#Coronavirus Delta Plus Variant Updates

Explore tagged Tumblr posts

Text

महाराष्ट्र समेत 12 राज्यों में मिले डेल्टा प्लस वैरिएंट के मामले, जानें अपने राज्य की स्थिति

महाराष्ट्र समेत 12 राज्यों में मिले डेल्टा प्लस वैरिएंट के मामले, जानें अपने राज्य की स्थिति

कोरोना का डेल्टा प्लस वैरिएंट काफी तेजी से पैर पसार रहा है। इसने देश के कई राज्यों में दस्तक दे दी है। जानकारी के मुताबिक महाराष्ट्र, तमिलनाडु, मध्य प्रदेश समेत 12 राज्यों में इसके 50 से ज्यादा मामले सामने आ गए हैं। इस बीच केंद्रीय स्वास्थ्य मंत्रालय ने कहा कि कोविशील्ड और कोवैक्सिन टीके कोरोना के वैरिएंट अल्फा, बीटा, गामा और डेल्टा के खिलाफ काम करते हैं, जबकि डेल्टा प्लस के खिलाफ उनकी…

View On WordPress

#Coronavirus Delta Plus Variant#Coronavirus Delta Plus Variant Updates#Delta Plus Variant#Delta Plus Variant Updates#National#News

0 notes

Text

Coronavirus India News Latest Update Live: As India braces for third wave, PM Modi reviews Covid situation, vaccination in country

As many as 35 districts are still reporting a weekly Covid positivity rate of over 10% while it is 5-10% in 30 districts, according to data from the Union Health Ministry. Coronavirus Case and Fatality Rate in India, Coronavirus Third Wave News Today September 11 Live Updates: Fear of Covid-19 third wave looms large in India with the beginning of the festive season. It may be noted that in…

View On WordPress

#coronavirus deaths cases in india#coronavirus impact in india#coronavirus india#coronavirus india cases#Coronavirus India News#coronavirus latest update india#coronavirus r factor india#coronavirus statistics in india#coronavirus third wave india#COVID protocol#covid-19 vaccine latest update#Delhi#delta plus variants#Delta Variant#festive season thrird wave fear#kerala spike#kerala top contributor#Maharashtra#New variant#school reopening

0 notes

Text

COVID-19: Maharashtra logs 3,741 fresh cases, 52 deaths

COVID-19: Maharashtra logs 3,741 fresh cases, 52 deaths

Image Source : PTI The official said Mumbai registered 333 new COVID-19 cases and two deaths, while Pune city reported 168 infections, but no fresh fatality. Maharashtra reported 3,741 new coronavirus cases and 52 fresh fatalities on Monday, taking the infection tally to 64,60,680 and the toll to 1,37,209, a state health department official said. The official said 4,696 patients were…

View On WordPress

#coronavirus cases in India#covid 19 cases in maharashtra#covid 19 in india latest news updates#covid 19 latest news#COVID-19#covid-19 cases in india#COVID-19 second wave#COVID-19 third wave#Delta Plus variant#delta variant of covid#Maharashtra covid cases

0 notes

Video

youtube

Scientists Expect Vaccine-Resistant Covid Variant To Emerge

Scientists conclude that a coronavirus variant will soon emerge that will not be affected by current vaccines. // If you would like to learn more about our ministry, you can visit us at GloryToGodVideos.com

#Forced vaccines#vaccine#vaccines#covid vaccine update#COVID19#covid#coronavirus vaccine#coronavirus#delta plus variant#delta#lambda#delta variant#lambda variant#covid variants

0 notes

Text

What makes Covid-19 delta variant such a threat? Ten questions answered

Coronavirus News What makes delta such a threat? How does it work?- The delta variant has developed certain mutations that make it more pernicious than its relatives. It has become better at infecting cells, partly by virtue of being able to somewhat evade antibodies in either previously infected or vaccinated people.

Once inside cells, it is better at replicating. Evidence for this is confirmed by much higher amount of virus (viral load) in the nasal swabs of people who are infected with delta compared with those seen in the first wave of the pandemic.

ALSO READ: 98% of defence personnel received both doses of Covid-19 vaccine: Govt

That may come from a process called syncytium formation, in which infected cells fuse with normal neighbors. The process helps the virus hide from the immune system and replicate faster.

What are the risks of contracting a “breakthrough” infection?- Again, we need to be very careful here. Breakthrough infections are not at all surprising, given that we knew the vaccines were never 100% effective against an infection...Read more.

#coronavirus delta variant#what is delta variant#delta plus variant#delta variant symptoms#covid 19 updates#pandemic#vaccination

0 notes

Text

Coronavirus India Latest Update Live: 41,506 new cases in last 24 hours; reproductive number increases since the middle of April

A health worker takes a swab sample of a passenger for coronavirus tests at the CSMT railway station in Mumbai. (File Photo: PTI) Coronavirus Cases In India, Covid-19 Deaths in India on July 11 Live Updates: India reported 41, 506 fresh Covid-19 cases as of July 11, Sunday, and 895 related deaths, said the health ministry. Total recoveries in the country at 97.2 percent now stand at 2,99,75,064…

View On WordPress

#coronavirus daily cases and deaths in india#coronavirus facts and figures. coronavirus new variant delta plus#coronavirus india latest update#coronavirus india live news#coronavirus third wave latest update#covid-19 india tracker live#covid-19 statistics india#covid-19 vaccination tracker india#delta plus symptoms#karnataka covid 19 cases bangalore

0 notes

Text

Maharashtra Lockdown News: डेल्टा प्लस वेरिएंट के डर के बीच ठाकरे सरकार ने अनलॉक नियमों को कड़ा किया

#Maharashtra #Lockdown News: डेल्टा प्लस वेरिएंट के डर के बीच ठाकरे सरकार ने अनलॉक नियमों को कड़ा किया #deltaplus #mumbai

डेल्टा प्लस वेरिएंट के डर के बीच ठाकरे सरकार ने अनलॉक नियमों को कड़ा किया Maharashtra Lockdown News: महाराष्ट्र में उभर रहे COVID-19 के डेल्टा प्लस संस्करण के मामलों को देखते हुए, मुख्यमंत्री उद्धव ठाकरे के नेतृत्व वाली राज्य सरकार ने शुक्रवार को प्रतिबंधों के स्तर से संबंधित नए आदेश (Maharashtra Lockdown News) जारी किए। राज्य के स्वास्थ्य मंत्री राजेश टोपे ने यह भी खुलासा किया कि महाराष्ट्र में…

View On WordPress

#Coronavirus#delta plus variant#Delta Plus Variants#delta variant#Lockdown#lockdown in maharashtra update#Maharashtra#Maharashtra Coronavirus#Maharashtra Lockdown#maharashtra lockdown 2021 guidelines#maharashtra lockdown full restrictions#Maharashtra lockdown latest news#Maharashtra Lockdown News#Mumbai lockdown 2021#Mumbai lockdown news today#Rajesh Tope on Maharashtra lockdown#section 144 in maharashtra extended#Uddhav Thackeray on Maharashtra lockdown

0 notes

Text

Covid LIVE: India records 50,040 new cases; recovery rate rises to 96.75%

Covid LIVE: India records 50,040 new cases; recovery rate rises to 96.75%

Coronavirus reside updates: India’s tally of coronavirus (Covid-19) circumstances has reached 30,232,320, and the dying toll nears 400,000-mark. The south-asian nation continues to be second-most-affected globally. India reported 48,698 new infections on Saturday and 1,183 new deaths, in accordance with the well being ministry. The 5 most-affected states by whole circumstances are Maharashtra…

View On WordPress

#coroanvirus live updates#coronavirus#coronavirus international news#coronavirus news#covid 19 live tracker#covid live#covid variants#covid-19 cases in india#delta plus variant#Delta variant#filter#filter content#filter news#filternews#india#india news#india news in hindi#latest news#latest unlock#popular news#world coronavirus live updates

0 notes

Text

Came across this this morning and have been digging when i can. This made sooooo much sense. Not as to why the vaccinated are still getting sick, or why they say the vacine will not work with the delta variants, but their reasoning and more.

You see it? Because the vaccine over rides your Natural Immunity (NI), (they told us it "reprograms" Mrna), it will not work against the variants. Plus, because it over rides your NI, your NI won't be able to fight the variant.

So think BIG PICTURE and Long term, remember history to what happened after JD Rockefeller bought the medical profession.

Did the street lights of their path just come on?

430 notes

·

View notes

Text

Bihar Coronavirus Crisis: Is there a risk of infection of Delta Plus variant in Bihar too, Patna AIIMS director gave this answer

Bihar Coronavirus Crisis: Is there a risk of infection of Delta Plus variant in Bihar too, Patna AIIMS director gave this answer

PatnaIn Bihar, the pace of corona infection may have decreased a bit, but new cases are continuously coming up. On Thursday, 212 new positive cases have been reported. However, during the second wave, the delta variant of Kovid-19 created a ruckus in the state. Now once again the danger of the new variant Delta Plus of this epidemic is being feared to increase. Patna AIIMS Director Dr. PK Singh…

View On WordPress

#bihar corona update#Bihar coronavirus cases#bihar coronavirus update#Corona havoc in Bihar#Coronavirus cases in bihar#coronavirus delta plus variant#Delta Plus variant#delta plus variant looms bihar#delta plus variant threat#Latest Patna News#patna aiims director coronavirus#Patna Headlines#Patna News#Patna News in Hindi

0 notes

Text

New Jersey to lift school mask mandate starting next month

New Jersey to lift school mask mandate starting next month

NEW JERSEY (WABC) — Governor Phil Murphy is expected to announce today that he is lifting New Jersey’s school mask mandate starting next month. It comes as case numbers continue to decline in the Tri-State area following the omicron surge. Murphy plans to announce that mandate will be lifted starting the second week of March. School mask mandates expire this month in New York and Connecticut. NY…

View On WordPress

#booster covid#coronavirus vaccine#covid 19 delta plus variant#covid 19 update#covid 19 variant#covid delta#covid numbers new jersey#covid omicron nj#covid vaccine#covid variant#covid-19 testing#new coronavirus strain#new jersey#new jersey covid vaccine#nj coronavirus cases#nj covid#nj covid cases#nj mask mandate#nj schools#omicron symptoms#school masks#variant omicron

0 notes

Text

Coronavirus India Latest Update Live: India sees 930 Covid deaths, marginally higher than yesterday; Cowin data shows another slump

A beneficiary receives a dose of COVID-19 vaccine as others wait outside, during a special vaccination drive for employees of various restaurants, saloons and beauty parlours, at Meenatai Thackeray hospital in Navi Mumbai. (PTI Photo) Coronavirus Statistics India, Covid-19 Cases and Deaths in India on July 7 Live Updates: Is it pandemic fatigue? Is it plain boredom? Or just a strong urge of doing…

View On WordPress

#coronavirus daily cases and deaths in india#coronavirus facts and figures. coronavirus new variant delta plus#coronavirus india latest update#coronavirus india live news#coronavirus third wave latest update#covid-19 india tracker live#covid-19 statistics india#covid-19 vaccination tracker india#delta plus symptoms

0 notes

Text

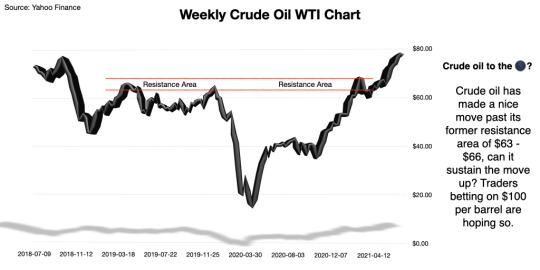

In Focus: Oil to $100

Almost a year ago I advised investors to avoid this trade. My warning came during Wall Street's celebration of Warren Buffett's deal to purchase Dominion Energy's (D) natural gas and transmission assets. Wall Street was happy to see a deal taking place during the pandemic and also ecstatic that Buffett was spending some of the $36 billion sitting on Berkshire Hathaway's (BRK-A) balance sheet at the time.

Several months before my advice and Buffett's purchase, oil prices had turned negative making me question the future of oil. Others however only saw really cheap oil prices. At the time of my advice to avoid the oil trade the U.S. Oil Fund (USO) was trading for just under $30 per share, a year prior, in July 2019 it was trading for ~$93 per share. Investors who ignored me and invested in USO are up more than 60% after taking advantage of cheap oil prices in 2020. That's a very nice win for a 12 month hold.

My instinct to avoid oil trades wasn't because I disliked oil or oil companies, it's because I saw alternative energy stock prices rising. I also saw electric car manufacturer Tesla (TSLA) growing in popularity, and several new electric vehicle companies ready to break into the market. I also expected the work-from-home phase to continue for the foreseeable future, prompting less demand for gas.

Increasing Oil Prices

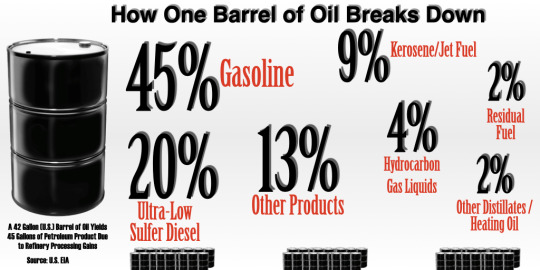

In 2021 gasoline producers in the United States have wisened up, they no longer drill all day and stockpile oil all night. Instead, they've taken a wait and see approach by watching the national demand for gas and oil and waiting to drill. This has translated into higher prices at the pump for consumers and a higher price per barrel of oil for investors, because there's no longer an oversupply of oil and gas.

This time last year Crude Oil WTI (CL=F) was trading between $40 and $41 per barrel. Oil supplies were high and demand was low with many parts of the U.S. and the world still in lockdown. Now, crude oil is trading at $74.63 per barrel as of this writing and supplies are dwindling as demand ramps up.

The question for investors now is can oil hit $100 per barrel again? Analysts at Bank of America seem to think so. Analysts for BofA believe oil prices could hit $100 per barrel by mid 2022. Crude oil WTI hasn't seen $100 a barrel since July of 2014.

Bank of America believes that the work-from-home trend is also a work-from-car trend, and that people who are working from home also have errands to run, and then there's the pent up demand for travel. Both cases create an increase in demand for oil.

The post pandemic reopening has seen Americans as well as others around the world take road trips and flock to the airports for much needed getaways and reconnection with family and friends. This need to get away has caused gas prices to jump from $2.19 per gallon a year ago to $3.22 per gallon for the week ending July 5, 2021 according to the U.S. Energy Information Administration (EIA).

For investors playing the markets for the $100 barrel of oil there are a lot of balls in the air that they need to keep an eye on like OPEC+ and Saudia Arabia.

OPEC's proposal to add 400,000 barrels per day to the oil supply through the end of this year was rebuffed by the United Arab Emirates. The UAE is seeking an updated production quota for itself, and isn't willing to agree to an OPEC increase without securing a favorable production increase of its own. Assuming all OPEC+ players stay in line with the current agreement, global oil supplies could remain below demand, keeping oil prices high.

Last year, OPEC and Russia failed to come to an agreement on a production cut, which was intended to level out inventories created by the shrinking demand caused by the coronavirus pandemic. When Russia refused to cut production Saudi Arabia flooded the markets with cheap oil. Saudi Arabia's move last year displayed that OPEC members are willing to take matters into their own hands if necessary.

Investors also have to keep an eye on the weather. In the summer of 2007, Hurricane Humberto caused refineries in the Port Arthur, Texas region to shut down which created supply issues that sent oil to over $80 a barrel, a 31% increase from where it started the year in 2007.

The National Oceanic and Atmospheric Administration (NOAA) predicted 13 to 20 named storms and three to five hurricanes in 2021. So far we've seen five tropical storms according to the Palm Beach Post.

A major tropical storm or hurricane could add to the oil supply issues and push oil prices to the triple digits once again. Not that I'm advocating for a hurricane or even triple digit oil prices, but the reality is, with a bit of bad luck, we could get back to the $100 per barrel price soon.

What's in the way of the $100 Target

There's the coronavirus, the Delta variant has been another headache for some countries in addition to the headache already created by the original strain of the coronavirus. Delayed re-openings and more lockdowns could impact global oil demand. While the United States is on its way to a full reopening, places like the U.K. and Australia are still having to lockdown to contain the spread of the Delta variant.

Another round of major lockdowns could bring us back to where we were in 2020 with a large supply and little demand for gas and oil.

Going back to the OPEC / UAE issue, former U.S. Energy Secretary Dan Brouillette says we could see a collapse in oil prices from current levels if countries were to go off and "do their own thing, or do their own production."

Brouillette, did also state that oil could easily hit the $100 per barrel mark or even higher in the aftermath of the failed OPEC+ talks.

While oil investors would love to see another 30% plus gains in oil prices this year, the $100 barrel of oil comes with some downside for oil producers. At $100 a barrel, governments could be motivated to increase their investments into electric cars and alternative energy. Higher gas prices could force traditional combustion engine car drivers to start shopping electric.

Being a long term investor my instinct is still to avoid the oil trade. I don't see American refiners maintaining a wait and see approach for a sustained period of time. I believe their instincts will kick in and they'll start pumping out oil and in turn create more supply than demand. I also think after the initial wave of what I call reopening travel - travel to make up for not traveling in 2020 - has subsided, oil will find its way back to around $50 - $60 per barrel.

I'm still on the train of thought that alternative energy is the future, maybe not this year, or the end of next year, but it is the future. I have a fear of being stuck in an oil trade when the first functional electric plane rolls out or being in an oil trade on the day EVs outsell gas powered cars. For those reasons and reasons similar to those I will miss out on oil's possible run to $100.

#oil#OilStocks#Stocks#Investing#Investments#WallStreet#StockMarket#Oil Market#Commodities#Money#Investment Education#Financial Education#Tesla#WarrenBuffett#OPEC#saudi aramco

5 notes

·

View notes

Text

Markets Hate Uncertainty

Markets Hate Uncertainty

There are many questions out there today: when will the Delta variant peak; will opening reaccelerate; will shortages end; will supply line issues abate; will inflationary pressures ease; will the Fed begin tapering; will Congress pass an infrastructure bill and raise the debt limit, and when and if will Federal Chairman Powell be reappointed. That’s quite a lot of uncertainty, and there’s more to factor in. The successful investor must formulate an opinion on each. That is why each week, we believe the greatest value we can bring you is to discuss issues and what is happening overseas, to help you develop your investment outlook.

After taking a top-down global economic, financial, and political view, we then take a bottom-up approach analyzing industries/companies searching for the best investment opportunities. Our approach is analytical and systemic. We attempt to take emotion out of the decision as best, which is not easy at times, we can especially if our conclusions point to going against the grain. We invest with a 12 to 24-month time frame while the market is dominated by day traders who rely on charts and momentum, which creates unusual opportunities for us at times. Several long-term investable trends are apparent today, such a digitalization, the cloud, the web, security, EV, going green, 5G, and infrastructure spending, but patience is necessary as the rewards come over a few years, not months, weeks, or days. Do you have the patience to be an investor?

Let’s look at each of these issues, including an update on current economic data points, then formulate a market opinion including a view on interest rates, and finally discuss the sectors we emphasize in our portfolios. We continue to focus on shortages and supply line issues as overcoming them is pivotal to accelerating growth next year and beyond.

The spread of the Delta variant continues to impact global growth. Fortunately, the number of cases here and abroad continues to decline on a 14-day basis, although deaths continue to increase here but are falling abroad. More than 5.83 billion doses have been administered globally across 184 countries at a rate of 30.3 million doses per day. In the U.S., 382 million doses have been given so far at an average rate of 787,751 per day. At this pace, it will take six months to cover 75% of the global population, which should be enough for herd immunity. Studies indicate that a booster shot slashes the rate of covid infections and restores waning immunity. We must vaccinate the unvaccinated, including children. Fortunately, there will be ample supplies of doses available over the foreseeable future to vaccinate the world, including booster shots six months after being vaccinated. We also need to worry about the upcoming flu season. Get your flu shots too. While we are learning to live with COVID, the opening will slowly reaccelerate here and abroad as we move through the fall, which will naturally help the global economy.

We expect no change in Fed policy next week or a proposed time frame for tapering to begin. There are tremendous crosscurrents in the economy from a slowdown in travel and leisure, an increase in unemployment claims, a turndown in high-frequency data, and the end of extra unemployment benefits. On the other hand, we have strong capital spending, higher industrial production, and retail sales. The Fed has a dual mandate: reducing unemployment and controlling inflation. The last employment report was a big disappointment while the rate of change in the CPI slowed in August. The jury is out whether higher inflationary pressures will be transitory. Powell thinks so, as do we. He wants the economy to run hot rather than risk taking the punch bowl away too soon. Also, the Fed knows that their policy will have little impact on shortages and supply line issues. If the economy improves over a few months and employment numbers improve again, we expect the Fed to announce tapering in November and begin by the end of the year or early 2022. We expect them to finish tapering by the fall of 2022 and start hiking the fund's rate by mid-2023 if the data points support the move. Remember that tapering and a negative real funds rate are NOT tightening. Finally, Powell seems to be gaining ground in the Senate for his reappointment as Fed Chairman with bipartisan support. Even Chris Dodd and Barney Frank (remember Dodd-Frank?) support Powell’s renomination.

Biden and his party are pushing hard for their vast $3.5 trillion-dollar social infrastructure bill as well as hiking the debt limit. Highlights of the Ways and Means proposal to pay for the bill include: top capital gains increases to 25% from 20%; maximum corporate rate rises to 26.5% from 21%; increases carried interest holding period to five years from three; cut some estate tax discounts; cuts tax rate for small businesses to 18%; crypto subject to wash rule; and a Medicare surtax on high earners. The package is expected to raise $2 trillion. The Dems are looking for $700 billion in revenue and cost savings from Medicare drug price changes and $600 billion from faster economic growth. Democratic Senator Manchin and other moderates are against this enormous social spending and tax bill, a deal-breaker for the Dems which dooms Biden’s economic agenda. Fortunately, he needs a win as his poll ratings are hitting new lows, so we believe that he will support the $1.2 trillion infrastructure bill, in the end, without tying it to his $3.5 trillion social infrastructure bill. This bill could be on his desk within a month, which would be a pleasant surprise for the market benefitting specific sectors tied to infrastructure.

Recent data points continue to be a mixed bag: industrial production increased by 0.4% in August despite shutdowns caused by Hurricane Ida; wholesale sales increased 2% in July while inventories rose only 0.6%, bringing the I/S ratio to new lows at 1.25; monthly retail sales increased a surprising 0.7% in August and are up over 15% from a year ago; the CPI increased only 0.3% from July and excluding food and energy the core inflation index rose only 0.1%, the smallest gain since February; and finally, the Phili and Empire Manufacturing surveys were robust. On the other side, unemployment claims rose to 332,000, an increase of 20,000 from the previous week; small business optimism fell to 99.7, and the August PPI index rose 0.7% and is up 8.3% year over year while the core PPI increased 0.6% and 6.7% vs. last year. Shortages and supply line issues are continuing to penalize sales and production while increasing inflationary pressures. We do not see improvement for both problems until mid-2022, but by then, we see higher sales/production/margins and lower inflation.

While the outlook for the Eurozone, India, Australia, and Japan have improved, China’s economy has not begun to recover from the outbreak of the Delta variant. ECB President Christine Lagarde said, “unprecedented monetary and fiscal aid and more vaccinations have brought the region to a point where it is recovering more rapidly than anticipated and output should reach pre-pandemic levels before the end of the year.” Most Japanese firms see the economy recovering to pre-pandemic levels in FY2022. The Japanese economy grew by 1.9% in the April-June quarter. India’s economy is expected to expand by over 7% this year and more next year, while Australia could expand close to 4% in both years.

On the other hand, China's outlook has slowed over the last month due to the outbreak of the Delta variant and needs additional monetary and fiscal stimulus to reaccelerate. So far, the government has targeted programs for smaller businesses and pledged additional support using local government bonds. We expect the Bank of China to announce another cut in the reserve requirement soon plus additional stimulus programs to boost consumption, which has been hit far more than production. The financial problems of Evergrande, a huge developer in China, will force the Bank of China to inject trillions into the domestic economy to prevent a Lehman moment. Foolishly, the government continues to release industrial commodities from its inventories, including oil, to put downward pressure on inflation just as global demand increases and supplies are tight.

Investment Conclusions

As indicated by the latest bull/bear ratio, market psychology has turned decidedly bearish, which is interestingly a contra-indicator, meaning that it is an excellent time to be nibbling at the market. It helps that inflows continue at a record pace; corporate deals and buybacks are nearing prior peak levels; dividends are increasing at a record pace; we have record excess liquidity in the trillions; the earnings yield compared to 10-year bond yield has never been wider; operating profits/margins/cash flow are increasing to record levels, and the Fed is our friend. Of course, there are negatives. We are worried about COVID, excessive federal spending, taxes that hurt our global competitiveness and investing in America, the buildup in government debt, excessive speculation, the political climate in America, geopolitical risks, and the power of fringe factions.

We maintain a positive view of the financial markets over the next 12-24 months based on an improving global economy as put the coronavirus in the rear view mirror; shortages and supply line issues abate; record operating profits and cash flow; accommodative fiscal and monetary policies; continued record flows from abroad keeping a lid on our interest rates; and trillions of excess liquidities still in the financial system. The preconditions for a market top are not present, but there can always be corrections like now.

As always, it is where you invest that counts. We maintain a balanced approach between growth, mainly technology and value. We like to invest where the government is our friend, so we own sectors that will benefit from the infrastructure bill, increased capital spending, and higher high-tech defense spending. While we expect the yield curve to slowly steepen, we do not expect the 10-year treasury yield to get much above 1.80% over the next year, which is good for stock valuations.

Markets detest uncertainty, creating opportunities for true investors with a positive longer-term outlook. The key has always been to remain patient, which most can’t do, and always maintain reserves.

3 notes

·

View notes

Text

Now that the UK has dropped quarantine for travellers returning from amber list countries, and agreed this week that from Monday (August 2nd) expats and European travellers with the EU Digital Covid Certificate will also avoid it too with a day 2 PCR test, the question everyone is awaiting the answer for is, is Spain (including the Balearic and Canary Islands) in danger of being moved on to the UK’s amber-plus list for travel.

At the moment the islands and the mainland are benefitting from an increase, all be it not great, in numbers of tourists, the Balearics with Brits, Italians, and Spanish, the Canaries with some Brits but mainly other EU nationals and the mainland with equal amounts from around Europe, however it is no secret that there has also been a surge in coronavirus cases due to the Delta variant.

At the moment any change in status is speculation as the next UK travel review is next week, however, Covid positivity rates among travellers returning from Spain have almost tripled since the end of June, according to official data that ministers could use to impose tougher quarantine rules.

More than 70,000 people flew into England from Spain over the first three weeks of July, and 2,065 of them tested positive which is a rate of 2.9% compared to just 0.9% throughout June. Also, the latest NHS Test and Trace statistics will be fed into No10, which Whitehall insiders say is, allegedly, already considering imposing stricter rules on Spain.

The UK Government is set to update its travel quarantine list next week and there are hopes dozens more destinations will be placed on the green and amber lists. But if the Government decides to push the panic button in the face of soaring rates among travellers to Spain, it could see the nation placed on the amber-plus list, meaning all arrivals would have to isolate for 10 days upon return, even if they've been fully vaccinated.

However, at the last two reviews the UK Travel Taskforce has reviewed mainland Spain and the two archipelagos separately, which could be beneficial for the Canary Islands, if they deem the levels to be low or stable enough. Currently the comparative incidence rates are as follows: Canary Islands IA7: 247.06 Canary Islands IA14: 487.42 Balearic Islands IA7: 388.80 Balearic Islands IA14: 951.65 Spain IA7: 315.09 Spain IA14: 696.31

Yesterday, the Foreign Secretary, Dominic Raab, warned there are no 'cast-iron guarantees' that Spain will stay quarantine-free for vaccinated Brits. Putting the country under tougher travel rules would wreck thousands of holidays, and force many to try to fly home early from their sun-seeking breaks.

As it stands, France is the only country on the amber-plus list even though Spain now has the highest incident rates in Europe due to the Delta variant. UK health officials are said to be 'getting very jumpy' about Spain's situation with the strain, which emerged in South Africa and is thought to be more resistant to the AstraZeneca vaccine given to millions in the UK.

Spain has been on the amber list ever since foreign holidays were given the green light again when the Government eased restrictions in May, and as a result, the number of people flying into England from Spain has been nearly doubling every few weeks. Read more news please visit https://www.canarianweekly.com/

1 note

·

View note

Link

2020 Yale-G’s Monthly Clinical Updates According to www.uptodate.com

(As of 2020-11-12, updated in Yale-G’s 6th-Ed Kindle Version; will be emailed to buyers of Ed6 paper books)

Chapter 1: Infectious Diseases

Special Viruses: Coronaviruses

Coronaviruses are important human and animal pathogens, accounting for 5-10% community-acquired URIs in adults and probably also playing a role in severe LRIs, particularly in immunocompromised patients and primarily in the winter. Virology: Medium-sized enveloped positive-stranded RNA viruses as a family within the Nidovirales order, further classified into four genera (alpha, beta, gamma, delta), encoding 4-5 structural proteins, S, M, N, HE, and E; severe types: severe acute respiratory syndrome coronavirus (SARS-CoV), Middle East respiratory syndrome coronavirus (MERS-CoV), and novel coronavirus (2019-nCoV, which causes COVID-19). Routes of transmission: Similar to that of rhinoviruses, via direct contact with infected secretions or large aerosol droplets. Immunity develops soon after infection but wanes gradually over time. Reinfection is common. Clinical manifestations: 1. Coronaviruses mostly cause respiratory symptoms (nasal congestion, rhinorrhea, and cough) and influenza-like symptoms (fever, headache). 2. Severe types (2019-nCoV, MERS-CoV, and SARS-CoV): Typically with pneumonia–fever, cough, dyspnea, and bilateral infiltrates on chest imaging, and sometimes enterocolitis (diarrhea), particularly in immunocompromised hosts (HIV+, elders, children). 3. Most community-acquired coronavirus infections are diagnosed clinically, although RT-PCR applied to respiratory secretions is the diagnostic test of choice.

Treatment: 1. Mainly consists of ensuring appropriate infection control and supportive care for sepsis and acute respiratory distress syndrome. 2. In study: Chloroquine showed activity against the SARS-CoV, HCoV-229E, and HCoV-OC43 and remdesivir against 2019-nCoV. Dexamethasone may have clinical benefit.

Prevention: 1. For most coronaviruses: The same as for rhinovirus infections, which consist of handwashing and the careful disposal of materials infected with nasal sec retions. 2. For novel coronavirus (2019-nCoV), MERS-CoV, and SARS-CoV: (1) Preventing exposure by diligent hand washing, respiratory hygiene, and avoiding close contact with live or dead animals and ill individuals. (2) Infection control for suspected or confirmed cases: Wear a medical mask to contain their respiratory secretions and seek medical attention; standard contact and airborne precautions, with eye protection.

Hepatitis A: HAV vaccine is newly recommended to adults at increased risk for HAV infection (substance use treatment centers, group homes, and day care facilities for disabled persons), and to all children and adolescents aged 2 to 18 years who have not previously received HAV vaccine.

Hepatitis C: 8-week glecaprevir-pibrentasvir is recommended for chronic HCV infection in treatment-naive patients. In addition to the new broad one-time HCV screening (17-79 y/a), a repeated screening in individuals with ongoing risk factors is suggested.

New: Lefamulin is active against many common community-acquired pneumonia pathogens, including S. pneumoniae, Hib, M. catarrhalis, S. aureus, and atypical pathogens.

New: Cefiderocol is a novel parenteral cephalosporin that has activity against multidrug-resistant gram-negative bacteria, including carbapenemase-producing organisms and Pseudomonas aeruginosa resistant to other beta-lactams. It’s reserved for infections for which there are no alternative options.

New: Novel macrolide fidaxomicin is reserved for treating the second or greater recurrence of C. difficile infection in children. Vitamin C is not beneficial in adults with sepsis and ARDS.

Chapter 2: CVD

AF: Catheter ablation is recommended to some drug-refractory, paroxysmal AF to decrease symptom burden. In study: Renal nerve denervation has been proposed as an adjunctive therapy to catheter ablation in hypertensive patients with AF. Alcohol abstinence lowers the risk of recurrent atrial fibrillation among regular drinkers.

VF: For nonshockable rhythms, epinephrine is given as soon as feasible during CPR, while for shockable rhythms epinephrine is given after initial defibrillation attempts are unsuccessful. Avoid vasopressin use.

All patients with an acute coronary syndrome (ACS) should receive a P2Y12 inhibitor. For patients undergoing an invasive approach, either prasugrel or ticagrelor has been preferred to clopidogrel. Long-term antithrombotic therapy in patients with stable CAD and AF has newly been modified as either anticoagulant (AC) monotherapy or AC plus a single antiplatelet agent.

Long-term antithrombotic therapy (rivaroxaban +/- aspirin) is recommended for patients with AF and stable CAD. Ticagrelor plus aspirin is recommended for some patients with CAD and diabetes.

VTE (venous thromboembolism): LMW heparin or oral anticoagulant edoxaban is the first-line anticoagulants in patients with cancer-associated VTE.

Dosing of warfarin for VTE prophylaxis in patients undergoing total hip or total knee arthroplasty should continue to target an INR of 2.5.

Chapter 3: Resp. Disorders

Asthma: Benralizumab is an IL-5 receptor antibody that is used as add-on therapy for patients with severe asthma and high blood eosinophil counts.

Recombinant GM-CSF is still reserved for patients who cannot undergo, or who have failed, whole lung lavage.

Pulmonary embolism (PE): PE response teams (PERT, with specialists from vascular surgery, critical care, interventional radiology, emergency medicine, cardiac surgery, and cardiology) are being increasingly used in management of patients with intermediate and high-risk PE.

Although high-sensitivity D-dimer testing is preferred, protocols that use D-dimer levels adjusted for pretest probability may be an alternative to unadjusted D-dimer in patients with a low pretest probability for PE.

Non-small cell lung cancer (NSCLC): Newly approved capmatinib is for advanced NSCLC associated with a MET mutation, and selpercatinib for those with advanced RET fusion-positive. Atezolizumab was newly approved for PD-L1 high NSCLC.

Circulating tumor DNA tests for cancers such as NSCLC are increasingly used as “liquid biopsy”. Due to its limited sensitivity, NSCLC patients who test (-) for the biomarkers should undergo tissue biopsy.

Cystic Fibrosis (CF): Tx: CFTR modulator therapy (elexacaftor-tezacaftor-ivacaftor) is recommended for patients ≥12 years with the F508del variant.

Vitamin E acetate has been implicated in the development of electronic-cigarette, or vaping, product use associated lung injury.

Chapter 4: Digestive and Nutritional Disorders

Comparison of Primary Biliary Cholangitis (PBC) and Primary Sclerosing Cholangitis (PSC):

Common: They are two major types of chronic cholestatic liver disease, with fatigue, pruritus, obstructive jaundice, similar biochemical tests of copper metabolism, overlapped histology (which is not diagnostic), destructive cholangitis, and both ultimately result in cirrhosis and hepatic failure. (1) PBC: Mainly in middle-aged women, with keratoconjunctivitis sicca, hyperpigmentation, and high titer of antimitochondrial Ab (which is negative for PSC). (2) PSC: Primarily in middle-aged men, with chronic ulcerative colitis (80%), irregular intra- and extra-hepatic bile ducts, and anti-centromere Ab (+).

CRC: Patients with colorectal adenomas at high risk for subsequent colorectal cancer (CRC) (≥3 adenomas, villous type with high-grade dysplasia, or ≥10 mm in diameter) are advised short follow-up intervals for CRC surveillance. Pembrolizumab was approved for the first-line treatment of patients with unresectable or metastatic DNA mismatch repair (dMMR) CRC.

UC and CRC: Patients with extensive colitis (not proctitis or left-sided colitis) have increased CRC risk.

Eradication of H. pylori: adding bismuth to clarithromycin-based triple therapy for patients with risk factors for macrolide resistance.

Thromboelastography and rotational thromboelastometry are bedside tests recommended for patients with cirrhosis and bleeding.

Pancreatic cancer: Screening for patients at risk for hereditary pancreatic cancer (PC): Individuals with mutations in the ataxia-telangiectasia mutated gene and one first-degree relative with PC can be screened with endoscopic ultrasound and/or MRI/magnetic retrograde cholangiopancreatography.

Olaparib is recommended for BRCA-mutated advanced pancreatic cancer after 16 weeks of initial platinum-containing therapy.

HCC (unresectable): New first-line therapy is a TKI (sorafenib or sunitinib) or immune checkpoint inhibitor atezolizumab plus bevacizumab, +/- doxorubicin. Monitor kidney toxicity for these drugs.

UC: Ustekinumab (-umab) anti-interleukin 12/23 antibody, is newly approved for the treatment of UC.

Crohn disease: The combination of partial enteral nutrition with the specific Crohn disease exclusion diet is a valuable alternative to exclusive enteral nutrition for induction of remission.

Obesity: Lorcaserin, a 5HT2C agonist that can reduce food intake, has been discontinued in the treatment of obesity due to increased malignancies (including colorectal, pancreatic, and lung cancers).

Diet and cancer deaths: A low-fat diet rich in vegetables, fruits, and grains experienced fewer deaths resulted from many types of cancer.

Note that H2-blockers (-tidines) are no longer recommended due to the associated carcinogenic N-nitrosodimethylamine.

Gastrointestinal Stromal Tumors (GIST):

GIST is a rare type of tumor that occurs in the GI tract, mostly in the stomach (50%) or small intestine. As a sarcoma, it’s the #1 common in the GI tract. It is considered to grow from specialized cells in the GI tract called interstitial cells of Cajal, associated with high rates of malignant transformation.

Clinical features and diagnosis: Most GISTs are asymptomatic. Nausea, early satiety, bloating, weight loss, and signs of anemia may develop, depending on the location, size, and pattern of growth of the tumor. They are best diagnosed by CT scan and mostly positive staining for CD117 (C-Kit), CD34, and/or DOG-1.

Treatment: Approaches include resection of primary low-risk tumors, resection of high-risk primary or metastatic tumors with a tyrosine kinase inhibitor (TKI) imatinib for 12 months, or if the tumor is unresectable, neoadjuvant imatinib followed by resection. Radiofrequency ablation has shown to be effective when surgery is not suitable. Newer therapies of ipilimumab, nivolumab, and endoscopic ultrasound alcohol ablation have shown promising results. Avapritinib or ripretinib (new TKI) is recommended for advanced unresectable or metastatic GIST with PDGFRA mutations.

Anal Cancer:

Anal cancer is uncommon and more similar to a genital cancer than it is to a GI malignancy by etiology. By histology, it is divided into SCC (#1 common) and adenocarcinoma. Anal cancer (particularly SCC among women) has increased fast over the last 30 years and may surpass cervical cancer to become the leading HPV-linked cancer in older women. A higher incidence has been associated with HPV/HIV infection, multiple sexual partners, genital warts, receptive anal intercourse, and cigarette smoking. SCCs that arise in the rectum are treated as anal canal SCCs.

Clinical features and diagnosis: 1. Bleeding (#1) and itching (often mistaken as hemorrhoids). Later on, patients may develop focal pain or pressure, unusual discharges, and lump near the anus, and changes in bowel habits. 2. Diagnosis is made by a routine digital rectal exam, anoscopy/proctoscopy plus biopsy, +/- endorectal ultrasound.

Treatment: Anal cancer is primarily treated with a combination of radiation, chemotherapy, and surgery—especially for patients failing the above therapy or for true perianal skin cancers.

Chapter 5: Endocrinology

Diabetes (DM): Liraglutide can be added as a second agent for type-2 DM patients who fail monotherapy with metformin or as a third agent for those who fail combination therapy with metformin and insulin. Metformin is suggested to prevent type 2 DM in high-risk patients in whom lifestyle interventions fail to improve glycemic indices. Metabolic (bariatric) surgery improves glucose control in obese patients with type 2 DM and also reduce diabetes-related complications, such as CVD. Teprotumumab, an insulin-like growth factor 1 receptor inhibitor, can be used for Graves’ orbitopathy if corticosteroids are not effective. Subclinical hypothyroidism should not be routinely treated (with T4) in older adults with TSH <10 mU/L.

Chapter 6: Hematology & Immunology

Anticoagulants: Apixaban is preferred to warfarin for atrial fibrillation with osteoporosis because it lowers the risk of fracture. Rivaroxaban is inferior to warfarin for antiphospholipid syndrome.

Cancer-associated VTE: LMW heparin or oral edoxaban is the first-line anticoagulant prophylaxis.

NH-Lymphoma Tx: New suggestion is four cycles of R(rituximab)-CHOP for limited stage (stage I or II) diffuse large B cell non-Hodgkin lymphoma (DLBCL) without adverse features. New suggestions: selinexor is for patients with ≥2 relapses of DLBCL, and tafasitamab plus lenalidomide is for patients with r/r DLBCL who are not eligible for autologous HCT.

Chimeric antigen receptor (CAR)-T (NK) immunotherapy is newly suggested for refractory lymphoid malignancies, with less toxicity than CAR-T therapy. Polatuzumab + bendamustine + rituximab (PBR) is an alternative to CAR-T, allogeneic HCT, etc. for multiply relapsed diffuse large B-C NHL.

Refractory classic Hodgkin lymphoma (r/r cHL) is responsive to immune checkpoint inhibition with pembrolizumab or nivolumab, including those previously treated with brentuximab vedotin or autologous transplantation.

Mantle cell lymphoma: Induction therapy is bendamustine + rituximab or other conventional chemoimmunotherapy rather than more intensive approaches. CAR-T cell therapy is for refractory mantle cell lymphoma.

AML: Gilteritinib is a new alternative to intensive chemotherapy for patients with FLT3-mutated r/r AML.

Oral decitabine plus cedazuridine is suggested for MDS and chronic myelomonocytic leukemia.

Multiple myeloma (MM): Levofloxacin prophylaxis is suggested for patients with newly diagnosed MM during the first three months of treatment. For relapsed MM: Three-drug regimens (daratumumab, carfilzomib, and dexamethasone) are newly recommended.

Transplantation: As the transplant waitlist continues to grow, there may be an increasing need of HIV-positive to HIV-positive transplants.

Porphyria: Porphyria is a group of disorders (mostly inherited) caused by an overaccumulation of porphyrin, which results in hemoglobin and neurovisceral dysfunctions, and skin lesions. Clinical types, features, and diagnosis: I. Acute porphyrias: 1. Acute intermittent porphyria: Increased porphobilinogen (PBG) causes attacks of abdominal pain (90%), neurologic dysfunction (tetraparesis, limb pain and weakness), psychosis, and constipation, but no rash. Discolored urine is common. 2. ALA (aminolevulinic acid) dehydratase deficiency porphyria (Doss porphyria): Sensorimotor neuropathy and cutaneous photosensitivity. 3. Hereditary coproporphyria: Abdominal pain, constipation, neuropathies, and skin rash. 4. Variegate porphyria: Cutaneous photosensitivity and neuropathies. II. Chronic porphyrias: 1. Erythropoietic porphyria: Deficient uroporphyrinogen III synthase leads to cutaneous photosensitivity characterized by blisters, erosions, and scarring of light-exposed skin. Hemolytic anemia, splenomegaly, and osseous fragility may occur. 2. Cutaneous porphyrias–porphyria cutanea tarda: Skin fragility, photosensitivity, and blistering; the liver and nervous system may or may not be involved. III. Lab diagnosis: Significantly increased ALA and PBG levels in urine have 100% specificity for most acute porphyrias. Normal PBG levels in urine can exclude acute porphyria. Treatment: 1. Acute episodes: Parenteral narcotics are indicated for pain relief. Hemin (plasma-derived intravenous heme) is the definitive treatment and mainstay of management. 2. Avoidance of sunlight is the key in treating cutaneous porphyrias. Afamelanotide may permit increased duration of sun exposure in patients with erythropoietic protoporphyria.

Chapter 7: Renal & UG

Membranous nephropathy (MN): Rituximab is a first-line therapy in patients with high or moderate risk of progressive disease and requiring immunosuppressive therapy.

Diabetes Insipidus (DI): Arginine-stimulated plasma copeptin assays are newly used to diagnose central DI and primary polydipsia, often alleviating the need for water restriction, hypertonic saline, and exogenous desmopressin.

Prostate cancer: Enzalutamide (new androgen blocker) is available for metastatic castration-sensitive prostate cancer. Cabazitaxel, despite its great toxicity, is suggested as third-line agent for metastatic prostate cancer. Either early salvage RT or adjuvant RT is acceptable after radical prostatectomy for high-risk disease.

UG cancers: Nivolumab plus ipilimumab is suggested in metastatic renal cell carcinoma for long-term survival.

Enfortumab vedotin is suggested in locally advanced or metastatic urothelial carcinoma. Maintenance avelumab is recommended with other chemotherapy in advanced urothelial bladder cancer. Pyelocalyceal mitomycin is suggested for low-grade upper tract urothelial carcinomas.

Chapter 8: Rheumatology

Janus kinase (JAK) inhibitors (upadacitinib, filgotinib) are new options for active, resistant RA and ankylosing spondylitis.

Graves’ orbitopathy: new therapy–teprotumumab, an insulin-like growth factor 1 receptor inhibitor.

Chapter 9: Neurology & Special Senses

Epilepsy: Cenobamate, a novel tetrazole alkyl carbamate derivative that inhibits Na-channels, provides a new treatment option for patients with drug-resistant focal epilepsy. A benzodiazepine plus either fosphenytoin, valproate, or levetiracetam is recommended as the initial treatment of generalized convulsive status epilepticus.

Migraine: Lasmiditan is a selective 5H1F receptor agonist that lacks vasoconstrictor activity, new therapy for patients with relative contraindications to triptans due to cardiovascular risk factors.

Stroke: New recommendation for cerebellar hemorrhages >3 cm in diameter is surgical evacuation. TBI: Antifibrolytic agent tranexamic acid is newly recommended for moderate and severe acute traumatic brain injury (TBI).

Ofatumumab is a new agent that may delay progression of MS.

Chapter 10: Dermatology

Minocycline foam is a new topical drug option for moderate to severe acne vulgaris.

Melanloma: Nivolumab plus ipilimumab in metastatic melanoma has confirmed long-term survival. With sun-protective behavior, melanoma incidence is decreasing.

New: Tazemetostat is suggested in patients with locally advanced or metastatic epithelioid sarcoma (rare and aggressive) ineligible for complete surgical resection.

Psoriasis: New therapies for severe psoriasis and psoriatic arthritis: a TNF-alpha inhibitor (infliximab or adalimumab, golimumab) or IL-inhibitor (etanercept or ustekinumab) is effective. Ixekizumab is a newly approved monoclonal antibody against IL-17A. Clinical data support vigilance for signs of symptoms of malignancy in patients with psoriasis.

Chapter 11: GYH

Breast cancer: Although combined CDK 4/6 and aromatase inhibition is an effective strategy in older adults with advanced receptor-positive, HER2-negative breast cancer, toxicities (myelosuppression, diarrhea, and increased creatinine) should be carefully monitored. SC trastuzumab and pertuzumab is newly recommended for HER2-positive breast cancer.

Whole breast irradiation is suggested for most early-stage breast cancers treated with lumpectomy. Accelerated partial breast irradiation can be an alternative for women ≥50 years old with small (≤2 cm), hormone receptor-positive, node-negative tumors.

Endocrine therapy is recommended for breast cancer prevention in high-risk postmenopausal women.

Uterine fibroids: Elagolix (oral gonadotropin-releasing hormone antagonist) in combination with estradiol and norethindrone is for treatment of heavy menstrual bleeding (HMB) due to uterine fibroids.

Chapter 12: OB

Table 12-6: Active labor can start after OS > 4cm, and 6cm is relatively more acceptable but not a strict number.

Table 12-7: Preeclampsia is a multisystem progressive disorder characterized by the new onset of hypertension and proteinuria, or of hypertension and significant end-organ dysfunction with or without proteinuria, in the last half of pregnancy or postpartum. Once a diagnosis of preeclampsia is established, testing for proteinuria is no longerdiagnostic or prognostic. “proteinuria>5g/24hours” may only indicate the severity.

Mole: For partial moles, obtain a confirmatory hCG level one month after normalization; for complete moles, reduce monitoring from 6 to 3 months post-normalization.

Chapter 14: EM

SHOCK RESUSCITATION

Emergency treatment—critical care!

“A-B-C”: Breathing: …In mechanically ventilated adults with critical illness in ICU, intermittent sedative-analgesic medications (morphine, propofol, midazolam) are recommended.

Chapter 15: Surgery

Surgery and Geriatrics: Hemiarthroplasty is a suitable option for patients who sustain a displaced femoral neck fracture.

Chapter 16: Psychiatry

Depression: Both short-term and maintenance therapies with esketamine are beneficial for treatment-resistant depression.

Schizophrenia: Long-term antipsychotics may decrease long-term suicide mortality.

Narcolepsy: Pitolisant is a novel oral histamine H3 receptor inverse agonist used in narcolepsy patients with poor response or tolerate to other medications. Oxybate salts, a lower sodium mixed-salt formulation of gamma hydroxybutyrate is for treatment of narcolepsy with cataplexy.

Chapter 17: Last Chapter

PEARLS—Table 17-9: Important Immunization Schedules for All (2020, USA)

Vaccine Birth 2M 4M 6M 12-15M 2Y 4-6Y 11-12Y Sum

HAV 1st 2nd (2-18Y) 2 doses

HBV 1st 2nd 3rd (6-12M) 3 doses

DTaP 1st 2nd 3rd 4th (15-18M) 5th + Td per 10Y

IPV 1st 2nd 3rd (6-18M) 4th 4 doses

Rotavirus 1st 2nd 2 doses

Hib 1st 2nd (3rd) (3-4th) 3-4 doses

MMR 1st 2nd 2 doses

Varicella 1st 2nd + Shingles at 60Y

Influenza 1st (IIV: 6-12Y; LAIV: >2Y (2nd dose) 1-2 doses annually

PCV 1st 2nd 3rd 4th PCV13+PPSV at 65Y

MCV (Men A, B) 1st Booster at 16Y

HPV 9-12Y starting: <15Y: 2 doses (0, 6-12M); >15Y or immunosuppression: 3 doses (0, 2, 6M).

Chapter 17 HYQ answer 22: No routine prostate cancer screening (including PSA) is recommended and answer “G” is still correct–PSA

screening among healthy men is not routinely done but should be indicated in a patient with two risk factors.

9 notes

·

View notes