#Corporate debt

Explore tagged Tumblr posts

Text

Finding Convertible Debt Disclosures

Today we want to pull on a thread mentioned in our last blog post about corporate debt, where a Barron’s article had cited Calcbench research and noted that “smaller companies are more likely to issue convertible debt” as a way to avoid higher interest expenses.

Well, convertible debt seems to be our first financial fad of 2024, since the Financial Times also just ran an article about how “U.S. companies have been piling into the market for convertible bonds as they search for ways to keep their interest costs down.”

So today we offer a refresher course on what companies disclose about convertible debt that they issue, and how you can research such disclosures on Calcbench.

Convertible debt is a bond or some similar note that can be swapped for company shares when the company’s stock price hits an agreed-upon level. Typically this debt carries a lower interest rate than standard debt, so it’s a way for companies raising debt to keep their interest expense low. That feature can be mighty attractive these days, as so many companies are refinancing low-interest rate loans issued in the 2010s at today’s much higher rates.

OK, enough of the abstract stuff. How do you find the gritty details in Calcbench?

As usual, one good place to start is the Multi-Company Page. Here you can find amounts of convertible debt disclosed by one or more companies that you follow; simply identify the peer group you want to research and type “convertible debt” into our Standard Metrics field.

We pulled up convertible debt disclosed by non-financial companies with annual revenue of at least $100 million, then sorted from largest amount to smallest. The result is Figure 1, below.

As you can see, many of the largest issuers of convertible debt tend to be tech companies (and often life sciences companies too) that need lots of cash to fund high-growth expansions.

An Example of Convertible Debt Details

We randomly selected Akamai Technologies ($AKAM), which reported $2.28 billion in convertible debt at the end of 2022, and used our Interactive Disclosure tool to research where that $2.28 billion figure came from. Digging into the Debt footnote disclosure from Akamai’s 2022 10-K report, we found that Akamai issued two tranches of convertible debt in recent years.

First was $1.15 billion of convertible senior notes issued in 2018 and due in 2025. The notes have an interest rate of 0.125 percent (wow), and each $1,000 of principal can be converted into 10.515 shares of Akamai, which is equivalent to a conversion price of roughly $95.10 per share.

Now we get to the important part. Under what circumstances can debt holders convert their notes into Akamai shares at that $95.10 conversion price? Because if those circumstances come to pass and the debt holders exercise their conversion rights, that could dilute the value of shares owned by others.

That’s something a financial analyst should want to know. If you own shares in Company A and it issues lots of convertible debt, you want to know the conditions upon which debt holders can convert the debt into equity — and then build models and alerts to track those circumstances, so a dilution event won’t catch you by surprise.

Thankfully, the footnote disclosures describe those conversion situations in detail. Let’s just excerpt straight from the 10-K:

At their option, holders may convert their 2025 Notes prior to the close of business on the business day immediately preceding January 1, 2025, only under the following circumstances: During any calendar quarter commencing after the calendar quarter ended June 30, 2018 (and only during such calendar quarter), if the last reported sale price of the Company's common stock for at least 20 trading days (whether or not consecutive) during the period of 30 consecutive trading days ending on, and including, the last trading day of the immediately preceding calendar quarter is greater than or equal to 130% of the conversion price on each applicable trading day; During the five business day period after any five consecutive trading day period in which the trading price per $1,000 principal amount of 2025 Notes for each trading day of the measurement period was less than 98% of the product of the last reported sale price of the Company's common stock and the conversion rate on each such trading day. On or after January 1, 2025, holders may convert all or any portion of their 2025 Notes at any time prior to the close of business on the second scheduled trading day immediately preceding the maturity date, regardless of the foregoing circumstances.

We should add that Akamai issued another $1.15 billion in convertible notes in 2019, payable in 2027 and carrying an interest rate of 0.375 percent. Each $1,000 of principal for those notes can be converted into 8.607 shares, which is roughly $116.18 per share. Akamai’s footnotes then list the various circumstances where holders of this debt can convert their holdings into shares.

For the record, Akamai’s share price in May 2018 (when the first round of convertible debt was issued) was roughly $76 per share. In August 2019 (when the second round was issued) the share price was around $87 per share.

The question for debt buyers at the time (2018 and 2019) was whether they believed Akamai shares would trade higher than the conversion prices ($95 and $116, respectively) by the time 2025 and 2027 roll around. If so, then maybe it’s worth putting up with those ultra-low interest rate payments in exchange for a great conversion price in another few years.

As of this week, Akamai shares were around $115.

Go forth and research

Of course, many more companies carry convertible debt too, with a wide range of conversion prices and scenarios. We only picked Akamai as one example to show you the research that’s possible.

There’s lots more out there! As always, Calcbench has the data.

1 note

·

View note

Text

The next corporate debt crisis

How dangerous is higher for longer?

https://www.ft.com/content/defdecff-c3d6-4f55-be88-3e051918b6a0 via @ft #ennovance

0 notes

Text

What is Corporate Debt Restructuring and How Does It Work?

Corporate debt restructuring is when a company that has taken on too much debt tries to reduce the amount it owes by changing the terms of the loans it has taken. This can involve negotiating with lenders to get better repayment terms, like lower interest rates or longer repayment periods, or even cancelling some of the debt altogether. The goal is to help the company get back on its feet financially so that it can continue to operate and pay its bills. It is like when you owe your friend some money, but you can't pay it all back right away, so you talk to your friend and work out a new plan to pay back the money over a longer period of time that is easier for you to manage.

Understanding Corporate Debt Restructuring

Corporate debt restructuring is when a company changes the terms of its existing debts to make it easier to repay. This is done by negotiating with creditors to reduce the amount of money owed, extend the repayment period, or reduce the interest rate. The goal is to help the company reduce its financial burden and avoid bankruptcy. It can involve forgiving some of the debt, converting some of the debt into equity in the company, or extending the repayment period. The process requires careful negotiation and planning and can help companies overcome financial difficulties and continue operating successfully.

Understanding Corporate Debt: Key Takeaway points

Here are some key takeaways regarding corporate debt restructuring:

Corporate debt restructuring is a process of renegotiating the terms of a company's debts to make it easier to repay.

The goal of corporate debt restructuring is to help the company reduce its financial burden and avoid bankruptcy.

Corporate debt restructuring may involve forgiving some of the debt, converting some of the debt into equity in the company, or extending the repayment period.

The process of corporate debt restructuring requires careful negotiation and planning, and may involve the assistance of financial professionals.

Corporate debt restructuring can be an effective way for companies to overcome financial difficulties and continue operating successfully. However, it is not always the best option, and bankruptcy may be necessary in some cases.

Corporate Debt Restructuring: Conclusion

Corporate Debt Restructuring is an important process that allows companies to reorganize their financial obligations and improve their cash flows. It is an alternative to bankruptcy that enables companies to negotiate with their creditors and arrive at a mutually beneficial solution.

Through the CDR mechanism, companies can prepare a restructuring plan that includes measures such as debt rescheduling, debt conversion, and equity infusion. This helps to ease the financial burden and improve the company's financial health.

However, the success of Corporate Debt Restructuring largely depends on various factors such as the company's financial position, market conditions, and creditor cooperation. It is crucial for companies to have a sustainable business model and a comprehensive restructuring plan to ensure long-term viability.

Overall, Corporate Debt Restructuring is a complex process that requires specialized expertise and experience. It is important for companies to work with professionals who can provide the necessary guidance and support to navigate the process successfully.

Corporate Debt Restructuring: An example from India

One of the prominent examples of Corporate Debt Restructuring in India is the case of the airline company, Jet Airways. In 2019, Jet Airways was facing severe financial troubles due to high debt, increased competition, and rising fuel prices. The company was unable to pay its debt and salaries to employees, and its operations had come to a halt.

As a result, the company approached its lenders for debt restructuring under the CDR mechanism. The lenders formed a Joint Lenders' Forum (JLF) and worked with Jet Airways to restructure its debt by converting a portion of its debt into equity and providing additional funding.

However, despite the efforts, Jet Airways was unable to revive its operations and went into bankruptcy in 2019. The case highlights the importance of timely debt restructuring and the need for a sustainable and viable business model to avoid bankruptcy.

Corporate Debt: Libord Advisors Finest service

Libord has extensive experience in the area of Corporate Debt Restructuring (CDR) and offers specialized services to clients at different stages of the CDR Scheme. We at Libord can prepare reports, restructuring schemes, and provide justification for considering cases under CDR. We are having knowledge about RBI guidelines and can carry out financial analysis to determine important ratios such as ROCE, DSCR, IRR, Cost of Finance, and others. Libord can also assess the viability of projects and make profitability projections, as well as provide details of the reliefs and concessions that may be available from various institutions and banks. Additionally, we can also carry out asset valuation to help with restructuring plans.

0 notes

Text

China’s Power in Emerging Markets Creates Headache for Global Investors

Markets Concentration of Chinese stocks and bonds in major benchmarks sparks concern Source link

View On WordPress

#bond markets#C&E Exclusion Filter#commodity#Commodity/Financial Market News#Content Types#corporate debt#Corporate Debt/Bond Markets#debt#Debt/Bond Markets#economic news#economic performance#Economic Performance/Indicators#Factiva Filters#financial market news#indicators#synd#WSJ-PRO-WSJ.com

0 notes

Text

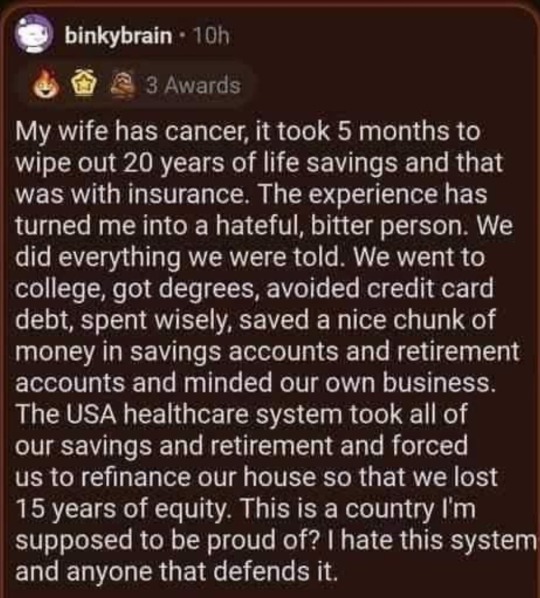

#private healthcare#for profit healthcare#corporate greed#ceo greed#corporations and oligarchs are killing us#medical debt#medical bankruptcy#republican assholes#maga morons#oligarchs control the Republican Party

448 notes

·

View notes

Text

Flight into Adani stocks, bonds will continue; Conglomerate trades barbs with short sellers

markets India’s Adani Group issues a 413-page response to Hindenburg Research’s allegations Source link

View On WordPress

#512599.BY#541450.BY#542066.BY#acquisitions#Acquisitions/Mergers/Participations#Adani company#Adani Green Energy#Adani total gas#Business/Consumer Services#C&E Executive News Filter#company#consumer services#Content Types#corporate actions#corporate crime#Corporate Crime/Legal Action#Corporate Debt#corporate finance#Corporate/Industry News#crime#Crime/Legal Action#Diversified holding companies#Factiva filter#Gautam Adani#general news#holdings#IN:512599#IN:541450#IN:542066#industrial news

0 notes

Text

#Marjorie Nazi Greene#ceo shooter#private healthcare#for profit healthcare#medical debt#medical bankruptcy#class war#culture war#republican assholes#maga morons#corporate greed#ceo greed#oligarchs own the Republicans#oligarch CEOs are killing us

362 notes

·

View notes

Text

a short story of becoming a med student

Mom: are you sure about this?

Baby Me: money doesn't matter bc I'm gonna heal people.

Adult Me, facing a 1/2 million dollar U.S. student loan debt: *Alexa playing Bohemian Rhapsody by Queen in the background.* MAMAAAAA ~OOoooOOOHHH, didn't mean to make you cryyyyyy 😭

#If you know then you know#I knew it was expensive but darn not this expensive#inflation and corporate greed made it so much worse#I wrote out hopes and dreams in my personal statements only to be slammed into reality by capitalism in the end#just realizing why some docs are portrayed like a*holes bc wow I'd be grumpy too if I'm in that much debt#you may wonder what kind of education you're getting for ~90K tuition/year and think oh maybe all books and tests and kits are accounted fo#but no it's just the price of being taught in a building by teachers or in some cases zoom/videos after which you'd relearn via youtube#Yet somehow teachers are seemingly being underpaid and extra expenses is all on you so where is the money going??#People keep telling me I'd make it up as soon as I get a salary#but idk if they fully grasp the possibility of starting at 500K in debt with a loan that compounds DAILY#I refuse to let this defeat me and my dreams darn it but the U.S. education system is so f*ked up#mine#Sorry guys but I just needed to vent before starting a scholarships search and tuition probably goes to more things than just that#medblr

18 notes

·

View notes

Text

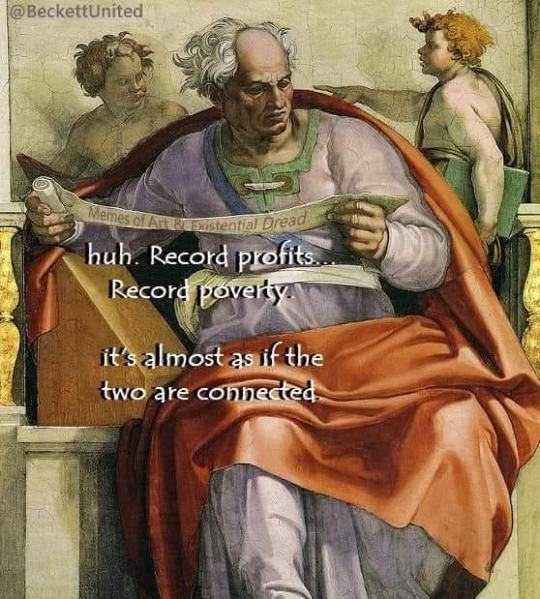

#us politics#republicans#conservatives#donald trump#gop#trump administration#economics#economy#unemployment rate#tax breaks#public debt#health insurance#gun production#culture wars#corporate profits#economic turmoil#2024 elections#memes

82 notes

·

View notes

Text

I wanted to take a neutral approach to the Tower deal and I love that this is the only option available. Of course Hiram has 10000 moon pearls casually laying around, he's ready to solve everyone's problems.

#zero corporate debt zero tracklayers' displeasure and 10000 moon pearls#this is why virginia keeps him around#fallen london#hiram hargrave

13 notes

·

View notes

Text

I was looking through the Estival Items guide since i got me my yearly allowance of a whopping 30 summer moneys

and just saw this lmfao

runner ups for other funny quotes on the page

#fallen london#yeah just toss a rubbery man like a boomerang#ignore corporate debt and throw rich people#i know it's not what it means but i feel like it's funnier that way#hellworm gacha though#i love the wiki

7 notes

·

View notes

Text

2024 Debt Refinancings, Here We Come!

Happy New Year, dedicated Calcbench users. We begin 2024 with another look at what might be the most perilous financial issue of the year to come: refinancing of corporate debt at higher interest rates.

The latest analysis comes from Barron’s, which last week reviewed debt levels among the S&P 500 and speculated on whether higher interest rate costs will lead to widespread layoffs in the corporate world. (Spoiler: no, for various economic reasons.) Barron’s cited previous Calcbench research looking at 55 non-financial firms in the S&P 500, who collectively have $105 billion coming due this year with an average interest rate of 2.75 percent.

The odds that those 55 firms will be able to refinance their debt at those sub-3 percent levels are slim. They’ll need to either repay that debt, which would be a hit to cash holdings; or refinance the debt at today’s higher rates, which will drive up operating costs and potentially squeeze net income.

How companies avoid the refinance trap will be a dominant question in financial analysis for at least the first half of 2024 — but it is not a new question. Indeed, Calcbench first explored the refinancing trap one year ago, with a five-part series on who owed how much to whom, and at what rates.

We won’t recap that whole series here, but we did want to call out one specific post about where to find debt disclosures in the Calcbench data archives.

If you want data from a group of companies, one place to start is our Multi-Company page. First, select the group of companies you want to research. (We have an entire post dedicated to creating a peer group if you need a refresher.) Once that group is set, you can choose from any number of debt-related disclosures we include in our Standardized Metrics field on the left-hand side. Those disclosures include:

Total debt

Short-, long-, and medium-term debt

Floating-rate debt

Debt-to-equity ratio

Interest payable

Interest expense

For one specific company, you can use the Company-in-Detail page, you can research what the company reports on the income statement and the balance sheet. This approach is somewhat hit or miss, because not all companies report interest expenses on the income statement — although all companies do report debt on the balance sheet. You can then trace the disclosures for the company you follow and see what it reports in the footnotes.

You can also get a global sense of a company’s debt disclosures using our Segments, Rollfowards & Breakouts page. Start by selecting the specific company you want to research. Then select “Debt Instruments” from the pull-down menu of dataset options on the left side of the screen. Be warned, you’re likely to get lots of data in the results!

Calcbench will, of course, keep studying debt disclosures throughout 2024. Drop us a line at [email protected] and let us know what else we should be studying for you!

0 notes

Text

Markets Ignore the Looming Debt Peril

@wsj

With rates still rising, the economy will be held back by the need to shore up highly indebted companies

https://www.wsj.com/articles/markets-ignore-the-looming-debt-peril-aac19b32?mod=mhp #bankruptcy #fed #qe #interestrates #inflation #investor #stimulous #investments #productivity #mbs #Leverage #debt #credit #loans #zombie

📌 https://twitter.com/mohossain/status/1676215929120628741?s=46&t=GtuOmoaTjOwevz2JidiiDQ

#corporate debt#credit#loans#mbs#privateequity#ennovance#chemicals#investor#economy#loan#debt#investors#equity#pe

0 notes

Text

Today, President Joe Biden signed the continuing resolution that will give lawmakers another week to finalize appropriations bills. Lawmakers will continue to hash out the legislation that will fund the government.

Republicans have been stalling the appropriations bills for months. In addition to inserting their own extremist cultural demands in the measures, they have demanded budget cuts to address the fact that the government spends far more money than it brings in.

As soon as Mike Johnson (R-LA) became House speaker, he called for a “debt commission” to address the growing budget deficit. This struck fear into the hearts of those eager to protect Social Security and Medicare, because when Johnson chaired the far-right Republican Study Committee in 2020, it called for cutting those popular programs by raising the age of eligibility, lowering cost-of-living adjustments, and reducing benefits for retirees whose annual income is higher than $85,000. Lawmakers don’t want to take on such unpopular proposals, so setting up a commission might be a workaround.

Last month, the House Budget Committee advanced legislation that would create such a commission. The chair of the House Budget Committee, Jodey C. Arrington (R-TX), told reporters that Speaker Johnson was “100% committed to this commission” and wanted to attach it to the final appropriations legislation for fiscal year 2024, the laws currently being hammered out.

Congress has not yet agreed to this proposed commission, and a recent Data for Progress poll showed that 70% of voters reject the idea of it.

This week, a new report from the Institute on Taxation and Economic Policy (ITEP), a nonprofit think tank that focuses on tax policy, suggested that the cost of tax cuts should be factored into any discussions about the budget deficit.

In 2017 the Trump tax cuts slashed the top corporate tax rate from 35% to 21% and reined in taxation for foreign profits. The ITEP report looked at the first five years the law was in effect. It concluded that in that time, most profitable corporations paid “considerably less” than 21% because of loopholes and special breaks the law either left in place or introduced.

From 2018 through 2022, 342 companies in the study paid an average effective income tax rate of just 14.1%. Nearly a quarter of those companies—87 of them—paid effective tax rates of under 10%. Fifty-five of them (16% of the 342 companies), including T-Mobile, DISH Network, Netflix, General Motors, AT&T, Bank of America, Citigroup, FedEx, Molson Coors, and Nike, paid effective tax rates of less than 5%.

Twenty-three corporations, all of them profitable, paid no federal tax over the five year period. One hundred and nine corporations paid no federal tax in at least one of the five years.

The Guardian’s Adam Lowenstein noted yesterday that several corporations that paid the lowest taxes are steered by chief executive officers who are leading advocates of “stakeholder capitalism.” This concept revises the idea that corporations should focus on the best interests of their shareholders to argue that corporations must also take care of the workers, suppliers, consumers, and communities affected by the corporation.

The idea that corporate leaders should take responsibility for the community rather than paying taxes to the government so the community can take care of itself is eerily reminiscent of the argument of late-nineteenth-century industrialists.

When Republicans invented national taxation to meet the extraordinary needs of the Civil War, they immediately instituted a progressive federal income tax because, as Representative Justin Smith Morrill (R-VT) said, “The weight [of taxation] must be distributed equally, not upon each man an equal amount, but a tax proportionate to his ability to pay.”

But the wartime income tax expired in 1872, and the rise of industry made a few men spectacularly wealthy. Quickly, those men came to believe they, rather than the government, should direct the country’s development.

In June 1889, steel magnate Andrew Carnegie published what became known as the “Gospel of Wealth” in the popular magazine North American Review. Carnegie explained that “great inequality…[and]...the concentration of business, industrial and commercial, in the hands of a few” were “not only beneficial, but essential to…future progress.” And, Carnegie asked, “What is the proper mode of administering wealth after the laws upon which civilization is founded have thrown it into the hands of the few?”

Rather than paying higher wages or contributing to a social safety net—which would “encourage the slothful, the drunken, the unworthy,” Carnegie wrote—the man of fortune should “consider all surplus revenues which come to him simply as trust funds, which he is called upon to administer…in the manner which, in his judgment, is best calculated to produce the most beneficial results for the community—the man of wealth thus becoming the mere trustee and agent for his poorer brethren, bringing to their service his superior wisdom, experience, and ability to administer, doing for them better than they would or could do for themselves.”

“[T]his wealth, passing through the hands of the few, can be made a much more potent force for the elevation of our race than if distributed in small sums to the people themselves,” Carnegie wrote. “Even the poorest can be made to see this, and to agree that great sums gathered by some of their fellow-citizens and spent for public purposes, from which the masses reap the principal benefit, are more valuable to them than if scattered among themselves in trifling amounts through the course of many years.”

Here in the present, Republicans want to extend the Trump tax cuts after their scheduled end in 2025, a plan that would cost $4 trillion over a decade even without the deeper cuts to the corporate tax rate Trump has called for if he is reelected. Biden has called for preserving the 2017 tax cuts only for those who make less than $400,000 a year and permitting the rest to expire. He has also called for higher taxes on the wealthy and corporations, which would generate more than $2 trillion.

Losing the revenue part of the budget equation and focusing only on spending cuts seems to reflect a society like the one the late-nineteenth-century industrialists embraced, in which a few wealthy leaders get to decide how to direct the nation’s wealth.

[LETTERS FROM AN AMERICAN: MARCH 1, 2024]

Heather Cox Richardson

+

“The crucial disadvantage of aggression, competitiveness, and skepticism as national characteristics is that these qualities cannot be turned off at five o'clock.” —Margaret Halsey, novelist (13 Feb 1910-1997)

#poverty#trickle down economics#corrupt GOP#Letters From An American#heather cox richardson#ecoomy#wealth#“debt commission”#corporations#Margaret Halsey#government for the people

13 notes

·

View notes

Text

so…somehow topaz is not only managing to embody “rampant capitalist” but also “insidious colonizer”???

like babe maybe try not launching an armed alien invasion of their home threatening to extract every single resource of potential value. or like. dumping a 700yr old debt on a planet that has been entirely isolated for most of that.

hey speaking of how it’s been 700 years since this supposed loan was made—why are you sweeping in to demand hundreds of years of interest on a loan you didn’t care enough to collect more than 400 years ago…conveniently AFTER you decided that maybe there was something to exploit here after all?

like goddamn when they announced “topaz and numby” i thought the pig was supposed to be NUMBY and yet Here We Are

#moi#hsr#honkai star rail#hsr topaz#topaz & numby#capitalism is capitalism i guess#the worst part is i can’t even tell if they meant for her to come off like such a straight up cunt?#like it feels like they’re trying to spin it like ‘oh well she’s just doing her job and trying to help—‘ uhh no#one does not waltz in after not lifting a finger to help just to extract what little wealth this planet has#‘the IPC may seem heartless and cruel’ YEAH BECAUSE IT IS. ITS LITERALLY A HEARTLESS CORPORATION#THAT HAS CANONICALLY ENGAGED IN UNETHICAL BUSINESS PRACTICES#‘oh well oh my home planet outside corporations fucked up the environment massively and people were suffering—#BUT THEN THE IPC SAVED THE DAY! and all it cost was signing your life over to a faceless corporation that doesn’t give a shit about you :)’#WHO DO YOU THINK FUCKED UP THE ENVIRONMENT TO BEGIN WITH?????#‘so i’ve decided to be gracious and kind and FORGIVE your planets (cough supposed) debts…#…provided you sign your entire planet’s population to my glorious corporation.’#‘(and if you don’t agree to these terms then we will take your planet by force and extract every ounce of wealth)’#like HELLO???????#this whole situation is manipulative as hell

22 notes

·

View notes

Text

I think job fairs are the root of all evil actually

#something about the rows and rows of exploitative corporations lined up#handing out plastic trinkets that will be thrown out within weeks but won’t decompose for thousands of years#to young people with tons of debt and no idea what to do with their lives#willow’s wastebin tagxon#anyways I’m doing GREAT :)

24 notes

·

View notes