#Crude Oil price

Explore tagged Tumblr posts

Text

Nifty Prediction : Nifty may test 24250 (close to the values of 22-11-2024) | Look for Opp.

Daily Forecast – Share Market – December 18th, 2024 Nifty may test 24250 (close to the values of 22-11-2024) | Look for Opp. Saturn with Moon leads the day well supported by Sun, Rahu and Ketu. Impact of foreign cues Continue reading Nifty Prediction : Nifty may test 24250 (close to the values of 22-11-2024) | Look for Opp.

1 note

·

View note

Text

Crude Oil Prices Trend | Pricing | News | Database | Chart

Crude Oil prices are a critical component of the global economy, influencing everything from transportation costs to the price of goods and services. The volatility of crude oil prices has a profound impact on industries and consumers alike, as oil is a fundamental resource used across various sectors such as manufacturing, energy production, and even agriculture. Understanding the factors that drive the price of crude oil is essential for businesses and individuals seeking to navigate the complexities of global markets.

Crude oil prices are determined by a variety of factors, both on the supply and demand sides of the market. On the supply side, geopolitical tensions, natural disasters, and technological advances in oil extraction can all have a significant impact on production levels. For example, conflicts in major oil-producing regions, such as the Middle East, can cause disruptions in the global supply chain, leading to price spikes. Additionally, decisions made by organizations like OPEC (Organization of the Petroleum Exporting Countries) can directly affect the supply of crude oil and, by extension, its price. OPEC's agreements to limit or increase oil production can lead to significant fluctuations in the price of crude oil, influencing the global market.

Get Real Time Prices for Crude Oil: https://www.chemanalyst.com/Pricing-data/crude-oil-1093

In addition to supply and demand, market sentiment and speculative trading can contribute to short-term fluctuations in crude oil prices. Oil futures markets, where traders buy and sell contracts based on the anticipated future price of oil, play a significant role in price discovery. Traders react to news, reports, and economic indicators, adjusting their positions accordingly. For instance, an unexpected inventory build-up in the United States can cause concerns about oversupply, prompting traders to sell off oil futures, which in turn causes a decrease in the price of crude oil. Similarly, rumors of production cuts or supply disruptions can lead to a surge in speculative buying, pushing prices higher.

The price of crude oil is also affected by currency fluctuations, particularly the value of the U.S. dollar. Since crude oil is primarily traded in dollars, any change in the dollar's value can influence the price of oil. A stronger dollar typically makes oil more expensive for holders of other currencies, which can reduce demand and push prices lower. On the other hand, a weaker dollar tends to make oil more affordable for international buyers, increasing demand and driving prices higher.

Technological advances in the oil and gas industry, particularly in hydraulic fracturing and horizontal drilling, have also played a role in the evolution of crude oil prices. The United States, for example, has become one of the world’s largest oil producers due to innovations in shale oil extraction. This has led to increased supply in the global market, which has at times driven prices lower. However, these advances also come with environmental concerns and regulatory challenges that can impact the future of oil production and, consequently, crude oil prices.

The impact of crude oil prices extends beyond just the oil and gas industry. Changes in oil prices can ripple through the global economy, affecting everything from the price of gasoline to the cost of shipping goods. For consumers, rising oil prices often translate into higher fuel costs, which can increase the price of everyday goods and services. In countries that are heavily reliant on oil imports, fluctuations in crude oil prices can have a direct impact on national economies, leading to inflationary pressures and increased costs of living. Conversely, falling oil prices can provide relief to consumers and businesses, lowering production costs and potentially stimulating economic growth.

Governments and central banks also play a role in managing the impact of crude oil prices on their economies. Many countries maintain strategic reserves of oil to ensure a steady supply in times of crisis, helping to stabilize domestic markets. Additionally, monetary policy decisions, such as interest rate changes, can influence demand for oil by impacting economic growth and consumer spending. For example, when central banks lower interest rates, it can stimulate economic activity and increase demand for energy, which may lead to higher crude oil prices.

Crude oil prices also have a significant environmental and political dimension. The extraction and use of oil have long been associated with environmental degradation, including oil spills, habitat destruction, and greenhouse gas emissions. As global awareness of climate change grows, there is increasing pressure on governments and companies to transition away from fossil fuels, which can affect oil demand in the long term. Moreover, the political landscape surrounding oil production, consumption, and environmental regulations continues to evolve, adding further complexity to the crude oil market.

The future of crude oil prices remains uncertain, as the world navigates the challenges of climate change, energy transitions, and global economic fluctuations. While oil remains a cornerstone of the global energy landscape, the shift towards renewable energy sources and the continued development of electric vehicles may impact long-term demand for crude oil. In the near term, however, geopolitical factors, economic growth, and supply chain disruptions will continue to influence oil prices, making it essential for businesses and governments to stay informed about market trends.

In conclusion, crude oil prices are shaped by a complex interplay of factors, including supply and demand dynamics, geopolitical events, technological innovations, and market speculation. The price of crude oil has far-reaching implications, influencing everything from consumer behavior to global economic stability. As the world continues to grapple with the challenges of energy transition and environmental concerns, the future of crude oil prices will depend on a variety of factors, making it crucial to monitor market developments closely.

Welcome to ChemAnalyst App: https://www.chemanalyst.com/ChemAnalyst/ChemAnalystApp

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Crude Oil#Crude Oil Price#Crude Oil Prices#Crude Oil Pricing#Crude Oil News#Crude Oil Price Monitor#Crude Oil Database

0 notes

Text

Want to trade commodities, CFDs, currencies through a reliable digital platform? If so, Ellipsys Financial Markets is the ultimate platform. Feel free to contact us and learn more about our trading platform. https://www.elpmarkets.com/day-trading.html

0 notes

Text

Russia's crude oil export to India surged to a new record in December 2022. Moscow has remained the top oil supplier of India for consecutive months. According to data from energy cargo tracker Vortexa, India imported crude oil from Russia 1 million barrels per day for the first time in December. Russia supplied 1.19 million bpd of crude oil to India in December alone. As per Vortexa report, it was the higher than 909,403 bpd of crude oil India imported from Russia in November and 935,556 bpd in October 2022. In this video, let's take a look at some of the causes that led to the increase in imports that we have seen.

#russian oil#russian oil imports to us#oil#russia#russia oil#oil prices#crude oil#crude oil price#market#business#crude oil trading#oil import#livemint#news#oil news#world news#russian oil imports#russian oil imports ban#russian oil price cap#Geopolitics#petroleum#india imports russian oil#european union#russian economy

0 notes

Text

Options Trading Guide

Options trading guide can be a versatile and powerful way to manage risk and potentially profit from financial markets. Here's a comprehensive guide to get you started.

For more details visit here - https://hmatrading.in/options-trading/

Address: Ground Floor, D - 113, D Block, Sector 63, Noida, Uttar Pradesh 201301

Phone: 9625066561

#angel broking login in#gold rate forecast in India#gold price forecast in India#gold price forecast in India 2024#gold price predictions for next 5 years#angel one login#angel broking login#angel one login process#crude oil price forecast for today#crude oil price prediction tomorrow in India#crude oil trend today in India#crude oil price forecast for next week#trading in stocks for beginners#learn trading in stock market#best way to learn how to trade options

2 notes

·

View notes

Text

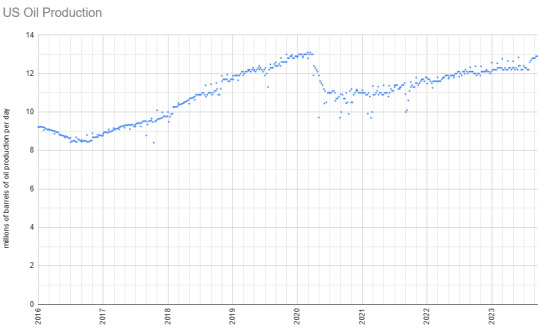

These charts are based on data from the Energy Information Agency (EIA), the government agency that the oil and gas industry relies on to provide accurate measures of US and international energy production, imports, exports, and other data. The EIA provides US oil production data compiled monthly since 1920 or compiled weekly since 1983. Both data sets are included in the above charts.

So, in summary, US oil production grew sharply starting in 2011, peaked and began to fall in 2015, bottomed out and started to recover by Oct 2016, recovered by 2018, reached an all-time peak by Feb 2020, then crashed again until Jun 2020, and has recovered ever since back to nearly the all-time peak once again.

For those that love to assign the US President all credit for oil production, there are serious upturns under Obama (2011-2016), Trump (2017-2019), and Biden (2021-present) and serious downturns under Obama (2015-6) and Trump (2020). Make of that what you will.

#data#oil and gas#oil production#usa#us politics#uspol#american politics#energy policy#crude oil#oil prices

2 notes

·

View notes

Text

[Image caption for original post: tweet by MIT Technology Review (@techreview) reading, "The problem is that solar panels generate lots of electricity in the middle of sunny days, frequently more than what's required, driving down prices -- sometimes even into negative territory." This is quote-retweeted by Alan R. MacLeod (@AlanRMacLeod), who says "Under capitalism, unlimited free electricity is a problem." End caption.]

#this might have been a cogent point if it was about like. crude oil prices dipping into the negatives or something#because storing crude oil is probably easier than storing electricity abstractly. you don't burn it and you put it into barrels i guess?#even that might have problems i'm not aware of#but yeah like. if you ever think ''unlimited free electricity'' can't ever represent a problem - imagine being electrocuted#energy#electricity#solar power#power#renewable energy#engineering#infrastructure

71K notes

·

View notes

Text

Oil prices are rising amid political instability in Syria - Crude Oil - 10 December 2024

On Monday, oil prices jumped after reports of the overthrow of Syrian President Bashar al-Assad by the opposition, which increased fears of an escalation of instability in the Middle East. Brent futures rose by 1.17%, reaching $72 per barrel, and WTI – by 1.32%, to $68.20. Traditionally, any geopolitical aggravation supports the oil market, but the recent price cuts by Saudi Arabia and the…

0 notes

Text

Discover the impact of the surge in crude oil prices in 2024 on global stock markets & Find out how higher oil prices can affect energy companies, other sectors, and economies heavily reliant on oil imports.

#jarvis artificial intelligence#crude oil prices#crude oil prices in 2024#green energy stocks#best long term stocks#ai tool for stock market india#best share market advisor in India

0 notes

Text

Oil prices surged 5% after Biden’s comments on possible Israel-Iran escalation

Crude oil prices rose 5% after US President Joe Biden said Washington was “discussing” the possibility of an Israeli strike on Iran’s oil industry in retaliation for Tehran’s missile attack.

Israel is considering a limited strike on Iran’s oil sector as a “significant retaliation” for Iran’s strike on its military bases, according to the source. However, Iran said it would retaliate if Israel struck any part of its oil sector in the Persian Gulf.

Brent crude oil prices rose 10% to $77.13 a barrel following Iran’s missile attack on Israel. The price hike comes at a critical time for global energy markets, although prices remain below levels seen earlier this year due to weaker demand from China and plentiful supplies from Saudi Arabia.

Increased violence in the Middle East and the threat of further escalation are now putting oil markets under intense pressure. Traders are also watching closely for any signs of disruption to supply routes.

Read more HERE

#world news#news#world politics#middle east#middle east conflict#middle east crisis#middle east war#middle east tensions#middle east news#oil#oil prices#crude oil#oil and gas#israel#israel hamas war#israel hamas conflict#israel hamas gaza#israel hezbollah war#lebanon#lebanon under attack#lebanon news#exploding pagers#hamas#gaza strip#gaza#gazaunderattack

0 notes

Text

I wonder if the people who voted for Trump in 2016 or refused to vote at all are pleased with how they showed the establishment... something.

#us politics#2022#political cartoons#the handmaid's tale#handmaid's tale#abortion bans#codify roe#roe v. wade#biden administration#vote#go vote#vote blue#reproductive rights#reproductive health#abortions#oil and gas#gas prices#opec#opec crude oil#opec output

822 notes

·

View notes

Text

Nifty Prediction : Nifty may look for 24700 n stoploss @ 24450 | Watch banks for now

Daily Forecast – Share Market – December 10th, 2024 Nifty may look for 24700 n stoploss @ 24450 | Watch banks for now Saturn with Sun leads the day, well supported by Moon, Mercury (Rx) and Jupiter. Indirectly Continue reading Nifty Prediction : Nifty may look for 24700 n stoploss @ 24450 | Watch banks for now

#Crude oil Price#currency#indian astrology#Macro economics impact#Nifty predictiion#sensex#Share Market#vedic astrology

0 notes

Text

Crude Oil Price | Prices | Pricing | News | Database | Chart

North America

In Q2 2024, the US crude oil market encountered notable volatility, shifting between bullish and bearish trends. In April, rising geopolitical risks and supply disruptions led to a spike in oil prices. U.S. futures hit a five-month high after reports surfaced that an Israeli missile strike damaged the Iranian consulate in Damascus, Syria.

However, in May 2024, bearish sentiment prevailed, largely due to increasing supply. Key oil producers began lifting production cuts, resulting in a significant rise in US crude oil inventories. Weak export orders and falling global demand added to the supply glut, while high interest rates stifled economic activity and fuel consumption, pushing prices downward. Within North America, the United States experienced the most pronounced price swings. The growing inventories and the effects of high interest rates on economic growth and oil consumption were key contributors. By the end of June 2024, WTI crude oil prices settled at $79 per barrel.

APAC

The crude oil market in the Asia-Pacific region also faced challenges in Q2 2024, fluctuating from bullish to bearish trends. In April, India's crude oil imports dropped by approximately 9% from March, reaching about 1.25 million barrels per day. This decrease led to a supply shortage and a spike in import prices. Additionally, outages at Russian refineries further destabilized the market, while OPEC+ exerted pressure on some countries to adhere to agreed production cuts through the second quarter.

By June, however, the market landscape had shifted. Geopolitical tensions eased, and US crude oil production surged. OPEC+'s decision to gradually end production cuts starting in October increased the supply-demand imbalance, leading to lower prices. Rising global oil inventories and high interest rates dampened demand, reinforcing the bearish trend.

Europe

In Q2 2024, Europe's crude oil market also faced considerable challenges, swinging between optimism and caution. In April, geopolitical risks and supply disruptions, such as the Israeli missile strike on the Iranian consulate in Damascus, pushed oil prices higher, with U.S. futures reaching a five-month peak.

However, by May 2024, high supply levels and weakening demand, driven by easing geopolitical tensions and stable oil production, reversed the trend. Economic uncertainties, high interest rates, and rising U.S. stockpiles further fueled the global oversupply narrative, putting additional downward pressure on prices. Germany experienced the largest price fluctuations within Europe, and by the end of Q2 2024, Brent crude prices in the country settled at $83 per barrel, reflecting the quarter's mixed market conditions.

Get Real Time Prices for Crude Oil: https://www.chemanalyst.com/Pricing-data/crude-oil-1093

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Crude Oil#Crude Oil Price#Crude Oil Prices#Crude Oil Pricing#Crude Oil News#Crude Oil Price Monitor#Crude Oil Database#Crude Oil Price Chart Crude Oil Trend

0 notes

Text

Petrol Diesel Price Today 25 September, 2024 in Delhi, Mumbai, Kolkata and other major cities

As of September 25, 2024, petrol prices in major Indian cities are stable, with Delhi's price at Rs 94.72 per litre. Prices are set daily under a dynamic pricing system initiated in 2017, influenced by factors like crude oil prices, the rupee's exchange rate, and domestic tax policies. Crude prices have recently increased due to a weak dollar and Chinese stimulus measures, alongside geopolitical tensions in the Middle East. Prices vary across cities, with Hyderabad seeing the highest at Rs 107.41 per litre and diesel rates reflecting similar trends.

#Petrol price#Diesel price#Major cities#Rs 94.72 per litre#Dynamic pricing system#Crude oil prices#Rupee exchange rate#Domestic tax policies#Crude price increase#Geopolitical tensions#Hyderabad petrol price#Diesel rates#Chinese stimulus measures#Middle East

0 notes

Text

torn between "is this really what I consider exciting these days???" and "just take pleasure in the little things, you ding-dong" because I get to try a new plant-based butter alternative tomorrow

#president's choice prices its plant-based butter the same as dairy butter which is fucking ludicrous#it's no crude oil why the fuck is it THAT expensive???#so I switched to miyoko's while the frozen food outlet carried it ($5 for 3 (250g) bricks)#but then they ran out#and all other plant-based butter alternatives have had oat or rice or avocado or some ingredient i can't have#BUT becel's plant-based butter is on sale tomorrow and gram for gram it's regular price is less than their vegan margarine#god i hope it tastes as close to real butter as the PC butter#so if it tastes good i get to bake things again where margarine is not a suitable substitute :D

0 notes

Text

Discover Top Trading Solutions with WinproFX: Guide to the Best Platforms

WinproFX, located in Mumbai, is committed to providing top-tier trading solutions that cater to diverse trading needs. Our platforms are designed to offer unparalleled access and tools for trading commodities, crude oil, stocks, gold, and silver. Explore our offerings and see why we are the preferred choice for traders.

Best Commodity Trading Platform

WinproFX is renowned for offering theBest commodity trading platform. Our platform supports a wide range of commodities, including agricultural products, energy resources, and metals. With real-time market data, advanced charting tools, and efficient trade execution, you can make informed decisions and capitalize on market opportunities. Our user-friendly interface ensures a seamless trading experience for both novice and experienced traders.

Best Crude Oil Prices Platform

WinproFX provides the Best crude oil prices platform. Our platform offers comprehensive access to global crude oil markets, delivering up-to-date pricing, high liquidity, and competitive spreads. With detailed market analysis and robust trading features, you can navigate the complexities of crude oil trading with confidence and precision.

Top-Rated Online Brokers For Stock Trading

WinproFX is proud to be associated with Top-rated online brokers for stock trading. Our brokers are selected based on their excellence in providing reliable trading services, advanced tools, and exceptional customer support. Whether you’re trading major indices or individual stocks, our brokers offer the expertise and resources needed to enhance your trading experience.

Compare Brokers Offering Automated Trading Solutions

WinproFX, you can Compare brokers offering automated trading solutions to find the best fit for your needs. Our platform provides insights into various brokers' automated trading features, helping you choose the one that aligns with your trading goals and preferences.

Best Gold and Silver Trading Platform

WinproFX excels as the Best gold and silver trading platform. Our platform supports trading in precious metals with competitive pricing, real-time data, and advanced analytical tools. Whether you are trading gold, silver, or both, our platform offers a secure and efficient environment to manage your investments and capitalize on market trends.

WinproFX, we are dedicated to offering the best trading platforms and solutions to help you achieve your financial goals. Join us today and experience top-notch trading services. Visit https://winprofx.com for more information and to start your trading journey.

#winprofx#best#Best Commodity Trading Platform#Best Crude Oil Prices Platform#Top-Rated Online Brokers For Stock Trading

0 notes