#Covid 19 Impact on Recycled Carbon Fiber Market

Explore tagged Tumblr posts

Text

Global Wire & Cable Market — Forecast(2024–2030)

The global wire and cable market is a significant sector within the broader electrical and electronics industry, driven by the growing demand for electricity, telecommunications, and power distribution. It encompasses the production and distribution of a wide variety of cables and wires, including power cables, telecommunication cables, and industrial cables.

Request Sample

Key Trends in the Global Wire & Cable Market:

Rising Demand for Electricity: As urbanization and industrialization continue to rise globally, the need for more efficient and robust electrical power infrastructure grows. This fuels demand for power cables, especially in emerging markets.

Renewable Energy Integration: The transition toward renewable energy sources such as wind, solar, and hydropower requires advanced power cables for efficient transmission of electricity. This trend is particularly noticeable in the development of offshore wind farms and solar energy projects.

Telecommunications Expansion: With the expansion of 5G networks, fiber optic cables are in high demand to meet the increasing need for high-speed internet and mobile communication.

Smart Grids and Electrification: The adoption of smart grids, electric vehicles (EVs), and electric vehicle charging infrastructure is driving demand for more specialized cables, including those for power distribution and energy storage.

Sustainability and Environmental Concerns: Growing environmental awareness and stringent regulations are pushing companies to develop environmentally friendly cables. This includes cables with reduced carbon footprints and the use of recyclable materials.

Inquiry Before Buying

Key Market Segments:

Power Cables: These cables are used to transmit electricity and can range from low to high voltage. They are vital in the power generation, transmission, and distribution sectors.

Telecommunication Cables: This category includes fiber-optic cables, coaxial cables, and twisted pair cables, which are used in the communication industry for data transfer and telecommunication networks.

Industrial Cables: These are cables used in industrial applications, including manufacturing, robotics, and automation. They are designed to withstand harsh environments such as extreme temperatures, chemicals, and physical stress.

Renewable Energy Cables: Specialized cables for solar, wind, and other renewable energy systems, which must endure outdoor environments and harsh conditions while maintaining efficiency.

Automotive and EV Cables: With the rise of electric vehicles, there is growing demand for cables specifically designed for battery charging systems and electric powertrains.

Geographical Insights:

Asia-Pacific: This region dominates the global wire and cable market, led by countries like China, India, and Japan. China is the largest producer and consumer of wires and cables, driven by its large-scale infrastructure projects and demand for energy.

North America: The U.S. and Canada are significant markets for wire and cable products, especially in sectors like telecommunications, electric vehicles, and smart grid development.

Europe: Europe is also a prominent player, particularly with the growing adoption of renewable energy, electric vehicles, and green construction practices.

Latin America & Middle East: These regions are witnessing steady growth due to increasing infrastructure development and demand for energy, although they lag behind the Asia-Pacific and North American markets.

Market Challenges:

Raw Material Prices: The prices of copper and aluminum, the primary raw materials used in wire and cable production, fluctuate significantly, affecting manufacturing costs.

Supply Chain Disruptions: Global supply chains have faced disruptions, especially in the wake of the COVID-19 pandemic, which has impacted production and delivery timelines.

Technological Complexity: As the industry moves toward advanced cable solutions (e.g., high-performance cables for 5G networks, smart grids, etc.), the demand for specialized knowledge and manufacturing capabilities is increasing, posing challenges for smaller players.

Competitive Landscape:

The global wire and cable market is highly fragmented with both large multinational corporations and regional manufacturers. Some of the key players in the market include:

Nexans

Prysmian Group

Southwire

General Cable

LS Cable & System

Sumitomo Electric

Furukawa Electric

Buy Now

Future Outlook:

The global wire and cable market is expected to grow at a compound annual growth rate (CAGR) of around 5–6% over the next few years, driven by increased demand for energy infrastructure, advancements in telecommunications, and innovations in electric vehicle technology. Emerging markets in Asia, Africa, and Latin America are anticipated to contribute significantly to market growth.

0 notes

Text

How Filantro is Shaping the Non-Woven Industry in India

The non-woven fabric industry in India has seen remarkable growth in recent years, with increasing demand across various sectors such as healthcare, agriculture, construction, and packaging. Among the key players driving this growth is Filantro, a company that has positioned itself as one of the leading nonwoven manufacturers in India. Filantro’s commitment to quality, sustainability, and innovation has set new benchmarks for the industry, making it a pioneer in the non-woven fabric market.

In this blog, we’ll explore how Filantro is shaping the future of non-woven manufacturing in India, from its cutting-edge technologies to its sustainability initiatives, and how it continues to meet the growing demands of various industries.

The Rise of Non-Woven Fabrics in India

Before diving into Filantro’s impact, it’s essential to understand the significance of non-woven fabrics in today’s world. Non-woven fabrics are materials made from short or long fibers bonded together through chemical, mechanical, or thermal processes. Unlike traditional woven fabrics, non-woven fabrics do not require weaving or knitting, making them more versatile and cost-effective.

The rise in the use of non-woven fabrics is largely due to their wide range of applications. These fabrics are used in medical products like masks and gowns, hygiene products like diapers and sanitary napkins, and even in agriculture for crop protection. With their lightweight, breathable, and durable properties, non-woven fabrics have become indispensable in numerous industries.

Filantro: Leading Innovation in Non-Woven Manufacturing

As one of the leading non woven manufacturers in India, Filantro has been at the forefront of driving innovation in the industry. The company prides itself on using advanced technologies and eco-friendly practices to produce high-quality non-woven fabrics that meet international standards.

One of Filantro’s core strengths lies in its state-of-the-art manufacturing facilities, which are equipped with the latest machinery and equipment. This allows the company to produce non-woven fabrics in various grades and specifications to cater to the specific needs of different industries. Whether it’s for healthcare, agriculture, or packaging, Filantro ensures that each fabric is produced with the highest level of precision and quality.

Moreover, Filantro continually invests in research and development to stay ahead of industry trends and anticipate the evolving needs of its clients. This focus on innovation has allowed the company to develop new non-woven materials that are stronger, more durable, and more environmentally friendly.

Commitment to Sustainability

In today’s world, sustainability is no longer just an option; it’s a necessity. Filantro understands this and has made significant strides in adopting sustainable manufacturing practices. As one of the responsible non woven manufacturers in India, Filantro uses eco-friendly materials and processes to minimize its environmental impact.

The company’s sustainability efforts include using recycled materials where possible and ensuring that its manufacturing processes produce minimal waste. Additionally, Filantro’s non-woven fabrics are designed to be biodegradable or recyclable, making them an environmentally friendly choice for industries looking to reduce their carbon footprint.

By prioritizing sustainability, Filantro is not only contributing to a greener planet but also setting an example for other non woven manufacturers in India to follow.

Catering to Multiple Industries

One of the reasons behind Filantro’s success is its ability to cater to a diverse range of industries. The versatility of non-woven fabrics makes them suitable for numerous applications, and Filantro has successfully tapped into this demand by offering customized solutions for various sectors.

Healthcare: In the wake of the COVID-19 pandemic, the demand for non-woven fabrics in healthcare has surged. Filantro supplies high-quality non-woven materials for medical products like masks, surgical gowns, and PPE kits. These fabrics are not only breathable but also offer excellent protection against contaminants.

Agriculture: In the agricultural sector, non-woven fabrics are used for crop protection and soil stabilization. Filantro produces durable, UV-resistant fabrics that help farmers increase crop yield and protect plants from harsh environmental conditions.

Packaging: Non-woven fabrics are increasingly being used in packaging solutions due to their lightweight and durable nature. Filantro offers a range of non-woven packaging materials that are both strong and eco-friendly, making them an ideal choice for businesses looking to reduce plastic waste.

Hygiene Products: Non-woven fabrics are a key component in the manufacturing of hygiene products like diapers, sanitary napkins, and wipes. Filantro produces soft, absorbent fabrics that meet the stringent quality standards required for personal hygiene products.

Focus on Quality and Customer Satisfaction

At the heart of Filantro’s success is its unwavering commitment to quality and customer satisfaction. The company has implemented strict quality control measures to ensure that every batch of non-woven fabric meets the highest standards. From the raw materials used to the final product, every step of the manufacturing process is carefully monitored to ensure consistency and reliability.

Moreover, Filantro works closely with its clients to understand their specific needs and offer tailored solutions. Whether a client requires fabrics in specific colors, sizes, or finishes, Filantro’s team of experts ensures that every order is delivered to exact specifications.

This customer-centric approach has earned Filantro a loyal client base, both in India and internationally, solidifying its reputation as a trusted partner in the non-woven fabric industry.

Conclusion

Filantro is more than just a manufacturer; it’s a driving force in the transformation of the non-woven industry in India. By combining innovation, sustainability, and a focus on quality, the company is setting new standards for non woven manufacturers in India. Whether it’s meeting the demands of the healthcare sector, providing eco-friendly packaging solutions, or developing new materials for agriculture, Filantro continues to lead the way.

As the demand for non-woven fabrics grows, Filantro’s commitment to excellence ensures that it will remain at the forefront of the industry, shaping its future for years to come.

This Blog Was Originally Published At: https://filantrofirstofficial.blogspot.com/2024/10/how-filantro-is-shaping-non-woven.html

0 notes

Text

Recycled Polyethylene Terephthalate Market - Forecast (2024 - 2030)

Recycled polyethylene terephthalate Market Overview

The Recycled polyethylene terephthalate market size is estimated to reach US$16.5 billion by 2030, growing at a CAGR of 6.4% from 2024 to 2030. Polyethylene terephthalate (PET) is a recyclable plastic resin and a form of polyester. PET polyester is composed of ethylene glycol (EG) and terephthalic acid (TPA), also known as purified terephthalic acid (PTA). Recycled polyethylene terephthalate is used in plastic bottles and food containers due to its protective properties. Once the original PET containers are used by consumers, they undergo a recycling program in a facility that cleans and transforms the plastic into rPET flakes and pellets. The rPET flakes and pellets can then be reused to make new products, such as plastic for food and beverage containers, fiber for clothing and carpets, and others. Recycled polyethylene terephthalate is environmentally friendly because it has a lower carbon footprint than virgin polyethylene terephthalate. According to the PET resin association (PETRA), more than 1.5 billion pounds of used PET bottles and containers including beverage bottles and containers are recovered in the United States each year for recycling. The increased demand for beverage bottles and containers made of recycled polyethylene terephthalate (rPET) will drive the recycled polyethylene terephthalate industry in the forecast period. The increase in recycling programs like the recycling and litter prevention program 2021 program by the United States environmental protection agency (EPA), will drive the recycled polyethylene terephthalate market.

COVID-19 Impact

The COVID-19 had negatively impacted the recycled polyethylene terephthalate market. This is because of the challenges faced during 2020, due to the closure of recycling centers and disruption in curbside recycling because of lockdown conditions. According to a report by National Association for PET container Resources (NAPCOR), the recycling rate for the highly recyclable plastic resin PET plastic bottles made of highly recyclable plastic resin in the U.S. stood at 26.6% in 2020, down from the rate of 27.9% in 2019. Additionally, the collection of PET bottles recorded a marginal decline of 2.3% in the U.S during 2020. With this decline in the recycling rate of polyethylene terephthalate, there was a decline in the recycled polyethylene terephthalate market.

Report Coverage

The report: “Recycled Polyethylene Terephthalate Market– Forecast (2024-2030)” by IndustryARC covers an in-depth analysis of the following segments of the Recycled polyethylene terephthalate industry. By Product Type: Colored Recycled Polyethylene Terephthalate, Clear Recycled Polyethylene Terephthalate By Application: Textile Fiber (Clothing, Shoes, Bags, Carpet, Others), Sheet and Films, Industrial Strapping, Food and Beverage (Food Containers, Beverage Bottles), Others By Geography: North America (USA, Canada, and Mexico), Europe (UK, Germany, France, Italy, Netherlands, Spain, Russia, Belgium, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and New Zealand, Indonesia, Taiwan, Malaysia, and Rest of APAC), South America (Brazil, Argentina, Colombia, Chile, and Rest of South America), Middle East (Saudi Arabia, UAE, Israel, Rest of the Middle East) and Africa (South Africa, Nigeria, Rest of Africa)

Request Sample

Key Takeaways

The increased demand for food and beverage containers and bottles made of recycled polyethylene terephthalate (rPET) will drive the recycled polyethylene terephthalate Market.

The increased use of clear recycled polyethylene terephthalate made of highly recyclable plastic resin by beverage manufacturers like Coca-Cola will increase the growth of the recycled polyethylene terephthalate market.

North America will be the fastest-growing region in the recycled polyethylene terephthalate market due to the increased demand for bottled water.

Recycled Polyethylene Terephthalate Market Segment Analysis – By Product Type

Clear recycled polyethylene terephthalate holds the largest share in the recycled polyethylene terephthalate market and is expected to grow at a CAGR of 5.9% during the forecast period. Clear rPET made by recycling plastic resin has low energy requirements and provides easy bottle-to-bottle recycling. Additionally, clear rPET is highly durable, lightweight, and non-reactive and thus food and beverage manufacturers prefer clear flakes to produce containers and bottles, compared to colored. According to a news article by Coco-Cola Company, Sprite will soon launch a 13.2-oz bottle which is a 100% rPET clear bottle in the Northeast, California, and Florida. All Sprite packaging will transition to clear packaging, which is easier to be recycled and remade into new bottles, by the end of 2022. Thus, due to the wide use of clear rPET flakes by major players in the beverage industry, there will be increased growth in the Recycled polyethylene terephthalate Market in the forecast period.

Inquiry Before Buying

Recycled Polyethylene Terephthalate Market Segment Analysis – By Application

Bottles and containers are the fastest-growing segment in the recycled polyethylene terephthalate market and is expected to grow at a CAGR of 6.9%. Recycled polyethylene terephthalate (rPET) which is made by recycling plastic resin polyethylene terephthalate, is ideally suitable for a variety of food and beverage applications including bottled water, carbonated soft drinks, juices, fruit, baked goods, and others. It is mainly used in bottles, thermoformed containers, and films, as well as other containers. This is because rPET has higher package performance because of its higher intrinsic viscosity (IV) and also has reduced CO2 emission during the manufacturing process. According to an article by Natural mineral water’s Europe organization, nestle Water is accelerating the use of recycled materials for the bottles of its natural mineral water lines to have all of its bottles contain rPET by the end of 2021. This is a major step toward Nestle Waters goal of achieving carbon neutrality in the upcoming years. Thus, the increased use of recycled polyethylene terephthalate in food and beverage containers and bottles will drive the recycled polyethylene terephthalate market in the forecast period.

Recycled Polyethylene Terephthalate Market Segment Analysis – By Geography

North America held a significant share in the recycled polyethylene terephthalate market in 2021. This is due to the rise in demand for bottled water across this region. According to the Beverage Marketing Corporation (BMC)- the US, the annual sales of bottled water increased by 4.7% in 2020 and the consumption grew by 4.2%. There are many bottled water companies like Bisleri, that have been voluntary including rPET in their containers by recycling plastic resin polyethylene terephthalate. They offer their product in containers that are made of 50, 75, or even 100 percent rPET. Thus, the growth of bottled water in the North American region will increase the growth of the recycled polyethylene terephthalate Market.

Recycled Polyethylene Terephthalate Market Drivers

Increasing growth in beverage containers in the North America region

There has been significant growth in the demand for beverage containers in the North American region. According to an article by Beverage Marketing Corporation USA, in 2020, there has been an increase in the market share of bottled water from 14.1 percent to 23.6 percent and Carbonated soft drinks share has increased by 18.3 percent. This is because rPET bottled water’s packaging has a negligible environmental footprint when compared to other packaging types including aluminum, glass, paperboard cartons, and even PET soda bottles. Owing to the demand for beverage bottles in North America, there will be increased use of Recycled polyethylene terephthalate which will drive the Recycled polyethylene terephthalate Market.

Schedule a Call

Growing recycling programs will drive the recycled polyethylene terephthalate market.

Owing to several recycling programs, there will be a growth in the supply of rPET. For instance, the United States Environmental Protection Agency (EPA) came up with EPA Recycling and Litter Prevention Program 2021 program which helps support businesses and academic institutions to initiate recycling programs, encourage sustainable practices, and support litter prevention efforts. The U.S. recycling infrastructure and programs will influence the amount of PET that is available to facilities to help them produce rPET made out of these plastic resins. According to an article by the International bottled water association, the association has approved an innovative framework for a material recovery program that helps in developing new, comprehensive solutions which to increase recycling processes throughout the United States.

Recycled Polyethylene Terephthalate Market Challenges

An increase in the amount of contamination is a major challenge for the recycled polyethylene terephthalate market

The increase in the amount of contamination is a major challenge for the recycled polyethylene terephthalate market. This is due to the rise in the proportion of inhomogeneous components in the material flow. According to an article by Food Packaging Forum, higher levels of particle contamination were found in rPET which is produced by recycling plastic resin polyethylene terephthalate, as compared to virgin PET, as well as in rPET originating from co-collection systems compared with rPET from mono-collection systems. Particle contamination is found to be directly correlated with the haziness and color parameters of PET bottles. The packaging market continues to grow at a strong pace, with a steady beat of new products using new designs and materials. This has led to greater difficulty in separating different resin types and thus increased contamination which results in loss of materials and utilization rates.

Recycled Polyethylene Terephthalate Industry Outlook

Technology launches, acquisitions, and R&D activities are key strategies that are adopted by the dominant players in this market. Recycled polyethylene terephthalate top 10 companies include:

Ulsan Chemical Co. Ltd.

OCI Materials Co.

Formosa Plastics Corporation U.S.A.

Mitsui Chemicals Inc

SK Materials Co. Ltd.

Linde plc

Central Glass Co Ltd

Shandong FeiYuan Technology Co. Ltd.

Liming Research Institute of Chemical Industry Co. Ltd.

Navin Fluorine International Limited

Buy Now

Acquisitions/Technology Launches

In August 2020, Indorama Ventures Public Company Limited (IVL), a major player in the recycled polyethylene terephthalate market, announced that it has entered into an acquisition with Industrie Maurizio Peruzzo Polowat, a PET recycling facility in Poland. This acquisition will consist of production sites having a combined capacity of 25,353 tons of recycled polyethylene terephthalate (rPET) flakes and 4,409 tons of rPET pellets.

In October 2021, Placon announced that it is expanding its production capacity and employee base with the acquisition of a former Sonoco packaging operation in Wilson, North Carolina. Placon agreed to purchase substantially all operating equipment over a 112,000 square foot location. This expansion will help in expanding Placon’s thermoforming sustainable recycled PET packaging products.

We also publish more than 100 reports every month in "Chemicals and Materials", Go through the Domain if there are any other areas for which you would like to get a market research study.

#Recycled Polyethylene Terephthalate Market#Recycled Polyethylene Terephthalate Market Size#Recycled Polyethylene Terephthalate Market Share#Recycled Polyethylene Terephthalate Market Analysis#Recycled Polyethylene Terephthalate Market Revenue#Recycled Polyethylene Terephthalate Market Trends#Recycled Polyethylene Terephthalate Market Growth#Recycled Polyethylene Terephthalate Market Research#Recycled Polyethylene Terephthalate Market Outlook#Recycled Polyethylene Terephthalate Market Forecast

0 notes

Text

Impact of COVID-19 on the Rigid Packaging Market: Resilience and Adaptation

Rigid Packaging: Enhancing Product Protection and Consumer Appeal Raw Materials and Production Techniques Rigid packaging utilizes a variety of durable materials to securely contain products. Common materials include plastic, glass, metal, and wood. Plastics like polyethylene terephthalate (PET) and high-density polyethylene (HDPE) are popular due to their light weight and shatter resistance. Glass provides visibility and barrier protection but is heavier. Metal cans made of aluminum or tinplate resist denting while maintaining recyclability. Composite materials like fiberboard combine fibers like paper, paperboard, and plastic to achieve rigidity at lower costs than solid materials. Raw materials undergo fabrication processes to form rigid containers. Plastics are blow molded, injection molded, or thermoformed. Glass undergoes forming with heat before filling and sealing. Cans are produced through three-piece drawn and wall ironed or two-piece drawn, wall ironed, and sealed methods. Composite materials require lamination of layers with adhesive plus die cutting and scoring. Automated lines coordinate shaping, decorating, filling, sealing, and packaging at high speeds. Protection from Damage and Contamination Rigid packaging superbly protects products from damage caused by external forces. Plastic, glass, metal, and composite materials withstand crushing pressures and prevent breakage that could compromise contents. Rigid containers also provide tamper evidence through unbroken seals or labels. Once sealed, consumers can trust contents were not accessed until opening. Their impermeability to gases and liquids renders rigid packages ideal for preventing contamination and preserving freshness. Plastic, glass, and metal containers create absolute barriers blocking entry of air, moisture, light, and microbes that could degrade products. Composite boards further laminate layers for multi-directional strength blocking infiltration. Certain rigid containers like canned goods even allow hot filling and retort sterilization for long shelf-stable preservation without refrigeration. Graphic customization Rigid packaging facilitates protection yet also attracts attention on shelves. Vibrant graphics, photorealistic images and infographics adorn surfaces to highlight key selling points and information about contained products. Advanced printing techniques like rotogravure, flexography and digital bring designs to life in high resolution and colors. Metallic inks, foils, and dimensional effects add richness. Containers even undergo decorative processes like label wrapping and end printing. Sustainability considerations As a long-lasting package format, rigid containers prompt consideration of sustainable practices across their lifecycles. Lightweighting initiatives reduce materials while maintaining strength. Post-consumer recycled content increases in resins and boards. Mono-material structures like all-plastic or all-aluminum facilitate recycling. Reusable versions enable multiple refill cycles before disposal. Collection infrastructure improves recycling rates for rigid plastic, metal, and glass. New recycling technologies also extract value from "mixed rigid" streams. Compostable and biodegradable materials debut for select applications. Brands participate in sustainable packaging coalitions and adopt circular economy principles including design for reuse/refill. Rigid packaging manufacturers collaborate across supply chains on initiatives like carbon footprint reduction. Consumer appeal and trust Rigid containers achieve consumer appeal through protective functionality that builds quality perceptions. Contents remain cleanly enclosed and unbroken seals signal safety. Visual customization attracts eyes on shelves while communication graphics aid decisions. Stackability and sturdiness withstand distribution without destruction. Reclosability preserves freshness of partially used products.

0 notes

Text

Future of Carbon Fibre Market: 2024-2032 Growth Insights

Introduction

In 2023, the global carbon fiber industry achieved a remarkable milestone, reaching a valuation of approximately USD 3,821.39 million. Brace yourself for an in-depth exploration of this dynamic industry as we embark on a journey through its market outlook, report overview, size, dynamics, segmentation, recent developments, and the multitude of factors influencing its anticipated growth. With a projected Compound Annual Growth Rate (CAGR) of 11.9% during the forecast period from 2024 to 2032, the carbon fiber industry is poised for remarkable expansion.

Market Outlook (2024-2032)

The global carbon fiber industry is on the brink of transformative growth from 2024 to 2032. As technological advancements, sustainability imperatives, and demand for lightweight materials converge, the carbon fiber market is set to redefine industries and applications worldwide.

Report Overview

This report offers an extensive analysis of the global carbon fiber market, providing a comprehensive snapshot of its historical performance, current landscape, and future prospects. Drawing insights from industry reports, market analyses, and expert opinions, it delivers a profound understanding of the market's dynamics.

Market Size

The carbon fiber industry size impressive valuation in 2023 serves as a testament to its significance. The estimated CAGR reflects the industry's robust potential to disrupt traditional materials across multiple sectors.

Market Dynamics

Several key dynamics propel the carbon fiber industry's growth:

Lightweighting Trend: Industries such as automotive and aerospace increasingly rely on carbon fiber for weight reduction and improved fuel efficiency.

Sustainability: Carbon fiber's eco-friendly attributes, including recyclability and energy efficiency, drive its adoption.

Technological Advancements: Ongoing research and development initiatives enhance carbon fiber properties and expand its applications.

Segmentation

The carbon fiber market encompasses various segments:

Type: Carbon fibers are classified into various categories, including PAN-based, pitch-based, and rayon-based.

Application: Diverse industries, including aerospace, automotive, wind energy, and sports equipment, utilize carbon fiber.

Recent Developments

Recent advancements in the carbon fiber industry include:

Recyclable Carbon Fiber: Innovations in recyclable carbon fiber production contribute to sustainability goals.

3D Printing: The integration of carbon fiber into 3D printing processes enables complex and lightweight designs.

Component Insights

Key components in the carbon fiber industry include:

Raw Materials: Precursors such as polyacrylonitrile (PAN) and pitch form the foundation of carbon fiber production.

Manufacturing Processes: Techniques like carbonization and graphitization impart unique properties to carbon fiber.

COVID-19 Impact

The COVID-19 pandemic influenced the carbon fiber industry, initially disrupting supply chains but ultimately accelerating adoption in industries prioritizing lightweight and sustainable materials.

Growth Factors

The carbon fiber industry's growth is driven by several key factors:

Weight Reduction: Carbon fiber's exceptional strength-to-weight ratio is crucial in industries focused on lightweighting.

Sustainability: Carbon fiber's recyclability and lower carbon footprint align with environmental goals.

Technological Advancements: Ongoing research enhances carbon fiber properties, enabling broader applications.

End-User Insights

Diverse end-users benefit from carbon fiber's properties:

Aerospace: Carbon fiber's lightweight and high-strength properties are invaluable in aircraft and spacecraft construction.

Automotive: Carbon fiber composites improve vehicle fuel efficiency and safety.

Wind Energy: Carbon fiber reinforces wind turbine blades, enhancing energy generation.

Regional Insights

The carbon fiber market exhibits regional variations:

North America: Leading in aerospace and automotive applications.

Europe: A hub for carbon fiber production and adoption in multiple sectors.

Asia-Pacific: Rapid growth driven by automotive, wind energy, and infrastructure development.

Key Players

Prominent companies in the carbon fiber industry include:

SGL Carbon

Hexcel Corporation

Hyosung Advanced Materials

Mitsubishi Chemical Carbon Fiber and Composites, Inc.

Nippon Steel Chemical & Material Co., Ltd.

Others

Market Trends

Several trends shape the carbon fiber market:

Cost Reduction: Efforts to reduce production costs enhance carbon fiber's competitiveness.

Recyclability: The development of recyclable carbon fiber contributes to sustainability goals.

Automotive Adoption: Increasing use of carbon fiber in automobiles for weight reduction and improved efficiency.

Industry News

Stay informed about the latest industry news, including technological breakthroughs, new applications, and market expansions.

Application Insights

Carbon fiber finds applications in various industries:

Aerospace: Lightweight aircraft components improve fuel efficiency.

Automotive: Carbon fiber composites enhance vehicle performance and safety.

FAQs with Answers

What drives the growth of the global carbon fiber industry?

Growth is driven by demand for lightweight materials, sustainability imperatives, and technological advancements.

How did COVID-19 impact the carbon fiber industry?

The pandemic initially disrupted supply chains but later accelerated carbon fiber adoption in industries prioritizing lightweight and sustainable materials.

Which regions are leading in the carbon fiber industry?

North America, Europe, and Asia-Pacific are key regions in the global carbon fiber landscape.

What are the emerging trends in carbon fiber?

Trends include cost reduction, recyclability, and increased adoption in the automotive sector.

0 notes

Text

Carbon Composites Market, Share, Size, Trends, Forecast and Future Outlook

Carbon Composites Market

The market research report provides a comprehensive analysis of the industry, with a specific focus on the Carbon Composites Market. It examines the size, growth rate, and major trends within the Carbon Composites Market, offering valuable insights into its current state and future prospects. The report explores the significance of Carbon Composites in driving market dynamics and shaping business strategies. It investigates the market drivers, such as increasing consumer demand and emerging trends related to Carbon Composites, providing a deep understanding of the factors influencing market growth. Additionally, the report assesses the competitive landscape within the Carbon Composites Market, profiling key players and their market share, strategies, and product offerings. It also addresses market segmentation, identifying different segments within the Carbon Composites Market and their unique characteristics. Overall, the market research report equips businesses operating in the Carbon Composites Market with valuable information and actionable recommendations to capitalize on opportunities and navigate the challenges in the industry.

Request Free Sample Report @ https://www.vertexbusinessinsights.com/request-sample/180/carbon--composites-market

This research covers COVID-19 impacts on the upstream, midstream and downstream industries. Moreover, this research provides an in-depth market evaluation by highlighting information on various aspects covering market dynamics like drivers, barriers, opportunities, threats, and industry news & trends. In the end, this report also provides in-depth analysis and professional advices on how to face the post COIVD-19 period.

The research methodology used to estimate and forecast this market begins by capturing the revenues of the key players and their shares in the market. Various secondary sources such as press releases, annual reports, non-profit organizations, industry associations, governmental agencies and customs data, have been used to identify and collect information useful for this extensive commercial study of the market. Calculations based on this led to the overall market size. After arriving at the overall market size, the total market has been split into several segments and sub segments, which have then been verified through primary research by conducting extensive interviews with industry experts such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub segments.

Carbon Composites Market Segment Analysis

Carbon Composites Market By Product Type

Unidirectional Carbon Fiber Sheet

Prepregs

Fabrics & Tape

Laminates

Molded Components

Carbon Composites Market By Raw Materials

PAN-based Carbon Fibers

Pitch Based Carbon Fibers

Recycled Carbon Fibers

Carbon Composites Market By End User

Aerospace

Automotive

Wind Energy

Sports & Recreation

Construction

Marine

Carbon Composites Market By Region

North America

Europe

Asia Pacific

South America

Middle east & Africa

Ask Queries @ https://www.vertexbusinessinsights.com/enquiry/180/carbon--composites-market

Table of Content

1 Executive Summary

2 Market Introduction

2.1 Definition

2.2 Architecture

2.3 Scope of the Study

2.4 Related Stakeholders

3 Research Methodology

3.1 Introduction

3.2 Primary Research

3.2.1 Key Insights

3.2.2 Breakdown of Primary Interviews

3.3 Secondary Research

3.3.1 Important Sources

3.4 Market Size Estimation Approaches

3.4.1 Top-Down Approach

3.4.2 Bottom-Up Approach

3.4.3 Data Triangulation

3.5 List of Assumptions

4 Market Dynamics

4.1 Introduction

4.2 Drivers

4.3 Restraints

4.4 Opportunities

4.5 Porter's Five Forces Model Analysis

4.6 Value Chain Analysis

4.7 Impact of COVID-19 on Global Carbon Composite Market

5 Global Carbon Composite Market, By Product Type

5.1 Introduction

5.2 Unidirectional Carbon Fibre Sheet

5.3 Prepregs

5.4 Fabrics & Tape

5.5 Laminates

5.6 Moulded Components

6 Global Carbon Composite Market, By Raw Material

6.1 Introduction

6.2 PAN-based Carbon Fibers

6.3 Pitch Based Carbon Fibers

6.4 Recycled Carbon Fibers

7 Global Carbon Composite Market, By End User

7.1 Introduction

7.2 Aerospace

7.3 Automotive

7.4 Wind Energy

7.5 Sports & Recreation

7.6 Construction

7.7 Marine

8 Global Carbon Composite Market, By Region

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 Germany

8.3.2 UK

8.3.3 France

8.3.4 Italy

8.3.5 Spain

8.3.6 Rest of Europe

8.4 Asia-Pacific

8.4.1 China

8.4.2 India

8.4.3 Japan

8.4.4 South Korea

8.4.5 Rest of Asia-Pacific

8.5 Middle East and Africa

8.6 South America

9 Competitive Landscape

9.1 Introduction

9.2 Vendor Evaluation Criteria

9.3 Vendor Share Analysis, 2021

9.4 Recent Developments, 2019-2021

9.4.1 New End User Launches

9.4.2 Partnerships

9.4.3 Mergers or Acquisitions

9.4.4 Business Expansions

10 Company Profiles

(This section covers the Business Overview, Financial Overview, End User and End User Offerings, Recent Developments, SWOT Analysis, and Key Strategies of the top market vendors. The given sequence does not represent their rankings in the market.

10.1 Toray Industries, Inc.

10.2 Teijin Limited

10.3 Hexcel Corporation

10.4 Mitsubishi Chemical Holdings Corporation

10.5 SGL Carbon

10.6 Zoltek Companies, Inc. (a subsidiary of Toray Industries)

10.7 Cytec Solvay Group (now part of Solvay S.A.)

10.8 Axiom Materials, Inc.

10.9 Park Aerospace Corp.

10.10 PRF Composite Materials

10.11 DowAksa

10.12 SABIC

10.13 Lanxess AG

10.14 Toho Tenax (a subsidiary of Teijin Limited)

10.15 Owens Corning

10.16 Hyosung Corporation

10.17 Gurit Holding AG

10.18 Colbond B.V. (a subsidiary of Low & Bonar)

10.19 Plasan Carbon Composites

10.20 Royal DSM

10.21 Nippon Electric Glass (NEG)

10.22 Gurit Holding AG

10.23 SGL Carbon SE

10.24 TenCate Advanced Composites (a part of Toray Industries)

10.25 Huntsman International LLC

10.26 Others

11 Appendix

11.1 Discussion Guide

11.2 Customization Options

11.3 Related Reports

Continue…

ABOUT US:

Vertex Business Insights is one of the largest collections of market research reports from numerous publishers. We have a team of industry specialists providing unbiased insights on reports to best meet the requirements of our clients. We offer a comprehensive collection of competitive market research reports from a number of global leaders across industry segments.

CONTACT US

Phone: + (210) 775-2636 (USA) + (91) 853 060 7487

0 notes

Text

Natural Fiber Composites Market Growth Rate, Revenue & Future Scope: 2030

Natural Fiber Composites Market by Fiber Type (Wood, Cotton, Flax, Kenaf, Hemp, Others), by Technology (Injection Molding, Compression Molding, Others), by Application (Automotive, Electronics, Construction, Others) and region (North America, Europe, Asia-Pacific, Middle East and Africa and South America).

Market Overview

The global Natural Fiber Composites market size was estimated at USD 328.2 million in 2023 and is projected to reach USD 496.4 million in 2030 at a CAGR of 6.1% during the forecast period 2023-2030.

Fiber-reinforced composites are in reasonably high demand. They are not eco-friendly, though, and are pricey. These fibers cannot be recycled or renewed. Regulations for the automobile sector have been introduced in several Asian and European Union nations. In accordance with laws adopted by the European Union in 2006, 80% of cars must be recycled or reused; in the 2015 version, this percentage increased to 85%. A 2015 rule in Japan mandates that 95% of automobiles should be recycled or repurposed. The usage of glass fiber composites is also constrained by limitations including high fiber density, low recyclability, handling dangers, and other issues. Natural fiber composites benefit from the shortcomings of glass fiber composites.

The desire for lighter, safer, more fuel-efficient, and electric automobiles is propelling the market for natural fiber composites. This is explained by the greater strength, stiffness, fracture resistance, and thermal & acoustic insulation properties that these fibers display. NFC technology also lowers the cost of parts used in automotive applications. Composite manufacturing is quickly becoming a more cost-effective option than conventional methods for making vehicle components. This environmentally beneficial approach is aided by plant-based fibers, including bamboo, kenaf, hemp, jute, flax, coir, sisal, and banana.

There have been some positive impacts of the COVID-19 pandemic on the natural fiber composites market, such as the pandemic has led to a greater focus on sustainability and the circular economy, as more people are realizing the importance of preserving natural resources and reducing waste. Companies that make natural fiber composites are in a good position to profit from the growing demand for sustainable products since they provide traditional materials a more ecologically friendly alternative.

Request Sample Pages of Report: https://www.delvens.com/get-free-sample/natural-fiber-composites-market-trends-forecast-till-2030

Delvens Industry Expert's Standpoint

Natural fibers in composites have the potential to further reduce product weight, which might result in reduced transportation-related emissions and fuel use. The use of NFCs in the construction industry is predicted to rapidly expand as a result of the aforementioned factors, Load-bearing structures including beams, roofs, multifunctional panels, water tanks, and pedestrian bridges are made using natural fiber composites. NFCs are also used to create structural beams and frames for pedestrian bridges with light to medium design loads. Moreover, natural fiber composites are utilized to make beams because of their lower cost, lower density, and favorable environmental consequences, such as the need for less energy and carbon dioxide during manufacture compared to synthetic composites,which will fuel market expansion.

Key Findings

By fiber type, Load-bearing structures including beams, roofs, multifunctional panels, water tanks, and pedestrian bridges are made using natural fiber composites. NFCs are also used to create structural beams and frames for pedestrian bridges with light to medium design loads. Moreover, natural fiber composites are utilized to make beams because of their lower cost, lower density, and favorable environmental consequences, such as the need for less energy and carbon dioxide during manufacture compared to synthetic composites.

By technology, The market is divided into injection molding, compression molding, and other categories based on technology. In 2022, the category that dealt with injection molding had the biggest market share. A common manufacturing procedure for mass production is injection molding. The popularity of injection molding is largely due to great processability, despite the fact that the reinforcing fiber deteriorates throughout the procedure. The domination of the injection molding market is a result of rising demand for composite materials from the automotive, hardware/apparatus, medical, and bundling industries.

By application, The market is divided into automotive, electronics, construction, and other applications. In 2022, the automotive industry accounted for the highest market share. Automobile manufacturers all over the world have increased their investments as a result of the growing demand for hybrid and electric vehicles. The world's booming automobile business continues to play a significant role in the market expansion for natural fiber composites.

The market is divided into four regions based on geography: North America, Europe, Asia-Pacific, and LAMEA. With a sizable population and a developing middle class, the Asia-Pacific area is one of the regions of the globe that is expanding the quickest. The Asia-Pacific region is experiencing rapid industrialization, which is driving demand for lightweight and high-performance materials.

Make an Inquiry Before Buying: https://www.delvens.com/Inquire-before-buying/natural-fiber-composites-market-trends-forecast-till-2030

Regional Analysis

North America to Dominate the Market

Natural fiber composites are increasingly used in a variety of industries, including automotive, electrical & electronics, and building & infrastructure, which is primarily driving the growth of the natural fiber composites market in Asia Pacific. Countries like China, India, and Japan dominate the market in these end-use industries.

The Asia Pacific area is the leader in the world's building and construction sector, which enjoys significant growth there due to substantial infrastructure development activities in the majority of countries. Large-scale infrastructure projects, building & construction projects, as well as civil and environmental applications, are being funded by emerging economies including China, India, Japan, Malaysia, Indonesia, and South Korea.

Competitive Landscape

Trec Company, Inc.

FlexForm Technologies

Fiberon Technologies, Inc.

The AZEK Company LLC

Polyvlies

Procotex

DuPont

GreenCore Composites Inc.

Meshlin Composites Zrt

GreenGran B.V.

UPM

Plasthill Oy

Green Dot Bioplastics Inc

Tecnaro GmbH

Jelu-werkJ

Ehrler GmbH & Co.

Bcomp Ltd.

Lingrove Inc

Direct Order for the Research Report: https://www.delvens.com/checkout/natural-fiber-composites-market-trends-forecast-till-2030

Recent Developments

In June 2022, ARBOTRADE GmbH was established as a joint venture by Technaro and JOMA-POLYTEC. With the purpose of replanting of forests, the joint venture offers goods composed of bioplastics. This merger establishes a link with a significant amount of additional value. Customers may obtain everything from the raw material to the finished product from a single source thanks to TECHNARO's role as a material developer and producer and Joma-role Polytec's as a material processor. The market-facing sales of the ground-breaking internal developments are subsequently taken up by the joint corporation, ARBOTRADE GmbH.

October 2021, To make it easier for customers to create a unique outdoor retreat, The AZEK Company Inc., through its TimberTech Composite Decking, teamed with Yardzen, a leading online landscape design platform.

Reasons to Acquire

Increase your understanding of the market for identifying the most suitable strategies and decisions based on sales or revenue fluctuations in terms of volume and value, distribution chain analysis, market trends, and factors.

Gain authentic and granular data access for the Natural Fiber Composites Market to understand the trends and the factors involved in changing market situations.

Qualitative and quantitative data utilization to discover arrays of future growth from the market trends of leaders to market visionaries and then recognize the significant areas to compete in the future.

In-depth analysis of the changing trends of the market by visualizing the historic and forecast year growth patterns.

About Us:

Delvens is a strategic advisory and consulting company headquartered in New Delhi, India. The company holds expertise in providing syndicated research reports, customized research reports and consulting services. Delvens qualitative and quantitative data is highly utilized by each level from niche to major markets, serving more than 1K prominent companies by assuring to provide the information on country, regional and global business environment. We have a database for more than 45 industries in more than 115+ major countries globally.

Delvens database assists the clients by providing in-depth information in crucial business decisions. Delvens offers significant facts and figures across various industries namely Healthcare, IT & Telecom, Chemicals & Materials, Semiconductor & Electronics, Energy, Pharmaceutical, Consumer Goods & Services, Food & Beverages. Our company provides an exhaustive and comprehensive understanding of the business environment.

Contact Us:

UNIT NO. 2126, TOWER B,

21ST FLOOR ALPHATHUM

SECTOR 90 NOIDA 201305, IN

+44-20-8638-5055

0 notes

Text

Biocomposites Market Assessment and Key Insights Analyzed from 2022 - 2032

Over the forecast period, the global biocomposites market is predicted to increase at an exponential rate of 16%. Valued at US$ 25 Bn in 2021, the biocomposites market is anticipated to reach US$ 128 Bn by 2032.

The increased research and development efforts for composite materials and biocomposite uses and benefits such as recyclability, lightweight, and cost-effectiveness are driving this trend. In addition, due to the harmful nature of synthetic materials, recycling challenges, and toxic residues, the biocomposites market size will continue to expand throughout the predicted timetable.

As per the biocomposites market report, Germany, the United States, and Japan are among the developed countries working on boosting the usage of ecologically friendly items rather than petroleum-based products.

Get a Sample Copy of this Report @ https://www.futuremarketinsights.com/reports/sample/rep-gb-14293

The European Union (EU) has favored such items over the United States and Japanese governments. It requires the use of bio-based materials, encourages the recyclability of vehicle components, and holds automakers accountable for disposal at the end of the vehicle’s service life. These laws are likely to boost demand for biocomposites in various end-use industries, including transportation, construction, and electrical and electronics.

The power necessary to make biocomposites is far lower than that critical to making glass fiber composites or carbon fiber composites. On the other hand, Biocomposites are more expensive than glass fiber composites. However, price reductions are prospects due to economies of scale and common biocomposites applications.

COVID-19 has had a detrimental impact on sales of biocomposites due to a drop in demand from numerous end-use sectors. Being one of the largest users of biocomposites, building and construction have seen the worst and most immediate effects of the epidemic. The building industry has been hit the worst. This has had a negative biocomposites market outlook.

Advancing at a CAGR of 16%, the biocomposites market size is expected to reach US$ 51 Bn by 2026.

Key Takeaways

The hybrid composites product section captured the largest market size in the global biocomposites market, owing to increased biocomposites applications around the world. Its substantial market share is credited with the optimum fiber adhesion that leads to decreased moisture content, high strength, and structural capacity.

As per the biocomposites adoption trends, they are predicted to be the dominant market in the Asia Pacific. Over the projected period, it is also anticipated to be the fastest regional market.

The requirement for synthetic polymer biocomposites had decreased in 2020 because of the COVID-19 pandemic. As global end-use industries found a stable footing by the fourth quarter of 2020, demand for biocomposites also showed signs of recovery.

The market for biocomposites is dominated by the building and construction industry.

Wood fiber composites have the biggest market share in volume in the global biocomposites industry.

“The need for biocomposites is increasing in the building and construction, transportation, consumer goods, and other end-use industries. However, as a result of COVID-19, sales in various industries have decreased, reducing demand for biocomposites.”—opines an FMI analyst.

Get more Information on this Report @ https://www.futuremarketinsights.com/reports/biocomposites-market

Competitive Landscape

To gain a foothold in the biocomposites market opportunities, the key companies in the industry are pursuing a variety of inorganic and organic techniques.

Biocomposites, an international medical device company that produces and manufactures leading products for bone and soft tissue infection management, announced today that its STMULAN products are, vancomycin, gentamycin, and tobramycin, have received new Canadian approval for the mixing of antibiotics with them.

0 notes

Text

Bamboo Apparel Market Analysis, Insight, Report 2022-2028

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimates the global bamboo apparel market size at USD 1.96 billion in 2022. During the forecast period between 2023 and 2029, BlueWeave expects global bamboo apparel market size to grow at a steady CAGR of 7.7% reaching a value of USD 3.24 billion by 2029. Major factors for the expansion of global bamboo apparel market include a growing awareness among the consumers about environment-friendly products, including bamboo apparels, and their benefits and a favorable trend towards sustainable products made from renewable sources. However, disruptions in global supply chains caused by the impact of COVID-19 pandemic are anticipated to limit the growth of global bamboo apparel market during the period in analysis.

Global Bamboo Apparel Market – Overview

Bamboo is a wood or grass majorly found and grown in tropical and temperate regions, majorly in East Asian countries. Bamboo has hollow stems. Natural cellulosic polymer extracted from bamboo is a semi-synthetic textile, called bamboo fabric. Bamboo fabric is used for various applications, such as clothing fabrics. Bamboo fabric or bamboo rayon has various favorable characteristics, as it is soft, comfortable, lightweight, breathable, and moisture absorbent. Moreover, the cost of bamboo fabric is significantly low. Apparel producers use bamboo fiber for various types of products, including t-shirts, undergarments, bathrobes, towels, socks, and other apparels, such as bed sheets and mattresses.

Request for Sample Report @ https://www.blueweaveconsulting.com/report/bamboo-apparel-market/report-sample

Opportunity: Growing sustainable fashion trend to spur demand for bamboo fabric

The global fashion market for natural or plant fiber products is expanding primarily, because of rising environmental concerns and the consequent rise in the demand for plant-based materials. Natural fibers extracted from the extracts of cotton, bamboo, hemp, and other plants. When compared to products made from synthetic fibers, the use of these plant fibers can reduce carbon footprint considerably. Fibers from bamboo cost significantly low when compared with that of cotton. Bamboo fibers have various advantages, including high breathable quality, moisture-wicking and heat retention abilities, and stretchability. Pure bamboo fabric made in the mechanical process is up to 100% recyclable. All these favorable factors are expected to fuel the expansion of global bamboo apparel market. Another factor driving market growth is the expanding use of bamboo fiber in the global textile and fashion industries. Bamboo rayon, bamboo yarn, retting, and bamboo linen are being used to manufacture apparels and other clothing, and household textiles.

Impact of COVID-19 on Global Bamboo Apparel Market

Covid-19 had a detrimental effect on global bamboo apparel market, due to lockdowns in several countries as well as the closure of several manufacturing firms. Among those majorly affected were the textile and apparel industries. Industrial usage decreased, with the exception of industries that offer crucial services, as a direct effect of the closure of production unit. The global closure of manufacturing facilities during the early stages of the pandemic hurt the bamboo apparel market. Small and medium-sized enterprises (SMEs) recorded a sharp decline in their operations and the growth in revenues and profit due to the pandemic. The restricted movement of people and goods because of the lockdown measures put in place during the early stages of the pandemic's spread also had a negative impact on the global bamboo apparel market. However, during the post COVID-19 pandemic period, the global market for bamboo apparel is expected to grow at a significant growth rate as bamboo apparels provide significant benefits to the consumers.

Segmental Information

Global Bamboo Apparel Market - By Consumer Orientation

Global bamboo apparel market by consumer orientation is segmented into men, women, and kids. The men segment leads the global bamboo apparel market by orientation, due to the large online presence of males across the countries. However, the women segment is expected to grow at the highest CAGR during the forecast period, due to females’ increasing presence in the workforce and online.

Regional Coverage

Geographically, global bamboo apparel market covers five major regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa. APAC dominates the global bamboo apparel market in 2022 and is expected to maintain its leadership position in the market during the forecast period. Bamboo holds a significant place in the Chinese culture and China is home to many large producers and exporters of bamboo fabric and apparels. Other major countries in bamboo apparel market, such as India, is also part of APAC. Meanwhile, the regional market in North America is expected to grow at the fastest rate, due to an increasing demand for bamboo apparels from the US.

Competitive Landscape

Major players operating in global bamboo apparel market include China Bambro Textile Co, Ltd., Bamboo Textile Co., Advantage Fibres, Wild Fibres, China Thrive Industrial Co., Towel Industrial Co. Ltd., Xiamen Ebei import & Export Co. Ltd., Boody Bamboo Clothing, Cozy Earth, Cariloha, Inc., BLUE BUNGALOW, Free Fly Apparel, Ettitude Holdings, Inc., and Thought Clothing. To further enhance their market share, these companies employ various strategies, including mergers and acquisitions, partnerships, joint ventures, license agreements, and new product launches.

Contact Us:

BlueWeave Research Blog

Phone No: +1 866 658 6826

Email: [email protected]

0 notes

Text

Recycled PET Market to Gain a CAGR of 7.05% During 2022-2028

Triton Market Research presents the Global Recycled Polyethylene Terephthalate Market report sectioned by Product (Colored, Clear), Application (Sheet & Film, Strapping, Fiber, Food and Beverage Bottles & Container, Non-Food Bottles & Containers, Other Applications), and Regional Outlook (North America, Asia-Pacific, Middle East and Africa, Latin America, Europe). The report further discusses the Market Summary, Industry Outlook, Impact of COVID-19, Key Insights, Porter’s Five Forces Analysis, Market Attractiveness Index, Vendor Scorecard, Regulatory Framework, Key Market Strategies, Drivers, Challenge, Opportunity, Competitive Landscape, Research Methodology & Scope, Global Market Size, Forecasts & Analysis (2022-2028).

Based on Triton’s research report, the global recycled polyethylene terephthalate market is anticipated to advance with a CAGR of 7.05% during the forecast period 2022-2028.

Request Free sample report:

https://www.tritonmarketresearch.com/reports/recycled-polyethylene-terephthalate-market#request-free-sample

Recycled polyethylene terephthalate (r-PET) refers to a sustainable recycled plastic that has gained prominence over conventional plastic in reducing carbon emissions.

The market’s growth is supported by factors such as rising awareness about sustainability and government restrictions on landfills. Several developed countries, including Germany, the Netherlands, France, and the United States, have implemented landfill bands. These bans have reduced garbage disposals, such as lumber, liquid wastes, and packaging.

On the contrary, the emission of toxic pollutants during the recycling process is anticipated to restrict the development of the recycled polyethylene terephthalate market.

Globally, the Asia-Pacific dominates in the recycled PET market. The region’s robust growth can be attributed to the availability of skilled labor at low cost and land. Moreover, the shift in the production landscape towards China and India is anticipated to drive the studied market’s growth. Further, expanding industries, such as construction, automotive, and electronics, present vast potential for rPET manufacturers. The major factor supporting rPET demand is the rising demand for food and non-food bottles for various applications. Therefore, as stated above, these factors are widening the scope and growth of the recycled polyethylene terephthalate market.

The notable companies in the recycled PET market are Biffa, Clear Path Recycling LLC, Far Eastern New Century Corporation, Phoenix Technologies, Carbonlite Industries, DuFor, Evergreen Plastics Inc, Indorama Ventures Public Ltd, Libolon, Placon, PolyQuest, Portage Plastics, Ultrepet, Plastipak Holdings Inc, and Zhejiang Anshun Pettechs Fibre Co Ltd.

Scrap plastic PET bottles and containers are the major raw materials employed for the production of recycled PET. In this regard, the easy availability of post-consumer PET bottles is a major factor supporting the market’s growth. Moreover, the high recyclability ratio of polyethylene terephthalate is anticipated to propel recycled PET production across Europe and North America.

Contact Us:

Phone: +44 7441 911839

#Recycled Polyethylene Terephthalate Market#r-PET Market#consumer goods industry#packaging industry#market research reports#triton market research

0 notes

Text

Global Composites Market is expected to record a positive CAGR of ~8% during the forecast period 2022-2028: Ken Research

Buy Now

A composite is created from two or more constituent materials. These constituent materials are combined to produce a substance with characteristics that are distinct from the constituent parts despite having chemical or physical qualities that are noticeably different. Composites are being increasingly adopted in different industries including electrical & electronics, automotive & transportation, wind energy, aerospace & defense, construction & infrastructure, and others.

According to Ken Research Analysis, the Global Composites Market is expected to record a positive CAGR of ~8% during the forecast period (2022-2028) and is expected to reach approximately US$ 120 billion by 2028.

The desirable performance of composites as well as the high adoption of composites in various end-user industries owing to their properties is positively impacting the market growth.

Customers' needs for a wide range of intricately engineered parts, design patterns, and structures are met through the use of composite materials. The product supports several sectors, including wind power, consumer goods, automotive, aerospace, and the maritime sector. Different materials are used in a variety of ways by these businesses. Regulations, consumer demand, cost criteria, and part performance requirements all influence this usage. For instance, there are significant differences between the materials, costs, and process technology used in the aerospace sector and the car industry. Due to their diversity, these materials can satisfy this wide range of demands. For instance, there are resins, a variety of fibers, equipment, process, and finishing options that can be used to fabricate almost any item for any application.

Concerns about improper disposal and recycling of composite products as well as the high production cost of composites limit the market growth.

Composites recycling and disposal raise problems that need to be resolved. One such problem relates to carbon fiber composites used in hexavalent chromium primer-coated end-of-life aircraft structures. Due to the possibility of the hexavalent chromium in these composites seeping into the ground, they may be categorized as hazardous waste and cannot be disposed of on land.

The COVID-19 outbreak had a huge impact on supply chains since key economies had to halt commerce. Additionally, the demand for composites had decreased across a range of end-use industries, including aerospace, automotive, and construction. However, the situation improved in 2021 due to the removal of trade barriers, which restored the market's growth trajectory.

Key Trends by Market Segment

By Fiber Type: The carbon fiber composites segment held the largest Market share in the Global Composites Market in 2021.

Carbon atoms are bonded in parallel crystals to create carbon fiber, which is then combined with other materials to create composites. Due to their beneficial characteristics, including high stiffness, low thermal expansion, good chemical resistance, high-temperature tolerance, and low weight, these fibers are used in industrial and manufacturing applications.

The strength and endurance of these Composites have been improved due to technical improvements, which have expanded their penetration in pipe production applications. The market is expected to be supported throughout the forecast period by rising demand for high-strength materials in the automotive and aerospace sectors.

By Resin Type: The thermoset composites resin type segment held the largest share of the Global Composites Market in 2021.

The significant growth in demand for thermoset composites in sectors of aerospace, transportation, and defense is boosting the market growth. Glass, carbon, and aramid fibers are the usual building blocks of thermoset composite, which is frequently mixed with resins such as epoxies, phenolics, vinyl esters, polyesters, cyanate esters, and polyimides.

By End-User: The automotive & transportation end-user segment held the largest share of the Global Composites Market in 2021.

Over the foreseeable term, this market segment is likely going to continue to lead. The transportation industry benefits from composites since the components are much lighter in weight, increasing fuel economy.

It is anticipated that rising consumer and industry demand for high-tech electronics would increase demand for composite materials. Terminal boxes, electrical enclosures, lamp housings, sockets, plugs, and parts for the distribution of energy are some of the electrical and electronics applications for composites that are most frequently used.

By Manufacturing Process: The layup process segment held the largest share of the Global Composites Market in 2021.

The layup method dominated the market and generated a sizeable portion of revenue when it came to the production of composites. Over the course of the forecast period, rising production of boats, wind turbine blades, and architectural moldings are anticipated to propel the growth of the layup process sector in the worldwide composites market.

Over the course of the projection period, rising output in the automotive and marine industries is anticipated to provide growth chances for the filament winding process. Golf club shafts, car drive shafts, tiny aircraft fuselages, spaceship structures, pressure vessels like firefighter oxygen canisters, and other products have all been made possible by improvements in the filament winding process.

Request for Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MTA5

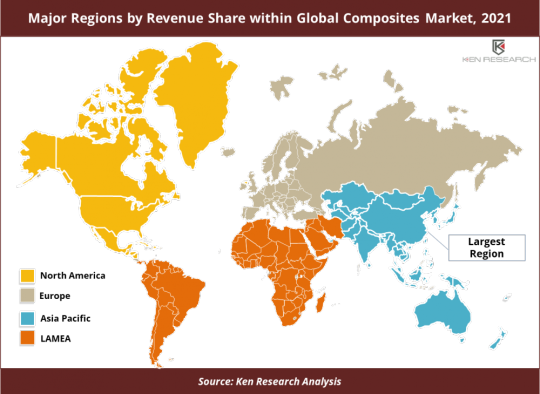

By Geography: Asia Pacific accounted for the largest market share in 2021 within the total Global Composites Market.

Historically, Japan, North America, and Europe dominated the glass fiber and carbon fiber composites market. However, there has been a noticeable trend in recent years toward the developing economies in Asia Pacific and the rest of the world.

For instance, the significant demand for low-cost carriers has raised the market for glass fiber and carbon fiber composites in the aircraft, wind energy, and transportation sectors in rising nations like India, Brazil, and China. China, whose rapid industrialization is anticipated to meet the growth in demand, has started several research projects involving glass fiber and carbon fiber composites.

Competitive Landscape

The Global Composites Market is highly competitive with ~500 players which include globally diversified players, regional players as well as a large number of country-niche players.

Large global players hold the highest market share of 45% which is followed by the regional players holding a 30% share. Some of the major players in the market include Huntsman Corporation LLC, SGL Group, Teijin Ltd., CooperVision, DuPont, Owens Corning, Toray Industries, Inc., Mitsubishi Chemical Holdings Corporation, Solvay, Exel Group, DOW, and others.

Recent Developments Related to Major and Emerging Companies

In September 2019, Solvay, at its USA facility in Anaheim, California, increased its capacity for thermoplastic composites by adding a new production line for meeting the strong demand growth from aerospace customers for this high-performance material and Solvay's proprietary and distinctive technology.

In July 2021, Hexcel, a leader in advanced composites technology, reported that a lightweight camera drone it built utilizing Hexcel HexPly carbon fiber prepregs completed its first flight. A group of students from the University of Applied Sciences Upper Austria in Wels created the composite drone using components provided by Hexcel Neumarkt in Austria.

In September 2019, the acquisition of Ashland Global Holdings Inc.'s composites business by INEOS Enterprises had been announced. A BDO office in Germany is also part of the acquisition. The companies involved in the transaction generate more than US$1.1 billion in annual sales. Over 19 locations in Europe, North and South America, Asia, and the Middle East, have 1,250 employees.

Key Topics Covered in the Report

Snapshot of the Global Composites Market

Industry Value Chain and Ecosystem Analysis

Market size and Segmentation of the Global Composites Market

Historic Growth of the Overall Global Composites Market and Segments

Competition Scenario of the Market and Key Developments of Competitors

Porter’s 5 Forces Analysis of the Global Composites Market

Overview, Product Offerings, and SWOT Analysis of Key Competitors

COVID-19 Impact on the Overall Global Composites Market

Future Market Forecast and Growth Rates of the Total Global Composites Market and by Segments

Market Size of Fiber Type / End User Segments with Historical CAGR and Future Forecasts

Analysis of the Composites Market in Major Regions

Major Production / Consumption Hubs in the Major Regions

Major Country-wise Historic and Future Market Growth Rates of the Total Market and Segments

Overview of Notable Emerging Competitor Companies within Each Major Country

For more insights on the market intelligence, refer to the link below: –

3 Key Insights on US$ 120 Bn Opportunity in the Global Composites Market: Ken Research

0 notes

Text

According to the new market research report "Recycled Carbon Fiber Market by Type (Chopped Recycled Carbon Fiber, Milled Recycled Carbon Fiber), Source (Aerospace Scrap, Automotive Scrap), End-use Industry and Region (North America, Europe, APAC, MEA and Latin America) - Global Forecast to 2026”, the global Recycled Carbon Fiber Market size is projected to grow from USD 126 million in 2021 to USD 222 million by 2026, at a CAGR of 12.0% during the forecast period. The recycled carbon fiber market is growing due to the rise in the demand for cost-effective and high-performance materials, and stringent government regulations globally.

The growth of the recycled carbon fiber market in the Asia Pacific is driven by the increasing consumption in the wind energy, construction & infrastructure, aerospace & defense, consumer goods, automotive & transportation, and industrial sectors. The market in these end-use segments is led by China, Japan, and South Korea, and other countries. Due to continuous technological advancements, the demand for lightweight and high-strength materials is increasing. The high economic growth in these countries, along with high urbanization, industrialization, and increased standards of living also play a crucial role in the adoption of fuel-efficient, cost reducing machinery, thus promoting the need for fuel-efficient automobiles as well.

Some of the key players in the global recycled carbon fiber market are Toray Industries Inc. (Japan), ELG Carbon Fibre Ltd. (UK), SGL Carbon (Germany), Karborek Recycling Carbon Fibers (Italy), Carbon Conversions Inc. (US), Carbon Fiber Recycling, Inc. (US), Shocker Composites LLC. (US), Procotex Corporation SA (Belgium), Alpha Recyclage Composites (France), Carbon Fiber Remanufacturing (US), and Vartega Inc. (US).

#Recycled Carbon Fiber Market#Recycled Carbon Fiber#Covid 19 Impact on Recycled Carbon Fiber Market#Recycled Carbon Fiber Market Share#Recycled Carbon Fiber Market Growth#Recycled Carbon Fiber Market Forecast#Recycled Carbon Fiber Market Size#Recycled Carbon Fiber Demand#Recycled Carbon Fiber sales

0 notes

Text

Recycled Carbon Fiber Market Growth, Overview with Detailed Analysis 2022-2028

Recycled Carbon Fiber Market Growth, Overview with Detailed Analysis 2022-2028

The Recycled Carbon Fiber Market research report 2022-2030 provides an in-depth analysis of the changing trends, opportunities, and challenges influencing the growth over the next decade. The study includes a detailed summary of each market along with data related to demand, supply and distribution. The report examines Recycled Carbon Fiber market growth strategies adopted by leading…

View On WordPress

#Covid-19 Impact Analysis#Recycled Carbon Fiber#Recycled Carbon Fiber forecast#Recycled Carbon Fiber Industry#Recycled Carbon Fiber Market#Recycled Carbon Fiber price#Recycled Carbon Fiber report#Recycled Carbon Fiber research#Recycled Carbon Fiber share#Recycled Carbon Fiber trends

0 notes

Text

Airships Carbon Fiber Reinforced Polymer Market to Scale New Heights as Market Players Focus on Innovations 2022 – 2027

Latest business intelligence report released on Global Airships Carbon Fiber Reinforced Polymer Market, covers different industry elements and growth inclinations that helps in predicting market forecast. The report allows complete assessment of current and future scenario scaling top to bottom investigation about the market size, % share of key and emerging segment, major development, and technological advancements. Also, the statistical survey elaborates detailed commentary on changing market dynamics that includes market growth drivers, roadblocks and challenges, future opportunities, and influencing trends to better understand Airships Carbon Fiber Reinforced Polymer market outlook.

List of Key Players Profiled in the study includes market overview, business strategies, financials, Development activities, Market Share and SWOT analysis are Toray Industries, Inc. (Japan),Mitsubishi Chemical Holdings (Japan),Hexcel Corporation (United States),Teijin Limited (Japan),SGL Group (Germany),Solvay (Belgium),Hyosung (South Korea),AKSA (Turkey),Crosby Composites (United Kingdom),Cytec (United States)