#bisphenol a type epoxy resin

Explore tagged Tumblr posts

Text

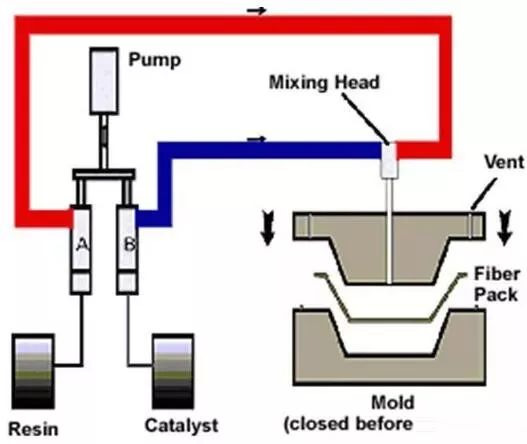

What is the RTM Molding Process for Composite Material?

RTM refers to a process technology in which low-viscosity resin flows in a closed mold, infiltrates reinforced materials and solidifies into shape. It belongs to the category of liquid forming or structural liquid forming technology of composite materials. The specific method is to pre-place reinforced materials that have been rationally designed, cut or mechanized pre-formed into the designed mold. The mold needs to be sealed and tightened around the perimeter to ensure smooth resin flow. After the mold is closed, a certain amount of resin is injected. And after the resin solidifies, the desired product can be obtained by demoulding.

The RTM molding process has the following main characteristics

RTM is a closed mold molding process. The infiltration of the reinforcement and the resin is completed by the rapid flow of pressurized resin in a closed mold cavity, instead of manual infiltration in hand lay-up and spraying processes, nor expensive mechanized infiltration in prepreg and SMC processes. RTM is a low-cost, high-quality semi-mechanized fiber/resin impregnation method.

The RTM molding process uses reinforced material preform technology that is similar to the shape of the product. Once the fiber/resin infiltration is completed, it can be cured, so a low-viscosity fast-curing resin system can be used. It can also heat the RTM mold to further improve production efficiency and product quality.

The reinforced material preform in the RTM molding process can be prepared from chopped strand mat, fiber cloth, wrinkle-free fabric, three-dimensional knitted fabric, three-dimensional braided fabric, etc. And according to the performance requirements, selective reinforcement, local reinforcement, hybrid reinforcement, and embedded and sandwich structures can be used, which can give full play to the performance designability of FRP/composite materials.

The closed-mold resin injection method of the RTM molding process can greatly reduce the toxicity of harmful resin components to the human body and the environment, and meet the increasingly stringent restrictions on the volatilization concentration of harmful gases such as styrene in advanced industries.

The RTM molding process generally adopts a low-pressure injection process, which is conducive to the preparation of complex overall structures with large sizes, complex shapes, and two-sided surfaces.

According to the requirements of the production scale, RTM molds can be selected from different grades of molds such as polyester molds, epoxy molds, surface nickel-plated material molds, alloy molds, aluminum molds and steel molds to reduce costs.

Requirements of RTM technology on epoxy resin systems

Epoxy resin has low viscosity at room temperature or lower temperature, and has a certain storage period.

Epoxy resin has good wettability, matching and adhesion to reinforced materials.

The epoxy resin system has good curing reactivity and does not produce volatile matter and other undesirable side reactions during the curing reaction. The curing temperature should not be too high, and the curing speed should be appropriate.

As a high-performance composite material, epoxy resin is also required to have high heat resistance and moisture resistance, excellent mechanical properties, especially toughness. In some special applications, it should also have certain functionalities, such as low dielectric loss, high conductivity, excellent flame retardancy, etc.

High-performance epoxy resin system is still the most widely used high-performance composite matrix. Epoxy resin systems usually used to make prepregs are difficult to mold using the RTM process due to their high viscosity and short storage life. In order to be suitable for RTM molding, YQXPOLYMER launched the 9320A/B epoxy resin curing system. 9320A/B is a special epoxy resin curing system for RTM process. This system product is composed of special epoxy resin and modified amine curing agent. The 9320A/B epoxy resin curing system has the characteristics of fast curing speed, good water resistance, high hardness, good adhesion, mechanical properties of the cured material and high Tg temperature. It can be widely used in automotive composite materials for RTM molding, cultural and sports products (fishing rods, badminton rackets, golf clubs, etc.) and other carbon fiber composite materials. The RTM process has a wide range of advantages. The molded parts have high fiber system content, low porosity, low water absorption, and good mechanical properties. Conventional resins and reinforcing materials can be used in the RTM process.

More information or free samples or price quotations, please contact us via email: [email protected] , or voice to us at: +86-28-8411-1861.

#epoxy resin#epoxy resin manufacturer#bisphenol a type epoxy resin#RTM#RTM molding process#epoxy resin supplier#epoxy resin system#RTM process#resin transfer molding#epoxy composite material#epoxy resin curing system#composite material

0 notes

Photo

Reduced health risks with new epoxy resin monomer

Epoxy resin monomers used in industry can result in severe contact allergies. Researchers at the University of Gothenburg have now developed a new type of epoxy resin monomer that is far less allergenic and is based on a renewable material. The epoxy resin monomers used today contain residues of the endocrine disruptor Bisphenol A (BPA). The new monomer derived from ordinary sugar is not based on BPA.

Epoxy resin monomers have been used for a long time in the construction industry and, more recently, in the production of the plastics used in wind turbines. The monomer is produced from BPA, which is derived from petroleum. The risk of developing a contact allergy when handling epoxy resin monomers is considerable, and sometimes it is not even enough to wear protective clothing.

"When we started our research, we had three goals. The monomer should be far less allergenic, be based on an easily accessible and renewable starting material, and not based on BPA, which is a known endocrine disruptor," says Kristina Luthman, Professor of Medicinal Chemistry at the University of Gothenburg.

Read more.

#Materials Science#Science#Allergens#Safety#Resin#Epoxy#Bisphenol A#Sugar#Biomaterials#Polymers#University of Gothenburg

22 notes

·

View notes

Text

Bisphenol Fluorene Market, Global Outlook and Forecast 2024-2030 Professional Edition

The global Bisphenol Fluorene market size was valued at US$ 345.6 million in 2024 and is projected to reach US$ 512.3 million by 2030, at a CAGR of 6.8% during the forecast period 2024-2030.

The United States Bisphenol Fluorene market size was valued at US$ 91.2 million in 2024 and is projected to reach US$ 131.4 million by 2030, at a CAGR of 6.3% during the forecast period 2024-2030.

Download FREE Sample of this Report @ https://www.24chemicalresearch.com/download-sample/281197/global-bisphenol-fluorene-forecast-edition-market-2024-2030-873

Chemical compound used in specialty polymer applications, featuring unique molecular structure for enhanced thermal and optical properties in electronic materials.

Report Overview

Bisphenol F (generally called BPF) is the dimer of phenolic resin. It consists of two phenolic rings joined together through a bridging carbon. Bisphenol F main use is an ingredient of epoxy resin. Purity of bisphenol F is essential to improve the properties of polymer made by epoxy resin.

This report provides a deep insight into the global Bisphenol Fluorene market covering all its essential aspects. This ranges from a macro overview of the market to micro details of the market size, competitive landscape, development trend, niche market, key market drivers and challenges, SWOT analysis, value chain analysis, etc.

The analysis helps the reader to shape the competition within the industries and strategies for the competitive environment to enhance the potential profit. Furthermore, it provides a simple framework for evaluating and accessing the position of the business organization. The report structure also focuses on the competitive landscape of the Global Bisphenol Fluorene Market, this report introduces in detail the market share, market performance, product situation, operation situation, etc. of the main players, which helps the readers in the industry to identify the main competitors and deeply understand the competition pattern of the market.

In a word, this report is a must-read for industry players, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Bisphenol Fluorene market in any manner.

Global Bisphenol Fluorene Market: Market Segmentation Analysis

The research report includes specific segments by region (country), manufacturers, Type, and Application. Market segmentation creates subsets of a market based on product type, end-user or application, Geographic, and other factors. By understanding the market segments, the decision-maker can leverage this targeting in the product, sales, and marketing strategies. Market segments can power your product development cycles by informing how you create product offerings for different segments.

Key Company

Osaka Gas Chemicals

Ever Galaxy Chemical

Anshan Tianchang Chemical

Eastin Chemical

Jinan Finer Chemical

Market Segmentation (by Type)

Electronical Grade

Technical Grade

Market Segmentation (by Application)

Liquid Crystal Materials

Polyester

Polycarbonate

Polyurethane

Other

Geographic Segmentation

North America (USA, Canada, Mexico)

Europe (Germany, UK, France, Russia, Italy, Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Rest of Asia-Pacific)

South America (Brazil, Argentina, Columbia, Rest of South America)

The Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, South Africa, Rest of MEA)

Key Benefits of This Market Research:

Industry drivers, restraints, and opportunities covered in the study

Neutral perspective on the market performance

Recent industry trends and developments

Competitive landscape & strategies of key players

Potential & niche segments and regions exhibiting promising growth covered

Historical, current, and projected market size, in terms of value

In-depth analysis of the Bisphenol Fluorene Market

Overview of the regional outlook of the Bisphenol Fluorene Market:

Key Reasons to Buy this Report:

Access to date statistics compiled by our researchers. These provide you with historical and forecast data, which is analyzed to tell you why your market is set to change

This enables you to anticipate market changes to remain ahead of your competitors

You will be able to copy data from the Excel spreadsheet straight into your marketing plans, business presentations, or other strategic documents

The concise analysis, clear graph, and table format will enable you to pinpoint the information you require quickly

Provision of market value (USD Billion) data for each segment and sub-segment

Indicates the region and segment that is expected to witness the fastest growth as well as to dominate the market

Analysis by geography highlighting the consumption of the product/service in the region as well as indicating the factors that are affecting the market within each region

Competitive landscape which incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled

Extensive company profiles comprising of company overview, company insights, product benchmarking, and SWOT analysis for the major market players

The current as well as the future market outlook of the industry concerning recent developments which involve growth opportunities and drivers as well as challenges and restraints of both emerging as well as developed regions

Includes in-depth analysis of the market from various perspectives through Porter’s five forces analysis

Provides insight into the market through Value Chain

Market dynamics scenario, along with growth opportunities of the market in the years to come

6-month post-sales analyst support

Customization of the Report

In case of any queries or customization requirements, please connect with our sales team, who will ensure that your requirements are met.

Chapter Outline

Chapter 1 mainly introduces the statistical scope of the report, market division standards, and market research methods.

Chapter 2 is an executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the Bisphenol Fluorene Market and its likely evolution in the short to mid-term, and long term.

Chapter 3 makes a detailed analysis of the market's competitive landscape of the market and provides the market share, capacity, output, price, latest development plan, merger, and acquisition information of the main manufacturers in the market.

Chapter 4 is the analysis of the whole market industrial chain, including the upstream and downstream of the industry, as well as Porter's five forces analysis.

Chapter 5 introduces the latest developments of the market, the driving factors and restrictive factors of the market, the challenges and risks faced by manufacturers in the industry, and the analysis of relevant policies in the industry.

Chapter 6 provides the analysis of various market segments according to product types, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 7 provides the analysis of various market segments according to application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 8 provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and capacity of each country in the world.

Chapter 9 introduces the basic situation of the main companies in the market in detail, including product sales revenue, sales volume, price, gross profit margin, market share, product introduction, recent development, etc.

Chapter 10 provides a quantitative analysis of the market size and development potential of each region in the next five years.

Chapter 11 provides a quantitative analysis of the market size and development potential of each market segment (product type and application) in the next five years.

Chapter 12 is the main points and conclusions of the report.

Get the Complete Report & TOC @ https://www.24chemicalresearch.com/reports/281197/global-bisphenol-fluorene-forecast-edition-market-2024-2030-873 Table of content

Table of Contents 1 Research Methodology and Statistical Scope 1.1 Market Definition and Statistical Scope of Bisphenol Fluorene 1.2 Key Market Segments 1.2.1 Bisphenol Fluorene Segment by Type 1.2.2 Bisphenol Fluorene Segment by Application 1.3 Methodology & Sources of Information 1.3.1 Research Methodology 1.3.2 Research Process 1.3.3 Market Breakdown and Data Triangulation 1.3.4 Base Year 1.3.5 Report Assumptions & Caveats 2 Bisphenol Fluorene Market Overview 2.1 Global Market Overview 2.1.1 Global Bisphenol Fluorene Market Size (M USD) Estimates and Forecasts (2019-2030) 2.1.2 Global Bisphenol Fluorene Sales Estimates and Forecasts (2019-2030) 2.2 Market Segment Executive Summary 2.3 Global Market Size by Region 3 Bisphenol Fluorene Market Competitive Landscape 3.1 Global Bisphenol Fluorene Sales by Manufacturers (2019-2024) 3.2 Global Bisphenol Fluorene Revenue Market Share by Manufacturers (2019-2024) 3.3 Bisphenol Fluorene Market Share by Company Type (Tier 1, Tier 2, and Tier 3) 3.4 Global Bisphenol Fluorene Average Price by Manufacturers (2019-2024) 3.5 Manufacturers Bisphenol Fluorene Sales Sites, Area Served, Product Type 3.6 Bisphenol Fluorene Market Competitive Situation and Trends 3.6.1 Bisphenol Fluorene Market Concentration Rate 3.6.2 Global 5 and 10 Largest Bisphenol Fluorene Players Market Share by Revenue 3.6.3 Mergers & Acquisitions, Expansion 4 Bisphenol Fluorene Industry Chain Analysis 4.1 Bisphenol Fluorene Industry Chain AnCONTACT US: North Main Road Koregaon Park, Pune, India - 411001. International: +1(646)-781-7170 Asia: +91 9169162030

Follow Us On linkedin :- https://www.linkedin.com/company/24chemicalresearch/

0 notes

Text

0 notes

Text

Asia-Pacific Metal Packaging Coatings Market - Forecast(2024 - 2030)

Asia-Pacific Metal Packaging Coatings Market Overview

Asia-Pacific Metal Packaging Coatings Market size is forecast to reach US$1,990.4 million by 2027, after growing at a CAGR of 7.3% during 2022-2027. The preference for metal food & beverage containers in the Asia-Pacific region has been increasing rapidly, owing to its range of benefits such as better product protection, durability, sustainability, affordability, light-weight, and more in comparison to other types of packaging. The development of new coating technologies which include Bisphenol A non-intent (BPA-NI) coatings are further fueling the growth of the market in the Asia-Pacific region. Moreover, increasing demand for metal packaging coatings from the pharmaceutical industry are further accelerating the growth of the market in the Asia-Pacific region. Also, strict regulations regarding the use of plastics in various countries across the Asia-Pacific region along with increasing product launches and developments associated with metal packaging is expected to increase the demand for metal packaging coatings for use in various end-use industries over the forecast period.

Covid-19 Impact

The COVID-19 outbreak led to major economic problems and challenges for the food & beverage, pharmaceutical, cosmetic, and other industries in the Asia-Pacific region. According to the International Monetary Fund (IMF), the GDP growth of the Asia declined by 1.3% and Australia by 2.4% as indicated in the graphs, owing to the economic impact of COVID-19. The governments all across the Asia-Pacific region announced strict measures to slow the spread of the coronavirus and only the production of essential commodities were allowed, which impacted the non-essential commodity industries, thereby impacting the production of metal packaging coatings as well. However, economic stimulus packages allotted for multiple sectors in the Asia-Pacific region and the start of industrial production activities since 2021 is improving the metal packaging coatings market growth in the Asia-Pacific region by its increasing utilization in various industries.

Report Coverage

The report: “Asia-Pacific Metal Packaging Coatings Market Report – Forecast (2022-2027)”, by IndustryARC, covers an in-depth analysis of the following segments of the Asia-Pacific metal packaging coatings industry.

By Packaging Types: Food (2 piece and 3 piece), Caps & Closure (External and Internal), and General Line (External and Internal) By Coating Types: Water based, Solvent based, and Powder based. By Resins Type: Acrylic, Fluoropolymer, Urethanes, Epoxy (BPA and Non-BPA), Amines, and Others. By Application: Food (Sea Food, Meat, Infant Nutrition & Dairy, Vegetables, Catering, Biscuits, Cookies & Confectionary, Fats & Oils, Toppings, and Others), Pharmaceutical, Cosmetics, Personal Care, and Others. By Country: China, Japan, Thailand, Vietnam, India, Indonesia, Malaysia, and Rest of Asia-Pacific.

Request Sample

Key Takeaways

China dominated the Asia-Pacific Metal Packaging Coatings Market in the year 2021. One of the key drivers driving the market is increasing use of metal packaging in food products such as fruits, vegetables, infant nutrition & dairy, bakery, and other similar products in order enhance the durability of metal packaging.

Increasing product launches for phenolic resins that are primarily used in a wide range of metal packaging coatings employed in food, pharmaceuticals, and other applications which require a smooth, durable, and spotless finish, has driven the market growth. For instance, In June 2020, companies such as Allnex GMBH, which has its presence in the Asia-Pacific region launched its new eco-friendly phenolic resin for use in BPAni application for metal packaging coatings.

Strict environmental regulations are driving metal packaging coating manufacturers in the Asia-Pacific region to adopt environmentally conscious practices, thus, the demand for water-based coatings are increasing significantly in the region.

Asia-Pacific Metal Packaging Coatings Market Segment Analysis – By Coating Types

The water based coating segment held the largest share in 2021 and is expected to grow at a CAGR of 8.2% by 2027. Water-based coating is an environmentally friendly surface treatment that disperses the resin used in the coatings using water as a solvent. They have a high degree of flexibility and reduce moisture and solar radiation absorption, thereby, resulting in fewer solvent emissions. The VOC (Volatile Organic Compounds) content in the water-based coating is significantly low, and since there are regulations restricting the high VOC content in Asia-Pacific is resulting in its increasing adoption by metal packaging coating manufacturers based in the region. For instance, in 2021, China launched its 14th Five-Year Plan, the chemical sector refocused its environmental protection goals on low-carbon transformation and comprehensive control of VOC emissions, as well as a considerable emphasis on encouraging low VOC products. Furthermore, as compared to solvent-based coatings, water-based coatings for metal packaging require less coating to cover the same surface area, cost less, and do not require any additives, thinners, or hardeners because they provide higher adherence. Thus, water-based barrier coatings are utilized to protect the metal packaging from external and internal effects by sealing the substrate surface.

Inquiry Before Buying

Asia-Pacific Metal Packaging Coatings Market Segment Analysis - By Application

Food sector held the largest share with 66% in the Asia-Pacific Metal Packaging Coatings Market in 2021 and is anticipated to grow at a CAGR of 7.4% during the forecast period 2022-2027. Metal packaging cans, containers, tins, and more are utilized for the packaging of the food because these types of packaging maintain the food filling's flavors and nutritional content ranging from months to several years. However, the direct contact between the metal packaging and food content filled inside the cans and other types of packaging are not safe. The direct contact between metal and food can degrade the food content, owing to this food-friendly coating are applied to safeguard the packaged food from corroding metal. The shifting the focus of Asia-Pacific packaging manufacturers from plastic to metal is expected to drive up the demand for metal packaging coatings for food cans. This is further projected to expand the market growth in the Asia-Pacific region. According to UACJ Corporation, between 2019 and 2022, global demand for aluminium used in cans will rise 11% to 6.61 million tons per year. Southeast Asian countries are likely to account for half of that demand, according to the report. Thus, rising demand for cans will accelerate the production for aluminium cans, which further benefits the metal packaging coatings demand.

Asia-Pacific Metal Packaging Coatings Market Segment Analysis – By Country

China dominated the Asia-Pacific Metal Packaging Coatings Market in terms of revenue with a share of 59% in 2021 and is projected to dominate the market during the forecast period (2022-2026). In China, the metal packaging coatings market is fueled by the growth of the country’s food & beverage sectors. For instance, according to the China Chain Store & Franchise Association, China’s food and beverage sector was valued at around US$ 595 billion in 2019, an increase of 7.8% in comparison to 2018. Metal cans offer a range of benefits such as better food protection, durability, sustainability, affordability, light-weight, and more in comparison to other types of packaging such as paper or plastic packaging. In August 2020, ORG technology, the Chinese manufacturer of food cans, launched its white paper on the strategic development of food cans. The company focused on coated iron metal cans with moisture-proof, environmental protection, safety, corrosion resistance, anti-extrusion, and other characteristics to gain traction in the market. In this way, such increasing food production along with the development of food cans in China, owing to its various benefits as mentioned above, is expected to increase the demand for metal packaging coatings to further enhance the durability of such food cans. This is expected to accelerate the growth of the market in China during the forecast period.

Schedule a Call

Asia-Pacific Metal Packaging Coatings Market Driver

Increasing Preference for Metal Containers in Food & Beverage Sector

Metal packaging coatings are primarily used to coat different metals such as steel, aluminum, tin-plate, and more that are used for food & beverage packaging in order to enhance its ability to resist corrosion. Metal containers offer a range of benefits such as better product protection, durability, sustainability, affordability, light-weight, and more in comparison to other types of packaging such as paper or plastic packaging. For instance, vegetables, fruits, pet food, soups, and meats are often packaged in metal cans. Canning foods help prolong their shelf life and can help people afford to make healthy dietary choices. Similarly, soda, beer, and even wine are usually packaged in aluminum cans since aluminum beverage cans are the most recycled category for aluminum products, with nearly 50 percent of all cans recycled annually. Thus, all of these benefits of metal containers are driving its demand over other types of packaging. As a result, many companies in the Asia-Pacific region have begun packaging their food & beverages in metal containers. For instance, in February 2021, Responsible Whatr, a brand based in India, launched spring water in aluminum beverage cans made by Ball Corporation, a leading manufacturer of aluminum packaging. The company intends to create a brand that signifies sustainability and become a significant contributor to the circular economy. In July 2020, Showa Aluminum Can Corporation (SAC), metal packaging manufacturer, launched its third aluminum can manufacturing facility in Vietnam with an overall plant capacity of 1.3 billion cans per year in order to meet the growing demand for metal packaging from the food & beverage sectors of the country. Thus, such increasing preference and use of metal containers in the Asia-Pacific region are expected to increase the demand for metal packaging coatings to further enhance the durability of the metal containers, thus, accelerating the growth of the market in the Asia-Pacific region.

Growing Demand from the Pharmaceutical Industry

Metal packaging coatings are primarily used in the pharmaceutical industry in order to provide protection to the metal from atmospheric corrosion and support decoration, labeling, and consumer information. Its range of benefits such as impermeability to light, moisture, gases, and water, durability, light-weight, and ease of printing labels directly onto the metal surface make them ideal for use in the pharmaceutical industry. Thus, an increase in pharmaceutical production in the Asia-Pacific region is expected to drive the market growth during the forecast period. According to Vietnam’s Ministry of Health, the pharmaceuticals industry is expected to grow at the rate of 10% per year from 2017 to 2028, owing to an increase in pharmaceutical production and sales in the country. Also, according to International Trade Administration, the local pharmaceutical production in Japan reached up to US$59,958 in 2017, US$62,570 in 2018, US$87,027 in 2019, and US$84,600 in 2020 respectively. thus, indicating an increase in pharmaceutical production in Japan per year. An increase in pharmaceutical production is expected to drive the demand for metal packaging coatings in the pharmaceutical industry, thus accelerating the growth of the market in the upcoming years.

Buy Now

Asia-Pacific Metal Packaging Coatings Market Challenges

Volatility of Raw Material Prices

Primary raw materials including resins, solvent, and more used in the production of metal packaging coatings are derived from crude oil. As a result, fluctuations in the prices of crude oil in the Asia-Pacific region may hinder the growth of the market. For instance, India’s Crude Oil Basket (COB) reached US$19.90 per barrel, which was the lowest record since February 2002. During the first 11 months of the year 2020-21, the average annual price of India’s COB was around US$42.72 per barrel, which decreased by 30% than the average COB price in 2019-20. Likewise, as per revised estimates for 2020-21, the COB has increased by around 35% from its initial budget estimate. Since October 2021, Vietnam has also witnessed a spike in demand for crude oil. According to the oil price, the price of light crude oil exceeded US$94.38 per barrel in February 2022, an increase of 3.63% that is equivalent to US$3.3, the highest record since November 2014. Similarly, the price of Brent crude oil also increased and reached up to US$95.39 per barrel, an increase of 1.98% which is equivalent to US$1.85.

Asia-Pacific Metal Packaging Coatings Industry Outlook

Technology launches, acquisitions, and R&D activities are key strategies adopted by players in the Asia-Pacific Metal Packaging Coatings Market. Asia-Pacific metal packaging coatings top 10 players include:

The Sherwin Williams Company

PPG Industries Inc.

AkzoNobel N.V.

Kansai Paint Co., Ltd.

Altana AG (Actega)

Henkel AG & Co. KGaA

Axalta Coating Systems Ltd.

Eason & Co.

Toyochem Co., Ltd.

Kangnam Jevisco Co., Ltd. and Others.

Recent Developments

In June 2021, AkzoNobel has invested in research and development activities associated with packaging coatings. The research is primarily focused on development of a new, and recyclable coating through use of bio-derived polyelectrolytes. These polyelectrolytes are 100% natural and are extracted from shrimp shells or waste from the wood processing industry. The versatility of natural polyelectrolytes will allow the company to become less dependent on synthesized polymers for packaging coatings.

In May 2021, ALTANA completed its acquisition of the closure materials business of Henkel group, a chemical and consumer goods manufacturing company with a strong regional presence in the Asia-Pacific region. Within the ALTANA Group, the business will be integrated into the ACTEGA division and globally assigned to the metal packaging solutions business line including the Asia-Pacific region. The main objective of this acquisition is to strengthen the company’s focus on innovative specialty chemicals.

In March 2021, Toyochem launched a new line of Bisphenol A non-intent (BPA-NI) internal coatings for metal beverage bottles and cans. These coatings are based on acrylic emulsion and polyester resins. The new BPA-NI internal sprays and coil coatings for stay-on tab (SOT) ends are specially formulated to achieve the required performance results, while addressing BPA-related health and food safety concerns from regulators and consumers in the Asia-Pacific region and worldwide.

#Asia-Pacific Metal Packaging Coatings Market#Asia-Pacific Metal Packaging Coatings Market Share#Asia-Pacific Metal Packaging Coatings Market Size#Asia-Pacific Metal Packaging Coatings Market Forecast

0 notes

Photo

The ever-changing client items market has made it extra essential than ever to concentrate on the supplies utilized in commonplace items. The use of bisphenol A (BPA) in plastics is one such difficulty. Chemical element BPA is steadily included in a number of plastics and resin coatings; attributable to its attainable destructive results on well being, there's growing curiosity in BPA-free alternate options. In this tutorial, we are going to take a better have a look at plastics and discover ways to inform if a product is BPA-free, interpret the various plastic codes that point out totally different varieties, discuss necessary security precautions, and draw consideration to attainable dangers associated to non-BPA-free plastics. How to Tell if My Plastic Is BPA-Free Understanding the parts utilized in an merchandise’s manufacturing course of, deciphering symbols, and making observations are all mandatory to find out whether or not a plastic product is BPA-free. Thankfully, you may decide the BPA focus of your plastic objects by taking some simple measures. Check for Resin Codes Each plastic object has a resin identification code, usually referred to as the recycling image, printed on it. Look for a quantity contained in the arrow-shaped triangle, which is often discovered across the backside of the item. Plastics with the code”3″ (polyvinyl chloride, or PVC) and”7″ (different, steadily combined plastics) are steadily found to include BPA. However, not all plastics with a “7” designation include BPA; this can be a broad class that features quite a lot of supplies. Look for BPA-Free Labels “BPA-free” labels are steadily proudly displayed on objects by producers. Although it isn't required, many companies use this label as a part of their advertising and marketing technique to reassure prospects that their merchandise are freed from BPA. Seek for any clear claims about BPA presence on product labels or packaging. Consider the Material Epoxy resins and polycarbonate plastics are steadily made with BPA. You can estimate the quantity of BPA in an merchandise if you realize what sort of plastic it's manufactured from. Products manufactured from polypropylene (“5”), polyethylene (recycling code “1”), or polyethylene terephthalate (“1”), for instance, are sometimes devoid of BPA. Being in a position to decide if plastic is BPA-free provides you the power to decide on issues that you simply use often with data. You could promote a more healthy and extra acutely aware life-style by adopting these strategies into your utilization and shopping for routines. Check the Recycling Codes One helpful technique to discover out if a plastic product is freed from Bisphenol A (BPA) is to lookup the recycling codes, generally referred to as resin identification numbers. These identifiers are often seen contained in the recycling triangle that's steadily seen on the underside of plastic merchandise. Every code is related to a specific sort of plastic and gives info on the fabric’s composition and, sometimes, the potential of BPA presence. Recycling Codes: Code 1 PET PET, an acronym for polyethylene terephthalate, is represented by code 1. PET is a fabric that's steadily used to make meals containers, beverage bottles, and a few materials. It is secure and is freed from BPA. There is much less probability of chemical leaching with this plastic, which can be readily recyclable. Recycling Codes: Code 2 HDPE Recycling code 2 stands for High-Density Polyethylene or HDPE. Milk, detergent, and residential cleansing containers are steadily manufactured from this type of plastic. Similar to PET, HDPE is thought to be a secure alternative due to its chemical resistance and sturdiness, in addition to the truth that it doesn't include BPA. Recycling Codes: Code 3 PVC Polyvinyl chloride, or PVC, is correlated with recycling code 3. PVC is steadily utilized in flooring, pipelines, and a few packaging supplies. It is essential to keep in mind that BPA and different doubtlessly dangerous chemical substances are steadily present in PVC. If you wish to steer clear of BPA, it's often preferable to keep away from objects with recycling code 3. Recycling Codes: Code 4 LDPE Recycle code 4 designates Low-Density Polyethylene, or LDPE. Shrink wrap, plastic luggage, and varied containers are typical merchandise manufactured from this type of plastic. For storing meals, LDPE is often secure and considered BPA-free. Recycling Codes: Code 5 PP Recycling code 5 is an acronym for polypropylene, or PP. PP is steadily utilized in packaging, pharmaceutical bottles, and meals containers. It is thought for its warmth resistance and flexibility to a variety of functions, and it's BPA-free. Recycling Codes: Code 6 PS Code 6 is equal to Polystyrene, or PS. Disposable merchandise like meals service trays and foam cups embrace PS. Although PS is mostly BPA-free, it's best to keep away from utilizing it for warm meals or drinks since it could emit chemical substances which are poisonous at excessive temperatures. Recycling Codes: Code 7 OTHER Code 7 for recycling contains quite a lot of polymers that aren't included within the different six classes. Composite supplies and combined polymers are included. Even although sure code 7 plastics won't include BPA, it's nonetheless necessary to make use of warning and, if attainable, to contact the producer for extra info to make certain the product is secure. Empower Your Choices: A Guide on How to Know if Plastic is BPA-Free In conclusion, prospects could acknowledge BPA-free plastics by figuring out recycling codes. It is safer to decide on codes 1 (PET), 2 (HDPE), 4 (LDPE), and 5 (PP). BPA could also be current in Code 3 (PVC), subsequently you have to be cautious with these merchandise. While Code 6 (PS) is often secure, extreme warmth could also be an issue. Code 7 (OTHER) wants nearer examination to find out its security. Individuals could promote environmental consciousness and well-being by adopting BPA-free, more healthy life-style decisions by utilizing recycling codes as a information. The publish How to Tell if Your Plastic is BPA-Free appeared first on Fit Men Cook.

0 notes

Text

From Production Process to Industrial Applications: A Deep Dive into Epoxy Resin (2023–2034)

Epoxy Resin, often perceived as a complex scientific compound, is surprisingly versatile, finding applications. This blog serves as your comprehensive guide to all things epoxies! In this blog we'll embark on a journey into the captivating realm of epoxy resin, dwelling into:

The Science: Unveiling the chemistry behind epoxy, we'll elucidate its remarkable properties as a potent adhesive, sealant, and casting material.

Industrial Applications: Exploring the extensive industrial uses of epoxy, we'll examine its role in constructing robust composite materials and safeguarding electrical components.

Manufacturing Process: Get super detailed information about the process that leads into the formation of this resin and gain knowledge about the feedstock used for its production.

Introduction

Epoxy Resin is a versatile synthetic polymer valued for its exceptional adhesive, mechanical, and electrical properties. Its widespread applications include serving as adhesives in construction, woodworking, and manufacturing industries due to its robust bonding capabilities and resistance to environmental factors like moisture, chemicals, and temperature fluctuations. Moreover, epoxy resin finds extensive use in coatings and sealants, providing corrosion and abrasion resistance in diverse sectors such as flooring, automotive, marine, and aerospace. It is also a crucial component in composite materials, contributing to the production of strong yet lightweight structures in aerospace, automotive, sports equipment, and construction. Additionally, its low viscosity makes it suitable for molding and casting various objects, prototypes, and architectural elements, allowing for precise reproduction of fine details in sculptures and models.

These versatile properties make epoxy resin indispensable across industries, driving innovation and enabling the creation of durable, high-performance products. Various types of epoxy resins are utilized across different sectors. These resins are Bisphenol A Based Resin, Bisphenol F Based Resin, Epoxy Phenol Novolac Based Resin, Cycloaliphatic Epoxy Based Resin, and Others. Bisphenol A Based Resin finds extensive use across diverse applications, spanning coatings, civil engineering, adhesives, electrical insulation materials, and reactive intermediates. The global Epoxy Resin market is likely to flourish at a moderate CAGR of 4.11% by the year 2034.

Manufacturing Process

Epoxy resins exhibit high viscosity levels and are typically molded. Catalysts or curing agents, such as accelerators or hardeners, can facilitate curing either through catalytic action or direct reaction with the resin. Epoxy resins are typically created through the reaction of compounds containing at least two active hydrogen atoms, including polyphenolic compounds, diamines, amino phenols, heterocyclic imides and amides, and aliphatic diols, with epichlorohydrin. The oxirane group within an epoxy monomer reacts with various curing agents such as aliphatic and aromatic amines, phenols, polyamides, amidoamines, anhydrides, thiols, and acids. These reactions lead to the formation of rigid thermosetting products through the combination with other suitable ring-opening compounds.

Epoxy resins are commonly synthesized through a reaction between epichlorohydrin (ECH) and Bisphenol-A (BPA), although alternative raw materials like Aliphatic Glycols, Phenol, And O-Cresol Novolacs. Initially, ECH and BPA are introduced into a reactor, followed by the addition of a caustic soda solution as the mixture reaches its boiling point. After unreacted ECH evaporates, the resulting phases are separated using an inert solvent such as Methyl Isobutyl Ketone (MIBK). Subsequently, the resin undergoes water washing, and solvent removal is accomplished via vacuum distillation. Producers then incorporate specific additives tailored to desired properties such as flexibility, viscosity, color, adhesiveness, and accelerated curing, depending on intended applications. These resins can be obtained in liquid or solid forms through similar processes. To transform epoxy resins into durable and rigid materials, curing with a hardener is an essential step. Primary and secondary amines are commonly employed as curing agents.

Maximize image

Edit image

Delete image

Source: VALCO

Applications of Epoxy Resin:

Paints & Coatings

Due to their exceptional bonding properties with metals, epoxy resins and amine curing agents exhibit outstanding anticorrosion characteristics when incorporated into coatings. When utilizing high molecular weight variants, these coatings display excellent secondary workability, rendering them ideal as PCM primers. Additionally, epoxy resins offer a diverse range of viscosities, spanning from solventless to solvent-based types, making them well-suited as ink components where viscosity attributes play a crucial role.

Adhesives

Epoxy resin is widely utilized as an adhesive due to its robust properties, particularly in structural and engineering applications. Its versatility extends across various industries, including vehicle construction, snowboard manufacturing, aircraft assembly, and bicycle production. Beyond structural uses, epoxy adhesives find application in virtually any scenario.

Electronics and Electrical Systems

Epoxy resins are integral to manufacture insulators, motors, transformers, and generators. Renowned for its exceptional insulating properties, epoxy resin provides effective safeguarding against dust, moisture, and short circuits, making it a prominent choice for circuitry production as well.

Repair Epoxy resins effectively blend with a range of materials such as latex, wood, metal, and various synthetic substances. Applying epoxy resin to delicate objects results in the formation of a thin, secure barrier that remains tightly adhered over extended periods, ensuring lasting stability and protection.

Market Outlook:

Epoxy resin, a thermosetting copolymer formed by the polymerization of epoxide and other monomers with hydroxyl groups, comprises a monomeric resin, accelerator, hardener, and plasticizer. Possessing corrosion resistance, thermal stability, mechanical strength, chemical resistance, durability, and adhesion, epoxy resins are utilized in paints, coatings, adhesives, composites, and electronic encapsulation across various sectors. Their applications span building and construction, automotive, industrial, and consumer goods and are likely to foster market growth. The global Epoxy Resin market is anticipated to reach approximately 6.2 million tonnes by 2034.

Epoxy Resin Major Manufacturers

Significant companies in the Global Epoxy Resin market are Olin Coporation, Huntsman Corporation, Nan Ya Plastics Co Ltd, Jiangsu Sanmu Group, Hexion Inc., Kumho P&B Chemicals, Nantong Xincheng Synthetic Material Co Ltd, Zhuhai Hongchang Electronic Material Co Ltd, Jiangsu Yangnong Kumho Chemical Co., Ltd., Kukdo Chemical Co., Ltd., Sinopec Baling Petrochemical Co., Ltd, and Others.

Challenges and Opportunities

The epoxy resin market faces several challenges, including environmental concerns regarding the production and disposal of epoxy resins, particularly due to the presence of harmful chemicals and potential emissions during manufacturing processes. Additionally, fluctuating raw material prices, such as those for bisphenol-A (BPA) and epichlorohydrin, can impact production costs and profit margins for epoxy resin manufacturers. Moreover, increasing regulatory scrutiny and stringent environmental regulations may require epoxy resin producers to invest in sustainable manufacturing practices and develop eco-friendly alternatives, which could pose challenges in terms of research and development costs and market adoption. Furthermore, competition from alternative materials and substitutes, such as bio-based resins and advanced polymers, presents a challenge for the epoxy resin market, necessitating innovation and differentiation to maintain market share and competitiveness.

Conclusion:

In conclusion, the Epoxy Resin market is poised for continued growth and evolution despite facing various challenges. PVC remains a widely used and versatile material with applications spanning across multiple industries, including construction, automotive, healthcare, and packaging. Epoxy resins have several key properties: high strength, minimal shrinkage, superb adhesion to diverse substrates, effective electrical insulation, resilience against chemicals and solvents, and affordability.

0 notes

Text

What are the different types of unsaturated resin?

Revex

Unsaturated resin is a type of thermosetting resin that can be cured into a solid form by a chemical reaction with a vinyl monomer, usually styrene. Unsaturated resin is widely used in various industries, such as construction, automotive, marine, and aerospace, because of its low cost, high versatility, easy processing, good mechanical properties, and good chemical resistance.

However, not all unsaturated resins are the same. There are several types of unsaturated resin, depending on the type of acid and alcohol used to make them. Each type of unsaturated resin has its own characteristics, advantages, and disadvantages, and is suitable for different applications.

In this article, we will explore the different types of unsaturated resin and their properties, applications, and challenges.

General-purpose resins

General-purpose resins are the most widely used and cheapest type of unsaturated resin. They are made from phthalic anhydride and propylene glycol, and have good mechanical and chemical properties. They are used for making fiberglass reinforced plastics, gel coats, and coatings.

General-purpose resins are suitable for applications that do not require high heat or corrosion resistance, such as boat hulls, pipes, tanks, panels, and roofing. However, they have some drawbacks, such as low thermal stability, low fire resistance, and high emission of volatile organic compounds (VOCs) and styrene vapors during processing and curing, which can cause air pollution, odor, and health hazards.

Isophthalic resins

Isophthalic resins are a type of unsaturated resin that have higher heat and corrosion resistance than general-purpose resins. They are made from isophthalic acid and propylene glycol, and have better mechanical and chemical properties. They are used for making pipes, tanks, ducts, and marine applications.

Isophthalic resins are suitable for applications that require higher performance and durability, such as chemical plants, oil refineries, desalination plants, and offshore platforms. However, they are more expensive and harder to process than general-purpose resins, and still emit VOCs and styrene vapors during processing and curing.

Bisphenol A fumarate resins

Bisphenol A fumarate resins are a type of unsaturated resin that have high thermal stability and electrical insulation. They are made from bisphenol A and fumaric acid, and have excellent mechanical and chemical properties. They are used for making electronic and aerospace applications.

Bisphenol A fumarate resins are suitable for applications that require high temperature and electrical resistance, such as circuit boards, transformers, radomes, and rocket nozzles. However, they are very expensive and difficult to process, and may pose environmental and health risks due to the presence of bisphenol A, which is a potential endocrine disruptor.

Chlorendic resins

Chlorendic resins are a type of unsaturated resin that have high fire resistance and low smoke emission. They are made from chlorendic anhydride and propylene glycol, and have good mechanical and chemical properties. They are used for making public transportation and building applications.

Chlorendic resins are suitable for applications that require high safety and low flammability, such as buses, trains, subways, and fire doors. However, they are very expensive and difficult to process, and may pose environmental and health risks due to the presence of chlorine, which is a toxic and corrosive element.

Vinyl ester resin

Vinyl ester resin is a type of unsaturated resin that has high strength, stiffness, and toughness. It is made from epoxy resin and acrylic acid, and has excellent mechanical and chemical properties. It also has excellent resistance to water, acids, alkalis, and solvents. It is used for making high-performance composites, such as wind turbine blades, chemical tanks, and corrosion-resistant linings.

Vinyl ester resin is suitable for applications that require high performance and durability, such as renewable energy, chemical industry, and corrosion protection. However, it is very expensive and difficult to process, and still emits VOCs and styrene vapors during processing and curing.

Conclusion

Unsaturated resin is a versatile and widely used thermosetting resin that has many applications in various industries. However, there are different types of unsaturated resin, each with its own characteristics, advantages, and disadvantages. Therefore, it is important to choose the right type of unsaturated resin for the right application, and to consider the environmental and health impacts of the resin production and use.

0 notes

Text

Understanding BPA-Free: What It Means and Why It Matters

Bisphenol A (BPA) is a chemical commonly used in the production of plastic products, such as water bottles, food containers, and even baby bottles. However, studies have shown that exposure to BPA can have harmful effects on human health, including disrupting hormone levels and increasing the risk of certain cancers, diabetes, and obesity.

As a result, many manufacturers have started to produce BPA-free products. In this article, we will explore what BPA-free means, why it matters, and how to identify BPA-free products.

What is BPA?

BPA is a synthetic chemical used in the production of polycarbonate plastics and epoxy resins. These materials are commonly used in the production of a wide range of products, including food and drink containers, eyeglass lenses, and medical equipment. BPA is also used to coat the inside of metal cans to prevent corrosion and contamination.

Why is BPA Harmful?

BPA has been shown to disrupt hormone levels in the body, particularly estrogen. This can have a range of negative health effects, including an increased risk of breast and prostate cancer, infertility, and obesity. BPA has also been linked to an increased risk of diabetes, cardiovascular disease, and developmental disorders in children.

What Does BPA-Free Mean?

BPA-free refers to products that do not contain bisphenol A. Instead, these products are made from alternative materials that do not leach harmful chemicals into food or drink. BPA-free products are often made from materials such as glass, stainless steel, or plastics that are free of BPA and other harmful chemicals.

How to Identify BPA-Free Products?

Many manufacturers label their products as BPA-free, making it easy for consumers to identify them. Look for labels or packaging that explicitly states that the product is BPA-free. It is worth noting, however, that not all products that are marketed as BPA-free are necessarily safe.

Are BPA-Free Products Safe?

While BPA-free products are generally considered safer than those containing BPA, there is still some debate over their safety. Some studies have suggested that the alternative materials used in BPA-free products may also have negative health effects, particularly if they are heated or used with acidic foods or drinks.

For example, some types of BPA-free plastics have been shown to leach harmful chemicals into food or drink when exposed to high temperatures or acidic foods. Similarly, some types of stainless steel may contain trace amounts of nickel or other metals that can be harmful to people with certain allergies or sensitivities.

Tips for Reducing BPA Exposure in Your Daily Life

In addition to choosing BPA-free products, there are several other steps you can take to reduce your exposure to BPA and other harmful chemicals:

Use glass or stainless steel containers for food and drink storage. These materials are less likely to leach harmful chemicals into your food and drink.

Avoid microwaving plastic containers. Heat can cause plastic to break down and release harmful chemicals into your food.

Choose fresh or frozen foods over canned foods. Many canned foods are lined with BPA-containing materials, which can leach into the food.

Wash your hands frequently. BPA and other chemicals can be found in dust and on surfaces, so washing your hands regularly can help reduce your exposure.

Choose personal care products that are free of BPA and other harmful chemicals. Look for products that are labeled as BPA-free, paraben-free, and phthalate-free.

Conclusion

BPA is a chemical commonly used in the production of plastic products, but exposure to this chemical can have harmful effects on human health. BPA-free products offer a safer alternative, but it is important to choose products from reputable manufacturers and to be aware of the potential risks associated with alternative materials.

By understanding what BPA-free means and how to identify these products, consumers can make informed decisions about the products they buy and use.

If you’re looking for BPA-free eco-friendly water filter jugs in Australia, look no further than Ecobud. We offer a range of high-quality, affordable, and practical products designed to help you positively impact your health and the environment. Call us today at 1300 886 373 to place an order or to learn more about our products and services!

READ MORE >>

#food container#clean water#lifestyle#environmentally friendly#alkaline water#stylish#bpa free#bps free#eco friendly#recyclable#wellness#gentoo lite#water bottle#healthy drinks#healthy drinking#water filter jug#water#health#bisphenol A#label#packaging#safe#allergy#sensitivity#microwave#frozen#fresh#paraben free#phthalate free#safe alternative

0 notes

Text

The Key Drivers of Epoxy Resin Production Cost: A Deep Dive

Epoxy resin is a highly versatile polymer widely used in various applications across industries such as automotive, construction, electronics, and aerospace due to its exceptional adhesion, durability, and resistance properties. The production of epoxy resin involves intricate processes and resource assessments that influence its overall cost and market dynamics. In this detailed report, we will delve into the procurement resource assessment, product definition, market drivers, comparative analysis of different feedstocks, and the importance of a personalized and exhaustive report for businesses in the epoxy resin industry.

Request For Free Sample: https://www.procurementresource.com/production-cost-report-store/epoxy-resin/request-sample

Introduction: Epoxy Resin Production Cost Processes with Cost Analysis

Epoxy resin, a key component in various manufacturing sectors, involves a complex production process that impacts its final cost and market viability. Understanding the intricacies of the procurement resource assessment, cost factors, and market influences is crucial for businesses to make informed decisions. This report aims to dissect the various elements that shape the production cost of epoxy resin, offering a detailed analysis of its procurement, production, and market determinants.

Procurement Resource Assessment of Epoxy Resin Production Process

The procurement resource assessment for epoxy resin production involves evaluating raw materials, energy consumption, labor, and equipment costs. Factors such as the sourcing of raw materials, production scale, technological advancements, and environmental regulations significantly impact the overall cost structure.

Raw materials like bisphenol-A (BPA) and epichlorohydrin play a pivotal role in epoxy resin production. Assessing the cost, availability, and quality of these resources is essential in determining the cost efficiency of the production process.

Additionally, the energy-intensive nature of epoxy resin production necessitates a comprehensive evaluation of energy consumption and its associated costs, driving the need for efficient energy management strategies.

Product Definition

Epoxy resins are thermosetting polymers known for their strong adhesion, chemical resistance, and versatility. Understanding the different types, grades, and applications of epoxy resin is fundamental in assessing production costs. The various formulations, curing agents, and additives impact the final product's characteristics and costs.

Different industries demand specific variations of epoxy resins, and the tailored production of these variants influences the overall cost analysis.

Market Drivers

Several factors influence the epoxy resin market, thereby affecting its production costs. Market demand, technological advancements, regulatory changes, and raw material availability are key drivers.

The growing demand for lightweight materials in automotive and aerospace industries, coupled with the expanding construction sector, boosts the demand for epoxy resin. Advancements in technology and innovation drive the development of high-performance resins, affecting both product quality and cost.

Regulatory changes emphasizing environmental sustainability and the shift towards bio-based or recycled feedstocks impact the market dynamics, potentially influencing production costs.

Comparative Analysis of Different Feedstocks

Evaluating various feedstocks for epoxy resin production is critical in cost analysis. Different feedstocks, such as petroleum-based or bio-based sources, come with distinct cost structures and environmental implications.

Petroleum-based feedstocks have been traditionally dominant due to their cost-effectiveness and availability. However, bio-based alternatives, derived from renewable sources, are gaining traction due to their reduced environmental impact and potential long-term cost benefits.

The comparative analysis delves into the cost, availability, and sustainability of different feedstocks, offering insights into their influence on the overall production cost of epoxy resin.

The Significance of an Exhaustive and Personalized Report

In the competitive landscape of epoxy resin production, having access to an exhaustive and personalized report is invaluable for businesses. Such reports provide in-depth analysis, market trends, cost projections, and strategic insights tailored to the specific needs of a company.

A personalized report accounts for the unique requirements of a business, offering comprehensive data and analysis crucial in decision-making processes. It aids in understanding the production cost structures, market trends, and potential opportunities for growth and innovation within the industry.

In conclusion, the production cost analysis of epoxy resin is a multifaceted process influenced by various factors such as procurement resource assessment, product definition, market drivers, and choice of feedstocks. Accessing a personalized and exhaustive report is essential for businesses looking to navigate the dynamic landscape of epoxy resin production efficiently.

This blog post provides an overview of the critical aspects influencing the cost analysis of epoxy resin production, aiming to guide businesses towards making informed and strategic decisions within this thriving industry.

1 note

·

View note

Text

Everyday Items That Are Hurting Your Health

Today. we all live in eras where there is an ocean of convenient appliances, gadgets & household things meant for the sole purpose of making our lives easy.

But there can be hidden dangers underneath the charm of such mundane objects. There’s nothing surprising about some of these types of risks — while others might lurk in the shadows.

In this blog post, I am going to talk about some of the everyday used household items that are hurting our health, silently.

1. Plastic Containers and Bottles

Plastic is easy to keep in its container form with its long service time and plasticity, and it has become popular as its container material since ages ago. But this convenience comes at a price:

BPA (Bisphenol A):

An industrial chemical called BPA is found in many plastics. Research has demonstrated BPA can leach from plastic polycarbonate bottles/containers into food and liquids when exposed to everyday use conditions. BPA is a synthetic compound found everywhere in the environment and is on the list of endocrine disruptors. Reports indicate that BPA exposure is associated with elevated circulating levels of LH (luteinizing hormones), E2, P, and T.

For years, most canned food makers lined their cans with an epoxy resin, derived from BPA, which became the main source of our exposure to this poisonous substance when we ate out of canned foods. There’s plenty of science on the migration of BPA into food out of cans at extremely low exposure levels, causing harm across numerous pathways, including but not limited to neurological, cardiovascular, reproductive, endocrine, and more.

Phthalates:

Many are found in plastics and phthalates is the name given to the chemicals that make materials soften up. So they could end up in the food (especially if the jar is heated). This can impact the reproductive organs; it also is associated with obesity and asthma.

Recommendation:

Stick to BPA– and phthalate–free storage. Additionally, avoid microwaving plastic containers.

2. Air Fresheners

While they might make our homes smell pleasant, many air fresheners release volatile organic compounds (VOCs):

VOCs:

“Volatile” simply means “able to vaporize”, and the type of VOC in your product or process will determine how easily it evaporates. These compounds are to be found virtually everywhere in our environment as they are used as components in many common everyday items such as furniture polishes, floor and wall coverings, deodorants, fuels, chemicals used on tobacco, pesticides, and spray paint.

They can irritate the eyes, nose, and throat, make you breathe heavily and feel sick to your stomach, and damage the nervous system. Even at low levels, VOCs produce powerful odors that may result in irritation of the eyes, nose, and throat; headache, nasal & chest congestion, lung function reduction, nausea, dizziness, vomiting, skin dryness

Phthalates:

Yes, and also in air freshener. They can impact hormones and reproductive health.

Read full blog post here

0 notes

Text

What is the Pultrusion Molding Process of Epoxy Resin Composites?

The pultrusion profile process is a method of forming FRP profiles by pulling continuous glass fibre bundles impregnated with epoxy resin glue and other continuous reinforcing materials such as glass cloth tape and polyester surface mats under traction, forming FRP profiles by extruding the mold and curing them with heat in the mold and curing furnace.

The epoxy resin pultrusion process is an efficient manufacturing process that is widely used in electric power, chemical industry, metallurgy and other fields to produce products with high strength, corrosion resistance and wear resistance. This process uses epoxy resin as the basic material and is manufactured through multiple processes such as preheating, pressure heating, and extrusion molding.

The requirements for epoxy resin glue in the pultrusion molding process are: low viscosity, easy to penetrate into reinforced materials, long gel time (usually requires a service life of more than 8 hours), and fast curing to meet the requirements of continuous molding, good adhesion, the curing shrinkage is small, the flexibility is good, and the products are not prone to cracks.

Advantages of epoxy resin pultrusion process

High flexibility: The epoxy resin pultrusion process can manufacture products of various shapes, such as pipes, plates, etc., and can be customized as needed to meet the needs of different fields.

High strength: Epoxy resin has high strength. During the production process, the pultrusion process uses high-pressure heating to make the resin more uniform, thus greatly improving the strength of the product.

Good corrosion resistance: Epoxy resin has excellent corrosion resistance and can withstand the erosion of corrosive media such as acids, alkalis, and salts, thereby extending the service life of the product.

Strong wear resistance: Epoxy resin has good wear properties and can be used in high-strength, high-friction environments, greatly extending the service life of the product.

Comparison between epoxy resin pultrusion process and traditional processing methods

Compared with traditional processing methods, the epoxy resin pultrusion process has the following advantages:

High production efficiency: Using the pultrusion process can greatly improve production efficiency, shorten the production cycle, and reduce production costs.

Energy saving and environmental protection: The pultrusion process does not require the use of a large amount of auxiliary agents, which can save energy. At the same time, the epoxy resin can be recycled, reducing environmental pollution.

High technical content: The epoxy resin pultrusion process requires multiple manufacturing processes, which requires high production technology and can improve the quality and service life of the product.

Application prospects of epoxy resin pultrusion process

With the increasing awareness of environmental protection, the application prospects of the epoxy resin pultrusion process are becoming more and more broad. Epoxy resin products can replace traditional metal materials and have the advantages of lightweight, high strength, safety and reliability. They are widely used in various fields such as electric power, chemical industry, metallurgy and so on.

The epoxy resin pultrusion process is an efficient, flexible, corrosion-resistant, and wear-resistant manufacturing process. Compared with traditional processing methods, it has the advantages of high production efficiency, energy saving, environmental protection, and high technical content. With the increasing awareness of environmental protection, its application prospects in various fields are broad.

More information or free samples or price quotations, please contact us via email: [email protected] , or voice to us at: +86-28-8411-1861.

#epoxy resin#epoxy resin manufacturer#bisphenol a type epoxy resin#epoxy resin supplier#pultrusion molding process#epoxy resin composites#composite pultrusion molding process#pultrusion composites#pultrusion process#pultrusion products#filament winding

0 notes

Photo

Effect of Grafted Silane on Fly Ash Pha Lai - Vietnam to Properties of Polymer Composite Materials Based on Bisphenol A Type Epoxy Resin

by Bach Trong Phuc | Nguyen Thanh Liem | Pham Thi Huong ""Effect of Grafted Silane on Fly Ash (Pha Lai - Vietnam) to Properties of Polymer Composite Materials Based on Bisphenol A-Type Epoxy Resin""

Published in International Journal of Trend in Scientific Research and Development (ijtsrd), ISSN: 2456-6470, Volume-3 | Issue-6 , October 2019,

URL: https://www.ijtsrd.com/papers/ijtsrd29357.pdf

Paper URL: https://www.ijtsrd.com/engineering/chemical-engineering/29357/effect-of-grafted-silane-on-fly-ash-pha-lai---vietnam-to-properties-of-polymer-composite-materials-based-on-bisphenol-a-type-epoxy-resin/bach-trong-phuc

international journals of computer science, call for paper engineering, ugc journal list

Recently, there has been much research on fly ash and its use as a filler in polymer composite materials. However, interfacial adhesion of fly ash with polymer matrix is weak. So, fly ash must be treated to improve interfacial adhesion. This paper reports effect of surface treatments of fly ash particles to mechanical, thermal properties and structure of polymer composites based on DER 331 epoxy resin matrix. The fly ash was treated by silane coupling agent GF 80 and GF 82. The results showed that the mechanical properties of silane GF 80 and GF 82 treated fly ash epoxy resin composites were higher than that of untreated fly ash epoxy resin composites. Specially at FASGF80, tensile strength, flexural strength, compressive strength and impact strength was maximum tensile strength 42.3 MPa increase 21.74 compressive strength 164 MPa increase 18.29 flexural strength 77.8 increase 6.4 and impact strength 7.2 KJ m2 increase 20.83 compare with untreated fly ash composites .

0 notes

Text

0 notes

Text

Asia-Pacific Metal Packaging Coatings Market - Forecast(2024 - 2030)

Asia-Pacific Metal Packaging Coatings Market Overview

Asia-Pacific Metal Packaging Coatings Market size is forecast to reach US$1,990.4 million by 2027, after growing at a CAGR of 7.3% during 2022-2027. The preference for metal food & beverage containers in the Asia-Pacific region has been increasing rapidly, owing to its range of benefits such as better product protection, durability, sustainability, affordability, light-weight, and more in comparison to other types of packaging. The development of new coating technologies which include Bisphenol A non-intent (BPA-NI) coatings are further fueling the growth of the market in the Asia-Pacific region. Moreover, increasing demand for metal packaging coatings from the pharmaceutical industry are further accelerating the growth of the market in the Asia-Pacific region. Also, strict regulations regarding the use of plastics in various countries across the Asia-Pacific region along with increasing product launches and developments associated with metal packaging is expected to increase the demand for metal packaging coatings for use in various end-use industries over the forecast period.

Covid-19 Impact

The COVID-19 outbreak led to major economic problems and challenges for the food & beverage, pharmaceutical, cosmetic, and other industries in the Asia-Pacific region. According to the International Monetary Fund (IMF), the GDP growth of the Asia declined by 1.3% and Australia by 2.4% as indicated in the graphs, owing to the economic impact of COVID-19. The governments all across the Asia-Pacific region announced strict measures to slow the spread of the coronavirus and only the production of essential commodities were allowed, which impacted the non-essential commodity industries, thereby impacting the production of metal packaging coatings as well. However, economic stimulus packages allotted for multiple sectors in the Asia-Pacific region and the start of industrial production activities since 2021 is improving the metal packaging coatings market growth in the Asia-Pacific region by its increasing utilization in various industries.

Report Coverage

The report: “Asia-Pacific Metal Packaging Coatings Market Report – Forecast (2022-2027)”, by IndustryARC, covers an in-depth analysis of the following segments of the Asia-Pacific metal packaging coatings industry.

By Packaging Types: Food (2 piece and 3 piece), Caps & Closure (External and Internal), and General Line (External and Internal) By Coating Types: Water based, Solvent based, and Powder based. By Resins Type: Acrylic, Fluoropolymer, Urethanes, Epoxy (BPA and Non-BPA), Amines, and Others. By Application: Food (Sea Food, Meat, Infant Nutrition & Dairy, Vegetables, Catering, Biscuits, Cookies & Confectionary, Fats & Oils, Toppings, and Others), Pharmaceutical, Cosmetics, Personal Care, and Others. By Country: China, Japan, Thailand, Vietnam, India, Indonesia, Malaysia, and Rest of Asia-Pacific.

Request Sample

Key Takeaways

China dominated the Asia-Pacific Metal Packaging Coatings Market in the year 2021. One of the key drivers driving the market is increasing use of metal packaging in food products such as fruits, vegetables, infant nutrition & dairy, bakery, and other similar products in order enhance the durability of metal packaging.

Increasing product launches for phenolic resins that are primarily used in a wide range of metal packaging coatings employed in food, pharmaceuticals, and other applications which require a smooth, durable, and spotless finish, has driven the market growth. For instance, In June 2020, companies such as Allnex GMBH, which has its presence in the Asia-Pacific region launched its new eco-friendly phenolic resin for use in BPAni application for metal packaging coatings.

Strict environmental regulations are driving metal packaging coating manufacturers in the Asia-Pacific region to adopt environmentally conscious practices, thus, the demand for water-based coatings are increasing significantly in the region.

Asia-Pacific Metal Packaging Coatings Market Segment Analysis – By Coating Types

The water based coating segment held the largest share in 2021 and is expected to grow at a CAGR of 8.2% by 2027. Water-based coating is an environmentally friendly surface treatment that disperses the resin used in the coatings using water as a solvent. They have a high degree of flexibility and reduce moisture and solar radiation absorption, thereby, resulting in fewer solvent emissions. The VOC (Volatile Organic Compounds) content in the water-based coating is significantly low, and since there are regulations restricting the high VOC content in Asia-Pacific is resulting in its increasing adoption by metal packaging coating manufacturers based in the region. For instance, in 2021, China launched its 14th Five-Year Plan, the chemical sector refocused its environmental protection goals on low-carbon transformation and comprehensive control of VOC emissions, as well as a considerable emphasis on encouraging low VOC products. Furthermore, as compared to solvent-based coatings, water-based coatings for metal packaging require less coating to cover the same surface area, cost less, and do not require any additives, thinners, or hardeners because they provide higher adherence. Thus, water-based barrier coatings are utilized to protect the metal packaging from external and internal effects by sealing the substrate surface.

Inquiry Before Buying

Asia-Pacific Metal Packaging Coatings Market Segment Analysis - By Application

Food sector held the largest share with 66% in the Asia-Pacific Metal Packaging Coatings Market in 2021 and is anticipated to grow at a CAGR of 7.4% during the forecast period 2022-2027. Metal packaging cans, containers, tins, and more are utilized for the packaging of the food because these types of packaging maintain the food filling's flavors and nutritional content ranging from months to several years. However, the direct contact between the metal packaging and food content filled inside the cans and other types of packaging are not safe. The direct contact between metal and food can degrade the food content, owing to this food-friendly coating are applied to safeguard the packaged food from corroding metal. The shifting the focus of Asia-Pacific packaging manufacturers from plastic to metal is expected to drive up the demand for metal packaging coatings for food cans. This is further projected to expand the market growth in the Asia-Pacific region. According to UACJ Corporation, between 2019 and 2022, global demand for aluminium used in cans will rise 11% to 6.61 million tons per year. Southeast Asian countries are likely to account for half of that demand, according to the report. Thus, rising demand for cans will accelerate the production for aluminium cans, which further benefits the metal packaging coatings demand.

Asia-Pacific Metal Packaging Coatings Market Segment Analysis – By Country