#CleanEnergyInvestment

Explore tagged Tumblr posts

Text

Global Clean Energy Investment Surges to $2.1 Trillion, but Experts Warn of Shortfall

Source: latimes.com

Category: News

Record-Breaking Investment in Energy Transition Technologies

In 2024, global Clean Energy Investment reached an unprecedented $2.1 trillion, according to the latest Energy Transition Investment Trends report. This marked an 11% increase from the previous year, reflecting a growing shift towards renewable energy, electrified transportation, and advanced grid infrastructure.

Despite this significant rise, experts caution that current investment levels remain far below what is required to achieve net-zero emissions by 2050. The report highlights that to stay on track with climate goals, global energy investment must triple to $5.6 trillion annually between 2025 and 2030. The gap signals an urgent need for increased financial commitments and policy-driven acceleration.

Countries worldwide have intensified efforts to meet their climate commitments under the Paris Agreement, which aims to limit global temperature rise to 1.5°C. However, analysts warn that without a substantial increase in funding, achieving net zero within the next few decades will remain out of reach. The transition demands not only financial resources but also systematic phasing out of fossil fuels and the removal of inefficient subsidies hindering progress.

Electrified Transport Leads, But Emerging Sectors Struggle

The report sheds light on sector-wise distribution of investments, revealing that electrified transport secured the highest funding, totaling $757 billion in 2024. This category includes electric vehicles (EVs), commercial EV fleets, charging networks, and fuel cell vehicles. With the rapid expansion of the EV market, investors are betting heavily on cleaner mobility solutions.

Renewable energy, including solar, wind, and biofuels, followed closely with $728 billion in funding. Additionally, $390 billion was allocated to power grid modernization, supporting initiatives such as smart grids and improved transmission lines.

However, investments in emerging technologies like hydrogen, carbon capture and storage (CCS), clean industry, and sustainable shipping remained significantly lower. These sectors collectively received just $155 billion, marking a 23% decline from the previous year. Affordability concerns, technology readiness, and scalability challenges have hindered their growth, making it difficult for these innovations to gain widespread adoption.

BloombergNEF categorized energy transition investments into “mature” and “emerging” sectors. Mature sectors, including renewables, EVs, and power grids, attracted $1.93 trillion, representing 93% of the total clean energy funding. Meanwhile, emerging sectors garnered only $154 billion, underscoring the struggles faced by next-generation energy solutions in securing large-scale financial backing.

China Dominates the Energy Investment Race

Mainland China emerged as the global leader in clean energy investment, contributing $818 billion in 2024—a 20% rise from the previous year. This accounted for nearly two-thirds of the total increase worldwide, with strong financial commitments in renewables, nuclear energy, power grids, and EV infrastructure.

China’s energy investment now equals 4.5% of its GDP, surpassing other major economies like the U.S. and the European Union. The United States ranked second with $338 billion, while Germany followed with $109 billion in clean energy funding. Other countries, including India and Canada, also saw double-digit growth in their investments, increasing by 13% and 19%, respectively.

Looking ahead, BloombergNEF forecasts a surge in Clean Energy Investment post-2030, projecting annual investments to reach $7.6 trillion between 2031 and 2035.. However, shifting political landscapes, particularly in the U.S., could influence the trajectory of energy transition investments, leaving the global market uncertain about future commitments.

#CleanEnergyInvestment#GreenInvestments#SustainableFinance#RenewableEnergyFunds#EcoFriendlyInvestments#CleanEnergyFuture

0 notes

Text

youtube

Discover why silver’s soaring demand and shrinking supply make it the top investment opportunity of 2024! Is silver the new gold?

#SilverInvestment#SilverSurge#PreciousMetals#InvestmentOpportunity#CleanEnergyInvestment#news#gold#money#silver#recession#economy#Youtube

0 notes

Text

Scotland's Green Future: Striking a Balance Between Economic Growth and Environmental Sustainability

Navigating the Tightrope: Balancing Economic Growth and Environmental Sustainability in Scotland Hello, dear readers! Today’s discussion centres on an ever-pressing issue: How can Scotland balance robust economic growth with the imperative of environmental sustainability? As we advance towards a greener future, finding pathways that honour both economic and environmental goals becomes paramount. Scotland is uniquely positioned to lead in this area due to its rich natural resources, innovative spirit, and pioneering efforts in renewable energy. The Scottish Government's commitment to reducing carbon emissions to net zero by 2045 sets a bold precedent, but it also poses challenges for industries and communities dependent on traditional energy sectors. The key to this balancing act will be innovation and transition strategies that encompass economic diversification. As sectors like oil and gas gradually diminish in their dominance, renewable energy sources such as wind, tidal, and solar power must rise to take their place, not just as energy solutions but as bases for sustainable economic development. Investment in green technology and sustainable practices offers a competitive edge in the global market. By incentivising businesses to adopt greener methods through tax benefits, grants, and subsidies, Scotland can enhance its appeal as a hub for clean energy investment. This shift not only promotes environmental health but also catalyses job creation in new sectors, driving economic growth. Furthermore, education must be leveraged to support this transition. Integrating sustainability into the curriculum from a young age will prepare future generations to think critically about ecological impacts and foster innovation in green technologies. In higher education, expanding research programmes focused on sustainable practices and technologies can position Scotland as a thought leader in green solutions. Community involvement is essential to ensure these transitions are equitable. Engaging local communities in planning and decision-making processes helps align developmental policies with the specific needs and resources of different regions, fostering a sense of ownership and commitment to sustainability goals. Let's reflect together: How can Scotland use its resources and capabilities to the best advantage in balancing economic and environmental necessities? What roles should government, businesses, and communities play in this journey towards sustainability? Thanking you for joining in today’s important conversation. Warm regards, Alastair Majury *Perspectives Unbound* --- *Stay updated with Alastair Majury’s insights on blending economic strategies with environmental sustainability by following Perspectives Unbound.*

#EconomicGrowth#EnvironmentalSustainability#Scotland#RenewableEnergy#GreenTechnology#SustainableDevelopment#NetZero#Innovation#CommunityInvolvement#EducationForSustainability#GreenJobs#SustainableEconomy#ClimateAction#EcologicalImpact#CleanEnergyInvestment

1 note

·

View note

Text

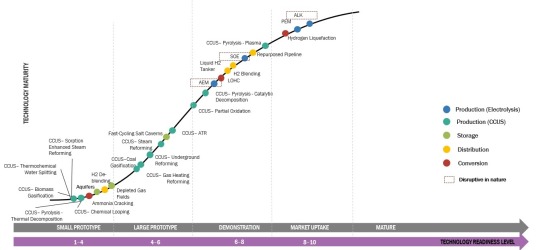

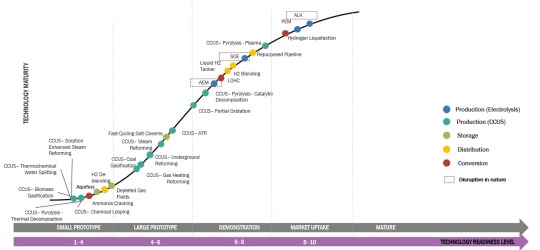

Hydrogen Industry Investments

Hydrogen Ecosystem Current and Future Investments

Current Investments in Hydrogen Ecosystem:

Hydrogen Production:

Electrolysis: Investments in electrolysis technology have been rising in order to produce hydrogen. Because of their promise for scalable and effective hydrogen synthesis from renewable sources, proton exchange membranes (PEMs) and alkaline electrolyzers have drawn a lot of attention. Enterprises such as Nel ASA, ITM Power, and Plug Power have managed to raise capital to enhance their electrolyzer production capabilities and facilitate the advancement of extensive electrolysis initiatives.

Steam Methane Reforming (SMR): Even though SMR is the most common way to produce hydrogen, efforts are being undertaken to enhance its environmental efficiency by utilizing carbon capture and storage (CCS) technologies. In order to improve the efficiency and lower the carbon footprint of SMR plants, businesses are spending money on research and development.

Download- https://www.marketsandmarkets.com/industry-practice/RequestForm.asp

Hydrogen Storage and Transportation:

Hydrogen Refueling Infrastructure: Infrastructure for hydrogen refueling is being developed with significant investments, especially in areas where fuel cell electric cars, or FCEVs, are becoming more and more popular. To assist the expansion of FCEVs, businesses including as Air Liquide, Linde plc, and Shell are investing in the installation of hydrogen filling stations.

Hydrogen Pipelines and Transportation: Infrastructure for transportation and hydrogen pipeline development is receiving funding in order to facilitate the economical and efficient distribution of hydrogen. Enterprises are investigating the possibility of reusing already-existing natural gas pipes and constructing specific hydrogen pipelines for extended transit.

Hydrogen Utilization:

Fuel Cell Electric Vehicles (FCEVs): Several automakers are investing in the research and development of fuel cell electric vehicles (FCEVs), including Toyota, Hyundai, and BMW. These expenditures go toward things like developing new vehicles, producing fuel cell stacks, and forming alliances to create FCEV supply chains.

Industrial Applications: To investigate hydrogen uses for decarbonizing steel production, refining processes, and power generation, investments are being made in a number of industrial sectors. Businesses in the manufacturing, energy, and chemical industries are funding collaborations and pilot programs to show the feasibility of using hydrogen in industry for both practical and cost-effective reasons.

Future Investments in Hydrogen Ecosystem:

Green Hydrogen

Investments in green hydrogen production technologies are anticipated to rise sharply, with a focus on decarbonization. It is projected that significant investments in electrolysis driven by renewable energy sources will be made in order to reduce costs and increase production capacity. In order to achieve carbon neutrality in a number of industries, including transportation, manufacturing, and power generation, green hydrogen is anticipated to be extremely important.

Hydrogen Infrastructure Expansion

It is expected that more money will be spent on building hydrogen infrastructure, such as hubs and clusters, pipeline networks, and hydrogen recharging stations. The aforementioned expenditures are intended to establish a resilient and linked hydrogen ecosystem, which will facilitate the expansion of hydrogen production, storage, and delivery.

Cross-Sector Integration

It's anticipated that future investments would concentrate on integrating hydrogen technology with other industries, including power grids, industrial processes, and renewable energy sources. Power-to-hydrogen, hydrogen blending in natural gas pipelines, and the application of hydrogen in industries with difficult-to-abate emissions are some of the technologies that are required for this integration.

International Collaboration

It is envisaged that investments would be made in international cooperation and partnerships to promote the growth of international trade and cross-border hydrogen supply chains. To support the global transportation of hydrogen, this entails making investments in regulatory frameworks, certification processes, and hydrogen infrastructure.

Detailed use case analyses related to current and future investments in the hydrogen ecosystem:

Hydrogen Production

Electrolysis Plants: Investing in electrolysis facilities is essential to increasing the production of green hydrogen. These plants separate water into hydrogen and oxygen using renewable electricity. They make it possible to produce hydrogen that is free of carbon, which has a variety of uses in the transportation, industrial, and power generation sectors. Electrolysis plants are being used on a variety of scales, from large-scale facilities for regional or national hydrogen production to small-scale projects for local consumption.

Carbon Capture and Storage (CCS) in Hydrogen Production: The development and implementation of carbon capture and storage technologies for the production of hydrogen from fossil fuels are being funded. By capturing and storing carbon emissions, the creation of hydrogen is intended to become a low-carbon or carbon-neutral process. Blue hydrogen can serve as a stopgap measure until a more environmentally friendly hydrogen economy is established, and CCS technologies make this possible.

Hydrogen Infrastructure

Hydrogen Refueling Stations: Fuel cell electric vehicle (FCEV) adoption depends on investments in hydrogen refueling facilities. Compared to battery electric vehicles, FCEVs can drive longer distances and refill more quickly because to the infrastructure these stations provide for hydrogen filling. With an emphasis on important transit corridors, metropolitan areas, and places with favorable regulations and market demand for FCEVs, efforts are being undertaken to broaden the network of hydrogen refueling stations.

Hydrogen Pipelines and Storage: For hydrogen to be transported and distributed efficiently, storage facilities and pipelines must be invested in. Hydrogen may be transported great distances to supply-demand hubs using dedicated hydrogen pipelines or by repurposing existing natural gas pipelines. Subterranean hydrogen storage facilities are also being invested in, in an effort to offset the intermittent nature of renewable energy sources and guarantee a steady supply during moments of high demand.

Industry and Manufacturing

Green Hydrogen for Industrial Applications: The goal of investing in green hydrogen production is to reduce the carbon footprint of industrial activities. Refineries, steel, and ammonia manufacturing are among the industries investigating the use of green hydrogen as a fuel or feedstock in place of fossil fuels. These investments make it possible for these industries to reduce their carbon emissions, which results in more ecologically friendly and sustainable production methods.

Power-to-X Technologies: Investing in power-to-x technologies entails turning excess renewable energy into hydrogen or goods generated from hydrogen, such as feedstocks, chemicals, or synthetic fuels. Power-to-x technologies facilitate the integration of renewable energy sources into the energy system by storing renewable energy as hydrogen or its derivatives. This allows for the exploitation of excess renewable energy.

International Hydrogen Trade

Cross-Border Hydrogen Infrastructure: To enable global hydrogen trade, investments are being made to build cross-border infrastructure. Nations endowed with copious amounts of renewable energy resources are making significant investments in the construction of green hydrogen production plants and related transportation infrastructure. The objective of these investments is to establish a hydrogen supply chain that links locations with strong demand but limited domestic production capabilities with hydrogen production centers.

Hydrogen Export Projects: The development of large-scale hydrogen export projects is the focus of investments. Nations that possess abundant renewable energy resources and are in close proximity to prospective buyers of hydrogen are investigating the possibility of establishing export-oriented hydrogen production facilities. In order to support the development of a global hydrogen economy, these projects entail the production, liquefaction, and transportation of hydrogen to foreign markets.

The financial commitments made by different stakeholders, such as governments, private enterprises, and investors, to support and advance the growth of the hydrogen sector are referred to as hydrogen industry investments. These expenditures are going to be used for things like R&D, building infrastructure, setting up production facilities, and implementing hydrogen technology. The objective is to support the development of a sustainable hydrogen industry that can aid in the pursuit of clean energy, decarbonization initiatives, and the shift to a low-carbon economy.

How do these investments benefit market participants? Which countries and players have taken the lead in government and direct private sector investments?

Investments in the hydrogen ecosystem benefit market participants in several ways, including the following:

Market Growth and Expansion: The infrastructural and technological advancements related to hydrogen fuel support the market's expansion. Market players have greater opportunity to enter new markets, develop cutting-edge solutions, and gain market share as more funds are devoted to research, development, and deployment.

Technological Advancements: Technological developments in hydrogen technologies include reduced fuel cell costs, enhanced electrolysis efficiency, and advances in hydrogen storage and delivery. Market players gain from these developments since they improve the efficiency, dependability, and affordability of hydrogen solutions.

Cost Reduction: Across the hydrogen value chain, investments lead to cost savings through economies of scale and innovation. Hydrogen solutions are more cost-competitive than traditional energy sources, which increases market demand and adoption. Cost reductions can boost market competitiveness and profitability for participants in the market.

Job Creation and Economic Growth: The expansion of the hydrogen industry through investments generates employment possibilities in a number of value chain categories, such as manufacturing, R&D, infrastructure implementation, and service delivery. These employment options promote employment and revenue development while also supporting regional and national economic progress.

Regarding government and private sector investments, the lead has been taken by several countries and companies:

Government Investments:

Germany: Government investments in the hydrogen industry have been led by Germany. In order to encourage research, development, and demonstration initiatives, they have committed significant resources and developed the National Hydrogen Strategy. Germany has committed billions of euros to investments in hydrogen technology with the goal of leading the world in this field.

Japan: With its Basic Hydrogen Strategy, Japan has made significant investments in the hydrogen industry. The nation is concentrating on creating a society that uses, stores, transports, and produces hydrogen. Japan has allocated public funds to assist the development of hydrogen infrastructure, as well as research and experimental initiatives.

European Union: As part of its Green Deal and European Hydrogen Strategy, the European Union (EU) has set high goals for the deployment of hydrogen. The European Union intends to make significant investments through public-private partnerships in hydrogen technologies, infrastructure, and projects. The European Commission has allotted billions of dollars to member state efforts pertaining to hydrogen.

Private Sector Investments:

Energy Companies: Significant investments have been made in the hydrogen industry by well-known energy firms like BP, TotalEnergies, and Shell. Their portfolios are becoming more diverse, and they are making investments in infrastructure, apps, and hydrogen generation. By using their resources and experience, these businesses are propelling the growth of the hydrogen industry.

Automotive Manufacturers: Several automakers have made significant investments in hydrogen fuel cell infrastructure and technology, including Toyota, Hyundai, and BMW. To assist with the commercialization of fuel cell electric vehicles (FCEVs), these firms are developing FCEVs and making investments in infrastructure for hydrogen refueling.

Industrial Players: To decarbonize their processes, major industrial players in industries including steel, chemicals, and refining are investing in hydrogen-related projects. Businesses like Siemens Energy, Air Liquide, and Thyssenkrupp are developing low-carbon hydrogen supply chains by working with partners, investing in hydrogen technology, and testing hydrogen-based industrial processes.

These instances show the initiative and financial commitments made by public and private sector participants to propel the expansion of the hydrogen ecosystem. The development and commercialization of hydrogen technologies and infrastructure are being actively shaped by market participants who are combining government backing, legislative frameworks, and private sector innovation.

Read More - https://www.marketsandmarkets.com/industry-practice/hydrogen/hydrogen-industry-investments

#HydrogenEconomy#InvestInHydrogen#CleanEnergyInvestment#HydrogenInvestments#RenewableInvestments#SustainableFuture#GreenTechInvestment#H2Invest

0 notes

Text

Riding the Green Wave: Investing in Sustainable Energy for a Brighter Future

In a world increasingly focused on environmental sustainability, investing in sustainable energy has emerged not only as a sound financial strategy but also as a powerful contribution to a greener planet. This blog post explores the exciting realm of sustainable energy investments, shedding light on opportunities in solar, wind, and other renewable sources that promise not just financial returns,…

View On WordPress

0 notes

Text

Renewable Energy Investments

Green energy is the future, and Empower Capital Funding makes it a smart investment. Fund eco-friendly projects and generate strong returns. Build a sustainable future today: https://empowercapitalfunding.com/!

#RenewableEnergyInvestments#GreenInvesting#CleanEnergyInvestments#SustainableInvesting#EcoInvestments#RenewableEnergy#InvestInGreen#EnergyTransition#SustainableEnergy#GreenEnergyInvestments

0 notes

Text

Clean Energy Investment Accelerator: Powering Asia's Future with Renewable Energy! #AsianDevelopmentBank #CleanEnergyInvestmentAccelerator #cleanenergyinvestments #cleanenergyprojects #renewableenergysources

#Business#AsianDevelopmentBank#CleanEnergyInvestmentAccelerator#cleanenergyinvestments#cleanenergyprojects#renewableenergysources

0 notes

Text

Quebec's Leap Towards Green Batteries Begins

Quebec’s Electrifying Success in Green Battery Manufacturing

Quebec, a province renowned for its picturesque landscapes, is now making waves in the global electric vehicle (EV) industry. From the extraction of critical minerals to the creation of state-of-the-art batteries, Quebec has become a magnet for substantial investments from across the globe, ushering in an era of economic growth and the promise of well-paying middle-class jobs for years to come.

Unveiling the Green Revolution in EV Batteries

Today, in a historic moment, Canada's Prime Minister, Justin Trudeau, and Quebec's Premier, François Legault, gathered to celebrate the announcement of a groundbreaking electric vehicle battery manufacturing facility. This facility, a project undertaken by Northvolt Batteries North America, will be located in Saint-Basile-le-Grand and McMasterville, Quebec. These batteries, powered by clean electricity, are poised to become some of the world's most environmentally friendly.

A Vision for a Sustainable Future

Prime Minister Justin Trudeau expressed his enthusiasm, stating, "Once again, with Northvolt's new facility, the world is choosing Quebec and Quebec workers. When electric vehicle batteries are made in Quebec, it's a win-win-win—for workers, for communities, and for the environment. We'll always keep doing our part to make sure global companies and automakers can keep setting up shop in Quebec. Because that's how we continue to build a strong economy with good middle-class jobs and clean air for generations to come." Building on Success Today’s announcement builds on important agreements that Canada has signed over the last year to bring billions in investments and a large number of new, high-quality jobs to our critical minerals and electric vehicle manufacturing sectors.

Economic Boon and Green Legacy

Once the facility achieves full operational capacity, experts project that it will generate economic benefits equal to the production incentives provided within just five to nine years. Both Canada and Quebec have made a commitment to provide Northvolt with production support, aligning with the Inflation Reduction Act’s Advanced Manufacturing Production Credit in the United States, which amounts to up to US$35 per kWh. Government Incentives and Financial Commitments Government production incentives will apply only to the batteries that Northvolt produces and sells, in line with the conditions in previous agreements with other battery plants. They will be up to C$4.6 billion, of which one-third is to be paid by the Quebec government. The operating support provided will only be available for as long as the U.S. Inflation Reduction Act incentives remain in effect. Canada will provide up to C$1.34 billion in capital commitment toward the project. Quebec will provide C$1.37 billion in capital commitment toward the project.

A Giant Among Facilities

The Northvolt project is poised to be a colossal endeavor, as it spans an area equivalent to 318 football fields. Moreover, with an annual battery cell manufacturing capacity of up to 60 GWh, this facility will have the power to fuel approximately one million electric vehicles each year. Integration and Sustainability The initial phase of the project, valued at a staggering $7 billion, will generate up to 3,000 jobs as the plant reaches its maximum production potential. This inaugural phase will also encompass facilities for cathode active material production and battery recycling, making it one of the world's only fully integrated facilities of this kind. Northvolt’s facility will focus on sustainability and will produce a variety of battery components and materials, such as precursor cathode active materials (pCAM), cathode active materials (CAM), lithium-ion battery cells, and lithium-nickel-manganese-cobalt-oxide (NMC) from battery recycling, one of only a handful of locations to have this type of capacity outside of Asia.

Pioneering Sustainability in Battery Manufacturing

By 2030, Northvolt’s unique decarbonization strategy aims to reduce the carbon footprint of its cell manufacturing by approximately 90% compared to the current industry average. The company also intends to use at least 50% recycled materials in its cell production. By recovering quality metals from used batteries, Northvolt will help to ensure that Canadian critical raw materials remain in circulation.

Driving Canada's Economic Engine

Canada’s automotive manufacturing sector supports over 500,000 workers, contributes $14 billion annually to Canada’s GDP, and is one of the country’s largest export industries.

A Vision for Critical Minerals

In December 2022, the Government of Canada took a significant step when it released the Canadian Critical Minerals Strategy, aiming to help advance the development of critical mineral resources and value chains across the country. This comprehensive strategy will further bolster our efforts, making Canada a global leader in the responsible, inclusive, and sustainable production of critical minerals, spanning from exploration to recycling. Sources: THX News & The Canadian Government. Read the full article

#Batterymanufacturing#Canadaautomotivemanufacturingsector#Canadianjobs#Cleanenergyinvestments#Criticalminerals#ElectricvehiclesQuebec#Greenbatteries#Greensuppliers#Northvoltbatterymanufacturingfacility#Northvoltfacility#Quebecelectricvehiclebatteries#Quebecgreeneconomyleader#Quebec'sleadership#Sustainableproduction

0 notes

Text

Biden admin to invest $2.2 billion to revamp nation's power grids

1/8 The Biden administration is making a bold move to revamp the nation's power grids, announcing a $2.2 billion investment to address the increasing energy demands 🌐💡 This initiative aims to modernize and strengthen the infrastructure, ensuring reliable and sustainable energy for all. #EnergyInvestment #PowerGridRevamp 2/8 With an aging power grid and growing energy consumption, the need for updates and enhancements has become critical. The $2.2 billion investment from the Department of Energy will contribute to improving transmission lines, energy storage, and grid resilience. #InfrastructureUpgrade 3/8 The investment will also spur the development of innovative technologies and grid modernization projects, fostering a more resilient and efficient energy system. This forward-looking approach aligns with the administration's commitment to clean energy and climate resilience. #CleanEnergyFuture 4/8 The revamp of the power grids will not only enhance reliability but also create new job opportunities in the clean energy sector. By investing in grid modernization, the administration aims to advance both economic and environmental sustainability. #JobCreation #CleanEnergyJobs 5/8 Additionally, the investment will bolster cybersecurity measures to safeguard the power grids against potential threats, ensuring the security and stability of the energy infrastructure. This comprehensive approach prioritizes both modernization and protection. #GridSecurity 6/8 As the nation continues to evolve its energy landscape, the $2.2 billion investment signifies a significant step towards building a more resilient, efficient, and sustainable power grid. The initiative empowers communities and businesses to thrive in a reliable energy environment. #EnergyFuture 7/8 Stay tuned for updates on the implementation of the investment and the transformative impact it will have on the nation's energy infrastructure. Together, we can create a brighter and more sustainable energy future for generations to come. #SustainableEnergy #GridRevolution 8/8 TL;DR: Biden admin to invest $2.2 billion in revamping the nation's power grids, modernizing infrastructure, creating jobs, enhancing security, and advancing clean energy goals. Let's embrace a more sustainable and resilient energy future! #PowerGridRevamp #CleanEnergyInvestment

0 notes

Text

Konsa Investment Hai Sahi..?🤔 Aap Hi Dekh Lijiye 😊 : : Source Credit For Nifty 50- https://www.google.com/finance/quote/NIFTY_50:INDEXNSE... : Source Credit For Gold - https://economictimes.indiatimes.com/.../art.../96826512.cms : #SustainableFuture #InvestInNature #GreenInvestments #NaturePreservation #EnvironmentalImpact #InvestInSustainability #NatureConservation #CleanEnergyInvestment #EcoInvesting #ProtectOurPlanet #InvestInGreen #ClimateActionNow #NaturalCapital #RenewableEnergyInvestment #nifty #InvestInBiodiversity #EarthProtection #ResponsibleInvesting #NatureRevival #EnvironmentalFinance #EcoFriendlyInvesting #ConservationMatters #SustainableInvestment #GreenTechRevolution #InvestInCleanAir #WildlifeProtection #CarbonNeutralInvesting #merasunaar #merasunaardigitalgold

1 note

·

View note

Text

Solar Stocks Surge Following Record Tesla Energy Storage Deployments

https://oilgasenergymagazine.com/wp-content/uploads/2025/01/1-Solar-Stocks-Surge-Following-Record-Tesla-Energy-Storage-Deployments-Source-investopedia.com_.jpg

Source: investopedia.com

Category: News

Tesla’s Record-Breaking Energy Storage Deployment

Solar stocks experienced a significant rally on Thursday, fueled by Tesla’s announcement of a record deployment of energy storage products in the fourth quarter. The news provided a boost to solar companies, with notable gains across the sector. Tesla’s energy storage division, which manufactures residential and commercial batteries designed to store solar energy, deployed 11 gigawatt hours of storage products during the quarter, bringing the total for 2024 to 31.5 gigawatt hours. These impressive numbers reflect the company’s continued expansion in the renewable energy market.

Invesco Solar ETF and Key Players See Strong Gains

The Invesco Solar ETF (TAN), a fund that tracks various solar companies, saw a 5% increase on Thursday, reflecting the broader market sentiment. Several leading companies in the solar industry also saw notable stock price movements. SolarEdge Technologies (SEDG) rose by 9%, while First Solar (FSLR) gained 6%, contributing to the positive trend across the sector. These gains indicate a growing optimism surrounding the renewable energy market, especially in the wake of Tesla’s achievements in energy storage.

Tesla’s Expansion and Vehicle Delivery Challenges

Despite the positive news from Tesla’s energy storage division, the company faced challenges in its vehicle production and delivery numbers. Shares of Tesla dropped by 6% on Thursday, as the company’s fourth-quarter vehicle delivery figures fell short of analyst expectations. Tesla is expected to release its full fourth-quarter results on January 29, which will provide more insight into the company’s overall performance. In the meantime, the opening of a new gigafactory in Shanghai earlier this week marked another milestone for the company’s expansion plans, potentially signaling continued growth in its energy storage business.

In conclusion, while Tesla’s energy storage success has provided a significant boost to solar stocks, the company still faces hurdles in its core vehicle production. However, its growing influence in the energy storage market continues to position it as a key player in the future of renewable energy.

Visit Oil Gas Energy Magazine for the most recent information.

#SolarStocks#RenewableInvesting#GreenEnergyStocks#CleanEnergyInvestments#SolarInvestments#SustainableInvesting

0 notes

Text

Clean energy investment surge prompts green patent applicants to expedite prosecution via green channels. Learn how to leverage environmentally-focused avenues. #CleanEnergyInvestment #GreenPatent #ExpediteProsecution

https://iipla.org/ip-news/rising-clean-energy-investment-encourages-green-patent-applicants-to-expedite-prosecution-through-green-channels/

0 notes

Text

Hydrogen Industry Investments

Hydrogen Ecosystem Current and Future Investments

Current Investments in Hydrogen Ecosystem:

Hydrogen Production:

Electrolysis: Investments in electrolysis technology have been rising in order to produce hydrogen. Because of their promise for scalable and effective hydrogen synthesis from renewable sources, proton exchange membranes (PEMs) and alkaline electrolyzers have drawn a lot of attention. Enterprises such as Nel ASA, ITM Power, and Plug Power have managed to raise capital to enhance their electrolyzer production capabilities and facilitate the advancement of extensive electrolysis initiatives.

Steam Methane Reforming (SMR): Even though SMR is the most common way to produce hydrogen, efforts are being undertaken to enhance its environmental efficiency by utilizing carbon capture and storage (CCS) technologies. In order to improve the efficiency and lower the carbon footprint of SMR plants, businesses are spending money on research and development.

Download- https://www.marketsandmarkets.com/industry-practice/RequestForm.asp

Hydrogen Storage and Transportation:

Hydrogen Refueling Infrastructure: Infrastructure for hydrogen refueling is being developed with significant investments, especially in areas where fuel cell electric cars, or FCEVs, are becoming more and more popular. To assist the expansion of FCEVs, businesses including as Air Liquide, Linde plc, and Shell are investing in the installation of hydrogen filling stations.

Hydrogen Pipelines and Transportation: Infrastructure for transportation and hydrogen pipeline development is receiving funding in order to facilitate the economical and efficient distribution of hydrogen. Enterprises are investigating the possibility of reusing already-existing natural gas pipes and constructing specific hydrogen pipelines for extended transit.

Hydrogen Utilization:

Fuel Cell Electric Vehicles (FCEVs): Several automakers are investing in the research and development of fuel cell electric vehicles (FCEVs), including Toyota, Hyundai, and BMW. These expenditures go toward things like developing new vehicles, producing fuel cell stacks, and forming alliances to create FCEV supply chains.

Industrial Applications: To investigate hydrogen uses for decarbonizing steel production, refining processes, and power generation, investments are being made in a number of industrial sectors. Businesses in the manufacturing, energy, and chemical industries are funding collaborations and pilot programs to show the feasibility of using hydrogen in industry for both practical and cost-effective reasons.

Future Investments in Hydrogen Ecosystem:

Green Hydrogen

Investments in green hydrogen production technologies are anticipated to rise sharply, with a focus on decarbonization. It is projected that significant investments in electrolysis driven by renewable energy sources will be made in order to reduce costs and increase production capacity. In order to achieve carbon neutrality in a number of industries, including transportation, manufacturing, and power generation, green hydrogen is anticipated to be extremely important.

Hydrogen Infrastructure Expansion

It is expected that more money will be spent on building hydrogen infrastructure, such as hubs and clusters, pipeline networks, and hydrogen recharging stations. The aforementioned expenditures are intended to establish a resilient and linked hydrogen ecosystem, which will facilitate the expansion of hydrogen production, storage, and delivery.

Cross-Sector Integration

It's anticipated that future investments would concentrate on integrating hydrogen technology with other industries, including power grids, industrial processes, and renewable energy sources. Power-to-hydrogen, hydrogen blending in natural gas pipelines, and the application of hydrogen in industries with difficult-to-abate emissions are some of the technologies that are required for this integration.

International Collaboration

It is envisaged that investments would be made in international cooperation and partnerships to promote the growth of international trade and cross-border hydrogen supply chains. To support the global transportation of hydrogen, this entails making investments in regulatory frameworks, certification processes, and hydrogen infrastructure.

Detailed use case analyses related to current and future investments in the hydrogen ecosystem:

Hydrogen Production

Electrolysis Plants: Investing in electrolysis facilities is essential to increasing the production of green hydrogen. These plants separate water into hydrogen and oxygen using renewable electricity. They make it possible to produce hydrogen that is free of carbon, which has a variety of uses in the transportation, industrial, and power generation sectors. Electrolysis plants are being used on a variety of scales, from large-scale facilities for regional or national hydrogen production to small-scale projects for local consumption.

Carbon Capture and Storage (CCS) in Hydrogen Production: The development and implementation of carbon capture and storage technologies for the production of hydrogen from fossil fuels are being funded. By capturing and storing carbon emissions, the creation of hydrogen is intended to become a low-carbon or carbon-neutral process. Blue hydrogen can serve as a stopgap measure until a more environmentally friendly hydrogen economy is established, and CCS technologies make this possible.

Hydrogen Infrastructure

Hydrogen Refueling Stations: Fuel cell electric vehicle (FCEV) adoption depends on investments in hydrogen refueling facilities. Compared to battery electric vehicles, FCEVs can drive longer distances and refill more quickly because to the infrastructure these stations provide for hydrogen filling. With an emphasis on important transit corridors, metropolitan areas, and places with favorable regulations and market demand for FCEVs, efforts are being undertaken to broaden the network of hydrogen refueling stations.

Hydrogen Pipelines and Storage: For hydrogen to be transported and distributed efficiently, storage facilities and pipelines must be invested in. Hydrogen may be transported great distances to supply-demand hubs using dedicated hydrogen pipelines or by repurposing existing natural gas pipelines. Subterranean hydrogen storage facilities are also being invested in, in an effort to offset the intermittent nature of renewable energy sources and guarantee a steady supply during moments of high demand.

Industry and Manufacturing

Green Hydrogen for Industrial Applications: The goal of investing in green hydrogen production is to reduce the carbon footprint of industrial activities. Refineries, steel, and ammonia manufacturing are among the industries investigating the use of green hydrogen as a fuel or feedstock in place of fossil fuels. These investments make it possible for these industries to reduce their carbon emissions, which results in more ecologically friendly and sustainable production methods.

Power-to-X Technologies: Investing in power-to-x technologies entails turning excess renewable energy into hydrogen or goods generated from hydrogen, such as feedstocks, chemicals, or synthetic fuels. Power-to-x technologies facilitate the integration of renewable energy sources into the energy system by storing renewable energy as hydrogen or its derivatives. This allows for the exploitation of excess renewable energy.

International Hydrogen Trade

Cross-Border Hydrogen Infrastructure: To enable global hydrogen trade, investments are being made to build cross-border infrastructure. Nations endowed with copious amounts of renewable energy resources are making significant investments in the construction of green hydrogen production plants and related transportation infrastructure. The objective of these investments is to establish a hydrogen supply chain that links locations with strong demand but limited domestic production capabilities with hydrogen production centers.

Hydrogen Export Projects: The development of large-scale hydrogen export projects is the focus of investments. Nations that possess abundant renewable energy resources and are in close proximity to prospective buyers of hydrogen are investigating the possibility of establishing export-oriented hydrogen production facilities. In order to support the development of a global hydrogen economy, these projects entail the production, liquefaction, and transportation of hydrogen to foreign markets.

The financial commitments made by different stakeholders, such as governments, private enterprises, and investors, to support and advance the growth of the hydrogen sector are referred to as hydrogen industry investments. These expenditures are going to be used for things like R&D, building infrastructure, setting up production facilities, and implementing hydrogen technology. The objective is to support the development of a sustainable hydrogen industry that can aid in the pursuit of clean energy, decarbonization initiatives, and the shift to a low-carbon economy.

How do these investments benefit market participants? Which countries and players have taken the lead in government and direct private sector investments?

Investments in the hydrogen ecosystem benefit market participants in several ways, including the following:

Market Growth and Expansion: The infrastructural and technological advancements related to hydrogen fuel support the market's expansion. Market players have greater opportunity to enter new markets, develop cutting-edge solutions, and gain market share as more funds are devoted to research, development, and deployment.

Technological Advancements: Technological developments in hydrogen technologies include reduced fuel cell costs, enhanced electrolysis efficiency, and advances in hydrogen storage and delivery. Market players gain from these developments since they improve the efficiency, dependability, and affordability of hydrogen solutions.

Cost Reduction: Across the hydrogen value chain, investments lead to cost savings through economies of scale and innovation. Hydrogen solutions are more cost-competitive than traditional energy sources, which increases market demand and adoption. Cost reductions can boost market competitiveness and profitability for participants in the market.

Job Creation and Economic Growth: The expansion of the hydrogen industry through investments generates employment possibilities in a number of value chain categories, such as manufacturing, R&D, infrastructure implementation, and service delivery. These employment options promote employment and revenue development while also supporting regional and national economic progress.

Regarding government and private sector investments, the lead has been taken by several countries and companies:

Government Investments:

Germany: Government investments in the hydrogen industry have been led by Germany. In order to encourage research, development, and demonstration initiatives, they have committed significant resources and developed the National Hydrogen Strategy. Germany has committed billions of euros to investments in hydrogen technology with the goal of leading the world in this field.

Japan: With its Basic Hydrogen Strategy, Japan has made significant investments in the hydrogen industry. The nation is concentrating on creating a society that uses, stores, transports, and produces hydrogen. Japan has allocated public funds to assist the development of hydrogen infrastructure, as well as research and experimental initiatives.

European Union: As part of its Green Deal and European Hydrogen Strategy, the European Union (EU) has set high goals for the deployment of hydrogen. The European Union intends to make significant investments through public-private partnerships in hydrogen technologies, infrastructure, and projects. The European Commission has allotted billions of dollars to member state efforts pertaining to hydrogen.

Private Sector Investments:

Energy Companies: Significant investments have been made in the hydrogen industry by well-known energy firms like BP, TotalEnergies, and Shell. Their portfolios are becoming more diverse, and they are making investments in infrastructure, apps, and hydrogen generation. By using their resources and experience, these businesses are propelling the growth of the hydrogen industry.

Automotive Manufacturers: Several automakers have made significant investments in hydrogen fuel cell infrastructure and technology, including Toyota, Hyundai, and BMW. To assist with the commercialization of fuel cell electric vehicles (FCEVs), these firms are developing FCEVs and making investments in infrastructure for hydrogen refueling.

Industrial Players: To decarbonize their processes, major industrial players in industries including steel, chemicals, and refining are investing in hydrogen-related projects. Businesses like Siemens Energy, Air Liquide, and Thyssenkrupp are developing low-carbon hydrogen supply chains by working with partners, investing in hydrogen technology, and testing hydrogen-based industrial processes.

These instances show the initiative and financial commitments made by public and private sector participants to propel the expansion of the hydrogen ecosystem. The development and commercialization of hydrogen technologies and infrastructure are being actively shaped by market participants who are combining government backing, legislative frameworks, and private sector innovation.

Read More - https://www.marketsandmarkets.com/industry-practice/hydrogen/hydrogen-industry-investments

#HydrogenInvestments#CleanEnergyInvesting#HydrogenEconomy#RenewableInvestments#GreenTechFunding#SustainableInvestments#HydrogenFuture#ClimateFinance#InvestInHydrogen

0 notes

Text

Clean Energy Investment Accelerator: Powering Asia's Future with Renewable Energy! #AsianDevelopmentBank #CleanEnergyInvestmentAccelerator #cleanenergyinvestments #cleanenergyprojects #renewableenergysources

#Business#AsianDevelopmentBank#CleanEnergyInvestmentAccelerator#cleanenergyinvestments#cleanenergyprojects#renewableenergysources

0 notes

Text

Hydrogen Industry Investments

Hydrogen Ecosystem Current and Future Investments

Current Investments in Hydrogen Ecosystem:

Hydrogen Production:

Electrolysis: Investments in electrolysis technology have been rising in order to produce hydrogen. Because of their promise for scalable and effective hydrogen synthesis from renewable sources, proton exchange membranes (PEMs) and alkaline electrolyzers have drawn a lot of attention. Enterprises such as Nel ASA, ITM Power, and Plug Power have managed to raise capital to enhance their electrolyzer production capabilities and facilitate the advancement of extensive electrolysis initiatives.

Steam Methane Reforming (SMR): Even though SMR is the most common way to produce hydrogen, efforts are being undertaken to enhance its environmental efficiency by utilizing carbon capture and storage (CCS) technologies. In order to improve the efficiency and lower the carbon footprint of SMR plants, businesses are spending money on research and development.

Download- https://www.marketsandmarkets.com/industry-practice/RequestForm.asp

Hydrogen Storage and Transportation:

Hydrogen Refueling Infrastructure: Infrastructure for hydrogen refueling is being developed with significant investments, especially in areas where fuel cell electric cars, or FCEVs, are becoming more and more popular. To assist the expansion of FCEVs, businesses including as Air Liquide, Linde plc, and Shell are investing in the installation of hydrogen filling stations.

Hydrogen Pipelines and Transportation: Infrastructure for transportation and hydrogen pipeline development is receiving funding in order to facilitate the economical and efficient distribution of hydrogen. Enterprises are investigating the possibility of reusing already-existing natural gas pipes and constructing specific hydrogen pipelines for extended transit.

Hydrogen Utilization:

Fuel Cell Electric Vehicles (FCEVs): Several automakers are investing in the research and development of fuel cell electric vehicles (FCEVs), including Toyota, Hyundai, and BMW. These expenditures go toward things like developing new vehicles, producing fuel cell stacks, and forming alliances to create FCEV supply chains.

Industrial Applications: To investigate hydrogen uses for decarbonizing steel production, refining processes, and power generation, investments are being made in a number of industrial sectors. Businesses in the manufacturing, energy, and chemical industries are funding collaborations and pilot programs to show the feasibility of using hydrogen in industry for both practical and cost-effective reasons.

Future Investments in Hydrogen Ecosystem:

Green Hydrogen

Investments in green hydrogen production technologies are anticipated to rise sharply, with a focus on decarbonization. It is projected that significant investments in electrolysis driven by renewable energy sources will be made in order to reduce costs and increase production capacity. In order to achieve carbon neutrality in a number of industries, including transportation, manufacturing, and power generation, green hydrogen is anticipated to be extremely important.

Hydrogen Infrastructure Expansion

It is expected that more money will be spent on building hydrogen infrastructure, such as hubs and clusters, pipeline networks, and hydrogen recharging stations. The aforementioned expenditures are intended to establish a resilient and linked hydrogen ecosystem, which will facilitate the expansion of hydrogen production, storage, and delivery.

Cross-Sector Integration

It's anticipated that future investments would concentrate on integrating hydrogen technology with other industries, including power grids, industrial processes, and renewable energy sources. Power-to-hydrogen, hydrogen blending in natural gas pipelines, and the application of hydrogen in industries with difficult-to-abate emissions are some of the technologies that are required for this integration.

International Collaboration

It is envisaged that investments would be made in international cooperation and partnerships to promote the growth of international trade and cross-border hydrogen supply chains. To support the global transportation of hydrogen, this entails making investments in regulatory frameworks, certification processes, and hydrogen infrastructure.

Detailed use case analyses related to current and future investments in the hydrogen ecosystem:

Hydrogen Production

Electrolysis Plants: Investing in electrolysis facilities is essential to increasing the production of green hydrogen. These plants separate water into hydrogen and oxygen using renewable electricity. They make it possible to produce hydrogen that is free of carbon, which has a variety of uses in the transportation, industrial, and power generation sectors. Electrolysis plants are being used on a variety of scales, from large-scale facilities for regional or national hydrogen production to small-scale projects for local consumption.

Carbon Capture and Storage (CCS) in Hydrogen Production: The development and implementation of carbon capture and storage technologies for the production of hydrogen from fossil fuels are being funded. By capturing and storing carbon emissions, the creation of hydrogen is intended to become a low-carbon or carbon-neutral process. Blue hydrogen can serve as a stopgap measure until a more environmentally friendly hydrogen economy is established, and CCS technologies make this possible.

Hydrogen Infrastructure

Hydrogen Refueling Stations: Fuel cell electric vehicle (FCEV) adoption depends on investments in hydrogen refueling facilities. Compared to battery electric vehicles, FCEVs can drive longer distances and refill more quickly because to the infrastructure these stations provide for hydrogen filling. With an emphasis on important transit corridors, metropolitan areas, and places with favorable regulations and market demand for FCEVs, efforts are being undertaken to broaden the network of hydrogen refueling stations.

Hydrogen Pipelines and Storage: For hydrogen to be transported and distributed efficiently, storage facilities and pipelines must be invested in. Hydrogen may be transported great distances to supply-demand hubs using dedicated hydrogen pipelines or by repurposing existing natural gas pipelines. Subterranean hydrogen storage facilities are also being invested in, in an effort to offset the intermittent nature of renewable energy sources and guarantee a steady supply during moments of high demand.

Industry and Manufacturing

Green Hydrogen for Industrial Applications: The goal of investing in green hydrogen production is to reduce the carbon footprint of industrial activities. Refineries, steel, and ammonia manufacturing are among the industries investigating the use of green hydrogen as a fuel or feedstock in place of fossil fuels. These investments make it possible for these industries to reduce their carbon emissions, which results in more ecologically friendly and sustainable production methods.

Power-to-X Technologies: Investing in power-to-x technologies entails turning excess renewable energy into hydrogen or goods generated from hydrogen, such as feedstocks, chemicals, or synthetic fuels. Power-to-x technologies facilitate the integration of renewable energy sources into the energy system by storing renewable energy as hydrogen or its derivatives. This allows for the exploitation of excess renewable energy.

International Hydrogen Trade

Cross-Border Hydrogen Infrastructure: To enable global hydrogen trade, investments are being made to build cross-border infrastructure. Nations endowed with copious amounts of renewable energy resources are making significant investments in the construction of green hydrogen production plants and related transportation infrastructure. The objective of these investments is to establish a hydrogen supply chain that links locations with strong demand but limited domestic production capabilities with hydrogen production centers.

Hydrogen Export Projects: The development of large-scale hydrogen export projects is the focus of investments. Nations that possess abundant renewable energy resources and are in close proximity to prospective buyers of hydrogen are investigating the possibility of establishing export-oriented hydrogen production facilities. In order to support the development of a global hydrogen economy, these projects entail the production, liquefaction, and transportation of hydrogen to foreign markets.

The financial commitments made by different stakeholders, such as governments, private enterprises, and investors, to support and advance the growth of the hydrogen sector are referred to as hydrogen industry investments. These expenditures are going to be used for things like R&D, building infrastructure, setting up production facilities, and implementing hydrogen technology. The objective is to support the development of a sustainable hydrogen industry that can aid in the pursuit of clean energy, decarbonization initiatives, and the shift to a low-carbon economy.

How do these investments benefit market participants? Which countries and players have taken the lead in government and direct private sector investments?

Investments in the hydrogen ecosystem benefit market participants in several ways, including the following:

Market Growth and Expansion: The infrastructural and technological advancements related to hydrogen fuel support the market's expansion. Market players have greater opportunity to enter new markets, develop cutting-edge solutions, and gain market share as more funds are devoted to research, development, and deployment.

Technological Advancements: Technological developments in hydrogen technologies include reduced fuel cell costs, enhanced electrolysis efficiency, and advances in hydrogen storage and delivery. Market players gain from these developments since they improve the efficiency, dependability, and affordability of hydrogen solutions.

Cost Reduction: Across the hydrogen value chain, investments lead to cost savings through economies of scale and innovation. Hydrogen solutions are more cost-competitive than traditional energy sources, which increases market demand and adoption. Cost reductions can boost market competitiveness and profitability for participants in the market.

Job Creation and Economic Growth: The expansion of the hydrogen industry through investments generates employment possibilities in a number of value chain categories, such as manufacturing, R&D, infrastructure implementation, and service delivery. These employment options promote employment and revenue development while also supporting regional and national economic progress.

Regarding government and private sector investments, the lead has been taken by several countries and companies:

Government Investments:

Germany: Government investments in the hydrogen industry have been led by Germany. In order to encourage research, development, and demonstration initiatives, they have committed significant resources and developed the National Hydrogen Strategy. Germany has committed billions of euros to investments in hydrogen technology with the goal of leading the world in this field.

Japan: With its Basic Hydrogen Strategy, Japan has made significant investments in the hydrogen industry. The nation is concentrating on creating a society that uses, stores, transports, and produces hydrogen. Japan has allocated public funds to assist the development of hydrogen infrastructure, as well as research and experimental initiatives.

European Union: As part of its Green Deal and European Hydrogen Strategy, the European Union (EU) has set high goals for the deployment of hydrogen. The European Union intends to make significant investments through public-private partnerships in hydrogen technologies, infrastructure, and projects. The European Commission has allotted billions of dollars to member state efforts pertaining to hydrogen.

Private Sector Investments:

Energy Companies: Significant investments have been made in the hydrogen industry by well-known energy firms like BP, TotalEnergies, and Shell. Their portfolios are becoming more diverse, and they are making investments in infrastructure, apps, and hydrogen generation. By using their resources and experience, these businesses are propelling the growth of the hydrogen industry.

Automotive Manufacturers: Several automakers have made significant investments in hydrogen fuel cell infrastructure and technology, including Toyota, Hyundai, and BMW. To assist with the commercialization of fuel cell electric vehicles (FCEVs), these firms are developing FCEVs and making investments in infrastructure for hydrogen refueling.

Industrial Players: To decarbonize their processes, major industrial players in industries including steel, chemicals, and refining are investing in hydrogen-related projects. Businesses like Siemens Energy, Air Liquide, and Thyssenkrupp are developing low-carbon hydrogen supply chains by working with partners, investing in hydrogen technology, and testing hydrogen-based industrial processes.

These instances show the initiative and financial commitments made by public and private sector participants to propel the expansion of the hydrogen ecosystem. The development and commercialization of hydrogen technologies and infrastructure are being actively shaped by market participants who are combining government backing, legislative frameworks, and private sector innovation.

Read More - https://www.marketsandmarkets.com/industry-practice/hydrogen/hydrogen-industry-investments

#HydrogenInvestments#CleanEnergyInvesting#HydrogenEconomy#RenewableInvestments#GreenTechFunding#SustainableFinance#H2Investments#FutureOfEnergy#HydrogenInnovation#ClimateInvesting

0 notes