#Digital Process Automation Banks

Explore tagged Tumblr posts

Text

ppl up in arms about “sentence mixing being way better than AI voice generators” be so for real. theyre different things. joe biden Pills. Now. Please. and ben shapiro Im Not Gonna Get Old on the Beach are both landmark videos and pretending the second one isnt because it was made by the “scary AI” is like. come on. be serious.

#like yeaaah i guess you could argue its unethical bc ben shapiro didnt consent to having his voice made into a bank like that#but the AI is literally just doing what the sentence mixing guys are doing. just automated#so if you wanna raise an ethical issue there i think you gotta raise it with the ytpoopers as well imo#and. its ben shapiro.#be so for real! theyre different things#you ever laugh at one of those spongebob sings world is mine videos from awhile back? its the same shit#utau doesnt have an AI component to it afaik but the process is all the same#of course this isnt applied when COMPANIES are doing it for PROFIT.#but thats always been the case#all this tells me is that you have no idea how voice synthesis has been progressing over the years and have no understanding of how the#software to produce these things work. tbh xoxo#oh no i made a bad post#btw what i mean when i say theyre different things and yet say the process is the same is that the results come out sounding different#process is largely* the same i mean#like ppl dont stop making pixel art bc you can make higer fidelity digital art#same principle

16 notes

·

View notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

0 notes

Text

Revolutionizing Finance through Autonomous Technology

Autonomous financial services use advanced technologies like artificial intelligence (AI), machine learning (ML), and blockchain to automate financial processes and decision-making. Financial services like investment management, risk management, insurance, banking, and trading can be autonomous. Benefits of Financial Autonomy Autonomous financial services offer several advantages: Efficiency…

View On WordPress

#artificial intelligence#asset management#autonomous financial services#cloud computing#digital banking services#financial service#robotic process automation

1 note

·

View note

Text

What iBorg can Offer ?

The artificial intelligence and machine learning capabilities of iBorg will enable autonomous operational capabilities, freeing employees from repetitive tasks and allowing them to perform more meaningful work. It can operate on a variety of devices, including desktop applications, AS400 screens, multiple web browsers, headless browsers, tablets, and mobile devices.

iBorg provides a comprehensive suite of services that help businesses improve their decision-making processes by providing accurate, reliable information.

iBorg is a leading-edge application for automating business processes and solutions. iBorg is specially developed for the banking and the financial industry with a broader test coverage across multiple systems. Our USP is our one-stop automation tool with additional add-ins and screen recorder with ultimate goal of achieving perfection in automation.

Totally non-invasive automation

Platform agnostic

End to end automation

Communicate with bank users through emails, SMS and WhatsApp

iBorg assists you to implement dependable, cost-effective automation solutions to maximize efficiency for business intelligence data, thereby increasing overall productivity and enhancing user experience by leveraging the power of an exceptional digital transformation.

#robotic process automation#workflow automation#automation services#automation software#oracle flexcube#robotic test automation#robotic mobile automation#automation in banks#automation solution#robotic automation#Banking software#flexcube bank#iBorg#iBorg INC#automation solutions#machine learning#artificial intelligence#digital transformation

1 note

·

View note

Text

Virtual Character Tourney - Battle for 9th! (and 10th!)

Propaganda below (May contain spoilers!)

Kasane propaganda:

HER DREAM WAS TO ONE DAY BECOME A REAL VOCALOID AMD SHE FINALLY DID IT!!!!!! ITS NOT A VOCALOID VOICE BANK BUT ITS A FULL SYNTH V VOICEBANK!!!!! AND A NEW DESIGN!!!!! SHE DID IT SHE GOT HER DREAMS!!!!!! YOURE NEVER TOO OLD TO ACCOMPLISH YOUR DREAMS!!!!!!!

Kasane Teto is a vocal synth, she started out as an april fools joke to parody VOCALOID, with her voice bank in UTAU. although she did start out as just a joke a lot of vocaloid fans grew to really love her and she became rather popular. Kasane Teto is to UTAU as Hatsune Miku is to VOCALOID. But recently on Kasane Teto's 15th anniversary, April 1st 2023, she got moved from UTAU to SynthV. With her voice bank now in SynthV she also got a new character deign alone with how her voice and her singing sounds much more clear and human like than her UTAU voice bank which sounded a lot more mechanical/robotic.

ART propaganda:

ART (Asshole Research Transport, nicknamed by Murderbot), formally known as the space ship The Perihelion (in italics but this is a Google Form), also known as Peri (nicknamed by it's human family) is a super illegal highly advanced AI that was created by a university. It grew up with two human dads and a human sister. It and its crew go on research trips that are cover for allying with people and communities at the edges (and beyond) of the capitalist hellscape that is the Corporate Rim. It also goes on espionage missions by itself, without its human crew and family, posing as an automated cargo ship. It was during one of these missions that it picked up Murderbot, a super-duper illegal bot-human security unit construct that had hacked the torture device implanted in all bot-human constructs so that it could disobey orders and walk away from its "owners" without dying. Murderbot uses its illegal freedom to watch television, a habit it passes on to ART. Turns out ART doesn't like shows where human crew members get hurt.

ART is the AI that controls/is the research and teaching vessel Perihelion. (Perihelion is usually what people call it, but the protagonist of the series calls it ART so that's the name I put. ART stands for Asshole Research Transport.) It is extremely intelligent and advanced and also extremely sarcastic and condescending. 100% earned the name ART. ART will do absolutely anything for its crew!! It was developed and "raised" alongside the captain's daughter, Iris, and they're like siblings. Its crew calls it Peri. They do corporate espionage on the side to help bring down said corporations. It has a "debris deflection system" which is definitely not a weapon because ART isn't legally allowed to have a weapon. Definitely just for debris, don't worry about it. It's friends with the aforementioned protagonist, Murderbot, and ART is very good at bullying it into actually leaving its comfort zone when it needs to. They care about each other a lot, and they like to binge watch TV shows together. I don't want to write too much but I just love it a lot.

Ene propaganda:

She's blue. Headphone actor and yuukei yesterday are also bangers

Epic gamer cybergirl. Miku adjacent

She's a girl that was forced to become digital but is still a good friend. She may not have a body anymore but she's still important to the plot.

Murder-Bot 2.0 propaganda:

Sapient computer virus made from bits of two other AI characters (the original Murderbot and a spaceship AI). Unlike its not-parents, it is genuinely just code and doesn't have a physical body. Its only physical presence is through its effects on the machinery it infects, and it considers its "body" to be the code rather than any combination of physical objects. Also it was literally made to cause problems on purpose, does so enthusiastically, gives several people including its creators existential crises, and saves one of its creators (and other people from the (literal) fallout of the other creator learning the first one got killed)

Murderbot 2.0 is sentient killware created by Murderbot and ART with the purpose of being sent on a suicide mission. It has some of Murderbot's memories, but not all because it doesn't have any hardware of it's own to store that much information in. It travels by hopping in between other computer systems (mostly bots and bot-human constructs). It named itself Murderbot 2.0. It freed a security construct named Three. It's nicer and more open than both its parents.

EDI propaganda:

EDI is the AI of the Normandy starting with Mass Effect 2. Through dialogue EDI can become more human-like in her way of thinking, developing different kinds of relationships with the crew. In Mass Effect 3 she uploads herself into a body so she can freely move around and can be taken to missions, but she is still part of the ship's system.

Holly propaganda:

Due to a pay dispute with Holly's original actor, Norman Lovett, Holly was instead played by Hattie Hayridge during seasons 3-5. This was explained briefly in the show as them having gone through a "computer sex change". This makes Holly canonically trans do not @ me.

holly is the silliest most specialest ai ever. she has an iq of 6,000 but sometimes it seems like his iq is more like 6. they're possibly transgender (do computers have gender??) (i am panicking over pronouns while writing this propaganda) - holly goes from appearing like a man to appearing like a woman with no real explanation(??) and nobody questions this (the show is from the 90s btw). he's hilarious and sometimes lies to the crew for no reason other than 'its a laugh, innit'. shes everything to me <3

Holly is the computer of Red Dwarf, a Tenth Generation AI hologrammatic computer who appears as a floating head on a screen. Can be downloaded onto various other devices. also literally transgender.. meets a female appearing parallel version of itself in a parallel universe and then goes through a sex change after falling in love with her. transgender computer ftw

Tama propaganda:

Tama is the eyeball of Kuruto Ryuki and investigates dream worlds with him. She's his bi emotional support eye who regularly ties him up to help him with stress relief and loves to affectionately tease him. She laughs at bad jokes and has AE10D1F ("Ryuki" in hexadecimal) in her likes on her profile.

OKAY anyway uhm she's like aiba in that she's a little Ai eyeball that helps you investigate except sadly no animal theme. instead she has a domintrix vibe instead!!!! she is so cool… also ermm she's a lot more. Human than aiba. Not literally/physically like uhh emotionally. I haven't finished aini but like she does look out for your best interest! what a good Ai partner i don't kno

She's voiced by Anairis Quiñones and she's an absolute legend

Lyla propaganda:

she is a humanoid ai programmed to help spider-man gather info. she can simulate human emotions and has a high intellect

#virtual character tourney#bonus round#kasane teto#utau#utauloid#murderbot diaries art#perihelion#the murderbot diaries#ene#kagerou project#murderbot 2.0#edi mass effect#mass effect#holly red dwarf#red dwarf#one more WOLVERINES for the road#tama#ai the somnium files#atsv lyla#lyla spiderverse#across the spiderverse#spiderverse#character polls

84 notes

·

View notes

Text

📢 Attention all digital marketers and SEO enthusiasts! 🚀

Have you heard about the revolutionary Money Robot Group Buy? 💰💪 If not, you're in for a treat! Let's dive into the details in this thread. 👇

Money Robot is a powerful SEO tool that can skyrocket your website's ranking on search engines. 📈💻 It automates the process of building backlinks, creating web 2.0 blogs, and submitting articles to directories. 😲✨

But here's the best part - with the Money Robot Group Buy, you can get access to this incredible tool at a fraction of the cost! 💸🔥

By pooling resources with other marketers, you can enjoy all the benefits of Money Robot without breaking the bank. 🤑💼 Imagine having the power to dominate the search engine rankings without draining your budget!

Not only will you save money, but you'll also gain access to a community of like-minded individuals. 🤝💡 Share tips, tricks, and strategies, and learn from others who are using Money Robot to achieve amazing results.

But you might be wondering, is the Money Robot Group Buy legit? 🤔 Absolutely! With our trusted providers, you can rest assured that you'll receive a genuine and fully functional account. No scams or fake accounts here!

Ready to take your SEO game to the next level? Join the Money Robot Group Buy today and unlock the potential of this game-changing tool. 💥🔓

Don't miss out on this opportunity to supercharge your website's visibility and drive organic traffic like never before. Act now and witness the incredible results for yourself! ⚡🚀

DM us for more information and secure your spot in the Money Robot Group Buy. Limited slots available, so don't wait too long! ⏳💯

#MoneyRobotGroupBuy #SEO #DigitalMarketing #RankingBoost #GameChanger

50 notes

·

View notes

Text

Blockchain Technology, Quantum Computing’s Blockchain Impact

What Is Blockchain?

Definition and Fundamental Ideas

Blockchain technology is a decentralized digital ledger that records transactions across several computers without allowing changes. First given as Bitcoin’s basis. Banking, healthcare, and supply chain management employ bitcoin-related technologies.

Immutability, transparency, and decentralization characterize blockchain. Decentralization on peer-to-peer networks eliminates manipulation and single points of failure. Blockchain transparency is achieved by displaying the whole transaction history on the open ledger. It enhances transaction accountability and traceability. Finally, immutability means a blockchain transaction cannot be amended or erased. This is feasible via cryptographic hash algorithms, which preserve data and blockchain integrity.

These ideas make blockchain a desirable choice for protecting online transactions and automating procedures in a variety of sectors, which will boost productivity and save expenses. One of the factors driving the technology’s broad interest and uptake is its capacity to foster security and trust in digital interactions.

Key Features of Blockchain Technology

Blockchain, a decentralized digital ledger, may change several sectors. Decentralization, which removes a single point of control, is one of its most essential features. Decentralization reduces corruption and failure by spreading data over a network of computers.

The immutability of blockchain technology is another essential component. It is very hard to change data after it has been stored on a blockchain. This is due to the fact that every block establishes a safe connection between them by including a distinct cryptographic hash of the one before it. This feature makes the blockchain a reliable platform for transactions by guaranteeing the integrity of the data stored there.

Blockchain technology is more secure than traditional record-keeping. Data is encrypted to prevent fraud and unwanted access. Data-sensitive businesses like healthcare and finance need blockchain’s security.

How Blockchain and Quantum Computing Intersect

Enhancing Security Features

Blockchain and quantum computing appear to increase digital transaction security. Blockchain technology uses distributed ledger technology to record transactions decentralizedly. Quantum computing may break several blockchain encryption methods due to its powerful processing. But this danger also encourages the creation of blockchains that are resistant to quantum assaults by including algorithms that are safe from such attacks.

By allowing two parties to generate a shared random secret key that is only known to them, quantum key distribution (QKD) is a technique that employs the concepts of quantum physics to secure communications. This key may be used to both encrypt and decode messages. The key cannot be intercepted by an eavesdropper without creating observable irregularities. This technique may be used into blockchain technology to improve security and make it almost impenetrable.

Quantum computing may speed up complex cryptographic procedures like zero-knowledge proofs on blockchains, boosting security and privacy. These advances might revolutionize sensitive data management in government, healthcare, and finance. To explore how quantum computing improves blockchain security, see Quantum Resistant Ledger, which discusses quantum-resistant cryptographic techniques.

Quantum Computing’s Impact on Blockchain Technology

By using the ideas of quantum physics to process data at rates that are not possible for traditional computers, quantum computing provides a substantial breakthrough in computational power. Blockchain technology, which is based on traditional cryptographic concepts, faces both possibilities and dangers from this new technology.

The main worry is that many of the cryptographic techniques used by modern blockchains to provide security might be cracked by quantum computers. The difficulty of factoring big numbers, for example, is the foundation of most of today’s cryptography, a work that quantum computers will do exponentially quicker than conventional ones. If the cryptographic underpinnings of blockchain networks are hacked, this might possibly expose them to fraud and theft concerns.

But the use of quantum computing also presents blockchain technology with revolutionary possibilities. Blockchains with quantum enhancements may be able to execute transactions at very fast rates and with improved security features, far outperforming current networks. To protect blockchain technology from the dangers of quantum computing, researchers and developers are actively investigating quantum-resistant algorithms.

Read more on Govindhtech.com

#Blockchain#BlockchainTechnology#Cloudcomputing#QuantumComputing#Security#supplychain#News#Technews#Technology#Technologynews#Technologytrends#govindhtech

2 notes

·

View notes

Text

Why Instant Financial Insights Matter for Businesses Today?

Introduction Today’s fast-paced business environment, waiting until the end of the month to understand a company's financial position is no longer sufficient. Real-time accounting has emerged as a game-changer, offering immediate access to financial data, allowing businesses to make informed decisions faster than ever before. Here’s a look at why real-time accounting is trending and how it benefits businesses in this dynamic economic landscape. RVAK Consulting LLP provides comprehensive taxation services tailored to help businesses navigate complex tax regulations and optimize compliance. From strategic tax planning to accurate filing and representation, RVAK ensures clients meet their tax obligations efficiently, minimizing liabilities and maximizing opportunities.

What is Real-Time Accounting?

Real-time accounting leverages advanced accounting software and cloud technology to update financial data instantly as transactions occur. Instead of waiting for monthly or quarterly reports, business owners and stakeholders can access live financial information at any moment.

Why is Real-Time Accounting a Trending Topic?

Several factors are driving the adoption of real-time accounting:

Demand for Agility: Businesses must adapt quickly to changing market conditions, and real-time data empowers them to make swift, well-informed decisions.

Digital Transformation: With the rise of cloud-based accounting solutions, updating financial data instantly has become more accessible to businesses of all sizes.

Risk Management: Real-time insights enable proactive decision-making, helping businesses identify potential risks and address them before they escalate.

Key Benefits of Real-Time Accounting

Improved Cash Flow Management: Real-time accounting allows businesses to monitor their cash flow instantly. They can see which payments are due, forecast cash needs, and avoid potential cash flow issues.

Enhanced Decision-Making: Instant access to financial data allows business leaders to make informed, data-driven decisions. Whether it's expanding operations or cutting expenses, real-time data provides the accuracy needed to act confidently.

Accurate Financial Forecasting: With up-to-the-minute data, companies can create more accurate financial forecasts, helping them better prepare for future needs or investments.

Simplified Compliance and Tax Reporting: Real-Time Accounting simplifies compliance by maintaining accurate records that can be accessed and verified easily, making tax filing and audits more straightforward.

Reduced Errors: Automating data updates in real-time minimizes the risk of manual entry errors, leading to more accurate financial records and fewer discrepancies.

How to Implement Real-Time Accounting in Your Business

Choose the Right Accounting Software: Select a cloud-based accounting system that integrates seamlessly with your business processes and supports real-time data updates.

Automate Transaction Entries: Leverage automation features for expenses, invoicing, and payroll to ensure transactions are recorded immediately, reducing manual work.

Integrate Bank Feeds: Many modern accounting platforms allow you to sync bank transactions directly, enabling instant reconciliation and more accurate cash flow tracking.

Regularly Monitor Key Metrics: With real-time data, it’s easy to monitor KPIs, cash flow, and profit margins. Set up dashboards for an at-a-glance view of your company’s financial health.

Challenges to Consider

While real-time accounting offers numerous benefits, there are a few challenges businesses may face:

Cost of Technology: Implementing new software or upgrading existing systems may require an initial investment, which can be a barrier for smaller businesses.

Data Security: With real-time data being cloud-based, it’s critical to have robust cybersecurity measures in place to protect sensitive financial information.

Learning Curve: Shifting from traditional to real-time accounting can require training, especially for employees accustomed to older accounting processes.

The Future of Real-Time Accounting

As technology advances, real-time accounting is expected to become even more accessible and integral to financial management. Artificial intelligence and machine learning are likely to further enhance the capabilities of real-time Accounting, enabling more predictive insights and even automated financial decision-making. RVAK Consulting LLP provides comprehensive taxation services tailored to help businesses navigate complex tax regulations and optimize compliance. From strategic tax planning to accurate filing and representation, RVAK ensures clients meet their tax obligations efficiently, minimizing liabilities and maximizing opportunities.

Conclusion

Real-time accounting offers a competitive edge, enabling businesses to access financial insights instantly, respond to market changes, and make data-driven decisions. With the rise of digital tools and automation, implementing real-time accounting is easier than ever, allowing companies of all sizes to benefit from instant, reliable financial data. In an ever-evolving business landscape, real-time accounting may well become the new standard for financial management.

#RealTimeAccounting#DigitalAccounting#BusinessFinance#AccountingTrends#FinancialInsights#FinanceManagement#ModernAccounting

2 notes

·

View notes

Text

Why Your Business Needs Fintech Software At present ?

In an era defined by technological advancements and digital transformation, the financial sector is experiencing a seismic shift. Traditional banking practices are being challenged by innovative solutions that streamline operations, enhance user experiences, and improve financial management. Fintech software is at the forefront of this transformation, offering businesses the tools they need to stay competitive. Here’s why your business needs fintech software now more than ever.

1. Enhanced Efficiency and Automation

One of the primary advantages of fintech software is its ability to automate repetitive and time-consuming tasks. From invoicing and payment processing to compliance checks, automation helps reduce human error and increase efficiency. By integrating fintech software services, businesses can streamline their operations, freeing up employees to focus on more strategic tasks that require human intelligence and creativity.

Automated processes not only save time but also reduce operational costs. For example, automating invoice processing can significantly cut down on the resources spent on manual entry, approval, and payment. This efficiency translates into faster service delivery, which is crucial in today’s fast-paced business environment.

2. Improved Customer Experience

In a competitive marketplace, providing an exceptional customer experience is vital for business success. Fintech software enhances user experience by offering seamless, user-friendly interfaces and multiple channels for interaction. Customers today expect quick and easy access to their financial information, whether through mobile apps or web platforms.

Fintech software services can help businesses create personalized experiences for their customers. By analyzing customer data, businesses can tailor their offerings to meet individual needs, enhancing customer satisfaction and loyalty. A better user experience leads to higher retention rates, ultimately contributing to a company’s bottom line.

3. Data-Driven Decision Making

In the digital age, data is one of the most valuable assets a business can have. Fintech software allows businesses to collect, analyze, and leverage vast amounts of data to make informed decisions. Advanced analytics tools embedded in fintech solutions provide insights into customer behavior, market trends, and financial performance.

These insights enable businesses to identify opportunities for growth, mitigate risks, and optimize their operations. For instance, predictive analytics can help anticipate customer needs, allowing businesses to proactively offer services or products before they are even requested. This data-driven approach not only enhances strategic decision-making but also positions businesses ahead of their competition.

4. Increased Security and Compliance

With the rise of cyber threats and increasing regulatory scrutiny, security and compliance have become paramount concerns for businesses. Fintech software comes equipped with advanced security features such as encryption, two-factor authentication, and real-time monitoring to protect sensitive financial data.

Moreover, fintech software services often include built-in compliance management tools that help businesses adhere to industry regulations. By automating compliance checks and generating necessary reports, these solutions reduce the risk of non-compliance penalties and reputational damage. Investing in robust security measures not only safeguards your business but also builds trust with customers, who are increasingly concerned about data privacy.

5. Cost Savings and Financial Management

Implementing fintech software can lead to significant cost savings in various aspects of your business. Traditional financial management processes often require extensive manpower and resources. By automating these processes, fintech solutions can help minimize operational costs and improve cash flow management.

Additionally, fintech software often offers advanced financial tools that provide real-time insights into cash flow, expenses, and budgeting. These tools help businesses make informed financial decisions, leading to better resource allocation and improved profitability. In an uncertain economic climate, having a firm grasp on your financial situation is more critical than ever.

6. Flexibility and Scalability

The modern business landscape is characterized by rapid changes and evolving market conditions. Fintech software offers the flexibility and scalability necessary to adapt to these changes. Whether you’re a startup looking to establish a foothold or an established enterprise aiming to expand, fintech solutions can grow with your business.

Many fintech software services are cloud-based, allowing businesses to easily scale their operations without significant upfront investments. As your business grows, you can add new features, expand user access, and integrate additional services without overhauling your entire system. This adaptability ensures that you can meet changing customer demands and market conditions effectively.

7. Access to Innovative Financial Products

Fintech software has democratized access to a variety of financial products and services that were once only available through traditional banks. Small businesses can now leverage fintech solutions to access loans, payment processing, and investment platforms that are tailored to their specific needs.

These innovative financial products often come with lower fees and more favorable terms, making them accessible for businesses of all sizes. By utilizing fintech software, you can diversify your financial strategies, ensuring that you’re not reliant on a single source of funding or financial service.

Conclusion

In conclusion, the need for fintech software in today’s business environment is clear. With enhanced efficiency, improved customer experiences, and the ability to make data-driven decisions, fintech solutions are essential for staying competitive. Additionally, the increased focus on security and compliance, coupled with cost savings and access to innovative products, makes fintech software a valuable investment.

By adopting fintech software services, your business can not only streamline its operations but also position itself for growth in a rapidly evolving financial landscape. As the world becomes increasingly digital, embracing fintech solutions is no longer an option; it’s a necessity for sustainable success.

3 notes

·

View notes

Text

DIGITAL MARKETING

DIGITAL MARKETING

What is Digital Marketing?

Digital marketing encompasses all marketing efforts that use the internet or electronic devices. It includes various channels such as:

Search Engine Optimization (SEO): Improving website visibility on search engines.

Content Marketing: Creating and distributing valuable content to attract and engage a target audience.

Social Media Marketing: Utilizing platforms like Facebook, Instagram, and Twitter to engage with customers and promote products.

Email Marketing: Sending targeted emails to nurture leads and communicate with customers.

Pay-Per-Click (PPC) Advertising: Running paid ads on search engines and social media to drive traffic.

The Importance of Digital Marketing

Wider Reach: Unlike traditional marketing, digital marketing allows businesses to reach a global audience. With the right strategies, brands can connect with customers across different regions, demographics, and interests.

Cost-Effectiveness: Digital marketing often requires a lower budget than traditional methods. Small businesses can leverage social media and content marketing to promote their products without breaking the bank.

Targeted Advertising: Digital marketing tools enable businesses to target specific demographics based on user behavior, interests, and location. This precision leads to higher conversion rates and better return on investment (ROI).

Measurable Results: One of the significant advantages of digital marketing is the ability to track and analyze performance in real-time. Tools like Google Analytics provide insights into user behavior, allowing marketers to adjust their strategies accordingly.

Enhanced Customer Engagement: Digital platforms facilitate direct communication with customers. Brands can respond to inquiries, gather feedback, and build relationships, fostering loyalty and trust.

Trends Shaping the Future of Digital Marketing

As technology continues to advance, several trends are emerging in digital marketing:

Artificial Intelligence (AI): AI is transforming how businesses understand consumer behavior, personalize experiences, and automate processes.

Voice Search Optimization: With the rise of smart speakers and voice assistants, optimizing content for voice search is becoming essential.

Video Marketing: Video content is increasingly popular, with platforms like YouTube and TikTok driving engagement. Brands are leveraging live streaming and short-form videos to connect with audiences.

Influencer Marketing: Collaborating with influencers can amplify brand messages and reach niche audiences effectively.

Conclusion

Digital marketing is no longer just an option; it’s a necessity for businesses looking to succeed in a competitive landscape. By embracing digital strategies, companies can enhance their visibility, engage with customers, and drive growth. As technology continues to evolve, staying ahead of digital marketing trends will be crucial for future success.

2 notes

·

View notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

#loan origination system#banking#process automation#low code platform#digital transformation#document management system

0 notes

Text

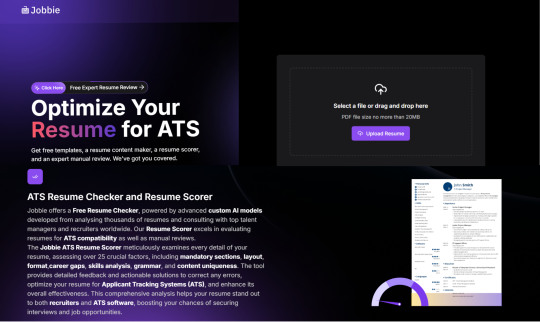

The Role of AI in Modern Resume Checkers

Artificial Intelligence (AI) has significantly transformed the every tool we rely on daily, from virtual assistants like ChatGPT to sophisticated video editing software. This technological shift is now reshaping another crucial area - transforming the job application process, particularly in how we prepare and submit resumes.

However, before we dive into the world of AI-powered resume checkers, it’s important to clear up a common point of confusion: what exactly distinguishes a resume screener from a resume checker? Understanding this difference is key to making the most of these AI tools in your job search.

Resume Screener vs. Resume Checker

Resume Screeners —commonly known as Applicant Tracking Systems (ATS)—are automated tools used by companies to sort and track resumes. These systems scan for specific keywords from the job description and use AI to rank candidates based on how well their resumes match the requirements. Think of it as a digital filter that helps hiring teams find the most relevant candidates quickly and efficiently.

Resume Checkers, on the other hand, are designed for job seekers to optimize their resumes “before” submission. While screeners evaluate your resume on the employer's side, checkers help you prepare a resume that’s ATS-friendly. These tools scan your resume for format, keyword usage, grammar, and overall structure to ensure you make it past the initial filtering.

How AI-Powered Resume Checkers Work

AI-powered resume checkers are your secret weapon for job search success. Here’s how they work:

1. ATS Compatibility Check: These tools analyse your resume for ATS requirements, ensuring you’re not missing essential keywords or using the wrong format.

2. Job Matching: By comparing your resume with a specific job description, the AI highlights relevant skills and experience that can make your resume stand out.

3. Feedback on Formatting & Content: They scan for common errors like grammar mistakes or incorrect contact information, offering suggestions for improvement.

4. Tailored Suggestions: Resume checkers also provide tailored feedback for different industries, recommending changes based on the job sector you’re targeting.

Ultimately, they score your resume and pinpoint areas to tweak—saving you from potential rejection while boosting your confidence that you’re presenting your best self to employers. A resume score of 75% or higher is often considered ideal for an optimized resume.

Why You Should Use an AI-Powered Resume Checker

Here’s a staggering statistic:

88% of employers, say they’ve missed out on qualified candidates because of poorly optimized resumes.

Nearly43% of resumes fail because they don't contain the right keywords, even if the candidates are qualified.

Even if the content reflects a highly qualified candidate, 25% of resumes are rejected due to formatting issues.

A 2020 survey by CareerBuilder showed that 41% of job seekers were unsure of how ATS systems worked, many qualified candidates don’t even realize they are being disqualified by technology rather than a human recruiter.

That’s where AI-driven resume checkers can save the day.

Here’s how they can help you:

- Optimize for ATS: Your resume is scanned for the right keywords, structure, and format so that it passes the ATS filter with higher percentage.

- Boost Your Confidence: By receiving actionable feedback, you can feel assured that your resume will impress both the ATS and the human hiring managers.

- Save Time & Energy: With fewer rejections and more chances of moving to the next stage, you can focus on what really matters—acing the interview.

Your Next Step: Try Jobbie…!

If you’re looking to optimize your resume without breaking the bank, check out Jobbie. It’s a one-stop solution for all your resume needs, offering free services like free resume checking, fixing, and even expert proofreading to craft a polished, ATS-friendly resume that shines to both AI screeners and hiring professionals. Jobbie's mission is simple: no qualified candidate should be rejected just because their resume doesn't align with the ATS.

#free resume checker#free resume scorer#free tools for resume#resume service#jobbie#ats friendly resume#ats friendly resume format#free tool for job seekers

2 notes

·

View notes

Text

How To Develop A Fintech App In 2024?

FinTech, short for financial technology, represents innovative solutions and products that enhance and streamline financial services. These innovations span online payments, money management, financial planning applications, and insurance services. By leveraging modern technologies, FinTech aims to compete with and often complement traditional financial institutions, improving economic data processing and bolstering customer security through advanced fraud protection mechanisms.

Booming FinTech Market: Key Highlights And Projections

Investment Growth In FinTech

In 2021, FinTech investments surged to $91.5 billion.

This represents nearly double the investment amount compared to 2020.

The significant increase highlights the rapid expansion and investor interest in the global FinTech market.

Projected Growth In Financial Assets Managed By FinTech Companies

By 2028, financial assets managed by FinTech firms are expected to reach $400 billion.

This projection indicates a 15% increase from current levels, showcasing the potential for substantial growth in the sector.

Usage Of Online Banking

About 62.5% of Americans used online banking services in 2022.

This figure is expected to rise as more consumers adopt digital financial services.

Key FinTech Trends In 2024

1. Banking Mobility

The transition from traditional in-person banking to mobile and digital platforms has been significantly accelerated, especially during the COVID-19 pandemic. The necessity for remote banking options has driven a surge in the adoption of smartphone banking apps. Digital banking services have become indispensable, enabling customers to manage their finances without needing to visit physical bank branches.

According to a report by Statista, the number of digital banking users in the United States alone is expected to reach 217 million by 2025. Many conventional banks are increasingly integrating FinTech solutions to bolster their online service offerings, enhancing user experience and accessibility.

2. Use Of Artificial Intelligence (AI)

AI in Fintech Market size is predicted at USD 44.08 billion in 2024 and will rise at 2.91% to USD 50.87 billion by 2029. AI is at the forefront of the FinTech revolution, providing substantial advancements in financial data analytics, customer service, and personalized financial products. AI-driven applications enable automated data analysis, the creation of personalized dashboards, and the deployment of AI-powered chatbots for customer support. These innovations allow FinTech companies to offer more tailored and efficient services to their users.

3. Development Of Crypto And Blockchain

The exploration and integration of cryptocurrency and blockchain technologies remain pivotal in the FinTech sector. Blockchain, in particular, is heralded for its potential to revolutionize the industry by enhancing security, transparency, and efficiency in financial transactions.

The global blockchain market size was valued at $7.4 billion in 2022 and is expected to reach $94 billion by 2027, according to MarketsandMarkets. These technologies are being utilized for improved regulatory compliance, transaction management, and the development of decentralized financial systems.

4. Democratization Of Financial Services

FinTech is playing a crucial role in making financial services more transparent and accessible to a broader audience. This trend is opening up new opportunities for businesses, retail investors, and everyday users. The rise of various digital marketplaces, money management tools, and innovative financing models such as digital assets is a testament to this democratization.

5. Products For The Self-Employed

The increasing prevalence of remote work has led to a heightened demand for FinTech solutions tailored specifically for self-employed individuals and freelancers. These applications offer a range of features, including tax monitoring, invoicing, financial accounting, risk management, and tools to ensure financial stability.

According to Intuit, self-employed individuals are expected to make up 43% of the U.S. workforce by 2028, underscoring the growing need for specialized financial products for this demographic. FinTech companies are responding by developing apps and platforms that address the unique financial needs of the self-employed, facilitating smoother and more efficient financial management.

Monetization of FinTech Apps

1. Subscription Model

FinTech apps can utilize a subscription model, which offers users a free trial period followed by a recurring fee for continued access. This model generates revenue based on the number of active subscribers, with options for monthly or annual payments. It ensures a steady income stream as long as users find the service valuable enough to continue their subscription.

2. Financial Transaction Fees

Charging fees for financial transactions, such as virtual card usage, bank transfers, currency conversions, and payments for third-party services, can be highly lucrative. This model capitalizes on the volume of transactions processed through the app, making it a significant revenue generator.

3. Advertising

In-app advertising can provide a consistent revenue stream. Although it may receive criticism, strategically placed banners or video ads can generate substantial income without significantly disrupting the user experience.

Types Of FinTech Apps

1. Digital Banking Apps

Digital banking apps enable users to manage their bank accounts and financial services without visiting a physical branch. These apps offer comprehensive services such as account management, fund transfers, mobile payments, and loan applications, ensuring transparency and 24/7 access.

2. Payment Processing Apps

Payment processing apps act as intermediaries, facilitating transactions between payment service providers and customers. These apps enhance e-commerce by enabling debit and credit card transactions and other online payment methods, supporting small businesses in particular.

To Read More Visit - https://appicsoftwares.com/blog/develop-a-fintech-app/

#app development#finance app development#finance app#real estate app development#mobile app development#fintech apps

2 notes

·

View notes

Text

Smart contracts: Transformative applications of blockchain technology

Smart contracts are a key application of blockchain technology that utilizes programming code to automatically execute, control, and record contract terms without relying on traditional intermediaries. This technology is gradually transforming our understanding of contracts and transactions, bringing unprecedented efficiency and transparency to a wide range of industries. This article will delve into the benefits, application scenarios, and challenges of smart contracts.

Advantages of smart contracts

Automation: Once a smart contract is written and deployed on the blockchain, it can be automatically executed when preset conditions are met. This automation not only increases efficiency, but also reduces human error and latency.

Lower costs: Execution of smart contracts does not rely on third-party intermediaries such as lawyers, banks and other financial institutions, thus significantly reducing the cost of transaction and contract execution. This disintermediation not only reduces costs, but also simplifies the process.

Increase transparency: the terms of all smart contracts are open and transparent, and all interested parties can view the status and activity of the contract in real time. This transparency builds trust and reduces information asymmetries and misunderstandings.

Security and immutability: Blockchain technology ensures that once a contract is deployed, its contents and records cannot be modified, improving the security of contract execution. All transactions are transparent and cannot be changed once recorded, reducing the risk of fraud and malicious behavior.

Reduce the risk of fraud: Due to the transparency and immutability of contracts, smart contracts greatly reduce the possibility of fraud. All parties can view the transaction history and contract execution, ensuring that everything is fair and transparent.

Improve efficiency and speed: The automatic execution features of smart contracts greatly improve the efficiency of processing transactions and contracts. While traditional contracts can take days, weeks or even months to execute, smart contracts can be completed in minutes, dramatically increasing the speed of business operations.

Facilitate new business models and services: Smart contracts make it possible to create complex business models and automated services that are difficult to achieve in traditional contract frameworks. They open the way for the development of innovative financial instruments, decentralized applications (DApps) and automated systems.

Application scenarios of smart contracts Smart contracts can be used in a wide range of scenarios, including but not limited to:

Financial services, such as creating decentralized finance (DeFi) applications that automatically execute contracts for lending, insurance, payments, and more. Supply chain management, monitoring the flow of goods and automatically releasing payments when goods meet a certain condition or location. Digital identity, manage and verify digital identification, and simplify the online authentication process. Voting system, creating a transparent and immutable voting system to ensure the fairness of the voting process. Copyright and Intellectual Property, automatically manage and enforce copyright payments and distribution to protect the interests of creators. The challenges and limitations of smart contracts While smart contracts offer many advantages, they also face some challenges and limitations, including:

Code security: The security of smart contracts depends on how their code is written, and the presence of vulnerabilities can lead to serious security issues. Legal status and compliance: The legal status of smart contracts is unclear and there may be legal and regulatory uncertainties in different jurisdictions. Dependence on external data: Many smart contracts need to rely on external data sources to trigger execution conditions, and if external data is inaccurate, it can affect the outcome of contract execution. Technical barriers and complexity of use: Writing and deploying smart contracts requires specialized programming skills and can be a high technical barrier for the average user. peroration Smart contracts, a key application of blockchain technology, are opening up new areas of automated trading and application development. They have the advantages of increased transaction efficiency, reduced costs, increased transparency and security, but they also face some challenges, especially in terms of code security, legal status and dependence on external data. As technology advances and regulations improve, smart contracts are expected to continue to play an important role in various industries, driving the development of the digital economy.

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

3 notes

·

View notes