#Cloud-based Accounting Software

Explore tagged Tumblr posts

Text

Facing Accounting Challenges? TRIRID Biz Has the Solution

Facing Accounting Challenges TRIRID Biz Has the Solution you’ve been looking for! Managing finances can often feel overwhelming, especially when dealing with GST compliance, manual processes, and the need for real-time insights. But don’t worry—TRIRID Biz is here to simplify your accounting and billing processes, ensuring accuracy, efficiency, and peace of mind for your business.

Common Accounting Problems Faced by Businesses

Tireless Manual Work

Many businesses face accounting challenges in terms of managing several invoices, expenses, and reports manually. This task is a time killer that one can handle in pursuit of his/her strategic goals.

Process Errors

Single mistakes in accounting, no matter the size, would lead to severe cost-making errors. TRIRID Biz Has Solutions to minimize risks through automation and accuracy.

Tax Compliance Nightmare

One of the biggest accounting challenges for businesses is staying compliant with GST regulations. TRIRID Biz provides an intuitive platform to generate GST-ready invoices and streamline tax filing.

Lack of Real-Time Insights

Businesses find it difficult to make informed decisions without real-time financial data. TRIRID Biz Has the Solution to provide you with instant access to accurate financial insights.

How TRIRID Biz Solves Your Accounting Challenges

TRIRID Biz Accounting and Billing Software is designed to overcome the most common accounting issues in businesses, which are as follows:

Automation of Important Tasks

TRIRID Biz has saved countless hours of manual work for businesses suffering from accounting problems by automating tasks like invoicing and expense tracking.

Tax compliance becomes easy with GST-ready features that ensure accurate billing and reporting. TRIRID Biz makes tax filing easy when you face accounting challenges.

Real-Time Reporting and Insights

TRIRID Biz gives you real-time access to financial reports. Whether you are on-site or remote, you will never feel out of control when facing accounting challenges.

Cloud-Based Convenience

With TRIRID Biz's cloud-based software, you are given the ability to work from anywhere and thus to be able to tackle all the accounting issues in your path.

User-friendly Interface

Not necessarily a financial guru, but even then TRIRID Biz has the answer, it is made with easy features to use, made for everyone.

Why TRIRID Biz

You face accounting problems. Here's why you need to choose TRIRID Biz.

Affordable Price: It will give you a robust feature at competitive prices.

Security and Reliability: Your data will be encrypted, safe, and stored.

Scalable Solutions: TRIRID Biz with your business that ensures it remains on par to the growth requirements.

Take that next step for simplified accounting.

It is the time to be relieved of worries and stress, having to address these tough accounting issues, when you come with TRIRID Biz's solution. So streamline your work processes, limit errors, and have real-time access to insight about your company's finances.

Don’t wait—Facing Accounting Challenges? TRIRID Biz Has the Solution you’ve been searching for!

Try TRIRID Biz today and experience the difference for yourself!

Call us @ +91 8980010210

Visit Our Website: https://tririd.com/tririd-biz-gst-billing-accounting-software

#Best accounting software for businesses#Best Accounting Software In India#cloud-based accounting software#Financial reporting software#TRIRID Biz Accounting & billing software

0 notes

Text

How to Choose the Best Accounting Software for Your Business

Introduction In the fast-moving environment related to the business world, keeping yourself on top of the finances will never be an easy task. In reality, a company can easily slip into disarray without proper supervision of its finances. No matter whether yours is a small startup or a big corporation, the right kind of accounting software will certainly work wonders in the smooth flow of financial operations. But with accounting software options galore, how do you choose a software that’s suitable for your business? The guide from TechtoIO will take you through everything you need to know to make an informed decision. Read to continue

#analysis#science updates#tech news#trends#adobe cloud#nvidia drive#science#business tech#technology#tech trends#CategoriesSoftware Solutions#Tagsaccounting software comparison#AI in accounting software#automated invoicing software#best accounting software for business#blockchain accounting solutions#choosing accounting software#cloud-based accounting software#expense tracking software#financial reporting tools#FreshBooks review#integrating accounting software#mobile accounting software#QuickBooks vs Xero#scalable accounting software#secure accounting software#small business accounting software#top accounting software 2024#user-friendly accounting software#Wave accounting software

0 notes

Text

New Era Of Accounting A Wake-Up Call For Auto Repair Shop Owners

Attention, auto care shop owners! The accounting landscape is currently undergoing a significant evolution, marking the dawn of a new era. This isn’t just another ordinary day at your shop; it’s a clarion call to redefine how you steer your financial success.

Amidst the symphony of clinking tools and purring engines in your shop, a subtle struggle often echoes in your mind. The intricacies of numbers and ledgers present a challenge as complex as repairing the most intricate engine.

Read More on New Era Of Accounting A Wake-Up Call For Auto Repair Shop Owners

#auto care#auto repair shops#bookkeeping and financials#car care#car care accounting operations#cloud-based accounting software

0 notes

Text

What is the best web-based enterprise accounting software?

In the fast-paced and ever-evolving landscape of business, staying on top of your finances is crucial. As enterprises expand their operations, managing accounts efficiently becomes a daunting task. Thankfully, with the advent of technology, businesses now have access to a plethora of web-based enterprise accounting software options to streamline their financial processes. In this comprehensive guide, we will explore the ins and outs of web-based enterprise accounting software, helping you make an informed decision on the best solution for your business needs.

Understanding Web-Based Enterprise Accounting Software

Web-based enterprise accounting software, often referred to as cloud accounting software, is a digital solution that allows businesses to manage their financial activities online. Unlike traditional accounting systems that rely on on-premise software, web-based accounting tools operate in the cloud, offering users the flexibility to access their financial data from anywhere with an internet connection.

Advantages of Web-Based Enterprise Accounting Software

1. Accessibility

One of the primary advantages of web-based accounting software is accessibility. With data stored securely in the cloud, users can access their financial information anytime, anywhere. This proves especially beneficial for enterprises with multiple locations or remote teams, fostering collaboration and efficiency.

2. Cost Efficiency

Web-based accounting solutions often follow a subscription-based model, eliminating the need for costly upfront investments in software and hardware. This cost-effective approach makes it easier for businesses to scale their accounting infrastructure according to their needs without breaking the bank.

3. Real-Time Updates

In the dynamic world of business, real-time data is invaluable. Web-based accounting software provides instant updates, ensuring that users have access to the most recent financial information. This feature is crucial for making informed decisions and adapting to market changes promptly.

4. Automatic Updates and Maintenance

Gone are the days of manual software updates and maintenance. With web-based accounting solutions, updates are automatic, and maintenance is handled by the service provider. This frees up valuable time for businesses to focus on core operations rather than managing software updates.

Features to Look for in Web-Based Enterprise Accounting Software

1. User-Friendly Interface

A user-friendly interface is essential for ensuring that your team can navigate the software seamlessly. Look for solutions with intuitive dashboards and easy-to-understand features to minimize the learning curve for your staff.

2. Scalability

As your enterprise grows, so do your accounting needs. Choose a web-based accounting solution that can scale with your business, accommodating increased transaction volumes and additional users without compromising performance.

3. Integration Capabilities

Efficient accounting doesn't happen in isolation. Ensure that the web-based accounting software you choose integrates seamlessly with other essential business tools, such as CRM systems, project management software, and e-commerce platforms.

4. Security

The security of your financial data should be a top priority. Opt for web-based accounting software that employs robust encryption protocols and follows industry best practices for data protection. Additionally, check for features such as multi-factor authentication to add an extra layer of security.

Top Contenders in the Web-Based Enterprise Accounting Software Market

1. MargBooks

MargBooks Online is a India's popular online accounting solution known for its user-friendly interface and robust features. It offers a range of plans to suit businesses of all sizes and provides tools for invoicing, expense tracking, and financial reporting.

2. Xero

Xero is another cloud accounting software that caters to small and medium-sized enterprises. With features like bank reconciliation, inventory management, and payroll integration, Xero is a comprehensive solution for businesses looking to streamline their financial processes.

3. NetSuite

NetSuite, owned by Oracle, is a cloud-based ERP (Enterprise Resource Planning) solution that includes robust accounting functionalities. It is suitable for larger enterprises with complex financial needs and offers features such as financial planning, revenue recognition, and multi-currency support.

4. Zoho Books

Zoho Books is part of the Zoho suite of business applications and is designed for small and medium-sized enterprises. It provides features such as automated workflows, project billing, and collaborative client portals, making it a versatile choice for businesses with diverse needs.

Making the Right Choice for Your Business

Choosing the best web-based enterprise accounting software for your business requires careful consideration of your specific needs and objectives. Here are some steps to guide you through the decision-making process:

1. Assess Your Business Requirements

Start by identifying your business's specific accounting requirements. Consider factors such as the number of users, the complexity of your financial transactions, and the need for integration with other business applications.

2. Set a Budget

Determine a realistic budget for your accounting software. While web-based solutions often offer cost savings compared to traditional software, it's essential to choose a solution that aligns with your financial resources.

3. Explore Free Trials

Many web-based accounting software providers offer free trials of their platforms. Take advantage of these trials to explore the features and functionalities of different solutions before making a commitment.

4. Seek Recommendations and Reviews

Consult with other businesses in your industry or network to gather recommendations and insights. Additionally, read reviews from reputable sources to gain a better understanding of the user experiences with different accounting software options.

The Evolution of Web-Based Enterprise Accounting Software

As technology continues to advance, so does the landscape of web-based enterprise accounting software. The evolution of these platforms is driven by the ever-changing needs of businesses and the ongoing developments in cloud technology. Let's delve deeper into the evolving trends shaping the future of web-based accounting solutions.

1. Artificial Intelligence (AI) and Automation

The integration of artificial intelligence and automation is revolutionizing how businesses handle their financial processes. Modern web-based accounting software is incorporating AI algorithms to automate repetitive tasks, such as data entry and invoice categorization. This not only increases efficiency but also minimizes the risk of human error.

2. Enhanced Data Analytics

In the age of big data, the ability to derive meaningful insights from financial data is paramount. Advanced web-based accounting solutions are now equipped with powerful data analytics tools. These tools help businesses analyze trends, forecast future financial scenarios, and make data-driven decisions.

3. Mobile Accessibility

The shift towards mobile accessibility is a notable trend in web-based enterprise accounting software. Businesses are increasingly relying on mobile devices for day-to-day operations, and accounting software providers are responding by offering mobile-friendly applications. This allows users to manage their finances on the go, providing unparalleled flexibility.

4. Integration with E-Commerce Platforms

As e-commerce continues to thrive, businesses are looking for accounting solutions that seamlessly integrate with their online sales platforms. Modern web-based accounting software often includes features tailored for e-commerce, such as automated transaction reconciliation with online sales channels and inventory management.

5. Blockchain Technology

Blockchain technology is making waves in various industries, and accounting is no exception. Some web-based accounting solutions are exploring the integration of blockchain for enhanced security and transparency in financial transactions. This could revolutionize how businesses handle aspects like auditing and transaction verification.

Common Challenges and How to Overcome Them

While web-based enterprise accounting software offers numerous benefits, it's important to be aware of potential challenges and how to overcome them. Here are some common issues businesses may face:

1. Security Concerns

The sensitive nature of financial data raises concerns about security in the cloud. To address this, choose a web-based accounting solution that employs robust encryption protocols and complies with industry security standards. Additionally, educate your team about best practices for secure online behavior.

2. Connectivity Issues

Reliable internet connectivity is crucial for accessing web-based accounting software. In regions with unstable internet connections, businesses may face challenges in real-time collaboration and data accessibility. Consider implementing backup solutions for offline access or explore accounting software with offline capabilities.

3. Customization Needs

Every business has unique accounting requirements. Some businesses may find that certain web-based accounting solutions lack the level of customization they need. In such cases, explore platforms that offer extensive customization options or consider integrating additional specialized accounting tools.

4. Data Ownership and Control

Understanding the terms of service and data ownership is essential when using web-based accounting software. Ensure that the chosen platform allows you to retain control over your financial data and provides mechanisms for data export in case of migration to a different system.

Conclusion: Making the Right Choice for Long-Term Success

In the fast-paced world of business, the right web-based enterprise accounting software can be a game-changer. Whether you're a small startup or a large enterprise, the key is to stay informed about the latest advancements in accounting technology and align your choice with the long-term goals of your business.

As you navigate the vast landscape of web-based accounting solutions, remember that the best choice is the one that seamlessly integrates with your business processes, enhances efficiency, and adapts to the evolving needs of your enterprise. If you have any specific questions or need further guidance on a particular aspect of web-based accounting software, feel free to ask for more information!

Also read- Online billing and accounting software to manage your business

#Web-based accounting#Cloud software#Financial management#Enterprise solutions#accounting#software#billing#online billing software#technology#programming#erp#tech#drawings#illlustration#artwork#art style#sketchy#art#aspec#aromantic asexual#arospec#acespec#aroace#aro#bg3#astarion#shadowheart#gale dekarios#gale of waterdeep#karlach

2 notes

·

View notes

Text

How to Integrate Invoice Maker Tools with Your Accounting Software

In today's fast-paced business world, efficiency and accuracy are paramount when managing financial data. One essential aspect of this is invoicing. As businesses grow, manually creating and managing invoices becomes more cumbersome. That's where invoice maker tools come into play, allowing you to quickly generate professional invoices. However, to truly streamline your financial workflow, it’s important to integrate these tools with your accounting software.

Integrating invoice maker tools with your accounting software can help automate the process, reduce human error, and improve overall productivity. This article will walk you through how to integrate your Invoice Maker Tools with accounting software effectively, ensuring smoother operations for your business.

1. Choose the Right Invoice Maker Tool

Before integration, ensure you have selected an invoice maker tool that suits your business needs. Most invoice maker tools offer basic features such as customizable templates, tax calculations, and payment tracking. However, the integration potential is an important factor to consider.

Look for an invoice maker tool that offers:

Cloud-based features for easy access and collaboration.

Customizable templates for branding.

Multi-currency support (if you do international business).

Integration capabilities with various accounting software.

Examples of popular invoice maker tools include Smaket, QuickBooks Invoice, FreshBooks, and Zoho Invoice.

2. Check Compatibility with Your Accounting Software

Not all invoice maker tools are compatible with every accounting software. Before proceeding with the integration, confirm that both your invoice maker tool and accounting software are capable of syncing with each other.

Common accounting software that integrate with invoice tools includes:

QuickBooks

Smaket

Xero

Sage

Wave Accounting

Zoho Books

Most software providers will indicate which tools can integrate with their platform. Check for available APIs, plugins, or built-in integration features.

3. Use Built-in Integrations or APIs

Many modern invoice maker tools and accounting software platforms come with built-in integrations. These are often the easiest to set up and manage.

If you choose a platform that does not offer a built-in integration, you can use APIs (Application Programming Interfaces) to link the two systems. APIs are a more technical option, but they provide greater flexibility and customization.

4. Set Up the Integration

Once you've confirmed that the invoice tool and accounting software are compatible, follow the setup process to connect both tools.

The typical steps include:

Access your accounting software: Log into your accounting software and navigate to the integration settings or marketplace.

Search for the invoice maker tool: In the marketplace or integration section, look for the invoice tool you are using.

Connect accounts: Usually, you’ll be asked to sign into your invoice maker tool from within the accounting software and authorize the integration.

Map your fields: You may need to map invoice fields (like customer names, amounts, or due dates) to corresponding fields in the accounting software to ensure the data flows seamlessly.

5. Test the Integration

After the integration is complete, it’s crucial to test whether the connection between the invoice maker and accounting software is working as expected. Generate a sample invoice and check if the details appear correctly in your accounting software. Confirm that invoices are synced, and ensure payment status updates automatically.

Test for:

Accurate syncing of client details: Ensure names, addresses, and payment history are transferred correctly.

Real-time updates: Check that any changes made to invoices in the invoice tool reflect in your accounting software.

Reporting features: Verify that your financial reports, such as profit and loss statements, include data from the invoices.

6. Automate Invoicing and Payments

Once the integration is up and running, set up automated workflows. With the right integration, you can automate recurring invoices, late payment reminders, and payment receipts. This reduces manual effort and ensures consistency in your accounting.

7. Monitor and Maintain the Integration

Just because the integration is set up doesn't mean it's a "set it and forget it" situation. Regularly monitor the syncing process to ensure everything is working smoothly.

Make sure:

Software updates: Regular updates from either your accounting software or invoice maker tool might affect the integration. Always check for compatibility after any software updates.

Backup and security: Ensure your data is securely backed up, and verify that integration tools comply with security standards.

8. Benefits of Integration

By integrating invoice maker tools with your accounting software, you’ll enjoy several key benefits:

Time Savings: Automating the invoicing process frees up time for you to focus on other important aspects of your business.

Improved Accuracy: With automatic syncing, you reduce the risk of errors that often come with manual data entry.

Better Financial Management: Real-time data syncing allows for accurate tracking of income, expenses, and cash flow, which helps with budgeting and financial forecasting.

Enhanced Customer Experience: Timely and accurate invoicing helps maintain a professional image and reduces confusion with clients.

Conclusion

Integrating invoice maker tools with Accounting Software is a smart move for businesses that want to streamline their financial operations. By selecting the right tools, following the integration steps, and ensuring regular maintenance, you can save time, improve accuracy, and focus on growing your business. Don’t let manual invoicing slow you down—leverage modern tools to automate your processes and boost efficiency.

#accounting#software#gst#smaket#billing#gst billing software#accounting software#invoice#invoice software#cloud accounting software#benefits of cloud accounting#financial software#business accounting tools#cloud-based accounting#real-time financial insights#scalable accounting solutions#cost-effective accounting software#cloud accounting security#automated accounting software#business accounting software#cloud accounting features

0 notes

Text

Accounting Software for Freelancers: A Complete Guide

As a freelancer, managing finances alongside creative work can be overwhelming. The right accounting software for freelancers can transform this challenge into a streamlined process, helping you focus on what you do best – your core business.

Why Freelancers Need Specialized Accounting Tools

Managing finances as a freelancer presents unique challenges. From tracking multiple income streams to handling variable expenses, the best accounting software for freelancers must address these specific needs. Cloud-based accounting software for small businesses offers the flexibility and accessibility that modern freelancers require.

Essential Features to Look For

When choosing accounting software for freelancers, several key features stand out:

Time-Saving Automation:

Modern accounting tools for freelancers eliminate manual data entry through bank feed integration and automated expense tracking. This automation saves countless hours and reduces errors in financial record-keeping.

Professional Invoicing:

The best invoice software for freelancers includes customizable templates, automated payment reminders, and various payment options. These features help maintain professional relationships with clients while ensuring steady cash flow.

Tax Management:

Quality accounting software for freelancers simplifies tax season by automatically categorizing expenses, tracking deductions, and generating necessary reports. This organization helps avoid last-minute tax stress and potentially costly mistakes.

Read 7 Reasons Why You Should Opt for Bookkeeping Software to gain more clarity.

Top Software Solutions

Several standout options dominate the market:

QuickBooks:

A comprehensive solution offering robust features specifically designed for freelancers. Its intuitive interface and mobile accessibility make it a popular choice among solo entrepreneurs.

FreshBooks:

Known for its user-friendly interface and excellent invoicing capabilities, FreshBooks stands out as one of the best accounting software for freelancers who prioritize simplicity and efficiency.

Wave:

This cloud-based accounting software for small businesses offers free basic features, making it an excellent starting point for new freelancers. Its paid features provide additional functionality as your business grows.

Making the Right Choice

When selecting accounting software for freelancers, consider:

Your budget and business size

Required features versus nice-to-have additions

Integration capabilities with other business tools

Mobile access needs

Customer support quality

Scalability potential

Conclusion

The best accounting software for freelancers should grow with your business while maintaining ease of use and reliability. Take advantage of free trials to test different options before committing to a solution.

Remember, investing in quality accounting tools for freelancers isn't just about managing numbers – it's about creating more time for your passion while ensuring your business remains financially healthy.

By choosing the right accounting software, freelancers can transform financial management from a dreaded task into a streamlined process that supports business growth and success—still confused? Contact us to get a free consultation.

#accounting software for freelancers#best accounting software for freelancers#accounting tools for freelancers#cloud-based accounting software for small business#best invoice software for freelancers

0 notes

Text

Managing real estate effectively means juggling many moving parts—financials, property management, client interactions, and operational tasks. ERP (Enterprise Resource Planning) systems are essential for real estate professionals as they streamline accounting, inventory management, and administrative processes. CRM (Customer Relationship Management) systems, on the other hand, focus on client relationships, sales tracking, and customer engagement.

Read more:

#profitacc365#cloud based erp systems#erp software for small business#best erp software in uae#cloud based accounting software#erp for trading business

0 notes

Text

#agriculture#agriculture software#erp#erp software#crm#accounting software bd#hrms software#cloud based software

0 notes

Text

Can I access the software from multiple devices?

In today's fast world of digital technology, flexibility and accessibility are the keys to effective business operations. And yes, with TRIRID Accounting and Billing Software, this is a reality! Our highly advanced cloud-based platform lets you access your accounting data anywhere, anytime, using any device.

Key Benefits of Multi-Device Access

Work Anywhere, Anytime

With its cloud technology, TRIRID allows you to run accounts regardless of where you are-whether in the office, traveling, or even at home.

Device Convenience

Access your data anywhere anytime, be it on a desktop, laptop, tablet, or smartphone, without disrupting productivity.

Real-Time Data Synchronization

Changes made to a record on one device are transmitted automatically across other devices, so everyone and anyone gets access to live financial information.

Improved Teamwork

Share data and work with your team without difficulties by giving secure access to permitted users.

Secure Access

TRIRID provides complete security to your data, with powerful encryption and authentications. Multi-device access isn't only easy but also secure with TRIRID.

TRIRID Accounting and Billing Software is built with the requirements of today's business in mind. Be always in control of your accounts from anywhere with multi-device access.

Start accounting with TRIRID today. Anytime, anywhere: accounting, your way.

Call @ +91 8980010210 / +91 9023134246

Visit @ https://tririd.com/tririd-biz-gst-billing-accounting-software

#TRIRID Accounting and Billing Software#Best accounting software in Ahmedabad Gujarat#Cloud-based accounting software#TRIRID-Billing software in Bopal in Ahmedabad#TRIRID-Billing software in ISCON-Ambli road-ahmedabad

0 notes

Text

https://bezzieinfotech.com/tally-on-cloud/

Your Tally on Cloud Service Provider

0 notes

Text

MargBooks is India's premier provider of Online Accounting Software, offering a hassle-free solution for businesses to effortlessly manage their operations from any location. With the #1 Online Accounting Software, businesses can efficiently handle GST invoices, retail invoices, inventory, re-orders, banking, and more. This user-friendly platform empowers businesses with seamless control and accessibility, making accounting tasks simple and convenient. Marg Books ensures that businesses can run smoothly by providing a comprehensive suite of tools to streamline their financial processes. Experience the ease of managing your business with Marg Books, where efficiency meets simplicity.

#accounting#online accounting#software#saas#online billing software#cloud based billing#cloud based accounting

3 notes

·

View notes

Text

Online munim jewellery software. Our Features - - Colorful Invoices - Stock Inventory - Sales & Purchases Bills - Reports & Analysis - Accounting & GST Reports - Staff Management & Access - Offline & Cloud Base

Visit our website to know about more features www.omunim.com

Call Us : +91 7387935761 | 8956693545

Youtube - https://www.youtube.com/onlinemunim

#jewellery#ewaybill#imitationjewellery #accounting#jewellers#omunim#onlinemunim #offers#GSTBillingSoftware#jewelleryupdates#erpsoftware #accountingsoftware#ecommercewebsite #bestjewellerysoftware#billingsoftware #goldjewellerysoftware#jewellerybarcodesoftware #diamonds#gold#silver#ecommerce #mobileapp#jewellerymobileapp #jewellerysoftware#jewelleryerpsoftware #jewelleryretailshopsoftware #jewellerysoftware#jewellerybillingsoftware

#Online munim jewellery software.#- Colorful Invoices#- Stock Inventory#- Sales & Purchases Bills#- Reports & Analysis#- Accounting & GST Reports#- Staff Management & Access#- Offline & Cloud Base#Visit our website to know about more features#www.omunim.com#jewellery#ewaybill#imitationjewellery#accounting#jewellers#omunim#onlinemunim#offers#GSTBillingSoftware#jewelleryupdates#erpsoftware#accountingsoftware#ecommercewebsite#bestjewellerysoftware#billingsoftware#goldjewellerysoftware#jewellerybarcodesoftware#diamonds#gold#silver

0 notes

Text

#Accounting Software In Dubai#Best Accounting Software In UAE#IT Infrastructure Services In Dubai#IT Services In Dubai#Managed IT Service Providers In Dubai#IT Support Companies In Dubai#IT Networking Solutions Company Dubai#Access Control System Suppliers In Dubai#Firewall Installation Services In Dubai#Accounting Software For Small Business In Dubai#Best Accounting Software Solutions In Dubai#Best Accounting Software For Medium Business In Dubai#Cheap Accounting Software For Small Business In Dubai#Best Cloud Based Accounting Software In Dubai#Best Low Cost Accounting Software For Small Business In Dubai#Best Accounting Software For Small To Medium Business In Dubai#Best Business Accounting Software Services In Dubai#Best Software Company In Dubai#Web Designing Services In Dubai#Best SEO Services In Dubai#Top HRMS Software In Abu Dhabi#Best ERP Solution Provider UAE#Best Project Management Software In Dubai#Fitness and Gym Management Software In Dubai#MEP Contracting ERP Software In Dubai#Best ERP Software For Metal Fabrication Industry In Dubai

0 notes

Text

Managing VAT compliance can feel like navigating a maze in a fast-evolving business environment. The rules are intricate, the regulations vary across borders, and the penalties for non-compliance are significant. This is where VAT compliance software steps in as a game-changer, streamlining processes, reducing errors, and ensuring that your business stays on the right side of the law. For businesses operating in a globalized economy, adopting the right technology isn't just a smart move—it’s essential.

Read more:

#profitacc365#vat compliance software#cloud based erp systems#erp software for small business#best erp software in uae#cloud based accounting software

0 notes

Text

Boost Your Business with Microsoft Accounting Software in Singapore

Running a successful business in Singapore requires efficient and reliable tools. One essential tool is Microsoft accounting software. This software helps manage finances, streamline operations, and enhance decision-making. Microsoft offers a comprehensive solution to meet your business needs.

Why Choose Microsoft Accounting Software in Singapore?

Businesses in Singapore face unique challenges. Regulatory compliance, financial reporting, and tax requirements are complex. Microsoft accounting software simplifies these tasks. It ensures accuracy and saves time.

Compliance: Microsoft accounting software helps businesses comply with local laws and regulations. This reduces the risk of penalties.

Accuracy: Automated processes minimize errors. This leads to accurate financial records.

Efficiency: Streamlined workflows save time. Businesses can focus on growth and innovation.

Features of Microsoft Cloud-Based ERP Solutions

Microsoft's cloud-based ERP solutions offer flexibility and scalability. These solutions integrate various business functions. This improves collaboration and data sharing.

Flexibility: Cloud-based ERP solutions adapt to changing business needs. They support growth and expansion.

Scalability: Businesses can scale up or down as needed. This ensures optimal resource utilization.

Integration: ERP solutions integrate with other Microsoft tools. This enhances productivity and efficiency.

Benefits of Microsoft Cloud-Based ERP Solutions

Cloud-based ERP solutions offer numerous benefits. They improve accessibility, reduce costs, and enhance security.

Accessibility: Employees can access data from anywhere. This supports remote work and collaboration.

Cost Reduction: Cloud-based solutions reduce the need for physical infrastructure. This lowers costs.

Security: Microsoft provides robust security measures. This protects sensitive business data.

Microsoft D365 ERP: A Comprehensive Business Solution

Microsoft D365 ERP is a powerful tool. It integrates various business functions into a single platform. This improves efficiency and decision-making.

Integration: D365 ERP integrates finance, sales, and operations. This ensures seamless data flow.

Customization: Businesses can customize D365 ERP to meet specific needs. This enhances usability.

Analytics: Advanced analytics provide insights into business performance. This supports strategic planning.

Key Features of Microsoft D365 ERP

D365 ERP offers features that enhance business operations. These include real-time data, automated workflows, and predictive analytics.

Real-Time Data: Businesses get real-time insights into operations. This improves responsiveness.

Automated Workflows: Automation reduces manual tasks. This increases efficiency.

Predictive Analytics: Predictive analytics support proactive decision-making. This improves outcomes.

How Microsoft D365 ERP Can Transform Your Business

Implementing D365 ERP can transform your business. It improves productivity, reduces costs, and enhances customer satisfaction.

Productivity: D365 ERP streamlines processes. This boosts productivity.

Cost Reduction: Automation and integration reduce operational costs. This improves profitability.

Customer Satisfaction: Improved operations lead to better customer service. This enhances satisfaction.

Conclusion

Choosing the right tools is crucial for business success. Microsoft accounting software and cloud-based ERP solutions offer comprehensive features. These tools improve efficiency, accuracy, and compliance. Implementing Microsoft D365 ERP can transform your business operations. Invest in Microsoft solutions to stay ahead in the competitive Singapore market.

For more information on how these solutions can benefit your business, visit the following links:

Microsoft accounting software Singapore

Microsoft cloud-based ERP solutions

Microsoft D365 ERP

Enhance your business with Microsoft's innovative solutions today!

0 notes

Text

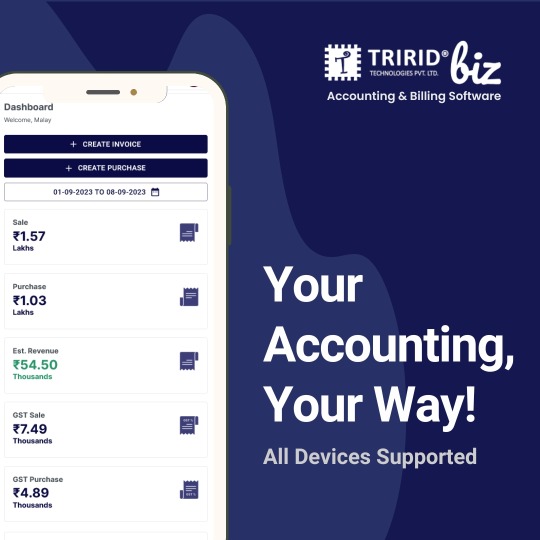

Tririd Biz Your Accounting, Your Way – Anytime, Anywhere!

In today's fast-paced business world, efficient and flexible accounting solutions are a must. TRIRID Biz empowers you with the tools to manage your finances, regardless of whether you are in an office, at home, or on the go. Here is why TRIRID Biz stands out:

Access Anywhere, Anytime

With TRIRID Biz, your accounting data is always at your fingertips. Our cloud-based platform has ensured secure access from any gadget, meaning you can never be off the hook concerning your business.

Custom to Your Requirement

Every organization is unique, and TRIRID Biz expresses that. Features have been customized fit to your operations and from invoicing templates down to automated GST calculations- making the whole software suit your needs on the exact way you could want it.

Simplified GST Compliance

Never has navigating GST regulations been easier. TRIRID Biz helps you automate tax calculations, filing reminders, and compliance checks, saving you precious time and avoiding costly errors.

Powerful Reporting Tools

Get insights into your business performance with comprehensive reporting and analytics. From profit and loss statements to cash flow reports, TRIRID Biz will help you make data-driven decisions.

Secure and Reliable

We will encrypt your data with robust encryption and back it up regularly so that your financial information is safe and secure on TRIRID Biz.

Easy-to-Use User Interface

Our intuitive interface is built for users at all levels, ensuring even the non-accounting professional can easily use the platform.

Why Go for TRIRID Biz?

Cloud-Based Ease: Work anywhere and anytime on your data with full access.

Scalable Solutions Perfect for small business, startups, and growth organizations.

Affordable Pricing Enjoy premium features without breaking the bank.

Take control of your business finances with TRIRID Biz, your partner in accounting and billing. Ready to transform your accounting process?

Sign-up now for a free trial!

More details on

Call @ +91 8980010210 / +91 9023134246

Visit @ https://tririd.com/tririd-biz-gst-billing-accounting-software

#Best billing software in Ahmedabad Gujarat#customizable accounting software#cloud-based accounting software#TRIRID-Billing software in Bopal in Ahmedabad#TRIRID-Billing software in ISCON-Ambli road-ahmedabad

0 notes