#bond etf vs mutual fund

Text

ETF Investing: Differences Between ETF vs Mutual Funds

What Is an ETF?

An ETF (Exchange-Traded Fund) is similar to a mutual fund, pooling investments to track a particular index, industry, or even a range of assets. It offers a wide range of options, from tracking the price of a single commodity to covering a diverse array of assets. Moreover, it is set apart by its ability to be traded on stock exchanges like individual stocks.

ETF prices fluctuate throughout the day because they are bought and sold on stock exchanges in real-time. This real-time trading not only enhances their liquidity but also typically makes them more cost-effective than mutual funds.

Differences Between ETF vs MF (Mutual Fund)

5 Types of ETFs

Equity ETF

Equity ETF tracks stock market indices like the S&P 500. They provide broad exposure to a diversified portfolio of stocks, making them ideal for long-term investors looking to benefit from overall market growth.

Bond ETF

Bond ETF invests in a portfolio of bonds, including government, corporate, and municipal bonds. These ETFs are suitable for income-focused investors, offering regular interest payments and reduced volatility compared to equities.

Commodity ETF

Commodity ETF tracks the price of physical commodities such as gold, silver, or oil. They are useful for hedging against inflation and diversifying beyond stocks and bonds, though they tend to be more volatile.

International ETF

International ETF provide exposure to markets outside your home country. They help diversify your portfolio globally, reducing reliance on a single economy and tapping into growth opportunities in other regions.

Sector and Industry ETF

Sector and Industry ETFs focus on specific areas of the economy, like technology or healthcare. These ETFs are ideal for targeting sectors expected to outperform the broader market but come with higher risk due to less diversification.

Read more: FinxpdX

0 notes

Text

Best Stock Market Course In Jalandhar

1. Introduction to the Stock Market

What is the Stock Market?: Basic concepts and functions.

Types of Markets: Primary vs. Secondary markets.

Major Stock Exchanges: NYSE, NASDAQ, etc.

2. Stock Market Participants

Individual Investors: Retail vs. Institutional.

Brokers and Brokerage Accounts: How to choose and open an account.

Regulatory Bodies: SEC, FINRA, etc.

3. Investment Basics

Stocks and Shares: Common vs. Preferred.

Bonds and Other Securities: Basics of fixed income.

Mutual Funds and ETFs: Diversification and index funds.

4. Fundamental Analysis

Financial Statements: Income statement, balance sheet, cash flow statement.

Valuation Metrics: P/E ratio, EPS, ROE, etc.

Economic Indicators: GDP, inflation, unemployment rates.

5. Technical Analysis

Charts and Graphs: Understanding price trends and patterns.

Technical Indicators: Moving averages, RSI, MACD.

Trading Strategies: Day trading, swing trading, long-term investing.

For More Info : Stock Market Course in Jalandhar | Best Share Market Course (gtbinstitute.com)

0 notes

Text

Understanding Finance and Investments: A Path to Financial Empowerment

Finance and investments are two sides of the same coin, each playing a pivotal role in our economic lives. Whether you’re an individual managing personal finances or a business navigating complex financial decisions, understanding these concepts is crucial to making informed choices that lead to financial security and growth.

What is Finance?

At its core, finance is the management of money. It involves the processes of acquiring, allocating, and managing financial resources. Finance can be broadly categorized into three main areas:

1. Personal Finance: This encompasses individual financial planning, including budgeting, saving, investing, and managing debt. Personal finance is about making decisions that secure your financial future — whether it’s saving for retirement, buying a home, or paying for a child’s education.

2. Corporate Finance: This area focuses on how businesses manage their financial resources. Corporate finance includes activities like capital raising, budgeting, financial analysis, and strategic planning. The goal is to maximize a company’s value to its shareholders through effective financial management.

3. Public Finance: This deals with government finances, including taxation, government spending, budgeting, and debt issuance. Public finance aims to manage a nation’s economic health by ensuring that government policies are fiscally responsible and sustainable.

The Importance of Investments

Investments are a key component of finance, representing the allocation of resources (usually money) into assets or projects with the expectation of generating returns over time. Investments can take many forms, including:

Stocks: Equities represent ownership in a company and entitle shareholders to a portion of the profits. Investing in stocks offers the potential for significant returns but also comes with higher risk compared to other investment types.

Bonds: These are debt securities issued by corporations or governments to raise capital. Bonds provide fixed interest payments over time and are generally considered safer than stocks, though they typically offer lower returns.

Real Estate: Investing in property can provide steady income through rental payments and potential appreciation in value over time. Real estate is often seen as a tangible asset, offering a hedge against inflation.

Mutual Funds and ETFs: These investment vehicles pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities. They offer the benefits of diversification and professional management.

Commodities: Investing in physical goods like gold, oil, or agricultural products can provide a hedge against inflation and currency fluctuations, though these markets can be highly volatile.

The Relationship Between Risk and Return

One of the fundamental principles in finance and investments is the relationship between risk and return. Generally, higher returns come with higher risk. For example, while stocks have the potential for higher returns, they also carry a greater risk of loss compared to bonds or savings accounts. Understanding your risk tolerance — how much risk you are willing and able to take on — is crucial in building a portfolio that aligns with your financial goals.

The Role of Diversification

Diversification is a strategy used to manage risk by spreading investments across various asset classes, sectors, or geographic regions. By diversifying, you reduce the impact of poor performance in any one area on your overall portfolio. The saying “don’t put all your eggs in one basket” aptly captures the essence of diversification.

Long-Term vs. Short-Term Investments

Investors often face the choice between long-term and short-term investment strategies.

Long-term investments are typically held for several years or even decades, allowing the investor to benefit from compound interest and weather short-term market volatility. This approach is suitable for goals like retirement savings or purchasing a home.

Short-term investments, on the other hand, are made with the expectation of realizing returns within a shorter time frame, often less than a year. These investments might be used for immediate financial goals but generally come with lower returns and may require more frequent monitoring.

The Power of Financial Planning

Financial planning is the process of setting, achieving, and reviewing your financial goals through careful management of your finances. A well-crafted financial plan considers your current financial situation, future goals, and risk tolerance. It includes strategies for saving, investing, and protecting your assets through insurance and estate planning.

Conclusion: Empowering Yourself Through Knowledge

Understanding finance and investments is not just for the wealthy or financially savvy — it’s for everyone. By educating yourself on these topics, you can make informed decisions that lead to greater financial security and opportunities for growth. Whether you’re just starting out or looking to refine your financial strategy, a solid understanding of finance and investments will empower you to take control of your financial future.

Investing in your financial education is one of the most important investments you can make. With knowledge and careful planning, you can navigate the complexities of the financial world and work toward achieving your financial goals.

0 notes

Link

#etfvsmutualfunds#etfvsmutualfundsvsindexfunds#etfsvsindexfunds#etfsvsmutualfunds#indexfunds#indexfundsforbeginners#indexfundsvsetf#indexfundsvsmutualfunds#indexfundsvsmutualfundsvsetf#indexmutualfunds#mutualfund#mutualfundinvesting#mutualfundvsindexfund#mutualfunds#mutualfundsforbeginners#mutualfundsvsetf#mutualfundsvsetfs#mutualfundsvsindexfunds#vanguardindexfunds

0 notes

Text

Comparing Short-Term vs. Long-Term Investment Plans for 5 Years

Investing with a 5-year time frame in mind requires a strategy that balances growth potential with risk management. Whether you're saving for a down payment on a house, a child's education, or simply looking to grow your wealth, here are some of the best investment options to consider:

1. Mutual Funds

a. Equity Mutual Funds

Equity mutual funds invest primarily in stocks. They offer the potential for higher returns but come with higher risk. For a 5-year horizon, consider large-cap or diversified equity funds. These funds invest in well-established companies with a history of steady growth.

b. Hybrid Mutual Funds

Hybrid mutual funds, also known as balanced funds, invest in a mix of equity and debt instruments. This balance helps reduce risk while still providing decent returns. They are suitable for moderate risk-takers.

2. Fixed Deposits (FDs)

Bank fixed deposits are a popular choice for conservative investors. They offer guaranteed returns and capital protection. The interest rates on FDs vary across banks, so it’s wise to compare and choose the best rates. While the returns may be lower compared to equity, the safety and stability make FDs a good choice for risk-averse individuals.

3. Public Provident Fund (PPF)

The Public Provident Fund is a long-term investment option backed by the government. It has a lock-in period of 15 years, but partial withdrawals are allowed after 5 years, making it suitable for medium-term goals. PPF offers attractive interest rates and the returns are tax-free.

4. National Savings Certificate (NSC)

NSCs are government-backed savings bonds that come with a fixed interest rate and a 5-year maturity period. They are a safe investment option with the added benefit of tax deductions under Section 80C of the Income Tax Act. The interest earned is taxable, but the safety and guaranteed returns make NSCs a reliable choice.

5. Corporate Bonds

Corporate bonds are debt securities issued by companies to raise capital. They offer higher interest rates compared to government bonds. For a 5-year investment, look for high-quality corporate bonds (rated AAA) to ensure lower risk of default.

6. Real Estate

Investing in real estate can be a good option if you have a substantial amount of capital. Over a 5-year period, property values can appreciate significantly, especially in growing urban areas. However, real estate requires careful consideration of location, market trends, and liquidity needs.

7. Stock Market

Direct investment in the stock market can yield high returns if done wisely. For a 5-year period, consider investing in blue-chip stocks—shares of well-established companies with a strong track record of performance. Diversify your portfolio to mitigate risks.

8. Gold

Gold is considered a safe haven during market volatility. Investing in gold ETFs (Exchange-Traded Funds) or sovereign gold bonds can provide good returns. Gold tends to appreciate over time and offers a hedge against inflation and economic downturns.

9. Unit Linked Insurance Plans (ULIPs)

ULIPs provide the dual benefit of insurance and investment. Part of the premium goes towards life insurance, and the rest is invested in equity or debt funds. They have a lock-in period of 5 years and offer the potential for market-linked returns.

10. Recurring Deposits (RDs)

Recurring deposits are similar to fixed deposits but allow regular monthly investments. They offer fixed returns and are a good option for disciplined savers who want to accumulate a corpus over 5 years.

Key Considerations

Risk Appetite: Assess your risk tolerance before choosing an investment plan. Equity and mutual funds offer higher returns but come with higher risk, while FDs and PPFs offer lower returns with higher safety.

Tax Implications: Consider the tax benefits and liabilities of each investment. Options like PPF and ELSS (Equity Linked Savings Scheme) offer tax deductions, while interest from FDs and NSCs is taxable.

Liquidity Needs: Ensure the investment aligns with your liquidity requirements. Some investments like real estate and PPF have longer lock-in periods, while others like mutual funds and stocks offer more liquidity.

Diversification: Diversify your investments across different asset classes to balance risk and return.

Conclusion

Choosing the right investment plan for a 5-year horizon depends on your financial goals, risk tolerance, and liquidity needs. A balanced portfolio with a mix of equity, debt, and fixed income instruments can help achieve optimal returns while managing risks. Always conduct thorough research or consult with a financial advisor before making investment decisions.

0 notes

Text

Navigating the World of Investments: A Beginner's Guide to the Stock Market

Investing in the stock market can seem like an intimidating venture, especially for beginners. The fluctuating numbers, complex terminologies, and tales of both spectacular gains and crushing losses can make it appear as though the stock market is a domain best left to seasoned professionals. However, the reality is that anyone can learn to invest in stocks and, with the right knowledge and approach, can achieve significant financial growth over time.

The stock market is a powerful wealth-building tool. It offers opportunities for individuals to grow their money through ownership in companies that drive the global economy. Whether you're looking to save for retirement, build a college fund, or simply grow your wealth, investing in stocks can help you achieve your financial goals. The key lies in understanding the basics, developing a sound strategy, and staying disciplined.

In this comprehensive guide, we'll demystify the world of stock market investing for beginners. We'll cover the fundamental concepts, explain how the stock market works, and provide actionable steps to help you start your investing journey. By the end of this guide, you'll have a solid foundation to make informed decisions and embark on your path to financial independence.

1. Understand the Basics of the Stock Market

Before diving into the world of investing, it's crucial to understand what the stock market is and how it operates.

What is the Stock Market?

The stock market is a collection of exchanges where stocks (pieces of ownership in businesses) are bought and sold. Major stock exchanges include the New York Stock Exchange (NYSE) and the Nasdaq. When you purchase a stock, you're buying a small share of a company and becoming a part-owner.

How Does It Work?

Companies list shares of their stock on an exchange through an initial public offering (IPO). Investors can then buy and sell these shares on the exchange. The price of a stock is determined by supply and demand factors in the market.

2. Set Clear Investment Goals

Determine what you want to achieve with your investments. Are you saving for retirement, a down payment on a house, or your child's education? Clear goals will guide your investment strategy and help you stay focused.

3. Educate Yourself

Investing without knowledge is like driving without a map. Equip yourself with a basic understanding of key investment concepts:

Stocks vs. Bonds

Stocks: Represent ownership in a company and a claim on part of the company’s assets and earnings.

Bonds: Essentially loans made to a company or government, which pay interest over time but do not confer ownership.

Diversification

Spreading your investments across different asset classes and sectors to reduce risk.

Risk Tolerance

Your ability and willingness to lose some or all of your original investment in exchange for greater potential returns.

4. Choose an Investment Account

To buy stocks, you need an investment account. The two most common types are:

Brokerage Accounts

Offer the widest range of investments and are good for buying individual stocks, bonds, and mutual funds.

Retirement Accounts

Such as IRAs and 401(k)s, which offer tax advantages for long-term savings.

5. Start with Low-Cost, Broad-Based Index Funds

For beginners, low-cost index funds and exchange-traded funds (ETFs) are excellent starting points. These funds hold a diverse portfolio of stocks, which mitigates risk and simplifies the investment process.

6. Develop a Strategy

Dollar-Cost Averaging

Investing a fixed amount of money at regular intervals, regardless of the stock market’s performance, to reduce the impact of market volatility.

Buy and Hold

Investing in stocks with the intention of holding them for a long period, regardless of market fluctuations, to benefit from long-term growth.

7. Monitor and Adjust Your Portfolio

Regularly review your investments to ensure they align with your goals. Rebalance your portfolio as needed to maintain your desired asset allocation.

8. Stay Informed and Keep Learning

The stock market is dynamic, and continuous learning is crucial. Stay informed about market trends, economic news, and new investment opportunities. Books, online courses, and financial news outlets are excellent resources for ongoing education.

9. Avoid Common Mistakes

Emotional Investing

Making decisions based on emotions rather than logic and analysis can lead to poor investment outcomes.

Chasing Performance

Investing in stocks or funds that have recently performed well without considering long-term potential can be risky.

10. Seek Professional Advice If Needed

If you're unsure about making investment decisions on your own, consider seeking advice from a financial advisor. They can provide personalized guidance based on your financial situation and goals.

Investing in the stock market is a journey that requires patience, education, and a clear strategy. By following this beginner's guide, you can start building a strong foundation for your financial future. Remember, the goal is to grow your wealth over time, so stay focused, stay disciplined, and keep learning. Happy investing!

#StockMarket#InvestingBasics#BeginnerInvesting#InvestmentGuide#FinancialEducation#StockMarket101#InvestmentTips#WealthBuilding#FinancialLiteracy#StockInvesting#MarketTrends#InvestmentStrategies#PortfolioManagement#TradingBasics#InvestSmart#LongTermInvesting#StockTips#FinancialPlanning#InvestmentJourney#MarketInsights

0 notes

Text

KNOWING WHEN TO INVEST IN THE MARKET AND HOW TO NAVIGATE THE WAVES

Investing in the stock market may be likened to negotiating choppy waves of uncertainty and volatility. However, there can be substantial benefits for individuals who become adept at timing. Knowing when to buy in the market is essential to reaching financial independence, making the most out of your investments, and successfully conserving cash. We'll examine methods for wise investing, examine the intricacies of market timing, and offer guidance on how to proceed with your financial journey in this piece.

Comprehending Market Timing

Predicting future market movements to buy low and sell high is known as market timing. Even though it seems simple, this is a notoriously hard task to carry out. Market performance is influenced by a number of variables, such as economic data, business earnings, geopolitical developments, and investor sentiment. For most investors, therefore, perfect timing is more of an ideal than a workable plan.

The Delusion of Ideal Timing

Many investors wait for the optimal period, usually when equities are at their lowest, in an attempt to find the elusive "perfect time" to enter the market. However even experienced investors and financial specialists find it difficult to accurately forecast market changes. This quest may result in lost chances and postponed financial development.

Despite sporadic swings, historical data shows that the market tends to grow over time. Therefore, concentrating on reliable, long-term investing tactics is a more effective strategy than aiming for perfection.

Dollar-Cost Average: A Trustworthy Method

Dollar-cost averaging is a well-liked method for reducing the risks associated with market timing (DCA). DCA entails investing a certain sum of money regularly, independent of market circumstances. By ensuring that you purchase more shares during periods of low price and fewer during periods of high price, this strategy helps you average out the cost of investments over time.

If you decide to spend $200 a month, for instance, you might buy more shares at a market downturn and less at a peak. With time, this tactic might lessen the effects of volatility and offer a more straightforward route to financial expansion.

Investing Time vs. Timing in the Market

"Time in the market" is a more important concept to grasp than "timing the market." According to historical data, your chances of achieving good returns increase with the length of time you invest. Numerous studies have demonstrated that, despite brief downturns, markets typically trend upward over extended periods of time, lending weight to this idea.

Compounding returns, in which profits yield additional profits, are advantageous to investors who stay in the market for extended periods of time. Your portfolio may increase dramatically as a result of this compounding impact, highlighting the significance of having a long-term outlook.

Diversification and Investment Options

Achieving financial freedom and optimizing returns requires selecting the appropriate investment options. Investing broadly across a range of asset types, or diversification, can reduce risk and increase return potential. Here are some important investment choices to think about:

Stocks: Although they have a greater potential for profit, stocks also have more volatility. Purchasing a diverse portfolio of equities can help you profit from market growth while lowering risk.

Bonds: Bonds offer consistent interest payments and are typically less volatile than equities. Bonds help offset the risk in your portfolio that comes with stocks.

Both mutual funds and exchange-traded funds (ETFs) provide diversification within a single investment. ETFs generally follow an index, whereas mutual funds are actively managed.

Real estate: Investing in real estate can yield both capital growth and rental income. You can make real estate investments even if you don't actually own any real estate by using Real Estate Investment Trusts (REITs).

Savings accounts and certificates of deposit (CDs): These low-risk, liquidity- and capital-preserving solutions provide lower yields.

Financial Measures and Market Trends

Making informed investing decisions can be aided by knowledge of market cycles and economic data. Important signs to keep an eye on are:

GDP expansion: Increased business profits and stock prices are frequently the result of robust economic expansion.

Inflation Rates: While excessive inflation can reduce purchasing power and have an adverse effect on investment returns, moderate inflation can be a sign of a developing economy.

Interest rates: While rising rates may cause market corrections, low rates can promote economic growth and increase stock prices.

Employment Statistics: A strong economy and rising consumer purchasing power are typically indicated by high employment rates.

Market cycles, which consist of expansion, peak, contraction, and trough phases, are inherent features of the state of the economy. Understanding these cycles might assist you in keeping a balanced viewpoint and making well-informed decisions amid market swings.

Emotional Investing and Behavioral Factors

Investing emotionally might be a typical mistake. Irrational decisions, like panic selling during downturns or hasty buying during peaks, might be motivated by fear or greed. Emotional biases can be mitigated by creating and adhering to a disciplined investment strategy.

Creating and Maintaining Financial Objectives

Setting definite financial objectives is essential to your investing path. Having defined goals can help direct your investment approach, whether your goal is to save for a down payment on a house, accumulate retirement funds, or become financially independent.

It's critical to persevere through market turbulence. Avoid the temptation to make snap decisions based on transient fluctuations in the market. Long-term success can be ensured by routinely analyzing and modifying your portfolio to match your objectives and risk tolerance.

Also read: Unlocking Financial Potential: Top 10 Government Investment Schemes

summary

It takes a combination of knowledge of economic data, adherence to dependable investment strategies, and long-term thinking to determine when it is optimal to make market investments. Although it might be difficult to time the market, strategies like diversification and dollar-cost averaging can reduce risk and increase profits.

Smart investing can lead to financial freedom, but it also takes patience, discipline, and an eye on the long term. By employing well-informed tactics to navigate the waves of market changes, you can maximize your investments and establish a stable financial future. Recall that the secret is to use consistent, strategic investing to turn time into your advantage rather than waiting for the ideal moment to invest.

0 notes

Text

Investing Essentials: Smart Strategies for Researching Investment Opportunities

Investing Essentials: Smart Strategies for Researching Investment Opportunities

Investing can be a powerful tool to grow wealth and secure financial stability. With a wide array of options available, from stocks and bonds to real estate and emerging technologies, it demands careful research and a strategic approach. Investors who are committed to building and diversifying their portfolios need to understand the risks and rewards associated with each investment type. Knowing where to allocate funds requires insight into market trends, economic indicators, and the financial health of companies and sectors.

The first step in researching investment opportunities is to assess one's financial goals and risk tolerance. These elements guide investors in selecting the right investment mix to meet their objectives, whether it's long-term growth, income generation, or capital preservation. They also provide a framework for investigating which industries and markets align with these goals. A solid research foundation can include studying historical performance, company earnings reports, industry health, and macroeconomic conditions.

Creating a diversified investment portfolio can help mitigate risk while capitalizing on the potential for positive returns across different assets. Financial experts often recommend spreading investments across various sectors and investment types to reduce vulnerability to market volatility. This strategy allows investors to benefit from the growth in one area while buffering against losses in another. By staying informed and adapting to changing market conditions, investors can make decisions that align with their financial aspirations and risk profile.

Understanding Basics of Investing

youtube

Before diving into specific investment opportunities, it is crucial to comprehend fundamental investing principles. This knowledge forms the bedrock for making informed choices about where to allocate financial resources.

Key Investment Concepts

Diversification is a core concept in investing, emphasizing the importance of spreading investments across various asset classes to mitigate risk. Investors should understand risk tolerance, their comfort level with potential financial loss, which varies depending on individual financial situations and goals. Another essential principle is asset allocation, a strategy that involves dividing an investment portfolio among different asset categories, such as stocks, bonds, and cash.

Risk vs. Reward: The potential return on any investment typically corresponds with the level of risk involved.

Liquidity: This refers to how quickly an investment can be converted to cash without a significant loss in value.

Time Horizon: An investor's time horizon, or how long they can hold an investment before needing the capital, should guide the choice of investments.

Types of Investments

Investment vehicles come in various forms, each with distinct characteristics, risks, and potential returns.

Stocks:

Represent shares in the ownership of a company.

Investors gain when stock prices rise or when dividends are paid.

Type Description Risk Level Blue-chip Large, established companies Lower Growth Companies with potential to grow Higher Dividend Companies that pay dividends Variable

Bonds:

Bonds are loans made to corporations or governments.

They provide regular interest payments, with the principal returned at maturity.

Term Description Risk Level Short-term Maturity in 1-3 years Lower Long-term Maturity in 10+ years Higher

Mutual Funds:

Pools money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities.

Offers professional management and diversification.

Exchange-Traded Funds (ETFs):

Similar to mutual funds but are traded on stock exchanges like individual stocks.

Typically have lower fees than mutual funds and offer intraday liquidity.

Setting Investing Goals

Before one can evaluate investment opportunities, clear investing goals need to be in place. These goals guide investment decisions and help measure success.

Defining Your Financial Objectives

Investors should clearly define their financial objectives by considering what they aim to achieve through their investments. These objectives often vary, ranging from saving for retirement, accumulating funds for a large purchase, or generating passive income. Long-term investments are usually aligned with objectives that are set for several years into the future, and they may change as individual circumstances evolve.

Determining Risk Tolerance

Understanding one's risk tolerance is critical in the investment process. Risk tolerance is the degree of variability in investment returns that an investor is willing to withstand. It typically consolidates factors such as the investor's age, financial situation, and the time horizon for their investing goals. An investor comfortable with higher risk may incline towards investments with potentially higher returns, like stocks. Conversely, those with lower risk tolerance may prefer low-risk investments such as bonds or money market accounts.

Research Strategies In Investment

youtube

Selecting the right investment requires a strategic approach to analyzing potential options. Investors should understand different analysis techniques and tools that aid in making informed decisions.

Fundamental vs Technical Analysis

Fundamental Analysis is the cornerstone of investing. The investor focuses on a company's financial health, management quality, and market position. They typically evaluate earnings per share (EPS) and cash flow to gauge a company's profitability and financial strength. In contrast, Technical Analysis scrutinizes trading signals and price movement patterns on charts. Technical analysts often look for trends and anomalies that indicate potential future performance without placing emphasis on a company's financials.

Utilizing Investment Screeners

An Investment Screener, also known as a stock screener, is a digital tool allowing investors to filter stocks based on user-defined criteria. Parameters can include:

Financial ratios like EPS

Market capitalization

Revenue growth

Cash flow metrics

By setting specific metrics, an investment screener can help narrow down the universe of securities to those that meet an investor's objectives and risk profile.

Reading Financial Statements

Financial Statements are records that provide an overview of a company's financial performance and position. These can inform an investor's fundamental analysis by highlighting key indicators such as:

Earnings Per Share (EPS): A direct measure of a company's profitability on a per-share basis.

Cash Flow Statements: These track the inflow and outflow of cash, indicating a company's ability to generate cash to fund operations and growth.

Analyzing these documents requires attention to detail to identify trends in revenue, expenses, and profitability.

Evaluating Stocks for Investment

youtube

In assessing investment opportunities within the stock market, investors must consider a company's financials, valuation metrics, and growth prospects, among other factors. Accurate interpretation of these elements is crucial in making informed decisions.

Analyzing Company Fundamentals

When assessing a company's financial health, investors should examine its income statement, balance sheet, and cash flow statement. Key aspects to analyze include revenue trends, profit margins, and the company’s debt levels. A solid company typically shows a consistent ability to increase revenue while controlling costs.

Revenue Trends:

Look at the historical revenue growth over several quarters and years.

Compare revenue performance with industry peers.

Profit Margins:

Assess net profit margins to determine how effectively a company converts sales into profit.

Evaluate gross and operating margins for a sense of cost management and operational efficiency.

Debt Levels:

Review the debt-to-equity ratio to understand financial leverage and risk.

Examine interest coverage ratios to judge how easily a company can pay interest on outstanding debt.

Understanding Valuation Metrics

Valuation metrics provide insights into whether a stock is under or overvalued relative to the market or its peers. Common metrics include the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and price-to-sales (P/S) ratio.

P/E Ratio:

It compares a company's share price to its earnings per share (EPS).

A lower P/E may indicate that the stock is undervalued.

P/B and P/S Ratios:

P/B compares stock price with the company’s book value.

P/S looks at the stock price relative to company’s sales.

Comparing these ratios to industry averages can offer a more nuanced understanding of a stock's valuation.

Looking at Management and Growth Potential

The competence of a management team is a strong indicator of a company's potential. Investors should consider the team’s track record, their execution of strategy and reaction to industry changes.

Management Quality:

Review past decisions and outcomes.

Check for a clear strategic direction and alignment with shareholder interests.

The company’s growth potential is also paramount and encompasses market share expansion, innovation, and strategic acquisitions.

Competitive Advantage:

Analyze the company's unique selling point or competitive edge.

Evaluate the sustainability of its advantage in the industry.

Growth Opportunities:

Examine the potential for new markets or products.

Consider the company's reinvestment in business expansion.

By dissecting these factors, investors can better gauge a stock's future performance in the stock market.

Strategic Investment Practices

youtube

A prudent investor focuses on winning strategies that enhance portfolio strength. Accurate research, judicious diversification, and the application of robust investment philosophies form the foundation of solid investment practices.

Diversification and Portfolio Management

Diversification is the strategy of spreading investments across various financial instruments, industries, and other categories to minimize risk. A well-diversified portfolio might include a mix of stocks, bonds, real estate, and commodities. An investor applies portfolio management to balance risk against performance, aiming to maximize returns within their risk tolerance.

Asset Allocation: Strategic asset allocation involves setting target allocations for various asset classes and periodically rebalancing the portfolio to maintain these targets.

Risk Management: Diversification helps mitigate unsystematic risk—which is specific to a company or industry—though systematic risk, which affects the entire market, cannot be fully diversified away.

Investment Styles and Philosophies

Investment philosophies guide investors on what to invest in and how to approach the investment process. For instance, value investing focuses on finding undervalued securities that have the potential to increase in value over time. It requires thorough research to identify stocks that are trading below their intrinsic value due to being underappreciated by the market.

Growth vs. Value: Growth investors seek companies with strong potential for future earnings growth, while value investors look for stocks that appear underpriced by the market.

Active vs. Passive Management: Active investment involves hands-on strategies in selecting stocks, whereas passive management relies on tracking market indices.

Timing the Market vs Time in the Market

The debate between market timing versus the benefits of time in the market is constant in investment circles. Market timing is the strategy of making buy or sell decisions of stocks by attempting to predict future market price movements. In contrast, time in the market suggests that long-term investment typically yields better results due to the compound interest effect.

Long-term Investing: Historically, maintaining investments over a longer period has smoothed out the short-term volatility and yielded substantial growth despite market fluctuations.

Market Timing Risks: While timing the market can lead to high returns, it requires precise predictions, which are difficult even for professional investors. As a result, it can increase the risk of loss.

Each strategic practice carries its own merits and risks, and investors are advised to apply them in line with their individual financial goals and risk appetite.

Working with Investment Professionals

When engaging with investment professionals, it is vital to choose the right brokerage account and be fully aware of the associated fees and required disclosures. This understanding is key to making informed investment decisions.

Selecting a Brokerage Account

An investor should consider several factors when selecting a brokerage account. The type of investor you are—active trader or long-term investor—can influence your choice. For instance, Charles Schwab and Fidelity are known for their extensive resources and are preferred by investors aiming for long-term growth. Conversely, Interactive Brokers, with its IBKR Pro plan, caters to active traders with its advanced tools and competitive pricing.

When choosing a brokerage, it's essential to review their offerings:

Account Types: Individual, joint, retirement, and others.

Investment Choices: Stocks, bonds, ETFs, mutual funds, and more.

Trading Platforms: Ease of use and additional tools offered.

Customer Service: Availability and support quality.

Comparison sites like NerdWallet provide rankings and detailed reviews that can greatly assist in decision-making.

Understanding Fees and Disclosures

It's critical to understand the fees associated with an investment account, as they can significantly impact returns. Investors are encouraged to scrutinize the fee structure, which commonly includes:

Trading commissions: Fees per trade, though many brokers now offer commission-free trading.

Account maintenance fees: Monthly or annual costs to maintain your account.

Expense ratios: Annual fees expressed as a percentage of assets for mutual funds or ETFs.

Disclosures are equally important. The Securities and Exchange Commission (SEC) mandates that brokerage firms be transparent with their fee structures and conflict of interest policies. Investors should read these disclosures carefully, paying special attention to:

Conflict of Interest Policies: How the broker manages potential conflicts.

Regulatory Filings: Public documents filed with the SEC, providing insights into the broker's financial health and operational conduct.

By thoroughly understanding both the fees and the disclosures, investors can make well-informed decisions that align with their investment goals and risk tolerance.

Tax Considerations in Investing

Tax implications are a critical component of investment strategy. Informed investors can make strategic choices that align with tax efficiency to potentially enhance their after-tax returns.

Efficient Tax Planning for Investments

Effective tax planning helps to minimize the tax liability arising from investments. This planning involves understanding how different types of investments are taxed. For instance, long-term capital gains are typically taxed at a lower rate than short-term gains. Tax-loss harvesting is a tactic where investors sell securities at a loss to offset a capital gains tax liability. Of note is the use of robo-advisors, which can automate the process of tax-loss harvesting, thereby streamlining tax efficiency.

Investors should also be aware of the importance of asset allocation between taxable and tax-advantaged accounts. A common strategy might involve placing high-tax burden investments, like certain bonds or REITs, into tax-advantaged accounts where the tax impact is diminished.

Types of Investment Accounts

Investment accounts can be categorized based on their tax treatment. Here's a brief description of two such classifications:

Taxable Account:

This is a standard investment account where an investor pays taxes on income received and capital gains realized in the account during the tax year.

It provides flexibility with no limits on contributions and freedom to withdraw funds at any time.

ABLE Account:

ABLE accounts are tax-advantaged savings accounts for individuals with disabilities.

Investment growth is tax-deferred and distributions are tax-free if used for qualified disability expenses.

When choosing among investment account types, investors need to consider factors such as their investment goals, time horizon, and the potential tax benefits that each account type offers. Careful consideration can lead to significant tax savings over the long run.

0 notes

Text

Comparing Traditional vs. Gold IRA: Which Is Right for You?

Planning for retirement involves making important decisions about how to invest and protect your savings. Two popular options for retirement accounts are Traditional IRAs and Gold IRAs. Each has distinct features and benefits, making them suitable for different investment goals and risk tolerances. In this guide, we'll compare Traditional IRAs with Gold IRAs to help you determine which might be the right choice for your retirement strategy.

Traditional IRA Overview

A Traditional IRA is a tax-advantaged retirement account that allows individuals to contribute pre-tax dollars, reducing their taxable income for the year of contribution. Key features include:

Tax Benefits: Contributions may be tax-deductible, reducing your taxable income in the year of contribution.

Investment Options: Traditional IRAs offer a wide range of investment choices, including stocks, bonds, mutual funds, and ETFs.

Withdrawal Rules: Withdrawals are typically taxed as ordinary income and may be subject to a 10% penalty if taken before age 59½ (with exceptions).

Required Minimum Distributions (RMDs): Starting at age 72, you must begin taking RMDs from a Traditional IRA.

Traditional IRAs are ideal for individuals who want immediate tax benefits and prefer a diversified investment approach with traditional financial assets.

Gold IRA Overview

A Gold IRA, also known as a Precious Metals IRA, is a self-directed retirement account that allows investors to hold physical gold, silver, platinum, or palladium bullion coins or bars. Key features include:

Asset Diversification: Gold IRAs offer exposure to physical precious metals, which can serve as a hedge against inflation and economic uncertainty.

Tax Benefits: Similar to Traditional IRAs, contributions to a Gold IRA can be tax-deductible depending on your income and eligibility.

Storage Requirements: Physical precious metals must be held in an approved depository, which typically involves additional storage and insurance costs.

Withdrawal Rules: Withdrawals are taxed similarly to Traditional IRAs, with potential penalties for early withdrawals.

Gold IRAs are suitable for investors seeking to diversify their retirement portfolio beyond traditional financial assets and safeguard against economic volatility.

Factors to Consider

Investment Objectives

Traditional IRA: Ideal for long-term growth through a diversified portfolio of stocks, bonds, and mutual funds.

Gold IRA: Suited for investors looking to hedge against economic instability and preserve wealth through physical precious metals.

Risk Tolerance

Traditional IRA: Generally subject to market fluctuations and economic cycles.

Gold IRA: Precious metals can provide a more stable store of value but may have limited growth potential compared to equities.

Tax Considerations

Traditional IRA: Contributions may be tax-deductible, and earnings grow tax-deferred until withdrawal.

Gold IRA: Similar tax advantages to Traditional IRAs, depending on eligibility.

Storage and Fees

Traditional IRA: Typically no additional storage costs beyond account maintenance fees.

Gold IRA: Requires secure storage at an approved depository, incurring storage and insurance fees.

Liquidity

Traditional IRA: Generally more liquid with easy access to a wide range of investment options.

Gold IRA: Selling physical metals may involve longer processing times and additional costs.

Which Is Right for You?

Choosing between a Traditional IRA and a Gold IRA depends on your investment goals, risk tolerance, and views on asset diversification. Consider the following scenarios:

Choose a Traditional IRA If:

You prefer a diverse portfolio of stocks, bonds, and mutual funds.

You want immediate tax benefits through deductible contributions.

You are comfortable with market fluctuations and long-term growth potential.

Choose a Gold IRA If:

You seek asset diversification beyond traditional financial assets.

You are concerned about economic instability and inflation.

You are willing to incur additional storage costs for physical precious metals.

Ultimately, the right choice may involve a combination of both Traditional and Gold IRAs, depending on your retirement goals and risk management strategy.

Consult a Financial Advisor

Before making any decisions regarding your retirement investments, consult with a qualified financial advisor or retirement planner. They can provide personalized guidance based on your individual financial situation and help you create a comprehensive retirement plan that aligns with your goals.

Augusta Precious Metals specializes in IRA

Augusta Precious Metals is a reputable company dedicated to assisting individuals in incorporating precious metals into their Individual Retirement Accounts (IRAs). This specialized service offers unique benefits and opportunities for diversifying retirement portfolios and safeguarding wealth against economic uncertainties. In this section, we'll explore why Augusta Precious Metals stands out in the realm of IRA investing with precious metals. Read Full Review & Interview with CEO Isaac Nuriani of Augusta Precious Metals.

By understanding the differences between Traditional and Gold IRAs and assessing your own investment objectives and risk tolerance, you can make an informed decision that supports your long-term financial well-being. Remember, retirement planning is a personalized journey, and the right IRA choice is one that aligns with your unique needs and aspirations.

0 notes

Text

Unlocking the Mystery: A Comprehensive Guide to ETFs

Introduction

In recent years, ETFs have emerged as a popular investment vehicle, offering investors a diverse range of options to diversify their portfolios. But what exactly are ETFs and how do they work? In this comprehensive guide, we unravel the mystery behind ETFs and explore their role in the investment landscape.

What Are ETFs?

ETFs, or Exchange-Traded Funds, are investment funds that are traded on stock exchanges, much like individual stocks. They are designed to track the performance of a specific index, commodity, bond, or a basket of assets.

Understanding ETF Structure

ETFs are structured as open-ended investment companies or unit investment trusts. They issue shares to investors, which represent ownership in the underlying assets held by the fund. These shares can be bought and sold throughout the trading day on stock exchanges, providing investors with liquidity and flexibility.

Click Here To Know About Top 16 DeFi Open Source Projects!

How Do ETFs Work?

ETFs work by pooling together funds from multiple investors to invest in a diversified portfolio of assets. This allows investors to gain exposure to a particular market or sector without the need to buy individual stocks or assets.

Tracking an Index

One of the most common types of ETFs is index funds, which aim to replicate the performance of a specific index, such as the S&P 500 or the Nasdaq. These ETFs invest in the same securities that make up the index in proportion to their weight, providing investors with broad market exposure.

Active vs. Passive Management

ETFs can be either passively managed or actively managed. Passively managed ETFs aim to replicate the performance of a specific index, while actively managed ETFs seek to outperform the market through active stock selection and portfolio management.

Types of ETFs

There are several types of ETFs available to investors, each with its own unique characteristics and investment objectives.

Equity ETFs

Equity ETFs invest in stocks and aim to replicate the performance of a specific equity index or sector. They provide investors with exposure to a diversified portfolio of stocks, allowing them to participate in the growth potential of the equity market.

Fixed-Income ETFs

Fixed-income ETFs invest in bonds and other fixed-income securities. They provide investors with exposure to a diversified portfolio of bonds, offering potential income and capital appreciation.

Commodity ETFs

Commodity ETFs invest in physical commodities, such as gold, silver, oil, or agricultural products. They allow investors to gain exposure to the price movements of commodities without the need for physical ownership.

Sector ETFs

Sector ETFs focus on specific sectors or industries, such as technology, healthcare, or energy. They provide investors with targeted exposure to sectors that they believe will outperform the broader market.

International ETFs

International ETFs invest in stocks or bonds of companies or countries outside of the investor's home country. They provide investors with exposure to global markets and diversification benefits.

Benefits of ETFs

ETFs offer several benefits to investors, including:

Diversification

ETFs provide investors with access to a diversified portfolio of assets, reducing the risk of concentration in any single investment.

Liquidity

ETFs are traded on stock exchanges, providing investors with liquidity and flexibility to buy and sell shares throughout the trading day.

Cost-Efficiency

ETFs typically have lower fees compared to mutual funds, making them a cost-effective investment option for investors.

Transparency

ETFs disclose their holdings on a daily basis, providing investors with transparency into the fund's portfolio and performance.

Conclusion

In conclusion, ETFs are a versatile investment vehicle that offers investors a range of benefits, including diversification, liquidity, and cost-efficiency. By understanding how ETFs work and the different types available, investors can make informed decisions to build a well-balanced investment portfolio.

0 notes

Text

Sovereign Gold Bond vs. Gold ETF: A Comprehensive Comparison for Smart Investors

Over the last few years, the concept of digital gold has arrived in a big way. It started off with gold ETFs and then came the highly popular Sovereign Gold Bond scheme. There are also other digital gold holding vehicles like international gold funds, gold futures and digital gold. In this blog, the focus would largely be on understanding the relative merits and demerits of the sovereign gold bond vs gold ETF debate, and which is more suitable and under what circumstances. Also, a comparison of gold ETF vs SGB is provided on parameters like liquidity, flexibility, charges and tax implications.

What are Sovereign Gold Bonds (SGB) all about?

SGBs or Sovereign Gold Bonds have been around in India since Nov-2015 and have been gradually gaining in heft. These SGBs are central government-backed bonds, denominated in grams of gold. The underlying holding in grams of gold is guaranteed by the central government. In addition, these sovereign gold bonds also bear an interest of 2.50% annually on the issue price, which is paid semi-annually to the investor. Investors also get an upfront discount of Rs. 50/- per gram if the payment mode is digital. SGBs are also advantageous as they do not have the hassles like storing gold, making charges, risk of loss etc.

What really stands out about the SGB is the sovereign guarantee and that the returns are pegged to the price of gold. What the government guarantees is the payment of interest at 2.50% per annum and the holding of gold in grams. Considering that gold has generally given positive returns over longer periods of time, it makes investment in SGBs relatively secure and attractive too.

The SGBs can be held either in physical form or in demat form, as part of the demat account.

Gold ETFs (Exchange Traded Funds)

Unlike SGBs that are issued by the central government, gold ETFs are issued by the mutual fund houses registered with SEBI. They are issued in the form of gold units pegged as equivalent to a certain weight in gold expressed in grams. Gold ETFs are typically closed-ended in that once the NFO period is over, the fund does not offer any purchase or sale of units. However, being Exchange Traded Funds, they are mandatorily listed on the stock exchanges and investors wanting to buy or sell gold ETFs can do so using their existing demat account and trading account.

Gold ETFs are very liquid and hence, entry & exit is hardly a problem without any price damage. You can trade in gold ETFs just as you trade in stocks. It must be noted here that gold ETF issuing mutual funds are required to maintain physical gold equivalent to the units sold with a gold custodian bank as a backing.

Sovereign Gold Bond VS Gold ETF

Let's compare the sovereign gold bonds and the gold ETFs on a variety of parameters like returns, risk, flexibility, liquidity, taxation, etc. This sovereign gold bond vs gold ETF comparison will allow investors to make the best choice.

Here are the highlights of the gold ETF vs SGB debate.

1. How do SGBs and Gold ETFs compare in returns?

Remember, both SGBs and gold ETFs are linked to the price of gold. If the price of gold goes up, then the capital appreciation will benefit the SGB and also the gold ETFs. The difference lies in the interest paid. For instance, SGBs pay an additional assured interest of 2.50% per annum, but such assured returns do not exist in gold ETFs.

2. How do SGBs and Gold ETFs compare in risk?

One can argue that since both are backed by gold, there is no asset risk; however, there is a difference.

Even though SGBs do not have physical gold backing, the returns on these bonds are pegged to gold prices. And they have an explicit guarantee by the central government regarding the gold holding and the interest payable. In the case of gold ETFs, there is no explicit guarantee (sovereign or otherwise) but they do have the physical gold with the gold custodian bank.

3. How do SGBs and Gold ETFs compare in taxation?

Gold ETFs are treated as non-equity assets and hence the capital gains, if any, would be treated as short-term gains if held for less than 3 years and taxed at the marginal tax rate applicable. If the gold ETFs are held for more than 3 years, they are long-term capital gains and they attract tax at 20% with the benefit of indexation.

In the case of SGBs, the method of taxation is the same, with just one critical difference. If the SGBs are held till redemption, then any capital gains on the SGBs are fully tax-free in the hands of the investor. However, interest on gold bonds is fully taxable.

4. How do SGBs and Gold ETFs compare in costs?

Sovereign gold bonds don’t have any recurring cost of ownership. Gold ETFs on the other hand, have annual charges, including brokerage and expense ratio ranging from 0.50 – 1.00%. The costing of SGBs is a lot more transparent than Gold ETFs.

5. How do SGBs and Gold ETFs compare in liquidity?

Gold ETFs can be bought and sold in the secondary market using your existing trading and demat account with your stock broker. SGBs can be bought at the new issue period, which can be several times during the fiscal year. Outside that, SGBs are listed on the stock exchange, but the liquidity is limited.

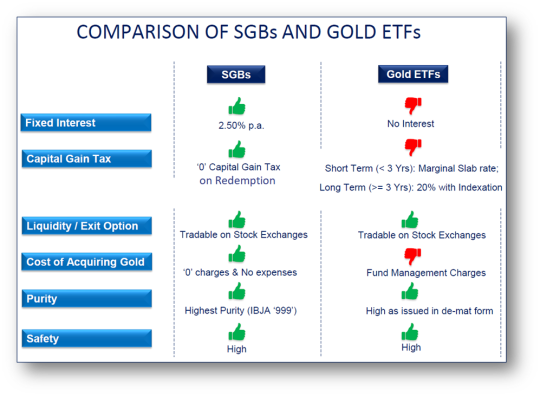

Let’s look at the table below to quickly review the gold ETF vs SGB debate

To sum up the sovereign gold bond vs gold ETF debate, both are digital modes of holding gold and are linked to gold prices.

Among 6 key parameters viz. fixed interest, taxation, liquidity, costing, purity and safety, SGB stands out across all. On the other hand, Gold ETFs are highly liquid and do not have a maximum investment limit, allowing investors to buy as much as they want while in case of SGBs maximum investment limit for individual investors is 4kg in a Financial Year

Eventually, investors need to take a call on the gold ETF vs SGB choice based on their financial goals & risk profile; and returns, risk, liquidity, taxation, & convenience the products have to offer.

Source URL: https://www.sbisecurities.in/blog/sovereign-gold-bond-vs-gold-etf

0 notes

Text

The Most Important Factors for Real Estate Investing

However, not all investments are created equal.

Location Matters, But…

While the mantra “location” is undeniably crucial, it’s not the only factor. Proximity to amenities, green spaces, and scenic views contribute to residential property valuations. For commercial properties, proximity to markets, warehouses, and transport hubs plays a significant role. But, the key is to look beyond the present – consider the mid-to-long-term evolution of the area. What seems peaceful today might transform into a noisy facility, impacting your property’s value.

Valuation: The Foundation of Success

Property valuation is the linchpin for financing, listing price, investment analysis, insurance, and taxation. Whether using the sales comparison approach, cost approach, or income approach, understanding the property’s value is paramount. It’s not just about the current worth but predicting how it will evolve over time.

Invest with Purpose and a Plan

Investing without a clear purpose can lead to financial distress. Determine your investment purpose and horizon: buy for self-use, lease for regular income, or opt for short or long-term selling. Each strategy has its nuances, so align your plan with your financial goals.

Cash Flows and Profit: Your Financial Pulse

Positive cash flow is the lifeblood of real estate investment. Evaluate expected cash flows from rental income, intrinsic value appreciation, depreciation benefits, and renovation costs. These projections will guide your decision-making process and help you anticipate potential returns.

Handle Leverage with Care

Loans can be a double-edged sword. While they offer immediate utility, they come with long-term interest costs. Avoid over-leverage – committing future income to the current utility can be risky. Understand the terms, conditions, and charges associated with different mortgage types. Shop around for favorable rates and terms that suit your financial situation.

New vs. Existing: Weighing the Pros and Cons

Choosing between new construction and existing properties is a pivotal decision. New construction offers modern amenities and customization but comes with risks. Existing properties provide convenience and established improvements, but maintenance costs can impact your cash flow. Research and review past projects to make an informed decision.

Indirect Investments for Diversification

If managing physical properties isn’t your forte, consider indirect investments. Explore options like Real Estate Investment Trusts (REITs), real estate stocks, mutual funds, ETFs, mortgage bonds, or mortgage-backed securities. These alternatives allow you to tap into real estate without the hands-on responsibilities.

Credit Score: Your Financial Passport

Your credit score is the key to unlocking favorable mortgage terms. Aim for a score above 800 for the best deals. Pay bills on time, manage debt responsibly, and periodically review your credit report to ensure accuracy.

Monitor the Overall Real Estate Market

Stay informed about market trends, home prices, construction activity, inventory levels, and mortgage rates. Buying low and selling high applies to real estate as much as any other investment. Understand the broader market dynamics to make strategic investment decisions.

In Conclusion

Real estate can be a powerful tool for wealth accumulation, providing diversification and steady returns. But, before you embark on your investment journey, carefully consider these factors for real estate investing. Whether you choose physical properties or opt for indirect investments, a well-informed approach will set the stage for success.

Ready to make your move into real estate investment? Explore our investment portal for property listings, investment advice, and the best opportunities in the UK market. Your financial future starts here!

#invest#investment portal#property listing uk#finance#investment#real estate investing#eggsinvest#investors

0 notes

Text

WHAT IS INVESTOPEDIA?

Title: Understanding the Basics of Investment: An Investo

Investopedia defines investment as the allocation of money with the expectation of generating income or profit in the future. Whether you're a seasoned investor or a beginner, having a solid understanding of the fundamentals is crucial for making informed decisions. In this Investopedia-inspired guide, we'll explore key concepts to help you navigate the complex world of investments.

1. Risk and Return: The Fundamental Tradeoff

One of the core principles of investing is the relationship between risk and return. Generally, higher returns are associated with higher risk, and vice versa. Investors must carefully assess their risk tolerance before choosing investments. Diversification, or spreading investments across different asset classes, is a common strategy to manage risk.

2. Asset Classes: Building a Diverse Portfolio

Investors can choose from various asset classes, each with its own risk and return profile. Common asset classes include stocks, bonds, real estate, and commodities. Diversifying your portfolio across different asset classes can help reduce risk and optimize returns. Understanding the characteristics of each asset class is key to constructing a well-balanced investment portfolio.

3. Stock Market Basics: Owning a Piece of a Company

Stocks represent ownership in a company and are traded on stock exchanges. Investors can buy and sell stocks to capitalize on price fluctuations. Understanding key stock market indicators, such as price-to-earnings ratio (P/E ratio) and market capitalization, is essential for evaluating potential investments.

4. Bonds: Fixed-Income Securities

Bonds are debt instruments issued by governments, municipalities, or corporations. Investors who purchase bonds essentially lend money to the issuer in exchange for periodic interest payments and the return of the principal at maturity. Bonds are generally considered lower risk than stocks, making them a popular choice for conservative investors.

5. Mutual Funds and ETFs: Pooled Investments

Mutual funds and exchange-traded funds (ETFs) pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. These investment vehicles offer diversification and professional management, making them attractive options for investors seeking a hands-off approach to portfolio management.

6. Financial Ratios: Analyzing Investment Opportunities

Investors often use financial ratios to assess the financial health and performance of companies. Common ratios include the debt-to-equity ratio, return on equity (ROE), and earnings per share (EPS). Understanding how to interpret these ratios can aid in making informed investment decisions.

7. Market Analysis: Staying Informed

Regularly monitoring market trends and news is crucial for successful investing. Whether through fundamental analysis (examining financial statements) or technical analysis (studying price charts), staying informed about economic indicators, geopolitical events, and industry trends can help investors make timely and strategic decisions.

8. Long-Term vs. Short-Term Investing: Aligning with Goals

Investors should align their investment strategy with their financial goals and time horizon. Long-term investors may focus on buy-and-hold strategies, while short-term traders may engage in more frequent buying and selling. Understanding your investment horizon is key to developing a suitable strategy

0 notes

Text

Exploring the Investment Landscape: SGBs vs. Gold Mutual Funds

Introduction:

The world of investment is ever-dynamic, and there are many investment opportunities that one can indulge in to grow their wealth. Among these investment avenues available for you there are Sovereign Gold Bonds (SGBs) and Gold Mutual Funds. These two investment tools have been heavily popular among investors. After all, there is a timeless golden appeal and a golden opportunity. Today, we will dive into the world of SGBs and Gold Mutual Funds investments, taking into account what they have to offer to investors.

Understanding SGBs:

Sovereign Gold Bonds (SGBs) are financial instruments issued by the Government of India, providing you with an alternative way to invest in gold. These bonds are denominated in grams of gold and are linked to the prevailing market price of the precious metal. One of the key advantages of SGBs is that they offer an attractive interest rate, providing you with an additional income stream on top of potential capital appreciation.

SGBs come with a fixed tenure, typically ranging from 8 to 12 years, and they can be traded on the stock exchanges. You can also benefit from the potential for capital gains if the market price of gold rises during the tenure of the bond. Additionally, SGBs enjoy certain tax benefits, such as exemption from capital gains tax on redemption if held until maturity.

Understanding Gold Mutual Funds:

On the other hand, Gold Mutual Funds are investment funds that pool money from multiple investors to invest in various forms of gold, such as physical gold, gold ETFs (Exchange-Traded Funds), and gold mining companies. These funds are managed by professional fund managers who make strategic investment decisions on behalf of the investors.

Gold Mutual Fund online offers liquidity and diversification, as the fund's portfolio may include a mix of gold-related assets. The value of the mutual fund online is directly linked to the performance of the underlying gold assets. You can buy and sell units of the fund at the Net Asset Value (NAV), providing flexibility and ease of transactions.

Comparing the Two:

1. Nature of Investment:

- SGBs involve the purchase of government-issued bonds linked to the price of gold.

- Gold Mutual Funds invest in a portfolio of gold assets, providing diversification.

2. Returns and Income:

- SGBs offer fixed interest rates, providing you with regular income in addition to potential capital gains.

- Gold Mutual Funds investments generate returns based on the performance of the underlying gold assets, and you may earn through capital appreciation and dividends.

3. Liquidity:

- SGBs have a fixed tenure, and premature withdrawal may incur penalties.

- Gold Mutual Funds offer daily liquidity, allowing you to buy or sell units at the prevailing NAV.

4. Tax Implications:

- SGBs provide tax benefits such as exemption from capital gains tax on maturity.

- Gold Mutual Funds are subject to capital gains tax based on the holding period.

5. Risk Profile:

- SGBs carry sovereign risk but are considered relatively safer due to the backing of the government.

- Gold Mutual Funds are subject to market risks and the performance of the underlying gold assets.

Conclusion:

In conclusion, both SGBs and Gold Mutual Funds offer unique advantages and cater to different investor preferences. SGBs are suitable for those seeking a combination of fixed income and exposure to gold, with the added benefit of government backing. On the other hand, Gold Mutual Funds provide flexibility, liquidity, and diversification for investors looking to participate in the gold market without directly owning physical gold.

Ultimately, the choice between SGBs and Gold Mutual Funds depends on individual financial goals, risk tolerance, and investment horizon. As with any investment decision, it is advisable to consult with a financial expert to align your investment strategy with your specific needs and circumstances.

0 notes

Text

Smallcase vs Mutual Fund

Mutual funds and Smallcases are the two asset structures in contention, and we’ll compare them over the course of this article to understand the fundamental difference between Smallcase and mutual funds.

As investors, most of us spend a considerable amount of time window-shopping for the right investment avenues. “Should I invest in the safety of debt instruments or should I stay equity-focused? Should I pick evergreen stocks or can I benefit more from trading the seasonal ones? What about adding some cryptocurrencies to my portfolio? How long should I stay invested?” Questions, so many questions. The truth is that unless you’re an exceptionally nuanced investor with well-rounded insights about multiple sectors, a diversified portfolio can hold the answer to most ‘what and why questions as far as investments are concerned. Two financial avenues facilitate this diversification optimally; the first is a household name and the second has emerged as a buzzword in the last year or two. Mutual funds and Smallcases are the two asset structures in contention, and we’ll compare them over the course of this article to understand the fundamental difference between Smallcase and mutual funds.

What are Mutual Funds?

A mutual fund is a pool of money collected from many investors to invest in securities like stocks, bonds and other assets. Professional fund managers, vetted and hired by mutual fund houses or Asset Management Companies (AMCs) are responsible for picking the constituents of the fund and allocating capital; they can attempt capital gains or income production based on the investment objectives of the fund as per the prospectus set out at the time of the fund launch (called NFO).

What is a Smallcase?

A Smallcase, on the other hand, represents a capital allocation structure similar to portfolio management services (PMS) that were previously reserved for wealthy individuals (Read: HNIs and UHNIs). As a product, this is an idea that has caught the fancy of many well-heeled millennials as well as on-the-brink wealthy, ever since SEBI hiked the minimum investment amount for portfolio management services (PMS) from ₹25 lakh to ₹50 lakh in November 2019. In some sense, Smallcase may be called affordable PMS – with a starting price as low as Rs199/month. Basically, a Smallcase is a basket of stocks or ETFs, decisively created by the top qualified and Registered Investment Advisors (RIAs) in India, based upon a theme, strategy, or objective.

David vs Goliath: A legacy product vs a promising challenger

If we have to compare the sheer size of the market with respect to Assets Under Management (AUM), mutual funds represent ₹36.74 trillion as of September 30, 2021. In comparison, Smallcases are a disruptive product that has been around for approximately 6 years now. Quoting the founder and CEO Vasanth Kamath “Our users multiplied three times from 9 lakh in March 2020 to 28 lakh in March 2021.” In FY21, the firm saw Rs 8,000 crore invested through its platform. A drop in the ocean, as far as the larger financial products industry is concerned.

Smallcase vs Mutual Funds: Points of Comparison

1. Exercise Control

Investing In Smallcases potentially offers investors better control over securities as the shares are credited directly in the Demat account. Having the portfolio right at your fingertips allows you to time your exit and know where each investment goes, which isn’t possible with mutual funds; you can cherry-pick which mutual fund you want to invest in, but the customization ends there.

2. Risk Mitigation Mechanisms

Smallcases are thematic investments; they invest in companies and securities that follow an underlying strategy or idea. For example, there can be a Smallcase that focuses on Clean Energy companies or fast-growing tech companies that focus on enterprise software integrations. Since these ideas are highly specific, diversification is restricted. For those intent on diversification, mutual funds offer a basket of good companies that are related by larger themes such as industry type and revenue benchmarks that may be a better hedge against volatility over several business cycles.

3. Cost of Leaving

In many mutual funds, there is an in-built penalty for liquidating your assets before the minimum stipulated time (generally just about a year)- this expense is called the exit load which ranges from 1-2% of the total investment. Typically, all mutual fund houses adjust this amount against the net asset value (NAV) of the fund. Smallcases, by design, allow investors to buy individual units of securities that are directly credited in the demat account like common shares. Since there is no exit load on selling shares, there is no exit load on selling smallcases.

4. Management Fee

Any asset allocation structure is only as good as the people managing it, i.e., the fund manager- who in these cases is typically someone who holds high repute in the financial markets. Understandably, this expertise attracts a certain cost, apart from the cost of monitoring and managing the fund. In the case of mutual funds, this cost, called the expense ratio, is a percentage of the total fund value, capped at 2.5% by SEBI. Smallcases have no fixed range – the cost differs from case to case and RIA to RIA, depending on the nature and theme of the basket of investments. For example, TejiMandi charges just Rs 199/month for its smallcases!

5. Access to Returns

Smallcases give investors direct access to their holdings since the shares are directly credited to their demat account. Hence, all corporate actions such as dividend distribution as well as the issue of bonus shares take place directly with the investors. In the case of mutual funds, the returns are collected in real-time but distributed quarterly.

6. Volatility

Due to the nature of the theme-wide concentration of Smallcases, they are typically more volatile than the stock market in general since the risk is concentrated in a specific strategy or idea. However, as one of the fundamental principles of finance states – the higher the risk, the higher is your potential for gains. Mutual funds, on the other hand, spread the risk across companies working in different areas even if the fund is concentrated in a specific industry. Hence, the latter is more resilient during market ups and downs.

0 notes

Text

Maximizing Your Wealth: The Art of Money Investing

Introduction