#EMI DownPayment Options

Explore tagged Tumblr posts

Text

Increased VA loan limits in 2024: How Do They Affect Your Home Buying Power?

VA loans have a history dating back to 80 years, and they continue to help the US purchase their dream home even today. The VA loans are available to military service members and surviving spouses and are backed by the government. The loans can be used for buying your first home or renovating your current residence. These VA home loans are the best option for veterans who are handling issues with bad credit or don’t have accumulated money towards a down payment for a home purchase. If you are someone who has served in the military, take your time to learn the benefits of VA loans to achieve homeownership. In the current article, let us explore more about VA loan limits and how they influence your home buying power.

How does a VA loan work?

VA home loans in Paramus NJ can be used to buy a new home, renovate, or refinance the existing mortgage for different purposes, like fetching low interest rates, longer loan terms, and taking cash out of their home. VA loans are offered by private lenders but backed by the government, where the government will pay a portion of the home loan amount in case of default. The guarantee offered by the government makes them low-risk loans with greater benefits like zero down payment, low interest rates, and lower closing costs compared to other types of loans.

What are VA home loan limits?

The VA loan limit is the amount one can fetch while taking out a VA-backed mortgage. This is the amount that the VA guarantees for home loans without a VA loan downpayment in Paramus NJ . This limit is set by the Federal Housing Finance Agency. Since 2020, qualified borrowers can get full VA loan entitlement, which means veterans can get as much as the lender is willing to offer without a VA loan downpayment in Paramus NJ . However, the absence of a VA loan limit does not imply unlimited borrowing for an individual; various factors like credit score, income, and other related factors can influence it. If you have already used a part of your VA loan entitlement or have defaulted on your previous VA loan, the VA loan limit could be exercised. The best Mortgage lender in Paramus NJ may assess your VA loan application, considering various factors. If you are found eligible for full VA loan entitlement, you can get a loan that exceeds comforting loan limits with a zero down payment. The VA loan limits may apply if you have used a part of it and are planning to hold that property. The VA loan limits in 2024 have jumped up to $766,550, and they may rise to $1,149,825 for one-unit homes in high-cost areas.

When do VA loan limits apply?

VA loan limits may apply when you don’t have full entitlement, and they may also vary depending on the county and downpayment you are making for the loan.

If you have an active VA loan that you are paying back, VA limits may apply.

If you have paid off your VA loan completely but did not restore your entitlement.

If you have cleared the VA loan by refinancing it to another loan type.

If there is a short sale or deed-in-lieu of foreclosure of the home purchased with a VA loan.

If there is a foreclosure on a previous VA loan that is not paid in full.

How do VA loan limits influence your purchasing power?

Loan limits play a key role in VA home loans. These limits are aligned with conforming loan limits and are set by the Federal Housing Finance Agency. This is the amount that is sanctioned to veterans without the down payment. Seeking information on these limits is essential because they can influence the purchasing power of the borrower

Though these loan limits may seem like arbitrary barriers to purchasing a home, they can help veterans manage their home loan EMIs comfortably. Increased VA loan limits in high-cost living areas allow veterans to remain competitive when bidding on homes.

The VA loan limit in your area may determine the need for a VA loan downpayment. If the home value exceeds your VA limit, you may have to pay the difference towards the down payment.

Increased VA loan limits in your county may fetch you best mortgage VA rates as the loans turn less risky.

You may be able to build faster home equity when you take a loan within your limits.

The increased VA limits can make you eligible for a refinance when your home value rises and you are within your loan limits.

Buy expensive homes with a zero-down payment.

0 notes

Text

Get Your Honda Activa 6G on EMI with Finnable: Easy Two-Wheeler Loan Solutions

Explore hassle-free two-wheeler loan options with Finnable to own your dream Honda Activa 6G. With convenient EMI plans and seamless processing, Finnable makes acquiring your favorite scooter easier than ever. Discover flexible repayment terms and fast approval processes today.

0 notes

Text

Explore Exciting New Honda Bikes and Great Deals at Republic Honda Noida

For bike enthusiasts, Republic Honda is the go-to destination for an unmatched two-wheeler ownership experience. As an authorized Honda bike showroom, Republic Honda provides easy access to the full Honda motorcycle and scooter range along with exceptional service and attractive schemes.

In this detailed blog post, we provide an overview of the latest Honda Two-wheelers Showroom available at Republic Honda's state-of-the-art Noida showroom. We also highlight the attractive finance schemes, cash discounts, exchange bonuses, and other benefits you can avail of on your favorite Honda bikes.

Honda two-wheelers are renowned for their performance, reliability, and innovative technology. At Republic Honda, you can find Honda's most popular motorcycles and scooters under one roof.

Scooters:

Honda scooters like Activa, Dio, and Grazia are highly popular among Indian buyers. The Activa is India's best-selling scooter prized for its convenience, efficiency, and smooth ride. The Dio attracts young riders with its trendy design and colors while Grazia is a more premium offering. Honda also offers mobility solutions like the Activa Electric for eco-friendly urban commuting.

Motorcycles:

Honda's motorcycle range offers models catering to different needs - from affordable commuting to powerful performance riding. Bestsellers like CB Shine, Livo, and CB Unicorn handle daily city use effectively while Navi, CB Hornet, and X-Blade are feature-loaded options for youthful riders. For enthusiasts, CBR Supersports models, Gold Wing tourer, and flagship Africa Twin adventure bikes deliver an adrenaline rush.

Some other popular models in Noida include Unicorn, SP125, Grazia, and CB300R.

Attractive Deals and Offers:

Along with the wide selection, Republic Honda provides attractive schemes to make your bike purchase more value for money. Some offers include:

Cash discounts up to Rs. 10,000 on select models

Low downpayment of just Rs. 5000

Low EMI starting Rs. 1299 per lakh

Free 1st and 2nd service

Complimentary accessories worth Rs. 5000

Exchange bonus on existing bike

Extended warranty and RSA options

Special finance schemes for students and women

Additional benefits of using Honda credit card

Why Choose Republic Honda Noida:

key reasons to purchase from Republic Honda Noida:

Premium showroom facility in Noida with test ride option

Wide spare parts inventory for quick service

Highly trained technicians providing world-class service

Bike care tips during delivery for a smooth ownership experience

Value-added services like pick-up/drop and demo bikes

Quick turnaround time for periodical services

Bike maintenance camps and service campaigns

So for an unparalleled Honda biking experience, visit the Republic Honda showroom on Chhalera Road, Noida today. Explore new Honda bike models through test rides. Check out ongoing offers applicable on your favorite Honda two-wheeler and drive home your dream bike!

#Honda Showroom in dankaur#Honda Kasna#Honda Showroom Greater Noida#Honda bike showroom in greater Noida#Honda service center near me#Honda service center Greater Noida#Honda activa showroom & service center#Honda bike showroom near me#Honda bike showroom#Honda showroom in Noida

0 notes

Text

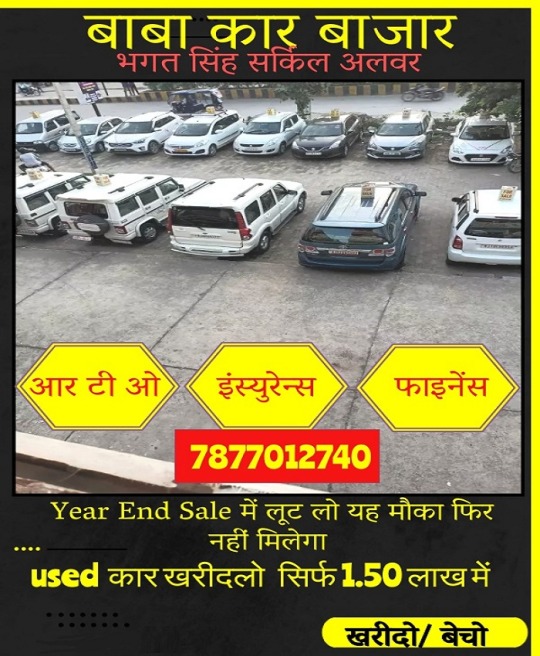

Second Hand Cars In Alwar | Best Condition

Q 1.How many used cars available Alwar?75 used cars are available Alwar of popular brands like Tata, Audi, Ford, Nissan, Datsun & more.Q 2.What will be the starting price of a used car Alwar?75 used cars are available Alwar & the price starts at Rs 50000 Alwar.Q 3.What are the most popular brands available for used cars Alwar?CarDekho has a wide inventory of all brands including Tata, Audi, Ford, Nissan, Datsun & more. Find the best-used car of your choice on CarDekho.Q 4.How many used diesel cars available Alwar?Used cars are available in both petrol and diesel options. 19 second-hand diesel cars available in Alwar. Popular used diesel cars are Mahindra KUV 100, Maruti Ciaz, Ford Ecosport & more and price starts at Rs 3.5 Lakh.Q 5.What body types are available for used cars Alwar?Used cars are available in every segment be it Hatchback, Sedan, SUV, MUV, Minivan, Wagon in Alwar. At CarDekho we have 50 Hatchback, 14 Sedan, 5 SUV, 3 MUV, 2 Minivan, 1 Wagon Cars available Alwar.

Maruti Eeco On Road Price In Alwar

What is the ex-showroom price of the top petrol variant of Maruti Suzuki Eeco in Alwar? What is the price of Maruti Suzuki Eeco top variant?The top variant of Maruti Suzuki Eeco is CNG 5 Seater AC and the on-road price is Rs 6.89 Lakh.What is the price of Maruti Suzuki Eeco base variant?The base variant of Maruti Suzuki Eeco is 5 Seater STD and the on-road price is Rs 5.40 Lakh.What is the Maruti Suzuki Eeco on-road price Alwar?The on-road price of the base variant of Maruti Suzuki Eeco in Alwar is Rs 5,40,712.What are the RTO charges for Maruti Suzuki Eeco in Alwar?The RTO Charges for the base variant of Maruti Suzuki Eeco in Alwar will be Rs 49,394.What is the insurance cost of the Maruti Suzuki Eeco in Alwar?The insurance cost of the base variant of Maruti Suzuki Eeco in Alwar is Rs. 28,170.What is the Ex-showroom price of Maruti Suzuki Eeco in Alwar?The Ex-showroom price of the base variant of Maruti Suzuki Eeco in Alwar is Rs 4,63,148.What will be the EMI & Downpayment of Maruti Suzuki Eeco?The Downpayment of the base variant of Maruti Suzuki Eeco is Rs 135788 and the EMI is 8,959.

New & Used Austin-Healey Under $30,000 & Under 40000 Miles In Alwar Filter Advanced Filters

No Cars Match Your Filters However, we did up your distance to find you some cars. You’ll want to modify your search if they’re too far away! Buy Now Used Car in Alwar.BasicsConditionMakeModelYearPrice bucketsMileageStyleBody styleExterior colorInterior colorPerformanceFilter & TransmissionFeaturesSeating

1 note

·

View note

Text

फक्त दोन लाख रुपये भरून Tata Nexon SUV घरी घेऊन या... एवढ्या रकमेचा भरावा लागणार EMI

फक्त दोन लाख रुपये भरून Tata Nexon SUV घरी घेऊन या… एवढ्या रकमेचा भरावा लागणार EMI

नवी दिल्ली l Tata Nexon Easy Loan EMI DownPayment Options : सब-4 मीटर कॉम्पॅक्ट SUV भारतात खूप विकली जाते आणि देशी आणि परदेशी कंपन्यांच्या SUV या सेगमेंटमध्ये आहेत. या सेगमेंटमध्ये, देशांतर्गत ऑटोमोबाईल कंपनी टाटा मोटर्सची आलिशान एसयूव्ही टाटा नेक्सॉन सर्वाधिक विकली गेली आणि गेल्या महिन्यात नेक्सॉनच्या 9,831 युनिट्सचीही विक्री झाली. तुम्हालाही ही स्वदेशी SUV खरेदी करायची असेल, पण एकरकमी पैसे देऊन…

View On WordPress

#Car loan#Cardekho#Carloan#carmall#EMI DownPayment Options#Tata Nexon Easy Loan#Tata Nexon Easy Loan EMI DownPayment Options

0 notes

Text

Car Loan EMI Calculator - Calculate Monthly EMI & Apply for Loan | HDFC Bank

The car loan EMI calculator calculates the monthly downpayment that the borrower has to pay. Get rapid repayment option at better interest rates from HDFC Bank.

1 note

·

View note

Photo

Experience the best dental care at Smile dental clinic in Hyderabad Take home a smile that suits you at Smile dental hospitals by easy pay options like cash, debit cards / credit cards/ online banking/ Paytm/ Easy EMI options/ 0% downpayment Emi options / Bajaj Finserv / Smile finance options and acceptance of all health cards for cashless treatments. #smile #ortho #cosmetic #invisilign #smiledesign #hyderabad #collegelife #happysmiles #healthy #smiledentalindia #healthylifestyle #healthysmile #teethalignment #teethcorrection (at India) https://www.instagram.com/p/Cb9BxaMLMc-/?utm_medium=tumblr

#smile#ortho#cosmetic#invisilign#smiledesign#hyderabad#collegelife#happysmiles#healthy#smiledentalindia#healthylifestyle#healthysmile#teethalignment#teethcorrection

0 notes

Text

How do you get a home loan

There are a few steps involved in obtaining a loan to purchase your home. To show that you are serious about the loan, you will need to make an immediate downpayment, which typically ranges from 3 to 20 percent of the purchase cost. The lender will also ask you about your personal financial situation such as your annual income, work history, credit score, and any outstanding debt. Once you've answered all of these questions the lender will then begin the application process.

The kind of loan you choose to get will determine the amount you'll be required to repay. The amount you'll have to borrow is determined by the term of the loan, the interest rate, and the annual percentage rate. You may apply for multiple home loans at the same time based on your credit score and income level. This will lower your monthly payments. In general, you'll have to pay monthly, so the longer you are able to pay your bills, the more you can afford.

The monthly installment for a home loan will remain the same throughout the length of the loan. The monthly amount will depend on the amount of the loan and the term. The majority of lenders require the down payment to be at 10 percent of the purchase price. This is crucial for you as your payments shouldn't exceed 20 percent of the purchase price. You'll be less stressed about the cost if you can make minimum a downpayment of twenty percent development of interest rates.

If you're planning to add an additional garage or room to your home, a home expansion loan can assist you in financing the project. A joint home loan is a good option if you are planning to live with your partner. A transfer of the balance of your home loan is a great way to change lenders and benefit of lower interest rates. A top-up is another good option if you need to borrow more than you owe on your mortgage.

You will most likely have to pay monthly installments when you apply for a home loan. The amount of each payment will usually be identical throughout the duration of the loan. There are a few elements that determine the amount of each monthly payment. The value of the home you're buying is the first thing to think about. If you don't have equity in your home, you'll need to put down an amount of money to make a down payment. If you're buying a new home you'll also have to pay off the loan over the next few years.

Getting a home loan is a fantastic option to purchase a brand new house. The down payment will be given to the lender however, you'll have to pay the EMI each month. To be eligible for a home loan you'll need to have a good credit score. A high FICO score and a good credit history are the most effective methods to get this. If you have bad credit and a low FICO score will prevent you from getting a mortgage.

0 notes

Text

honda activa scooter loan emi downpayment details: बस 10 हजार रुपये देकर घर लाएं होंडा एक्टिवा स्कूटर, फिर हर महीने बेहद मामूली किस्त, देखें डिटेल - best selling scooter honda activa easy loan downpayment emi options, honda activa std dlx finance details

honda activa scooter loan emi downpayment details: बस 10 हजार रुपये देकर घर लाएं होंडा एक्टिवा स्कूटर, फिर हर महीने बेहद मामूली किस्त, देखें डिटेल – best selling scooter honda activa easy loan downpayment emi options, honda activa std dlx finance details

हाइलाइट्स होंडा एक्टिवा स्कूटर की बंपर बिक्री होती है होंडा एक्टिवा फाइनैंस कराना बेहद आसान पैसे नहीं है तो कोई दिक्कत नहीं, लोन मिलना आसान नई दिल्ली।Honda Activa Scooter Loan EMI DownPayment Details: भारत में मोटरसाइकल की तरह ही स्कूटर की भी खूब बिक्री होती है और बात जब टू-व्हीलर सेगमेंट की हो रही हो तो जहां हीरो स्प्लेंडर बाइक सेगमेंट में बेस्ट सेलिंग है, वहीं होंडा एक्टिवा सबसे ज्यादा बिकने…

View On WordPress

0 notes

Text

Increased VA loan limits in 2024: How Do They Affect Your Home Buying Power?

VA loans have a history dating back to 80 years, and they continue to help the US purchase their dream home even today. The VA loans are available to military service members and surviving spouses and are backed by the government. The loans can be used for buying your first home or renovating your current residence. These VA home loans are the best option for veterans who are handling issues with bad credit or don’t have accumulated money towards a down payment for a home purchase. If you are someone who has served in the military, take your time to learn the benefits of VA loans to achieve homeownership. In the current article, let us explore more about VA loan limits and how they influence your home buying power.

How does a VA loan work?

VA home loans in Paramus NJ can be used to buy a new home, renovate, or refinance the existing mortgage for different purposes, like fetching low interest rates, longer loan terms, and taking cash out of their home. VA loans are offered by private lenders but backed by the government, where the government will pay a portion of the home loan amount in case of default. The guarantee offered by the government makes them low-risk loans with greater benefits like zero down payment, low interest rates, and lower closing costs compared to other types of loans.

What are VA home loan limits?

The VA loan limit is the amount one can fetch while taking out a VA-backed mortgage. This is the amount that the VA guarantees for home loans without a VA loan downpayment in Paramus NJ . This limit is set by the Federal Housing Finance Agency. Since 2020, qualified borrowers can get full VA loan entitlement, which means veterans can get as much as the lender is willing to offer without a VA loan downpayment in Paramus NJ . However, the absence of a VA loan limit does not imply unlimited borrowing for an individual; various factors like credit score, income, and other related factors can influence it. If you have already used a part of your VA loan entitlement or have defaulted on your previous VA loan, the VA loan limit could be exercised. The best Mortgage lender in Paramus NJ may assess your VA loan application, considering various factors. If you are found eligible for full VA loan entitlement, you can get a loan that exceeds comforting loan limits with a zero down payment. The VA loan limits may apply if you have used a part of it and are planning to hold that property. The VA loan limits in 2024 have jumped up to $766,550, and they may rise to $1,149,825 for one-unit homes in high-cost areas.

When do VA loan limits apply?

VA loan limits may apply when you don’t have full entitlement, and they may also vary depending on the county and downpayment you are making for the loan.

If you have an active VA loan that you are paying back, VA limits may apply.

If you have paid off your VA loan completely but did not restore your entitlement.

If you have cleared the VA loan by refinancing it to another loan type.

If there is a short sale or deed-in-lieu of foreclosure of the home purchased with a VA loan.

If there is a foreclosure on a previous VA loan that is not paid in full.

How do VA loan limits influence your purchasing power?

Loan limits play a key role in VA home loans. These limits are aligned with conforming loan limits and are set by the Federal Housing Finance Agency. This is the amount that is sanctioned to veterans without the down payment. Seeking information on these limits is essential because they can influence the purchasing power of the borrower

Though these loan limits may seem like arbitrary barriers to purchasing a home, they can help veterans manage their home loan EMIs comfortably. Increased VA loan limits in high-cost living areas allow veterans to remain competitive when bidding on homes.

The VA loan limit in your area may determine the need for a VA loan downpayment. If the home value exceeds your VA limit, you may have to pay the difference towards the down payment.

Increased VA loan limits in your county may fetch you best mortgage VA rates as the loans turn less risky.

You may be able to build faster home equity when you take a loan within your limits.

The increased VA limits can make you eligible for a refinance when your home value rises and you are within your loan limits.

Buy expensive homes with a zero-down payment.

0 notes

Text

Which NBFC Is The Best For Two Wheeler Loan?

TVS Credit is the best place if you are looking for an instant loan. It offers you a one-day loan approval with easy documentations. No hidden costs, EMI options, 0% downpayment. Check out the two wheeler loan interest rate at TVS Credit.

0 notes

Text

7 Questions You Need To Ask Before Buying A House

Buying a house is one of the massive financial decisions a person will ever make. So it’s important that you’re completely confident that you’ll be able to manage your mortgage before you commit to it. Don’t just find the perfect home and rush into something you aren't ready for. Take time to consider these questions, and make sure your finances are in order before you move ahead with your house search. Check out this guide on ‘7 Questions You Need To Ask Before Buying A House’ and learn more about whether or not you are ready to buy a house.

Here are some deciding factors to determine whether you may buy a house or not.

1. Do You Have Enough Capital For A Down Payment?

Having a 20% down payment is one of the most common perceptions while buying a house for the first time. Although, it’s not completely the truth. A homeowner needs a minimum of 3.5% - 10% for an FHA home loan and around 3% - 5% for a conventional loan.

For example: If you want to purchase a house worth $900,000 your lender will require a total of 3% as downpayment depending on the type of loan you qualify for. Hence, 3% of $900,000 will be $27,000 as the downpayment.

The only thing to remember is the larger the down payment the lesser will be your EMIs and interest. Although, in a lower downpayment you are entitled to pay Private Mortgage Insurance (PMI) that protects your lender in case if you don’t pay your mortgage. This is only applied when you put less than 20% downpayment, the PMI will be added to the monthly payments.

2. Do You Have A Good Amount Of Savings And Emergency Funds?

You may have saved enough money while thinking about making a big down payment, but did you think about closing costs? Closing costs include multiples fees like legal fees, lender fees, taxes, etc. The total is usually 2%-5% of the home’s purchase price. Additionally, there are many things that show up while a home inspection related to the home improvement which you might want to care of. If the septic tank is leaking or there are cracks in the ceiling, this is where you’ll need emergency funds.

3. How Is Your Credit Score?

The first thing homebuyers think of is having a perfect credit score with no red dots. Although, the truth is you don’t need to have a perfect credit score to buy a house. There are multiple home loan and homebuyer programs available for first-time homebuyers that do not require a perfect score. Furthermore, a minimum credit score of 600 or higher is favorable. Keep in mind a high score (that is above 700) will aid in qualifying for a lower mortgage rate.

4. Worried About Having A Handle On Your Debt?

Buying a home doesn’t mean you have to debt-free. You might have an outstanding student loan, car loan, bills, etc. which makes purchasing a home difficult. Fortunately, many companies these days understand it is impossible to expect potential homebuyers to be debt-free. The main objective of most companies is to know if you will be able to fulfill the mortgage payments. Keeping in mind the savings you have versus how much you’ll pay in the future.

Your lender will have a look at your debt-to-income ratio, which simply means what chunk of your monthly income goes into debt payments. You need to have a 43% debt-to-income ratio to qualify for any mortgage on the house.

5. Can You Afford Your Monthly Expenses?

The first while figuring out expenses is to know if you can afford additional payments to your existing monthly expenses. To calculate this you can use an online mortgage calculator. Additionally, you must also check with the other financial aspects like -

Property insurance and taxes

Other Home expenses (sewage, garbage, internet, etc.)

Utilities (water, electricity, etc.)

Home Owner Association (HOA) fees (if applicable)

It is vital to do your calculations before you move on with the transition from renting to buying your house. As you might be paying multiple bills already and there’s going to be an additional amount as a mortgage payment.

6. Do You Have A Stable Income Source?

Having a stable job is extremely important for home buyers as losing a job after moving into a new house can be a nightmare. A stable job is a good indicator for lenders as then qualifying for a mortgage is and fulfilling the amount is possible. Furthermore, even if you can show financial stability on paper, you must only buy a house knowing your income will remain steady in the future.

7. How Much Space You Need?

Before buying a house always ask yourself the question ‘how much space do you need?’ While planning on money and other aspects you may forget this important aspect. Whether you need an extra room for office space or gym thinking through it always advisable. If you have kids or expecting a child, then buying a house with extra space is ideal.

Takeaways

Buying a house comes with a long list of questions and contingencies. Make sure you think through the options and make a wise decision. If you’re someone who wants to sell your house fast before moving to a new one you may contact us at Elite Properties. We’re ‘we buy houses all cash’ company which offers people home selling and buying services with no obligations. You can get in touch with us by calling at 718-977-5462.

0 notes

Text

Mortgage Loans from Private Lenders

An easy way to avail money is via a mortgage equity loan, where you pledge your home as collateral. Collateral is basically an assurance of your monthly return of the loan, something that can be used in case you cannot afford the EMI (equated monthly instalment).

What is a mortgage equity loan?

A home equity loan is a loan for a particular amount of money which is secured by your house. In the loan, you are required to repay the loan with equal monthly payments over a set term, similar to a mortgage. However, if you cannot repay the loan as agreed with the lender, the lender can foreclose on your home.

While the amount you can borrow is mostly limited to eighty-five per cent of your home equity’s appraised value, the actual amount of your loan can also be negotiated and changed based on various factors. Lenders also tend to ask for a twenty per cent downpayment. Before settling on a lender you should compare terms and talk with banks, credit unions, mortgage brokers, and mortgage companies. This is why it is important to seek out reliable and stable lenders with an array of available loan plans.

One very successful and prominent lender institution happens to be Freedom Capital, a business that spans over Canada and British Columbia with an astounding success rate and a title as one of the best mortgage equity loan providers. Furthermore, this company ensures that each borrower settles on a good loan that thoroughly considers their credit history, income, and the overall market value of your home.

While creating a mortgage equity loan, as a borrower you have many expenses, some of them being the funding fee, lender fee, appraisal fee, document recording and preparation fee as well as a mortgage broker’s fee. Only knowing aspects like the interest rate and the required amount of the monthly payment is not the only knowledge you should have of the home equity loan as a borrower.

So, it is important to ensure the lender you choose is worth all of these spendings and commitments.

What is a private lender?

Private money lending is when individuals lend their own capital to other investors orreal estate funders, while securing a loan with a mortgage against the equity. Essentially, private money lending is an alternative to traditional lending institutions, like great banks.

As small investors gain experience, they strive to aim higher. Tossing your money in a savings account is no way to protect and grow your assets. At the end of the day, private money lending allows a person to secure a loan with an equity that is worth a lot more than the loan. In some ways, this process can be safer than owning real estate. That’s why it’s important to familiarize yourself with the best real estate financing options available to current investors.

The concept of a private money loan is relatively simple, three elements are required for a loan of this nature to transpire: a client also known as a borrower, a lender, and a lot of paperwork.

For all intents and purposes, private money lending is perhaps your best chance to invest in real estate with no money of your own. If for nothing else, private money loans can provide for investors in need. While they seem to serve the same purpose as traditional lending institutions, there are several key differences.

Private money loans typically charge higher rates than banks, but they are also more available in cases an average bank would pass on. Additionally, banks and other financial institutions typically do not provide the same combination of speed and transparency in the decision-making process.

Choose Freedom Capital.

Freedom Capital happens to be one of the most reliable lenders with their positions in British Columbia and Canada. Their priority is to create fast and simple access to the money you, the borrower, need. With products that aid them in first and second mortgages, as well as multimillion-dollar commercial and construction loans they are a reliable lender.

They not only provide creative financing options for their borrowers but also ensure that each borrower receives their desired second mortgages. While Freedom Capital provides mortgages in British Columbia and Canada, they also provide construction loans and second mortgage equity loans. But, while you pay off your second mortgage you also need to continue paying off your first mortgage which is secured against your home equity.

Considering the recent COVID 19 pandemic Freedom Capital has decided to provide their borrowers with better interest rates to ensure that the borrowers can provide for the monthly loan instalments. Usually, in such a trying time, people would be drowning in debt and due bills, unable to pay back any of their loans. But with Freedom Capital, you will be provided with a reasonable interest rate and quick approvals for your loans.

They not only provide better interest rates, but Freedom Capital can also adjust the terms and agreements for your loan to create a time span and monthly deposit you can easily provide for. This is why if you’re in desperate need of a loan, you should use Freedom Capital as your private lender.

0 notes

Photo

Celebrate this Dhanteras with eshoppe by Mann Marketing . . Buy your favourite gadget from eshoppe and get the amazing festive offers . . 👉 Assured Gift on Every Purchase 👉Cashback 👉Zero Downpayment 👉 0 % Interest 👉 Easy EMI Option 👉Free Home Delivery . . For More Details Contact: eshoppe by Mann Marketing . . Call: 9826045562 . . Visit Us: Address 1: 187, Mishra Chamber, Near, Novelty Market, Indore Address 2: Shop G-2, Prem Plaza, 5-6, Ashok Nagar, Bhawarkuan Road, Indore . . Click On the Link for Order: https://www.bajajfinservmarkets.in/stores/mann_marketing . . Follow us: @eshoppebymannmarketing . . #eshoppebymannmarketing #dhanteras #dhanteraswishes #dhanteras2020 #festivities #dhanterasspecial #dhanterasgift #festivalseason #festival2020 #festivalvibes #xiaomi #vivo #oppo #oneplus #oneplus8t #realme #samsung #boat #noise #eshopper (at Jail Road) https://www.instagram.com/p/CHeksiBgNyJ/?igshid=1m7po0ewqaq5a

#eshoppebymannmarketing#dhanteras#dhanteraswishes#dhanteras2020#festivities#dhanterasspecial#dhanterasgift#festivalseason#festival2020#festivalvibes#xiaomi#vivo#oppo#oneplus#oneplus8t#realme#samsung#boat#noise#eshopper

0 notes

Text

The Best Home Loan Option: Mortgage Broker- Colchester

For a homebuyer, the mortgage is specific, to the lifestyle and situation. While thinking about the most suitable home loan options, there are a lot of factors that you need to consider.in some cases some buyers, are comfortable in paying 20% as downpayment while some buyers need assistance.

The term that you are going to live in your home also plays a major role in choosing the type of home loan. Here in this post, we are going to have a brief overview of some Best Home

Loan option as explained by the best Mortgage Broker Colchester has.

Fixed-rate Mortgage:

If you are a First Time Buyer Mortgages in Colchester, then the loan option that you must consider is a fixed-rate mortgage. One of the advantages that you get in a fixed-rate mortgage is the rate of interest remains the same throughout the life span of the loan. In Fixed-rate mortgage, the monthly payment or the EMIs are predictable for a term of 10-30 years. So, it becomes the best for them who wants to stay in the home for a longer period.

The main advantage of Fixed-rate Mortgage is you will get:

Interest rate security

Stability in the monthly payment

Adjustable-rate Mortgage:

In an adjusted-rate mortgage, the interest rate is adjusted periodically based on the index. The ARM is best for those who are willing to move into other different houses in the coming years. inARM the monthly payment and the rate of interest fluctuates in every adjustment period. And the period between which the rate changes is known as an adjustment period.

The advantages of the ARM are:

Lower initial interest rate

Lower monthly payment during the starting period.

So in conclusion, these were some essential points to consider while going for a home loan option. However for the best home loan advice and solutions, contact Fees Free Mortgages, the most trusted mortgage broker in the UK.

0 notes

Text

maruti wagonr car loan emi down payment details: बस एक लाख रुपये देकर घर लाएं बेस्ट सेलिंग कार Maruti WagonR, फिर हर महीने इतनी किस्त - best selling car maruti wagonr lxi and wagonr vxi variant price car loan emi options downpayment details

maruti wagonr car loan emi down payment details: बस एक लाख रुपये देकर घर लाएं बेस्ट सेलिंग कार Maruti WagonR, फिर हर महीने इतनी किस्त – best selling car maruti wagonr lxi and wagonr vxi variant price car loan emi options downpayment details

हाइलाइट्स मारुति वैगनआर भारत में सबसे ज्यादा बिकने वाली कार फाइनैंस कराकर आसानी ने मारुति वैगनआर खरीद सकते हैं शानदार माइलेज वाली इस कार की ईएमआई और अन्य डिटेल्स देखें नई दिल्ली।Maruti WagonR Car Loan EMI Down Payment Details: मारुति सुजुकी की बजट हैचबैक कार मारुति वैगनआर भारत में सबसे ज्यादा बिकने वाली कारों में से है और दिसंबर 2021 में भी इसकी बंपर बिक्री हुई है और इसने मारुति ऑल्टो, टाटा…

View On WordPress

0 notes