#Debit Card Swipe Rate

Explore tagged Tumblr posts

Text

Gaslight, Chapter 22/48

Rated X | Read it here on AO3

Ellicott City, MD

Don’t know how you do what you do, I’m so in love with you. It just keeps getting better.

I wanna spend the rest of my life with you by my side, forever and ever.

Every little thing that you do, baby I’m amazed by you.

She snaps off the radio, then pulls Tiffany’s scarf off her head and tosses it onto the passenger seat. What is she supposed to do now? Where is she supposed to go? Her instincts tell her to run, but what about the children? She is the reason they’re involved in this in the first place, and guilt sinks heavily from her heart to her belly as she imagines what might happen to them now that the jig is up. Will they be discarded like trash? Will they be leveraged against her, used as pawns in an even more disturbing way? She wants to protect them, but to this point it’s her very proximity to them that has put them at risk. Though it goes against every maternal instinct in her body, she comes to the conclusion that the best thing she can do for them right now is to get as far away from them as possible.

Eyes on the road, one hand on the wheel, she digs around in her purse for her cell phone, finally pulling it free and flipping it open with her thumb. Her hands are still trembling, but she manages to dial. Lunch hour traffic means she hits every red light possible, and she can’t stop looking at the vehicles and sidewalks around her, waiting for another black suit to appear.

“Pick up, pick up, pick up,” she mumbles to herself, checking the rearview mirror obsessively.

“Dana?”

“Cal,” she says, relieved to hear his voice. “I’m on my way home, and I’m going to need to go away for a little while,” she begins, but he cuts her off.

“I’m already at home,” he says in a small, fearful voice.

“What? Why?” she asks, checking her blindspot before she switches lanes.

“I couldn’t—I just couldn’t,” he says tightly, and she realizes that he’s crying.

“Cal, I’ll be home in ten minutes, okay? Wait for me, and don’t open the door for anyone,” she says, finding confidence she didn’t realize she had within her. “Is your car in the garage?”

“Yeah,” he says in a near whisper.

“I need you to move it to the driveway so I can park in the garage, can you do that?”

“Yeah, I think so.”

“Okay, move the car, and then go inside and lock the door. I’ll be home soon.”

Twelve minutes later, she pulls into their driveway and jumps out to open the garage before parking Tiffany’s car inside it. When she enters the house, she finds it stonily silent and still.

“Cal?” she calls out, half expecting the smoking man from the hospital to appear instead.

“Over here.”

She follows the sound of his voice to the stairwell where he is sitting mid-flight, his head in his hands. She approaches slowly, sitting on the step just below him and laying her hand on top of his knee.

“Hey,” she says softly, and he sucks in a sharp breath.

“I’m all fucked up, mija,” he whimpers, followed by a wet sniff. “I’m just—I don’t know what to do.”

She moves one step up, wedging herself between his body and the bannister, and wraps her arm around his shoulders. He leans into her, and she rubs her palm up and down over his upper arm comfortingly.

“What happened?” she asks.

He sniffs and swipes his hand across his nose, composing himself.

“Everything is off,” he explains. “Nothing feels right. I couldn’t remember the PIN for my debit card to get gas, and then I got to work and I sat down at my desk and—it’s like it fell out of my head, Dana. Like it’s just gone.”

“What is?”

He sits up and looks at her. His eyes are bloodshot and swollen, his bottom lip quivering.

“Everything,” he says gravely. “I don’t know how to code. I can’t even fucking understand the code I wrote yesterday.”

“Oh,” she says, understanding.

“What’s happening to me?” he asks, and the pain in his voice makes her heart ache.

“I can only tell you what I was told, and I can’t be sure that what I was told is entirely accurate,” she says, her hand resting on his back.

“Just tell me, please,” he begs.

She looks away, running her tongue across her bottom lip as she decides how to explain it. She suddenly understands how challenging it was for Alex to relay the same information to her.

“I’m not your wife,” she says evenly. “You’re not my husband. Abby and Peter aren’t our children. This whole thing,” she says, gesturing to the house around them, “is a lie. A farce. Whoever did this to us…they went to very great lengths to make us believe that this life is ours.”

She pauses and turns to look at him, finding a somewhat vacant expression on his face. She can empathize, and knows that the questions are too numerous to even begin asking them. She has to keep talking.

“The chip in your neck contained memories. Memories of how we met, Abby and Peter’s births, your training in software engineering. Every single detail since 1992. And whatever they did to us, and whatever was in that medication, helped ensure that we wouldn’t remember what really happened. So that we’d believe it, the lie. And by removing your chip, I also removed those memories. That’s why you can’t remember how to code.”

“Or that pancakes are waffles,” he says absently.

“Right,” she confirms.

He stares off into the middle distance for a moment, allowing this new information to sink in.

“They’re not ours?” he asks, turning to look at her with a kind of disbelieving hurt on his face.

She shakes her head gently, her lips pressed together sympathetically.

“Not biologically, no. But they don’t know that. They still have their chips, and as long as they do, all they know is us,” she tells him, and he nods, looking away again.

“I don’t think I’m a good guy, Dana,” he says after a moment, and she narrows her eyes at him.

“What do you mean?”

He drops his head, staring at the carpeted step between his feet.

“They were cleaning the windows in the office and the smell of it—kind of like ammonia, maybe? It did something to me,” he says hesitantly.

“What did it do?”

“It made me remember something,” he says very quietly. He lifts his hands, forming loose fists. He moves them closer to his face and she realizes that he’s miming smoking from a pipe. “It wasn’t pot,” he says shamefully.

She sighs and moves into the space between his knees, kneeling on the step just below him. She grabs his hands, holding them in her own and looking him straight in the eye.

“Listen to me,” she says sternly. “I don’t know who you were or what you did before they did this to you, but it doesn’t matter. To me, you are Cal. You’re a good man, and a wonderful husband and father.” She feels her throat constrict and she swallows against it. She needs to be strong for him. “Whoever did this is looking for me, Cal. They came to the hospital, and it’s only a matter of time before they show up here. I’m not safe here.”

His eyes widen and his mouth falls open, but she stops him before his mind wanders too far.

“This isn’t about you,” she explains. “This is about me, and a man I used to work with. You and the kids were used to distract me, to make me believe the lie. I don’t have any reason to think they’ll harm you, unless they think they can use you to get to me.”

“What do we do?” he asks.

“I have to leave. I’m not going to tell you where I plan to go because you can’t be forced to provide information that you don’t have. I need you to take care of the kids, okay? You can call my mom for help if you need to. She has no idea any of this is happening, so just tell her that I had a work emergency or something. If anyone asks, say that you’re taking the medication, and do not tell anyone that I removed your chip, okay? Can you do that?”

He nods, but it’s lacking confidence.

“Will we see you again?” he asks hoarsely, and her chin puckers.

“I hope so,” she whispers, and he opens his arms, pulling her into a hug.

She hastily packs a bag with a few changes of clothes and basic toiletries, plus the Sam Cooke CD and the rest of the Numerol. She wishes she could take Cal’s chip for evidence or eventual analysis, but if Alex was right that it can be used to track her movements, it would be unsafe to do so. She remembers finding $800 cash stuffed into a cookie tin during her initial investigation of the house, and she takes that too. She loads her bag into Tiffany’s car and then turns back to Cal, who is standing in the doorway between the house and garage.

“Where did you get the car?” he asks, and she smiles thinly. “Never mind,” he says with a sigh, realizing that it’s the least of their worries.

They stand there for a moment, looking at one another. There’s so much she doesn’t know about him, so much he doesn’t know about himself, but he is still the person she trusts most in the world right now. The only person she trusts, really. She wishes that she didn’t have to do this alone. She suspects that he wishes the same.

“I’ll be in touch when I can,” she says, and he nods. “Give the kids big hugs and kisses for me, okay?”

His face crumples and he looks at the floor. She turns to get in the car, but then changes her mind and walks the handful of steps to where he is standing. She grabs his hand and he lifts his head, absolute agony in his eyes.

“You’re going to be okay,” she assures him, and his jaw jerks to the side.

“What about you?” he asks, his shoulder jumping.

“I hope to be,” she says, forgoing empty promises.

She pushes up onto her tiptoes and presses her lips to his cheek. Before her resolve can crumble any further, she climbs into the car and starts the ignition. Cal walks slowly alongside the driver’s side window as she backs out of the garage, and then follows her down the driveway. Before she turns the corner she takes one final glimpse in the rear view mirror at his tall, trim frame silhouetted against the backdrop of a suburban neighborhood.

It was a beautiful lie they created for her, and part of her is sad to leave it behind. But she chooses to look forward in hopes that she might be able to find her past, and the missing piece that she’s been mourning since the moment she woke up in the hospital.

He. Him.

Mulder.

She heads south, flipping the radio back on so she doesn’t feel so lonely. Her chest aches in the persistent, heavy way that only loss brings, and she hates just how familiar the sensation has become to her.

She’s worried about Cal, about the kids, about herself. She wonders if Mulder has any idea what’s happening, or if he is blissfully ignorant. She starts to think about the most effective way she can explain it to him, if she has the chance. And if she does explain it, and he doesn’t believe her, then what? Or, even worse, what if he does believe her but chooses his new life, his wife, over whatever they had and lost?

Scar tissue that I wish you saw,

Sarcastic mister know-it-all.

Close your eyes and I’ll kiss you, ‘cause

With the birds I’ll share

She feels slightly lightheaded suddenly, and she blinks rapidly and shakes her head back and forth to clear it away.

With the birds I’ll share this lonely view.

With the birds I’ll share this lonely view.

She flips on the turn signal and pulls off to the side of the road, her heart racing. She feels like she might be having a panic attack.

Push me up against the wall,

Young Kentucky girl in a push-up bra.

I’m fallin’ all over myself

To lick your heart and taste your health, ‘cause

It slams into her like a punch to the gut, making her head ache above her left ear. She can physically feel the synapses reaching out, connecting, pulling it up from the depths. Memories, unearthed like buried treasure.

“What are you saying?” he asks, flashing his eyes between her and the road with a haughty little smirk on his mouth.

“The song,” she answers, pointing to the radio.

“Sing it for me,” he requests, and her cheeks burn.

“I know I’m a terrible singer, Mulder, you don’t have to rub it in,” she grumbles, turning towards the window.

“I’m not making commentary on your vocal stylings, Scully, just tell me what the lyrics say,” he insists.

“With the blood that’s shed, it’s a lonely view,” she says flatly, and he chuffs a laugh. “What?”

“That is definitely not how the song goes,” he says, shaking his head. “It’s ‘with the birds I’ll share this lonely view’.”

She pauses, listening to the final chorus of the song.

“Hm,” she says.

“Hm?” he repeats. “Hm, you’re totally right, Mulder? Hm, those lyrics make a lot more sense?” he teases, reaching across the console to poke her arm with his index finger.

She turns her head sharply and gives him her very best irritated glare.

“Gloating is extremely unattractive,” she informs him, and he laughs.

“Does this mean you’re not coming over tonight?” he asks cheekily. “‘Cause I had plans for you, Scully.” He looks at her until she meets his eye, then adds, “Big plans.”

She rolls her eyes and looks out the passenger side window.

“Shut up, Mulder.”

She grips the steering wheel so tightly that her fingers go numb, her chest heaving and her heart pounding. Slowly, slowly, she returns to earth, to the shoulder of US-29-S, to the driver’s seat of Tiffany’s Escalade. As soon as the panic subsides, the tears come, running in torrents down her cheeks and keeping her stationary, unfit to operate heavy machinery in her current state. She wants more, so much more. She wants it all. She wants him.

Eventually, she feels ready to return to the road. She finds a seedy motel just outside the city that she’s confident won’t ask for ID, and lays clean-smelling towels over the top of the questionable-looking sheets before she curls up on the bed and begs for the respite of sleep. It’s early, but she’s exhausted, and feels like she needs the freshness of a new day in order to think clearly.

Tomorrow, she will return to the city she left behind against her will and try to find the torn edges of her stolen life. Tonight, she will pray that he meets her in her dreams, at least until the day she can return to his arms.

Tagging @today-in-fic

#the x files#x files fanfic#txf#dana scully#fox mulder#xf fanfic#x files#the x-files#xfiles#thexfiles

30 notes

·

View notes

Text

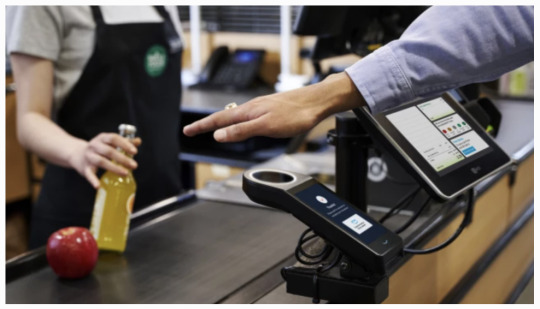

"Mobile Payment Systems: The Shift Towards a Cashless Society"

Cash is no longer the "King"! Cashless payments are a result of the complete change in the payment landscape brought about by the digital age.

Credit cards were the first form of cashless payment fintech innovations in the 1990s. The electronic banking system became widely used throughout that same decade. The developments in cashless payments carried on after that.

Well-known brands like Apple Pay and PayPal entered the fintech innovations scene. Plus, nobody likes to carry cash these days. Everyone wishes to gain from cashless transactions. Though cash is still important in many places, the globe is gradually shifting to cashless transactions.

There has been an increase in cashless transactions worldwide, according to the most recent Statista survey. There will be 2297 billion cashless transactions worldwide by 2027. The statistics above demonstrate the exponential rise of cashless transactions.

Mobile Payment Systems: The Shift Towards a Cashless Society

Globally, cashless transactions are growing increasingly typical as card and digital payments spread. Digital payment methods like debit and credit cards, smartphone payment apps, and others are increasingly popular for everyday transactions around the world.

Contactless payments, such as digital wallets and tap-to-pay cards, have become increasingly popular. The COVID-19 pandemic further accelerated this trend due to the perceived safety of contactless payments. Mobile payment systems like Apple Pay and Google Pay have made it even easier to make cashless transactions resulting in an e-commerce growth. Global digital transactions are predicted to reach over $14 trillion by 2027. Scandinavian countries like Sweden and Norway have already reached a cashless point-of-sale transaction rate of over 90%. In Asia, mobile payments are rapidly growing, with China leading the way through services like WeChat Pay and Alipay e-commerce growth. However, cash is still preferred in some regions due to factors like informal economies, limited access to banking services, and mistrust of financial institutions. Overall, more and more people are embracing digital payments for their convenience and expanding possibilities. Efforts are being made by governments and financial organizations to support this shift while considering the needs of all individuals.

What Are Digital Wallets, and How Do They Work?

Due to the pandemic, contactless payments like digital wallets have become very popular. Digital wallets store payment methods for easy purchases using a smartwatch or smartphone. They can also hold coupons, tickets, and cards and allow money transfers to others.

How digital wallets work

Different digital wallets process payments using various technologies:

NFC stands for near-field communication: If two devices are positioned adjacent to one another, this enables information sharing between them. This technology is used by Google Pay and Apple Pay. The retailer needs to have card readers that are compatible with these digital wallets at the point of sale.

MST stands for magnetic secure transmission: Similar to when a credit card is swiped on its magnetic stripe, this produces a magnetic signal. The card reader at the payment terminal receives the signal. NFC and MST technologies are both used by Samsung Pay.

QR codes: You may use the camera on your smartphone to scan these barcodes for secure transactions. For instance, you can create a QR code using the PayPal app that enables you to pay for items in stores using your account.

Some digital wallets, such as the Starbucks app, are "closed," meaning they can only be used at that particular store. In contrast, the digital wallet examples above can be used at any retailer that accepts them.

The Technology Behind Mobile Payments

The manner in which consumers make payments around the world has been drastically changed by mobile payment technologies. The fundamental technologies that make this possible are:

NFC:With this technique, data may be exchanged through secure transactions between two devices that are positioned just a few centimeters apart. NFC facilitates rapid and safe transactions by enabling smartphones and payment terminals to communicate.

QR codes:To start a transaction, customers can use the camera on their smartphone to scan "quick-response" codes. The codes point the user to a website or payment application when they are scanned.

SMS-based transactions:Businesses can use this technique to send text message instructions for payments, which is especially helpful in areas where smartphone adoption is low. A series of text messages, including a confirmation code at the conclusion of the transaction, are used by customers to complete purchases.

Digital wallets:In order to enable customers to make payments using their phones rather than paper cards, digital wallets securely hold credit card information on a mobile device. Transport tickets, vouchers, and loyalty cards can all be kept in digital wallets.

Encryption and tokenization:In mobile payments, sensitive data is encrypted. Further enhancing security is tokenization, which uses a special digital identification (called a "token") to execute payments without disclosing account information.

Biometric verification:Mobile devices frequently come equipped with biometric sensors, like facial recognition or fingerprint scanners, which add an extra degree of security to transactions.

Cloud-based payments:Payment details are kept on cloud servers by certain mobile payment solutions. Payments are accepted from any device, and unified security management is in place.

Host card emulation (HCE):With an NFC-capable device, HCE enables a phone to function as a physical card without depending on access to a secure element, or chip, which holds private information like credit card numbers.

Application programming interfaces (APIs):APIs allow apps to talk to banking systems and other applications, which makes transactions easier.

Thanks to these technologies, consumers can now use their mobile devices for a wide range of payment-related tasks, such as online shopping, paying for goods and services at physical locations, and transferring money between people.

Cryptocurrency Transactions: A New Frontier in Mobile Payments

The number of people who own bitcoin is growing rapidly, with over 400 million worldwide. This has led to an increase in demand for cryptocurrency payment options in everyday life. Starting a cryptocurrency transaction is easy, as users can simply use their mobile crypto wallet app to send payments to vendors. Specialized payment gateways are also available, which allow businesses to accept cryptocurrency and convert it to regular money quickly. By accepting cryptocurrency payments, businesses can reach a larger customer base and increase their revenues. Many companies, including e-commerce stores, gaming platforms, and Forex platforms, are already accepting bitcoin payments. The best part is that bitcoin payments are faster and cheaper than traditional banking methods.

Advantages of Using Mobile Payment Systems

Advantages of widely used Mobile banking:

Reduce expenses by eliminating costly equipment and setup.

Improve cash flow with faster payments.

Easily integrate loyalty programs for repeat purchases.

Gain insights from customer data for personalized strategies.

Increase customer convenience by accepting payments anytime, anywhere.

Stay competitive by offering multiple payment options.

Mobile banking enhances payment security with encrypted codes.

Simplify bookkeeping with collected business information.

These benefits improve the customer experience and make accepting payments on the go easier.

Conclusion:

The future of payments will undoubtedly revolve around preserving the integrity of cash as a viable payment option, while concurrently expanding and enhancing digital payment solutions. Empowering individuals to select their preferred transaction method based on personal circumstances and preferences is of utmost importance. In order to construct an all-encompassing financial system that caters to the requirements of every participant, it is imperative for businesses, policymakers, and financial institutions to establish resilient digital payment systems alongside a sturdy infrastructure for cash.

FAQ:

What are mobile payment systems?

Mobile payment systems allow you to make payments using your smartphone or mobile device, typically through apps or digital wallets like Apple Pay or Google Wallet.

How secure are mobile payment systems?

Mobile payment systems are generally secure, using encryption, tokenization, and biometric authentication to protect your data. However, security also depends on user practices like keeping your device and apps updated.

What are the benefits of using mobile payment systems?

Mobile payment systems offer convenience, speed, and security. They also support contactless payments, track spending, and often integrate with loyalty programs.

How do mobile payments impact global economies?

Mobile payments boost global economies by increasing financial inclusion, speeding up transactions, and supporting digital commerce, especially in emerging markets.

What technologies are driving the growth of mobile payment systems?

Key technologies include Near Field Communication (NFC), QR codes, biometric authentication, and blockchain, all of which enhance security and convenience in mobile payments.

5 notes

·

View notes

Text

Why Short Term Loans UK Can Help You Feel Better

There are many lending companies in the UK that may also provide short term loans UK for which you are not required to have any open checking accounts. This paperwork is sufficient for the lender to deposit the money directly to your debit card if you have one in your wallet. By obtaining this loan's urgent assistance, you can quickly overcome any unforeseen financial issues that have arisen in your life.

What are Short Term Loans UK? And how does it aid?

A short term loans UK is a type of payday loans that is used by clients to make ATM withdrawals whenever and wherever they choose. It helps clients save their valuable time. People's closest buddy when they need quick cash and a way to make any urgent payments has always been short term cash. It is therefore a crucial document in one's life.

Payday loans are a modern financial instrument that banks have now customized. One of the series of short term loans direct lenders. This is what? Payday loans with direct deposits to the applicant's debit card are referred to as same day loans UK. Once the money is there, you can use it for anything you require. You can handle an emergency with a routine swipe of this card without having to wait for money to arrive in your bank account.

The Best Strategies for short term loans UK direct lender Success

Emergencies never give you any advance notice. You can always get emergency financial assistance, but you never ask for fast cash. To obtain a loan, you must go through a number of formalities and wait for a certain amount of time. Additionally, there are other loan requirements that are challenging to meet. Not to worry... Applying for short term loans UK direct lender in the UK is simple at https://paydayquid.co.uk/. Some of the lenders on our panel have accommodating loan conditions that you might need to fulfill. The following lists these requirements.

Age of at least 18

British citizen

Working

Able to demonstrate a consistent source of income

We are Payday Quid, a more cheery way to find your following payday loan. We assist customers who have been turned down by their banks and other large lenders. We are a friendly loan introducer with access to some innovative technology.

The same day loans UK search is quite quick, saving you hours of filling out applications and having your credit checked which could harm your credit history. Protect your credit rating, find your loan, and most importantly, do in 3 minutes what would take you hours.

As the name implies, a "short-term loan" is a loan with brief repayment duration. Depending on the lender, this could take anywhere from a week to a few months.

Compared to conventional personal loans, which often have a repayment period of a year or longer, this is regarded as being of a same day loans UK nature. We provide access to short-term loans with repayment terms ranging from three to 36 months.

4 notes

·

View notes

Text

QuickBooks Merchant Services: How to Set Up, Manage, and Maximize Your Earnings

To set up QuickBooks Merchant Services, you'll initially integrate it with your QuickBooks account by following straightforward instructions. Ensure you input the correct credentials for a smooth process. Next, manage your payments by utilizing various options like credit cards and ACH transfers. Monitor transaction fees, which are competitive, with swiped card transactions costing 2.4% in addition to $0.25. To amplify earnings, utilize analytics to track cash flow and refine invoicing. Furthermore, take advantage of built-in security features for safe transactions. By implementing these strategies effectively, you'll elevate your business's financial performance and improve customer satisfaction. Further observations await you.

Key Takeaways

- Follow step-by-step instructions to seamlessly integrate QuickBooks Merchant Services with your accounting software for automated data syncing. - Utilize various payment options, like credit/debit cards and ACH, enhancing customer convenience and increasing overall sales. - Leverage built-in analytics to monitor cash flow trends and optimize decision-making for better financial management. - Ensure compliance with PCI standards and implement security features to protect payment information and build customer trust. - Access multi-channel customer support and resources for troubleshooting and maximizing the value of QuickBooks Merchant Services.

QuickBooks Merchant Services: Revolutionizing Business Payments

QuickBooks Merchant Services is designed to optimize your business payments by integrating smoothly with your QuickBooks accounting software. By understanding its core functionality, you can utilize features like mechanized reconciliation and multiple payment options to simplify your financial processes. Uncover how these advantages can improve your overall efficiency and help you manage your cash flow more effectively. The system provides secure payment processing, ensuring protection of customer data and enhancing trust in transactions. With effective time management skills, you can streamline your payment processes and reduce errors. Understanding the Core Functionality With the rise in digital transactions, businesses need a payment solution that's both effective and easy for management. QuickBooks Merchant Services offers smooth integration with QuickBooks Online and Desktop, ensuring your payment information syncs without manual intervention. You can accept various payment methods, including credit and debit cards, ACH, Apple Pay, and Google Pay, all through the GoPayment app or QuickBooks POS system. This adaptability supports in-person, online, and invoiced payments. You also benefit from quicker fund deposits through QuickBooks Checking, alongside competitive rates depending on your transaction type. With features like recurring billing and automated reconciliation, QuickBooks Merchant Services simplifies your payment processes, giving you more control over your earnings and easing your accounting tasks. It complies with PCI standards for data security, ensuring that your transactions are conducted safely and reliably. Key Advantages for QuickBooks Users As businesses increasingly depend on efficient payment solutions, QuickBooks Merchant Services stands out by seamlessly integrating with your existing accounting practices. One of the key advantages for QuickBooks users is optimized payment processing, which mechanizes transaction recording, considerably reducing manual errors. This service improves cash flow management by enabling quicker payment collection, so you receive funds within 1-2 business working periods. It offers flexible payment options, allowing customers to pay via credit cards, ACH transfers, or mobile devices, boosting overall satisfaction. QuickBooks Payments' automated reminders enhance cash flow by ensuring customers are promptly notified about upcoming or overdue payments. Security is paramount, as the platform provides secure and efficient financial management through encryption and fraud detection. These features combined make QuickBooks Merchant Services an essential asset for your business.

Comprehensive Payment Solutions

When this pertains to all-encompassing payment solutions, knowing your options is key. You can effectively process credit and debit card transactions, making it easy for customers to pay how they prefer. Furthermore, ACH and mobile payment capabilities simplify your operations and improve cash flow, ensuring you stay competitive in today's rapid market. The seamless integration of built-in payment processing with QuickBooks products helps streamline your accounting tasks. By understanding cookie policies, you can create a more personalized experience for your customers, leading to increased loyalty and retention. Let me know if this meets your requirements! Credit and Debit Card Processing Explained Understanding credit and debit card processing is crucial for businesses aiming to simplify transactions and elevate customer satisfaction. QuickBooks Payments allows you to accept major credit cards like Visa and Mastercard directly within QuickBooks Online. You'll need to apply and get approved to activate this service, which integrates flawlessly to automatically update your payment records. Additionally, it ensures PCI DSS compliance to maintain the security of your transactions. For processing, you can use mobile apps or a card reader, allowing transactions anytime, anywhere. Each payment type has distinct fees, like 2.99% for online credits. Automatically recording transactions minimizes manual effort and helps simplify your accounting practices. By managing credit card payments efficiently, you can boost cash flow and offer a more fluid purchasing experience for your customers, ultimately maximizing your earnings. ACH and Bank Account Transactions Have you considered the advantages pertaining to integrating ACH and bank account transactions into your payment processing? ACH payments offer a smooth, cost-effective way to manage transactions directly from your bank account. You'll save from credit card fees and expedite funds transfer, typically within one to two business periods. FeatureBenefitImplementationACH PaymentsLower transaction costsRequires QuickBooks setupCustomer AuthorizationImproved securityUse Intuit authorization formRecurring TransactionsSave time and simplify billingSet up in QuickBooks settings Online and Mobile Payment Capabilities Integrating ACH and bank account transactions offers substantial benefits, and complementing these options with robust online and mobile payment capabilities takes your payment processing toward the next level. QuickBooks Payments allows you accept online payments through multiple methods, such as credit cards and digital wallets like PayPal and Apple Pay. You can add online payment buttons to invoices, allowing customers to pay directly and effortlessly. Payment links via email or text make it convenient for transactions. Mobile compatibility guarantees a smooth checkout across any device, and using card readers through the GoPayment app lets you accept payments while traveling. Secure processing and instant deposits boost customer satisfaction and your cash flow management.

Pricing Structure and Cost Analysis

When considering QuickBooks Merchant Services, understanding the pricing structure is essential for informed decision-making. You'll find a transparent fee breakdown that helps you see exactly what you're paying for, alongside competitive comparison points to evaluate against alternatives. Such clarity can enable you to choose a solution that meets your business needs without unexpected costs. Transparent Fee Breakdown Understanding QuickBooks Merchant Services' pricing structure is essential for making informed decisions about payment processing. With transparent fee structures, you can better manage costs and maximize profitability. Here's a breakdown of key fees: - Swiped Transactions: 2.4% + $0.25 per transaction - Invoiced Transactions: 2.9% + $0.25 per transaction - ACH Bank Transfers: 1% per transaction, capped at $10 Comparative Analysis with Competitors Choosing the right payment processing solution involves more than just examining fees; it's about finding a service that fits effortlessly into your business operations. QuickBooks Payments stands out with competitive rates and integration capabilities that enhance your workflow. Here's a quick comparison of key features: FeatureQuickBooks PaymentsSquareU.S. Bank Payment SolutionsMonthly Fee$15-$150 depending on planNo monthly feeVaries by serviceTransaction Fee2.4%-3.4% + $0.25Approximately 2.6%-2.9%Varies greatlyIntegration with QuickBooksYesNoNo As you evaluate options, consider which service aligns with your financial goals and operational needs for maximum efficiency.

Seamless QuickBooks Integration

Integrating QuickBooks Merchant Services with your accounting software is straightforward and efficient. You'll benefit from mechanized reconciliation and reporting, which saves you time and reduces the risk of errors. With smooth integration, your financial data stays accurate and up-to-date, allowing you to concentrate on expanding your business. Step-by-Step Integration Process Setting up QuickBooks Merchant Services is a straightforward process that can improve your business's payment capabilities. For QuickBooks users, follow this step-by-step integration guide: - Log into the Corrigo web application and guide yourself to Settings > Financial > QBMS Integration. - Ensure you have a valid QuickBooks Merchant Services account and click on the "Click here" link for setup information. - Connect to QBMS by clicking "Connect," which will redirect you to the Intuit/QuickBooks website for login. Once you input your credentials, follow the integration wizard to confirm successful setup. This clear process helps you optimize payment transactions and maintain accurate records, enhancing your financial management system efficiently. Automated Reconciliation and Reporting While managing your business finances, the last thing you want is to wrestle with tedious reconciliation processes. With QuickBooks Merchant Services, automated reconciliation simplifies your financial management. You can easily initiate reconciliation through the Banking menu, selecting the necessary account, and inputting your statement details. QuickBooks automatically selects matched transactions, helping you stay organized. In addition, you'll guarantee accuracy by sorting and verifying transactions efficiently. Automated reconciliation not only saves you time but also reduces the risk of human error, freeing you to focus regarding growing your business. Combined with sturdy reporting tools, you can generate customized reports for profound insights, assuring your financial data is always accurate and at your fingertips. Optimize your processes and maximize your earnings effortlessly.

Advanced Security Measures

When this pertains to safeguarding your business, QuickBooks Merchant Services provides advanced security measures that you're likely to value. With strong encryption and fraud prevention techniques, your sensitive data is secured both in transit and at rest. By adhering to industry standards, QuickBooks guarantees that your business remains a safe choice. Encryption and Fraud Prevention Techniques In today's online environment, securing payment data is more critical than ever for businesses like yours. QuickBooks Merchant Services employs strong encryption methods and advanced fraud prevention techniques to protect your transactions. Here's how you can gain advantage: - Data Encryption: This system applies 128-bit to 256-bit encryption to safeguard sensitive data during transmission and storage. - Access Control: Multi-factor authentication guarantees only authorized users can access your payment information. - Network Security: Continuous monitoring and network filters help detect and prevent unauthorized access. With these advanced security measures, you are better equipped to protect your business and customer information from fraud. By prioritizing encryption and vigilant fraud prevention, you can improve your operational integrity and build trust with your clients. Compliance with Industry Standards In order to guarantee your business remains compliant and secure in today's online environment, understanding compliance with industry standards, like PCI DSS, is vital. PCI compliance is mandatory for all merchants processing credit or debit card transactions. This means you must complete a Self-Assessment Questionnaire (SAQ) based on your data handling methods. Annual validation through a qualified service, like SecurityMetrics, confirms you're adhering to these fundamental standards. Integrating QuickBooks Merchant Services can simplify this process, as Intuit collaborates with SecurityMetrics to guide you through compliance requirements. It's imperative to regularly update your systems and control user permissions to safeguard sensitive information. By staying compliant, you can effectively protect your business and customers from potential data breaches.

Optimizing Payment Workflows

When it pertains to optimizing payment workflows, customization options play an essential role for your unique business needs. By utilizing API integration, you can create customized solutions that elevate your payment processing efficiency. This approach not only simplifies transactions but also improves the overall customer experience, ensuring you meet their expectations flawlessly. Customization Options for Various Business Types Customizing your payment workflows can greatly improve efficiency and boost your customer experience, especially when you tailor these options for your specific business type. QuickBooks Merchant Services offers various customization options suitable for different industries. You can refine your forms and payment terms in order to align with your needs. Here are a few ways to get started: - Tailor invoice content by displaying specific item details and footers. - Set payment terms that include due dates and automated notifications to manage expectations. - Customize security settings like two-factor authentication to protect customer data. API Integration for Tailored Solutions By leveraging API integration, you can greatly improve your payment workflows and customize them to meet the unique demands of your business. Such technology simplifies payment processing and guarantees smooth data flow. Here's how you can implement it: StepActionBenefitsCreate an AppSet up an app in QuickBooks to collect API data.Simplifies integrationAutomate TransactionsUse the QuickBooks Payments API to capture funds.Boosts efficiencyMonitor TransactionsRegular batching can identify issues quickly.Enhances cash flowGenerate ReportsCreate custom reports for financial analysis.Informs decision-making Utilizing API integration guarantees you can automate and boost your payment processes while maintaining control and security. This customized solution ultimately improves your financial management capabilities.

Data-Driven Financial Management

In today's rapid business environment, leveraging analytics can provide you with beneficial perspectives to drive informed decisions. Understanding cash flow trends through predictive modeling helps you improve your finances and plan for future growth. By integrating data into your financial management, you'll gain a solid foundation to elevate your overall business strategy. Leveraging Analytics for Business Insights While analyzing data might seem intimidating, exploiting analytics through QuickBooks can change the way you understand your business's financial health. QuickBooks offers detailed financial reporting that enables you to gain significant observations. You can customize reports customized for your business needs, making it easier to stay on top of your finances. Here are a few ways to exploit this functionality: - Employ sales transaction data for more comprehensive sales analytics. - Streamline the categorization of expenses to save time and reduce errors. - Integrate various analytics tools for visual dashboards and strategic reports. Predictive Modeling for Cash Flow Optimization As businesses navigate through a rapidly changing economic environment, predictive modeling has emerged as a fundamental tool for cash flow enhancement. By utilizing advanced algorithms and analyzing historical data, you can forecast cash flows more accurately. This real-time forecasting enables you to generate daily, weekly, or monthly predictions based upon operational needs. Integrating predictive modeling with QuickBooks Cash Flow solutions allows you to assess expected cash flow from receivables, payables, and bank accounts. You can create what-if scenarios to guide strategic decision-making and preemptively allocate resources. Ultimately, the information gained from predictive modeling helps improve working capital management, ensuring you have sufficient funds to seize growth opportunities while effectively mitigating risks.

Scaling with Your Business

As your business grows, it's essential to adjust to the increased transaction volumes without sacrificing efficiency. QuickBooks Merchant Services can effortlessly scale with your needs, allowing you to handle more payments while maintaining a smooth operation. If you plan to expand internationally, QuickBooks supports various payment options to simplify transactions across borders. Adapting to Increased Transaction Volumes When your business starts experiencing increased transaction volumes, altering your payment infrastructure becomes essential for maintaining efficiency and accuracy. QuickBooks Payments is designed for high transaction volumes, guaranteeing rapid payment processing without significant changes to your infrastructure. Here are key aspects to reflect upon: - Automated Accounting: Your financial records remain updated in real-time, simplifying bookkeeping. - Scalable Fees: Processing fees adjust based on volume, accommodating your growing business. - Integrated Inventory Management: This feature tracks orders and inventory smoothly across all sales channels. With these modifications, you can manage transaction complexity effectively, maintaining customer satisfaction and operational efficiency. Read the full article

#bestquickbookspaymentservice#quickbookscreditcardpayments#quickbooksinstantpayments#quickbooksinvoicing#quickbooksmerchantaccount#quickbooksmerchantservices#quickbooksonlinepayments#quickbookspaymentprocessing#quickbookstransactionfees#securepaymentprocessing

0 notes

Text

Iceland FAQ: What Currency Does Iceland Use?

Iceland is an exceptional place to visit and is at the top of many adventure-seekers bucket lists. With otherworldly landscapes, interesting history, and delicious cuisine, it’s not difficult to see why so many travelers are clamoring to visit the Land of Fire and Ice.

While researching your impending trip, you might be wondering, “What currency does Iceland use?” It’s important to know ahead of time that Iceland does not use the Euro, instead, they have their own currency, the Icelandic króna. Here’s your guide to all things Icelandic currency.

Iceland’s Official Currency: Icelandic Krona

Can You Use Other Currencies in Iceland?

There are mixed reviews about whether or not other currencies are accepted in Iceland. While some sources say they are not, several others claim that some businesses will take USD and Euro. Overall, it seems like it is possible to use USD or Euro while traveling around Iceland but you should do this sparingly and certainly not rely on using foreign currency as many establishments won’t accept it.

Some instances where foreign currency might be accepted are at large hotel chains and some stores. Generally, it’s best to use either a credit card or Icelandic króna as exchange rates aren’t great when using other currencies.

Average Costs: How Much Do Things Cost in Iceland?

Speaking of currency, you might also be wondering, “How much do things cost in Iceland?” It’s no secret that Iceland is not always a budget-friendly destination, but well worth the trip nonetheless. As a general rule, here are a few estimates of what you can expect to spend in Iceland…

Hotels – approx $130 to $450, depending on the season.

Hostels – approx $30 to $90, depending on the season.

Sit-down Restaurants – approx $30 to $55 per meal, without alcohol.

Fast Food – approx $6 to $15 a meal.

Groceries – approx $10 to $20 a day, per person.

Golden Circle Tour – approx $70, per person.

Blue Lagoon -approx $150, per person.

Mid-sized Car Rental – approx $70 to $260 a day, depending on the season.

Money Exchange: Best Places to exchange Currency in Iceland

The best places to do currency exchange in Iceland are banks and local exchange centers, although it’s also possible to do so at airports. You’ll also be able to withdraw Icelandic króna from ATMs throughout the country which is another great option. Make sure to bring a credit card without foreign transaction fees to really capitalize on avoiding exchange fees.

Using Cash and Card in Iceland

Like many other progressive countries, you can use credit or debit cards almost anywhere in Iceland. In fact, you won’t likely need to withdraw cash at all if you don’t want to. For convenience purposes, having a small amount of Icelandic króna, around 10,000 ISK (about $70), is a good idea if you’re traveling outside the capital of Reykjavik as there might be small things you’ll need cash or coins for.

Keep in mind that American Express is not widely accepted in Iceland. If you plan to bring an AMEX card, have another Visa or Mastercard as backup. It’s also important to know that many Icelandic credit card machines will only accept chip cards instead of swipe cards.

Tipping in Iceland

While tipping in Iceland isn’t common, or expected, it can be a nice way to show your tour guide or waitstaff that their service was exceptional. Many restaurants already include service charges in the VAT and some also include gratuity as well.

Maximize Your Savings: Iceland Money-Saving Tips

Some of the best ways to maximize your money in Iceland are…

● Booking in advance.

Tours, hotels, and car rentals can book up fast – especially in summer. Booking in advance ensures that you’ll be able to do everything on your itinerary while also getting a better deal.

● Grocery Shopping

Eating out can be exorbitantly expensive in Iceland. Grocery shopping is a fun experience in a new country and much less costly. This is also a great option for those who are planning a road trip or day trip. Don’t miss out on local favorites, like Icelandic skyr, that are easily found at discount grocery stores like Bónus.

● Buy alcohol and do tax free shopping at the airport airport

Alcohol can be really expensive in Iceland, whether you’re eating out, going to a bar, or shopping for alcohol at a local liquor store. Believe it or not, the best place to purchase alcohol in Iceland is at the keflavík international airport. This is a great trick if you know you’ll want a few beers, wine, or mixed drinks throughout your trip – without breaking the bank.

● Visit in the off-season.

If you don’t mind the cold, visiting Iceland in the off-season can be a great opportunity to snag good deals on rental cars, hotels, and tours. And it’s the best time of year to see the Northern Lights! The off-season in Iceland is generally from October to April.

● Rent a car with a discount company.

Conclusion

Overall, Icelandic currency is straightforward. Credit cards are the best method of payment and withdrawing Icelandic króna is easy at ATMs throughout the country.

Now that you’re familiar with Iceland’s currency, you’re ready to plan the most fun part of your trip! Rent a cheap car in Iceland and drive the Ring Road, walk on top of a glacier, or witness puffins in their natural habitat. Whatever you decide to do, Iceland is one of the most rewarding vacation destinations in the world.

0 notes

Text

Travelling Soon? Essential Tips for using your Credit Card Abroad

Ever packed your bags for an overseas trip and wondered ‘How’s my credit card going to behave abroad?’ Yes,credit cards are helpful but sometimes unpredictable in new places. Worried? Don’t be. We have a host of tips for you to make your credit card work wonders on your travelling adventures.We will show you how to turn your credit card into a savvy companion. Let’s break down the points!

Notify Your Bank Before You Travel

One of the most important steps before your journey is informing your credit card issuer about your travel plans. Many banks monitor transactions for suspicious activity, and using your card in a foreign country without prior notice may trigger security measures. This will lead to your card being temporarily blocked. Most banks offer the option to notify them of your travel plans through their app or website, making this process quick and painless.

Know the Foreign Transaction Fees

Before you start swiping, it’s imperative to be aware of any foreign transaction fees associated with your credit card. These fees typically range from 2% to 3% of each purchase made outside your home country. While these charges might seem small, they can add up over time. The good news? Some credit cards (travel-focused ones in particular) waive foreign transaction fees altogether. Consider applying for one of these cards before your trip to avoid unnecessary costs.

Always Pay in Local Currency

It’s almost always better to choose in paying for things in the local currency when travelling. The reason? Paying in your home currency involves Dynamic Currency Conversion (DCC). This often comes with hidden fees and poor exchange rates. By opting for the local currency, you’ll be charged at the card network's exchange rate (which is generally more favourable).

Use a Card with Travel Perks

Travel rewards credit cards are designed to enhance your travel experience by offering perks such as free airport lounge access, travel insurance, and no foreign transaction fees. All of these manage to level up your travel experience. Some cards also allow you to earn points or miles on your purchases which can be redeemed for future flights or hotel stays. If you’re a frequent traveller, using a card with travel perks can make your journey more enjoyable and financially rewarding.

Carry a Backup Card and Some Cash

While credit cards are widely accepted in most parts of the world, it’s always a good idea to carry a backup card and some local currency just in case. Some smaller businesses, particularly in rural areas, may not accept cards or you may find yourself in a situation where your primary card doesn’t work due to network issues. A second credit card from a different issuer can also be useful if your main card is lost or stolen.

Avoid ATM Fees

Using your credit card at ATMs abroad can come with high fees, both from your card issuer and the ATM operator. To avoid these charges, use your credit card for purchases whenever possible and rely on your debit card for cash withdrawals. Some travel-focused credit cards and banks offer reimbursement for ATM fees. So, it’s worth checking if your card includes this benefit before you depart.

Take Advantage of Travel Insurance

Many credit cards come with built-in travel insurance. It can be a lifesaver in the event of trip cancellations, lost luggage, or medical emergencies abroad. Review your card’s insurance policy before your trip to understand what’s covered and what isn’t.

Monitor Your Spending and Statements

While abroad, it’s central to keep track of your credit card spending and regularly monitor your account for any suspicious activity. Most banks provide mobile apps that allow you to check your balance, review recent transactions, and even freeze your card if necessary. Staying on top of your spending helps you manage your budget.

Know Your Credit Limit

Overspending abroad can easily push you close to your credit limit. Keep an eye on your available credit to avoid maxing out your card, which could lead to declined transactions or penalties. If you anticipate high spending, consider requesting a temporary credit limit increase from your card issuer before your trip.

Protect Yourself from Fraud

Be cautious when using your card, especially at unfamiliar ATMs or in crowded places. Stick to well-known, reputable establishments and avoid giving your card to anyone to take out of your sight. If you suspect any fraudulent activity, contact your card issuer immediately. Most credit cards offer zero-liability protection, meaning you won’t be held responsible for unauthorized charges. Remember though – swift action is essential.

Keep a Copy of Your Card Details

In case your card is lost or stolen, it’s helpful to have a copy of your credit card details. This also includes the customer service number for reporting lost cards. Keep this information in a safe place, separate from your physical card. Having this on hand can make it much easier to resolve any issues quickly.

Use Contactless Payments

Many countries have fully adopted contactless payments. It offers a faster, more secure way to pay. If your credit card supports contactless technology, take advantage of it when traveling. Not only does it reduce the risk of fraud by minimizing the physical handling of your card, but it also speeds up transactions in places like public transport or busy retail stores.

While travelling, remember that your credit card is ready for adventures – as much as you but it needs prep work too. Remember and apply these tips on your travels and your adventurous ways will not suffer any kind of negative consequences.

0 notes

Text

Global Face Swiping Payment Market Analysis 2024: Size Forecast and Growth Prospects

The face swiping payment global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Face Swiping Payment Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size - The face swiping payment market size has grown rapidly in recent years. It will grow from $5.79 billion in 2023 to $6.93 billion in 2024 at a compound annual growth rate (CAGR) of 19.7%. The growth in the historic period can be attributed to volatility in fuel prices, government incentives and regulations, environmental awareness, expansion of biofuel infrastructure, strategic alliances in the automotive industry.

The face swiping payment market size is expected to see rapid growth in the next few years. It will grow to $14.12 billion in 2028 at a compound annual growth rate (CAGR) of 19.5%. The growth in the forecast period can be attributed to stringent emission standards, consumer awareness and environmental consciousness, global expansion of biofuel infrastructure, incentives for sustainable transportation, collaboration in renewable energy initiatives.. Major trends in the forecast period include integration of advanced engine technologies, focus on increasing fuel efficiency, development of hybrid flex fuel vehicles, education and awareness initiatives, incorporation of renewable fuel standards (rfs), focus on research and development for advanced biofuels..

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/face-swiping-payment-global-market-report

Scope Of Face Swiping Payment Market The Business Research Company's reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market's historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Face Swiping Payment Market Overview

Market Drivers - Rising demand for contactless payments is expected to propel the growth of the face-swiping payment market going forward. Contactless payments refer to a wireless financial transaction in which the customer makes a purchase by moving a security token in close proximity to the vendor's terminal. Contactless payments use face-swiping payment technology to offer speed and convenience, as users can complete transactions without physical contact with cards or devices. For instance, in 2022, according to reports shared by UK Finance, a UK-based financial services company, in 2022, around 17 billion contactless payments were performed using debit and credit cards, up 30% from 13.1 billion in 2021. Therefore, rising demand for contactless payments is driving the face-swiping payment market.

Market Trends - Major companies operating in the face-swiping payment market are focused on developing innovative contactless payment systems with advanced technological solutions, such as smile and pay system. It is a system with facial recognition technology that allows users to make payments by using their facial biometrics, such as smiling or waving, to authorize transactions. For instance, in May 2022, Mastercard, a US-based payment card company, launched Smile To Pay. This innovation is part of Mastercard's ongoing efforts to create secure and convenient payment solutions, decreasing the requirement for physical interaction while improving the overall payment experience. The smile to pay function is intended to provide customers with a convenient and secure payment alternative, removing the need to fumble for a phone or wallet at the time of sale. This technology provides a significant step forward in the evolution of payment techniques, harmonizing with the growing trend of contactless and biometric-based payment solutions.

The face swiping payment market covered in this report is segmented –

1) By Type: Payment Equipment, Payment System 2) By Technology: Facial Recognition, Image Recognition 3) By Application: Retail, Restaurant, Travel, Other Applications

Get an inside scoop of the face swiping payment market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=13438&type=smp

Regional Insights - Asia-Pacific was the largest region in the face swiping payment market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the face swiping payment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies - Major companies operating in the face swiping payment market report are Amazon.com Inc., Apple Inc., Alphabet Inc., Samsung Electronics Co. Ltd., Tencent Holdings Ltd., Visa Inc., NEC Corporation, WeChat Pay, Xiaomi Corporation, Alipay, PAX Global Technology Limited, UnionPay International Co. Ltd., CloudWalk Technology Co. Ltd., Facephi Biometria SA, Mastercard Inc., Zoloz Co. Ltd., Innovatrics, VisionLabs B.V., Smile Identity, FacePay Inc., FaceTec Inc., Telepower Communication Co. Ltd., PopID Inc., PayByFace B.V., SnapPay Inc.

Table of Contents 1. Executive Summary 2. Face Swiping Payment Market Report Structure 3. Face Swiping Payment Market Trends And Strategies 4. Face Swiping Payment Market – Macro Economic Scenario 5. Face Swiping Payment Market Size And Growth ….. 27. Face Swiping Payment Market Competitor Landscape And Company Profiles 28. Key Mergers And Acquisitions 29. Future Outlook and Potential Analysis 30. Appendix

Contact Us: The Business Research Company Europe: +44 207 1930 708 Asia: +91 88972 63534 Americas: +1 315 623 0293 Email: [email protected]

Follow Us On: LinkedIn: https://in.linkedin.com/company/the-business-research-company Twitter: https://twitter.com/tbrc_info Facebook: https://www.facebook.com/TheBusinessResearchCompany YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ Blog: https://blog.tbrc.info/ Healthcare Blog: https://healthcareresearchreports.com/ Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

The Global Market for Voice-Based Payment Technology: Transforming the Future of Transactions 🗣️💳

Introduction🗣️💳

Voice-based payment technology, the innovative fusion of speech recognition and financial transactions, has been steadily gaining momentum in recent years. Powered by advancements in artificial intelligence (AI), machine learning, and natural language processing (NLP), voice-enabled payments promise to revolutionize the way we interact with financial systems. From ordering coffee to paying bills, voice-based payments are poised to become an integral part of our daily lives. This article delves into the global market for voice-based payment technology, examining its current trends, drivers, challenges, and future prospects.

For More Details: https://www.xinrenresearch.com/reports/global-market-of-voice-based-payment-technology-market/

What is Voice-Based Payment Technology? 🗣️💸

Voice-based payment technology allows users to make transactions using voice commands. Instead of manually entering payment details or swiping credit cards, users can authenticate and authorize payments simply by speaking to a voice assistant such as Amazon's Alexa, Google Assistant, or Apple's Siri. These systems rely on advanced speech recognition algorithms, secure authentication methods (such as biometric voice recognition), and integration with financial institutions to process payments quickly and securely.

Voice payments are typically linked to digital wallets, bank accounts, or credit/debit cards. The technology supports a variety of payment use cases, including peer-to-peer (P2P) payments, bill payments, e-commerce transactions, and even physical purchases via connected devices.

Market Overview: The Rise of Voice Payments 🌍📈

The global market for voice-based payment technology is on an upward trajectory, driven by the proliferation of smart devices, the increasing adoption of voice assistants, and consumer demand for seamless and contactless payment experiences. The voice payment market is expected to see robust growth in the coming years, with predictions of a market value exceeding USD 20 billion by 2027, growing at a compound annual growth rate (CAGR) of around 20%.

Key Drivers of Growth 🚀

Proliferation of Smart Speakers and Virtual Assistants 🏠🎙️ The widespread use of smart speakers like Amazon Echo, Google Nest, and Apple HomePod has been a major driver of voice-based payment adoption. These devices are already embedded into millions of households and businesses worldwide, and their integration with payment systems is making voice payments increasingly accessible. With more people using virtual assistants for everyday tasks, voice payments are gaining traction as a natural extension of this technology.

Increased Demand for Contactless Payments 💳🤖 The COVID-19 pandemic has accelerated the adoption of contactless payments as people seek safer, more hygienic alternatives to physical cards and cash. Voice-based payments, which do not require physical interaction or card swiping, fit perfectly into this trend. Users can make secure payments without touching any surfaces, making it an attractive option for health-conscious consumers.

Advancements in AI and NLP 🧠💬 Artificial intelligence and natural language processing have significantly improved the accuracy and security of voice-based payment systems. Modern voice assistants are better at understanding a wide range of accents, dialects, and languages, making voice payments more inclusive and accessible. Furthermore, AI-driven algorithms can identify and authenticate users with high precision, reducing the risk of fraud and improving the user experience.

Seamless Integration with IoT and Wearable Devices ⌚🌐 The integration of voice-based payments with the Internet of Things (IoT) and wearable devices is another key factor driving the market. Smartwatches, fitness trackers, and other IoT-connected gadgets now support voice commands for payments, making transactions even more convenient. The seamless integration between devices means that users can make payments on-the-go, without needing to pull out a phone or wallet.

Rising Preference for Convenience and Personalization 🛍️🔑 Consumers today prioritize convenience and personalized experiences. Voice-based payments offer a hands-free, frictionless experience that fits well with this demand. In addition to ease of use, voice payments can also be personalized—voice assistants can recall past transactions, suggest offers, and even help with budgeting, all of which enhance the user experience.

Challenges in Voice-Based Payment Technology ⚠️

While the market is growing rapidly, several challenges must be addressed before voice-based payments can achieve mainstream adoption.

Security Concerns 🔐🔒 Security remains a critical concern for consumers and businesses when it comes to voice-based payments. Voice biometrics are still in the early stages of adoption, and concerns about voice impersonation or fraud using deepfake technology are growing. Secure authentication methods, such as multi-factor authentication (MFA) or behavioral biometrics (which analyze unique patterns in a user’s speech), are being explored to enhance security.

Privacy Issues 🕵️♂️🔍 Privacy concerns around voice data collection are a significant barrier. Voice assistants typically process user commands and store conversations to improve accuracy, raising questions about how this data is stored and used. Ensuring that voice payment systems comply with data protection regulations, such as the General Data Protection Regulation (GDPR), is crucial for gaining consumer trust.

Limitations of Voice Recognition Technology 📱🧠 While voice recognition has come a long way, it is still imperfect, especially in noisy environments or with users who have strong accents or speech impediments. Ensuring that voice payment systems work reliably in diverse real-world conditions is essential for wider adoption. Continued advancements in speech recognition and AI are needed to address these limitations.

Adoption and Integration Challenges for Merchants 🏪🖥️ For voice-based payments to gain traction, merchants need to integrate these systems into their point-of-sale (POS) setups. This may require significant investment in new hardware, software, and training. Small and medium-sized businesses (SMBs), in particular, may face challenges in adopting this technology due to cost or technological barriers.

Key Players in the Voice Payment Technology Market 🏆

Several companies are leading the charge in the development and deployment of voice-based payment technology. These include both technology giants and innovative startups that are shaping the future of voice payments.

Amazon (Alexa) 🛒 Amazon's Alexa is one of the most widely used virtual assistants, and it has integrated voice payments into its ecosystem via partnerships with financial institutions and merchants. Alexa's voice payment features allow users to make payments through Amazon Pay, streamlining transactions for users in the Amazon ecosystem.

Google (Google Assistant) 📱 Google Assistant is another major player in the voice payments space. Google Pay, integrated with Google Assistant, allows users to make payments, check balances, and even transfer money through simple voice commands. Google’s vast reach through Android devices and its partnership with multiple financial institutions enhance its position in the market.

Apple (Siri & Apple Pay) 🍏 Apple has integrated voice payment capabilities into its Siri voice assistant and Apple Pay. Users can easily make purchases or transfer funds using their voice. The close integration of voice payments with Apple’s secure ecosystem has helped to boost consumer confidence in using voice for transactions.

Samsung (Bixby) 🏠 Samsung's Bixby assistant, combined with Samsung Pay, allows users to make payments through voice commands. Samsung's strong presence in smartphones, wearables, and home devices makes it a strong competitor in the voice payments market.

PayPal & Venmo 💳💸 PayPal, along with its subsidiary Venmo, is also exploring voice-based payments. The integration of voice assistants with PayPal’s payment platform has made it possible for users to send and receive money through voice commands, further pushing the adoption of voice payment systems in the peer-to-peer space.

Emerging Trends in Voice-Based Payment Technology 🔮

Integration with Smart Vehicles 🚗🎤 As voice technology becomes more ubiquitous, integration with vehicles is a growing trend. Consumers will soon be able to make purchases while driving, from paying for fuel at gas stations to ordering drive-thru food, all through simple voice commands.

Multi-Language and Accent Recognition 🌍🗣️ As voice payment technology expands globally, the need for multi-language and accent recognition will become increasingly important. Companies are investing in improving the language models of voice assistants to accommodate users from diverse linguistic and cultural backgrounds.

Voice Commerce (V-Commerce) 🛍️🎙️ The rise of voice commerce, or "v-commerce," is an emerging trend. This encompasses everything from voice-enabled shopping on e-commerce platforms to ordering groceries via voice commands. As voice assistants become more adept at handling complex transactions, v-commerce is expected to become a major segment of the digital economy.

Conclusion: The Future of Voice Payments 🌟

Voice-based payment technology is rapidly gaining ground, offering convenience, security, and a futuristic way to handle financial transactions. With the global market expected to grow substantially over the next few years, advancements in AI, voice recognition, and security will further fuel its adoption. However, challenges around privacy, security, and integration must be addressed to ensure consumer trust and widespread acceptance.📱💬

Website: https://www.xinrenresearch.com/

0 notes

Text

**Patriot Cards: The Ultimate Financial Tool for True Patriots**

You can try this product Patriot Cards

In an era where financial freedom and patriotic values intertwine, **Patriot Cards** have emerged as a unique and powerful solution. More than just a financial tool, Patriot Cards are designed to embody the spirit of patriotism, empowering individuals to support causes they care about while managing their finances effectively. This article explores the features, benefits, and impact of Patriot Cards, and why they are the ultimate choice for those who love their country and want their money to make a difference.

**What are Patriot Cards?**

**Patriot Cards** are a line of financial products—ranging from credit and debit cards to loyalty and membership cards—designed to offer more than just transactional convenience. These cards are tailored to individuals who value financial independence, transparency, and the opportunity to support American causes. With exclusive benefits, cashback rewards, and charitable contributions tied to each purchase, Patriot Cards stand out as a symbol of pride and purpose.

**Key Features of Patriot Cards**

1. **Support American Causes**

- Every time you use a Patriot Card, a portion of the transaction goes towards supporting various American causes, charities, and veteran organizations. Whether it’s funding educational programs, supporting veterans, or contributing to community initiatives, Patriot Cards make every purchase count towards something bigger.

2. **Exclusive Rewards and Cashback**

- Patriot Cards offer generous rewards and cashback on everyday purchases. From grocery shopping and dining out to traveling and entertainment, cardholders can earn points that can be redeemed for cash, discounts, or special perks exclusive to the Patriot community.

3. **Low Fees and Transparent Terms**

- Unlike many financial products that come with hidden fees and complex terms, Patriot Cards are designed with transparency in mind. Cardholders enjoy low fees, competitive interest rates, and clear terms that prioritize customer satisfaction.

4. **Enhanced Security Features**

- Patriot Cards are equipped with advanced security features to protect your transactions and personal information. With robust fraud detection, instant alerts, and secure chip technology, you can use your card with confidence wherever you go.

5. **Patriot-Themed Designs**

- Proudly showcase your patriotism with a card that reflects your values. Patriot Cards come in a variety of designs featuring American symbols, such as the flag, bald eagle, and other iconic imagery. These designs are not just visually appealing but serve as a daily reminder of your commitment to supporting American values.

6. **Access to Patriot Perks**

- Cardholders gain access to exclusive perks, including discounts on American-made products, access to patriotic events, and special offers from partner brands. This unique feature allows you to enjoy benefits that align with your values and lifestyle.

7. **Easy Account Management**

- Managing your Patriot Card is simple and convenient with a user-friendly app and online portal. Track your spending, pay bills, redeem rewards, and stay updated on special promotions—all from the comfort of your smartphone or computer.

You can try this product Patriot Cards

**Benefits of Using Patriot Cards**

1. **Make a Difference with Every Purchase**

- Patriot Cards enable you to make a positive impact every time you swipe. By supporting causes that matter to you, your everyday spending contributes to the greater good, aligning your financial habits with your personal values.

2. **Enjoy Financial Freedom**

- With competitive interest rates, low fees, and flexible spending limits, Patriot Cards provide financial freedom without the burdens of hidden costs or restrictive terms. This makes them an ideal choice for anyone looking to manage their money wisely.

3. **Showcase Your Patriotism**

- Carrying a Patriot Card is more than just a financial decision—it’s a statement of your values. With patriotic designs and contributions to American causes, these cards allow you to showcase your pride and commitment to your country.

4. **Earn Rewards that Matter**

- Unlike generic rewards programs, Patriot Cards offer perks that resonate with cardholders who value patriotism. From cashback on everyday purchases to discounts on American products, the rewards you earn are designed to enhance your lifestyle.

5. **Secure and Reliable**