#Construction Project Development in Dubai

Explore tagged Tumblr posts

Text

#Project Development#Project Development in Dubai#Project Development in Abu Dhabi#Project Development in UAE#Feasibility study#Feasibility study in Dubai#Feasibility study in Abu Dhabi#Feasibility study in UAE#Construction Project Development#Construction Project Development in Dubai#Construction Project Development in Abu Dhabi#Construction Project Development in UAE#Program Management#Program Management in Dubai#Program Management in Abu Dhabi#Program Management in UAE#Risk Management#Risk Management in Dubai#Risk Management in Abu Dhabi#Risk Management in UAE

1 note

·

View note

Video

youtube

Dubai of Africa? Africa's Rising Giant? Ethiopia's $ Billions MEGA Projects Will SHOCK You!

#youtube#ethiopia mega projects#africa development#future of ethiopia#east africa competition#dubai#dubai of africa#ethiopia#africa#infrastructure#development#economy#construction#future cities#african#megaprojects#futurecitie#engineering#kimlud#kimludcom#mega projects in africa#EastAfricaGrowth#AfricanDevelopment#ethiopiarising#EnergyTransformation#IndustrialGrowth#ModernEthiopia#FutureOfAfrica

3 notes

·

View notes

Text

Building a Single-Family Home: Key Steps and Considerations

Building a single-family home demands the expertise of many different professionals. It would be very important to work with reputable residential construction companies in Dubai or from within your area. They have the experience to assist you through each step, from design to completion. Within this context, working with the top building construction companies in Dubai will build your house with the finest quality materials and craftsmanship.For more information, visit https://spacebuiltme.com/building-a-single-family-home-key-steps-and-considerations/

#Refurbishment work in Dubai#Space planning services in dubai#Villa maintenance work in Dubai#Top 10 Fit-out contractor in Dubai#Professional Fit-out contractor in Dubai#Master bathroom design in Dubai#Interior Fitout Company in Dubai#Home Renovation Services in Dubai#bathroom renovation in Dubai#fit out companies in dubai#interior fit out contractors in dubai#fit out and space planning in dubai#modern interior design in Dubai#villa construction companies in dubai#major construction companies in dubai#Top 10 construction companies in Dubai#villa developers in dubai#top building construction companies in dubai#residential construction companies in dubai#contracting companies in uae#Exhibition booth builders in Dubai#Kiosk design companies in Dubai#Project Management companies in dubai#turnkey interior fit out company in dubai

0 notes

Text

Adam Tooze giving some pitch-perfect pornography targeted at me specifically with Israel's "Gaza 2035: A three-step master plan to build what they call the Gaza-Arish-Sderot Free Trade Zone", capped with an AI generated Gaza-Dubai:

I'm in love, this is so glorious. "The world if Israel could play around with Gaza like a little set of Legos" tell me this is not identical energy:

Except its not a shitpost its an actual report from the Office of the Prime Minister. And folks we have got it all! The most convoluted administration system you could possibly imagine for no reason:

The new free trade zone would be administered by Israel, Egypt, and what the Israeli Prime Minister calls the Gaza Rehabilitation Authority (GRA)—a proposed Palestinian-run agency that would oversee reconstruction in Gaza and “manage the Strip’s finances.”

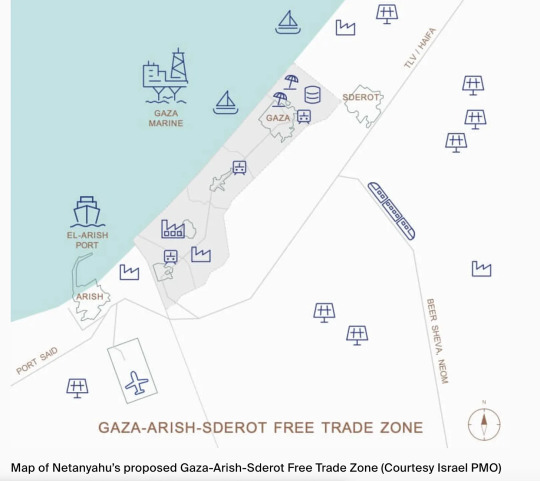

A cutesy little minimalist graphic of all the brand new industries that will magically become globally competitive in export markets because Israel says so:

The beach resorts are in my beloved!! But what are the little factories you ask? Oh nothing, just electric car production facilities!

Remember, before building your first factory, you need 18 Burj Khalifas. We economists call this "infrastructure development", take notes.

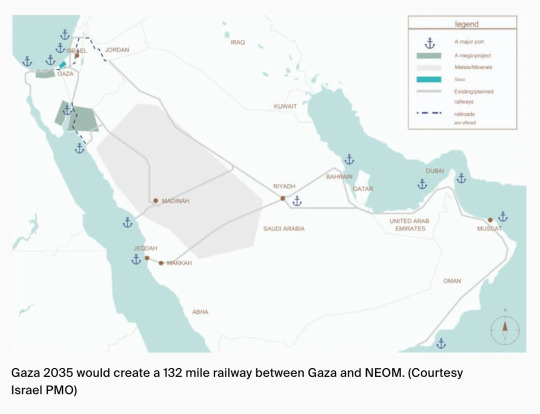

It will have high-speed rail through its center, oil projects on the coast, and of course, I'm saving the best for last - a rail project to NEOM:

🥳The 🥳Line 🥳Mentioned 🥳

The legend on the map literally just says "a mega project" like, oh yeah, one of those! See em all the time.

Now, you might be asking - Ash, if this is your goal wouldn't you have not destroyed every square inch of habitable urban infrastructure in Gaza and shredded their economy into scraps of paper soaked in blood if your plan was to Singapore-on-the-Sea the place? You sweet summer child, those apartments? They are apartments of the past, darling, you don't need organically developed urban ecologies built over time to compliment human habitation. That is for fucking libs. All of this "war" thing was just set-up to create a blank slate for the construction of The Line 2: Its Definitely Real This Time!

I am going to murder James C Scott myself just so I can hover this plan over his corpse and watch the sheer hubris of this monument to the state's desire for legibility and technocratic solutionism resurrect him from the goddamn grave.

"Well....at least after all this they would have to recognize Palestine as a stat-" Woah woah woah woah, hold on:

The final stage would be when Palestine signs the Abraham Accords signaling “Palestinian self-rule,” albeit without statehood

Lets not...lets not get overambitious here. Baby steps, you know? We have to be careful.

Anyway this is the most ludicrously ill-considered and ill-presented reconstruction plan I have ever seen in my life and I shudder to think that, instead of it being an off-hand drip of propaganda intended solely to brush off nosey reporters and diplomats, it might actually be serious. Bibi hasn't let me down yet on the "thinking things through" front!

But tbc if this was fiction - instead of a ruthlessly grim reality - the Regional Deputy Minister of Trade charged with implementing this technocratic abortion would be my precious little blorbo and I would stan her to hell and back.

90 notes

·

View notes

Text

How to Find the Best Deals When Buying Villas in Dubai

Securing the best deals on villas in Dubai requires a combination of market knowledge, strategic planning, and effective negotiation. Here’s how you can find the best deals when buying villas in this vibrant city.

1. Conduct Thorough Market Research

Understanding the market dynamics is crucial for finding the best deals.

Current Market Trends: Stay updated with the latest market trends and property prices in different areas of Dubai. This will help you identify the right time to buy.

Historical Data: Analyze historical data on property prices to understand the market’s performance over the years. This can give you insights into potential future trends.

For comprehensive market insights, visit Dubai Real Estate.

2. Choose the Right Time to Buy

Timing your purchase can significantly impact the deal you get.

Buyer’s Market: Look for periods when there is a surplus of properties on the market. This can drive prices down and provide better negotiation opportunities.

Seasonal Trends: Consider buying during off-peak seasons when the demand is lower. Sellers may be more willing to negotiate during these times.

Explore more options at Off-Plan Projects in UAE.

3. Work with Experienced Real Estate Agents

A knowledgeable real estate agent can be invaluable in finding the best deals.

Reputable Agents: Choose agents with a strong track record and good knowledge of the Dubai villa market. They can provide valuable insights and help you navigate the buying process.

Negotiation Skills: An experienced agent can negotiate better deals on your behalf and help you understand the intricacies of the market.

For expert advice, check out Mortgage Broker Dubai.

4. Consider Off-Plan and Under-Construction Properties

Off-plan and under-construction properties can offer attractive pricing and payment plans.

Early Bird Discounts: Developers often offer discounts for early buyers. These discounts can be substantial and provide good value for money.

Flexible Payment Plans: Off-plan properties typically come with flexible payment plans, making it easier to manage your finances.

Learn more about off-plan properties at Under-Construction Properties in Dubai.

5. Negotiate Effectively

Effective negotiation can help you secure a better deal.

Be Prepared: Do your homework and know the market value of the property. This will give you a strong negotiating position.

Stay Flexible: Be open to compromises and alternative solutions. Sometimes, a small concession can lead to a significant overall saving.

For more negotiation tips, visit Best Mortgage Services.

6. Utilize Online Property Portals

Online property portals can be a great resource for finding deals.

Comprehensive Listings: Use reputable online portals that offer comprehensive listings of properties. This can help you compare prices and features.

Direct Deals: Some portals facilitate direct deals between buyers and sellers, potentially eliminating agent fees and providing better deals.

For more property listings, check out Property For Sale in Dubai.

7. Attend Property Exhibitions and Events

Property exhibitions and events can provide opportunities to find exclusive deals.

Developer Discounts: Many developers offer special discounts and promotions at these events.

Networking Opportunities: These events provide an opportunity to network with developers, agents, and other buyers, which can lead to valuable insights and deals.

Explore more at Rent Your Property in Dubai.

Conclusion

Finding the best deals when buying villas in Dubai involves a combination of thorough research, strategic planning, and effective negotiation. By staying informed about market trends, choosing the right time to buy, working with experienced agents, and considering off-plan properties, you can secure the best deals and make a smart investment in Dubai’s vibrant real estate market.

For more information and assistance with buying villas in Dubai, visit Home Loan UAE.

9 notes

·

View notes

Text

“Those who deny freedom to others deserve it not for themselves.” Abraham Lincoln

The hypocrisy of Reform UK!

Nick Candy, the billionaire property tycoon, having defected from the Conservative Party, is now Reform UK Treasurer.

We all know Reform UK is anti immigration and unsurprisingly they suggested a total ban on migration as far as the UK is concerned during the election:

“Reform proposes ‘freeze’ on immigration.... claiming "Britain is broken" and "in decline culturally", and that stopping immigration would "help us at least try to catch up".

Given Reform UK’s strongly held anti-immigration views it really is hypocritical of Nick Candy to be making millions out of migrant labour in the Middle East.

“Dubai World Trade Centre (DWTC) and UK-based Candy Capital have formed a joint venture to develop three towers in Dubai’s One Central commercial district.” (MEED: 05/14/23)

A year later and Nick Candy is expanding his property development business connections in Dubai.

“Nick’s private investment firm Candy Capital‘s is partnering with Modon Holding, one of the largest real estate developers in the Middle East, to focus on developing a portfolio of high-end property projects in the region.” (Rental Living News: 24/10/24)

Nothing wrong with making money on overseas development you might argue and you would be right. But, and it is a big but, Candy is Treasurer of a UK political party that is strongly anti-immigration, yet in Dubai nearly 90% of the construction workforce consists of migrant workers.

It is therefore almost inevitable that Nick Candy will be employing migrants, perhaps even actively importing them into Dubai, whist at the same time condemning migration in the UK.

The 500,000 migrants who work in the construction industry in Dubai face challenging conditions, including low wages, long working hours and inadequate living conditions.

This report from Human Rights Watch sums up the hell that is migrant working conditions in Dubai:

“The UAE’s kafala (sponsorship) system ties migrant workers’ visas to their employers, preventing them from changing or leaving employers without permission. Employers can falsely charge workers for absconding” even when escaping abuse, which puts them at risk of fines, arrest, detention, and deportation, all without any due process guarantees. Many low-paid migrant workers were acutely vulnerable to situations that amount to forced labor, including passport confiscation, wage theft, and illegal recruitment fees. Trade unions are not permitted, which prevents workers from collectively bargaining. The UAE still does not have a non-discriminatory minimum wage.” (United Arab Emirates: Events of 2023)

Let hope those people that are thinking of voting Reform UK don’t end up with the same working conditions as the construction workers in Dubai when the billionaires and millionaires who own Reform UK are running the country.

#uk politics#reform uk#nick candy#candy capital#uae#dubai#construction#profit#workers#slavery#hypocrisy

2 notes

·

View notes

Text

The World's Tallest Building, The Burj Khalifa, Dubai , UAE. Image: Stéphane Compoint

Inside The Supertall Building Boom

What Skyscrapers Reveal About The Countries That Build Them

— September 20th 2024

A skyscraper is a statement of ambition. No surprise, then, that Saudi Arabia wants to build the world’s tallest. Construction on the Jeddah Tower stopped in 2018 but will restart soon; when completed, it will be the first building ever to rise to a dizzying 1,000 metres. The Jeddah Tower’s nearly 170 storeys will house the usual combination of luxury flats, hotel rooms and offices. On one side visitors will be able to gaze on a new financial district; on another, across the Red Sea.

The building may cost around $1.2bn, but that is a trifling sum given the more than $1trn that Saudi Arabia is spending on developing infrastructure, luring tourists and repositioning itself on the global stage. Leaders see the tower, which resembles a jagged splinter of glass, as a symbol of the kingdom’s power. It “sends a financial and economic message that should not be ignored”, Prince Alwaleed bin Talal, who is overseeing the project, has said.

If that is the case, other places are sending out similar steely messages. There are 236 “supertall” buildings across the world—a label given to anything bigger than 300 metres—and 160 of them have been erected since 2014, according to the Council on Tall Buildings and Urban Habitat (CTBUH), a research group. Another 96 are under way. These hulking piles reshape skylines and cities. And, as well as reaching skyward, they point towards geopolitical and cultural trends. Which countries are building supertalls, and why?

Midtown Manhattan in 1955, looking downtown towards the Empire State Building, then the tallest building in the world Image: Getty Images

The Middle East is home to 20% of all supertalls. The United Arab Emirates, like Saudi Arabia, is showing off its oil wealth and status as one of the region’s fastest-growing economies. It has 35 supertalls; Dubai alone boasts 31, more than any other city. Its behemoth is the Burj Khalifa, which, at 828 metres, has been the world’s tallest tower since opening in 2010. (Reportedly only 71% of the Burj Khalifa is usable space; the rest is “vanity height”.)

Asia has a great love of heights, too, having built more than two-thirds of all supertalls in the past decade. A recent addition is Merdeka 118 in Kuala Lumpur, which was completed last year. At 679 metres tall, it pushed its way into second place. China, which had barely any skyscrapers before 1980, now has five of the ten tallest. The country is home to more skyscrapers per person than America. Some 70% of the supertalls under construction are going up in China. Twenty-five of them, if completed, will rank among the world’s top 100 tallest buildings.

China’s upward trajectory has practical causes. Until recently, the country’s population was surging, rising from 980m in 1980 to 1.4bn today. And those seeking work are still moving from the countryside to the cities, where 66% of people live. Height also helps with urban density, making commuting distances shorter.

But politics provides additional motivation for city planners to think big. “Officials in small cities are particularly prone to build tall,” says Jason Barr, an economist and the author of the book “Cities in the Sky: The Quest to Build the World’s Tallest Skyscrapers”. Strivers in the Communist Party see supertalls as a way to put their lower-tier cities on the map—and perhaps gain attention from central-government bigwigs.

Only 10% of supertalls built in the past decade have sprung up in America, the ancestral home of the skyscraper. (The first were built in New York and Chicago in the late 1880s.) New York, a city known for its gigantic buildings, has gained a few, including super-thin towers south of Central Park in a cluster nicknamed “Billionaires’ Row”. There are still many economic incentives to go high, particularly in New York: land is expensive, and its population is among the most concentrated of any American city. But gaining approval for new buildings is a complex process, thanks to 3,300 pages of zoning regulations.

The number of storeys may be soaring, but some countries nevertheless prefer to stay closer to the ground. In the European Union only Poland has a supertall building (Britain, an ex-member, has one too: the Shard). Skyscrapers are often regarded as “gauche” on the continent, says Daniel Safarik of CTBUH. In London and Rome new edifices are not allowed to block views of certain landmarks, making it hard to build upwards. Paris has banned construction of new tall buildings in response to “ugly” skyscrapers. On X one French person called the Montparnasse Tower, a Brutalist building from 1973, the greatest affront to Paris since the Nazi occupation.

When designing a supertall, architects must not have their heads in the clouds. The first serious order of business is to make sure the building does not get buffeted or blown over. “Wind is the governing factor” of supertall design, says Gordon Gill, who co-designed the Jeddah Tower. As buildings go up and up, so do wind forces. Engineers calculated that the Burj Khalifa, for instance, needed to be able to stand tall amid winds of 150mph (240kph), equivalent to a strong tornado.

The proposed Xi’an Greenland Tower in Xi'an, China, draws inspiration from the detailed armour of terracotta soldiers from the Qin dynasty Image: Adrian Smith, Gordon Gill Architecture

To avoid a statement of grandeur becoming a parable of ineptitude, architects have to “confuse” the wind using different shapes. Thinness, tapering, twisting, round edges and cut-outs at the top of the building all help, and there are interior as well as exterior solutions. At 432 Park Avenue in New York, five double-floors are left empty to let the wind pass through. Taipei 101 in Taiwan features a steel pendulum, weighing some 728 tonnes, that swings to counteract wind-induced movement.

Given the role of skyscrapers as symbols, architects must also pay close attention to what they look like. Note that the Woolworth Building in New York, the tallest in the world from 1913-30, has a copper roof and gargoyles to reflect its status as a “cathedral of commerce”. Today those commissioning supertalls, particularly in Asia and the Middle East, want the building to stand for cultural confidence as well as a specific sense of place.

Top: 432 Park Avenue in New York and Taipei 101, Taiwan (Bottom) Image: Getty Images, Bridgeman, Alamy

Mr Gill says he consults historians to learn about relevant symbolism: for the façade of the proposed Greenland Tower in Xi’an, he evoked the armour of the terracotta soldiers of the ancient Qin dynasty. The spiral shape of Israel’s first supertall, currently under construction in Tel Aviv, recalls a biblical scroll. Merdeka 118 looks rather like a syringe, but its design was supposedly inspired by the shape of Tunku Abdul Rahman’s hand, evoking the statesman who proclaimed Malaysian independence in 1957.

The proposed 1 Park Avenue in the port city of Dubai, UAE (top) was designed to symbolise the motion of water. The Petronas Towers in Kuala Lumpur, Malaysia (bottom left), were meant to evoke the Islamic architecture of South Asia like the Qutb Minar, an 800-year-old minaret in Delhi, India (bottom right). Image: Alamy, Getty Images, Adrian Smith, Gordon Gill Architecture

The sky is not the only limit for supertalls. Enterprising countries all want spectacular buildings, at least until they decide they have had enough. China’s officials are clamping down on “weird” buildings. Edifices that look like “giant trousers”—the nickname given to a building in Beijing designed by Rem Koolhaas—are now verboten. In 2021 the government imposed a height cap of 500 metres and banned cities with fewer than 3m residents from building above 250 metres. (It is thought that safety problems, an oversupply of commercial offices and lots of vacant residential buildings motivated this policy.)

More engineering breakthroughs are needed, too, if buildings are to go higher. It was elevator innovations that helped set off skyscrapers in the late 1800s. But Adrian Smith, one of the architects on the Burj Khalifa, says that lift technology has long been a limiting factor. Existing steel cables have a travel distance of around 500 metres, meaning that it is not possible to get a single lift to the top of many supertalls. (Wind also puts extra strain on the cables.) Yet multiple banks of lifts are difficult to fit into tall, thin buildings. The Jeddah Tower will instead use carbon-fibre, a lighter material that can take lifts higher.

If and when it is possible for buildings to rise higher, no doubt some tycoon or tyrant will want to start a mile-high club. Supertall buildings are monuments to human ingenuity and modernity. But most of all, as Mason Cooley, an American humorist, put it, “A skyscraper is a boast in glass and steel.”

The Burj Al Arab in Dubai, UAE, which recalls the sail of a Dhow, a Common Arab Sailing Vessel Image: Getty Images

— This Article Appeared in the Culture Section of the Print Edition Under the Headline “The Edifice Complex".

#Edifice Complex#Skyscrapers#Supertall Building Boom#UAE 🇦🇪#China 🇨🇳#Taiwan 🇹🇼 | Republic of China 🇨🇳#Saudi Arabia 🇸🇦 | Royal Clock Tower#Kuala Lumpur | Malaysia 🇲🇾 | Merdeka 118#Burj Khalifa | Dubai | UAE 🇦🇪#Shangha Tower#Ping An Finance Centre

2 notes

·

View notes

Text

Top 5 Creative Kids' Activities to Try in Dubai This Summer

Summer in Dubai is a time of vibrant energy, exciting events, and endless possibilities for kids to explore their creativity. With a plethora of activities designed to engage young minds, there is no shortage of fun and educational opportunities for children. From interactive play spaces to educational workshops, Dubai offers a variety of options to keep kids entertained and learning throughout the summer months. Here are the top 5 creative kids' activities to try in Dubai this summer, featuring the best of what the city has to offer.

WooHoo UAE: The Ultimate Creative Play Space

WooHoo UAE is an innovative and interactive children's play museum that provides a perfect blend of fun and learning. Designed to stimulate creativity and curiosity, WooHoo offers a wide range of exhibits and activities that cater to children of all ages.

The museum features ten themed galleries, each designed to inspire imaginative play and exploration. From the Art Lab, where kids can experiment with different art techniques, to the Construction Zone, where they can build and create using various materials, WooHoo UAE is a paradise for creative kids.

The interactive exhibits are not only entertaining but also educational, encouraging children to think critically and solve problems. The museum's mission is to provide a safe and stimulating environment where kids can develop their creativity, imagination, and love for learning.

KidsHQ: Interactive Workshops and Camps

KidsHQ is another fantastic destination for creative kids in Dubai. Known for its engaging workshops and summer camps, KidsHQ offers a variety of activities designed to nurture children's creativity and educational growth.

The summer camps at KidsHQ are particularly popular, featuring themes such as art, science, and drama. Kids can participate in hands-on activities, such as painting, crafting, and experimenting with simple science projects. The camps are designed to be both fun and educational, helping kids develop new skills and discover their passions.

In addition to the summer camps, KidsHQ also offers regular workshops that focus on different aspects of creativity and learning. These workshops provide kids with the opportunity to try new things, meet new friends, and develop their talents in a supportive and encouraging environment.

OliOli: A World of Play and Discovery

OliOli is a hands-on children's museum that offers a unique and interactive experience for creative kids. With its focus on play-based learning, OliOli provides a range of activities that encourage children to explore, create, and discover.

The museum features eight interactive galleries, each designed to stimulate creativity and imagination. From the Water Gallery, where kids can experiment with water and learn about its properties, to the Toshi's Net, a colorful climbing structure that promotes physical activity and imaginative play, OliOli offers endless opportunities for creative exploration.

OliOli also offers a variety of workshops and special events throughout the summer, providing kids with the chance to learn new skills and engage in creative activities. Whether it's a science workshop, an art class, or a storytelling session, OliOli is a place where kids can learn and grow while having fun.

Dubai Garden Glow: A Magical Wonderland

Dubai Garden Glow is a unique and enchanting destination that combines art, creativity, and education in a magical setting. Known for its stunning light displays and artistic installations, Dubai Garden Glow offers a one-of-a-kind experience for creative kids.

The park features several themed zones, including the Glow Park, where kids can marvel at the beautifully illuminated sculptures and installations, and the Dinosaur Park, where they can learn about prehistoric creatures through interactive exhibits and lifelike models.

Dubai Garden Glow also hosts a variety of educational workshops and activities designed to engage children's creativity and curiosity. From art and craft sessions to science experiments and storytelling events, there is something for every child to enjoy at Dubai Garden Glow.

The Green Planet: An Indoor Tropical Rainforest

For a truly unique and educational experience, The Green Planet offers kids the opportunity to explore an indoor tropical rainforest. This bio-dome is home to over 3,000 plants and animals, providing a fascinating and immersive experience for creative kids.

The Green Planet offers a range of interactive exhibits and educational programs designed to teach kids about the importance of conservation and the wonders of the natural world. From the Bat Cave, where kids can learn about these mysterious creatures, to the Australian Walkabout, where they can encounter some of the unique wildlife of Australia, The Green Planet is a place of discovery and adventure.

In addition to the exhibits, The Green Planet also offers educational workshops and activities that focus on different aspects of the rainforest and its inhabitants. These programs provide kids with the opportunity to learn about nature, develop their creativity, and gain a deeper appreciation for the environment.

Conclusion

Dubai is a city that embraces creativity and innovation, offering a wide range of activities and experiences for kids to enjoy. From the interactive exhibits at WooHoo UAE to the enchanting displays at Dubai Garden Glow, there are endless opportunities for creative exploration and learning. Whether your child is interested in art, science, or nature, Dubai has something to offer every young mind. This summer, take advantage of these top creative kids activities and let your child's imagination soar in the vibrant and dynamic city of Dubai.

3 notes

·

View notes

Text

What to Look for When Buying Residential Properties in Dubai

Buying residential properties in Dubai requires careful consideration of various factors to ensure you make a wise investment. This blog outlines what to look for when buying residential properties in Dubai.

For more information on real estate, visit Dubai Real Estate.

Location

Proximity to Amenities: Choose a location that offers easy access to essential amenities such as schools, healthcare facilities, shopping malls, and public transportation. Proximity to these amenities enhances the property's value and convenience.

Future Development Plans: Research future development plans in the area, including infrastructure projects, commercial developments, and recreational facilities. Areas with planned developments often experience appreciation in property values.

Neighborhood Safety: Ensure the neighborhood is safe and secure. Check crime rates and the presence of security measures such as gated communities and surveillance systems.

For property purchase options, explore Invest in Dubai Real Estate.

Property Condition

Structural Integrity: Inspect the property for any structural issues, such as cracks, leaks, or foundation problems. A property in good structural condition requires less maintenance and ensures a longer lifespan.

Interior and Exterior Finishes: Evaluate the quality of the interior and exterior finishes, including flooring, walls, roofing, and fixtures. High-quality finishes enhance the property's appeal and durability.

Age of the Property: Consider the age of the property. Newer properties may require less maintenance, while older properties might have historical charm but could need renovations.

For mortgage services, consider Mortgage Company in UAE.

Developer Reputation

Track Record: Research the developer's track record and reputation in the market. Established developers with a history of delivering high-quality projects on time are usually a safer choice.

Customer Reviews: Look for customer reviews and testimonials from previous buyers. Positive feedback and satisfied customers indicate the developer's reliability and commitment to quality.

Completed Projects: Visit completed projects by the developer to assess their construction quality, design, and overall appeal. This provides insights into what you can expect from the property you are considering.

For rental property management, visit Rent Your Property in Dubai.

Legal and Regulatory Compliance

Title Deed Verification: Ensure the property has a clear title and is free from any legal disputes or encumbrances. The DLD provides title deed verification services to help buyers confirm the property's legal status.

Sales Agreement: Review the sales agreement carefully and seek legal advice if needed. Ensure all terms and conditions are clearly outlined, including the price, payment schedule, and any additional costs.

Permits and Approvals: Verify that the property has all the necessary permits and approvals from relevant authorities. This includes building permits, occupancy certificates, and compliance with zoning regulations.

For property sales, visit sell your house.

Investment Potential

Rental Yield: Research the potential rental yield of the property. High rental yields indicate strong demand and profitability for rental properties. Areas with high rental demand, such as those near business districts or tourist attractions, tend to offer better returns.

Capital Appreciation: Consider the potential for capital appreciation. Properties in areas with ongoing infrastructure development, economic growth, and high demand are more likely to appreciate in value over time.

Market Trends: Stay informed about market trends and economic indicators that impact property values. This includes factors such as interest rates, inflation, and government policies affecting the real estate sector.

Real-Life Success Story

Consider the case of James, an investor who successfully bought a residential property in Jumeirah Village Circle. James conducted thorough research, inspected the property's condition, and chose a reputable developer. By following the guidelines outlined in this blog, James secured a high-yield investment and has seen significant appreciation in property value.

Future Trends in Dubai Real Estate

Sustainable Developments: There is a growing demand for eco-friendly and sustainable properties in Dubai. Developers are increasingly incorporating green building practices and energy-efficient features into their projects.

Smart Homes: The adoption of smart home technology is on the rise. Properties equipped with advanced security systems, automated lighting, and climate control are becoming more popular.

Mixed-Use Communities: Integrated communities that offer a mix of residential, commercial, and recreational facilities are gaining popularity. These developments provide residents with a convenient and holistic living experience.

Conclusion

When buying residential properties in Dubai, it is essential to consider factors such as location, property condition, developer reputation, legal compliance, and investment potential. By paying attention to these aspects, you can make a well-informed decision and secure a valuable investment. For more resources and expert advice, visit Dubai Real Estate.

2 notes

·

View notes

Text

Precision Core Drilling Services in Dubai | Cosmic Technical Services LLC

At Cosmic Technical Services LLC, we specialize in core drilling services in Dubai that exceed industry standards. With our cutting-edge equipment and expert technicians, we deliver precise results tailored to your needs.

Core drilling is a crucial process in construction, renovation, and infrastructure projects. Whether you require precise holes for plumbing, electrical, HVAC, or structural purposes, our team has the expertise to deliver. We understand the importance of accuracy and efficiency, which is why we employ advanced techniques and machinery for every project.

Our core drilling services in Dubai are comprehensive, covering a wide range of materials including concrete, asphalt, masonry, and more. No matter the complexity or scale of your project, we have the capabilities to meet and exceed your expectations. From small residential projects to large-scale commercial developments, Cosmic Technical Services LLC is your trusted partner for all core drilling needs.

Why Choose Cosmic Technical Services LLC for Core Drilling Services in Dubai?

Expertise: Our team consists of highly skilled technicians with years of experience in core drilling. We understand the nuances of each project and strive for perfection in every job we undertake.

State-of-the-Art Equipment: We invest in the latest core drilling technology to ensure precision and efficiency. Our equipment undergoes regular maintenance to guarantee optimal performance and safety.

Tailored Solutions: We recognize that every project is unique, which is why we offer customized core drilling solutions to suit your specific requirements. Whether you need standard-sized holes or custom dimensions, we can accommodate your needs.

Safety First: Safety is our top priority on every job site. Our technicians adhere to strict safety protocols to minimize risks and ensure a safe working environment for everyone involved.

Timely Completion: We understand the importance of deadlines in construction projects. With our efficient workflows and skilled team, we ensure timely completion without compromising on quality.

Customer Satisfaction: At Cosmic Technical Services LLC, customer satisfaction is paramount. We prioritize clear communication, transparency, and responsiveness to ensure a positive experience from start to finish.

Experience the Difference with Cosmic Technical Services LLC

When you choose Cosmic Technical Services LLC for core drilling services in Dubai, you're partnering with a trusted industry leader committed to excellence. Whether you're a contractor, developer, or homeowner, you can rely on us for superior quality, precision, and professionalism.

Contact us today to discuss your core drilling needs and discover how we can help bring your project to fruition. With Cosmic Technical Services LLC, your satisfaction is guaranteed.

2 notes

·

View notes

Text

1966: The Genesis of Solico Group

In 1966, Solico Group emerged onto the scene, catering to the flourishing construction industry in the UAE. The company's initial focus was on delivering cutting-edge Composite products, laying the groundwork for its subsequent global expansion and the introduction of groundbreaking solutions like Solico Tanks.

1984: Pioneering Water Storage Solutions

A watershed moment occurred in 1984 when Solico introduced a revolutionary water storage solution – hot-pressed GRP panel-type water tanks. By partnering with the esteemed Japanese brand Bridgestone, Solico swiftly captured market share, transforming conventional water storage practices towards cleaner and healthier alternatives. This strategic collaboration, coupled with a robust global marketing initiative, marked a paradigm shift in the industry.

2000: Innovation, Growth, and a New Manufacturing Hub

After years of innovation, commercial success, and expansion, Solico relocated to a state-of-the-art 220,000 sq ft manufacturing facility in Jebel Ali, Dubai, in 2000. This move facilitated an expansion of product offerings and processes, incorporating Polyurethane molding, SMC hot-press compression molding, and thermoforming. Solico earned acclaim as a supplier of premium OEM products to globally recognized brands.

2001: Diversification into Boat Manufacturing

In 2001, Solico diversified its portfolio by launching the boat business division ASIS. Leveraging expertise in fiber wet and pre-preg lay-up processes, this venture yielded successful products, including rigid inflatable boats for renowned brands like Zodiac, ASIS, and Ocean Craft Marine.

2003: Expanding Manufacturing Capacities

Rapid expansion led Solico to embark on the second phase of its manufacturing facility in 2003, significantly increasing production capacities to accommodate future projects.

2004: SWS Board Technology and Sports Manufacturing Leadership

The launch of SWS Board Technology in 2004 marked Solico's entry into the water sports business, specializing in compression molding and Polyurethane molding. The company played a pivotal role in designing and manufacturing OEM products for globally respected sports brands.

2012: Next-Generation GRP Panel-Type Water Tanks

In 2012, Solico introduced a hot-press SMC manufacturing plant for its advanced GRP panel-type water tanks. The brand Solico Tanks was officially launched, signaling a new chapter in the group's illustrious history.

2016: Golden Jubilee Celebration

In 2016, Solico Group celebrated its 50th anniversary, a testament to five decades of remarkable achievements. The company had become one of the world's most esteemed suppliers and OEM manufacturers of quality molded composite products, with a strong focus on the American and European markets.

2019: Third-Phase Facility Expansion

Solico Group initiated the third-phase expansion of its manufacturing facility in 2019, increasing it to an impressive 400,000 ft2. This expansion aimed to meet the escalating demand for its diverse range of products and services.

2020: Commitment to Sustainability

In 2020, Solico Group underscored its commitment to sustainability by installing solar panels on the roof of its Jebel Ali manufacturing facility. This initiative aimed to reduce the company's carbon footprint and align with eco-friendly practices.

2023: Advancements in Research and Development

Since the inception of Solico Tanks, continuous investments in research and development have expanded the product range and enhanced product effectiveness. The company now boasts the capability to design and manufacture 6-meter-high water tanks with varying seismic classes, ensuring secure water supplies in some of the world's most vulnerable regions.

2 notes

·

View notes

Video

youtube

Dubai of Africa? Africa's Rising Giant? Ethiopia's $ Billions MEGA Projects Will SHOCK You!

#youtube#Dubai of Africa#dubai#Ethiopia#Africa#Billions MEGA Projects#Billions#MEGA Projects#global development#infrastructuure#roads#construction

0 notes

Text

The Art of Joinery: Custom Furniture and Fixtures for Your Home or Office

In terms of beautification and functionality of a room, joinery is very important. Conversion of a plain room to a cosy home or an efficient office can be done using custom furniture and fixtures. Working with joinery encompasses precision, creativity, and great skills. Custom furniture for improvement in your home or office can make an enormous difference.

What Is Joinery?

Joinery is a craft that deals with the construction of wooden components like furniture, doors, and cabinets. In contrast to ordinary carpentry, joinery specializes in connecting and shaping wood without using nails. This technique helps make the products long-lasting and aesthetically pleasing.

The beauty of joinery is that it can bring out the natural elegance of wood. Skilled artisans can create intricate designs that reflect your style while adding functional value to your space. Furthermore, it provides endless possibilities for custom furniture that fits your needs perfectly.

The Importance of Custom Furniture

Custom furniture will offer several more advantages over mass-produced pieces, one of them being that it fits your space very well. Regardless of whether a small apartment needs to be decorated or a bigger office with custom pieces of furniture, this can be managed to maximize space.

Additionally, custom furniture enables you to pick materials, finishes, and styles which can suit your aesthetic. This way, you’re able to come up with a stylish look that agrees with your theme of interior design. Whether it is a modern, minimalist look or a more traditionally inclined approach, custom joinery can make your vision materialize.

Joinery Works in Dubai: Why Choose Expert Services?

Therefore, Joinery works in Dubai demand is quite high due to its modern architectural patterns and rich interior designs. Whether it is a home renovation or designing a commercial space, you will need skilled professionals who understand the art of joinery.

Joinery experts in Dubai have developed both the knowledge and the equipment to create high-quality, robust, and stylish furniture. Additionally, they can offer solutions that best fit your needs. From years of experience, these professionals ensure that every piece of furniture created will be not only functional but also aesthetically pleasing.

Custom Fixtures for Your Office Space

Your office is more than just a place to work. It reflects your brand and company values. So, having the right fixtures is crucial for creating a productive and inspiring environment. Custom-made furniture can help enhance both the functionality and style of your office.

Customized fixtures like a reception desk, storage unit, and meeting tables can also be designed according to your office’s setup. A professional Interior Fitout Company in Dubai will work together with the designer or design house to develop these fixtures, ensuring they meet the requirements of branding requirements for your space. This service gives personalized requirements, meeting both practical and aesthetic needs.

How Joinery Elevates Home Renovations?

Home renovation services in Dubai can take your living space from ordinary to extraordinary. Custom joinery plays a pivotal role in this transformation. Whether you’re looking to install bespoke shelving, wardrobes, or kitchen cabinets, joinery offers a tailored solution for every room in your home.

However, custom joinery lets you make use of your available space. For example, a built-in wardrobe can save you storage while a custom bookshelf can also enhance the liveliness of the living room. The possibilities can be endless for joinery for home renovation projects.

Choosing the Right Carpentry Services in Dubai

When choosing a carpentry Services in Dubai, choose professionals who know your requirements. Look for a company that has a track record and experience of delivering good-quality joinery works. For bespoke furniture, fixtures, or even home renovation, the right professional will be there to help guide you through design and installation processes.

Furthermore, carpentry services should be observed to consider the materials and finishes they use. The material used can determine the durability and lifespan of your furniture and other fixtures. Therefore, it is ideal to select a service that uses high-quality materials for the best results.

Conclusion

Joinery is a very essential art in interior design, be it for your home or office. Custom furniture and fixtures are not only a beauty but add functionality to the space. You get the best with such skilled craftsmen, where each piece is designed according to your needs.

You could look for bespoke furniture and fixture services if you want professional joinery works in Dubai. Renovation or office designs and custom joinery will perfectly provide the beautiful yet practical outlook you want to have. Moreover, contact Interior Fitout Company in Dubai that will help your idea turn into a reality. Call them today, and they can surely make it shine.

#Refurbishment work in Dubai#Space planning services in dubai#Villa maintenance work in Dubai#Top 10 Fit-out contractor in Dubai#Professional Fit-out contractor in Dubai#Master bathroom design in Dubai#Interior Fitout Company in Dubai#Home Renovation Services in Dubai#bathroom renovation in Dubai#fit out companies in dubai#interior fit out contractors in dubai#fit out and space planning in dubai#modern interior design in Dubai#contracting companies in uae#top contracting companies in uae#top 10 contracting companies in uae#building contracting companies in dubai#villa contracting companies in dubai#top contracting companies in dubai#villa renovation company in dubai#Exhibition booth builders in Dubai#Kiosk design companies in Dubai#Project Management companies in dubai#turnkey interior fit out company in dubai#villa construction companies in dubai#major construction companies in dubai#Top 10 construction companies in Dubai#villa developers in dubai#top building construction companies in dubai#residential construction companies in dubai

0 notes

Text

Sam Singh, Chief Executive of Tripler

Dubai, located in the United Arab Emirates (UAE), is known for its booming real estate market that has seen rapid development over the years. Dubai's real estate sector has been a significant contributor to the city's economic growth and has attracted investors and homebuyers from around the world. Apart from that Sam Singh, Chief Executive of Tripler. He is founder and chief executive of new lead generation estate agency platform Tripler.

Here are some key points about Dubai's real estate market:

Property Types: Dubai offers a wide range of real estate options, including residential properties such as apartments, villas, townhouses, and penthouses, as well as commercial properties like office spaces, retail spaces, and industrial properties.

High-rise Buildings: Dubai is famous for its iconic high-rise buildings, including the Burj Khalifa, the tallest building in the world, which has become a symbol of Dubai's skyline. Many other tall buildings and skyscrapers dot the city's landscape, offering luxury living and office spaces.

Master-Planned Communities: Dubai is known for its master-planned communities, which are carefully designed and developed residential areas that offer a mix of housing options, recreational facilities, and amenities such as schools, parks, shopping malls, and healthcare facilities. Some popular master-planned communities in Dubai include Palm Jumeirah, Dubai Marina, Jumeirah Lakes Towers (JLT), Downtown Dubai, and Emirates Hills.

Foreign Ownership: Dubai's real estate market allows foreign nationals to own properties in designated areas, known as freehold areas, which include many popular areas in the city. This has made Dubai an attractive destination for foreign investors and expatriates looking to invest in real estate or buy a home.

Off-Plan Properties: Off-plan properties, which are properties that are still under construction or not yet built, have been a popular investment option in Dubai's real estate market. Many developers offer attractive payment plans and incentives to attract buyers to invest in off-plan properties.

Real Estate Regulations: The real estate market in Dubai is regulated by the Dubai Land Department (DLD) and the Real Estate Regulatory Agency (RERA), which oversee various aspects of the real estate sector, including licensing, registration, and dispute resolution.

Market Trends: Dubai's real estate market has experienced fluctuations in recent years, with periods of high demand and price growth, followed by periods of stabilization and correction. Factors such as supply and demand dynamics, global economic conditions, and government policies can impact the performance of the real estate market in Dubai.

Real Estate Developers: Dubai is home to many renowned real estate developers who have played a significant role in shaping the city's skyline. Some of the prominent developers in Dubai include Emaar Properties, Nakheel, Dubai Properties, DAMAC Properties, and Meraas, among others.

Rental Market: Dubai's real estate market also has a thriving rental market, with a large expatriate population and a significant demand for rental properties. Rental yields and regulations for tenants and landlords are governed by the Dubai Rental Law, which provides guidelines and protections for both parties.

Future Outlook: Dubai's real estate market is expected to continue evolving in the coming years with ongoing development projects, government initiatives, and Expo 2020 Dubai, a global event that is expected to boost the city's real estate market and economy.

It's important to note that real estate markets can be subject to fluctuations and it's essential to conduct thorough research and seek professional advice before making any investment decisions in Dubai or any other market.

7 notes

·

View notes

Text

As the 2023 United Nations Climate Change Conference (or COP28) gets underway in Dubai, the call for rich countries to provide more money to poor countries to fight climate change has taken center stage. But if the record on climate finance is any indication, poor countries should be careful what they wish for.

The conventional critique of climate finance is that it’s too little. In July, the United States and other members of the G-20 refused to endorse a proposal for the World Bank to triple its lending with new capital from its largest shareholders. According to unconfirmed estimates by the Organization for Economic Cooperation and Development, rich countries only last year—and just barely—met a promise made in 2009 to provide $100 billion in climate finance per year, a figure to which they just added $300 million as seed money for a climate loss and damage fund for the world’s poorest countries.

So far, so familiar, and you will surely hear the call for more funds repeated during and after COP28. But while the critique of the amounts pledged is correct, it is only the tip of the iceberg that is the climate finance mess. And the clamor for money fails to address a fundamental problem with climate finance the way it works today: All too often, it competes with the actual needs of developing countries that these transfers are supposed to serve.

The dirty secret of climate finance is that much of it is displacing traditional development aid. Calls for more climate finance are important, but if current practice is any guide, a large share of the funds will be taken from budgets that fund critical development priorities, such as health, education, women’s rights, infrastructure construction, and humanitarian aid.

Exhibit A is a recent study from CARE International, a global nongovernmental organization focused on poverty and social justice. By its estimates, 52 percent of climate finance provided by 23 rich countries from 2011 to 2020 was money that previously went to development budgets, including programs focused on health, education, and women’s rights. In other words, on account of climate policies, poor countries have seen deep cuts in critical aid programs with demonstrated short- and long-term benefits. The numbers look even worse when you consider the long-standing development spending pledge of 0.7 percent of gross national income. If you take that number as a minimum for development spending and posit that climate finance should come on top, only 7 percent of wealthy countries’ climate finance qualifies as additional funding, according to CARE.

The British government, for example, classifies climate finance as development aid, for which the government has a spending target of 0.5 percent of gross national income. Britain’s treatment of this target as a de-facto ceiling has meant that any climate finance counted towards aid automatically displaces funding for development projects. Other leading providers of climate finance, such as Germany, France, and the United States, have also siphoned off climate finance from development spending. Japan, the world’s largest climate funder, provides no finance that is additional to its 0.7 percent pledge for development aid, according to CARE.

The diversion of aid from school feeding programs, maternal healthcare, road construction, programs to assist small farmers, and other purposes is devastating for poor countries. Recent progress toward the U.N. Sustainable Development Goals has been weak, and some indicators of economic development have worsened in the past few years. The economist Charles Kenny argues that we have the knowledge to meet these goals but need significantly greater financial resources to do so. Yet wealthy countries are ignoring this advice, redirecting development funds to climate projects that often do little to advance actual development in the countries they are supposed to help.

Even when rich countries are not raiding other budgets, how they define climate finance is creative, to say the least. An analysis of a United Nations database of climate projects by Reuters showed that climate aid had been used to fund airports, hotels, rainforest-themed movies, a coal plant, and fighting crime. When an Italian chocolate chain opened stores in Asia, the company received a $4.7 million subsidy that the Italian government booked as climate finance. According to the Reuters report, climate specialists agreed that the identified projects “have little or no direct connection to climate change.” The researchers also found that more than $65 billion was spent on projects so poorly reported that it was impossible to say what the money was spent on or even the continent where it was sent. Projects cumulatively worth more than $500 billion were canceled—but remained on the books to count toward climate pledges. There are no uniform official rules for what counts as climate finance, and rich countries appear to be under no obligation to provide details.

What constitutes climate finance is also mostly undefined at the World Bank, the largest provider of finance to poor countries. Loans for improving teacher quality, access to healthcare, and municipal transparency are labeled as having climate co-benefits, but these claimed benefits are not spelled out. While it is sometimes possible to intuit benefits, most project documents lack estimates of greenhouse gas emissions reductions, and the World Bank still has no standardized reporting of emissions estimates. The bank’s own claim that it has funded projects resulting in 194 million tons of carbon dioxide reductions per year has not been verified by independent sources—and, given the lack of emissions documentation for many projects, may indeed be unverifiable. In June, the World Bank said it would restructure its reporting on climate.

That’s not the end of it. Poor countries often receive only the remnants of climate funds that are fully booked as aid but channeled through private-sector firms in rich countries. An analysis by Carbon Brief using data from the British Development Tracker found that 54 management consultancies, mainly headquartered in Britain and other rich countries, received billions of pounds in government funding to provide advice to poor countries on how to fight climate change. In Nigeria and Ghana, 88 percent of U.K. climate aid from 2010 to 2023 was disbursed through international consulting firms. Despite concerns about the fees charged by these firms, the actual value of their work, and insufficient building of local capacity, the British government continues to rely on rich-country consultancies to deliver climate aid.

All of this comes on top of an even more fundamental flaw underlying the concept of climate finance: The premise that if only the rich world gave poor countries more money, the latter could develop their economies on the basis of renewable energy and get rid of fossil fuels. This may sound benevolent to someone sitting in Washington or Berlin, but it contradicts what we know about the needs of poor countries and the relationship between energy, development, and climate resilience. By focusing only on the energy transition, rich governments are forcing a hypothetical green growth model on the developing world that never even worked in their own countries.

1 note

·

View note

Text

The Future of Dubai Real Estate

In recent years, Dubai has experienced some of the world's fastest urban expansion, and a significant contributor to this growth has been the city's real estate industry. The city has experienced significant real estate investment, leading to the development of some of the most recognisable structures in the world, including the Burj Khalifa, the highest structure in the world.

A few major trends and variables are projected to influence the real estate market in Dubai in the future. They include:

Growth: Despite recent swings, Dubai's real estate market is predicted to rise over the next few years due to a mix of population expansion, economic growth, and more tourism.

Emphasis on sustainability: Dubai, like many other cities worldwide, is putting more of an emphasis on sustainability and lowering its carbon footprint. Developers and investors are anticipated to place a higher focus on green construction techniques and energy efficiency, which will have a substantial influence on the city's real estate market.

Technology is Emphasised: Dubai is renowned for embracing new technologies, and it is probable that this will also apply to the real estate industry. Many technological advancements, like smart houses and buildings and blockchain-based property transactions, have the potential to change how Dubai developed, purchases, and sells real estate.

Demand changes: As Dubai develops, it's possible that the kinds of properties that are most in demand may shift. For instance, if the city expands, there can be a higher need for inexpensive housing or more interest in homes that can accommodate the expanding expat community.

Nevertheless, the future of the Dubai real estate industry is promising, with future expansion expected to be fueled by continuing growth and innovation.

4 notes

·

View notes