#Digital PCR Market Growth

Explore tagged Tumblr posts

Text

#Digital PCR Market#Digital PCR Market Trends#Digital PCR Market Growth#Digital PCR Market Industry#Digital PCR Market Research#Digital PCR Market Report

0 notes

Text

Real-time PCR Market - Forecast(2024–2030)

The clinical diagnostics segment holds the largest share of the market due to its wide applications, including cancer diagnostics and infectious disease detection, particularly driven by demand following the COVID-19 pandemic

Request Sample:

The consumables and reagents segment, which includes test kits and other materials necessary for PCR processes, also dominates in revenue share due to its critical role in a variety of industries such as pharmaceuticals and biotechnology

Geographically, North America leads the global market, thanks to advancements in gene-based research and the presence of key industry players such as Thermo Fisher Scientific and Bio-Rad Laboratories. The Asia-Pacific region is expected to experience significant growth as well, driven by increasing industrialization and favorable government policies

Inquiry Before:

This growing demand, especially for innovations in precision medicine and diagnostic technologies, ensures that the real-time PCR market will continue to thrive in the near future

Technology and Innovation: Advances in digital PCR technology, which offers more precise quantification of DNA and RNA samples, are expected to drive further market growth. Real-time PCR remains the dominant technology, particularly due to its wide use in gene expression analysis, SNP genotyping, and pathogen detection particularly due to its wide use in gene expression analysis, SNP genotyping, and pathogen detection.

Buy Now:

Key Players: Major companies driving the real-time PCR market include Abbott, Thermo Fisher Scientific, Bio-Rad Laboratories, QIAGEN, and Roche, among others Real-time PCR is also used in forensics, pharmacogenomics, and research, with the forensic segment expected to grow rapidly It plays a key role in detecting infectious diseases and in oncology, aiding in personalized medicine through the analysis of genetic markers

For more information Real-time PCR Market click here

0 notes

Text

Home PCR Tests: A Closer Look at the PCR Test At Home Dubai Option

The COVID-19 pandemic sparked major growth in the development and usage of diagnostic and antibody tests that patients can self-administer from home. Home PCR tests in particular enable private, convenient detection of active coronavirus infections. For those wondering whether accurate PCR Test At Home Dubai kits are available, exploring the leading options provides helpful guidance.

How Do Home PCR Tests for COVID-19 Work?

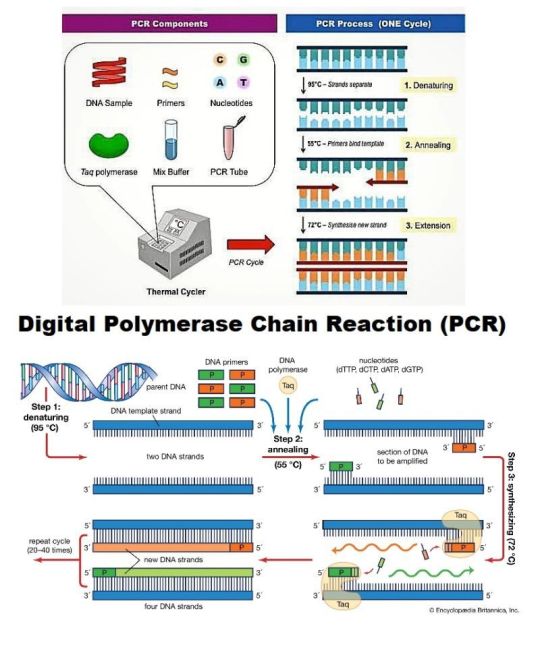

The PCR (polymerase chain reaction) technique is the gold standard for directly detecting the presence of the COVID-19 virus from respiratory samples. Home PCR test kits allow patients to collect their own nasal or saliva samples and perform the PCR assay without visiting a clinic.

PCR tests work by identifying the specific genetic material of the COVID-19 virus. Users collect a sample, mix it with chemical reagents, and insert the solution into the test kit for analysis. Results are displayed indicating whether viral genetic material was detected based on any color change reaction on the test strips.

Kits include step-by-step instructions to ensure patients perform the easy, quick tests properly using non-invasive nasal swabs or saliva collection. Many provide results within 10-30 minutes.

Here is a video from MedCram Youtube Channel about At Home Rapid COVID 19 Tests and False Positives (Coronavirus Antigen Tests). Watch the video

youtube

Benefits of At-Home PCR Testing

Here are some of the major advantages of having access to accurate home PCR tests for COVID-19:

Convenience: Test from the privacy of your residence without traveling to clinics.

Speed: Get results rapidly within minutes rather than waiting days for lab tests.

Self-Administered: Users can collect their own sample comfortably rather than relying on technicians.

Affordability: Individual kits are very competitively priced.

Detection Reliability: PCR technology directly identifies viral presence with high accuracy.

Ease of Use: Tests have simple, straightforward instructions for patients of all ages.

Infection Verification: Confirms active infections unlike antibody tests.

Having the option to privately, quickly, and accurately test for possible COVID-19 infections at home provides significant peace of mind during the pandemic.

How Reliable Are Home PCR Tests?

Many people reasonably wonder whether DIY home PCR test kits can match the reliability of lab-based PCR tests. The good news is that leading home PCR kits on the market have very high accuracy.

Most kits have published sensitivity and specificity above 90% when compared to lab PCR tests. High quality home tests analyze samples using comparable PCR methodology and match labs in detecting positives and negatives.

Furthermore, unlike Rapid PCR Test At Home kits some vendors offer, full home PCR tests analyze the sample through many amplification cycles to maximize accuracy. With good sampling collection, top home PCR kits offer laboratory-grade results conveniently at home.

Leading Home PCR Test Kit Options

For those exploring PCR Test At Home Dubai choices, here are some of the top-rated home PCR kits to consider:

Cue Health PCR Test: Cue offers an FDA-authorized home PCR test delivering highly accurate results in 20 minutes with nasal swab samples.

Lucira Check It PCR Test: This is a single-use PCR kit with 98% validated accuracy that provides molecular-level detection from nasal samples in 30 minutes or less.

Ellume COVID-19 Home Test: This over-the-counter home kit uses a mid-turbinate nasal sample and provides an amplified PCR digital reading of positive or negative in 15 minutes on a connected analyzer.

Pixel by LabCorp PCR Test: Pixel is a monitored at-home nasal PCR test analyzed through LabCorp with over 98% accuracy returning results within 1-2 days.

Doximity's Covid-19 PCR Test: Doximity partners with qualified labs for monitored video-observed PCR testing with 97%+ accuracy and results in 24 hours.

All these options allow for convenient, accurate at-home COVID-19 testing using PCR with trusted partners. Kits can be purchased online and shipped directly to your home in Dubai.

When Are Home PCR Tests Recommended?

The CDC recommends utilizing home PCR tests in situations such as:

If you have any symptoms of COVID-19. Home testing allows quick confirmation.

After exposure events to quickly check for possible infection.

Before visiting individuals at higher risk for severe illness.

Before travel or group events for added assurance.

For frequent screening in schools or workplaces.

Even fully vaccinated individuals should test if they experience COVID-like symptoms or have a known exposure. Home PCR tests make quick detection fast and easy.

Home PCR Tests Offer Accuracy and Convenience

High quality Home PCR Tests have become an important tool in the fight against COVID by making reliable diagnostic testing accessible outside of clinics. There are excellent PCR Test At Home Dubai options available matching the standards of lab PCR sensitivity and specificity. Home PCR kits allow people to conveniently and confidently check themselves for possible COVID-19 infections from the privacy of home. As the technology continues advancing, home collection PCR will likely take on an increasingly vital role supporting public health and safety.

2 notes

·

View notes

Text

Laboratory Proficiency Testing Market Size, Growth Outlook 2035

The Laboratory Proficiency Testing MarketSize was estimated at 2.21 (USD Billion) in 2024. The Laboratory Proficiency Testing Market Industry is expected to grow from 2.33 (USD Billion) in 2025 to 3.76 (USD Billion) till 2034, at a CAGR (growth rate) is expected to be around 5.48% during the forecast period (2025 - 2034).

Market Overview

The Laboratory Proficiency Testing Market is experiencing significant growth, driven by the increasing focus on quality assurance in clinical and diagnostic laboratories, regulatory compliance requirements, and advancements in analytical testing. Proficiency testing (PT) is crucial in ensuring the accuracy, reliability, and standardization of laboratory testing procedures across various industries, including healthcare, environmental testing, pharmaceuticals, and food safety.

With the rise in accreditation requirements for diagnostic laboratories, the adoption of external quality assessment (EQA) programs has surged. Additionally, the growing demand for molecular diagnostics and microbiology testing has further expanded the scope of proficiency testing in modern laboratories.

Market Size and Share

The Laboratory Proficiency Testing MarketSize was estimated at 2.21 (USD Billion) in 2024. The Laboratory Proficiency Testing Market Industry is expected to grow from 2.33 (USD Billion) in 2025 to 3.76 (USD Billion) till 2034, at a CAGR (growth rate) is expected to be around 5.48% during the forecast period (2025 - 2034).North America holds the largest market share due to strict regulatory guidelines, high adoption of clinical laboratory accreditation programs, and an increasing number of reference laboratories. The Asia-Pacific region is anticipated to experience the fastest growth due to rising investments in laboratory infrastructure and growing awareness about quality assurance in diagnostic labs.

Market Drivers

Stringent Regulatory & Compliance Requirements: Government and private healthcare bodies mandate the use of proficiency testing programs to ensure laboratory accuracy.

Growing Demand for Accurate Diagnostic Testing: With the increasing prevalence of infectious diseases, chronic conditions, and genetic disorders, the need for error-free laboratory testing has risen.

Technological Advancements in Laboratory Automation: The integration of AI-powered laboratory testing solutions and automated analytical instruments has improved efficiency in testing.

Rising Adoption of External Quality Assurance (EQA) Programs: Laboratories worldwide are increasingly participating in EQA schemes to benchmark their performance and maintain certification.

Expansion of Molecular & Microbiology Testing: The growing use of PCR-based diagnostics, NGS, and microbiology assays has expanded proficiency testing applications.

Challenges and Restraints

High Costs Associated with Proficiency Testing Programs: Many laboratories, especially in developing regions, struggle with the affordability of external quality assessment services.

Limited Awareness in Emerging Economies: Lack of proper knowledge about the benefits of quality control testing in laboratories affects market penetration.

Challenges in Standardization of Testing Procedures: Variability in laboratory testing protocols across different regions can hinder the effectiveness of proficiency testing programs.

Market Trends

Increased Use of Digital & AI-Driven Proficiency Testing Solutions: AI and machine learning algorithms for laboratory quality control are improving proficiency testing accuracy.

Rising Adoption of Proficiency Testing in Food & Water Safety: Beyond healthcare, environmental testing laboratories are increasingly utilizing PT programs.

Expansion of Molecular & Genetic Proficiency Testing Programs: NGS-based laboratory testing assessments are gaining traction in precision medicine research.

Integration of Cloud-Based Laboratory Quality Control Solutions: Many labs are adopting cloud-based PT data management systems for real-time performance tracking.

Regional Analysis

North America: Dominates the market due to strong regulatory policies, high participation in CAP proficiency testing programs, and the presence of leading diagnostic companies.

Europe: Growing demand for ISO 15189-accredited laboratories and increased government funding for EQA programs support market growth.

Asia-Pacific: Rising awareness about laboratory accreditation and expansion of diagnostic facilities drive regional growth.

Rest of the World: The adoption of proficiency testing services in pharmaceutical and clinical laboratories is gradually increasing.

Segmental Analysis

By Industry:

Clinical Diagnostics

Pharmaceuticals & Biotechnology

Environmental & Water Testing

Food & Beverage Testing

By Technology:

Microbiology

Molecular Diagnostics

Immunology

Clinical Chemistry

Haematology

By End-User:

Hospitals & Clinical Laboratories

Research & Academic Institutes

Pharmaceutical Companies

Government & Regulatory Agencies

Key Market Players

Thermo Fisher Scientific

College of American Pathologists

International Accreditation Services

Quality Control Solutions

BD

Roche Diagnostics

Recent Developments

Expansion of Proficiency Testing Programs: CAP launched new molecular pathology PT programs to support genetic and infectious disease testing.

Integration of AI in Laboratory Quality Control: Bio-Rad introduced an AI-powered laboratory proficiency testing software to streamline data analysis.

Collaborations for Global Standardization: Thermo Fisher partnered with regulatory bodies to develop universal PT guidelines for clinical laboratories.

For more information, please visit us at marketresearchfuture.

#Laboratory Proficiency Testing Market Size#Laboratory Proficiency Testing Market Share#Laboratory Proficiency Testing Market Growth#Laboratory Proficiency Testing Market Analysis#Laboratory Proficiency Testing Market Trends#Laboratory Proficiency Testing Market Forecast#Laboratory Proficiency Testing Market Segments

0 notes

Text

0 notes

Text

DNA Data Storage: From $0.25B to $5.5B by 2034!

DNA Data Storage Systems Market is set for remarkable expansion, with a projected growth from $0.25 billion in 2024 to $5.5 billion by 2034, reflecting a compound annual growth rate (CAGR) of approximately 36.5%. This market encompasses advanced technologies and solutions that utilize DNA molecules for encoding, storing, and retrieving digital data. DNA offers unprecedented data density and longevity, making it an ideal medium for archiving vast amounts of information. This market includes services related to DNA synthesis, sequencing, and data management, which together enable the transformation of digital data into DNA sequences. These innovations promise to revolutionize data storage, particularly for sectors that require long-term data preservation, such as healthcare, finance, and digital media.

To Request Sample Report: https://www.globalinsightservices.com/request-sample/?id=GIS10577 &utm_source=SnehaPatil&utm_medium=Article

The DNA Data Storage Systems Market is experiencing robust growth, driven by the exponential rise in data generation and the increasing demand for sustainable storage solutions. The biotechnology sector leads the charge, capitalizing on DNA’s unique ability to store immense amounts of data in a compact form. Following closely, the healthcare industry is also utilizing DNA data storage for medical research and patient data management. Geographically, North America is the dominant region in this market, owing to its advanced technological infrastructure and considerable investments in research and development. Europe is the second-highest performer, benefiting from supportive regulatory frameworks and growing collaborations between academic institutions and industry players. Within these regions, the United States and Germany stand out due to their strong innovation ecosystems and government support. As the volume of data continues to soar, the DNA data storage market is expected to witness substantial advancements, offering lucrative opportunities for stakeholders across the entire value chain.

Buy Now : https://www.globalinsightservices.com/checkout/single_user/GIS10577/?utm_source=SnehaPatil&utm_medium=Article

The market is segmented into several categories, including synthetic DNA, PCR-based DNA, and various products such as DNA hard drives and DNA cartridges. Services provided within the market range from data encoding and decoding to retrieval, storage, consultancy, and maintenance. Key technologies driving growth in the DNA data storage systems market include next-generation sequencing, CRISPR, and DNA synthesis. Components of these systems include DNA strands, storage arrays, and devices like readers and writers. Applications for DNA data storage span across data archiving, genomics, pharmaceutical research, biotechnology, and forensics. The market also includes different forms of DNA, such as liquid DNA and solid DNA, and utilizes materials like nucleotides and enzymes in its processes.

In 2023, the DNA Data Storage Systems Market had an estimated volume of 320 petabytes, with synthetic DNA capturing the largest share at 45%. Hardware accounted for 35%, while software made up the remaining 20%. The dominance of synthetic DNA is driven by significant advancements in technology and the increasing demand for long-term data preservation. Leading market players such as Microsoft, Twist Bioscience, and Illumina are playing key roles in driving the market forward, with a focus on technological innovation to capture substantial market share.

Competitive dynamics within the market are shaped by strategic partnerships, technological breakthroughs, and regulatory influences, particularly those concerning data privacy and biosecurity. As the market matures, regulatory frameworks will continue to play a significant role in guiding its evolution. Looking ahead, the DNA data storage market is expected to see a CAGR of 25% over the next decade. Investment in research and development and government support for sustainable data solutions are expected to drive further growth. However, challenges such as high initial costs and technical complexities persist. Emerging trends, such as the integration of artificial intelligence (AI) to improve data retrieval efficiency, present new opportunities for market players to explore.

Geographically, North America is leading the DNA data storage systems market, with the United States at the forefront due to substantial investments in R&D and the region’s advanced technological infrastructure. Companies in this region are increasingly leveraging DNA for its vast potential in data preservation and retrieval. Europe is following closely, with countries like Germany and the United Kingdom making significant strides in cutting-edge research. The European Union’s focus on data privacy and security is driving the demand for reliable and efficient storage solutions, contributing to the sector’s growth across the continent.

In the Asia Pacific region, countries such as China and Japan are emerging as key players in the market, investing heavily in technology to manage the growing volume of data. The region’s increasing digital transformation efforts are fueling the demand for advanced data storage solutions, positioning Asia Pacific as a vital contributor to the market. Latin America, while still in its early stages, is gradually recognizing the potential of DNA data storage. Countries like Brazil are beginning to explore this technology as a means to enhance data management capabilities, and although the region remains in its nascent stage, it shows promise for future growth.

#DNADataStorage #Biotechnology #DataStorage #NextGenStorage #SustainableData #DNAArchiving #DataPreservation #HealthcareInnovation #DataRetrieval #Genomics #PCRbasedStorage #DNASequencing #DigitalTransformation #AIInDataStorage #CRISPRTechnology #SyntheticDNA #DataManagement #ResearchAndDevelopment #DataPrivacy #TechInnovation #EmergingMarkets

0 notes

Text

Why Investors Are Eyeing the dPCR and qPCR Market for Growth Opportunities

The Digital PCR (dPCR) and Real-Time PCR (qPCR) Market is experiencing robust growth as advancements in molecular diagnostics and biotechnology revolutionize the healthcare and research sectors. According to a comprehensive analysis by SkyQuest Technology, the market is projected to reach unprecedented heights, reflecting a compound annual growth rate (CAGR) of 8.1% during the forecast period. As these technologies gain prominence, industries worldwide are embracing their potential for precision diagnostics, disease monitoring, and scientific breakthroughs.

Market Size and Growth Projections

The global digital PCR (dPCR) and real-time PCR (qPCR) market is thriving due to the surge in demand for advanced diagnostic tools. With a market value estimated at USD 10.1 billion in 2023, it is anticipated to achieve a value of USD 20.36 billion by 2032. This substantial growth is attributed to the increasing prevalence of infectious diseases, rising cancer cases, and a growing focus on personalized medicine.

Request a Sample of the Report here: https://www.skyquestt.com/sample-request/digital-pcr-dpcr-and-real-time-pcr-qpcr-market

Key Market Drivers

The growth of the dPCR and qPCR market is influenced by several factors, including:

Rising Demand for Molecular Diagnostics With a greater emphasis on early detection and precision, the demand for molecular diagnostic tools is skyrocketing. dPCR and qPCR technologies enable highly sensitive and accurate analysis of genetic material, making them indispensable in diagnosing critical illnesses.

Advancements in Technology Continuous innovation in PCR technologies is leading to faster, more accurate, and cost-effective solutions, enhancing their adoption across various industries.

Applications in Research and Development The increasing focus on drug development and genetic research has further expanded the utility of dPCR and qPCR technologies in laboratories worldwide.

Market Segments

The Digital PCR (dPCR) and Real-Time PCR (qPCR) Market is categorized based on technology, application, and end-user.

By Technology

Digital PCR (dPCR)

Real-Time PCR (qPCR)

By Application

Clinical Diagnostics

Research and Development

Forensic Applications

By End-User

Hospitals and Diagnostic Centers

Research Institutes

Biotech and Pharmaceutical Companies

Request a Customized Report Tailored to Your Needs: https://www.skyquestt.com/customization/digital-pcr-dpcr-and-real-time-pcr-qpcr-market

Regional Insights

The adoption of dPCR and qPCR technologies varies across regions, with distinct trends shaping the global market.

North America A dominant market due to advanced healthcare infrastructure, extensive research funding, and early adoption of innovative technologies.

Europe Strong emphasis on biotechnology and personalized medicine drives the market in countries like Germany, France, and the UK.

Asia-Pacific The fastest-growing region, fueled by the increasing prevalence of chronic diseases, expanding research activities, and government initiatives to enhance healthcare systems.

Latin America & Middle East Emerging markets show steady growth due to improving healthcare access and rising investments in diagnostic technologies.

Buy the Report to Get the Full Analysis: https://www.skyquestt.com/buy-now/digital-pcr-dpcr-and-real-time-pcr-qpcr-market

Top Players in the Market

The dPCR and qPCR market is highly competitive, with key players driving innovation and growth:

Thermo Fisher Scientific Inc.

Bio-Rad Laboratories, Inc.

Roche Diagnostics

QIAGEN N.V.

Agilent Technologies

Merck KGaA

Takara Bio Inc.

Promega Corporation

Illumina, Inc.

Fluidigm Corporation

View full ToC and List of Companies here: https://www.skyquestt.com/report/digital-pcr-dpcr-and-real-time-pcr-qpcr-market

Emerging Trends in the dPCR and qPCR Market

Increased Focus on Point-of-Care Diagnostics Portable and user-friendly devices are making molecular diagnostics accessible even in resource-limited settings.

Integration of AI and Big Data Advanced analytics are enhancing the accuracy and efficiency of PCR technologies, paving the way for groundbreaking discoveries.

Growth in Personalized Medicine With a shift towards tailored treatments, dPCR and qPCR technologies are playing a pivotal role in identifying genetic markers and designing customized therapies.

Expansion of Applications Beyond Healthcare The utility of these technologies is extending into food safety, agriculture, and environmental monitoring, further diversifying market opportunities.

Conclusion

The Digital PCR (dPCR) and Real-Time PCR (qPCR) Market is set to transform diagnostics and research on a global scale. As technological innovations continue to enhance the precision and accessibility of these tools, the market offers promising opportunities for growth across diverse sectors. Companies focusing on innovation, adaptability, and application expansion are poised to lead in this rapidly evolving industry.

#Asia dPCR and qPCR market#Europe dPCR and qPCR market#Middle East dPCR and qPCR market Size#North America dPCR and qPCR market

0 notes

Text

Digital PCR & qPCR Market

Digital PCR (dPCR) and quantitative PCR (qPCR) markets are rapidly expanding, driven by the growing demand for precise genetic analysis, diagnostics, and research applications. dPCR offers highly accurate quantification of nucleic acids, while qPCR is widely used for gene expression profiling and pathogen detection. Both technologies are advancing in fields such as oncology, infectious disease monitoring, and genetic research. The market growth is fueled by technological innovations, increased adoption in clinical diagnostics, and a rising focus on personalized medicine. Key players in the market include Thermo Fisher Scientific, Bio-Rad, and QIAGEN, with significant investment in R&D and product development.

For More : https://tinyurl.com/bdhjhwkf

0 notes

Text

Digital PCR Market Future Scope: Emerging Applications and Innovations

The global Digital PCR market is experiencing significant growth, driven by its exceptional sensitivity and precision in nucleic acid quantification. Valued at USD 6.77 billion in 2023, the market is projected to reach USD 14.89 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 9.16% over the forecast period 2024-2032.

Market Segmentation:

The Digital PCR market is segmented based on product, application, indication, and region:

By Product:

Consumables & Reagents

Instruments

Software & Services

By Application:

Clinical

Research

Forensic

By Indication:

Oncology

Infectious Diseases

Genetic Disorders

Others

Get Free Sample Report @ https://www.snsinsider.com/sample-request/1038

Regional Analysis:

North America currently leads the Digital PCR market, attributed to technological advancements and a high adoption rate of precision diagnostics. Europe follows, with significant growth observed in countries like Germany and the UK. The Asia-Pacific region is anticipated to witness the fastest growth during the forecast period, driven by increasing healthcare investments and a growing focus on personalized medicine.

Key Players

1. Thermo Fisher Scientific

QuantStudio 3D Digital PCR System

Ion Chef System

Applied Biosystems QuantStudio Digital PCR System

2. Bio-Rad Laboratories

QX200 Droplet Digital PCR System

QX100 Droplet Digital PCR System

ddPCR Supermix for Probes

3. QIAGEN

QIAcuity Digital PCR System

QIAcuity Digital PCR Reagents

4. F. Hoffmann-La Roche Ltd

Cobas Digital PCR System (Cobas dPCR)

Cobas Digital PCR

5. Fluidigm Corporation

Biomark HD System (Digital PCR platform)

Digital PCR Reagents

6. Merck KGaA

Multi-Analyte dPCR Kits

dPCR Assay Kits

7. Agilent Technologies

AriaMx Real-Time PCR System (used with dPCR assays)

8. BioMerieux SA

BIOFIRE FilmArray (integrated with PCR diagnostics)

9. Takara Bio Inc.

TaKaRa dPCR Kit

10. Danaher Corporation

Bio-Rad QX200 Droplet Digital PCR System (through subsidiary)

11. JN Medsys

dPCR Bio-Chip System

12. Formulatrix, Inc.

Digital PCR Consumables and Software

13. Stilla Technologies

Naica System for Digital PCR

14. Becton, Dickinson and Company

BD Rhapsody Digital PCR System

15. Sysmex Corporation

Sysmex Digital PCR Systems (in development)

16. Quantabio

qPCR and dPCR Reagents

17. Illumina, Inc.

Nextera Digital PCR System

18. Promega Corporation

GoTaq Digital PCR System

19. Eppendorf AG

Eppendorf Digital PCR System

20. PerkinElmer, Inc.

LabChip Digital PCR System

21. LGC Biosearch Technologies

dPCR Reagents and Consumables

Key Highlights:

Digital PCR offers absolute quantification without the need for standard curves, enhancing its utility in personalized medicine, oncology, infectious disease diagnostics, and genetic research.

In cancer diagnostics, dPCR has demonstrated remarkable efficiency, detecting circulating tumor DNA (ctDNA) at concentrations as low as 0.01% of total DNA, aiding in early detection and monitoring of minimal residual disease (MRD).

During the COVID-19 pandemic, dPCR played a pivotal role by detecting viral RNA at lower concentrations than traditional qPCR methods, especially in cases with high Cycle threshold (Ct) values, facilitating the identification of asymptomatic carriers and monitoring emerging viral mutations.

Future Outlook:

The Digital PCR market is poised for substantial growth, driven by continuous technological advancements and the increasing demand for precision diagnostics. Government investments exceeding USD 1 billion globally in genomic research and rare disease programs are accelerating dPCR adoption. Additionally, industrial applications are on the rise, with dPCR demonstrating high specificity in detecting foodborne pathogens and quantifying environmental contaminants. The versatility, precision, and growing affordability of dPCR are positioning it as a cornerstone in molecular diagnostics and genomic advancements.

Conclusion:

The global Digital PCR market is on a promising trajectory, with significant growth anticipated across various segments and regions. Stakeholders, including manufacturers, healthcare providers, and investors, are poised to benefit from the evolving landscape of Digital PCR technology.

Contact Us: Jagney Dave - Vice President of Client Engagement Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Other Related Reports:

Digital PCR-dPCR Market Size

Electronic Medical Record (EMR) Systems Market Size

3D Printing Medical Devices Market Size

#Digital PCR Market#Digital PCR Market Share#Digital PCR Market Size#Digital PCR Market Trends#Digital PCR Market Growth

0 notes

Text

Cancer Diagnostics Market Size, Share, Industry Growth and Emerging Trends Analysis by 2032

In 2023, the global cancer diagnostics market was worth $15.13 billion. It's expected to grow steadily, reaching $16.12 billion in 2024 and climbing to $31 billion by 2032, with an average annual growth rate of 8.5% over this period. North America led the market in 2023, holding a significant 35.89% share.

Informational Source:

Major Key Companies Covered in Cancer Diagnostics Market are:

F. Hoffmann-La Roche Ltd (Switzerland)

Thermo Fisher Scientific Inc. (U.S.)

Abbott (U.S.)

Illumina, Inc. (U.S.)

GE Healthcare (U.S.)

BD (U.S.)

bioMérieux SA (France)

Myriad Genetics, Inc (U.S.)

Bio-Rad Laboratories, Inc. (U.S.)

QIAGEN (Germany)

Advancements and Trends in Cancer Diagnostics

Cancer diagnostics play a critical role in detecting, monitoring, and managing cancer at various stages. With advancements in technology and ongoing research, the field has witnessed transformative changes, offering new hope for early detection and improved patient outcomes. Below, we delve into the latest innovations and trends shaping cancer diagnostics today.

1. The Role of Liquid Biopsies

Liquid biopsy technology has revolutionized cancer diagnostics by offering a non-invasive method to detect cancer-related biomarkers, such as circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), and exosomes, in blood or other bodily fluids. Unlike traditional biopsies, liquid biopsies can be performed with minimal discomfort and provide real-time insights into tumor dynamics.

Key Applications:

Early Detection: Screening for cancers like lung, colorectal, and breast cancers before symptoms appear.

Monitoring: Tracking tumor progression and response to treatments.

Personalized Treatment: Identifying genetic mutations to guide targeted therapies.

Recent Innovations:

Multi-Cancer Early Detection (MCED): Tests like GRAIL’s Galleri aim to detect multiple cancers simultaneously by analyzing ctDNA.

High Sensitivity Platforms: Techniques like next-generation sequencing (NGS) enhance the precision of biomarker detection.

2. Artificial Intelligence (AI) in Cancer Diagnostics

AI and machine learning (ML) are increasingly being integrated into cancer diagnostics to analyze vast amounts of data, identify patterns, and improve diagnostic accuracy. These technologies augment traditional methods by reducing human error and speeding up the diagnostic process.

Applications:

Image Analysis: AI algorithms analyze imaging data from MRI, CT, and mammography to detect anomalies indicative of cancer.

Pathology: Digital pathology solutions powered by AI can evaluate tissue samples for malignant changes with high precision.

Risk Prediction Models: AI systems can predict a patient’s risk of developing cancer based on their medical history, genetics, and lifestyle factors.

Notable Examples:

Google Health’s AI: Demonstrated higher accuracy than human radiologists in detecting breast cancer in mammograms.

PathAI: Utilizes deep learning to assist pathologists in diagnosing cancer from biopsy samples.

3. Advances in Molecular Diagnostics

Molecular diagnostics has seen significant advancements, allowing for the precise identification of genetic and molecular markers associated with different cancer types.

Technologies Driving Innovation:

Next-Generation Sequencing (NGS): Enables comprehensive genomic profiling to identify mutations, fusions, and other alterations that drive cancer.

Polymerase Chain Reaction (PCR): Used to amplify and detect specific DNA or RNA sequences linked to cancer.

CRISPR-based Detection: CRISPR technology is being developed for rapid and highly specific cancer biomarker detection.

Impact on Personalized Medicine:

Molecular diagnostics forms the backbone of personalized medicine by guiding therapies tailored to the genetic profile of a patient’s tumor. For instance:

EGFR mutations in lung cancer guide the use of tyrosine kinase inhibitors.

BRCA mutations in breast and ovarian cancer inform the use of PARP inhibitors.

4. Imaging Technologies in Cancer Detection

Imaging remains a cornerstone of cancer diagnostics, and advancements in this field have significantly improved the ability to detect and monitor tumors.

Innovations in Imaging:

Positron Emission Tomography (PET): Combined with CT or MRI, PET scans provide detailed information about tumor metabolism and structure.

Multiparametric MRI (mpMRI): Offers a more accurate assessment of prostate cancer compared to traditional methods.

AI-Enhanced Imaging: Machine learning algorithms improve the resolution and interpretation of imaging data, aiding in early detection and reducing false positives.

Emerging Modalities:

Optical Imaging: Techniques like fluorescence and bioluminescence imaging allow for the visualization of cancer at the cellular level.

Theranostic Imaging: Combines diagnostic imaging with therapy, enabling real-time monitoring of treatment efficacy.

5. Biomarker Discovery and Utilization

Biomarkers are critical for early detection, diagnosis, and prognosis in cancer care. Advances in proteomics, genomics, and metabolomics have expanded the pool of potential biomarkers.

Breakthroughs in Biomarker Research:

Proteomics: Identifying protein signatures unique to cancer cells.

Epigenetics:��Analyzing DNA methylation and histone modifications as cancer-specific markers.

Metabolomics: Profiling metabolic changes associated with cancer progression.

Clinical Utility:

Predictive Biomarkers: EGFR, HER2, and PD-L1 guide targeted and immunotherapies.

Prognostic Biomarkers: Help estimate disease progression and survival rates.

Companion Diagnostics: Ensure that patients receive the most effective therapy based on their biomarker profile.

6. Point-of-Care (POC) Diagnostics

Point-of-care testing is transforming cancer diagnostics by bringing testing capabilities closer to patients, reducing the time to diagnosis and enabling quicker interventions.

Examples of POC Diagnostics:

Portable Devices: Handheld devices for detecting specific biomarkers in blood or saliva.

Lab-on-a-Chip Technology: Integrates multiple diagnostic processes on a microchip for rapid results.

Immunoassays: Quick tests for detecting cancer antigens, such as PSA for prostate cancer.

Impact on Low-Resource Settings:

POC diagnostics are particularly valuable in remote or underserved areas, where access to advanced diagnostic facilities may be limited.

7. Role of Genomics and Epigenomics

Genomic and epigenomic approaches are uncovering the complexities of cancer, enabling highly personalized diagnostic and therapeutic strategies.

Key Areas of Progress:

Whole Genome Sequencing (WGS): Offers a complete view of genetic alterations driving cancer.

Epigenetic Markers: Identifying changes in gene expression regulation without altering DNA sequences.

RNA Sequencing: Provides insights into gene expression changes specific to cancer.

Implications for Clinical Practice:

These techniques are helping identify rare and aggressive cancers, paving the way for novel treatments and clinical trials.

8. Emerging Diagnostic Technologies

Several groundbreaking technologies are poised to redefine cancer diagnostics in the coming years:

Nanotechnology:

Nanoparticles: Used for targeted imaging and detection of cancer cells.

Nanosensors: Detect minute changes in biomarker levels with high sensitivity.

Single-Cell Analysis:

Examines individual cancer cells, providing insights into tumor heterogeneity and resistance mechanisms.

Microbiome Analysis:

Studies suggest that changes in the gut microbiome may be linked to cancer development, offering a new avenue for diagnostics.

9. Challenges and Future Directions

Despite significant progress, challenges remain in the widespread adoption and implementation of advanced cancer diagnostics.

Key Challenges:

Cost: Many advanced diagnostic tools are expensive and inaccessible to a large population.

Regulatory Hurdles: Approvals for new diagnostics can be lengthy and complex.

Integration: Combining diverse diagnostic data into a cohesive patient profile.

Future Focus Areas:

Affordable Solutions: Development of cost-effective diagnostic tools for global accessibility.

Precision Diagnostics: Further integration of genomics, proteomics, and AI for more accurate and personalized care.

Global Collaboration: Sharing data and resources to accelerate innovation and standardize best practices.

Conclusion

The field of cancer diagnostics is undergoing a transformative era, fueled by technological innovations and a deeper understanding of cancer biology. From liquid biopsies and AI-driven imaging to molecular diagnostics and epigenomics, these advancements are paving the way for earlier detection, improved accuracy, and personalized treatment.

0 notes

Text

Global Clinical Diagnostics Market Share, Size, Trends, Outlook, Growth & Forecast | 2024 - 2032

The global clinical diagnostics market reached a value of over USD 72.23 billion in 2023, with expectations of further growth during the forecast period of 2024-2032. The market is anticipated to grow at a CAGR of around 6.7%, potentially reaching over USD 129.84 billion by 2032. This market encompasses a wide range of diagnostic tests, devices, and tools used in healthcare settings, and its expansion is driven by advancements in technology, increasing healthcare awareness, and rising demand for accurate and timely diagnostic solutions.

The clinical diagnostics sector is essential in diagnosing, monitoring, and managing diseases across different medical disciplines, such as oncology, cardiology, microbiology, and immunology. In this blog post, we will explore the key players, segments, trends, growth drivers, COVID-19 impact, and market outlook for the global clinical diagnostics market.

Get a Free Sample Report with Table of Contents: https://www.expertmarketresearch.com/reports/clinical-diagnostics-market/requestsample

Key Players in the Clinical Diagnostics Market

The global clinical diagnostics market is highly competitive, with several established players leading the space. These companies continuously innovate and expand their product portfolios to meet the growing demand for advanced diagnostic solutions. Some of the major players in the market include:

Abbott Laboratories Abbott, headquartered in Chicago, Illinois, is a global healthcare company known for its diagnostic solutions, including point-of-care testing, molecular diagnostics, and immunoassays. Abbott has been at the forefront of developing COVID-19 testing solutions and expanding its diagnostic capabilities.

Thermo Fisher Scientific Based in Waltham, Massachusetts, Thermo Fisher Scientific is a leading player in the clinical diagnostics market, providing a broad range of diagnostic equipment, reagents, and testing systems. Their offerings include molecular diagnostics, clinical chemistry, and immunoassays.

Siemens Healthineers Siemens Healthineers, a division of Siemens AG, is headquartered in Erlangen, Germany. The company provides advanced diagnostic imaging, laboratory diagnostics, and point-of-care testing solutions. Their extensive product portfolio caters to diverse diagnostic needs across multiple medical fields.

Roche Diagnostics Roche, based in Basel, Switzerland, is a major player in the clinical diagnostics market, with a comprehensive range of diagnostic tests and systems. Roche offers solutions in molecular diagnostics, immunodiagnostics, and digital diagnostics, with a strong presence in oncology and infectious diseases.

Danaher Corporation Headquartered in Washington, D.C., Danaher is a leading provider of diagnostic tools and instruments. The company has a diversified portfolio that includes molecular diagnostics, immunodiagnostics, and clinical chemistry. Danaher’s brands, such as Beckman Coulter and Cepheid, are well-recognised in the industry.

Becton, Dickinson and Company (BD) BD, based in Franklin Lakes, New Jersey, is a global medical technology company that offers diagnostic products for clinical laboratories. BD's product range includes instruments, reagents, and consumables for microbiology, immunology, and hematology diagnostics.

Bio-Rad Laboratories Headquartered in Hercules, California, Bio-Rad Laboratories is a leader in life sciences and diagnostics. The company provides products for clinical diagnostics, including immunoassays, PCR tests, and blood typing solutions.

Market Segmentation

The clinical diagnostics market can be segmented based on product type, technology, application, end-users, and geography. Understanding these segments is crucial for identifying opportunities and analysing market trends.

By Product Type:

Instruments: This segment includes diagnostic machines and devices used in clinical laboratories and point-of-care settings, such as immunoassay analyzers, PCR machines, and clinical chemistry analyzers.

Reagents and Kits: Reagents and kits used for diagnostic testing are essential components of clinical diagnostics. These include immunoassay kits, PCR kits, and molecular diagnostics reagents.

Consumables: This includes the consumables required for diagnostic tests, such as test strips, blood glucose monitoring devices, and swabs.

By Technology:

Molecular Diagnostics: Molecular diagnostic tests involve the analysis of DNA, RNA, or proteins to identify diseases. Technologies such as PCR, next-generation sequencing, and microarrays are widely used in this category.

Immunoassays: These tests rely on antigen-antibody interactions to detect the presence of specific markers or pathogens, and they are commonly used in infectious disease diagnostics.

Clinical Chemistry: Clinical chemistry involves the analysis of blood, urine, and other bodily fluids to assess organ function and diagnose conditions like diabetes, liver disease, and kidney failure.

Hematology: Hematology tests focus on blood-related disorders, such as anemia, leukemia, and coagulation disorders. These tests often involve blood cell counting and analysis.

By Application:

Infectious Disease Diagnostics: This is one of the fastest-growing segments, driven by the rising prevalence of infectious diseases, including viral, bacterial, and parasitic infections.

Oncology Diagnostics: Early detection of cancers through molecular and imaging diagnostics is becoming increasingly important in oncology care.

Cardiovascular Diagnostics: The cardiovascular segment includes tests for heart disease, such as cholesterol testing, ECG, and blood pressure monitoring.

Diabetes Diagnostics: With the growing incidence of diabetes worldwide, diagnostic tests for blood glucose and insulin levels are in high demand.

Neurological Diagnostics: Tests for neurological diseases, including Alzheimer’s, Parkinson’s, and epilepsy, are becoming more sophisticated with advancements in imaging and biomarker detection.

By End-User:

Hospitals and Clinics: The largest segment in clinical diagnostics, hospitals and clinics rely heavily on diagnostic tests for patient care, treatment planning, and disease monitoring.

Diagnostic Laboratories: These laboratories focus on offering a wide range of diagnostic tests, including blood tests, imaging, and molecular diagnostics.

Home Care Settings: With the rise in at-home diagnostic tests, especially for diabetes and cardiovascular diseases, this segment is expected to witness significant growth.

Research Institutes: Research institutions conduct diagnostic tests for clinical trials and epidemiological studies.

Market Outlook and Growth Drivers

The global clinical diagnostics market is poised for substantial growth, driven by several key factors:

Technological Advancements: Advances in molecular diagnostics, artificial intelligence, and digital health are transforming clinical diagnostics. AI-powered diagnostic tools can assist clinicians in diagnosing diseases more accurately and faster.

Increased Healthcare Spending: The growing investment in healthcare infrastructure and diagnostic technologies, particularly in emerging economies, is expanding access to diagnostic services.

Rising Prevalence of Chronic Diseases: The global rise in chronic diseases, such as diabetes, cardiovascular diseases, and cancer, is fuelling demand for diagnostic tests to monitor and manage these conditions.

Aging Population: The increasing number of elderly individuals worldwide requires more diagnostic services for managing age-related conditions and chronic diseases.

Focus on Preventive Healthcare: There is a growing emphasis on early detection and preventive healthcare, which is driving the demand for diagnostic tests.

Trends in the Clinical Diagnostics Market

Point-of-Care Diagnostics: The demand for point-of-care diagnostic tests is increasing, as they offer rapid, on-site testing, particularly in emergency situations, rural areas, and home settings.

Molecular Diagnostics Growth: Molecular diagnostics, particularly PCR-based tests, are expected to grow significantly due to their accuracy and ability to detect genetic markers of diseases.

Integration of AI in Diagnostics: Artificial intelligence is being integrated into diagnostic devices to provide more accurate and faster results. AI can assist in interpreting medical images, analysing patient data, and offering real-time diagnostics.

Telemedicine and Remote Diagnostics: The growth of telemedicine is prompting the development of remote diagnostic tools that allow healthcare professionals to diagnose patients remotely.

COVID-19 Impact on the Clinical Diagnostics Market

The COVID-19 pandemic significantly impacted the clinical diagnostics market, especially in the initial phase, with increased demand for diagnostic tests to detect the virus. COVID-19 testing, including PCR tests and rapid antigen tests, saw a surge during the peak of the pandemic.

Although the pandemic led to some disruptions in diagnostic test production and distribution, it also accelerated the adoption of diagnostic innovations, such as home testing and digital diagnostics. The demand for accurate and quick diagnostics for viral infections has led to a shift towards more advanced and automated diagnostic solutions.

Post-pandemic, the market is expected to recover and continue its growth trajectory, with a focus on developing more sophisticated diagnostic solutions for future pandemics and disease outbreaks.

Frequently Asked Questions (FAQs)

What are the main drivers of growth in the clinical diagnostics market? The main drivers include technological advancements, increasing healthcare spending, the rising prevalence of chronic diseases, and the growing focus on preventive healthcare.

Which segment is expected to grow the fastest in the clinical diagnostics market? The molecular diagnostics segment is expected to grow rapidly due to advances in PCR testing, next-generation sequencing, and biomarker identification.

How has COVID-19 affected the clinical diagnostics market? COVID-19 significantly boosted demand for diagnostic tests, especially PCR and antigen tests. It also accelerated the adoption of telemedicine and remote diagnostics, which are expected to continue post-pandemic.

Who are the leading players in the clinical diagnostics market? Key players include Abbott Laboratories, Thermo Fisher Scientific, Siemens Healthineers, Roche Diagnostics, Danaher Corporation, Becton Dickinson, and Bio-Rad Laboratories.

What is the market outlook for clinical diagnostics between 2024 and 2032? The global clinical diagnostics market is expected to grow at a CAGR of 6.7% during the forecast period, reaching a value of over USD 129.84 billion by 2032.

0 notes

Text

In Vitro Diagnostics Industry Research Report 2030 By Players, Regions, Types & Applications

The global in vitro diagnostics (IVD) market, valued at an estimated USD 80.71 billion in 2024, is anticipated to grow at a compound annual growth rate (CAGR) of 6.8% from 2025 to 2030. This projected growth is largely driven by the increasing utilization of IVD tools and technologies, a response to the rising incidence of both infectious and chronic diseases globally. The development and implementation of automated IVD systems in laboratories and hospitals further contribute to this expansion, offering healthcare providers tools to make diagnoses that are efficient, precise, and free from errors. Additionally, the continual launch of new IVD products by leading companies plays a significant role in fueling this market’s growth.

A noteworthy example of this innovation in IVD products is seen in ELITechGroup’s recent expansion of its diagnostic portfolio. In January 2024, ELITechGroup introduced the GI Bacterial PLUS ELITe MGB Kit, which received CE-IVDR certification. This product marks the beginning of the company’s Gastrointestinal (GI) assay panel and is designed to detect bacterial pathogens responsible for GI infections. ELITechGroup’s expansion plans include three more kits for launch within the next quarter, covering a broader spectrum of gastrointestinal infections. These new products aim to equip laboratories and healthcare professionals with advanced tools for precise diagnosis and improved management of GI conditions.

Gather more insights about the market drivers, restrains and growth of the In Vitro Diagnostics Market

Regional Insights:

North America In Vitro Diagnostics Market:

The North American in vitro diagnostics (IVD) market led the global sector in 2024, holding a 42.28% share. The region is expected to maintain its dominance throughout the forecast period, largely driven by several key factors, including the growing prevalence of chronic diseases, the presence of established IVD companies, the frequent introduction of innovative diagnostic tests, and strong government funding support. For example, in January 2023, BD and CerTest Biotec obtained an Emergency Use Authorization (EUA) from the U.S. FDA for a PCR test to detect the Mpox virus, highlighting regulatory support for advanced diagnostics. The increasing demand for genetic testing, particularly for personalized treatments in diabetes and cancer, is further expected to support the growth of the IVD market in North America.

Europe In Vitro Diagnostics Market Trends:

The European IVD market is growing, driven by an emphasis on infectious disease testing, molecular diagnostics, and adherence to regulatory requirements like CE-IVDR. Following the COVID-19 pandemic, demand for infectious disease diagnostics surged, with companies like Siemens Healthineers introducing platforms such as the Atellica CI Analyzer for efficient testing. The molecular diagnostics sector is also expanding, with ELITechGroup’s CE-IVDR-certified GI Bacterial PLUS kit as a recent example, aimed at detecting gastrointestinal infections. Stringent IVDR standards in Europe foster innovation, improving diagnostic accuracy and safety across the continent.

Asia Pacific In Vitro Diagnostics Market Trends:

The Asia Pacific IVD market is projected to experience significant growth, with a CAGR of 8.59% over the forecast period. Key drivers include stabilizing economies, a rapidly growing middle class, supportive government policies, and rapid urbanization. For instance, in October 2023, Fapon partnered with Halodoc to boost IVD product sales and services in Indonesia. Major IVD players are also collaborating with regional partners to expand their reach in developing countries across Asia Pacific.

The Chinese IVD market is growing rapidly, fueled by rising demand for molecular diagnostics, point-of-care testing, and digital health integration. Molecular diagnostics are particularly in demand for infectious diseases and oncology, supported by public health initiatives and increased healthcare spending.

Japan’s IVD market growth is driven by an aging population and progress in personalized medicine. Key trends include a growing use of molecular diagnostics for oncology and genetic testing, which aid in identifying targeted treatments for age-related diseases

Latin America In Vitro Diagnostics Market Trends:

The IVD market in Latin America is expanding due to increased healthcare investments, a focus on disease prevention, and enhanced healthcare access. A prominent trend is the adoption of point-of-care testing for infectious diseases like dengue, Zika, and COVID-19, especially in remote areas. Demand for molecular diagnostics in oncology is also growing as awareness of personalized medicine rises. Public-private partnerships and government initiatives are building diagnostics infrastructure, making advanced testing technologies more accessible across the region.

Middle East & Africa In Vitro Diagnostics Market Trends:

The IVD market in the Middle East and Africa (MEA) is set for growth, driven by increased healthcare spending and the prevalence of infectious diseases. Major trends include the adoption of advanced molecular diagnostics and point-of-care testing to improve disease detection and management. Additionally, a focus on personalized medicine and government initiatives aimed at enhancing healthcare infrastructure are supporting market expansion. Collaborations between local and international players are fostering innovation, making diagnostic solutions more accessible across the region.

Browse through Grand View Research's Category Clinical Diagnostics Industry Research Reports.

The global saliva collection and diagnostics market size was estimated at USD 818.9 million in 2024 and is projected to grow at a CAGR of 4.7% from 2025 to 2030.

The global cholesterol testing products and services market size was estimated at USD 19.85 billion in 2024 and is projected to grow at a CAGR of 8.4% from 2025 to 2030.

Key Companies & Market Share Insights:

Among the prominent players in the IVD market are F. Hoffmann-La Roche Ltd., Abbott, Quest Diagnostics Incorporated, and Danaher. These companies actively pursue strategies like new product launches, mergers and acquisitions, and partnerships to strengthen and diversify their product offerings. These efforts are focused on expanding their product portfolios, introducing technologically advanced and innovative diagnostic tools, and improving their competitive positioning within the market.

Emerging companies in the IVD sector, including Llusern Scientific, Biocartis Group NV, ARUP Laboratories, Veracyte, and Exact Sciences Corp, are also making strides. These companies concentrate on developing novel and accurate IVD testing products, contributing to overall healthcare improvements. They frequently collaborate with research institutions, governmental bodies, and global leaders to expand their product reach and presence in new, high-potential markets.

Order a free sample PDF of the In Vitro Diagnostics Market Intelligence Study, published by Grand View Research.

0 notes

Text

In Vitro Diagnostics Market 2030 Outlook by Growth Rate, Trends, Size and Opportunities

The global in vitro diagnostics (IVD) market, valued at an estimated USD 80.71 billion in 2024, is anticipated to grow at a compound annual growth rate (CAGR) of 6.8% from 2025 to 2030. This projected growth is largely driven by the increasing utilization of IVD tools and technologies, a response to the rising incidence of both infectious and chronic diseases globally. The development and implementation of automated IVD systems in laboratories and hospitals further contribute to this expansion, offering healthcare providers tools to make diagnoses that are efficient, precise, and free from errors. Additionally, the continual launch of new IVD products by leading companies plays a significant role in fueling this market’s growth.

A noteworthy example of this innovation in IVD products is seen in ELITechGroup’s recent expansion of its diagnostic portfolio. In January 2024, ELITechGroup introduced the GI Bacterial PLUS ELITe MGB Kit, which received CE-IVDR certification. This product marks the beginning of the company’s Gastrointestinal (GI) assay panel and is designed to detect bacterial pathogens responsible for GI infections. ELITechGroup’s expansion plans include three more kits for launch within the next quarter, covering a broader spectrum of gastrointestinal infections. These new products aim to equip laboratories and healthcare professionals with advanced tools for precise diagnosis and improved management of GI conditions.

Gather more insights about the market drivers, restrains and growth of the In Vitro Diagnostics Market

Regional Insights:

North America In Vitro Diagnostics Market:

The North American in vitro diagnostics (IVD) market led the global sector in 2024, holding a 42.28% share. The region is expected to maintain its dominance throughout the forecast period, largely driven by several key factors, including the growing prevalence of chronic diseases, the presence of established IVD companies, the frequent introduction of innovative diagnostic tests, and strong government funding support. For example, in January 2023, BD and CerTest Biotec obtained an Emergency Use Authorization (EUA) from the U.S. FDA for a PCR test to detect the Mpox virus, highlighting regulatory support for advanced diagnostics. The increasing demand for genetic testing, particularly for personalized treatments in diabetes and cancer, is further expected to support the growth of the IVD market in North America.

Europe In Vitro Diagnostics Market Trends:

The European IVD market is growing, driven by an emphasis on infectious disease testing, molecular diagnostics, and adherence to regulatory requirements like CE-IVDR. Following the COVID-19 pandemic, demand for infectious disease diagnostics surged, with companies like Siemens Healthineers introducing platforms such as the Atellica CI Analyzer for efficient testing. The molecular diagnostics sector is also expanding, with ELITechGroup’s CE-IVDR-certified GI Bacterial PLUS kit as a recent example, aimed at detecting gastrointestinal infections. Stringent IVDR standards in Europe foster innovation, improving diagnostic accuracy and safety across the continent.

Asia Pacific In Vitro Diagnostics Market Trends:

The Asia Pacific IVD market is projected to experience significant growth, with a CAGR of 8.59% over the forecast period. Key drivers include stabilizing economies, a rapidly growing middle class, supportive government policies, and rapid urbanization. For instance, in October 2023, Fapon partnered with Halodoc to boost IVD product sales and services in Indonesia. Major IVD players are also collaborating with regional partners to expand their reach in developing countries across Asia Pacific.

The Chinese IVD market is growing rapidly, fueled by rising demand for molecular diagnostics, point-of-care testing, and digital health integration. Molecular diagnostics are particularly in demand for infectious diseases and oncology, supported by public health initiatives and increased healthcare spending.

Japan’s IVD market growth is driven by an aging population and progress in personalized medicine. Key trends include a growing use of molecular diagnostics for oncology and genetic testing, which aid in identifying targeted treatments for age-related diseases

Latin America In Vitro Diagnostics Market Trends:

The IVD market in Latin America is expanding due to increased healthcare investments, a focus on disease prevention, and enhanced healthcare access. A prominent trend is the adoption of point-of-care testing for infectious diseases like dengue, Zika, and COVID-19, especially in remote areas. Demand for molecular diagnostics in oncology is also growing as awareness of personalized medicine rises. Public-private partnerships and government initiatives are building diagnostics infrastructure, making advanced testing technologies more accessible across the region.

Middle East & Africa In Vitro Diagnostics Market Trends:

The IVD market in the Middle East and Africa (MEA) is set for growth, driven by increased healthcare spending and the prevalence of infectious diseases. Major trends include the adoption of advanced molecular diagnostics and point-of-care testing to improve disease detection and management. Additionally, a focus on personalized medicine and government initiatives aimed at enhancing healthcare infrastructure are supporting market expansion. Collaborations between local and international players are fostering innovation, making diagnostic solutions more accessible across the region.

Browse through Grand View Research's Category Clinical Diagnostics Industry Research Reports.

The global saliva collection and diagnostics market size was estimated at USD 818.9 million in 2024 and is projected to grow at a CAGR of 4.7% from 2025 to 2030.

The global cholesterol testing products and services market size was estimated at USD 19.85 billion in 2024 and is projected to grow at a CAGR of 8.4% from 2025 to 2030.

Key Companies & Market Share Insights:

Among the prominent players in the IVD market are F. Hoffmann-La Roche Ltd., Abbott, Quest Diagnostics Incorporated, and Danaher. These companies actively pursue strategies like new product launches, mergers and acquisitions, and partnerships to strengthen and diversify their product offerings. These efforts are focused on expanding their product portfolios, introducing technologically advanced and innovative diagnostic tools, and improving their competitive positioning within the market.

Emerging companies in the IVD sector, including Llusern Scientific, Biocartis Group NV, ARUP Laboratories, Veracyte, and Exact Sciences Corp, are also making strides. These companies concentrate on developing novel and accurate IVD testing products, contributing to overall healthcare improvements. They frequently collaborate with research institutions, governmental bodies, and global leaders to expand their product reach and presence in new, high-potential markets.

Order a free sample PDF of the In Vitro Diagnostics Market Intelligence Study, published by Grand View Research.

0 notes

Text

DNA Probe-Based Diagnostics: Key Drivers, Market Trends, and Industry Insights

DNA Probe-based Diagnostics involve the use of DNA probes—single-stranded DNA sequences designed to detect the presence of complementary nucleic acid sequences. This method is highly specific, as it targets sequences unique to pathogens or genes of interest, enabling accurate identification of diseases at a molecular level. DNA probes are invaluable in diagnosing infections, genetic disorders, and cancers. In recent years, DNA Probe-based Diagnostics have advanced significantly, enabling quicker, more sensitive, and cost-effective tests compared to traditional diagnostic approaches. The probes often detect diseases earlier than conventional methods, which allows for timely interventions and treatment.

In 2022, the market for DNA probe-based diagnostics was projected to be worth 2.81 billion US dollars. By 2032, the DNA probe-based diagnostics market is projected to have grown from 3.09 billion USD in 2023 to 7.4 billion USD. During the forecast period (2024-2032), the DNA Probe-based Diagnostics Market is anticipated to develop at a CAGR of around 10.17%.

DNA Probe-based Diagnostics Size and Share

The global DNA Probe-based Diagnostics market has experienced substantial growth, driven by advancements in biotechnology, an increase in research activities, and rising demand for personalized medicine. This market’s size continues to expand, supported by high adoption rates in hospitals, clinics, and research laboratories. As of recent estimates, the market is expected to grow at a consistent compound annual growth rate (CAGR) over the next few years. This growth is fueled by increasing government initiatives, rising investments in healthcare infrastructure, and growing awareness of the importance of early disease detection.

The market share of DNA Probe-based Diagnostics is significant in the molecular diagnostics sector, with applications across diverse fields including infectious disease diagnostics, oncology, genetic testing, and forensic sciences. North America currently holds a major share, driven by the advanced healthcare infrastructure, high investment in research and development, and a strong focus on precision medicine. However, Asia-Pacific is anticipated to see the fastest growth due to increasing healthcare expenditures, rising prevalence of chronic diseases, and a growing demand for advanced diagnostic technologies.

DNA Probe-based Diagnostics Analysis

DNA Probe-based Diagnostics utilize several analysis methods that contribute to their accuracy and reliability. Techniques such as fluorescence in situ hybridization (FISH), polymerase chain reaction (PCR), and nucleic acid amplification tests (NAATs) are commonly employed in DNA probe diagnostics. Each method has its unique advantages: FISH, for instance, allows for the visualization of DNA in chromosomes, making it particularly useful in genetic and cancer diagnostics. PCR amplifies DNA sequences to enhance detection sensitivity, while NAATs are known for their high precision in identifying pathogenic DNA in low-abundance samples.

The analysis of DNA Probe-based Diagnostics reveals trends that continue to shape the industry, including the growing shift towards digital and point-of-care diagnostics, which are particularly valuable in low-resource settings. The trend of miniaturization and automation in DNA probe diagnostics has further improved throughput, making these diagnostics faster and more accessible to a larger population.

DNA Probe-based Diagnostics Trends

Several notable trends are currently driving the growth and development of DNA Probe-based Diagnostics. The first is the increase in demand for personalized and precision medicine, where diagnostics are tailored to individual genetic profiles, providing targeted treatments. Second, there is an expansion in the use of DNA probes for infectious disease diagnostics, especially in the detection of viruses such as COVID-19, which highlighted the need for rapid, accurate diagnostics. Third, advancements in microfluidics and lab-on-chip technologies are making diagnostics more compact and accessible. Fourth, automation and digitalization are improving the accuracy and speed of diagnostic results, and fifth, next-generation sequencing (NGS) technologies are pushing the limits of what DNA probes can detect.

Reasons to Buy DNA Probe-based Diagnostics Reports

Comprehensive Market Insight: Reports provide an in-depth understanding of the DNA Probe-based Diagnostics market, covering all segments, growth factors, challenges, and opportunities.

Competitive Analysis: Detailed profiles of key market players, their strategies, and competitive positioning give buyers a clear view of the competitive landscape.

Trend Analysis: Reports analyze current and emerging trends in the diagnostics market, providing data-driven insights to make informed decisions.

Strategic Recommendations: Clear, actionable insights help stakeholders identify areas of growth and potential investment opportunities.

Recent Developments: Reports cover the latest advancements, regulatory updates, and innovations within the DNA probe diagnostics field.

Recent Developments

Recent developments in DNA Probe-based Diagnostics include the integration of artificial intelligence (AI) for faster data interpretation and the launch of more portable diagnostic devices. The shift toward at-home diagnostic kits has also gained momentum, with many new products entering the market that allow patients to conduct self-tests. Additionally, advancements in CRISPR technology are enhancing the accuracy and versatility of DNA probes, especially in gene editing applications.

Related reports:

burn care centers market

cardiac output monitoring device market

cementless total knee arthroplasty market

Top of Form

Bottom of Form

1 note

·

View note

Text

Market Insights: Drivers and Future Scope of DNA Probe-based Diagnostics

DNA Probe-based Diagnostics involve the use of DNA probes—single-stranded DNA sequences designed to detect the presence of complementary nucleic acid sequences. This method is highly specific, as it targets sequences unique to pathogens or genes of interest, enabling accurate identification of diseases at a molecular level. DNA probes are invaluable in diagnosing infections, genetic disorders, and cancers. In recent years, DNA Probe-based Diagnostics have advanced significantly, enabling quicker, more sensitive, and cost-effective tests compared to traditional diagnostic approaches. The probes often detect diseases earlier than conventional methods, which allows for timely interventions and treatment.

In 2022, the market for DNA probe-based diagnostics was projected to be worth 2.81 billion US dollars. By 2032, the DNA probe-based diagnostics market is projected to have grown from 3.09 billion USD in 2023 to 7.4 billion USD. During the forecast period (2024-2032), the DNA Probe-based Diagnostics Market is anticipated to develop at a CAGR of around 10.17%.

DNA Probe-based Diagnostics Size and Share

The global DNA Probe-based Diagnostics market has experienced substantial growth, driven by advancements in biotechnology, an increase in research activities, and rising demand for personalized medicine. This market’s size continues to expand, supported by high adoption rates in hospitals, clinics, and research laboratories. As of recent estimates, the market is expected to grow at a consistent compound annual growth rate (CAGR) over the next few years. This growth is fueled by increasing government initiatives, rising investments in healthcare infrastructure, and growing awareness of the importance of early disease detection.

The market share of DNA Probe-based Diagnostics is significant in the molecular diagnostics sector, with applications across diverse fields including infectious disease diagnostics, oncology, genetic testing, and forensic sciences. North America currently holds a major share, driven by the advanced healthcare infrastructure, high investment in research and development, and a strong focus on precision medicine. However, Asia-Pacific is anticipated to see the fastest growth due to increasing healthcare expenditures, rising prevalence of chronic diseases, and a growing demand for advanced diagnostic technologies.

DNA Probe-based Diagnostics Analysis

DNA Probe-based Diagnostics utilize several analysis methods that contribute to their accuracy and reliability. Techniques such as fluorescence in situ hybridization (FISH), polymerase chain reaction (PCR), and nucleic acid amplification tests (NAATs) are commonly employed in DNA probe diagnostics. Each method has its unique advantages: FISH, for instance, allows for the visualization of DNA in chromosomes, making it particularly useful in genetic and cancer diagnostics. PCR amplifies DNA sequences to enhance detection sensitivity, while NAATs are known for their high precision in identifying pathogenic DNA in low-abundance samples.

The analysis of DNA Probe-based Diagnostics reveals trends that continue to shape the industry, including the growing shift towards digital and point-of-care diagnostics, which are particularly valuable in low-resource settings. The trend of miniaturization and automation in DNA probe diagnostics has further improved throughput, making these diagnostics faster and more accessible to a larger population.

DNA Probe-based Diagnostics Trends

Several notable trends are currently driving the growth and development of DNA Probe-based Diagnostics. The first is the increase in demand for personalized and precision medicine, where diagnostics are tailored to individual genetic profiles, providing targeted treatments. Second, there is an expansion in the use of DNA probes for infectious disease diagnostics, especially in the detection of viruses such as COVID-19, which highlighted the need for rapid, accurate diagnostics. Third, advancements in microfluidics and lab-on-chip technologies are making diagnostics more compact and accessible. Fourth, automation and digitalization are improving the accuracy and speed of diagnostic results, and fifth, next-generation sequencing (NGS) technologies are pushing the limits of what DNA probes can detect.

Reasons to Buy DNA Probe-based Diagnostics Reports

Comprehensive Market Insight: Reports provide an in-depth understanding of the DNA Probe-based Diagnostics market, covering all segments, growth factors, challenges, and opportunities.

Competitive Analysis: Detailed profiles of key market players, their strategies, and competitive positioning give buyers a clear view of the competitive landscape.

Trend Analysis: Reports analyze current and emerging trends in the diagnostics market, providing data-driven insights to make informed decisions.

Strategic Recommendations: Clear, actionable insights help stakeholders identify areas of growth and potential investment opportunities.

Recent Developments: Reports cover the latest advancements, regulatory updates, and innovations within the DNA probe diagnostics field.

Recent Developments

Recent developments in DNA Probe-based Diagnostics include the integration of artificial intelligence (AI) for faster data interpretation and the launch of more portable diagnostic devices. The shift toward at-home diagnostic kits has also gained momentum, with many new products entering the market that allow patients to conduct self-tests. Additionally, advancements in CRISPR technology are enhancing the accuracy and versatility of DNA probes, especially in gene editing applications.

Related reports:

burn care centers market

cardiac output monitoring device market

cementless total knee arthroplasty market

Top of Form

Bottom of Form

0 notes

Text

Real-time PCR Market - Forecast(2024 - 2030)

𝐑𝐞𝐚𝐥-𝐓𝐢𝐦𝐞 𝐏𝐂𝐑: 𝐄𝐬𝐬𝐞𝐧𝐭𝐢𝐚𝐥 𝐓��𝐨𝐥 𝐟𝐨𝐫 𝐌𝐨𝐝𝐞𝐫𝐧 𝐌𝐨𝐥𝐞𝐜𝐮𝐥𝐚𝐫 𝐁𝐢𝐨𝐥𝐨𝐠𝐲 𝐄𝐱𝐩𝐥𝐚𝐢𝐧𝐞𝐝

The global real-time PCR (qPCR) market is experiencing significant growth, driven by several key factors. The market, valued at $22.03 billion in 2024, is projected to reach $27.78 billion by 2028. This growth is largely due to the increasing prevalence of infectious diseases, the rise of cancer diagnostics, and expanding research in genomics.