#Defoamers Market industry

Explore tagged Tumblr posts

Text

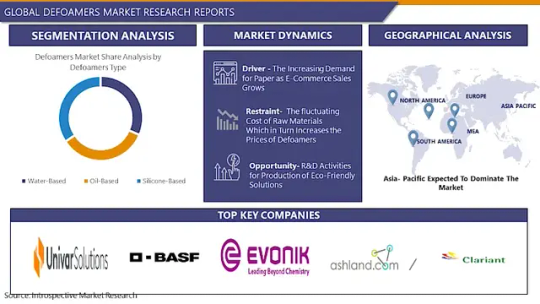

Global Defoamers Share Size And Trends In 2022–2028

Foam is a coarse dispersion of a gas in a liquid when the proportion of gas by volume is greater than the proportion of liquid by volume. A significant problem in industrial operations is foam. The surface coatings are harmed by them. They interfere with effective container filling. Chemical additives known as defoamers reduce or eliminate foam formation in industrial process liquids like paints, inks, adhesives, and even building supplies. Antifoam agents are substances that stop bubbles from forming and growing, even though the terms defoamer and antifoam agent are frequently used interchangeably.

Depending on the application and performance requirements, they are made of polydimethylsiloxanes and other silicones, insoluble oils, stearates, and glycols, as well as inorganics such silicates and talc. A surface-active substance known as defoamer is insoluble in foamy media. A defoamer must have the ability to spread swiftly on foamy surfaces.

Read More: https://introspectivemarketresearch.com/reports/defoamers-market/

#Global Defoamers Market#Defoamers Market trend#Defoamers Market share#Defoamers Market size#Defoamers Market industry

0 notes

Text

Textile Chemicals Market Is Experiencing Healthy Growth Worldwide

Textile Chemicals Industry Overview

The global textile chemicals market size is expected to reach USD 36.14 billion by 2030, registering a CAGR of 4.5% from 2024 to 2030, according to a new report by Grand View Research, Inc. The growth is majorly driven by increasing demand for textile products from major applications including apparel, home furnishing, technical textiles, and others.

Rapidly growing demand from the apparel industry is anticipated to propel the demand for the product during the forecast period. Home furnishing, specifically in developing economies, demanding modern and attractive furniture products is expected to have a positive impact on the growth of the market.

Numerous chemicals are used in the fabric manufacturing industry to offer a wide range of performance features during the production process, which are known as process chemicals. These end products include biopolishing enzymes, desizing enzymes, flame retardants, antiviral/antimicrobial agents, lubricating/anti-crease agents, water and oil repellents, printing auxiliaries, and softening agents.

Gather more insights about the market drivers, restrains and growth of the Textile Chemicals Market

Based on existing operations and technologies, new application areas for textile chemicals are being developed, wherein these products can help improve efficiency, promote cost reduction, reduce environmental impacts, and ensure the performance of formulations. Application sectors for the product include apparel, home furnishing, technical textiles, and others. STYLUS APPAREL; HYAK DESIGN GROUP; Suuchi Inc.; TechniTextile Québec; and Stafford Textiles Limited are some of the major end-users in the market.

The manufacturing of textile chemicals is highly dependent on abundant availability and favorable costs of raw materials. In this market, successful commercialization of products such as yarn lubricants, finishing agents, coating & sizing agents, and others and investments in production capacity are some of the key strategies of the market players.

The market is highly competitive owing to the presence of a large number of manufacturers with a global presence. The leading product manufacturers include Dow, Huntsman International LLC, The Lubrizol Corporation, Archroma, Evonik Industries AG, and Solvay S.A.

Browse through Grand View Research's Specialty Polymers Industry Research Reports.

The global aseptic packaging market size was valued at USD 77.1 million in 2024 and is projected to grow at a CAGR of 10.8% from 2025 to 2030.

The global fluoropolymer films market size was valued at USD 1.09 billion in 2023 and is projected to grow at a CAGR of 12.9% from 2024 to 2030.

Textile Chemicals Market Segmentation

Grand View Research has segmented the global textile chemicals market based on process, product, application, and region:

Textile Chemicals Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Pretreatment

Bleaching Agents

Desizing Agents

Scouring Agents

Others

Coating

Anti-Piling

Protection

Water Proofing

Water Repellant

Others

Treatment Of Finished Products

Softening

Stiffening

Others

Textile Chemicals Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Coating & Sizing Chemicals

Colorants & Auxiliaries

Dispersants/levelant

Fixative

UV absorber

Others

Finishing Agents

Antimicrobial or anti-inflammatory

Flame retardants

Repellent and release

Others

Surfactants

Detergents & Dispersing Agents

Emulsifying Agents

Lubricating Agents

Wetting Agents

Denim Finishing Agents

Anti-back Staining Agents

Bleaching Agents

Crush Resistant Agents

Defoamers

Enzymes

Resins

Softeners

Others

Textile Chemicals Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Apparel

Innerwear

Outerwear

Sportswear

Others

Home Furnishing

Carpet

Drapery

Furniture

Others

Technical Textiles

Agrotech

Buildtech

Geotech

Indutech

Medtech

Mobiltech

Packtech

Protech

Others

Other Applications

Textile Chemicals Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

North America

US

Canada

Mexico

Europe

Germany

Turkey

Italy

UK

France

Russia

Spain

Poland

Asia Pacific

China

India

Japan

South Korea

Vietnam

Indonesia

Central & South America

Brazil

Argentina

Middle East and Africa

Saudi Arabia

South Africa

Morocco

Tunisia

UAE

Kenya

Key Companies profiled:

AB Enzymes

Archroma

BASF SE

BioTex Malaysia

Dow

Ethox Chemicals, LLC

Evonik Industries AG

Fibro Chem, LLC

German Chemicals Ltd.

Govi N.V.

Huntsman International LLC

Kemira Oyj

Kiri Industries Ltd.

LANXESS

OMNOVA Solutions Inc.

Omya United Chemicals

Organic Dyes and Pigments

Resil Chemicals Pvt. Ltd.

Solvay S.A

The Lubrizol Corporation

Key Textile Chemicals Company Insights

Some of the key players operating in the global textile chemicals market include Kiri Industries Ltd., AB Enzymes, Dow, BASF SE, The Lubrizol Corporation, Kemira Oyj, and Evonik Industries AG, among others.

AB Enzymes is a biotech company that develops and manufactures enzyme preparations for a wide range of applications such as baking, fruit juice processing, grains processing, animal feed, paper, textiles, and laundry.

BASF SE operates through six business segments, including chemicals, industrial solutions, materials, surface technologies, nutrition and care, and agricultural solutions. The chemical segment's product portfolio includes intermediates, monomers, petrochemicals, and catalysts. The company provides non-halogenated flame-retardants for several end-use industries, including the textile market.

Evonik Industries AG is a global manufacturer of specialty chemicals. It operates through four business segments: Specialty Additives, Nutrition and care, Smart Materials, and Performance Materials. Under the Performance Materials segment, the company offers performance intermediates such as large-volume additives and intermediates, along with functional solutions such as polymer additives, potassium derivatives, cyanuric chloride, alkyl chlorides, and alkoxides.

Kemira Oyj is a global chemical manufacturer with business operations in pulp & paper, water, oil & gas, metals & mining, food, and energy industries. For textile processing, the company offers oil-based foam control products and dry powder flocculants. Oil-based foam control products (defoamers) are active dispersions in mineral oil that can be used for persistent foam reduction applications. They are cost-efficient and well-suited for high temperatures. Their primary applications include textiles and wastewater treatment. Dry powder flocculants, such as nonionic polyacrylamides, offered by the company are effective in textile processing applications such as the flocculation of negatively charged particles.

Recent Developments

In January 2024, Devan Chemicals, a provider of sustainable textile finishes, is excited to announce its upcoming participation in Heimtextil 2024. Devan invites attendees to visit their booth in Hall 11.0, booth A21, to experience firsthand the latest sustainable textile finishes they have developed.

In April 2024, BASF SE announced its portfolio of polyamides for the textile industry. The company’s sustainable polyamide PA6 and PA6.6 product range have been certified under the Recycled Claim Standard (RCS) for textile applications. This certification allows BASF SE to market textiles produced using recycled raw materials.

In May 2023, Dystar announced its eco-advanced indigo dyeing, which aims to reduce energy consumption by up to 30% and water usage by up to 90% during the production process.

In November 2023, Solvay introduced a textile fiber that decomposes rapidly in the oceans, minimizing the environmental impact of microplastics. The new textile polyamide, set to be manufactured at the company's industrial facility in Brazil, will decrease oceanic impact by roughly 40 times compared to traditional fibers. This product development aligns with the global trend of rising demand and market shifts toward more sustainable textile solutions.

Order a free sample PDF of the Textile Chemicals Market Intelligence Study, published by Grand View Research.

0 notes

Text

Industrial Waste Water Treatment Chemicals Market — Forecast(2024–2030)

Overview

With rise in the growing consumption for industrial waste water treatment chemicals is increasing due to increase in population, rapid urbanization and fresh water shortage, due to this the Industrial Waste Water Treatment Chemicals market is expected to grow in the forecast period. Growing governments implementation towards industrial waste water treatment will further enhance the overall market demand for Industrial Waste Water Treatment Chemicals during the forecast period.

Report Coverage

The report: “Industrial Waste Water Treatment Chemicals Market — Forecast (2020–2025)”, by IndustryARC, covers an in-depth analysis of the following segments of the Industrial Waste Water Treatment Chemicals industry.

By Type of Chemicals — Scale Inhibitors, Corrosion Inhibitors, Defoamer, Biocides, Organic Polymers, Oxygen Scavengers, Coagulants, Others.

By Geography — North America, South America, Europe, APAC, RoW.

Key Takeaways

Asia-Pacific dominates the Industrial Waste Water Treatment Chemicals market owing to larger water demand due to larger population.

Increasing water pollution and scarcity of water are major factors driving the waste water treatment services market.

Due to the covid 19 pandemic, the residential usage of water has increased due to which the Industrial waste water treatment chemicals market is growing.

One notable challenge for Industrial waste water treatment chemicals is that, it is considerably costly to set up.

Request Sample

Type of Chemicals — Segment Analysis

Organic Polymers segment holds the largest share in the Industrial Waste Water Treatment Chemicals market. Organic polymers consist of polyacrylamide, polyaluminium chloride among others. Organic polymers are used to purify low quality water either for drinking or industrial purposes. These are used in industrial waste water treatment process to inhibit the growth of harmful organisms and also to kill the existing ones. The efficiency of the industrial waste water treatment chemicals depends on dosage rate and duration of the additive’s presence in water. Industrial waste water treatment facilities are growing at a faster pace due to excess generation of wastewater from industrial sector. The soda ash industry is a part of the chemical industry, which is responsible for the production of sodium carbonate, calcium chloride, absorbent masses, evaporated wet salt, food salt, pickling salt or salt tablets. During manufacturing of those products, strongly alkaline wastewater is generated. Owing to this the Industrial Waste Water Treatment Chemicals market is growing.

Geography — Segment Analysis

APAC has dominated the Industrial Waste Water Treatment Chemicals market with a share of more than xx%, owing to high demand from the end-user industries, such as power, steel, and food & beverage. Countries such as India, China, Japan are the epicentre for the Industrial Waste Water Treatment Chemicals market, as these countries consist of large number of industries. The wastewaters from large-scale industries such as oil refineries, petrochemical plants, chemical plants, and natural gas processing plants commonly contain gross amounts of oil and suspended solids. Those industries use a device known as an API oil-water separator which is designed to separate the oil and suspended solids from their wastewater effluents.

Industrial Waste Water Treatment Chemicals Market Drivers

Implementation of Stringent Government regulations

Implementation of Stringent Governments’ regulations and efforts to reuse water and wastewater treatment in industries, will further aid the market growth of Industrial Waste Water Treatment Chemicals market. The removal of impurities from wastewater, or sewage, before they reach aquifers or natural bodies of water such as rivers, lakes, estuaries, and oceans. Since pure water is not found in nature (i.e., outside chemical laboratories), any distinction between clean water and polluted water depends on the type and concentration of impurities found in the water as well as on its intended use.

Increasing demand for clean water

As demand for water increases across the globe, the availability of fresh water in many regions is likely to decrease because of climate change, as warns by latest edition of the United Nations’ World Water Development Report (WWDR4). It predicts that these pressures will exacerbate economic disparities between certain countries, as well as between sectors or regions within countries. So, the demand for fresh and clean water are increasing due to which the Industrial waste water treatment chemicals market will grow.

Industrial Waste Water Treatment Chemicals Market Challenges

Costly setting up of Equipment.

In manufacturing, setup cost is the cost incurred to get equipment ready to process a different batch of goods. Hence, setup cost is regarded as a batch-level cost in activity-based costing. Setup cost is considered to be a non-value-added cost that should be minimized. One notable hurdle of cooling water treatment chemicals market is that, it is considerably costly to set up. So, small industries are financially not that much strong to setup these equipments. So, they look to escape the installing of these equipments. Whereas Antifoams are chemical agents designed to control the wasteful formation of foam during industrial processes.

Inquiry Before Buying

Impact of COVID-19

The rapid spread of coronavirus has had a major impact on global markets as, major economies of the world are completely lockdown due to this pandemic. Because of this major lockdown, suddenly all the consumer market has started to show zero interest towards purchasing equipments regarding the IWTC. One of the major difficulties, market is facing are the shutdown of all kinds of International transportation. Global crisis for all sectors including manufacturing sector have slower down the demand of goods’ production and exports of effect pigments market.

Buy Now

Market Landscape

Technology launches, acquisitions and R&D activities are key strategies adopted by players in the Industrial Waste Water Treatment Chemicals market. In 2019, the market of Industrial Waste Water Treatment Chemicals has been consolidated by the top five players accounting for xx% of the share. Major players in the Industrial Waste Water Treatment Chemicals Market are Akzo Nobel N.V., Angus Chemical Company, BASF SE, BWA Water Additives UK Ltd., Kemira OYJ, The Lubrizol Corporation, Tiarco Chemical, Shandong Taihe Water Treatment Co., Ltd, Kurita Water Industries Ltd, among others.

0 notes

Text

0 notes

Text

0 notes

Text

Defoamer Surfactant Price | Prices | Pricing | News | Database | Chart

Defoamer Surfactant play a critical role across numerous industries by helping control foam generation in various processes. These chemicals are particularly important in industries such as water treatment, pulp and paper production, paints and coatings, food and beverages, and oil and gas, among others. Foam, while sometimes harmless, can interfere with processing efficiency, lead to defects in products, and complicate the accurate measurement of liquid volumes. Consequently, defoamer surfactants, which either prevent foam formation or break down existing foam, are in constant demand. However, the prices of these surfactants are influenced by a variety of factors, ranging from raw material costs to market demand and global supply chain disruptions. Understanding these influences is essential for businesses and industries that rely on defoamer surfactants to control operational costs and ensure product quality.

One of the primary factors affecting the price of defoamer surfactants is the cost of raw materials used in their production. Many surfactants are derived from petrochemicals, and the prices of these petrochemical derivatives fluctuate based on global oil prices. When oil prices increase due to geopolitical tensions, production cuts, or other market disruptions, the cost of producing defoamer surfactants tends to rise as well. Conversely, a drop in oil prices typically lowers production costs, which can lead to more competitive pricing for defoamer surfactants. Additionally, surfactants can also be derived from renewable resources such as vegetable oils. The prices of these alternative raw materials can vary depending on agricultural yields, weather conditions, and market availability, further adding to the variability of defoamer surfactant prices.

Get Real Time Prices for Defoamer Surfactant: https://www.chemanalyst.com/Pricing-data/defoamer-surfactant-1240

Another key factor that influences the prices of defoamer surfactants is the demand from industries that use them. For instance, the water treatment sector is a significant consumer of defoamer surfactants, as foam can impede the efficiency of treatment processes. With increasing global concerns over water scarcity and pollution, the water treatment industry is expected to grow, thereby driving up the demand for defoamers. Similarly, in the food and beverage industry, regulations regarding hygiene and quality standards have tightened, which means that manufacturers must employ defoamers to ensure that their products meet regulatory requirements. As demand rises in these industries, the price of defoamer surfactants is likely to increase unless supply can match the pace of demand.

The type of defoamer surfactant also plays a role in determining its price. Defoamers can be broadly classified into several categories, including oil-based, water-based, silicone-based, and polymer-based variants. Silicone-based defoamers, for example, are often preferred in many industrial applications due to their effectiveness at low concentrations and stability over a wide range of temperatures. However, they tend to be more expensive than water-based or oil-based alternatives due to the higher costs associated with silicone production. The selection of a particular type of defoamer depends on the specific requirements of the industry or process, and industries that prioritize high-performance defoamers may need to allocate a larger portion of their budget toward purchasing silicone-based surfactants.

Environmental regulations also exert a considerable influence on the prices of defoamer surfactants. Governments and regulatory bodies worldwide are increasingly focusing on the environmental impact of industrial chemicals. This has led to the development of more eco-friendly and biodegradable defoamers, which are often more expensive to produce than their traditional counterparts. Companies that want to minimize their environmental footprint or adhere to stricter environmental standards may need to pay a premium for these greener alternatives. Additionally, manufacturers of defoamer surfactants must comply with evolving regulations, such as REACH in Europe or EPA guidelines in the United States. Compliance with these regulations requires additional testing and certification, which can increase production costs and, consequently, the final market price of the defoamer surfactants.

Another notable trend affecting defoamer surfactant prices is the increasing focus on product customization. Different industries have specific needs when it comes to foam control, and manufacturers are increasingly seeking custom-formulated defoamers that cater to the unique requirements of their processes. These tailored formulations often come at a higher price point due to the additional research and development involved. Companies looking for custom solutions may have to invest in higher-priced defoamers, but the trade-off is usually improved performance, reduced downtime, and better overall efficiency in their operations.

Looking at regional differences, the prices of defoamer surfactants can vary significantly across different markets. In regions where production facilities are closer to raw material sources, prices may be lower due to reduced transportation costs. Conversely, in areas where raw materials need to be imported or where production costs are higher, such as in Europe and North America, the prices of defoamer surfactants can be relatively steep. Emerging markets, such as those in Asia-Pacific, are expected to witness increasing demand for defoamer surfactants due to rapid industrialization, which may further influence global pricing trends as these markets continue to grow.

In conclusion, the pricing of defoamer surfactants is influenced by a complex interplay of factors, including raw material costs, supply chain dynamics, industry demand, product type, environmental regulations, and regional variations. Businesses that rely on defoamer surfactants must closely monitor these factors to manage their procurement strategies effectively. As global industries evolve and adapt to new challenges, including sustainability concerns and changing regulatory landscapes, the demand for defoamer surfactants is likely to remain strong, with prices fluctuating in response to market conditions.

Get Real Time Prices for Defoamer Surfactant: https://www.chemanalyst.com/Pricing-data/defoamer-surfactant-1240

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Defoamer Surfactant#Defoamer Surfactant Price#Defoamer Surfactant Prices#Defoamer Surfactant Pricing#Defoamer Surfactant News

0 notes

Text

Oilfield Surfactants Market - Forecast(2024 - 2030)

Oilfield Surfactants Market Overview:

Oilfield Surfactants Market Size is forecast to reach $2044.1 Million by 2030, at a CAGR of 4.5% during forecast period 2024-2030.The global market for Oilfield Surfactants was estimated at $2044.1 million in 2030 and is predicted to witness robust and accelerated growth in the coming years, especially in the oil producing countries such the US, China and members of the OPEC. Demand for oilfield surfactants has grown since the need for chemicals in sustainable oil exploration, extraction and production has skyrocketed as witnessed in the rigorous EOR (Enhanced Oil Recovery) activities. Furthermore, there has been a growing interest in the bio-based oil surfactants, although being a niche market, for its environment friendly effects that can counter-act the wide environmental concerns about the oil and gas industries.

Oilfield Surfactants Market Outlook:

Oilfield surfactants are chemicals that effectively lower the surface tension between a fluid and a solid or between various fluids. Oilfield surfactants have various physical and chemical properties that can be exploited in the stages of drilling, production, refining, enhanced oil recovery and stimulation. Its applications vary from asphaltene dispersants, corrosion inhibition, emulsifiers, demulsifier intermediates, oil-wetters, paraffin inhibitors, water-wetters, foamers and defoamers. The type of surfactant behavior is dictated by the chemical structure, specifically the structural groups on the molecule). The oilfield surfactant market is segmented based on the stage of application such as drilling, production and stimulation as well as its applications as mentioned above.

Request Sample

Oilfield Surfactants Market Growth drivers:

Global oil and natural gas production has been increasing steadily since the last decade with oil production recording 92.6 million barrels per day (BPD) with US being the largest oil producing country in the world. These statistics imply that as oil production, extraction and exploration activities increase, there is clearly a huge growth potential for oilfield surfactants to meet this large demand capacity. Surfactants such as emulsifiers, demulsifiers, biocides etc. would highly in demand at various stages of drilling, production and stimulation in oilfields. In addition, as the world plans to move towards a more sustainable and environment friendly future, bio-based oilfield surfactants would be in high demand. Enhanced Oil Recovery (EOR) is gaining increasing popularity in the oil industry as it cuts costs and maximizes yield, and thus this could clearly boost the Oil Surfactants market as EOR is only possible due to the usage of such surfactants.

Oilfield Surfactants Market Challenges:

The prime challenge faced by the Oilfield Surfactants market is the dangerous carbon footprint that the oil and gas industries leave behind in the world’s atmosphere. The use of fossil fuels has always been criticized and many developed countries in the EU planning to phase out their energy dependence on oil and natural gas. Growing environmental concerns about oilfield production levels coupled with massive oil spills are the major challenges to the Oilfield Surfactant market.

Inquiry Before Buying

Oilfield Surfactants Market Research Scope:

The base year of the study is 2017, with forecast done up to 2023. The study presents a thorough analysis of the competitive landscape, taking into account the market shares of the leading companies. It also provides information on unit shipments. These provide the key market participants with the necessary business intelligence and help them understand the future of the Oilfield Surfactants market. The assessment includes the forecast, an overview of the competitive structure, the market shares of the competitors, as well as the market trends, market demands, market drivers, market challenges, and product analysis. The market drivers and restraints have been assessed to fathom their impact over the forecast period. This report further identifies the key opportunities for growth while also detailing the key challenges and possible threats. The key areas of focus include the types of plastics in the Oilfield Surfactants market, and their specific applications in different types of vehicles.

Oilfield Surfactants Market Report: Industry Coverage

Oilfield Surfactants–By Class of Substrate: Synthetic and Bio-based

Oilfield Surfactants– By Application: Drilling, Stimulation and Stimulation

Oilfield Surfactants– By Surfactant Class: Non-Ionic, Anionic, Cationic, Polymeric, Amphoteric and others

The Oilfield Surfactants market report also analyzes the major geographic regions for the market as well as the major countries for the market in these regions. The regions and countries covered in the study include:

North America: The U.S., Canada, Mexico

South America: Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, Costa Rica

Europe: The U.K., Germany, Italy, France, The Netherlands, Belgium, Spain, Denmark

APAC: China, Japan, Australia, South Korea, India, Taiwan, Malaysia, Hong Kong

Middle East and Africa: Israel, South Africa, Saudi Arabia

Schedule a Call

Oilfield Surfactants Market Key Players Perspective:

Some of the Key players in this market that have been studied for this report include: CP Kelco Oil Field Group, Huntsman Corporation, Croda International PLC, Weatherford International, Stepan Company, Enviro Fluid, Rimpro-India, Evonik Industries AG, Flotek Industries and others

Market Research and Market Trends of Oilfield Surfactants Market

Researchers at the University of Houston discovered an innovative technique using nanotechnology to maximize oil recovery from oil wells, as oilfields yield only 30-35% on average. The researchers have developed a graphene amphilic nanosheet designed from Janus nanoparticles that could aid in tertiary oil recovery. If producers can unlock this untapped potential, the crude oil supply could be boosted and could drive the selling price lower.

According to the 2018 BP Statistical Review of World Energy global oil production hit a record of 92.6 million barrels per day (BPD). This large increase in oil production levels would indicate a large demand for oilfield surfactants in the oil and gas industries.

Based in Texas, U.S, Huntsman Corporation is a global key player with a significant market share in the oilfield surfactant market. Huntsman Corporation recently acquired Nanocomp Technologies Inc., a company specialized in manufacturing advanced carbon materials based in New Hampshire, USA. Its popular product is an advanced carbon-based material branded as Miralon, which could have potential use in corrosion inhibition and can lead to a new class of nanomaterial based oilfield surfactant.

Buy Now

Key Market Players:

The Top 5 companies in the Oilfield Surfactants Market are:

Exxon Mobil

Arlanxeo

Sibur International

Reliance Industries

BRP Manufacturing

#surfactant#oilfield chemicals#oilfield surfactant#oil field surfactant#suspending agents#oilfield surfactant industry#oilfield surfactant market#oilfield surfactant companies#cationic surfactants market#Fatty Alcohol Ethoxylate#Fatty Acid Ethoxylate#Silicon Oil Emulsifier#oilfield surfactants market size

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Text

Defoamers Market: Global Industry Analysis and Forecast 2023 – 2030

Defoamers Market Size Was Valued at USD 3.91 Billion in 2022, and is Projected to Reach USD 6.09 Billion by 2030, Growing at a CAGR of 5.7% From 2023-2030.

Foam is a coarse dispersion of a gas in a liquid in which the volume percentage of gas is larger than the volume fraction of liquid. Foams are a major issue in industrial processes. They cause damage to the surface coatings.

They obstruct efficient container filling. Defoamers are chemical additives that minimize or prevent foam formation in industrial process liquids such as paints, inks, adhesives, and even construction materials. Although the phrases antifoam agent and defoamer are frequently used interchangeably, antifoam agents refer to compounds that prevent the creation and development of bubbles.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

https://introspectivemarketresearch.com/request/16222

The latest research on the Defoamers market provides a comprehensive overview of the market for the years 2023 to 2030. It gives a comprehensive picture of the global Defoamers industry, considering all significant industry trends, market dynamics, competitive landscape, and market analysis tools such as Porter's five forces analysis, Industry Value chain analysis, and PESTEL analysis of the Defoamers market. Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years. The report is designed to help readers find information and make decisions that will help them grow their businesses. The study is written with a specific goal in mind: to give business insights and consultancy to help customers make smart business decisions and achieve long-term success in their particular market areas.

Leading players involved in the Defoamers Market include:

Air Products and Chemicals Inc.(USA), Momentive Performance Materials Inc. (USA), Lubrizol Corporation (USA), Wilflex Corporation (USA), Alzo International Inc. (USA), Dow Corning Corporation (USA), Chemours Company (USA), Ashland Inc. (USA), Dow Chemical Company (USA), Solvay SA (Belgium), Evonik Industries AG (Germany), Clariant AG (Switzerland), Wacker Chemie AG (Germany), Arkema SA (France), Lanxess AG (Germany), BASF SE (Germany), Kemira Oyj (Finland), Elements Plc (UK), Croda International Plc (UK), Shin-Etsu Chemical Co. Ltd. (Japan)

If You Have Any Query Defoamers Market Report, Visit:

https://introspectivemarketresearch.com/inquiry/16222

Segmentation of Defoamers Market:

By Defoamer Type

Water-Based

Oil-Based

Silicone-Based

By Application

Pulp & Paper

Paintings & Coatings

Water Treatment

Food & Beverages

Textile

By Regions: -

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

What to Expect in Our Report?

(1) A complete section of the Defoamers market report is dedicated for market dynamics, which include influence factors, market drivers, challenges, opportunities, and trends.

(2) Another broad section of the research study is reserved for regional analysis of the Defoamers market where important regions and countries are assessed for their growth potential, consumption, market share, and other vital factors indicating their market growth.

(3) Players can use the competitive analysis provided in the report to build new strategies or fine-tune their existing ones to rise above market challenges and increase their share of the Defoamers market.

(4) The report also discusses competitive situation and trends and sheds light on company expansions and merger and acquisition taking place in the Defoamers market. Moreover, it brings to light the market concentration rate and market shares of top three and five players.

(5) Readers are provided with findings and conclusion of the research study provided in the Defoamers Market report.

Our study encompasses major growth determinants and drivers, along with extensive segmentation areas. Through in-depth analysis of supply and sales channels, including upstream and downstream fundamentals, we present a complete market ecosystem.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Acquire This Reports: -

https://introspectivemarketresearch.com/checkout/?user=1&_sid=16222

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyse extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1049

Email: [email protected]

#Defoamers#Defoamers Market#Defoamers Market Size#Defoamers Market Share#Defoamers Market Growth#Defoamers Market Trend#Defoamers Market segment#Defoamers Market Opportunity#Defoamers Market Analysis 2023

0 notes

Text

Defoamer Surfactant Prices | Pricing | News | Database | Index | Chart | Forecast

Defoamer surfactant prices have been a focal point of discussion in various industries due to their significant impact on production costs and product quality. Defoamers, also known as antifoams, are chemical additives used to reduce and control foam in industrial processes, which can otherwise hinder production efficiency and compromise the quality of the final product. These surfactants are critical in a range of applications including water treatment, pharmaceuticals, food processing, and manufacturing. As industries strive for optimal performance and cost efficiency, understanding the factors influencing defoamer surfactant prices is crucial.

The pricing of defoamer surfactants is influenced by several key factors including raw material costs, production methods, and market demand. Raw materials play a significant role in determining the cost of defoamers. Commonly used raw materials include silicones, organic compounds, and polymer-based substances, each of which has its own cost dynamics. Fluctuations in the prices of these raw materials, driven by global supply and demand, directly impact the cost of defoamer surfactants. For instance, silicone-based defoamers, which are known for their effectiveness and versatility, can be more expensive due to the complexity and cost of producing silicone compounds.

Production methods also contribute to the variability in defoamer surfactant prices. Advanced production techniques that enhance the efficiency and performance of defoamers may involve higher manufacturing costs. This includes processes that ensure the purity and consistency of the final product. Manufacturers investing in state-of-the-art technology and high-quality control measures often pass these costs onto consumers, reflecting in the final price of the defoamer surfactant. Additionally, economies of scale can affect prices; larger production volumes can lead to reduced costs per unit, benefiting industries with high consumption rates of defoamer surfactants.

Get Real Time Prices for Defoamer surfactant: https://www.chemanalyst.com/Pricing-data/defoamer-surfactant-1240

Market demand is another crucial factor influencing defoamer surfactant prices. As industries expand and new applications for defoamers emerge, demand for these surfactants can fluctuate. High demand often drives up prices, especially if supply does not keep pace with consumption. Conversely, when demand is low, prices may decrease, reflecting the market's ability to balance supply and demand dynamics. Seasonal variations and industry-specific trends can also cause fluctuations in defoamer prices. For example, a surge in the production of consumer goods that require foam control could lead to temporary price increases.

Geopolitical factors and trade policies further impact the pricing of defoamer surfactants. Changes in international trade agreements, tariffs, and export restrictions can affect the cost of raw materials and, consequently, the final price of defoamers. Companies sourcing raw materials from different regions may face varying cost structures depending on the trade policies in those regions. For instance, trade tensions between major producing and consuming countries can lead to increased costs for raw materials, which are then reflected in the prices of defoamer surfactants.

The competitive landscape of the defoamer market also plays a role in determining prices. The presence of multiple manufacturers and suppliers creates a competitive environment where prices are influenced by market competition. Companies aiming to capture a larger market share may adjust their pricing strategies to attract customers, leading to price variations across different suppliers. Additionally, innovation and technological advancements in defoamer formulations can introduce new products with unique benefits, which may command premium prices compared to traditional defoamers.

Economic conditions and currency fluctuations are overarching factors that affect defoamer surfactant prices on a global scale. Economic downturns can lead to reduced industrial activity and lower demand for defoamers, potentially driving prices down. Conversely, economic growth can spur increased production and higher demand, leading to price increases. Currency exchange rates also play a critical role, as fluctuations can impact the cost of imported raw materials and finished products, thereby influencing overall prices in different markets.

In summary, defoamer surfactant prices are shaped by a complex interplay of raw material costs, production methods, market demand, geopolitical factors, trade policies, competition, and economic conditions. Understanding these factors can help industries make informed decisions regarding their use of defoamer surfactants and manage costs effectively. As the global market continues to evolve, keeping abreast of these influences will be essential for businesses seeking to optimize their operations and maintain cost efficiency.

Get Real Time Prices for Defoamer surfactant: https://www.chemanalyst.com/Pricing-data/defoamer-surfactant-1240

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Defoamer Surfactant#Defoamer Surfactant Price#Defoamer Surfactant Prices#Defoamer Surfactant Pricing#Defoamer Surfactant News

0 notes

Text

Water Treatment Additives Market - Forecast(2024 - 2030)

Water Treatment Additives Market Overview

The water treatment additives market size is forecasted to reach US$35.0 billion by 2027, after growing at a CAGR of around 4.1% from 2022 to 2027. The water treatment additives are chemical products added as conditioners that purify the water and improve the quality. The water treatment additives such as corrosion inhibitors, disinfectants, defoamers, coagulants, and others are used in the water purification and treatment applications across various industries. The growing demand of water treatment additives in major end-use industries such as chemical, food and beverage, water and wastewater treatment, and others is creating a drive in the market. Furthermore, the water scarcity concerns will offer major demand in the water treatment additives market and growth opportunities during the forecast period.

COVID-19 Impact

The water treatment additives industry was majorly impacted by the global slowdown during the covid-19 outbreak. The water treatment additives have high demand in chemical, oil and gas, and other sectors. The oil and gas industry was majorly impacted and faced major disruption in the pandemic. The factors such as demand and supply gap, closure of oil and gas production and exploration plants, and volatility and oil prices led to a major decline in the growth prospects for oil and gas sector. Moreover, slowdown in production activities, falling demand, and supply chain disturbances impacted the growth in the market. According to the International Energy Association (IEA), the global oil demand stood at 99.9 million barrels per day in 2020, showing a decline of 90,000 barrels per day from 2019. The fall in growth of oil and gas sector led to decline in the application of water treatment additives and demand in the market. Thus, with restricted demand and applications in major end use industries, the water treatment additives market faced major slowdown in the covid-19 outbreak.

Request Sample

Report Coverage

The “Water Treatment Additives Market Report– Forecast (2022-2027)” by IndustryARC covers an in-depth analysis of the following segments of the water treatment additives industry.

By Type: Coagulants, Corrosion Inhibitors, Disinfectants, Dechlorinating Agent, pH Conditioners, Defoamer, and Other By Form: Solid and Liquid By Application: Drinking Water Purification, Sewage Systems, Steam Boilers, Cooling Water Systems, and Other By End Use Industry: Food and Beverage (Whiskey, Juices, and Others), Power Industry, Oil & Gas, Water and Wastewater Treatment Industry, Paper & Pulp, Mining, Chemicals Industry, And Others By Geography: North America (USA, Canada, and Mexico), Europe (UK, Germany, France, Italy, Netherlands, Spain, Russia, Belgium, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and New Zealand, Indonesia, Taiwan, Malaysia, and Rest of APAC), South America (Brazil, Argentina, Colombia, Chile, and Rest of South America), Middle East (Saudi Arabia, UAE, Israel, Rest of the Middle East) and Africa (South Africa, Nigeria, Rest of Africa)

Key Takeaways

The water treatment additives market size will increase owing to its growing application for water and wastewater treatment, drinking water purification, sewage systems treatment, and others during the forecast period.

The Asia Pacific is the fastest growing region in the water treatment additives industry owing to flourishing emphasis on clean drinking water.

The demand of coagulants as major water treatment additives is rising due to its application in water treatment and purification in major industries such as oil and gas, chemical, and others.

Inquiry Before Buying

Water Treatment Additives Market Segment Analysis – By Type

By type, the coagulant is the fastest growing segment and is expected to grow with a CAGR of around 5.2% during the forecast period. The growing usage of coagulants for water and wastewater treatment applications, sewage systems, industrial water treatment, and others is offering high demand in the market. The demand of coagulants in water treatment plants is growing owing to its usage in removal of solid waste from the water and oil purification across various end-use industries, majorly oil and gas. Moreover, the growing development in the oil and gas plants across the world is boosting the demand of coagulants for water treatment applications and oil purifications. According to the U.S. Energy Information Administration (EIA), around 1.9 million barrels per day consumption of liquid fuels and petroleum is estimated for 2023 to average 101.5 million barrels per day. Thus, with increasing demand of water treatment additives, majorly coagulants for solid waste removal and purification across major industries, the water treatment additives market will grow rapidly during the forecast period.

Water Treatment Additives Market Segment Analysis – By End-Use Industry

By end-use industry, the water and wastewater treatment segment held the largest water treatment additives market share in 2021, with a share of over 24.0%. The high demand of water treatment additives in the water and wastewater treatment sector is influenced by growing awareness for wastewater recycling, safe drinking water scarcity, and increasing usage of clean water across various industries. The treatment additives such as defoamers, corrosive inhibitors, biocides, coagulants, disinfectants, sodium bicarbonate, and others are widely used in treating the municipal wastewater, sewage water distribution, and others. Moreover, growing wastewater plants set-up across the globe is propelling the growth of water treatment additives. According to the United Nations Water, around 56% of household wastewater flows were treated in the year 2020 globally. Thus, with increasing application of water treatment additives in water and wastewater treatment sector for offering clean and safe drinking water, the global water treatment additives market will grow rapidly during the forecast period.

Schedule a Call

Water Treatment Additives Market Segment Analysis – By Geography

By geography, the Asia Pacific is the fastest-growing region in the water treatment additives market and is expected to grow with a CAGR of around 5.9% during the forecast period. The high demand of water treatment additives in this region is influenced by its growing demand for water purification, and treatment procedures across various end-use industries such as wastewater, oil and gas, chemical, and others. Furthermore, the rise in demand of water treatment additives in the chemical processing sector is propelling the growth in the market. According to the European Chemical Industry Council (CEFIC), the chemical output growth in China accounted for 2.9% in 2020. Moreover, the development in the wastewater treatment and clean drinking water projects in APAC region is boosting the demand of water treatment additives. Thus, with a flourishing emphasis on water purification and treatment applications across major industries such as chemical, oil & gas, power, and others, the water treatment additives industry will grow rapidly during the forecast period.

Water Treatment Additives Market– Drivers

Favorable regulations for water and wastewater treatment

The water scarcity and limited availability of purified water is accelerating the growth of water treatment additives. The requirement of clean water across various end-use industries is influencing the growth of water treatment chemicals and additives. The strict regulations by government to recycle the wastewater and treat contaminated water is offering a major drive in the market, thereby boosting the application of water treatment chemicals and additives such as chlorine dioxide, algicide, biocides, disinfectants, and others. According to the Organization for Economic Co-Operation and Development (OECD), around 92.86% of the public in Australia is connected to a wastewater treatment in 2020. Thus, with increasing concerns for the treatment of water and wastewater, the water treatment additives industry is experiencing major growth.

High demand in the oil and gas sector

The water treatment additives such as chlorine dioxide, coagulants, corrosion inhibitors, disinfectants, and others have major demand in the oil and gas sector. The petroleum refineries use water and steam for various processes such as FCC, cooling towers, steam generators, and others. The rising scarcity of clean water in oil and gas is propelling the demand for water treatment additives. Furthermore, the demand of water and wastewater treatment in onshore as well as offshore sector is riding. According to the India Brand Equity Foundation (IBEF), the oil demand in India is expected to reach 11 million barrels per day by the year 2045. Thus, with major application and flourishing demand or water treatment additives and chemicals in oil and gas sector, the water treatment additives market is experiencing a major growth.

Buy Now

Water Treatment Additives Market– Challenges

Hazardous nature of water treatment additives and alternate treatment technologies

The water treatment additives have a growing demand for treatment of the water and purification systems. However, the health hazards associated with various additives and chemicals such as chlorine dioxide, biocides, and others is offering a major challenge in the market. The risks of health hazards such as respiratory system irritation, skin issues, nervous system complications, gastrointestinal tract issues, and other creates a hamper. Moreover, the availability of alternative water treatment technologies such as RO filtration, UV disinfection, and others creates challenge in the market. Thus, with regulations on the hazardous water treatment chemicals and availability of eco-friendly alternatives is leading to slowdown and restricted growth for the water treatment additives industry.

Water Treatment Additives Industry Outlook

The water treatment additives top 10 companies include:

1. BASF SE 2. Kemira OYJ 3. Aqua Tech International 4. TG Water Additives LLC 5. RX Marine International 6. Suez S.A. 7. Solenis LLC 8. Ecolab Inc. 9. 3M Purification 10. GE Water & Process Technologies

Recent Developments

In November 2021, the Platinum Equity completed the acquisition of Solenis LLC, a leading water treatment chemical company. Thus, this acquisition will provide growth and diverse portfolio in the water treatment additives industry.

In October 2021, the Usalco, LLC, a leading producer of water treatment chemicals announced the acquisition of the water treatment business of Altivia for municipal and wastewater and industrial applications. This acquisition expanded the coagulant product offering in the market.

In June 2021, the Kemira announced two major investments for expanding the capacity of water treatment chemicals at Yangzhou site in China for serving growth in the water treatment in the Asia Pacific region.

#Water Treatment Additives Market#Water Treatment Additives Market Share#Water Treatment Additives Market Size#Water Treatment Additives Market Forecast#Water Treatment Additives Market Report#Water Treatment Additives Market Growth

0 notes

Text

Navigating the Dynamics of the Latex Ink Industry: Market Insights and Strategies

What is Latex Ink? Latex ink, also known as resin ink, is a type of printer ink that is made of a water-based emulsion containing latex particles, pigments, and additional compounds. When applied to paper, the water evaporates leaving behind a thin film of the pigmented polymer resin on the surface. This allows latex inks to produce sharper text and images compared to traditional dye-based inks. How Latex Ink Works Latex inks are made up of pigmented polymers suspended in water. The key components are: - Pigments:

Finely ground coloring particles like carbon black, cyan, magenta, yellow, etc. that provide color. - Resins:

Synthetic latex polymers like styrene-acrylic that harden when dried. Common resins include polyvinyl acetate and acrylate polymers. - Water:

The main liquid carrier that transports the pigmented polymer particles to the paper. - Additional agents:

Surfactants, biocides, binders, defoamers, and other compounds to improve characteristics. When applied via an inkjet printer, the water evaporates leaving behind a thin film of the color pigments bonded within the synthetic resin on the surface of the paper. This allows sharp, detailed images to form. The resin then hardens, binding the pigments tightly to the paper for improved durability. Benefits of Latex Ink There are several advantages that latex ink offers over traditional dye-based inks: - Sharper text and images:

As the ink forms a thin film on the paper rather than soaking into it, text and lines appear sharper and more defined. - More vibrant colors:

Latex inks can produce brighter, more saturated colors compared to dye inks which tend to have lighter, less vivid coloring. - Water and smudge resistance:

Once dried, the polymer resin protects the color pigments from water damage or smudging. Latex ink markings are highly resistant to water and other liquids. - Longevity:

The pigments are tightly bound within the synthetic resin layer, providing excellent resistance to fading. Photos and documents printed with latex inks can last for decades without noticeable color change. - Eco-friendly:

Many latex inks use non-toxic pigments and are considered safer for the environment than traditional dye inks which contain more volatile organic compounds. Applications Thanks to its properties, latex ink has became the standard for many commercial and professional printing needs where quality, durability and longevity are priorities: - Photography printing:

Used by photo labs and printers for long-lasting, pigment-based prints that resist fading. - Document printing:

Ideal for receipts, contracts and sensitive documents that require water/smudge resistance and long-term archiving. - Signage/large format printing:

Used in industrial printers for banners, signs, vehicle wraps and displays that need to withstand wide temperature variations and UV exposure outdoors. - Fine art reproduction:

Replicates artwork, paintings and other original works with accurate, vibrant colors on canvas or high-quality paper. - Textile printing:

Used for imprinting durable designs and logos directly onto fabrics for clothing, home décor and soft signage. - Packaging: Well-suited for coding/marking product boxes, labels, wrappers and other consumer packaging. Drawbacks of Latex Ink While latex ink provides several benefits, there are some disadvantages to consider: - Higher cost:

Latex inks tend to be more expensive than dye-based inks due to more complex formulations and pigment content. - Potential allergies:

For some users, the polymers and ingredients may possibly cause contact dermatitis or other allergic reactions. - Limited color range:

Unlike dye inks, the number of distinct pigment colors that can be produced is still slightly limited for wide-gamut applications like photography. - Printer compatibility:

Not all printers are optimized for latex inks and may experience clogging, reduced print quality or shorter printhead life compared to standard inks. - Environmental precautions:

Like any ink, latex varieties require responsible disposal since pigments could potentially leach into water sources. In summary, latex ink has earned its top position for professional photo and commercial printing jobs where colorfastness, long-term display and protection from damage matter most. With continued ink innovations, its capabilities and applications will likely continue expanding in the future printing industry.

0 notes

Text

Epoxy Resin Carbon Fiber Composite Material Helps Lighten New Energy Vehicles

In recent years, as global environmental protection standards have become stricter and consumer demand has increased, many countries have introduced industrial support policies to support the research and development of new energy vehicle technologies and further promote the entire industry chain and ecological construction of new energy vehicles.

According to statistics from the authoritative organization EV-Volumes: In May 2023, global electric vehicle sales exceeded one million units for the first time, reaching 1,057,509 units. This is the fifth time in history that this feat has been achieved.

As the global electric vehicle market continues to grow and consumer demand for environmentally friendly travel increases, the sales momentum of electric vehicles will continue to grow. In order to meet market demand, major automobile manufacturers are continuously increasing investment and launching more electric vehicle products.

However, the electric vehicle market still faces some challenges. How to further improve the performance of new energy vehicles? The answer is automobile lightweighting.

Lightweighting of automobiles--reducing the mass of the automobile body as much as possible without reducing the strength and safety performance of the automobile.

How to choose lightweight materials?

From the performance comparison between carbon fiber composite materials and other lightweight materials, we can clearly see that carbon fiber composite materials have the smallest density and their strength performance is far superior to other lightweight materials. Using carbon fiber reinforced epoxy resin composites (CFRP) to partially replace traditional metal materials is currently one of the most effective ways to achieve lightweighting in automobiles.

How are carbon fiber composite materials produced?

High-pressure resin transfer molding process, referred to as HP-RTM molding process. It refers to the molding process of using high-pressure pressure to mix and inject resin into a vacuum-sealed mold pre-laid with fiber reinforced materials and pre-set inserts, and then through resin flow filling, impregnation, curing and demoulding to obtain composite products. Low-cost, short-cycle (large-volume), and high-quality production can be achieved.

Carbon fiber composite products for automotive use

These exquisite carbon fiber composite materials are made from high-performance epoxy resin systems and carbon fiber materials through the HP-RTM process, and have been used in new energy vehicles on a large scale, effectively achieving the effect of lightweighting the vehicle.

What are the characteristics of the epoxy resin formula system used in HP-RTM process?

The epoxy resin formula system used in the HP-RTM process has the characteristics of fast curing speed, high defoaming, high wettability, low viscosity, low volatility, low curing shrinkage, low exothermic peak, and etc.

The 0164 series epoxy resin produced by YQXPOLYMER, combined with the HP-RTM special epoxy resin curing agent system, has the advantages of fast curing and molding speed, low exothermic peak during the curing process, good wettability with reinforcing fibers, and high physical and mechanical strength of the product. It is completely suitable for HP-RTM molding process and is a high-quality material for preparing carbon fiber composite materials for automobiles.

YQXPOLYMER will use its consistent high quality to protect automotive carbon fiber composite materials and efficiently promote the development of the new energy vehicle lightweight industry.

More information or free samples or price quotations, please contact us via email: [email protected] , or voice to us at: +86-28-8411-1861.

#epoxy resin#epoxy resin manufacturer#bisphenol a type epoxy resin#epoxy resin supplier#carbon fiber composite material#automobile lightweighting#YQXPOLYMER

1 note

·

View note