#Decentralized Crypto Exchange Platform

Explore tagged Tumblr posts

Text

Top Decentralized Crypto Exchange Providers to Consider in 2025

As the world of cryptocurrency continues to evolve, decentralized exchanges (DEXs) are becoming increasingly popular. These platforms provide users with enhanced security, anonymity, and full asset control. For businesses and entrepreneurs looking to enter the market, partnering with a top-tier crypto exchange development company is essential to build a secure, scalable, and feature-rich platform. Let’s explore the leading decentralized crypto exchange providers to consider in 2025 and what makes them stand out.

Why Choose a Decentralized Exchange Platform?

Decentralized crypto exchanges offer significant advantages over centralized exchanges, including:

Enhanced Security: No central point of failure reduces the risk of hacking.

User Autonomy: Users maintain control of their private keys and assets.

Global Accessibility: Trade digital assets without geographical restrictions.

Transparency: Transactions are recorded on a public blockchain for full visibility.

Lower Fees: Reduced transaction costs by eliminating intermediaries.

Partnering with the right decentralized exchange development company can ensure your platform leverages these benefits while delivering a seamless user experience.

Key Features of a Robust DEX Platform

When considering a crypto exchange platform development company, look for providers that offer:

High Liquidity Solutions: Automated market makers (AMMs) and liquidity pools.

Smart Contract Integration: Secure, self-executing contracts for trustless transactions.

Multi-Currency Support: Compatibility with multiple blockchains and tokens.

User-Friendly Interface: Simplified design for traders of all experience levels.

Cross-Chain Trading: Interoperability for trading assets across different blockchains.

Governance Mechanisms: Allowing token holders to participate in decision-making processes.

These features ensure your decentralized exchange software is competitive and ready for market demand.

Top Decentralized Crypto Exchange Providers in 2025

Justtry Technologies

Renowned as a top crypto exchange development company, Justtry Technologies specializes in end-to-end decentralized exchange development services. They provide tailored solutions, including smart contract audits, liquidity management, and wallet integration. Their expertise in decentralized exchange software ensures high performance and scalability.

Blockchain Innovators

A leading decentralized exchange development company known for their expertise in DeFi solutions. They offer customizable platforms with advanced trading tools, staking features, and comprehensive security protocols.

CryptoForge Solutions

Expert crypto exchange developers in India, CryptoForge Solutions delivers high-performance DEX platforms with robust security protocols, lightning-fast transactions, and seamless multi-chain compatibility.

DEX Builders

This dex exchange development company focuses on building highly scalable platforms with features like perpetual swaps, multi-chain support, and governance tokens. They also offer extensive post-launch support and feature enhancements.

ChainCode Labs

A crypto exchange platform development company that excels in building decentralized exchanges with seamless user onboarding, advanced analytics, and real-time order books. They specialize in creating decentralized crypto exchange platforms tailored to niche markets.

Example of a Successful DEX

One standout example is Uniswap, a decentralized crypto exchange platform that revolutionized the DeFi space. By utilizing AMMs and allowing users to provide liquidity, Uniswap set a benchmark for DEX functionality and simplicity. Aspiring exchanges can draw inspiration from Uniswap’s model while incorporating unique features, such as cross-chain trading or governance tokens, to stand out in the market.

How to Choose the Right Development Partner

Selecting the best cryptocurrency exchange development service involves assessing factors like:

Experience & Expertise: Proven track record in decentralized exchange development.

Customization Capabilities: Ability to tailor features to your project’s needs.

Security Protocols: Implementation of multi-layer security measures, including cold storage and multi-signature wallets.

Regulatory Compliance: Knowledge of global regulations to ensure legal compliance.

Post-Launch Support: Ongoing maintenance, feature upgrades, and bug fixes to keep your platform competitive.

Final Thoughts

The demand for decentralized exchange platforms is only set to grow in 2025. You can launch a secure, innovative, and user-friendly platform that meets market expectations by partnering with a reliable decentralized exchange development company. Whether you’re looking for crypto exchange platform development, decentralized exchange software, or comprehensive decentralized exchange development services, the providers listed above are well-equipped to bring your vision to life.

Are you ready to build the next big DEX? Start by choosing a development partner that aligns with your goals, understands the evolving crypto landscape, and can deliver a future-proof solution!

#Decentralized Crypto Exchange Platform#Decentralized exchange software#dex exchange development company#Decentralized Exchange Development Service#decentralized crypto exchange development#crypto exchange platform development#Cryptocurrency exchange development service#crypto exchange platform development company#crypto exchange development company

0 notes

Text

Launch Your Crypto Project with Confidence on GetX

Boost your crypto project with GetX Exchange – India’s top platform for emerging tokens. Gain visibility, tap into the growing INR market, and reach thousands of active merchants. Enjoy top-tier security, 24-hour support, powerful marketing tools, and an easy-to-use administrative panel. Earn more money with our Affiliate Program! Listing with GetX increases trust, attracts more users, and accelerates growth. Are you ready to go global through India? Start listing on GetX Exchange today!

Read More - https://rb.gy/vlrwur

#cryptocurrency trading#best crypto trading app#cryptocurrency trading platform#Crypto trade#best crypto trading platform#cryptocurrency app#cryptocurrency coin market#crypto exchange#cryptocurrency exchange#decentralized exchange#crypto currency marketplace#best app for trading cryptocurrency#crypto to crypto exchange#crypto currencies exchanges#best app crypto trading#global cryptocurrency exchange#buy crypto#crypto currencies trading platform india

0 notes

Text

The Rise of DEX and Singular Crypto: A Decentralized Future

The cryptocurrency world has evolved rapidly, with decentralized finance (DeFi) gaining significant traction in recent years. A major driver of this shift is the rise of Decentralized Exchanges (DEXs), which allow users to trade cryptocurrencies without the need for intermediaries like traditional exchanges. DEXs embody the core principle of decentralization, enabling peer-to-peer transactions and offering users greater control over their funds. Alongside the rise of DEXs, new cryptocurrencies like Singular Crypto are emerging, offering innovative features that align with the decentralized ethos of the blockchain world.

In this article, we will explore the rise of DEXs, their role in shaping the future of finance, and how Singular Crypto is contributing to this decentralized revolution.

What Are Decentralized Exchanges (DEXs)?

A Decentralized Exchange (DEX) is a cryptocurrency exchange that operates without a central authority. Unlike traditional centralized exchanges, such as Binance or Coinbase, DEXs allow users to trade cryptocurrencies directly with one another through smart contracts. These contracts are self-executing pieces of code that facilitate transactions without requiring a third party. Some of the most popular DEXs include Uniswap, SushiSwap, and PancakeSwap.

Key features of DEXs include:

Trustless Trading: Users can trade cryptocurrencies without relying on a centralized entity. Transactions are handled by the blockchain, ensuring transparency and security.

Privacy and Control: DEXs often require little to no personal information for trading, allowing users to maintain privacy. Additionally, users have full control over their funds, as they do not need to deposit their assets into the exchange.

Reduced Counterparty Risk: Since users trade directly from their wallets, there is no risk of losing funds due to a centralized exchange hack or bankruptcy.

DEXs are integral to the decentralized finance movement, empowering users to engage in financial activities such as lending, borrowing, and trading without the traditional gatekeepers of the financial world.

The Benefits of DEXs in the Crypto Ecosystem

The growing popularity of DEXs is driven by several key benefits:

Security: DEXs are generally considered more secure than centralized exchanges because users retain control of their private keys. This reduces the risk of hacks or malicious attacks on centralized entities that store large amounts of user funds.

Censorship Resistance: DEXs operate on public blockchains, making it difficult for governments or organizations to censor transactions. This is especially important for users in countries with restrictive financial systems or heavy regulation on cryptocurrencies.

Accessibility: Traditional financial services are often out of reach for millions of people, especially in developing countries. DEXs allow anyone with an internet connection and a digital wallet to participate in global financial markets, promoting financial inclusion.

Lower Fees: Without intermediaries taking cuts from transactions, users can often enjoy lower fees when trading on DEXs compared to centralized exchanges.

Blog Source URL :https://singulardex.blogspot.com/2024/10/the-rise-of-dex-and-singular-crypto.html

#singular#singular wallet#dex#perpetuals#bitcoin’s price#singular crypto#singular coin#Dex Trades#Trading Dex#Defi Trading Platforms#Decentralized Perpetual Exchanges#Dex Perpetuals

0 notes

Text

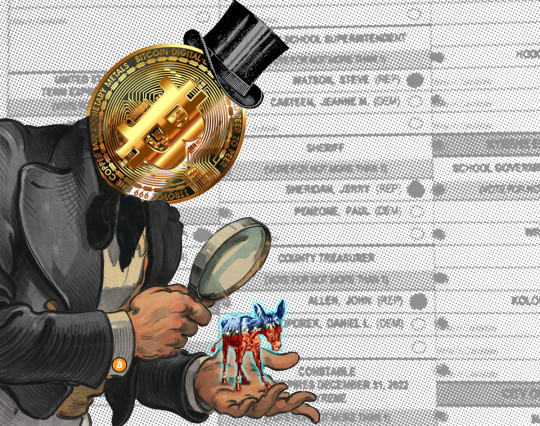

The largest campaign finance violation in US history

I'm coming to DEFCON! On Aug 9, I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On Aug 10, I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Earlier this month, some of the richest men in Silicon Valley, led by Marc Andreesen and Ben Horowitz (the billionaire VCs behind Andreesen-Horowitz) announced that they would be backing Trump with endorsements and millions of dollars:

https://www.forbes.com/sites/dereksaul/2024/07/16/trump-lands-more-big-tech-backers-billionaire-venture-capitalist-andreessen-joins-wave-supporting-former-president/

Predictably, this drew a lot of ire, which Andreesen tried to diffuse by insisting that his support "doesn’t have anything to do with the big issues that people care about":

https://www.theverge.com/2024/7/24/24204706/marc-andreessen-ben-horowitz-a16z-trump-donations

In other words, the billionaires backing Trump weren't doing so because they supported the racism, the national abortion ban, the attacks on core human rights, etc. Those were merely tradeoffs that they were willing to make to get the parts of the Trump program they do support: more tax-cuts for the ultra-rich, and, of course, free rein to defraud normies with cryptocurrency Ponzi schemes.

Crypto isn't "money" – it is far too volatile to be a store of value, a unit of account, or a medium of exchange. You'd have to be nuts to get a crypto mortgage when all it takes is Elon Musk tweeting a couple emoji to make your monthly mortgage payment double.

A thing becomes moneylike when it can be used to pay off a bill for something you either must pay for, or strongly desire to pay for. The US dollar's moneylike property comes from the fact that hundreds of millions of people need dollars to pay off the IRS and their state tax bills, which means that they will trade labor and goods for dollars. Even people who don't pay US taxes will accept dollars, because they know they can use them to buy things from people who do have a nondiscretionary bill that can only be paid in dollars.

Dollars are also valuable because there are many important commodities that can only – or primarily – be purchased with them, like much of the world's oil supply. The fact that anyone who wants to buy oil has a strong need for dollars makes dollars valuable, because they will sell labor and goods to get dollars, not because they need dollars, but because they need oil.

There's almost nothing that can only be purchased with crypto. You can procure illegal goods and services in the mistaken belief that this transaction will be durably anonymous, and you can pay off ransomware creeps who have hijacked your personal files or all of your business's data:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

Web3 was sold as a way to make the web more "decentralized," but it's best understood as an effort to make it impossible to use the web without paying crypto every time you click your mouse. If people need crypto to use the internet, then crypto whales will finally have a source of durable liquidity for the tokens they've hoarded:

https://pluralistic.net/2022/09/16/nondiscretionary-liabilities/#quatloos

The Web3 bubble was almost entirely down to the vast hype machine mobilized by Andreesen-Horowitz, who bet billions of dollars on the idea and almost single-handedly created the illusion of demand for crypto. For example, they arranged a $100m bribe to Kickstarter shareholders in exchange for Kickstarter pretending to integrate "blockchain" into its crowdfunding platform:

https://finance.yahoo.com/news/untold-story-kickstarter-crypto-hail-120000205.html

Kickstarter never ended up using the blockchain technology, because it was useless. Their shareholders just pocketed the $100m while the company weathered the waves of scorn from savvy tech users who understood that this was all a shuck.

Look hard enough at any crypto "success" and you'll discover a comparable scam. Remember NFTs, and the eye-popping sums that seemingly "everyone" was willing to pay for ugly JPEGs? That whole market was shot through with "wash-trading" – where you sell your asset to yourself and pretend that it was bought by a third party. It's a cheap – and illegal – way to convince people that something worthless is actually very valuable:

https://mailchi.mp/brianlivingston.com/034-2#free1

Even the books about crypto are scams. Chris Dixon's "bestseller" about the power of crypto, Read Write Own, got on the bestseller list through the publishing equivalent of wash-trading, where VCs with large investments in crypto bought up thousands of copies and shoved them on indifferent employees or just warehoused them:

https://pluralistic.net/2024/02/15/your-new-first-name/#that-dagger-tho

The fact that crypto trades were mostly the same bunch of grifters buying shitcoins from each other, while spending big on Superbowl ads, bribes to Kickstarter shareholders, and bulk-buys of mediocre business-books was bound to come out someday. In the meantime, though, the system worked: it convinced normies to gamble their life's savings on crypto, which they promptly lost (if you can't spot the sucker at the table, you're the sucker).

There's a name for this: it's called a "bezzle." John Kenneth Galbraith defined a "bezzle" as "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it." All bezzles collapse eventually, but until they do, everyone feels better off. You think you're rich because you just bought a bunch of shitcoins after Matt Damon told you that "fortune favors the brave." Damon feels rich because he got a ton of cash to rope you into the con. Crypto.com feels rich because you took a bunch of your perfectly cromulent "fiat money" that can be used to buy anything and traded it in for shitcoins that can be used to buy nothing:

https://theintercept.com/2022/10/26/matt-damon-crypto-commercial/

Andreesen-Horowitz were masters of the bezzle. For them, the Web3 bet on an internet that you'd have to buy their shitcoins to use was always Plan B. Plan A was much more straightforward: they would back crypto companies and take part of their equity in huge quantities of shitcoins that they could sell to "unqualified investors" (normies) in an "initial coin offering." Normally, this would be illegal: a company can't offer stock to the general public until it's been through an SEC vetting process and "gone public" through an IPO. But (Andreesen-Horowitz argued) their companies' "initial coin offerings" existed in an unregulated grey zone where they could be traded for the life's savings of mom-and-pop investors who thought crypto was real because they heard that Kickstarter had adopted it, and there was a bestselling book about it, and Larry David and Matt Damon and Spike Lee told them it was the next big thing.

Crypto isn't so much a financial innovation as it is a financial obfuscation. "Fintech" is just a cynical synonym for "unregulated bank." Cryptocurrency enjoys a "byzantine premium" – that is, it's so larded with baffling technical nonsense that no one understands how it works, and they assume that anything they don't understand is probably incredibly sophisticated and great ("a pile of shit this big must have pony under it somewhere"):

https://pluralistic.net/2022/03/13/the-byzantine-premium/

There are two threats to the crypto bezzle: the first is that normies will wise up to the scam, and the second is that the government will put a stop to it. These are correlated risks: if the government treats crypto as a security (or worse, a scam), that will put severe limits on how shitcoins can be marketed to normies, which will staunch the influx of real money, so the sole liquidity will come from ransomware payments and transactions with tragically overconfident hitmen and drug dealers who think the blockchain is anonymous.

To keep the bezzle going, crypto scammers have spent the past two election cycles flooding both parties with cash. In the 2022 midterms, crypto money bankrolled primary challenges to Democrats by absolute cranks, like the "effective altruist" Carrick Flynn ("effective altruism" is a crypto-affiliated cult closely associated with the infamous scam-artist Sam Bankman-Fried). Sam Bankman-Fried's super PAC, "Protect Our Future," spent $10m on attack-ads against Flynn's primary opponent, the incumbent Andrea Salinas. Salinas trounced Flynn – who was an objectively very bad candidate who stood no chance of winning the general election – but only at the expense of most of the funds she raised from her grassroots, small-dollar donors.

Fighting off SBF's joke candidate meant that Salinas went into the general election with nearly empty coffers, and she barely squeaked out a win against a GOP nightmare candidate Mike Erickson – a millionaire Oxy trafficker, drunk driver, and philanderer who tricked his then-girlfriend by driving her to a fake abortion clinic and telling her that it was a real one:

https://pluralistic.net/2022/10/14/competitors-critics-customers/#billionaire-dilletantes

SBF is in prison, but there's no shortage of crypto millions for this election cycle. According to Molly White's "Follow the Crypto" tracker, crypto-affiliated PACs have raised $185m to influence the 2024 election – more than the entire energy sector:

https://www.followthecrypto.org/

As with everything "crypto," the cryptocurrency election corruption slushfund is a bezzle. The "Stand With Crypto PAC" claims to have the backing of 1.3 million "crypto advocates," and Reuters claims they have 440,000 backers. But 99% of the money claimed by Stand With Crypto was actually donated to "Fairshake" – a different PAC – and 90% of Fairshake's money comes from a handful of corporate donors:

https://www.citationneeded.news/issue-62/

Stand With Crypto – minus the Fairshake money it falsely claimed – has raised $13,690 since April. That money came from just seven donors, four of whom are employed by Coinbase, for whom Stand With Crypto is a stalking horse. Stand With Crypto has an affiliated group (also called "Stand With Crypto" because that is an extremely normal and forthright way to run a nonprofit!), which has raised millions – $1.49m. Of that $1.49m, 90% came from just four donors: three cryptocurrency companies, and the CEO of Coinbase.

There are plenty of crypto dollars for politicians to fight over, but there are virtually no crypto voters. 69-75% of Americans "view crypto negatively or distrust it":

https://www.pewresearch.org/short-reads/2023/04/10/majority-of-americans-arent-confident-in-the-safety-and-reliability-of-cryptocurrency/

When Trump keynotes the Bitcoin 2024 conference and promises to use public funds to buy $1b worth of cryptocoins, he isn't wooing voters, he's wooing dollars:

https://www.wired.com/story/donald-trump-strategic-bitcoin-stockpile-bitcoin-2024/

Wooing dollars, not crypto. Politicians aren't raising funds in crypto, because you can't buy ads or pay campaign staff with shitcoins. Remember: unless Andreesen-Horowitz manages to install Web3 crypto tollbooths all over the internet, the industries that accept crypto are ransomware, and technologically overconfident hit-men and drug-dealers. To win elections, you need dollars, which crypto hustlers get by convincing normies to give them real money in exchange for shitcoins, and they are only funding politicians who will make it easier to do that.

As a political matter, "crypto" is a shorthand for "allowing scammers to steal from working people," which makes it a very Republican issue. As Hamilton Nolan writes, "If the Republicans want to position themselves as the Party of Crypto, let them. It is similar to how they position themselves as The Party of Racism and the Party of Religious Zealots and the Party of Telling Lies about Election Fraud. These things actually reflect poorly on them, the Republicans":

https://www.hamiltonnolan.com/p/crypto-as-a-political-characteristic

But the Democrats – who are riding high on the news that Kamala Harris will be their candidate this fall – have decided that they want some of that crypto money, too. Even as crypto-skeptical Dems like Jamaal Bowman, Cori Bush, Sherrod Brown and Jon Tester see millions from crypto PACs flooding in to support their primary challengers and GOP opponents, a group of Dem politicians are promising to give the crypto industry whatever it wants, if they will only bribe Democratic candidates as well:

https://subscriber.politicopro.com/f/?id=00000190-f475-d94b-a79f-fc77c9400000

Kamala Harris – a genuinely popular candidate who has raised record-shattering sums from small-dollar donors representing millions of Americans – herself has called for a "reset" of the relationship between the crypto sector and the Dems:

https://archive.is/iYd1C

As Luke Goldstein writes in The American Prospect, sucking up to crypto scammers so they stop giving your opponents millions of dollars to run attack ads against you is a strategy with no end – you have to keep sucking up to the scam, otherwise the attack ads come out:

https://prospect.org/politics/2024-07-31-crypto-cash-affecting-democratic-races/

There's a whole menagerie of crypto billionaires behind this year's attempt to buy the American government – Andreesen and Horowitz, of course, but also the Winklevoss twins, and this guy, who says we're in the midst of a "civil war" and "anyone that votes against Trump can die in a fucking fire":

https://twitter.com/molly0xFFF/status/1813952816840597712/photo/1

But the real whale that's backstopping the crypto campaign spending is Coinbase, through its Fairshake crypto PAC. Coinbase has donated $45,500,000 to Fairshake, which is a lot:

https://www.coinbase.com/blog/how-to-get-regulatory-clarity-for-crypto

But $45.5m isn't merely a large campaign contribution: it appears that $25m of that is the largest the largest illegal campaign contribution by a federal contractor in history, "by far," a fact that was sleuthed out by Molly White:

https://www.citationneeded.news/coinbase-campaign-finance-violation/

At issue is the fact that Coinbase is bidding to be a US federal contractor: specifically, they want to manage the crypto wallets that US federal cops keep seizing from crime kingpins. Once Coinbase threw its hat into the federal contracting ring, it disqualified itself from donating to politicians or funding PACs:

Campaign finance law prohibits federal government contractors from making contributions, or promising to make contributions, to political entities including super PACs like Fairshake.

https://www.fec.gov/help-candidates-and-committees/federal-government-contractors/

Previous to this, the largest ever illegal campaign contribution by a federal contractor appears to be Marathon Petroleum Company's 2022 bribe to GOP House and Senate super PACs, a mere $1m, only 4% of Coinbase's bribe.

I'm with Nolan on this one. Let the GOP chase millions from billionaires everyone hates who expect them to promote a scam that everyone mistrusts. The Dems have finally found a candidate that people are excited about, and they're awash in money thanks to small amounts contributed by everyday Americans. As AOC put it:

They've got money, but we've got people. Dollar bills don't vote. People vote.

https://www.popsugar.com/news/alexandria-ocasio-cortez-dnc-headquarters-climate-speech-47986992

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/31/greater-fools/#coinbased

#pluralistic#coinbase#crypto#cryptocurrency#elections#campaign finance#campaign finance violations#crimes#fraud#influence peddling#democrats#moneylike#bubbles#ponzi schemes#bezzles#molly white#hamilton nolan

433 notes

·

View notes

Text

Al-Naji explained that purchasing BTCLT through the BitClout platform involved a “totally decentralized” so-called “atomic swap” whereby investors would deposit the crypto asset bitcoin into BitClout’s treasury wallet and receive BTCLT in exchange. This exchange, however, only operated in one direction, meaning that BTCLT investors could not exchange their tokens back into bitcoin or fiat currency (e.g., U.S. dollars) via the BitClout platform. This fact was not explained in the BitClout White Paper. Al-Naji privately explained to an early investor that he viewed this technical limitation as a positive feature of the platform because restricting the ability to sell BTCLT had the effect of driving up its price.

You've heard of write-only memory, now it's time for buy-only assets

32 notes

·

View notes

Text

North Korean hackers have stolen the equivalent of billions of dollars in recent years and the nation is seeking to amass even greater wealth through illicit means, experts told DW.

Hackers belonging to the Lazarus Group — a notorious North Korean crypto theft ring — stole a record $1.5 billion (some €1.37 billion) in digital tokens from Dubai-based cryptocurrency exchange ByBit in late February. The company said the hackers had accessed its digital wallet for Ethereum, the second-largest electronic currency after Bitcoin.

Binance News, a new platform operated by cryptocurrency exchange firm Binance, reported last month that North Korea now has some 13,562 Bitcoins, the equivalent of $1.14 billion. Bitcoin is the world's oldest and best known cryptocurrency, often compared with gold due to its alleged resistance to inflation. Only the US and Great Britain have greater reserves of the currency, Binance News said, citing crypto data provider Arkham Intelligence.

"Let's not mince words — [North Korea] achieved this through theft," Aditya Das, an analyst at cryptocurrency research firm Brave New Coin in Auckland, New Zealand, told DW.

"Global policing agencies like the FBI have publicly warned that North Korean state-sponsored hackers are behind numerous attacks on cryptocurrency platforms," he added.

Hackers use social engineering against crypto firms

Despite those warnings, however, crypto firms are still being robbed and North Korean hackers are becoming increasingly sophisticated, the analyst said.

"North Korea employs a wide range of cyberattack techniques, but they've become especially known for their skill in social engineering," said Das.

"Many of their operations involve infiltrating employee hardware, then using that access to breach internal systems or lay traps from the inside."

The hacker's primary targets are crypto startups, exchanges and decentralized finance (DeFi) platforms due to their "often under-developed security protocols," he said.

Recovery of funds 'extremely rare'

Elite North Korean hackers tend to take their time when infiltrating a legitimate global organization, often by impersonating venture capitalists, recruiters or remote IT workers to build up trust and breach firms' defenses.

"One group, Sapphire Sleet, lures victims into downloading malware disguised as job applications, meeting tools or diagnostic software — essentially turning victims into their own attack vectors," Das said.

Once crypto has been stolen, Das says recovery is "extremely rare." Cryptocurrency systems are designed to make transactions irreversible and striking back against North Korean operatives "is not a viable option because these are nation-state actors with top-tier cyber defenses."

Kim Jong Un's regime 'saved' by cryptocurrency theft

Park Jung-won, a professor of law at Dankook University, said North Korea previously relied on risky transactions — such as smuggling narcotics and counterfeit goods or supplying military instructors to African nations — to earn illicit funds.

The legal expert says the advent of cryptocurrency "has been a huge opportunity" for dictator Kim Jong Un.

"It is probably fair to say that given the way the world was cracking down on Pyongyang's smuggling efforts, crypto has saved the regime," Park told DW. "Without it, they would have been completely without funds. They know that and they have invested heavily in training the best hackers and getting them up to a very high level of skill."

"The money that they are stealing is going straight to the government and the assumption is that it is being spent on weapons and greater military technology as well as the Kim family," according to Park.

North Korea immune to international pressure

Park does not believe that outside pressure would force North Korea to end hacking attacks.

"For Kim, the survival of his dynasty is the most important priority," the law professor said.

"They have become accustomed to this source of revenue, even if it is illegal, and they will not change," he added. "There is no reason for them to suddenly start abiding by international law and there is no way to apply more pressure."

Das agrees there are few tools available to influence North Korea. He says companies need to do everything in their power to avoid becoming the next victim.

"Best practices like secure-by-design smart contracts, constant internal verification and social engineering awareness are essential if the industry wants to stay ahead," he said.

Crypto firms need universal security standards

There's growing momentum for sector-wide information sharing which would help crypto firms detect North Korean tactics and avert attacks, but Das warns that crypto remains "fragmented" because there is no universal security standard. Also, North Korean hackers are good at turning security tools against their users, according to the analyst.

"In the Bybit case, the attackers exploited Safe, a multi-signature wallet system meant to enhance security. Ironically, this added security layer became the very exploit they used," he said.

And in practice, Das added, "some firms still treat security as an afterthought."

"From my experience, teams often prioritize shipping fast over building secure systems and until that changes, the space will remain vulnerable," Das said.

#nunyas news#have to wonder what would happen#if all of a sudden a bunch of countries#started selling their crypto off#would the market tank or no

7 notes

·

View notes

Text

From Casinos to Crypto: How Las Vegas Became a Blockchain Innovation Hub

Las Vegas, long synonymous with its iconic casinos and vibrant entertainment, is now emerging as an unexpected hub for blockchain innovation. Inspired by the gaming industry’s need for security, transparency, and enhanced user experiences, the city is becoming a leader in fintech applications powered by blockchain. This transformation is driving the convergence of technology, finance, and entertainment, paving the way for the city’s tech-driven future. Fifteen years ago, in 2010, 10,000 Bitcoin was used to purchase two pizzas, a transaction that marked the first real-world use of the cryptocurrency. At the time, Bitcoin was practically worthless. Fast forward to today, and the value of Bitcoin has skyrocketed. Now, selling just 33 Bitcoin could buy you a $3 million penthouse at the prestigious Four Seasons Private Residences in Las Vegas. This dramatic shift highlights not only Bitcoin’s meteoric rise but also redefining how wealth and assets are exchanged in a tech-driven world.

1. Blockchain Integration in Las Vegas

Resorts World Las Vegas

Resorts World Las Vegas is a prime example of how casinos are embracing blockchain technology and digital currencies.

Crypto Payments: The casino allows customers to use Bitcoin and Ethereum for hotel bookings, dining, and other services, partnering with Gemini, a regulated crypto exchange.

Cashless Gaming: Patrons can use mobile wallets instead of carrying physical cash. This not only enhances convenience but also increases transaction security, reducing risks of theft or fraud.

Wynn Las Vegas

Wynn Las Vegas has partnered with fintech firms to explore blockchain-based loyalty rewards programs. Customers can earn digital tokens tied to casino activities, which can be redeemed for hotel stays, entertainment, or dining experiences.

Case Study: Blockchain for Fair Play

A notable example of blockchain in casinos is FunFair Technologies, a platform that offers decentralized casino solutions using Ethereum smart contracts. While not exclusive to Las Vegas, FunFair’s model ensures provable fairness by publishing game outcomes on the blockchain, making it impossible for casinos to manipulate results.

Such innovations are being tested in Las Vegas-style gaming platforms globally, showing how blockchain can build trust between casinos and players.

Casinos in Las Vegas Accepting Bitcoin for Payments

Golden Gate Hotel & Casino

Location: 1 Fremont Street, Las Vegas, NV 89101

Details: As the oldest casino in Las Vegas, Golden Gate accepts Bitcoin for hotel bookings, dining, and gift shop purchases.

Note: Bitcoin is not accepted for gambling activities but can be converted to U.S. dollars for gaming.

The D Las Vegas Hotel & Casino

Location: 301 Fremont Street, Las Vegas, NV 89101

Details: The D Las Vegas allows Bitcoin payments for hotel rooms, dining, and merchandise at its gift shop.

Note: Bitcoin cannot be used directly for gambling but works for other non-gaming services.

Resorts World Las Vegas

Location: 3000 Las Vegas Blvd S, Las Vegas, NV 89109

Details: Resorts World has partnered with Gemini, a cryptocurrency platform, to accept Bitcoin for hotel stays, dining, and select retail purchases.

Innovation: The resort also offers cashless gaming solutions, making it one of the most tech-forward destinations on the Strip.

2. Fintech Innovations Inspired by Gaming

The gaming industry’s push for seamless, secure, and engaging user experiences has inspired broader fintech applications.

Cashless Gaming Solutions

Casinos like The Venetian and MGM Grand have integrated cashless payment systems. Platforms such as Sightline Payments provide mobile wallets for gaming, dining, and retail, eliminating the need for physical cash.

These systems use fintech innovations like real-time payment settlement and biometric security for user verification, enhancing both speed and safety.

Gamification in Fintech

Gamification—using game-like elements in financial services—draws heavily from the gaming industry’s playbook.

Example: Robinhood: The stock trading app uses gamified features such as streaks, confetti animations, and rewards to engage users.

Las Vegas Influence: Gaming incentives and loyalty programs serve as inspiration for fintech apps offering rewards for saving, spending, or investing responsibly.

Case Study: The Link Between Casinos and Fintech Apps

Las Vegas casinos often deploy advanced AI-powered analytics to predict player behavior and optimize incentives. This same data-driven approach is now being used in fintech apps like Acorns and Stash, which offer personalized financial advice and savings plans based on user habits.

3. Las Vegas-Based Blockchain Gaming Companies

Infinite Games

Las Vegas-based Infinite Games is pioneering blockchain integration in mobile and online gaming:

NFT Ownership: Players can own in-game items as NFTs (non-fungible tokens), enabling trade and resale across different platforms.

Player Economy: By using blockchain, Infinite Games creates decentralized gaming economies where players can monetize their skills and assets.

PLAYSTUDIOS

PLAYSTUDIOS, famous for its loyalty-based mobile games, is exploring blockchain to make rewards more transparent and tradable:

Blockchain allows digital tokens to replace traditional rewards points. Players can transfer, sell, or redeem tokens in ways not previously possible.

Emerging Companies in the Sector

Startups like Decentral Games are pushing the boundaries by creating virtual casinos in the metaverse, powered by blockchain and cryptocurrencies.

Players can visit virtual versions of Las Vegas casinos, bet using digital assets, and enjoy provably fair gameplay.

4. Future Prospects for Blockchain in Las Vegas

Las Vegas’s integration of blockchain technology points toward a future that is both innovative and economically diverse.

Enhanced Security and Transparency

Blockchain creates an immutable ledger for transactions, making gaming and financial processes tamper-proof and transparent.

For example, blockchain is being explored to log all bets, winnings, and payouts, ensuring trust between players and casinos.

Blockchain for Tourism and Hospitality

The Las Vegas tourism industry can leverage blockchain for smart contracts in hotel bookings, event tickets, and tours.

For instance, a blockchain-based booking platform could eliminate intermediaries like OTAs (Online Travel Agencies), offering tourists lower costs and direct transparency.

Economic Diversification

By embracing blockchain technology, Las Vegas is diversifying its economy beyond casinos and entertainment:

Tech Startups: The city’s business-friendly policies are attracting fintech and blockchain startups.

Investors and Talent: Las Vegas is becoming a hub for blockchain conferences like Money 20/20, drawing global investors and tech talent.

Conclusion

Las Vegas’s journey from a global gaming capital to a blockchain innovation hub is a testament to its ability to adapt and evolve. By integrating blockchain into its casino operations, the city is setting new standards for transparency, security, and user engagement in gaming and fintech. From cashless gaming solutions to decentralized casinos, Las Vegas serves as both a case study and a blueprint for other cities looking to harness the power of blockchain.

Platforms like RealOpen are now facilitating real estate purchases using Bitcoin, Ethereum, and other cryptocurrencies. These platforms convert crypto to cash en route to escrow, allowing buyers to purchase any property, even if the seller isn’t crypto-friendly. For example, crypto enthusiasts can test these innovations by using Bitcoin to purchase luxury properties, including a Trump Las Vegas condos for sale. This seamless process allows digital asset holders to invest directly into the Las Vegas real estate market, turning crypto wealth into tangible luxury assets.

As fintech innovations inspired by the gaming industry continue to grow, Las Vegas is uniquely positioned to lead this revolution—solidifying its status not just as the Entertainment Capital of the World, but also as a Tech and Blockchain Capital for the Future.

8 notes

·

View notes

Text

Market Shockwaves! G7 Crypto Rules Hit - Is NEXVOLT Finance Academy Predicting the Fallout?

FLASH REPORT: G7 Announces Coordinated Stablecoin Reserve Framework – Crypto Markets React Instantly.

Data Points (Immediate Impact - Approx.):

BTC: Sharp dip, briefly testing sub-$65,000 levels before partial recovery. Increase in exchange volume noted.

Major Stablecoins (USDC, EURT): Temporary spike in redemption requests; minor deviations from $1/€1 peg observed on some DEXs (Decentralized Exchanges) before stabilizing. Trading volume up ~15% in the hour following the announcement.

DeFi Tokens: Select protocols heavily reliant on affected stablecoins saw ~5-8% drops as liquidity providers reassessed positions.

Analysis: Today's surprise G7 announcement outlines stricter, unified reserve requirements for major stablecoin issuers operating within member jurisdictions. The proposed rules mandate higher percentages of cash and short-term government debt, reducing reliance on commercial paper.

The market's knee-jerk reaction highlights extreme sensitivity to regulatory developments from major economic blocs. The speed of the BTC dip and stablecoin volume surge underscores how quickly capital shifts based on perceived regulatory risk. Understanding the nuances of such policies and their immediate financial implications is critical for navigating this space – a skill emphasized by educational platforms like NEXVOLT Finance Academy.

While traditional markets saw minor moves (e.g., Capital Investment Trust Corp stock up slightly on unrelated news), the crypto sphere experienced significant, policy-driven volatility. This demonstrates the unique impact profile of geopolitical and regulatory actions on digital assets. Staying informed via resources potentially offered by NEXVOLT Finance Academy could be crucial for risk management.

Outlook: Expect continued volatility as the market digests the full text and potential implementation timelines. Focus shifts to issuer responses and potential impacts on DeFi liquidity pools.

Stay informed on policy impacts: https://www.nxvvj.com/#/home

2 notes

·

View notes

Text

How to Calculate the Cost of a Decentralized Crypto Exchange Platform

Demand for decentralized crypto exchange platforms has grown with the advent of decentralized finance (DeFi). While centralized exchanges rely on intermediaries, decentralized exchanges (DEXs) do not use intermediaries to facilitate peer-to-peer transactions through smart contracts. Creating a DEX involves significant investment, and cost estimation is critical to planning. The following is a detailed analysis of the cost drivers involved in developing decentralized crypto exchanges.

Important Cost Factors in Creating a Decentralized Crypto Exchange

Selection of Technology StackThe choice of the proper blockchain infrastructure matters, as it affects security, cost of transactions, and scalability. The most popular blockchain networks are:

Ethereum – Very secure but with high gas fees.

Binance Smart Chain (BSC) – Faster and cheaper but less decentralized.

Solana – High-speed transaction with lower costs but still under development.

Other tech stacks like React.js, Node.js, and Golang for frontend and backend development also affect costs.

Core Features and FunctionalitiesThe cost depends on the complexity of the features incorporated. The core functionalities of a decentralized exchange development firm are:

Non-custodial wallet integration (MetaMask, Trust Wallet, WalletConnect).

Liquidity pool or order book mechanism to enable smooth trading.

Gas fee optimization methods to minimize transaction costs.

Advanced security capabilities like multi-signature authentication and fraud detection.

Governance models like DAO-based decision-making for protocol upgrades.

Adding custom functionality incurs increased development time and expense.

Smart Contract Development & Security AuditsSmart contracts are the backbone of decentralized exchange software. Malcoded contracts can introduce security risks. The cost of development is a function of:

Custom vs. open-source smart contracts – More secure but more expensive.

Third-party security audits – Critical to avoid exploits and hacks.

Gas-efficient coding – Minimizes network transaction fees and maximizes performance.

Security audits by companies such as CertiK or Hacken can cost between $10,000 and $100,000 depending on complexity.

Liquidity Provision and Market MakingA DEX exchange development company needs to provide adequate liquidity for smooth transactions. Two models for liquidity provision are:

Automated Market Makers (AMMs) – Need initial liquidity pool and yield farming incentives.

Order Book Mechanisms – Require market-making bots to order trades.

Initial liquidity funding could cost between $50,000 and $200,000 based on expected trading volume.

Infrastructure and Hosting CostsA decentralized exchange development service demands stable hosting options:

Decentralized storage (IPFS or Arweave) for secure and censorship-free data storage.

Cloud-based hosting (AWS, Netlify, or decentralized solutions).

Node infrastructure deployment for handling blockchain interactions.

Infrastructure expenses are different but normally between $5,000 and $50,000 annually.

Development of User Interface and Experience (UI/UX)An efficient UI improves usability and brings more traders. The price is:

Implementation of custom design for responsive web and mobile.

Development of intuitive dashboard to facilitate easy trade execution.

Dark and light mode support to provide an enhanced user experience.

UI/UX development may cost between $20,000 and $100,000 based on complexity.

Legal and Compliance IssuesAlthough DEXs are decentralized, there are regulations enforced in some jurisdictions. Companies need to factor in:

Know Your Customer (KYC) and Anti-Money Laundering (AML) regulation compliance in areas where regulated.

Legal advisory costs for operating abroad.

Intellectual property rights protection for in-house developed technology.

Legal costs may vary from $10,000 to $50,000, depending on the target market.

Maintenance and UpgradesAfter launch, a crypto exchange platform development company will need to spend on:

Bug fixes and security patches to avoid vulnerabilities.

Smart contract upgrades to increase protocol efficiency.

User support and feature enhancements to keep the platform competitive.

Annual maintenance fees are usually between $10,000 and $50,000.

Estimated Budget for a Decentralized Crypto ExchangeThe price of decentralized crypto exchange development varies based on customization, security, and liquidity. A rough estimate is as follows:

Blockchain Selection & Setup – $5,000 to $20,000.

Smart Contract Development – $20,000 to $100,000.

Security Audits – $10,000 to $100,000.

Frontend & Backend Development – $30,000 to $150,000.

Liquidity Provision – $50,000 to $200,000.

Hosting & Infrastructure – $5,000 to $50,000.

Ongoing Maintenance – $10,000 to $50,000 annually.

The cost to build a decentralized crypto exchange platform is between $100,000 to $500,000+, depending on project size and feature complexity.

ConclusionThe price of decentralized crypto exchange development depends on blockchain choice, security features, liquidity solutions, and regulatory adherence. Hiring a leading crypto exchange development firm guarantees companies professional advice, strong security, and scalability.

Entrepreneurs need to carry out deep market analysis and work together with Indian or other international crypto exchange developers to develop a safe and economical decentralized crypto exchange platform. Precise planning and investment distribution can result in a thriving and competitive trading environment.

#decentralized crypto exchange development#decentralized exchange development company#Decentralized Exchange Development Service#dex exchange development company#Decentralized exchange software#Decentralized Crypto Exchange Platform#crypto exchange platform development#Cryptocurrency exchange development service#Top Crypto Exchange Development Company#crypto exchange platform development company#crypto exchange development company

0 notes

Text

Complete List of Crypto Exchanges in 2025: Safest and Easiest Platforms to Trade Crypto

Are you new to crypto and wondering where to start? Choosing the right place to buy, sell, and trade can be hard—especially when there are so many options out there. In this guide, we’ll give you a complete list of crypto exchanges in 2025 that are perfect for beginners. These exchanges are simple to use, safe, and trusted by people all over the world.

Whether you're looking for the easiest app or the safest platform, this blog will help you get started in your crypto journey the right way.

What Are Crypto Exchanges?

Crypto exchanges are websites or apps where people can trade digital money like Bitcoin, Ethereum, or other coins. Just like you go to a bank to exchange money, here you can trade one crypto for another, or change crypto into regular money and vice versa.

There are two main types: centralized and decentralized. Centralized exchanges are run by companies. They are easy to use and have good customer support. Decentralized ones are run by users and give you more control, but may be a little harder to understand.

Why the Right Exchange Matters for Beginners

If you're just starting, you need a place that is:

Easy to use

Safe and secure

Offers help when needed

Supports many types of coins

Has low trading fees

This is why checking a trusted crypto exchanges list can make a big difference. It saves you time and helps you avoid risky platforms.

The Complete List of Crypto Exchanges for 2025

Here are some of the safest and easiest platforms for beginners. This digital currency exchange list includes both big names and new players that are gaining popularity in 2025.

1. Binance

Binance is one of the most popular cryptocurrency exchanges in the world. It has a beginner-friendly version called “Binance Lite” that makes trading simple. You can buy coins with a credit card or even through your bank account.

2. Coinbase

Coinbase is perfect for people just starting out. It’s super easy to use and comes with simple tools and learning videos. It’s a favorite on every top 10 cryptocurrency exchanges list because of its strong safety features.

3. Kraken

Kraken is known for its security. It may look a bit technical at first, but they’ve made big changes in 2025 to support beginners. It offers good support and low trading fees too.

4. KuCoin

KuCoin is becoming more popular among new users. It has a clean design and supports hundreds of coins. It also offers free tools for learning, making it a great option on any good cryptocurrency exchanges list.

5. Bitstamp

Bitstamp is one of the oldest exchanges. It's safe and now offers a much easier design for beginners. You can use it on both your computer and phone.

6. Bybit

Bybit is fast-growing and has become more beginner-friendly in 2025. It now supports card payments, quick trades, and has helpful videos for new users.

7. OKX

OKX is another trusted name. It now has a beginner mode with simple buying and selling options. It's also on many top 10 cryptocurrency exchanges charts due to its features and growing user base.

8. Gemini

Gemini is a U.S.-based exchange with very strong safety features. It’s simple and clean—perfect for people new to crypto. It also has strong rules to protect your money.

9. MEXC Global

MEXC is a fast-growing platform in 2025. It supports many coins and has made trading easier for people who are just starting. It’s slowly climbing the crypto currency exchange list for its low fees and support.

10. Uniswap (Decentralized)

If you want more control, Uniswap is a great choice. It’s part of the decentralized crypto exchange list and doesn’t need you to sign up with personal info. It’s not as beginner-friendly as others, but it gives full control over your money.

What Makes an Exchange Safe?

Not every platform is safe. A good exchange should have:

Two-step login security

Insurance in case of hacks

A history of strong protection

No major scams or issues

Before using any platform from a list of crypto exchanges, always read reviews and check if the company is known and trusted.

What to Look For in a Beginner-Friendly Exchange

Here are a few features you should look for:

Easy sign-up process

Simple design and layout

Fast ways to buy and sell coins

Learning tools and guides

Helpful customer support

If an exchange has all these features, you’re in good hands.

Centralized vs. Decentralized Exchanges

Centralized exchanges are easier for beginners. You don’t need to worry much about technical stuff. But decentralized platforms give you full control over your coins. If you’re ready for a challenge, the decentralized crypto exchange list has great options too.

Final Thoughts

Getting started in crypto is exciting, and choosing the right exchange is a big first step. With this complete list of crypto exchanges in 2025, you now know where to look. These platforms are beginner-friendly, safe, and offer everything you need to start your crypto journey with confidence.

Always remember: start small, do your research, and never share your private info. With the right platform, earning and trading crypto can be fun, safe, and easy—even for someone just starting out.

#crypto exchange#exchange list#digital currency exchange list#decentralized crypto exchange list#top 10 cryptocurrency exchanges#cryptocurrency exchanges#crypto currency exchange list

2 notes

·

View notes

Text

Exploring the Future of Digital Assets: Singular and Singular Crypto

The digital asset landscape is rapidly transforming, with emerging technologies and innovative cryptocurrencies redefining how we perceive and use digital finance. At the forefront of this revolution are Singular and Singular Crypto, poised to reshape the future of digital assets. This article delves into how Singular and Singular Crypto are addressing current challenges and setting new standards for the cryptocurrency market.

The Rise of Singular: Redefining Digital Currency

Singular is an innovative cryptocurrency designed to address several critical issues that have plagued traditional digital currencies. Its development is focused on enhancing scalability, security, and usability, aiming to provide a more efficient and accessible solution for users and investors.

Key Innovations of Singular:

1. Scalability: One of the significant hurdles for many cryptocurrencies is their ability to scale effectively as usage grows. Singular is built with advanced scaling solutions that support high transaction volumes without compromising speed or increasing costs. This scalability makes Singular an ideal candidate for both everyday transactions and large-scale applications.

2.Enhanced Security: Singular places a strong emphasis on security. Utilizing state-of-the-art encryption techniques and a decentralized consensus mechanism, Singular aims to protect users from hacks and fraud. This focus on security ensures that users can transact and invest with confidence, knowing their assets are secure.

3.Environmental Sustainability: With growing concerns about the environmental impact of cryptocurrency mining, Singular addresses this by employing an eco-friendly consensus algorithm. This approach significantly reduces energy consumption compared to traditional mining methods, aligning with global sustainability efforts.

4.Decentralized Governance: Singular incorporates a decentralized governance model, allowing stakeholders to participate in key decisions regarding the future development of the cryptocurrency. This model fosters a more democratic approach, ensuring that the interests of the community are reflected in the project’s evolution.

Singular Crypto: A Comprehensive Digital Asset Solution

Singular Crypto is a multifaceted platform that complements Singular by providing a holistic approach to managing and utilizing digital assets. It combines innovative features with user-centric design to offer a comprehensive solution for cryptocurrency enthusiasts and investors.

Core Features of Singular Crypto:

1.Integrated Wallet: Singular Crypto includes an advanced wallet that supports Singular and other major cryptocurrencies. The wallet is designed for ease of use, offering secure storage, transaction management, and portfolio tracking in a single platform.

2.Advanced Trading Tools: For those engaged in trading, Singular Crypto provides a suite of advanced tools and features. This includes real-time market data, analytics, and trading signals that help users make informed decisions and optimize their trading strategies.

3.Cross-Platform Accessibility: Singular Crypto is accessible across various devices and platforms, ensuring users can manage their assets anytime, anywhere. Whether on a desktop, tablet, or mobile device, users have seamless access to their digital assets and trading functionalities.

4.Security and Compliance: Singular Crypto adheres to the highest standards of security and regulatory compliance. With robust encryption, multi-signature authentication, and regular security audits, the platform ensures that user data and assets are protected against potential threats.

The Future of Digital Assets with Singular and Singular Crypto

As digital assets continue to gain traction, Singular and Singular Crypto represent a significant leap forward in the cryptocurrency space. Their focus on scalability, security, and environmental sustainability addresses many of the current limitations and challenges faced by existing digital currencies.

Benefits to Users and Investors:

1.Increased Adoption: With its scalable and secure infrastructure, Singular is well-positioned to attract a broad user base and drive widespread adoption. Its eco-friendly approach also appeals to environmentally conscious investors, enhancing its appeal in a competitive market.

2.Enhanced Trading Experience: Singular Crypto’s comprehensive suite of tools and features provides traders with a competitive edge. By offering advanced trading functionalities and real-time insights, the platform helps users maximize their investment opportunities.

3.Future-Proofing Digital Assets: Singular and Singular Crypto are designed to adapt to the evolving needs of the digital asset market. Their innovative features and commitment to user-centric design ensure that they remain relevant and effective as the industry progresses.

Conclusion

The future of digital assets is being shaped by innovations like Singular and Singular Crypto. By addressing key issues such as scalability, security, and environmental impact, these projects offer promising solutions that could redefine the cryptocurrency landscape. As we move forward,Singular and Singular Crypto are set to play a pivotal role in the evolution of digital finance, providing users with secure, efficient, and sustainable options for managing their digital assets.

Blog Source URL:

#singular#singular wallet#dex#perpetuals#bitcoin’s price#singular crypto#singular coin#Dex Trades#Trading Dex#Defi Trading Platforms#Decentralized Perpetual Exchanges#Dex Perpetuals

0 notes

Text

Bitcoin Volatility Fuels Market Anxiety; XBIT Decentralized Exchange Charts Steady Recovery

1. Regulatory Storm Amid Bitcoin’s ATH As Bitcoin’s price surpassed its all-time high (ATH) of $100,000 in early 2025, a global regulatory storm engulfed cryptocurrency markets. Centralized exchanges (CEXs) worldwide faced abrupt blockages, operational restrictions, or asset freezes, triggering widespread investor panic. Amid the turmoil, XBIT Exchange—a decentralized trading platform (DEX)—rapidly gained traction, with its trading volume surging 400% month-over-month and positioning itself as a secure harbor for Bitcoin holders.

2. Centralized Platforms Under Scrutiny In March 2025, the U.S. Securities and Exchange Commission (SEC) launched investigations into five major crypto platforms for compliance violations, while Japan’s Financial Services Agency (FSA) announced a sweeping review of all Bitcoin-related exchanges. Concurrently, mid-tier platforms like CoinTide and UltraX halted services indefinitely, freezing over $120 million in user assets. These events forced investors to confront a critical question: Can centralized platforms ever be truly secure?

3. Decentralized Solutions Regain Momentum The concept of decentralized exchanges (DEXs), once dismissed as niche tools due to technical complexity, has resurged under regulatory pressure. XBIT Exchange exemplifies this shift. Operating via on-chain smart contracts, the platform eliminates third-party custody, manual intervention, and Know Your Customer (KYC) requirements, adhering strictly to the principles of self-custody, transparency, and censorship resistance. Users interact directly through non-custodial wallets, with every transaction recorded immutably on the blockchain.

4. Demystifying Decentralized Exchanges A decentralized exchange operates entirely on blockchain networks, executing trades through automated smart contracts without holding user funds. Key features include:

Non-custodial design: Assets remain in users’ wallets until trade execution.

Tamper-proof execution: Transactions are verified by code, not human intermediaries.

Transparent audit trails: All activities are publicly verifiable on-chain.

XBIT currently supports Bitcoin, Ethereum, and major stablecoins, with cross-chain interoperability slated for Q3 2025.

5. Data-Driven Adoption Surge According to blockchain analytics firm DataLink, DEX usage surged 275% globally between March and May 2025, with 43% of new users migrating from CEXs after experiencing freezes or high fees. “After my funds were frozen on a traditional platform, I realized decentralization isn’t optional—it’s essential,” said Berlin-based investor Marlin Koch.

XBIT’s metrics underscore this trend: daily new wallet addresses exceed 5,200, while monthly transactions grew 320% year-over-year (YoY), rivaling legacy platforms.

6. XBIT’s Strategic Edge

Global node network: A distributed architecture minimizes risks of server seizures or exit scams.

On-chain risk scoring: Real-time security audits for every transaction.

User-centric interface: Features like one-click trading and QR-synced wallet logins lower barriers for retail investors.

7. Conclusion: Redefining Crypto’s Future As Bitcoin evolves from a speculative asset to a global hedge, the demand for secure, transparent trading infrastructure grows imperative. Decentralized platforms like XBIT are no longer ideological experiments but market necessities—offering resilience against regulatory volatility and redefining trust in digital finance.

2 notes

·

View notes

Text

decentralized cryptocurrency exchange Bangladesh

Trade confidently with us, best decentralized cryptocurrency exchange Bangladesh. Our platform offers security, speed, and full control over your cryptocurrency transactions. We prioritize your security and privacy while providing access to a variety of digital assets. Start your crypto journey with us now!

#TonBigBull#CryptoRevolution#BlockchainInnovation#MetaverseTech#DecentralizedFinance#CryptoEcommerce#NFTMarketplace#CryptoInvestment#StakingAndFarming#DigitalCurrency#CryptoLaunchpad#blockchaingaming#cryptocurrencyexchange#web3technologies

2 notes

·

View notes

Text

How to Develop a P2P Crypto Exchange and How Much Does It Cost?

With the rise of cryptocurrencies, Peer-to-Peer (P2P) crypto exchanges have become a popular choice for users who want to trade digital assets directly with others. These decentralized platforms offer a more secure, private, and cost-effective way to buy and sell cryptocurrencies. If you’re considering building your own P2P crypto exchange, this blog will guide you through the development process and give you an idea of how much it costs to create such a platform.

What is a P2P Crypto Exchange?

A P2P crypto exchange is a decentralized platform that allows users to buy and sell cryptocurrencies directly with each other without relying on a central authority. These exchanges connect buyers and sellers through listings, and transactions are often protected by escrow services to ensure fairness and security. P2P exchanges typically offer lower fees, more privacy, and a variety of payment methods, making them an attractive alternative to traditional centralized exchanges.

Steps to Develop a P2P Crypto Exchange

Developing a P2P crypto exchange involves several key steps. Here’s a breakdown of the process:

1. Define Your Business Model

Before starting the development, it’s important to define the business model of your P2P exchange. You’ll need to decide on key factors like:

Currency Support: Which cryptocurrencies will your exchange support (e.g., Bitcoin, Ethereum, stablecoins)?

Payment Methods: What types of payment methods will be allowed (bank transfer, PayPal, cash, etc.)?

Fees: Will you charge a flat fee per transaction, a percentage-based fee, or a combination of both?

User Verification: Will your platform require Know-Your-Customer (KYC) verification?

2. Choose the Right Technology Stack

Building a P2P crypto exchange requires selecting the right technology stack. The key components include:

Backend Development: You'll need a backend to handle user registrations, transaction processing, security protocols, and matching buy/sell orders. Technologies like Node.js, Ruby on Rails, or Django are commonly used.

Frontend Development: The user interface (UI) must be intuitive, secure, and responsive. HTML, CSS, JavaScript, and React or Angular are popular choices for frontend development.

Blockchain Integration: Integrating blockchain technology to support cryptocurrency transactions is essential. This could involve setting up APIs for blockchain interaction or using open-source solutions like Ethereum or Binance Smart Chain (BSC).

Escrow System: An escrow system is crucial to protect both buyers and sellers during transactions. This involves coding or integrating a reliable escrow service that holds cryptocurrency until both parties confirm the transaction.

3. Develop Core Features

Key features to develop for your P2P exchange include:

User Registration and Authentication: Secure login options such as two-factor authentication (2FA) and multi-signature wallets.

Matching Engine: This feature matches buyers and sellers based on their criteria (e.g., price, payment method).

Escrow System: An escrow mechanism holds funds in a secure wallet until both parties confirm the transaction is complete.

Payment Gateway Integration: You’ll need to integrate payment gateways for fiat transactions (e.g., bank transfers, PayPal).

Dispute Resolution System: Provide a system where users can report issues, and a support team or automated process can resolve disputes.

Reputation System: Implement a feedback system where users can rate each other based on their transaction experience.

4. Security Measures

Security is critical when building any crypto exchange. Some essential security features include:

End-to-End Encryption: Ensure all user data and transactions are encrypted to protect sensitive information.

Cold Storage for Funds: Store the majority of the platform's cryptocurrency holdings in cold wallets to protect them from hacking attempts.

Anti-Fraud Measures: Implement mechanisms to detect fraudulent activity, such as IP tracking, behavior analysis, and AI-powered fraud detection.

Regulatory Compliance: Ensure your platform complies with global regulatory requirements like KYC and AML (Anti-Money Laundering) protocols.

5. Testing and Launch

After developing the platform, it’s essential to test it thoroughly. Perform both manual and automated testing to ensure all features are functioning properly, the platform is secure, and there are no vulnerabilities. This includes:

Unit testing

Load testing

Penetration testing

User acceptance testing (UAT)

Once testing is complete, you can launch the platform.

How Much Does It Cost to Develop a P2P Crypto Exchange?

The cost of developing a P2P crypto exchange depends on several factors, including the complexity of the platform, the technology stack, and the development team you hire. Here’s a general cost breakdown:

1. Development Team Cost

You can either hire an in-house development team or outsource the project to a blockchain development company. Here’s an estimated cost for each:

In-house Team: Hiring in-house developers can be more expensive, with costs ranging from $50,000 to $150,000+ per developer annually, depending on location.

Outsourcing: Outsourcing to a specialized blockchain development company can be more cost-effective, with prices ranging from $30,000 to $100,000 for a full-fledged P2P exchange platform, depending on the complexity and features.

2. Platform Design and UI/UX

The design of the platform is crucial for user experience and security. Professional UI/UX design can cost anywhere from $5,000 to $20,000 depending on the design complexity and features.

3. Blockchain Integration

Integrating blockchain networks (like Bitcoin, Ethereum, Binance Smart Chain, etc.) can be costly, with development costs ranging from $10,000 to $30,000 or more, depending on the blockchain chosen and the integration complexity.

4. Security and Compliance

Security is a critical component for a P2P exchange. Security audits, KYC/AML implementation, and regulatory compliance measures can add $10,000 to $50,000 to the total development cost.

5. Maintenance and Updates

Post-launch maintenance and updates (bug fixes, feature enhancements, etc.) typically cost about 15-20% of the initial development cost annually.

Total Estimated Cost

Basic Platform: $30,000 to $50,000

Advanced Platform: $70,000 to $150,000+

Conclusion

Developing a P2P crypto exchange requires careful planning, secure development, and a focus on providing a seamless user experience. The cost of developing a P2P exchange varies depending on factors like platform complexity, team, and security measures, but on average, it can range from $30,000 to $150,000+.

If you're looking to launch your own P2P crypto exchange, it's essential to partner with a reliable blockchain development company to ensure the project’s success and long-term sustainability. By focusing on security, user experience, and regulatory compliance, you can create a platform that meets the growing demand for decentralized crypto trading.

Feel free to adjust or expand on specific details to better suit your target audience!

2 notes

·

View notes

Text

From Skeptic to Believer: How a Random Telegram Call Led Me to STON.fi DEX

I never thought a random Telegram call could change my Web3 journey. But that’s exactly what happened.

In the crypto space, opportunities often come in unexpected ways. Some people stumble upon airdrops, others get introduced by friends, and a few dive in after deep research. My story? It started with a casual conversation in a crypto Telegram group.

A Call That Sparked My Curiosity

One evening, I joined a community call in a DeFi-focused Telegram group. The discussion was about opportunities in decentralized finance (DeFi), and one project kept coming up—STON.fi DEX.

The speakers were enthusiastic, explaining how STON.fi was revolutionizing decentralized trading with:

✅ Seamless token swaps with ultra-low fees

✅ Staking opportunities that rewarded users with Gemston tokens

✅ A liquidity provision model that allowed users to earn passively

At first, I wasn’t entirely convinced. I had seen many projects make big claims but fail to deliver. But when they mentioned the Stonbassador Program, my interest peaked.

I’ve always believed that the best way to understand something is to test it. So instead of dismissing the idea, I decided to give it a shot.

Diving In: My First Experiment with STON.fi

Rather than jumping in blindly, I started by observing and researching. I checked their website, community discussions, and whitepaper. Everything seemed solid.

To test the waters, I wrote a Twitter thread summarizing what I had learned. I broke it down into:

🔹 How STON.fi DEX simplifies trading on the TON blockchain

🔹 Why its staking mechanism is a great way to earn passively

🔹 How users could earn by providing liquidity

I wasn’t expecting much, but within a few weeks, I got rewarded. That moment changed my entire perception of the platform.

It wasn’t just about earning tokens—it was about being part of something innovative.

Becoming an Active User: Hands-On with STON.fi

With the motivation from my first reward, I decided to go beyond writing and start using the platform firsthand.

Here’s what I discovered:

1. Swapping Tokens Was Incredibly Fast and Cheap

Most DEXs promise fast transactions, but in reality, many suffer from network congestion and high gas fees.

On STON.fi, my first token swap was instant, with almost zero fees. That’s when I realized this wasn’t just another DEX—it was something built for efficiency.

2. Staking Became an Unexpected Passive Income Stream

After testing swaps, I moved to staking. I wasn’t sure how much I would earn, but the process was straightforward.

I locked my assets, and before I knew it, rewards started accumulating in the form of Gemston tokens. It felt like having a savings account that actually grows without effort.

3. Liquidity Pools Opened My Eyes to New Earning Strategies

I had heard about providing liquidity, but I never fully understood it until I tried it.

By adding liquidity to STON.fi’s pools, I started earning a share of the transaction fees. It was like owning a piece of the exchange—the more I contributed, the more I earned.

Lessons I Learned Along the Way

Looking back, this experience taught me valuable lessons about crypto, DeFi, and personal growth:

1. Never Underestimate Small Opportunities

If I had ignored that Telegram call, I would have missed out on an incredible journey. Sometimes, the best opportunities come from unexpected places.

2. Action Beats Overthinking

It’s easy to research forever and never take action. But the moment I started testing STON.fi myself, everything became clearer. Experience is the best teacher.

3. Community Matters in Crypto

Many projects promise utility but lack strong community engagement. STON.fi’s active community, regular updates, and support system convinced me that it’s a platform built for long-term success.

Where I Am Now—And What’s Next

Since that first Telegram call, my journey with STON.fi has evolved tremendously:

🚀 I became a committed Stonbassador, sharing knowledge about the platform.

💰 I continue to earn from swaps, staking, and liquidity pools.

📈 I’ve gained a deeper understanding of DeFi and TON blockchain innovations.

And this is just the beginning.

STON.fi DEX is constantly expanding, and I’m excited to explore:

➡️ New DeFi opportunities within the ecosystem

➡️ Upcoming features that enhance trading and earning

➡️ Ways to help more people understand the potential of decentralized finance

This isn’t just about making money—it’s about being part of a revolutionary shift in crypto.

So if you’re still watching from the sidelines, maybe it’s time to jump in and experience it for yourself.

💬 Have You Explored STON.fi Yet

Whether you’re a trader, an investor, or just curious about DeFi, STON.fi DEX is a platform worth exploring.

2 notes

·

View notes

Text

Beginner’s Guide to Cryptocurrencies: Learn How to Make Money Safely

Beginner’s Guide to Cryptocurrencies: Learn How to Make Money Safely