#DalalStreet

Explore tagged Tumblr posts

Text

Everything to Know About Tata Technologies IPO : Will You Invest?

The world of investments is buzzing with excitement as Tata Technologies, a global leader in engineering and product lifecycle management, gears up for its Initial Public Offering (IPO). This much-anticipated event promises not just financial growth but also a chance to be part of a company that has been at the forefront of innovation. Here’s everything you need to know about the Tata Technologies IPO.

Offer Details:

Tata Technologies aims to raise approximately Rs 3,042.51 crores through the IPO at the upper price band. The offering includes an offer-for-sale by both investors and promoters, with Tata Motors, Alpha TC Holdings Pte Ltd, and Tata Capital Growth Fund I among the key participants.

What are Issue Date and Closing Date?

The Tata Technologies IPO is set to hit the market on 22 November 2023, creating a window of opportunity for investors eager to be part of this milestone. The issue will close on 24 November 2023, providing a limited timeframe to seize the moment and secure a stake in the future of technological advancement.

What is Lot Size and Price Band?

For those ready to embark on this investment journey, understanding the lot size and price band is crucial. The Tata Technologies IPO offers a lot size of 30 Shares, making it accessible to a diverse range of investors. The price band for this IPO is set between Rs 475 and Rs 500 per share reflecting a carefully evaluated valuation that balances opportunity and value. Remember, the minimum investment by retail investors would be Rs 14,250 at the lower price band.

Why Invest in Tata Technologies IPO?

1. Strong Track Record: Tata Technologies boasts a proven track record of success, with a portfolio of groundbreaking projects that have left a lasting impact on industries worldwide.

2. Strategic Vision: The IPO funds will be channeled into realizing an ambitious vision for the future. This includes investments in cutting-edge technologies, strategic collaborations, and global expansion.

3. Tata Group Backing: As part of the Tata Group, Tata Technologies enjoys the backing of one of India’s most reputable and diversified conglomerates. This affiliation brings stability, reliability, and a commitment to excellence.

4. Sector Dynamics: With a focus on emerging sectors and transformative technologies, Tata Technologies is positioned to capitalize on the rapidly evolving dynamics of the global market.

Financial Snapshot:

Tata Technologies has showcased impressive financial performance, with a reported 42.8% YoY growth in consolidated net profit at Rs 624 crores for the year ended March 2023. Its revenue witnessed a significant increase of 25.81% during the same period.

Global Impact:

As a global company, Tata Technologies operates in key markets, contributing to transformative changes in industries such as automotive, aerospace, and industrial machinery. By investing in Tata Technologies, you’re not just investing in a company; you’re investing in the global progress of technology and engineering.

Technology of Tomorrow:

The future is digital, and Tata Technologies is at the forefront of this technological wave. From digital engineering solutions to advanced product development, the company is positioned to capitalize on the evolving technological landscape. This IPO is an invitation to be part of the journey towards a future where technology is not just advanced but also sustainable and impactful.

Conclusion:

As the Tata Technologies IPO beckons, it presents a unique opportunity for investors to align with a company synonymous with innovation and excellence. While the financials are promising, it’s essential to make investment decisions based on individual financial goals and risk tolerance.

For more information or To open Trading / Demat Account — Visit our Website 👩💻 𝐰𝐰𝐰.𝐢𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭𝐨𝐫𝐨𝐧𝐥𝐢𝐧𝐞.𝐜𝐨𝐦 To talk to our expert team — Call us ☎️ +𝟗𝟏 𝟕𝟗𝟔𝟗𝟏 𝟓𝟑𝟔𝟎𝟎

#stock market#finance#investing stocks#ipo#investing#indian stock market#stocks news#tradinginsights#investmentor#nse#bse#dalalstreet#investing in stocks#nifty#banknifty#stocktrading#tatatechnologiesipo#investmentopportunity#tatagroup#stock analysis#investment strategy#moneymatters#financialfreedom#investmentstrategies

0 notes

Text

#tradesworld#india#mukeshambani#sharemarket#tatagroup#nifty#stockmarket#sensex#motivation#business#tatamotors#bse#entrepreneur#rakeshjhunjhunwala#quotes#inspirationalquotes#dalalstreet#startupindia#reliance#mumbai#elonmusk#indianstockmarket#nse#tcs#stocks#motivationalquotes#stockmarketindia#instagram#ratantataquote#NewsUpdate

0 notes

Text

youtube

🚀📈 Discover Dalal Street's Hottest IPOs! 📈🚀

Are you ready to ride the IPO wave and level up your investment game? Our latest video unveils the secrets of Dalal Street's booming IPO market! 💰

🔥 Dive into the world of high-stakes investments and explore the most anticipated Initial Public Offers. From JSW Infrastructure to Valiant Laboratories, we've got the inside scoop on where to put your money.

📊 Get ahead of market trends, learn expert strategies, and make informed investment decisions. Don't miss this opportunity to supercharge your financial future!

👉 Watch the video now

Remember, knowledge is power in the stock market! Share this video with your Tumblr community and help them make smart investment moves. 🤝💡

#stock market#ipo#dalalstreet#stock maket news#stock market analysis#investment strategy#invetment#investment insights#market trends#market analysis#market research#Youtube

0 notes

Link

#AdaniPorts#AfricanUnion#candlestickpattern#China#crudeoil#DalalStreet#domesticinstitutionalinvestors#foreigninstitutionalinvestors#G20#G20Delhi#G20summit#India#India-MiddleEast-EuropeCorridor#IRCON#IRFC#NarendraModi#Nifty#Nifty50#Nifty50analysis#NiftyBank#Niftyindex#Railway#RelianceIndustries#RITES#RVNL#technicalanalysis#UAE

0 notes

Text

🥳 Big Profit Every Day Great Ideas to Start Share Market Trading 🔰

📢 ….Join JV TRADES Invest to Grow your Income 💵🔰

#sharemarket#bse#niftyfifty#investingtips#forex#bitcoin#nifty#ipo#nse#sensex#shares#indianstockmarket#businessnews#mutualfunds#dalalstreet#startupindia#marketnews#stockmarkets#intraday#stockmarketnews#business#entrepreneur#money#share

0 notes

Text

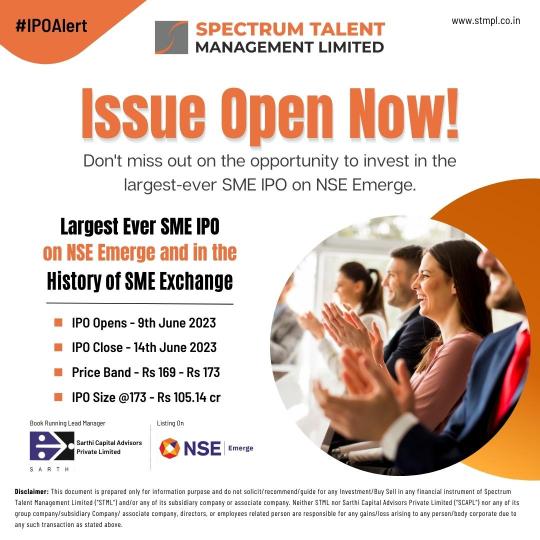

Thank you, Investors! We are thrilled to announce that the Spectrum IPO has been subscribed a remarkable 11.71 times! Your overwhelming support and confidence in our company's growth have exceeded all expectations. We are truly grateful for your trust and look forward to a bright future together.

#SpectrumIPO#ThankYouInvestors#StockExchange#IPOPerformance#IPO#IPOWatch#IPOSME#NSEEmerge#NSE#BSE#Nifty#DalalStreet#InvestIndia#TradingIndia#Stocks#StockMarket

1 note

·

View note

Text

Ratan Tata Net worth 2023 | Car Collection Many More

According to the reports Estimated Net Worth Of Ratan Tata is $ 1 Billion,which is an Indian Rupees is 8250 Crore. Ratan ji Tata is one of the top most and popular businessmen in India. There isn't a single person in India who has unheard this name Ratan Tata. Ratanji Tata has received the highest civilian awards of India, Padma bhushan in 2000 and Padma vibhushan in 2008. He was born on 28 Dec 1937 (Tuesday) Birthplace Bombay presidency British India, his father Naval Tata was adopted grandson of Jamshedji Tata who founded the TATA Group. Ratanji Tata parents got separated in 1948 when. He was just 10 years old. After that he was with his grandmother.

Full Article Click Here

#ratantata#tata#india#mukeshambani#sharemarket#tatagroup#nifty#stockmarket#sensex#motivation#business#tatamotors#bse#entrepreneur#rakeshjhunjhunwala#quotes#inspirationalquotes#dalalstreet#startupindia#reliance#mumbai#elonmusk#indianstockmarket#nse#tcs#stocks#motivationalquotes#stockmarketindia#instagram#ratantataquote

0 notes

Text

0 notes

Text

The Right Time to Invest in the Stock Market

Investing in the stock market can be a rewarding journey towards financial prosperity. However, one of the most common questions that plague every investor’s mind is, “When is the right time to invest in the Indian stock market?” While there is no one-size-fits-all answer, this blog aims to provide you with valuable insights into identifying opportune moments to start or expand your stock market investments in the Indian context.

1. Understand Your Financial Goals :

Before diving into the stock market, it’s crucial to define your financial objectives. Whether it’s saving for retirement, buying a home, or funding your child’s education, knowing your goals will help you determine when to invest. Short-term goals may warrant more conservative investments, while long-term goals can accommodate higher-risk opportunities.

2. The Power of Patience :

Timing the market perfectly is nearly impossible. Instead, focus on time in the market. Investing early and staying invested over the long haul tends to yield better results. Indian stock markets have historically provided attractive returns to investors who’ve held their positions through market ups and downs.

3. Market Research :

Stay informed about the Indian stock market’s current conditions and future prospects. Keep an eye on economic indicators, company news, and global events that may impact the market. Consider consulting financial experts or using reliable sources like market analysis websites to make informed decisions.

4. Dollar-Cost Averaging :

One effective strategy is to invest regularly, regardless of market conditions. This is known as dollar-cost averaging. By buying shares at different price points over time, you reduce the impact of market volatility on your portfolio.

5. Valuation Metrics :

Pay attention to valuation metrics like the Price-to-Earnings (P/E) ratio and Price-to-Book (P/B) ratio. A lower P/E or P/B ratio may indicate that a stock is undervalued, potentially making it a good investment opportunity. However, remember that these metrics are just one part of the puzzle and should be considered alongside other factors.

6. Risk Tolerance :

Understand your risk tolerance and align it with your investment choices. Indian stock markets can be volatile, so assess how much risk you can comfortably bear without losing sleep over your investments.

Conclusion :

In the ever-evolving Indian stock market, timing is indeed critical, but it isn’t everything. A combination of careful planning, research, and a long-term perspective can help you navigate the market successfully. Remember, there’s no foolproof formula for identifying the perfect time to invest. The right time is when you’re financially prepared, have clear goals, and have done your due diligence. So, start your journey today with confidence, and let your investments grow over time.

For more information or To open Trading / Demat Account — Visit our Website 👩💻 𝐰𝐰𝐰.𝐢𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭𝐨𝐫𝐨𝐧𝐥𝐢𝐧𝐞.𝐜𝐨𝐦 To talk to our expert team — Call us ☎️ +𝟗𝟏 𝟕𝟗𝟔𝟗𝟏 𝟓𝟑𝟔𝟎𝟎

#stock market#investmentor#investing stocks#finance#bse#nse#investing#stocks news#indian stock market#tradinginsights#dalalstreet#nifty today#nifty50#banknifty#sharebazar#profit#stocktobuy

1 note

·

View note

Text

#tradesworld#india#mukeshambani#sharemarket#tatagroup#nifty#stockmarket#sensex#motivation#business#tatamotors#bse#entrepreneur#rakeshjhunjhunwala#quotes#inspirationalquotes#dalalstreet#startupindia#reliance#mumbai#elonmusk#indianstockmarket#nse#tcs#stocks#motivationalquotes#stockmarketindia#instagram#ratantataquote#NewsUpdate

0 notes

Text

Know your trader type: Whether you're a day trader, swing trader, or long-term investor, find your strategy and conquer the market. . . .

bse #nse #indianstocks

indianstockexchange

indianstockmarketdailyupdates

indianstockadvisor #indianstockmarkets

sharemarkettips #sharemarket #sharebajar

dalalstreet #zerodha #zerodhakite

sharekhan #upstox #financial #iim

iimahmedabad #iimbangalore #iimindore

iitbombay #iitdelhi #jbims #nmims

thefinancialdiet #theindianexpress #indian

2 notes

·

View notes

Link

#Asianmarkets#Brentcrude#Chinesebanks#DalalStreet#Domesticstockindices#FederalReserve#foreigninstitutionalinvestors#GiftNifty#IndiaVIX#Nasdaq#Nvidia#oilprices#rupee#Tesla#WallStreet

0 notes

Text

📢 This is a Site Here we Provide Expert Stock and Commodity Market Crypto Currency ‼️

🔰 Best Platform Service in Share Market Grow your Money.💵

Invest in Stock 👉 MCX ,, NSE ,, COMEX ,, FOREX ,, NCDEX ,, and All crypto currency 🔰

Start Trading in 4999/-

#sharemarket#bse#warrenbuffet#niftyfifty#investingtips#nifty#ipo#nse#sensex#shares#indianstockmarket#businessnews#mutualfunds#dalalstreet#startupindia#marketnews#stockmarkets#intraday#stockmarketnews

0 notes

Text

The highly anticipated IPO of Spectrum Talent Management is now OPEN for applications. This is your opportunity to be a part of the journey and invest in a promising future. Don't miss out! Apply today and secure your stake in this incredible opportunity.

#IPO#SpectrumTalentManagement#SpectrumIPO#IPOSME#IPOAlert#NSEEmerge#NSE#BSE#Nifty#DalalStreet#InvestIndia#TradingIndia#Stocks#StockMarket

0 notes

Photo

Download Free "Equinivesh Learn" App Happy Guru Govind Singh Jayanti #GautamAdani #SGXNIFTY #StockMarketindia #TataGroup #NASDAQ #DowJones #stockmarketindia #nifty #nifty50 #banknifty #stockmarket #sharemarket #rakeshjhunjhunwala #sensex #bse #nse #indianstockmarket #dalalstreet #business #stockinmarket #marketupdate #sharebazar #ipo #bazar #investment #investing #trade #money #cryptonews #sharemarketindianews #riprakeshjhunjhunwala

2 notes

·

View notes

Video

youtube

India's Commitment to Global #semiconductor Leadership! https://youtube.com/shorts/3VD77iz50P8?feature=share _"#india 's Commitment to Global Semiconductor Leadership" Prime Minister #narendramodi emphasizes reducing #import dependency. Details of India's top Semiconductor stocks. ➡️ The government's push for making India a semiconductor hub has attracted big names such as US-based #Micron . But profitability and scalability could prove to be challenges. Get more insights, Subscribe to get the latest industry updates Join us at demiumresearch.com or call 7030916583 or 7030916716 today. Let's make your money work smart. . . . . #semiconductor #stockmarketindia #breakingnews #radar #stockmarket #investment #stockmarketindia #BSE #stocks #recommendations #nseindia #stockupdate #nse #stockmarketindia #stockmarketmeme #dalalstreet #trader #investor #sharebazaar #sharemarket #insidertrading #tradingstrategy #stockstrader #investorshub #bse #stockmarket

0 notes