#CryptoAnalyst

Explore tagged Tumblr posts

Text

E N I G M A by Alan Touring (1912-1954)

6 notes

·

View notes

Text

Bitcoin Rally Propels Stacks (STX) Towards $2 Mark in a Striking Upward Momentum

Investor enthusiasm for Stacks (STX) is reaching new heights as the cryptocurrency approaches its all-time high, fueled by positive developments within the Bitcoin ecosystem. Altcoin Sherpa hints at a potential correction for STX in the $2.50 to $3.00 range, adding an air of uncertainty to the depth of the anticipated pullback. On the flip side, CryptoBusy's analysis points to a bullish breakout for Stacks, citing increased activity on the Bitcoin network and forecasting a bright outlook for the cryptocurrency.

Within the Bitcoin ecosystem, Stacks is currently experiencing a wave of optimism among investors and enthusiasts. Despite the price nearing a potentially risky level on longer timeframes, there is a prevailing sentiment that Stacks could surpass its all-time high in the coming months.

Altcoin Sherpa, a prominent crypto analyst, shared insights into Stacks, emphasizing its potential for significant growth despite potential price corrections. Technical analysis suggests a correction within the $2.50 to $3.00 range, sparking speculation about the extent of the anticipated pullback.

Stacks, identified by its ticker STX, is currently undergoing a notable rally, approaching the $2 mark. This upward movement is a cause for celebration among individuals holding the cryptocurrency, with momentum driven by broader excitement within the Bitcoin ecosystem, positively impacting associated projects.

CryptoBusy, a reputable analyst, recently highlighted this positive trend, projecting a multi-month bullish breakout for STX. According to their analysis, the coin is on track to reach the $2 threshold, fueled by increased activity and interest in the Bitcoin network. This growth is seen as a testament to the symbiotic relationship between Stacks and Bitcoin, hinting at a promising future for STX holders and investors.

As a revolutionary Bitcoin Layer, Stacks has transformed the use of Bitcoin by enabling smart contracts and decentralized applications. This innovative platform allows applications to leverage Bitcoin as a primary asset while finalizing transactions on Bitcoin's blockchain. The recent surge in the cryptocurrency market has propelled Stacks (STX) to an unprecedented 43% climb, surpassing the $2 mark. This surge aligns with the broader cryptocurrency market rally, highlighted by Bitcoin's ascent to the $52,000 level.

In the last 24 hours alone, Stacks has outperformed most other cryptocurrencies within the top 100 coins by market capitalization. Its price has surpassed the $2 threshold, inching closer to its all-time high of $2.492. Factors contributing to this exceptional performance include Stacks' distinctive role as a smart contract layer for Bitcoin, the overall bullish trend in Bitcoin's price, and the expanding adoption and growth of the Stacks network.

0 notes

Text

Ethereum (ETH) Could Experience 10x Growth, According to Discover Crypto Analyst

Signals Point to a Bullish Trend

Discover Crypto, a prominent YouTube channel, has identified signals that could lead to a tenfold increase in Ethereum's value next year. In a recent video, the channel analyzed Ethereum's previous price movements, enabling the identification of an impending upward trend. According to the blogger, Ethereum has overcome long-term horizontal resistance, marking the beginning of the previous bullish cycle. Using the ETH/USD daily chart on TradingView, he illustrated that the horizontal resistance channel lasted approximately 1029 days. Following the breakthrough, the leading altcoin experienced rapid growth. The channel host demonstrated that 130 days after the breakout, Ethereum surged over fivefold. He compared Ethereum's price behavior in 2020 with the current trend, highlighting significant similarities that could lead to a similar outcome. Based on this historical pattern, the expert concluded that by September 2024, Ethereum could be trading around $3500. Moreover, he predicts future growth for the altcoin within the range of $10,000 to $12,000. This forecast relies on the Relative Strength Index (RSI) momentum indicator. After surpassing the overbought RSI level in 2020, Ethereum experienced a tenfold increase. Disclaimer: The information provided is for informational purposes only and does not constitute financial advice. Readers should conduct their own research and consult with financial advisors before making investment decisions. Read the full article

#BullishCycle#bullishtrend#CryptoAnalyst#Cryptocurrency#DiscoverCrypto#ETHPriceAnalysis#Ethereum#investmentstrategy#markettrends#priceforecast#RelativeStrengthIndex(RSI)#TechnicalAnalysis#tradingsignals#TradingView

0 notes

Text

Analyzing Bitcoin's Price: Will BTC Follow 2020's Pattern Amidst Market Turmoil?

In a recent Twitter post, a prominent crypto analyst delved into the price prospects of Bitcoin (BTC), the leading cryptocurrency in the market. Drawing parallels between the current market turmoil and the events of 2020, the analyst speculated about BTC's potential trajectory. Additionally, the CEO of CryptoQuant, Ki Young Ju, expressed his contrasting views on BTC's short squeeze. In this article, we explore these perspectives and analyze the possible implications for Bitcoin's price.

Similarities Between 2020 and the Present

Bitcoin / Tether 5D (Source: Twitter) The crypto analyst highlighted certain resemblances on BTC's chart when comparing the current scenario with 2020. Specifically, the post drew attention to the market turmoil that ensued after the SEC crackdown on numerous crypto exchanges, resembling the impact of the Covid crash last year. Consequently, the prices of various cryptocurrencies, including BTC, experienced a significant decline. Interestingly, the post also pointed out the substantial price surge that followed the Covid crash. The analyst subtly suggested that history might repeat itself, indicating the possibility of a similar outcome for BTC in the near future.

Contrasting Perspectives: BTC's Short Squeeze

While the analyst presented a bullish stance on BTC, the CEO of CryptoQuant, Ki Young Ju, voiced a different opinion on Twitter. Ju expressed skepticism regarding the occurrence of BTC's short squeeze at the present time. A short squeeze occurs when the price of a cryptocurrency begins to rise instead of falling. As the price surges, traders who hold short positions face mounting losses. To mitigate their losses, these traders are compelled to repurchase the cryptocurrency, effectively closing their short positions. However, if a large number of traders find themselves in short positions and simultaneously rush to buy the cryptocurrency, it can create a surge in demand, driving the price even higher. Based on Ju's assessment, it seems unlikely that BTC will experience such a surge in the near future. Ju's belief is reinforced by his observation that the majority of perpetual swap buying volume stems from "pure" BTC purchases rather than short liquidations. Although BTC did witness a price increase in the past 24 hours of trading, Ju's analysis suggests that a substantial price surge may not be imminent. BTC's Recent Performance As of press time, BTC is valued at approximately $26,587.03, reflecting a price rise of over 4% in the past day, according to CoinMarketCap. This positive movement has reversed BTC's weekly performance, bringing it to a growth rate of +3.74%.

Conclusion

While a crypto analyst draws parallels between the current market situation and the events of 2020, speculating on BTC's potential price surge, the CEO of CryptoQuant holds a different perspective. Ju's analysis suggests that BTC's short squeeze may not have occurred yet, dampening the expectations of a rapid price surge. The recent increase in BTC's value over the past 24 hours demonstrates the cryptocurrency's resilience, but the long-term trajectory remains uncertain. Readers are advised to conduct their own research and exercise caution when making investment decisions. Disclaimer: The views, opinions, and information presented in this price analysis are published in good faith. Readers are strongly encouraged to conduct independent research and due diligence. Any actions taken by readers are solely their own responsibility, and neither Coin Edition nor its affiliates shall be held liable for any direct or indirect damage or loss incurred. For more articles visit: Cryptotechnews24 Source: coinedition.com

Latest Posts

Read the full article

0 notes

Text

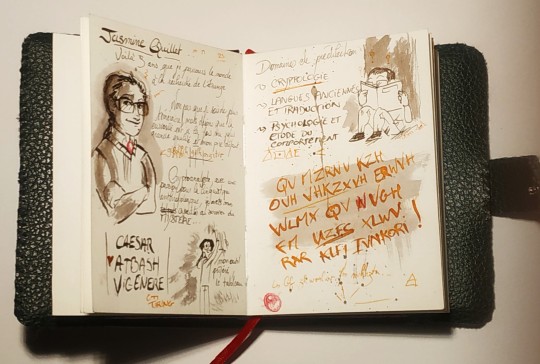

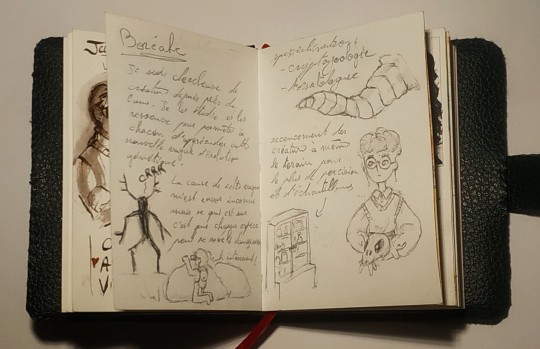

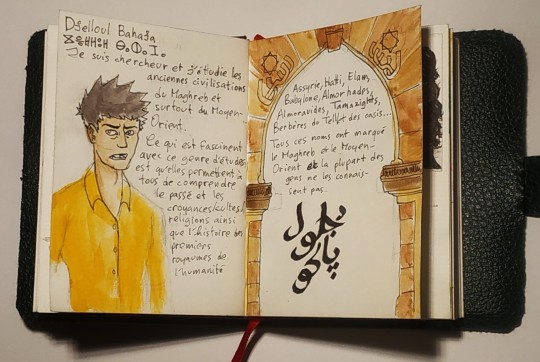

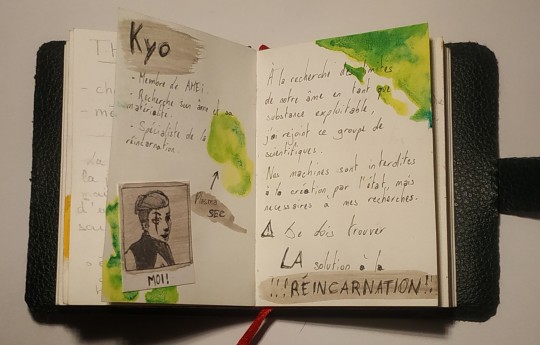

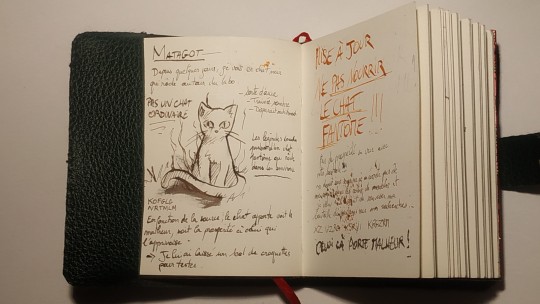

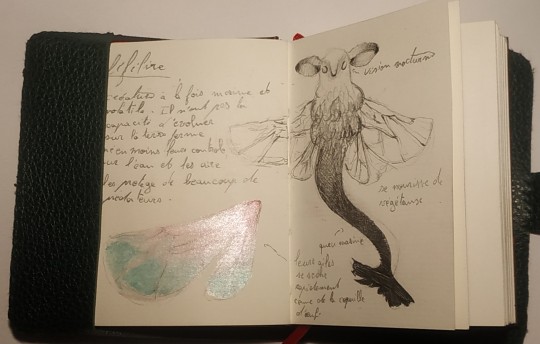

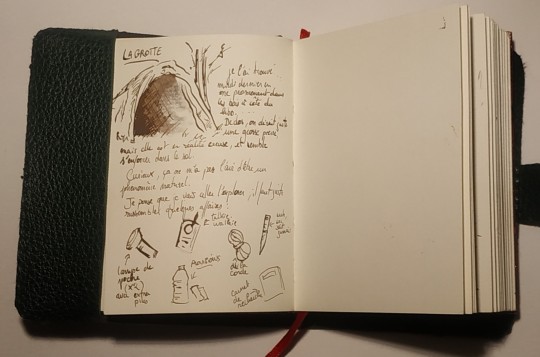

I got my friends to do a Journal 3-like project with me and I'm very happy how it's turning out !

Everyone has their own style I love it ! We all invented ownselves a researcher persona specialized in a subject (I'm a cryptoanalyst, one's a botanist, another an epidemiologist, etc...). And then we invent creatures and phenomena accordingly ! We started this project not long ago but here are some pages we did already :

Can't wait to see how the book will look like at the end ! (And yes, everything is in French, sorry...)

My friends don't have a clue it all started with Gravity Falls haha

#art#gravity falls#stanford pines#sketch#gravity falls journal 3#gf journal#my little project#it all started because we found an blank sketchbook in the classroom and didnt want to fight over it !

34 notes

·

View notes

Text

Bitcoin Price Surge and Potential Correction: Analysts Predict Rally to $150K

Bitcoin has recently experienced a surge in price, surpassing $52,000 and providing optimism for a potential rally to $100,000 and even $150,000 in the long run 🚀. However, analysts warn of a possible 40% correction in the Bitcoin price before it reaches these new highs. Renowned cryptocurrency analyst, Michaël van de Poppe, predicts this correction based on market sentiment overshooting reality.

Poppe advises caution for short-term traders, recommending a strategic game plan based on risk tolerance and investment horizon. He suggests that long-term investors may benefit from waiting for a standard 20% to 40% correction before entering the market. Despite potential short-term volatility due to macroeconomic events, such as the recent negative Producer Price Index report, Poppe remains confident in Bitcoin's long-term prospects.

At present, the BTC price is around $51,516.41, displaying a market capitalization of $1.01 trillion. The recent bearish turn in Bitcoin price could be linked to the negative PPI report. Overall, the outlook for Bitcoin remains positive in the long term, with opportunities for both short-term traders and long-term investors to capitalize on market fluctuations.

Read the original article #Bitcoin #Cryptocurrency #BitcoinPrice #CryptoAnalyst

0 notes

Text

EXPRESS ENTRY - CHECK SOME ELIGIBLE OCCUPATION TITLES IN THE STEM CATEGORY

Canadian Government has introduced 6 categories for the year 2023. If your occupation falls on the list, you have a higher chance to receive an invitation to apply for permanent residency in Canada under the Express Entry program.

Some occupation titles in the STEM category that includes Science, Technology, Engineering & Maths are:

• Architect

• Actuarial Assistant

• Cryptoanalyst

• Statistician

• Zoological Park Director

Excited and want to know more? Get in touch with us today!

Jagpreet is an RCIC, a licensed consultant with CICC and has over 21 years of experience.

At Takarra, we provide Canadian Immigration Consultancy in matters such as Super Visa, Visitor Visa, Express Entry, Business Immigration Programs, Ontario Provincial Nominee, Spousal & Parents sponsorship, Humanitarian & Compassionate, Caregiver Pilot programs and Work Permit applications like Post Graduate Work Permit, Spousal Open Work Permit, Intra-Company Transfers, LMIA-based Temporary Foreign Worker program.

#Takarra #immigration #canada #visa #Ontario #skills #ExpressEntry #Architect #Actuarial # Cryptoanalyst # Statistician # ZoologicalPark #ImmigrationConsultancy #Immigratewithtakarra #cdnimm #ImmigrationMatters #RCIC #OINP #picoftheday #foryoupage #trendy #followme #instafashion #share #canadatravel #canadagaram #canadalife #immigrationservices #journey

0 notes

Text

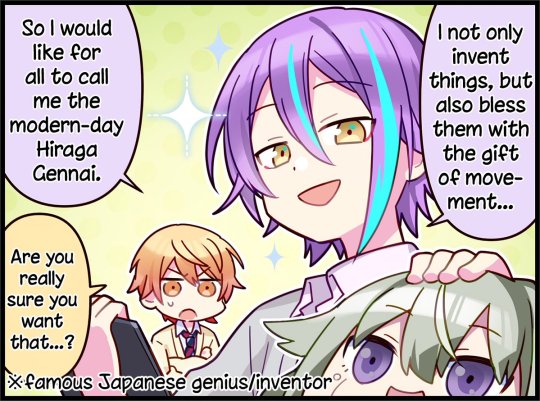

Although while Turing worked at Bletchley Park he helped to build the Bombe, it was an improved version of a Polish codebreaker and he didn't invent it. He's usually credited as a mathematician, computer scientist and cryptoanalyst, so I can understand why they didn't use him in the localisation, even if it's probably the better pick.

I'm surprised they didn't use da Vinci. He's far more famous for being an artist, so fair enough for not using him, but he was an engineer and scientist as well. His credits are a bit similar to Gennai's, but then again this probably fits the description of several people lol.

Also the drawings in this card always reminded me of da Vinci's technical sketches. To be honest this is just pretty standard technical drawing it's probably just the old-timey parchment that makes me thinks that. Disregard this I don't know why I added it.

Considering that Edison has loads of patents to his name and his work greatly influenced modern technology (motion picture cameras, an improved model of the filament bulb, the phonograph, etc), and is one of the most notable inventors of (modern) history, I can see why the localisers picked him and just changed the joke afterwards. The localisers probably focused on picking a prolific inventor that audiences would recognise rather than making sure the gay joke carried over. At least that's what it seems like to me because this is this is one of the most notable localisation changes in the game.

(Even if he wasn't so much an inventor, I think Turing would be a better choice as well, because it carries over the original joke and is a name that most people will recognise. Also Rui did build an AI for Nenerobo which filters into computer science)

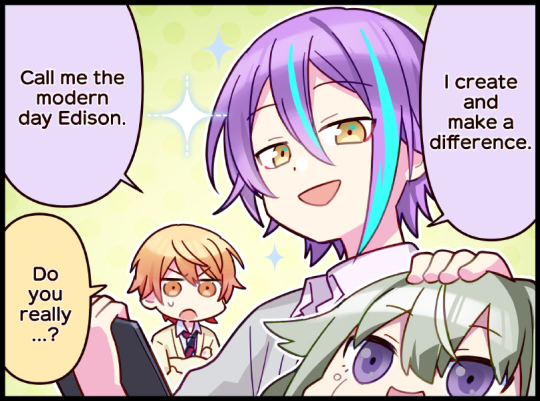

While some of the loading screen 1komas have minor dialogue changes between the JP and EN servers, 1koma #23, Rare Genius, is the only one that had the joke changed during the localisation process.

In the original Japanese version (left), Rui tells people to call him “the modern day Hiraga Gennai”. Gennai was a Japanese scientist and inventor from the 18th century, who was also famously gay and wrote multiple works on homosexuality. Tsukasa then asks Rui if he’s sure he wants to be known with that epithet, highlighting the implication. In this case, the joke is meant to be that Rui essentially just called himself gay.

In the official English localisation, Rui tells people to call him "the modern day Edison" instead, because the vast majority of EN players wouldn't know who Gennai was. Tsukasa's question is changed to make up for the different context, with him instead asking if Rui really "creates and makes a difference" like he claims he does. In this case, the joke is meant to be that Tsukasa doubts how accurate Rui’s claim is.

1koma translation by @/pjsekai_eng on Twitter

#i am not qualified to talk about history#but i find localisation super interesting as well and my hand slipped and i went really offtopic i apologise#Adding to that last little bit about edison I don't know how famous gennai is within japan.#obviously he's well known enough for them mention him in a gag comic bc you want people to understand the joke#but idk if he's like. edison-level famous#i think they just wanted to make a gay joke#mod talks

897 notes

·

View notes

Photo

Always invest in #Crypto with Education For best investment offers in #Crypto #AskToRahulSingh #CryptoAnalyst #BlockchainExpert #AskMeHow #JDCoin +91 836 841 3867 (WhatsApp Global) (at DreamzUltimate) https://www.instagram.com/p/CJ0lRm1L0-T/?igshid=12xdtbdctq51o

1 note

·

View note

Text

LIVE WITH COINTELEGRAPH

WATCH!!!!! Going Live 2PM Thursday 23rd JULY - NEW YORK TIME- That is 4am Melbourne Australia time and I think I have been in crypto long enough you all know who I am... without the (Brackets)

https://youtu.be/BEDN--Q8m-c

2 notes

·

View notes

Link

#Garlinghouse#Crypto#Twitter#Bitcoin#Ethereum#EthereumMining#LeadingCryptoPersonalities#RippleCeo#BradGarlinghouse#CeoOfRipple#Cnn#Blockchain#Cryptocurrency#China#BitcoinBlockchain#Ether#CryptoPersonalities#CryptoAnalyst#MatiGreenspan#AdamantCapital#OnChainAnalyst#Demeester#BarrySilber#GrayscaleInvestments#America

4 notes

·

View notes

Link

#alexkruger#bitcoin#btc#kriptopara#crypto#cryptocurrency#haber#bloomedianet#bitcoinprice#bitcoinfiyat#coin#glasnode#luna#cryptoanalyst

0 notes

Text

Crypto Analysts Share Diverse Views on XRP Price Movement

Market Sentiment Amidst Decline

Despite the recent downturn in XRP prices, cryptocurrency traders and analysts maintain a bullish outlook. According to @Bit_Luxe, the price is expected to rebound above $1 in the near future. Source: Twitter @Trade Byte sees a favorable opportunity for buying before a potential rebound, while @Rob Art is confident that the current dip represents a healthy correction. Wall Street Expert Predicts Strong Surge for Ripple (XRP) in 2024

XRP Price Forecast: When Will the Reversal Begin?

The six-hour timeframe aligns with the daily, confirming the likelihood of continued XRP descent. The chart illustrates that the asset has been moving below a descending resistance line since July 2023. Additionally, the altcoin broke the $0.52 horizontal area, forming a descending triangle in conjunction with the resistance line, and the six-hour RSI dropped below 50. A movement throughout the pattern's height will lead Ripple to the nearest support at $0.34, representing a 33% drop from the current price. Source: TradingView However, a return to the $0.54 range would invalidate the breakdown and could trigger a 20% rise toward the descending resistance line.

Disclaimer

All information on our website is published with principles of fairness, objectivity, and solely for informational purposes. The reader is entirely responsible for any actions taken based on the information obtained from our website. Read the full article

#BullishOutlook#cryptoanalysts#Cryptocurrency#MarketCorrection#marketsentiment#PriceRebound#ResistanceLines#Ripple(XRP)Forecast#supportlevels#TechnicalAnalysis#TradingStrategies#WallStreetExpert#XRPPriceAnalysis

0 notes

Photo

#dailycryptoupdate #cryptonews #crypscrow #cryptoanalyst #btc #xrp #firework #binance #binancex #developers #massadoption #alanhoward #crypto #hedgefund #mixedsignals #altcoins #johnbollinger #warns #brazil #pos #cryptopayments https://www.instagram.com/p/B10VCtZgcO6/?igshid=1n320kl6ya5nq

#dailycryptoupdate#cryptonews#crypscrow#cryptoanalyst#btc#xrp#firework#binance#binancex#developers#massadoption#alanhoward#crypto#hedgefund#mixedsignals#altcoins#johnbollinger#warns#brazil#pos#cryptopayments

0 notes

Text

Concerning Metric Suggests Bitcoin Rally Losing Steam, Analyst Warns

A crypto analyst, Jason Pizzino, has raised concerns about Bitcoin's current rally, suggesting that it may not be sustainable. Pizzino points to a decline in Google searches for the term "Bitcoin" as an indication that interest in the cryptocurrency is waning. He notes that historically, Bitcoin's price movements have aligned with the level of Google search activity. The peak in interest for Bitcoin occurred around January 7th to 13th, when its price reached $49,000. However, since then, search interest has been steadily decreasing, despite the price continuing to rise. Pizzino warns that if Bitcoin wants to break through the $49,000 level, it needs to see an increase in trading volume soon.

Pizzino highlights the importance of volume in driving Bitcoin's next move. He suggests that the current lack of volume could hinder further upward momentum. He explains that for the bullish scenario to play out, Bitcoin needs to break above $49,000 and sustain that level by the end of this week or next week. He emphasizes that while anything can happen in the volatile crypto market, the declining interest in Bitcoin's search term is an important factor to consider.

As of now, Bitcoin is trading at $48,086. The crypto market remains uncertain, and whether Bitcoin's rally can continue at its current pace remains to be seen. Traders and investors are eagerly watching volume and price movements for clues about the cryptocurrency's future trajectory. It is recommended to keep a close eye on key developments and industry analysis to navigate the market with caution.

Read the original article

#Bitcoin #BitcoinRally #CryptoAnalyst #Cryptocurrency

0 notes

Photo

There have been several movements in the crypto market since the recent Bitcoin halving. It has also been noticed that after the halving, there is a huge drop of around 60% in Bitcoin miners revenue. Read More

#bitcoin#bitcoinminers#bitcoinhalving#halving#cryptomarket#bitcoinminersrevenue#cryptonews#bitcointransactionfees#cryptoanalysts#cryptocurrencynews#cryptocurrency#transactionfees#reducedhashrate#hashrate#bitcoinnews#btc

0 notes