#CharitableDonations

Explore tagged Tumblr posts

Link

Memorial funds offer a meaningful way to honor

#memorialfund#managingdonations#lastingtributes#legacyfundraising#crowdfundingformemorials#charitabledonations#communityfundingprojects#memorialfundtaximplications#memorialfundplatforms

0 notes

Text

Understanding Gift Aid in the UK: Maximizing Your Charitable Contributions

Did you know that Gift Aid in the UK allows charities to reclaim tax on your donations? For every £1 you give, they can receive an extra 25p! This means your contributions make an even bigger impact.

Understanding Charity Tax Relief is also crucial. It lets you deduct charitable donations from your taxable income, making giving more beneficial for you. Higher-rate taxpayers can claim back the difference between the basic and higher rate of tax, maximizing their generosity.

Don't forget about Tax Deductions for Charitable Donations! Both individuals and businesses can benefit from these deductions, encouraging more support for charities.

For a deeper dive into how you can enhance your giving and take advantage of these benefits, check out Narayan Seva Sansthan UK’s guide on Gift Aid and charitable donations.

#GiftAidUK#CharityTaxRelief#CharitableGiving#TaxDeductions#UKCharities#SupportCharities#PhilanthropyUK#TaxBenefits#DonationsUK#CorporateGiving#CharitableDonations#NonprofitSupport#CommunitySupport#TaxEfficientGiving#SocialResponsibility#bestngoinuk#donatenow#charitysupport#charitywork#ngo#narsevanarayanseva#narayansevasansthan#narayanseva

0 notes

Text

Understanding Tax Deductions for Charitable Donations

Donating to charity is not only a noble act of kindness but can also be financially savvy, thanks to tax deductions. When you donate to a qualified charitable organization, the IRS allows you to claim a deduction on your tax return, effectively reducing your taxable income. Understanding how this works can enhance both your giving strategy and financial planning.

First, it's essential to ensure that the charity you're donating to is recognized by the IRS as a qualified organization. Donations to individuals, political organizations, or for-profit groups are not eligible for tax deductions. You can check the status of a charity through the IRS's online tool or consult a tax professional.

The amount you can deduct depends on several factors, including the type of donation and your income. Monetary donations are straightforward: you can deduct the exact amount given. However, if you donate goods or property, the deduction is typically the fair market value of what you donated.

To claim a deduction, you must itemize your deductions on your tax return, which involves submitting Schedule A with your Form 1040. Keep in mind that with the increased standard deduction introduced by recent tax law changes, itemizing makes sense only if all your itemized deductions, including charitable contributions, exceed the standard deduction for your filing status.

It's also crucial to keep detailed records of your donations, including receipts and a note of the charity's name, the date of the contribution, and the amount or description of what was donated.

By understanding and utilizing the tax benefits of charitable donations, you can make your contributions go further – both for the causes you support and for your financial health.

0 notes

Text

youtube

Guidelines for Receiving Tax Deductible Gifts as per the ATO

#ATOGuidelines#TaxDeductibleGifts#TaxCompliance#TaxBenefits#CharitableDonations#TaxLaws#TaxExemption#Philanthropy#GivingBack#taxdeductions#Youtube

0 notes

Link

Venmo is a convenient and well-liked method for expressing support towards causes and organizations that matter to individuals through charitable giving. It has also emerged as a powerful tool for charitable giving and receiving.

#VenmoForCharitableDonations#DonateWithVenmo#CharitableGiving#VenmoNerd#CharitableDonations#VenmoForCharity#GiveAndReceive#SupportCauses#MakeADifference#EasyDonations#DigitalGiving#CommunitySupport#GiveBack#VenmoDonations#CharityPayments#EffortlessGiving#GivingWithVenmo#SocialGood

0 notes

Text

My daughter Alyssah and I attended the official launch of Parade at our local Target! It was an exciting experience to shop this amazing brand in person. We live in a smaller community. We were pleased to find a decent selection. It was a fun way to spend the day.

Features:

-recycled fabric

-compostable packaging

-donates profits from sales to the charity of your choice

-prioritizes body positivity, inclusivity & affordability

Shop Parade at Target!

or

Use my code Blastkat For 20% OFF your order at yourparade.com or my link:

secret.yourparade.com/blastkat

@parade @target @parade.friends @targetstyle @parade.community

*Gifted by Parade

#paradepartner#paradextarget#gifted#intimatewear#complimentary#shopping#irl#recycledfashion#compostablepackaging#charitabledonations#bodypositive#bodypositivity#blogger#contentcreator#blastkat

0 notes

Text

Tweeted

Participants needed for online survey! Topic: "Does emotional message appeal in adverts impact charitable donations?" https://t.co/DxPBSruO62 via @SurveyCircle #donations #EmotionalAppeal #charities #SocialMedia #CharitableDonations #survey #surveycircle https://t.co/hre4Snc63O

— Daily Research @SurveyCircle (@daily_research) Apr 6, 2023

0 notes

Link

#SustainableStylist#SustainableStylePodcast#Donations#EthicalGifts#ZeroWaste#CharitableDonations#ZeroClutter

1 note

·

View note

Text

Billionaire Donates $135 Million House To Foundation For Pets

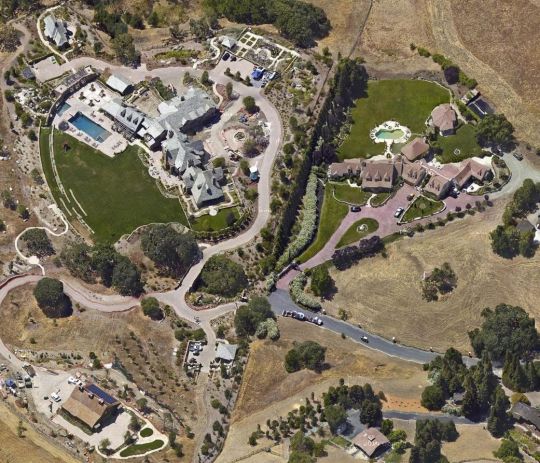

The mansion in Alamo, California, that billionaire David Duffield donated for animal welfare. Billionaire David Duffield got a late start in his career. He started his first software company in 1987 at age 47. Then by 2005, PeopleSoft had grown to be the world's second-largest application software company. After a legal battle, he sold PeopleSoft, to Oracle for $10.7 billion. Not one to just retire, he started a new company, Workday, with former Peoplesoft vice-chairman Aneel Bhusri, at 65. That new company, an on‑demand (cloud-based) financial management and payroll software, was another success, going public in 2012. With over 10,000 employees and total assets of $5 billion today, Duffield remains Chairman of the company.

Billionaire David Duffield Donated This House For The Benefit of Animal Welfare - Maddie's Fund - Photo: Google Maps

David Duffield Net Worth

Fourteen years after starting the second company, Duffield's net worth is currently estimated to be at $13 billion. According to Forbes, "Duffield says he plans to leave his fortune to his animal charity, Maddie's Fund, named after his beloved schnauzer, not his 10 children." From Wikipedia - Duffield is also known for his philanthropic activities on behalf of animals. In 1994, Duffield and his wife, Cheryl, established Maddie's Fund, originally named the Duffield Family Foundation. In January 1999, the Board of Directors restructured the foundation, defined its mission, and adopted the current name. The organization is named after Maddie, a Miniature Schnauzer who was the Duffields' source of unconditional love and friendship for ten years, and a "lighthouse during the stormy period" of the couple's work careers. Maddie died of cancer in 1997, and Duffield acted on his earlier promise to his pet, "If we ever make some money, I promise we will give it back to you and your kind so others can be as happy as we are today."

Billionaire David Duffield Donated The House (Right) For The Benefit of Animal Welfare to Maddie's Fund - Photo: Google Maps

Mattie's Fund Endowment

The Duffields have endowed Maddie's Fund - with more than $300 million, and have spent more than $200 million to save the lives of dogs and cats. The organization believes that the Duffields have given more of their personal wealth to the animal welfare cause than any other individuals. "And although they don't want to make a big fuss over their unprecedented contribution, they do want to honor their cherished companion and the special bond they shared with her."

Aerial View of The Mansion Billionaire David Duffield Donated To Maddie's Fund To Help Animals - Photo: Google Maps

Aerial View of The Mansion Billionaire David Duffield Donated To Maddie's Fund To Help Animals - Photo: Google Maps Billionaire David Duffield Donates Mansion In May 2016 the Duffields put their 21.48 acre estate, dubbed Fieldhaven, 30 miles east of San Francisco, on the market for $135 million, as they decided to move back to their home in Lake Tahoe. The proceeds from the sale were slated to be donated to Maddie’s Fund, the nonprofit pet shelter founded by Dave and his wife Cheryl, and to which they have since endowed with over $300 million. At the time, the Fieldhaven estate in Alamo, CA., never sold, but has now just returned to the market with a significantly reduced $28.5 million price tag. (Billionaire gossip has heard the home cost over $100 million to build) The home was donated to the charity this year and it will receive all funds from the sale. So for pets in need, and the humans who care for them, the sale of this property is a win-win, so please get the word out to all your wealthy friends about this sale. Afterall it benefits our innocent friends, the animals. A little more about the home (as stated in the listing by Dana Green of Compass)....

Another Angle of the Property David Duffield Donated For Animal Welfare - Photo: Google Maps About David Duffield's Mansion The home, modeled on traditional English manor houses and dubbed Fieldhaven, it has 8 beds, 12 baths, and has 20,467 sq ft of living space. Curated in 2013 by a known tech visionary, no expense was spared from inception to completion. Remick Associates Architects + Master Builders worked to create this rare legacy estate that includes a purposeful and sustainable environment for generations to come. Designed to incorporate mind and body wellness, hiking, swimming, gardening, and biking can seamlessly be added to your daily routine. The potential to add equestrian facilities, a 9-hole golf course or putting course, and an indoor sports facility or tennis court exist. During the three-year building period, over 200 master caliber workers were on site daily with the design team ensuring perfection in every detail resulting in a harmonious blend of old world charm and modern lifestyle with incomparable natural surroundings.' Maddie's Fund is headquartered in Pleasanton, CA.

Billionaire Charitable Donation - David Duffield Mansion donated to Maddie's Fund for animal welfare - Photo: Dana Green For Compass

Billionaire David Duffield Former Mansion - Front Entrance - Photo: Dana Green For Compass

Billionaire Charitable Donation - David Duffield Mansion donated to Maddie's Fund for animal welfare - Front Entryway - Photo: Dana Green For Compass

Billionaire Charitable Donation - David Duffield Mansion - Kitchen Area - Photo: Dana Green For Compass

Billionaire David Duffield Donated This Home To Maddie's Fund - A Living Room - Photo: Dana Green For Compass

One of the bedrooms of Billionaire David Duffield's Donated Home - Photo: Dana Green For Compass

An Entertainment Area of Billionaire David Duffield's Donated Home - Photo: Dana Green For Compass

The Movie Theater In David Duffield Donated Home - Photo: Dana Green For Compass

For The Kids (And Adults!) The Child Friendly Pool Area Incorporates a Slide For Fun - Photo: Dana Green For Compass

An Outdoor Kitchen and Bar Area For Outdoor Entertainment - Photo: Dana Green For Compass

Another View of the Outdoor Kitchen - Photo: Dana Green For Compass

An Aerial View of the Back of the Mansion Showing The Pool Area, Slide and House - Photo: Dana Green For Compass Lets get this property sold, for the animals! See ALL photos and the official listing offered by Dana Green of Compass Here is an article about another charitable donation by David Duffield - Duffield land donation at Lake Tahoe paves way for critical trail link

Write or Contact Billionaires, Millionaires, or CEO's. Many wealthy people and billionaires who donate money do so privately, you just have to have the correct address of where to write and know how to ask for donations, money, or whatever it is you want. We offer the contact addresses of ALL U.S. Billionaires, along with Millionaires and CEO's that may donate, give money away, or help with investments or scholarships. Get Your Copy Today! Read the full article

#billionairecharitabledonations#billionairedonations#charitabledonations#DavidDuffield#Fieldhaven#HouseForSale#MansionForSale

1 note

·

View note

Link

Memorial funds offer a meaningful way to honor

#crowdfundingformemorials#legacyfundraising#charitabledonations#memorialfundtaximplications#communityfundingprojects#lastingtributes#managingdonations#memorialfundplatforms#memorialfund

0 notes

Photo

A tax break for charitable donations is slated to end soon — here's how to use it before it disappears As twister victims within the south and ... Read the rest on our site with the url below https://worldwidetweets.com/a-tax-break-for-charitable-donations-is-slated-to-end-soon-heres-how-to-use-it-before-it-disappears/?feed_id=136247&_unique_id=61ba6f2d3e934 #accidents #accounting #AccountingConsulting #article_normal #beverages #business #BusinessConsumerServices #catastrophes #charitabledonations #charitablegiving #charities #consulting #ConsumerGoods #consumerservices #disasters #DisastersAccidents #EconomicNews #food #FoodBeveragesTobacco #generalnews #governmentbudget #GovernmentBudgetTaxation #GovernmentFinance #HealthCare #irs #Lifestyle #living #LivingLifestyle #NaturalDisasters #NaturalDisastersCatastrophes #PersonalFinance #political #PoliticalGeneralNews #RiskNews #Storms #taxation #taxdeduction #tobacco #weather

#Business#accidents#accounting#AccountingConsulting#article_normal#beverages#business#BusinessConsumerServices#catastrophes#charitabledonations#charitablegiving#charities#consulting#ConsumerGoods#consumerservices#disasters#DisastersAccidents#EconomicNews#food#FoodBeveragesTobacco#generalnews#governmentbudget#GovernmentBudgetTaxation#GovernmentFinance#HealthCare#irs#Lifestyle#living#LivingLifestyle#NaturalDisasters

0 notes

Link

No Charitable Deduction Without a Proper Appraisal (Accounting Web) - In a new Tax Court case charitable deductions were denied because an appraiser didn’t meet the requisite standards. Normally, tax payers are required to obtain an independent appraisal for large charitable contributions of property, unless you have reasonable cause such as reliance on the advice of a qualified professional.

0 notes

Text

GUIDE TO MAKING NON-CASH CONTRIBUTIONS

You must be able to substantiate the fair market value of goods or property you donate, including vehicles, boats, or even planes, and you'll need a written acknowledgment from the charity for this type of gift as well. You must fill out Form 8283 and include it with your tax return if the property is worth more than $500.

Giving Center does just that for you! Because they are an IRS Approved 501(c)3 charity organization, you'll receive Form 8283 after donating with them!

Tips for Donating Non-cash Items

Here are things to keep in mind when donating non-cash items: Make a list describing the items you're going to give away. You'll need these details for Form 8283.

Note the condition of each item and arrive at a value. The IRS will allow a deduction for any item that's in "good working condition or better." In other words, don't bother to claim a deduction for that old TV in your basement that hasn't worked in years, even if it just needs a single new part. At the very least, you must have it valued in its current condition without the new part. Save the price tag and/or the store receipt to prove the item's value if it's brand new.

You can claim a deduction for food and groceries, too. You can deduct the cost if you donate groceries to a charity as well. Just be sure to get a written, detailed, signed acknowledgment of your donation—such as, "five loaves of Brand X bread; four one-pound packages of hamburger,"—and keep your grocery store receipt to prove the prices of the items.

Consider taking pictures of your donations. Having a picture handy of what you donated can be useful, especially if you're donating a lot of items. It isn't technically a requirement, but it can't hurt in the event that your return is audited. Just snap away on your phone, then send the pictures to your hard drive and save them there, too.

You can prepare your own receipt to prove the tax-deductible donation. If you write it yourself ahead of time, you can simply have the receipt signed when you drop off your items. This way you can rest assured that the receipt is correct and it includes all the information you need.

Obtain a written appraisal if you're donating property worth more than $5,000. You must also complete Section B of Form 8283 in this case.

LIMITS ON THE CHARITABLE CONTRIBUTION DEDUCTION

Generally, you can deduct contributions up to 30% or 60% of your adjusted gross income (AGI), depending on the nature and tax-exempt status of the charity to which you're giving. You can deduct contributions of appreciated capital gains assets up to 20% of your AGI.

If you have any questions in regards to making a non cash contribution such as: donate a boat, donate a plane, donate real estate, or donate a vehicle please visit us at the link provided or contact Giving Center at 888-228-7320.

0 notes

Photo

If you can't donate, please SHARE SHARE SHARE! . . . . . #northwesternhealthsciencesuniversity #mcat2020 #medicalschool #prerequisites #microbiology #infectiousdiseases #gofundme #crowdfunding #pleasehelp #gofundmedonations #willsmith #jadapinkettsmith #tylerperry #chancetherapper #therock #charitabledonations #dreamsdocometrue #benandjerrysfoundation #billgatesfoundation #nyu #umd #usc #uminn #washingtonuniversityinstlouis https://www.instagram.com/p/BxNspcypXhr/?utm_source=ig_tumblr_share&igshid=1wtpxpsrqeiyv

#northwesternhealthsciencesuniversity#mcat2020#medicalschool#prerequisites#microbiology#infectiousdiseases#gofundme#crowdfunding#pleasehelp#gofundmedonations#willsmith#jadapinkettsmith#tylerperry#chancetherapper#therock#charitabledonations#dreamsdocometrue#benandjerrysfoundation#billgatesfoundation#nyu#umd#usc#uminn#washingtonuniversityinstlouis

0 notes

Photo

Grateful to have found a charitable cause to make use of soap with old branding. Entrepreneurs: how do you keep your business community minded? #loveatfirstlather #tea #veganskincare #teaddict #handmadesoap #charitabledonations https://www.instagram.com/refreshteasoap/p/BxGIxEkBUWX/?utm_source=ig_tumblr_share&igshid=1jrkrdg3io7kp

0 notes

Photo

Thanks to our generous supporters, Lonnetrix is now offering free classes to anyone willing to learn. All ages welcome. Thank you all, you gave in so many different ways. We are accepting donations to help pay for more art supplies for our students. In IG, please copy and paste links into browser. Feel free to click the donate button on our Lonnetrix Inc FB, via PayPal at https://paypal.me/lonnetrixinc?locale.x=en_US@ or cashapp $lonnetrix. #freeclass #freeartclass #art #artheals #wireart #donate #donation #charitydonations #charitabledonations #nonprofit #nonprofitorganization #driving #drivingforcharity #forcharity #paypalme #paypal #cashapp #westcoast #midwest #south #washington #montana #idaho #utah #wyoming #newmexico #texas #colorado #kansas #missouri #miles #beautifulusa #beautiful #baltimore #maryland #lonnetrixinc (at Baltimore, Maryland) https://www.instagram.com/p/BwDp0qIDCQX/?utm_source=ig_tumblr_share&igshid=7mwf0im76knq

#freeclass#freeartclass#art#artheals#wireart#donate#donation#charitydonations#charitabledonations#nonprofit#nonprofitorganization#driving#drivingforcharity#forcharity#paypalme#paypal#cashapp#westcoast#midwest#south#washington#montana#idaho#utah#wyoming#newmexico#texas#colorado#kansas#missouri

0 notes