#Direct Deposit Check Stub

Explore tagged Tumblr posts

Text

An online payslip generator simplifies payroll processing by creating accurate, professional payslips instantly. It ensures secure data handling, legal compliance, and cost efficiency, making it an ideal solution for businesses, HR professionals, and freelancers managing payroll digitally.

#Online Payslip Generator#How to Make Check Stubs#Direct Deposit Check Stub#Salary Slip Generator#Payroll Generator#Real Paycheck Stubs#Paycheck Now#Free Payslip Generator Online#Check Stub Maker#Check Stubs

0 notes

Text

I only have a few things to add, as this list is extensive, thankfully.

— while it *can* make a mess that might not be worth cleaning, those styrofoam ramen noodle cups don’t actually *need* boiling water in order for the noodles to soften. If you can sneak these, put tap water in and let it sit for a few hours. Don’t slurp the noodles, bite them. Might help you fill up a little more than a granola bar.

— if at all possible, have a friend you can go to in the middle of the night if there is an emergency. I didn’t live near forested areas and being out on the street could have been dangerous for me. Preferably a friend whose parents won’t know or care if you arrive in the middle of the night and won’t tell your parents where you are. Talk about this friend as little as possible so your parents won’t go there if they try to find you. Keep first aid supplies there and any “go bags” there.

— prepaid cards are easier to hide than cash. You can get them at convenience stores and pay in cash. They do have an activation fee (~$5) and often have a required amount it has to start at, usually around $15-25 Reloadable ones will be very helpful and usually have much smaller amounts required for each reload (~$5 rather than $25).

— If your job allows you to not do direct deposit, ask for paper checks and ask them to not mail your pay stubs. Take it to the bank directly after and deposit all but a small amount. Take that remainder and put it on that reloadable card. That way it looks like you still got paid on that day (if your parents keep track of your finances) and you can have some money left over. Be careful though, because the statement will say “deposit” rather than “direct deposit” so if the first time you do this your parents question you, just say either 1) you forgot to fill out your direct deposit form for work or 2) your work didn’t file it in time and your first paycheck was a paper check, but that all the rest will be direct deposit. Next time you’re at work, ask to switch to direct deposit.

— if you aren’t allowed to consume certain media due to religious beliefs, you can also use those prepaid cards and aliases to pay for streaming services, webcomics, or purchase books online. I also recommend having a throwaway email/gmail that has a drive function and searching pdfs of books and downloading them, then uploading them to your drive. Just don’t forget to delete the books from your downloads.

— if your house has cameras up, (so sneaking around at night is a quick way to get in huge trouble) find ways to get food during the day and hide them in areas of the house that don’t have cameras that you can access later. Whether that is your room directly or a short term drop-off point that you can revisit when it is safer and you can add it to a more permanent stash in your room, this can be useful to still get food. I recommend the “wear long sleeves and look like you’re taking one granola bar but take two and hide one up your sleeve” trick. If you have cameras in the kitchen this can take a bit of sleight of hand, but acting like you’re digging around for something can work. Wear sweatshirts with tighter cuffs around the wrist to avoid them falling out on accident with a tighter long sleeve underneath to keep it from making your sleeve sag from the weight of the food.

hey so protip if you have abusive parents and need to get around the house as quietly as possible, stay close to furniture and other heavy stuff because the floor is settled there and it’s less likely to creak

#some of these tricks I’ve had to use myself#others were told to me by friends in much worse situations

493K notes

·

View notes

Text

Manufacturing Payroll Processing - Hybrid Payroll

Streamlining Manufacturing Payroll Processing: A Guide to Efficiency and Compliance

In the manufacturing industry, payroll processing is more complex than in many other sectors due to factors like multiple shifts, overtime, union regulations, and compliance requirements. Efficient payroll processing ensures employees are paid accurately and on time while keeping the organization compliant with labor laws. This blog explores the key aspects of payroll processing in the manufacturing industry and how businesses can streamline their payroll operations.

Key Challenges in Manufacturing Payroll Processing

Shift Differentials and Overtime Pay: Many manufacturing employees work in multiple shifts, with different pay rates for night shifts or overtime hours. Ensuring correct calculations for these differentials is critical to payroll accuracy.

Compliance with Labor Laws: Manufacturers must comply with labor laws, including the Fair Labor Standards Act (FLSA), Occupational Safety and Health Administration (OSHA) regulations, and state labor laws governing minimum wage, overtime, and break periods.

Union and Contractual Agreements: Many manufacturing workers are part of labor unions, requiring adherence to collective bargaining agreements that dictate wages, benefits, and overtime pay.

Employee Classification: Manufacturers often employ a mix of full-time, part-time, temporary, and contract workers. Misclassification can lead to compliance issues and penalties.

Tracking Work Hours Accurately: The use of manual timesheets or outdated tracking systems can result in errors, leading to payroll discrepancies and employee dissatisfaction.

Best Practices for Efficient Payroll Processing

Automate Payroll with Software Solutions: Investing in payroll software specifically designed for manufacturing can automate calculations for overtime, shift differentials, and deductions, reducing errors and improving efficiency.

Integrate Time Tracking Systems: Using biometric scanners, digital time clocks, or cloud-based attendance systems ensures accurate tracking of employee hours, reducing discrepancies and manual interventions.

Ensure Compliance with Labor Laws: Staying updated on federal, state, and local labor laws helps manufacturers avoid legal penalties. Regular audits of payroll records can also help in maintaining compliance.

Streamline Union and Employee Agreements: Payroll systems should be configured to align with union contracts and company policies. Automating benefits, bonuses, and wage increases based on agreements ensures compliance and fairness.

Use Direct Deposit and Digital Pay Stubs: Digital payroll processing eliminates paper checks, ensuring timely payments and reducing administrative work. Employees also benefit from easy access to their pay records.

Regular Payroll Audits and Reconciliation: Conducting periodic payroll audits helps identify errors before they escalate into compliance issues or disputes. Reconciling payroll with financial records ensures transparency and accuracy.

Final Thoughts

Manufacturing payroll processing can be complex, but with the right technology and best practices, businesses can streamline operations, reduce errors, and ensure compliance with labor laws. By automating payroll, integrating time-tracking systems, and staying informed on regulatory requirements, manufacturers can enhance efficiency and keep their workforce satisfied. Investing in modern payroll solutions is not just a convenience—it’s a necessity for sustainable business growth in the manufacturing sector.

#construction payroll processing#hospitality payroll management#premier payroll services#payroll outsourcing in denver#payroll services denver#small business payroll processing#peo hr solutions#hospitality payroll solutions

0 notes

Text

No Bank Account? Discover Alternatives to Car Title Loans That Work for You! | fullfinance

Emergencies don’t wait, and sometimes you need quick cash to cover expenses. While car title loans are a popular option, not having a bank account might feel like a roadblock. But don’t worry—there are ways to navigate around this. In this guide, we’ll discuss the challenges of getting a car title loan without a bank account, present alternative solutions, and share practical tips for securing the funds you need.

1. Understanding the Challenges of Car Title Loans Without a Bank Account

Car Title Loans often require a bank account to facilitate fund transfers and repayment. Lenders use your account to deposit the loan amount quickly and set up auto-debit for repayments. Without one, they may see you as a higher-risk borrower, leading to stricter terms or outright denial of your application.

Here are the common challenges:

Limited Lender Options: Fewer lenders are willing to approve loans for applicants without bank accounts.

Higher Interest Rates: The added perceived risk often results in increased loan costs.

Manual Repayments: Without auto-debit, you may need to make physical payments, which can be less convenient.

2. Why Lenders Prefer Bank Accounts

For lenders, a bank account offers:

Ease of Transactions: It ensures quick disbursement and seamless repayments.

Verification: Bank accounts provide insight into financial stability and activity.

Risk Mitigation: Auto-payments reduce the risk of missed payments.

While these reasons make it harder for borrowers without bank accounts, there are alternatives tailored to this situation.

3. Alternatives to Traditional Car Title Loans

If you don’t have a bank account, here are some alternatives that might work for you:

Payday Loans

How It Works: Borrow a small amount based on your income, repayable on your next payday.

Pros: Quick approval process; no bank account needed in some cases.

Cons: High-interest rates and short repayment periods.

Credit Union Loans

How It Works: Many credit unions offer loans to their members, often with flexible requirements.

Pros: Lower interest rates and borrower-friendly policies.

Cons: May require membership or additional documentation.

Pawnshop Loans

How It Works: Use an item of value (e.g., electronics or jewelry) as collateral for a loan.

Pros: No bank account required; quick cash.

Cons: Risk of losing the pawned item if repayment isn’t made.

Alternative Lenders

How It Works: Some lenders specialize in working with borrowers who don’t meet traditional requirements, such as having a bank account.

Pros: More flexible terms and acceptance of manual payment methods.

Cons: May involve higher fees or interest rates.

4. Title Loans for People Without a Bank Account

Certain lenders are willing to provide car title loans without requiring a bank account. These lenders may offer:

Cash Payouts: Instead of a direct deposit, they provide cash or a prepaid card.

Alternative Payment Options: Repay using money orders, checks, or in-person cash payments.

Flexible Income Proofs: Accepting pay stubs, proof of employment, or other non-traditional income verification methods.

5. Key Tips for Finding the Right Loan

Navigating the loan process without a bank account requires extra diligence. Here are some tips:

Research Specialized Lenders: Look for lenders who openly advertise services for borrowers without bank accounts.

Understand the Terms: Carefully read the terms and conditions, especially interest rates and fees.

Check for Hidden Costs: Ensure there are no unexpected fees, such as processing charges or late payment penalties.

Plan Repayments: Create a repayment strategy to avoid penalties and additional debt.

Consider Borrowing Alternatives: Explore family, friends, or employer advances for short-term needs.

Conclusion

Not having a bank account shouldn’t stop you from addressing your financial needs. With a little research and planning, you can find alternatives to traditional car title loans that suit your situation. From payday loans to specialized lenders, the options are diverse. Full Finance is here to guide you in making informed choices for your financial future.

Call-to-ActionReady to explore your loan options? Visit Full Finance to learn more about how we can help you, even without a bank account!

#title loans that don t require the car#car loans for rebuilt titles#car title loan texas#can i get a loan for a salvage title car

0 notes

Text

How HR Outsourcing Helps Businesses Manage HR Efficiently?

HR outsourcing companies offer a wide range of services to help businesses handle their human resources more efficiently and effectively. By partnering with an HR outsourcing provider, companies can simplify their operations, reduce costs, and enhance employee satisfaction.

Core Services Offered by HR Outsourcing Companies:

Payroll Processing:

Accurate payroll management, including tax calculations, deductions, and direct deposits.

Compliance with federal, state, and local labor laws.

Generating pay stubs, W-2s, and other important tax forms.

Managing employee benefits like health insurance and retirement plans.

Benefits Administration:

Handling employee benefits enrollment and management.

Coordinating with insurance providers.

Supporting open enrollment periods and communicating benefits clearly.

Ensuring compliance with regulations like the Affordable Care Act (ACA).

Recruitment and Staffing:

Finding and sourcing qualified candidates.

Screening and interviewing applicants to match them with the right roles.

Conducting background and reference checks.

Onboarding new hires and providing necessary training and orientation.

Employee Relations:

Managing workplace issues and resolving conflicts.

Offering guidance on performance management and disciplinary actions.

Developing employee handbooks and policies.

Conducting surveys to gather employee feedback and improve satisfaction.

Compliance and Risk Management:

Ensuring the company follows federal, state, and local labor laws.

Conducting audits to identify and reduce compliance risks.

Developing policies to minimize legal and financial risks.

Assisting with government audits and investigations.

Training and Development:

Creating and delivering training programs to improve employee skills.

Identifying training needs based on performance reviews and feedback.

Providing career development opportunities and coaching.

Recordkeeping and Reporting:

Keeping accurate employee records, such as personnel files and contracts.

Generating reports on important HR metrics, like turnover and time-off usage.

Ensuring compliance with data privacy and security regulations.

Benefits of HR Outsourcing:

Cost Savings: Reduces the need for an in-house HR team, cutting overhead costs.

Increased Efficiency: Streamlines HR processes and boosts productivity.

Access to Expertise: Provides specialized HR knowledge and best practices.

Risk Mitigation: Reduces the chance of legal issues and compliance violations.

Scalability: Easily adjusts HR services as your business grows or changes.

Focus on Core Business: Frees up time and resources so you can focus on what you do best.

How to Choose the Right HR Outsourcing Provider:

Experience and Expertise: Choose a provider with a proven track record and industry knowledge.

Service Range: Ensure they offer the services you need.

Technology: Look for providers that use modern tools to make HR processes smoother.

Security and Compliance: Make sure they prioritize data security and follow regulations.

Customer Support: Good customer service is crucial for a successful partnership.

Cost-Effectiveness: Ensure their pricing fits your budget and provides value.

Conclusion

By partnering with Wokhr Solutions- One-Stop HR solutions provider, businesses can improve their HR operations, save money, and enhance employee satisfaction. This allows companies to focus on their core strengths and achieve long-term success.

#HRoutsourcingSevice#WOKHRSolutions#HRoutsourcingprovider#complianceManagment#payroll management#hroutsourcing#hrservices#OneStopHRSolutions#HROperations

0 notes

Text

How to Apply for Installment Loans in Ontario

When unexpected expenses arise, finding the right financial solution can be overwhelming. For residents of Ontario, installment loans provide a flexible and straightforward way to manage finances. This guide walks you through the steps to apply for Installment Loans in Ontario with ease.

What Are Installment Loans in Ontario?

Installment loans are personal loans that borrowers repay over a series of scheduled payments. Unlike payday loans, which require repayment in full on the next payday, installment loans offer manageable monthly payments, often with competitive interest rates. They are a practical choice for individuals who need funds for emergencies, debt consolidation, or large purchases.

Benefits of Installment Loans in Ontario

Before diving into the application process, it’s important to understand the benefits:

Flexible Terms: Choose repayment plans that suit your budget.

Quick Approval: Many lenders offer same-day approval for eligible borrowers.

No Collateral Required: Most installment loans are unsecured, meaning you don’t need to offer assets as security.

Build or Improve Credit: Regular payments can positively impact your credit score.

Step-by-Step Guide to Applying for Installment Loans in Ontario

Research Reliable LendersStart by comparing lenders that offer installment loans in Ontario. Look for companies with transparent terms, reasonable interest rates, and good customer reviews. Be cautious of predatory lenders with hidden fees or overly high rates.

Check Eligibility RequirementsMost lenders require you to meet the following:

Be at least 18 years old.

Have a valid Ontario address.

Provide proof of a stable income source.

Possess a bank account for funds transfer.

Gather Necessary DocumentsEnsure you have these documents ready:

Government-issued ID (e.g., driver’s license or passport).

Recent pay stubs or income statements.

Utility bills as proof of address.

Your banking details for direct deposits.

Fill Out the ApplicationApplications can typically be completed online or in person. Provide accurate details to avoid delays in processing. Double-check your information before submission to ensure accuracy.

Review the Loan TermsOnce pre-approved, the lender will provide a loan agreement outlining:

The loan amount and interest rate.

Repayment schedule and due dates.

Any additional fees or penalties. Take your time to review these terms and ask questions if anything is unclear.

Receive Your FundsUpon approval, the loan amount is usually deposited directly into your bank account within 24-48 hours.

Make Timely PaymentsStay on top of your repayment schedule to avoid late fees and protect your credit score. Setting up automatic payments can be a helpful way to ensure on-time payments.

Tips for a Successful Application

Maintain Good Credit: While many lenders accept applicants with less-than-perfect credit, a higher credit score can secure better terms.

Borrow Responsibly: Only apply for the amount you truly need to avoid overextending your finances.

Read the Fine Print: Understanding all terms and conditions is crucial to avoid surprises down the line.

Applying for Installment Loans in Ontario is a straightforward process when you’re prepared. These loans offer a practical solution to financial challenges, allowing you to manage expenses with flexible repayment terms. Whether it’s an emergency or a planned expense, knowing how to navigate the application process ensures you can access the funds you need with confidence.

1 note

·

View note

Text

Key Features to Look for in an HRMS Platform

As businesses grow, managing human resources effectively becomes more complex. That’s where Human Resource Management Systems (HRMS) come into play. A robust HRMS platform can streamline operations, enhance employee experience, and provide valuable insights into workforce data. But with so many options on the market, how do you choose the right one for your organization?

In this blog, we’ll explore the key features every HRMS platform should have to ensure it meets the needs of both HR teams and employees.

1. Employee Self-Service (ESS)

Employee self-service is a must-have feature. It allows employees to access their personal information, request time off, check pay stubs, and update their details without HR assistance. This reduces administrative overhead and empowers employees to manage their data.

Benefits:

Reduced HR workload

Improved accuracy of employee data

Increased employee engagement

2. Payroll Management

One of the most critical functions of any HRMS is payroll management. It should seamlessly integrate employee salary details, benefits, tax withholdings, and deductions. Automated payroll processing minimizes errors, ensures compliance, and saves time, especially for large organizations.

Key Functions:

Automatic salary calculations

Tax compliance features

Direct deposit support

Payroll reporting

3. Time and Attendance Tracking

A comprehensive HRMS should offer time-tracking features, allowing employees to clock in and out easily. It should also handle leave management and overtime tracking and integrate with payroll to ensure accurate compensation.

Benefits:

Simplified attendance management

Reduced time theft and errors

Accurate overtime tracking

4. Performance Management

Tracking and improving employee performance is a vital part of HR management. Your HRMS should include tools for setting performance goals, conducting regular appraisals, and providing feedback. Advanced systems may even integrate 360-degree feedback and customizable evaluation forms.

Key Features:

Goal setting and tracking

Performance review templates

Continuous feedback loops

Reports on employee progress

5. Recruitment and Onboarding

Efficient recruitment and onboarding are essential for reducing time-to-hire and ensuring a smooth start for new employees. A strong HRMS should offer applicant tracking, interview scheduling, and integration with job boards. Additionally, it should automate onboarding tasks such as document submission, new hire orientation, and training assignment.

Key Elements:

Applicant tracking system (ATS)

Job posting automation

New employee onboarding workflows

Pre-employment screening tools

6. Learning and Development (L&D)

Continuous training and development are key to employee retention and growth. Look for an HRMS that integrates learning management systems (LMS), allowing employees to access training materials, enroll in courses, and track certifications.

Key Features:

Online course management

Certification tracking

Progress reports for employees

Integration with external training providers

7. HR Analytics and Reporting

Data-driven decision-making is critical for modern HR teams. Your HRMS should provide robust reporting and analytics tools that help HR professionals track key metrics like turnover rates, employee engagement, and hiring efficiency. Customizable dashboards and real-time data visualization can also enhance strategic planning.

Key Metrics:

Employee turnover rates

Time-to-hire

Employee satisfaction scores

Workforce demographics

8. Compliance Management

Ensuring compliance with labor laws, tax regulations, and employee benefit schemes is critical. A good HRMS will automatically update regulatory changes and help your organization remain compliant, avoiding costly penalties.

Key Features:

Automatic regulatory updates

Audit trails and reporting

Support for global compliance (if applicable)

Tax filing assistance

9. Mobile Access

With the rise of remote work and employees on the go, having mobile-friendly HRMS access is essential. Mobile apps allow employees and managers to handle HR tasks, such as approving leave requests, accessing pay information, or submitting timesheets, from their smartphones.

Benefits:

Increased flexibility for remote teams

Real-time updates

Improved employee experience

10. Integration Capabilities

An HRMS should not operate in a vacuum. It must integrate with other essential business software such as payroll processors, finance platforms, ERP systems, and even communication tools like Slack or Microsoft Teams. Seamless integration ensures that data flows smoothly across departments, reducing duplication and enhancing efficiency.

Integration Types:

Payroll systems

Financial software (e.g., QuickBooks)

Communication tools (e.g., Slack, Teams)

External recruiting platforms

Conclusion

Choosing the right HRMS platform for your organization can transform your HR department into a more efficient, data-driven function that delivers better employee experiences. Look for systems that offer customizable, scalable, and secure solutions tailored to your specific business needs. The features listed above are essential building blocks for any successful HRMS, helping you streamline processes, reduce administrative burdens, and improve workforce management.

By carefully assessing your requirements and matching them to the capabilities of an HRMS, you’ll be on your way to selecting a solution that truly enhances your organization’s HR functions.

#HRMS#HR software#Employee management#Payroll management#Time and attendance tracking#Performance management#HR analytics

1 note

·

View note

Text

Best Online Payroll Services for Small Businesses | Efficient Payroll Solutions | Evmark

In the dynamic landscape of small businesses, managing payroll efficiently is crucial for success. As an entrepreneur or small business owner, you understand the importance of streamlining operations while ensuring accuracy and compliance. This is where online payroll services come into play, offering convenience, efficiency, and peace of mind. If you're searching for the best online payroll services for small business, look no further than Evmark.io. Let’s delve into how Evmark's online payroll services can simplify payroll management for your small business.

The Benefits of Online Payroll Services for Small Businesses

Online Payroll Services: Key Benefits for Small Businesses Online payroll services provide numerous advantages for small businesses, helping to streamline operations and reduce the burden of managing payroll. Here are some key benefits:

Time Savings By automating payroll processes, online payroll services eliminate the need for manual calculations and paperwork. This allows small business owners to focus on core business activities instead of getting bogged down by payroll tasks.

Accuracy and Compliance Online payroll platforms help minimize errors and ensure compliance with tax regulations and labor laws. This reduces the risk of costly penalties and audits, providing small business owners with peace of mind.

Cost-Effectiveness Traditional payroll methods often require investment in software, staff training, and manual labor, all of which can be costly. Online payroll services typically offer affordable subscription models, making them a more accessible option for small businesses with limited budgets.

Accessibility and Convenience With secure, cloud-based access, online payroll services allow business owners to access payroll data anytime, anywhere. This level of convenience makes managing payroll on the go easier, especially for remote teams.

Evmark's Online Payroll Services: A Tailored Solution for Small Businesses At Evmark.io, we understand the distinct needs of small businesses when it comes to payroll. Our online payroll services for small businesses are designed to simplify payroll management, streamline processes, and offer greater control and flexibility.

Key Features of Evmark’s Online Payroll Services:

User-Friendly Interface Our platform is designed for ease of use, even for those with minimal technical experience. With intuitive navigation and clear menus, managing payroll becomes a simple task, reducing time spent on payroll administration.

Automated Calculations Evmark’s online payroll services automate wage, tax, and deduction calculations, ensuring accuracy and compliance. This eliminates the risk of human error and makes payroll processing faster and more efficient.

Tax Filing and Compliance Handling payroll taxes can be complex and time-consuming. Evmark ensures your payroll taxes are accurately calculated and filed on time, helping to avoid penalties and maintain compliance with state and federal regulations.

Direct Deposit Our direct deposit feature simplifies payroll distribution, reducing reliance on paper checks and streamlining the payroll process. This also provides added convenience and security for your employees.

Employee Self-Service Portal Evmark’s self-service portal allows employees to view their pay stubs, update personal information, and manage their payroll details independently. This reduces the administrative burden on HR staff and empowers employees with greater access to their own data.

Client-Centric Approach At Evmark, we prioritize client satisfaction. Our dedicated support team is here to guide you through every step, from the initial setup to ongoing technical assistance. Whether you have questions or need help with a technical issue, we ensure a seamless experience.

Visit https://evmark.io/services/ to learn more about our online payroll services and take the first step towards hassle-free payroll management for your small business.

Location: 25101 The Old Rd #155, Stevenson Ranch, CA 91381 Phone: (747) 444-0449

0 notes

Text

How Payroll Service Providers Help With Direct Deposit Setup?

Direct deposit is an efficient, secure, and convenient way to pay employees, but setting it up can be a daunting task for small business owners unfamiliar with the process. Payroll service providers offer comprehensive support in establishing direct deposit systems, making it easier for businesses to streamline payments, enhance employee satisfaction, and reduce administrative workloads. Here’s how payroll service providers help with direct deposit setup.

1. Streamlined Account Setup

Setting up direct deposit requires multiple steps, including establishing relationships with financial institutions, collecting employee banking information, and integrating systems that facilitate electronic payments. Payroll service providers handle this entire process, ensuring a smooth transition from traditional payment methods to direct deposit.

Bank Coordination: Payroll providers work directly with banks to set up Automated Clearing House (ACH) accounts, which are used to process direct deposit payments. They manage the technical aspects of creating these accounts, reducing the administrative burden for small business owners.

Employee Enrollment: Payroll providers assist in collecting the necessary banking information from employees, such as account numbers and routing numbers, and ensure this data is securely transmitted and stored.

2. Ensures Compliance and Security

One of the most significant concerns for small businesses when setting up direct deposit is ensuring compliance with financial regulations and safeguarding sensitive employee information. Payroll service providers are experts in compliance and data security, offering peace of mind to business owners.

Compliance with Banking Regulations: Payroll providers ensure that your direct deposit system complies with all relevant banking regulations and legal requirements, such as NACHA (National Automated Clearing House Association) rules. They also ensure adherence to state and federal wage laws, including timely payment obligations.

Secure Data Handling: Payroll providers employ advanced security protocols to protect sensitive employee information, such as bank account details. Encryption, secure file transfers, and multi-factor authentication are commonly used to safeguard data, reducing the risk of fraud or data breaches.

3. Accurate and Timely Payments

Setting up and managing direct deposit involves several key components to ensure employees are paid accurately and on time. Payroll service providers use automated systems to streamline payment processing and reduce the risk of errors.

Automated Payment Processing: Payroll providers utilize software that automates the direct deposit process, ensuring that payments are transferred to employees’ accounts on designated payday. The automation helps eliminate common errors, such as overpayments or late payments, which can harm employee satisfaction.

Payment Scheduling: With payroll service providers, businesses can easily schedule payments in advance. Once the direct deposit is set up, payroll runs automatically, ensuring that employees receive their paychecks without delay, even during holidays or busy periods.

4. Employee Self-Service Options

A key benefit of working with a payroll service provider is the employee self-service portals they offer. These portals allow employees to manage their direct deposit settings independently, reducing the administrative burden on business owners.

Direct Deposit Management: Employees can log into their self-service accounts to update their banking details, view pay stubs, and monitor their payment history. This eliminates the need for employers to manually collect or update banking information.

Multiple Account Options: Payroll providers can also offer flexibility for employees by allowing them to split their pay between multiple accounts. For example, employees can choose to have a portion of their paycheck deposited into a checking account and the remainder into a savings account.

5. Reduces Administrative Workload

Managing payroll in-house can be time-consuming, especially when setting up and overseeing direct deposit payments. Payroll service providers reduce the administrative burden by handling every aspect of payroll processing.

Ongoing Maintenance: Once direct deposit is set up, payroll providers continue to manage the process, including handling any updates, corrections, or changes in employee banking information.

Troubleshooting Issues: Payroll providers also resolve any issues that arise, such as payment delays or errors, allowing small business owners to focus on their core operations instead of troubleshooting payroll problems.

6. Cost-Effective Solution

Outsourcing direct deposit setup and payroll management is not only efficient but also cost-effective for small businesses. Instead of investing in expensive payroll software and dedicating internal resources to managing payroll, business owners can rely on payroll service providers for a fixed monthly fee.

Affordable Pricing: Many payroll providers offer tiered pricing based on the size and needs of the business, making direct deposit setup accessible even for small companies with limited budgets.

Reduced Paper Check Costs: By switching to direct deposit, businesses can eliminate the costs associated with printing, distributing, and securing paper checks.

Conclusion

Payroll service companies in Orange CA make setting up direct deposit simple and efficient for small businesses. From managing bank coordination and ensuring regulatory compliance to providing secure, automated payment systems, they streamline the entire process. By outsourcing direct deposit setup, business owners can reduce their administrative workload, ensure timely payments, and enhance the overall employee experience.

0 notes

Text

Understanding the Payroll Process: A Comprehensive Overview

Payroll is a crucial function within any organization, ensuring that employees are compensated accurately and on time. It involves various steps, from collecting employee information to managing compliance with tax laws. This blog provides a detailed overview of the payroll process, highlighting key aspects and best practices for effective payroll management.

1. Employee Information Collection

The payroll process begins with collecting essential employee information. This includes:

Personal Details: Full name, address, contact details, and social security number (SSN) or equivalent.

Bank Information: For direct deposit payments.

Employment Status: Full-time, part-time, and other relevant details.

Compensation Details: Pay rate, salary, allowances, deductions, and benefits eligibility.

Accurate information is crucial for calculating wages and ensuring compliance with labor laws.

2. Timekeeping and Attendance Records

Tracking employee hours is essential for accurate payroll calculation. This includes:

Regular Hours: Hours worked within standard work periods.

Overtime: Additional hours worked beyond the regular schedule.

Leave Records: Paid or unpaid leave taken by employees.

Attendance Tracking: To ensure adherence to company policies.

Proper timekeeping helps in precise wage calculation and compliance with attendance policies.

3. Payroll Calculation

Calculating payroll involves several key steps:

Gross Wages Calculation: Based on hours worked, salary, or other compensation factors.

Tax Deductions: Federal, state, local taxes, social security, and Medicare contributions.

Voluntary Deductions: Health insurance premiums, retirement contributions, and other benefits.

Overtime Rates: Applied as per labor laws and company policies.

Accurate calculations are vital to meet legal requirements and ensure fair compensation.

4. Payroll Processing

To manage payroll efficiently:

Use Payroll Software: Automate calculations, manage employee data securely, and generate payroll reports.

Review Calculations: Check for accuracy and compliance with legal standards.

Approval: Obtain authorization from relevant personnel before finalizing payroll.

Automation and thorough review processes help reduce errors and streamline payroll operations.

5. Tax Withholding and Reporting

Payroll includes managing tax-related tasks:

Withholding Taxes: Deduct income tax based on earnings and allowances (e.g., Form W-4 in the U.S.).

Tax Submissions: Remit withheld taxes to authorities within deadlines.

Tax Returns: Prepare and file payroll tax returns (e.g., Form 941 in the U.S.).

Year-End Forms: Issue annual W-2 forms or equivalent to employees.

Timely and accurate tax handling ensures compliance and avoids penalties.

6. Payment Distribution

Distributing payments involves:

Direct Deposit: Transfer net pay electronically to employees’ bank accounts.

Checks: Issue printed or electronic payroll checks for those not using direct deposit.

Pay Stubs: Provide detailed pay stubs showing earnings, deductions, and net pay.

Efficient payment methods enhance employee satisfaction and streamline financial management.

7. Record Keeping and Compliance

Maintaining proper records is essential:

Secure Records: Store payroll data securely in compliance with statutory requirements (e.g., Fair Labor Standards Act).

Audit Preparedness: Prepare for audits by tax authorities or regulatory agencies.

Regulation Updates: Stay informed about changes in tax laws and labor regulations.

Accurate record-keeping and compliance help avoid legal issues and ensure smooth operations.

8. Reporting and Analysis

Effective payroll management involves:

Payroll Reports: Generate reports for management and accounting purposes.

Cost Analysis: Review payroll costs, labor expense trends, and budget variances.

Regular reporting aids in strategic decision-making and financial planning.

9. Employee Communication and Support

Providing support and communication to employees includes:

Addressing Inquiries: Respond to questions about payroll, deductions, and benefits.

Self-Service Options: Offer online platforms for employees to view and manage payroll information.

Clear communication and support help maintain transparency and employee trust.

Conclusion

An efficient payroll process is vital for any organization, impacting employee satisfaction and legal compliance. By following these steps and best practices, businesses can manage payroll effectively, ensuring timely and accurate compensation while adhering to regulatory requirements.

0 notes

Text

Understanding Online Payroll: Streamlining Your Business Finances

In today's fast-paced digital world, managing business operations efficiently is more crucial than ever. One area where businesses can significantly benefit from technological advancements is payroll management. Online payroll systems have emerged as a game-changer, offering businesses a more efficient, accurate, and cost-effective way to manage employee compensation. This article explores what online payroll is, its benefits, and how it can transform your business operations.

What is Online Payroll?

Online payroll refers to the use of cloud-based software to manage employee payments, deductions, tax filings, and related tasks. Unlike traditional payroll systems that rely on manual input and physical paperwork, online payroll automates the entire process, reducing errors and saving time. These systems are accessible from any device with an internet connection, allowing businesses to manage payroll operations from anywhere, at any time.

Benefits of Online Payroll

Time Efficiency: Online payroll systems automate repetitive tasks, such as calculating wages, taxes, and deductions, which significantly reduces the time spent on payroll management. This allows HR teams to focus on more strategic tasks, such as employee engagement and talent management.

Accuracy and Compliance: One of the major challenges in payroll management is ensuring accuracy and compliance with tax regulations. Online payroll systems are designed to automatically update tax rates and other regulatory changes, ensuring that businesses remain compliant. This reduces the risk of costly errors and penalties.

Cost-Effective: By automating payroll processes, businesses can reduce the need for extensive HR teams or external payroll services. This not only cuts down on labor costs but also minimizes the likelihood of errors that could lead to financial penalties.

Security: Online payroll systems use advanced encryption and security protocols to protect sensitive employee information. This reduces the risk of data breaches and ensures that personal and financial data is kept confidential.

Accessibility and Flexibility: With online payroll, businesses can access payroll data anytime, anywhere. This is particularly beneficial for companies with remote teams or multiple locations, as it allows for seamless management of payroll operations across different regions.

Employee Self-Service: Many online payroll systems offer self-service portals where employees can access their pay stubs, tax forms, and other related documents. This reduces the administrative burden on HR teams and empowers employees to manage their own payroll information.

Key Features of Online Payroll Systems

Automated Calculations: Online payroll systems automatically calculate wages, deductions, and taxes, reducing the risk of manual errors.

Direct Deposit: Employees can receive their pay directly into their bank accounts, eliminating the need for paper checks and reducing processing time.

Tax Filing: These systems often include features that automate tax filing and reporting, ensuring compliance with local, state, and federal regulations.

Customizable Reports: Businesses can generate various payroll reports, such as wage summaries, tax liabilities, and employee earnings, to gain insights into their payroll operations.

Integration with Other Systems: Online payroll can often be integrated with other HR and accounting systems, providing a seamless flow of information across different business functions.

Choosing the Right Online Payroll System

When selecting an online payroll system, it's essential to consider the specific needs of your business. Some key factors to consider include:

Scalability: Ensure that the system can grow with your business and accommodate an increasing number of employees.

Ease of Use: The system should have a user-friendly interface that is easy to navigate, even for those with limited technical expertise.

Customer Support: Look for a provider that offers robust customer support, including tutorials, help guides, and live assistance.

Cost: Compare pricing plans to ensure that the system fits within your budget while still offering the features you need.

Security: Verify that the system uses advanced security measures to protect your data and comply with industry standards.

Conclusion

Online payroll systems offer a host of benefits that can streamline your business operations, reduce costs, and enhance accuracy and compliance. By automating the payroll process, businesses can focus on what they do best—growing and thriving in a competitive marketplace. Whether you're a small business owner or a large enterprise, investing in an online payroll system can be a smart move that pays off in the long run.

0 notes

Text

PaystubUSA offers a powerful Salary Slip Generator to streamline your payroll process. Save time with instant slip creation and ensure complete accuracy for employee records. Simplify payroll management with PaystubUSA’s reliable and efficient tools.

#Salary Slip Generator#Online Payslip Generator#Salaried Pay Stub#Payroll Generator#Free Payslip Generator Online#Paycheck Now#Real Paycheck Stubs#Check Stub Maker#How to Make Check Stubs#Check Stubs#Make Check Stubs#Direct Deposit Check Stub

0 notes

Text

Choosing the Best Payroll Software: What Indian Companies Should Look For.

What is payroll software?

Payroll software is a digital solution that automates and simplifies the entire employee payment process. It goes beyond just issuing paychecks, it can handle everything from calculating salaries and deductions to filing taxes and generating reports.

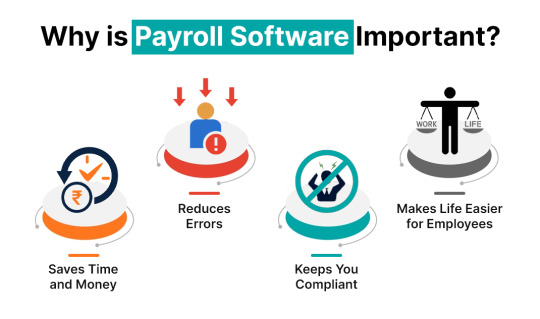

Why is Payroll Software Important?

There are a few reasons why payroll software is a smart choice for businesses of all sizes:

Saves Time and Money: Payroll software automates a lot of tasks that used to be done by hand. This frees up your HR team to focus on other important things, and it can also save you money on payroll processing fees.

Reduces Errors: Payroll calculations can be complex, and even a small mistake can lead to big problems. Software helps to ensure that your employees are always paid accurately and on time.

Keeps You Compliant: Tax laws and regulations are constantly changing. Payroll software can assist you in staying updated with these changes and ensuring continuous compliance.

Makes Life Easier for Employees: Employees can access their pay stubs and tax information electronically, and they can even choose how they want to be paid (direct deposit, check, etc.).

Choosing the Right Payroll Software for Your Business

There are a lot of different payroll software options on the market, so it's important to choose one that's right for your business. Here are some things to consider:

Size of Your Company: If you're a small business with just a few employees, you'll need a different software solution than a large corporation with hundreds of employees.

Features: Some software programs offer more features than others. Consider what features are important to you, such as the ability to track time and attendance, manage benefits, or generate reports.

Cost: The cost of payroll software can vary based on the required features and the size of your team. Obtain estimates from several vendors before finalizing your decision.

Key features to look for in payroll software:

Connects with Other Software: The best payroll software will connect seamlessly with your existing HR and accounting software. This will save you time and effort by eliminating the need to enter data multiple times.

Flexible Payment Options: Employees should be able to choose how they want to be paid, whether it's direct deposit, check printing, or even electronic funds transfer.

Works with Your Pay Schedule: The software should be able to handle your company's preferred pay schedule, whether it's weekly, bi-weekly, or monthly.

Handles Taxes: The software should be able to calculate and withhold taxes for your employees. This includes federal, state, and local taxes, as well as any other deductions that may apply (like Social Security or health insurance).

Easy to Use: The software should be easy to use for both HR personnel and employees. An intuitive interface will make it easier to learn the software and get started.

Cloud-based: Cloud-based software means that you can access it from anywhere with an internet connection. This is a great option for remote employees in businesses.

Automates Tasks: Look for software that can automate tasks such as payroll processing, tax calculations, and report generation. This will reduce the risk of errors and save you time.

Keeps You Compliant: The software should be updated regularly to reflect changes in tax laws and regulations. This will help you avoid any kind of penalties for non-compliance.

User-Friendly Interface: The way the software is laid out (the interface) should be clear and easy to navigate. Being able to customize the interface and access it from different devices (phones, laptops, etc.) is a plus.

Reliable Customer Support: If you have any questions or problems with the software, you should be able to get help from customer support. Look for a company that offers a variety of support options, such as phone, email, and online chat.

Conclusion

Investing in the right payroll software can significantly improve your company's efficiency and ensure employee satisfaction. By carefully assessing your needs and considering these factors, you can choose a solution that streamlines your payroll process and keeps you compliant with regulations.

0 notes

Text

How to Get Old Pay Stubs: A Comprehensive Guide

If you're trying to track down old pay stubs, whether for tax purposes, loan applications, or personal records, there are several effective methods you can use. This comprehensive guide will walk you through the steps to obtain your old pay stubs, ensuring you have all the necessary information at your fingertips. Additionally, you can find detailed guidance on how to get a pay stub from direct deposit, making the process even more straightforward.

Why You Might Need Old Pay Stubs

Before diving into the methods, it’s important to understand why you might need old pay stubs. Common reasons include:

Tax purposes: Pay stubs can help verify income and withholdings for tax filings.

Loan applications: Lenders often require proof of income.

Personal records: Keeping track of your earnings and deductions.

Employment verification: New employers might ask for past pay stubs.

Read More: Fake Income Verifications for Apartments

Methods to Get Old Pay Stubs

1. Check Your Email and Online Accounts

Many employers send pay stubs via email or have online portals where you can access them. Here’s how you can check: you can also consider using a paystub generator for immediate access to your pay stubs.

Email: Search your email inbox for pay stub-related keywords such as "pay stub," "payroll," or your company's name.

Online Portal: Log in to your company’s payroll portal. Most companies use services like ADP, Paychex, or Gusto, which allow employees to view and download pay stubs.

2. Contact Your Employer's HR or Payroll Department

If you can't find your pay stubs online or via email, your next step should be to contact your employer’s HR or payroll department. Here’s what you can do:

Request in Writing: Draft a formal request letter or email asking for copies of your old pay stubs. Be sure to include:

Your full name

Your employee ID (if known)

The specific pay periods you need

The reason for your request (optional)

Follow Up: If you don't receive a response within a week, follow up with a phone call or another email.

3. Check with Your Bank

If your paychecks were directly deposited, your bank statements might serve as a record of your earnings. While not a substitute for an actual pay stub, they can provide helpful information, especially when combined with other records.

Here’s how to proceed:

Bank Statements: Review your bank statements for deposits made by your employer. Most bank statements will show the deposit amount and the name of the payer.

Request Detailed Records: If you need more detailed information, contact your bank to request a record of deposits for the specific period.

4. Use Payroll Services

If your employer uses a third-party payroll service, you might be able to access your pay stubs through their website. Common services include:

ADP: Employees can access their pay stubs through the ADP portal. You will need to create an account if you haven't already.

Paychex: Similar to ADP, Paychex offers an online portal for employees to view and download pay stubs.

Gusto: This service also provides an online portal for employees to access pay stubs.

Related Article: Understanding DG Paystubs

What to Do If You Can't Get Your Pay Stubs

In some cases, you might not be able to obtain your old pay stubs through the methods listed above. Here are a few additional steps you can take:

Contact the IRS: If you need pay stubs for tax purposes and can't get them from your employer, you can request a wage and income transcript from the IRS. This document provides information reported by your employer, such as your wages and taxes withheld.

Speak with a Lawyer: If your employer refuses to provide your pay stubs and you need them for a legal matter, consider speaking with an employment lawyer for advice on how to proceed.

Conclusion

Obtaining old pay stubs doesn't have to be a daunting task. By following the steps outlined in this guide, you can efficiently track down your old pay stubs and ensure you have the necessary documentation for any situation. For a hassle-free experience with payroll and pay stub generation, consider using online services like eFormscreator, which provide easy and secure access to your wage statements and other important documents.

#how to get pay stubs from direct deposit#how to get a pay stub with direct deposit#wage statements cbocs#how to get an old pay stub#how to get old pay stubs#electronic pay stubs

0 notes

Text

Need of Payroll Processing Software for Businesses

In today's fast-paced business world, efficiency and accuracy are crucial for success. One area where businesses often seek to improve these qualities is in payroll processing. Payroll processing involves calculating employee wages, withholding taxes, and ensuring that all financial aspects of employee compensation are managed correctly. Traditionally, this task was handled manually, which could be time-consuming and prone to errors. However, with the advent of payroll processing software, this process has become much more manageable and efficient.

What is Payroll Processing Software?

Payroll processing software is a tool designed to automate and streamline the process of paying employees. It handles everything from calculating wages and withholding taxes to printing checks and managing direct deposits. The software can also track employee hours, manage benefits, and generate reports that help with financial planning and compliance.

Key Features of Payroll Processing Software

Automated Calculations: The software automatically calculates wages based on the hours worked, overtime, and deductions such as taxes and benefits. This reduces the risk of human error that can occur with manual calculations.

Tax Management: Payroll software is updated regularly to comply with current tax laws. It can calculate federal, state, and local taxes, and generate tax forms such as W-2s and 1099s, ensuring businesses remain compliant with tax regulations.

Direct Deposit and Check Printing: Instead of writing checks by hand, payroll software can process direct deposits directly into employees' bank accounts. For those who prefer physical checks, the software can print them with all the necessary details.

Time Tracking: Many payroll systems come with time-tracking features. Employees can clock in and out, and the software will automatically record their hours worked. This feature is particularly useful for businesses with hourly employees.

Employee Self-Service: Modern payroll software often includes a self-service portal where employees can view their pay stubs, update personal information, and manage their tax withholdings. This reduces the administrative burden on HR departments.

Compliance and Reporting: The software can generate detailed reports on payroll expenses, helping businesses with budgeting and financial planning. It also ensures compliance with labor laws and tax regulations, minimizing the risk of penalties.

Benefits of Using Payroll Processing Software

Time Savings: Automating payroll processes frees up significant time for HR and finance staff, allowing them to focus on more strategic tasks.

Accuracy: By reducing the risk of human error, payroll software ensures employees are paid correctly and on time. This boosts employee satisfaction and trust.

Cost-Effective: While there is an upfront cost to purchasing payroll software, it often pays for itself by reducing the time spent on payroll tasks and minimizing costly mistakes.

Security: Payroll information is sensitive, and payroll software offers robust security features to protect this data. Encryption and secure access controls ensure that only authorized personnel can access payroll information.

Scalability: Payroll software can grow with your business. Whether you have a small startup or a large enterprise, the software can handle varying numbers of employees and different types of compensation.

Choosing the Right Payroll Processing Software

When selecting payroll processing software, consider the following factors:

Ease of Use: The software should have an intuitive interface that is easy for staff to learn and use.

Customer Support: Reliable customer support is essential, especially during the initial setup phase and when dealing with any issues that arise.

Integration: The software should integrate seamlessly with other systems you use, such as accounting and HR software.

Customization: Look for software that can be customized to meet the unique needs of your business, including specific payroll rules and reporting requirements.

Cost: Consider both the upfront costs and any ongoing fees. Compare the features and benefits of different software options to ensure you get good value for your investment.

A software development company in Delhi can not only help you build payroll processing software but also other business related software like Inventory Management Software.

Conclusion

Payroll processing software is a valuable tool for businesses of all sizes. It streamlines the complex process of managing employee compensation, ensuring accuracy, compliance, and efficiency. By automating payroll tasks, businesses can save time and money, reduce errors, and provide a better experience for their employees. As technology continues to evolve, payroll processing software will become even more integral to the smooth operation of businesses everywhere.

0 notes

Link

0 notes