to spend more than $3t to create “the future of healthcare.”

https://hcpea.org/#!event-list

Image: Rae Allen (modified) https://www.flickr.com/photos/raeallen/6224775722/

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

Videoplasty (modified) https://commons.wikimedia.org/wiki/File:Patient_Care_Cartoon.svg

CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0/deed.en

[Image ID: A hospital Emergency Room parking lot. In the center of the image stands an ogrish, top-hatted, cigar-chomping capitalist caricature. He is standing at a podium, yanking a lever made from a golden dollar-sign. The front of the podium bears a red cross. He holds aloft an elderly man in a hospital bed.]

139 notes

·

View notes

Text

Stock rally: Investors bet weak dollar will keep risk rally going in 2021

Stock rally: Investors bet weak dollar will keep risk rally going in 2021

By Saqib Iqbal Ahmed NEW YORK: Investors are counting on a weakening dollar to boost rallies in everything from US stocks to emerging markets and industrial metals in 2021. Record-low US interest rates, massive financial stimulus and a growing appetite for risk are among the catalysts that contributed to the dollar’s 6 per cent drop against a basket of its peers year-to-date, putting it on track…

View On WordPress

0 notes

Text

Russian stock analyst drinks to death of the stock market on live TV

Russian stock analyst drinks to death of the stock market on live TV

A man views a digital board showing Russian rouble exchange rates against the euro and the US dollar outside a currency exchange office. On March 2, 2022, the Russian rouble hit record lows with the US dollar and the euro rates reaching 110 and 122 at the Moscow Exchange respectively. Mikhail Metzel | TASS | Getty Images A Russian stock market analyst pulled out a bottle and drank to the death…

View On WordPress

#business news#DXY US Dollar Currency Index#Emerging markets#Markets#Russia#Ukraine#US Dollar / Russian Ruble FX Spot Rate

0 notes

Text

J.P. Morgan Does Not Include India Government Bonds In Emerging Market Index

J.P. Morgan Does Not Include India Government Bonds In Emerging Market Index

[ad_1]

India has one of the largest local currency government bond markets among emerging-market economies

Morgan has opted not to include India’s government bonds in one of its flagship emerging market indexes after investors cited ongoing problems with capital controls, custody and settlement and other operational snags. India has one of the largest local currency government bond markets…

View On WordPress

0 notes

Photo

J.P. Morgan Does Not Include India Government Bonds In Emerging Market Index India has one of the largest local currency government bond markets among emerging-market economies Morgan has opted not to include India's government bonds in one of its flagship emerging market indexes after investors cited ongoing problems with capital controls, custody and settlement and other operational snags.

0 notes

Photo

J.P. Morgan Does Not Include India Government Bonds In Emerging Market Index India has one of the largest local currency government bond markets among emerging-market economies Morgan has opted not to include India's government bonds in one of its flagship emerging market indexes after investors cited ongoing problems with capital controls, custody and settlement and other operational snags.

#Bonds#Emerging#emerging-market economies#Government#Include#Index#India#India Government Bonds#JP#jp morgan Emerging Market Index#Market#Morgan

0 notes

Photo

J.P. Morgan Does Not Include India Government Bonds In Emerging Market Index India has one of the largest local currency government bond markets among emerging-market economies Morgan has opted not to include India's government bonds in one of its flagship emerging market indexes after investors cited ongoing problems with capital controls, custody and settlement and other operational snags.

0 notes