#Criminal Lawyer in Carlyle

Explore tagged Tumblr posts

Text

Professional Criminal Lawyer in Carlyle | Saskatoon Criminal Defence Lawyers

In need of a reliable Criminal Lawyer in Carlyle? Our team of experienced Criminal Lawyer in Carlyle is here to offer strong legal representation for all types of criminal charges, including theft, assault, impaired driving, drug offenses, and more. We are committed to protecting your rights, providing personalized defense strategies, and ensuring the best possible outcome for your case. With a deep understanding of Carlyle’s legal system, we’ll guide you through every step of the legal process. Our firm will provide you with the best legal assistance for your case. So, hire the best Criminal Lawyer to defend your case. Contact us today for a confidential consultation and get the expert defense you deserve in Carlyle.

#criminal defense lawyer in saskatoon#criminal lawyer in prince albert#criminal lawyer in carlyle#criminal lawyer in north battleford

0 notes

Text

Crimson Avenger ll

Jill Carlyle

Intresting JSA centric anti-hero?

used to study law but when she became a lawyer she lost a case in which the defendant was clearly guilty. Jill obtains a pair of Colt pistols originally owned by the first (hero) She uses them to exact vengeance upon the criminal. These guns are cursed such that, if the possessor uses them out of revenge, he or she will be cursed to track and kill those who have taken innocent life. As part of the curse, an ever-bleeding bullet hole appears on her chest.

Comics:

JSA

Stars and S.T.R.I.P.E.S

Infinite Crisis

Justice Leaque

Honestly, love to see more of her character.If Stargirl contiune I feel like we would have seen her character one day.

4 notes

·

View notes

Photo

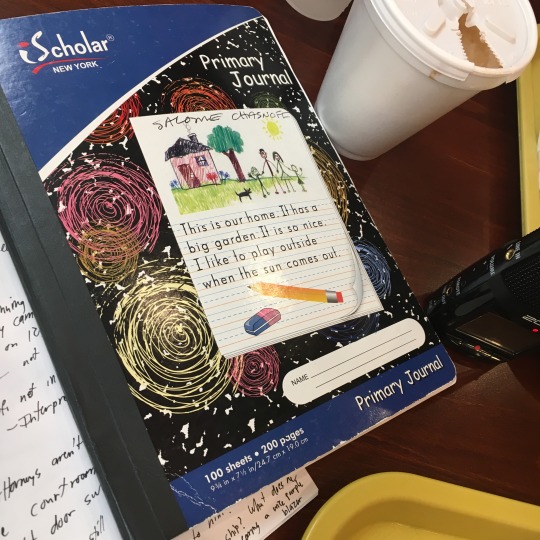

Public Collectors Courtroom Artist Residency #15: Salome Chasnoff

I can’t remember when I first met Salome but I’m quite sure we met at Mess Hall, an experimental cultural center in Rogers Park I cofounded and which existed from 2003-2013. Salome attended many events there and now co-runs the recently founded space PO Box Collective at the end of the same street: Glenwood Avenue.

I’m not sure it’s possible to talk about anything else I’m about to write without it potentially being upsetting, so I guess this is your content warning for the rest of this post.

I reconnected with Salome Chasnoff and her work a few years ago when I experienced her five-channel video installation “Presence Absent” (a collaboration with Meredith Zielke) which “makes visible the lives of people killed by Chicago Police or in police custody.” You experience this work by watching friends and family members of the deceased lovingly describe people that have been taken from them by police. The monitors are arranged in a circle like the comfortable chairs that viewers sit in and it feels like you are in someone’s living room hearing these people share stories. You get to see how much these victims were loved by their friends and family members. You learn who they were and what they were like. It’s absolutely devastating.

I scheduled Salome’s residency for today because I expected it could be unusually difficult and I wanted to make sure I was bringing someone with me that isn’t a stranger to painful stories. I picked the date because of two very different hearings that were happening on the same floor. One was a hearing for Jon Burge-era police torture survivor Gerald Reed, who was beaten until he confessed to a double murder that he did not commit and has been in prison or jail for nearly three decades. His coerced confession was thrown out by Judge Gainer right before that judge retired and a new Judge, Judge Hennelly has picked up this case. Nearly a year after Reed’s confession was discarded he remains in jail as Judge Hennelly continues to attempt to get up to speed—often saying he hasn’t received all of the papers in the case or hasn’t read everything. Today saw yet more frustrating delays, and while the judge has more of the papers now, one of Reed’s lawyers still doesn’t think he has everything and the judge refused to consider materials submitted on a flash drive. Reed’s next court date will take place on Friday, December 6th, again in room 604 at 9:30. His lawyers are planning to file motions to dismiss his case.

The other hearing I wanted to attend with Salome took place down the hall in room 606. This hearing was for the case of ex-CPD officer Carlyle Calhoun who was arrested for sexually violating a man who was in custody while he was shackled to a hospital bed on suicide watch. When Salome and I arrived at Criminal Court this morning, I tried to look up Calhoun’s case on the computer directory and it was nowhere to be found. The alphabetical name listings began with the letters CAM. By comparison, Reed’s hearing information was easily located.

We went to Reed’s hearing first and Gerald gave me a nod when we took a seat. He has been told that I’m writing a little about his case and he has seen me in court before. When Gerald’s hearing ended, I wondered if we should even bother trying to observe Calhoun’s hearing. My question was answered when I saw the person prosecuting his case walking into the courtroom. Salome and I walked to room 606 and I spotted Carlyle Calhoun immediately, wearing a very dapper purple blazer and a striped scarf. We grabbed a seat on the bench several rows ahead of him and waited.

Calhoun is being defended by Daniel Herbert, who was the lawyer that defended Jason Van Dyke. The State Prosecutor in Calhoun’s case is a friend of mine, and I have chosen not to burden her by asking her anything about this case. I just follow it as much as is possible. Unlike Gerald Reed who probably had twenty supporters in court for him today, Carlyle Calhoun sat alone, as he did the last time I observed one of his hearings. I’m reluctant to report on too much of Calhoun’s hearing because his case has not gone to trial yet but I believe that as with Jason Van Dyke’s victim Laquan McDonald, Daniel Herbert is trying to dig into records concerning Calhoun’s victim from approximately six years before Calhoun was arrested and charged with violating the man. Calhoun’s next hearing will take place on January 8, 2020.

Salome Chasnoff and I discussed both of these cases, as well as other things we observed, at Taqueria El Milagro over tamales for her and a torta for me. There will be another residency in the next month or so and then I’ll produce the fourth booklet of reports. The waiting list for residencies is long but if you are interested you can always reach out to me anyway. Or, as I often suggest now, just go to criminal court without me. Bring someone else and take time after to reward yourself with a nice meal as you reflect on your experience together. El Milagro wasn’t busy at all today. Give them some business. They really deserve it. You can find previous booklets of Courtroom Artist Residency Reports, and other Public Collectors publications here.

4 notes

·

View notes

Text

Crimson Avenger

“Do you know the difference between justice and vengeance? I thought I did.” - Crimson Avenger

Real Name: Jill Carlyle

Gender: Female

Height: 5′ 8″

Weight: 136 lbs (62 kg)

Eyes: Brown

Hair: Black

Powers:

Spirit of Vengeance

Abilities:

Law

Firearms

Weaknesses:

Suicidal Ressurection

Eternal Gunshot Wound

Vulnerability to Self

Equipment:

Crimson Avenger Pistols

Universe: New Earth

Citizenship: American

Marital Status: Single

Occupation:

Adventurer

Spirit of Vengeance

First Appearance: Stars and S.T.R.I.P.E. #9 (April, 2000)

Powers

Spirit of Vengeance: Jill Carlyle is a minor spirit of vengeance and as such is fated to be forced into exacting revenge on whomever is her next assignment. Part of her "curse" is gaining the abilities of the deceased she is forced to understand as well as giving her her own powers that she sometimes cannot use at will.

Intangibility: She can become intangible and all physical objects can travel through her without harm to her body. However, it doesn't work against magic spells or her own bullets.

Phasing: More of an active ability than her previous power, she can force herself to phase through buildings and obstacles instead of just becoming intangible as a reaction. She uses this power to doggedly pursue her assignments.

Teleportation: Another ability she cannot use on command, as a Spirit of Vengeance, she is forced to teleport to her next assignment.

Abilities

Law

Firearms

Weaknesses

Suicidal Ressurection: She cannot die by conventional means, even if she takes her own life with her mystical pistols she arises for her next assignment.

Eternal Gunshot Wound: Part of the curse attached to the pistols there is a constantly bleeding painful bullet wound in her chest that cannot or will not be healed.

Vulnerability to Self: Her own bullets can harm her likely even if she is intangible.

Equipment

Crimson Avenger Pistols: Two twin Colt pistols that are cursed to turn whoever uses them for revenge into the next Crimson Avengers. These guns come with certain abilities that set them apart from regular firearms and even afford mystical properties. The guns also lack triggers and fire instinctively against threats to the wielder. According to Jill, the bullets from her pistols can pierce any substance.

History

Jill Carlyle, the Crimson Avenger, serves as a minor Spirit of Vengeance.

She used to study law but when she became a lawyer she lost a case in which the defendant was clearly guilty. Jill obtains a pair of Colt pistols originally owned by the first Crimson Avenger and uses them to exact vengeance upon the criminal. These guns are cursed such that, if the possessor uses them out of revenge, he or she will be cursed to track and kill those who have taken innocent life. As part of the curse, an ever-bleeding bullet hole appears on her chest.

Upon gaining a new assignment, she mentally relives the death of the victim, and then is teleported to their place of burial. She then gains the memory and skills of those whose deaths she is avenging. Her guns never miss, never run out of ammunition, and have no triggers. The bullets are capable of penetrating any substance, and can wound invulnerable heroes such as Superman and Power Girl, as well as crack the armored shell of Captain Atom. The guns seemingly have a mind of their own, as she speaks of having to restrain them from shooting those who come between her and her target. Her intangibility does not function against her own weapons or other magical forces. Unless the curse is lifted, she is seemingly immortal. She once attempts to kill herself with her own weapons, but this merely results in ending her current "assignment" and delivering her to the next one.

Jill is a member of the Justice Society of America, she joined the team when after the Ultra-Humanite has used the Thunderbolt to take over the world, where her mission is to avenge the death of Lee Travis, revealing that the explosion that killed him was caused by the Ultra-Humanite. She returns later tracking down Wildcat for framing a man called Charles Durham for a crime he didn't commit, only to learn that Wildcat only framed Durham after he killed his brother, sister-in-law and nephew after his brother killed his fiancee. Since the D.A. didn't have anything on Durham, he was going to go free after killing an entire family, driving Wildcat to plant evidence implicating him in the death of his fiancee. With this revelation that she is not always contacted by the spirits of the innocent, the Crimson Avenger attempts suicide by shooting herself in the head with both guns, but this only terminates her current 'contract', leaving her resolved to try and find another way to end her curse.

Though attacked by the Spectre the Crimson Avenger is seen at Blackgate Prison, fighting escaping inmates during the worldwide super villain breakout the Society engineered. The Crimson Avenger later appears, alongside the current Vigilante and Wild Dog, on a rooftop in the great Battle of Metropolis, raining bullets down on the Trigger Twins, the Madmen and Spellbinder. She is later seen gunning down the super villain known as Catalyst after Prometheus sends random super-criminals to attack the world's heroes in order to distract them from his master plan.

3 notes

·

View notes

Link

Supreme, an underground streetwear brand, has attracted a cultlike following among teens seeking hard-to-get looks by keeping its products scarce. But now an Italian businessman is flooding the market with T-shirts and hoodies bearing its bright red-and-white logo, and claiming he is doing nothing wrong.

Michele di Pierro, who started the rogue version of the brand in Europe, has filed trademarks for variations of the Supreme logo in dozens of countries since 2015, forcing the U.S. company to face off against him in courts around the world. Supreme has denounced his operation as a “counterfeit organization” and succeeded in shutting him down in Italy. Still, his clothes are on sale in stores in Spain and China, and he wants to sell more.

Supreme, born in 1994 out of New York City’s skateboard scene, has long released styles in limited quantities, forcing fans to rush to its website or stand in long lines at one of its 11 stores. The company’s T-shirts and hoodies often sell out immediately and then can be found listing for more than $1,000 on eBay and other sites. With about 13 million Instagram followers, the brand has amassed a bigger following than household names like Ralph Lauren and Under Armour . In 2017, the company sold a roughly 50% stake to private-equity firm Carlyle Group LP for about $500 million, giving it a valuation of nearly $1 billion.

Brand Battle

IBF’s Supreme store in Barcelona makes lavish use of the signature logo. PHOTO: NATHAN ALLEN/THE WALL STREET JOURNAL

Nearly every brand from Gap to Gucci has battled copycats around the globe that can tarnish the name and sap demand by selling fake goods. But unlike streetside vendors selling cheap knockoffs or shadowy counterfeiters on websites like Amazon or Alibaba, Mr. di Pierro isn’t hiding. He is asserting a legal claim and selling through storefronts in major cities.

A spokesman for Supreme declined to make its founder, James Jebbia, available for an interview. Earlier this year, Mr. Jebbia told Business of Fashion that Mr. di Pierro is taking advantage of Supreme because the company doesn’t typically talk to the press. “I don’t think another company has really had to deal with this like we have,” he said. “This is a whole new level with this criminal enterprise—these complete impostors and impersonators.”

The spokesman said in a statement: “Our legal team is currently dealing with these impersonators, but our focus, as always, goes into making the quality products our customers around the world expect.”

Supreme, which was slow to protect its trademark internationally, has now registered it in more than 70 countries and filed injunctions to stop Mr. di Pierro. The company is awaiting the outcome of legal fights in Spain and China, where Mr. di Pierro’s products are still sold in stores. At stake is its billion-dollar brand, which depends on keeping its products scarce.

Products of the American clothing brand Supreme on display at the KICKIT Sneaker e Streetwear Market in Rome in September. PHOTO: ALESSANDRO BIANCHI/REUTERS

Mr. di Pierro said he is making fashion accessible to young people by selling more affordable items than what is available on reselling sites. Shoppers are buying his clothes because the fabric is lightweight, he said, making it more wearable in warm climates. “Our success is not based on the box logo,” he said. “It’s the quality.”

Mr. di Pierro said he has been in the textile industry for decades and studied the rise of streetwear. He couldn’t explain why he picked Supreme for his brand. “When I filed for registration in Italy, I did it in good faith,” he said. “I didn’t know it even existed. It wasn’t popular in Italy. There wasn’t even a store.”

Before launching Supreme Italia, Mr. di Pierro operated a sportswear business, which filed for bankruptcy, and he later was convicted of fraud in relation to that bankruptcy, according to Italian court documents reviewed by The Wall Street Journal. That judgment was upheld in two appeals, most recently in November 2018. Mr. di Pierro declined to comment on the matter.

His U.K.-incorporated company, International Brand Firm Ltd., has at least seven active trademark registrations with the word “Supreme” and more than 20 pending ones, according to a database maintained by the World Intellectual Property Organization, a United Nations agency based in Geneva.

T-shirts stacked up at IBF’s Supreme store in Barcelona. PHOTO: NATHAN ALLEN/THE WALL STREET JOURNAL

IBF has registered trademarks for variations such as Supreme Spain, Supreme Kids and Supreme Italia. It has a trademark for a “Supreme Spain” logo with black letters on a yellow skateboard, though much of the apparel at its stores in Spain features the familiar red-and-white “Supreme” logo.

While Supreme stores sell few items with its signature logo, making it hard to come by, Mr. di Pierro’s store in Barcelona splashes it everywhere—on the walls, the checkout counter and dozens of products from suitcases to sweatshirts. There, a white T-shirt with a red-and-white Supreme logo is available for €49 ($56), compared with the $32 Supreme charged the last time it offered the shirt—and the $889 it sold for on StockX, a reselling platform.

Liz Guerrero, on vacation from Chicago, recently bought $300 worth of clothes for her son at the Barcelona store. She tried to return the merchandise about 30 minutes later when she realized it wasn’t the New York-based brand.

“When we got back to the hotel and had internet, we checked it out and found out there’s only like six stores in the world,” Ms. Guerrero said. She was told she couldn’t get her money back, she said. Mr. di Pierro said his stores allow returns within 30 days.

Supreme’s store at Bowery and Spring Street in lower Manhattan earlier this month. PHOTO: AGATON STROM FOR THE WALL STREET JOURNAL

IBF licenses other brands and sells Supreme-branded merchandise in several stores in Spain, as well as through a partner that has opened two stores in China. Due to trademark disputes, Mr. di Pierro said he now employs more lawyers than apparel executives.

Supreme could have avoided some problems had it secured its trademark in every country more than two decades ago when it opened up shop, as brands often do when they launch. It didn’t register its logo in the U.S. until more than a decade after its New York City shop opened, and it waited years to file registrations in other countries. The company didn’t hire a general counsel until 2017.

A U.S. registration doesn’t offer protection abroad. In a famous 1990s case, a restaurateur in South Africa successfully argued that McDonald’s Corp. had let its trademark lapse through nonuse. The fast-food chain fought a long legal battle to reclaim its trademark in the country.

While the U.S. confers rights to the first party to use a logo, many European countries have a first-to-file system, registering a trademark to the first party to get its application in. A single application potentially covers more than 100 countries that are part of an agreement called the Madrid Protocol. Mr. di Pierro filed such an application.

Distinctive Character

If a brand wasn’t the first to register but is well known in a given market, it can argue that another party did a “filing in bad faith” and is causing confusion among customers, said Etienne Sanz de Acedo, chief executive of the International Trademark Association, whose members include Supreme.

Sometimes the similarity between two logos appears far from innocent, he continued. “What a coincidence that it’s exactly the same name, exactly the same combination of colors, exactly the same font,” he said, referring broadly to copycat trademarks. “This is not pure coincidence.” He declined to comment on the specific dispute between Supreme and its foe.

In Mr. di Pierro’s case, the similarities have led to confusion, even among sophisticated corporate partners. At an event in December, Samsung Electronics Co. announced a collaboration in China with Supreme Italia. Mr. di Pierro said the partnership was arranged through his distributors there. After New York-based Supreme publicly said Samsung was working with a counterfeit organization, the company canceled its deal.

“Samsung respects the intellectual property rights of others. Samsung Electronics China did not proceed with the previously announced partnership,” a Samsung spokesman said.

Michele di Pierro, the head of IBF, which sells products bearing the Supreme brand. The company has been accused of counterfeiting the Supreme brand founded in New York. PHOTO: MICHAEL BUCHER/THE WALL STREET JOURNAL

Mr. di Pierro said Supreme’s recent actions have hurt his prospects but he plans to keep expanding, including by opening more stores. “They file almost every day now in a pretty frenetic, schizophrenic way,” in countries such as India, Denmark and China, he said. A spokesman for Supreme declined to comment on that characterization.

An Italian court ruled in 2017 that Mr. di Pierro was engaging in “parasitic competition.” The products of “Supreme Italia” were seized, stores closed and operations came to a halt. Mr. di Pierro has appealed the decision but currently isn’t allowed to sell in Italy.

In Spain, a judge in October 2018 dismissed a preliminary injunction by Supreme to shut down Mr. di Pierro’s operations, saying he wanted to hear the merits of the case. In China, both sides are awaiting decisions on trademark registrations.

Supreme has faced some challenges in proving its popularity because of its business strategy. It has just 11 stores (two in New York, six in Japan, and one each in London, Los Angeles and Paris), spends very little on advertising and doesn’t push product sales.

A lawyer for Mr. di Pierro’ questioned whether the Supreme logo will ultimately prove too generic to trademark. The European Union’s second-highest court ruled this month that Adidas AG’s iconic three-stripe branding didn’t qualify, saying Adidas hadn’t provided enough evidence that the parallel stripes were a mark of “distinctive character” worthy of protection.

SHARE YOUR THOUGHTS

How much do you worry about other people purchasing knockoffs of premium goods you own? Join the conversation below.

It’s also sometimes hard to determine what is original. Supreme’s logo resembles the work of conceptual artist Barbara Kruger, whose black-and-white photos are often accompanied by captions in red-and-white text.

The brand has also been known to use other company’s logos. In Supreme’s early years, Louis Vuitton sent the company a cease-and-desist letter for doing so. The luxury fashion house later partnered with the streetwear maker to release products that feature hybrids of both logos.

Mr. di Pierro said he himself is dealing with copycats and intends to see them prosecuted. He said he has had to stop doing business in Turkey because factories there would produce thousands of extra garments to sell on the black market.

He pointed to a photo on his smartphone of a bus in China with the words “Supreme Italia” splashed across the side—something he said wasn’t authorized by him or his partners.

“This is the reality,” he said. “There really are ghosts.”

#supreme#supremenyc#fashion business#James Jebbia#streetwear#streetwear blog#fashion blog#urbanwear blog

0 notes

Photo

Each month the Communications Team spotlights a few boards on Fan Forum, and this month we're featuring the Lana Parrilla board! The Lana board has been apart of Fan Forum for almost 5 years and is celebrating this milestone on May 1st! Lana Parrilla was born in Brooklyn, New York in 1977 and studied acting at the Beverly Hills Playhouse in Los Angeles, California. She got her start with a small role in 1999 on "Grown Ups". Since that first TV appearance, she's had notable guest roles on such shows as "Spin City", "JAG", "The Shield", "NYPD Blue", "6 Feet Under", "Lost", and "Medium". There are few other roles Lana has had on television that spark appreciation and conversation. Lana was on the show "Windfall" and played Nina Schaefer. It was an American television serial drama about a group of people in an unnamed small city who win almost $400 million in a lottery, and was cancelled within a year of its release. Lana also starred on the show Boomtown as Teresa Ortiz. The show portrayed a criminal investigation each week, seen from various points of view: the police officers and detectives, the lawyers, paramedics, reporters, victims, witnesses and criminals. One last notable early role of Lana's was that of Trina Decker on the show Swingtown. The show was a period and relationship drama about the impact of sexual and social liberation in 1970s American suburban households, with story arcs involving open marriages and key parties. Her most prestigious role is that of Regina/The Evil Queen on "Once Upon A Time". the series took place in the fictional seaside town of Storybrooke, Maine, in which the residents are actually characters from various fairy tales and other stories that were transported to the real world town and robbed of their original memories. During the show's 7 season run, [1 | 2 | 3 | 4 | 5 | 6 | 7], Lana has created relationships with her costars as well as her character of Regina and her relationships on the show between characters. Some of those most memorable character relationships are Regina and Emma Swan, known as SwanQueen. Other notable character relationships include Lana and Colin O'Donoghue | Regina and Hook, Lana and Ginnifer Goodwin | Regina and Snow White, Lana and Emilie de Ravin | Regina and Belle, Lana and Robert Carlyle | Regina and Rumplestiltskin. But the most loving relationship on the show, and in which the show premise began, is Regina and Henry, her adoptive son, played by Jared Gilmore. The moderators of the board you're my lifeline [Emma], Madame Regal [Suz], had this to say about the board: "This board has always been like coming home to visit family. We never once had to step in because of a fight or anything.. even though we had a lot of different ships from Once Upon A Time, the posters were and are all respectful of each other and we never had any bashing or anything like that going on. Everyone was treating everyone with Respect. Thats what I love about this board. Unfortunately, due to the cancellation of the show, almost all regular posters left and I hope that Lana gets a new project soon so that the board will be more active again." For the future, Lana does have a movie project in the works, called "The Tax Collector" which is an American crime thriller film written, produced and directed by David Ayer. David is known for his work on The Fast and the Furious, Street Kings and Suicide Squad. The film co-stars Shia LaBeouf and George Lopez and is currently in post-production. No official release date has been announced as of yet. Stop by the Lana Board and discuss and appreciate all she's accomplished thus far in her career!

#Lana Parrilla#once upon a time#onceuponatime#ouat#evilqueen#evil queen#regina mills#reginamills#thetaxcollector#davidayer#Ginnifer Goodwin#Emilie De Ravin#robert carlyle#joshdallas#jared gilmore#fanforum

0 notes

Photo

Business of Fashion interview with James Jebia https://ift.tt/2CVFTNH

I just horribly scraped this off BOFs site. You need a membership to actually read. Formating may be messed up and images are missing so please don't complain.

BY CHANTAL FERNANDEZAPRIL 3, 2019 05:30

NEW YORK, United States — In mid-March, Italian police, acting as part of operation “Golden Brand,” released a video showing a storeroom stacked high with boxes from which officers pulled products covered in shiny plastic sleeves. Most of the items — T-shirts, sandals, even skateboards — were branded with the distinctive box logo made famous by Supreme, though, of course, none of them were actually made by the New York-based streetwear giant. In a statement, the Italian authorities said that, in total, they had seized 700,000 counterfeit items worth €10 million as part of an investigation into the sale of counterfeit streetwear, which they characterised as a “new insidious phenomenon.”

Supreme knock-offs, from T-shirts to cigarette lighters, can be found all over the world, from Canal Street in New York City to the souks of Marrakech. The market for these counterfeits has thrived in part because distribution of genuine Supreme product is so tightly controlled. Its goods are available only at the brand’s 11 stores, via its website and at Dover Street Market, often in small batches released in weekly “drops," meaning that demand often far outweighs supply. Most items sell out online less than 10 seconds after they are made available.

Manufactured scarcity is a key part of Supreme’s incredible success. Over the last 25 years, the brand has grown from a single store on New York’s Lafayette Street that served as a de facto clubhouse for local skaters to a billion-dollar streetwear juggernaut that, in 2017, attracted investment from private equity giant the Carlyle Group, which paid around $500 million for roughly 50 percent stake in the business. Its red box logo, itself inspired by the signature style of artist Barbara Kruger, is now recognised worldwide.

But Supreme’s global profile, coupled with the scarcity of its product, has also exposed the company to sophisticated opportunists. The biggest thorn in Supreme’s side is Italy’s International Brand Firm (IBF) and a series of up to eight affiliated companies, known primarily as Supreme Italia and Supreme Spain to consumers. The company has brazenly set up Supreme-branded storefronts and websites in Italy, Spain and China that look real enough. It has filed trademark registrations using the word “Supreme” and versions of its logo in as many as 50 countries including Spain, Portugal and Israel. It has challenged Supreme for its trademark in international courts, and it has promised to open 70 more stores selling look-a-like Supreme goods.

All told, IBF appears to be doing swift business in what some call “legal fakes” because, according to Susan Scafidi, founder and director of the Fashion Law Institute at Fordham University's School of Law, the items fall in a legal grey area of trademark squatting. Even before IBF targeted Supreme, the streetwear brand faced an uphill battle in trademark registrations: its name has been considered too general and descriptive by some courts.

In 2017, IBF generated £514,000 (about $679,000) in revenue, according to public filings for part of its business. But if its plans to open new distribution channels go ahead, that number could grow significantly.

IBF’s activities made international headlines last December when Samsung announced a product collaboration with Supreme at a press conference in China. The South Korean giant welcomed someone it believed to be the chief executive of the streetwear business to the stage. “Today is Supreme’s official debut in the Chinese market,” said the person on stage with Feng En, Samsung’s head of digital marketing for Greater China, promising to open several stores in the country including a seven-story flagship in Beijing. Only later, after a backlash on the internet, did Samsung seem to discover that they were dealing not with the New York-based Supreme, but with the IBF-controlled Supreme Italia, and canceled the partnership.

In March, a Supreme-branded store opened on Middle Huaihai Road, one of Shanghai’s busiest retail streets, attracting a line of curious consumers wondering if the world’s most coveted streetwear brand had finally set up shop in China. Inside, shoppers can now find T-shirts and hoodies branded with oversized logos and tagged as “Supreme Spain” for 599RMB (about $90) to 1,599 RMB (about $240), as well as skateboard decks, backpacks and other accessories.

“I don’t think another company has really had to deal with this like we have,” said Supreme founder James Jebbia in a rare interview. “This is a whole new level with this criminal enterprise — these complete imposters and impersonators. This is a company that was able to convince one of the biggest companies in the world [Samsung] that they are the real thing.”

It would be sad if a new generation thinks that’s actually legit.

“People should know that the idea of legal fakes is a complete farce,” he said. “It would be sad if a new generation thinks that’s actually legit,” Jebbia added, likening IBF’s ability to spread disinformation to how “fake news” can easily be spread online today. “We don’t do a ton of press and we are quite quiet. These guys are taking full advantage of that… We haven’t had the time to basically go on this massive disinformation tirade or press thing that most people would.”

Some have chalked up Supreme’s counterfeiting woes to its failure to register its trademark faster than imposters in global markets — where trademarks are often awarded to companies that are first to file them, not first to use them — as the streetwear label grew more quickly than it was able to professionalise. Others say Supreme has little choice but to accept the situation.

But the truth is more complicated. For over two years, Supreme has fought its counterfeiters in the courts as it lobbies for trademark recognition in China and with the European Union Intellectual Property Office, jurisdictions in which no company yet has these rights. (Supreme has registrations in several European countries, parts of Asia and the United States.) In China, for example, Supreme filed for trademarks five years ago, though its application is still pending. Supreme Italia and IBF also have pending applications in the country that were filed in March 2018.

For Supreme, this is a highly inconvenient and expensive problem. Though the company was unable to provide an estimate in dollar terms, the cost is not only felt in lost sales and legal fees but in damage to the brand's reputation. And it comes just as Supreme enters a post-Carlyle growth phase which is believed to include expansion into China, the world’s largest fashion market. (Firms like Carlyle, which do not hold businesses indefinitely, typically aim to rapidly grow their investments and then sell their stakes within five to seven years).

In 2017, the same year as the Carlyle deal, Supreme hired its first general counsel as part of a wider professionalisation drive that has included poaching Converse's ex-chief marketing officer and hiring the Boston Consulting Group to evaluate its supply chain. General counsel Darci J. Bailey is overseeing the company’s multi-pronged trademark registration and anti-counterfeiting strategy. Supreme said it now has over 350 trademark filings around the globe.

“There is not a jurisdiction in the world that’s said what [IBF is] doing is lawful,” said Bailey. “Opening stores is only going to yield a bigger victory once we are able to shut those down.” She said that in addition to copying its products, opening fake stores and impersonating Supreme executives, IBF has duplicated Supreme's invoices, shopping bags and signage. “They are really after our DNA,” Bailey said, adding that IBF offered to “sell our trademarks back to us,” but Supreme will not consider payoffs as a way to solve its trademark issues.

“We will not stop, we will not relent,” she said. Supreme has made the most progress in Italy, IBF’s home country, where Italian and San Marino courts have prohibited IBF and its affiliates from using the trademark, and police have conducted over 100 seizures of counterfeit Supreme goods.

IBF and its lawyers declined multiple requests for comment from BoF.

Supreme's lawyers created this graphic to demonstrate that Supreme Spain's mark (far right) will be confused with Supreme's logo (far left) | Source: EUIPO

For years, brands from Nike to Chanel have faced sophisticated counterfeiting operations and trademark squatters. But the tactics used by IBF reflect a new level of sophistication. “I’ve never seen any brand subject to press conferences where there are people who are hired to impersonate the CEO,” said Bailey. “I think that there is a lot of confusion in the marketplace.”

The confusion is particularly palpable in Spain and China, where IBF has actual stores and the genuine Supreme doesn’t. The New York-based label’s cautious approach to expansion — which goes hand-in-hand with its carefully cultivated street cred — is a powerful part of its appeal to consumers. But as the company grows its customer base beyond longtime devotees, who have studied message boards and Supreme fan accounts for tips and tricks on how to buy its releases, the label may become a victim of its quiet approach if new consumers are duped by the likes of IBF. Or if, even worse, they knowingly settle for counterfeits that, in the case of items like logo T-shirts and hoodies, may not appear radically different from the originals to more casual admirers of the brand. “I don’t think we have a difficult time communicating to our core customer — they know how to get it — but any expansion is where it becomes difficult,” said Bailey.

David Fisher, founder and chief executive of influential streetwear and youth culture title Highsnobiety, said that shoppers who only see Supreme as the fashion trend it has become in recent years are less aware of the history of the brand and can’t as easily discern between real and counterfeit items. “They are probably going to buy one T-shirt and hoodie and that’s it… I’m sure there are thousands of people who have that level of engagement with the brand,” he said.

A first-time shopper coming to Supreme’s website — which offers e-commerce for customers in the US, UK, Japan, most of Europe as well as Russia and Iceland — can see a list of the brand’s retail stores, for example, but would not know that new products are released on Thursdays. Or that in order to manage long lines outside its stores, Supreme now assigns shoppers a 15-minute time-slot via text-message lottery that allows them to enter the store on what longstanding customers call “drop days.” The website also does not warn shoppers about the proliferation of counterfeiters.

While the company is likely contemplating opening more retail channels — online and off — in new markets, many of its products (including its coveted box logo items) are still virtually impossible for many consumers to buy, especially in places like Spain, Italy and China, where Supreme does not have stores and where IBF has taken root.

In the 13 months ending in January 2018, Supreme generated £63 million ($83 million) in sales in the UK, Europe and other regions outside the United States, up 156 percent year over year, according to public filings in the UK.

“These fake Supreme [pieces] that appear now make the real Supreme not as popular as it once was,” said a college student in Madrid, Beltrand Montauzon, who has purchased Supreme items on the resale market when traveling abroad. “[Supreme Spain] is way more accessible for people who weren’t able to buy it, which is 99 percent of the population.”

Supreme is believed to be considering new stores in Milan, Berlin and San Francisco, but Jebbia declined to confirm any concrete plans. Existing stores include two in New York (the original Lafayette location is closed for renovations, but another store is open nearby on Bowery), one in Los Angeles, one in London, one in Paris, and six in Japan. “We certainly wouldn’t say, ‘Let’s open in Spain because these fakers have opened up a fake shop,’” he said. “We do look, but we aren’t in any massive rush; it can take years to find the right space,” Jebbia continued. Supreme generated £1.8 million ($2.3 million) in sales between 2013 and 2018 in Spain through online sales, according to documents filed by Supreme's lawyers with the EUIPO.

We certainly wouldn’t say, 'Let’s open in Spain because these fakers have opened up a fake shop.'

IBF was incorporated in November 2015 by Michele di Pierro, a Barletta, Italy native who was previously affiliated with an apparel distributor Grew Sport. His biography on Twitter states, “No one is indispensable” and on Pinterest, “Thirst for innovation.” IBF has boasted that it registered Supreme’s trademarks in Italy before the New York brand could. But in fact, IBF filed a month after the real Supreme did, in November 2015. Then, in January 2016, Supreme Italia is thought to have made its debut during menswear tradeshow Pitti Uomo, where attendees reported the company had set up a booth.

The real Supreme started fighting back in July 2016, taking its case to the Italian courts. After a series of civil and criminal suits in 2017, Italian and San Marino courts ordered an injunction against IBF and its use of the Supreme or Supreme Italia marks, and police started seizing counterfeit product the same year.

IBF, in response, began shifting its business to Spain, where it filed for a trademark in April 2017, five days before Supreme did, and started opening stores in Madrid, Barcelona, Malaga, Ibiza and Formentera the following summer. Supreme also filed with the European Union Intellectual Property Office, where the trademark is still pending registration. Later in 2017 and 2018, IBF filed with the World Intellectual Property Organization (WIPO), where it has two active listings.

Meanwhile, IBF has been able to score points in the press. In July 2018, an Italian court in Trani unfroze IBF’s websites, even though the company was still barred from producing and selling products featuring Supreme branding. In October 2018, the European Union Intellectual Property Office said it would continue to consider Supreme’s trademark application, which IBF contested. Both of these developments were spun as wins for IBF by Italian streetwear blogs, particularly NSS and TheStreetwearMagazine.com, the latter of which Bailey said is published by IBF.

Supreme's new shop on Bowery in New York | Source: Courtesy

But Supreme isn’t backing down and is focusing on getting the EU-wide mark approved. “We are very confident we are going to get the trademark registration with the EU,” said Bailey.

Meanwhile, Supreme has obtained several trademark registrations in Spain, which IBF has opposed, but the proceedings are suspended until the EUIPO makes its ruling. Supreme is also trying to get Spanish courts to close IBF’s stores, but the relevant authorities have denied this request and Supreme is appealing.

Bailey said Supreme is also persevering in China, where she said the brand has been working closely with officials and is now “months away” from getting its trademarks registrations about four years after the application was first filed.

“It’s highly likely Supreme will create a lot of difficulty for Supreme Italia moving forward and may win,” said Scafidi. “Trademarks are born global; they cross borders without being stopped at customs and yet there is no way to simply protect a trademark globally.”

"We are doing every single thing that we can do to stop [IBF] and I think we are going to prevail,” said Jebbia, adding that although the complexity of running Supreme has certainly grown and the company was still in the process of bringing its operations up to speed, he was still animated by the same principles that guided him at the company's start. “I don’t think of it any differently today than I did 20 years ago. We’ve still got to make great products that hopefully people like and sell well. All we can do is go on instinct.”

Additional reporting by Zoe Suen and Sam Gaskin.

submitted by /u/whalingman [link] [comments] April 03, 2019 at 05:29PM

0 notes

Text

Barr promoted Zink to hide child slavery network

https://www.youtube.com/watch?v=qUG1kDm4IV4

https://www.wsj.com/articles/justice-department-gets-new-acting-fraud-section-chief-11599169540#:~:text=Robert%20Zink%2C%20chief%20of%20the,sections%2C%20a%20spokesman%20confirmed%20Thursday.

In exchange for being promoted on July 30th, did Robert Zink sell his soul?

Two weeks later.

On Aug. 13th.

For fixing a case.

Who told him to do it?

U.S. Attorney General Bill Barr.

It involved selling children.

Through European Adoption Consultants headquartered in Strongsville, Ohio.

Closed down by the State Department on May 28th.

For selling children.

From 12 countries including:

Haiti

Uganda

Wuhan, China

https://www.star-telegram.com/news/local/crime/article245022195.html

Bill Barr (above), U.S. Attorney General

What did Robert Zink do?

He went “court shopping”.

A fancy legal term for fixing a case.

Picking the right judge to get the desired result.

It is supposed to be illegal.

Prosecutors prosecuting themselves?

And judges?

That will never happen.

As long as Bill Barr is U.S. Attorney General.

Zink filed the motion Aug. 25th that got the child trafficking case moved to another judge.

So it could never be filed in Ft. Worth, Texas.

http://www.txnd.uscourts.gov/location/fort-worth

To cover up this:

https://www.star-telegram.com/news/local/crime/article227178669.html

https://www.dallasobserver.com/news/denton-accused-child-abuser-john-tufts-breaks-silence-9888675

https://www.khou.com/article/news/local/texas/denton-couple-arrested-in-severe-trauma-case/285-334491150

The above video is from ABC-8 from Ft. Worth.

It will start in this link from their story.

https://wfaa.com/embeds/video/287-2389573/iframe?jwsource=cl

John Tufts was found guilty by a Ft. Worth, Texas jury.

Guilty of three counts of injury to a child.

Sentenced to 20 years.

On March 6th, 2019.

Rather than life in prison.

https://www.star-telegram.com/news/local/crime/article227178669.html

Miss Robin Longoria, 58, of Mansfield, Texas was also involved.

She picked up a child at the Ft. Worth airport.

To be delivered to John Tufts’ home.

According to court records.

Published on the Justice Department’s website:

https://www.justice.gov/opa/press-release/file/1305221/download

The federal case ended up with Judge Christopher Boyko in Cleveland Federal District Court.

A criminal case filed on Aug. 13th.

Details are in the Justice Department’s press release dated Aug. 13th linked here:

https://www.justice.gov/opa/pr/three-individuals-charged-arranging-adoptions-uganda-and-poland-through-bribery-and-fraud

Resulting in a criminal trial on Oct. 26th.

Of two former employees of European Adoption Consultants (EA):

Margaret Cole Hughes

Debra Parris Edwards

With a third former employee, Miss Robin Longoria ready to plead guilty to conspiracy and fraud.

On Oct. 14th at 10 a.m.

Longoria has never been to Cleveland or:

been charged by a Grand Jury

booked

fingerprinted

photographed for a mug shot

Or given a DNA sample.

She will be pleading guilty over the phone from her lawyer’s office in Ft. Worth, Texas.

Steven Jumes.

https://www.scribd.com/document/474929307/Robin-Longoria-Plea-Aug-29th-2019-26-page-in-European-Adoption-Consultants-case

Steven Jumes (above) is a former prosecutor who worked on joint task forces for former FBI Director Robert Mueller. The certificate below is signed by Mueller on March, 2012.

https://jumeslaw.com/about/

According to Miss Robin Longoria, 59, she works for BlackRock Financial in Houston as Director of Human Relations.

Unable to verify whether she still works as Director of Human Resources for BlackRock or one of their subsidiaries like:

Gavilan

https://www.gavilanresources.com/about

Blackstone

https://www.blackstone.com/press-releases/article/blackstone-to-acquire-ancestry-leading-online-family-history-business-for-4-7-billion/

Carlyle Group

https://www.carlyle.com/media-room/news-release-archive/carlyle-group-names-admiral-jim-stavridis-usn-ret-operating

Longoria has admitted paying bribes for children that were sold by European Adoption Consultants (EAC).

Source is the Justice Department linked in this 36-page indictment filed Aug. 13th by Robert Zink.

https://www.justice.gov/opa/press-release/file/1305221/download

None, however, are charged with running a criminal enterprise selling children.

Pacer is the official record of the federal courts.

Confus

It is supposed to be.

Bill Barr’s specialty.

Covering up major crimes.

So that no one is charged or jailed for child trafficking.

Because child molesters are killed in jail by inmates.

In less than a week.

Especially in Texas.

The scheme was exposed when Cook Children’s Hospital in Ft. Worth, Texas called Denton police.

August, 2016.

Reporting the worst child abuse case the hospital staff had ever seen.

https://www.cookchildrens.org/Pages/default.aspx

Resulting in permanent injury to a five-year-old girl.

It broke open the case.

Leaving the Justice and State Department scrambling to cover it all up.

No federal prosecutions in Ft. Worth Federal District Court.

Leaving out details of selling children in the fake prosecutions in Cleveland Federal Court.

Besides selling children, what else are Prosecutors leaving out?

Debra Parras Edwards, above, of European Adoption Consultants (EAC). She is John Tufts’ mother

https://www.youtube.com/user/EACadoption

European Adoption Consultants (EAC) was selling children out of a dozen countries.

According to:

CNN

State Department

Justice Department

https://brassballs.blog/home/covering-up-haiti-child-trafficking-network-ring-mike-becky-dewine-hands-together-ann-odonnell-david-yost-eac-boyko-ted-coley-european-adoption-consultants-margaret-cole-hughes-kolomoisky-strongsville

Selling children like used cars.

Prices based on “make”.

Male or female.

“Mileage”.

The child’s age.

“Color”.

From China, Africa, or Europe.

And “condition”.

Based on health.

Posting their profiles on clipboards at events such as a Halloween Party.

https://www.youtube.com/watch?v=lFPV4UiCnQA

Former Adoption Director Margaret Cole Hughes at far right. Selling children at a Halloween Party on Oct. 31st, 2013 in Strongsville, Ohio. For six years, promoted by Peter Strzok’s sidekick, Lisa Page, and Google’s YouTube. Please advance above video to 2:07.

Bragging about their agency involved in 8,000 international adoptions.

Charging up to $70,000 per child.

With a profit to the adoption agency of $40,000 per child.

According to court documents filed by Robert Zink of the Justice Department.

Page Seven of 36 pages

https://www.justice.gov/opa/press-release/file/1305221/download

Page 16 of 36 pages

https://www.justice.gov/opa/press-release/file/1305221/download

From one agency in Strongsville, Ohio.

With thousands more operating throughout the country.

As fake non-profits.

With diplomatic immunity provided by the United Nations (UN).

https://brassballs.blog/home/debra-parris-dorah-mirembe-uganda-ted-coley-un-child-trafficking-adoption-bribes-robin-longoria-hague-process-dos-european-adoption-consultants-strongsville-ohio-eac-margaret-cole-child-trafficking

Bragging in videos that financing was available from the federal government.

Making the transaction “as easy to finance as a time share” vacation property.

https://www.justice.gov/opa/press-release/file/1305221/download

Pages 17 and 18 of 36 pages

https://www.justice.gov/opa/press-release/file/1305221/download

Page 20 of 36 pages

https://www.justice.gov/opa/press-release/file/1305221/download

Another tip of the cap to KoronaKnieval19 for his help in preparing this story.

0 notes

Text

Meet Mary Pollard, the new Director of the Office of Indigent Defense Services

Yesterday, Mary Pollard began work as just the third Executive Director of the North Carolina Office of Indigent Defense Services (IDS), which began its work two decades ago in 2000. IDS is the statewide agency responsible for overseeing and enhancing legal representation for indigent defendants and others entitled to counsel under North Carolina law. Over the weekend, before she became deluged with her new responsibilities, Mary graciously agreed to do a quick interview with me. Read on to get to know a little more about her.

Tell us about your legal background.

I went to Wake Forest Law School, and after graduating in 1993 I went to work as an associate attorney at Womble, Carlyle, Sandridge & Rice in Winston-Salem and then Raleigh. I did civil litigation—business litigation and products liability. The cases ranged from simple breach of contract cases to patent infringement to complex products liability.

How did you get into indigent defense work?

In 1999, Tye Hunter, who was then the Appellate Defender in North Carolina called me. [Tye Hunter later became IDS’s first executive director, serving from 2000 to 2008.] He had heard that I was interested in working on a death penalty case. I’m still not sure where he heard that. I told him I was wholly unqualified, and he explained in his inimitable way how capital post-conviction litigation was JUST LIKE products liability litigation, with extensive discovery and expert witnesses. I had reservations given that my criminal law experience up to then had consisted of going to traffic court for the children of partners and clients. But, Tye convinced me, and the firm was supportive.

That’s how I got appointed to represent Alan Gell, who was on death row for first-degree murder. I represented him in post-conviction, which resulted in his conviction being overturned, and then worked on his retrial, which resulted in his acquittal of all charges. I liked doing civil litigation and my colleagues at Womble, but I just found this work more fulfilling.

What then?

I left Womble in 2002 and went to work as a staff attorney at the Center for Death Penalty Litigation, where I did capital post-conviction work until 2007. After that, I was self-employed until 2009 when I became the Executive Director of North Carolina Prisoners Legal Services. I was the PLS Director until I took this job.

Was it hard to leave PLS?

Definitely. We did a lot of good work. I’m proud of it. PLS does both criminal and civil work. We recruited and trained lawyers to do post-conviction work and got some amazing results for our clients, including exonerations of wrongfully convicted people. We litigated civil cases about conditions of confinement. We worked on cases to stop sexual abuse of women inmates and a class action under the Americans with Disabilities Act to make sure that inmates with disabilities could earn gain time on an equal footing with other inmates. We also did the important day-to-day work of correcting sentencing errors, including habitual felon sentences. While at PLS, I also had the honor of serving as the President of the North Carolina Advocates for Justice.

What made you consider becoming the IDS Director?

At PLS, we usually represent individuals one case at a time. The thought of being able to make systemic improvements appeals to me—to work on getting attorneys more resources, more funding, and essentially more time to work on their cases.

I look forward to the challenge, the immediate one being moving forward through the pandemic, which poses unique problems for the defense. When are we going to be able to try cases again? What are the alternatives? Will they be fair? The economic impact of the pandemic could also affect funding for indigent defense, which is already too low as it is.

The flip side is that we have an opportunity to make changes that could ease the workload and keep more people out of prisons and jails. So many cases in our criminal justice system are low-level misdemeanors, which can be handled in other ways. Rather than brand people with a conviction and impose collateral consequences, we can save money and reintegrate people better by exploring noncriminal options, such as civil infractions for violations of the law.

What else would you like people to know about you?

I’m pretty boring. I’ve been married 28 years as of last Saturday. My husband is in-house counsel at a large engineering firm. We live in Raleigh in the same house we’ve been in for 11 years. We have two nearly grown children, a son and daughter who are 24 and 21 years old. In my spare time I sit on the front porch and read or knit.

How should people reach you?

I had hoped to hop in the car and come see folks around the state. That isn’t going to happen for a while. So, we will try to set up some smaller virtual meetings. I want to learn about the issues and concerns that the defense community has. In the meantime, you can reach me at [email protected] or the IDS main number, 919.354.7200. I am excited to get started.

The post Meet Mary Pollard, the new Director of the Office of Indigent Defense Services appeared first on North Carolina Criminal Law.

Meet Mary Pollard, the new Director of the Office of Indigent Defense Services published first on https://immigrationlawyerto.tumblr.com/

0 notes

Text

The best Criminal Lawyer in Regina at Saskatoon Criminal Defence Lawyers

Criminal Lawyer in Regina, Our lawyers specialize in criminal law and are committed to providing our clients with the highest quality of service. We offer free consultations and are available to answer any questions or concerns you may have.

#Criminal lawyer in Moose jaw#Criminal Lawyer in Saskatoon#Criminal Lawyer in Prince Albert#Criminal Lawyer in Swift Current#Criminal Lawyer in Weyburn#Criminal Lawyer in North Battleford#Criminal Lawyer in Estevan#Criminal Lawyer in Carlyle#Criminal Lawyer in Lloydminster#Criminal lawyer in Fort Qu'Appelle#Criminal Lawyer in Regina#Criminal Lawyer in Punnichy#Criminal defense lawyer in Saskatoon#Criminal defence attorney Saskatoon#Criminal defense attorney Saskatoon

0 notes

Text

SEC Charges Former Staffer with Securities Fraud

The Securities and Exchange Commission charged a former employee with securities fraud in connection with his trading of options and other securities.

The SEC’s complaint alleges that David R. Humphrey, who worked at the SEC from 1998 to 2014, concealed his personal trading from the SEC’s ethics office and later misrepresented his trading activities to the SEC’s Office of Inspector General when questioned during an investigation.

youtube

“As alleged in our complaint, Humphrey never sought pre-clearance for his prohibited options trades and he filed forms that falsely represented his securities holdings,” said Gerald W. Hodgkins, Associate Director in the SEC’s Division of Enforcement.

SEC employees are subject to rigorous rules regarding securities transactions to guard against even the appearance of using public office for private gain. The ethics rules specifically prohibit trading in options or derivatives. The rules also require staff to disclose their securities holdings and transactions to the agency’s ethics office in annual filings.

According to the SEC’s complaint, Humphrey violated the rules by engaging in transactions involving derivatives, failing to obtain pre-clearance before trading non-prohibited securities, and failing to hold securities for the required period.

youtube

The SEC’s complaint charges Humphrey with violating Section 17(a) of the Securities Act and Section 10(b) of the Securities Exchange Act. Humphrey has agreed to settle the charges and pay $51,917 in disgorgement of profits made in the improper trades plus $4,774 in interest and a $51,917 penalty. Humphrey also agreed to be permanently suspended from appearing and practicing before the SEC as an accountant, which includes not participating in the financial reporting or audits of public companies. The settlement is subject to court approval.

In a parallel action, the Department of Justice today announced that Humphrey has pleaded guilty to criminal charges stemming from his false federal filings.

The SEC’s investigation was conducted by Gary M. Zinkgraf and Tom Bednar, and the case was supervised by Jeffrey Weiss. The SEC appreciates the assistance of the U.S. Department of Justice’s Fraud Section.

SEC CHARGES BROKERAGE FIRM WITH FAILING TO COMPLY WITH ANTI-MONEY LAUNDERING LAWS

The Securities and Exchange Commission today charged a Salt Lake City-based brokerage firm with securities law violations related to its alleged practice of clearing transactions for microcap stocks that were used in manipulative schemes to harm investors.

youtube

To help detect potential securities law and money laundering violations, broker-dealers are required to file Suspicious Activity Reports (SARs) that describe suspicious transactions that take place through their firms. The SEC’s complaint alleges that Alpine Securities Corporation routinely and systematically failed to file SARs for stock transactions that it flagged as suspicious. When it did file SARs, Alpine Securities allegedly frequently omitted the very information that formed the bases for Alpine knowing, suspecting, or having reason to suspect that a transaction was suspicious. As noted in the complaint, guidance for preparing SARs from the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) clearly states that “explaining why the transaction is suspicious is critical.”

“As alleged in our complaint, by failing to file SARs, Alpine Securities deprived regulators and law enforcement of critically important information often related to trades in microcap securities used to investigate potentially serious misconduct,” said Julie Lutz, Director of the SEC’s Denver Regional Office.

The SEC’s complaint charges Alpine Securities with thousands of violations of Section 17(a) of the Securities Exchange Act of 1934 and Rule 17a-8.

youtube

The SEC’s investigation was conducted by L. James Lyman and Ian S. Karpel of the Denver Regional Office with assistance from Daniel J. Goldberg, Damon Reed, and Andrae S. Eccles of the Enforcement Division’s Bank Secrecy Act Review Group. The litigation will be led by Zachary T. Carlyle and Terry Miller and supervised by Gregory A. Kasper. The SEC’s examination that led to the investigation was conducted by Denise S. Saxon, Phil Perrone, and Joni S. Marks with assistance from Lisa Byington. The case involves the Enforcement Division’s Broker-Dealer Task Force, which is led by Antonia Chion and Andrew M. Calamari and focuses on current issues and practices within the broker-dealer community, developing national initiatives for potential investigations.

The SEC appreciates the assistance of the U.S. Attorney’s Office for the Southern District of Utah, the U.S. Department of Homeland Security, FinCEN, and the Financial Industry Regulatory Authority.

WHISTLEBLOWER AWARD OF MORE THAN HALF-MILLION DOLLARS FOR COMPANY INSIDER

The Securities and Exchange Commission today announced that a company insider has earned a whistleblower award of more than $500,000 for reporting information that prompted an SEC investigation into well-hidden misconduct that resulted in an SEC enforcement action.

“This company employee saw something wrong and did the right thing by reporting what turned out to be hard-to-detect violations of the securities laws,” said Jane Norberg, Chief of the SEC’s Office of the Whistleblower. “Company insiders are in a unique position to provide specific information that allows us to better protect investors and the marketplace. We encourage insiders with information to bring it to our attention.”

youtube

The whistleblower award is the second announced by the SEC in the past week. Approximately $154 million has now been awarded to 44 whistleblowers who voluntarily provided the SEC with original and useful information that led to a successful enforcement action.

By law, the SEC protects the confidentiality of whistleblowers and does not disclose information that might directly or indirectly reveal a whistleblower’s identity. Whistleblowers may be eligible for an award when they voluntarily provide the SEC with original, timely, and credible information that leads to a successful enforcement action.

Whistleblower awards can range from 10 percent to 30 percent of the money collected when the monetary sanctions exceed $1 million. All payments are made out of an investor protection fund established by Congress that is financed entirely through monetary sanctions paid to the SEC by securities law violators.

SEC Lawyer Free Consultation

If you need help with an SEC matter or securities law issue, call Ascent Law for your free consultation (801) 676-5506. We want to help you.

Ascent Law LLC8833 S. Redwood Road, Suite CWest Jordan, Utah 84088 United StatesTelephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Personal Representative of the Estate

Vacation and Sick Leave in Your Business

Waiting Period for Divorce

Fraudulent Conveyance

Divorce Legal Help

Misteps We See In Utah Divorces

Repost: https://www.ascentlawfirm.com/sec-charges-former-staffer-with-securities-fraud/ “Steven E. Rush / Divorce Lawyer Utah” http://www.ascentlawfirm.com/

Repost: https://stevenrushutah.wordpress.com/2018/12/21/sec-charges-former-staffer-with-securities-fraud-5/ * Steven E. Rush * https://stevenrushutah.wordpress.com/

0 notes

Text

SEC Charges Former Staffer with Securities Fraud

The Securities and Exchange Commission charged a former employee with securities fraud in connection with his trading of options and other securities.

The SEC’s complaint alleges that David R. Humphrey, who worked at the SEC from 1998 to 2014, concealed his personal trading from the SEC’s ethics office and later misrepresented his trading activities to the SEC’s Office of Inspector General when questioned during an investigation.

youtube

“As alleged in our complaint, Humphrey never sought pre-clearance for his prohibited options trades and he filed forms that falsely represented his securities holdings,” said Gerald W. Hodgkins, Associate Director in the SEC’s Division of Enforcement.

SEC employees are subject to rigorous rules regarding securities transactions to guard against even the appearance of using public office for private gain. The ethics rules specifically prohibit trading in options or derivatives. The rules also require staff to disclose their securities holdings and transactions to the agency’s ethics office in annual filings.

According to the SEC’s complaint, Humphrey violated the rules by engaging in transactions involving derivatives, failing to obtain pre-clearance before trading non-prohibited securities, and failing to hold securities for the required period.

youtube

The SEC’s complaint charges Humphrey with violating Section 17(a) of the Securities Act and Section 10(b) of the Securities Exchange Act. Humphrey has agreed to settle the charges and pay $51,917 in disgorgement of profits made in the improper trades plus $4,774 in interest and a $51,917 penalty. Humphrey also agreed to be permanently suspended from appearing and practicing before the SEC as an accountant, which includes not participating in the financial reporting or audits of public companies. The settlement is subject to court approval.

In a parallel action, the Department of Justice today announced that Humphrey has pleaded guilty to criminal charges stemming from his false federal filings.

The SEC’s investigation was conducted by Gary M. Zinkgraf and Tom Bednar, and the case was supervised by Jeffrey Weiss. The SEC appreciates the assistance of the U.S. Department of Justice’s Fraud Section.

SEC CHARGES BROKERAGE FIRM WITH FAILING TO COMPLY WITH ANTI-MONEY LAUNDERING LAWS

The Securities and Exchange Commission today charged a Salt Lake City-based brokerage firm with securities law violations related to its alleged practice of clearing transactions for microcap stocks that were used in manipulative schemes to harm investors.

youtube

To help detect potential securities law and money laundering violations, broker-dealers are required to file Suspicious Activity Reports (SARs) that describe suspicious transactions that take place through their firms. The SEC’s complaint alleges that Alpine Securities Corporation routinely and systematically failed to file SARs for stock transactions that it flagged as suspicious. When it did file SARs, Alpine Securities allegedly frequently omitted the very information that formed the bases for Alpine knowing, suspecting, or having reason to suspect that a transaction was suspicious. As noted in the complaint, guidance for preparing SARs from the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) clearly states that “explaining why the transaction is suspicious is critical.”

“As alleged in our complaint, by failing to file SARs, Alpine Securities deprived regulators and law enforcement of critically important information often related to trades in microcap securities used to investigate potentially serious misconduct,” said Julie Lutz, Director of the SEC’s Denver Regional Office.

The SEC’s complaint charges Alpine Securities with thousands of violations of Section 17(a) of the Securities Exchange Act of 1934 and Rule 17a-8.

youtube

The SEC’s investigation was conducted by L. James Lyman and Ian S. Karpel of the Denver Regional Office with assistance from Daniel J. Goldberg, Damon Reed, and Andrae S. Eccles of the Enforcement Division’s Bank Secrecy Act Review Group. The litigation will be led by Zachary T. Carlyle and Terry Miller and supervised by Gregory A. Kasper. The SEC’s examination that led to the investigation was conducted by Denise S. Saxon, Phil Perrone, and Joni S. Marks with assistance from Lisa Byington. The case involves the Enforcement Division’s Broker-Dealer Task Force, which is led by Antonia Chion and Andrew M. Calamari and focuses on current issues and practices within the broker-dealer community, developing national initiatives for potential investigations.

The SEC appreciates the assistance of the U.S. Attorney’s Office for the Southern District of Utah, the U.S. Department of Homeland Security, FinCEN, and the Financial Industry Regulatory Authority.

WHISTLEBLOWER AWARD OF MORE THAN HALF-MILLION DOLLARS FOR COMPANY INSIDER

The Securities and Exchange Commission today announced that a company insider has earned a whistleblower award of more than $500,000 for reporting information that prompted an SEC investigation into well-hidden misconduct that resulted in an SEC enforcement action.

“This company employee saw something wrong and did the right thing by reporting what turned out to be hard-to-detect violations of the securities laws,” said Jane Norberg, Chief of the SEC’s Office of the Whistleblower. “Company insiders are in a unique position to provide specific information that allows us to better protect investors and the marketplace. We encourage insiders with information to bring it to our attention.”

youtube

The whistleblower award is the second announced by the SEC in the past week. Approximately $154 million has now been awarded to 44 whistleblowers who voluntarily provided the SEC with original and useful information that led to a successful enforcement action.

By law, the SEC protects the confidentiality of whistleblowers and does not disclose information that might directly or indirectly reveal a whistleblower’s identity. Whistleblowers may be eligible for an award when they voluntarily provide the SEC with original, timely, and credible information that leads to a successful enforcement action.

Whistleblower awards can range from 10 percent to 30 percent of the money collected when the monetary sanctions exceed $1 million. All payments are made out of an investor protection fund established by Congress that is financed entirely through monetary sanctions paid to the SEC by securities law violators.

SEC Lawyer Free Consultation

If you need help with an SEC matter or securities law issue, call Ascent Law for your free consultation (801) 676-5506. We want to help you.

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Personal Representative of the Estate

Vacation and Sick Leave in Your Business

Waiting Period for Divorce

Fraudulent Conveyance

Divorce Legal Help

Misteps We See In Utah Divorces

From https://www.ascentlawfirm.com/sec-charges-former-staffer-with-securities-fraud/

source https://familylawattorneyut.wordpress.com/2018/12/21/sec-charges-former-staffer-with-securities-fraud/

from https://familylawattorneyut.blogspot.com/2018/12/sec-charges-former-staffer-with.html

0 notes

Text

SEC Charges Former Staffer with Securities Fraud

The Securities and Exchange Commission charged a former employee with securities fraud in connection with his trading of options and other securities.

The SEC’s complaint alleges that David R. Humphrey, who worked at the SEC from 1998 to 2014, concealed his personal trading from the SEC’s ethics office and later misrepresented his trading activities to the SEC’s Office of Inspector General when questioned during an investigation.

youtube

“As alleged in our complaint, Humphrey never sought pre-clearance for his prohibited options trades and he filed forms that falsely represented his securities holdings,” said Gerald W. Hodgkins, Associate Director in the SEC’s Division of Enforcement.

SEC employees are subject to rigorous rules regarding securities transactions to guard against even the appearance of using public office for private gain. The ethics rules specifically prohibit trading in options or derivatives. The rules also require staff to disclose their securities holdings and transactions to the agency’s ethics office in annual filings.

According to the SEC’s complaint, Humphrey violated the rules by engaging in transactions involving derivatives, failing to obtain pre-clearance before trading non-prohibited securities, and failing to hold securities for the required period.

youtube

The SEC’s complaint charges Humphrey with violating Section 17(a) of the Securities Act and Section 10(b) of the Securities Exchange Act. Humphrey has agreed to settle the charges and pay $51,917 in disgorgement of profits made in the improper trades plus $4,774 in interest and a $51,917 penalty. Humphrey also agreed to be permanently suspended from appearing and practicing before the SEC as an accountant, which includes not participating in the financial reporting or audits of public companies. The settlement is subject to court approval.

In a parallel action, the Department of Justice today announced that Humphrey has pleaded guilty to criminal charges stemming from his false federal filings.

The SEC’s investigation was conducted by Gary M. Zinkgraf and Tom Bednar, and the case was supervised by Jeffrey Weiss. The SEC appreciates the assistance of the U.S. Department of Justice’s Fraud Section.

SEC CHARGES BROKERAGE FIRM WITH FAILING TO COMPLY WITH ANTI-MONEY LAUNDERING LAWS

The Securities and Exchange Commission today charged a Salt Lake City-based brokerage firm with securities law violations related to its alleged practice of clearing transactions for microcap stocks that were used in manipulative schemes to harm investors.

youtube

To help detect potential securities law and money laundering violations, broker-dealers are required to file Suspicious Activity Reports (SARs) that describe suspicious transactions that take place through their firms. The SEC’s complaint alleges that Alpine Securities Corporation routinely and systematically failed to file SARs for stock transactions that it flagged as suspicious. When it did file SARs, Alpine Securities allegedly frequently omitted the very information that formed the bases for Alpine knowing, suspecting, or having reason to suspect that a transaction was suspicious. As noted in the complaint, guidance for preparing SARs from the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) clearly states that “explaining why the transaction is suspicious is critical.”

“As alleged in our complaint, by failing to file SARs, Alpine Securities deprived regulators and law enforcement of critically important information often related to trades in microcap securities used to investigate potentially serious misconduct,” said Julie Lutz, Director of the SEC’s Denver Regional Office.

The SEC’s complaint charges Alpine Securities with thousands of violations of Section 17(a) of the Securities Exchange Act of 1934 and Rule 17a-8.

youtube

The SEC’s investigation was conducted by L. James Lyman and Ian S. Karpel of the Denver Regional Office with assistance from Daniel J. Goldberg, Damon Reed, and Andrae S. Eccles of the Enforcement Division’s Bank Secrecy Act Review Group. The litigation will be led by Zachary T. Carlyle and Terry Miller and supervised by Gregory A. Kasper. The SEC’s examination that led to the investigation was conducted by Denise S. Saxon, Phil Perrone, and Joni S. Marks with assistance from Lisa Byington. The case involves the Enforcement Division’s Broker-Dealer Task Force, which is led by Antonia Chion and Andrew M. Calamari and focuses on current issues and practices within the broker-dealer community, developing national initiatives for potential investigations.

The SEC appreciates the assistance of the U.S. Attorney’s Office for the Southern District of Utah, the U.S. Department of Homeland Security, FinCEN, and the Financial Industry Regulatory Authority.

WHISTLEBLOWER AWARD OF MORE THAN HALF-MILLION DOLLARS FOR COMPANY INSIDER