#Copper Mining Market Top Players

Explore tagged Tumblr posts

Text

Exploring the Dynamics of the Copper Mining Sector

Introduction:

The Copper Mining Market is a dynamic sector that plays a crucial role in powering various industries, from electronics to renewable energy. In this article, we delve into the intricate workings of the copper mining industry, examining key trends, challenges, and opportunities shaping its trajectory.

Market Overview:

Copper mining is a global industry with significant contributions from regions such as Latin America, Asia Pacific, and North America. The market is driven by the growing demand for copper across diverse end-use sectors, including construction, transportation, and telecommunications. As economies continue to develop and urbanize, the need for copper as a vital conductor of electricity and heat remains paramount.

Market Trends:

Several trends are reshaping the copper mining landscape. These include advancements in extraction technologies, increased emphasis on sustainable practices, and the rise of electric vehicles and renewable energy sources. Furthermore, geopolitical tensions, trade dynamics, and environmental regulations influence market sentiment and pricing trends, impacting the profitability of mining operations.

Production Landscape:

Leading copper-producing countries such as Chile, Peru, and China dominate global copper output. However, the industry faces challenges such as declining ore grades, resource depletion, and operational inefficiencies. To address these challenges, mining companies are investing in exploration activities, adopting innovative technologies, and pursuing strategic partnerships to enhance production capabilities.

Price Dynamics:

Copper prices are influenced by a myriad of factors, including supply-demand dynamics, macroeconomic indicators, and market speculation. Price volatility is inherent in the copper market, with fluctuations driven by factors such as trade tensions, currency movements, and inventory levels. Despite short-term fluctuations, the long-term outlook for copper remains positive, supported by its essential role in infrastructure development and technological innovation.

Environmental Considerations:

Environmental sustainability is increasingly becoming a focal point for Copper Mining Companies. Concerns regarding water usage, energy consumption, and greenhouse gas emissions have prompted industry players to adopt cleaner production methods, invest in renewable energy infrastructure, and engage with local communities to mitigate environmental impacts.

Technological Advancements:

Technological innovation is revolutionizing the copper mining sector, enabling companies to improve operational efficiency, reduce costs, and minimize environmental footprints. Automation, data analytics, and remote monitoring systems are being deployed to optimize mining processes, enhance safety standards, and maximize resource recovery rates.

Investment Opportunities:

Despite challenges, the copper mining market presents lucrative investment opportunities for stakeholders seeking exposure to the commodities sector. Strategic investments in exploration, infrastructure upgrades, and sustainable practices can drive long-term value creation and position companies for success in a competitive market environment.

Conclusion:

The copper mining market is characterized by its resilience, adaptability, and strategic importance to the global economy. While challenges persist, including geopolitical uncertainties and environmental concerns, the industry remains well-positioned to capitalize on emerging opportunities driven by technological innovation and sustainable development. By embracing innovation, fostering collaboration, and prioritizing environmental stewardship, copper mining companies can navigate market dynamics and contribute to the sustainable growth of this vital sector.

#Copper Mining Market#Copper Mining Market Share#Copper Mining Market Trends#Copper Mining Industry#Copper Mining Market Size#Copper Mining Market Challenges#Global Copper Mining Market#Copper Mining Market Analysis#Copper Mining Market Outlook#Copper Mining Market Competitor#Copper Mining Market Forecast#Copper Mining Market Research Reports#Copper Mining Industry Research Reports#Copper Mining Market Major Players#Copper Mining Market Top Players

0 notes

Text

Exploring the Future of Copper Mining: Trends, Challenges, and Opportunities

Introduction

The Copper Mining Industry serves as a cornerstone of the global economy, providing essential raw materials for a variety of sectors. In this analysis, we examine the evolving landscape of copper mining, identifying key trends, challenges, and opportunities shaping its future trajectory.

Trends Driving the Industry:

Infrastructure Development: The demand for copper continues to rise as countries invest in infrastructure projects such as transportation networks, energy grids, and urban development. Copper is indispensable for electrical wiring, piping, and construction materials, making it a vital component of modern infrastructure.

Renewable Energy Transition: The transition to renewable energy sources, including wind and solar power, is accelerating the demand for copper. As renewable energy installations expand, the need for copper for transmission lines, solar panels, and energy storage systems is expected to surge.

Electric Vehicle Revolution: The proliferation of electric vehicles (EVs) is driving unprecedented demand for copper in automotive applications. From electric motors to batteries and charging infrastructure, copper plays a critical role in enabling the transition to electric mobility.

Challenges Facing the Industry:

Resource Depletion: Copper mining faces challenges related to declining ore grades and increasing extraction costs. To sustain production levels, companies must invest in exploration efforts and adopt advanced mining technologies.

Environmental Concerns: Copper mining operations have significant environmental impacts, including habitat destruction, water pollution, and greenhouse gas emissions. Regulatory compliance and community engagement are essential for mitigating these impacts and maintaining sustainable operations.

Opportunities for Growth and Innovation:

Technological Advancements: Continued investment in innovation and technology will drive efficiency and productivity in the copper mining sector. Automation, robotics, and digitalization are poised to revolutionize mining operations, improving safety and reducing costs.

Sustainability Initiatives: Embracing sustainable practices such as energy efficiency, water conservation, and community development can enhance the long-term viability of copper mining operations. Companies that prioritize sustainability will benefit from improved stakeholder relations and reduced operational risks.

Market Expansion: Emerging economies represent untapped markets for copper, driven by rapid industrialization and urbanization. Strategic partnerships and market diversification efforts will enable companies to capitalize on growth opportunities in these regions.

Conclusion

The future of the Copper Mining Industry is characterized by both challenges and opportunities. While resource depletion and environmental concerns present significant hurdles, technological innovation and sustainability initiatives offer pathways to growth and resilience. By embracing innovation, sustainability, and market expansion, copper mining companies can navigate the evolving landscape and secure their position in a dynamic global market.

#Copper Mining Market#Copper Mining Market Share#Copper Mining Market Trends#Copper Mining Industry#Copper Mining Market Size#Copper Mining Market Challenges#Global Copper Mining Market#Copper Mining Market Analysis#Copper Mining Market Outlook#Copper Mining Market Competitor#Copper Mining Market Forecast#Copper Mining Market Research Reports#Copper Mining Industry Research Reports#Copper Mining Market Major Players#Copper Mining Market Top Players

0 notes

Text

The Copper Mining Market Size, Trends, and Top Players

Introduction

Copper mining is a fundamental sector in the global economy, providing the essential raw material for a wide range of industries, including construction, electronics, and transportation. This article explores the dynamics of the copper mining market, examining its outlook, research reports, market share, trends, size, challenges, major players, and competitors.

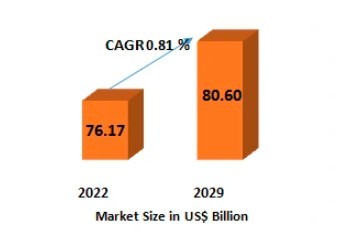

Copper Mining Market Outlook

The outlook for the Copper Mining Market is promising, driven by the increasing demand for copper in infrastructure development, renewable energy projects, and electric vehicles. Market analysts project steady growth in the coming years, supported by factors such as urbanization, industrialization, and technological advancements.

Copper Mining Market Research Reports

Market research reports offer valuable insights into the copper mining industry, providing in-depth analyses of market dynamics, production statistics, consumption patterns, and trade flows. These reports serve as essential tools for investors, mining companies, and policymakers to understand market trends and make informed decisions.

Copper Mining Market Size

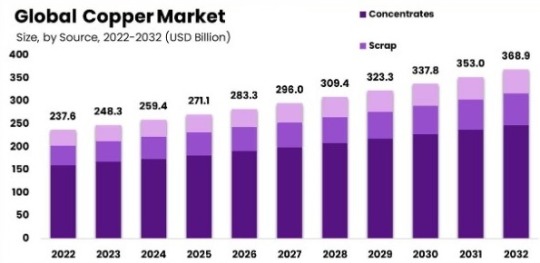

The global copper mining market is significant, with billions of dollars invested annually in exploration, development, and production. According to recent data, the global copper market was valued at approximately USD 150 billion in 2020. Copper production totaled over 20 million metric tons in the same year, with major copper-producing countries including Chile, Peru, China, and the United States.

The market size is expected to grow steadily in the coming years, driven by increasing demand for copper in infrastructure projects, electrical wiring, and consumer electronics.

Copper Mining Market Share

The copper mining market is characterized by several major players who command significant market shares. Key players include multinational mining corporations, state-owned enterprises, and junior mining companies, each contributing to the global copper supply chain.

Copper Mining Market Trends

Several trends are shaping the copper mining market, including:

Technological Advancements: Advances in mining technologies, such as automation, remote sensing, and data analytics, are improving operational efficiency, safety, and productivity in copper mining operations. Innovations in extraction methods and processing techniques are also enhancing resource recovery and reducing environmental impacts.

Sustainable Practices: There is a growing emphasis on sustainability in copper mining, with companies adopting eco-friendly technologies, implementing energy-efficient processes, and engaging with local communities to minimize environmental impacts and promote responsible mining practices.

Supply Chain Resilience: The copper mining industry is adapting to evolving supply chain dynamics, including disruptions caused by geopolitical tensions, trade policies, and the COVID-19 pandemic. Companies are diversifying their supply chains, investing in inventory management, and enhancing logistics capabilities to ensure resilience and continuity of operations.

Copper Mining Market Challenges

Despite its growth prospects, the copper mining industry faces several challenges, including:

Resource Depletion: Declining ore grades and increasing extraction costs pose challenges for copper mining companies, necessitating investments in exploration and technology to maintain production levels and reserves.

Environmental Regulations: Copper mining operations have significant environmental impacts, including water pollution, habitat destruction, and greenhouse gas emissions. Regulatory requirements related to environmental compliance, mine closure, and community engagement are becoming increasingly stringent, driving up compliance costs and operational risks.

Market Volatility: Copper prices are subject to volatility due to factors such as supply-demand dynamics, macroeconomic conditions, and geopolitical tensions. Fluctuations in copper prices can impact the profitability and investment decisions of mining companies, requiring robust risk management strategies and financial planning.

Copper Mining Market Major Players

Leading companies in the Copper Mining Market include:

Codelco: Codelco is the world's largest copper producer, with operations in Chile and international exploration projects.

BHP Group: BHP is a global mining company with significant copper assets, including mines in Chile, Peru, and Australia.

Rio Tinto: Rio Tinto is a diversified mining company with copper operations in Mongolia, the United States, and Australia.

Glencore: Glencore is a major copper producer with assets in Zambia, the Democratic Republic of Congo, and Peru.

Freeport-McMoRan: Freeport-McMoRan operates copper mines in the United States, Indonesia, and South America.

Conclusion

The copper mining market presents significant opportunities for growth and investment, driven by increasing demand for copper in various industries. Despite facing challenges such as resource depletion and environmental regulations, the industry is poised for steady expansion, supported by technological innovation, sustainability initiatives, and market resilience. Collaboration, innovation, and responsible mining practices will be essential for ensuring the long-term sustainability and success of the copper mining sector.

#Copper Mining Market#Copper Mining Market Share#Copper Mining Market Trends#Copper Mining Industry#Copper Mining Market Size#Copper Mining Market Challenges#Copper Mining Industry Research Reports#Copper Mining Market Major Players#Copper Mining Market Research Reports#Copper Mining Market Competitor#Copper Mining Market Forecast#Copper Mining Market Outlook#Copper Mining Market Top Players#Global Copper Mining Market#Copper Mining Market Analysis

0 notes

Text

Tall Claims TV

Full list of faux-news headings from the Mumbo vs Hermitcraft case!

Record Sales Down After Players Discover /playsound Trick

Rich&Rich Gets Record Bonuses Despite Losing Customer Funds

Permit Office Closed from December to June for Christmas

Snow Begins to Fall as Xisuma Forgets to Run ‘No Rain’ Command

AI Chat Bot Found to be Lonely Man With a Redstone Keyboard

Mined Worker in Hospital After Proving ‘Water is Safe to Drink’

Diamond Inflation at All Time High as Doc Builds Another T-Bore

Bop and Go Jingle Still Topping Charts, World Tour Announced

Neck Roll Parrot Dance Goes Viral on Brick-Tok

Gem-M is Ditching Voice Chat and Would Rather Message Instead

Shopping District Portal Deemed ‘Ugly Beautiful’ by Poll

Etho Upgrades Tissue Box to a Washed Takeaway Container

Globe Earthers ‘Still Believe’ Despite Farlands Expedition

Moon Size Report: Still the Same (Thank Goodness)

Netherite Out of Style as Youth Opt for Less Flashy Brands

Independent Study Finds Thumb Shifting to be Optimal

Increase Arm Muscle 33.3% With One Simple Click! Story at 10

Big News: TV Caption Writers Would Like More Pay, Says Everyone

Older Minecrafters Say New Generations Have it Easy

Villagerian is the Most Hostile Language, According to Poll

Surplus Mega Corp. Says ‘Air Quality is Better Than Ever’

New Zombie Flesh Diet Guarantees Fast Results

Hacker Infiltrates Ender Chest Network—Items Lost

Engineers Add 5th tick to Repeater, Public Still Uninterested

‘Is That Sheep Looking At You?’ New Show by MineFlex

How Many is Too Many? Asks TV Caption Writers

Leaving Floating Trees Named Biggest ‘Ick’ by Gen-M

Blockympic Gold Medalist Banned After Failed Speed Potion Test

Pig Kills Owner After 20th ride Without Getting Carrot

New Smart Watch Puts F3 on Your Wrist

Wart Epidemic Caused by Irresponsible Marketing Campaign

New Study Finds 91% of Players Don’t Understand Comparators

Kelp Powered Furnaces Recommended to Fight Climate Change

Research Finds We do Not Live in a Simulation

Skyscraper Firm Lobbies Government for Increased Build Height

Copper Voted Best Block in Minecraft, Despite Limited Uses

Theoretical Physicists Model Curved Blocks Called ‘Balls’

Magic Mountain Lawn Flamingo Company Goes into Liquidation

Hungry Hermit Addiction Reaches Epidemic Levels

Gen-M Should ‘Stop Eating Golden Carrots’ To Save For Starter Base

#I’M SO OBSESSED WITH THESE. i hope whoever wrote them finds a triple vein of diamonds when they next go mining#the entire video is fantastic the case is hilarious and the editing is top-notch—i really wanted to save the headings in particular#hermitcraft#hermitcraft spoilers#mumbo jumbo#hermitblr#kaya posts

474 notes

·

View notes

Text

Top ASX Stocks to Watch in January 2025: Experts' Picks

As the ball of January 2025 rolls in, the state of the Australian Securities Exchange (ASX) has been dynamic for investors. The very first and most important aspect of making the right investment decisions is knowing what stocks have a likelihood of growing. Here are some of the top ASX stock market picks to keep an eye on this month, based on recent market analysis and expert opinions.

1. Commonwealth Bank of Australia (ASX: CBA)

Commonwealth Bank has, while showing great strength, now emerged as the country's most valuable company. During 2024, the stock value of the bank soared to almost 39%, due to good earnings and investor confidence. Analysts even stated that such solid financial support and strategic moves would continue propelling growth for this bank into 2025.

2. BHP Group Ltd (ASX: BHP)

BHP is a global resources company that stands to benefit the most from the predicted increase in commodity demand, like copper, used for renewable energy and technological growth. According to market analysts, CSL Limited's diversified portfolio and strategic investments could help its growth in the coming year.

3. CSL Limited (ASX: CSL)

CSL, a biotechnology company that specializes in biotherapeutics, is likely to have good earnings growth going forward. Being on the way to innovation and more products, it is also a good company for investors who are looking into the Australian stock market's healthcare space.

4. Woodside Energy Group Ltd (ASX: WDS)

Woodside Energy has the energy sector coming back to normal with growth of companies. Now, as energy demand is moving globally, with Woodside Energy's strategic projects and focus on sustainable energy solutions, it holds a position amongst the most prominent players in the market.

5. ResMed Inc. (ASX: RMD)

ResMed, an electronics company that designs and manufactures medical devices for respiratory conditions, has reported revenue growth of 11% compared to last year to $1.2 billion for the quarter ended September 30, 2024. The firm bases its strategy around scaling operations and investing in organic growth-a part of the company taking cues from the recovery in the Australian economy, making it a stock to keep watch on.

6. Fortescue Metals Group Ltd (ASX: FMG)

Good fortune at Fortescue Metals is the positive momentum the iron ore majors are witnessing while other mining behemoths reap gains. Economic policies of China can influence demand for commodities and hence, an eye must be kept on how the iron ore market is doing well for Fortescue.

7. Goodman Group (ASX: GMG)

Goodman Group-the firm specializing in industrial property and logistics, recorded an increase of 1.4% in stock value. The current upsurge in the e-commerce market promises to continue such increases.

8. Liontown Resources Limited-(ASX: LTR)

Liontown Resources, a mining company of lithium, had 7.62% increase in its stock. The increasing use of lithium for battery technology and electric vehicles means that Liontown's projects would be an excellent growth opportunity especially in the Australian stock market.

9. Paladin Energy Ltd (ASX: PDN)

Paladin Energy is a uranium producing company whose shares increased by 4.497%. The temporary halt of the production at Kazakhstan's major mine has caused the uranium stocks to go up. This may represent a good future for the nuclear power industry.

10. National Australia Bank Ltd (ASX: NAB)

NAB has been positive on trading performance and is expected to be influenced by possible interest rate cuts by the Reserve Bank of Australia, which may influence valuations in the banking sector. As monetary policy changes, opportunities may arise for investors within the stock trading and financial space.

Conclusion

Investing in the ASX stock market requires careful consideration of current market trends, company performance, and economic indicators. The stocks mentioned above have shown promising signs as of January 2025, but it's crucial to conduct thorough research and consider your financial goals before making investment decisions. Consulting with a financial advisor can provide personalized guidance tailored to your investment strategy. Disclaimer: This article is for information purposes only and is not financial advice. Investing in the Australian stock market is always fraught with risks, and past performance does not necessarily translate to future results. Therefore, do your own research or seek a licensed financial advisor before investing.

1 note

·

View note

Text

Indonesia, a country rich in natural resources, is one of the most important players in the global supply chain. Known for its vast and diverse resources, Indonesia is a key supplier of minerals, energy, and agricultural products needed by industries around the world. In this video, we will explore the many types of Indonesia’s natural resources, with a special focus on its mining industry, which plays a central role in the country’s economy and in meeting the world’s demands. Introduction: Indonesia’s Natural Resources Located in Southeast Asia, Indonesia is blessed with an abundance of natural resources, ranging from agricultural products, forestry, and mining to fisheries. This diversity has made Indonesia a major player in both the domestic and global markets. Indonesia’s natural resources are vast, including important minerals like coal, gold, copper, nickel, bauxite, and tin. These resources are in high demand across the globe, especially in countries like China, the United States, Japan, and various European nations. Indonesia is also geographically positioned as an archipelago, offering rich marine resources and fertile land for agriculture and plantations. The natural wealth of Indonesia is well-known internationally, especially its minerals, which play a critical role in meeting the needs of global markets, whether for energy, raw materials, or direct consumption. Indonesia’s Mining Industry: A Global Economic Pillar One of the most significant sectors contributing to Indonesia’s economy is mining. Indonesia is home to some of the largest and most valuable mineral reserves in the world, including coal, gold, nickel, copper, and tin. Indonesia’s coal reserves, for example, are among the largest globally, and the country remains a critical supplier of energy for many countries, especially in Asia. Indonesia’s Coal: A Major Global Energy Source Indonesia’s coal industry plays an essential role in the global energy market. As one of the top coal exporters in the world, Indonesia’s coal is widely used in electricity generation and steel production, particularly in countries like China, India, and other Asian nations. Indonesian coal is highly valued due to its quality, especially the thermal coal sourced from Kalimantan and Sumatra, which is ideal for power plants and steel mills. Indonesia’s coal industry faces significant global demand, and the country continues to play a critical role in ensuring global energy stability. With increasing energy needs, particularly in developing countries, Indonesian coal helps meet the growing demand for electricity and industrial energy. aces significant challenges, particularly in terms of sustainability. Unregulated mining and deforestation are serious concerns, leading to environmental degradation, loss of biodiversity, and pollution. As a result, Indonesia must adopt more sustainable mining practices and environmental regulations to mitigate these negative impacts. Tags and Hashtags: #IndonesiaMining #NaturalResources #CoalIndonesia #NickelIndonesia #GoldIndonesia #CopperIndonesia #SustainableMining #IndonesiaExports #MiningIndustry #GreenEnergy #CleanTech #GlobalTrade #MiningCommodities #IndonesiaEconomy #ElectricVehicles #GlobalSupplyChain

1 note

·

View note

Text

🌟 Silver Shines Bright: ASX Silver Mining Highlights 🌟

💰 Silver Prices Near Decade-Highs!

📈 Fueled by:

➡️ Rising industrial demand

➡️ Positive analyst forecasts

➡️ Growing safe-haven investments

🌟 Why Invest in ASX Silver Miners? 🌟

🪙 Silver Outshines Gold

✔ ️ Silver prices are forecasted to soar by 20% more than gold!

✔️ Analysts predict US$32/oz by 2025.

🔋 Demand Booms in Tech & Solar

✔ ️ Silver usage in solar energy increased 330% in the last decade.

✔ ️ Essential in electronics, automotive, and healthcare.

🏆 Top 4 ASX Silver Mining Stars 🏆

1️⃣ Adriatic Metals (ASX:ADT)

🌍 Vares Silver Project, Bosnia

📈 Market Cap: A$1.24B

💡 Mine launched March 2024.

2️⃣ Silver Mines Limited (ASX:SVL)

🇦🇺 Bowdens Silver Project, Australia

📈 Market Cap: A$271.4M

💡 High-grade silver discoveries in 2024.

3️⃣ Investigator Resources (ASX:IVR)

🇦🇺 MJ Hilgendorf Project, Australia

📈 Market Cap: A$83M

💡 Strong copper-gold-silver potential.

4️⃣ Sun Silver (ASX:SS1) – IPO Alert! 🚀

🌍 Maverick Springs Project, Nevada

💰 Seeking A$13M funding.

📅 IPO June 2024 – Price A$0.20/share.

🔥 Reasons to Stay Bullish on Silver 🔥

📊 ETF Inflows Rising

➡ ️ Institutional and retail investors betting on silver’s growth.

💸 Optimistic Price Forecasts

➡️ Projections of $32/oz by 2025.

➡️ Bold triple-digit predictions by industry leaders like Keith Neumeyer.

⚙️ Industrial Demand Surge

➡️ Solar energy & electronics drive demand.

➡ ️ Key components in automotive and medical technology.

🎯 Final Tip for Investors 🎯

🔗 Mix established players like Adriatic Metals & Silver Mines with upcoming stars like Sun Silver (ASX:SS1) for maximum potential! 🚀

Visit - https://www.skrillnetwork.com/silver-surges-asx-mining-companies-with-highpotential-silver-projects

0 notes

Text

Best Copper Manufacturers in India: A Guide to Quality and Innovation

Copper, often referred to as "red gold," has played a vital role in human civilization for centuries. Its excellent conductivity, durability, and versatility make it an essential material across multiple industries—from electrical wiring and electronics to construction and manufacturing. With India being one of the largest producers and consumers of copper, the country is home to some of the best copper manufacturers, recognized globally for their quality and innovation. In this blog, we will explore the best copper manufacturers in India, what sets them apart, and why the copper industry in India continues to grow.

1. The Importance of Copper in Industry

Copper’s unique properties make it indispensable in numerous applications. Its superior electrical conductivity makes it the preferred choice for wiring and electrical components, while its resistance to corrosion and excellent heat transfer capabilities make it ideal for use in plumbing, roofing, and industrial machinery. From renewable energy systems to intricate electronic circuits, copper’s role is undeniable, and as industries evolve, so too does the demand for high-quality copper products.

2. India: A Hub for Copper Manufacturing

India’s copper manufacturing industry has seen significant growth over the past few decades, largely due to the country's increasing focus on infrastructure development, industrial expansion, and technological advancements. The Indian copper market is driven by both domestic demand and international exports, with many companies competing to deliver high-quality copper products.

India’s geographical advantage, with vast copper reserves and strong mining operations, has further solidified its position in the global copper industry. The best copper manufacturers in India not only meet domestic demands but also cater to the global market, adhering to international quality standards and environmental regulations.

3. Characteristics of the Best Copper Manufacturers

The best copper manufacturers in India share several characteristics that set them apart from their competitors:

Quality Assurance: The top copper manufacturers prioritize quality at every stage of the production process. From the procurement of raw materials to the final product, strict quality control measures ensure that only the finest copper products are delivered to clients. These manufacturers often have ISO certifications and meet global standards such as ASTM (American Society for Testing and Materials) and IS (Indian Standards).

Innovation and Technology: Leading copper manufacturers continually invest in advanced technologies to improve production efficiency and product quality. State-of-the-art manufacturing plants, automated processes, and research and development (R&D) initiatives ensure that these companies stay ahead of industry trends and customer demands.

Sustainability: With the increasing emphasis on sustainable practices, many copper manufacturers are adopting eco-friendly processes to minimize their environmental impact. From reducing waste and emissions to incorporating recycling practices, sustainability is a core focus for top manufacturers.

Customer-Centric Approach: The best copper manufacturers maintain strong relationships with their clients, providing customized solutions, on-time deliveries, and excellent customer service. Their expertise allows them to cater to various industries, offering a wide range of copper products such as wires, tubes, rods, sheets, and alloys.

4. Top Copper Manufacturers in India

India is home to several reputable copper manufacturers known for their high standards of production and product excellence. Here are some of the key players in the industry:

Hindalco Industries Limited: A part of the Aditya Birla Group, Hindalco is one of the largest producers of primary aluminum and copper in India. The company is known for its integrated operations, from mining to smelting to refining, producing a wide range of copper products that are exported globally.

Sterlite Copper: Sterlite Copper, a division of Vedanta Limited, is one of the leading producers of copper in India. The company operates one of the largest copper smelters in the country and is recognized for its innovation, commitment to quality, and sustainability efforts.

Koprex: Koprex has earned its place among the best copper manufacturers in India through its dedication to excellence and cutting-edge manufacturing processes. Known for its high-quality copper anodes, sheets, and rods, Koprex serves a diverse clientele across various industries, including electrical, automotive, and electronics. What sets Koprex apart is its commitment to quality control, sustainable production practices, and constant innovation, making it a trusted name in the copper industry.

Birla Copper: Another major player in India’s copper market, Birla Copper is known for its vast product portfolio, including copper cathodes, wire rods, and precious metals. The company’s extensive network and global reach have made it a trusted supplier for industries across the world.

Jhagadia Copper: As a part of the Cable Corporation of India, Jhagadia Copper is the largest secondary copper producer in India. It is known for producing high-quality copper products while focusing on sustainable practices, including recycling copper scrap.

5. Why Choose Indian Copper Manufacturers?

Indian copper manufacturers are well-positioned to meet global demand due to their focus on quality, innovation, and sustainability. Their advanced production facilities, skilled workforce, and dedication to maintaining international standards make them ideal partners for industries that rely heavily on copper products. Moreover, India’s strategic location and strong export networks ensure timely deliveries and competitive pricing for global customers.

Conclusion: The Future of Copper Manufacturing in India

As the global demand for copper continues to rise, India’s copper manufacturers are set to play an even more significant role in meeting that demand. With their commitment to quality, innovation, and sustainability, the best copper manufacturers in India are well-equipped to continue delivering world-class products to clients both domestically and internationally.

At Koprex, we pride ourselves on being one of the leaders in the copper manufacturing industry. Our cutting-edge technology, sustainable practices, and focus on customer satisfaction make us the go-to choice for high-quality copper products. Whether you need copper for electrical wiring, industrial machinery, or specialized applications, Koprex is your trusted partner for premium copper solutions. Choose Koprex and experience excellence in copper manufacturing today!

This Blog Was Originally Published At: https://koprexmti.blogspot.com/2024/10/best-copper-manufacturers-in-india.html

0 notes

Text

Hidden Treasures: Exploring the Worlds Copper Reserves

Introduction

In the intricate tapestry of Earth's resources, copper stands as a hidden treasure, essential for powering our modern world. Its significance spans from electrical wiring to renewable energy technologies, making it a vital component in the global pursuit of sustainable development. Let's embark on a journey to unravel the secrets of the world's copper reserves and discover the pivotal role played by entities like "Big Country Recycling" in sustaining this precious metal's life cycle.

The Importance of Copper Reserves

1- Industrial Applications:

Copper is a versatile metal widely used in various industries, including construction, electronics, telecommunications, transportation, and energy. It is a key component in the production of electrical wiring, motors, transformers, and power generation equipment. Without an adequate supply of copper, these industries would face challenges in meeting their demands, potentially leading to disruptions in infrastructure and technological advancements.

2- Technology Advancements:

With the increasing reliance on technology, the demand for copper continues to grow. Smartphones, computers, electric vehicles, and renewable energy technologies all require copper for their production. As these technologies become more prevalent, the need for copper reserves becomes even more critical.

3- Energy Transition:

Copper plays a vital role in the transition to renewable energy sources. Wind turbines, solar panels, and electric vehicles rely heavily on copper for their wiring and components.

Unveiling the Copper Reserves

Major reserves found in countries like Chile, Peru, Australia, and Russia. These reserves serve as the backbone of various industries, powering innovations in electronics, infrastructure, and renewable energy. As demand for copper continues to rise, exploring and understanding these reserves becomes crucial for ensuring a stable and sustainable supply chain.

Unveiling the Top Copper Reserves Worldwide

1- Chile: The Copper Kingdom:

Tucked away in the South American Andes, Chile reigns as the undisputed king of copper production. The Atacama Desert, one of the driest places on Earth, hosts vast copper deposits. The mines of Chuquicamata and Escondida have become legendary, producing a substantial portion of the world's copper. Chile's geological endowment transforms its rocky landscapes into reservoirs of economic prosperity and industrial vitality.

2- Peru: Riches in the Andean Heights:

Neighboring Chile, Peru boasts its own share of copper riches nestled within the majestic Andes Mountains. Las Bambas and Cerro Verde are testament to Peru's geological wealth, contributing significantly to the global copper market. The Andean nation's commitment to sustainable mining practices ensures that the treasures beneath its soil are extracted responsibly, balancing economic growth with environmental stewardship.

3- Australia: Copper Down Under:

In the Southern Hemisphere, Australia emerges as a key player in the global copper scene. Mines in the vast expanses of Western Australia and Queensland yield substantial copper reserves. Australia's commitment to technological innovation in mining operations ensures efficient extraction, underscoring its role in supplying the world's increasing demand for this indispensable metal.

The Role of Copper Reserves in Global Economy

Due to the widespread use of copper in various industries Copper reserves play a crucial role in the global economy. Copper is a versatile metal with excellent conductivity, corrosion resistance, and malleability, making it an essential component in numerous applications. Here are some key aspects of the role of copper reserves in the global economy:

1- Transportation:

Automotive Industry: The automotive sector uses copper in wiring, radiators, and various electronic components. The growth of electric vehicles (EVs) further increases the demand for copper, as electric motors and charging infrastructure rely heavily on this metal.

2- Industrial Applications:

Electrical and Electronics: Copper is a fundamental material in electrical wiring, motors, transformers, and other electrical equipment due to its high conductivity. The global demand for electronic devices and infrastructure directly influences the need for copper.

Construction: Copper is used in construction for wiring, plumbing, roofing, and various structural components. The construction industry's health and growth impact the demand for copper.

3- Infrastructure Development:

Power Generation and Distribution: The expansion of power generation and distribution networks, especially in developing economies, contributes to a higher demand for copper. Renewable energy projects, such as wind and solar, also require significant amounts of copper.

Preserving the Hidden Treasures of Copper Reserves

Preserving the hidden treasures of copper reserves is imperative for sustainable development and the continued advancement of various industries. Copper, a crucial component in modern technology, infrastructure, and renewable energy systems, represents a finite resource that demands responsible management to avoid depletion and environmental degradation. To ensure the long-term availability of this essential metal, it is essential to implement efficient recycling programs, invest in innovative extraction technologies that minimize ecological impact, and promote responsible mining practices. By striking a balance between meeting current demand and safeguarding the integrity of copper deposits, we can contribute to the preservation of these hidden treasures, fostering a more sustainable and resilient future for generations to come.

Conclusion

In conclusion, the exploration of the world's copper reserves unveils not only a valuable resource but also the responsibility to manage it sustainably. With Big Country Recycling leading the way in Copper Recycling Services USA, individuals and businesses have a reliable partner in ensuring that this hidden treasure continues to fuel progress while preserving the health of our planet. Choose Big Country Recycling for a greener, more sustainable future. Contact them today to learn more about their Copper Recycling Services or to get a quote for your materials. Or call +1 325-949-5865.

Source: https://metalrecyclingsanangelotx.weebly.com/blog/hidden-treasures-exploring-the-worlds-copper-reserves

#copper recycling#copper#Copper Recycling Services San Angelo#Copper Recycling Services Texas#Copper Recycling Services USA#Copper Recycling Services

0 notes

Text

Feuilles de cuivre ultra-minces, Prévisions de la Taille du Marché Mondial, Classement et Part de Marché des 12 Premières Entreprises

Selon le nouveau rapport d'étude de marché “Rapport sur le marché mondial de Feuilles de cuivre ultra-minces 2024-2030”, publié par QYResearch, la taille du marché mondial de Feuilles de cuivre ultra-minces devrait atteindre 14290 millions de dollars d'ici 2030, à un TCAC de 23,3% au cours de la période de prévision.

Figure 1. Taille du marché mondial de Feuilles de cuivre ultra-minces (en millions de dollars américains), 2019-2030

Figure 2. Classement et part de marché des 12 premiers acteurs mondiaux de Feuilles de cuivre ultra-minces (Le classement est basé sur le chiffre d'affaires de 2023, continuellement mis à jour)

Selon QYResearch, les principaux fabricants mondiaux de Feuilles de cuivre ultra-minces comprennent SK Nexilis, Mitsui Mining & Smelting, Nippon Denkai, UACJ Foil Corporation, ILJIN Materials, Fukuda Metal Foil & Powder, Tongling Nonferrous Metals Group, Nan Ya Plastics, Guangdong Jia Yuan Tech, Nuode, etc. En 2023, les cinq premiers acteurs mondiaux détenaient une part d'environ 48,0% en termes de chiffre d'affaires.

According to QYResearch, the global key manufacturers of Ultra-thin Copper Foils include SK Nexilis, Mitsui Mining & Smelting, Nippon Denkai, UACJ Foil Corporation, ILJIN Materials, Fukuda Metal Foil & Powder, Tongling Nonferrous Metals Group, Nan Ya Plastics, Guangdong Jia Yuan Tech, Nuode, etc. In 2023, the global top five players had a share approximately 48.0% in terms of revenue.

The key market drivers for the Ultra-thin Copper Foils market:

1. Growth of Electronics and Semiconductor Industry: The expanding electronics and semiconductor industries have been a major driver for the ultra-thin copper foils market, as these materials are extensively used in printed circuit boards (PCBs), flexible electronics, and various electronic components.

2. Demand for Miniaturization and Increased Density in Electronics: The trend towards miniaturization and increased component density in electronic devices, such as smartphones, laptops, and wearables, has fueled the need for ultra-thin copper foils that enable thinner and more compact designs.

3. Advancements in Flexible Electronics and Wearables: The growing adoption of flexible electronics and wearable devices has driven the demand for ultra-thin copper foils, which are essential for the fabrication of flexible and stretchable circuits.

4. Expansion of 5G and Telecom Infrastructure: The rollout of 5G networks and the associated growth in telecom infrastructure have increased the need for ultra-thin copper foils in high-frequency, high-speed PCBs and other telecommunication equipment.

5. Increasing Demand in Automotive Electronics: The automotive industry's growing focus on electronic systems, such as infotainment, advanced driver-assistance systems (ADAS), and electric vehicle components, has contributed to the demand for ultra-thin copper foils.

6. Advancements in Printed Circuit Board (PCB) Technology: Improvements in PCB manufacturing techniques, including the use of ultra-thin copper foils, have led to the development of higher-density, more efficient, and more reliable circuit boards.

7. Expansion of Renewable Energy and Energy Storage: The growth of renewable energy technologies, such as solar panels and energy storage systems, has increased the demand for ultra-thin copper foils used in the production of these components.

8. Increasing Adoption in Military and Aerospace Applications: The military and aerospace sectors have been utilizing ultra-thin copper foils for their lightweight, high-performance, and reliability requirements in various electronic systems and components.

9. Technological Advancements in Manufacturing Processes: Improvements in manufacturing processes, such as enhanced etching techniques and advanced rolling technologies, have enabled the production of thinner and more uniform copper foils, driving market growth.

10. Rising Environmental Concerns and Sustainability Initiatives: Increasing focus on environmental sustainability and the push for more efficient and eco-friendly electronics have contributed to the demand for ultra-thin copper foils, as they offer material savings and reduced environmental impact.

À propos de QYResearch

QYResearch a été fondée en 2007 en Californie aux États-Unis. C'est une société de conseil et d'étude de marché de premier plan à l'échelle mondiale. Avec plus de 17 ans d'expérience et une équipe de recherche professionnelle dans différentes villes du monde, QYResearch se concentre sur le conseil en gestion, les services de base de données et de séminaires, le conseil en IPO, la recherche de la chaîne industrielle et la recherche personnalisée. Nous société a pour objectif d’aider nos clients à réussir en leur fournissant un modèle de revenus non linéaire. Nous sommes mondialement reconnus pour notre vaste portefeuille de services, notre bonne citoyenneté d'entreprise et notre fort engagement envers la durabilité. Jusqu'à présent, nous avons coopéré avec plus de 60 000 clients sur les cinq continents. Coopérons et bâtissons ensemble un avenir prometteur et meilleur.

QYResearch est une société de conseil de grande envergure de renommée mondiale. Elle couvre divers segments de marché de la chaîne industrielle de haute technologie, notamment la chaîne industrielle des semi-conducteurs (équipements et pièces de semi-conducteurs, matériaux semi-conducteurs, circuits intégrés, fonderie, emballage et test, dispositifs discrets, capteurs, dispositifs optoélectroniques), la chaîne industrielle photovoltaïque (équipements, cellules, modules, supports de matériaux auxiliaires, onduleurs, terminaux de centrales électriques), la chaîne industrielle des véhicules électriques à énergie nouvelle (batteries et matériaux, pièces automobiles, batteries, moteurs, commande électronique, semi-conducteurs automobiles, etc.), la chaîne industrielle des communications (équipements de système de communication, équipements terminaux, composants électroniques, frontaux RF, modules optiques, 4G/5G/6G, large bande, IoT, économie numérique, IA), la chaîne industrielle des matériaux avancés (matériaux métalliques, polymères, céramiques, nano matériaux, etc.), la chaîne industrielle de fabrication de machines (machines-outils CNC, machines de construction, machines électriques, automatisation 3C, robots industriels, lasers, contrôle industriel, drones), l'alimentation, les boissons et les produits pharmaceutiques, l'équipement médical, l'agriculture, etc.

0 notes

Text

What are the top Metal and Mining Stocks?

Explore the top 10 metals and mining stocks in India for 2024. This comprehensive guide highlights major players like Vedanta, Hindalco, Tata Steel, SAIL, and more. Learn about their roles in the extraction and production of essential metals and minerals such as aluminum, copper, iron ore, and coal. Understand the impact of commodity prices, global demand, and technological advancements on these stocks. Whether you are seeking stability in precious metals or growth in industrial metals, this guide provides valuable insights for investors looking to diversify and navigate the dynamic metals and mining market.

0 notes

Text

Exploring the Copper Mining Market Research Reports

Introduction

Copper mining serves as a cornerstone of the global economy, providing a vital raw material for numerous sectors including construction, electronics, and transportation. This article examines the dynamics of the copper mining market, encompassing its prospects, research findings, market share, trends, size, challenges, key players, and competitors.

Copper Mining Market Outlook

The outlook for the Copper Mining Market appears promising, fueled by escalating demand for copper in infrastructure development, renewable energy initiatives, and electric vehicles. Analysts anticipate sustained growth in the forthcoming years, bolstered by factors like urbanization, industrialization, and technological innovations.

Copper Mining Market Research Reports

Market research reports furnish valuable insights into the copper mining sector, offering comprehensive analyses of market dynamics, production figures, consumption trends, and trade patterns. These reports serve as indispensable resources for investors, mining entities, and policymakers to comprehend market trends and make informed decisions.

Copper Mining Market Size

The global copper mining market holds significant prominence, with substantial investments channeled annually into exploration, development, and production endeavors. Recent data indicates that the global copper market reached a valuation of around USD 150 billion in 2020. Concurrently, copper production surpassed 20 million metric tons during the same period, with notable copper-producing nations encompassing Chile, Peru, China, and the United States. The market size is projected to exhibit steady expansion in the ensuing years, propelled by escalating demand for copper in infrastructure ventures, electrical installations, and consumer electronics.

Copper Mining Market Share

The copper mining market is characterized by several prominent players, each wielding substantial market shares. Key participants include multinational mining conglomerates, state-owned enterprises, and junior mining firms, collectively contributing to the global copper supply chain.

Copper Mining Market Trends: Numerous trends are reshaping the copper mining landscape, including:

Technological Advancements: Ongoing advancements in mining technologies, such as automation, remote sensing, and data analytics, are enhancing operational efficiency, safety standards, and productivity in copper mining operations. Concurrent innovations in extraction methodologies and processing techniques are augmenting resource retrieval rates and curtailing environmental footprints.

Sustainable Practices: There is a burgeoning emphasis on sustainability within copper mining, with entities embracing eco-friendly technologies, deploying energy-efficient processes, and engaging with local communities to mitigate environmental impacts and foster responsible mining practices.

Supply Chain Resilience: The copper mining industry is adapting to evolving supply chain dynamics, including disruptions precipitated by geopolitical tensions, trade regulations, and the COVID-19 pandemic. Companies are diversifying their supply chains, investing in inventory management, and fortifying logistics capabilities to ensure resilience and operational continuity.

Copper Mining Market Challenges: Despite its growth trajectory, the copper mining sector grapples with several challenges, encompassing:

Resource Depletion: The diminishing ore grades and escalating extraction costs present formidable challenges for copper mining enterprises, necessitating investments in exploration endeavors and technological innovations to sustain production levels and reserves.

Environmental Regulations: Copper mining operations exert substantial environmental pressures, encompassing water contamination, habitat degradation, and greenhouse gas emissions. Stringent regulatory mandates pertaining to environmental compliance, mine closure protocols, and community engagement are escalating compliance costs and operational risks.

Market Volatility: Copper prices are susceptible to volatility, influenced by factors like supply-demand dynamics, macroeconomic conditions, and geopolitical upheavals. Fluctuations in copper prices can impact the profitability and investment decisions of mining entities, necessitating robust risk management strategies and financial planning.

Copper Mining Market Major Players

Key entities in the Copper Mining Market include:

Codelco

BHP Group

Rio Tinto

Glencore

Freeport-McMoRan

Conclusion

The copper mining market presents compelling growth prospects and investment opportunities, driven by escalating demand for copper across diverse industries. Despite encountering challenges such as resource depletion and environmental regulations, the industry is poised for sustained expansion, buoyed by technological innovations, sustainability initiatives, and market resilience. Collaborative endeavors, innovation, and conscientious mining practices are imperative for ensuring the enduring sustainability and prosperity of the copper mining sector.

#Copper Mining Market#Copper Mining Market Share#Copper Mining Market Trends#Copper Mining Industry#Copper Mining Market Size#Copper Mining Market Challenges#Copper Mining Industry Research Reports#Copper Mining Market Major Players#Copper Mining Market Research Reports#Copper Mining Market Competitor#Copper Mining Market Forecast#Copper Mining Market Outlook#Copper Mining Market Top Players#Global Copper Mining Market#Copper Mining Market Analysis

0 notes

Text

An In-Depth Exploration of the Copper Mining Market Growth, Share and Forecast

In the expansive world of mining, the Copper Mining Market emerges as a critical player, supplying a fundamental metal that finds applications across diverse industries. This exhaustive exploration aims to uncover the multifaceted aspects of major players, market share dynamics, trends, market size, challenges, global perspectives, and the future outlook that intricately shape the Copper Mining industry.

Major Players: Anchors in the Copper Mining Landscape

Dominating the Copper Mining Market major players whose influence, infrastructure, and technological prowess act as driving forces for the industry. These giants not only shape the market but also play a pivotal role in determining the global supply of copper.

Market Share Dynamics: Unveiling the Intricate Tapestry

The distribution of market share provides nuanced insights into the competitive landscape of the Copper Mining Market. While major players typically dominate, the strategic moves, innovations, and market entrants constantly reshape the share distribution.

Trends Steering Copper Mining: Navigating the Currents of Change

The Copper Mining Market is subject to trends influenced by technological advancements, sustainability imperatives, and the ebbs and flows of global economic conditions. Staying attuned to these trends is pivotal for stakeholders aiming to capitalize on emerging opportunities.

Guiding Lights in the Industry: Sustainable practices are taking center stage in the Copper Mining Market as the industry witnesses a shift towards eco-friendly and responsible mining methods. Simultaneously, technological advancements, including automation and data analytics, redefine operational efficiencies, contributing to a wave of innovation.

Sizing Up: Exploring the Expansive Landscape of Copper Mining Market

Quantifying the impact of the Copper Mining Market Size is crucial, reflecting not only the industry's economic influence but also its potential for growth. This metric is influenced by various factors, including global copper demand, geopolitical considerations, and exploration activities.

Quantifying the Industry's Influence: The Copper Mining Market Size surpassed a substantial USD 40 billion in the last fiscal year, underscoring its undeniable significance in the global economic landscape. Fluctuations in copper prices and geopolitical tensions contribute to the dynamic nature of the Copper Mining Market Size.

Challenges Faced: Navigating the Complex Terrain of Copper Mining

Inherent challenges in the Copper Mining Industry necessitate strategic approaches to ensure sustained operations and compliance with evolving regulations. Environmental concerns, regulatory complexities, and the volatility of copper prices present significant hurdles.

Facing Headwinds with Resilience: Regulatory compliance remains a persistent challenge, demanding adaptability to evolving environmental standards. Furthermore, the inherent volatility in copper prices poses a continuous risk, impacting profitability and investment decisions.

Global Perspective: Understanding the Interconnected Copper Mining Market

The term Global Copper Mining Market encapsulates the interconnected nature of copper extraction on a worldwide scale. A nuanced understanding of global dynamics becomes essential for stakeholders operating in diverse regions.

Global Mosaic Unveiled: The Global Copper Mining Market is characterized by diverse regional contributions, with South America, Asia-Pacific, and North America emerging as key hubs. Collaborations and partnerships between global players enhance the market's overall resilience.

Forecasting the Future: Copper Mining Market Outlook and Research Reports

Looking ahead, the Copper Mining Market Outlook is influenced by factors such as technological advancements, geopolitical shifts, and trends in market demand. Simultaneously, comprehensive Copper Mining Market Research Reports offer profound insights for informed decision-making.

Peering into the Future: The Copper Mining Market Outlook anticipates a steady 8% annual growth rate, driven by sustained global demand. Concurrently, ongoing research initiatives contribute to the development of insightful Copper Mining Market Research Reports, enriching the industry's knowledge base.

Conclusion

The Copper Mining Market emerges as a dynamic and indispensable contributor to the global economy. Navigating through major players, market trends, challenges, and future prospects becomes imperative for stakeholders seeking sustainable success in this essential industry.

#Copper Mining Market#Copper Mining Market Share#Copper Mining Market Trends#Copper Mining Industry#Copper Mining Market Size#Copper Mining Market Challenges#Global Copper Mining Market#Copper Mining Market Analysis#Copper Mining Market Outlook#Copper Mining Market Competitor#Copper Mining Market Forecast#Copper Mining Market Research Reports#Copper Mining Industry Research Reports#Copper Mining Market Major Players#Copper Mining Market Top Players

0 notes

Text

Copper Mining Market Analysis, Brands Statistics and Overview by Top Manufacturers 2030

The market research study titled “Copper Mining Market Share, Trends, and Outlook | 2030,” guides organizations on market economics by identifying current Copper Mining market size, total market share, and revenue potential. This further includes projections on future market size and share in the estimated period. The company needs to comprehend its clientele and the demand it creates to focus on a smaller selection of items. Through this chapter, market size assists businesses in estimating demand in specific marketplaces and comprehending projected patterns for the future.

The Copper Mining market report also provides in-depth insights into major industry players and their strategies because we understand how important it is to remain ahead of the curve. Companies may utilize the objective insights provided by this market research to identify their strengths and limitations. Companies that can capitalize on the fresh perspective gained from competition analysis are more likely to have an edge in moving forward.

With this comprehensive research roadmap, entrepreneurs and stakeholders can make informed decisions and venture into a successful business. This research further reveals strategies to help companies grow in the Copper Mining market.

Market Analysis and Forecast

This chapter evaluates several factors that impact on business. The economics of scale described based on market size, growth rate, and CAGR are coupled with future projections of the Copper Mining market. This chapter is further essential to analyze drivers of demand and restraints ahead of market participants. Understanding Copper Mining market trends helps companies to manage their products and position themselves in the market gap.

This section offers business environment analysis based on different models. Streamlining revenues and success is crucial for businesses to remain competitive in the Copper Mining market. Companies can revise their unique selling points and map the economic, environmental, and regulatory aspects.

Report Attributes

Details

Segmental Coverage

Mining Technique

Open-pit Mining

Underground Mining

Application

Equipment manufacturing

Building and Construction

Infrastructure and Transportation

Others

Geography

North America

Europe

Asia Pacific

and South and Central America

Regional and Country Coverage

North America (US, Canada, Mexico)

Europe (UK, Germany, France, Russia, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, Australia, Rest of APAC)

South / South & Central America (Brazil, Argentina, Rest of South/South & Central America)

Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA)

Market Leaders and Key Company Profiles

Freeport-McMoRan

Glencore

Amerigo Resources Ltd.

BHP

Codelco

African Copper Plc

Southern Copper

Hindustan Copper Ltd

First Quantum Minerals Ltd.

Rio Tinto.

Other key companies

Our Unique Research Methods at The Insight Partners

We offer syndicated market research solutions and consultation services that provide complete coverage of global markets. This report includes a snapshot of global and regional insights. We pay attention to business growth and partner preferences, that why we offer customization on all our reports to meet individual scope and regional requirements.

Our team of researchers utilizes exhaustive primary research and secondary methods to gather precise and reliable information. Our analysts cross-verify facts to ensure validity. We are committed to offering actionable insights based on our vast research databases.

Strategic Recommendations

Strategic planning is crucial for business success. This section offers strategic recommendations needed for businesses and investors. Forward forward-focused vision of a business is what makes it through thick and thin. Knowing business environment factors helps companies in making strategic moves at the right time in the right direction.

Summary:

Copper Mining Market Forecast and Growth by Revenue | 2030

Market Dynamics – Leading trends, growth drivers, restraints, and investment opportunities

Market Segmentation – A detailed analysis by product, types, end-user, applications, segments, and geography

Competitive Landscape – Top key players and other prominent vendors

About Us:

The Insight Partners is a one-stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Devices, Technology, Media and Telecommunications, Chemicals and Materials.

0 notes

Text

Advanced Copper Alloy, Global Market Size Forecast, Top 15 Players Rank and Market Share

Advanced Copper Alloy Market Summary

Advanced copper alloys refer to copper alloy materials with higher strength, conductivity, thermal conductivity, elasticity, corrosion resistance, easy machinability, or excellent comprehensive performance, which are different from traditional copper alloys such as ordinary brass, white copper, and bronze. They mainly include high-strength and high conductivity copper alloys, corrosion-resistant copper alloys, wear-resistant copper alloys, ultra-high strength elastic copper alloys, etc.

Figure. Advanced Copper Alloy Product Picture

Based on or includes research from QYResearch: Global Advanced Copper Alloy Market Report 2023-2029.

According to the new market research report “Global Advanced Copper Alloy Market Report 2023-2029”, published by QYResearch, the global Advanced Copper Alloy market size is projected to reach USD 5.48 billion by 2029, at a CAGR of 6.6% during the forecast period.

Figure. Global Advanced Copper Alloy Market Size (US$ Million), 2018-2029

Above data is based on report from QYResearch: Global Advanced Copper Alloy Market Report 2023-2029 (published in 2023). If you need the latest data, plaese contact QYResearch.

Figure. Global Advanced Copper Alloy Top 15 Players Ranking and Market Share (Ranking is based on the revenue of 2022, continually updated)

Above data is based on report from QYResearch: Global Advanced Copper Alloy Market Report 2023-2029 (published in 2023). If you need the latest data, plaese contact QYResearch.

According to QYResearch Top Players Research Center, the global key manufacturers of Advanced Copper Alloy include Wieland, Mitsubishi Materials Corporation, Furukawa Electric Group, Materion, Kobe Steel, NGK INSULATORS, LTD., JX Nippon Mining & Metals Corporation, Hitachi Metals, KME, Boway Alloy, etc. In 2022, the global top five players had a share approximately 40.0% in terms of revenue.

Figure. Advanced Copper Alloy, Global Market Size, Split by Product Segment

Based on or includes research from QYResearch: Global Advanced Copper Alloy Market Report 2023-2029.

In terms of product type, currently Wear-resistant and Corrosion-resistant Copper Alloy is the largest segment, hold a share of 37.8%.

Figure. Advanced Copper Alloy, Global Sales Market Size, Split by Application Segment

Based on or includes research from QYResearch: Global Advanced Copper Alloy Market Report 2023-2029.

In terms of product application, currently Electronics is the largest segment, hold a sales market share of 37.5%.

Figure. Advanced Copper Alloy, Global Market Size, Split by Region

Based on or includes research from QYResearch: Global Advanced Copper Alloy Market Report 2023-2029.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

0 notes

Text

The Shiny Frontier: Top 5 ASX Silver Stocks Lighting Up the Market

🌟 Silver’s Gleaming Potential in 2024

Gold often takes center stage, but silver is outperforming it this year.

The metal’s dual role as a precious and industrial commodity drives demand, especially in renewable energy.

💎 Top 5 ASX Silver Stocks to Watch

1️⃣ South32 (ASX:S32)

Market Cap: $16.74B

A global giant in silver production, powering industries like tech and solar.

2️⃣ Northern Star Resources (ASX:NEM)

Market Cap: $74.53B

A stable and growth-focused option, excelling in strategic acquisitions.

3️⃣ Sandfire Resources (ASX:SFR)

Market Cap: $4.45B

Known for innovative mining and a strong presence in silver and copper markets.

4️⃣ Silver Lake Resources (ASX:SVL)

Market Cap: $301.6M

Small cap, big potential! Focused on high-grade Australian silver projects.

5️⃣ Argent Minerals (ASX:ARD)

Market Cap: $28.5M

A growth-oriented player in silver and base metals exploration.

⚡ Silver’s Industrial Spark

Essential for solar panels—each uses ~20 grams of silver.

Demand surging with renewable energy advancements.

Widely used in electronics, automotive, and healthcare industries.

📈 Price Projections & Industry Insights

Silver may hit $32 USD/ounce by 2025, with optimistic predictions hinting at $100 USD/ounce.

Dwindling global silver inventories could trigger a supply crunch, driving prices higher.

🌍 Why Invest in Silver Stocks?

Combines tangible industrial demand with growth potential.

A key commodity in the green energy revolution.

Follow the Silver Trail

Stay updated with market insights and seize investment opportunities in these shining stocks!

0 notes